Attached files

| file | filename |

|---|---|

| 8-K - 8-K - R1 RCM INC. | achi-20210111.htm |

39th Annual J.P. Morgan Healthcare Conference January 11, 2021 Exhibit 99.1

2 Forward-Looking Statements and Non-GAAP Financial Measures This presentation includes information that may constitute “forward-looking statements,” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements relate to future, not past, events and often address our expected future growth, plans and performance or forecasts. These forward-looking statements are often identified by the use of words such as “anticipate,” “believe,” “designed,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “will,” or “would,” and similar expressions or variations, although not all forward-looking statements contain these identifying words. These forward-looking statements include, among other things, statements about the potential impacts of the COVID-19 pandemic, our strategic initiatives, our capital plans, our costs, our ability to successfully deliver on our commitments to our customers, our ability to deploy new business as planned, our ability to successfully implement new technologies, our future financial performance and our liquidity, and the anticipated benefits of acquisitions, dispositions, and other strategic transactions. Such forward- looking statements are based on management’s current expectations about future events as of the date hereof and involve many risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in our forward-looking statements. Subsequent events and developments, including actual results or changes in our assumptions, may cause our views to change. We do not undertake to update our forward-looking statements except to the extent required by applicable law. Readers are cautioned not to place undue reliance on such forward-looking statements. All forward-looking statements included herein are expressly qualified in their entirety by these cautionary statements. Our actual results and outcomes could differ materially from those included in these forward-looking statements as a result of various factors, including, but not limited to, the severity, magnitude and duration of the COVID-19 pandemic; responses to the pandemic by the government and healthcare providers and the direct and indirect impacts of the pandemic on our customers and personnel; the disruption of national, state and local economies as a result of the pandemic; the impact of the pandemic on our financial results, including possible lost revenue and increased expenses; risks that the expected benefits from acquisitions, dispositions, and other strategic transactions will not be realized or will not be realized within the expected time period; the risk that acquired businesses will not be integrated successfully; significant transaction costs; unknown or understated liabilities; and the factors discussed under the heading “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2019, our quarterly reports on Form 10-Q and any other periodic reports that the Company files with the Securities and Exchange Commission. This presentation includes the following non-GAAP financial measure: Adjusted EBITDA. Please refer to the Appendix located at the end of this presentation for a reconciliation of the non-GAAP financial measure to the most directly comparable GAAP financial measure.

3 R1 Investment Highlights Leading, technology-driven revenue cycle platform with a compelling financial model Tech-driven End-to-end capabilities Scale Leverage Differentiated Technology Acute & Physician RCM Market $110B 3-Year Revenue CAGR, 2018-2021E >15% CAGR Leading Revenue Cycle Platform Large Market Opportunity Significant Growth >90% Recurring Revenue Strong Financial Trajectory 2021 Adjusted EBITDA Outlook From $230-240M in 2020 $315-330M Note: Adjusted EBITDA is a non-GAAP measure, please refer to the Appendix for a reconciliation of non-GAAP financial measures

4 Significant Improvements for Integrated Health Systems NEED ▪ Lower costs ▪ Faster collections ▪ Higher revenue ▪ Higher patient satisfaction Growing pressure to run revenue cycle more efficiently We plug into health providers’ existing IT systems VALUE ADD RESULTS OPERATING MODEL Proprietary Technology Experienced Talent Analytics and Alerts Proven Results Global Shared Services

5 Comprehensive Revenue Cycle Capabilities for Providers Transforming revenue cycle performance across care settings and payment models Revenue Cycle Phases Order to Intake Care to Claim Claim to Payment Payment Models Fee-for-service Patient Self-pay Value-based Solutions address the full spectrum of needs and operations Care Settings Physician Acute Post-Acute

6 Leading Position to Extend Scale Advantage Proven Ability to Deliver Scale Benefits Further Differentiates R1 Value Proposition Scale advantage ��= Proven operating system + Innovative technology+ Globaldelivery+ Performanceanalytics

7 Financial Outlook Expect to add $4B in new end-to-end NPR under management in 2021 Note: Adjusted EBITDA is a non-GAAP measure, please refer to the Appendix for a reconciliation of non-GAAP financial measures $M Revenue1 Operating Income Adjusted EBITDA 2021 1,410 – 1,460 135 – 155 315 – 330 Medium-Term2 Objectives Annual growth in end-to-end NPR under management: 10-12% Annual adjusted EBITDA Growth: 12-15% Adjusted EBITDA Margin: ~25% Note1: 2021 guidance assumes patient volumes at 90-95% pre-COVID levels Note2: Medium-term is defined as 3-5 years post-2021

8 Technology Drives Long-Term Operational Model Digitization Expected to Drive Significant Margin Expansion Technology costs Labor and related costs Adjusted EBITDA margin 2020E Future >30% SG&A costs <5% Costs as % of R1 revenue ~7% ~19% ~62% ~10% ~20% <45%

9 R1 Investment Highlights 2. Differentiated Value Proposition 1. Large, Underpenetrated Market 3. Multiple Growth & Profit Drivers 4. Strong Financial Trajectory

10 Market Dynamics Play to Our Strengths Best value proposition Transformed patient experience Revenue improvement Cost reduction Faster collections Industry Consolidation Infrastructure not delivering scale advantages Capital Constraints Priority on clinical investments Financial Pressure Declining reimbursement Weaker margins Increasing Complexity Higher costs Third-party inefficiencies Patient Experience Demands for consumer-friendly technology

11 12% 5% Large, Growing and Underpenetrated RCM Market Market dynamics support strong incremental growth External Spend ~$30B Internal Spend ~$80B $110B Market1 Note1: CMS NHE Projections and R1 estimates Note2: Research and Markets Global Forecast to 2027, published March 2020 Acute-Care $70B Physician $40B Total TAM $110B R1 Growing Faster External Spend Growing >2x Market2 Annual spend CAGR projected through 2027 External Spend Internal >15% CAGR R1 Revenue CAGR (2018-2021E)

12 R1 Investment Highlights 2. Differentiated Value Proposition 1. Large, Underpenetrated Market 3. Multiple Growth & Profit Drivers 4. Strong Financial Trajectory

13 Extensive Capabilities Across the Revenue Cycle 1 2 3 4 5 6 7 8 9 10 11 12 13 Pre-Reg. / Financial Clearance Scheduling Financial Counseling Check-in / Arrival Level of Care Case Management / Utilization Review Charge Compliance Coding & Acuity Capture Billing & Follow-up Denials Management Customer Service Patient Pay / Pre-Collect Underpayments OPERATING SYSTEM PROVEN METHODS + STANDARDIZATION + OPERATING RHYTHM + COMPLIANCE ANALYTICS VISIBILITY + ACTIONABLE INTELLIGENCE + PERFORMANCE MANAGEMENT DELIVERY DEPLOYMENT + CENTRALIZED OPERATIONS + TALENT + GLOBAL NETWORK TECHNOLOGY NORMALIZING TECHNOLOGY + AUTOMATION SOLUTIONS + SECURITY Order to Intake Care to Claim Claim to Payment WORKFLOW

14 Broadest Portfolio of Technology Tools PATIENT EXPERIENCE LINK ACCESS CHART MGR INSIGHT PAS CONTACT DECISION R1 Proprietary Technology Patient Access & Intake Yield & Denial Mitigation Analytics Automation ANALYTICS AUTOMATE PROVIDER AWARENESS Integrated Bill Pay Scoring and Personalization Financial Counseling Digital Check-In Price Estimation Financial Clearance Scheduling Order Management Simple and Complex Coding Claim Status Triage Clinical and Technical Appeals Documentation Management Revenue Capture and Integrity Denial Detection and Triage Yield-Based Follow-Up Alerts and Messaging Dimensional Visualization Actionable Performance Monitoring Predictive Analytics Digital Self-Service Natural Language Processing Web Service Integration Robotic Process Automation (RPA) Omni-Channel Communications Cognitive Automation POST

15 Patient Experience Solution: Facilitating a Great Experience R1, SCI, and Tonic combined to create the most comprehensive patient and provider-centric platform for care coordination – No waiting on hold – No confusing paper orders – Confirm time instantly – Full digital self-service – Rules engine = accuracy – Price transparency – Automated onboarding forms – Automated underlying RCM – White glove or fully digital – Smooth payment – Satisfying experience – Encourages return visit Find1. Consumer friendly scheduler presents only real, clinically appropriate appointments online Comprehensive pre-check instills patient confidence, limits surprises and improves performance Smooth check-in improves satisfaction and returns patient and provider focus to high-quality care Reliable availability Book Easy access 2. Fast-track welcome Arrive3.

16 Platform Components Key R1 Intellectual Property Capabilities Enabled User Interface ▪ Tonic for Health, DPX ▪ R1 Unity (SCI) Provider Portal ▪ Self-service search & schedule ▪ Self-service intake Data Management ▪ Top 3 EHR API partnerships ▪ R1 proprietary APIs ▪ Data travels w/ patient ▪ Plug & Play ▪ Enterprise configurability Rules Engines & Work Drivers ▪ R1 Access financial clearance ▪ R1 Insight price calculation ▪ R1 Unity (SCI) orders & booking rules ▪ Comprehensive Demographics ▪ Full Price Transparancy ▪ Eligiblity & Authorization Rules ▪ Financial Clearance & Payment Analytics & Operating System ▪ R1 PX operating playbook ▪ Dedicated deployment & standardization team ▪ Digital adoption ▪ Process fool-proofing ▪ Operational enablement Most Advanced Patient Experience Solution on Market Unique IP advantage in key process areas drives step-change digital adoption R1 uniquely positioned to bring critical pieces together, delivering comprehensive platform for patients and providers R 1 a d d re ss e s si g n if ic a n t ga p s in t h e m a rk e t

17 Leading Automation of the Revenue Cycle R1’s automation ecosystem expands beyond RPA to transform end-to-end RCM operations More than Robotic Process Automation (RPA) Dedicated Efforts to Uncover New Digitization Opportunities Built for Scale and Growth Transformative Technology for R1; Built-for-Purpose Ecosystem ▪ Platform of expert rules, machine learning, OCR/NLP, RPA, and workflow orchestration expands automation opportunities ▪ Strategic business partnerships with leading RPA platforms enables efficient scaling and hardens security 1 Significant Investment Drives Scaled Execution Capability ▪ Invested $30M+ in Digitization since 2018 ▪ Center of Excellence with 120+ dedicated resources ▪ Secure connections to 75+ Health IT systems 2 Applications Architecturally Built for Scale Support R1’s Strategic Growth Plan ▪ Differentiated capability automating 30M+ tasks and the work of 1,200+ FTEs annually ▪ $20M+ annual EBITDA contribution from current production routines demonstrates value ▪ Able to rapidly scale across R1’s captive operational footprint 3

18 R1 Investment Highlights 2. Differentiated Value Proposition 1. Large, Underpenetrated Market 3. Multiple Growth & Profit Drivers 4. Strong Financial Trajectory

19 Multiple Growth and Profit Drivers 1 2 3 Onboard and optimize contracted business Drive digitization and automation New commercial wins 4 Targeted M&A

20 1. Onboard and Optimize Contracted End-to-End Business Note1: $700M NPR End-to-End Operating Partner Physician Group signed in Q3 2019 Ascension Pre-2016 and Phase-1 ($9B NPR) Ascension Phase-2 and Wisconsin ($5B NPR) AMITA and Ascension Medical Group ($6B NPR) Quorum Health, Physician Group1, and RUSH ($4B NPR) Penn State Health, LifePoint Health ($5B NPR) Intermountain Health ($6B NPR) 2019 2020 2021 2022 Midpoint of adjusted EBITDA contribution margin depending on contracting model: -16% to -20% 17% to 28% 30% to 45% Launch Phase 0-12 Months Margin-ramp 12-36 Months Steady State 36+ Months $15B NPR in margin- ramp phase exiting 2021

21 2. Drive Digitization and Automation Transformation Measures 2020E 2022E Expected EBITDA Contribution ~$20M ~$40M Tasks Automated >30M >60M Machine Learning Models 4 >25 PX Locations Deployed >300 >600 Digital Self-Service Tasks >12M >30M Robotic Process Automation (RPA) Digital Self-Service & Patient Experience (PX) Cognitive and Machine Learning (ML) 1 2 3 …Driving Significant EBITDA… …with Runway to Expand3 Proven Levers… ~400M Manual Tasks 45M in Development 30M in Production 50M to Process Map 1 2 5 M A ss e ss e d

22 3. New Commercial Wins Expect 10-12% Growth in End-to-End NPR Under Management Over the Next 3-5 Years NPR Cross-Sell Opportunity into Non-E2E Base: PAS Installed Base SCI Installed Base Cerner Partnership RevWorks Base $92B $88B $77B $28B Continued Sales Execution to Convert End-to-End Pipeline 1 2 3 Aggressive Market Launch of PX Offering following 2020 Commercial Wins Cross Sell into Installed Base via expanded commercial leadership roles 2021 Commercial Focus Areas Sizeable Cross-Sell Opportunity

23 4. Committed to Capital Deployment via Targeted M&A Targeted M&A is a Core Component of R1’s Growth Strategy Operational Control of $40B in NPR Creates Opportunity for Outsized Synergies Net Debt1: $454M 2021 Adj. EBITDA: $315-330M Net Leverage1: <2x Note1: Data as of 9/30/20. Net debt is defined as gross debt less cash and cash equivalents. Net leverage is defined as Net debt divided by annual adjusted EBITDA. Strong Balance Sheet Position Scaled Platform for Synergy Realization Feb 2018 Proven M&A Track Record June 2020 and Jan 2020

24 R1 Investment Highlights 2. Differentiated Value Proposition 1. Large, Underpenetrated Market 3. Multiple Growth & Profit Drivers 4. Strong Financial Trajectory

25 Track Record of High Recurring Revenue and Margin Expansion Revenue ($M) Adj. EBITDA ($M) EBITDA Margin1 $869 $1,186 2018 2019 2021E $1,410-1,460 $57 $168 2018 2019 2021E $315-330 6.6% 14.2% 2018 2019 2021E ~23% >15% CAGR >50% CAGR +1600 BPS Note1: Based on midpoints of 2021 revenue and adjusted EBITDA guidance

26 Financial Outlook Expect to add $4B in new end-to-end NPR under management in 2021 Note: Adjusted EBITDA is a non-GAAP measure, please refer to the Appendix for a reconciliation of non-GAAP financial measures $M Revenue1 Operating Income Adjusted EBITDA 2021 1,410 – 1,460 135 – 155 315 – 330 Medium-Term2 Objectives Annual growth in end-to-end NPR under management: 10-12% Annual adjusted EBITDA Growth: 12-15% Adjusted EBITDA Margin: ~25% Note1: 2021 assumes patient volumes at 90-95% pre-COVID levels Note2: Medium-term is defined as 3-5 years post-2021

27 Appendix

28 Contract Economics by Engagement Model Co-ManagedOperating Partner Modular Illustrative Revenue and EBITDA Contribution Based on Typical $3B NPR Year 1 Year 4 70-80 120-150 (12) 35-45 Revenue contribution EBITDA contribution (pre-SG&A) $M $M $M Year 1 Year 4 5-15 30-50 (2) 15-20 10-20 10-20 3-12 3-12 Year 1 Year 4

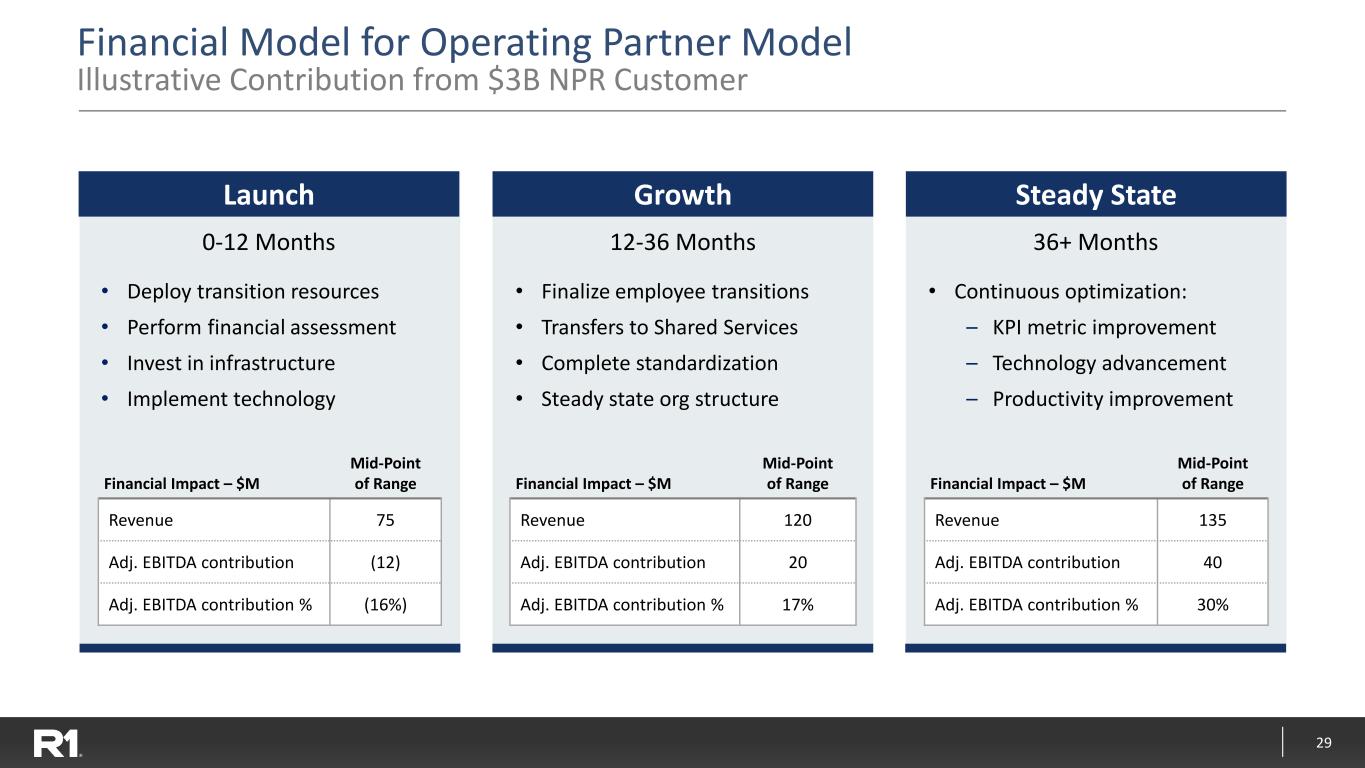

29 Financial Model for Operating Partner Model Illustrative Contribution from $3B NPR Customer Growth • Deploy transition resources • Perform financial assessment • Invest in infrastructure • Implement technology • Finalize employee transitions • Transfers to Shared Services • Complete standardization • Steady state org structure • Continuous optimization: – KPI metric improvement – Technology advancement – Productivity improvement Financial Impact – $M Mid-Point of Range Revenue 120 Adj. EBITDA contribution 20 Adj. EBITDA contribution % 17% Launch Steady State Financial Impact – $M Mid-Point of Range Revenue 75 Adj. EBITDA contribution (12) Adj. EBITDA contribution % (16%) Financial Impact – $M Mid-Point of Range Revenue 135 Adj. EBITDA contribution 40 Adj. EBITDA contribution % 30% 0-12 Months 12-36 Months 36+ Months

30 Financial Model for Co-Managed Partner Model Illustrative Contribution from $3B NPR Customer Growth • Deploy transition resources • Perform financial assessment • Invest in infrastructure • Implement technology • Complete standardization • Workflow optimization • Rationalize third-party vendors • Continuous optimization: – KPI metric improvement – Technology advancement – Productivity improvement Financial Impact – $M Mid-Point of Range Revenue 25 Adj. EBITDA contribution 7 Adj. EBITDA contribution % 28% Launch Steady State Financial Impact – $M Mid-Point of Range Revenue 10 Adj. EBITDA contribution (2) Adj. EBITDA contribution % (20%) Financial Impact – $M Mid-Point of Range Revenue 40 Adj. EBITDA contribution 18 Adj. EBITDA contribution % 45% 0-12 Months 12-36 Months 36+ Months

31 Capital Structure Normalization On January 6, 2021, R1 announced that it has entered into an agreement for the conversion of preferred stock held by Ascension and TowerBrook to common stock. As part of the agreement, the holders will receive: ▪ 139.3 million common shares ▪ A one-time cash payment of $105 million, funded with cash from balance sheet Basic Common Shares Outstanding "As Converted" Preferred Stock to Common Shares Pre-Transaction / Common Shares Post- Transaction Future PIK Dividends (“As Converted” to Common Shares) Pre-Transaction Total Common Shares Outstanding, inclusive of “As Converted” Preferred Stock Pre-Transaction Pre-Transaction (1/4/21) Post-Transaction {shares in millions) Total Adjusted Basic Shares Outstanding 117.7 238.8 21.6 260.4 121.1 139.3 260.4 - 260.4 121.1

32 Use of Non-GAAP Financial Measures ▪ In order to provide a more comprehensive understanding of the information used by R1’s management team in financial and operational decision making, the Company supplements its GAAP consolidated financial statements with certain non-GAAP financial performance measures, including adjusted EBITDA. Adjusted EBITDA is defined as GAAP net income before net interest income/expense, income tax provision/benefit, depreciation and amortization expense, share-based compensation expense, expense arising from debt extinguishment, strategic initiatives costs, transitioned employee restructuring expense, digital transformation office expenses, and certain other items. ▪ Our board of directors and management team use adjusted EBITDA as (i) one of the primary methods for planning and forecasting overall expectations and for evaluating actual results against such expectations and (ii) a performance evaluation metric in determining achievement of certain executive incentive compensation programs, as well as for incentive compensation programs for employees. ▪ A reconciliation of GAAP net income to Adjusted EBITDA and GAAP operating income guidance to non-GAAP adjusted EBITDA guidance is provided below. Adjusted EBITDA should be considered in addition to, but not as a substitute for, the information presented in accordance with GAAP. 2020 2021 GAAP Operating Income Guidance $90-110 $135-155 Plus: Depreciation and amortization expense $65-75 $70-80 Share-based compensation expense $20-25 $55-60 Strategic initiatives, severance and other costs $45-50 $50-55 Adjusted EBITDA Guidance $230-240 $315-330 Reconciliation of GAAP Operating Income Guidance to Non-GAAP Adjusted EBITDA Guidance $ in millions