Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Black Creek Diversified Property Fund Inc. | dpf-20200831x8k.htm |

| EX-99.1 - EX-99.1 - Black Creek Diversified Property Fund Inc. | dpf-20200831xex99d1.htm |

Exhibit 99.2

September 15, 2020

Dear Valued Shareholders,

In light of continued disruptions of COVID-19 (COVID) throughout the global economy and commercial real estate, we want to provide you with an update regarding Black Creek Diversified Property Fund (DPF).

DPF’s total return for the month ending August 31, 2020 was 0.46%, comprised of a monthly distribution of $0.03125 per share, which is equivalent to an annualized yield of 4.99%1. NAV per share remained flat at $7.512. Our trailing one-year total return is 7.76% and our annualized return since NAV inception3 is 6.65%, with less volatility than stock and bond markets4.

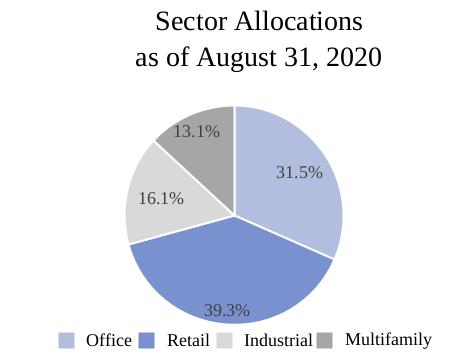

While no property sector is immune to COVID related economic disruption, we are pleased with how our portfolio of industrial, multifamily, office and grocery-anchored retail properties are continuing to perform throughout the pandemic. Our properties are 92.3% leased, with a diversified tenant base that includes an abundance of quality tenants with strong operating histories and a weighted average lease term of 5.0 years5 across our commercial portfolio – all of which we believe create stability and resiliency.

We continue to be pleased with total rent collections in our portfolio since the onset of COVID, which we believe exemplify the defensive nature of our assets in the face of an economic crisis. We have collected 95.5% of August rent to date, which reflects one of our higher monthly collection percentages since the onset of COVID. While we chose to execute short-term rent deferral agreements in 2Q 2020 with certain of our otherwise successful tenants, the need for additional rent deferrals has declined considerably since the onset of COVID. A detailed summary of our August rent collections to date as well as other summary statistics are shown below.

August, 2020 | |

Rent Collections Before Forbearance6 | |

Office | 97.1% |

Retail | 93.2% |

Industrial | 95.7% |

Multifamily | 97.3% |

Total | 95.5% |

Rent Collections After Forbearance7 | |

Total | 97.2% |

Summary Statistics as of August 31, 2020 | ||

Gross Real Estate Value | $2.4B | |

Number of Properties | 53 | |

Percent Leased | 92.3% | |

Weighted Avg. Lease Term5 | 5.0 years | |

Commercial Tenant Count | 451 | |

Multifamily Unit Count | | 985 |

With a healthy balance sheet at 35.4%8 leverage and considerable liquidity, DPF is continuing to acquire institutional quality, income-producing and defensive real estate, with a focus on industrial and multifamily opportunities. In accordance with this strategy, last month DPF acquired a newly constructed, class A industrial building located in the San Francisco Bay Area for $48.5 million. Given an uptick in e-commerce demand since COVID began9 and the strong performance that we continue to see within the industrial sector10, we remain committed to increasing our industrial allocation which has increased from 11.0% as of December 31, 2019 to 16.1% as of August 31, 2020.

While much remains unknown regarding the broader economy, we believe DPF is in a position of strength to weather the effects of COVID while providing our shareholders with access to high quality, income-producing commercial real estate. We are confident in

our disciplined investment strategy, asset base and underlying tenant composition and remain available should you have any questions or want to discuss our portfolio further. As always, we appreciate the continued trust you have placed in DPF.

Sincerely,

The Black Creek Team

Forward-Looking Statements

This letter includes certain statements that are intended to be deemed “forward-looking statements” within the meaning of, and to be covered by the safe harbor provisions contained in, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements are generally identifiable by the use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” “project,” “continue,” or other similar words or terms. These statements are based on certain assumptions and analyses made in light of our experience and our perception of historical trends, current conditions, expected future developments and other factors we believe are appropriate. Such statements are subject to a number of assumptions, risks and uncertainties that may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements. Among the factors that may cause results to vary are the negative impact of COVID-19 on our financial condition and results of operations being more significant than expected, the negative impact of COVID-19 on our tenants being more significant than expected, general economic and business (particularly real estate and capital market) conditions being less favorable than expected, the business opportunities that may be presented to and pursued by us, changes in laws or regulations (including changes to laws governing the taxation of real estate investment trusts (“REITs”)), risk of acquisitions, availability and creditworthiness of prospective tenants, availability of capital (debt and equity), interest rate fluctuations, competition, supply and demand for properties in current and any proposed market areas in which we invest, our tenants’ ability and willingness to pay rent at current or increased levels, accounting principles, policies and guidelines applicable to REITs, environmental, regulatory and/or safety requirements, tenant bankruptcies and defaults, the availability and cost of comprehensive insurance, including coverage for terrorist acts, and other factors, many of which are beyond our control. For a further discussion of these factors and other risk factors that could lead to actual results materially different from those described in the forward-looking statements, see “Risk Factors” under Item 1A of Part 1 of DPF’s Annual Report on Form 10-K for the year ended December 31, 2019 and subsequent periodic and current reports filed with the SEC. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of future events, new information or otherwise.

1 Represents annualized distribution rate for Class I shares. Annualized distribution rate for Class S shares is 4.14%, for class T shares is 4.14%, for class D shares is 4.74% and for Class E shares is 4.99%. Reflects the current quarter’s distribution annualized minus distribution fees annualized, if applicable, and divided by NAV. The amount of distributions DPF may make is uncertain and is not guaranteed.

2 See DPF’s Current Report on Form 8-K, filed with the SEC on September 15, 2020 for important additional information concerning the calculation of our NAV as of August 31, 2020.

3 NAV inception was September 30, 2012, which is when we first sold shares of our common stock after converting to an NAV-based REIT on July 12, 2012.

4 Total returns presented are based on the historical NAV and distributions per share of Class I shares. Performance varies by share class. For the month ended August 31, 2020, Class S shares (without sales load) returned 0.39%, Class S shares (with sales load) returned -3.00%, Class T shares (without sales load) returned 0.39%, Class T shares (with sales load) returned -3.00%, Class D shares returned 0.44%, and Class E shares returned 0.46%. During the same trailing one-year period, Class S shares (without sales load) returned 6.85%, Class S shares (with sales load) returned 3.23%, Class T shares (without sales load) returned 6.85%, Class T shares (with sales load) returned 3.23%, Class D shares returned 7.49%, and Class E shares returned 7.76%. During the same since NAV inception period, Class S shares (without sales load) returned 5.66% annualized, Class S shares (with sales load) returned 5.27% annualized, Class T shares (without sales load) returned 5.66% annualized, Class T shares (with sales load) returned 5.27% annualized, Class D shares returned 6.22% annualized, and Class E shares returned 6.71% annualized.

The historical returns since “NAV inception” show share performance since September 30, 2012, which is when DPF first sold Class A, W and I shares after converting to a NAV REIT on July 12, 2012. Subsequently, as a result of a share restructuring effective as of September 1, 2017, DPF’s outstanding Class A, W and I shares changed to Class T, Class D and a new version of Class I shares, respectively. DPF also created a new Class S share, with the same NAV per share and class-specific expenses as Class T shares. Accordingly, the presented returns of Class T and Class S shares reflect the performance of Class A shares since NAV inception through the restructuring date; the return of Class D shares shown reflects the performance of Class W shares since NAV inception through the restructuring date; and the return of the new version of Class I shares reflects the performance of the prior Class I shares since NAV inception through the restructuring date. In connection with the restructuring, DPF also revised its fee structure with its advisor and dealer manager and its NAV methodology, which will affect returns going forward. Please see DPF’s definitive proxy statement filed with the Securities and Exchange Commission on June 7, 2017, for more information about the fee changes and our pro forma estimates of how those fee changes would have affected returns on DPF shares in the years 2013-2016. Investors in DPF’s fixed price offerings prior to NAV inception on 09/30/12 are likely to have a lower return. Since NAV inception returns are annualized utilizing a compounding method consistent with the IPA Practice Guideline 2018.

The returns have been prepared using unaudited data and valuations of the underlying investments in DPF’s portfolio, which are estimates of fair value and form the basis for DPF’s NAV. Valuations based upon unaudited or estimated reports from the underlying investments may be subject to later adjustments or revisions, may not correspond to realized value and may not accurately reflect the price at which assets could be liquidated on any given day.

5 Amount excludes our multi-family properties as the majority of leases at such properties expire within 12 months.

6 Percentages reflect rent received through September 9, 2020.

7 Percentages reflect rent received or deferred across sectors through September 9, 2020 and after accounting for forbearance agreements that we chose to execute with many of our otherwise successful tenants, allowing them to defer certain rent until 2021.

8 Calculated as outstanding principal balance of our borrowings less cash and cash equivalents, divided by the fair value of our real property and debt-related investments not associated with the DST Program (determined in accordance with our valuation procedures). Amounts represent balances as of August 31, 2020.

9 U.S. Census Bureau

10 National Council of Real Estate Investment Fiduciaries, 2020.