Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________________________________________________

FORM 10-K

_____________________________________________________________

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2016

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 000-52596

_____________________________________________________________

Dividend Capital Diversified Property Fund Inc.

(Exact name of registrant as specified in its charter)

_____________________________________________________________

Maryland | 30-0309068 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

518 Seventeenth Street, 17th Floor, Denver, CO | 80202 |

(Address of principal executive offices) | (Zip Code) |

(303) 228-2200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Title of each class

Unclassified Shares of Common Stock, $0.01 par value

Class A Shares of Common Stock, $0.01 par value

Class W Shares of Common Stock, $0.01 par value

Class I Shares of Common Stock, $0.01 par value

_____________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes ý No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ý (Do not check if a smaller reporting company) | Smaller reporting company | ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

There is no established market for the Registrant’s shares of common stock. The Registrant publishes a daily net asset value (“NAV”), based on procedures and methodologies established by its board of directors, with an NAV on June 30, 2016, the last business day of the Registrant’s most recently completed second fiscal quarter, of $7.37 per share for its unclassified shares of common stock (referred to as “Class E” shares) and each of its Class A, Class W and Class I classes of common stock. As of December 31, 2016, the daily NAV was $7.57 per share for each of its Class E, Class A, Class W and Class I classes of common stock.

There were approximately 126,473,453 outstanding shares of Class E common stock, 1,884,288 outstanding shares of Class A common stock, 2,119,104 outstanding shares of Class W common stock, and 29,067,092 outstanding shares of Class I common stock, held by non-affiliates, as of June 30, 2016, the last business day of the Registrant’s most recently completed second fiscal quarter.

As of February 24, 2017, 112,526,991 shares of Class E common stock, 2,027,074 shares of Class A common stock, 2,372,400 shares of Class W common stock, and 33,942,117 shares of Class I common stock of the Registrant, each with a par value $0.01 per share, were outstanding.

DIVIDEND CAPITAL DIVERSIFIED PROPERTY FUND INC.

ANNUAL REPORT ON FORM 10-K

For the Year Ended December 31, 2016

TABLE OF CONTENTS

Cautionary Statement Regarding Forward-Looking Statements

This Annual Report on Form 10-K includes certain statements that may be deemed to be “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the “Securities Act,” and Section 21E of the Securities Exchange Act of 1934, as amended, or the “Exchange Act.” Such forward-looking statements relate to, without limitation, our future capital expenditures, distributions and acquisitions (including the amount and nature thereof), other developments and trends of the real estate industry, business strategies, and the expansion and growth of our operations. These statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions, expected future developments and other factors we believe are appropriate. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act. Such statements are subject to a number of assumptions, risks and uncertainties which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by these forward-looking statements. Forward-looking statements are generally identifiable by the use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” “project,” “continue,” or the negative of these words, or other similar words or terms. Readers are cautioned not to place undue reliance on these forward-looking statements.

Some of the risks and uncertainties that may cause our actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include, among others, the following:

• | the impact of macroeconomic trends, such as the unemployment rate and availability of credit, which may have a negative effect on the following, among other things: |

• | the fundamentals of our business, including overall market occupancy, tenant space utilization, and rental rates; |

• | the financial condition of our tenants, some of which are financial, legal and other professional firms, our lenders, and institutions that hold our cash balances and short-term investments, which may expose us to increased risks of breach or default by these parties; and |

• | the value of our real estate assets, which may limit our ability to dispose of assets at attractive prices or obtain or maintain debt financing secured by our properties or on an unsecured basis; |

• | general risks affecting the real estate industry (including, without limitation, the inability to enter into or renew leases, dependence on tenants’ financial condition, and competition from other developers, owners and operators of real estate); |

• | our ability to effectively raise and deploy proceeds from our ongoing public offering of Class A, Class W and Class I shares; |

• | risks associated with the availability and terms of debt and equity financing and the use of debt to fund acquisitions and developments, including the risk associated with interest rates impacting the cost and/or availability of financing; |

• | the business opportunities that may be presented to and pursued by us, changes in laws or regulations (including changes to laws governing the taxation of real estate investment trusts (“REITs”)); |

• | conflicts of interest arising out of our relationships with Dividend Capital Total Advisors Group LLC (our “Sponsor”), Dividend Capital Total Advisors LLC (our “Advisor”), and their affiliates; |

• | changes in accounting principles, policies and guidelines applicable to REITs; |

• | environmental, regulatory and/or safety requirements; and |

• | the availability and cost of comprehensive insurance, including coverage for terrorist acts. |

For further discussion of these and other factors, see “Item 1A. Risk Factors” in this Annual Report on Form 10-K. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of future events, new information or otherwise.

- 2-

PART I

ITEM 1. BUSINESS

Overview

Dividend Capital Diversified Property Fund Inc. is a Maryland corporation formed on April 11, 2005 to invest in a diverse portfolio of real property and real estate-related investments. As used herein, “the Company,” “we,” “our” and “us” refer to Dividend Capital Diversified Property Fund Inc. and its consolidated subsidiaries and partnerships except where the context otherwise requires.

We believe we have operated in such a manner as to qualify as a real estate investment trust (“REIT”) for federal income tax purposes, commencing with the taxable year ended December 31, 2006, when we first elected REIT status. We utilize an Umbrella Partnership Real Estate Investment Trust (“UPREIT”) organizational structure to hold all or substantially all of our assets through our operating partnership, Dividend Capital Total Realty Operating Partnership, LP (our “Operating Partnership”). Furthermore, our Operating Partnership wholly owns a taxable REIT subsidiary, DCTRT Leasing Corp. (the “TRS”), through which we execute certain business transactions that might otherwise have an adverse impact on our status as a REIT if such business transactions were to occur directly or indirectly through our Operating Partnership.

Our Portfolio

We are currently invested in a diverse portfolio of real properties and, to a lesser extent, real estate-related debt investments. Our investment in real property consists of office, industrial, and retail properties located in the United States. As of December 31, 2016, our real property portfolio was approximately 91.2% leased. Additionally, we are invested in certain real estate-related debt investments, including originating and participating in mortgage loans secured by real estate (herein referred to as “debt-related investments”).

As of December 31, 2016, we had total gross investments with an estimated fair value of approximately $2.3 billion (calculated in accordance with our valuation procedures), comprised of approximately $2.3 billion in investments in real property and approximately $15.2 million in net debt-related investments.

As of December 31, 2016, we had three reportable operating segments: office property, industrial property and retail property. Operating results from our business segments are discussed further in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 13 to our financial statements beginning on page F-1 of this Annual Report on Form 10-K.

Whenever we refer to the “fair value” of our real estate investments in this Annual Report on Form 10-K, we are referring to the fair value as determined pursuant to our valuation procedures, unless stated otherwise.

Our Advisor

We are managed by our Advisor, which is wholly owned by our Sponsor. Our Advisor was formed as a Delaware limited liability company in April 2005. Subject to oversight by our board of directors, we rely on our Advisor to manage our day-to-day activities and to implement our investment strategy. In addition, subject to the oversight, review and approval of our board of directors, our Advisor undertakes to, among other things, research, identify, review and make investments in and dispositions of real property and real estate-related investments on our behalf consistent with our investment policies and objectives. Our Advisor performs its duties and responsibilities under an advisory agreement with us (the “Advisory Agreement”) as a fiduciary of ours and our stockholders. The term of the Advisory Agreement is for one year, subject to renewals by our board of directors for an unlimited number of successive one-year periods. The current term of the Advisory Agreement expires on June 30, 2017. Our officers and our two interested directors are all employees of an affiliate of our Advisor.

Our Offerings

On July 12, 2012, we commenced an ongoing public offering of up to $3,000,000,000 of our shares of common stock, of which $2,250,000,000 of shares were expected to be offered to the public in a primary offering and $750,000,000 of shares were expected to be offered to our stockholders pursuant to an amended and restated distribution reinvestment plan (subject to our right to reallocate such amounts) (the “Prior Offering”). We terminated the Prior Offering on September 15, 2015.

- 3-

On September 16, 2015, we commenced a follow-on ongoing public offering of up to $1,000,000,000 of our shares of common stock, of which $750,000,000 of shares are expected to be offered to the public in a primary offering and $250,000,000 of shares are expected to be offered to stockholders of the Company pursuant to its distribution reinvestment plan (subject to the our right to reallocate such amounts) (the “Follow-On Offering”). In the Follow-On Offering, we are offering to the public three classes of shares: Class A shares, Class W shares and Class I shares with net asset value (“NAV”) based pricing. We are offering to sell any combination of Class A shares, Class W shares and Class I shares with a dollar value up to the maximum offering amount.

Dividend Capital Securities LLC, which we refer to as our “Dealer Manager,” is distributing the shares of our common stock in the Class A, Class W and Class I offering on a “best efforts” basis. Our Dealer Manager is an entity related to our Advisor and is a member of the Financial Industry Regulatory Authority, Inc., or FINRA. Our Dealer Manager coordinates our distribution effort and manages our relationships with participating broker-dealers and financial advisors and provides assistance in connection with compliance matters relating to marketing the offering.

We also continue to sell shares of our unclassified common stock, which we refer to as “Class E” shares, pursuant to our distribution reinvestment plan offering.

As of December 31, 2016, we had approximately 112,325,127 Class E shares, 2,001,359 Class A shares, 2,271,361 Class W shares, and 34,038,546 Class I shares outstanding.

Our Classes of Common Stock

We have four classes of common stock: Class E, Class A, Class W and Class I shares. The payment of class-specific expenses results in different amounts of distributions being paid with respect to each class of shares. In addition, as a result of the different ongoing fees and expenses allocable to each share class, each share class could have a different NAV per share. If the NAV of our classes are different, then changes to our assets and liabilities that are allocable based on NAV may also be different for each class. Our four classes of common stock also have different rights upon liquidation to the extent that their NAV per share differs. In the event of a liquidation event, our assets, or the proceeds therefrom, will be distributed ratably in proportion to the respective NAV for each class until the NAV for each class has been paid. Other than differing allocable fees and expenses and liquidation rights, Class E shares, Class A shares, Class W shares, and Class I shares have identical rights and privileges.

Our Operating Partnership

We own all of our interests in our investments through our Operating Partnership or its subsidiaries. We are the sole general partner of our Operating Partnership. In addition, we have contributed 100% of the proceeds received from our offerings of common stock to our Operating Partnership in exchange for partnership units representing our interest as a limited partner of the Operating Partnership. As of December 31, 2016, we held a 92.6% limited partnership interest in the Operating Partnership. We refer to partnership units in the Operating Partnership as “OP Units.” As of December 31, 2016, our Operating Partnership had outstanding OP Units held by third-party investors representing approximately a 7.4% limited partnership interest. These units were issued by the Operating Partnership in connection with its exercise of options to acquire certain fractional interests in real estate that were previously sold to such investors pursuant to private placements previously conducted by the Operating Partnership. The holders of OP Units (other than us) generally have the right to cause the Operating Partnership to redeem all or a portion of their OP Units for, at our sole discretion, shares of our common stock, cash, or a combination of both.

Our Operating Partnership has classes of OP Units that correspond to our four classes of common stock: Class E OP Units, Class A OP Units, Class W OP Units and Class I OP Units. The OP Units of each class are economically equivalent to the same respective class of our common stock. We sometimes refer to our Class E shares, Class A shares, Class W shares and Class I shares, along with the OP Units held by third parties, collectively as “Fund Interests” because they all represent interests held by investors in our Operating Partnership, through which we own all of our investments and conduct all of our operations. We sometimes refer to the NAV of all of the Fund Interests as the “Aggregate Fund NAV.”

Net Asset Value Calculation and Valuation Procedures

Our board of directors, including a majority of our independent directors, has adopted valuation procedures that contain a comprehensive set of methodologies to be used in connection with the calculation of our NAV. One fundamental element of the valuation process, the valuation of our real property portfolio, is managed by Altus Group U.S., Inc., an independent valuation firm approved by our board of directors, including a majority of our independent directors (the “Independent Valuation Firm”).

- 4-

Altus Group is a multidisciplinary provider of independent, commercial real estate consulting and advisory services in multiple offices around the world, including Canada, the U.K., Australia, the United States and Asia Pacific. Altus Group is engaged in the business of valuing commercial real estate properties and is not affiliated with us or the Advisor.

Our NAV is calculated for each of our share classes after the end of each business day that the New York Stock Exchange is open for unrestricted trading by ALPS Fund Services Inc., a third-party firm approved by our board of directors, including a majority of our independent directors (our “NAV Accountant”). Our NAV is not audited by our independent registered public accounting firm. See “Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities” and Exhibit 99.1 of this Annual Report on Form 10-K for a more detailed description of our valuation procedures and valuation components, and our NAV as of December 31, 2016.

DST Program

In March 2016, we, through the Operating Partnership, initiated a program to raise capital in private placements exempt from registration under the Securities Act of 1933, as amended, or the “Securities Act” through the sale of beneficial interests ("Interests") in specific Delaware statutory trusts holding real properties, including properties currently indirectly owned by the Operating Partnership (the “DST Program”). From 2006 through 2009, we, through our subsidiaries conducted similar private placement offerings of fractional interests in which we raised a total of $183.1 million in gross proceeds. These fractional interests were all subsequently acquired by the Operating Partnership in exchange for an aggregate of 17.7 million OP Units.

Under the DST Program, each private placement will offer interests in one or more real properties placed into one or more Delaware statutory trust(s) by the Operating Partnership or its affiliates (“DST Properties”). We anticipate that these interests may serve as replacement properties for investors seeking to complete like-kind exchange transactions under Section 1031 of the Code. Additionally, properties underlying interests sold to investors pursuant to such private placements will be leased-back by an indirect wholly owned subsidiary of the Operating Partnership on a long term basis of up to 29 years. The lease agreements are expected to be fully guaranteed by the Operating Partnership. Additionally, the Operating Partnership will retain a fair market value purchase option giving it the right, but not the obligation, to acquire the Interests from the investors at a later time in exchange for OP Units.

Similar to our prior private placement offerings, we expect that the DST Program will give us the opportunity to expand and diversify our capital raise strategies by offering what we believe to be an attractive and unique investment product for investors that may be seeking replacement properties to complete like-kind exchange transactions under Section 1031 of the Code. We expect to use the net proceeds of these private placements to make investments in accordance with our investment strategy and policies, to provide liquidity to our investors and for general corporate purposes (which may include repayment of our debt or any other corporate purposes we deem appropriate). The specific amounts of the net proceeds that are used for such purposes, and the priority of such uses, will depend on the amount and timing of receipts of such proceeds and what we deemed to be the best use of such proceeds at such time.

Investment Objectives

Our primary investment objectives are:

• | providing current income to our stockholders in the form of quarterly cash distributions; |

• | preserving and protecting our stockholders’ capital investments; |

• | realizing capital appreciation in our share price from active investment management and asset management; and |

• | providing portfolio diversification in the form of multi-asset class investing in direct real estate. |

There is no assurance that we will attain our investment objectives. Our charter places numerous limitations on us with respect to the manner in which we may invest our funds. In most cases these limitations cannot be changed unless our charter is amended, with the approval of our stockholders.

Investment Strategy

Our investment strategy is designed to focus on generating income to support the quarterly dividend, protecting capital and growing net asset value over time. We seek to leverage our extensive knowledge of targeted real estate markets and property types to capitalize on opportunities where there is a disconnect between our assessment of an investment’s intrinsic

- 5-

value relative to its market value. In addition, we seek to optimize the value of our portfolio through strategic financing, diligent asset management and selective asset disposition.

We believe that the real estate market is cyclical, with different demand for property types at different times. Although we do not invest for the short term, we are active portfolio managers and we will seek to take advantage of opportunities to acquire or dispose of assets presented to us by real estate markets. One reason we focus on multiple property types and markets is to increase our ability to take advantage of these market cycles. We believe that the more opportunities we see in which to invest our capital, the more selective we can be in choosing strategic and accretive investments, which we believe may result in attractive total returns for our stockholders. Seeing more opportunities also may allow us to be consistent and meaningful investors throughout different cycles. When we believe one market is overvalued, we patiently wait and focus on another market that we believe is overlooked.

We also believe that value generally is based on the investment’s ability to produce cash flow and not what the next buyer will pay at any point in time. We generally focus on select, targeted markets that exhibit characteristics of being supply-constrained with strong demand from tenants seeking quality space.

We may target investments in four primary property categories of office, industrial, retail and multifamily. Although we may own properties in each of these categories, we are not tied to specific allocation targets and we may not always have significant holdings, or any holdings at all, in each category. For example, we do not currently own multifamily investments, although we intend to consider multifamily investment opportunities in the future. Also, through the disposition of assets, our ownership of industrial assets has declined to less than 5% of our portfolio as of December 31, 2016. From 2013 through the first half of 2016, our investment strategy has primarily been focused on multi-tenant office and necessity-oriented, multi-tenant retail investments located in what we believe are strong markets poised for long-term growth. Our current investment strategy will continue to focus on these multi-tenant office and necessity-oriented, multi-tenant retail investments. We intend to also incorporate industrial properties into our current investment strategy. We also continue to monitor opportunities to invest in multi-family assets. However, there can be no assurance that we will be successful in this investment strategy, including with respect to any particular asset class. To a lesser extent we may invest in other types of real estate including, but not limited to, hospitality, medical offices, student housing and unimproved land. We anticipate that the majority of our real property investments will be made in the United States, although we may also invest in Canada and Mexico, and potentially elsewhere on a limited basis, to the extent that opportunities exist that may help us meet our investment objectives.

To provide diversification to our portfolio, we have invested and may continue to invest in real estate-related debt, which will generally include mortgage loans secured by real estate, mezzanine debt and other related investments. Any investments in real estate-related securities generally will focus on equity issued by public and private real estate companies and certain other securities, with the primary goal of such investments being the preservation of liquidity in support of our share redemption programs.

In 2015 and 2016, we disposed of approximately $716.3 million of properties and we acquired approximately $407.8 million of properties. The properties that we sold were generally higher-yielding than the new properties we acquired, although we believe the acquired assets exhibit greater potential for future revenue growth. We believe that market conditions may cause us to continue to explore in certain markets the disposition of higher-yielding assets and in certain target markets the acquisition of assets that may generate lower yields but with greater growth potential. Although there can be no assurance that we will continue to pursue this strategy or be successful in its execution, for some period of time this may mean that higher-yielding assets are sold from our portfolio in exchange for assets that initially may produce lower current income but which we believe will generate increased income over time through increased tenant demand and rental rate growth in order to generate long term growth in net asset value.

Diversification Across Real Estate Investment Types

Our objective is to build a high-quality, diversified real estate portfolio. Although there can be no assurance that we will achieve this objective, we intend to diversify our portfolio by key portfolio attributes including, but not limited to, (1) property type, (2) target market, with consideration given to geographic concentrations, (3) average lease terms and portfolio occupancy expectations, (4) tenant concentrations, including credit and exposure to particular businesses or industries and (5) debt profile with the goal of maximizing flexibility while seeking to minimize cost and mitigate the risks associated with changes in interest rates and debt maturities.

- 6-

Real Property

We generally utilize a long-term hold strategy for strategic investments within our portfolio of real estate assets. The majority of our current portfolio consists of primarily “core” or “core-plus” properties that have significant operating histories and existing leases whereby a significant portion of the total investment return is expected to be derived from current income. In addition, we have invested in a relatively smaller proportion of “value added” opportunities that have arisen in circumstances where we have determined that a real property may be situationally undervalued or where product re-positioning, capital expenditures and/or improved property management may increase cash flows, and where the total investment return is generally expected to have a relatively larger component derived from capital appreciation. As described above, although we do not invest for the short term, we are active portfolio managers and we will seek to take advantage of opportunities to acquire or dispose of assets presented to us by the real estate market. Furthermore, we have invested in a small number of “opportunistic” real property investments, and may pursue similar opportunities in the future, that are either under-leased at acquisition or present expansion or re-development opportunities, where we may realize a significant portion of the total investment return from value appreciation. As of December 31, 2016, we had invested in a total of 55 operating properties located in 20 geographic markets throughout the United States at a total gross investment amount of approximately $2.2 billion aggregating approximately 9.0 million net rentable square feet.

Debt-Related Investments

To date, our debt-related investments have consisted primarily of (i) originations of and participations in commercial mortgage loans secured by real estate, (ii) B-notes, and (iii) mezzanine debt and other related investments secured by equity interests in entities that indirectly own real properties. As of December 31, 2016, we had three distinct debt-related investments secured by real properties located in three geographic markets with a total net investment amount of approximately $15.2 million.

Diversification Across Real Property Sectors

Through our investments in real properties and debt-related investments, we made direct investments, via equity interests and/or joint ventures, in real properties in multiple sectors, including office, industrial, and retail. In the future, we may also invest in multifamily, hospitality, and other real property types.

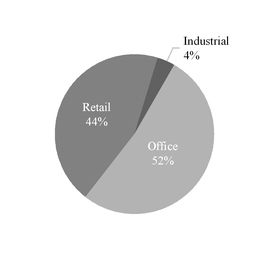

The chart below describes the diversification of our investment portfolio across real property type. Percentages in the chart correspond to the fair value as of December 31, 2016.

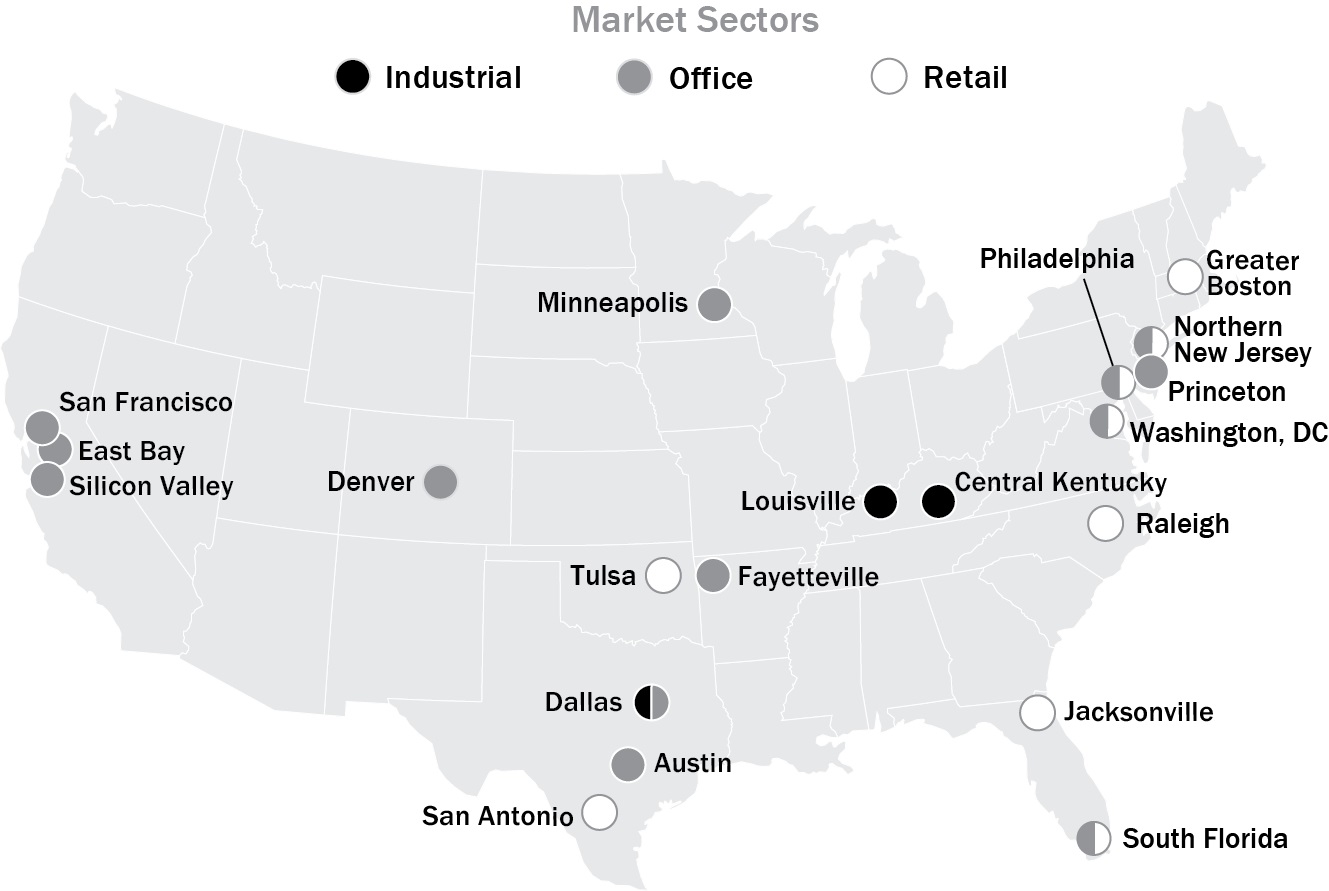

Diversification Across Geographic Regions

Through our investments in real property and debt-related investments, we also seek diversification across multiple geographic regions primarily located in the United States. The chart below shows the current allocations of our real property investments across geographic regions within the continental United States. Percentages in the chart correspond to our fair value as of December 31, 2016. Any market for which we do not show a corresponding percentage of our total fair value comprises 1% or less of the total fair value of our real property portfolio. As of December 31, 2016, our real property

- 7-

investments were geographically diversified across 20 markets. Our debt-related investments are located in three additional markets resulting in a combined portfolio allocation across 23 markets.

To date, and for the foreseeable future, the majority of our real property investments will be made in the United States, although we may also invest in Canada and Mexico, and potentially elsewhere on a limited basis, to the extent opportunities exist that may help us meet our investment objectives.

Diversification Across Tenant Profiles and Lease Terms

We believe that the tenant base that occupies our real property assets is generally stable and well-diversified. As of December 31, 2016, our consolidated operating real properties had leases with approximately 520 tenants. We intend to maintain a well-diversified mix of tenants to limit our exposure to any single tenant or industry. Our diversified investment strategy inherently provides for tenant diversity, and we continue to monitor our exposure relative to our larger tenant industry sectors. The following table describes our top ten tenant industry sectors based on annualized base rent as of December 31, 2016 (dollar and square footage amounts in thousands).

Industry Sector | Number of Leases | Annualized Base Rent (1) | % of Annualized Base Rent | Occupied Square Feet | % of Occupied Square Feet | ||||||||||

Securities, Commodity Contracts, and Other Financial Investments and Related Activities | 26 | $ | 26,026 | 15.3 | % | 677 | 8.3 | % | |||||||

Food and Beverage Stores | 40 | 24,471 | 14.4 | % | 1,640 | 20.1 | % | ||||||||

Publishing Information (except Internet) | 3 | 19,044 | 11.2 | % | 413 | 5.1 | % | ||||||||

Professional, Scientific and Technical Services | 102 | 13,205 | 7.8 | % | 589 | 7.2 | % | ||||||||

Food Services and Drinking Places | 86 | 7,108 | 4.2 | % | 233 | 2.9 | % | ||||||||

Clothing and Clothing Accessories Stores | 30 | 6,248 | 3.7 | % | 425 | 5.2 | % | ||||||||

Ambulatory Health Care Services | 57 | 5,921 | 3.5 | % | 231 | 2.8 | % | ||||||||

Credit Intermediation and Related Activities | 34 | 5,815 | 3.4 | % | 156 | 1.9 | % | ||||||||

Chemical Manufacturing | 3 | 5,509 | 3.2 | % | 461 | 5.6 | % | ||||||||

Hospitals | 2 | 4,887 | 2.9 | % | 170 | 2.1 | % | ||||||||

Other (2) | 284 | 51,648 | 30.4 | % | 3,178 | 38.8 | % | ||||||||

Total | 667 | $ | 169,882 | 100.0 | % | 8,173 | 100.0 | % | |||||||

_______________________________

(1) | Annualized base rent represents the annualized monthly base rent of executed leases as of December 31, 2016. |

- 8-

(2) | Other industry sectors include 41 additional sectors. |

Our properties are generally leased to tenants for the longer term and as of December 31, 2016, the weighted average remaining term of our leases was approximately 4.7 years, based on annualized base rent, and 4.5 years, based on leased square footage. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report on Form 10-K for a schedule of expiring leases for our consolidated operating properties by annualized base rent and square footage as of December 31, 2016.

Tenant Concentration

Rental revenue from our lease with Charles Schwab & Co., Inc. (“Schwab”), as master tenant of one of our office properties, represented approximately 11.8% of our total revenue from continuing operations for the year ended December 31, 2016. However, nine of Schwab’s subleases that comprise approximately 7.4% of our annualized base rent as of December 31, 2016 will become our direct tenants following the expiration of our lease with Schwab in 2017. These direct leases will expire between September 2020 and September 2032. See “Concentration of Credit Risk” in Note 3 to our financial statements beginning on page F-1 of this Annual Report on Form 10-K for information regarding the top five tenants as a percentage of consolidated annual base rent and occupied square feet.

Leverage

We use financial leverage to provide additional funds to support our investment activities. We calculate our leverage for reporting purposes as the outstanding principal balance of our total borrowings divided by the fair value of our real property and debt-related investments. Based on this methodology, our leverage was 45.9% as of December 31, 2016, compared to 45.4% as of December 31, 2015. There are other methods of calculating our overall leverage ratio that may differ from this methodology, such as the methodology used in determining our compliance with corporate borrowing covenants. Our current leverage target is between 40-60%. Although we will generally work to maintain the targeted leverage ratio over the near term, we may change our targeted leverage ratio from time to time. In addition, we may vary from our target leverage ratio from time to time, and there are no assurances that we will maintain the targeted range disclosed above or achieve any other leverage ratio that we may target in the future. Our board of directors may from time to time modify our borrowing policy in light of then-current economic conditions, the relative costs of debt and equity capital, the fair values of our properties, general conditions in the market for debt and equity securities, growth and acquisition opportunities or other factors.

Competition

We believe that the current market for investing in real property and debt-related investments continues to be extremely competitive and we continue to see a flight to quality for both equity and debt capital. Higher quality investments located in desirable markets are subject to strong competition. We compete with many different types of companies engaged in real estate investment activities, including other REITs, pension funds and their advisors, foreign investors, bank and insurance company investment accounts, real estate limited partnerships, various forms of banks and specialty finance companies, mutual funds, private equity funds, hedge funds, individuals and other entities. Some of these competitors, including larger REITs, have substantially greater financial and other resources than we do and generally may be able to accept more risk and leverage. They may also possess significant competitive advantages that result from, among other things, a lower cost of capital and enhanced operating efficiencies.

In addition to competing for attractive investment opportunities, the current leasing and operating environment is also extremely competitive. Improving real estate fundamentals, such as vacancy and rental rates, generally have provided us with opportunities to increase rental rates across many of our markets. However, we continue to compete with similar owners and operators of commercial real estate and, as a result, we may have to provide free rent, incur charges for tenant improvements or offer other inducements in order to compete, all of which may have an adverse impact on our results of operations.

Conflicts of Interest

We are subject to various conflicts of interest arising out of our relationship with our Advisor and other affiliates, including: (i) conflicts related to the compensation arrangements between our Advisor, certain affiliates and us, (ii) conflicts with respect to the allocation of the time of our Advisor and its key personnel and (iii) conflicts with respect to the allocation of investment and leasing opportunities. Our independent directors have an obligation to function on our behalf in all situations in which a conflict of interest may arise and have a fiduciary obligation to act on behalf of our stockholders. See “Item 13. Certain Relationships and Related Transactions, and Director Independence” of this Annual Report on Form 10-K for a description of the conflicts of interest that arise as a result of our relationships with our Advisor and its affiliates.

- 9-

Compliance with Federal, State and Local Environmental Laws

Properties that we may acquire, and the properties underlying our investments, are subject to various federal, state and local environmental laws, ordinances and regulations. Under these laws, ordinances and regulations, a current or previous owner of real estate (including, in certain circumstances, a secured lender that succeeds to ownership or control of a property) may become liable for the costs of removal or remediation of certain hazardous or toxic substances or petroleum product releases at, on, under or in its property. These laws typically impose cleanup responsibility and liability without regard to whether the owner or control party knew of or was responsible for the release or presence of the hazardous or toxic substances. The costs of investigation, remediation or removal of these substances may be substantial and could exceed the value of the property. An owner or control party of a site may be subject to common law claims by third parties based on damages and costs resulting from environmental contamination emanating from a site. Certain environmental laws also impose liability in connection with the handling of or exposure to materials containing asbestos. These laws allow third parties to seek recovery from owners of real properties for personal injuries associated with materials containing asbestos. Our operating costs and the values of these assets may be adversely affected by the obligation to pay for the cost of complying with existing environmental laws, ordinances and regulations, as well as the cost of complying with future legislation, and our income and ability to make distributions to our stockholders could be affected adversely by the existence of an environmental liability with respect to our properties. We will endeavor to ensure our properties are in compliance in all material respects with all federal, state and local laws, ordinances and regulations regarding hazardous or toxic substances or petroleum products.

Employees

The Advisory Agreement provides that our Advisor will assume principal responsibility for managing our affairs, and as a result we have no employees. See “Item 10. Directors, Executive Officers and Corporate Governance” of this Annual Report on Form 10-K for additional discussion regarding our directors and executive officers.

Available Information

This Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q, our Current Reports on Form 8-K, as well as any amendments to those reports, and proxy statements that we file with the Securities and Exchange Commission (the “Commission”) are available free of charge as soon as reasonably practicable through our website at www.dividendcapitaldiversified.com. The information contained on our website is not incorporated into this Annual Report on Form 10-K.

ITEM 1A. RISK FACTORS

RISKS RELATED TO INVESTING IN SHARES OF OUR COMMON STOCK

There is no public trading market for the shares of our common stock and we do not anticipate that there will be a public trading market for our shares; therefore, your ability to dispose of your shares will likely be limited to redemption or repurchase by us. If you do sell your shares to us, you may receive less than the price you paid.

There is no public market for the shares of our common stock and we currently have no obligation or plans to apply for listing on any public securities market. Therefore, redemption or repurchase of shares by us will likely be the only way for you to dispose of your shares. Under our share redemption programs, we will redeem shares at a price equal to the NAV per share of the class of shares being redeemed on the date of redemption, and not based on the price at which you initially purchased your shares. Pursuant to tender offers, we may purchase our shares at a discount to NAV. We may redeem Class A, Class W or Class I shares if holders of such shares fail to maintain a minimum balance of $2,000 in shares, even if your failure to meet the minimum balance is caused solely by a decline in our NAV. Subject to limited exceptions, Class A, Class W or Class I shares redeemed within 365 days of the date of purchase will be subject to a short-term trading discount equal to 2% of the gross proceeds otherwise payable with respect to the redemption, which will inure indirectly to the benefit of our remaining stockholders. As a result of this and the fact that our NAV will fluctuate, you may receive less than the price you paid for your shares upon redemption or repurchase by us.

- 10-

Our ability to redeem or repurchase your shares is limited, and our board of directors may modify, suspend or terminate our share redemption programs at any time.

Generally, our Class A, Class W and Class I share redemption program imposes a quarterly cap on aggregate net redemptions of our Class A, Class W and Class I share classes equal to the amount of shares of such classes with a value (based on the redemption price per share on the day the redemption is effected) of up to 5% of the aggregate NAV of the outstanding shares of such classes as of the last day of the previous calendar quarter.

Our current Class E share redemption program is even more limited. On an ongoing basis, it is only available for redemptions in connection with the death or disability of a stockholder. With respect to all other Class E stockholders, our board of directors evaluates each quarter whether to make liquidity available through our Class E share redemption program or through a tender offer process. Although no assurances can be made, our board of directors currently intends to make a minimum amount of liquidity available to Class E stockholders each quarter (other than liquidity made available in the event of the death or disability of a stockholder through the Class E share redemption program) in an amount that is the greater of (A) (i) funds received from the sale of Class E shares under our distribution reinvestment plan during such calendar quarter, plus (ii) 50% of the difference between (a) the proceeds (net of sales commissions) received by us from the sale of Class A, Class W and Class I shares in any public primary offering and under our distribution reinvestment plan during the most recently completed calendar quarter, and (b) the dollar amount used to redeem Class A, Class W and Class I shares during the most recently completed calendar quarter pursuant to the Class A, Class W and Class I share redemption program, less (iii) funds used for redemptions of Class E shares in the most recently completed quarter due to qualifying death or disability requests of a stockholder during such calendar quarter and (B) the amount that would result in repurchases or redemptions, during any consecutive twelve month period, at least equal to five percent of the number of Class E shares outstanding at the beginning of such twelve-month period (the “Class E Liquidity Amount”), regardless of whether such liquidity will be made available through the Class E share redemption program or a tender offer, and excluding liquidity made available in the event of the death or disability of a stockholder through the Class E share redemption program. Our board of directors may at any time decide to reduce or eliminate the Class E Liquidity Amount.

The vast majority of our assets will consist of properties which cannot generally be readily liquidated on short notice without impacting our ability to realize full value upon their disposition. Therefore, we may not always have a sufficient amount of cash to immediately satisfy redemption requests. Our board of directors may modify, suspend or terminate our share redemption programs and also may elect not to make liquidity available to Class E stockholders through a tender offer process. As a result, your ability to have your shares redeemed or purchased by us may be limited, and our shares should be considered as having only limited liquidity and at times may be illiquid. See “Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities – Share Redemption Program and Other Redemptions” of this Annual Report on Form 10-K.

Our capacity under our share redemption programs to redeem shares may be further limited if we experience a concentration of investors.

The current limitations of our share redemption programs are based, in part, on the number of outstanding shares. Thus, the ability of a single investor, or of a group of investors acting similarly, to redeem all of their shares may be limited if they own a large percentage of our shares. Similarly, if a single investor, or a group of investors acting in concert or independently, owns a large percentage of our shares, a significant redemption request by such investor or investors could significantly further limit our ability to satisfy redemption requests of other investors of such classes. Such concentrations could arise in a variety of circumstances, especially with respect to the Class A, Class W and Class I share redemption program while we have relatively few outstanding Class A, Class W and Class I shares. For example, we could sell a large number of our shares to one or more institutional investors, either in a public offering or in a private placement. In addition, we may issue a significant number of our shares in connection with an acquisition of another company or a portfolio of properties to a single investor or a group of investors that may request redemption at similar times following the acquisition. As of December 31, 2016, based on the NAV per share of $7.57 on that date, we had outstanding approximately $850.3 million in Class E shares, $15.1 million in Class A shares, $17.2 million in Class W shares, and $255.5 million in Class I shares.

A portion of the proceeds raised in the Follow-On Offering are expected to be used to redeem Class E shares, and such portion of the proceeds may be substantial.

We currently expect to use a portion of the proceeds from the Follow-On Offering to enhance liquidity for our Class E stockholders through self-tender offers and our Class E share redemption program. On an ongoing basis, our current Class E share redemption program is only available for redemptions in the event of the death or disability of a stockholder. Unless approved by our board of directors, we will not make, during any consecutive twelve-month period, redemptions in the event of

- 11-

the death or disability of a stockholder that exceed five percent of the number of Class E shares of common stock outstanding at the beginning of such twelve-month period. However, with respect to all other Class E stockholders, our board of directors evaluates each quarter whether to make liquidity available through the Class E share redemption program or through a tender offer process. Our board of directors currently intends to make liquidity available to Class E stockholders each quarter (other than liquidity made available in the event of the death or disability of a stockholder through the Class E share redemption program) in the Class E Liquidity Amount, regardless of whether such liquidity will be made available through the Class E share redemption program or a tender offer, and excluding liquidity made available in the event of the death or disability of a stockholder through the Class E share redemption program. However, our board of directors may from time to time authorize funds for redemptions of Class E shares in greater or lower amounts. Our board of directors may at any time decide to reduce or eliminate the Class E Liquidity Amount.

There has been significant demand from Class E holders to have their shares purchased pursuant to a tender offer or to have their shares redeemed under our Class E share redemption program, and we plan to use a portion of the proceeds from the Follow-On Offering to purchase or redeem Class E shares. As a result, we may have fewer offering proceeds available to retire debt or acquire additional properties, which may result in reduced liquidity and profitability or restrict our ability to grow our NAV.

With respect to liquidity for our Class E stockholders, our long-term goal is to raise sufficient proceeds in the Follow-On Offering so as to be able to accommodate those holders of Class E shares who would like to have their shares purchased pursuant to a tender offer or to have their shares redeemed under our Class E share redemption program. However, if we are not successful over time in generating liquidity to holders of our Class E shares through our self-tender offers and the Class E share redemption program, we may explore additional liquidity strategies for our Class E stockholders. There can be no assurances that we will be successful in achieving liquidity strategies for our Class E stockholders within any certain time frame or at all. In any event, our board of directors will seek to act in the best interest of the Company as a whole, taking into consideration all classes of stockholders.

You will not have the opportunity to evaluate future investments we will make with the proceeds raised in our Follow-On Offering prior to purchasing shares of our common stock.

We have not identified future investments that we will make with the proceeds of our Follow-On Offering. As a result, you will not be able to evaluate the economic merits, transaction terms or other financial or operational data concerning our future investments prior to purchasing shares of our common stock. You must rely on our Advisor and our board of directors to implement our investment policies, to evaluate our investment opportunities and to structure the terms of our investments. Because you cannot evaluate all of the investments we will make in advance of purchasing shares of our common stock, this additional risk may hinder your ability to achieve your own personal investment objectives related to portfolio diversification, risk-adjusted investment returns and other objectives.

We may raise significantly less than the maximum offering amounts in our ongoing public offerings.

We presently intend to conduct ongoing public offerings of our Class A, Class W and Class I shares of common stock pursuant to registration statements filed with the Commission. However, we may raise significantly less than the maximum amounts offered pursuant to such registration statements. The less capital we raise, the less capital we will have available to make investments in accordance with our investment strategy and policies, to provide liquidity to our stockholders and for general corporate purposes (which may include repayment of our debt or any other corporate purposes we deem appropriate).

Furthermore, the estimated use of proceeds figures presented in such registration statements and the related offering prospectuses are estimates based on a maximum raise that are derived at the beginning of each offering and are not updated throughout the offering. The actual percentage of net proceeds available to us will depend on a number of factors, including the amount of capital we raise, the actual offering costs and the portion of capital raised with respect to which we pay a primary dealer fee. For example, if we raise less than the maximum amount offered pursuant to a registration statement, we would expect the percentage of net offering proceeds available to us to be less than the estimated use of proceeds figures presented in the registration statement and related offering prospectus because many offering costs are fixed and do not depend on the amount of capital raised in the offering. In our prior offering of Class A, W and I shares that terminated on September 15, 2015, before class-specific expenses, we raised total gross proceeds of approximately $183.0 million, of which approximately 89% in net proceeds was available to us for investment, redemptions, tender offers, and other corporate purposes.

- 12-

Even if we are able to raise substantial funds in our Follow-On Offering, investors in our common stock are subject to the risk that our offering, business and operating plans may change.

Although we intend to operate as a perpetual-life REIT with an ongoing offering and share redemption programs (or self-tender offers), this is not a requirement of our charter. Even if we are able to raise substantial funds in the Follow-On Offering, if circumstances change such that our board of directors believes it is in the best interest of our stockholders to terminate our Follow-On Offering or to terminate our share redemption programs (or stop conducting self-tender offers), we may do so without stockholder approval. Our board of directors may also change our investment objectives, borrowing policies, or other corporate policies without stockholder approval. In addition, we may change the way our fees and expenses are incurred and allocated to different classes of stockholders if the tax rules applicable to REITs change such that we could do so without adverse tax consequences. Our board of directors may decide that certain significant transactions that require stockholder approval such as dissolution, merger into another entity, consolidation or the sale or other disposition of all or substantially all of our assets, are in the best interests of our stockholders. Holders of all classes of our common stock have equal voting rights with respect to such matters and will vote as a single group rather than on a class-by-class basis. Accordingly, investors in our common stock are subject to the risk that our offering, business and operating plans may change.

Valuations and appraisals of our properties, real estate-related assets and real estate-related liabilities are estimates of value and may not necessarily correspond to realizable value.

The valuation methodologies used to value our properties and certain real estate-related assets involve subjective judgments regarding such factors as comparable sales, rental revenue and operating expense data, the capitalization or discount rate, and projections of future rent and expenses based on appropriate analysis. In addition, we generally do not undertake to mark-to-market our debt investments or real estate-related liabilities, but rather these assets and liabilities are usually included in our determination of NAV at an amount determined in accordance with GAAP. As a result, valuations and appraisals of our properties, real estate-related assets and real estate-related liabilities are only estimates of current market value. Ultimate realization of the value of an asset or liability depends to a great extent on economic and other conditions beyond our control and the control of the Independent Valuation Firm and other parties involved in the valuation of our assets and liabilities. Further, these valuations may not necessarily represent the price at which an asset or liability would sell, because market prices of assets and liabilities can only be determined by negotiation between a willing buyer and seller. Valuations used for determining our NAV also are generally made without consideration of the expenses that would be incurred in connection with disposing of assets and liabilities. Therefore, the valuations of our properties, our investments in real estate-related assets and our liabilities may not correspond to the timely realizable value upon a sale of those assets and liabilities. Our NAV does not currently represent enterprise value and may not accurately reflect the actual prices at which our assets could be liquidated on any given day, the value a third party would pay for all or substantially all of our shares, or the price that our shares would trade at on a national stock exchange. There will be no retroactive adjustment in the valuation of such assets or liabilities, the price of our shares of common stock, the price we paid to redeem shares of our common stock or NAV-based fees we paid to our Advisor and our Dealer Manager to the extent such valuations prove to not accurately reflect the true estimate of value and are not a precise measure of realizable value. Because the price you will pay for shares of our common stock in our offerings, and the price at which your shares may be redeemed or repurchased by us pursuant to our share redemption programs or self-tender offers, are based on our estimated NAV per share, you may pay more than realizable value or receive less than realizable value for your investment.

In order to disclose a daily NAV, we are reliant on the parties that we engage for that purpose, in particular the Independent Valuation Firm and the appraisers that we hire to value and appraise our real estate portfolio.

In order to disclose a daily NAV, our board of directors, including a majority of our independent directors, has adopted valuation procedures that contain a comprehensive set of methodologies to be used in connection with the calculation of our NAV and caused us to engage independent third parties such as the Independent Valuation Firm, to value our real estate portfolio on a daily basis, and independent appraisal firms, to provide periodic appraisals with respect to our properties. We have also engaged a firm to act as the NAV Accountant and may engage other independent third parties or our Advisor to value other assets or liabilities. Although our board of directors, with the assistance of our Advisor, oversees all of these parties and the reasonableness of their work product, we will not independently verify our NAV or the components thereof, such as the appraised values of our properties. Our management’s assessment of the market values of our properties may also differ from the appraised values of our properties as determined by the Independent Valuation Firm. If the parties engaged by us to determine our daily NAV are unable or unwilling to perform their obligations to us, our NAV could be inaccurate or unavailable, and we could decide to suspend our offerings and our share redemption programs.

- 13-

Our NAV is not subject to GAAP, will not be independently audited and will involve subjective judgments by the Independent Valuation Firm and other parties involved in valuing our assets and liabilities.

Our valuation procedures and our NAV are not subject to GAAP and will not be subject to independent audit. Our NAV may differ from equity (net assets) reflected on our audited financial statements, even if we are required to adopt a fair value basis of accounting for GAAP financial statement purposes. Additionally, we are dependent on our Advisor to be reasonably aware of material events specific to our properties (such as tenant disputes, damage, litigation and environmental issues) that may cause the value of a property to change materially and to promptly notify the Independent Valuation Firm so that the information may be reflected in our real estate portfolio valuation. In addition, the implementation and coordination of our valuation procedures include certain subjective judgments of our Advisor, such as whether the Independent Valuation Firm should be notified of events specific to our properties that could affect their valuations, as well as of the Independent Valuation Firm and other parties we engage, as to whether adjustments to asset and liability valuations are appropriate. Accordingly, you must rely entirely on our board of directors to adopt appropriate valuation procedures and on the Independent Valuation Firm and other parties we engage in order to arrive at our NAV, which may not correspond to realizable value upon a sale of our assets.

No rule or regulation requires that we calculate our NAV in a certain way, and our board of directors, including a majority of our independent directors, may adopt changes to the valuation procedures.

There are no existing rules or regulatory bodies that specifically govern the manner in which we calculate our NAV. As a result, it is important that you pay particular attention to the specific methodologies and assumptions we use to calculate our NAV. Other public REITs may use different methodologies or assumptions to determine their NAV. In addition, each year our board of directors, including a majority of our independent directors, will review the appropriateness of our valuation procedures and may, at any time, adopt changes to the valuation procedures. For example, we generally do not undertake to mark-to-market our debt investments or real estate-related liabilities, but rather these assets and liabilities are usually included in our determination of NAV at an amount determined in accordance with GAAP. As a result, the realizable value of specific debt investments and real property assets encumbered by debt that are used in the calculation of our NAV may be higher or lower than the value that would be derived if such debt investments or property-related liabilities were marked to market. In some cases such difference may be significant. We also do not currently include any enterprise value or real estate acquisition costs in our assets calculated for purposes of our NAV. If we acquire real property assets as a portfolio, we may pay a premium over the amount that we would pay for the assets individually. Our board of directors may change these or other aspects of our valuation procedures, which changes may have an adverse effect on our NAV and the price at which you may sell shares to us under our share redemption programs (or self-tender offers). See “Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities — Net Asset Value Calculation” and our valuation procedures attached as Exhibit 99.1 to this Annual Report on Form 10-K for more details regarding our valuation methodologies, assumptions and procedures.

Our NAV per share may suddenly change if the valuations of our properties materially change from prior valuations or the actual operating results materially differ from what we originally budgeted.

It is possible that the annual appraisals of our properties may not be spread evenly throughout the year and may differ from the most recent daily valuation. As such, when these appraisals are reflected in our Independent Valuation Firm’s valuation of our real estate portfolio, there may be a sudden change in our NAV per share for each class of our common stock. Property valuation changes can occur for a variety reasons, such as local real estate market conditions, the financial condition of our tenants, or lease expirations. For example, we regularly face lease expirations across our portfolio, and as we move further away from lease commencement toward the end of a lease term, the valuation of the underlying property will be expected to drop depending on the likelihood of a renewal or a new lease on similar terms. Such a valuation drop can be particularly significant when closer to a lease expiration, especially for single tenant buildings or where an individual tenant occupies a large portion of a building. We are at the greatest risk of these valuation changes during periods in which we have a large number of lease expirations as well as when the lease of a significant tenant is closer to expiration. Similarly, if a tenant will have an option in the future to purchase one of our properties from us at a price that is less than the current valuation of the property, then if the value of the property exceeds the option price, the valuation will be expected to decline and begin to approach the purchase price as the date of the option approaches. In addition, actual operating results may differ from what we originally budgeted, which may cause a sudden increase or decrease in the NAV per share amounts. We accrue estimated income and expenses on a daily basis based on annual budgets as adjusted from time to time to reflect changes in the business throughout the year. On a periodic basis, we adjust the income and expense accruals we estimated to reflect the income and expenses actually earned and incurred. We will not retroactively adjust the NAV per share of each class for any adjustments. Therefore, because actual results from operations may be better or worse than what we previously budgeted, the adjustment to reflect actual operating results may cause the NAV per share for each class of our common stock to increase or decrease.

- 14-

New acquisitions may be valued for purposes of our NAV at less than what we pay for them, which would dilute our NAV.

Pursuant to our valuation procedures, the acquisition price of newly acquired properties will serve as our appraised value for the year of acquisition, and thereafter will be part of the rotating appraisal cycle such that they are appraised at least every calendar year. This is true whether the acquisition is funded with cash, equity or a combination thereof. However, the Independent Valuation Firm always has the ability to adjust property valuations for purposes of our NAV from the most recent appraised value. Similarly, if the Independent Valuation Firm believes that the purchase price for a recent acquisition does not reflect the current value of the property, the Independent Valuation Firm has the ability to adjust the valuation for purposes of our NAV downwards immediately after acquisition. Even if the Independent Valuation Firm does not adjust the valuation downwards immediately following the acquisition, when we obtain an appraisal on the property, it may not appraise at a value equal to the purchase price. Accordingly, the value of a new acquisition as established under our NAV procedures could be less than what we pay for it, which could negatively affect our NAV. Large portfolio acquisitions, in particular, may require a “portfolio premium” to be paid by us in order to be a competitive bidder, and this “portfolio premium” may not be taken into consideration in calculating our NAV. In addition, acquisition expenses we incur in connection with new acquisitions will negatively impact our NAV. We may make acquisitions (with cash or equity) of any size without stockholder approval, and such acquisitions may be dilutive to our NAV.

The NAV per share that we publish may not necessarily reflect changes in our NAV that are not immediately quantifiable.

From time to time, we may experience events with respect to our investments that may have a material impact on our NAV. For example, and not by way of limitation, changes in governmental rules, regulations and fiscal policies, environmental legislation, acts of God, terrorism, social unrest, civil disturbances and major disturbances in financial markets may cause the value of a property to change materially. The NAV per share of each class of our common stock as published on any given day may not reflect such extraordinary events to the extent that their financial impact is not immediately quantifiable. As a result, the NAV per share that we publish may not necessarily reflect changes in our NAV that are not immediately quantifiable, and the NAV per share of each class published after the announcement of a material event may differ significantly from our actual NAV per share for such class until such time as the financial impact is quantified and our NAV is appropriately adjusted in accordance with our valuation procedures. The resulting potential disparity in our NAV may inure to the benefit of redeeming stockholders or non-redeeming stockholders and new purchasers of our common stock, depending on whether our published NAV per share for such class is overstated or understated.

The realizable value of specific properties may change before the value is adjusted by the Independent Valuation Firm and reflected in the calculation of our NAV.

Our valuation procedures generally provide that the Independent Valuation Firm will adjust a real property’s valuation, as necessary, based on known events that have a material impact on the most recent value (adjustments for non-material events may also be made). We are dependent on our Advisor to be reasonably aware of material events specific to our properties (such as tenant disputes, damage, litigation and environmental issues, as well as positive events such as new lease agreements) that may cause the value of a property to change materially and to promptly notify the Independent Valuation Firm so that the information may be reflected in our real estate portfolio valuation. Events may transpire that, for a period of time, are unknown to us or the Independent Valuation Firm that may affect the value of a property, and until such information becomes known and is processed, the value of such asset may differ from the value used to determine our NAV. In addition, although we may have information that suggests a change in value of a property may have occurred, there may be a delay in the resulting change in value being reflected in our NAV until such information is appropriately reviewed, verified and processed. For example, we may receive an unsolicited offer, from an unrelated third party, to sell one of our assets at a price that is materially different than the price included in our NAV. Or, we may be aware of a new lease, lease expiry, or entering into a contract for capital expenditure. Where possible, adjustments generally are made based on events evidenced by proper final documentation. It is possible that an adjustment to the valuation of a property may occur prior to final documentation if the Independent Valuation Firm determines that events warrant adjustments to certain assumptions that materially affect value. However, to the extent that an event has not yet become final based on proper documentation, its impact on the value of the applicable property may not be reflected (or may be only partially reflected) in the calculation of our NAV.

Because we generally do not mark our debt investments or real estate-related liabilities to market, the realizable value of specific debt investments and real property assets that are encumbered by debt may be higher or lower than the value used in the calculation of our NAV.

We generally do not undertake to mark-to-market our debt investments or real estate-related liabilities, but rather these assets and liabilities are usually included in our determination of NAV at an amount determined in accordance with GAAP. As a

- 15-

result, the realizable value of specific debt investments and real property assets that are encumbered by debt used in the calculation of our NAV may be higher or lower than the value that would be derived if such debt investments or liabilities were marked to market. In some cases such difference may be significant. For example, in Note 8 to our financial statements beginning on page F-1 of this Annual Report on Form 10-K for the year ended December 31, 2016, we disclosed that the estimated fair value of our debt liabilities, net of the fair value of our debt investments, was $5.2 million higher than the GAAP carrying balance, meaning that if we used the fair value of our debt rather than the carrying balance, our NAV would have been lower by approximately $5.2 million as of December 31, 2016. We record all derivative instruments at fair value, which we do not expect to be significantly different from the realizable value of our derivative instruments used in the calculation of our NAV.

Due to daily fluctuations in our NAV, the price at which your purchase is executed could be higher than our NAV per share at the time you submit your purchase order, and the price at which your redemption is executed could be lower than our NAV per share at the time you submit your redemption request.

The purchase and redemption price for shares of our common stock will be determined at the end of each business day based on our NAV and will not be based on any established trading price. In our Follow-On Offering, each accepted purchase order will be executed at a price equal to our NAV per share for the class of shares being purchased next determined after the purchase order is received in good order, plus, for Class A shares sold in the primary offering only, any applicable selling commissions. For example, if a purchase order is received in good order on a business day and before the close of business (4:00 p.m. Eastern time) on that day, the purchase order will be executed at a purchase price equal to our NAV per share for the class of shares being purchased determined after the close of business on that day, plus, for Class A shares sold in the primary offering only, any applicable selling commissions. If a purchase order is received in good order on a business day, but after the close of business on that day, the purchase order will be executed at a purchase price equal to our NAV per share for the class of shares being purchased determined after the close of business on the next business day, plus, for Class A shares sold in the primary offering only, any applicable selling commissions. Similarly, redemption requests received in good order will be effected at a redemption price equal to the next-determined NAV per share for the class of shares being redeemed (subject to a 2% short-term trading discount in certain circumstances). In addition, there may be a delay between your purchase or redemption decision and the execution date caused by time necessary for you and your participating broker-dealer to put a purchase order or redemption request in “good order,” which means, for these purposes, that all required information has been completed, all proper signatures have been provided, and, for purchase orders, funds for payment have been provided. As a result of this process, you will not know the purchase or redemption price at the time you submit your purchase order or redemption request. The purchase price per share at which your purchase order is executed could be higher than the NAV per share on the date you submitted your purchase order, and the redemption price per share at which your redemption request is executed could be lower than the NAV per share on the date you submitted your redemption request.

Our NAV and the NAV of your shares may be diluted in connection with our Follow-On Offering and future securities offerings.