Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - MARRIOTT VACATIONS WORLDWIDE Corp | pressrelease-champannounce.htm |

| EX-2.1 - EX-2.1 - MARRIOTT VACATIONS WORLDWIDE Corp | projectchampagne-mergeragr.htm |

| 8-K - 8-K - MARRIOTT VACATIONS WORLDWIDE Corp | vac-20210126.htm |

JANUARY 26, 2021

MVW 2 This presentation contains “forward-looking statements” within the meaning of federal securities laws, including statements about anticipated future events and expectations that are not historical facts and the anticipated benefits of the acquisition of Welk Resorts. The Company cautions you that these statements are not guarantees of future performance and are subject to numerous risks and uncertainties, including, without limitation, conditions beyond our control such as the length and severity of the current COVID-19 pandemic and its effect on our operations; the effect of any governmental actions or mandated employer-paid benefits in response to the COVID-19 pandemic; the Company’s ability to manage and reduce expenditures in a low revenue environment; volatility in the economy and the credit markets, changes in supply and demand for vacation ownership, competitive conditions, the availability of additional financing when and if required, and other matters disclosed under the heading “Risk Factors” contained in the Company’s most recent Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) and in subsequent SEC filings, any of which could cause actual results to differ materially from those expressed in or implied in this presentation. These statements are made as of January 26, 2021 and the Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise. In this presentation we use certain financial measures that are not prescribed by United States generally accepted accounting principles (“GAAP”). We discuss our reasons for reporting these non-GAAP financial measures herein and reconcile the most directly comparable GAAP financial measure to each non-GAAP financial measure that we report (in the Appendix). Non-GAAP financial measures are identified in the footnotes in the pages that follow and are further explained in the Appendix. Although we evaluate and present these non-GAAP financial measures for the reasons described in the Appendix, please be aware that these non-GAAP financial measures have limitations and should not be considered in isolation or as a substitute for revenues, net income, earnings per share or any other comparable operating measure prescribed by GAAP. In addition, these non-GAAP financial measures may be calculated and / or presented differently than measures with the same or similar names that are reported by other companies, and as a result, the non-GAAP financial measures we report may not be comparable to those reported by others.

MVW 1. Adjusted EBITDA multiple excludes value of 2 years of excess built inventory and land for future development and after transaction costs and anticipated rebranding costs. 3 • Entered into an agreement to acquire Welk Resorts (“Welk”) for approximately $430 million including ~1.4 million MVW common shares. • Welk is one of the largest privately owned vacation ownership (“VO”) companies in the U.S. with a high-quality portfolio of eight VO resorts and one hotel • Intend to rebrand both the resorts and points program to Hyatt Residence Club, accelerating its growth • Transaction is expected to be completed in early second quarter of 2021, subject to customary closing conditions • Attractive transaction economics at ~5.6x Adjusted EBITDA1 The Ranahan by Welk Resorts, Breckenridge, CO

MVW 4 Opportunity to expand Hyatt Residence Club and accelerate its growth Rebranding Welk will more than double the number of Hyatt Residence Club Owners High quality and complementary resort portfolio primarily in West Coast vacation markets Expect to increase Welk’s contract sales and expand margins substantially Potential to more than double Welk’s 2019 Adjusted EBITDA Northstar Lodge by Welk Resorts, Lake Tahoe, CA

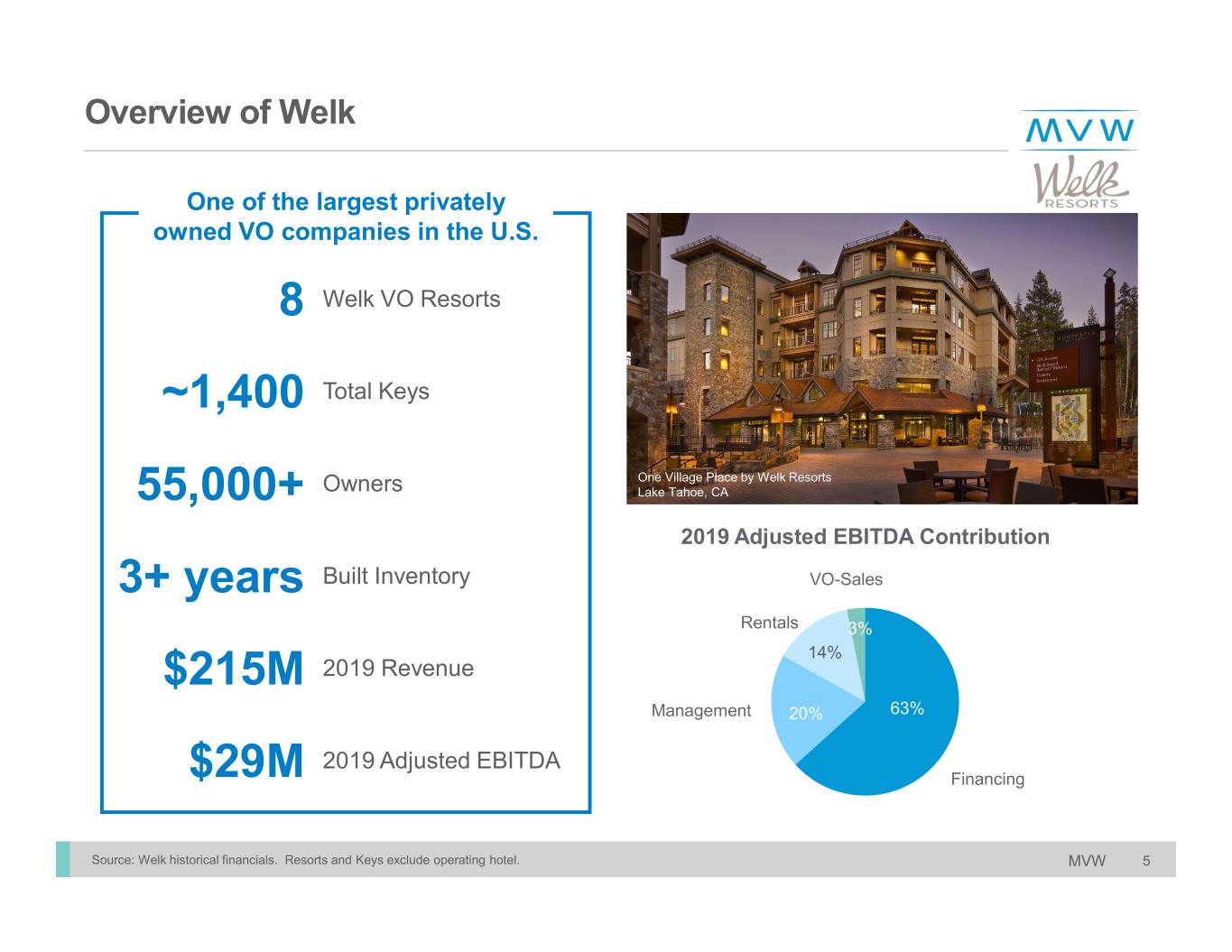

MVW J 5 Financing Management Rentals VO-Sales Welk VO Resorts Owners Built Inventory 2019 Revenue 2019 Adjusted EBITDA 20% 63% 3% Total Keys Source: Welk historical financials. Resorts and Keys exclude operating hotel. One Village Place by Welk Resorts Lake Tahoe, CA 14%

MVW 61. Locations for Hyatt Residence Club presented exclude Puerto Rico Welk Resorts San Diego, Escondido, CA Keys: 714 Desert Oasis by Welk Resorts, Palm Springs, CA Keys: 162 The Lodges at Timber Ridge, Branson, MO Keys: 104 Welk Resorts El Corazon, Santa Fe, NM Keys: 72 Sirena del Mar by Welk Resorts, Cabo San Lucas, MX Keys: 108 Northstar Lodge by Welk Resorts, Lake Tahoe, CA Keys: 104 One Village Place by Welk Resorts, Lake Tahoe, CA Keys: 21 The Ranahan by Welk Resorts, Breckenridge, CO Keys: 67 Welk Resorts Branson Hotel, Branson, MO Keys: 158 The Lodges at Timber Ridge, MO Desert Oasis by Welk Resorts, CA Welk Resorts San Diego, CA Sirena del Mar, Cabo San Lucas, MX Welk Resorts El Corazon, NM One Village Place by Welk Resorts, CA Northstar Lodge by Welk Resorts, CA The Ranahan by Welk Resorts, CO Branson Hotel, MO Existing Hyatt Residence Club markets1

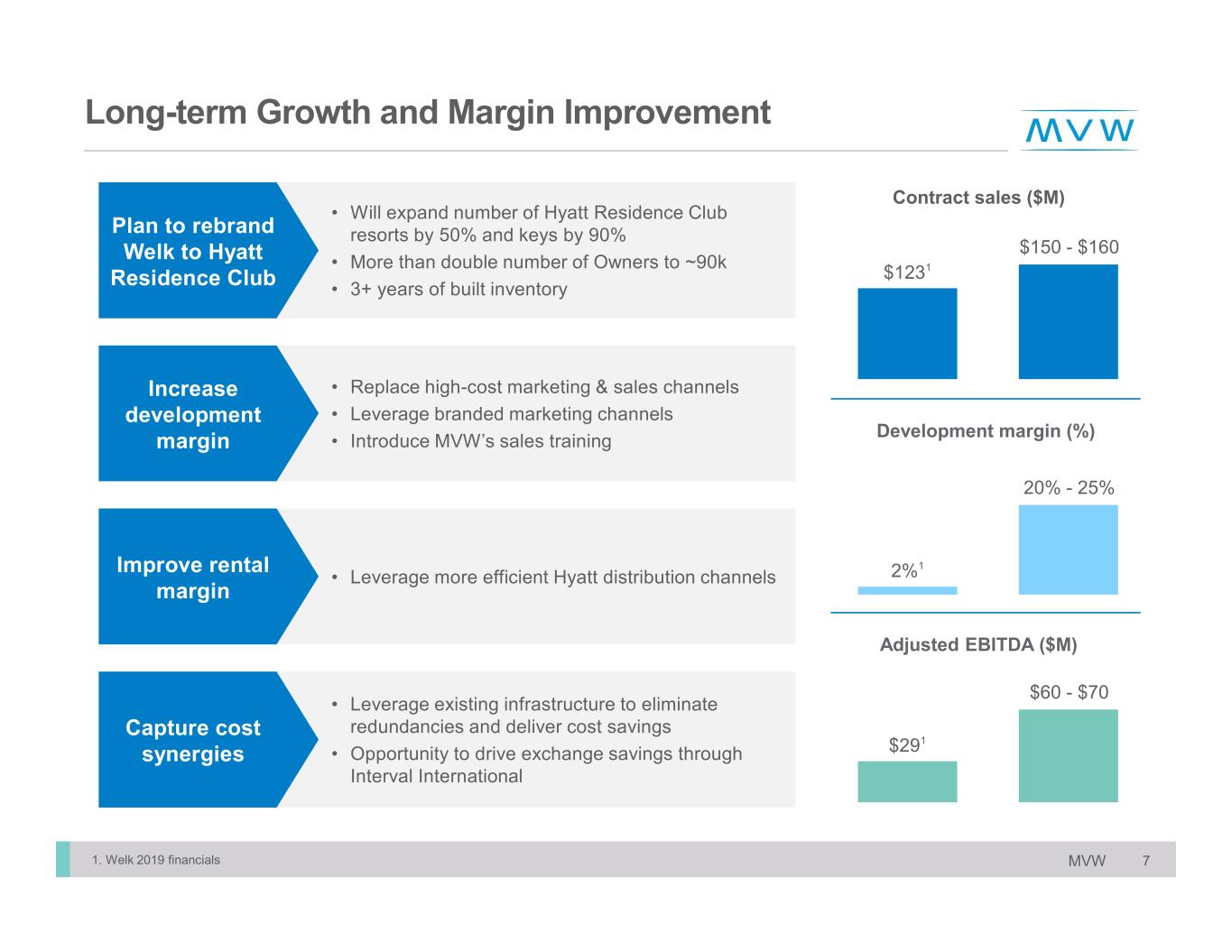

MVW 7 $1231 $150 - $160 $291 $60 - $70 • Will expand number of Hyatt Residence Club resorts by 50% and keys by 90% • More than double number of Owners to ~90k • 3+ years of built inventory • Replace high-cost marketing & sales channels • Leverage branded marketing channels • Introduce MVW’s sales training • Leverage more efficient Hyatt distribution channels • Leverage existing infrastructure to eliminate redundancies and deliver cost savings • Opportunity to drive exchange savings through Interval International 1. Welk 2019 financials 2%1 20% - 25%

MVW Transaction value of ~$461m includes ~$31m of transaction costs and anticipated rebranding costs. Adjusted EBITDA multiple based on mid-point of management expectations. 1. Value of 2 years of excess built inventory and land for future development 8 ~$366M ~$461M $95M Sirena del Mar by Welk Resorts, Cabo San Lucas, MX

MVW 9 Opportunity to expand Hyatt Residence Club and accelerate its growth Rebranding Welk will more than double the number of Hyatt Residence Club Owners High quality and complementary resort portfolio primarily in West Coast vacation markets Expect to increase Welk’s contract sales and expand margins substantially Potential to more than double Welk’s 2019 Adjusted EBITDA Northstar Lodge by Welk Resorts, Lake Tahoe, CA

MVW A-1 Welk Resorts San Diego, Escondido, CA

MVW A-11 A-2 (In millions) 2019 State and Foreign Income Taxes 1 Cash Flow Depreciation & Amortization 7 Amortization of Non Recurring Debt Issuance Costs 1 Recourse Financing Expense 5 Non Recurring Expenses 3 Source: Welk historical financials