Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Kraton Corp | kra-20201029.htm |

Kraton Corporation Third Quarter 2020 Earnings Presentation October 29, 2020

Disclaimers CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION Some of the written and oral statements and information in this presentation contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are often characterized by the use of words such as “outlook,” “believes,” “target,” “estimates,” “expects,” “projects,” “may,” “intends,” “plans,” “on track”, “forsees”, “future,” or “anticipates,” or by discussions of strategy, plans, or intentions. The statements in this presentation that are not historical statements, including, but not limited to, statements regarding our expectations as to the continued impact of the COVID-19 pandemic (including governmental and regulatory actions) on demand for our products, on the economy and on our customers, suppliers, employees, business and results of operations, our expectations for our business and volume recovery for the remainder of 2020 and 2021, our ability to execute our innovation pipeline and deliver innovative and sustainable products and whether the expected benefits of those products will be realized, our plans for operation improvements, our ability to obtain necessary regulatory approvals for BIAXAM on our anticipated timeline, or at all, and whether the expected benefits of the product will be realized, our expectations with respect to debt reduction and consolidated net debt leverage ratio, our expectations regarding the call premium of our 7% senior notes and our expectations regarding the feasibility of future refinancings, our expected use of remaining proceeds from the Cariflex transaction, capital spending and run rate cost savings for 2020 and the information and the matters described under the caption “Business Outlook by Geography and End Use Application,” are forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties, assumptions, and other important factors that could cause the actual results, performance or our achievements, or industry results, to differ materially from historical results, any future results, or performance or achievements expressed or implied by such forward-looking statements. There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements contained in this presentation. Important factors that could cause our actual results to differ materially from those expressed as forward-looking statements include, but are not limited to the factors set forth in this presentation, in our latest Annual Report on Form 10-K, including but not limited to “Part I, Item 1A. Risk Factors” and “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” therein, and in our other filings with the Securities and Exchange Commission (the “SEC”). Many of these risks and uncertainties are currently amplified by and will continue to be amplified by, or in the future may be amplified by, the COVID-19 pandemic. There may be other factors of which we are currently unaware or deem immaterial that may cause our actual results to differ materially from the forward-looking statements. In addition, to the extent any inconsistency or conflict exists between the information included in this presentation and the information included in our prior presentations and other filings with the SEC, the information contained in this presentation updates and supersedes such information. Forward-looking statements are based on current plans, estimates, assumptions and projections, and, therefore, you should not place undue reliance on them. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update them in light of new information or future events. Kraton Third Quarter 2020 Earnings Call 2

Disclaimers GAAP Disclaimer This presentation includes the use of both GAAP and non-GAAP financial measures. The non-GAAP financial measures are defined below. Tables included in this earnings release reconcile each of these non-GAAP financial measures with the most directly comparable U.S. GAAP financial measure. For additional information on the impact of the spread between first-in-first-out (“FIFO”) and Estimated Current Replacement Cost (“ECRC”), see Management’s Discussion and Analysis of Financial Condition and Results of Operations in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019. We consider these non-GAAP financial measures to be important supplemental measures of our performance and believe they are frequently used by investors, securities analysts, and other interested parties in the evaluation of our performance including period-to-period comparisons and/or that of other companies in our industry. Further, management uses these measures to evaluate operating performance, and our incentive compensation plan based incentive compensation payments on our Adjusted EBITDA performance and attainment of net debt reduction, along with other factors. These non-GAAP financial measures have limitations as analytical tools and in some cases can vary substantially from other measures of our performance. You should not consider them in isolation, or as a substitute for analysis of our results under U.S. GAAP in the United States. EBITDA, Adjusted EBITDA, and Adjusted EBITDA Margin: For our consolidated results, EBITDA represents net income (loss) before interest, taxes, depreciation, and amortization. For each reporting segment, EBITDA represents operating income (loss) before depreciation and amortization, and earnings of unconsolidated joint ventures. Among other limitations EBITDA does not: reflect the significant interest expense on our debt or reflect the significant depreciation and amortization expense associated with our long-lived assets; and EBITDA included herein should not be used for purposes of assessing compliance or non-compliance with financial covenants under our debt agreements, which can vary from the terms used herein. The calculation of EBITDA in our debt agreements includes adjustments, such as extraordinary, non-recurring or one-time charges, proforma cost savings, certain non-cash items, turnaround costs, and other items included in the definition of EBITDA in the debt agreements. Other companies in our industry may calculate EBITDA differently than we do, limiting its usefulness as a comparative measure. As an analytical tool, Adjusted EBITDA is subject to all the limitations applicable to EBITDA. We prepare Adjusted EBITDA by eliminating from EBITDA the impact of a number of items we do not consider indicative of our on-going performance, including the spread between FIFO and ECRC and the material impairment charge, but you should be aware that in the future we may incur expenses similar to the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. In addition, due to volatility in raw material prices, Adjusted EBITDA may, and often does, vary substantially from EBITDA and other performance measures, including net income calculated in accordance with U.S. GAAP. We define Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of revenue (for each reporting segment or on a consolidated basis, if applicable). Because of these and other limitations, EBITDA and Adjusted EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our business. Adjusted Gross Profit and Adjusted Gross Profit Per Ton: We define Adjusted Gross Profit Per Ton as Adjusted Gross Profit divided by total sales volume (for each reporting segment or on a consolidated basis, as applicable). We define Adjusted Gross Profit as gross profit excluding certain charges and expenses. Adjusted Gross Profit is limited because it often varies substantially from gross profit calculated in accordance with U.S. GAAP due to volatility in raw material prices. Adjusted Diluted Earnings Per Share: We prepare Adjusted Diluted Earnings per Share by eliminating from Diluted Earnings per Share the impact of a number of non-recurring items we do not consider indicative of our on-going performance, including the spread between FIFO and ECRC and the material impairment charge. Consolidated Net Debt and Consolidated Net Debt excluding the effect of foreign currency: We define Consolidated Net Debt as total consolidated debt (including debt of KFPC) less consolidated cash and cash equivalents. Management uses Consolidated Net Debt to determine our outstanding debt obligations that would not readily be satisfied by its cash and cash equivalents on hand. Management believes that using Consolidated Net Debt is useful to investors in determining our leverage since we could choose to use cash and cash equivalents to retire debt. We also present Consolidated Net Debt, as adjusted for foreign exchange impact accounts for the foreign exchange effect on our foreign currency denominated debt agreements. Consolidated Net Debt Leverage Ratio: The consolidated net debt leverage ratio is defined as consolidated net debt as of the balance sheet date divided by Adjusted EBITDA for the twelve months then ended. Our use of this term may vary from the use of similarly-titled measures by others in our industry due to the potential inconsistencies in the method of calculation and differences due to items subject to interpretation. Kraton Third Quarter 2020 Earnings Call 3

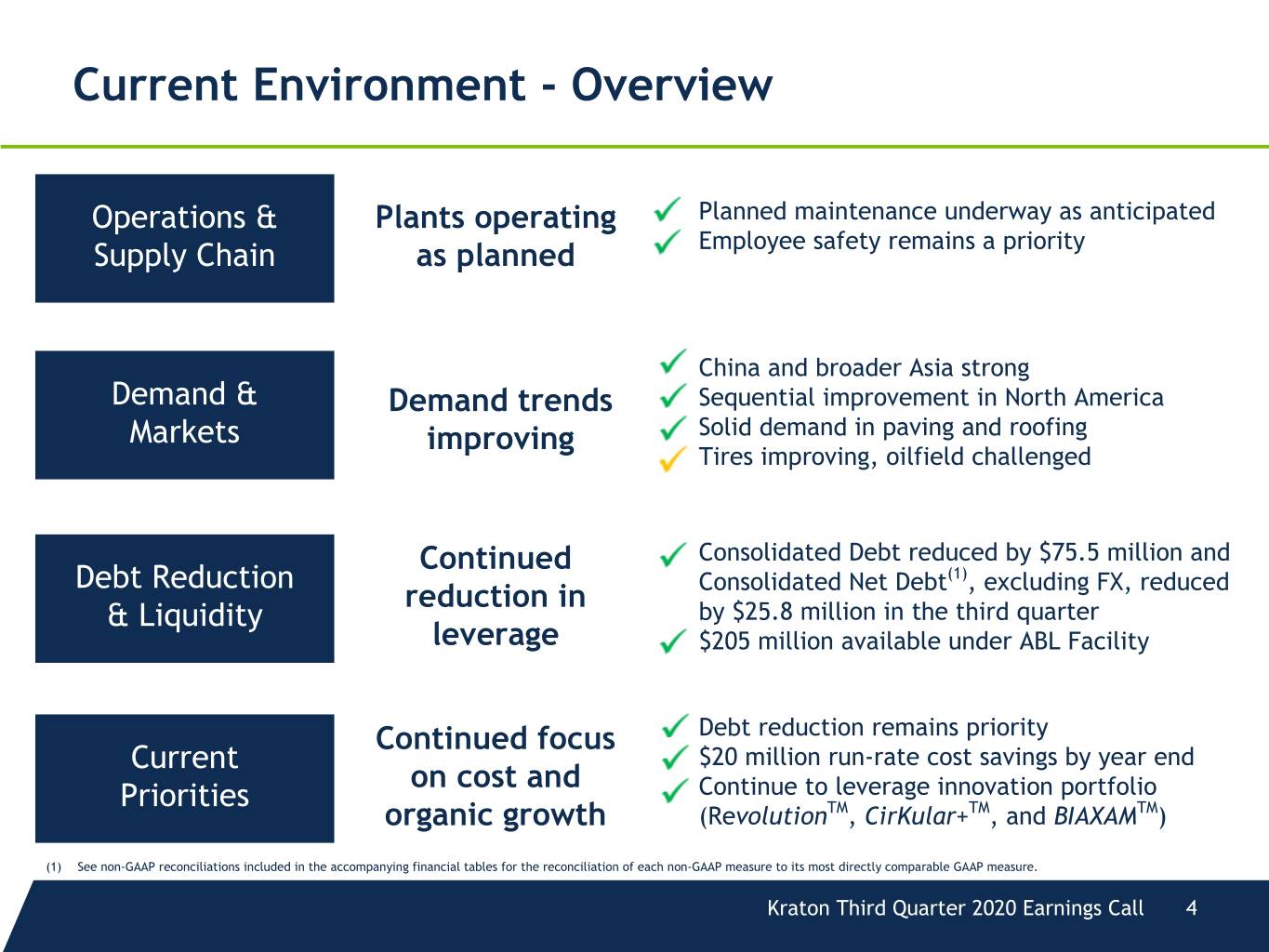

Current Environment - Overview Operations & Plants operating Planned maintenance underway as anticipated Supply Chain as planned Employee safety remains a priority China and broader Asia strong Demand & Demand trends Sequential improvement in North America Markets improving Solid demand in paving and roofing Tires improving, oilfield challenged Continued Consolidated Debt reduced by $75.5 million and Debt Reduction (1) reduction in Consolidated Net Debt , excluding FX, reduced & Liquidity by $25.8 million in the third quarter leverage $205 million available under ABL Facility Continued focus Debt reduction remains priority Current $20 million run-rate cost savings by year end on cost and Priorities Continue to leverage innovation portfolio organic growth (RevolutionTM, CirKular+TM, and BIAXAMTM) (1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. Kraton Third Quarter 2020 Earnings Call 4

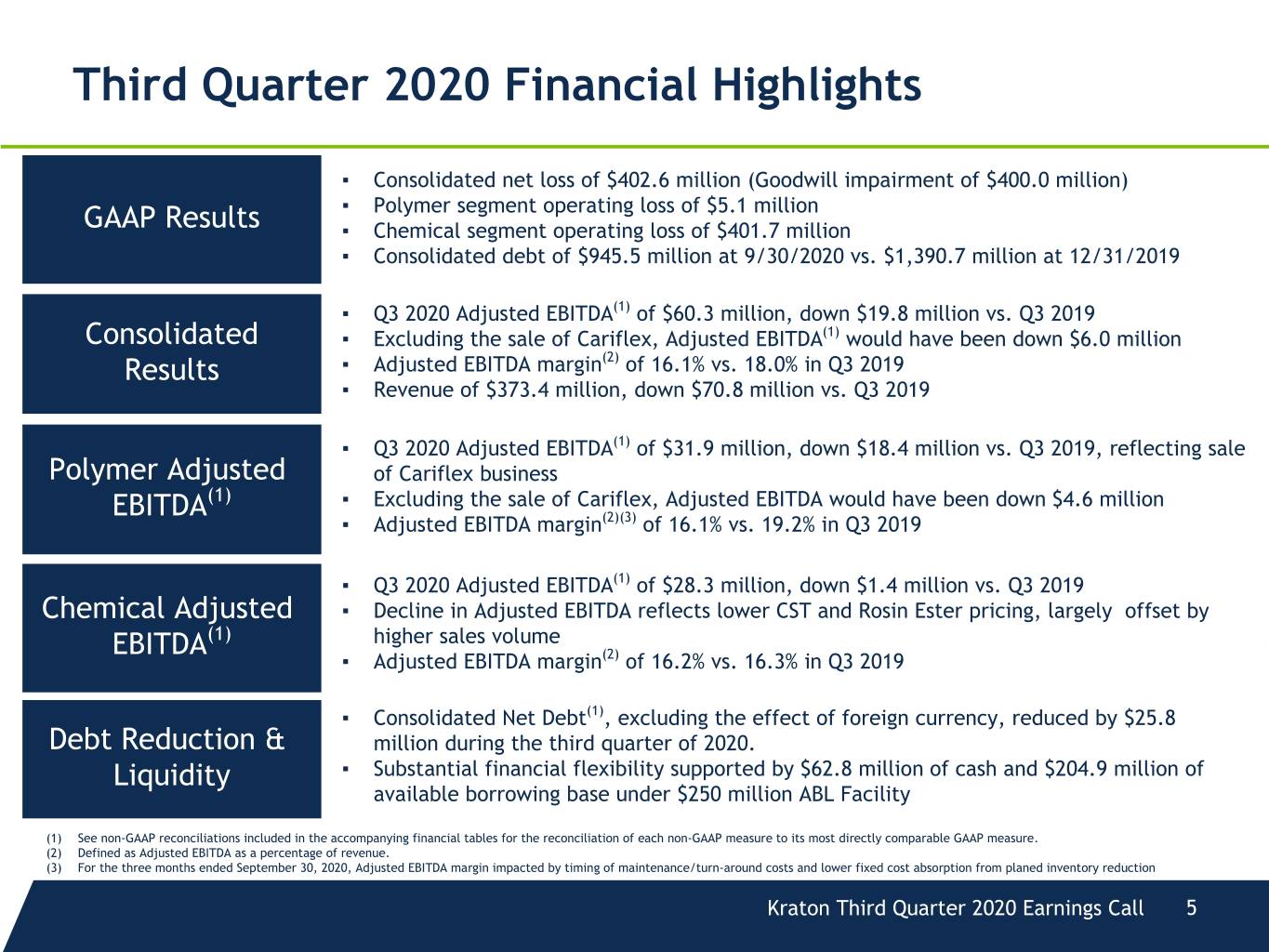

Third Quarter 2020 Financial Highlights ▪ Consolidated net loss of $402.6 million (Goodwill impairment of $400.0 million) ▪ Polymer segment operating loss of $5.1 million GAAP Results ▪ Chemical segment operating loss of $401.7 million ▪ Consolidated debt of $945.5 million at 9/30/2020 vs. $1,390.7 million at 12/31/2019 ▪ Q3 2020 Adjusted EBITDA(1) of $60.3 million, down $19.8 million vs. Q3 2019 Consolidated ▪ Excluding the sale of Cariflex, Adjusted EBITDA(1) would have been down $6.0 million Results ▪ Adjusted EBITDA margin(2) of 16.1% vs. 18.0% in Q3 2019 ▪ Revenue of $373.4 million, down $70.8 million vs. Q3 2019 ▪ Q3 2020 Adjusted EBITDA(1) of $31.9 million, down $18.4 million vs. Q3 2019, reflecting sale Polymer Adjusted of Cariflex business EBITDA(1) ▪ Excluding the sale of Cariflex, Adjusted EBITDA would have been down $4.6 million ▪ Adjusted EBITDA margin(2)(3) of 16.1% vs. 19.2% in Q3 2019 ▪ Q3 2020 Adjusted EBITDA(1) of $28.3 million, down $1.4 million vs. Q3 2019 Chemical Adjusted ▪ Decline in Adjusted EBITDA reflects lower CST and Rosin Ester pricing, largely offset by EBITDA(1) higher sales volume ▪ Adjusted EBITDA margin(2) of 16.2% vs. 16.3% in Q3 2019 ▪ Consolidated Net Debt(1), excluding the effect of foreign currency, reduced by $25.8 Debt Reduction & million during the third quarter of 2020. Liquidity ▪ Substantial financial flexibility supported by $62.8 million of cash and $204.9 million of available borrowing base under $250 million ABL Facility (1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. (2) Defined as Adjusted EBITDA as a percentage of revenue. (3) For the three months ended September 30, 2020, Adjusted EBITDA margin impacted by timing of maintenance/turn-around costs and lower fixed cost absorption from planed inventory reduction Kraton Third Quarter 2020 Earnings Call 5

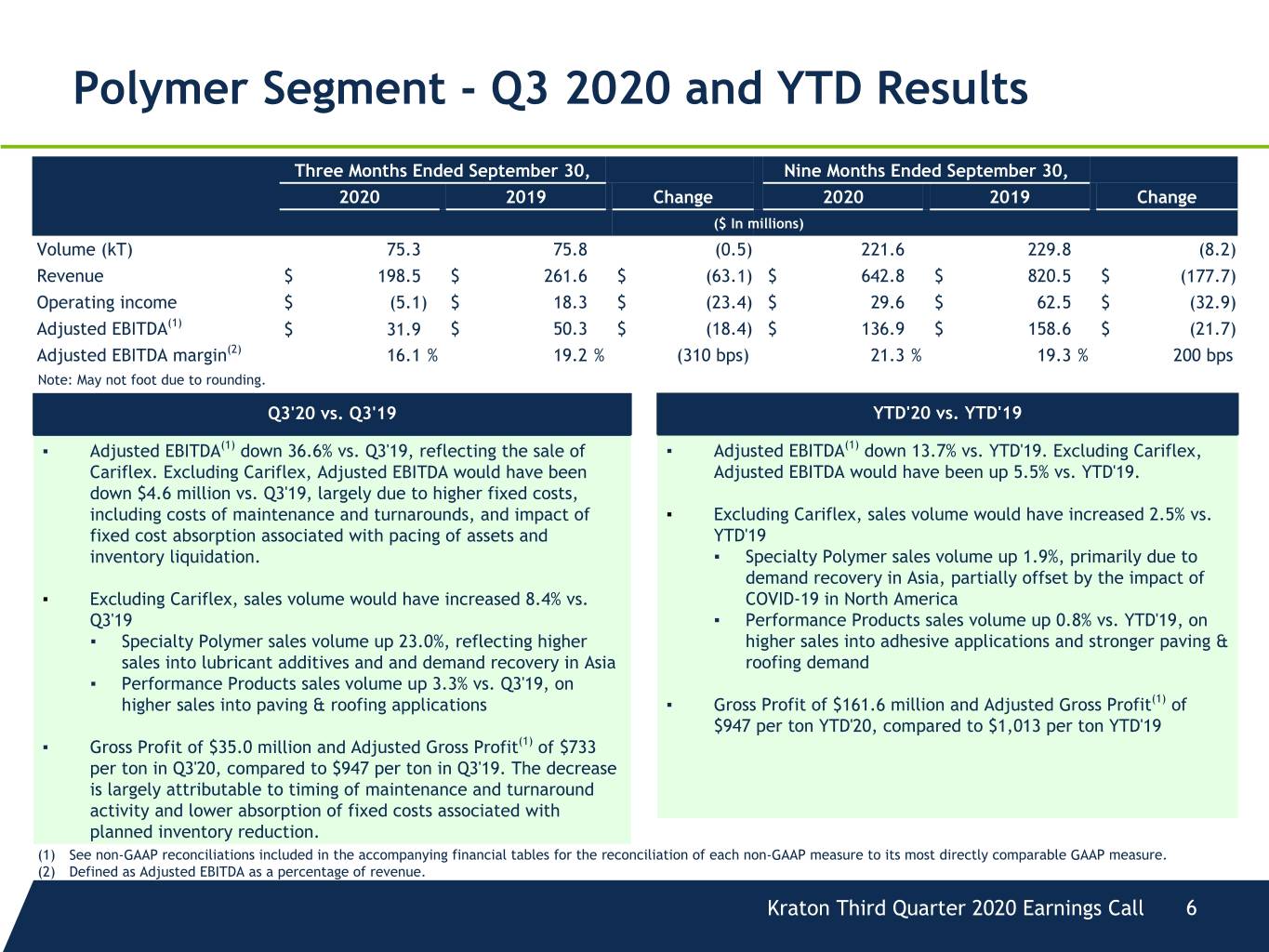

Polymer Segment - Q3 2020 and YTD Results Three Months Ended September 30, Nine Months Ended September 30, 2020 2019 Change 2020 2019 Change ($ In millions) Volume (kT) 75.3 75.8 (0.5) 221.6 229.8 (8.2) Revenue $ 198.5 $ 261.6 $ (63.1) $ 642.8 $ 820.5 $ (177.7) Operating income $ (5.1) $ 18.3 $ (23.4) $ 29.6 $ 62.5 $ (32.9) Adjusted EBITDA(1) $ 31.9 $ 50.3 $ (18.4) $ 136.9 $ 158.6 $ (21.7) Adjusted EBITDA margin(2) 16.1 % 19.2 % (310 bps) 21.3 % 19.3 % 200 bps Note: May not foot due to rounding. Q3'20 vs. Q3'19 YTD'20 vs. YTD'19 ▪ Adjusted EBITDA(1) down 36.6% vs. Q3'19, reflecting the sale of ▪ Adjusted EBITDA(1) down 13.7% vs. YTD'19. Excluding Cariflex, Cariflex. Excluding Cariflex, Adjusted EBITDA would have been Adjusted EBITDA would have been up 5.5% vs. YTD'19. down $4.6 million vs. Q3'19, largely due to higher fixed costs, including costs of maintenance and turnarounds, and impact of ▪ Excluding Cariflex, sales volume would have increased 2.5% vs. fixed cost absorption associated with pacing of assets and YTD'19 inventory liquidation. ▪ Specialty Polymer sales volume up 1.9%, primarily due to demand recovery in Asia, partially offset by the impact of ▪ Excluding Cariflex, sales volume would have increased 8.4% vs. COVID-19 in North America Q3'19 ▪ Performance Products sales volume up 0.8% vs. YTD'19, on ▪ Specialty Polymer sales volume up 23.0%, reflecting higher higher sales into adhesive applications and stronger paving & sales into lubricant additives and and demand recovery in Asia roofing demand ▪ Performance Products sales volume up 3.3% vs. Q3'19, on higher sales into paving & roofing applications ▪ Gross Profit of $161.6 million and Adjusted Gross Profit(1) of $947 per ton YTD'20, compared to $1,013 per ton YTD'19 ▪ Gross Profit of $35.0 million and Adjusted Gross Profit(1) of $733 per ton in Q3'20, compared to $947 per ton in Q3'19. The decrease is largely attributable to timing of maintenance and turnaround activity and lower absorption of fixed costs associated with planned inventory reduction. (1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. (2) Defined as Adjusted EBITDA as a percentage of revenue. Kraton Third Quarter 2020 Earnings Call 6

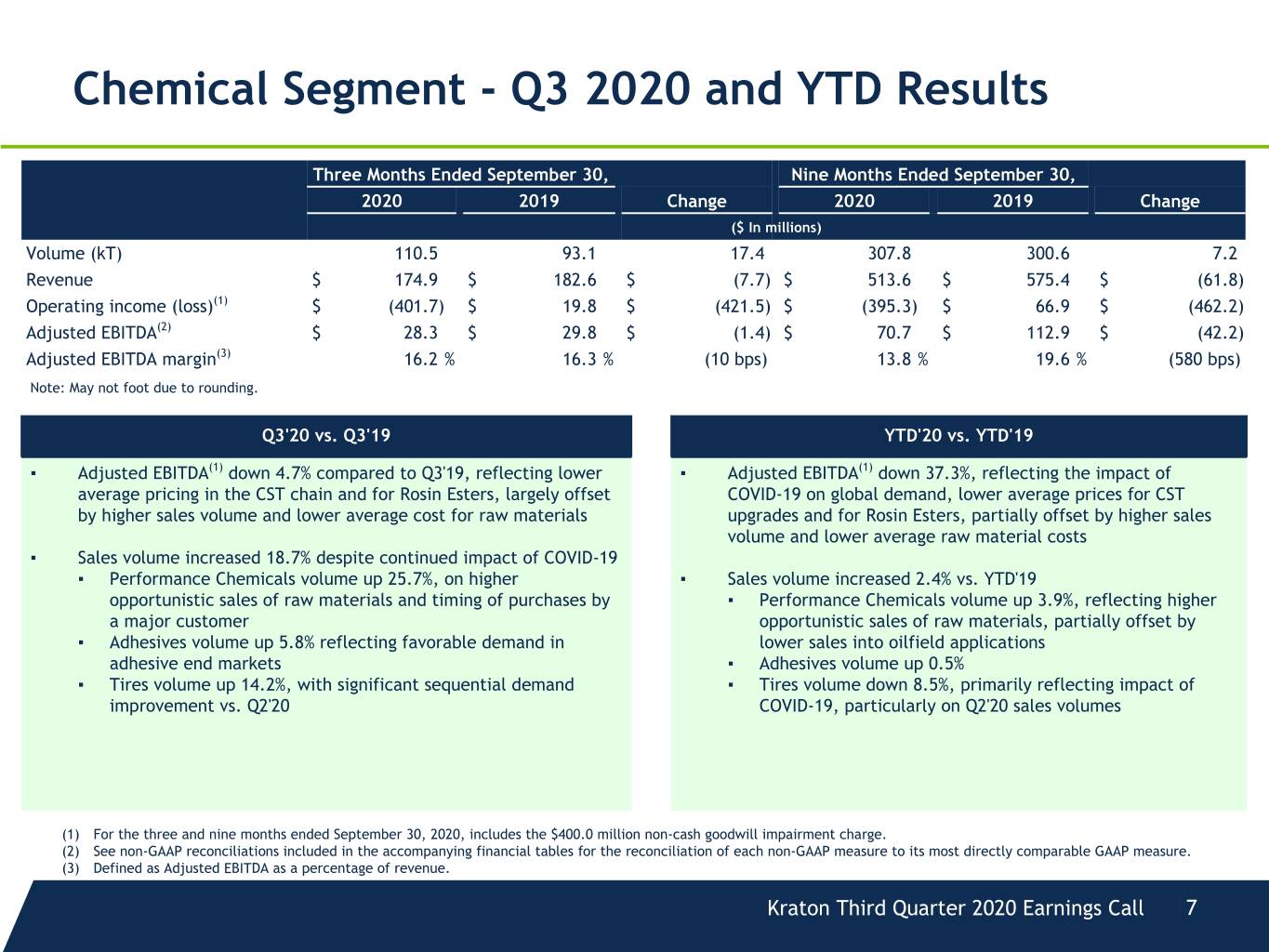

Chemical Segment - Q3 2020 and YTD Results Three Months Ended September 30, Nine Months Ended September 30, 2020 2019 Change 2020 2019 Change ($ In millions) Volume (kT) 110.5 93.1 17.4 307.8 300.6 7.2 Revenue $ 174.9 $ 182.6 $ (7.7) $ 513.6 $ 575.4 $ (61.8) Operating income (loss)(1) $ (401.7) $ 19.8 $ (421.5) $ (395.3) $ 66.9 $ (462.2) Adjusted EBITDA(2) $ 28.3 $ 29.8 $ (1.4) $ 70.7 $ 112.9 $ (42.2) Adjusted EBITDA margin(3) 16.2 % 16.3 % (10 bps) 13.8 % 19.6 % (580 bps) Note: May not foot due to rounding. Q3'20 vs. Q3'19 YTD'20 vs. YTD'19 ▪ Adjusted EBITDA(1) down 4.7% compared to Q3'19, reflecting lower ▪ Adjusted EBITDA(1) down 37.3%, reflecting the impact of average pricing in the CST chain and for Rosin Esters, largely offset COVID-19 on global demand, lower average prices for CST by higher sales volume and lower average cost for raw materials upgrades and for Rosin Esters, partially offset by higher sales volume and lower average raw material costs ▪ Sales volume increased 18.7% despite continued impact of COVID-19 ▪ Performance Chemicals volume up 25.7%, on higher ▪ Sales volume increased 2.4% vs. YTD'19 opportunistic sales of raw materials and timing of purchases by ▪ Performance Chemicals volume up 3.9%, reflecting higher a major customer opportunistic sales of raw materials, partially offset by ▪ Adhesives volume up 5.8% reflecting favorable demand in lower sales into oilfield applications adhesive end markets ▪ Adhesives volume up 0.5% ▪ Tires volume up 14.2%, with significant sequential demand ▪ Tires volume down 8.5%, primarily reflecting impact of improvement vs. Q2'20 COVID-19, particularly on Q2'20 sales volumes (1) For the three and nine months ended September 30, 2020, includes the $400.0 million non-cash goodwill impairment charge. (2) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. (3) Defined as Adjusted EBITDA as a percentage of revenue. Kraton Third Quarter 2020 Earnings Call 7

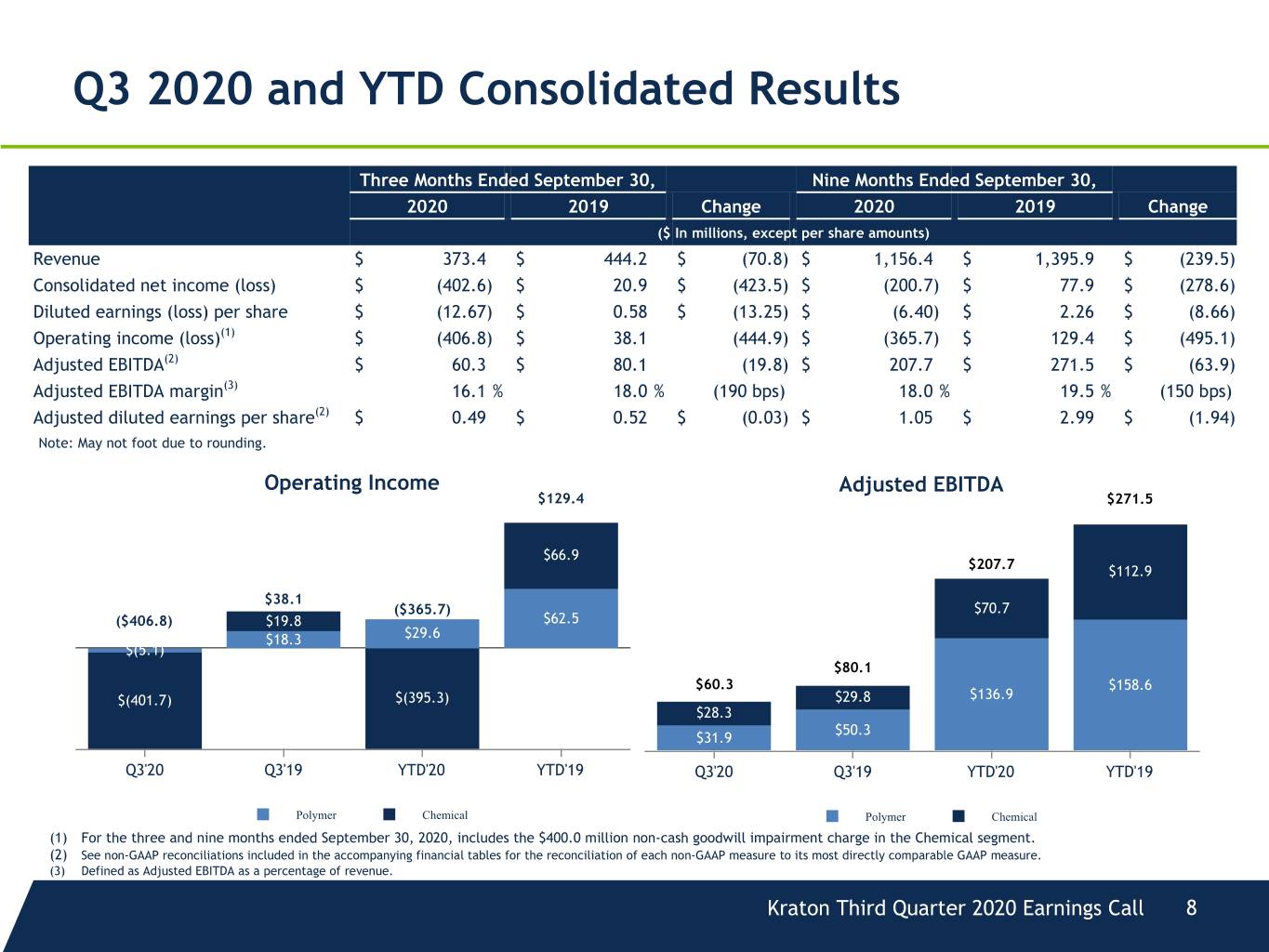

Q3 2020 and YTD Consolidated Results Three Months Ended September 30, Nine Months Ended September 30, 2020 2019 Change 2020 2019 Change ($ In millions, except per share amounts) Revenue $ 373.4 $ 444.2 $ (70.8) $ 1,156.4 $ 1,395.9 $ (239.5) Consolidated net income (loss) $ (402.6) $ 20.9 $ (423.5) $ (200.7) $ 77.9 $ (278.6) Diluted earnings (loss) per share $ (12.67) $ 0.58 $ (13.25) $ (6.40) $ 2.26 $ (8.66) Operating income (loss)(1) $ (406.8) $ 38.1 (444.9) $ (365.7) $ 129.4 $ (495.1) Adjusted EBITDA(2) $ 60.3 $ 80.1 (19.8) $ 207.7 $ 271.5 $ (63.9) Adjusted EBITDA margin(3) 16.1 % 18.0 % (190 bps) 18.0 % 19.5 % (150 bps) Adjusted diluted earnings per share(2) $ 0.49 $ 0.52 $ (0.03) $ 1.05 $ 2.99 $ (1.94) Note: May not foot due to rounding. Operating Income Adjusted EBITDA $129.4 $271.5 $66.9 ($401.7) $207.7 $112.9 $38.1 ($365.7) $70.7 ($406.8) $19.8 $62.5 $18.3 $29.6 $(5.1) $80.1 $60.3 $158.6 $(401.7) $(395.3) $29.8 $136.9 $28.3 $50.3 $31.9 Q3'20 Q3'19 YTD'20 YTD'19 Q3'20 Q3'19 YTD'20 YTD'19 Polymer Chemical Polymer Chemical (1) For the three and nine months ended September 30, 2020, includes the $400.0 million non-cash goodwill impairment charge in the Chemical segment. (2) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. (3) Defined as Adjusted EBITDA as a percentage of revenue. Kraton Third Quarter 2020 Earnings Call 8

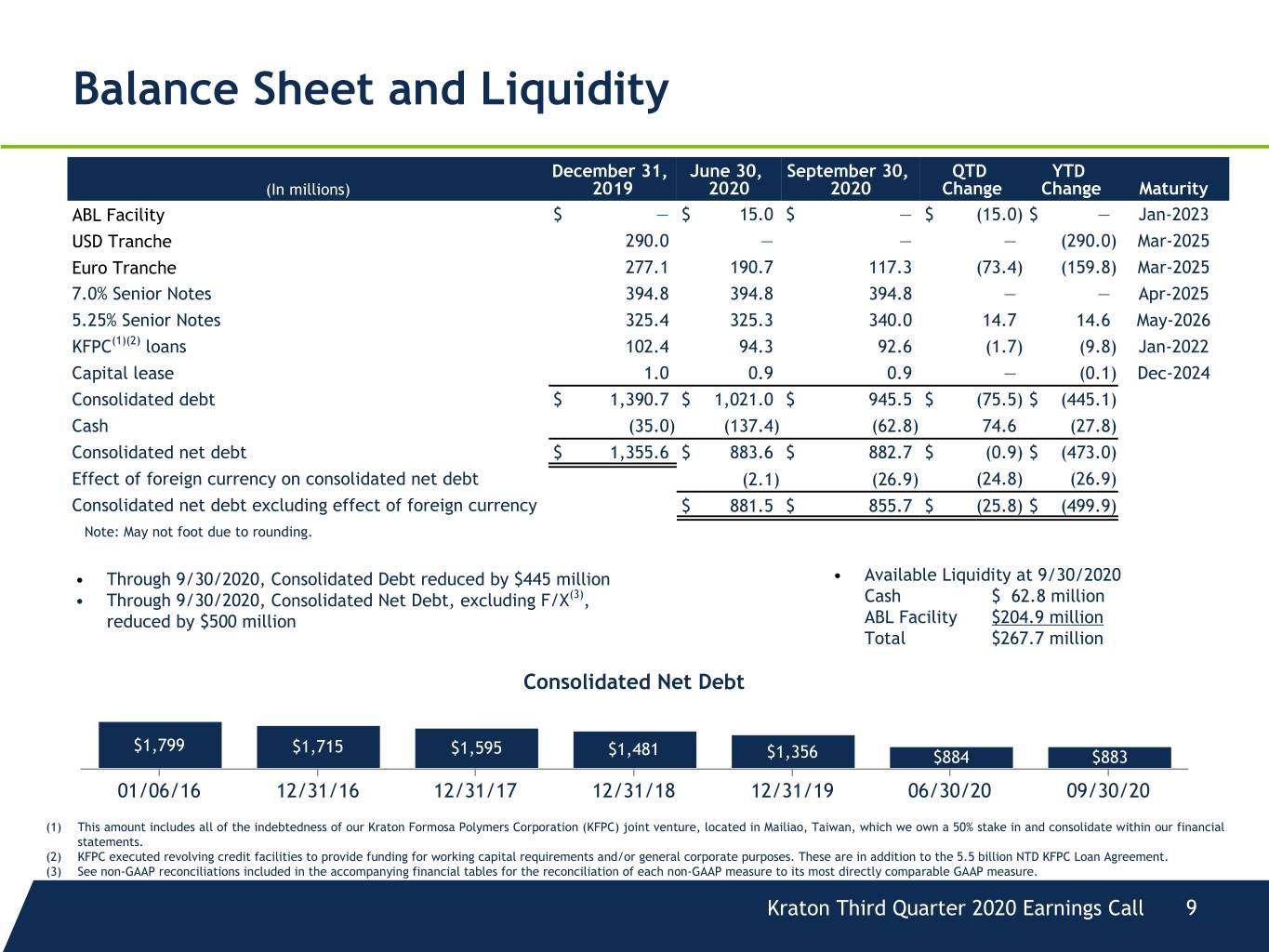

Balance Sheet and Liquidity December 31, June 30, September 30, QTD YTD (In millions) 2019 2020 2020 Change Change Maturity ABL Facility $ — $ 15.0 $ — $ (15.0) $ — Jan-2023 USD Tranche 290.0 — — — (290.0) Mar-2025 Euro Tranche 277.1 190.7 117.3 (73.4) (159.8) Mar-2025 7.0% Senior Notes 394.8 394.8 394.8 — — Apr-2025 5.25% Senior Notes 325.4 325.3 340.0 14.7 14.6 May-2026 KFPC(1)(2) loans 102.4 94.3 92.6 (1.7) (9.8) Jan-2022 Capital lease 1.0 0.9 0.9 — (0.1) Dec-2024 Consolidated debt $ 1,390.7 $ 1,021.0 $ 945.5 $ (75.5) $ (445.1) Cash (35.0) (137.4) (62.8) 74.6 (27.8) Consolidated net debt $ 1,355.6 $ 883.6 $ 882.7 $ (0.9) $ (473.0) Effect of foreign currency on consolidated net debt (2.1) (26.9) (24.8) (26.9) Consolidated net debt excluding effect of foreign currency $ 881.5 $ 855.7 $ (25.8) $ (499.9) Note: May not foot due to rounding. • Through 9/30/2020, Consolidated Debt reduced by $445 million • Available Liquidity at 9/30/2020 • Through 9/30/2020, Consolidated Net Debt, excluding F/X(3), Cash $ 62.8 million reduced by $500 million ABL Facility $204.9 million Total $267.7 million Consolidated Net Debt $1,799 $1,715 $1,595 $1,481 $1,356 $884 $883 01/06/16 12/31/16 12/31/17 12/31/18 12/31/19 06/30/20 09/30/20 (1) This amount includes all of the indebtedness of our Kraton Formosa Polymers Corporation (KFPC) joint venture, located in Mailiao, Taiwan, which we own a 50% stake in and consolidate within our financial statements. (2) KFPC executed revolving credit facilities to provide funding for working capital requirements and/or general corporate purposes. These are in addition to the 5.5 billion NTD KFPC Loan Agreement. (3) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. Kraton Third Quarter 2020 Earnings Call 9

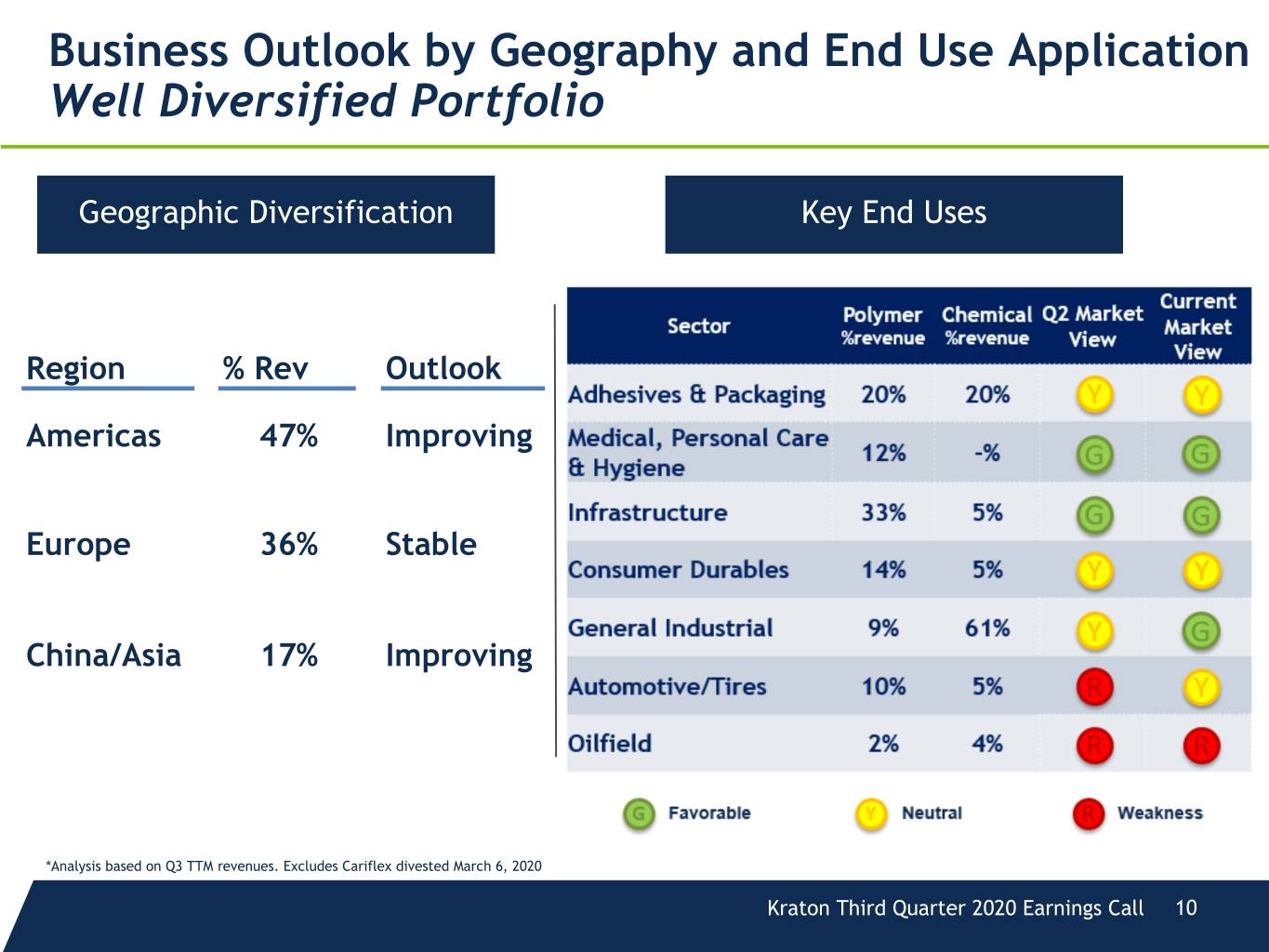

Business Outlook by Geography and End Use Application Well Diversified Portfolio Geographic Diversification Key End Uses Region % Rev Outlook Americas 47% Improving Europe 36% Stable China/Asia 17% Improving *Analysis based on Q3 TTM revenues. Excludes Cariflex divested March 6, 2020 Kraton Third Quarter 2020 Earnings Call 10

Appendix

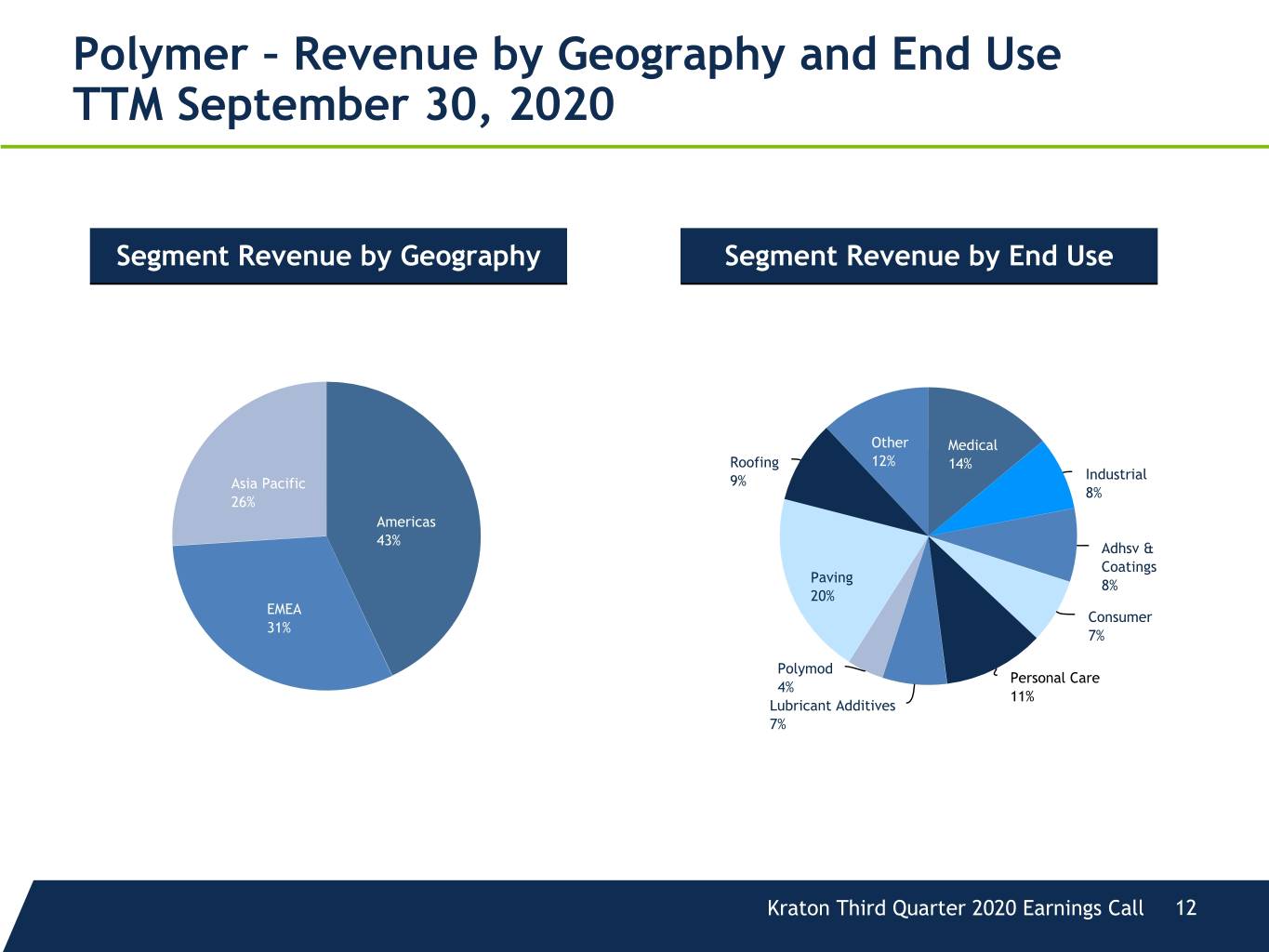

Polymer – Revenue by Geography and End Use TTM September 30, 2020 Segment Revenue by Geography Segment Revenue by End Use Other Medical Roofing 12% 14% Industrial Asia Pacific 9% 8% 26% Americas 43% Adhsv & Coatings Paving 8% 20% EMEA Consumer 31% 7% Polymod Personal Care 4% 11% Lubricant Additives 7% Kraton Third Quarter 2020 Earnings Call 12

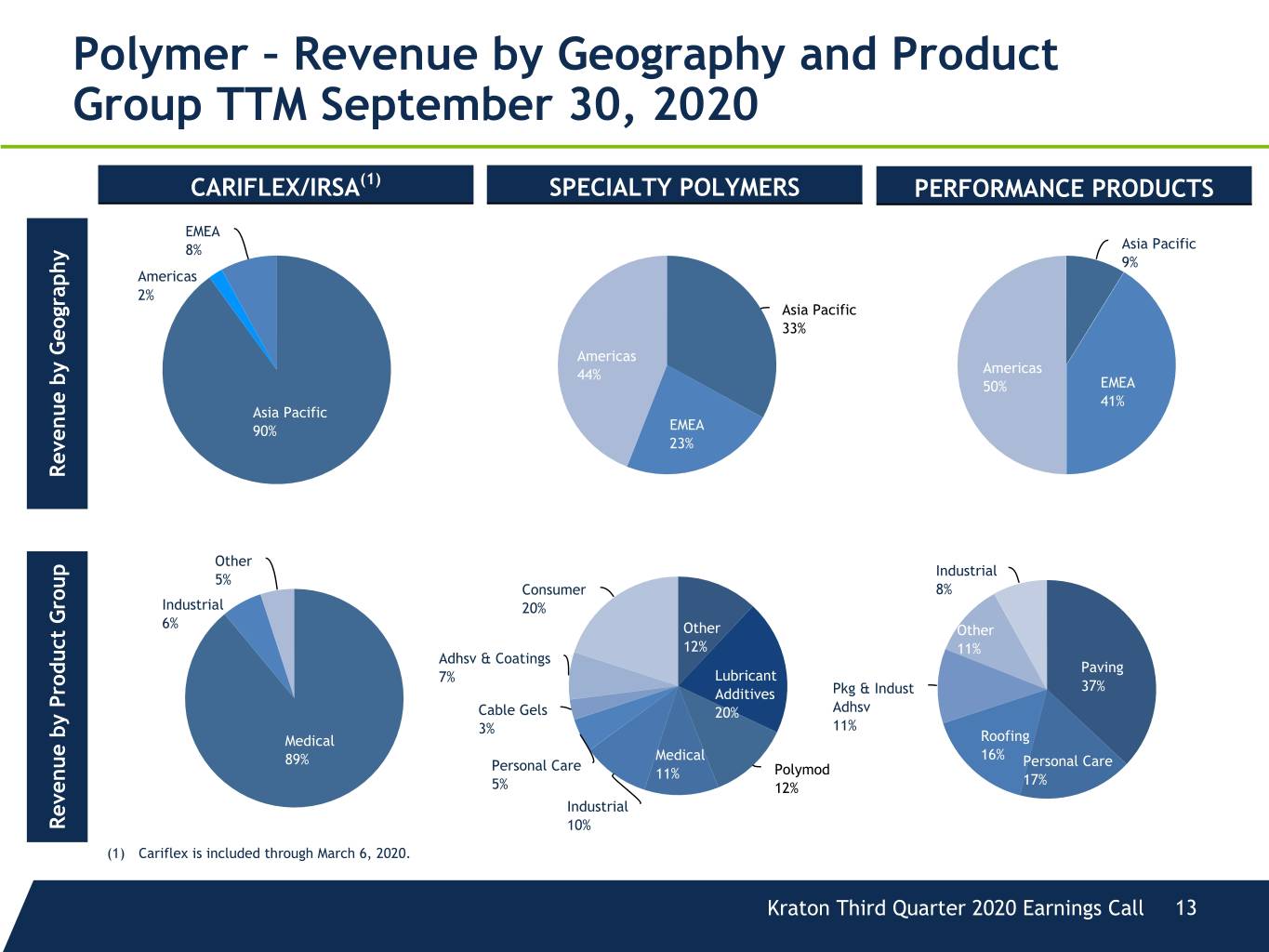

Polymer – Revenue by Geography and Product Group TTM September 30, 2020 CARIFLEX/IRSA(1) SPECIALTY POLYMERS PERFORMANCE PRODUCTS EMEA Asia Pacific 8% 9% Americas 2% Asia Pacific 33% Americas 44% Americas 50% EMEA 41% Asia Pacific 90% EMEA 23% Revenue by Geography Other Industrial 5% Consumer 8% Industrial 20% 6% Other Other 12% 11% Adhsv & Coatings Paving 7% Lubricant 37% Additives Pkg & Indust Cable Gels 20% Adhsv 11% 3% Medical Roofing 89% Medical 16% Personal Care Personal Care Polymod 11% 17% 5% 12% Industrial Revenue by Product Group 10% (1) Cariflex is included through March 6, 2020. Kraton Third Quarter 2020 Earnings Call 13

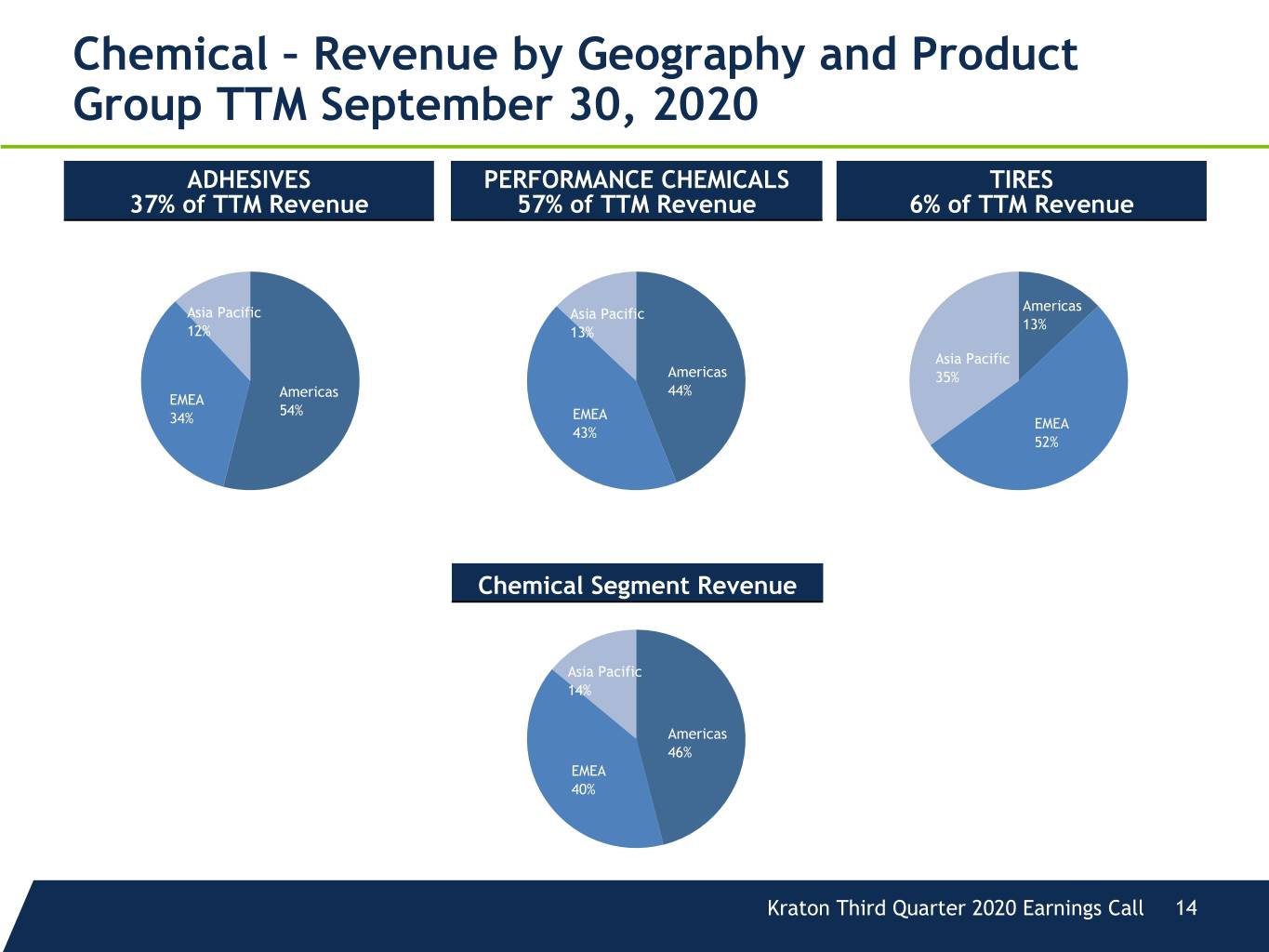

Chemical – Revenue by Geography and Product Group TTM September 30, 2020 ADHESIVES PERFORMANCE CHEMICALS TIRES 37% of TTM Revenue 57% of TTM Revenue 6% of TTM Revenue Americas Asia Pacific Asia Pacific 13% 12% 13% Asia Pacific Americas 35% Americas 44% EMEA 54% EMEA 34% EMEA 43% 52% Chemical Segment Revenue Asia Pacific 14% Americas 46% EMEA 40% Kraton Third Quarter 2020 Earnings Call 14

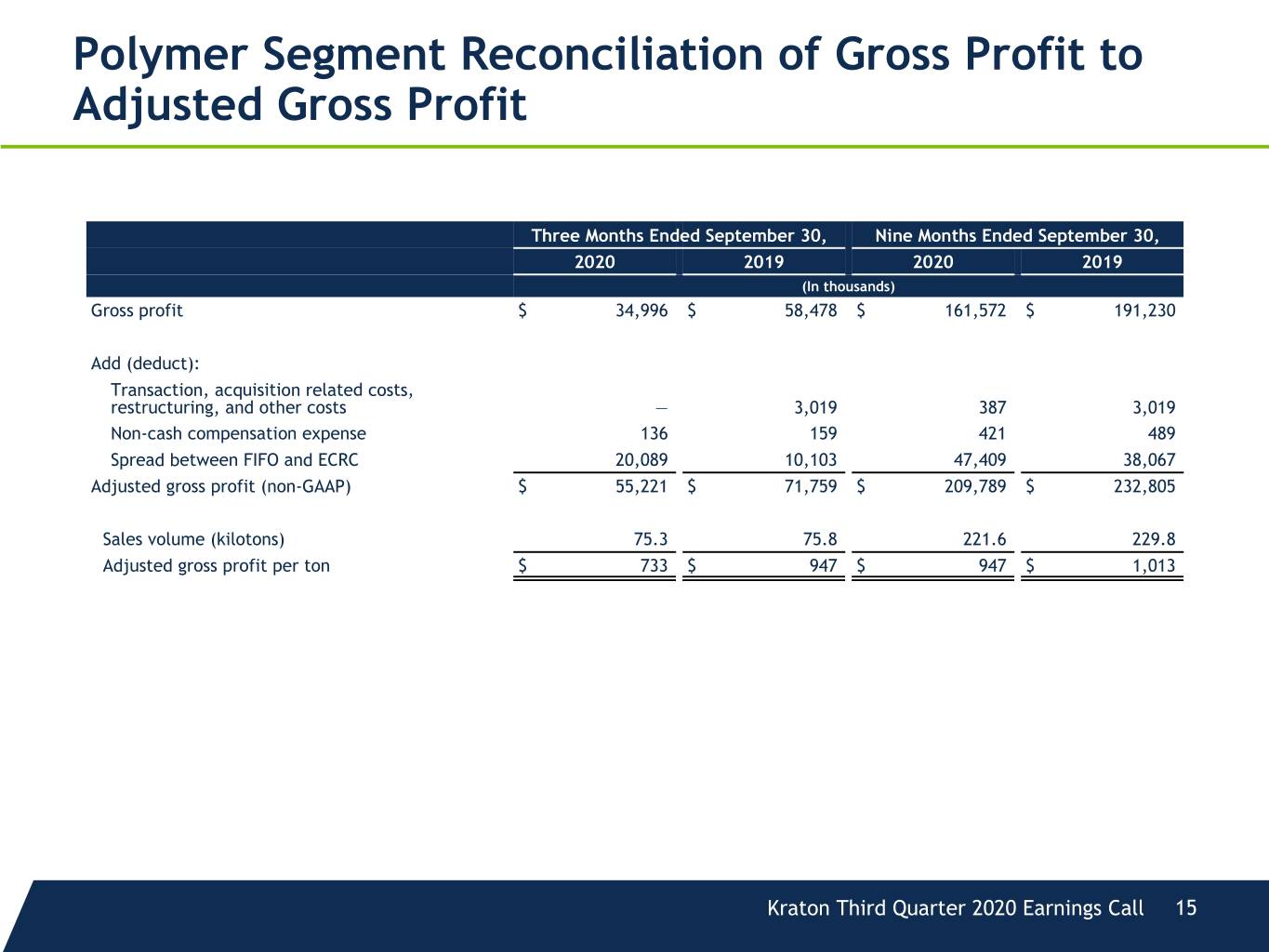

Polymer Segment Reconciliation of Gross Profit to Adjusted Gross Profit Three Months Ended September 30, Nine Months Ended September 30, 2020 2019 2020 2019 (In thousands) Gross profit $ 34,996 $ 58,478 $ 161,572 $ 191,230 Add (deduct): Transaction, acquisition related costs, restructuring, and other costs — 3,019 387 3,019 Non-cash compensation expense 136 159 421 489 Spread between FIFO and ECRC 20,089 10,103 47,409 38,067 Adjusted gross profit (non-GAAP) $ 55,221 $ 71,759 $ 209,789 $ 232,805 Sales volume (kilotons) 75.3 75.8 221.6 229.8 Adjusted gross profit per ton $ 733 $ 947 $ 947 $ 1,013 Kraton Third Quarter 2020 Earnings Call 15

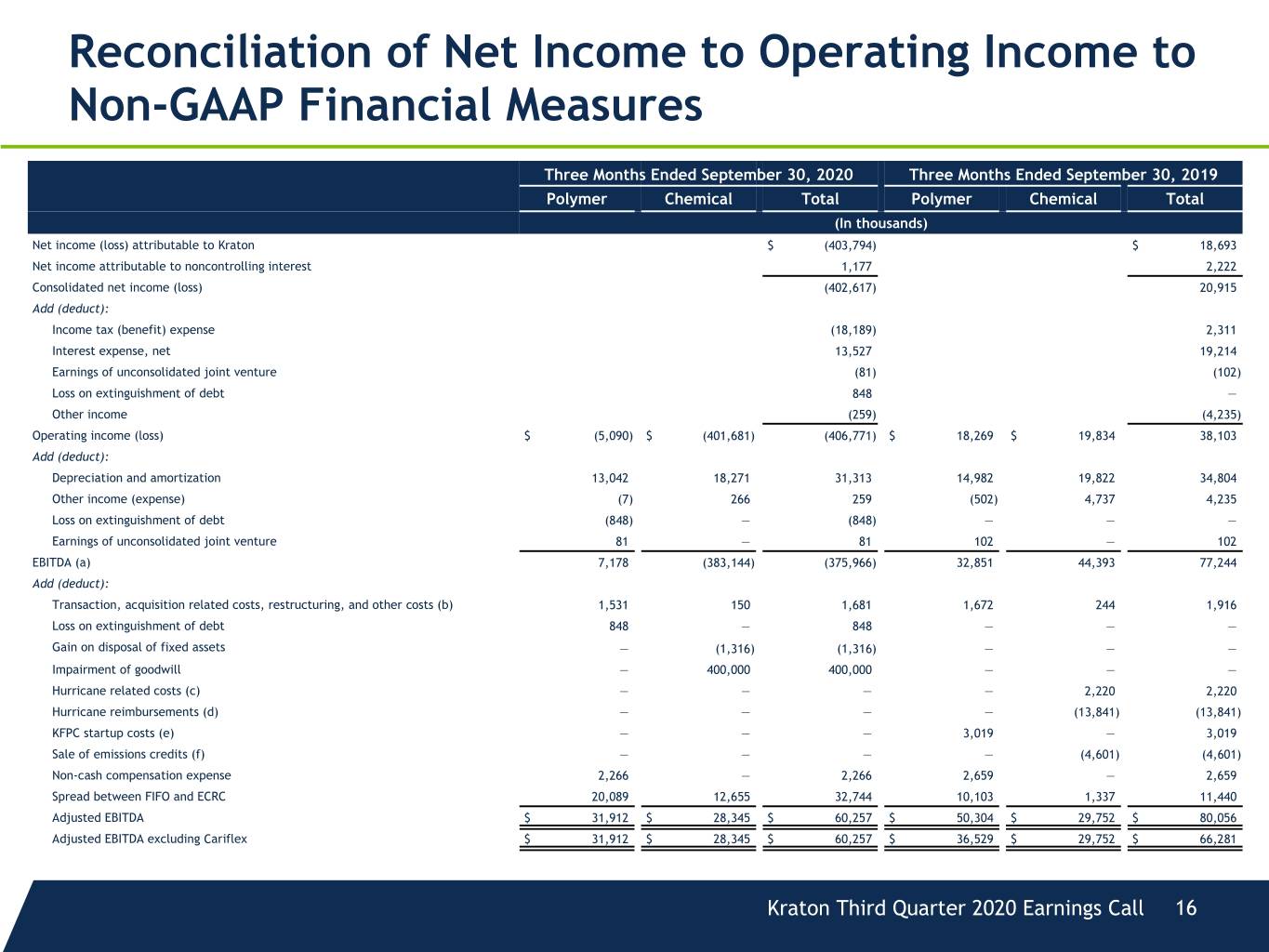

Reconciliation of Net Income to Operating Income to Non-GAAP Financial Measures Three Months Ended September 30, 2020 Three Months Ended September 30, 2019 Polymer Chemical Total Polymer Chemical Total (In thousands) Net income (loss) attributable to Kraton $ (403,794) $ 18,693 Net income attributable to noncontrolling interest 1,177 2,222 Consolidated net income (loss) (402,617) 20,915 Add (deduct): Income tax (benefit) expense (18,189) 2,311 Interest expense, net 13,527 19,214 Earnings of unconsolidated joint venture (81) (102) Loss on extinguishment of debt 848 — Other income (259) (4,235) Operating income (loss) $ (5,090) $ (401,681) (406,771) $ 18,269 $ 19,834 38,103 Add (deduct): Depreciation and amortization 13,042 18,271 31,313 14,982 19,822 34,804 Other income (expense) (7) 266 259 (502) 4,737 4,235 Loss on extinguishment of debt (848) — (848) — — — Earnings of unconsolidated joint venture 81 — 81 102 — 102 EBITDA (a) 7,178 (383,144) (375,966) 32,851 44,393 77,244 Add (deduct): Transaction, acquisition related costs, restructuring, and other costs (b) 1,531 150 1,681 1,672 244 1,916 Loss on extinguishment of debt 848 — 848 — — — Gain on disposal of fixed assets — (1,316) (1,316) — — — Impairment of goodwill — 400,000 400,000 — — — Hurricane related costs (c) — — — — 2,220 2,220 Hurricane reimbursements (d) — — — — (13,841) (13,841) KFPC startup costs (e) — — — 3,019 — 3,019 Sale of emissions credits (f) — — — — (4,601) (4,601) Non-cash compensation expense 2,266 — 2,266 2,659 — 2,659 Spread between FIFO and ECRC 20,089 12,655 32,744 10,103 1,337 11,440 Adjusted EBITDA $ 31,912 $ 28,345 $ 60,257 $ 50,304 $ 29,752 $ 80,056 Adjusted EBITDA excluding Cariflex $ 31,912 $ 28,345 $ 60,257 $ 36,529 $ 29,752 $ 66,281 Kraton Third Quarter 2020 Earnings Call 16

Reconciliation of Net Income to Operating Income to Non-GAAP Financial Measures (a) Included in EBITDA is a $14.3 million gain on insurance for the three months ended September 30, 2019, a reimbursement for a portion of the direct costs we have incurred to date related to Hurricane Michael. Also included in EBITDA are Isoprene Rubber sales to Daelim under the IRSA. Sales under the IRSA are transacted at cost. Included in Adjusted EBITDA is the amortization of non-cash deferred income of $0.3 million for the three months ended September 30, 2020, which represents revenue deferred until the products are sold under the IRSA. (b) Charges related to the evaluation of acquisition transactions, severance expenses, and other restructuring related charges. (c) Incremental costs related to Hurricane Michael, which are recorded in cost of goods sold. (d) Reimbursement of incremental costs related to Hurricane Michael, which is recorded in gain on insurance proceeds. (e) Startup costs related to the joint venture company, KFPC. (f) We recorded a gain of $4.6 million in other income (expense) related to the sale of emissions credits accumulated by our Swedish Chemical legal entity. Kraton Third Quarter 2020 Earnings Call 17

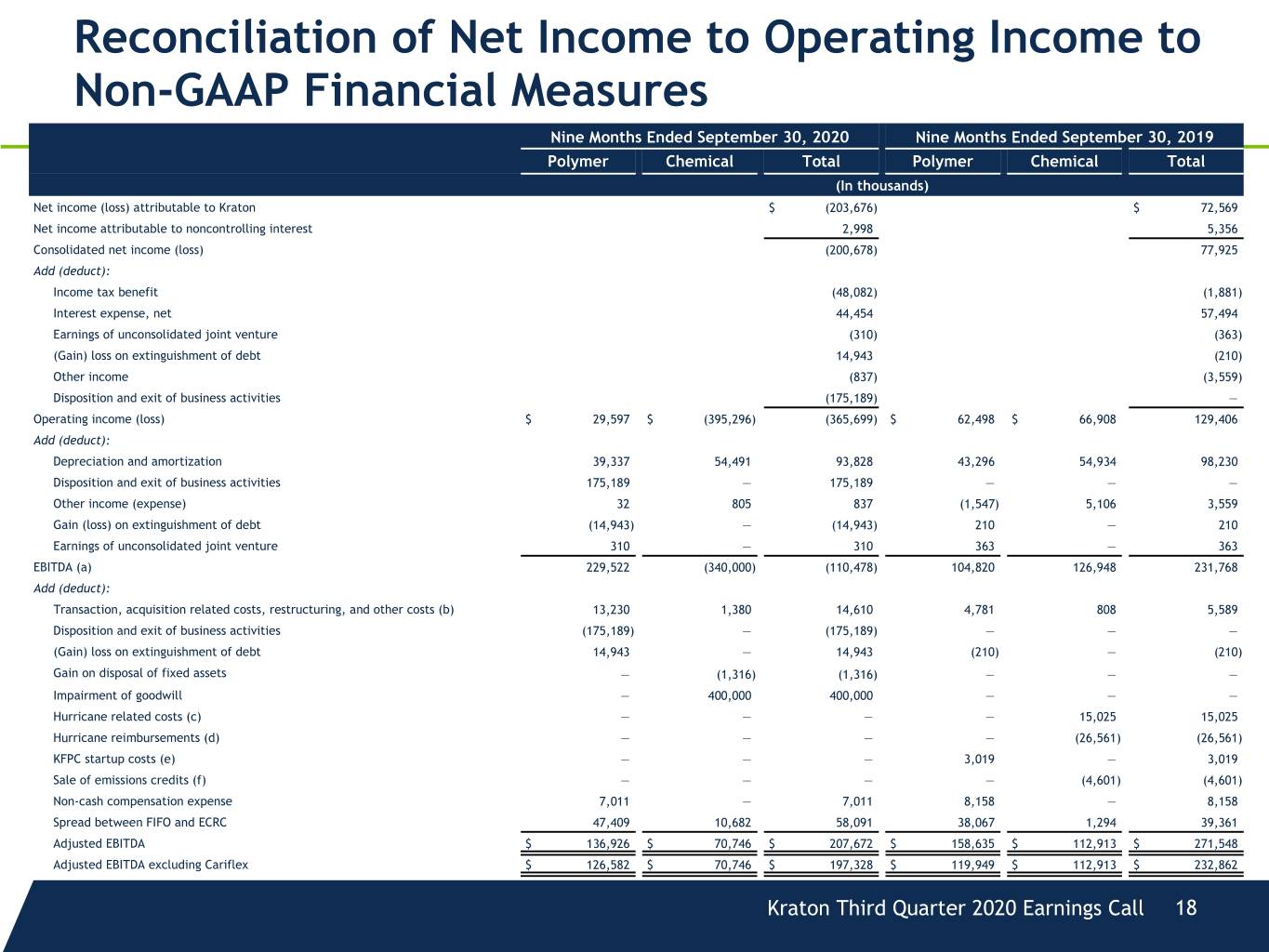

Reconciliation of Net Income to Operating Income to Non-GAAP Financial Measures Nine Months Ended September 30, 2020 Nine Months Ended September 30, 2019 Polymer Chemical Total Polymer Chemical Total (In thousands) Net income (loss) attributable to Kraton $ (203,676) $ 72,569 Net income attributable to noncontrolling interest 2,998 5,356 Consolidated net income (loss) (200,678) 77,925 Add (deduct): Income tax benefit (48,082) (1,881) Interest expense, net 44,454 57,494 Earnings of unconsolidated joint venture (310) (363) (Gain) loss on extinguishment of debt 14,943 (210) Other income (837) (3,559) Disposition and exit of business activities (175,189) — Operating income (loss) $ 29,597 $ (395,296) (365,699) $ 62,498 $ 66,908 129,406 Add (deduct): Depreciation and amortization 39,337 54,491 93,828 43,296 54,934 98,230 Disposition and exit of business activities 175,189 — 175,189 — — — Other income (expense) 32 805 837 (1,547) 5,106 3,559 Gain (loss) on extinguishment of debt (14,943) — (14,943) 210 — 210 Earnings of unconsolidated joint venture 310 — 310 363 — 363 EBITDA (a) 229,522 (340,000) (110,478) 104,820 126,948 231,768 Add (deduct): Transaction, acquisition related costs, restructuring, and other costs (b) 13,230 1,380 14,610 4,781 808 5,589 Disposition and exit of business activities (175,189) — (175,189) — — — (Gain) loss on extinguishment of debt 14,943 — 14,943 (210) — (210) Gain on disposal of fixed assets — (1,316) (1,316) — — — Impairment of goodwill — 400,000 400,000 — — — Hurricane related costs (c) — — — — 15,025 15,025 Hurricane reimbursements (d) — — — — (26,561) (26,561) KFPC startup costs (e) — — — 3,019 — 3,019 Sale of emissions credits (f) — — — — (4,601) (4,601) Non-cash compensation expense 7,011 — 7,011 8,158 — 8,158 Spread between FIFO and ECRC 47,409 10,682 58,091 38,067 1,294 39,361 Adjusted EBITDA $ 136,926 $ 70,746 $ 207,672 $ 158,635 $ 112,913 $ 271,548 Adjusted EBITDA excluding Cariflex $ 126,582 $ 70,746 $ 197,328 $ 119,949 $ 112,913 $ 232,862 Kraton Third Quarter 2020 Earnings Call 18

Reconciliation of Net Income to Operating Income to Non-GAAP Financial Measures (a) Included in EBITDA is a $32.9 million gain on insurance for the nine months ended September 30, 2019, fully offsetting the lost margin in the first quarter of 2019, and reimbursement for a portion of the direct costs we have incurred to date related to Hurricane Michael. Also included in EBITDA are Isoprene Rubber sales to Daelim under the IRSA. Sales under the IRSA are transacted at cost. Included in Adjusted EBITDA is the amortization of non-cash deferred income of $7.5 million for the nine months ended September 30, 2020, which represents revenue deferred until the products are sold under the IRSA. (b) Charges related to the evaluation of acquisition transactions, severance expenses, and other restructuring related charges. (c) Incremental costs related to Hurricane Michael, which are recorded in cost of goods sold. (d) Reimbursement of incremental costs related to Hurricane Michael, which is recorded in gain on insurance proceeds. (e) Startup costs related to the joint venture company, KFPC. (f) We recorded a gain of $4.6 million in other income (expense) related to the sale of emissions credits accumulated by our Swedish Chemical legal entity. Kraton Third Quarter 2020 Earnings Call 19

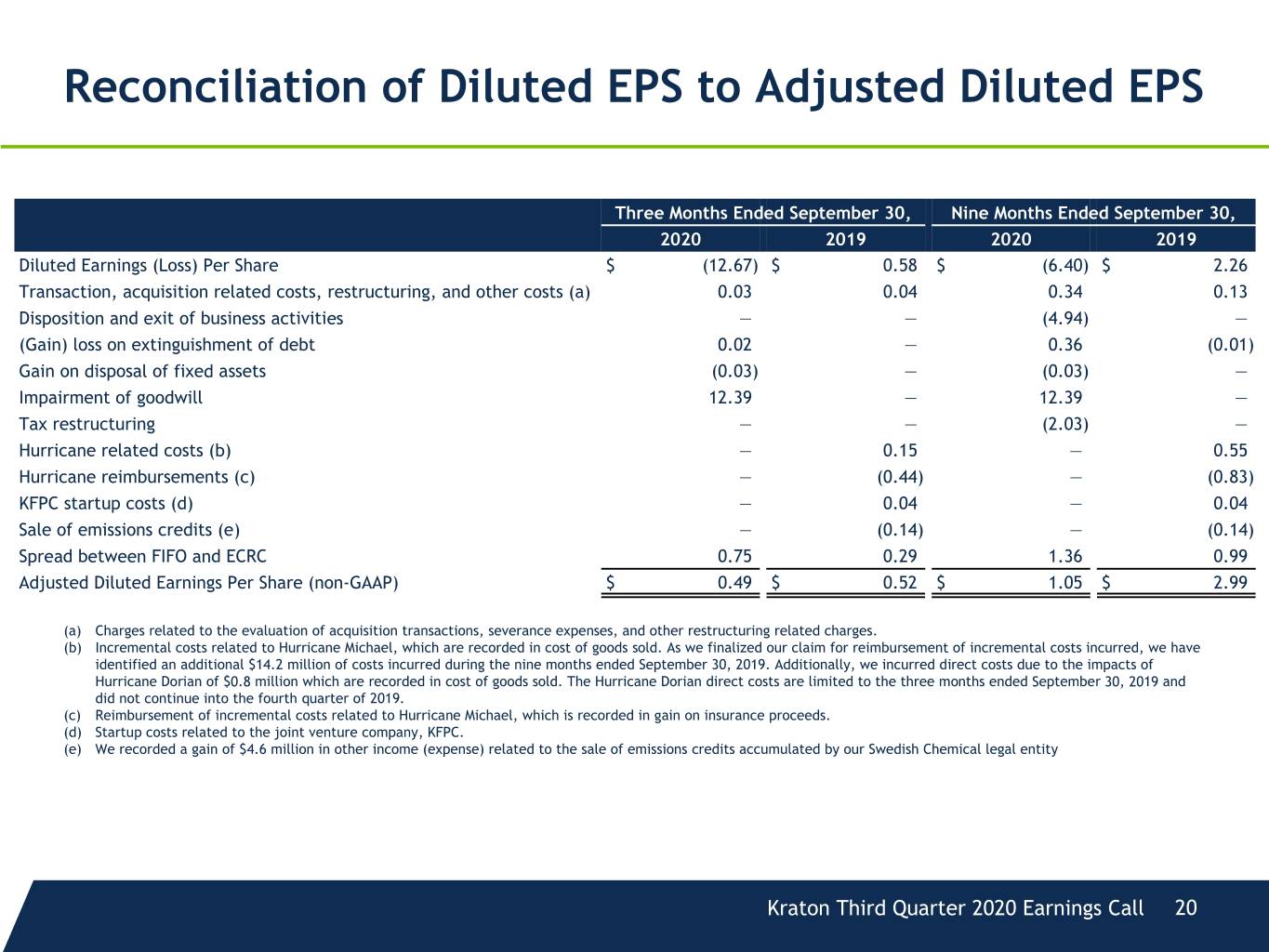

Reconciliation of Diluted EPS to Adjusted Diluted EPS Three Months Ended September 30, Nine Months Ended September 30, 2020 2019 2020 2019 Diluted Earnings (Loss) Per Share $ (12.67) $ 0.58 $ (6.40) $ 2.26 Transaction, acquisition related costs, restructuring, and other costs (a) 0.03 0.04 0.34 0.13 Disposition and exit of business activities — — (4.94) — (Gain) loss on extinguishment of debt 0.02 — 0.36 (0.01) Gain on disposal of fixed assets (0.03) — (0.03) — Impairment of goodwill 12.39 — 12.39 — Tax restructuring — — (2.03) — Hurricane related costs (b) — 0.15 — 0.55 Hurricane reimbursements (c) — (0.44) — (0.83) KFPC startup costs (d) — 0.04 — 0.04 Sale of emissions credits (e) — (0.14) — (0.14) Spread between FIFO and ECRC 0.75 0.29 1.36 0.99 Adjusted Diluted Earnings Per Share (non-GAAP) $ 0.49 $ 0.52 $ 1.05 $ 2.99 (a) Charges related to the evaluation of acquisition transactions, severance expenses, and other restructuring related charges. (b) Incremental costs related to Hurricane Michael, which are recorded in cost of goods sold. As we finalized our claim for reimbursement of incremental costs incurred, we have identified an additional $14.2 million of costs incurred during the nine months ended September 30, 2019. Additionally, we incurred direct costs due to the impacts of Hurricane Dorian of $0.8 million which are recorded in cost of goods sold. The Hurricane Dorian direct costs are limited to the three months ended September 30, 2019 and did not continue into the fourth quarter of 2019. (c) Reimbursement of incremental costs related to Hurricane Michael, which is recorded in gain on insurance proceeds. (d) Startup costs related to the joint venture company, KFPC. (e) We recorded a gain of $4.6 million in other income (expense) related to the sale of emissions credits accumulated by our Swedish Chemical legal entity Kraton Third Quarter 2020 Earnings Call 20