UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| |

|

|

| þ |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

OR

| |

|

|

| o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________________ to ____________________

Commission file number 1-6368

Ford Motor Credit Company LLC

(Exact name of registrant as specified in its charter)

| |

|

|

Delaware

(State of organization)

|

|

38-1612444

(I.R.S. employer identification no.) |

| |

|

|

One American Road, Dearborn, Michigan

(Address of principal executive offices)

|

|

48126

(Zip code) |

Registrant’s telephone number, including area code (313) 322-3000

Securities registered pursuant to Section 12(b) of the Act:

| |

|

|

| |

|

Name of each Exchange |

| Title of each class |

|

on which registered |

| 7 3/8% Notes due October 15, 2031

|

|

New York Stock Exchange |

| 7.60% Notes due March 1, 2032

|

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule

405 of the Securities Act. þ Yes o No

Indicate by check mark if the registrant is not required to file reports pursuant to Section

13 or Section 15(d) of the Act. o Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed

by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that the registrant was required to file such reports), and (2) has been

subject to such filing requirements for the past 90 days. þ Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its

Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files). o Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation

S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in

definitive proxy or information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated

filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act. (Check one):

| |

|

|

|

|

|

|

| Large accelerated filer o

|

|

Accelerated filer o

|

|

Non-accelerated filer þ

(Do not check if a smaller reporting company)

|

|

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of

the Act). o Yes þ No

All of the limited liability company interests in the registrant (“Shares”) are held by an

affiliate of the registrant. None of the Shares are publicly traded.

REDUCED DISCLOSURE FORMAT

The registrant meets the conditions set forth in General Instruction I(1)(a) and (b) of Form

10-K and is therefore filing this Form with the reduced disclosure format.

EXHIBIT

INDEX APPEARS AT PAGE 56

TABLE OF CONTENTS

PART I

ITEM 1. BUSINESS

Overview

Ford Motor Credit Company LLC (referred to herein as “Ford Credit”, the “Company”, “we”, “our”

or “us”) was incorporated in Delaware in 1959 and converted to a limited liability company in 2007.

We are an indirect, wholly owned subsidiary of Ford Motor Company (“Ford”). Our principal

executive offices are located at One American Road, Dearborn, Michigan 48126, and our telephone

number is (313) 322-3000.

Our annual reports on Form 10-K and quarterly reports on Form 10-Q filed with the Securities

and Exchange Commission (“SEC”) pursuant to Section 13(a) or 15(d) of the Securities Exchange Act

are available free of charge through our website located at

www.fordcredit.com/investorcenter/.

These reports and our current reports on Form 8-K can be found on the SEC’s website located at

www.sec.gov.

Products and Services. We offer a wide variety of automotive financing products to and

through automotive dealers throughout the world. Our primary financing products fall into three

categories:

| |

• |

|

Retail financing — purchasing retail installment sale and lease contracts from

dealers, and offering financing to commercial customers, primarily vehicle leasing

companies and fleet purchasers, to lease or purchase vehicle fleets; |

| |

| |

• |

|

Wholesale financing — making loans to dealers to finance the purchase of

vehicle inventory, also known as floorplan financing; and |

| |

| |

• |

|

Other financing — making loans to dealers for working capital, improvements to

dealership facilities, and to purchase or finance dealership real estate. |

We also service the finance receivables and leases we originate and purchase, make loans to

Ford affiliates, purchase certain receivables of Ford and its subsidiaries and provide insurance

services related to our financing programs.

We earn our revenue primarily from:

| |

• |

|

Payments made under retail installment sale and lease contracts that we

purchase; |

| |

| |

• |

|

Interest supplements and other support payments from Ford and affiliated

companies on special-rate financing programs; and |

| |

| |

• |

|

Payments made under wholesale and other dealer loan financing programs. |

Geographic Scope of Operations and Segment Information. We conduct our financing operations

directly and indirectly through our subsidiaries and affiliates. We offer substantially similar

products and services throughout many different regions, subject to local legal restrictions, and

market conditions. We divide our business segments based on geographic regions: Ford Credit North

America (“North America Segment”) and Ford Financial International (“International Segment”). The

North America Segment includes our operations in the United States and Canada. The International

Segment includes our operations in all other countries in which we do business directly and

indirectly. For additional financial information regarding our operations by business segments and

operations by geographic regions, see Note 19 of our Notes to the Financial Statements.

North America Segment

We do business throughout the United States and Canada. Our United States operations

accounted for 64% and 65% of our total managed receivables at year-end 2009 and 2008, respectively,

and our Canadian operations accounted for about 11% and 9% of our total managed receivables at

year-end 2009 and 2008, respectively. Managed receivables include on-balance sheet receivables,

excluding unearned interest supplements related to finance receivables, and securitized off-balance

sheet receivables that we continue to service. For additional information on how we review our

business performance, including on a managed basis, refer to the “Results of Operations” section of

Item 7 of Part II of our 10-K Report.

In the United States and Canada, under the Ford Credit brand name, we provide financing services to

and through dealers of Ford, Lincoln and Mercury brand vehicles and non-Ford vehicles also sold by

these dealers and

their affiliates. We provide similar financial services under the Volvo brand name to and through

Volvo dealers.

1

Item 1. Business (Continued)

International Segment

Our International Segment includes operations in three main regions: Europe, Asia-Pacific, and

Latin America. Our Europe region is our largest international operation, accounting for about 22%

of our total managed receivables at year-end 2009 and 2008. Within the International Segment our

Europe region accounted for 88% and 85% of our managed receivables at year-end 2009 and 2008,

respectively. Most of our European operations are managed through a United Kingdom-based

subsidiary, FCE Bank plc (“FCE”), which operates in the United Kingdom and has active branches in

11 other European countries. In addition, FCE has operating subsidiaries in Hungary, Poland, and

the Czech Republic that provide a variety of wholesale, leasing and retail vehicle financing. FCE

also has subsidiaries in Sweden and the United Kingdom. In our largest European markets, Germany

and the United Kingdom, FCE offers most of our products and services

under the Ford Credit/Bank brand.

In the U.K., FCE also offers products and services under the Volvo Car Finance brand while in

Germany this is provided through a different Ford subsidiary. For additional information on

Jaguar, Land Rover, Mazda, and Volvo, refer to the “Overview — Our Response” section of Item 7 of

Part II of our 10-K Report. FCE generates most of our European revenue and contract volume from

Ford Credit/Bank brand products and services. FCE, through our Worldwide Trade Financing division,

provides financing to distributors/importers in countries where typically there is no established

local Ford presence. The Worldwide Trade Financing division currently provides financing in over

70 countries. In addition, other private label operations and alternative business arrangements

exist in some European markets. In the Asia-Pacific region, we operate in Australia and China. In

the Latin America region, we operate in Mexico, Brazil, and Argentina. We have joint ventures with

local financial institutions and other third parties in various locations around the world.

Dependence on Ford

The predominant share of our business consists of financing Ford vehicles and supporting Ford

dealers. Any extended reduction or suspension of Ford’s production or sale of vehicles due to a

decline in consumer demand, work stoppage, governmental action, negative publicity or other event,

or significant changes to marketing programs sponsored by Ford, would have an adverse effect on our

business. Additional information about Ford’s business, operations, production, sales and risks

can be found in Ford’s Annual Report on Form 10-K for the year ended December 31, 2009 (“Ford’s

2009 10-K Report”), filed separately with the SEC and incorporated by reference as an exhibit to

our 2009 10-K Report (without financial statements and exhibits).

Ford has sponsored special-rate financing programs available only through us. Similar

programs may be offered in the future. Under these programs, Ford makes interest supplements or

other support payments to us. These programs increase our financing volume and share of financing

sales of Ford vehicles. Our funding costs have increased compared with our competition; this has

increased our reliance on Ford-sponsored special-rate financing programs offered exclusively

through us. For additional information regarding interest supplements and other support costs

earned from affiliated companies, see Note 18 of our Notes to the Financial Statements.

Competition

The automotive financing business is highly competitive due in part to web-based credit

aggregation systems that permit dealers to send, through standardized systems, retail credit

applications to multiple finance sources to evaluate financing options offered by these finance

sources. Our principal competitors for retail and wholesale financing are:

| |

|

|

| Retail |

|

Wholesale |

• Banks

|

|

• Banks |

|

|

|

• Independent finance companies

|

|

• Other automobile manufacturers’ affiliated finance

companies |

|

|

|

• Credit unions and savings and loan associations

|

|

• Credit unions |

|

|

|

• Leasing companies |

|

|

|

|

|

• Other automobile manufacturers’ affiliated finance

companies |

|

|

We compete mainly on the basis of service and financing rate programs, including those

sponsored by Ford. A key foundation of our service is providing broad and consistent purchasing

policies for retail installment sale and lease contracts and consistent support for dealer

financing requirements across economic cycles. Through these

policies we have built strong relationships with Ford’s dealer network that enhance our

competitiveness. Our ability to provide competitive financing rates depends on effectively and

efficiently originating, purchasing and servicing our receivables, and accessing the capital

markets. We routinely monitor the capital markets and develop funding alternatives to optimize our

competitive position. Ford sponsored special-rate financing programs available only through us

gives us a competitive advantage in providing financing to Ford dealers and their customers.

2

Item 1. Business (Continued)

Seasonal Variations

As a finance company, we own and manage a large portfolio of finance receivables and operating

leases that are generated throughout the year and are collected over a number of years, primarily

in fixed monthly payments. As a result, our overall financing revenues do not exhibit seasonal

variations.

Retail Financing

Overview and Purchasing Process

We provide financing services to retail customers through automotive dealers that have

established relationships with us. Our primary business consists of purchasing retail installment

sale and lease contracts for new and used vehicles mainly from Ford, Lincoln and Mercury dealers.

We report in our financial statements the receivables from customers under installment sale

contracts and certain leases with fleet customers as finance receivables. We report in our

financial statements most of our retail leases as net investment in operating leases with the

capitalized cost of the vehicles recorded as depreciable assets.

In general, we purchase from dealers retail installment sale contracts and lease contracts

that meet our credit standards. These contracts primarily relate to the purchase or lease of new

vehicles, but some are for used vehicles. Dealers typically submit customer applications

electronically. Some of the applications are automatically evaluated and either approved or

rejected based on our origination scorecard and credit policy criteria. In other cases, our credit

analysts evaluate applications using our written guidelines.

Retail Installment Sale Contracts

The amount we pay for a retail installment sale contract is based on a negotiated vehicle

purchase price agreed to between the dealer and the retail customer, plus any additional products,

such as insurance and extended service plans, that are included in the contract, less any vehicle

trade-in allowance or down payment from the customer applied to the purchase price. The net

purchase price owed by the customer typically is paid over a specified number of months with

interest at a fixed rate negotiated between the dealer and the retail customer. The dealer may

retain a limited portion of the finance charge.

We offer a variety of retail installment sale financing products. In the United States,

retail installment sale contract terms for new Ford, Lincoln and Mercury brand vehicles range

primarily from 24 to 72 months. The average original term of our retail installment sale contracts

was 58 months and 60 months in the United States for contracts purchased in 2009 and 2008,

respectively. A small portion of our retail installment sale contracts have non-uniform payment

periods and payment amounts to accommodate special cash flow situations. We also offer a retail

balloon product in Europe under which the retail customer may finance their vehicle with an

installment sale contract with a series of monthly payments followed by paying the amount remaining

in a single balloon payment. The customer can satisfy the balloon payment obligation by payment in

full of the amount owed, by refinancing the amount owed, or by returning the vehicle to us and

paying additional charges for mileage and excess wear and use, if any. We sell vehicles returned

to us to Ford and non-Ford dealers through auctions. Customers who choose our retail balloon

product may also qualify for special-rate financing offers from Ford.

We hold a security interest in the vehicles purchased through retail installment sale

contracts. This security interest provides us certain rights and protections. As a result, if our

collection efforts fail to bring a delinquent customer’s payments current, we generally can

repossess the customer’s vehicle, after satisfying local legal requirements, and sell it at

auction. The customer typically remains liable for any deficiency between net auction proceeds and

the defaulted contract obligations, including any repossession-related expenses. We require retail

customers to carry fire, theft, and collision insurance on financed vehicles.

3

Item 1. Business (Continued)

Retail Lease Plans

We offer leasing plans to retail customers through our dealers. Our highest volume

retail-leasing plan is called Red Carpet Lease, which is offered in North America through dealers

of Ford, Lincoln and Mercury brands. We offer similar lease plans through Volvo dealers. Under

these plans, dealers originate the leases and offer them to us for purchase. Upon our purchase of

a lease, we take ownership of the lease and title to the leased vehicle from the dealer. After we

purchase a lease from a dealer, the dealer generally has no further obligation to us in connection

with the lease. The customer is responsible for properly maintaining the vehicle and is obligated

to pay for excess wear and use as well as excess mileage, if any. At the end of the lease, the

customer has the option to purchase the vehicle for the price specified in the lease contract, or

return the vehicle to the dealer. If the customer returns the vehicle to the dealer, the dealer

may buy the vehicle from us or return it to us. We sell vehicles returned to us to Ford and

non-Ford dealers through auctions.

The amount we pay to a dealer for a retail lease, also called the acquisition cost, is based

on the negotiated vehicle price agreed to by the dealer and the retail customer plus any additional

products, such as insurance and extended service plans, that are included in the contract, less any

vehicle trade-in allowance or down payment from the customer. The customer makes monthly lease

payments based on the acquisition cost less the contractual residual value of the vehicle, plus

lease charges. Some of our lease programs, such as our Red Carpet Lease Advance Payment Plan,

provide certain pricing advantages to customers who make all or some monthly payments at lease

inception or purchase refundable higher mileage allowances. We require lease customers to carry

fire, theft, liability, and collision insurance on leased vehicles. In the case of a contract

default and repossession, the customer typically remains liable for any deficiency between net

auction proceeds and the defaulted contract obligations, including any repossession-related

expenses.

In the United States, retail operating lease terms for new Ford, Lincoln and Mercury brand

vehicles range primarily from 24 to 48 months. In 2009 and 2008, the average original lease term

for contracts purchased was 37 months and 35 months, respectively.

Other Vehicle Financing

We offer vehicle-financing programs to commercial customers including leasing companies, daily

rental companies, government entities and fleet customers. These financings include both lease

plans and installment purchase plans and are primarily for terms of 24 to 60 months. The financing

obligations are collateralized by perfected security interests on financed vehicles in almost all

instances and, where appropriate, an assignment of rentals under any related leases. At the end of

the finance term, a lease customer may be required to pay any shortfall between the fair market

value and the specified end of term value of the vehicle. If the fair market value of the vehicle

at the end of the finance term exceeds the specified end of term value, the lease customer may be

paid the excess amount. These financings are included in retail finance receivables and net

investment in operating leases in our financial statements. For certain commercial financing

programs, we have alternative business arrangements whereby we provide marketing and sales support

and funding is provided by a third party.

4

Item 1. Business (Continued)

Wholesale Financing

We offer a wholesale financing program for qualifying dealers to finance new and used vehicles

held in inventory. We generally finance the vehicle’s wholesale invoice price for new vehicles and

up to 100% of the dealer’s purchase price for used vehicles. Dealers generally pay a floating

interest rate on wholesale loans. In the United States, the average wholesale receivable,

excluding the time the vehicle was in transit from the assembly plant to the dealership, was

outstanding for 72 days in 2009 compared with 73 days in 2008. Our wholesale financing program

includes financing of large multi-brand dealer groups that are some of our largest wholesale

customers based on the amount financed.

When a dealer uses our wholesale financing program to purchase vehicles we obtain a secured

interest in the vehicles and, in many instances, other assets of the dealer. Our subsidiary, The

American Road Insurance Company (“TARIC”), generally provides insurance for vehicle damage and

theft of vehicles held in dealer inventory that are financed by us.

Other Financing

We make loans to dealers for improvements to dealership facilities, working capital and the

purchase and financing of dealership real estate. These loans are included in other finance

receivables in our financial statements. These loans typically are secured by mortgages on

dealership real estate, secured interests in other dealership assets and sometimes personal

guarantees from the individual owners of the dealership.

We also purchase certain receivables generated by divisions and affiliates of Ford, primarily

in connection with the delivery of vehicle inventories from Ford, the sale of parts and accessories

by Ford to dealers and the purchase of other receivables generated by Ford. These receivables are

included in other finance receivables in our financial statements.

Marketing and Special Programs

We actively market our financing products and services to automotive dealers and customers.

Through personal sales contacts, targeted advertisements in trade publications, participation in

dealer-focused conventions and organizations, and support from manufacturers, we seek to

demonstrate to dealers the value of entering into a business relationship with us. Our marketing

strategy is based on our belief that we can better assist dealers in achieving their sales,

financial, and customer satisfaction goals by being a stable, committed finance source with

knowledgeable automotive and financial professionals offering personal attention and interaction.

We demonstrate our commitment to dealer relationships with a variety of materials, measurements,

and analyses showing the advantages of a full range of automotive financing products that allows

consistent and predictable single source financing. From time to time, we promote increased dealer

transactions through incentives, bonuses, contests, and selected program and rate adjustments.

We promote our retail financing products primarily through pre-approved credit offers to

prospective customers, point-of-sale information, and ongoing communications with existing

customers. Our communications to these customers promote the advantages of our financing products,

the availability of special plans and programs, and the benefits of affiliated products, such as

extended warranties, service plans, insurance coverage, gap protection, and excess wear and use

waivers. We also emphasize the quality of our customer service and the ease of making payments and

transacting business with us. For example, through our web site

located at www.fordcredit.com, a

customer can make inquiries, review an account balance, examine current incentives, schedule an

electronic payment, or qualify for a pre-approved credit offer.

We also market our non-consumer financial services described above in “Other Vehicle Financing”

with a specialized group of employees who make direct sales calls on dealers, and, often at the

request of such dealers, on potential high-volume commercial customers. This group also uses

various materials to explain our flexible programs and services specifically directed at the needs

of commercial and fleet vehicle customers.

5

Item 1. Business (Continued)

Servicing

General. After we purchase retail installment sale contracts and leases from dealers and

other customers, we manage the contracts during their contract terms. This management process is

called servicing. We service the finance receivables and leases we originate and purchase. Our

servicing duties include the following:

| |

• |

|

applying monthly payments from customers; |

| |

| |

• |

|

contacting delinquent customers for payment; |

| |

| |

• |

|

maintaining a security interest in the financed vehicle; |

| |

| |

• |

|

monitoring insurance coverage for lease vehicles in certain states; |

| |

| |

• |

|

providing billing statements to customers; |

| |

| |

• |

|

responding to customer inquiries; |

| |

| |

• |

|

releasing the secured interest on paid-off finance contracts; |

| |

| |

• |

|

arranging for the repossession of vehicles; and |

| |

| |

• |

|

selling repossessed and returned vehicles at auction. |

Customer Payment Operations. In the United States and Canada, customers are directed in their

monthly billing statements to mail payments to a bank for deposit in a lockbox account. Customers

may also make payments through electronic payment services, a direct debit program, or a telephonic

payment system.

Servicing Activities — Consumer Credit. We design our collection strategies and procedures

to keep accounts current and to collect on delinquent accounts. We employ a combination of

proprietary and non-proprietary tools to assess the probability and severity of default for all of

our receivables and leases and implement our collection efforts based on our determination of the

credit risk associated with each customer. As each customer develops a payment history, we use an

internally developed behavioral scoring model to assist in determining the best collection

strategies. Based on data from this scoring model, we group contracts by risk category for

collection. Our centralized collection operations are supported by auto-dialing technology and

proprietary collection and workflow operating systems. Our United States systems also employ a

web-based network of outside contractors who support the repossession process. Through our

auto-dialer program and our monitoring and call log systems, we target our efforts on contacting

customers about missed payments and developing satisfactory solutions to bring accounts current.

Supplier Operations. We engage vendors to perform many of our servicing processes. These

processes include depositing monthly payments from customers, monitoring the perfection of security

interests in financed vehicles, monitoring insurance coverage on lease vehicles in certain states,

imaging of contracts and electronic data file maintenance, generating retail and lease billing

statements, providing telephonic payment systems for retail customers, handling of some inbound

customer service calls, handling of some inbound and outbound collections calls, and recovering

deficiencies for selected accounts.

Payment Extensions. We may offer payment extensions to customers who have encountered

temporary financial difficulty that limits their ability to pay as contracted. Each month about

1-2% of our U.S. retail contracts outstanding are granted payment extensions. A payment extension

allows the customer to extend the term of the contract, usually by paying a fee that is calculated

in a manner specified by law. Following a payment extension, the customer’s account is no longer

delinquent. Before agreeing to a payment extension, the service representative reviews the

customer’s payment history, current financial situation, and assesses the customer’s desire and

capacity to make future payments. The service representative decides whether the proposed payment

extension complies with our policies and guidelines. Regional business center managers review, and

generally must approve, payment extensions outside these guidelines.

Repossessions and Auctions. We view repossession of a financed or leased vehicle as a final

step that we undertake only after all other collection efforts have failed. We usually sell

repossessed vehicles at auction and apply the proceeds to the amount owed on the customer’s

account. We continue to attempt collection of any deficient amounts until the account is paid in

full, we obtain mutually satisfactory payment arrangements with the debtor or we determine that the

account is uncollectible.

We manage the sale of repossessed vehicles and returned leased vehicles. Repossessed vehicles

are reported in other assets on our balance sheet at values that approximate expected net auction

proceeds. We inspect and

recondition the vehicle to maximize the net auction value of the vehicle. Repossessed

vehicles are sold at open auctions. Returned leased vehicles are sold at open auctions, in which

any licensed dealer can participate and at closed auctions, in which only Ford dealers may

participate.

6

Item 1. Business (Continued)

Wholesale and Commercial. In the United States and Canada, we require dealers to submit

monthly financial statements that we monitor for potential credit deterioration. We assign an

evaluation rating to each dealer, which among other things determines the frequency of physical

audits of vehicle inventory. We electronically audit vehicle inventory utilizing integrated

systems allowing us to access information from Ford reported sales. We monitor dealer inventory

financing payoffs daily to detect deviations from typical repayment patterns and take appropriate

actions. We provide services to fleet purchasers, leasing companies, daily rental companies, and

other commercial customers. We generally review our exposure under these credit arrangements at

least annually. In our international markets, this business is governed by the respective regional

offices, executed within the local markets, and similar risk management principles are applied.

Insurance

We conduct insurance operations primarily through TARIC in the United States and Canada and

through various other insurance subsidiaries outside the United States and Canada. TARIC offers a

variety of products and services, including:

| |

• |

|

Contractual liability insurance on extended service contracts and, in the state

of Florida, extended service plan contracts; |

| |

| |

• |

|

Physical damage insurance covering vehicles at dealers’ locations and vehicles

in-transit between final assembly plants and dealers’ locations; and |

| |

| |

• |

|

Physical damage/liability reinsurance covering Ford dealer daily rental

vehicles. |

We also offer various Ford branded insurance products throughout the world underwritten by

non-affiliated insurance companies from which we receive fee income but the underwriting risk

remains with the non-affiliated insurance companies. In addition, TARIC has provided to Ford and

its subsidiaries various types of surety bonds, including bonds generally required as part of any

appeals of litigation, financial guarantee bonds, and self-insurance workers’ compensation bonds.

Premiums from our insurance business generated approximately 1% of our total revenues in 2009 and

2008.

Employee Relations

Our full-time employees numbered approximately 8,200 and 10,200 at year-end 2009 and 2008,

respectively. Most of our employees are salaried, and most are not represented by a union. We

consider employee relations to be satisfactory.

Governmental Regulations

As a finance company, we are highly regulated by the governmental authorities in the locations

where we operate.

United States

Within the United States, our operations are subject to regulation, supervision and licensing

under various federal, state, and local laws and regulations.

Federal Regulation. We are subject to extensive federal regulation, including the

Truth-in-Lending Act, the Equal Credit Opportunity Act and the Fair Credit Reporting Act. These

laws require us to provide certain disclosures to prospective purchasers and lessees in consumer

retail and lease financing transactions and prohibit discriminatory credit practices. The

principal disclosures required under the Truth-in-Lending Act for retail finance transactions

include the terms of repayment, the amount financed, the total finance charge and the annual

percentage rate. For retail lease transactions, we are required to disclose the amount due at

lease inception, the terms for payment, and information about lease charges, insurance, excess

mileage, wear and use charges, and liability on early termination. The Equal Credit Opportunity

Act prohibits creditors from discriminating against credit applicants and customers on a variety of

factors, including race, color, sex, age, or marital status. Pursuant to the Equal Credit

Opportunity Act, creditors are required to make certain disclosures regarding consumer rights and

advise consumers whose credit applications are not approved of the reasons for being denied. In

addition, any of the credit scoring systems we use during the application process or other

processes must comply with the requirements for such systems under the Equal Credit Opportunity

Act. The Fair Credit Reporting

7

Item 1. Business (Continued)

Act requires us to provide certain information to consumers whose credit applications are not approved on the basis of a consumer credit report

obtained from a national credit bureau and sets forth requirements related to identity theft,

privacy, and enhanced accuracy in credit reporting content. We are also subject to the

Servicemember’s Civil Relief Act that prohibits us from charging interest in excess of 6% on

transactions with customers who subsequently enter into full-time service with the military and

request such interest rate modification, and limits our ability to collect future payments from

lease customers who terminate their lease early. In addition, we are subject to other federal

regulation, including the Gramm-Leach-Bliley Act, that requires us to maintain confidentiality and

safeguard certain consumer data in our possession and to communicate periodically with consumers on

privacy matters.

State Regulation — Licensing. In most states, a consumer credit regulatory agency regulates

and enforces laws relating to finance companies. Rules and regulations generally provide for

licensing of finance companies, limitations on the amount, duration and charges, including interest

rates that can be included in finance contracts, requirements as to the form and content of finance

contracts and other documentation, and restrictions on collection practices and creditors’ rights.

We must renew these licenses periodically. Moreover, several states have laws that limit interest

rates on consumer financing. In periods of high interest rates, these rate limitations could have

an adverse effect on our operations if we were unable to purchase retail installment sale contracts

with finance charges that reflect our increased costs. In certain states, we are subject to

periodic examination by state regulatory authorities.

State Regulation — Repossessions. To mitigate our credit losses, sometimes we repossess a

financed or leased vehicle. Repossessions are subject to prescribed legal procedures, including

peaceful repossession, one or more customer notifications, a prescribed waiting period prior to

disposition of the repossessed vehicle, and return of personal items to the customer. Some states

provide the customer with reinstatement rights that require us to return a repossessed vehicle to

the customer in certain circumstances. Our ability to repossess and sell a repossessed vehicle is

restricted if a customer declares bankruptcy.

International

In some countries outside the United States, some of our subsidiaries, including FCE, are

regulated banking institutions and are required, among other things, to maintain minimum capital

reserves. FCE is authorized as a deposit taking business and insurance intermediary under the

Financial Services and Markets Act of 2000 and is regulated by the U.K. Financial Services

Authority (“FSA”). FCE also holds a standard license under the U.K. Consumer Credit Act of 1974

and other licenses to conduct financing business in other European locations. Since 1993, FCE has

obtained authorizations from the Bank of England (now the FSA) pursuant to the Banking

Consolidation Directive entitling it to operate through a European branch network and operate

branches in 11 countries. In many other locations where we operate, governmental authorities

require us to obtain licenses to conduct our business.

Regulatory Compliance Status

We believe that we maintain all material licenses and permits required for our current

operations and are in compliance with all material laws and regulations applicable to us and our

operations. Failure to satisfy those legal and regulatory requirements could have a material

adverse effect on our operations, financial condition, and liquidity. Further, the adoption of new

laws or regulations, or the revision of existing laws and regulations, could have a material

adverse effect on our operations, financial condition, and liquidity.

We actively monitor proposed changes to relevant legal and regulatory requirements in order to

maintain our compliance. Through our governmental relations efforts, we also attempt to

participate in the legislative and administrative rule-making process on regulatory initiatives

that impact finance companies. The cost of our ongoing compliance efforts has not had a material

adverse effect on our operations, financial condition, or liquidity.

8

Item 1. Business (Continued)

Transactions with Ford and Affiliates

On November 6, 2008, we and Ford entered into an Amended and Restated Support Agreement

(“Support Agreement”) (formerly known as the Amended and Restated Profit Maintenance Agreement).

Pursuant to the Support Agreement, if our managed leverage for a calendar quarter were to be higher

than 11.5 to 1 (as reported in our most recent Form 10-Q Report or Form 10-K Report), we can

require Ford to make or cause to be made a capital contribution to us in an amount sufficient to

have caused such managed leverage to have been 11.5 to 1. A copy of the Support Agreement was

filed as an exhibit to our Quarterly Report on Form 10-Q for the quarterly period ended September

30, 2008 and is incorporated by reference herein as an exhibit. No capital contributions have been

made to us pursuant to the Support Agreement. In addition, we have an agreement to maintain FCE’s

net worth in excess of $500 million. No payments have been made to FCE pursuant to the agreement

during the 2007 through 2009 periods.

We entered into an Amended and Restated Agreement with Ford dated December 12, 2006 relating

to our set-off arrangements and long-standing business practices with Ford, a copy of which was

included in our Form 8-K dated the same date and is incorporated by reference herein as an exhibit.

The principal terms of this agreement include the following:

| |

• |

|

In certain circumstances, our obligations to Ford may be set-off against Ford’s

obligations to us; |

| |

| |

• |

|

Any extension of credit from us to Ford or any of Ford’s automotive affiliates

will be on arm’s length terms and will be enforced by us in a commercially reasonable

manner; |

| |

| |

• |

|

We will not guarantee more than $500 million of the indebtedness of, make any

investments in, or purchase any real property or manufacturing equipment classified as an

automotive asset from Ford or any of Ford’s automotive affiliates; |

| |

| |

• |

|

We and Ford agree to maintain our shareholder’s interest at a commercially

reasonable level to support the amount, quality and mix of our assets taking into account

general business conditions affecting us; |

| |

| |

• |

|

We will not be required by Ford or any of Ford’s automotive affiliates to

accept credit or residual risk beyond what we would be willing to accept acting in a

prudent and commercially reasonable manner (taking into consideration any interest rate

supplements or residual value support payments, guarantees, or other subsidies that are

provided to us by Ford or any of Ford’s automotive affiliates); and |

| |

| |

• |

|

We and Ford are separate, legally distinct companies, and we will continue to

maintain separate books and accounts. We will prevent our assets from being commingled

with Ford’s assets, and hold ourselves out as a separate and distinct company from Ford and

Ford’s automotive affiliates. |

More information about transactions between us and Ford and other affiliates is contained in Note

18 of our Notes to the Financial Statements, “Business — Overview”, “Business — Retail

Financing”, “Business — Other Financing” and the description of Ford’s business in Exhibit

99.

9

ITEM 1A. RISK FACTORS

We have listed below (not necessarily in order of importance or probability of occurrence) the

most significant risk factors applicable to us:

A Prolonged Disruption of the Debt and Securitization Markets — Government-sponsored

securitization funding programs (e.g., the U.S. Federal Reserve’s Commercial Paper Funding Facility

— “CPFF” and the U.S. Federal Reserve’s Term Asset-Backed Securities Loan Facility — “TALF”)

intended to improve conditions in the capital markets are scheduled to expire in 2010. If, due to

the expiration of such programs or otherwise, there is a prolonged disruption of the debt and

securitization markets, we would consider further reducing the amount of receivables we purchase or

originate. A significant reduction in the amount of receivables we purchase or originate would

significantly reduce our ongoing profits, and could adversely affect our ability to support the

sale of Ford vehicles. To the extent our ability to provide wholesale financing to Ford’s dealers

or retail financing to those dealers’ customers is limited, Ford’s ability to sell vehicles would

be adversely affected.

Inability to Access Debt, Securitization or Derivative Markets Around the World at Competitive

Rates or in Sufficient Amounts due to Credit Rating Downgrades, Market Volatility, Market

Disruption or Otherwise — The lower credit ratings assigned to us over the past several years have

increased our unsecured borrowing costs and have caused our access to the unsecured debt markets to

be more restricted. In response, we have increased our use of securitization transactions

(including other structured financings) and other sources of funding. Our ability to obtain

funding under our committed asset-backed liquidity programs and certain other asset-backed

securitization transactions is subject to having a sufficient amount of assets eligible for these

programs as well as our ability to obtain appropriate credit ratings and, for certain committed

programs, derivatives to manage the interest rate risk. Over time, and particularly in the event

of any credit rating downgrades, market volatility, market disruption, or other factors, we may

need to reduce the amount of receivables we purchase or originate. In addition, we would need to

reduce the amount of receivables we purchase or originate if there is a significant decline in the

demand for the types of securities we offer or we are unable to obtain derivatives to manage the

interest rate risk associated with our securitization transactions. A significant reduction in the

amount of receivables we purchase or originate would significantly reduce our ongoing profits, and

could adversely affect our ability to support the sale of Ford vehicles. For additional

information on market risk, refer to the “Market Risk” section of Item 7A of Part II of our 10-K

Report.

Higher-Than-Expected Credit Losses — Credit risk is the possibility of loss from a customer’s

or dealer’s failure to make payments according to contract terms. Credit risk (which is heavily

dependent upon economic factors, including unemployment, consumer debt service burden, personal

income growth, dealer profitability, and used vehicle prices) has a significant impact on our

business. Our credit losses could exceed our expectations and adversely affect our financial

condition and results of operations.

Lower-Than-Anticipated Residual Values or Higher-Than-Expected Return Volumes for Leased

Vehicles — We project expected residual values (including residual value support payments from

Ford) and return volumes of the vehicles we lease. Actual proceeds realized by us upon the sale of

returned leased vehicles at lease termination may be lower than the amount projected, which reduces

the profitability of the lease transaction to us. Among the factors that can affect the value of

returned lease vehicles are the volume of vehicles returned, economic conditions and the quality or

perceived quality, safety or reliability of the vehicles. Actual return volumes may be higher than

expected and can be influenced by contractual lease-end values relative to auction values,

marketing programs for new vehicles, and general economic conditions. All of these, alone or in

combination, have the potential to adversely affect our profitability.

10

Item 1A. Risk Factors (Continued)

Increased Competition from Banks or Other Financial Institutions Seeking to Increase Their

Share of Financing Ford Vehicles — No single company is a dominant force in the automotive finance

industry. Most of our bank competitors in the United States use credit aggregation systems that

permit dealers to send, through standardized systems, retail credit applications to multiple

finance sources to evaluate financing options offered by these finance sources. This process has

resulted in greater competition based on financing rates. In addition, we may face increased

competition on wholesale financing for Ford dealers. Competition from such competitors with lower

borrowing costs may increase, which could adversely affect our profitability and the volume of our

business.

Fluctuations in Foreign Currency Exchange Rates and Interest Rates — We are exposed to the

effects of changes in foreign currency exchange rates and interest rates. Changes in currency

exchange rates and interest rates cannot always be predicted or hedged. As a result, substantial

unfavorable changes in foreign currency exchange rates or interest rates could have a substantial

adverse effect on our financial condition and results of operation.

Collection and Servicing Problems Related to Our Finance Receivables and Net Investment in

Operating Leases — After we purchase retail installment sale contracts and leases from dealers and

other customers, we manage or service the receivables. Any disruption of our servicing activity,

due to inability to access or accurately maintain our customer account records or otherwise, could

have a significant negative impact on our ability to collect on those receivables and/or satisfy

our customers.

New or Increased Credit, Consumer or Data Protection, or Other Regulations Could Result in

Higher Costs and/or Additional Financing Restrictions — As a finance company, we are highly

regulated by governmental authorities in the locations where we operate. In the United States, our

operations are subject to regulation, supervision and licensing under various federal, state, and

local laws and regulations, including the federal Truth-in-Lending Act, Equal Credit Opportunity

Act, and Fair Credit Reporting Act. In some countries outside the United States, our subsidiaries

are regulated banking institutions and are required, among other things, to maintain minimum

capital reserves. In many other locations, governmental authorities require companies to have

licenses in order to conduct financing businesses. Efforts to comply with these laws and

regulations impose significant costs on us, and affect the conduct of our business. Additional

regulation could add significant cost or operational constraints that might impair the

profitability of our business.

Changes in Ford’s Operations or Changes in Ford’s Marketing Programs Could Result in a Decline

in Our Financing Volumes — Most of our business consists of financing Ford vehicles and supporting

Ford dealers. If there were significant changes in the production or sales of Ford vehicles to

retail customers, the quality or resale value of Ford vehicles, or other factors impacting Ford or

its employees, such changes could significantly affect our profitability and financial condition.

In addition, for many years, Ford has sponsored special-rate financing programs available only

through us. Under these programs, Ford makes interest supplements or other support payments to us.

These programs increase our financing volume and share of financing sales of Ford vehicles. If

Ford were to adopt marketing strategies in the future that de-emphasized such programs in favor of

other incentives, our financing volume could be reduced.

Inability to Obtain Competitive Funding — Other institutions that provide automotive

financing to certain of Ford’s competitors have access to relatively low-cost government-insured or

other funding. For example, financial institutions with bank holding company status may have

access to other lower cost sources of funding. Access by these competitors’ dealers and customers

to financing provided by financial institutions with relatively low-cost funding that is not

available to us could adversely affect our ability to support the sale of Ford vehicles at

competitive cost and rates.

We Have Significant Exposure to Ford — At December 31, 2009, in the United States and Canada,

Ford is obligated to pay us about $1 billion of interest supplements (including supplements related

to sold receivables) and $180 million of residual value support payments over the terms of the

related finance contracts and operating leases, compared with $2.5 billion of interest supplements

and about $450 million of residual value support at December 31, 2008, in each case for contracts

purchased prior to January 1, 2008. The interest supplements and residual value support payment

obligations on these contracts will continue to decline as the contracts liquidate. In the event

Ford is unable to pay, fails to pay or is delayed in paying these amounts or any other obligations

to us, our profitability, financial condition, and cash flow could be adversely affected.

11

Item 1A. Risk Factors (Continued)

Failure of Financial Institutions to Fulfill Commitments Under Committed Credit and Liquidity

Facilities — As included in the “Liquidity” section of Item 7 of Part II of our 10-K Report, at

December 31, 2009, we had $33.8 billion of committed liquidity programs, asset-backed commercial

paper, and credit facilities of which $18.3 billion were utilized leaving $15.5 billion available

for use for which we pay commitment fees. To the extent the financial institutions that provide

these committed facilities and programs were to default on their obligation to fund the

commitments, these facilities and programs would not be available to us.

We are Jointly and Severally Responsible with Ford and its Other Subsidiaries for Funding

Obligations Under Ford’s and its Subsidiaries’ Qualified U.S. Defined Benefit Pension Plans —

Pursuant to the Employee Retirement Income Security Act of 1974 (“ERISA”), we are jointly and

severally liable to the Pension Benefit Guaranty Corporation (“PBGC”) for certain Ford

IRS-qualified U.S. defined benefit pension plan liabilities and to any trustee appointed if one or

more of these pension plans were to be terminated by the PBGC in a distress termination. We are

liable to pay any plan deficiencies and could have a lien placed on our assets by the PBGC to

collateralize this liability. Our financial condition and ability to repay unsecured debt could be

materially adversely affected if we were required to pay some or all of these obligations.

12

ITEM 1B. UNRESOLVED STAFF COMMENTS

We have none to report.

ITEM 2. PROPERTIES

We own our world headquarters in Dearborn, Michigan. We lease our corporate offices in

Brentwood, England, from an affiliate of Ford. Most of our automotive finance branches and

business centers are located in leased properties. The continued use of any of these leased

properties is not material to our operations. At December 31, 2009, our total future rental

commitment under leases of real property was $76 million.

We operate in the United States through four regional business centers. Additionally, we

operate in Canada through a service center and an origination center in Oakville, Ontario.

Our North American regional business and service centers are located in:

| |

|

|

|

|

United States:

|

|

Colorado Springs, Colorado

|

|

Greenville, South Carolina |

|

|

Tampa, Florida

|

|

Nashville, Tennessee |

|

|

|

|

|

Canada:

|

|

Edmonton, Alberta |

|

|

Each of these centers generally services dealers and customers located within its region. All

of our U.S. business centers are electronically linked and workload can be allocated across these

centers. In addition, our Canadian service and origination centers share a similar electronic

linkage and workload allocation capability.

We also have five specialty service centers in North America that focus on specific servicing

activities:

| |

• |

|

Customer Service Center — Omaha, Nebraska; |

| |

| |

• |

|

Loss Prevention Centers — Henderson, Nevada and Irving, Texas; |

| |

| |

• |

|

National Bankruptcy Service Center — Dearborn, Michigan; and |

| |

| |

• |

|

National Recovery Center — Mesa, Arizona. |

In Europe, we have dealer and customer servicing activities in St. Albans, England, to support

our U.K. operations and customers, and in Cologne, Germany, to support our German operations and

customers. In smaller countries, we provide servicing through our local branches.

13

ITEM 3. LEGAL PROCEEDINGS

We are subject to legal actions, governmental investigations, and other proceedings and claims

relating to state and federal laws concerning finance and insurance, employment-related matters,

personal injury matters, investor matters, financial reporting matters, and other contractual

relationships. Some of these matters are class actions or matters where the plaintiffs are seeking

class action status. Some of these matters may involve claims for compensatory, punitive or treble

damages and attorneys’ fees in very large amounts, or request other relief which, if granted, would

require very large expenditures. We have no significant pending legal proceedings.

Litigation is subject to many uncertainties and the outcome is not predictable. It is

reasonably possible that matters could be decided unfavorably to us. Although the amount of

liability at December 31, 2009 with respect to litigation matters cannot be ascertained, we believe

that any resulting liability should not materially affect our operations, financial condition, and

liquidity.

In addition, any litigation, investigation, proceeding or claim against Ford that results in

Ford incurring significant liability, expenditures or costs could also have a material adverse

affect on our operations, financial condition, and liquidity. For a discussion of pending

significant cases against Ford, see Item 3 in Ford’s 2009 10-K Report.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

Not Required.

PART II

ITEM

5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED SHAREHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

At December 31, 2009, all of our Shares were owned by Ford Holdings, LLC, a wholly owned

subsidiary of Ford. We did not issue or sell any equity interests during 2009, and there is no

market for our Shares. In 2009, we paid distributions of $1.5 billion, including cash and non-cash

distributions. In 2008, we did not pay any distributions. Our Shares are pledged as collateral

for Ford’s secured credit facilities.

ITEM 6. SELECTED FINANCIAL DATA

Not Required.

14

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

Our primary objective remains to profitably and consistently support the sale of Ford, Lincoln

and Mercury vehicles. Meeting this objective in 2009 was more difficult due to: the adverse impact

of the worldwide credit crisis on the capital markets; low consumer confidence; lower consumer

spending and reduced vehicle demand; higher repossessions; and the impact of our declining

receivables on our ability to maintain a competitive cost structure.

Despite these challenges, we have been able to fund our business and support the sale of Ford

vehicles. We have accomplished this by: using our committed liquidity programs; accessing capital

markets for securitization transactions, much of which were supported by government-sponsored

funding programs in the United States and Europe, and unsecured debt issuances; reducing our

receivables; maintaining consistent risk management practices; and restructuring our business to

maintain a competitive cost structure.

The Challenging Economic Environment

Consistent with the overall market, we have been impacted by volatility and disruptions in the

capital markets since August 2007, particularly the asset-backed securitization market where we

obtain the majority of our funding. The recent global credit environment has presented many

challenges, including reduced access to capital markets, increased credit spreads associated with

our funding, higher renewal costs on our committed liquidity programs, reduced net proceeds from

securitization transactions due to greater enhancements, shorter maturities in our public and

private securitization transactions in certain circumstances, and reduced capacity to obtain

derivatives to manage market risk, including interest rate risk, in our securitization programs.

While challenges remain, we saw improvement in the capital markets in the last three quarters

of 2009 evidenced by improvement in market access and credit spreads, including: four unsecured

debt issuances in the United States and one in Europe totaling about $5 billion with significantly

improved U.S. credit spreads from the first to the most recent; increasingly tighter spreads on the

triple-A rated classes of our U.S. retail securitization transactions; a non-TALF public retail

securitization transaction in November 2009; two European public retail securitization transactions

in the fourth quarter of 2009; our first public wholesale securitization transaction since 2006 in

October 2009; a two-year committed lease facility in December 2009; and the sale of over $150

million of subordinated notes from our September 2009 public retail securitization transaction.

In the United States, low consumer confidence and high unemployment have contributed to lower

consumer spending and reduced vehicle demand. Sales of new vehicles in the United States declined

about 20% in 2009 compared with 2008.

Our Response

More than half of our funding during 2009 was completed through our committed liquidity

programs and government-sponsored funding programs due to constrained public and private

securitization markets. Most of our public securitization issuance in the United States during

2009 was eligible for TALF and we also utilized the CPFF commercial paper program and the European

Central Bank (“ECB”) open market operations program. In 2009, we completed six TALF-eligible

securitization transactions totaling $10.3 billion and structured two transactions that provided

$1.2 billion of additional funding through the ECB open market operations program. Our reliance on

CPFF declined throughout 2009 and our last outstanding issuance matured in September 2009. Since

the third quarter of 2009, we significantly reduced the use of government-sponsored securitization

funding programs as our access to the public and private securitization and unsecured markets

continued to improve. For additional information on our use of these programs, refer to the

“Funding” section of Item 7 of Part II of our 10-K Report.

15

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (Continued)

Our funding requirements have decreased as managed receivables declined to $95 billion at

December 31, 2009 from $118 billion at year-end 2008. In 2009, lower global automotive industry

sales resulted in fewer purchases of retail installment sale and lease contracts. In addition, as

part of our commitment to support the sale of Ford, Lincoln and Mercury brand vehicles, Jaguar,

Land Rover, Mazda, and Volvo began to transition their financing to other sources. We also

continued our strategy to execute divestitures and alternative business arrangements in certain

international markets where securitization and other funding availability were limited. We will

continue to explore alternative business arrangements and divestitures. For additional information

on our divestitures, see Note 14 of our Notes to the Financial Statements.

We continue to maintain consistent risk management practices, and continuously strive to

improve our origination and servicing capabilities. For our retail and lease business, we use our

risk management experience to test large sample sizes in developing proprietary origination scoring

models which outperform generic scoring models. Our collection models evaluate several factors,

including origination characteristics, updated credit bureau data, and historical payment patterns.

These models allow for more focused collection activity on higher risk accounts and further refine

our risk-based staffing model to ensure collection resources are aligned with portfolio risk. The

credit quality of our retail and lease originations remains high and our servicing practices remain

sound. For our wholesale and dealer loan business, lower industry sales in the first half of 2009

had a significant adverse effect on dealer profitability and creditworthiness. Although market

conditions remained challenging in the second half of 2009, there was some improvement in dealer

financial performance. Our proprietary commercial risk scorecards use historical experience to

predict a dealer’s ability to meet its financial obligations. Our scorecards are reviewed annually

and continue to be highly predictive in the segmentation of dealer risk. In 2009, to improve our

monthly monitoring process performed on all dealers, we developed a statistically driven monthly

monitoring scorecard allowing more rapid identification of deteriorating dealer performance.

We are also taking steps to maintain a competitive cost structure. In 2009, we eliminated

about 1,200 U.S. staff and agency positions within our servicing, sales, and central operations.

In February 2010, we announced to our employees our plan to continue to reduce our staffing

requirements in our U.S. operations to meet changing business conditions, including the decline in

our receivables. We plan to eliminate about 1,000 additional staff and agency positions, or about

20% of our U.S. staff. The reductions will occur in 2010 through attrition, retirements, and

involuntary separations. Restructuring in locations outside of the United States will continue as

appropriate.

16

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (Continued)

Results of Operations

Generation of Revenue, Income and Cash

The principal factors that influence our earnings are the amount and mix of finance

receivables and net investment in operating leases and financing margins. The performance of these

receivables and leases over time, mainly through the impact of credit losses and variations in the

residual value of leased vehicles, also affects our earnings.

The amount of our finance receivables and net investment in operating leases depends on many

factors, including:

| |

• |

|

the volume of new and used vehicle sales and leases; |

| |

| |

• |

|

the extent to which we purchase retail installment sale and lease contracts and

the extent to which we provide wholesale financing; |

| |

| |

• |

|

the sales price of the vehicles financed; |

| |

| |

• |

|

the level of dealer inventories; |

| |

| |

• |

|

Ford-sponsored special-rate financing programs available exclusively through

us; and |

| |

| |

• |

|

the availability of cost-effective funding for the purchase of retail

installment sale and lease contracts and to provide wholesale financing. |

For finance receivables, financing margin equals the difference between revenue earned on

finance receivables and the cost of borrowed funds. For operating leases, financing margin equals

revenue earned on operating leases, less depreciation expense and the cost of borrowed funds.

Interest rates earned on most receivables and rental charges on operating leases generally are

fixed at the time the contracts are originated. On some receivables, primarily wholesale

financing, we charge interest at a floating rate that varies with changes in short-term interest

rates.

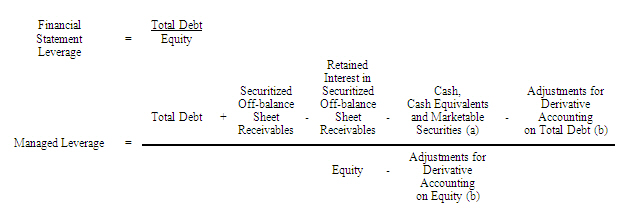

Business Performance

We review our business performance from several perspectives, including:

| |

• |

|

On-balance sheet basis — includes the receivables and leases we own and

securitized receivables and leases that remain on our balance sheet (includes other

structured financings and factoring transactions that have features similar to

securitization transactions); |

| |

| |

• |

|

Securitized off-balance sheet basis — includes receivables sold in

securitization transactions that, when sold, do not remain on our balance sheet; |

| |

| |

• |

|

Managed basis — includes on-balance sheet receivables, excluding unearned

interest supplements related to finance receivables, and securitized off-balance sheet

receivables that we continue to service (off-balance sheet retail receivables were about

$100 million at December 31, 2009); and |

| |

| |

• |

|

Serviced basis — includes managed receivables and leases, and receivables sold

in whole-loan sale transactions where we retain no interest in the sold receivables, but

which we continue to service. |

We analyze our financial performance primarily on a managed and on-balance sheet basis. We

retain interests in receivables sold in off-balance sheet securitization transactions and, with

respect to subordinated retained interests, we have credit risk. As a result, we evaluate credit

losses, receivables, and leverage on a managed basis as well as on an on-balance sheet basis. In

contrast, we do not have the same financial interest in the performance of receivables sold in

whole-loan sale transactions, and as a result, we generally review the performance of our serviced

portfolio only to evaluate the effectiveness of our origination and collection activities. To

evaluate the performance of these activities, we monitor a number of measures, such as

delinquencies, repossession statistics, losses on repossessions, and the number of bankruptcy

filings.

We measure the performance of our North America Segment and our International Segment

primarily on an income before income taxes basis, after excluding the impact to earnings from gains

and losses related to market valuation adjustments to derivatives primarily related to movements in

interest rates, because our risk management activities are carried out on a centralized basis at

the corporate level, with only certain elements allocated to our two segments. For additional

information regarding our segments, see Note 19 of our Notes to the Financial Statements.

17

|

|

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations (Continued) |

Full Year 2009 Compared with Full Year 2008

In 2009, our net income was $1.3 billion, compared with a net loss of $1.5 billion in 2008.

On a pre-tax basis, we earned $2 billion in 2009, compared with a loss of $2.6 billion in 2008.

The improvement in pre-tax earnings primarily reflected:

| |

• |

|

The non-recurrence of the 2008 impairment charge to our North America Segment operating

lease portfolio for contracts terminating beginning third quarter of 2008 (about $2.1

billion); |

| |

| |

• |

|

Lower depreciation expense for leased vehicles and lower residual losses on returned

vehicles due to higher auction values (about $1.9 billion); |

| |

| |

• |

|

A lower provision for credit losses primarily related to non-recurrence of higher

severity offset partially by higher repossessions (about $800 million); |

| |

| |

• |

|

The non-recurrence of net losses related to market valuation adjustments to

derivatives, shown as unallocated risk management in the table below ($367 million); |

| |

| |

• |

|

Net gains related to unhedged currency exposure primarily from cross-border

intercompany lending (about $300 million); |

| |

| |

• |

|

Lower net operating costs (about $200 million); and |

| |

| |

• |

|

Higher financing margin primarily attributable to lower borrowing costs (about $100

million). |

These factors were offset partially by:

| |

• |

|

Lower volume primarily reflecting lower industry volumes, lower dealer stocks, the

impact of divestitures and alternative business arrangements, and changes in currency

exchange rates (about $1 billion); |

| |

| |

• |

|

The non-recurrence of the gain related to the sale of approximately half of our

ownership interest in our Nordic operations (about $100 million); and |

| |

| |

• |

|

A valuation allowance for Australian finance receivables sold in 2009 (about $50

million). |

For additional information on the 2008 impairment charge, refer to the “Results of Operations —

Impairment of Net Investment in Operating Leases” section of Item 7 of Part II of our 10-K Report.

Results of our operations by business segment and unallocated risk management for 2009 and

2008 are shown below:

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Full Year |

|

| |

|

|

|

|

|

|

|

|

|

2009 |

|

| |

|

|

|

|

|

|

|

|

|

Over/(Under) |

|

| |

|

2009 |

|

|

2008 |

|

|

2008 |

|

| |

|

(in millions) |

|

Income/(Loss) before income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

North America Segment |

|

$ |

1,905 |

|

|

$ |

(2,749 |

) |

|

$ |

4,654 |

|

International Segment |

|

|

46 |

|

|

|

507 |

|

|

|

(461 |

) |

Unallocated risk management |

|

|

50 |

|

|

|

(317 |

) |

|

|

367 |

|

|

|

|

|

|

|

|

|

|

|

Income/(Loss) before income taxes |

|

|

2,001 |

|

|

|

(2,559 |

) |

|

|

4,560 |

|

Provision for/(Benefit from) income

taxes and Gain on disposal of

discontinued operations |

|

|

722 |

|

|

|

(1,023 |

) |

|

|

1,745 |

|

|

|

|

|

|

|

|

|

|

|

Net income/(loss) |

|

$ |

1,279 |

|

|

$ |

(1,536 |

) |

|

$ |

2,815 |

|

|

|

|

|

|

|

|

|

|

|

The improvement in North America Segment pre-tax earnings primarily reflected non-recurrence

of the impairment charge for operating leases, lower depreciation expense for leased vehicles and

lower residual losses on returned vehicles due to higher auction values, a lower provision for

credit losses, net gains related to unhedged currency exposure from cross-border intercompany

lending, higher financing margin, and lower operating costs. These factors were offset partially

by lower volume.