Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Professional Holding Corp. | tmb-20200908x8k.htm |

Exhibit 99.1

| LOAN MODIFICATION SUMMARY SEPTEMBER 8, 2020 COVID-19 |

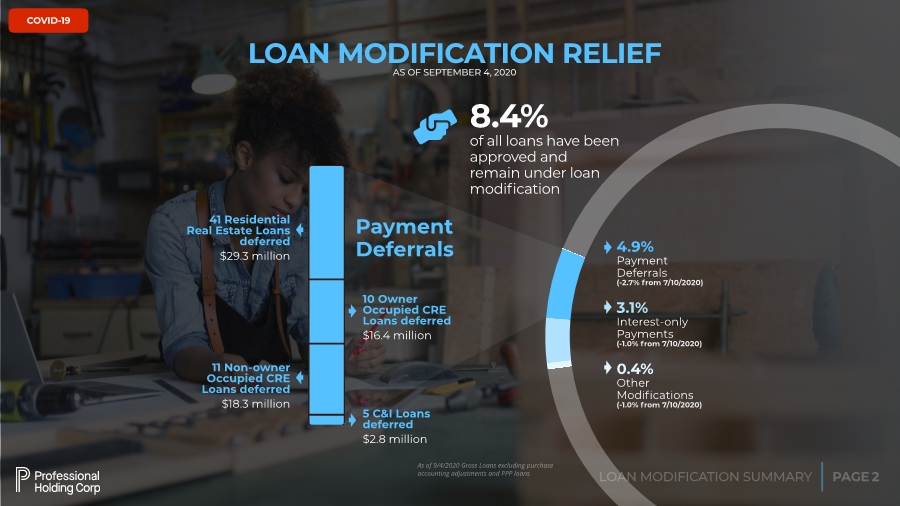

| COVID-19 PAGE LOAN MODIFICATION SUMMARY 2 8.4% of all loans have been approved and remain under loan modification Payment Deferrals 11 Non-owner Occupied CRE Loans deferred $18.3 million 41 Residential Real Estate Loans deferred $29.3 million 10 Owner Occupied CRE Loans deferred $16.4 million 5 C&I Loans deferred $2.8 million LOAN MODIFICATION RELIEF AS OF SEPTEMBER 4, 2020 4.9% Payment Deferrals (-2.7% from 7/10/2020) 3.1% Interest-only Payments (-1.0% from 7/10/2020) 0.4% Other Modifications (-1.0% from 7/10/2020) ! As of 9/4/2020 Gross Loans excluding purchase accounting adjustments and PPP loans |

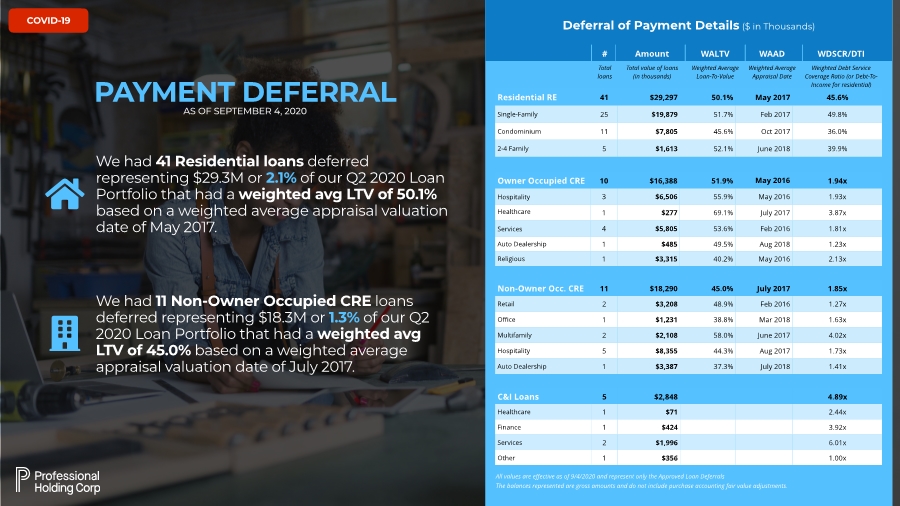

| COVID-19 PAGE LOAN MODIFICATION SUMMARY 3 C&I Loans 5 $2,848 4.89x Healthcare 1 $71 2.44x Finance 1 $424 3.92x Services 2 $1,996 6.01x Other 1 $356 1.00x All values are effective as of 9/4/2020 and represent only the Approved Loan Deferrals The balances represented are gross amounts and do not include purchase accounting fair value adjustments. # Amount WALTV WAAD WDSCR/DTI Total loans Total value of loans (in thousands) Weighted Average Loan-To-Value Weighted Average Appraisal Date Weighted Debt Service Coverage Ratio (or Debt-To- Income for residential) Non-Owner Occ. CRE 11 $18,290 45.0% July 2017 1.85x Retail 2 $3,208 48.9% Feb 2016 1.27x Office 1 $1,231 38.8% Mar 2018 1.63x Multifamily 2 $2,108 58.0% June 2017 4.02x Hospitality 5 $8,355 44.3% Aug 2017 1.73x Auto Dealership 1 $3,387 37.3% July 2018 1.41x Owner Occupied CRE 10 $16,388 51.9% May 2016 1.94x Hospitality 3 $6,506 55.9% May 2016 1.93x Healthcare 1 $277 69.1% July 2017 3.87x Services 4 $5,805 53.6% Feb 2016 1.81x Auto Dealership 1 $485 49.5% Aug 2018 1.23x Religious 1 $3,315 40.2% May 2016 2.13x Residential RE 41 $29,297 50.1% May 2017 45.6% Single-Family 25 $19,879 51.7% Feb 2017 49.8% Condominium 11 $7,805 45.6% Oct 2017 36.0% 2-4 Family 5 $1,613 52.1% June 2018 39.9% Deferral of Payment Details ($ in Thousands) PAYMENT DEFERRAL AS OF SEPTEMBER 4, 2020 We had 41 Residential loans deferred representing $29.3M or 2.1% of our Q2 2020 Loan Portfolio that had a weighted avg LTV of 50.1% based on a weighted average appraisal valuation date of May 2017. " We had 11 Non-Owner Occupied CRE loans deferred representing $18.3M or 1.3% of our Q2 2020 Loan Portfolio that had a weighted avg LTV of 45.0% based on a weighted average appraisal valuation date of July 2017. # |

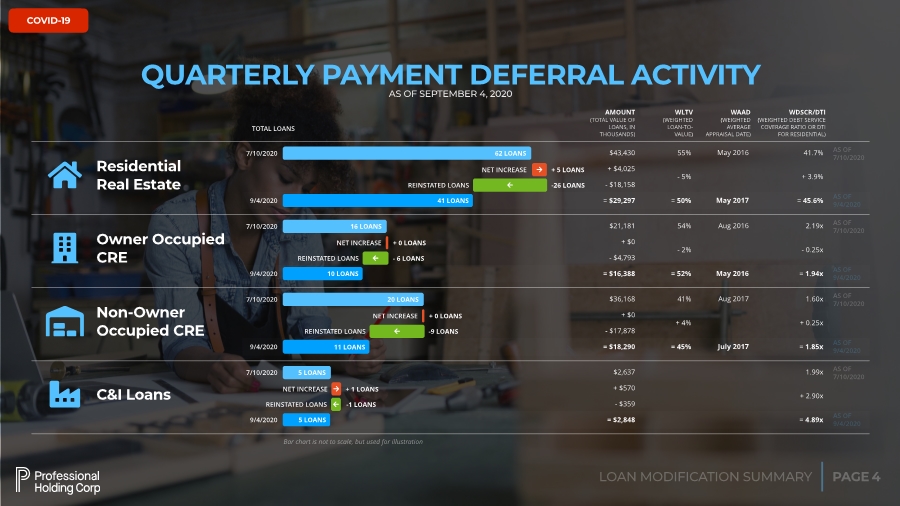

| COVID-19 PAGE LOAN MODIFICATION SUMMARY 4 QUARTERLY PAYMENT DEFERRAL ACTIVITY AS OF SEPTEMBER 4, 2020 ! 7/10/2020 Residential Real Estate 62 LOANS 9/4/2020 41 LOANS NET INCREASE " + 5 LOANS REINSTATED LOANS # -26 LOANS $43,430 + $4,025 - $18,158 = $29,297 55% - 5% = 50% TOTAL LOANS AMOUNT (TOTAL VALUE OF LOANS, IN THOUSANDS) AS OF 9/4/2020 41.7% + 3.9% = 45.6% WLTV (WEIGHTED LOAN-TO- VALUE) May 2016 May 2017 WAAD (WEIGHTED AVERAGE APPRAISAL DATE) WDSCR/DTI (WEIGHTED DEBT SERVICE COVERAGE RATIO OR DTI FOR RESIDENTIAL) AS OF 7/10/2020 $ 7/10/2020 Owner Occupied CRE 16 LOANS 9/4/2020 10 LOANS NET INCREASE + 0 LOANS REINSTATED LOANS # - 6 LOANS $21,181 + $0 - $4,793 = $16,388 54% - 2% = 52% AS OF 9/4/2020 2.19x - 0.25x = 1.94x Aug 2016 May 2016 AS OF 7/10/2020 % 7/10/2020 Non-Owner Occupied CRE 20 LOANS 9/4/2020 11 LOANS NET INCREASE + 0 LOANS REINSTATED LOANS # -9 LOANS $36,168 + $0 - $17,878 = $18,290 41% + 4% = 45% AS OF 9/4/2020 1.60x + 0.25x = 1.85x Aug 2017 July 2017 AS OF 7/10/2020 & 7/10/2020 C&I Loans 5 LOANS 9/4/2020 5 LOANS NET INCREASE " + 1 LOANS REINSTATED LOANS # -1 LOANS $2,637 + $570 - $359 = $2,848 AS OF 9/4/2020 1.99x + 2.90x = 4.89x AS OF 7/10/2020 Bar chart is not to scale, but used for illustration |