Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number

| Kraton Performance Polymers, Inc. | 001-34581 |

KRATON PERFORMANCE POLYMERS, INC.

(Exact Name of Registrant as Specified in its Charter)

| Kraton Performance Polymers, Inc. | Delaware | 20-0411521 | ||

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |||

| 15710 John F. Kennedy Blvd, Suite 300 Houston, TX 77032 |

281-504-4700 | |||

| (Address of principal executive offices, including zip code) | (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Kraton Performance Polymers, Inc. Common Stock, par value $0.01 |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ¨ NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Securities Exchange Act. (Check one):

| Large accelerated filer: ¨ | Accelerated filer: x | Non-accelerated filer: ¨ | Smaller reporting company: ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO x

Estimated aggregate market value of the common equity held by nonaffiliates of Kraton Performance Polymers, Inc. at June 30, 2010: $214,961,640. Number of shares of Kraton Performance Polymers, Inc. Common Stock, $0.01 par value, outstanding at February 28, 2011: 31,736,514.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Kraton Performance Polymers, Inc.’s proxy statement for the 2011 Annual Meeting of Shareholders are incorporated by reference in Part III.

Table of Contents

on Form 10-K for

Year Ended December 31, 2010

| PAGE | ||||||

| PART I | ||||||

| Item 1. | 4 | |||||

| Item 1A. | 21 | |||||

| Item 1B. | 34 | |||||

| Item 2. | 34 | |||||

| Item 3. | 36 | |||||

| Item 4. | 36 | |||||

| PART II | ||||||

| Item 5. | 37 | |||||

| Item 6. | 39 | |||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

42 | ||||

| Item 7A. | 62 | |||||

| Item 8. | 63 | |||||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

63 | ||||

| Item 9A. | 63 | |||||

| Item 9B. | 64 | |||||

| PART III | ||||||

| Item 10. | 65 | |||||

| Item 11. | 65 | |||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

65 | ||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

65 | ||||

| Item 14. | 65 | |||||

| PART IV | ||||||

| Item 15. | 66 | |||||

2

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Some of the statements in this Annual Report on Form 10-K under the headings “Business,” “Risk Factors,” “Selected Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Financial Statements and Supplementary Data” and elsewhere contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We may also make written or oral forward-looking statements in our periodic reports on Forms 10-Q and 8-K, in press releases and other written materials and in oral statements made by our officers, directors or employees to third parties. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. Forward-looking statements are often characterized by the use of words such as “believes,” “estimates,” “expects,” “projects,” “may,” “intends,” “plans” or “anticipates,” or by discussions of strategy, plans or intentions. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause the actual results, performance or our achievements, or industry results, to differ materially from historical results, any future results, or performance or achievements expressed or implied by such forward-looking statements. There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements contained in this report. Important factors that could cause our actual results to differ materially from those expressed as forward-looking statements are set forth in this report, including but not limited to those under the heading “Risk Factors.” There may be other factors of which we are currently unaware or deem immaterial that may cause our actual results to differ materially from the forward-looking statements.

Forward-looking statements are based on current plans, estimates and projections, and, therefore, you should not place undue reliance on them. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update them publicly in light of new information or future events.

Presentation of Financial Statements.

The terms “Kraton,” “our company,” “we,” “our,” “ours” and “us” as used in this report refer collectively to Kraton Performance Polymers, Inc. and its consolidated subsidiaries.

This Form 10-K includes financial statements and related notes that present the consolidated financial position, results of operations and cash flows of Kraton, and its subsidiaries. Kraton is a holding company whose only material asset is its investment in Kraton Polymers LLC, which is its wholly owned subsidiary. Kraton Polymers LLC and its subsidiaries own all of the consolidated operating assets.

3

Table of Contents

PART I

| Item 1. | Business. |

General

Our Company

We believe we are the world’s leading producer of styrenic block copolymers (“SBCs”) as measured by 2010 sales revenue. We market our products under the widely recognized KRATON® brand. SBCs are highly-engineered synthetic elastomers that we invented and commercialized almost 50 years ago, which enhance the performance of numerous end use products, imparting greater flexibility, resilience, strength, durability and processability. We focus on the end use markets we believe offer the highest growth potential and greatest opportunity to differentiate our products from competing products. Within these end use markets, we believe that we provide our customers with a broad portfolio of highly-engineered and value-enhancing polymers that are critical to the performance of our customers’ products. We seek to maximize the value of our product portfolio by introducing innovations that command premium pricing and by consistently upgrading from lower margin products. As the industry leader, we believe we maintain significant competitive advantages, including an almost 50-year proven track record of innovation; world-class technical expertise; customer, geographical and end use market diversity; and industry-leading customer service capabilities. These advantages are supported by a global infrastructure and a long history of successful capital investments and operational excellence.

Our SBC products are found in many everyday applications, including disposable baby diapers, the rubberized grips of toothbrushes, razor blades, power tools and in asphalt formulations used to pave roads. We believe that there are many untapped uses for our products, and we will continue to develop new applications for SBCs. We also develop, manufacture and market niche, non-SBC products that we believe have high growth potential, such as isoprene rubber latex (“IRL”). IRL is a highly-engineered, reliable synthetic substitute for natural rubber latex. We believe the versatility of IRL offers significant opportunities for new, high-margin applications. Our IRL products, which are used in applications such as surgical gloves and condoms, have not been found to contain the proteins present in natural latex and are, therefore, not known to cause allergies. We believe we produce the highest purity IRL globally and that we are the only significant third-party supplier of the product. Our IRL business has grown at a compound annual growth rate of 36%, based on revenues, from 2008 to the end of 2010.

We currently offer approximately 800 products to more than 700 customers in over 60 countries worldwide, and we manufacture our polymers at five manufacturing facilities on four continents, including our flagship plant in Belpre, Ohio, the most diversified SBC plant in the world. Our facility in Japan is operated by an unconsolidated manufacturing joint venture. Our products are typically developed using our proprietary, and in many cases patent-protected, technology and require significant engineering, testing and certification. In 2010, we were awarded 81 patents for new products or applications and at December 31, 2010, we had approximately 1,053 granted patents and approximately 349 pending patent applications. We are widely regarded as the industry’s leading innovator and cost-efficient manufacturer in our end use markets. We work closely with our customers to design products that meet application-specific performance and quality requirements. We expect these innovations to drive our organic growth, sustain our leadership position, expand our market share, improve our margins and produce a high return on invested capital.

Over the past several years, we have implemented a range of strategic initiatives designed to enhance our profitability and end use market position. These include fixed asset investments to expand our capacity in high value products, to enhance productivity at our existing facilities and to significantly reduce our fixed cost structure through headcount reductions, production line closures at our Pernis, the Netherlands, facility (“Pernis”) and system upgrades. During this period, we have shifted our portfolio to higher-margin products, substantially exited low-margin businesses such as footwear and implemented smart pricing strategies that have improved our

4

Table of Contents

overall margins and return on invested capital. We believe these initiatives provide us with a strong platform to drive growth, create significant operating leverage and position us to benefit from volume recovery in our end use markets.

We believe that starting in late 2008 the global economic downturn and associated reduction in customer and end user inventory levels, caused an unprecedented slowdown across the industry. We experienced a decline in sales volume across all of our end use markets, including the traditionally more stable consumer and medical applications. We believe that a significant factor in this decline was inventory de-stocking. Our first and second quarter 2009 sales volumes were 39% and 24%, respectively, less than our sales volumes in the comparable 2008 quarters. The trend began to reverse itself in June 2009, as demand patterns began to shift towards recovery such that our third quarter 2009 sales volume was 10% less than the sales volume in the third quarter of 2008 and our fourth quarter 2009 sales volume was 16% above the sales volume in the fourth quarter of 2008. More recently, we have seen demand returning to more normal levels with 2010 sales volume up 18% compared to 2009.

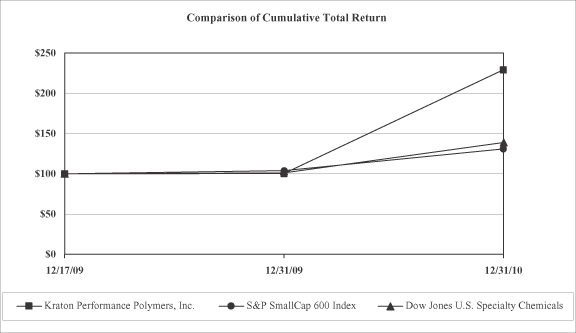

Corporate History

Prior to our initial public offering and related reorganization transactions in December 2009, we were an indirect wholly-owned subsidiary of TJ Chemical Holdings LLC and were indirectly owned by certain affiliates of TPG Capital, L.P., which we refer to collectively as “TPG,” and certain affiliates of J.P. Morgan Partners, LLC, which we refer to collectively as “JPMP,” and certain members of our management. We conduct our business through Kraton Polymers LLC and its consolidated subsidiaries. Prior to our initial public offering (“IPO”), Kraton Polymers LLC’s parent company was Polymer Holdings LLC, a Delaware limited liability company. On December 16, 2009, Polymer Holdings LLC was converted from a Delaware limited liability company to a Delaware corporation and renamed Kraton Performance Polymers, Inc., which remains Kraton Polymers LLC’s parent company. In addition, prior to the closing of the initial public offering, TJ Chemical was merged into (and did not survive the merger with) Kraton Polymers LLC. Trading in our common stock on the New York Stock Exchange commenced on December 17, 2009 under the symbol “KRA.” The IPO was completed on December 22, 2009.

Our Competitive Strengths

We believe the following competitive strengths help us to sustain our market leadership position and contribute to our ability to generate superior margins and strong cash flow. We expect these strengths to support our growth in the future:

The Market Leader in SBCs

We believe we hold the number one global market position, based on 2010 sales revenue, in each of our four core end use markets, with sales of approximately $1,228 million and sales volumes of approximately 307 kilotons for the year ended December 31, 2010. We generated approximately 98% of our 2010 product sales in our core end use markets. Our Belpre, Ohio facility is the most product-diversified SBC plant in the world, and we believe our Wesseling, Germany facility is world scale and cost efficient. As the pioneer of SBCs almost 50 years ago, we believe our KRATON® brand is widely recognized for our industry leadership, and we are particularly well regarded for our process technology expertise and long track record of market-driven innovation.

Growth Through Innovation and Technological Know-How

SBC production and product development requires complex and specific expertise, which we believe many of our competitors are currently unable to replicate. As the industry pioneer, Kraton maintains a constant focus on enhancing the value-added attributes of our products and on developing new applications for SBCs. At December 31, 2010, we had approximately 1,053 granted patents and approximately 349 pending patent applications. Our “Vision 20/20” program targets generating 20% of sales revenues from new products or

5

Table of Contents

applications introduced in the prior five years. In 2010, we generated 13% of our sales from innovation driven revenue. We believe that our new product innovation will allow us to drive increases in our volume, expand unit contribution margins (the excess of the sale price of a unit of product over the variable cost to produce that unit) and increase our customers’ reliance on Kraton’s products and technical expertise. For example, for the year ended December 31, 2010, our Emerging Businesses end use market, which includes isoprene rubber (“IR”) and IRL, represented 7% of sales revenues. Furthermore, our IRL business has grown, on a revenue basis, at a compound annual growth rate of 36% from 2008 to the end of 2010 and is earning a unit contribution margin in excess of the company’s as a whole. In addition to IRL, we believe we have a robust portfolio of innovations at various stages of development and commercialization that we believe will fuel our future growth. Examples include, PVC alternatives for wire & cable and medical applications, and polymers used in slush molding for automotive applications, and our Nexar™ family of membrane polymers for water filtration and breathable fabrics.

Diverse Global Manufacturing Capabilities and End Use Market Exposures

We manufacture our polymers at five manufacturing facilities on four continents (North America, Europe, South America and Asia) producing what we believe to be the highest quality grades available of unhydrogenated SBCs (“USBCs,”) hydrogenated SBCs (“HSBCs,”) and high purity IRL. We believe we are the only SBC producer with this breadth of technical capabilities and global footprint, selling approximately 800 products to more than 700 customers in over 60 countries. Since 2003, we have successfully completed plant expansions totaling 60 kilotons of capacity at a total cost of less than $50 million, giving us a total capacity of 420 kilotons. Our manufacturing and product footprint allow revenue diversity, both geographically and by end use market. We believe our scale and footprint make us an attractive customer for our monomer suppliers, which, in turn, allows us to offer a high degree of supply security to customers.

Long-Standing, Strong Customer Relationships Supported by Leading Service-Offering

We sell our products to over 700 customers, many of which we have had relationships with for 15 years or more. Our customers are broad-based, with no single customer accounting for more than 5% of our sales revenue in 2010 (our top 10 customers together represented 29% of sales in 2010). Our customers’ manufacturing processes are typically calibrated to the performance specifications of our products. Given the technical expertise and investment required to develop these formulations and the lead times required to replace them, we believe our customers face high switching costs. We believe our customers view our products as being high value-added, even though our products generally represent a small proportion of the overall cost of the finished product. Leveraging our global infrastructure, we believe we offer our customers a best-in-class service level that aligns us to their respective business models through “on demand” order delivery and product development specifically designed for each customer’s needs.

6

Table of Contents

Experienced Management Team with a Track Record of Growth and Productivity Improvements

Our senior management team has an average industry experience of approximately 25 years, most of which has been with some of the world’s leading companies, including Koch Industries, Hoechst AG and Chevron Phillips Chemical. Since early 2008, when the majority of the current executive team was put in place, we have instituted a number of strategic initiatives designed to enhance productivity, reduce costs and capital intensity, expand margins and drive innovation-led growth.

Our Business Strategy

Building on these competitive strengths, we are focused on achieving profitable top-line growth and improving margins through the introduction of highly-engineered, high value-added products to drive strong and sustainable cash flow.

Drive Growth and Margin Expansion Through Innovation

We have an almost 50-year track record of innovation dating back to our development of the first SBCs. Our research and development effort is focused on end use markets and new product developments that we believe offer high growth as well as opportunities to develop highly-differentiated products for our customers, thus yielding higher margin potential. We work very closely with our longstanding customer base to produce products that solve their specific technical requirements. For example, to address an industry trend to provide an alternative to PVC in applications such as medical packaging and wire and cable, we have developed and commercialized a series of custom-designed polymers and compounds. In addition to this innovation-led growth, we believe that there are a number of end use market dynamics that will also drive growth in our business, such as the general demand by customers for higher value-added product performance characteristics.

Pursue “Smart Pricing”

In late 2007, we undertook a comprehensive review of our entire product portfolio, including both product-specific and customer-specific profitability analysis. As a result, we took a variety of actions including reducing or eliminating our exposure to lower margin business and increasing our prices to reflect the significant value-added benefits of our products to our customers’ products. Since the end of 2007, we have increased our unit contribution margins by more than 50%. We will continue to pursue pricing strategies that reflect the contribution to the end product of our high value and complex product offerings for which limited substitutes exist.

Invest in Key Growth Initiatives

For the year ended December 31, 2010, capital expenditures were approximately $56 million. We currently expect 2011 capital expenditures will be approximately $80 million to $85 million. Our minimum annual capital expenditure levels to maintain and achieve required improvements in our facilities in each of the next three to five years are expected to be approximately $16 million to $22 million. Included in our 2011 capital expenditure estimate is $13 million for engineering related to our ongoing assessment of a possible HSBC manufacturing facility in Asia, $11 million to replace IR production from the closure of our Pernis facility, $6 million for the multi-year systems and control upgrades, approximately $3 million to upgrade or replace our coal-burning boilers at our Belpre, Ohio, facility, and $3 million for IRL expansion at our Paulinia facility.

Continue to Pursue Operational Efficiencies

We have a history of implementing continuous process and cost improvement plans that have resulted in a significant reduction in our cost position and an improvement in the way we run our business. Since the beginning of 2008, we have implemented cost saving initiatives that have reduced costs by over $50 million, on an annual basis. These initiatives include:

| • | approximately $25 million for programs to streamline our operations and lower staffing levels, |

7

Table of Contents

| • | approximately $10 million associated with the shutdown of SIS production in our Pernis facility in 2008; |

| • | approximately $5 million in cost reductions related to the implementation of our new Enterprise Resource Planning (“ERP”) system in 2009; and |

| • | approximately $12 million in ongoing cost reductions related to the shutdown of IR production in our Pernis facility. |

Through these actions, we have created substantial operating leverage in our business and we continue to pursue initiatives to lower our cost structure and improve operational efficiencies.

New Innovations

Consistent with our strategy, we believe that we continue to lead SBC innovation as evidenced by numerous developments announced across several of our core end use markets throughout 2010. Below are our most recently announced product innovations.

In May 2010, we announced we commercialized DX405 as a new functional polymer to our product line of polymers for Adhesives, Sealants, and Coatings. This technology will allow our customers to more efficiently and expediently manufacture products that are stronger and softer. DX405 has a low styrene content, which promotes ease of processing, low viscosity, and the attainment of lower application temperatures. This adds efficiency and simplification to the manufacturing process, which shortens batch times, increases extrusion rates and improves productivity. DX405 has a wide formulation window and its versatility makes it suitable for solvent-based compositions, hot melt adhesives, and sealant applications. It can be formulated with other polymers, resins, fillers, pigments, oils, thickeners, waxes and stabilizers to obtain a desired balance of properties.

In July 2010, we announced the addition of Kraton D1183 BT, a new SIS grade, to our line of polymers for use in applications where softness, ease-in-processing, and high temperature resistance are essential. Kraton D1183 BT is suitable for use in many adhesive applications including thermal printing labels, high temperature resistant labels, elastic labels and diaper tabs. It is an excellent choice for adhesives in hygiene applications and its shear strength is particularly good at body temperature. Moreover, it offers economically attractive adhesive formulations, and gives formulators the ability to dilute it further to obtain equivalent performance levels of competing products, which can result in cost-savings. It can also achieve significantly higher cohesive strength and higher temperature resistance without the use of expensive endblock resins. Therefore, Kraton D1183 BT is not only economically attractive, but also substantially stronger and offers a wider formulating space than products currently on the market. Prior to the commercialization of Kraton D1183 BT, innovators used low-coupled SIS block copolymers to impart softness to end-products. Although they offered improved adhesion on open and porous substrates and good label die-cutting performance, they often lacked cohesion, which hampered their use in applications where higher shear and temperature resistance was required. In comparison, Kraton D1183 BT is a 40% diblock SIS, which shows superior performance to low-coupled SIS block copolymers and, we believe, is therefore the polymer of choice for these applications.

In August 2010, we announced that our roof coating formulation containing Kraton G1643 exceeds requirements in the ASTM International D6083 standard specification recognized in the elastomeric roof coating market. ASTM D6083 is an industry standard that establishes minimum performance levels in the following areas: viscosity, weight and volume solids; mechanical properties; adhesion; low temperature flexibility after accelerated weathering; tear resistance; permeation and water swelling; and fungi resistance. This gives innovators an opportunity to more effectively compare polymer-to-polymer for roof coating formulations. This SBC-based polymer has a proven track record of improving the performance of roof coatings because it adds superior water resistance, improved adhesion, and increased elongation to formulations. In December 2010, elastomeric roof coating formulation containing Kraton G1643 completed a major milestone towards achieving the ENERGY STAR rating, the trusted, government-backed symbol for products that are energy efficient,

8

Table of Contents

cost-effective and sustainable. We tested the reflectance and emittance of our G1643 elastomeric roof coating formulation using ASTM C1549 and ASTM C1371 standards. The results indicated reflectance of 0.89, and emittance of 0.88, respectively, which are considered best in class when compared to other roof coatings formulations in the market today. Reflectance and emittance properties are measured on a scale of 0 - 1.0 where 1.0 is the most reflective or emissive according to the Cool Roof Rating Council (CRRC). The ENERGY STAR program also uses these standards to evaluate the energy efficiency of elastomeric roof coatings. Roof coating formulations containing Kraton G1643 can reduce the total cost of installation and offer a fast cure coating that works better in cold, humid, or wet conditions. They can withstand ponding water, provide excellent adhesion to all types of roofing substrates, are ideal for low slope roofs (or high traffic areas), deliver excellent reflectance to reduce energy costs, and extend the life of a roof. It can be used to help lower volatile organic compounds (VOCs) in a solvented formulation, which have significant vapor pressures that can affect the environment and human health. In addition, our tested formulation can be used under the EPA’s regulation for thermoplastic rubber coatings and mastic.

In October 2010, we announced the development of a new SBC-based alternative for slush molded interior soft skins. Slush molding is a specialized processing operation traditionally designed for polyvinyl chloride (PVC) based compounds to produce the interior surface of automobiles such as instrument panel skins, door panels, airbags and consoles. Kraton Performance Polymers and SO.F.TER. SPA formed a strategic alliance to leverage the leading innovation and scientific capabilities of both companies. This resulted in the development of a superior and more environmentally-friendly alternative to PVC and thermoplastic polyurethanes (TPU) which provides a major technology and performance leap for the automotive industry. Manufacturers can achieve significant improvements in low-temperature performance, fogging, and recyclability while still using existing slush molding equipment and standard processing conditions. An additional benefit is lowered manufacturing costs due to reduced service temperatures and decreased processing time. Our new product provides a 30% to 40% reduction in material weight, better aging properties, and improved soft touch compared to existing materials. These benefits help automotive manufacturers reduce the weight of vehicle components, while enhancing aesthetics and performance.

Products

Our Kraton polymer products are high performance elastomers, which are engineered for a wide range of end use applications. Our products possess a combination of high strength and low viscosity, which facilitates ease of processing at elevated temperatures and high processing speeds. Our products can be processed in a variety of manufacturing applications, including injection molding, blow molding, compression molding, extrusion, hot melt and solution applied coatings.

We offer our customers a broad portfolio of products that includes approximately 250 core commercial grades of SBCs. We believe that the diversity and depth of our product portfolio is unmatched in the industry, serving the widest set of applications within each end use.

While we organize our commercial activities around our four core end uses, we manufacture our products along five primary product lines based upon polymer chemistry and process technologies: (1) USBCs; (2) HSBCs; (3) IR; (4) IRL; and (5) Compounds. The majority of worldwide SBC capacity is dedicated to the production of USBCs, which are primarily used in the Paving and Roofing, Adhesives, Sealants and Coatings and Footwear end use applications. HSBCs, which are significantly more complex and capital-intensive to manufacture than USBCs, are primarily used in higher value-added end uses, including soft touch and flexible materials, personal hygiene products, medical products, automotive components and certain adhesives and sealant applications. The following product summaries highlight our portfolio of product grades, their key performance characteristics and selected applications:

HSBCs. We developed the first HSBC polymers in the late 1960s for use in production of soft, strong compounds for handles and grips and elastic components in diapers. As of December 31, 2010, our HSBC product portfolio includes 106 core commercial grades of products. Our technical expertise in HSBC

9

Table of Contents

manufacturing and our history of HSBC innovation have led to what we believe is a number one market share of HSBC sales in terms of industry sales revenue. HSBC products are significantly more complex to produce than USBC products and, as a result, generally command selling prices that are significantly higher than those for USBCs and generate higher margins. Sales of HSBC products comprised approximately 33%, 34%, and 31% of our total sales revenue (which excludes by-product sales) in 2010, 2009 and 2008, respectively.

HSBC products impart higher performance characteristics than USBC products including: color range and stability, including resistance to ultraviolet light; processing stability and viscosity; and elevated temperature resistance. HSBCs are primarily used in our Advanced Materials and our Adhesives, Sealants and Coatings end use markets to impart improved performance characteristics such as: (1) stretch properties in disposable diapers and adult incontinence products; (2) soft feel in numerous consumer products such as razor blades, power tools, and automobile internals; (3) impact resistance for demanding engineering plastic applications; (4) flexibility for wire and cable plastic outer layers; and (5) improved flow characteristics for many industrial and consumer sealants lubricating fluids.

USBCs. We developed the first USBC polymers in 1964. Our flagship Belpre, Ohio, site, the first dedicated block copolymer plant, was built in 1971. As of December 31, 2010, our USBC product portfolio includes 146 core commercial grades of products. We believe we hold the number one market share of USBC sales in terms of industry sales revenue, excluding Footwear. Sales of USBC products comprised approximately 67%, 66%, and 69% of our total sales revenue (which excludes by-product sales) in 2010, 2009 and 2008, respectively.

USBCs are used in all our end use markets in a range of products to impart desirable characteristics, such as: (1) resistance to temperature and weather extremes in roads and roofing; (2) resistance to cracking, reduced sound transmission and better drainage in porous road surfaces; (3) impact resistance for consumer plastics; and (4) increased processing flexibility in adhesive applications, such as packaging tapes and labels, and materials used in disposable diapers. As with SBCs in general, USBCs are most often blended with substrates to impart the aforementioned performance enhancements. We made the strategic decision to largely exit the less attractive footwear market and focus our resources on the greater value proposition offered by the remaining end uses for our USBC products.

IR. Isoprene Rubber (formed from polymerizing isoprene) is a line of high purity isoprene rubber products and is a non-SBC product. These products combine the key qualities of natural rubber, such as good mechanical properties and hysteresis, with superior features such as high purity, excellent clarity, good flow, low gel content, no nitrosamines and no natural rubber proteins. Our IR polymers are available as bales of rubber or as latex. IR polymers are useful in the production of medical products, adhesives, tackifiers, paints, coatings and photo-resistors. We include IR in our USBC product line.

IRL. Isoprene Rubber Latex (emulsion of IR in water) is a substitute for natural rubber latex, particularly in applications with high purity requirements, such as medical, healthcare, personal care and food contact operations. Our IRL is unique polyisoprene latex with controlled structure and low chemical impurity levels manufactured through an anionic polymerization process followed by a proprietary latex processing step, both of which were developed by us. IRL is durable, tear resistant, soft, transparent and odorless. In addition, the synthetic material has unparalleled consistency, and it is non-allergenic, providing a distinct property advantage over natural rubber latex. We include IRL in our USBC product line.

Compounds. Our Compounds are a mixture of Kraton polymers and other polymers, resins, oils or fillers to enhance the final properties for processing. Compounds cover a wide range of polymers tailored to meet specific customer needs in consumer and industrial applications. Compounds can be formulated so that they can be extruded, injection molded, foamed, etc. to meet the final application requirements. These products are primarily used in soft-touch grips, sporting equipment, automotive components and personal care products. Compounds comprised approximately 2%, 3%, and 3% of our total sales revenue in 2010, 2009 and 2008, respectively. Compounds are included in our USBC and HSBC product lines, as appropriate.

10

Table of Contents

Our End Use Markets

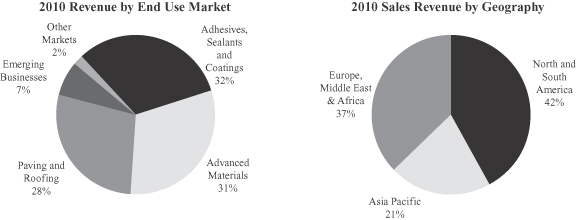

We have aligned our commercial activities to serve four core end use markets that we believe have the highest growth and profitability potential: (1) Advanced Materials; (2) Adhesives, Sealants and Coatings; (3) Paving and Roofing; and (4) Emerging Businesses. The following table describes our four core end use markets and other end use markets, and their approximate relative sizes:

| Revenue Mix (1) | ||||||||||||||

| End Use Markets |

2010 | 2009 | 2008 | Selected Applications/Products | ||||||||||

| Advanced Materials |

31 | % | 31 | % | 30 | % | • Soft touch for consumer products (tooth brushes and razor blades) and power tools • Impact resistant engineering plastics • Impact resistant for polyolefin based totes and bins • Automotive components • Elastic films for disposable diapers and adult incontinence branded products • Skin care products and lotions • Disposable food packaging • Medical packaging films and tubing, often as alternative to PVC • Wire & cable insulation/jacketing, alternative to PVC | |||||||

| Adhesives, Sealants and Coatings |

32 | % | 32 | % | 32 | % | • Tapes and labels • Non-woven and industrial adhesives • Industrial and consumer weather sealants | |||||||

| Paving and Roofing |

28 | % | 26 | % | 31 | % | • Asphalt modification for performance roadways, bridges and airports • Asphalt modification for roofing felts and shingles | |||||||

| Emerging Businesses |

7 | % | 7 | % | 3 | % | • Surgical gloves • Condoms | |||||||

| Other Markets |

2 | % | 4 | % | 4 | % | • Lubricants and fuel additives • High styrenics’ packaging • Footwear | |||||||

| (1) | Based on 2010, 2009 and 2008 sales of $1,228 million, $920 million and $1,171 million (excludes by-product sales, which are reported as other revenues). |

Advanced Materials. Through sales of HSBC, USBC and IR products, as well as certain Compounds, we maintained a leading position in the global Advanced Materials end use market.

In the Advanced Materials end use market, our products compete against a wide variety of chemical and non-chemical alternatives, including thermoplastic vulcanizates, ethylene propylene diene monomer rubber, known as EPDM, thermoplastic polyolefin elastomers and thermoplastic polyurethanes, known as TPUs. The choice between these materials is influenced by performance characteristics, ease of use, desired aesthetics and total end-product cost. In addition, competing materials include spandex, natural rubber, polyvinyl chloride polymers and compounds, polyolefins, polyethylene terephthalate, known as PET, nylon and polycarbonate, based on performance, ease of use, desired aesthetics and total end-product cost.

Advanced Materials polymers and compounds from Kraton are used in a range of diverse applications, many of which require customized formulations, product testing with long lead time approvals, and production

11

Table of Contents

evaluations for specific end use customers and applications. As such, customer loyalty tends to be strongest in this end use market, helped in part by the fact that many of the applications are patent protected. The degree of complexity in the manufacturing of these products and the attractive value proposition for our customers drives higher sustainable margins for this end use market.

We believe our Advanced Materials’ growth is driven by customers’ desire for improved product flexibility and resilience, impact resistance, moisture resistance and aesthetics (clarity and feel) in consumer products, medical products, packaging and automotive components. In addition, due to health and environmental concerns, one trend that is particularly a focus for our company is in providing alternative solutions to PVC in a number of demanding medical (blood and intravenous bags, tubes and stoppers) and electronic (wire and cable outer layer) applications.

A differentiating driver for our expected Advanced Materials’ growth is our unique ability to design and manufacture certain custom compound formulations. One specific example is Kraton compounds that provide critical stretch performance for the infant care (diaper) and adult incontinence markets.

Revenue from Advanced Materials represented approximately 31%, 31%, and 30% of total sales revenue (which excludes by-product sales) in 2010, 2009 and 2008, respectively.

Adhesives, Sealants and Coatings. Through sales of HSBC, USBC and certain IR products, we have continued our tradition of holding a leading position in the global Adhesives, Sealants and Coatings end use market.

In the Adhesives, Sealants and Coatings end use market, SBC products primarily compete with acrylics, silicones, solvent-based rubber systems and thermoplastic polyolefin elastomers. The choice between these materials is influenced by bond strength, specific adhesion, consistent performance to specification, processing speed, hot-melt application, resistance to water and total end-product cost.

Our Adhesives, Sealants and Coatings polymers are used in a number of demanding applications such as: adhesives for diapers and hygiene products; sealants for construction and automotive applications; and adhesives for tapes and labels. Our coatings polymers have expanded into the high growth market of elastomeric white roof coatings. The coating provides not only weather resistance, but improved energy efficiency, reducing solar absorption on bitumen based industrial roofs. We expect our growth to be supported by the continuing substitution of adhesives for mechanical fastening systems and the growing demand within developing countries for disposable hygiene products that contain adhesives and sealants.

Another significant growth application for our SBCs is for tapes and labels. In both solvent-based and hot-melt forms, Kraton SBCs impart water resistance, color stability, strong bonding characteristics, high cohesive strength, good ultraviolet light resistance, heat stability and long shelf life. Specifically, the pressure sensitive label market continues to expand using SBC technology at the expense of paper labels, driven by cost reduction and higher consumer market appeal. In addition, our SBCs’ compatibility with many other formulating ingredients and their suitability for hot-melt systems are major factors in demand growth. Furthermore, we believe use of our styrene-isoprene-butadiene-styrene (SIBS) with rosin esters, C9 & C5/C9 based hydrocarbon resins can produce a tape with properties similar to a traditional styrene-isoprene-styrene (SIS) hydrocarbon resin formulation but lower use of hydrocarbon resins which are in tight supply. We have expanded our offering of formulated compounds for adhesive films that protect LCD panels and consumer appliances providing improved adhesive performance with no residue or haze after removal. Both applications are growing rapidly in Asia as SBC based technology penetrates preferentially versus acrylic based films. In 2008, we largely exited the increasingly commoditized portions of the tape and label business, choosing to refocus our development and manufacturing capacity on higher value-added and more proprietary products. Our history of innovation in the Adhesives, Sealants and Coatings end use market has allowed us to capitalize on our unique product offerings, significantly enhancing the value of this end use market to the business.

12

Table of Contents

Revenue from Adhesives, Sealants and Coatings represented approximately 32%, 32%, and 32% of total sales revenue (which excludes by-product sales) in 2010, 2009 and 2008, respectively.

Paving and Roofing. In 2010, we maintained a leading market position in the global asphalt modification SBC industry, primarily through sales of USBC products.

We believe that our sales into the Paving and Roofing end use market will see meaningful growth driven by an overall volume recovery to a level more in line with historical norms, improvement in roofing demand including re-stocking of depleted roofing supply chains, and continued penetration globally of polymer modified road surfaces.

The addition of our SBS in asphalt greatly improves the strength and elasticity of asphalt-based paving compositions over an extended temperature range, thus increasing resistance to wear, rutting and cracking. In roofing applications, SBS-modified asphalt produces stronger and more durable felts and shingles, thus reducing the possibility of damage from weather, ice and water build-up and again extending service life.

We believe our growth in the Paving and Roofing end use market will benefit from new products we have recently introduced, and those that are currently under development, to respond to industry trends for elevated polymer content roads and surfaces, over-lay compatibility with concrete systems, and general environmental awareness (for example, road construction emissions).

Revenue from Paving and Roofing represented approximately 28%, 26%, and 31% of total sales revenue (which excludes by-product sales) in 2010, 2009 and 2008, respectively.

Emerging Businesses. In this end use, we commercialize and manage innovations that are outside of our other three primary end use markets. Currently, Emerging Businesses includes our IR and IRL businesses. IR is a line of high purity isoprene rubber products that combines the key qualities of natural rubber, such as good mechanical properties and hysteresis, with superior features such as high purity, excellent clarity, good flow, low gel content, no nitrosamines and no natural rubber proteins. IR polymers in general are used in high volume, lower value-added applications such as tire rubber. However, we focus our unique IR polymers, produced using state-of-the-art nanotechnology, in more demanding applications such as medical products, adhesives and tackifiers, paints, coatings and photo-resistors. Approximately half of our current IR production is converted into IRL (emulsion of IR in water), a substitute for natural rubber latex, particularly in applications with high purity requirements, such as medical, healthcare, personal care and food contact applications. IRL is durable, tear resistant, soft, transparent and odorless. Most importantly, IRL is non-allergenic for both doctor and patient, providing a distinct property advantage over natural rubber latex.

IRL is predominately used in the synthetic surgical gloves and condoms markets. Our IRL business has grown, on a revenue basis, at a compound annual growth rate of 36% from 2008 to the end 2010. The combination of increasing demand, favorable market dynamics and competitive differentiation make this a key product offering for us. We currently anticipate growth to continue for the foreseeable future, and will likely need to continue adding capacity to our global supply system.

Revenue from Emerging Businesses represented approximately 7%, 7%, and 3% of total sales revenue (which excludes by-product sales) in 2010, 2009 and 2008, respectively.

Research, Development and Technology

Our research and development program is designed to develop new products and applications, provide technical service to customers, develop and optimize process technology and assist in marketing new products. We spent $24 million, $21 million, and $27 million for research and development for the years ended

13

Table of Contents

December 31, 2010, 2009 and 2008, respectively. From time to time, we also engage in customer-sponsored research projects, with spending of approximately $1 million a year for the three-year period ended December 31, 2010. As of December 31, 2010, 103 personnel are dedicated to this critical business activity.

Our research and development activities are primarily conducted in laboratories in Houston, Texas, and Amsterdam, the Netherlands. We also own a laboratory in Paulinia, Brazil, that provides technical services to our South American customers. Our application and technical service laboratories in Shanghai, China and Tsukuba, Japan provide support to our Asian customers. In addition, we have technical service staff located in Mont St. Guibert, Belgium.

Our experienced, knowledgeable professionals perform research using extensive scientific application equipment located at our Houston and Amsterdam research and development facilities. At both of our major research and development facilities, we produce new Kraton product samples for our customers and provide guidance to our manufacturing organization. Application equipment is used to evaluate polymers and compounds to determine optimal formulations. Our Houston facility also includes a comprehensive pilot plant to test new raw materials and new process technologies in order to improve the manufacturing performance of our products.

Since the introduction of SBCs in the mid-1960s, we have experienced strong demand for the development of new products that utilize the enhancing properties offered by our polymers. We believe we have a strong new product pipeline to take advantage of many new opportunities. As a proven product innovator, we will continue to employ our product knowledge and technical expertise to provide application-based solutions for our customers’ highly specialized needs. This can include modifications to current products as well as significant new innovations aimed at displacing more expensive, less efficient product solutions in the marketplace.

Sales and Marketing

Our business is predominantly based on a short sales cycle. We sell our products through a number of channels including a direct sales force, marketing representatives and distributors. The majority of our products are sold through our direct sales force. In countries where we generate substantial revenues, our sales force is organized by end use market in order to meet the specific needs of our customers. In geographic areas where it is not efficient for us to organize our sales force by end use market, we may use one sales team to service all end use markets.

In smaller markets, we often utilize marketing representatives who act as independent contractors to sell our products. In addition, we utilize distributors to service our smaller customers in all regions. Distributors sell a wide variety of products, which allows smaller customers to obtain multiple products from one source. In addition to our long-term relationships with distributors in North America and Europe, we have established relationships with a wide network of distributors in Latin America and the Asia Pacific region.

Our sales force, distributors and agents interact with our customers to provide both product advice and technical assistance. In general, they arrange and coordinate contact between our customers and our research and development personnel to provide quality control and new product solutions. Our close interaction with our customers has allowed us to develop and maintain strong customer relationships. In addition, we focus our sales efforts on those customers who value the quality of our products, service and technical support.

Total operating revenues from our operations outside the United States were approximately 66%, 67%, and 66% of our total operating revenues in the years ended December 31, 2010, 2009 and 2008, respectively. Direct sales we make outside of the United States are generally priced in local currencies and can be subject to currency exchange fluctuations when reported in our consolidated financial statements, which are maintained in U.S. dollars in accordance with U.S. Generally Accepted Accounting Principles (GAAP). For geographic reporting, revenues are attributed to the geographic location in which the customers’ facilities are located. We generated

14

Table of Contents

approximately 42% of our 2010 sales from customers located in the Americas, 37% in Europe, the Middle East and Africa and 21% in the Asia Pacific region. See Note 12 to our Consolidated Financial Statements for geographic reporting for total operating revenues and long-lived assets as of and for the years ended December 31, 2010, 2009 and 2008.

Sources and Availability of Raw Materials

We use three monomers as our primary raw materials in the manufacture of our products: styrene, butadiene and isoprene. For the years ended December 31, 2010, 2009, and 2008, these monomers together represented approximately 56%, 43%, and 49% of our total cost of goods sold, respectively. The cost of these monomers has generally correlated with changes in crude oil prices. Prices have fluctuated significantly due to global supply and demand and global economic conditions. During 2009, styrene pricing increased from lows in the first quarter of 2009 trending higher through the second half of 2009. Styrene pricing remained volatile in 2010 with prices up in the first half of 2010, declining in the third quarter, then rising to a higher level in the fourth quarter. Butadiene pricing also increased from the lows of the first quarter of 2009 and stabilized during the third quarter of 2009. During 2010, butadiene pricing increased into the third quarter before declining in the fourth quarter. In 2009, spot isoprene prices were volatile in the first half of the year, but prices stabilized during the third quarter of 2009 before trending higher in late 2009. Spot isoprene pricing continued to increase through the first half of 2010 before declining in the second half due to improved supply/demand. Overall, monomer pricing in the fourth quarter of 2010 was comparable to the third quarter of 2010, and average monomer costs in 2010 were up significantly compared to 2009. Styrene, butadiene and isoprene used by our U.S. and European facilities are predominantly supplied by a portfolio of suppliers under long-term supply contracts and arrangements with various expiration dates. For our U.S. facilities, we also procure a substantial amount of isoprene from a variety of suppliers from Russia, China and Japan. These purchases include both spot and contract arrangements. We generally contract with these suppliers on a short-term basis, and the number of such contracts has been increasing since 2008. We have increased the number of these contracts since 2008 to ensure the availability of our isoprene supply.

In Japan, butadiene and isoprene supplies for our joint venture plant are supplied under our joint venture agreement, where our partner supplies our necessary requirements. Styrene in Japan is sourced from local third-party suppliers. Our facility in Paulinia, Brazil, generally purchases all of its raw materials from local third-party suppliers.

We believe our contractual and other arrangements with suppliers of styrene, butadiene and isoprene provide an adequate supply of raw materials at competitive, market-based prices. We can provide no assurances that contract suppliers will not terminate these contracts at the expiration of their contract terms, that we will be able to obtain substitute arrangements on comparable terms, or that we generally will be able to source raw materials on an economic basis in the future.

Styrene. Styrene is available on the global petrochemical market with approximately 11 producers located in the Americas, 13 producers located in Europe and 49 producers located in Asia. The top five producers worldwide are: Shell Chemicals, LyondellBasell, BASF, Total and Ineos, which collectively account for approximately 29% of global capacity. Styrene prices are primarily driven by worldwide supply and demand and the cost of ethylene and benzene and are influenced by prevailing crude oil and natural gas prices.

We satisfy our styrene requirements in the United States pursuant to several purchase agreements with maturities up to the end of 2011, subject to renewal conditions. Our contracts that satisfied our styrene requirements in Europe expired on February 28, 2010 and we have executed one supply agreement with a vendor that will cover a portion of our requirements and are finalizing a second supply agreement with another vendor that we anticipate will satisfy our remaining needs for styrene through February 2013. In Japan and Brazil, styrene is sourced from local third-party suppliers. As contracts expire, we cannot give assurances that we will obtain new long-term supply agreements or that the terms of any such agreements will be on terms favorable to us, and consequently our future acquisition costs for styrene may therefore increase.

15

Table of Contents

For our agreements covering our manufacturing facility in the United States, the price we pay for styrene varies with the published prices of styrene and/or the raw materials used to produce styrene. The price we pay for styrene under our agreements covering France and Germany reflects market conditions and varies with factors including the published prices for styrene.

Butadiene. Butadiene is available on the global petrochemical market with approximately 7 producers in the Americas, 20 producers in Western Europe and 37 producers located in Asia. Prices for butadiene reflect worldwide supply and demand and prevailing crude oil and ethylene prices. We believe our contractual and other arrangements with our suppliers will generally provide adequate supplies of butadiene at competitive prices to support our current sales levels. Growth in the production of our products that require butadiene could be limited by our ability to source additional butadiene at competitive prices.

We currently source butadiene in the United States pursuant to contractual arrangements with maturities up to the end of 2012, subject to renewal conditions. Prices for U.S. butadiene purchases vary with the published prices for butadiene on world markets. Due to political unrest in Libya and U.S. sanctions recently imposed upon the Libyan government and certain members of the Qadhafi family, crude C4 exports to the United States from Libya could be interrupted, which could affect our ability to obtain butadiene in the United States in the quantities or at the prices we require. We have supplemented our requirements by purchasing spot supply as needed. No assurances can be given that any other agreement(s) will be entered into or as to the volumes or terms of any such agreement(s).

We currently source our butadiene in Europe pursuant to contracts and arrangements with LyondellBasell. The contract covering Germany will expire on December 31, 2040, and will be renewed automatically at the conclusion of the current term unless terminated with prior written notice by either party. The contract covering France expired effective December 31, 2008. We are presently acquiring butadiene in France from LyondellBasell under interim arrangements, pending resolution of an agreed arbitration between the parties to determine, among other matters, the effect of a term sheet previously reached between the parties that had been governing Butadiene purchases by us from LyondellBasell at Berre from January 2009 until September 2010. In this regard, we can provide no assurance as to the nature of any final arrangement whereby we will continue to purchase butadiene from LyondellBasell at Berre, including, without limitation, the volumes, prices or terms of sale that would be applicable to any such final arrangement. The price we pay for butadiene under our arrangements or agreements covering France and Germany vary based upon the published price for butadiene, the amount of butadiene purchased during the preceding calendar year and/or the cost of butadiene manufactured.

In Brazil, butadiene is obtained from a local third-party source. In Kashima, Japan, a majority of our butadiene needs are sourced from JSR Corporation (“JSR”) on a commercial supply basis. As contracts expire, we cannot give assurances that we will obtain new long-term supply agreements, or that the terms of any such agreements will be on terms favorable to us, and as a consequence, our future acquisition costs for butadiene may therefore increase.

Isoprene. Isoprene is primarily produced and consumed captively by manufacturers for the production of IR, which is primarily used in the manufacture of rubber tires. As a result, there is limited non-captive isoprene available in the market place. Prices for isoprene are determined by the supply and prices of natural and synthetic rubber, crude oil and natural gas prices, and existing supply and demand in the market.

We source our global isoprene requirements through several contractual arrangements. We also purchase additional supplies of isoprene from various suppliers at prevailing market prices. In Kashima, Japan, the majority of our isoprene needs are sourced from JSR on a commercial supply basis and from alternative suppliers as needed. As contracts expire, we may not be able to obtain new long-term supply agreements and the terms of any such agreement may not be on terms favorable to us.

We have historically had adequate supplies of isoprene. However, we have periodically experienced periods of limited supply due to operational problems at key producers, or as was the case during 2008, due to limited availability of crude raw materials for the isoprene extraction units. During these periods, we are normally able to

16

Table of Contents

meet most of our needs by acquiring relatively expensive isoprene from other suppliers. After an initial improvement in supply availability in 2008, isoprene availability was reduced for most of 2008. In response, we were forced to allocate SIS supplies. Similarly, supply constraints in 2009 limited isoprene purchases under some of our existing contracts. We satisfied our requirements by supplementing purchases from a variety of other suppliers. Going forward, we believe our contractual arrangements with several suppliers as well as spot arrangements and longstanding relationships with other third-party suppliers of isoprene will generally provide adequate future supplies of isoprene at competitive prices to support our current sales levels. Growth in the production of our products that require isoprene could be limited by our ability to source additional isoprene at competitive prices, and we can provide no assurances in this regard.

Competition

We compete with other SBC product and non-SBC product producers primarily on the basis of price, breadth of product availability, product quality and speed of service from order to delivery. We believe our customers also base their supply decisions on the supplier’s ability to design and produce custom products and the availability of technical support.

SBC Industry. Our most significant competitors in the SBC industry are: Asahi Chemical, Chi Mei, Dexco Polymers, Dynasol Elastomers, Kuraray, Korea Kumho P.C., Lee Chang Yung, LG Chemical, Polimeri Europa, Sinopec, Taiwan Synthetic Rubber Corporation and Zeon Corporation. Generally, however, individual competitors do not compete in all of our end use markets. Rather, there are different competitors in each of our end use markets, which is indicative of the depth and breadth of our product offerings.

Product Substitution. We also compete against a broad range of alternative, non-SBC products within each end use market.

In the Advanced Materials end use market, our products compete against a wide variety of chemical and non-chemical alternatives, including thermoplastic vulcanizates, ethylene propylene diene monomer rubber, known as EPDM, thermoplastic polyolefin elastomers and thermoplastic polyurethanes, known as TPUs. The choice between these materials is influenced by performance characteristics, ease of use, desired aesthetics and total end-product cost. In addition, competing materials include spandex, natural rubber, polyvinyl chloride polymers and compounds, polyolefins, polyethylene terephthalate, known as PET, nylon and polycarbonate, based on performance, ease of use, desired aesthetics and total end-product cost.

In the Adhesives, Sealants and Coatings end use market, the primary product alternatives include acrylic polymers, silicones, solvent-based natural rubber systems and metallocene polyolefins.

In the Paving and Roofing end use market, the primary product substitute for roofing is atactic polypropylene, whereas for road surfaces it is styrene butadiene rubber, or SBR. Customers also have a choice to use unmodified asphalts.

Operating and Other Agreements

Operating Agreements. Shell Nederland Refinery operated our manufacturing facility located in Pernis, the Netherlands until December 31, 2009 when we ceased production at Pernis and completed the exit of the location and terminated the relevant operating agreements effective March 31, 2010.

LyondellBasell operates our manufacturing facility located in Berre, France. This facility is situated on a major LyondellBasell refinery and petrochemical site at which other third party tenants also own facilities. LyondellBasell charges us fees based on certain costs incurred in connection with operating and maintaining this facility, including the direct and indirect costs of employees and subcontractors, reasonable insurance costs, certain taxes imposed on LyondellBasell (other than income taxes) and depreciation and capital charges on certain assets. Pursuant to the agreement, LyondellBasell employs and provides all staff, other than certain plant

17

Table of Contents

managers, assistant plant managers and technical personnel whom we may appoint. The agreement has an initial term of 20 years, beginning in February 2001, and thereafter will automatically renew indefinitely for consecutive five-year periods. Either party may terminate the agreement (totally or partially) under various circumstances, including if such party ceases its operations at the facility and provides 18 months prior written notice; or if any of the services, utilities, materials and facilities agreements have been terminated, and the terminating party provides notice as required by such agreement.

Pursuant to an agreement dated March 31, 2000, LyondellBasell operates and provides certain services, materials and utilities required to operate our manufacturing facility in Wesseling, Germany. We pay LyondellBasell a monthly fee, as well as costs incurred by LyondellBasell in providing the various services, even if the facility fails to produce any output (whether or not due to events within LyondellBasell’s control), and even if we reject some or all output. This agreement has an initial term of 40 years and will automatically renew subject to five years prior written notice of non-renewal. This agreement will terminate at any earlier date as of which the facility can no longer operate in a safe and efficient manner.

Site Services, Utilities, Materials and Facilities Agreements. LyondellBasell, through local operating affiliates, provides various site services, utilities, materials and facilities for the Berre, France, and Wesseling, Germany, manufacturing sites. Generally, these services, utilities, materials and facilities are provided by LyondellBasell on either a long-term basis, short-term basis or a sole-supplier basis. Items provided on a sole-supplier basis may not be terminated except upon termination of the applicable agreement in its entirety. Items provided on a long-term or short-term basis may be terminated individually under certain circumstances.

Information Systems

In 2009 and 2010, we upgraded our ERP software systems to support each of our facilities worldwide. In addition to providing increased reliability and functionality, we expect annual cost savings of approximately $5.0 million will be achieved as a result of the new ERP system. The ERP system is supported by internal resources. We also have in place a laboratory quality assurance system, including bar code based material management systems and manufacturing systems. An annual disaster recovery exercise is performed on critical systems utilizing third-party data centers.

Patents, Trademarks, Copyrights and Other Intellectual Property Rights

We rely on a variety of intellectual property rights to conduct our business, including patents, trademarks and trade secrets. As of December 31, 2010, approximately one-third of our patent portfolio (349 of 1,053) consisted of patent applications (the majority of which were filed after 2003). In light of the fact that patents are generally in effect for a period of 20 years as of the filing date, this means that a significant portion of the portfolio would remain in effect for a long period (assuming most of these applications will be granted). The granted patents and the applications cover both the United States and foreign countries. We do not expect that the expiration of any single patent or specific group of patents would have a material impact on our business. Our material trademarks will remain in effect unless we decide to abandon any of them, subject to possible third-party claims challenging our rights. Similarly, our trade secrets will preserve their status as such for as long as they are the subject of reasonable efforts, on our part, to maintain their secrecy. Since January 2003, we have filed 112 new patent applications with filings in the United States and many foreign countries. A significant number of patents in our patent portfolio were acquired from Shell Chemicals. Shell Chemicals retained for itself fully-transferable and exclusive licenses for their use outside of the elastomers field, as well as fully-transferable, non-exclusive licenses within the field of elastomers for certain limited uses in non-competing activities. Shell Chemicals is permitted to sublicense these rights. Shell Chemicals also retains the right to enforce these patents outside the elastomers field and recover any damages resulting from these actions. Shell Chemicals may engage in or be the owner of a business that manufactures and/or sells elastomers in the elastomers field, so long as they do not use patent rights or technical knowledge exclusively licensed to us.

18

Table of Contents

As a general matter, our trade names are protected by trademark laws. Our SBC products are marketed under the trademark “Kraton”, “Elexar”, and “Giving Innovators Their Edge”, which are registered, and “Nexar” and “Cariflex”, for which registration is pending in the United States and in many other countries.

In our almost 50 years in the SBC business, we have accumulated a substantial amount of technical and business expertise. Our expertise includes: product development, design and formulation, information relating to the applications in which our products are used, process and manufacturing technology, including the process and design information used in the operation, maintenance and debottlenecking of our manufacturing facilities, and the technical service that we provide to our customers. We hold extensive discussions with customers and potential customers to define their market needs and product application opportunities. Where necessary, we have implemented trade secret protection for our technical knowledge through non-analysis, secrecy and related agreements.

Employees

We had 884 full-time employees at December 31, 2010. In addition, 175 LyondellBasell manufacturing employees operate our manufacturing facilities and provide maintenance services in Europe under various operating and services arrangements. See “—Operating and Other Agreements.” None of our employees in the United States are subject to collective bargaining agreements. In Europe, Brazil and Japan, a significant number of our employees are in arrangements similar to collective bargaining arrangements. We believe our relationships with our employees continue to be good.

Environmental Regulation

Our operations in the United States and abroad are subject to a wide range of environmental laws and regulations at the national, state and local levels. These laws and regulations govern, among other things, air emissions, wastewater discharges, solid and hazardous waste management, site remediation programs and chemical use and management.

Pursuant to these laws and regulations, our facilities are required to obtain and comply with a wide variety of environmental permits for different aspects of their operations. Generally, many of these environmental laws and regulations are becoming increasingly stringent and the cost of compliance with these various requirements can be expected to increase over time.

On February 21, 2011, U.S. Environmental Protection Agency Regulations were promulgated and are awaiting publication in the Federal Register. If ultimately implemented as promulgated, these new regulations would require us to incur capital investments and asset retirement obligations (“ARO”) related to upgrading or replacing our coal-burning boilers at our Belpre, Ohio, facility. Preliminary capital expenditure and ARO requirements are estimated to be $20 million to $25 million and $5 million to $7 million, respectively, of which approximately $3 million may be spent in 2011 and the balance to be incurred between 2012 and 2014.

Environmental laws and regulations in various jurisdictions also establish programs and, in some instances, obligations to clean up contamination from current or historic operations. Under some circumstances, the current owner or operator of a site can be held responsible for remediation of past contamination regardless of fault and regardless of whether the activity was legal at the time that it occurred. Evaluating and estimating the potential liability related to site remediation projects is a difficult undertaking, and several of our facilities have been affected by contamination from historic operations.

Our Belpre, Ohio, facility is the subject of a site investigation and remediation program administered by the Environmental Protection Agency pursuant to the Resource Conservation and Recovery Act. In March 1997, Shell Chemicals entered into a consent order to investigate and remediate areas of contamination on and adjacent to the site. In March 2003, we joined Shell Chemicals in signing a new consent order that required additional remediation and assessment of various areas of contamination and continues to require groundwater-monitoring and reporting. Shell Chemicals continues to take the lead in this program, has posted financial assurance of

19

Table of Contents

$5 million for the work required under the consent order and has also indemnified us for the work required under this program, subject to the condition that we provide notice of any claims on or prior to February 28, 2021. In turn, we have agreed with Shell Chemicals that we will, for a fee, provide certain services related to the remediation program. We have agreed with Shell Chemicals that we will pay up to $100,000 per year for the groundwater monitoring associated with the 2003 consent order.

Our Brazilian facility has also been affected by prior Shell Chemicals operations. A Shell Chemicals pesticide manufacturing operation previously was located on a tract of land adjacent to our Brazilian facility. In addition, areas of our facility were used by Shell Chemicals as part of its crop protection business. Shell Chemicals has retained responsibility for remediating a former manufacturing facility located on our site and has also indemnified us for a number of the identified waste management areas used in prior operations. The indemnity from Shell Chemicals expired in 2004 for the following categories of claims to the extent notice was not previously provided by us: (1) remediation activity required by applicable environmental laws or third-party claims, (2) third-party claims for exposure to hazardous substances and (3) violations of environmental law. The indemnity for remediation relating directly to the plant for the previous pesticide manufacturing operations and for disposal activity related to that plant and for third-party claims regarding hazardous substance disposal requires us to give notice of any claims on or prior to February 28, 2021. Shell Chemicals has installed a hydraulic barrier to prevent migration of ground water contamination and has completed other cleanup actions on the site.

Shell Chemicals agreed to indemnify us for specific categories of environmental claims brought with respect to matters occurring before our separation from Shell Chemicals in February 2001. Coverage under the indemnity also varies depending upon the nature of the environmental claim, the location giving rise to the claim and the manner in which the claim is triggered. The indemnity from Shell Chemicals expired in 2004 for the following categories of claims to the extent notice was not previously provided by us: (1) site clean-up other than those matters specifically agreed with Shell Chemicals, (2) third-party claims for exposure to hazardous substances and (3) violations of environmental law. The indemnity for site clean-up matters specifically agreed with Shell Chemicals and for third-party claims regarding hazardous substance disposal requires us to give notice on or prior to February 28, 2021. Hence, if claims arise in the future related to past operations, we cannot give assurances that those claims will be covered by the Shell Chemicals’ indemnity and also cannot be certain that any amounts recoverable will be sufficient to satisfy claims against us.