Attached files

| file | filename |

|---|---|

| 8-K - 8-K - U.S. CONCRETE, INC. | d939557d8k.htm |

| EX-99.3 - EX-99.3 - U.S. CONCRETE, INC. | d939557dex993.htm |

| EX-99.2 - EX-99.2 - U.S. CONCRETE, INC. | d939557dex992.htm |

Exhibit 99.1

Unless the context otherwise requires or indicates, all references to “U.S. Concrete,” the “Company,” “we,” “our” and “us” refer to U.S. Concrete, Inc., a Delaware corporation, and its subsidiaries.

Our Company

We are a leading heavy building materials supplier of aggregates and ready-mixed concrete in select geographic markets in the United States, the U.S. Virgin Islands and Canada. We are focused on growing both organically and through strategic acquisitions in our target markets, particularly within our aggregate products segment. We are a leading supplier for large-scale commercial and industrial, residential and infrastructure (including streets, highways and other public works) construction projects in high-growth markets across the country. We hold leading vertically integrated (aggregates and ready-mixed concrete) market positions in New York City, New Jersey, Dallas-Fort Worth, West Texas and the San Francisco Bay Area.

We operate our business through two primary segments: aggregate products and ready-mixed concrete. Aggregate products are granular raw materials essential in the production of ready-mixed concrete. Ready-mixed concrete is an important building material used in the vast majority of commercial, residential and infrastructure construction projects.

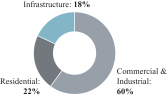

We serve substantially all segments of the construction industry in our select geographic markets. Our customers include contractors for commercial and industrial, residential and infrastructure sectors. Ready-mixed concrete product revenue by type of construction activity for the twelve months ended June 30, 2020 was approximately 60% commercial and industrial, 22% residential and 18% infrastructure.

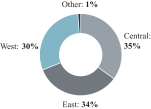

We operate principally in our East Region (which we define to include New York City, New Jersey, Washington, D.C. and Philadelphia), our Central Region (which we define as Texas and Oklahoma), and our West Region (which we define to include California and British Columbia, Canada), with those markets representing approximately 34%, 35% and 30%, respectively, of our consolidated revenue for the twelve months ended June 30, 2020. We believe we are well positioned for strong growth in these attractive regions.

Total revenue for the twelve months ended June 30, 2020 was $1.4 billion, of which we derived approximately 86% from our ready-mixed concrete segment, 10% from our aggregate products segment (excluding $57.8 million sold internally) and 4% from our other operations. For the twelve months ended June 30, 2020, we had net income attributable to U.S. Concrete of $20.4 million, net income of $21.7 million and our Adjusted EBITDA (as defined herein) was $189.4 million, which includes $154.9 million from our ready-mixed concrete reporting segment and $64.1 million from our aggregate products reporting segment offset by the negative impact of $(29.6) million of eliminations and other corporate allocations. See “Summary Historical and Pro Forma Financial and Other Data” for a reconciliation of Adjusted EBITDA to income from continuing operations.

| Revenue by region (twelve months ended June 30, 2020) | Ready-mixed revenue by end market (twelve months ended June 30, 2020) | |

|

|

| |

As of June 30, 2020, we operated 176 standard and portable ready-mixed concrete plants, 16 volumetric ready-mixed concrete plants, 20 producing aggregates facilities, and seven aggregates distribution terminals. During the twelve months ended June 30, 2020, these plants and facilities produced approximately 8.8 million cubic yards of ready-mixed concrete and 12.5 million tons of aggregates. As of June 30, 2020, we owned or leased more than 1,619 drum mixer trucks and 114 volumetric mixer trucks.

Recent Developments

Impact of COVID-19

On March 11, 2020, the World Health Organization characterized the outbreak of COVID-19 as a global pandemic and recommended containment and mitigation measures. On March 13, 2020, the United States declared a national emergency concerning the outbreak, and several states and municipalities have declared public health emergencies. Residents throughout the U.S. have spent varying periods under “stay-at-home” or “shelter-in-place” orders. The full, long-term impacts of the pandemic are unknown and rapidly evolving.

Construction has generally been considered an “essential” service and thus excluded from many stay-at-home orders. While we generally remained operational during the second quarter of 2020 in the regions we serve with the implementation of new, enhanced safety and health protocols, certain of our operations were more negatively impacted, particularly in April and May 2020, in states with more stringent restrictions. For example, our ready-mixed concrete sales decreased $39.8 million during the six months ended June 30, 2020 compared to the six months ended June 30, 2019, primarily resulting from a decline in ready-mixed concrete operations in New York and California, both of which had more stringent restrictions relating to COVID-19. However, as restrictions gradually lifted in many of these areas, construction levels began improving.

We continue to monitor the impact on our customers and our ongoing projects and pipeline. The business contingency plans and cost-cutting measures that we have implemented, and continue to implement, across our operations, which are continually reviewed and updated in response to the evolving pandemic, helped to mitigate the impact from the decrease in ready-mixed concrete sales volumes on our operating income in the second quarter of 2020. Given the unprecedented uncertainty surrounding COVID-19, we are currently unable to estimate the impact the pandemic will have on our results of operations for the full year of 2020 and beyond.

For a more detailed description of the risk posed to us by the COVID-19 pandemic, see “Risk Factors—Risks Related to Our Business—Our business could be materially and adversely disrupted by an epidemic or pandemic, or similar public threat, or fear of such an event, and the measures that international, federal, state and local governments, agencies, law enforcement and/or health authorities implement to address it.”

2

Voluntary Reduction in Commitments under Revolving Facility

On July 30, 2020, we elected to permanently reduce our revolving commitments under the Revolving Facility from $350.0 million to $300.0 million effective August 4, 2020. The reduction does not affect our current available liquidity.

Key Strategic Acquisitions

Our revenue has more than doubled since 2014, due in part to our acquisitions, which we have funded through existing cash balances, debt and equity. During 2017, we expanded our operations with the acquisitions of the assets of Corbett Aggregate Companies, LLC (“Corbett”) located in Quinton, New Jersey; Harbor Ready-Mix located in Redwood City, California; A-1 Materials, Inc. and L.C. Frey Company, Inc. located in San Carlos, California; and Action Supply Co., Inc. located in Philadelphia, Pennsylvania; and the outstanding common stock of Polaris Materials Corporation (“Polaris”) located in British Columbia, Canada. The Polaris acquisition added a significant amount of aggregates production and reserves to our portfolio, represented a key step in our vertical integration for the San Francisco Bay Area, and provides us a broader growth platform for the entire West Coast. Beyond our traditional markets, Polaris also serves aggregates-only markets in Southern California and Hawaii. The Corbett acquisition increased our vertical integration in the New York City Area. The 2017 acquisitions included two aggregate facilities with approximately 130 million tons of proven aggregates reserves, seven ready-mixed concrete plants, 51 mixer trucks and four aggregate distribution terminals.

During 2018, we expanded our operations with the acquisitions of the assets of: Golden Spread Redi-Mix located in Amarillo, Texas; On Time Ready Mix, Inc. located in Flushing, New York; Leon River Aggregate Materials, LLC located in Proctor, Texas; and two individually immaterial ready-mixed concrete operations located in our East Region and Central Region. The combined assets acquired through our 2018 acquisitions included 149 mixer trucks, 20 ready-mixed concrete plants and two aggregates facilities, significantly expanding our ready-mixed concrete operations in the East Region and our ready-mixed concrete and aggregate products operations in the Central Region.

Consistent with our strategy to vertically integrate by growing our aggregates business, on February 24, 2020, we acquired all of the equity of Coram Materials Corp. and certain of its affiliates (collectively, “Coram”) for total consideration of $142.9 million, subject to certain post-closing adjustments (the “Coram Acquisition”). We funded the Coram Acquisition with borrowings under our Revolving Facility. Coram is a premier provider of high-quality sand and gravel products located on Long Island, New York. Coram’s operations supply natural sand to the New York City area, which is used in concrete and other applications across industry sectors and within all construction categories. The assets acquired through the Coram Acquisition included an aggregates facility with 330 acres of land, including 180 mining acres containing approximately 41.9 million tons of in-place, proven and permitted aggregate reserves and approximately 7.5 million tons of in-place, proven, but unpermitted reserves. The Coram Acquisition increases the vertical integration of our New York City operations and reduces our dependency on third-party suppliers. In addition, the Coram Acquisition strengthens our competitive position, while furthering our strategy of expanding into higher margin aggregates businesses at attractive valuations.

Our Business

Aggregate Products

We produce crushed stone, sand and gravel from 20 aggregates facilities located in New Jersey, Texas, Oklahoma, the U.S. Virgin Islands and British Columbia, Canada. We sell these aggregates for use in commercial, industrial and public works projects in the markets we serve, as well as consume them internally in

3

the production of ready-mixed concrete. We produced approximately 12.5 million tons of aggregates during the twelve months ended June 30, 2020, with British Columbia, Canada representing 42%, Texas and Oklahoma representing 33%, New Jersey representing 23% and the U.S. Virgin Islands representing 2% of the total production. While we sold 34% of this production internally in the twelve months ended June 30, 2020, we currently sell the majority of our aggregate products to third parties. We believe our aggregates reserves provide us with additional raw materials sourcing flexibility and supply availability.

Ready-mixed Concrete

Our ready-mixed concrete business engages principally in the formulation, preparation and delivery of ready-mixed concrete to our customers’ job sites. We provide our ready-mixed concrete from our operations in Texas, New Jersey, New York City, Washington, D.C., Philadelphia, Northern California, Oklahoma and the U.S. Virgin Islands. Ready-mixed concrete is a highly versatile construction material that results from combining coarse and fine aggregates, such as gravel, crushed stone and sand, with water, various chemical admixtures and cement. We also provide services intended to reduce our customers’ overall construction costs by lowering the installed, or “in-place,” cost of concrete. These services include the formulation of mixtures for specific design uses, on-site and lab-based product quality control and customized delivery programs to meet our customers’ needs. We generally do not provide paving or other finishing services, which construction contractors or subcontractors typically perform.

Our standard ready-mixed concrete products consist of proportioned mixes we produce and deliver in an unhardened plastic state for placement and shaping into designed forms at the job site. Selecting the optimum mix for a job entails determining not only the ingredients that will produce the desired permeability, strength, appearance and other properties of the concrete after it has hardened and cured, but also the ingredients necessary to achieve a workable consistency considering the weather and other conditions at the job site. We believe we can achieve product differentiation for the mixes we offer because of the variety of mixes we can produce, our volume production capacity and our scheduling, delivery and placement reliability. Additionally, we believe our environmentally friendly technology initiative, which utilizes alternative materials and mix designs that result in lower CO2 emissions, helps differentiate us from our competitors. We also believe we distinguish ourselves with our value-added service approach that emphasizes reducing our customers’ overall construction costs by reducing the in-place cost of concrete and the time required for construction.

Our volumetric concrete operations, the largest volumetric operation in the country, expand our ready-mixed concrete delivery and service offerings primarily in Texas. Volumetric ready-mixed concrete trucks mix concrete to the customer’s specification on the job site, better serving smaller jobs and specialized applications, and allowing flexibility for servicing remote job locations. Because of their versatility, these trucks offer the contractor multiple options for a single job without the inconvenience or added costs typically associated with standard ready-mixed trucks delivering special or short-loads to a job site. Because of their unique on-demand production capabilities, these trucks minimize the amount of wasted concrete, which improves margins and reduces environmental impact.

We also provide portable and mobile concrete plants for high-volume or remote projects. While currently operating predominantly in our existing regions, our fast-track mobilization business unit, U.S. Concrete On-Site, Inc., can dispatch a portable or mobile ready-mixed concrete plant anywhere in the continental U.S. These mobile solutions have reached an exceptional level of turnkey operations customized to deliver outstanding on-site solutions for all types of concrete construction. Not only are we providing industry leading concrete production operations to our customers, we are providing technical services and a substantial mitigation of risk with on-site production.

4

Other

Other products include our building materials stores, hauling operations, aggregates distribution terminals, a recycled aggregates operation and concrete blocks. Two specific products included in this category are ARIDUS® Rapid Drying Concrete technology and the Where’s My Concrete?TM family of web and mobile applications. ARIDUS Rapid Drying Concrete reduces the drying time and risks associated with excess moisture vapor in concrete slabs, enabling faster, more effective floor topping installations. ARIDUS was developed and patented by U.S. Concrete’s National Research Laboratory, USC Technologies, Inc., to address changes in environmental government regulations that limit or restrict volatile organic compounds in flooring adhesives. Where’s My Concrete? is our real-time cloud-based data delivery program that helps concrete producers provide value-added service and transparency to their customers, while improving their own business through critical analytics and operational efficiencies. We use this program in our operations as well as market it to third parties.

Competitive Strengths

Large, high quality, vertically integrated asset base in attractive construction markets. Our core competitive strength lies in building strong, vertically integrated market positions in complex urban environments that require manufacturing and time-sensitive delivery of high performance concrete in challenging settings.

We have developed strategic raw materials sourcing capabilities, particularly our aggregate and sand vertical integration in areas of the country where aggregates are expensive and depleting. These sources coupled with our water borne and strategically located docks further strengthens our self-supply model.

Our ability to internally source aggregates requirements for our most challenging projects, and in every market we serve, gives us a distinct competitive strength. Zoning and permitting regulations make it difficult to permit new quarries and ready-mixed concrete plants in many of the markets we serve. This acts as a barrier to entry that makes our strong market positions more valuable. In addition, our business is uniquely local and given the relatively low selling price of aggregates, transportation costs can quickly exceed the product cost. Further, due to the occurrence of chemical reactions during transport, concrete is a perishable product and must be unloaded within 60 to 90 minutes from being loaded into the mixer truck at the concrete batch plant. These factors serve to make our strategic locations near highly attractive, large and growing construction markets a meaningful competitive advantage.

Our sourcing network extends and supports our large, high quality asset base, which is comprised of 192 ready mixed concrete plant facilities, 20 aggregates facilities and seven distribution terminals, and is well positioned to supply large, complex projects in large metropolitan markets that are difficult to serve. Such projects include infrastructure projects with complex Federal Highway Administration or Federal Aviation Administration specifications and extensive delivery requirements. Our comprehensive asset base enables greater efficiencies and asset utilization, while scale leverages purchasing power advantages and delivery and asset utilization efficiencies.

Our national research laboratory, while working closely with each of our regional laboratories, is developing industry leading solutions and ensuring local capability needs are met. Concrete mix design expertise and the ability to meet stringent specifications through the work of these labs is yet another competitive strength that ties the more upstream raw material sourcing and asset base to our downstream value-added products.

Top 3 positions in favorable geographic markets with attractive fundamentals. We operate in favorable construction markets where we believe we have an advantage compared to our competitors given our ability to handle complex projects across a broad array of industry sectors. We have a large, high-quality asset

5

base focused in the Texas/Oklahoma, Northern California, New York City/New Jersey, Washington, D.C. and the U.S. Virgin Islands markets. Our management team believes we have a leading market position in all of our geographic markets.

Focus on environmental sustainability. Sustainability and environmentally friendly solutions continue to grow and be in high demand in our industry, and we expect domestic and global sustainable demand to continue to grow at attractive rates. We are a leader in the sustainable concrete market, and we take pride in our commitment to deliver these critical solutions. We were the first company in the United States concrete industry to adopt the 2030 Challenge to develop Environmental Product Declarations (“EPD”) for our ready-mixed concrete products. This challenge, issued by Architecture 2030, calls on architecture, planning and building industries worldwide to specify, design and manufacture products that meet specific carbon reduction targets between now and the year 2030. Our operating unit in Northern California, Central Concrete Supply Co., was the first of our business units to adopt the challenge, and our EPD adoption spread across the Company. Currently, our operating units combined have over 15,000 EPDs.

Beyond EPDs, we have found a competitive strength in low CO2 concrete mix designs aimed at reducing a construction project’s total carbon footprint. Our national and regional research laboratories have developed significant expertise in concrete mix design, enabling industry leading solutions while ensuring local capability needs are met. For example, our early development of EF® Technology lead to development and adoption of many CO2 reducing capabilities from raw material substitution to injecting CO2 into concrete mixes to sequester it and improve the performance of the concrete. Our EF Technology innovation and other sustainability measures also positively affect the performance of the final product, further enhancing our value proposition.

Long-term customer relationships. Our management and sales personnel focus on developing and maintaining successful long-term relationships with our key customers. Customer concentration in our key markets allows us to better serve our new and existing customers with expedited delivery, lower transportation costs and scale efficiencies. Key elements of our customer-focused approach include: (i) corporate-level marketing and sales expertise; (ii) technical service expertise to develop innovative new branded products; and (iii) training programs that emphasize successful marketing and sales techniques that focus on the sale of high-margin concrete mix designs.

Our customer engagement model results in contractors returning year after year to us as a supplier they can trust. In 2019, no single customer or project accounted for more than 10% of our total revenue. For the twelve months ended June 30, 2020, we had more than 8,000 active customers and more than 21,000 total projects. Our top 20 customers and top 100 projects in terms of revenue represented 24% and 27%, respectively, of work performed during the twelve months ended June 30, 2020. Our broad, yet targeted, customer base enables us to develop an efficient, stable business model and tap into the market in a variety of ways. We believe that by providing high quality, reliable services and customized products and solutions, we are able to maintain important long-term relationships. To further entrench our customer relationships, we have invested in technology, such as our proprietary dispatch and analytics system, Where’s My Concrete?, providing a higher level of service and real-time information to our customers.

A top supplier to large and complex commercial projects. We provide alternative solutions for designers and contractors by offering value-added concrete products, such as color-conditioned, fiber-reinforced, steel reinforced and high-performance concrete. We believe this innovation enhances our ability to compete for and win supply contracts for some of the largest and most prestigious commercial projects.

6

Selected commercial projects

| Project |

Location |

Cubic Yards |

Status |

|||||||

| LaGuardia Airport* |

Queens, New York | 355,000 | In Progress | |||||||

| Newark Airport Terminal A - Paving |

Newark, New Jersey | 145,320 | In Progress | |||||||

| Charles Schwab Westlake Campus |

Westlake, Texas | 141,526 | In Progress | |||||||

| Passport Park |

DFW Airport, Texas | 108,440 | In Progress | |||||||

| NTI Expressway |

Tarrant County, Texas | 101,244 | In Progress | |||||||

| 66 Hudson Blvd |

Manhattan New York | 90,000 | In Progress | |||||||

| Adobe North Tower Office Building |

San Jose, California | 83,000 | In Progress | |||||||

| 200 Park Avenue |

San Jose, California | 81,506 | In Progress | |||||||

| The Village Town Center |

Dallas, Texas | 80,000 | In Progress | |||||||

| Google Caribbean Mt. View |

Mt. View, California | 75,000 | Upcoming | |||||||

| Carter Distribution |

Fort Worth, Texas | 65,100 | In Progress | |||||||

| UTSW BICC, Dallas-Vaughn |

Dallas, Texas | 65,010 | In Progress | |||||||

| I680 / SR 4 Interchange |

Martinez, California | 65,000 | In Progress | |||||||

| Columbus Hi Rise |

Jersey City, New Jersey | 65,000 | In Progress | |||||||

| Texas Instruments RFA2 |

Richardson, Texas | 60,000 | In Progress | |||||||

| * | Joint venture with two other providers. |

Solid balance sheet and ample liquidity. We have successfully improved our financial performance by refocusing our financial objectives over the past several years. Our management team has focused on reducing our cost structure while expanding our existing and acquired businesses in our core operating regions to drive strong performance. As a result, we have grown revenue, improved profit margins and increased liquidity. We benefit from available liquidity through our Revolving Facility, Delayed Draw Facility and cash flow from operations. We believe our solid balance sheet and ample liquidity will allow us to take advantage of strategic opportunities as well as provide ample cushion against general downturns in economic activity.

Demonstrable track record of successful acquisitions. Our ability to replicate our business model successfully through strategic acquisitions is another competitive strength. Our mergers and acquisitions team has deep industry relationships, which facilitate proprietary sourcing of successful acquisitions. A repeatable acquisition and integration process maximizes our synergies.

Experienced management team. Our senior management team consists of 15 executives with an average of more than 25 years of experience and is comprised of individuals with a proven track record in the construction materials industry. Ronnie Pruitt has served as Chief Executive Officer since April 2020 and has over 25 years of construction materials industry experience, including having previously served as President and Chief Operating Officer from April 2019 to April 2020. John E. Kunz has served as our Senior Vice President and Chief Financial Officer since 2017 and has extensive financial management experience. Our management team’s deep market knowledge enables us to effectively assess potential new opportunities to solidify our leading market presence. We will continue to focus on recruiting and retaining motivated and knowledgeable professional managers to continue to develop our business and maintain our leading market positions.

These strengths give us distinct competitive advantages, and together have allowed us to grow and continue our positive momentum into the future. The ability to self-supply aggregates and use our technical expertise to design and track our shipments, coupled with our intense focus on operational excellence will further our model of continuous improvement.

7

Our Business Strategy

We strive to be the top one or two producer in the ready-mixed concrete markets we serve and operate in some of the fastest growing and most attractive metropolitan markets in the United States, including New York City, Philadelphia, Washington, D.C., Dallas-Fort Worth and the San Francisco Bay Area. These markets represent five of the top 12 metropolitan statistical areas. Our business is uniquely local. Given the relatively low selling price of aggregates, transportation costs can quickly exceed the product cost. Further, due to the chemical reaction while in the mixer truck, concrete is a perishable product and must be unloaded within 60 to 90 minutes from being loaded at the concrete batch plant.

Our business strategies are (1) vertically integrate through aggregates, (2) market focus, including growing our markets through acquisitions, (3) do what we know and (4) focus on growing profits.

Vertically integrate through aggregates. Our ready-mixed concrete operations consume a significant amount of aggregates. Aggregates are a major component in ready-mixed concrete, comprising approximately 75% by weight. We believe our ready-mixed concrete operations where we are vertically integrated through aggregates have a competitive advantage. Internally sourcing aggregates provides a consistent and reliable stream of raw materials for our ready-mixed concrete operations. In addition to consuming high margin aggregates internally, third party sales are available for other aggregate products. These high margin sales enhance our profitability. Aggregates also provide an additional growth segment for us to expand through strategic acquisitions.

Market focus—Go where the people are. Markets drive our strategic growth initiatives. There are 11 identified megaregions in the United States that drive 75% of the gross domestic product and house 70% of the nation’s population, but only represent 20% of the U.S. land mass. By focusing on these megaregions, we can be very deliberate on how and when we enter markets. Further, by being selective on which markets we want to be in and the projects we want to pursue, we can spend more time on developing relationships with the targets we prioritize. We are focused on building strong, defensible positions in strong, growing and vibrant markets, which are very difficult to replicate.

Do what we know. We expect to be a leading supplier of heavy building materials in our current and future markets. We are dedicated to increasing our aggregates positions and related downstream products, such as ready-mixed concrete.

Drive margin improvement. We are focused on driving continuous improvement, resulting in increasing profit margins. We believe we are best in class in ready-mixed concrete margins, but there is still more work to be done. We will continue to push new technology, sales programs, raw material sourcing, and any opportunity to drive more profit while operating safely.

Our Industry

Aggregates. The aggregates industry produces engineered granular materials consisting of crushed stone, gravel, and sand of varying mineralogies, manufactured to specific grades and sizes for use in downstream construction applications. Crushed stone, sand, and gravel are used as aggregate in foundations for infrastructure and buildings or as road base. Crushed stone is also an input to cement, concrete products, and personal consumer goods. The National Stone, Sand & Gravel Association (“NSSGA”) estimates that the U.S. domestic production and use of construction aggregates amounted to 2.5 billion tons of crushed stone, sand and gravel, valued at $25.1 billion. The aggregates industry employs approximately 100,000 highly skilled men and women. Due to high transportation costs, approximately 90% of aggregates are consumed within 50 miles of the place of extraction.

8

Ready-mixed Concrete. Ready-mixed concrete manufacturers produce concrete and deliver it in an unhardened state to end users, such as contractors, who then place and form the concrete at construction sites. Downstream applications include commercial, industrial, residential, infrastructure, and other construction sectors. The industry is composed of varying sized family owned businesses to multi-national corporations. As concrete is a perishable product, production facilities are typically located within 60 to 90 minutes from construction projects. The National Ready Mixed Concrete Association (“NRMCA”) estimated there were about 6,800 ready-mixed concrete plants and 70,000 ready-mixed concrete mixer trucks that delivered approximately 371 million cubic yards of product to the point of placement, accounting for $40 billion in revenue across the United States in 2019. For 2020, the NRMCA projects that annual production of ready-mixed concrete will be 394.7 million cubic yards.

The key drivers for aggregates and ready-mixed concrete include infrastructure funding, residential construction spending, private non-residential construction spending, fluctuations in interest rates, weather conditions, and national, regional and local economic conditions. Ready-mixed concrete and aggregates are used in streets and highways, foundations and suspended floors, tilt walls, transportation terminals, sporting stadiums and petrochemical plants, among other uses.

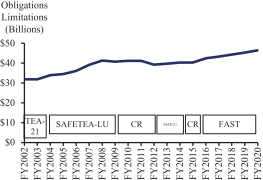

| Federal Highway Spending | State Transportation Spending, change from previous year | |

|

| |

| Source: Federal Highway Administration Fiscal Year 2012 and Fiscal Year 2020 Budget | Source: National Association of State Budget Officers | |

Infrastructure Spending. We expect that U.S. infrastructure, including transportation, water, and other systems, will continue to benefit from strong investment for years to come. The country’s vast network of transportation infrastructure, power grids, and communications facilities are aging and in need of repair and upgrade. In 2017, the American Society of Civil Engineers gave U.S. infrastructure a grade of D+, indicating significant under investment. In 2018, the Department of Transportation reported that 64% of highways were in less than good condition and 25% of bridges were in need of significant repair amounting to an estimated backlog of $836 billion of capital and investment needs.

9

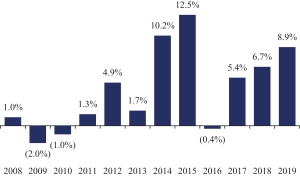

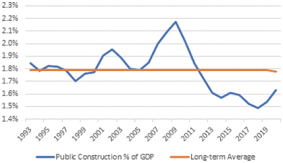

| Private Construction Investment % of GDP | Public Construction Investment % of GDP | |

|

| |

Source: U.S. Census Bureau and U.S. Bureau of Economic Analysis

Residential Construction. U.S. residential new construction peaked in 2006 before the economic downturn drove new home construction to Depression-era levels. Since 2011, the recovery of residential new construction has generated increasing demand for aggregates and concrete. We expect the housing recovery to continue, supported by favorable interest rates, housing inventory levels, and millennials increasingly entering the housing market. Average industry forecasts from leading industry associations (e.g., National Association of Homebuilders, National Association of Realtors, Mortgage Bankers Association and Fannie Mae) suggests total housing starts (both single and multi-family) will grow from 1.29 million in 2019 to 1.35 million in 2022, representing a 1.3% compounded annual growth rate.

Commercial Construction. The commercial construction market contracted significantly during the economic downturn as the construction of commercial buildings such as office buildings, warehouses, commercial and industrial buildings slowed. In recent years, however, the market has experienced sustained growth as the economy continues a slow but steady recovery. The steady recovery of the non-residential construction industry is observed in the Dodge Momentum Index, a leading indicator which has shown steady improvement in the market since the economic downturn. We expect continued growth in commercial construction market subsectors, including warehouses, distribution centers and data centers. According to ConstructConnect’s Commercial Construction Insight, while the U.S. commercial construction outlook is expected to decline 27.9% in 2020, it is expected to grow 17.5% in 2021.

10