Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - Professional Holding Corp. | tmb-20210201x8ka.htm |

Exhibit 99.1

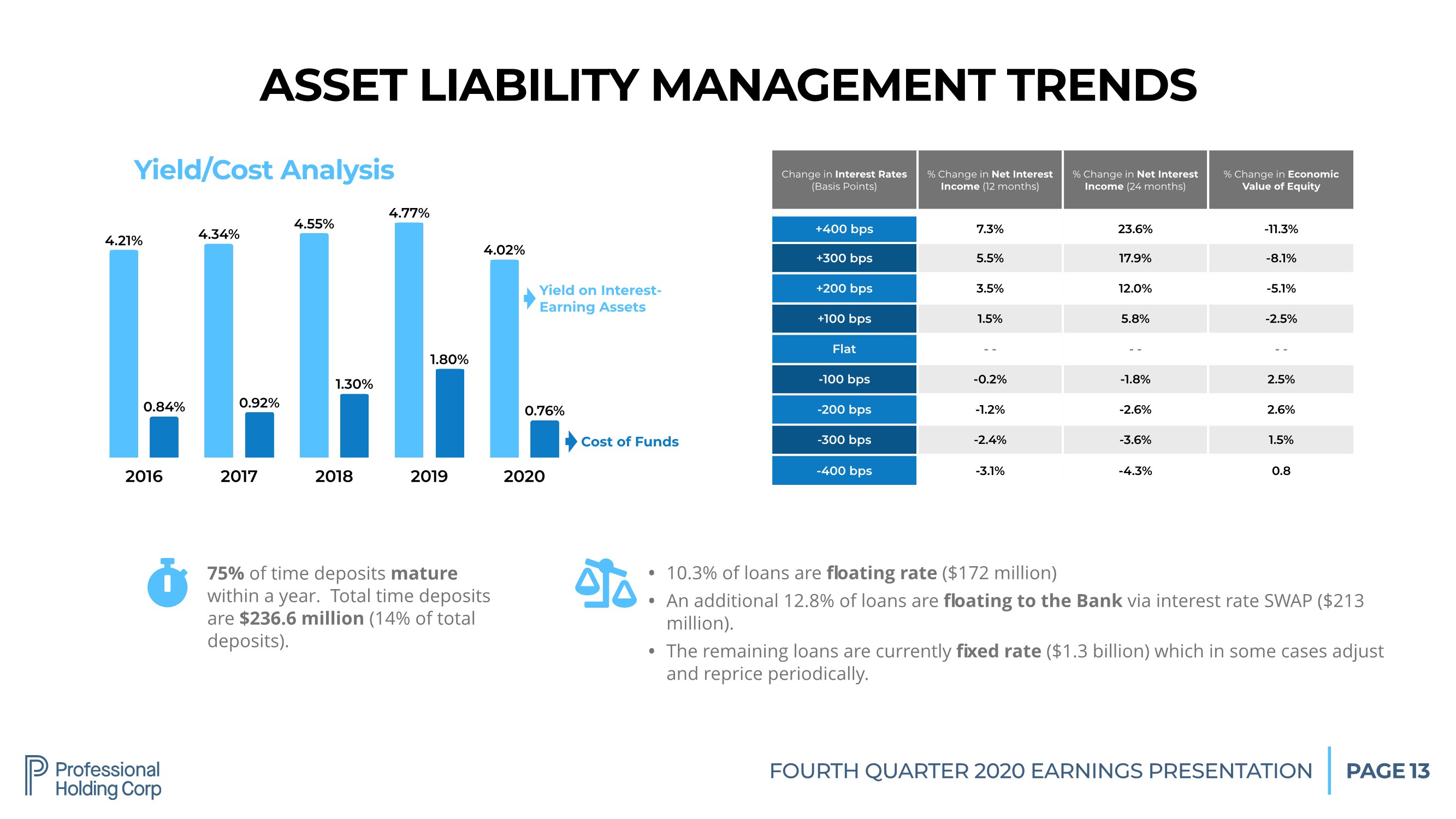

| FOURTH QUARTER 2020 EARNINGS PRESENTATION PAGE 13 ASSET LIABILITY MANAGEMENT TRENDS • 10.3% of loans are floating rate ($172 million) • An additional 12.8% of loans are floating to the Bank via interest rate SWAP ($213 million). • The remaining loans are currently fixed rate ($1.3 billion) which in some cases adjust and reprice periodically. ! 75% of time deposits mature within a year. Total time deposits are $236.6 million (14% of total deposits). " 2016 2017 2018 2019 2020 0.76% 1.80% 1.30% 0.92% 0.84% 4.02% 4.77% 4.55% 4.34% 4.21% Yield/Cost Analysis Yield on Interest- Earning Assets Cost of Funds Change in Interest Rates (Basis Points) % Change in Net Interest Income (12 months) % Change in Net Interest Income (24 months) % Change in Economic Value of Equity +400 bps 7.3% 23.6% -11.3% +300 bps 5.5% 17.9% -8.1% +200 bps 3.5% 12.0% -5.1% +100 bps 1.5% 5.8% -2.5% Flat - - - - - - -100 bps -0.2% -1.8% 2.5% -200 bps -1.2% -2.6% 2.6% -300 bps -2.4% -3.6% 1.5% -400 bps -3.1% -4.3% 0.8 |