Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HIGHWATER ETHANOL LLC | arefebruary2021newsletter.htm |

1 February 2021 Winter Newsletter Highwater Ethanol, LLC Contact Info: 24500 US Highway 14 PO Box 96 Lamberton, MN 56152 PHONE: (507) 752-6160 FAX: (507) 752-6162 TOLL FREE: (888) 667-3385 EMAIL: info@highwaterethanol.com WEBSITE: www.highwaterethanol.com From the Desk of Highwater Ethanol, LLC CEO Brian Kletscher Wishing you a Happy and Prosperous New Year!! We are nearing the completion of 11.5 years of operations at Highwater Ethanol. We believe that we have made great progress on our operations and debt reduction. Our debt as of October 31, 2020 on our long - term loan was at $0 as we paid off the loan at the end of 2020 Fiscal year and $5.99 million on our term revolver which we use for operations. Highwater did apply for the Payroll Protection Program {PPP} in mid - April 2020 this was part of the COVID19 stimulus package approved by the Federal Government, Highwater received a loan for $712,000, we have applied for this loan to be forgiven. This is a nice reduction from where we started 11.5 years ago with debt at $65.4 million. As reported earlier in our reports filed with the SEC, we entered an agreement to install equipment to produce High Purity Alcohol for the use in the sanitizer market and obtained a term loan from Compeer Financial to support this project. At October 31, 2020, the balance on this loan was $6 million. We filed our Form 10-K for the fiscal year ended October 31, 2020 on January 21, 2021. We had a net loss of approximately $6.366 million for the 2020 Fiscal Year. Margins continued to be up and down this year. We continue to focus on operations to ensure the best efficiencies we can get at your facility. During the 2020 Fiscal Year, we produced an average of approximately 3.04 gallons of denatured ethanol per bushel of corn ground. We have maintained these efficiencies since August 2019 due to a number of factors. We continue to review enzymes, yeast and other items to ensure the best efficiencies and we are proud of our team for maintaining this production rate! In October 2019, we received our air emission permit from Minnesota Pollution Control Agency {MPCA} to increase production from 58 million gallons of undenatured ethanol per year to 68.5 million gallons or about 70.2 million gallons of denatured ethanol per year. We have moved our production rates up approximately 12% since receiving the new permit to 65 million gallons per year. This has been accomplished with your current facility with no additional capital expenses. Margins in the ethanol industry remained at a low we have not seen since 2012. 2020 was one of the most intensely difficult years for margins as of the result from the outbreak of COVID-19. Ethanol prices have varied widely from under $.90/gallon to $1.27/gallon. We have also seen corn prices vary from $2.70 - $5.00 bushel locally. However, during our 2020 Fiscal Year, we experienced some of the lowest ethanol net backs in the past 15 years. We have seen demand for ethanol decrease domestically by approximately 10 – 12% because of the COVID-19 pandemic and export demand has remained stable. We believe that 2021 will likely be a very interesting year for renewable ethanol and renewable Biofuels and we will continue to work to obtain additional market share for our products. This swing in the markets is one of the primary factors that prompted Highwater to look at diversifying our product line to include 190 proof High Purity Alcohol. We look forward to producing this product in the near future. Highwater continues to purchase corn from our area producers. The 2020 corn crop quality and bushels has been a blessing for this area. Good quality corn certainly helps us maintain our efficiencies. Highwater Ethanol, LLC Investor Update

2 Industry Information. E15 and Exports should be a continued priority in 2021. Exports are needed to support a very efficient U.S Ethanol industry which has reduced production of ethanol approximately 10 – 12% to match the reduction of ethanol used in the United States due to the COVID-19 pandemic. As production capacity is available in the U.S. exports will be the key for the industry in the future. We anticipate and look forward to increased interest from countries including Mexico, Canada, China and Japan with the on-going trade agreements, as well as continued interest from Vietnam, Philippines, India and many others. We encourage you to use a higher blend such as E15, E30 or E85! We believe that use of higher blends will continue to reduce our dependence on crude oil and contribute to cleaner air!! Highwater Ethanol continues to support E10 blend, E15 blend for 2001 and new vehicles and higher blends if you have a flex fuel vehicle. We believe the ethanol industry can respond to meeting the higher blend rates. Highwater Ethanol continues to work with Minnesota Bio Fuels Association to promote ethanol use and we are working to move E15 forward in the State of Minnesota. Minnesota currently has over 384 - E15 pumps available as well as many blend pumps to ensure the consumer has a choice. As owners in the ethanol industry, each member should be doing his or her part in using a higher blend of ethanol and asking for the higher blends of ethanol if it is currently not available in your area. We are members of the Renewable Fuels Association and American Coalition for Ethanol. These entities do a great job in representing the ethanol industry at the Federal level. Our Mission Statement: “To successfully operate a bio – energy facility, which will be profitable to our investor owners while contributing to the economic growth in the region. Highwater Ethanol is committed to the present while focusing on the future.” Highwater Ethanol’s Vision Statement: Highwater Ethanol will identify opportunities that position the business to provide sustainable competitive advantages through short and long - term core investments. A few core priorities that were identified include: 1) remain a low cost, efficient and high-quality producer; 2) Review new technology opportunities; 3) Review all opportunities within our core business; and 4) Continue long term debt reduction. I encourage you to visit our web page at highwaterethanol.com. This website will give you markets, weather, investor information and related items. Like us on Facebook! If you are ever passing through the area and would like a tour of your facility, please stop by as we would be very happy to walk you through the facility. Our management team consists of: Luke Schneider, CFO, Derek Trapp Co-Plant/Production Manager, Dillon Imker Co-Plant/Production Manager, Tom Streifel, Risk/Commodity, Jon Osland, Maintenance Manager, Lisa Landkammer, EHS Manager and Derek Schultz, Lab Manager. We have positioned our team to be successful in the ethanol industry. A reminder that our 2021 Highwater Ethanol Annual Members’ Meeting is scheduled for Thursday, March 11, 2021 at 9:30 a.m. Due to the COVID-19 pandemic, we will be hosting the meeting electronically. In order to participate, you must register in advance of the meeting at: https://attendee.gotowebinar.com/register/5100536996975991308 After registering for the meeting, you will receive a confirmation email containing information on how to join the electronic meeting including an access code needed to join the 2021 Annual Meeting electronically. There will be no in person meeting. Have a safe winter!!! We will take care of the present as we focus on the future!!!

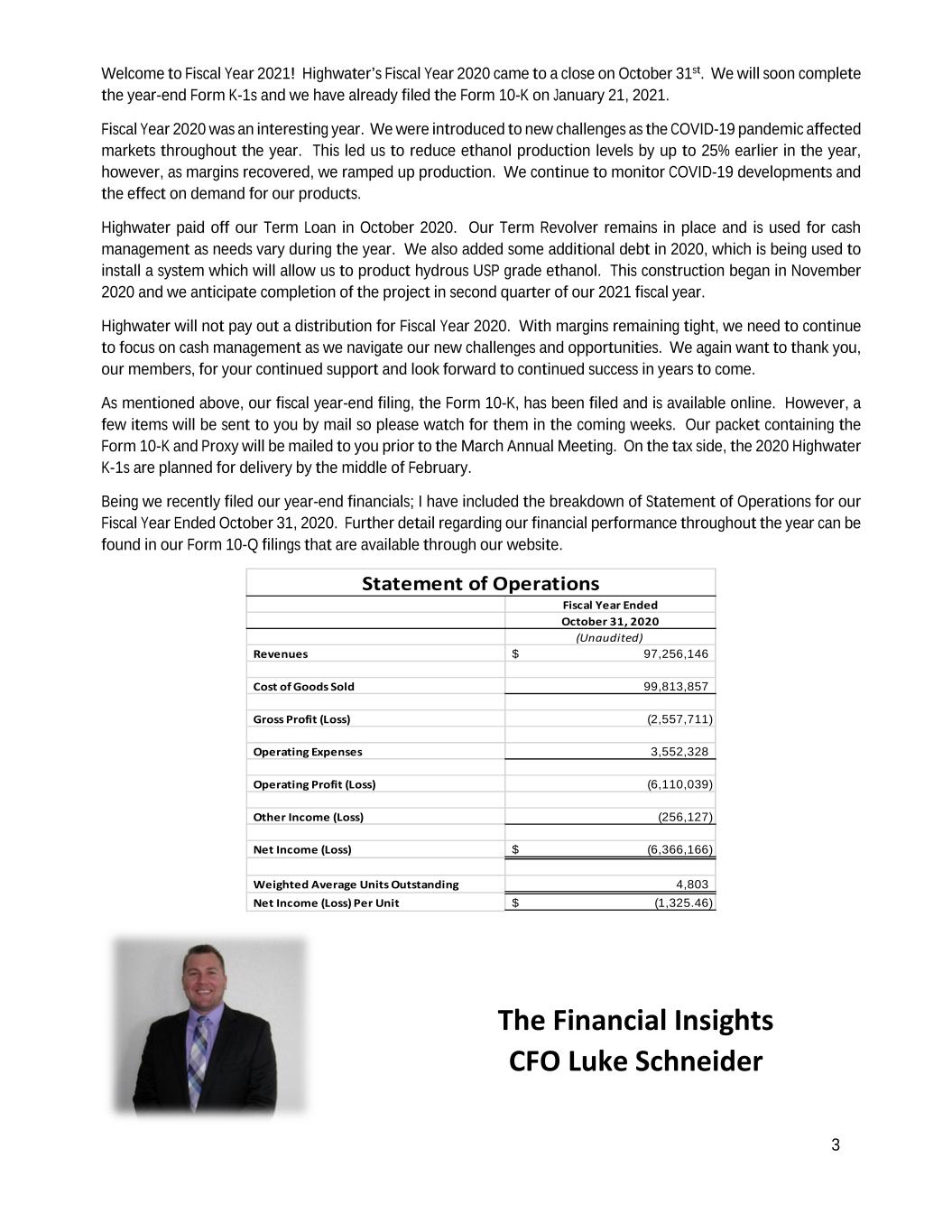

3 Welcome to Fiscal Year 2021! Highwater’s Fiscal Year 2020 came to a close on October 31st. We will soon complete the year-end Form K-1s and we have already filed the Form 10-K on January 21, 2021. Fiscal Year 2020 was an interesting year. We were introduced to new challenges as the COVID-19 pandemic affected markets throughout the year. This led us to reduce ethanol production levels by up to 25% earlier in the year, however, as margins recovered, we ramped up production. We continue to monitor COVID-19 developments and the effect on demand for our products. Highwater paid off our Term Loan in October 2020. Our Term Revolver remains in place and is used for cash management as needs vary during the year. We also added some additional debt in 2020, which is being used to install a system which will allow us to product hydrous USP grade ethanol. This construction began in November 2020 and we anticipate completion of the project in second quarter of our 2021 fiscal year. Highwater will not pay out a distribution for Fiscal Year 2020. With margins remaining tight, we need to continue to focus on cash management as we navigate our new challenges and opportunities. We again want to thank you, our members, for your continued support and look forward to continued success in years to come. As mentioned above, our fiscal year-end filing, the Form 10-K, has been filed and is available online. However, a few items will be sent to you by mail so please watch for them in the coming weeks. Our packet containing the Form 10-K and Proxy will be mailed to you prior to the March Annual Meeting. On the tax side, the 2020 Highwater K-1s are planned for delivery by the middle of February. Being we recently filed our year-end financials; I have included the breakdown of Statement of Operations for our Fiscal Year Ended October 31, 2020. Further detail regarding our financial performance throughout the year can be found in our Form 10-Q filings that are available through our website. Fiscal Year Ended October 31, 2020 (Unaudited) Revenues 97,256,146$ Cost of Goods Sold 99,813,857 Gross Profit (Loss) (2,557,711) Operating Expenses 3,552,328 Operating Profit (Loss) (6,110,039) Other Income (Loss) (256,127) Net Income (Loss) (6,366,166)$ Weighted Average Units Outstanding 4,803 Net Income (Loss) Per Unit (1,325.46)$ Statement of Operations The Financial Insights CFO Luke Schneider

4 As we close the door on 2020 and open the door to 2021, we have lots to be thankful for. We all know the trying times COVID-19 has had on our communities. Those trying times also hit HWE, but with a great team we have been able to make some good things come out of it. The farmers had a fairly dry year and coming in to fall it made for great harvest conditions. It not only is great for the farmers after having a few wet years in a row but, it is also has brought a great crop to Highwater. The fall went fast and the quality of corn that was harvested is great for production. As we move forward, we are operating at approximately 180,000 gallons a day and plan to operate at this rate for the time being. With corn prices on the rise the team at Highwater continues to look for ways to be more efficient. We are currently trialing new chemicals to increase our yield. For the month of December our yield was 3.04 gallons of Denatured Ethanol produced from one Bushel of corn. We continue to work hard to make the most out of every bushel. Corn oil has also surprised us this year as the price continues to climb. We are currently producing around .84 LBS/BU. As we look back at 2020 you may recall that we announced Industrial Grade Ethanol was coming to Highwater Ethanol for the use in sanitizing and disinfecting market. Your team has been busy getting everything set in place for operation. With a mild winter we have been able to get some work done with fairly nice weather. Your two new storage tanks have been put up, along with a concrete pad poured for distillation. The distillation columns for industrial grade ethanol have arrived on site. We are currently waiting for contractors to install the columns and structural supports. We anticipate this project to come on line in March of 2021. As we push forward into 2021, we look forward to the challenges that this year brings! Co-Plant Managers Derek Trapp & Dillon Imker

5 NOTICE OF 2021 ANNUAL MEETING OF MEMBERS To be Held Thursday, March 11, 2021 *Please note that the meeting will be held electronically* *There will be no in person meeting and no votes will be accepted during the electronic meeting* To our Members: Due to concerns regarding the COVID-19 pandemic and current state restrictions on public gatherings, the 2021 annual meeting of members (the “2021 Annual Meeting”) of Highwater Ethanol, LLC (the “Company”) will be held electronically on Thursday, March 11, 2021. The 2021 Annual Meeting will commence at approximately 9:30 a.m. There will be no in person meeting. In order to participate in the 2021 Annual Meeting, you must register for the meeting by going to the following website (copy link below in web browser) any time before the 2021 Annual Meeting: https://attendee.gotowebinar.com/register/5100536996975991308 After registering for the meeting, you will receive a confirmation email containing information on how to join the electronic meeting including an access code needed to join the 2021 Annual Meeting electronically. Registration will also include a telephone number that can be used to call in and listen to the 2021 Annual Meeting if you do not wish to participate in the videoconference format. The purposes of the meeting are to: (1) Elect three governors to the Board of Governors; and (2) Transact such other business as may properly come before the 2021 Annual Meeting or any adjournments thereof. The foregoing items of business are more fully described in the proxy statement accompanying this notice. If you have any questions regarding the information in the proxy statement or regarding completion of the enclosed proxy card, please call the Company at (507) 752-6160. Only members listed on the Company's records at the close of business on January 21, 2021 are entitled to notice of the 2021 Annual Meeting and to vote at the 2021 Annual Meeting and any adjournments thereof. The proxy statement and proxy card are also available at www.highwaterethanol.com. To be certain that your membership units will be represented at the 2021 Annual Meeting, please return your proxy card by 5:00 p.m. on Wednesday, March 10, 2021. However, proxy cards may still be accepted by the Company at any time prior to the polls officially closing. No votes will be accepted during the electronic meeting. If you wish to vote, you must submit a proxy card. To assure the presence of a quorum, the Board of Governors requests that you promptly sign, date and return the enclosed proxy card, which is solicited by the Board of Governors. Proxy cards are available on the Company's website at http://www.highwaterethanol.com and may be printed by the members. No personal information is required to print a proxy card. If you wish to revoke your proxy card, you may do so by giving notice to our CEO, Brian Kletscher, or our CFO, Lucas Schneider, prior to the commencement of the meeting. You may fax your completed proxy card to the Company at (507) 752-6162 or mail it to the Company at P.O. Box 96, 24500 US Highway 14, Lamberton, MN 56152. If you have any questions regarding the information in the proxy statement or completion of the proxy card or if you have questions about registration or how to attend the electronic meeting, please contact the Company using the information listed above. By order of the Board of Governors, /s/ David Moldan Chairman of the Board- Lamberton, MN

6 Welcome and Call to Order: David Moldan, Chairman and Brian Kletscher, CEO https://attendee.gotowebinar.com/register/5100536996975991308 Introduction of HWE Board of Governors: David Moldan, Chairman Ron Jorgenson, Vice Chairman; David Eis, Secretary; Mark Pankonin, Treasurer; Directors: Russell Derickson, Mike Landuyt George Goblish, Luke Spalj and Gerald Forsythe Introduction of Guests, Management & Staff: Brian Kletscher, CEO Call the Meeting to Order: David Moldan, Chairman Rules of Conduct/Proof of Notice of Meeting/Report on Quorum: David Eis, Secretary Proposals: Mandy Hughes, Brown Winick Law Office Proposal #1: Election of three governors. Standing for election are incumbent governors: George Goblish Mark Pankonin Luke Spalj Voting on Proposals: David Moldan Report by Chairman: David Moldan Presentation of Financial Statements: Lucas Schneider, CFO Overview of Operations: Brian Kletscher, CEO Election Results: Mandy Hughes, Brown Winick Law Office Questions and Answers Adjourn 2021 Annual Meeting Highwater Ethanol, LLC 2021 Annual Meeting Agenda

7 2020 is now hindsight. It was a volatile year with all the news in the first half being negative to corn and ethanol. Prospects of too many planted acres on top of demand destruction; lost gasoline demand & net less demand for corn-based ethanol had corn and ethanol prices on defense the first half of 2020. National yield prospects were good for corn during the first half of the growing season. The negative news peaked in early August with HE cash price hitting a multi-year low of $2.70. The next several months had the opposite story with yields in some parts of the country disappointing, plus the USDA vastly revised the planted acres estimates as well as reduced prior year’s supply. Then along comes China with their huge appetite for US commodities, so exports surge & prices rise. The 2021 outlook at this time is opposite of a year ago with tight corn and bean supplies. It is requiring we have expanded planted acreage and good yields this year. Another new feature going forward is now in the infant stages with the Biden Administration rolling out new climate directives. Fossil fuels are on the bad list while anything to reduce the carbon footprint is on the good list. Ethanol needs to promote the clean fuel characteristics again. We can expect lower gasoline consumption over time, so the ethanol industry’s goal is to increase the inclusion / blend rate. Check back next year and see what 2021 hindsight looks like. From the Commodity Desk Tom Streifel This newsletter contains forward-looking statements that involve future events, our future performance and our expected future operations and actions. In some cases, you can identify forward-looking statements by the use of words such as “may,” “will,” “should,” “anticipate,” “believe,” “expect,” “plant,” “future,” “intend,” “could,” “estimate,” “predict,” “hope,” “potential,” “continue,” or the negative of these terms or other similar expressions. These forward- looking statements are only our predictions and involve numerous assumptions, risks and uncertainties, including, but not limited to those listed below and those business risks and factors described in our filings with the Securities and Exchange Commission (“SEC”). Changes in our business strategy, capital improvements or development plans; Changes in plant production capacity or technical difficulties in operating the plant; Changes in the environmental regulations that apply to our plant site and operations; Changes in general economic conditions or the occurrence of certain events causing an economic impact in the agriculture, oil or grains; Changes in federal and/or state laws (including the elimination of any federal and/or state ethanol tax incentives); Overcapacity within the ethanol industry; Changes and advances in ethanol production technology; Competition in the ethanol industry and from alternative fuel additives; Lack of transportation, storage and blending infrastructure preventing ethanol from reaching high demand markets; Volatile commodity and financial markets; and the results of our hedging transactions and other risk management strategies. Our actual results or actions could and likely will differ materially from those anticipated in the forward-looking statements for many reasons, including the reasons described in these communications. We are not under any duty to update the forward-looking statements contained in this newsletter. We cannot guarantee future results, levels of activity, performance or achievements. We caution you not to put undue reliance on any forward-looking statements, which speak only as of the date of this communication. You should read this newsletter with the understanding that our actual results may be materially different from what we currently expect. We qualify all of our forward-looking statements by these cautionary statements. USP High Purity Alcohol Tanks Being Built