Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Nemaura Medical Inc. | nmra_8k-011121.htm |

Exhibit 99.1

Corporate Presentation H.C.WAINWRIGHT & CO BIOCONNECT 2021 Conference Dr Faz Chowdhury, CEO January 11 - 14, 2021

Forward - Looking Statements

• This presentation includes forward - looking statements that are subject to many risks and uncertainties. These forward - looking statements, such as statements about Nemaura’s short - term and long - term growth strategies, can sometimes be identified by use of terms such as “intend,” “expect,” “plan,” “estimate,” “future,” “strive,” and similar words. These statements involve many risks and uncertainties that may cause actual results to differ from what may be expressed or implied in these statements. • These risks are discussed in Nemaura’s filings with the Securities and Exchange Commission (the “Commission”), including the risks identified under the section captioned “Risk Factors” in Nemaura’s Annual Report on Form 10 - K filed with the Commission in June 2019 as the same may be updated from time to time. • Nemaura disclaims any obligation to update information contained in these forward - looking statements whether as a result of new information, future events, or otherwise. 2 www.nemauramedical.com

Investment Highlights A World first daily wear Continuous glucose monitor Commercialized as sugarBEAT® (Class 2b CE approved medical device) and proBEAT Ρ (in USA under wellbeing category pre - PMA approval) Applicable for Pre - diabetes (diabetes prevention), Type 1 (glucose trending) and Type 2 Diabetes (glucose trending and diabetes reversal) Total addressable market exceeding $ 150 Billion 1,2,3 CE approved Class 2b Medical device – adjunct to finger - prick test BEAT diabetes program launched in the USA in December 2020 BEAT diabetes planned for broader global roll out in 2021 with partners PMA submitted, with anticipated approval by end 2021 1. https ://drug - dev.com/global - type - 2 - diabetes - market - set - to - almost - double - to - 58 - 7 - billion / 2. https://www.prnewswire.com/news - releases/global - digital - diabetes - market - outlook - to - 2026 - a - 16 - billion - industry - opportunity - 300980794. html 3. https://www.absolutemarketsinsights.com/reports/Global - Noninsulin - Therapies - for - Diabetes - Market - 2019 - 2027 - 259 3

Core Technology

Benefits over HbA1c

BEAT Ρ diabetes Global program L aunched in the USA in December 2020 Key Targets: 1. Prevent diabetes – target >80 million people with pre - diabetes in the USA 1. Reverse Diabetes – targeting >25 million persons in the USA 8

Obesity and Diabetes: TWO of the major drivers of the chronic disease Epidemic The added cost of managing a Type 2 diabetic person is >$6000/year. This can be avoided by preventing or reversing Type 2 Diabetes 9 Pre - Diabetics >80 million Type 2 >25 million

10 FULL PROGRAM LAUNCHED DECEMBER 2020 IN USA 3 CORE COMPONENTS 1. Weight loss program originally developed at the Joslin Institute – over 12 years of clinical evidence. Sustained long term weight loss achieved 2. proBEAT Ρ glucose profiling – worlds first daily - wearable glucose sensor, developed in - house 3. Coaching: digital 24/7 using app, and specialist 1 to 1 coaching

Intermittent Glucose Profiling: B enefits 11 7 - point glucose profiles every 4 weeks. Patients received guidance for diet and exercise adjustments based on SMBG. Outcome: Significant reductions in HbA1c, weight, BMI, systolic BP, diastolic BP, and LDL Cholesterol Kempf et. al., Diabetes Technol Ther (2010 )

12 Glucose trend and diet , exercise , and other parameters used to determine individual metabolic health . Combine with education and guidance

13

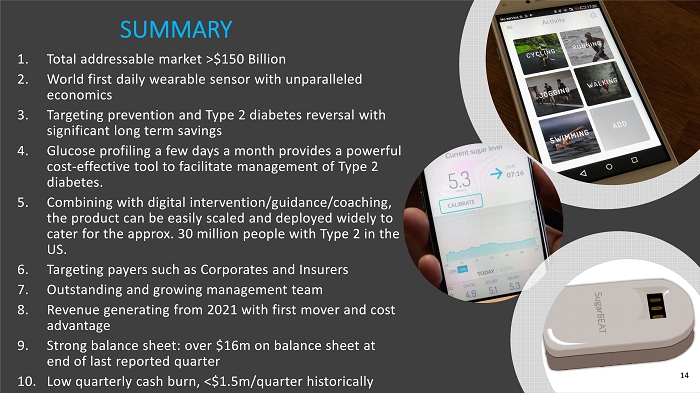

SUMMARY 1. Total addressable market >$150 Billion 2. World first daily wearable sensor with unparalleled economics 3. Targeting prevention and Type 2 diabetes reversal with significant long term savings 4. Glucose profiling a few days a month provides a powerful cost - effective tool to facilitate management of Type 2 diabetes. 5. Combining with digital intervention/guidance/coaching, the product can be easily scaled and deployed widely to cater for the approx. 30 million people with Type 2 in the US. 6. Targeting payers such as Corporates and Insurers 7. Outstanding and growing management team 8. Revenue generating from 2021 with first mover and cost advantage 9. Strong balance sheet: over $16m on balance sheet at end of last reported quarter 10. Low quarterly cash burn, <$1.5m/quarter historically 14