Attached files

| file | filename |

|---|---|

| 8-K - 8-K - W R GRACE & CO | a082020presentation8-k.htm |

Investor Presentation August 2020

DISCLAIMER Statement Regarding Safe Harbor For Forward-Looking Statements This presentation and the exhibits hereto contain forward-looking statements, that is, information related to future, not past, events. Such statements generally include the words “believes,” “plans,” “intends,” “targets,” “will,” “expects,” “suggests,” “anticipates,” “outlook,” “continues,” or similar expressions. Forward-looking statements include, without limitation, statements regarding: expected financial positions; results of operations; cash flows; financing plans; business strategy; operating plans; capital and other expenditures; impact of COVID-19 on Grace's business; competitive positions; growth opportunities for existing products; benefits from new technology; benefits from cost reduction initiatives, plans and objectives; succession planning; and markets for securities. For these statements, Grace claims the protections of the safe harbor for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act. Grace is subject to risks and uncertainties that could cause actual results or events to differ materially from its projections or that could cause other forward-looking statements to prove incorrect. Factors that could cause actual results or events to differ materially from those contained in the forward-looking statements include, without limitation: risks related to foreign operations, especially in areas of active conflicts and in emerging regions; the costs and availability of raw materials, energy and transportation; the effectiveness of Grace’s research and development and growth investments; acquisitions and divestitures of assets and businesses; developments affecting Grace’s outstanding indebtedness; developments affecting Grace's pension obligations; legacy matters (including product, environmental, and other legacy liabilities) relating to past activities of Grace; its legal and environmental proceedings; environmental compliance costs (including existing and potential laws and regulations pertaining to climate change); the inability to establish or maintain certain business relationships; the inability to hire or retain key personnel; natural disasters such as storms and floods; fires and force majeure events; the economics of our customers’ industries, including the petroleum refining industry; public health and safety concerns, including pandemics and quarantines; changes in tax laws and regulations; international trade disputes, tariffs, and sanctions; the potential effects of cyberattacks; and those additional factors set forth in Grace's most recent Annual Report on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, which have been filed with the Securities and Exchange Commission and are readily available on the internet at www.sec.gov. Grace’s reported results should not be considered as an indication of its future performance. Readers are cautioned not to place undue reliance on Grace's projections and forward-looking statements, which speak only as of the dates those projections and statements are made. Grace undertakes no obligation to release publicly any revisions to the projections and forward- looking statements contained in this presentation and the exhibits thereto, or to update them to reflect events or circumstances occurring after the date of this presentation. Non-GAAP Financial Measures In this presentation, Grace presents financial information in accordance with U.S. generally accepted accounting principles (U.S. GAAP), as well as the non-GAAP financial information described in the Appendix. Grace believes that this non-GAAP financial information provides useful supplemental information about the performance of its businesses, improves period-to-period comparability, and provides clarity on the information management uses to evaluate the performance of its businesses. In the Appendix, Grace has provided reconciliations of these non- GAAP financial measures to the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP. These non-GAAP financial measures should not be considered as a substitute for financial measures calculated in accordance with U.S. GAAP, and the financial results calculated in accordance with U.S. GAAP and reconciliations from those results should be evaluated carefully. Investor Presentation | August 2020 2020 W. R. Grace & Co. | 2

Grace Overview & Strategy

GRACE AT A GLANCE (NYSE:GRA) The Leading Global Supplier of Process Catalysts and Specialty Silicas Materials Technologies Catalyst Technologies ~$3.0B $2B $0.5B 19% Sales $2.0B2 81% Sales2 Market Cap1 2019 Sales Traditional Fuels 24% PetroChem Feedstocks 8% ~80% >72% of sales in Chemical Process 7% Sales Outside segments where the US $2.5B we are #1 or #2 2019 Sales2 Consumer/Pharma 6% Plastics 28% Coatings 6% 29% 20% Clean Fuels 21% 2019 Adj. EBITDA 2019 Adj. Margin EBIT ROIC Operating Refining Technologies | Specialty Catalysts | Materials Technologies Segments 1 As of 08/17/2020 2 Catalysts Technologies sales includes sales from unconsolidated ART joint venture; percentages may be off due to rounding * Definitions of non-GAAP financial measures and reconciliations to the closest GAAP measure are provided in the Appendix Investor Presentation | August 2020 2020 W. R. Grace & Co. | 4

STRATEGIC UPDATE 1 Invest to accelerate • Sustaining strategic growth initiatives to accelerate long-term growth and extend competitive advantages growth and extend our competitive advantages – Maintaining R&D spending; focused on technology and innovation • Pandemic does not change the value of our technology, our long- term growth potential, or the strategic value of our specialty 2 Invest in great people chemicals franchise to strengthen our • Over $250 million growth capacity investments since 2017 high-performance culture – Three major capacity additions now online for polyolefin catalysts, hydroprocessing catalysts, and colloidal silica 33 • Customer-Driven Innovation and Commercial Excellence are Execute the competitive differentiators Grace Value Model – $6M and >50,000 employee hours invested to upgrade commercial to drive operating excellence capabilities to drive win rates, share of wallet, and profitability – 44% of sales directly contribute to customer sustainability objectives 4 – Over 65% of R&D directed to sustainability technologies Acquire to build our technology and manufacturing • Over $20 million invested in the Grace Manufacturing System capabilities for our customers and Operating Excellence – GMS investments contributed 75 bps to margins in 2019; will increase as demand returns Long-Term Strategic Framework is Fully Intact Investor Presentation | August 2020 2020 W. R. Grace & Co. | 5

COMPELLING INVESTMENT THESIS • Increasing demand for high-performance plastics, petrochemical feedstocks, and clean transportation fuels Enduring Growth Drivers • Rising living standards and growing middle class incomes • Growing global focus on stricter environmental standards, improving health and wellness and sustainability • Comprehensive framework to improve profitability; significant runway for value creation Delivering Value • Commercial excellence and customer-driven innovation reinforce and extend our through the competitive advantages Grace Value Model • Differentiated capabilities and strategies enable above market sales growth rates • Operating excellence delivers productivity and efficiencies in our operations Investing to Extend • High-return investments in growth capacity, technology, and operating excellence Our Competitive accelerates sales and earnings growth Advantages • Balanced and disciplined capital allocation strategy drives strong investment returns • Strong strategic positions in high-value markets Long-Term Value • Mid-Single Digit growth portfolio Creation Framework • Value creation model drives earnings growth faster than sales growth • Strong cash flow available for acquisitions and return to shareholders Strategy, Operating Discipline, and Leadership to Create Shareholder Value Investor Presentation | August 2020 2020 W. R. Grace & Co. | 6

LEADING POSITIONS IN HIGH-VALUE END MARKETS TIED TO POSITIVE, LONG-TERM TRENDS ▪ Independent Polypropylene ▪ Hydroprocessing Process Technology Licensing ▪ Hydrocracking of sales in segments # ▪ Polyolefin Catalysts ▪ Specialty Silica Gel ~80% where we are #1 or #2 1 ▪ FCC Catalysts Specialty Catalysts Materials Technologies Refining Technologies 2019 Sales $791M 2019 Sales 2019 Sales FCC $705M $461M $527M ART 36% Polypropylene Catalysts 31% Consumer/Pharma 60% Fluid Catalytic Cracking (FCC) 7% Polypropylene Process Technology Licensing 30% Coatings 40% Hydroprocessing 49% Polyethylene Catalysts 34% Chemical Process 8% Chemical Catalysts 5% Other HSD + Demand for high-value plastics MSD + Rising living standards LSD (FCC) + Demand for cleaner Expected + Increasing population Expected + Growing middle class incomes transportation fuels HSD (ART) Long-Term Long-Term + Demand for petrochemical Growth1 + Rising living standards Growth1 + Increased focus on health and wellness Expected feedstocks + Growing middle class incomes Long-Term + Stricter regulatory environment Growth1 + Increasing energy consumption 1 Source: See W.R. Grace Investor Day Presentation, March 2, 2018 for market growth rates. Investor Presentation | August 2020 2020 W. R. Grace & Co. | 7

GRACE PRODUCTS CONTRIBUTE TO OUR CUSTOMERS’ SUSTAINABILITY OBJECTIVES 2019 Sales Examples of Grace Products and Benefits • High-performing PP catalysts for lightweighting auto parts to improve fuel economy Improving our • Custom single-site PE catalysts for downgauging packaging to reduce plastics use customers’ products1 ~$0.1B • Silicas for tires to reduce rolling resistance and improve fuel economy • Zeolites for dual pane windows to reduce energy use Improving our 2 • Advanced FCC catalysts to reduce raw material and energy requirements customers’ processes1 ~$0.5B • Advanced silica gel for filtration to reduce water use and waste Enabling our customers • Hydroprocessing catalysts to meet cleaner fuels standards (e.g., IMO 2020) to meet stricter • Additives to reduce SOx and NOx emissions from refinery operations environmental ~$0.4B • Colloidal silicas for vehicle emission control devices standards Enabling our customers • Non-phthalate PP catalysts for safer packaging and household items to reformulate their • Silicas for anti-corrosive coatings that are heavy-metal free products to meet ~$0.1B • Silicas for high performance paints with low-VOCs consumer demand 2019 sales directly contributing to sustainability ~$1.1B2 ~44% up from ~$1.0B and ~38% in 2018 objectives R&D efforts aligned to Estimate that ~65% of R&D projects and ~70% of revenue customers’ sustainability objectives growth tied to at least one of four sustainability drivers 1 Represents revenues aligned to SASB Chemicals Sustainability Accounting Standards definition of products designed for use-phase resource efficiency, including improving energy efficiency, eliminating/lowering emissions, reducing raw materials consumption, increasing product longevity, and/or reducing water consumption 2 Figure includes unconsolidated ART joint venture Investor Presentation | August 2020 2020 W. R. Grace & Co. | 8

LEVERAGING THE GRACE VALUE MODEL (GVM) At the company level, we focus on portfolio, strategic position, and capital allocation • We invest to grow our businesses, improve our strategic position, and maintain our high ROIC At the business level, we focus on customers, innovation, growth, and profitability • Our customer-focused, solutions-oriented approach to innovation is a competitive advantage • Value selling is the core of our commercial approach • The Grace Manufacturing System is the foundation of our operating excellence strategy • Integrated Business Management aligns our core processes Great talent and our high-performance culture are competitive advantages • We invest in great people to strengthen our high- performance culture Tightly Aligned Business Model Delivers Value for All Stakeholders Investor Presentation | August 2020 2020 W. R. Grace & Co. | 9

Financial Review & Capital Allocation Framework

3Q20 UPDATE 3Q20 Planning Assumptions Refining Market Commentary Impact of Recent Announcements of U.S. Refinery Closures Sales: Planning for 3Q sales to be down 10%-13% YOY; sequentially, sales roughly flat vs. 2Q driven by: • No Grace FCC catalysts customers impacted by recent announcements – FCC up reflecting better end market demand offset by lower refinery utilization as refiners reduce inventories – FCC catalyst market is driven by demand for transportation fuels; it is not driven by number of producers in market – Specialty Catalysts roughly flat with lower demand offset by less customer inventory corrections • Pandemic has created near-term volatility, remain well – Materials Technologies down slightly due to mild seasonality in positioned to return to normal operating levels and capture Europe and order timing in consumer/pharma (strong 2Q20) growth opportunities as underlying markets recover Gross Margin: Expecting 3Q gross margin to increase 300- • Long-term view of FCC catalyst market has not changed 400 bps sequentially from 2Q – Post-pandemic expect low-single digit annual sales growth, – Production volumes will remain below prior year levels; not including improved pricing of 1-2 points on average planning on significant further inventory reductions in 3Q – Committed to maintaining global market share and delivering – Gross margins will recover to 40%-42% as demand increases value to customers through innovative products and technical services 3Q20 Sequential Adj. Gross Margin • From planning perspective, our models reflect net growth in FCC catalysts globally, including 37% - 38% – New modern capacity coming on line in Asia, the Middle East and 34.1% 300-400 Africa which more than offsets some contraction in North America bps and Western Europe – Current levels of contraction are in line with estimates Renewable Diesel • Grace is supporting customers with EnRich™ catalysts and 2Q20A 3Q20E pretreat catalysts for renewables applications as well as TriSyl® adsorbents for pre-treatment of feedstocks * Definitions of non-GAAP financial measures and reconciliations to the closest GAAP measure are provided in the Appendix Investor Presentation | August 2020 2020 W. R. Grace & Co. | 11

3Q20 SEGMENT DEMAND ASSESSMENT 2Q20 Sales Demand Factor Demand Outlook Inventory levels Commentary Transportation Fuels & 2Q20 → 3Q20 2Q20 3Q20 Petrochemical feedstocks • Gasoline demand down 30% y/y in 2Q Sequential Outlook Refined Refining on July 30th • Refinery utilization bottomed in April and Products started to improve in May and June Technologies Inventories • Refined product inventories grew in 2Q; this inventory build will have to be worked down $149.2M Catalyst Inventories1 • 3Q demand up sequentially, but partially offset down (28.4%) by lower refinery utilization • No Grace FCC catalysts customers impacted by recent announcements 2Q20 3Q20 75-80% non-durables 2Q20 → 3Q20 • 2Q down on weaker end market demand and Sequential Outlook Finished resin and catalyst inventory reductions Specialty th on July 30 Resin • Some customer catalyst inventory corrections Catalysts Inventories in 2Q, but not as much as we planned for • Planning for additional customer inventory 20-25% durables Catalyst reductions in the 2H this year $159.8M Inventories1 • 3Q roughly flat sequentially; slightly weaker down (14.7%) end market demand offset by less impact from customer inventory corrections 2Q20 3Q20 65% non-durables 2Q20 → 3Q20 • Very strong growth in consumer/pharma end Sequential Outlook Customer uses in 2Q; more than offset by weak demand Materials on July 30th Finished in coatings and industrial end uses Product Technologies • MT outperformed its end markets in coatings and consumer/pharma and was in line with 35% durables Grace $109.7M Product industrial end markets Inventories1 • 3Q down slightly sequentially; mild seasonality down (7.0%) (Europe) and order timing in consumer/pharma (growth y/y but down sequentially) 1 Grace product inventory at customer or in Grace supply chain Sources: Total Product Stocks – Absolute, Wood Mackenzie Investor Presentation | August 2020 2020 W. R. Grace & Co. | 12

STRONG FINANCIAL POSITION Ample Liquidity – Strong cash flow in 2Q20 led to increase in cash and Cash and >$680M ~$250M liquidity; liquidity up approximately $75M since end of 1Q20 Liquidity1 Liquidity Cash-on-Hand – Over $680M in available liquidity, including roughly $250M of cash-on-hand1 Strong Balance Sheet – We have not drawn on the $400M revolving credit facility Capital – Pro forma net debt of $1.7B and net leverage of 3.5x Structure – Proven track record to de-leverage quickly; target net leverage of 2.0x to 3.0x (post-pandemic) ($M) Limited Near-Term Debt Service1 Debt – Completed $750M offering of senior unsecured notes due Maturity 2027 and fully redeemed senior unsecured notes due Sept. 2021 Schedule1 – No significant debt maturities until 2024 – Minimal pension funding requirements Revolving Credit Notes/Bonds Term Loan/Other 1 As of June 30, 2020 and excluding the $740M used to redeem the September 2021 notes on July 13, 2020. Investor Presentation | August 2020 2020 W. R. Grace & Co. | 13

DISCIPLINED CAPITAL ALLOCATION CAPITAL ALLOCATION FRAMEWORK INVEST IN ORGANIC GROWTH PURSUE STRATEGIC ACQUISITIONS DIVIDENDS RETURN CASH TO SHAREHOLDERS BUYBACKS NEAR-TERM SHIFT IN PRIORITIES IN RESPONSE TO COVID-19 2x - 3x – Lowered capital spending; maintaining R&D and Target targeted strategic investments – Slowing M&A activities given current economic environment – Temporary suspension of share repurchases; expect to reinstate at appropriate time $250M $418M – Fully committed to maintaining quarterly cash dividend Acquisition Acquisition (3Q16) (2Q18) * Definitions of non-GAAP financial measures and reconciliations to the closest GAAP measure are provided in the Appendix Capital Allocation Framework Intact; Near-Term Shift in Priorities Investor Presentation | August 2020 2020 W. R. Grace & Co. | 14

Supplemental Information

GRACE’S RESPONSE TO COVID-19 PANDEMIC Committed to health and safety of our employees Grace Pharma Joins the Fight Against COVID-19 Acted early and effectively to implement new DETECT safety protocols across global operations Following guidance of public health authorities and local authorities Our materials support the fight against SUSTAIN COVID-19 TREAT As the COVID-19 pandemic continues across the globe, our employees and the Grace Foundation have supported numerous initiatives in our local communities. ▪ Food Bank Assistance to organizations near our U.S. ® operations UNIPOL PP Process Technology and Catalysts ▪ United Way of Central Maryland’s COVID-19 relief fund Support Production of PPE & Medical Supplies ▪ Employee’s Supporting their Local Communities: – In Worms and Düren, raised funds to provide PPE to Licensees and catalyst customers leverage Grace's differentiated retirement homes and health organizations technologies to produce resins for critical applications, such as: – In Kuantan, Malaysia, provided tents to be used as COVID-19 response and testing centers – Masks – Protective Suits Grace is proud to support these initiatives and programs to – Ventilator Valves – Gel Dispensers assist in the communities where we live and work. – Syringes Grateful to be Able to Help Our Communities Investor Presentation | August 2020 2020 W. R. Grace & Co. | 16

2Q20 HIGHLIGHTS 2Q20 Actual (y/y) 2Q20 Overview • Sales and earnings better than we expected Sales – Customer inventory corrections less than expected in 2Q; planning for impact to shift to 3Q $419M • Exceptional cash flow performance in the quarter driven by decisive actions to mitigate the effects of the pandemic down 18.5% – Successfully implemented actions to reduce full-year capital expenditures, working capital, and operating costs Adj. EBIT – Raising estimate for full-year cash flow benefit from $100M to $125M $64M – Reduced inventory by $52M; more than twice initial estimates and reflected in 2Q gross margins down 49.6% – Gross margins will recover to 40%-42% as demand increases • Very well positioned for growth as end markets recover Adj. EPS • Refinanced 2021 debt maturities at lower rate and increased liquidity to over $680M $0.49 • Recorded a pretax charge of $37M, or $0.47 per share, for changes to our Refining Technologies manufacturing operations and global footprint down 57.8% – Hydroprocessing catalysts manufacturing operations: accelerated GMS implementation, including organizational changes and optimization of plant processes to drive operating efficiencies Adj. Free Cash Flow – Middle East FCC catalysts plant: discontinued previously announced project due to rapid advance $100M of FCC catalyst technology up $75M * Definitions of non-GAAP financial measures and reconciliations to the closest GAAP measure are provided in the Appendix Solid Performance in Very Difficult Economic Environment Investor Presentation | August 2020 2020 W. R. Grace & Co. | 17

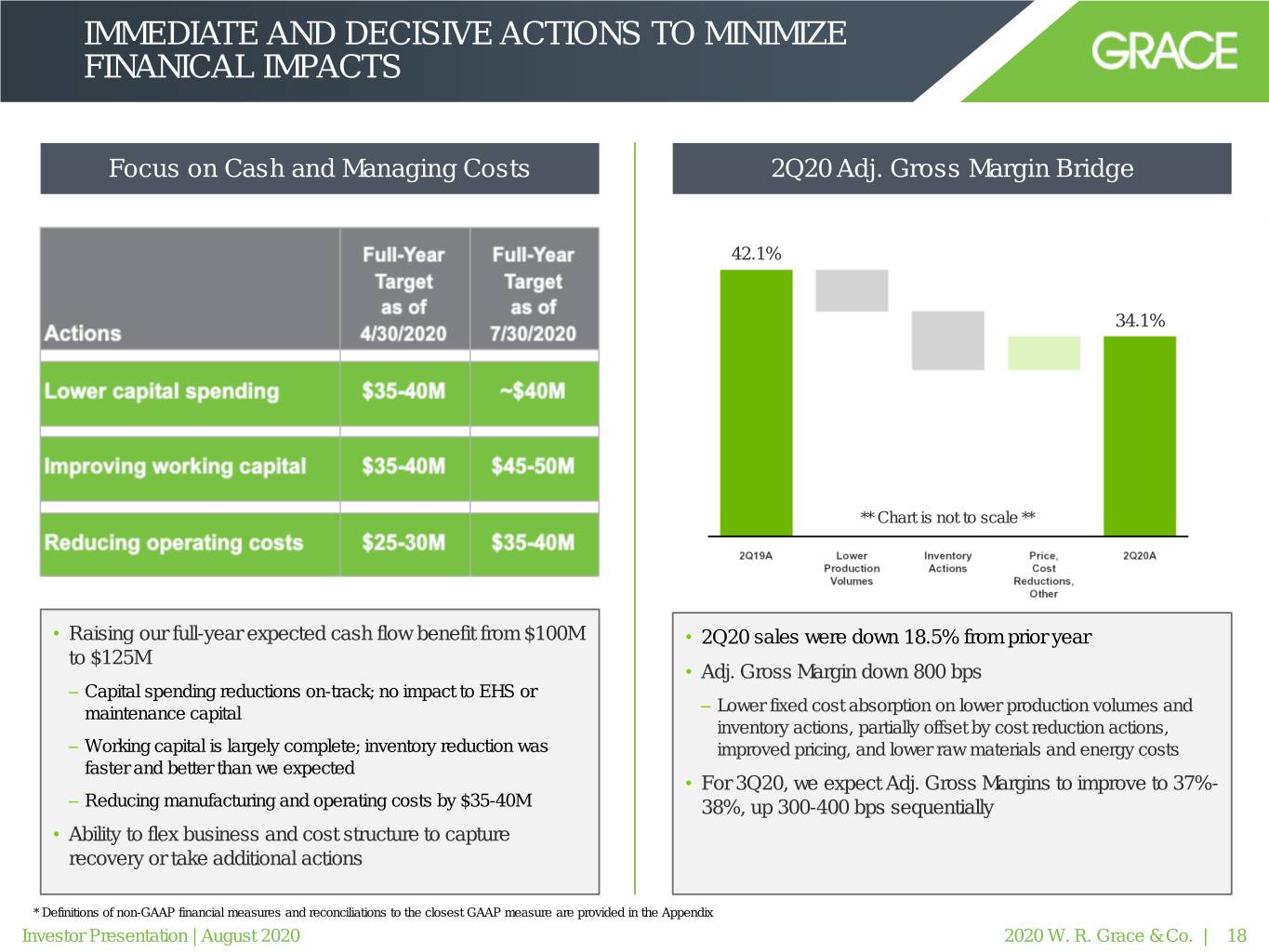

IMMEDIATE AND DECISIVE ACTIONS TO MINIMIZE FINANICAL IMPACTS Focus on Cash and Managing Costs 2Q20 Adj. Gross Margin Bridge 42.1% Full-Year Full-Year Target Target as of as of 34.1% Actions 4/30/2020 7/30/2020 Lower capital spending $35-40M ~$40M Improving working capital $35-40M $45-50M ** Chart is not to scale ** Reducing operating costs $25-30M $35-40M • Raising our full-year expected cash flow benefit from $100M • 2Q20 sales were down 18.5% from prior year to $125M • Adj. Gross Margin down 800 bps – Capital spending reductions on-track; no impact to EHS or maintenance capital – Lower fixed cost absorption on lower production volumes and inventory actions, partially offset by cost reduction actions, – Working capital is largely complete; inventory reduction was improved pricing, and lower raw materials and energy costs faster and better than we expected • For 3Q20, we expect Adj. Gross Margins to improve to 37%- – Reducing manufacturing and operating costs by $35-40M 38%, up 300-400 bps sequentially • Ability to flex business and cost structure to capture recovery or take additional actions * Definitions of non-GAAP financial measures and reconciliations to the closest GAAP measure are provided in the Appendix Investor Presentation | August 2020 2020 W. R. Grace & Co. | 18

REFINING TECHNOLOGIES MANUFACTURING OPERATIONS AND GLOBAL FOOTPRINT • In connection with our on-going operating excellence initiatives, we have accelerated the implementation of the GMS at our three hydroprocessing catalysts manufacturing sites, including key organizational changes and optimization of plant processes Actions – Write off inventory now deemed obsolete based on the process and footprint changes Taken • In agreement with our local partner, we have discontinued the project to build a full-scale FCC catalysts plant in the Middle East – Remain fully committed to our customers and partners in the Middle East by leveraging our existing presence in the region • Actions in hydroprocessing manufacturing operations will support the long-term global growth in hydroprocessing catalysts through significantly improved operating rates and raw material consumption – Changes will benefit operating margins in our ART joint venture in the range of 150 to 200 bps with the savings to be realized beginning in 3Q20; Grace will recognize the margin benefits through its equity earnings in the JV Strategic Rationale • Our global FCC catalysts manufacturing network includes three world-class plants in the U.S. and Germany with the flexibility and capability required to produce today's advanced catalysts and additives platforms – Ability to support long-term market growth of 1-2% by leveraging our existing footprint to meet our growth capacity needs • Pretax charge of $37M, or $0.47 per share, recorded in 2Q20 – Charge includes inventory write-off of $20M and engineering and site cost write-off of $17M • Expected future cash costs to implement the realignment are approximately $2M Financial Impact Aligning Refining Technologies to Support Long-Term Global Growth Investor Presentation | August 2020 2020 W. R. Grace & Co. | 19

Appendix: Definitions and Reconciliations of Non-GAAP Measures Non-GAAP Financial Measures (A) In the above, Grace presents financial information in accordance with U.S. generally accepted accounting principles (U.S. GAAP), as well as the non-GAAP financial information described below. Grace believes that this non-GAAP financial information provides useful supplemental information about the performance of its businesses, improves period-to-period comparability and provides clarity on the information management uses to evaluate the performance of its businesses. In the above charts, Grace has provided reconciliations of these non-GAAP financial measures to the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP. These non-GAAP financial measures should not be considered as a substitute for financial measures calculated in accordance with U.S. GAAP, and the financial results calculated in accordance with U.S. GAAP and reconciliations from those results should be evaluated carefully. Grace defines these non-GAAP financial measures as follows: • Adjusted EBIT means net income attributable to W. R. Grace & Co. shareholders adjusted for interest income and expense; income taxes; costs related to legacy matters; restructuring and repositioning expenses and asset impairments; pension costs other than service and interest costs, expected returns on plan assets, and amortization of prior service costs/credits; gains and losses on sales and exits of businesses, product lines, and certain other investments; third-party acquisition-related costs and the amortization of acquired inventory fair value adjustment; the effects of these items on equity in earnings of unconsolidated affiliate; and certain other items that are not representative of underlying trends. • Adjusted EBITDA means Adjusted EBIT adjusted for depreciation and amortization and depreciation and amortization included in equity in earnings of unconsolidated affiliate (collectively, Adjusted Depreciation and Amortization). • Adjusted EBIT Return on Invested Capital means Adjusted EBIT (on a trailing four quarters basis) divided by Adjusted Invested Capital, which is defined as equity adjusted for debt; underfunded and unfunded defined benefit pension plans; liabilities related to legacy matters; cash, cash equivalents, and restricted cash; net income tax assets; and certain other assets and liabilities. • Adjusted Gross Margin means gross margin adjusted for pension-related costs included in cost of goods sold, the amortization of acquired inventory fair value adjustment, and write-offs of inventory related to exits of businesses and product lines and significant manufacturing process changes. • Adjusted EPS means diluted EPS adjusted for costs related to legacy matters; restructuring and repositioning expenses and asset impairments; pension costs other than service and interest costs, expected returns on plan assets, and amortization of prior service costs/credits; gains and losses on sales and exits of businesses, product lines, and certain other investments; third-party acquisition-related costs and the amortization of acquired inventory fair value adjustment; certain other items that are not representative of underlying trends; and certain discrete tax items and income tax expense related to historical tax attributes. • Adjusted Free Cash Flow means net cash provided by or used for operating activities minus capital expenditures plus cash flows related to legacy matters; cash paid for restructuring and repositioning; capital expenditures related to repositioning; cash paid for third-party acquisition-related costs; and accelerated payments under defined benefit pension arrangements. • The change in net sales on a constant currency basis, which we sometimes refer to as "Net Sales, constant currency," means the period-over-period change in net sales calculated using the foreign currency exchange rates that were in effect during the previous comparable period. • Organic sales growth means the period-over-period change in net sales excluding the sales growth attributable to acquisitions. “Legacy matters” include legacy (i) product, (ii) environmental, and (iii) other liabilities, relating to past activities of Grace. In the 2020 first quarter, the definition of Adjusted EBIT was modified to adjust for the effects of interest and taxes on equity in earnings of unconsolidated affiliate. The definition of Adjusted EBITDA was modified to adjust for the effects of depreciation and amortization on equity in earnings of unconsolidated affiliate. Grace made these changes to provide clarity about the impacts of these items on Grace's equity in earnings of unconsolidated affiliate and to improve consistency in Grace's application of non-GAAP financial measures. Previously reported amounts were revised to conform to the current presentation. Investor Presentation | August 2020 2020 W. R. Grace & Co. | 20

Appendix: Definitions and Reconciliations of Non-GAAP Measures (continued) Non-GAAP Financial Measures Adjusted EBIT, Adjusted EBITDA, Adjusted EBIT Return On Invested Capital, Adjusted Gross Margin, Adjusted EPS, Adjusted Free Cash Flow, Net Sales, constant currency, and Organic sales growth do not purport to represent income or liquidity measures as defined under U.S. GAAP, and should not be considered as alternatives to such measures as an indicator of Grace's performance or liquidity. Grace uses Adjusted EBIT as a performance measure in significant business decisions and in determining certain incentive compensation. Grace uses Adjusted EBIT as a performance measure because it provides improved period-to-period comparability for decision making and compensation purposes, and because it better measures the ongoing earnings results of its strategic and operating decisions by excluding the earnings effects of legacy matters; restructuring and repositioning activities; certain acquisition-related items; and certain other items that are not representative of underlying trends. Grace uses Adjusted EBITDA, Adjusted EBIT Return On Invested Capital, Adjusted Gross Margin, and Adjusted EPS as performance measures and may use these measures in determining certain incentive compensation. Grace uses Adjusted EBIT Return On Invested Capital in making operating and investment decisions and in balancing the growth and profitability of operations. Grace uses Net Sales, constant currency as a performance measure to compare current period financial performance to historical financial performance by excluding the impact of foreign currency exchange rate fluctuations that are not representative of underlying business trends and are largely outside of its control. Grace uses Organic sales growth to measure its businesses' sales performance, excluding the impacts of acquisitions. Grace uses Adjusted Free Cash Flow as a liquidity measure to evaluate its ability to generate cash to support its ongoing business operations, to invest in its businesses, and to provide a return of capital to shareholders. Grace also uses Adjusted Free Cash Flow as a performance measure in determining certain incentive compensation. Adjusted EBIT, Adjusted EBITDA, Adjusted EBIT Return On Invested Capital, Adjusted Gross Margin, Adjusted EPS, Adjusted Free Cash Flow, Net Sales, constant currency, and Organic sales growth do not purport to represent income measures as defined under U.S. GAAP, and should not be used as alternatives to such measures as an indicator of Grace’s performance. These measures are provided to investors and others to improve the period-to-period comparability and peer-to-peer comparability of Grace’s financial results, and to ensure that investors and others understand the information Grace uses to evaluate the performance of its businesses. They distinguish the operating results of Grace's current business base from the costs of Grace's legacy matters; restructuring and repositioning activities; and certain other items. These measures may have material limitations due to the exclusion or inclusion of amounts that are included or excluded, respectively, in the most directly comparable measures calculated and presented in accordance with U.S. GAAP and thus investors and others should review carefully the financial results calculated in accordance with U.S. GAAP. Adjusted EBIT has material limitations as an operating performance measure because it excludes costs related to legacy matters, and may exclude income and expenses from restructuring and repositioning activities, which historically have been material components of Grace’s net income. Adjusted EBITDA also has material limitations as an operating performance measure because it excludes the impact of depreciation and amortization expense. Grace’s business is substantially dependent on the successful deployment of capital, and depreciation and amortization expense is a necessary element of our costs. Grace compensates for the limitations of these measurements by using these indicators together with net income as measured under U.S. GAAP to present a complete analysis of our results of operations. Adjusted EBIT and Adjusted EBITDA should be evaluated together with net income and net income attributable to Grace shareholders, measured under U.S. GAAP, for a complete understanding of Grace’s results of operations. Grace is unable without unreasonable efforts to estimate the annual mark-to-market pension adjustment or future net income or diluted EPS. Without the availability of this significant information, Grace is unable to provide reconciliations for certain forward-looking information set forth in the Outlook, above. (B) Grace's segment operating income includes only Grace's share of income from consolidated and unconsolidated joint ventures. Investor Presentation | August 2020 2020 W. R. Grace & Co. | 21

Appendix: Definitions and Reconciliations of Non-GAAP Measures (continued) Non-GAAP Financial Measures (C) Certain pension costs include only ongoing costs recognized quarterly, which include service and interest costs, expected returns on plan assets, and amortization of prior service costs/credits. Catalysts Technologies and Materials Technologies segment operating income and corporate costs do not include any amounts for pension expense. Other pension related costs including annual mark-to-market adjustments and actuarial gains and losses are excluded from Adjusted EBIT. These amounts are not used by management to evaluate the performance of Grace's businesses and significantly affect the peer-to-peer and period-to-period comparability of our financial results. Mark-to-market adjustments and actuarial gains and losses relate primarily to changes in financial market values and actuarial assumptions and are not directly related to the operation of Grace's businesses. (D) Restructuring and repositioning expenses attributable to W. R. Grace & Co. shareholders is net of restructuring expenses attributable to noncontrolling interests. (E) Inventory write-off in 2020 related to the changes in hydroprocessing catalysts manufacturing operations. Inventory write-off in 2019 related to the idling of Grace’s methanol-to-olefins (“MTO”) manufacturing facility in China. (F) Grace's historical tax attribute carryforwards (net operating losses and tax credits) unfavorably affected its tax expense with respect to certain provisions of the Tax Cuts and Jobs Act of 2017. To normalize the effective tax rate, an adjustment was made to eliminate the tax expense impact associated with the historical tax attributes. Investor Presentation | August 2020 2020 W. R. Grace & Co. | 22

Appendix: Reconciliation of Non-GAAP Financial Measures (continued) Adjusted EBIT by Operating Segment(A)(B): 2019 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Catalysts Technologies segment operating income $ 467.4 $ 101.7 $ 125.8 $ 104.7 $ 135.2 $ 82.0 $ 71.7 Materials Technologies segment operating income 97.8 24.0 24.1 26.1 23.6 19.0 12.6 Corporate costs (72.7) (16.2) (18.0) (18.5) (20.0) (15.6) (16.7) Certain pension costs(C) (18.4) (4.8) (4.6) (4.5) (4.5) (3.1) (3.5) Adjusted EBIT(A)(B) 474.1 104.7 127.3 107.8 134.3 82.3 64.1 Restructuring and repositioning expenses attributable to W. R. Grace & Co. shareholders(D) (13.7) (2.3) (6.4) (3.4) (1.6) (2.7) (21.4) Inventory write-offs(E) (3.6) — (3.6) — — — (19.7) Costs related to legacy matters (103.5) (46.9) (1.5) (3.7) (51.4) (2.7) (2.8) Third-party acquisition-related costs (3.6) (0.3) (1.0) (1.4) (0.9) (1.5) (2.0) Taxes and interest included in equity in earnings of unconsolidated affiliate (0.9) (0.3) (0.6) — (0.2) Benefit plan adjustment (5.0) — — — (5.0) — — Pension MTM adjustment and other related costs, net (85.9) — — — (85.9) — — Interest expense, net (74.8) (19.3) (19.2) (18.3) (18.0) (17.7) (18.9) (Provision for) benefit from income taxes (56.8) (10.9) (18.8) (27.3) 0.2 (15.7) (6.4) Net income (loss) attributable to W. R. Grace & Co. shareholders $ 126.3 $ 24.7 $ 76.2 $ 53.7 $ (28.3) $ 42.0 $ (7.3) Investor Presentation | August 2020 2020 W. R. Grace & Co. | 23

Appendix: Reconciliation of Non-GAAP Financial Measures (continued) Adjusted Free Cash Flow(A): YTD 2Q 2020 YTD 2Q 2019 Net cash provided by (used for) operating activities $ 184.6 $ 144.9 Cash paid for capital expenditures (95.0) (101.5) Free Cash Flow 89.6 43.4 Cash paid for legacy matters 12.3 7.8 Cash paid for repositioning 3.8 10.0 Cash paid for third-party acquisition-related costs 2.4 0.6 Cash paid for restructuring 1.6 6.3 Adjusted Free Cash Flow $ 109.7 $ 68.1 Four Quarters Ended June 30, Calculation of Adjusted EBIT Return on Invested Capital (trailing four quarters)(A): 2020 2019 Net income (loss) attributable to W. R. Grace & Co. shareholders $ 60.1 $ 186.1 Adjusted EBIT 388.5 472.5 Reconciliation to Adjusted Invested Capital: Total equity 349.6 387.3 Total debt 2,717.4 1,983.0 Underfunded and unfunded defined benefit pension plans 520.5 433.9 Liabilities related to legacy matters 200.1 165.5 Cash, cash equivalents, and restricted cash (997.8) (159.9) Income taxes, net (497.1) (502.1) Other 22.0 18.7 Adjusted Invested Capital $ 2,314.7 $ 2,326.4 Return on equity 17.2% 48.1% Adjusted EBIT Return on Invested Capital 16.8% 20.3% Investor Presentation | August 2020 2020 W. R. Grace & Co. | 24

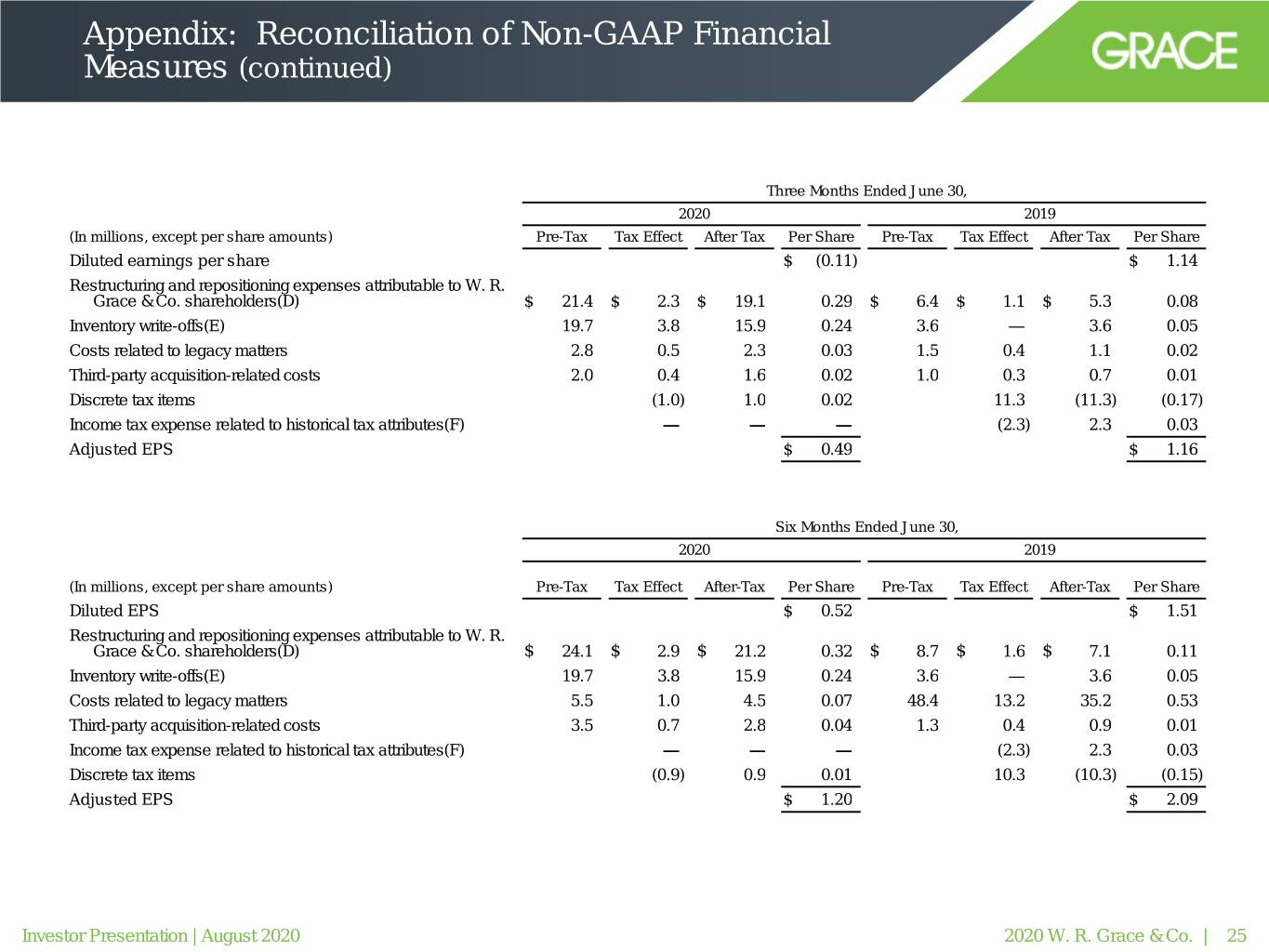

Appendix: Reconciliation of Non-GAAP Financial Measures (continued) Three Months Ended June 30, 2020 2019 (In millions, except per share amounts) Pre-Tax Tax Effect After Tax Per Share Pre-Tax Tax Effect After Tax Per Share Diluted earnings per share $ (0.11) $ 1.14 Restructuring and repositioning expenses attributable to W. R. Grace & Co. shareholders(D) $ 21.4 $ 2.3 $ 19.1 0.29 $ 6.4 $ 1.1 $ 5.3 0.08 Inventory write-offs(E) 19.7 3.8 15.9 0.24 3.6 — 3.6 0.05 Costs related to legacy matters 2.8 0.5 2.3 0.03 1.5 0.4 1.1 0.02 Third-party acquisition-related costs 2.0 0.4 1.6 0.02 1.0 0.3 0.7 0.01 Discrete tax items (1.0) 1.0 0.02 11.3 (11.3) (0.17) Income tax expense related to historical tax attributes(F) — — — (2.3) 2.3 0.03 Adjusted EPS $ 0.49 $ 1.16 Six Months Ended June 30, 2020 2019 (In millions, except per share amounts) Pre-Tax Tax Effect After-Tax Per Share Pre-Tax Tax Effect After-Tax Per Share Diluted EPS $ 0.52 $ 1.51 Restructuring and repositioning expenses attributable to W. R. Grace & Co. shareholders(D) $ 24.1 $ 2.9 $ 21.2 0.32 $ 8.7 $ 1.6 $ 7.1 0.11 Inventory write-offs(E) 19.7 3.8 15.9 0.24 3.6 — 3.6 0.05 Costs related to legacy matters 5.5 1.0 4.5 0.07 48.4 13.2 35.2 0.53 Third-party acquisition-related costs 3.5 0.7 2.8 0.04 1.3 0.4 0.9 0.01 Income tax expense related to historical tax attributes(F) — — — (2.3) 2.3 0.03 Discrete tax items (0.9) 0.9 0.01 10.3 (10.3) (0.15) Adjusted EPS $ 1.20 $ 2.09 Investor Presentation | August 2020 2020 W. R. Grace & Co. | 25