Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Philip Morris International Inc. | earningscallscriptpm-ex992.htm |

| EX-99.1 - EX-99.1 - Philip Morris International Inc. | earningsreleasepm-ex991xq4.htm |

| 8-K - 8-K - Philip Morris International Inc. | pm-20210204.htm |

Delivering a Smoke-Free Future 2020 Fourth-Quarter and Full-Year Results February 4, 2021 Introduction • A glossary of key terms and definitions, including the definition for reduced-risk products, or "RRPs," additional heated tobacco unit market data, as well as adjustments, other calculations and reconciliations to the most directly comparable U.S. GAAP measures are at the end of today’s webcast slides, which are posted on our website • Unless otherwise stated, all references to IQOS are to our IQOS heat-not-burn devices and consumables • Comparisons presented on a like-for-like basis reflect pro forma 2019 results, which have been adjusted for the deconsolidation of our Canadian subsidiary, Rothmans, Benson & Hedges, Inc. (RBH), effective March 22, 2019 • Growth rates presented on an organic basis reflect currency-neutral underlying results and "like-for-like" comparisons, where applicable 2 Exhibit 99.3

Forward-Looking and Cautionary Statements • This presentation and related discussion contain projections of future results and other forward-looking statements. Achievement of future results is subject to risks, uncertainties and inaccurate assumptions. In the event that risks or uncertainties materialize, or underlying assumptions prove inaccurate, actual results could vary materially from those contained in such forward-looking statements. Pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, PMI is identifying important factors that, individually or in the aggregate, could cause actual results and outcomes to differ materially from those contained in any forward-looking statements made by PMI • PMI's business risks include: excise tax increases and discriminatory tax structures; increasing marketing and regulatory restrictions that could reduce our competitiveness, eliminate our ability to communicate with adult consumers, or ban certain of our products; health concerns relating to the use of tobacco and other nicotine-containing products and exposure to environmental tobacco smoke; litigation related to tobacco use and intellectual property; intense competition; the effects of global and individual country economic, regulatory and political developments, natural disasters and conflicts; changes in adult smoker behavior; lost revenues as a result of counterfeiting, contraband and cross-border purchases; governmental investigations; unfavorable currency exchange rates and currency devaluations, and limitations on the ability to repatriate funds; adverse changes in applicable corporate tax laws; adverse changes in the cost and quality of tobacco and other agricultural products and raw materials; and the integrity of its information systems and effectiveness of its data privacy policies. PMI's future profitability may also be adversely affected should it be unsuccessful in its attempts to produce and commercialize reduced-risk products or if regulation or taxation do not differentiate between such products and cigarettes; if it is unable to successfully introduce new products, promote brand equity, enter new markets or improve its margins through increased prices and productivity gains; if it is unable to expand its brand portfolio internally or through acquisitions and the development of strategic business relationships; or if it is unable to attract and retain the best global talent. Future results are also subject to the lower predictability of our reduced-risk product category's performance • PMI is further subject to other risks detailed from time to time in its publicly filed documents, including the Form 10-Q for the quarter ended September 30, 2020. PMI cautions that the foregoing list of important factors is not a complete discussion of all potential risks and uncertainties. PMI does not undertake to update any forward-looking statement that it may make from time to time, except in the normal course of its public disclosure obligations 3 Forward-Looking and Cautionary Statements (COVID-19) • The COVID-19 pandemic has created significant societal and economic disruption, and resulted in closures of stores, factories and offices, and restrictions on manufacturing, distribution and travel, all of which will adversely impact our business, results of operations, cash flows and financial position during the continuation of the pandemic • Our business continuity plans and other safeguards in place may not be effective to mitigate the impact of the pandemic. Currently, significant risks include our diminished ability to convert adult smokers to our RRPs, significant volume declines in our duty-free business and certain other key markets, disruptions or delays in our manufacturing and supply chain, increased currency volatility, and delays in certain cost saving, transformation and restructuring initiatives. Our business could also be adversely impacted if key personnel or a significant number of employees or business partners become unavailable due to the COVID-19 outbreak. The significant adverse impact of COVID-19 on the economic or political conditions in markets in which we operate could result in changes to the preferences of our adult consumers and lower demand for our products, particularly for our mid-price or premium-price brands. Continuation of the pandemic could disrupt our access to the credit markets or increase our borrowing costs. Governments may temporarily be unable to focus on the development of science-based regulatory frameworks for the development and commercialization of RRPs or on the enforcement or implementation of regulations that are significant to our business. In addition, messaging about the potential negative impacts of the use of our products on COVID-19 risks may lead to increasingly restrictive regulatory measures on the sale and use of our products, negatively impact demand for our products, the willingness of adult consumers to switch to our RRPs and our efforts to advocate for the development of science-based regulatory frameworks for the development and commercialization of RRPs • The impact of these risks also depends on factors beyond our knowledge or control, including the duration and severity of the outbreak, its recurrence in our key markets, actions taken to contain its spread and to mitigate its public health effects, and the ultimate economic consequences thereof 4

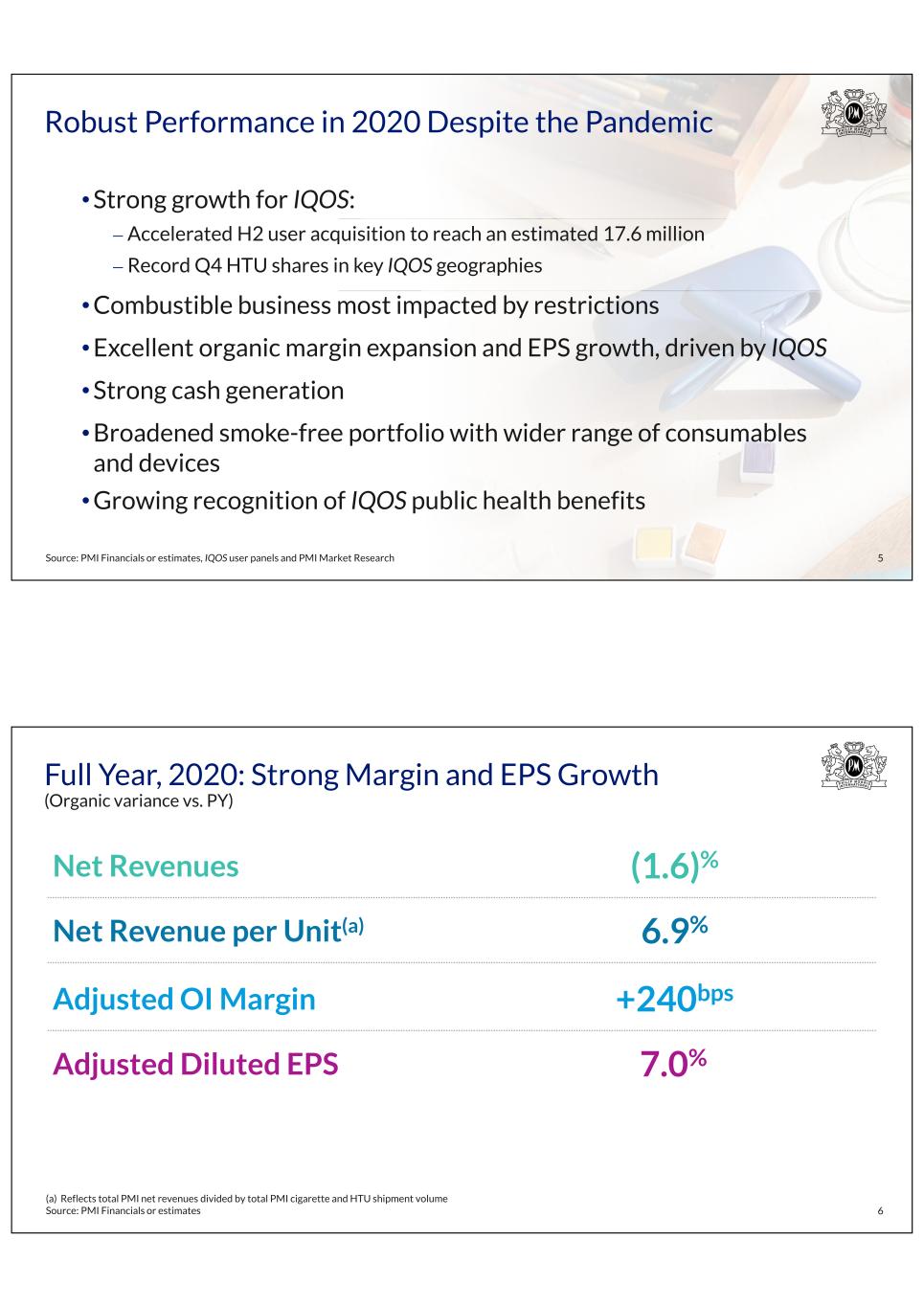

Robust Performance in 2020 Despite the Pandemic • Strong growth for IQOS:⎼ Accelerated H2 user acquisition to reach an estimated 17.6 million⎼ Record Q4 HTU shares in key IQOS geographies • Combustible business most impacted by restrictions • Excellent organic margin expansion and EPS growth, driven by IQOS • Strong cash generation • Broadened smoke-free portfolio with wider range of consumables and devices • Growing recognition of IQOS public health benefits 5Source: PMI Financials or estimates, IQOS user panels and PMI Market Research 6 Net Revenues Adjusted Diluted EPS Adjusted OI Margin Full Year, 2020: Strong Margin and EPS Growth (Organic variance vs. PY) +240bps 7.0% (1.6)% Net Revenue per Unit(a) 6.9% (a) Reflects total PMI net revenues divided by total PMI cigarette and HTU shipment volume Source: PMI Financials or estimates

(a) Reflects total PMI net revenues divided by total PMI cigarette and HTU shipment volume Source: PMI Financials or estimates 7 Q4, 2020: Similar Strong Dynamics as Full Year (Organic variance vs. PY) Net Revenues Adjusted Diluted EPS Adjusted OI Margin Net Revenue per Unit(a) 7.4% +200bps 5.2% (3.5)% Q4, 2020: Strong Underlying Finish to the Year • Record HTU shipment volumes with strong finish in Japan • Impact of tightening social restrictions less severe than Q2, 2020 • Mid-single digit top-line growth in ‘IQOS’ regions(a) • Continued challenges in Indonesia and Duty Free • Total market lower in the Philippines post-price increase • Improved top-line performance expected in Q1, 2021 despite pandemic and tough prior year comparison 8 (a) European Union, Eastern Europe and East Asia & Australia Source: PMI Financials or estimates

9 +1.2pp +0.9pp 64.6 % 66.6% 66.7% 2019 2020 (Excluding Currency) 2020 Currency (a) Pro forma: excluding Gross Profit Margin impact attributable to RBH (+0.1pp) from January 1, 2019 to March 21, 2019 (b) Includes productivity savings in manufacturing, procurement and supply chain operations Source: PMI Financials or estimates 2020: Multiple Levers Driving Higher Gross Margin +0.1pp +1.0pp (0.9)pp (0.2)pp HTU Mix and Price Impact Combustible Pricing Manufacturing Productivity(b) Combustible Volume Mix / Other Devices (a) 10 +0.9pp (0.4)pp 25.1% 24.7% 25.6% 2019 2020 (Excluding Currency) 2020 2020: Cost Efficiencies Support Organic Margin Expansion SG&A / Other Currency Marketing, Admin. & Research Costs (as a % of Net Revenues) (a) Pro forma: excluding impact attributable to RBH (-0.1pp) from January 1, 2019 to March 21, 2019 Note: Variances are vs. prior year as a percentage of net revenues 2019 excludes asset impairment and exit costs ($422million), Russia excise and VAT audit charge ($374 million), the Canadian tobacco litigation-related expense ($194 million) and the loss on deconsolidation of RBH ($239 million) totaling $1,229 million (refer to slide 54) 2020 excludes asset impairment and exit costs ($149 million) offset by a Brazil indirect tax credit $119 million totaling $30 million (refer to slide 54) Source: PMI Financials or estimates (a)

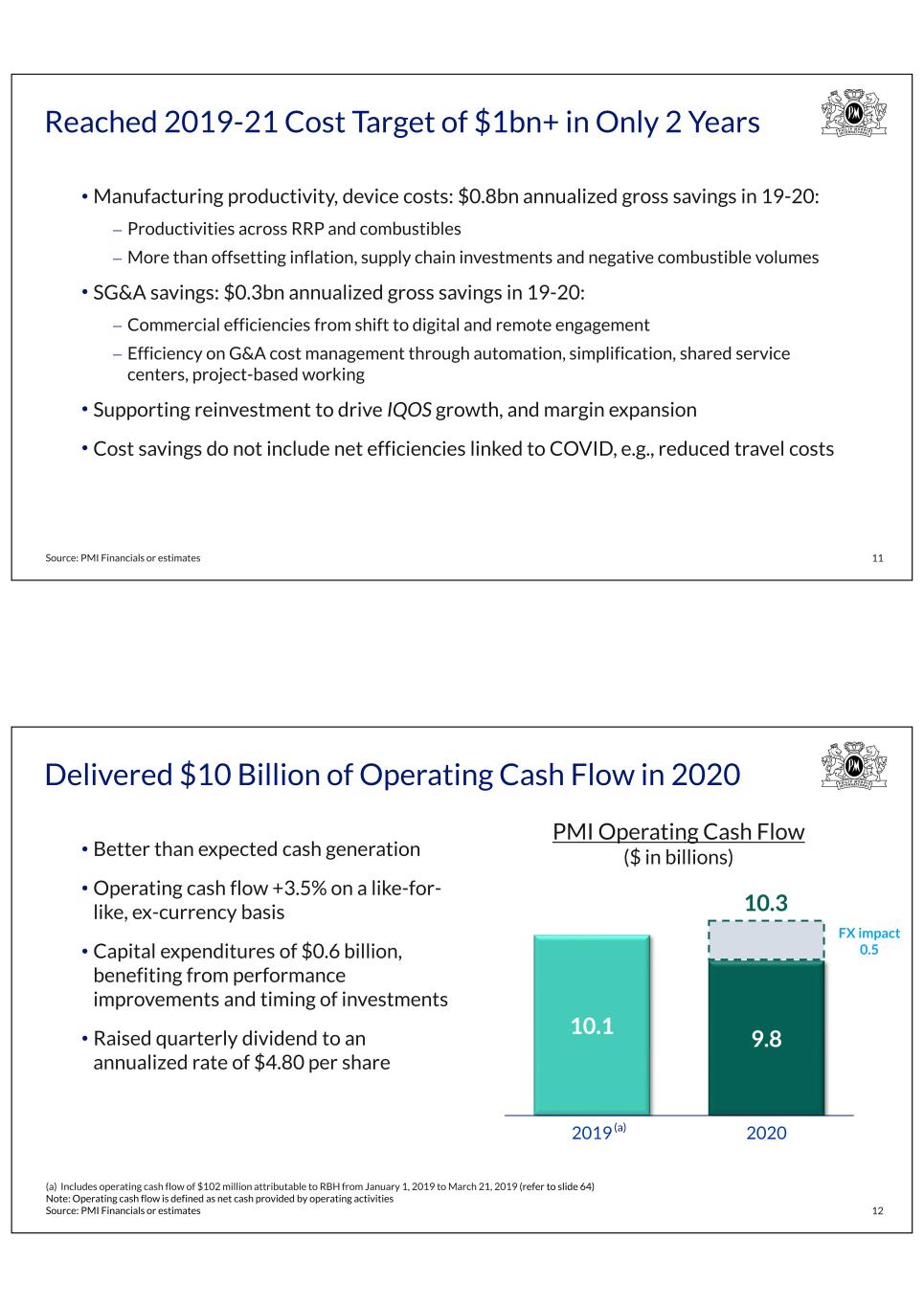

Reached 2019-21 Cost Target of $1bn+ in Only 2 Years • Manufacturing productivity, device costs: $0.8bn annualized gross savings in 19-20:⎼ Productivities across RRP and combustibles⎼ More than offsetting inflation, supply chain investments and negative combustible volumes • SG&A savings: $0.3bn annualized gross savings in 19-20:⎼ Commercial efficiencies from shift to digital and remote engagement⎼ Efficiency on G&A cost management through automation, simplification, shared service centers, project-based working • Supporting reinvestment to drive IQOS growth, and margin expansion • Cost savings do not include net efficiencies linked to COVID, e.g., reduced travel costs 11Source: PMI Financials or estimates Delivered $10 Billion of Operating Cash Flow in 2020 • Better than expected cash generation • Operating cash flow +3.5% on a like-for- like, ex-currency basis • Capital expenditures of $0.6 billion, benefiting from performance improvements and timing of investments • Raised quarterly dividend to an annualized rate of $4.80 per share (a) Includes operating cash flow of $102 million attributable to RBH from January 1, 2019 to March 21, 2019 (refer to slide 64) Note: Operating cash flow is defined as net cash provided by operating activities Source: PMI Financials or estimates 10.1 9.8 2019 2020 PMI Operating Cash Flow ($ in billions) 12 FX impact 0.5 10.3 (a)

Industry Volume Impacted by COVID 13 (a) Cigarettes and HTUs, excluding China and the U.S. Source: PMI Financials or estimates (2-3)% (5.8)% Average Historical Decline Total Industry Volume(a) (Change vs. PY) • Difference to historic trend largely attributable to COVID • Outsized impact on Duty-Free and markets with high number of daily wage workers • Expect daily consumption to gradually recover as pandemic recedes 2020 (a) Pro forma: excluding volume attributable to RBH from January 1, 2019 to March 21, 2019 Source: PMI Financials or estimates 14 705.7 628.5 59.7 76.1 765.4 704.6 FY, 2019 FY, 2020 Total PMI Shipment Volume (billion units) HTUs Cigarettes Total 27.6% (10.9)% (7.9)% 27.5% In-Market Sales (10.8)% (7.8)% Change vs. PY (a)

Well On Track to Deliver HTU Shipment Volume Target of 90 to 100 Billion Units in 2021 Source: PMI Financials or estimates 76 billion units in 2020 15 +27.6% vs. PY HTUs Now Comprise Over 10% of Total Volume (as a % of PMI Total Shipment Volume) 16Source: PMI Financials or estimates 0.0% 0.9% 4.5% 5.3% 7.8% 10.8% 2015 2016 2017 2018 2019 2020 7.4 59.7 PMI HTU Shipment Volume (billion units) 41.436.20.4 76.1 12.3% Q4 2020

Source: PMI Financials or estimates 17 Growing Contribution of IQOS to Net Revenues (as a % of Total PMI Net Revenues) 0.2% 2.7% 12.7% 13.8% 18.7% 23.8% 2015 2016 2017 2018 2019 2020 $0.7 $6.8$4.1$3.6$0.1 $5.6 RRP Net Revenues ($ in billions) 26.0% Q4 2020 PMI Total International Market Volume Share 18 +0.8pp (0.6)pp (0.5)pp (0.3)pp 28.4% 28.6% 27.7% 2019 2020 (a) HTUs include a (0.1)pp impact of Duty Free HTUs Note: Excluding China and the U.S. Current view (reflecting the deconsolidation of RBH, PMI’s total market share has been restated for previous periods). Sales volume of PMI cigarettes and HTUs as a percentage of the total industry sales volume for cigarettes and HTUs. Sum of the drivers does not foot due to rounding Source: PMI Financials or estimates Cigarettes excluding Duty Free and Indonesia Duty Free Cigarettes Indonesia HTUs (a)

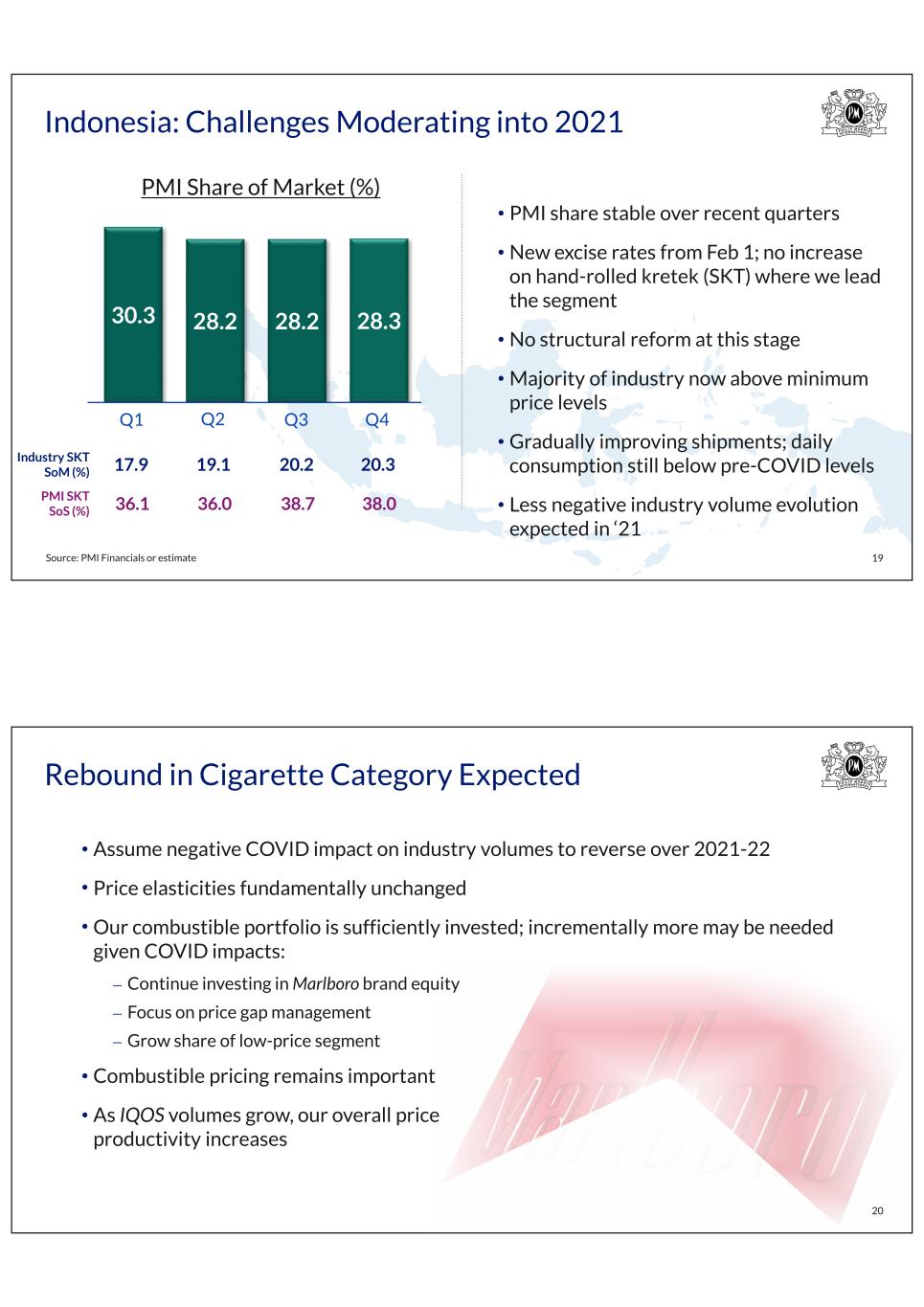

30.3 28.2 28.2 28.3 Indonesia: Challenges Moderating into 2021 19Source: PMI Financials or estimate • PMI share stable over recent quarters • New excise rates from Feb 1; no increase on hand-rolled kretek (SKT) where we lead the segment • No structural reform at this stage • Majority of industry now above minimum price levels • Gradually improving shipments; daily consumption still below pre-COVID levels • Less negative industry volume evolution expected in ‘21 PMI Share of Market (%) 74%75%78% Industry SKT SoM (%) PMI SKT SoS (%) 36.1 36.0 38.7 38.0 17.9 19.1 20.2 20.3 Q1 Q2 Q3 Q4 Rebound in Cigarette Category Expected • Assume negative COVID impact on industry volumes to reverse over 2021-22 • Price elasticities fundamentally unchanged • Our combustible portfolio is sufficiently invested; incrementally more may be needed given COVID impacts:⎼ Continue investing in Marlboro brand equity⎼ Focus on price gap management⎼ Grow share of low-price segment • Combustible pricing remains important • As IQOS volumes grow, our overall price productivity increases 20

(a) See Glossary for definition Source: PMI Financials or estimates, IQOS user panels and PMI Market Research Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Approaching 18 Million Users in 2020 21 20202019 0.8 0.8 1.0 1.3 0.9 0.9 1.1 1.2 Sequential Change vs. Previous Quarter Total IQOS Users(a) Estimated users who have switched to IQOS and stopped smoking(a) Estimated users who are in various stages of conversion(a) 17.6 16.4 15.3 14.4 13.5 12.2 11.2 10.4 70% 70% 71% 71% 73% 72% 72% 72% EU Region: Continued HEETS Share Growth 22 3.2% 3.9% 3.9% 3.9% 5.0% Q4 Q1 Q2 Q3 Q4 (a) Excluding the estimated impact of retailer inventory movements and consumer pantry loading (the latter primarily impacting Q1, 2020) Source: PMI Financials or estimates 10.8% Sequential Adjusted IMS Growth(a) 14.6%11.2%9.1%15.1% 20202019

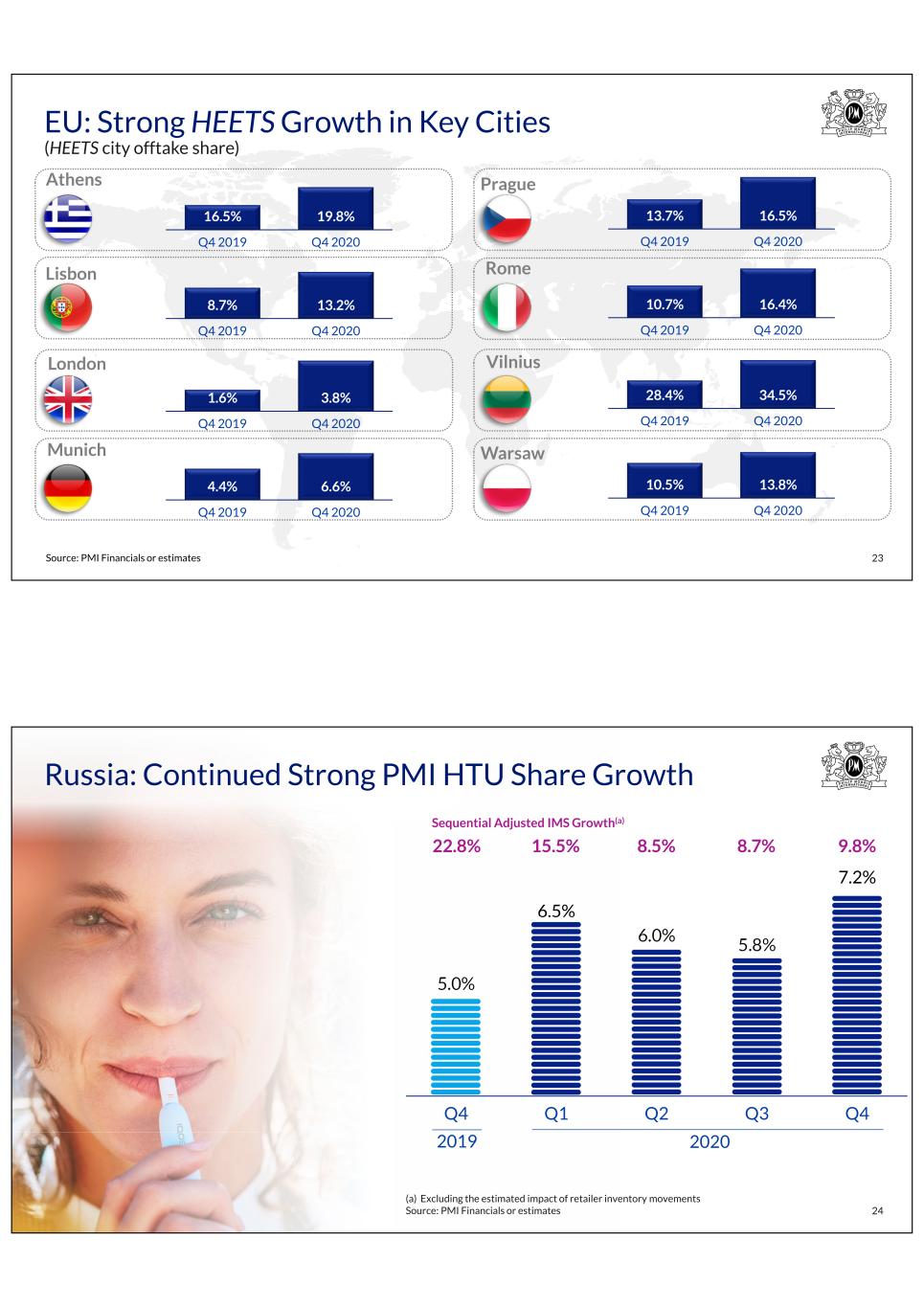

Source: PMI Financials or estimates EU: Strong HEETS Growth in Key Cities (HEETS city offtake share) 23 Munich London RomeLisbon PragueAthens Warsaw Vilnius 16.5% 19.8% Q4 2019 Q4 2020 8.7% 13.2% Q4 2019 Q4 2020 1.6% 3.8% Q4 2019 Q4 2020 4.4% 6.6% Q4 2019 Q4 2020 13.7% 16.5% Q4 2019 Q4 2020 10.7% 16.4% Q4 2019 Q4 2020 28.4% 34.5% Q4 2019 Q4 2020 10.5% 13.8% Q4 2019 Q4 2020 (a) Excluding the estimated impact of retailer inventory movements Source: PMI Financials or estimates Russia: Continued Strong PMI HTU Share Growth 24 5.0% 6.5% 6.0% 5.8% 7.2% Q4 Q1 Q2 Q3 Q4 9.8% Sequential Adjusted IMS Growth(a) 8.7%8.5%15.5%22.8% 20202019

(a) Estimated underlying offtake share Source: PMI Financials or estimates Eastern Europe: Excellent Share in Key Cities (PMI HTU city offtake share) 25 Kiev MoscowAlmaty (a) TbilisiMinsk Sarajevo 13.1% 17.4% Q4 2019 Q4 2020 13.6% 22.8% Q4 2019 Q4 2020 2.3% 5.9% Q4 2019 Q4 2020 13.5% 14.6% Q4 2019 Q4 2020 3.6% 8.6% Q4 2019 Q4 2020 6.1% Q4 2020 17.7% 19.1% 20.2% 20.4% 22.1% Q4 Q1 Q2 Q3 Q4 (a) Excluding the impact of estimated trade inventory movements, and including the cigarillo category Source: PMI Financials or estimates Japan: Continuing PMI HTU Share Growth 26 20.0% Adjusted SoM(a) 18.8%18.7%17.8%17.1% 20202019

(a) Japan total market includes the cigarillo category Note: Kuala L. is Kuala Lumpur Source: PMI Financials or estimates East Asia: Strong Traction in Key Cities (PMI HTU city offtake share) 27 Tokyo(a) Seoul Sendai(a) Kuala L. 20.6% 24.9% Q4 2019 Q4 2020 21.2% 24.6% Q4 2019 Q4 2020 9.5% 10.0% Q4 2019 Q4 2020 7.9% 12.1% Q4 2019 Q4 2020 IQOS Geographic Expansion 28 Market Launches 2019 (8) 2015 (7) 2016 (13) 2017 (18) 2018 (6) 2020 (12) (a) Status at December 31, 2020 Note: Reflects markets where IQOS is available in key cities or nationwide. Reflects date of initial geographic expansion beyond pilot launch city. The number of markets includes International Duty Free. While IQOS is currently available for sale in Mexico, the country has banned the importation of e-cigarettes and devices that heat tobacco 64 Markets Worldwide(a) Of which 33 Non-OECD

Rolling Out IQOS VEEV • Czech Republic first EU launch in December 2020 • Entering further markets in 2021 including Italy and Finland in coming weeks • Leveraging IQOS commercial infrastructure • Premium-positioned devices and cartridges • Testing age verification technology 29 Major Sustainability Milestones in 2020 Product • 12.7 million legal-age smokers switched to IQOS and stopped smoking • Pioneering role in Tobacco harm reduction • Outperformed on DJSI(a), leading on technology and innovation Environment • CDP Triple-A rated • Validation of new science based targets with the 1.5°C scenario (SBTi(b)) • Well on track to achieving carbon neutrality (scope 1+2) by 2030 Social • 100% of PMI’s portfolio of electronic smoke-free devices to be equipped with age-verification technology by 2023 • DJSI(a) leading on human rights • Included in Bloomberg Gender Equality Index Governance • Appointment of Chief Diversity Officer, reporting to CEO • Sustainability moves under Finance, reporting to CFO • Statement of Purpose, issued by BoD • Issued first Integrated Report 30 (a) Dow Jones Sustainability Index (b) Science Based Targets initiative, 1.5°C scenario refers to setting net-zero carbon emissions targets in line with limiting global average temperatures to 1.5°C above pre-industrial levels

v Source: PMI Financials or estimates Significant Recovery Expected in 2021 (Organic basis) • Adjusted diluted EPS range of $5.90 to $6.00, representing 14-16% growth in dollar terms:⎼ Includes an estimated favorable currency impact of approximately 25 cents at prevailing rates⎼ Does not assume share repurchases 31 FY 2021 Net Revenue Growth 4-7% Adjusted OI Margin Expansion ≥150bps Adjusted Diluted EPS Growth 9-11% HTU Shipment Volume 90-100 billion v Note: Operating cash flow is defined as net cash provided by operating activities Source: PMI Financials or estimates 2021: Key Assumptions 32 Total Industry Volume Flat to -3% PMI Total Shipment Volume +1% to -2% Effective Tax Rate ~22% Operating Cash Flow ~$11.0 bn Capital Expenditures ~$0.8 bn

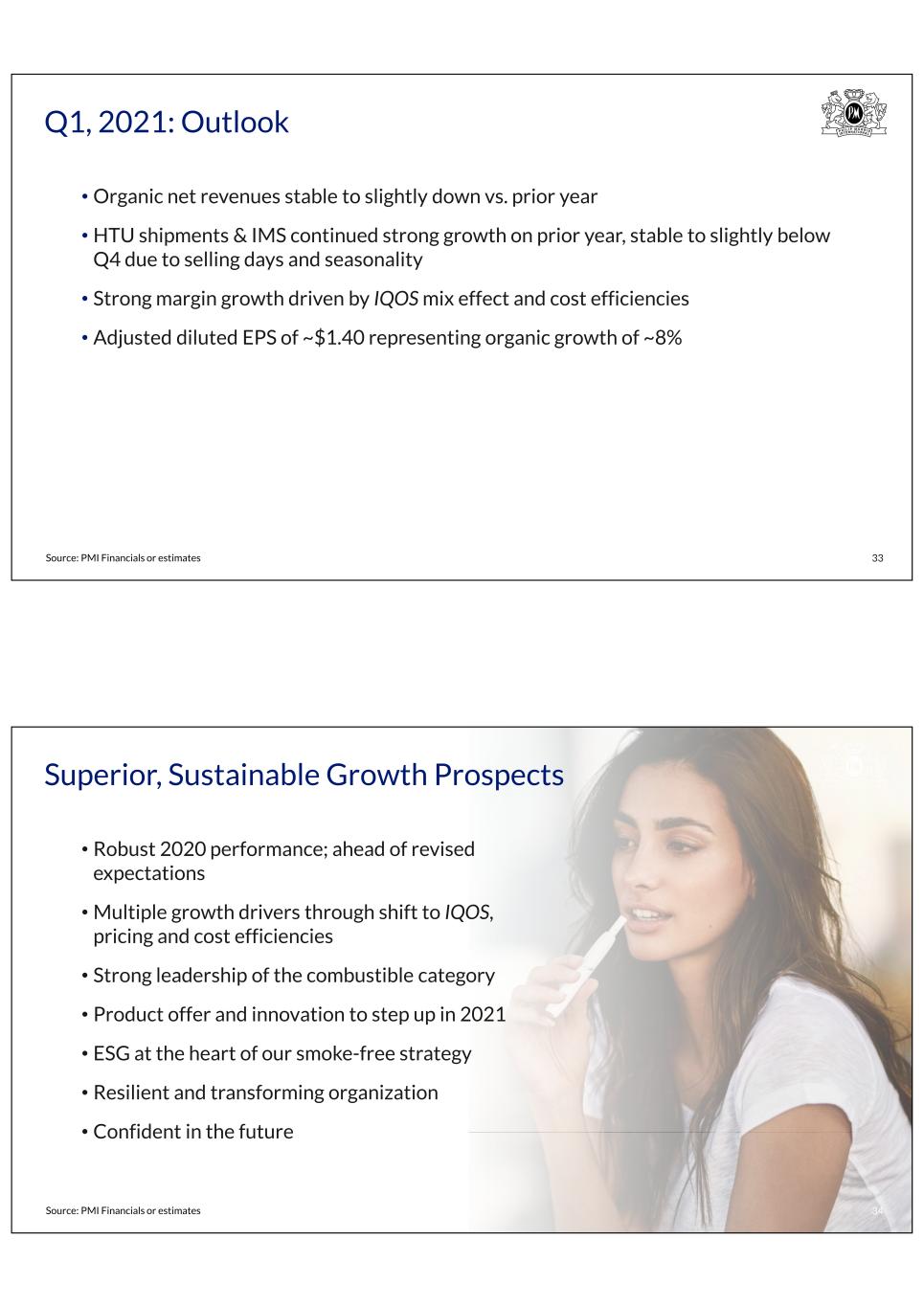

Source: PMI Financials or estimates Q1, 2021: Outlook • Organic net revenues stable to slightly down vs. prior year • HTU shipments & IMS continued strong growth on prior year, stable to slightly below Q4 due to selling days and seasonality • Strong margin growth driven by IQOS mix effect and cost efficiencies • Adjusted diluted EPS of ~$1.40 representing organic growth of ~8% 33 Superior, Sustainable Growth Prospects • Robust 2020 performance; ahead of revised expectations • Multiple growth drivers through shift to IQOS, pricing and cost efficiencies • Strong leadership of the combustible category • Product offer and innovation to step up in 2021 • ESG at the heart of our smoke-free strategy • Resilient and transforming organization • Confident in the future 34Source: PMI Financials or estimates

Delivering a Smoke-Free Future 2020 Fourth-Quarter and Full-Year Results Questions & Answers Delivering a Smoke-Free Future 2020 Fourth-Quarter and Full-Year Results February 4, 2021

37 Glossary of Key Terms and Definitions, Appendix, and Reconciliation of Non-GAAP Measures Glossary: General Terms • "PMI" refers to Philip Morris International Inc. and its subsidiaries • Until March 28, 2008, PMI was a wholly owned subsidiary of Altria Group, Inc. ("Altria"). Since that time the company has been independent and is listed on the New York Stock Exchange (ticker symbol "PM") • "RBH" refers to PMI’s Canadian subsidiary, Rothmans, Benson & Hedges Inc. • The Companies’ Creditors Arrangement Act (CCAA) is a Canadian federal law that permits a Canadian business to restructure its affairs while carrying on its business in the ordinary course • Trademarks are italicized • Comparisons are made to the same prior-year period unless otherwise stated • Unless otherwise stated, references to total industry, total market, PMI shipment volume and PMI market share performance reflect cigarettes and heated tobacco units • References to total international market, defined as worldwide cigarette and heated tobacco unit volume excluding the U.S., total industry, total market and market shares are PMI estimates for tax-paid products based on the latest available data from a number of internal and external sources and may, in defined instances, exclude the People's Republic of China and/or PMI's duty free business. In addition, to reflect the deconsolidation of PMI's Canadian subsidiary, Rothmans, Benson & Hedges, Inc. (RBH), effective March 22, 2019, PMI's total market share has been restated for previous periods • 2020 estimates for total industry volume and market share in certain geographies reflect limitations on the availability and accuracy of industry data during pandemic-related restrictions • "OTP" is defined as "other tobacco products," primarily roll-your-own and make-your-own cigarettes, pipe tobacco, cigars and cigarillos, and does not include reduced-risk products • "Combustible products" is the term PMI uses to refer to cigarettes and OTP, combined • In-market sales, or "IMS," is defined as sales to the retail channel, depending on the market and distribution model • "Total shipment volume" is defined as the combined total of cigarette shipment volume and heated tobacco unit shipment volume 38

Glossary: General Terms (cont.) • "EU" is defined as the European Union Region • "EE" is defined as the Eastern Europe Region • "ME&A" is defined as the Middle East & Africa Region and includes PMI's duty free business • "S&SA" is defined as the South & Southeast Asia Region • "EA&A" is defined as the East Asia & Australia Region • "LA&C" is defined as the Latin America & Canada Region • Following the deconsolidation of PMI's Canadian subsidiary, Rothmans, Benson & Hedges, Inc. (RBH), PMI will continue to report the volume of brands sold by RBH for which other PMI subsidiaries are the trademark owner. These include HEETS, Next, Philip Morris and Rooftop • From time to time, PMI’s shipment volumes are subject to the impact of distributor inventory movements, and estimated total industry/market volumes are subject to the impact of inventory movements in various trade channels that include estimated trade inventory movements of PMI’s competitors arising from market-specific factors that significantly distort reported volume disclosures. Such factors may include changes to the manufacturing supply chain, shipment methods, consumer demand, timing of excise tax increases or other influences that may affect the timing of sales to customers. In such instances, in addition to reviewing PMI shipment volumes and certain estimated total industry/market volumes on a reported basis, management reviews these measures on an adjusted basis that excludes the impact of distributor and/or estimated trade inventory movements. Management also believes that disclosing PMI shipment volumes and estimated total industry/market volumes in such circumstances on a basis that excludes the impact of distributor and/or estimated trade inventory movements, such as on an IMS basis, improves the comparability of performance and trends for these measures over different reporting periods • "Illicit trade" refers to domestic non-tax paid products • "SoM" stands for share of market • "ESG" stands for environmental, social, and governance • "OECD" is defined as Organisation for Economic Co-operation and Development 39 Glossary: Financial Terms • Net revenues related to combustible products refer to the operating revenues generated from the sale of these products, including shipping and handling charges billed to customers, net of sales and promotion incentives, and excise taxes. PMI recognizes revenue when control is transferred to the customer, typically either upon shipment or delivery of goods • Net revenues related to RRPs represent the sale of heated tobacco units, heat-not-burn devices and related accessories, and other nicotine- containing products, primarily e-vapor products, including shipping and handling charges billed to customers, net of sales and promotion incentives, and excise taxes. PMI recognizes revenue when control is transferred to the customer, typically either upon shipment or delivery of goods • "SG&A" stands for selling, general & administrative • "Adjusted Operating Income (OI) Margin" is calculated as adjusted OI, divided by net revenues • "Net debt" is defined as total debt, less cash and cash equivalents • Growth rates presented on an organic basis for consolidated financial results reflect currency-neutral underlying results and "like-for-like" comparisons, where applicable • Management reviews net revenues, OI, OI margins, operating cash flow and earnings per share, or "EPS," on an adjusted basis, which may exclude the impact of currency and other items such as acquisitions, asset impairment and exit costs, tax items and other special items. Organic growth rates reflect the way management views underlying performance for these measures. PMI believes that such measures, including pro forma measures, will provide useful insight into underlying business trends and results, and will provide a more meaningful performance comparison for the period during which RBH remains under CCAA protection. For PMI's 2018 pro forma adjusted diluted EPS by quarter and year-to-date, see Schedule 3 in PMI’s third-quarter 2019 earnings release • "Fair value adjustment for equity security investments" reflects the adjustment resulting from share price movements in passive investments for publicly traded entities that are not controlled or influenced by PMI. Under U.S. GAAP, such adjustments are required, since January 1, 2018, to be reflected directly in the income statement 40

Glossary: Reduced-Risk Products • "Reduced-risk products," or "RRPs," is the term PMI uses to refer to products that present, are likely to present, or have the potential to present less risk of harm to smokers who switch to these products versus continuing smoking. PMI has a range of RRPs in various stages of development, scientific assessment and commercialization. PMI RRPs are smoke-free products that produce an aerosol that contains far lower quantities of harmful and potentially harmful constituents than found in cigarette smoke • "Aerosol" refers to a gaseous suspension of fine solid particles and/or liquid droplets • "Combustion" is the process of burning a substance in oxygen, producing heat and often light • "Smoke" is a visible suspension of solid particles, liquid droplets and gases in air, emitted when a material burns • "Heated tobacco units," or "HTUs," is the term PMI uses to refer to heated tobacco consumables, which for PMI include the company's HEETS, HEETS Creations, HEETS Dimensions, HEETS Marlboro and HEETS FROM MARLBORO (defined collectively as HEETS), Marlboro Dimensions, Marlboro HeatSticks and Parliament HeatSticks, as well as the KT&G-licensed brand, Fiit and Miix (outside of Korea) • The IQOS heat-not-burn device is a precisely controlled heating device into which a specially designed and proprietary tobacco unit is inserted and heated to generate an aerosol • “PMI heat-not-burn products” include licensed KT&G heat-not-burn products • “PMI HTUs” include licensed KT&G HTUs • HTU "offtake volume" represents the estimated retail offtake of HTUs based on a selection of sales channels that vary by market, but notably include retail points of sale and e-commerce platforms • HTU "offtake share" represents the estimated retail offtake volume of HTUs divided by the sum of estimated total offtake volume for cigarettes and HTUs • Market share for HTUs is defined as the total sales volume for HTUs as a percentage of the total estimated sales volume for cigarettes and HTUs • “Total IQOS users” is defined as the estimated number of Legal Age (minimum 18 years) users of PMI heat-not-burn products for which PMI HTUs represented at least 5% of their daily tobacco consumption over the past seven days. Note: as of December 2020, PMI heat- not-burn products and HTUs include licensed KT&G heat-not-burn products and HTUs, respectively 41 Glossary: Reduced-Risk Products (cont.) • The estimated number of adults who have "switched to IQOS and stopped smoking“ reflects:⎼ for markets where there are no heat-not-burn products other than PMI heat-not-burn products: daily individual consumption of PMI HTUs represents the totality of their daily tobacco consumption in the past seven days⎼ for markets where PMI heat-not-burn products are among other heat-not-burn products: daily individual consumption of HTUs represents the totality of their daily tobacco consumption in the past seven days, of which at least 70% is PMI HTUs Note: as of December 2020, PMI heat-not-burn products and HTUs include licensed KT&G heat-not-burn products and HTUs, respectively • "FDA" stands for the U.S. Food & Drug Administration • "MRTP" stands for Modified Risk Tobacco Product, the term used by the U.S. FDA to refer to RRPs • "MRTP application" stands for Modified Risk Tobacco Product application under section 911 of the FD&C Act • "PMTA" stands for Premarket Tobacco Application under section 910 of the FD&C Act 42

Glossary: IQOS in the United States • On April 30, 2019, the U.S. Food and Drug Administration (FDA) announced that the marketing of a version of PMI's Platform 1 product, namely, IQOS 2.4, together with its heated tobacco units (the term PMI uses to refer to heated tobacco consumables), is appropriate for the protection of public health and authorized it for sale in the U.S. The FDA’s decision followed its comprehensive assessment of PMI’s premarket tobacco product applications (PMTAs) submitted to the Agency in 2017 • In the third quarter of 2019, PMI brought IQOS 2.4 and three variants of its heated tobacco units to the U.S. through its license with Altria Group, Inc., whose subsidiary, Philip Morris USA Inc., is responsible for marketing the product and complying with the provisions set forth in the FDA's marketing orders • On July 7, 2020, the FDA authorized the marketing of a version of PMI's Platform 1 product, namely, IQOS 2.4, together with its heated tobacco units, as a Modified Risk Tobacco Product (MRTP). In doing so, the agency found that an IQOS exposure modification order is appropriate to promote the public health. The decision followed a review of the extensive scientific evidence package PMI submitted to the FDA in December 2016 to support its MRTP applications • On December 7, 2020, the FDA confirmed that the marketing of a version of PMI's Platform 1 product, namely, IQOS 3, is appropriate for the protection of public health and authorized it for sale in the U.S. The FDA’s decision followed an assessment of a PMI's PMTA filed with the agency in March 2020 • Shipment volume of heated tobacco units to the U.S. is included in the heated tobacco unit shipment volume of the Latin America & Canada segment. Revenues from shipments of Platform 1 devices, heated tobacco units and accessories to Altria Group, Inc. for sale under license in the U.S. are included in Net Revenues of the Latin America & Canada segment 43 Key Cities Provide Excellent Base for Growth 44 (a) Japan total market includes the cigarillo category Note: Kuala L. is Kuala Lumpur Source: PMI Financials or estimates 34.5% 24.9% 22.8% 19.8% 17.1% 16.5% 16.4% 14.6% 13.8% Vilnius Tokyo Kiev Athens Bratislava Prague Rome Moscow Warsaw 13.2% 12.1% 11.7% 10.0% 6.6% 6.3% 6.0% 3.8% 2.1% Lisbon Kuala L. Milan Seoul Munich Zurich Bucharest London Madrid +6.1pp +3.3pp +3.9pp +2.8pp +5.7pp +3.3pp +4.5pp +0.5pp +2.2pp +3.0pp +0.8pp +0.6pp PMI HTU Offtake Shares (Q4, 2020) +2.2pp +1.1pp Change vs. PY (a) +4.3pp +9.2pp +4.2pp +3.4pp

Key Cities Provide Excellent Base for Growth 45 (a) Japan total market includes the cigarillo category Note: Kuala L. is Kuala Lumpur Source: PMI Financials or estimates 30.7% 23.3% 18.4% 17.6% 15.3% 15.5% 14.5% 14.0% 12.1% Vilnius Tokyo Kiev Athens Bratislava Prague Moscow Rome Warsaw 11.1% 10.1% 10.0% 9.9% 6.2% 5.8% 5.0% 2.9% 1.9% Lisbon Milan Kuala L. Seoul Munich Bucharest Zurich London Madrid +7.6pp +3.7pp +2.5pp +2.7pp +3.7pp +4.6pp +3.4pp (0.1)pp +2.6pp +0.8pp +2.2pp +0.6pp PMI HTU Offtake Shares (FY, 2020) +1.9pp +5.3pp Change vs. PY (a) +2.9pp +6.9pp +3.7pp +3.5pp EU Region: HEETS SoM Performance in Select Markets Note: Select markets where HEETS share is ≥ 1%. Sales volume of PMI HTUs as a percentage of the total industry sales volume for cigarettes and HTUs Source: PMI Financials or estimates 46 Q4, 2020 Growth vs. PY Q4, 2020 Growth vs. PY Q4, 2020 Growth vs. PY Croatia 5.8% +1.8pp Italy 9.6% +3.5pp Romania 3.3% +0.9pp Czech Republic 10.2 +3.0 Latvia 14.7 +7.0 Slovak Republic 10.2 +2.7 Germany 2.6 +1.0 Lithuania 22.8 +5.3 Slovenia 6.3 +2.6 Greece 13.1 +2.6 Poland 7.4 +3.6 Switzerland 4.6 +1.7 Hungary 13.3 +9.0 Portugal 10.9 +3.6 UK 1.8 +1.2

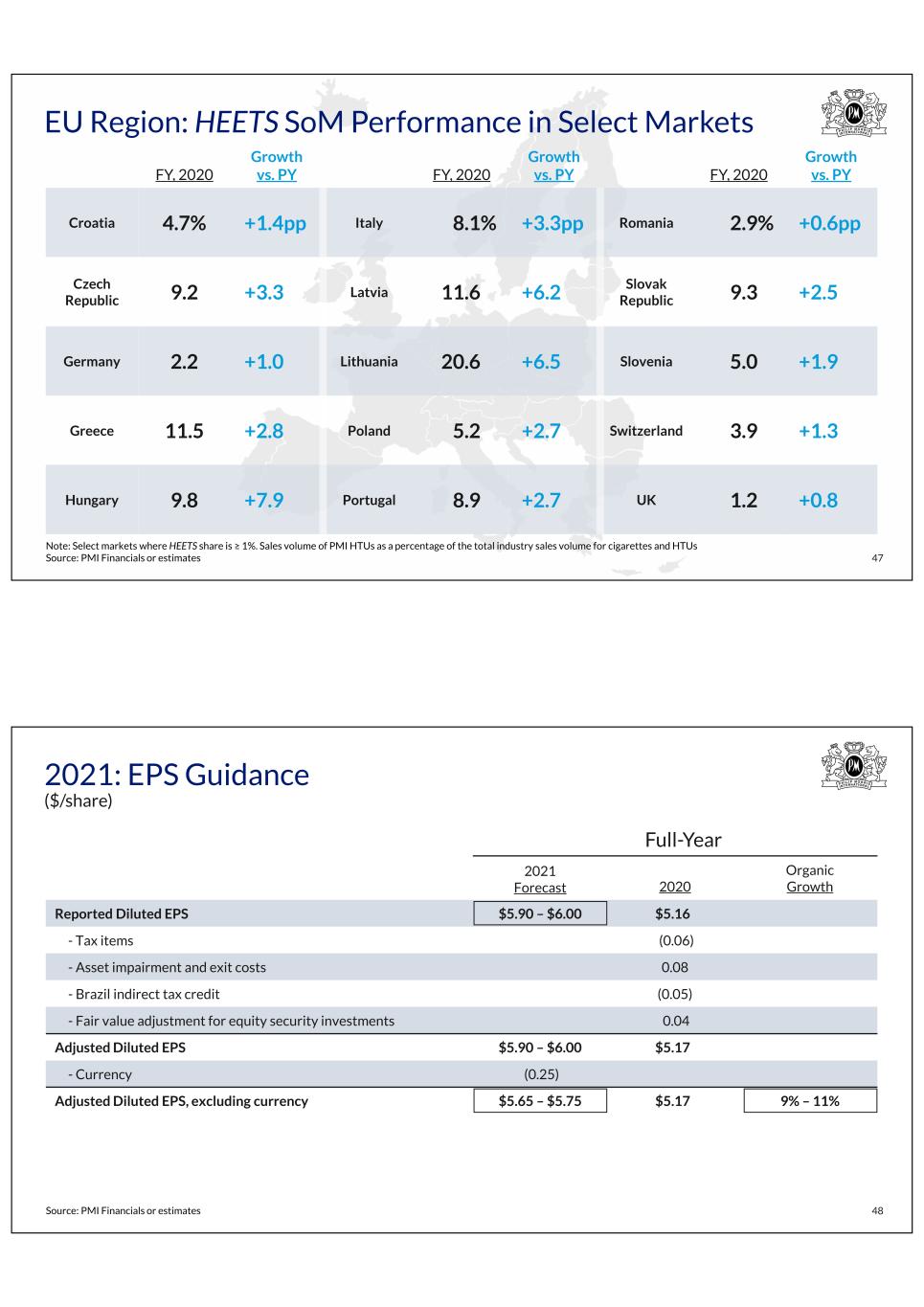

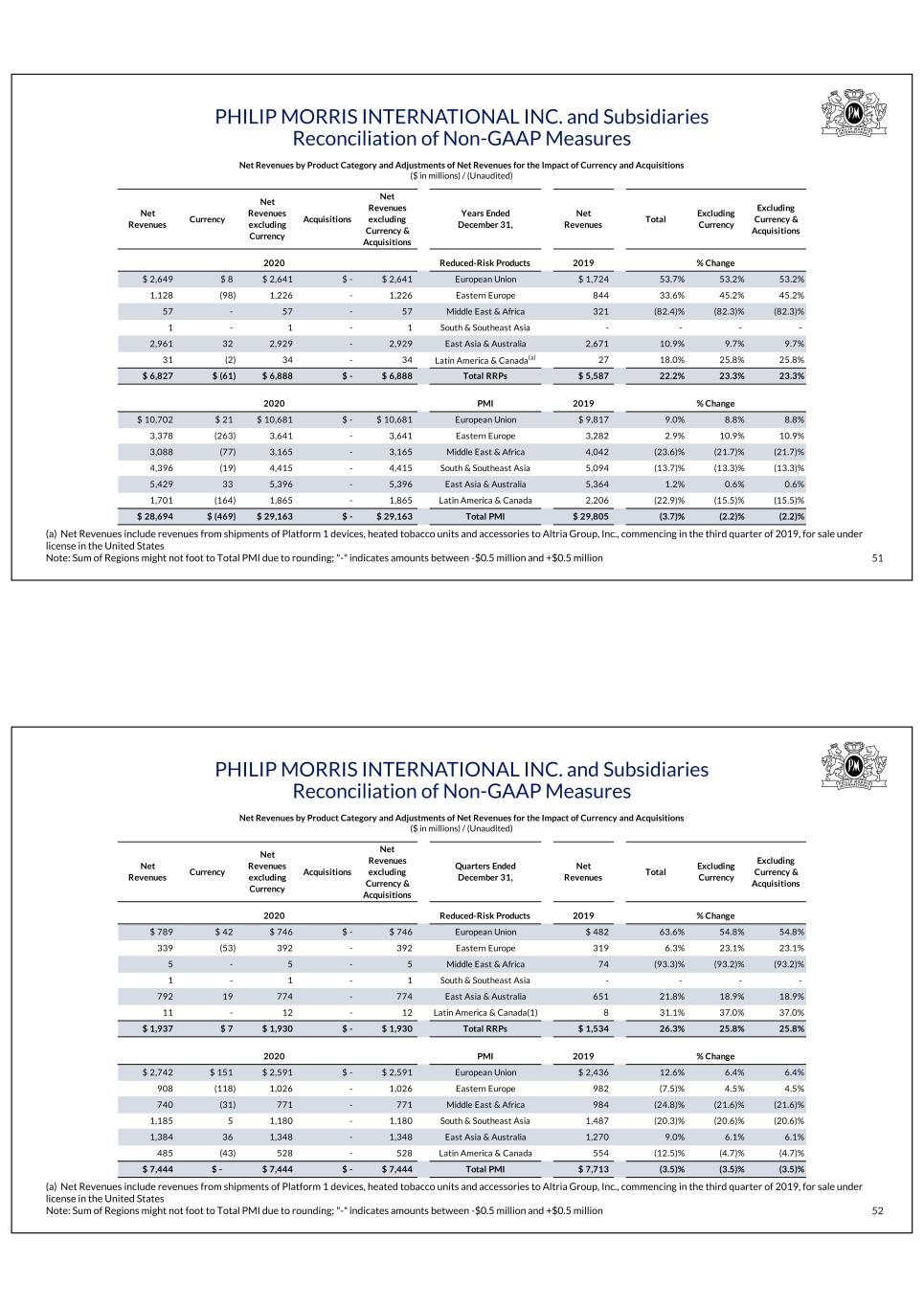

EU Region: HEETS SoM Performance in Select Markets Note: Select markets where HEETS share is ≥ 1%. Sales volume of PMI HTUs as a percentage of the total industry sales volume for cigarettes and HTUs Source: PMI Financials or estimates 47 FY, 2020 Growth vs. PY FY, 2020 Growth vs. PY FY, 2020 Growth vs. PY Croatia 4.7% +1.4pp Italy 8.1% +3.3pp Romania 2.9% +0.6pp Czech Republic 9.2 +3.3 Latvia 11.6 +6.2 Slovak Republic 9.3 +2.5 Germany 2.2 +1.0 Lithuania 20.6 +6.5 Slovenia 5.0 +1.9 Greece 11.5 +2.8 Poland 5.2 +2.7 Switzerland 3.9 +1.3 Hungary 9.8 +7.9 Portugal 8.9 +2.7 UK 1.2 +0.8 Source: PMI Financials or estimates 2021: EPS Guidance ($/share) 48 Full-Year ≥ 2021 Forecast 2020 Organic Growth Reported Diluted EPS $5.90 – $6.00 $5.16 - Tax items (0.06) - Asset impairment and exit costs 0.08 - Brazil indirect tax credit (0.05) - Fair value adjustment for equity security investments 0.04 Adjusted Diluted EPS $5.90 – $6.00 $5.17 - Currency (0.25) Adjusted Diluted EPS, excluding currency $5.65 – $5.75 $5.17 9% – 11%

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures 49 Reconciliation of Reported Diluted EPS to Reported Diluted EPS, excluding Currency, and Reconciliation of Reported Diluted EPS to Adjusted Diluted EPS, excluding Currency (Unaudited) Quarters Ended December 31, 2020 2019 % Change 2020 2019 % Change $ 1.27 $ 1.04 22.1% Reported Diluted EPS $ 5.16 $ 4.61 11.9% (0.05) Less: Currency (0.32) $ 1.32 $ 1.04 26.9% Reported Diluted EPS, excluding Currency $ 5.48 $ 4.61 18.9% Quarters Ended December 31, 2020 2019 % Change 2020 2019 % Change $ 1.27 $ 1.04 22.1% Reported Diluted EPS $ 5.16 $ 4.61 11.9% 0.04 0.20 Asset impairment and exit costs 0.08 0.23 - - Canadian tobacco litigation-related expense - 0.09 - - Loss on deconsolidation of RBH - 0.12 - - Russia excise and VAT audit charge - 0.20 (0.05) - Brazil indirect tax credit (0.05) - - (0.02) Fair value adjustment for equity security investments 0.04 (0.02) - - Tax items (0.06) (0.04) $ 1.26 $ 1.22 3.3% Adjusted Diluted EPS $ 5.17 $ 5.19 (0.4)% (0.05) Less: Currency (0.32) $ 1.31 $ 1.22 7.4% Adjusted Diluted EPS, excluding Currency $ 5.49 $ 5.19 5.8% Years Ended December 31, Years Ended December 31, PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures 50 Years Ended December 31, 2020 2019 % Change Adjusted Diluted EPS $ 5.17 $ 5.19 (0.4)% Net earnings attributable to RBH (0.06) Adjusted Diluted EPS $ 5.17 $ 5.13 0.8% Currency (0.32) Adjusted Diluted EPS, excluding Currency $ 5.49 $ 5.13 7.0% (a) For the calculation, see previous slide (b) Represents the impact attributable to RBH from January 1, 2019 to March 21, 2019 (c) Pro forma Adjustments for the Impact of RBH, excluding Currency (Unaudited) (c) (c) (a) (b)

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Net Revenues by Product Category and Adjustments of Net Revenues for the Impact of Currency and Acquisitions ($ in millions) / (Unaudited) 51 (a) Net Revenues include revenues from shipments of Platform 1 devices, heated tobacco units and accessories to Altria Group, Inc., commencing in the third quarter of 2019, for sale under license in the United States Note: Sum of Regions might not foot to Total PMI due to rounding; "-" indicates amounts between -$0.5 million and +$0.5 million Net Revenues Currency Net Revenues excluding Currency Acquisitions Net Revenues excluding Currency & Acquisitions Years Ended December 31, Net Revenues Total Excluding Currency Excluding Currency & Acquisitions 2020 Reduced-Risk Products 2019 % Change $ 2,649 $ 8 $ 2,641 $ - $ 2,641 European Union $ 1,724 53.7% 53.2% 53.2% 1,128 (98) 1,226 - 1,226 Eastern Europe 844 33.6% 45.2% 45.2% 57 - 57 - 57 Middle East & Africa 321 (82.4)% (82.3)% (82.3)% 1 - 1 - 1 South & Southeast Asia - - - - 2,961 32 2,929 - 2,929 East Asia & Australia 2,671 10.9% 9.7% 9.7% 31 (2) 34 - 34 Latin America & Canada(a) 27 18.0% 25.8% 25.8% $ 6,827 $ (61) $ 6,888 $ - $ 6,888 Total RRPs $ 5,587 22.2% 23.3% 23.3% 2020 PMI 2019 % Change $ 10,702 $ 21 $ 10,681 $ - $ 10,681 European Union $ 9,817 9.0% 8.8% 8.8% 3,378 (263) 3,641 - 3,641 Eastern Europe 3,282 2.9% 10.9% 10.9% 3,088 (77) 3,165 - 3,165 Middle East & Africa 4,042 (23.6)% (21.7)% (21.7)% 4,396 (19) 4,415 - 4,415 South & Southeast Asia 5,094 (13.7)% (13.3)% (13.3)% 5,429 33 5,396 - 5,396 East Asia & Australia 5,364 1.2% 0.6% 0.6% 1,701 (164) 1,865 - 1,865 Latin America & Canada 2,206 (22.9)% (15.5)% (15.5)% $ 28,694 $ (469) $ 29,163 $ - $ 29,163 Total PMI $ 29,805 (3.7)% (2.2)% (2.2)% 52 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Net Revenues by Product Category and Adjustments of Net Revenues for the Impact of Currency and Acquisitions ($ in millions) / (Unaudited) (a) Net Revenues include revenues from shipments of Platform 1 devices, heated tobacco units and accessories to Altria Group, Inc., commencing in the third quarter of 2019, for sale under license in the United States Note: Sum of Regions might not foot to Total PMI due to rounding; "-" indicates amounts between -$0.5 million and +$0.5 million Net Revenues Currency Net Revenues excluding Currency Acquisitions Net Revenues excluding Currency & Acquisitions Quarters Ended December 31, Net Revenues Total Excluding Currency Excluding Currency & Acquisitions 2020 Reduced-Risk Products 2019 % Change $ 789 $ 42 $ 746 $ - $ 746 European Union $ 482 63.6% 54.8% 54.8% 339 (53) 392 - 392 Eastern Europe 319 6.3% 23.1% 23.1% 5 - 5 - 5 Middle East & Africa 74 (93.3)% (93.2)% (93.2)% 1 - 1 - 1 South & Southeast Asia - - - - 792 19 774 - 774 East Asia & Australia 651 21.8% 18.9% 18.9% 11 - 12 - 12 Latin America & Canada(1) 8 31.1% 37.0% 37.0% $ 1,937 $ 7 $ 1,930 $ - $ 1,930 Total RRPs $ 1,534 26.3% 25.8% 25.8% 2020 PMI 2019 % Change $ 2,742 $ 151 $ 2,591 $ - $ 2,591 European Union $ 2,436 12.6% 6.4% 6.4% 908 (118) 1,026 - 1,026 Eastern Europe 982 (7.5)% 4.5% 4.5% 740 (31) 771 - 771 Middle East & Africa 984 (24.8)% (21.6)% (21.6)% 1,185 5 1,180 - 1,180 South & Southeast Asia 1,487 (20.3)% (20.6)% (20.6)% 1,384 36 1,348 - 1,348 East Asia & Australia 1,270 9.0% 6.1% 6.1% 485 (43) 528 - 528 Latin America & Canada 554 (12.5)% (4.7)% (4.7)% $ 7,444 $ - $ 7,444 $ - $ 7,444 Total PMI $ 7,713 (3.5)% (3.5)% (3.5)%

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures 53 Adjustments for the Impact of RBH, excluding Currency ($ in millions) / (Unaudited) (a) Represents the impact attributable to RBH from January 1, 2019 to March 21, 2019 (b) Pro forma (a) % Change % Change Net Revenues $ 7,444 $ 7,713 (3.5)% $ 28,694 $ 29,805 (3.7)% Net Revenues attributable to RBH - (181) Net Revenues $ 7,444 $ 7,713 (3.5)% $ 28,694 $ 29,624 (3.1)% Less: Currency - (470) Net Revenues, ex. currency $ 7,444 $ 7,713 (3.5)% $ 29,164 $ 29,624 (1.6)% Quarters Ended December 31, Years Ended December 31, 2020 2019 2020 2019 (b) (b) PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Operating Income to Adjusted Operating Income, excluding Currency and Acquisitions ($ in millions) / (Unaudited) 54 (a) Represents asset impairment and exit costs (b) Includes the Brazil indirect tax credit $119 million and asset impairment and exit costs ($9 million) (c) Represents the Russia excise and VAT audit charge (d) Includes asset impairment and exit costs ($60 million), the Canadian tobacco litigation-related expense ($194 million) and the loss on deconsolidation of RBH ($239 million) Operating Income Asset Impairment & Exit Costs and Others Adjusted Operating Income Currency Adjusted Operating Income excluding Currency Acqui- sitions Adjusted Operating Income excluding Currency & Acqui- sitions Operating Income Asset Impairment & Exit Costs and Others Adjusted Operating Income Total Excluding Currency Excluding Currency & Acqui- sitions 2020 2019 $ 5,098 $ (57) $ 5,155 $ (24) $ 5,179 $ - $ 5,179 European Union $ 3,970 $ (342) $ 4,312 19.6% 20.1% 20.1% 871 (15) 886 (299) 1,185 - 1,185 Eastern Europe 547 (374) 921 (3.8)% 28.7% 28.7% 1,026 (19) 1,045 (65) 1,110 - 1,110 Middle East & Africa 1,684 - 1,684 (37.9)% (34.1)% (34.1)% 1,709 (23) 1,732 2 1,730 - 1,730 South & Southeast Asia 2,163 (20) 2,183 (20.7)% (20.8)% (20.8)% 2,400 (26) 2,426 21 2,405 - 2,405 East Asia & Australia 1,932 - 1,932 25.6% 24.5% 24.5% 564 110 454 (110) 564 - 564 Latin America & Canada 235 (493) 728 (37.6)% (22.5)% (22.5)% $ 11,668 $ (30) $ 11,698 $ (475) $ 12,173 $ - $ 12,173 Total PMI $ 10,531 $ (1,229) $ 11,760 (0.5)% 3.5% 3.5% % Change Years Ended December 31, (b) (a) (a) (a) (a) (a) (a) (c) (a) (d)

55 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Operating Income to Adjusted Operating Income, excluding Currency and Acquisitions ($ in millions) / (Unaudited) Operating Income Asset Impairment & Exit Costs and Others Adjusted Operating Income Currency Adjusted Operating Income excluding Currency Acqui- sitions Adjusted Operating Income excluding Currency & Acqui- sitions Operating Income Asset Impairment & Exit Costs Adjusted Operating Income Total Excluding Currency Excluding Currency & Acqui- sitions 2020 2019 $ 1,174 $ (30) $ 1,204 $ 83 $ 1,121 $ - European Union $ 624 $ (342) 24.6% 16.0% 16.0% 261 (8) 269 (91) 360 - Eastern Europe 263 - 2.3% 36.9% 36.9% 207 (10) 217 (36) 253 - Middle East & Africa 380 - (42.9)% (33.4)% (33.4)% 419 (12) 431 2 429 - South & Southeast Asia 692 - (37.7)% (38.0)% (38.0)% 608 (13) 621 19 602 - East Asia & Australia 412 - 50.7% 46.1% 46.1% 236 114 122 (25) 147 - Latin America & Canada 135 (15) (18.7)% (2.0)% (2.0)% $ 2,905 $ 41 $ 2,864 $ (48) $ 2,912 $ - Total PMI $ 2,506 $ (357) - 1.7% 1.7% % Change Quarters Ended December 31, (a) Represents asset impairment and exit costs (b) Includes the Brazil indirect tax credit $119 million and asset impairment and exit costs ($5 million) (b) (a) (a) (a) (a) (a) (a) (a) PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures 56 Adjustments for the Impact of RBH, excluding Currency ($ in millions) / (Unaudited) (a) Represents the impact attributable to RBH from January 1, 2019 to March 21, 2019 (b) Pro forma Years Ended December 31, 2020 2019 % Change Operating Income $ 11,668 $ 10,531 10.8% Asset impairment and exit costs (149) (422) Canadian tobacco litigation-related expense - (194) Loss on deconsolidation of RBH - (239) Russia excise and VAT audit charge - (374) Brazil indirect tax credit 119 - Adjusted Operating Income $ 11,698 $ 11,760 (0.5)% Operating Income attributable to RBH (126) Adjusted Operating Income $ 11,698 $ 11,634 0.6% Currency (474) Adjusted Operating Income, excluding Currency $ 12,172 $ 11,634 4.6% (a) (b) (b)

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Adjusted Operating Income Margin, excluding Currency and Acquisitions ($ in millions) / (Unaudited) 57 (a) For the calculation of Adjusted Operating Income and Adjusted Operating Income excluding currency and acquisitions refer to slide 54 (b) For the calculation of Net Revenues excluding currency and acquisitions refer to slide 51 Adjusted Operating Income (a) Net Revenues Adjusted Operating Income Margin Adjusted Operating Income excluding Currency (a) Net Revenues excluding Currency (b) Adjusted Operating Income Margin excluding Currency Adjusted Operating Income excluding Currency & Acqui- sitions (a) Net Revenues excluding Currency & Acqui- sitions (b) Adjusted Operating Income Margin excluding Currency & Acqui- sitions Adjusted Operating Income (a) Net Revenues Adjusted Operating Income Margin Adjusted Operating Income Margin Adjusted Operating Income Margin excluding Currency Adjusted Operating Income Margin excluding Currency & Acqui- sitions 2020 2019 % Points Change $ 5,155 $ 10,702 48.2% $ 5,179 $ 10,681 48.5% $ 5,179 $ 10,681 48.5% European Union $ 4,312 $ 9,817 43.9% 4.3 4.6 4.6 886 3,378 26.2% 1,185 3,641 32.5% 1,185 3,641 32.5% Eastern Europe 921 3,282 28.1% (1.9) 4.4 4.4 1,045 3,088 33.8% 1,110 3,165 35.1% 1,110 3,165 35.1% Middle East & Africa 1,684 4,042 41.7% (7.9) (6.6) (6.6) 1,732 4,396 39.4% 1,730 4,415 39.2% 1,730 4,415 39.2% South & Southeast Asia 2,183 5,094 42.9% (3.5) (3.7) (3.7) 2,426 5,429 44.7% 2,405 5,396 44.6% 2,405 5,396 44.6% East Asia & Australia 1,932 5,364 36.0% 8.7 8.6 8.6 454 1,701 26.7% 564 1,865 30.2% 564 1,865 30.2% Latin America & Canada 728 2,206 33.0% (6.3) (2.8) (2.8) $ 11,698 $ 28,694 40.8% $ 12,173 $ 29,163 41.7% $ 12,173 $ 29,163 41.7% Total PMI $ 11,760 $ 29,805 39.5% 1.3 2.2 2.2 Years Ended December 31, 58 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Reconciliation of Adjusted Operating Income Margin, excluding Currency and Acquisitions ($ in millions) / (Unaudited) Adjusted Operating Income (a) Net Revenues Adjusted Operating Income Margin Adjusted Operating Income excluding Currency (a) Net Revenues excluding Currency (b) Adjusted Operating Income Margin excluding Currency Adjusted Operating Income excluding Currency & Acqui- sitions (a) Net Revenues excluding Currency & Acqui- sitions (b) Adjusted Operating Income Margin excluding Currency & Acqui- sitions Adjusted Operating Income (a) Net Revenues Adjusted Operating Income Margin Adjusted Operating Income Margin Adjusted Operating Income Margin excluding Currency Adjusted Operating Income Margin excluding Currency & Acqui- sitions 2020 2019 % Points Change $ 1,204 $ 2,742 43.9% $ 1,121 $ 2,591 43.3% $ 1,121 $ 2,591 43.3% European Union $ 966 $ 2,436 39.7% 4.2 3.6 3.6 269 908 29.6% 360 1,026 35.1% 360 1,026 35.1% Eastern Europe 263 982 26.8% 2.8 8.3 8.3 217 740 29.3% 253 771 32.8% 253 771 32.8% Middle East & Africa 380 984 38.6% (9.3) (5.8) (5.8) 431 1,185 36.4% 429 1,180 36.4% 429 1,180 36.4% South & Southeast Asia 692 1,487 46.5% (10.1) (10.1) (10.1) 621 1,384 44.9% 602 1,348 44.7% 602 1,348 44.7% East Asia & Australia 412 1,270 32.4% 12.5 12.3 12.3 122 485 25.2% 147 528 27.8% 147 528 27.8% Latin America & Canada 150 554 27.1% (1.9) 0.7 0.7 $ 2,864 $ 7,444 38.5% $ 2,912 $ 7,444 39.1% $ 2,912 $ 7,444 39.1% Total PMI $ 2,863 $ 7,713 37.1% 1.4 2.0 2.0 Quarters Ended December 31, (a) For the calculation of Adjusted Operating Income and Adjusted Operating Income excluding currency and acquisitions refer to slide 55 (b) For the calculation of Net Revenues excluding currency and acquisitions refer to slide 52

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures 59 Adjustments for the Impact of RBH, excluding Currency ($ in millions) / (Unaudited) (a) For the calculation of Adjusted Operating Income refer to slide 54 (b) Represents the impact attributable to RBH from January 1, 2019 to March 21, 2019 (c) Pro forma Years Ended December 31, 2020 2019 % Change Adjusted Operating Income $ 11,698 $ 11,760 (0.5)% Net Revenues $ 28,694 $ 29,805 (3.7)% Adjusted OI Margin 40.8% 39.5% 1.3 Adjusted OI Margin attributable to RBH (0.2) Adjusted OI Margin 40.8% 39.3% 1.5 Currency (0.9) Adjusted OI Margin, excluding Currency 41.7% 39.3% 2.4 (c) (c) (a) (b) PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures 60 Reconciliation of Reported Diluted EPS to Pro Forma Adjusted Diluted EPS (Unaudited) (a) Represents the impact of net earnings attributable to RBH from January 1, 2019 to March 21, 2019 Note: EPS is computed independently for each of the periods presented. Accordingly, the sum of the quarterly EPS amounts may not agree to the total for the year Reported Diluted EPS $ 0.87 $ 1.49 $ 2.36 $ 1.22 $ 3.57 $ 1.04 $ 4.61 Asset impairment and exit costs 0.01 0.01 0.02 0.01 0.03 0.20 0.23 Canadian tobacco litigation-related expense 0.09 - 0.09 - 0.09 - 0.09 Loss on deconsolidation of RBH 0.12 - 0.12 - 0.12 - 0.12 Russia excise and VAT audit charge - - - 0.20 0.20 - 0.20 Fair value adjustment for equity security investments - - - - - (0.02) (0.02) Tax items - (0.04) (0.04) - (0.04) - (0.04) Adjusted Diluted EPS $ 1.09 $ 1.46 $ 2.55 $ 1.43 $ 3.97 $ 1.22 $ 5.19 Net earnings attributable to RBH (0.06) (a) - (0.06) (a) - (0.06) (a) - (0.06) (a) Pro Forma Adjusted Diluted EPS $ 1.03 $ 1.46 $ 2.49 $ 1.43 $ 3.91 $ 1.22 $ 5.13 Nine Months Ended Sept 30, 20192019 Quarter Ended Mar 31, Quarter Ended June 30, 2019 Six Months Ended June 30, 2019 Quarter Ended Sept 30, 2019 Quarter Ended Dec 31, 2019 Year Ended Dec 31, 2019

PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Net Revenues by Product Category and Adjustments of Net Revenues for the Impact of Currency and Acquisitions ($ in millions) / (Unaudited) 61Note: Sum of Regions might not foot to Total PMI due to rounding; "-" indicates amounts between -$0.5 million and +$0.5 million Net Revenues Currency Net Revenues excluding Currency Acquisitions Net Revenues excluding Currency & Acquisitions Years Ended December 31, Net Revenues Total Excluding Currency Excluding Currency & Acquisitions 2018 Reduced-Risk Products 2017 % Change $ 865 $ 36 $ 829 $ - $ 829 European Union $ 269 +100% +100% +100% 324 (22) 346 - 346 Eastern Europe 55 +100% +100% +100% 382 4 378 - 378 Middle East & Africa 94 +100% +100% +100% - - - - - South & Southeast Asia - - - - 2,506 33 2,474 - 2,474 East Asia & Australia 3,218 (22.1)% (23.1)% (23.1)% 19 - 19 - 19 Latin America & Canada 4 +100% +100% +100% $ 4,096 $ 51 $ 4,045 $ - $ 4,045 Total RRPs $ 3,640 12.5% 11.1% 11.1% 2018 PMI 2017 % Change $ 9,298 $ 489 $ 8,809 $ - $ 8,809 European Union $ 8,318 11.8% 5.9% 5.9% 2,921 (118) 3,039 - 3,039 Eastern Europe 2,711 7.7% 12.1% 12.1% 4,114 (193) 4,307 - 4,307 Middle East & Africa 3,988 3.2% 8.0% 8.0% 4,656 (244) 4,900 - 4,900 South & Southeast Asia 4,417 5.4% 10.9% 10.9% 5,580 62 5,518 - 5,518 East Asia & Australia 6,373 (12.4)% (13.4)% (13.4)% 3,056 (99) 3,155 - 3,155 Latin America & Canada 2,941 3.9% 7.3% 7.3% $ 29,625 $ (103) $ 29,728 $ - $ 29,728 Total PMI $ 28,748 3.1% 3.4% 3.4% PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Net Revenues by Product Category and Adjustments of Net Revenues for the Impact of Currency and Acquisitions ($ in millions) / (Unaudited) 62Note: Sum of Regions might not foot to Total PMI due to rounding; "-" indicates amounts between -$0.5 million and +$0.5 million Net Revenues Currency Net Revenues excluding Currency Acquisitions Net Revenues excluding Currency & Acquisitions Years Ended December 31, Net Revenues Total Excluding Currency Excluding Currency & Acquisitions 2017 Reduced-Risk Products 2016 % Change $ 269 $ 5 $ 264 $ - $ 264 European Union $ 57 +100% +100% +100% 55 3 52 - 52 Eastern Europe 6 +100% +100% +100% 94 (3) 98 - 98 Middle East & Africa 4 +100% +100% +100% - - - - - South & Southeast Asia - - - - 3,218 (94) 3,312 - 3,312 East Asia & Australia 666 +100% +100% +100% 4 - 4 - 4 Latin America & Canada 1 +100% +100% +100% $ 3,640 $ (89) $ 3,729 $ - $ 3,729 Total RRPs $ 733 +100% +100% +100% 2017 PMI 2016 % Change $ 8,318 $ 45 $ 8,273 $ - $ 8,273 European Union $ 8,162 1.9% 1.4% 1.4% 2,711 229 2,482 - 2,482 Eastern Europe 2,484 9.1% (0.1)% (0.1)% 3,988 (520) 4,508 - 4,508 Middle East & Africa 4,516 (11.7)% (0.2)% (0.2)% 4,417 (63) 4,480 - 4,480 South & Southeast Asia 4,396 0.5% 1.9% 1.9% 6,373 (74) 6,447 - 6,447 East Asia & Australia 4,285 48.7% 50.5% 50.5% 2,941 (54) 2,995 - 2,995 Latin America & Canada 2,842 3.5% 5.4% 5.4% $ 28,748 $ (437) $ 29,185 $ - $ 29,185 Total PMI $ 26,685 7.7% 9.4% 9.4%

63 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Net Revenues by Product Category and Adjustments of Net Revenues for the Impact of Currency and Acquisitions ($ in millions) / (Unaudited) Note: Sum of Regions might not foot to Total PMI due to rounding; "-" indicates amounts between -$0.5 million and +$0.5 million Net Revenues Currency Net Revenues excluding Currency Acquisitions Net Revenues excluding Currency & Acquisitions Years Ended December 31, Net Revenues Total Excluding Currency Excluding Currency & Acquisitions 2016 Reduced-Risk Products 2015 % Change $ 57 $ (2) $ 60 $ - $ 60 European Union $ 29 96.4% +100% +100% 6 - 6 - 6 Eastern Europe - - - - 4 1 3 - 3 Middle East & Africa - - - - - - - - - South & Southeast Asia - - - - 666 70 597 - 597 East Asia & Australia 35 +100% +100% +100% 1 - 1 - 1 Latin America & Canada - - - - $ 733 $ 67 $ 666 $ - $ 666 Total RRPs $ 64 +100% +100% +100% 2016 PMI 2015 % Change $ 8,162 $ (147) $ 8,309 $ - $ 8,309 European Union $ 8,068 1.2% 3.0% 3.0% 2,484 (340) 2,824 - 2,824 Eastern Europe 2,735 (9.2)% 3.3% 3.3% 4,516 (260) 4,776 - 4,776 Middle East & Africa 4,629 (2.4)% 3.2% 3.2% 4,396 (71) 4,467 - 4,467 South & Southeast Asia 4,288 2.5% 4.2% 4.2% 4,285 63 4,222 - 4,222 East Asia & Australia 3,915 9.5% 7.8% 7.8% 2,842 (525) 3,367 - 3,367 Latin America & Canada 3,159 (10.0)% 6.6% 6.6% $ 26,685 $ (1,280) $ 27,965 $ - $ 27,965 Total PMI $ 26,794 (0.4)% 4.4% 4.4% 64 PHILIP MORRIS INTERNATIONAL INC. and Subsidiaries Reconciliation of Non-GAAP Measures Adjustments for the Impact of RBH, excluding Currency ($ in millions) / (Unaudited) Years Ended December 31, 2020 2019 % Change Net cash provided by operating activities (a) 9,812 $ 10,090 (2.8)% Net cash provided by operating activities attributable to RBH (b) (102) Net cash provided by operating activities (a) $ 9,812 $ 9,988 (1.8)% Currency (524) Net cash provided by operating activities,excluding currency $ 10,336 $ 9,988 3.5% (a) Operating cash flow (b) Represents the impact of operating activities attributable to RBH from January 1, 2019 to March 21, 2019

Delivering a Smoke-Free Future 2020 Fourth-Quarter and Full-Year Results February 4, 2021