Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - BUILD-A-BEAR WORKSHOP INC | a52359208ex99_1.htm |

| 8-K - BUILD-A-BEAR WORKSHOP, INC. 8-K - BUILD-A-BEAR WORKSHOP INC | a52359208.htm |

|

|

Exhibit 99.2

|

1 2021 ICR CONFERENCE

Forward Looking and Cautionary Statements This presentation contains certain statements that are, or

may be considered to be, “forward-looking statements” for the purpose of federal securities laws, including, but not limited to, statements that reflect our current views with respect to future events and financial performance. We generally

identify these statements by words or phrases such as “may,” “might,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “intend,” “predict,” “future,” “potential” or “continue,” the negative or any derivative of these terms and

other comparable terminology. Forward-looking statements are based on current expectation and assumptions that are subject to risks and uncertainties which may cause results to differ materially from the forward-looking statements. We

undertake no obligation to update or revise publicly any forward-looking statements, whether because of new information, future events or otherwise. Risks and uncertainties to which our forward-looking statements are subject include: (1) the

COVID-19 pandemic has negatively impacted our business and continues to cause significant uncertainties; (2) general global economic conditions may decline, which could lead to disproportionately reduced consumer demand for our products,

which represent relatively discretionary spending; (3) a decline in consumer traffic at malls and tourist locations could adversely affect our financial performance and profitability; (4) modification of our interactive shopping experience in

response to COVID-19 could have a negative impact on the appeal of our interactive shopping experience; (5) we may experience store closures in shopping malls and tourist locations and other impacts to our business resulting from civil

disturbances; (6) we may be restricted from offering the hands-on, interactive and high touch service model that is important to our brand; (7) there may be a reluctance to celebrate special occasions that have historically been a key driver

for store traffic; (8) the COVID-19 pandemic may adversely affect consumer spending during this year’s holiday season; (9) we may be unable to generate demand for our interactive retail experience and products, including as the economy

emerges from the restrictions imposed by the COVID-19 pandemic, and otherwise respond to consumer preferences; (10) sales of our licensed products based on feature films with planned theatrical launches could be negatively affected by

delayed movie releases as a result of the COVID-19 pandemic; (11) we may be unable to leverage the flexibility within our existing real estate portfolio; (12) our success depends on the ongoing effectiveness of our marketing and online

initiatives to build consumer affinity for our brand and drive consumer demand for key products and services; (13) we are subject to a number of risks related to disruptions, failures or security breaches of our information technology

infrastructure; (14) we may not be able to operate successfully if we lose key personnel; (15) we are subject to risks associated with technology and digital operations; (16) we may not be able to evolve our store locations to align with

market trends, successfully diversify our store models and formats, or otherwise effectively manage our overall portfolio of stores; (17) we rely on a few global supply chain vendors to supply substantially all of our merchandise, and

significant price increases or disruption in their ability to deliver merchandise could harm our ability to source products and supply inventory to our stores; (18) our company-owned distribution center and our third-party distribution center

providers may experience disruptions in their ability to support our stores or they may operate inefficiently; (19) our merchandise is manufactured by foreign manufacturers and the availability and costs of our products, as well as our

product pricing, may be negatively affected by risks associated with international manufacturing and trade, tariffs and foreign currency fluctuations; (20) we may be unable to effectively manage our international franchises, attract new

franchisees or the laws relating to our international franchises change; (21) we may not be able to operate our international corporately-managed locations profitably; (22) we may fail to renew, register or otherwise protect our trademarks

or other intellectual property and may be sued by third parties for infringement or misappropriation of their proprietary rights; (23) we may suffer negative publicity or be sued if the manufacturers of our merchandise or Build-A-Bear branded

merchandise sold by our licensees ship products that do not meet current safety standards or production requirements or if such products are recalled or cause injuries; (24) we may suffer negative publicity or be sued if the manufacturers of

our merchandise violate labor laws or engage in practices that consumers believe are unethical; (25) our profitability could be adversely impacted by fluctuations in petroleum products prices; (26) our business may be adversely impacted by

a significant variety of competitive threats; (27) we may suffer negative publicity or a decrease in sales or profitability if the products from other companies that we sell in our stores do not meet our quality standards or fail to achieve

our sales expectations; (28) we may be unsuccessful in engaging in various strategic transactions, which may negatively affect our financial condition and profitability; (29) the duration of our plan to not utilize cash to resume share

repurchases while we continue to take measure to preserve our cash position may negatively impact our financial condition; (30) fluctuations in our quarterly results of operations could cause the price of our common stock to substantially

decline; (31) the market price of our common stock is subject to volatility, which could in turn attract the interest of activist shareholders; and (32) provisions of our corporate governing documents and Delaware law may prevent or frustrate

attempts to replace or remove our management by our stockholders, even if such replacement or removal may be in our stockholders’ best interests. For additional information concerning factors that could cause actual results to materially

differ from those projected herein, please refer to our most recent reports on Form 10-K, Form 10-Q and Form 8-K. 2

BBW 3 CCVVVV CCVVVV CCVVVV SOUND STRATEGY EVEN AMID COVID DISRUPTIONDesigned

to drive profitable growth and leverage and monetize brand equity to diversify revenue streams FOCUSED ON CONTINUED OPPORTUNITY IN 2021Driving results in digital transformation and retail evolution CCVVVV ACCELERATED KEY STRATEGIC

INIATIVES IN 2020While securing financial stability POWERFUL and EVOLVED BRANDBuild-A-Bear has multi-generational consumer connections and monetizable brand equity almost 25 years in the making EXPERIENCED and DRIVEN TEAMFlexible,

responsive and disciplined management team and organization

4 1997 2021 Build-A-Bear Workshop launches as the leading experiential retail-entertainment

concept, predominately located in malls where families with children primarily went for shopping and entertainment at the time. BBW: AN ICONIC BRAND EVOLVES…. Build-A-Bear has extended BEYOND TRADITIONAL MALL RETAIL to - new locations and

formats- digital platforms, and- entertainment & content offerings to reach a broader range of consumers in a variety of new ways. Build-A-Bear becomes a multi-generational brand that is recognized by and connected to consumers

globally.

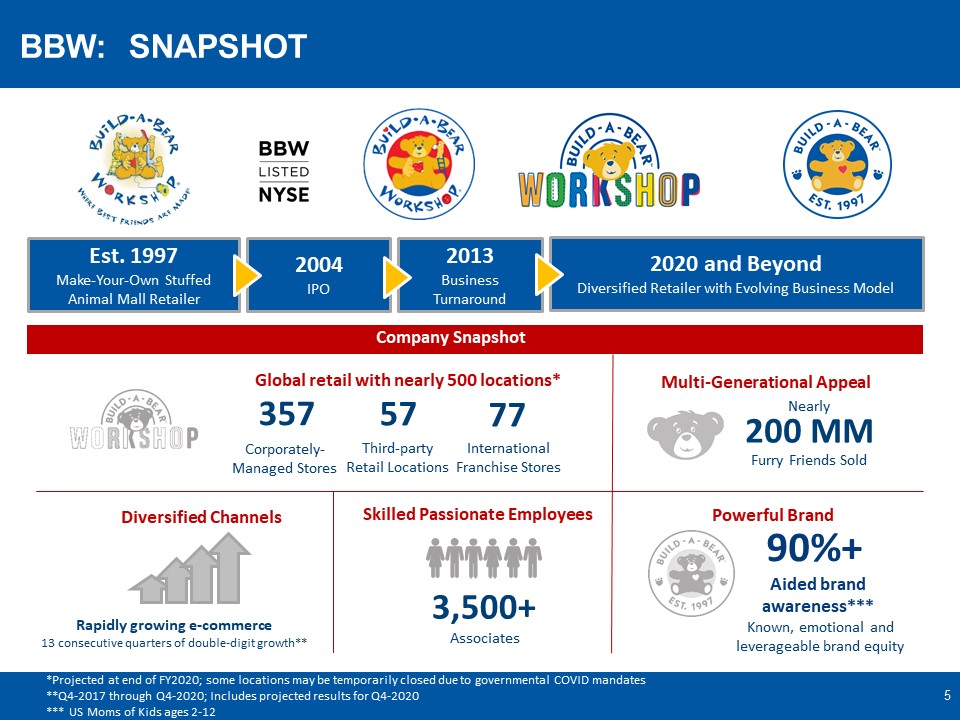

BBW: SNAPSHOT BBW 2019 5 Est. 1997Make-Your-Own Stuffed Animal Mall Retailer 2004IPO 2020 and

BeyondDiversified Retailer with Evolving Business Model 2013Business Turnaround 357 Corporately-Managed Stores 57 Third-party Retail Locations 77 International Franchise Stores 3,500+ Associates Rapidly growing

e-commerce13 consecutive quarters of double-digit growth** 200 MM Furry Friends Sold Nearly Known, emotional and leverageable brand equity Global retail with nearly 500 locations* Multi-Generational Appeal Diversified Channels Skilled

Passionate Employees Powerful Brand 90%+ Aided brand awareness*** *Projected at end of FY2020; some locations may be temporarily closed due to governmental COVID mandates**Q4-2017 through Q4-2020; Includes projected results for

Q4-2020*** US Moms of Kids ages 2-12 Company Snapshot

BBW: BRAND POWER 6 Build-A-Bear is a brand that has consumer TRUST and LOVE Over 80% of Moms say BAB

is “a brand they trust” and over 80% of kids say BAB is “fun to visit” 12% 22% 15% 25% 26% Age range 1/3 Male 2/3 Female With Broad Demographic Appeal… …and a Loyal, Passionate Consumer Base Source: C&R Research 2017 AND

YES, OVER 40% OF END USERS ARE TWEENS, TEENS AND ADULTS 9MM Bonus Club Members and Opted-in E-mail data base

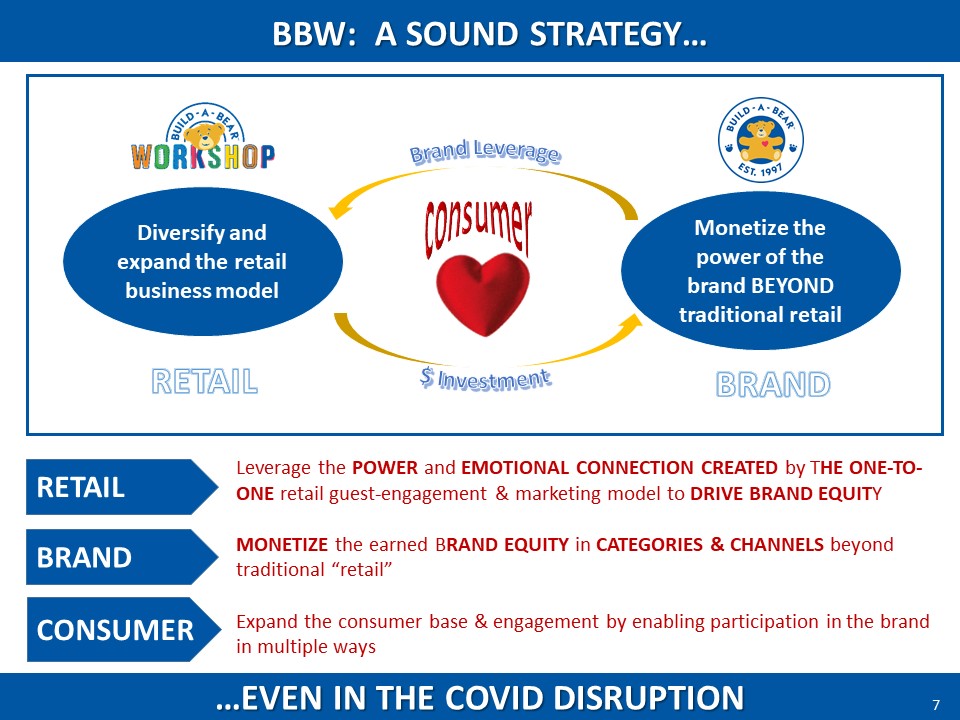

BRAND RETAIL …EVEN IN THE COVID DISRUPTION 7 BBW: A SOUND STRATEGY… Leverage the POWER and

EMOTIONAL CONNECTION CREATED by THE ONE-TO-ONE retail guest-engagement & marketing model to DRIVE BRAND EQUITYMONETIZE the earned BRAND EQUITY in CATEGORIES & CHANNELS beyond traditional “retail”Expand the consumer base &

engagement by enabling participation in the brand in multiple ways consumer Diversify and expand the retail business model Monetize the power of the brand BEYOND traditional retail Brand Leverage $

Investment BRAND RETAIL CONSUMER

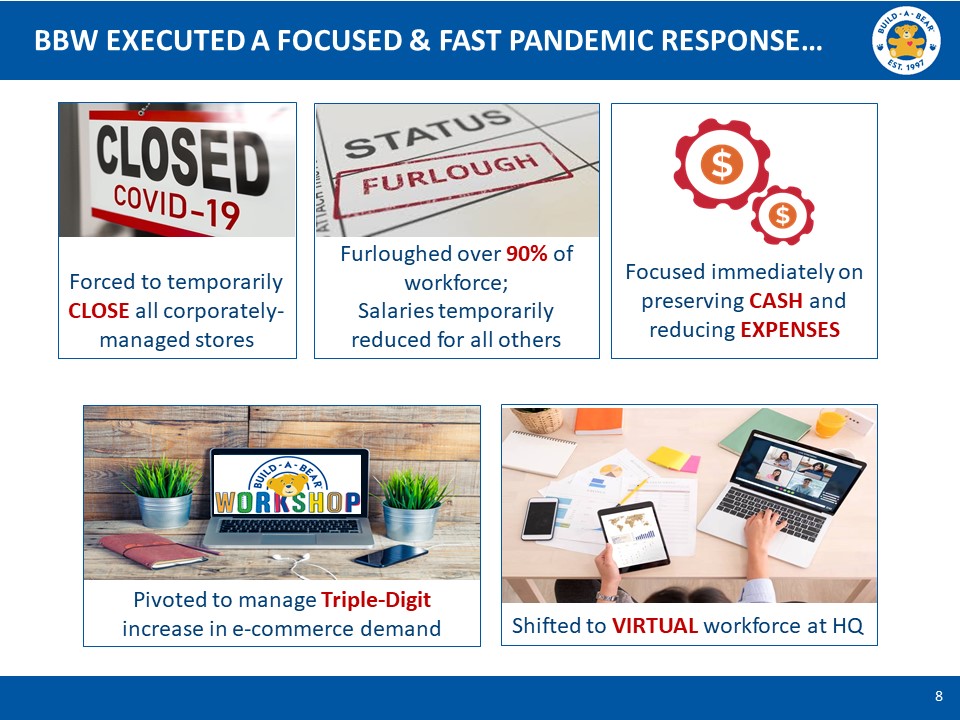

BBW EXECUTED A FOCUSED & FAST PANDEMIC RESPONSE… 8 Forced to temporarily CLOSE all

corporately-managed stores Focused immediately on preserving CASH and reducing EXPENSES Shifted to VIRTUAL workforce at HQ Pivoted to manage Triple-Digit increase in e-commerce demand Furloughed over 90% of workforce; Salaries

temporarily reduced for all others

…WHILE ACCELERATING KEY LONGER-TERM STRATEGIES in 2020 9 After initially responding to and managing

the immediate challenges brought by COVID, a rapid shift was made to leverage the circumstances to accelerate our strategic initiatives for long-term benefit. Resources focused in 3 areas: 1) Accelerated the Digital Transformation to Drive

Awareness, Demand and Revenue 2) Rapidly Evolved Retail Leveraging Rent Optionality after Safely Reopening 3) Secured Financial Stability and Well-Being Drove demand with key licensed products with e-comm first strategy Recognized

consumer mind shifts and needs Leveraged content to stay engaged Drove brand involvement and awareness with entertainment content Innovated with digital only promotions and events Reopened Retail Stores with modified service

model Utilized existing store overhead to help fulfill increased digital demand Over 99% of leases were renegotiated in NA(and >90% in EU) AGGRESSIVE CASH MANAGEMENT CORPORATE REORGANIZATION New Asset-Based Credit Facility

BBW: Q4-2020 SELECT FINANCIAL EXPECTATIONS 10 * Comparisons vs Prior Year at mid-point of 2020

range;** These non-GAAP financial measures are defined and reconciled to the most comparable GAAP measure later in this document;*** Projected at end of FY2020 ($ in millions) Q4 20 Range Actual 2019 Mid Pt vs PY* Total Revenues $88.0 -

$92.0 $104.6 ($14.6) Gross Profit $43.5 - $46.0 $52.7 ($8.0) SG&A $39.5 -$40.0 $45.1 ($5.4) EBIT** $4.0 - $6.0 $7.6 ($2.6) EBITDA** $7.3 - $9.3 $10.9 ($2.6) Cash & Equivalents*** $32 - $37 $26.7 +$7.8 Q4-2020

Expectations: Q4-2020 Expectations: +90-100% E-Commerce Operating Hours Conversion DPT Net Retail Sales Commercial Revenue Operating Days Conversion AOV Traffic 3rd Party Retail Intl Franchising AOV

represents Average Order Volume;DPT represents Dollars Per Transaction - Down Double Digits Net Retail Sales COMMENTSQ4-2020 revenue declined ~14% compared to FY2019, driven by ~18% fewer operating days for corporately-managed

retail stores in the quarter compared to the prior year's period including the closure of all UK-based stores early in January 2021. In addition to less days, during the open days, our stores had reduced operating hours and we followed

mandates and regulations regarding capacity, which further impacted the comparison to last year. Disciplined management of controllable costs and the impact of rent negotiations from earlier in the year helped to deliver a profitable quarter

despite the decline in revenue.Commercial revenue declined due to negative impact from COVID.

FY2020 SELECT FINANCIAL EXPECTATIONS 11 ($ in millions) H1-2020 H1-2019 vs PY Proj

H2-2020* H2-2019 vs PY Proj FY2020* Act FY2019 vs PY Actual Actual Mid-pt of Q4 Range Actual Mid-pt of Q4 range Actual Total Revenues $87.0 $163.6 ($76.6) $164.7 $174.9 ($10.2) $251.7 $338.5 ($86.8) Gross

Profit $15.6 $73.2 ($57.6) $79.5 $80.4 ($0.9) $95.1 $153.6 ($58.5) SG&A $48.2 $71.5 ($23.3) $72.8 $80.5 ($7.7) $121.0 $152.0 ($31.0) EBIT** ($32.6) $1.7 ($34.3) $6.7 ($0.1) +$6.8 ($25.9) $1.6 ($27.5) EBITDA** ($25.9) $8.5 ($34.4) $13.2 $6.8 +$6.4 ($12.7) $15.3 ($28.0) Cash

& Equivalents*** $34.5 $26.7 +$7.8 * H2-2020 and Proj FY2020 reflect Q4 results at mid-point of expected range;** These non-GAAP financial measures are defined and reconciled to the most comparable GAAP measure later in

this document;*** Projected at end of FY2020 FY2020 Expectations: COMMENTSNet retail sales were negatively impacted by temporary store closures due to COVID, partially offset by strong growth in e-commerce demand. Commercial revenues also

declined due to negative COVID impact. Disciplined management of items within our control contributed to an improvement in H2 profit compared to the prior year.There is a direct correlation between the total revenue decline and the number of

operating days due to COVID restrictions by quarter and by region where BBW has corporately managed stores. Q1 Q2 Q3 Q4 US (49%) (60%) (7%) (10%) UK (52%) (63%) (7%) (66%) TTL (50%) (60%) (7%) (18%) Decline in Store

Operating Days By Geography and Quarter In addition, crowd size restrictions and reduced operating hours due to government mandates impacted brick-and-mortar sales particularly during the high-volume holiday period.

12 2 1 3 2021: CONTINUE TO EVOLVE OUR KEY INITATIVES Further acceleration of digital

transformation Rapidly evolve retail capabilities Financial stability and liquidity management Expand digital capabilities and drive optimization across the entire organization to grow revenues and improve profitability. Extend ways to

connect with and meet the changing needs of consumers across all retail channels while driving omni-channel engagement and expanded delivery options. Maintain the financial discipline required to support our business during on-going COVID

uncertainty, while making select strategic investments designed for future growth.

13 2 3 Rapidly evolve retail capabilities Financial stability and liquidity

management 1 Accelerate the company’s digital transformation Broaden addressable market & expand consumer base with omni-channel engagement using occasion-based offerings and high-appeal licenses;Launch disruptive new digital retail

experience to drive revenue and trial;Expand fulfillment capabilities to efficiently deliver increased demand creation. Focus on prudent and conservative cash usage during ongoing COVID uncertainty;Maintain disciplined expense management,

including SG&A, as well as ongoing lease negotiations retaining optionality while continuing to evolve real estate portfolio;Strategically manage capital to support key initiatives. SELECT INITATIVES 13 Advance overall digital

capabilities across the enterprise including CRM programs;Improve digital marketing capabilities and efficiency;Utilize digital media, content & entertainment as marketing and brand-building tools to engage consumers and drive

sales.

14 2 3 Rapidly evolve retail capabilities Financial stability and liquidity

management 1 Accelerate digital transformation SELECT INITATIVES 14

90%+ US Aided Brand Awareness Consideration Post-Purchase Engagement Repeat

Purchase Retargeting 2021: ACCELERATE DIGITAL TRANSFORMATIONAdvance overall digital capabilities across the enterprise including CRM programs Enhance digital technology & capabilities via Salesforce platform, combined with robust CRM

data to enable new, multi-channel buyer journeys designed to acquire new consumers and drive lifetime value of existing guests. Consumer Funnel: Key Communication Tools include: Push Marketing (E-mail, SMS/TXT, Paid Social), New buyer

journeys, Lead generation, Targeted messaging, Content & Entertainment creation and distribution, Stores, PR, etc. PURCHASE Omnichannel Experience Customized Offerings Single 360O view of guest CONSUMERACQUISITION GUEST

RETENTION Conversion 15 Increase lifetime value through repeat purchase 1

16 2021: ACCELERATE DIGITAL TRANSFORMATIONImprove digital marketing capabilities and

efficiency 1 Use improved analytics and tools to further enhance identification of target consumers via their interests, intent and engagement including:Search, queries, ad engagement, profile and “look-alike” dataPersonalized product

suggestions and promotional offers. Evolve and accelerate consumer engagement in preferred digital platforms with a cumulative opted-in access to over 10MM consumers:Facebook, Instagram, Google Ads (YouTube, Search, Display), programmatic,

TikTok, Opted-in e-mails, etc. Expand on-line streaming events to drive consumer awareness, engagement and sales:Hosted a number of on-line streaming events in 2020, some of which included new in-app immediate purchase capabilities.

DIGITAL TRAFFIC AVERAGE ON-LINE ORDER VALUE OPTED-IN E-MAIL LIST Our digital-first approach leverages changes in consumer media preferences with projected TRIPLE-DIGIT E-COMMERCE GROWTH IN FY2020 ENABLED BY: H2* E-MAIL

ENGAGEMENT DIGITAL RETURN ON AD SPEND (ROAS) H2* DIGITAL DEMAND $ FROM E-MAIL H2* DIGITAL DEMAND $ PER E-MAIL DRIVEN VISIT +12% +20% +15% +80% +20% +100% +75% 2021 select tactics include: * H2 includes FY 2020 Q3 results

and Q4 through December Also, enhanced digital technology by adding Queue-it and a “bear bot” to improve e-commerce interface.

17 2021: ACCELERATE DIGITAL TRANSFORMATIONUtilize digital media, content & entertainment as

marketing and brand-building tools to engage consumers and drive sales 1 VALUE CREATION WHEEL Continue to focus on digital and non-traditional media communications efforts in 2021 via:A multi-dimensional marketing model designed to drive

consumer brand connections while shifting media expenditures toward digital efforts - and away from venues like traditional TV - while generating alternative coverage and impressions with strategies including entertainment content;A focused

Public Relations effort which remains an important lever for BBW particularly given our brand’s high recognition. Generated over 10 billion media impressions in 2020 with digital-first integrated multi-touchpoint consumer

communications.

18 2 3 Rapidly evolve retail capabilities Financial stability and liquidity

management 1 Accelerate digital transformation SELECT INITATIVES 18

19 2021: RAPIDLY EVOLVE RETAIL CAPABILITESBroaden addressable market & expand consumer base with

omni-channel engagement using occasion-based offerings and high-appeal licenses Expand digital capabilities to market broad-appeal licensed offerings and occasion-based products, to increase purchase consideration and drive both new guest

acquisition and repeat business. 2 BROAD-APPEAL HIGH AFFINITY LICENSES SEASONAL AND SPECIAL OCCASIONS BROAD-APPEAL GIFTING Build on digital media algorithms and ID targeting to “find” new affinity consumers and roll out new

customer journeys to drive repeat purchase. Continue to leverage key licenses like “The Child” and “Harry Potter” (which drove the majority of new guest acquisition demand in 2020) as we expect these properties to have “long tails” in 2021

& beyond.Introduce a new highly-requested affinity product line based on a video game with over 10 million players via our NINTENDO relationship. 2020 H2 on-line demand included:+ 130% increase in new guests+ 190% increase in repeat

purchases from lapsed guests 2021 select tactics include: * H2 includes FY 2020 Q3 results and Q4 through December

20 2021: RAPIDLY EVOLVE RETAIL CAPABILITESLaunch disruptive new digital retail experience to

drive revenue and trial 2 20 THIS NEW “CYBEAR” WORKSHOP: Is designed to elevate our e-commerce platform to be a more interactive & personalized digital experience, reflecting some of the attributes of our iconic

"retail-tainment" store process;Creates an additive, disruptive e-commerce opportunity as our digital demand has increased at triple-digit rates;Was developed “mobile first,” leveraging the fact that over 80% of Build-A-Bear digital demand

comes from mobile devices. Interactive from Stuffing to Purchasing

21 CHOOSE ME STUFF ME ADD A

HEART FLUFF ME DRESS ME TAKE ME HOME Introducing… 2021: RAPIDLY EVOLVE RETAIL CAPABILITESLaunch disruptive new digital retail experience to drive revenue and trial 2 Coming in 2021

22 2 2021: RAPIDLY EVOLVE RETAIL CAPABILITESExpand fulfillment capabilities to efficiently deliver

increased demand creation Ohio Warehouse Reconfiguration Shipt Same Day Delivery Buy Online Pick-up In Store Curbside Pickup Buy Online Ship From Store 2020 delivered expanded and diversified options to fulfill digital demand. Given

the expected continued growth in on-line demand, BBW is making a strategic investment to expand the fulfillment, efficiency and through-put of our current warehouse facility. More than doubled e-commerce fulfillment capacity with

improved warehouse throughput and the addition of stores as “mini-warehouses” which also leveraged in-store labor30% of digital demand during Q4 holiday season was fulfilled by storesAdded new capabilities including: BOSFS, BOPIS and CURBSIDE

PICK UPEnhanced “last mile” and same day opportunities with new Shipt relationship 2021 SELECT TACTICS INCLUDE: We also expect to see the full year benefit of the enhanced and new capabilities above, while driving continuous

improvement.

23 2 3 Rapidly evolve retail capabilities Financial stability and liquidity

management 1 Accelerate digital transformation SELECT INITATIVES 23

24 FINANCIAL STABILITY AND LIQUIDITY MANAGEMENTWe plan to maintain the financial discipline

required to support our business during on-going COVID uncertainty, while making strategic investments in the future Signed 5-year $25MM credit facility agreement with PNC Bank in 2020. Disciplined Cash Management Strategic Use of

Capital Focused Expense Management Cash and equivalents expected to be $32MM-$37MM at end of FY2020. Focus on cash preservationContinue to improve inventory management 2021 Capital Expenditures are expected to be in the range of $5.0 -

$10.0MM, with Depreciation and Amortization in the range of $12.0-$14.0MMPlan to invest in warehouse reconfiguration and to continue to support digital transformation Currently forecasting FY2021 SG&A to be less than FY2019With

ongoing lease negotiations, expect to maintain high optionality while continuing to evolve real estate portfolio 3

BBW 25 CCVVVV CCVVVV CCVVVV SOUND STRATEGY EVEN AMID COVID DISRUPTIONDesigned

to drive profitable growth and leverage and monetize brand equity to diversify revenue streams FOCUSED ON CONTINUED OPPORTUNITY IN 2021Driving results in digital transformation and retail evolution CCVVVV ACCELERATED KEY STRATEGIC

INIATIVES IN 2020While securing financial stability POWERFUL and EVOLVED BRANDBuild-A-Bear has multi-generational consumer connections and monetizable brand equity almost 25 years in the making EXPERIENCED and DRIVEN TEAMFlexible,

responsive and disciplined management team and organization

Explanatory Note on Non-GAAP Financial Measures: 26 Build-A-Bear Workshop (NYSE: BBW) reports it

financial results in accordance with generally accepted accounting principles (GAAP). We have supplemented the reporting of our financial information determined in accordance with GAAP with certain non-GAAP financial measures. These results

are included as a complement to results provided in accordance with GAAP because management believes these non-GAAP financial measures help identify underlying trends in the Company’s business and provide useful information to both management

and investors by excluding certain items that may not be indicative of the Company’s core operating results. These measures should not be considered a substitute for or superior to GAAP results. These non-GAAP financial measures are defined

and reconciled to the most comparable GAAP measure within this appendix.

Reconciliation of Non-GAAP Measures:Projected Q4 FY20 Range and Actual Q4 FY19 27 FY20 Q4

Range ($ in millions) Low High Income before income taxes (pre-tax) $4.0 $6.0 Interest $0 $0 Earnings before interest and taxes (EBIT) $4.0 $6.0 Depreciation & Amortization $3.3 $3.3 Earnings before interest, taxes,

depreciation and amortization (EBITDA) $7.3 $9.3 Actual Q4 FY19 ($ in millions) Q4 FY19 Income before income taxes (pre-tax) $7.6 Interest $0 Earnings before interest and taxes (EBIT) $7.6 Depreciation &

Amortization $3.3 Earnings before interest, taxes, depreciation and amortization (EBITDA) $10.9

Reconciliation of Non-GAAP Measures:First Half 2020 and 2019 Results 28 ($ in millions) Actual H1

FY20 Actual H1 FY19 (Loss)/Income before income taxes (pre-tax) ($32.6) $1.7 Interest $0 $0 Earnings before interest and taxes (EBIT) ($32.6) $1.7 Depreciation & Amortization $6.7 $6.8 Earnings before interest, taxes,

depreciation and amortization (EBITDA) ($25.9) $8.5

29 ($ in millions) ProjectedH2 FY20 ActualH2 FY19 Income/(Loss) before income taxes

(pre-tax) $6.7 ($0.1) Interest $0 $0 Earnings before interest and taxes (EBIT) $6.7 ($0.1) Depreciation & Amortization $6.5 $6.9 Earnings before interest, taxes, depreciation and amortization

(EBITDA) $13.2 $6.8 Reconciliation of Non-GAAP Measures:Mid Point for Projected Second Half 2020 and Actual Second Half 2019

Reconciliation of Non-GAAP Measures:Mid Point for Projected Full Year 2020 and Actual Full Year

2019 30 ($ in millions) ProjectedFull Year FY20 ActualFull Year FY19 (Loss)/Income before income taxes (pre-tax) ($25.9) $1.6 Interest $0 $0 Earnings before interest and taxes (EBIT) ($25.9) $1.6 Depreciation &

Amortization $13.2 $13.7 Earnings before interest, taxes, depreciation and amortization (EBITDA) ($12.7) $15.3

Buildabear.com#celeBEARate