Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FORD MOTOR CREDIT CO LLC | fmcc-20201002.htm |

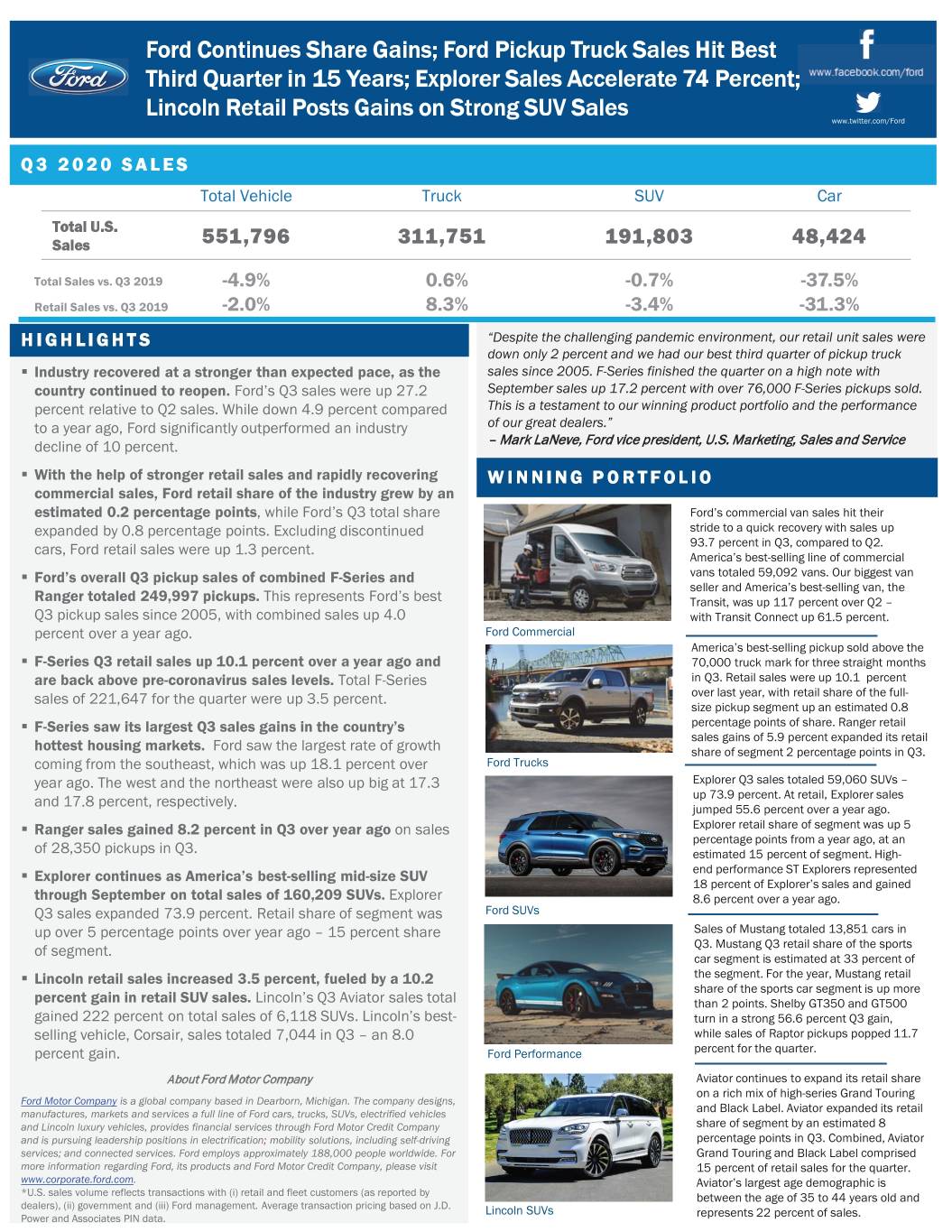

Ford Continues Share Gains; Ford Pickup Truck Sales Hit Best Third Quarter in 15 Years; Explorer Sales Accelerate 74 Percent; Lincoln Retail Posts Gains on Strong SUV Sales www.twitter.com/Ford Q 3 2 0 2 0 S A L E S Total Vehicle Truck SUV Car Total U.S. Sales 551,796 311,751 191,803 48,424 Total Sales vs. Q3 2019 -4.9% 0.6% -0.7% -37.5% Retail Sales vs. Q3 2019 -2.0% 8.3% -3.4% -31.3% H I G H L I G H T S “Despite the challenging pandemic environment, our retail unit sales were down only 2 percent and we had our best third quarter of pickup truck ƒ Industry recovered at a stronger than expected pace, as the sales since 2005. F-Series finished the quarter on a high note with country continued to reopen. Ford’s Q3 sales were up 27.2 September sales up 17.2 percent with over 76,000 F-Series pickups sold. percent relative to Q2 sales. While down 4.9 percent compared This is a testament to our winning product portfolio and the performance to a year ago, Ford significantly outperformed an industry of our great dealers.” decline of 10 percent. – Mark LaNeve, Ford vice president, U.S. Marketing, Sales and Service ƒ With the help of stronger retail sales and rapidly recovering W I N N I N G P O R T F O L I O commercial sales, Ford retail share of the industry grew by an estimated 0.2 percentage points , while Ford’s Q3 total share Ford’s commercial van sales hit their expanded by 0.8 percentage points. Excluding discontinued stride to a quick recovery with sales up cars, Ford retail sales were up 1.3 percent. 93.7 percent in Q3, compared to Q2. America’s best-selling line of commercial ƒ Ford’s overall Q3 pickup sales of combined F-Series and vans totaled 59,092 vans. Our biggest van seller and America’s best-selling van, the Ranger totaled 249,997 pickups. This represents Ford’s best Transit, was up 117 percent over Q2 – Q3 pickup sales since 2005, with combined sales up 4.0 with Transit Connect up 61.5 percent. percent over a year ago. Ford Commercial America’s best-selling pickup sold above the ƒ F-Series Q3 retail sales up 10.1 percent over a year ago and 70,000 truck mark for three straight months are back above pre-coronavirus sales levels. Total F-Series in Q3. Retail sales were up 10.1 percent sales of 221,647 for the quarter were up 3.5 percent. over last year, with retail share of the full- size pickup segment up an estimated 0.8 ƒ F-Series saw its largest Q3 sales gains in the country’s percentage points of share. Ranger retail sales gains of 5.9 percent expanded its retail hottest housing markets. Ford saw the largest rate of growth share of segment 2 percentage points in Q3. coming from the southeast, which was up 18.1 percent over Ford Trucks year ago. The west and the northeast were also up big at 17.3 Explorer Q3 sales totaled 59,060 SUVs – and 17.8 percent, respectively. up 73.9 percent. At retail, Explorer sales jumped 55.6 percent over a year ago. ƒ Ranger sales gained 8.2 percent in Q3 over year ago on sales Explorer retail share of segment was up 5 percentage points from a year ago, at an of 28,350 pickups in Q3. estimated 15 percent of segment. High- Explorer continues as America’s best-selling mid-size SUV end performance ST Explorers represented ƒ 18 percent of Explorer’s sales and gained through September on total sales of 160,209 SUVs. Explorer 8.6 percent over a year ago. Q3 sales expanded 73.9 percent. Retail share of segment was Ford SUVs up over 5 percentage points over year ago – 15 percent share Sales of Mustang totaled 13,851 cars in of segment. Q3. Mustang Q3 retail share of the sports car segment is estimated at 33 percent of ƒ Lincoln retail sales increased 3.5 percent, fueled by a 10.2 the segment. For the year, Mustang retail share of the sports car segment is up more percent gain in retail SUV sales. Lincoln’s Q3 Aviator sales total than 2 points. Shelby GT350 and GT500 gained 222 percent on total sales of 6,118 SUVs. Lincoln’s best- turn in a strong 56.6 percent Q3 gain, selling vehicle, Corsair, sales totaled 7,044 in Q3 – an 8.0 while sales of Raptor pickups popped 11.7 percent gain. Ford Performance percent for the quarter. About Ford Motor Company Aviator continues to expand its retail share on a rich mix of high-series Grand Touring Ford Motor Company is a global company based in Dearborn, Michigan. The company designs, manufactures, markets and services a full line of Ford cars, trucks, SUVs, electrified vehicles and Black Label. Aviator expanded its retail and Lincoln luxury vehicles, provides financial services through Ford Motor Credit Company share of segment by an estimated 8 and is pursuing leadership positions in electrification ; mobility solutions, including self-driving percentage points in Q3. Combined, Aviator services; and connected services. Ford employs approximately 188,000 people worldwide. For Grand Touring and Black Label comprised more information regarding Ford, its products and Ford Motor Credit Company, please visit 15 percent of retail sales for the quarter. www.corporate.ford.com . Aviator’s largest age demographic is *U.S. sales volume reflects transactions with (i) retail and fleet customers (as reported by between the age of 35 to 44 years old and dealers), (ii) government and (iii) Ford management. Average transaction pricing based on J.D. Lincoln SUVs Power and Associates PIN data. represents 22 percent of sales.