Attached files

| file | filename |

|---|---|

| EX-21 - EXHIBIT 21 - W R GRACE & CO | a2196633zex-21.htm |

| EX-24 - EXHIBIT 24 - W R GRACE & CO | a2196633zex-24.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

| For the fiscal year ended December 31, 2009 | Commission file number 1-13953 |

W. R. GRACE & CO.

| Incorporated under the Laws of the State of Delaware |

I.R.S. Employer Identification No. 65-0773649 |

7500 Grace Drive, Columbia, Maryland 21044-4098

(410) 531-4000

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Common Stock, $.01 par value Preferred Stock Purchase Rights |

New York Stock Exchange, Inc. |

Securities registered pursuant to Section 12(g) of the Exchange Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K is not contained herein and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of W. R. Grace & Co. voting and non-voting common equity held by non-affiliates as of June 30, 2009 (the last business day of the registrant's most recently completed second fiscal quarter) based on the closing sale price of $12.37 as reported on the New York Stock Exchange was $617,329,093.*

At January 31, 2010, 72,322,118 shares of W. R. Grace & Co. Common Stock, $.01 par value, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

- *

- Based on 49,905,343 shares of W. R. Grace & Co. ("Grace") Common Stock, $.01 par value, held by non-affiliates (72,160,218 shares outstanding as of June 30, 2009 less 22,254,875 shares held by stockholders, whose beneficial ownership exceeds 10% of the outstanding shares of Grace Common Stock, as listed in the Grace 2008 Annual Report on Form 10-K as filed with the SEC on March 2, 2009, directors and named executive officers). Exclusion of shares held by any person should not be construed to indicate that such person possesses the power, direct or indirect, to direct or cause the direction of the management or policies of Grace, or that such person is controlled by or under common control with Grace.

Grace®, Grace® logo and, except as otherwise indicated, the other trademarks, service marks or trade names used in the text of this report are trademarks, service marks or trade names of operating units of W. R. Grace & Co. or its affiliates and/or subsidiaries. Responsible Care® is a trademark, registered in the United States and/or other countries, of the American Chemistry Council. OCR® is a trademark, registered in the United States and/or other countries, of Chevron Intellectual Property, LLC.

Unless the context otherwise indicates, in this document the terms "Grace," "we," "us," "our" or "the company" mean W. R. Grace & Co. and/or its consolidated subsidiaries and affiliates. Unless otherwise indicated, the contents of websites mentioned in this report are not incorporated by reference or otherwise made a part of this report.

BUSINESS OVERVIEW

W. R. Grace & Co. is engaged in the production and sale of specialty chemicals and specialty materials on a global basis through its two operating segments, Grace Davison and Grace Construction Products. We entered the specialty chemicals industry in 1954, when we acquired both the Dewey and Almy Chemical Company and the Davison Chemical Company. During the 1980s and 1990s, we divested a substantial number of businesses that were not then consistent with our business strategy. Grace is the successor to a company that originated in 1854 and originally became a public company in 1953.

In 2001, Grace and 61 of its United States subsidiaries and affiliates filed voluntary petitions for reorganization under Chapter 11 of the United States Bankruptcy Code and, since then, has been subject to the jurisdiction of the United States Bankruptcy Court for the District of Delaware.

In the fourth quarter of 2007, we realigned our reportable operating segments to reflect the transfer of our packaging technologies product line to the Grace Davison operating segment. Our previous Grace Performance Chemicals operating segment was renamed "Grace Construction Products" as a result of the transfer. All segment information contained herein reflects this realignment.

On November 30, 2009, we completed the sale of a 5% interest in Advanced Refining Technologies LLC, or ART, to our partner Chevron Products Company. We reduced our 55% interest to 50% to achieve a balanced ownership structure with Chevron. We deconsolidated ART's results from our consolidated financial statements on a prospective basis effective December 1, 2009. Previously, we reported 100% of ART's sales and 55% of ART's income, with the remaining 45% of ART's income reported as income attributable to noncontrolling interests.

Grace Davison markets its products primarily to a wide range of industrial customers, including those in the energy and refining industry, consumer, industrial and packaging industries, petro-/bio- chemical industries and the pharmaceutical and life sciences industries. Grace Davison includes the following product groups:

- •

- Refining Technologies, which includes:

- •

- fluid catalytic cracking, or FCC, catalysts, that help to "crack" the hydrocarbon chain in distilled crude oil to produce

transportation fuels, such as gasoline and diesel fuels, and other petroleum-based products; and FCC additives used to reduce sulfur in gasoline, maximize propylene production from refinery FCC units,

and reduce emissions of sulfur oxides, nitrogen oxides and carbon monoxide from refinery FCC units, and

- •

- hydroprocessing catalysts, marketed through our ART joint venture with Chevron, in which Grace holds a 50% economic

interest, that are used in process reactors to upgrade heavy oils into lighter, more useful products by removing impurities such as nitrogen, sulfur and heavy metals, allowing less expensive

feedstocks to be used in the petroleum refining process;

- •

- Materials Technologies which includes:

- •

- silica-based and silica-alumina-based engineered materials used in:

- •

- industrial applications, such as rubber and tires, precision investment casting, refractory, insulating glass windows, and drying applications, fulfilling various functions such as reinforcement, high temperature binding and moisture scavenging,

1

- •

- consumer applications, as a free-flow agent, carrier or processing aid in food and personal care products; as

a toothpaste abrasive; and for the processing and stabilization of edible oils and beverages,

- •

- coatings and print media applications, consisting of functional additives that provide matting effects and corrosion

protection for industrial coatings, enable enhanced media and paper quality in ink jet coatings, and act as a functional filler and retention aid in paper,

- •

- sealants and coatings used in rigid food and beverage packaging, including can and closure sealants used to seal and

enhance the shelf life of can and bottle contents, and coatings for cans and closures that prevent metal corrosion, protect package contents from the influence of metal and ensure proper adhesion of

sealing compounds and technologies designed to reduce off-taste effects and extend the shelf-life of packaged products; and

- •

- Specialty Technologies, which includes:

- •

- polyolefin catalysts and catalyst supports that are essential components in the manufacture of polyethylene and

polypropylene resins, and other chemical catalysts and process technologies used in a variety of industrial, environmental and consumer applications,

- •

- catalysts and adsorbents for the efficient conversion of renewable feedstocks to fuels and chemicals,

- •

- silica-based separation media and complementary purification products including chromatography columns and consumables

used in the pharmaceutical, life science and related industries, silica excipients used in pharmaceutical formulations and CO2 adsorbents used in anesthesiology and mine safety

applications, and

- •

- instrumentation and reference standards used in the pharmaceutical, life science and related industries.

Grace Davison accounted for approximately 68.5% of our 2009 sales.

Grace Construction Products, or GCP, produces and sells specialty construction chemicals and specialty building materials, including:

- •

- concrete admixtures and fibers used to modify the rheology, improve the durability and enhance various other properties of

concrete, mortar, masonry and other cementitious construction materials;

- •

- additives used in cement processing to improve energy efficiency in manufacturing, enhance the characteristics of finished

cement and improve ease of use;

- •

- building materials used in commercial and residential construction and renovation to protect buildings and civil

engineering structures from water, vapor and air penetration; and

- •

- fireproofing materials used to retard the spread of fire in buildings.

Grace Construction Products accounted for approximately 31.5% of our 2009 sales.

Our principal executive offices are located at 7500 Grace Drive, Columbia, Maryland 21044, telephone (410) 531-4000. As of December 31, 2009, we had approximately 5,940 global employees.

2

Global Scope

We operate our business on a global scale with approximately 69% of our 2009 sales outside the United States. We conduct business in over 40 countries and in more than 30 currencies. We manage our operating segments on a global basis, to serve global markets. Currency fluctuations in relation to the U.S. dollar affect our reported results of operations, cash flows, and financial position.

Strategy Overview

Our strategy is to seek increased enterprise value by profitably growing our specialty chemicals and specialty materials businesses in the global marketplace and achieving high levels of efficiency. To achieve these objectives, we plan to:

- •

- invest in research and development activities, with the goal of introducing new high-performance, technically

differentiated products and services while continuing to enhance manufacturing processes and operations;

- •

- expand sales and manufacturing into emerging economies, including China, India, Eastern Europe, the Middle East and Latin

America;

- •

- pursue selected acquisitions and alliances that complement our current product offerings or provide opportunities for

faster penetration of desirable market or geographic segments; and

- •

- continue our commitment to process and productivity improvements and cost-management, such as rigorous controls on working capital and capital spending, integration of functional support services worldwide, and programs for supply chain management, which include both procurement and materials management.

CHAPTER 11 FILING

On April 2, 2001, Grace, along with 61 of our United States subsidiaries and affiliates, filed voluntary petitions for reorganization under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware. The cases are being jointly administered under case number 01-01139. Our non-U.S. subsidiaries and certain of our U.S. subsidiaries were not included in the bankruptcy filing.

Background of Chapter 11

A bankruptcy filing under Chapter 11 of the United States Bankruptcy Code is generally a voluntary action taken by a debtor to resolve financial problems such as major liabilities. Chapter 11 gives a debtor the chance to restructure its finances so that it may continue to operate, provide its employees with jobs and pay its creditors. Chapter 11 can be used by debtors that are faced with large numbers of product liability lawsuits in multiple jurisdictions to provide a practical way to address the potential liabilities under the supervision of one court. A Chapter 11 filing generally stops all lawsuits against a debtor and prevents creditors from taking action to enforce claims or collect any monies or property that might be owed at the time of filing.

Chapter 11 permits a debtor to define and resolve its liabilities under a court-supervised process generally referred to as a reorganization. Unlike a Chapter 7, or liquidation bankruptcy, which results in the sale or distribution of all of the assets of a business, Chapter 11 reorganization permits a debtor to continue its normal business operations. Existing management may continue to manage the debtor's operations during the reorganization. As a debtor-in-possession, a debtor is able to do business with suppliers and customers in a routine manner. Certain other activities, including transactions outside the ordinary course of business, generally require specific approval of the bankruptcy court.

3

After a debtor files Chapter 11, one or more official committees that represent the interests of general unsecured creditors, other creditors and stockholders may be appointed. Normally these committees and their respective advisors are actively involved in the process to monitor the bankruptcy and protect the interests of their respective constituencies. The fees and expenses of these committees and advisors are paid by the debtor.

The Chapter 11 process generally ends when the bankruptcy court approves a plan of reorganization for the debtor. In cases similar to ours with complex asbestos liabilities, debtors have taken several years to complete the Chapter 11 process.

Grace Chapter 11 Filing

We voluntarily entered Chapter 11 to resolve comprehensively the nearly 130,000 asbestos personal injury and property damage claims against us, as well as any future demands which may be asserted. These claims and demands relate to past products and processes that involved asbestos, a mineral formerly used widely for many decades in building and other commercial products. Prior to 2000, we were able to resolve asbestos-related claims through direct negotiations and litigation, paying over $2 billion in claims and legal costs over a 20-year period. In most of the personal injury lawsuits, we are one of many defendants. In 2000 and the first quarter of 2001, the litigation environment changed with an unexpected 81% increase in personal injury claims filed against us, which we believe was caused by a surge in unmeritorious claims. We also became a defendant in class action lawsuits alleging damages from Zonolite® Attic Insulation, or ZAI, a former attic insulation product. Trends in claims filing and settlement demands showed no sign of returning to historic levels and these unfavorable trends were exacerbated by the bankruptcy filings of several of our co-defendants in asbestos personal injury litigation. These trends greatly increased the risk that we would not be able to resolve our pending and future asbestos-related claims under the state court system.

After a thorough review of these developments, our Board of Directors concluded that a federal court-supervised bankruptcy process provided the best forum available to achieve fairness in resolving these claims and demands. On April 2, 2001, we, along with 61 of our United States subsidiaries and affiliates, filed voluntary petitions for reorganization under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware, referred to herein as the Bankruptcy Court. Since that time, we have been subject to the jurisdiction of the Bankruptcy Court.

We are currently operating as a debtor-in-possession under court protection from creditors and claimants. We believe that our bankruptcy filing will permit a comprehensive resolution of the claims against us, while preserving the inherent value of our businesses. As a consequence of our bankruptcy filing, litigation against us as of the petition date is generally stayed (subject to certain exceptions in the case of governmental authorities), and no party may take any action to realize its pre-petition claims except pursuant to an order of the Bankruptcy Court. Since our bankruptcy filing, the Bankruptcy Court has approved all motions necessary for us to conduct normal business activities.

Four committees have been appointed in the bankruptcy cases, two representing asbestos claimants, a third representing other unsecured creditors and a fourth representing shareholders. These committees, a legal representative of future asbestos personal injury claimants and a legal representative of future asbestos property damage claimants, have the right to be heard on all matters that come before the Bankruptcy Court and are playing important roles in the bankruptcy cases. We are required to bear certain costs of the committees and of the representatives of future asbestos claimants, including those of their counsel and financial advisors.

4

See disclosure in this Report in Item 8 (Financial Statements and Supplementary Data) in the Financial Supplement under Note 2 (Chapter 11 Information) and Note 3 (Asbestos-Related Litigation) to the Consolidated Financial Statements for a description of our proposed joint plan of reorganization and the current status of our Chapter 11 cases.

PRODUCTS AND MARKETS

Specialty Chemicals and Materials Industry Overview

Specialty chemicals and specialty materials are high-value-added products used as catalysts, intermediates, components, protectants or additives in a wide variety of products and applications. They are generally produced in relatively small volumes (compared with commodity chemicals) and must satisfy well-defined performance requirements and specifications. Specialty chemicals and specialty materials are often critical components of end products, catalysts for the production of end products or components used in end products. Consequently, they are tailored to meet customer needs, which generally results in a close relationship between the producer and the customer.

We focus our business on the following, which we believe are important competitive factors in the specialty chemicals and specialty materials industry:

- •

- value-added products and services, sold at competitive prices;

- •

- customer service, including rapid response to changing customer needs;

- •

- technological leadership (resulting from investment in research and development and technical customer service); and

- •

- reliability of product and supply.

We believe that our focus on these competitive factors enables us to deliver increased value to customers and competitive operating margins notwithstanding the increased customer service and research and development costs that this focus entails.

Grace Davison Operating Segment

Grace Davison principally applies silica, alumina, zeolite and rubber and lattice technology in the design and manufacture of products to create significant value for our diverse customer base. Our customers include major oil refiners, plastics and chemical manufacturers, producers of rigid food and beverage packaging, coatings manufacturers, consumer product manufacturers and pharmaceutical companies. We believe that our technological expertise provides a competitive advantage, allowing us to quickly design products and materials that help our customers create value in their markets.

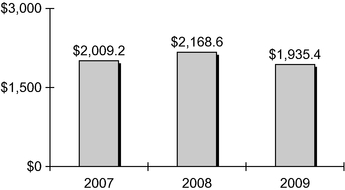

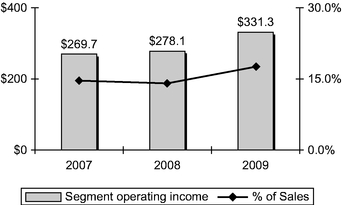

The following table sets forth Grace Davison sales of similar products as a percentage of Grace total revenue.

| |

2009 | 2008 | 2007 | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Sales | % of Grace Revenue |

Sales | % of Grace Revenue |

Sales | % of Grace Revenue |

|||||||||||||

| |

(In millions) |

||||||||||||||||||

Refining Technologies |

$ | 992.1 | 35.1 | % | $ | 1,099.1 | 33.1 | % | $ | 971.1 | 31.2 | % | |||||||

Materials Technologies |

606.0 | 21.5 | % | 694.8 | 20.9 | % | 663.5 | 21.3 | % | ||||||||||

Specialty Technologies |

337.3 | 11.9 | % | 374.7 | 11.3 | % | 374.6 | 12.0 | % | ||||||||||

Total Grace Davison Revenue |

$ | 1,935.4 | 68.5 | % | $ | 2,168.6 | 65.3 | % | $ | 2,009.2 | 64.5 | % | |||||||

5

The following table sets forth Grace Davison sales by region as a percentage of Grace Davison total revenue.

| |

2009 | 2008 | 2007 | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Sales | % of Grace Davison Revenue |

Sales | % of Grace Davison Revenue |

Sales | % of Grace Davison Revenue |

|||||||||||||

| |

(In millions) |

||||||||||||||||||

North America |

$ | 563.1 | 29.1 | % | $ | 645.9 | 29.8 | % | $ | 578.4 | 28.8 | % | |||||||

Europe Middle East Africa |

802.1 | 41.4 | % | 913.4 | 42.1 | % | 915.6 | 45.6 | % | ||||||||||

Asia Pacific |

378.4 | 19.6 | % | 434.7 | 20.0 | % | 362.7 | 18.0 | % | ||||||||||

Latin America |

191.8 | 9.9 | % | 174.6 | 8.1 | % | 152.5 | 7.6 | % | ||||||||||

Total Grace Davison Revenue |

$ | 1,935.4 | 100.0 | % | $ | 2,168.6 | 100.0 | % | $ | 2,009.2 | 100.0 | % | |||||||

Refining Technologies

FCC Catalysts

We are a global leader in developing and manufacturing fluid catalytic cracking, or FCC, catalysts and additives that enable petroleum refiners to increase profits by improving product yields and quality. Our FCC products also enable refiners to reduce emissions from their FCC units and reduce sulfur content in the gasoline that they produce.

Oil refining is a highly specialized discipline, and FCC catalysts must be tailored to meet local variations in crude oil and a refinery's product mix. We work regularly with our customers to identify the most appropriate catalyst formulations for their changing needs. We are dependent on the economics of the petroleum industry, specifically, the impacts of demand for transportation fuels and petrochemical products and crude oil supply, which affect the extent to which our customers utilize the available capacity of their refinery FCC units. In general, as a refinery utilizes more of its capacity, it needs a disproportionately greater amount of FCC catalyst. In recent years, global economic growth, especially in emerging markets, has increased the demand for transportation fuels, and our FCC catalysts and additives. Other factors may reduce the demand for petroleum-based transportation fuels such as weak economic conditions and high retail gasoline and diesel fuel prices. In addition, government policy that encourages the use of non-petroleum-based fuels, discourages the use of diesel fuel or encourages greater vehicular fuel economy may negatively affect demand for our FCC catalysts and additives.

Refinery feedstocks vary in quality from sweet to heavy crude oil. Sweet crude feedstocks are typically more expensive than heavy crude and yield a greater proportion of high-value petroleum products. They also yield a lower proportion of residual oil, or "resid," which is generally the lowest-value feedstock contained in crude oil. Although heavy crude feedstocks with high resid content are typically less expensive than higher quality feedstocks, the processing of high-resid feedstocks is more difficult because of their relatively high metals, nitrogen and sulfur contamination and higher boiling points. We have designed our MIDAS®, IMPACT®, NEKTOR™, and NOMUS™ product portfolios to enable our customers to increase the efficiency and yield of high-resid feedstock refining.

As a result of volatility in the price of diesel fuel as compared to gasoline, refiners desire the flexibility to adjust the yield of light cycle oil, a component of diesel fuel, from their FCC units. We have designed our MIDAS® 300 and DieseliseR™ products to increase the yield of light cycle oil from refinery FCC units.

6

Many U.S. petroleum refiners have entered into consent decrees with the U.S. Environmental Protection Agency under which the refiners have agreed to reduce emissions of nitrogen oxides and sulfur oxides. The European Union has also imposed requirements on refineries with respect to nitrogen oxides and sulfur oxides emissions. FCC units are generally the largest emitters of these pollutants in a refinery. Our additives are designed to assist refineries in meeting their obligations to reduce these pollutants. Our Super DESOX® additive reduces sulfur oxides emissions from commercial FCC units. Our XNOx® and DENOX® additives are designed to achieve reductions in nitrogen oxides emissions comparable to those obtained from the capital-intensive alternatives available to a refinery.

Global economic growth, especially in emerging markets, has increased the demand for plastics. As a result, our refinery customers have sought increased profits from petrochemicals by increasing the yield of propylene from their FCC units. Our ZSM-5-based technology, including our OlefinsMax® and OlefinsUltra® products, is designed to maximize the propylene output of FCC units.

In recent years, many countries and regions, including the U.S., European Union, Russia, India and China have imposed or increased the regulatory limitations on the sulfur content of gasoline and diesel fuel. We have developed a portfolio of products designed to assist refiners in meeting their gasoline sulfur reduction targets including our D-PriSM® and GSR® 5 additives and our SuRCA® and Neptune™ catalyst families.

Competition in FCC catalysts and additives is based on technology, product performance, customer service and price. Our principal FCC catalyst competitors are Albemarle and BASF which, with Intercat, are also principal competitors in FCC additives. We also have multiple regional competitors for FCC catalysts and additives.

Hydroprocessing Catalysts

We market hydroprocessing catalysts through ART, our joint venture with Chevron. We established ART to combine our technology with that of Chevron and to develop, market and sell hydroprocessing catalysts to customers in the petroleum refining industry worldwide.

As discussed above, our business is dependent on the economics of the petroleum industry. Refineries increasingly use feedstocks that have high resid content. We are a leading supplier of hydroprocessing catalysts designed for processing these feedstocks. We offer products for fixed-bed resid hydrotreating, on-stream catalyst replacement, ebullating-bed high-resid feedstock hydrocracking and distillate hydrotreating processes.

We also offer a full line of catalysts, customized for individual refiners, used in processing ultra-low sulfur content gasoline and diesel fuel, including our SmART Catalyst System® and ApART™ catalyst system. As discussed above, regulatory limitations on the sulfur content of gasoline and diesel fuel are becoming more common. These products are designed to help refiners to reduce the sulfur content of their products.

Competition in the hydroprocessing catalyst industry is based on technology, product performance, customer service and price. Albemarle and Criterion are our leading global competitors in hydroprocessing catalysts. We also have multiple regional competitors.

Materials Technologies

We provide enabling technologies that are silica- and silica-alumina-based functional additives and process aids, such as silica gel, colloidal silica, zeolitic adsorbents, precipitated silica and silica-aluminas, for a wide variety of applications. We are a global leader in can and closure sealants that,

7

along with our specialized can, Al-monoblock and closure coatings, we supply to the packaging industry. Or product portfolio includes:

Application

|

Use | Key Brands | ||

|---|---|---|---|---|

| Industrial | Reinforcing agents for rubber and tires | PERKASIL® | ||

Inorganic binders and surface smoothening aids for precision investment casting and refractory applications |

LUDOX® |

|||

Adsorbents for dual pane windows and industrial applications, desiccant granules, beads, powders and bags and polyurethane moisture scavengers |

PHONOSORB®, PHONOSORB MTX®, SYLOBEAD®, SYLOSIV®, CRYOSIV®, SAFETYSORB® |

|||

Chemical metal polishing aids and formulations for chemical mechanical planarization/electronics applications |

LUDOX®, PoliEdge® |

|||

Consumer |

Toothpaste abrasives and thickening agents, free-flow agents, anticaking agents, tabletting aids, cosmetic additives and flavor carriers |

SYLODENT®, SYLOID® FP™, SYLOBLANC®, ELFADENT®, SYLOID®, SYLOSIV® |

||

Edible oil refining agents, beer stabilizers and clarification aids for beer, juices and other beverages |

DARACLAR®, TriSyl® |

|||

Coatings and Print Media |

Matting agents, anticorrosion pigments, TiO2 extenders and moisture scavengers for paints and lacquers |

SYLOID®, SHIELDEX®, SYLOSIV®, SYLOWHITE™ |

||

Additives and formulations for matte, semi-glossy and glossy ink receptive coatings on high performance ink jet papers, photo paper, and commercial wide-format print media |

SYLOJET®, DURAFILL®, LUDOX® |

|||

Paper retention aids, functional fillers, paper frictionizers |

DURAFILL®, LUDOX® |

|||

Packaging |

Can sealants for rigid containers, that ensure a hermetic seal between the lid and the body of beverage, food, aerosol and other cans |

DAREX® |

||

Sealants for metal and plastic bottle closures that are used on pry-off and twist-off metal crowns, as well as roll-on pilfer-proof and plastic closures to seal and enhance the shelf life of food and beverages in glass and plastic bottles and jars |

DAREX®, DARAFORM®, DARASEAL®, DARABLEND®, Sincera®, Celox® |

|||

Coatings for metal packaging that are used in the manufacture of cans and closures to protect the metal against corrosion, protect the contents against the influences of metal, ensure proper adhesion of sealing compounds to metal surfaces, and provide base coats for inks and for decorative purposes |

DAREX®, Apperta®, Sistiaga® |

|||

Active packaging including oxygen scavenging closure sealants and moisture scavenging silica sachets, polymeric desiccants and desiccants for bottlestopper applications |

Celox®, SYLOSORB®, SAFETYSORB® |

8

Our products are integrated into our customers' manufacturing processes and, when combined with our technical support, increase the efficiency and performance of their products. By working closely with our customers, we help them to respond quickly to the changing needs of brand owners and consumers. We focus on high-growth segments and seek to develop and introduce new products that add additional value to the current and future needs of our customers. For example, our customers have incorporated our products into higher resolution print media, active packaging with oxygen or moisture scavenging functionality, less abrasive high cleaning toothpastes and technologies that are friendly to the environment such as water-based and VOC-compliant coatings, green tires with lower roll resistance and non-toxic anticorrosion protection.

Our packaging products are designed to address major industry trends such as lighter weight packaging, lower energy consumption, personal convenience, and highly individualized packaging. Our growth is driven by innovation of higher performing products, continuous discovery of new applications, the need for sustainability and rising disposable income in emerging markets. We seek to capitalize upon our technical customer service, global infrastructure and expertise in global regulatory compliance (including food law compliance) to enhance our growth, especially in emerging markets.

Our Materials Technologies product group is global. Our major competitors include PQ/INEOS, Evonik, UOP and Altana, all of which market their products on a global basis. Competition is generally based on product performance, technical service and reliability, as well as additional value-added features to address the needs of our customers, end-users and brand owners.

Specialty Technologies

Specialty Catalysts and Process Technologies

We are a leading provider of catalyst systems and catalyst supports to the polyolefins industry for a variety of polyethylene and polypropylene process technologies. These types of catalysts are used for the manufacture of polyethylene and polypropylene resins used in products such as plastic film, high-performance plastic pipe, automobile parts, household appliances and household containers. We use a combination of proprietary catalyst and support technology, as well as technology licensed from third parties, to provide unique catalyst-based solutions to industry, and to provide a broad technology portfolio for enhancing collaboration opportunities with technology leaders.

Our Magnapore® polymerization catalyst is used to produce high performance polyethylene in the slurry loop process for pipe and film applications. Our POLYTRAK® polymerization catalyst is designed to achieve improved polymer performance, particularly for impact-resistant applications such as automobile bumpers and household appliances.

Our Sylobloc® polymer additives for producers and processors of plastic products prevent layers of polymer film from sticking together, improve dispersement of pigments and ease removal from molds.

Our renewables product line draws upon our expertise in catalysis and separations to develop and provide technologies for purification, drying, and biofeedstock conversion, including our EnSieve® desiccants for ethanol dehydration and EnPure® adsorbents for biodiesel purification. Growth in our renewables business is driven by sales into ethanol dehydration and bio-diesel purification applications as a result of government mandates and escalating fuel prices.

Our Davicat® standard and customized catalysts offer a wide range of chemical and physical properties based on our material science technology for supported catalysts and biotechnology applications such as nylon and artificial sweeteners. Our Raney® nickel, cobalt and copper hydrogenation and dehydrogenation catalysts are used for the synthesis of organic compounds for the fibers, pharmaceuticals, plastics, perfumes, soaps, color couplers and petroleum industries.

9

Our Sylobead® process adsorbents are used in petrochemical and natural gas processes for such applications as ethylene-cracked-gas-drying, natural gas drying and sulfur removal.

The specialty catalyst industry is technology-intensive and suppliers must provide products formulated to meet customer specifications. There are many manufacturers of polyolefin and other specialty catalysts including PQ/INEOS, Albemarle, LyondellBasell, Univation and BASF, and most sell their products worldwide.

Discovery Sciences

We market chromatography and related purification products, pharmaceutical excipients and CO2 adsorbents including:

Products

|

Key Brands | |

|---|---|---|

| Flash chromatography systems and consumables | Reveleris®, RevealX™, GraceResolv™ | |

Analytical scale high performance liquid chromatograph (HPLC) columns and detectors |

VisionHT™, Vydac®, Alltech®, Alltima™ |

|

Preparative scale purification products including media, column hardware, and equipment |

Davisil®, Vydac®, MODcol®, Spring®, Multipacker® |

|

Pharmaceutical excipients |

Syloid® FP |

|

CO2 adsorbents for anesthesiology and re-breathing applications |

Sodasorb® |

Our products are used in a wide range of applications, including drug discovery and purification, for the pharmaceutical and biotechnology industries, environmental analysis, forensics, petrochemical analysis and the manufacture of food, cosmetics, vitamins and biofuels. We also market chromatography consumables and analytical and preparative columns packed with our specialty media. We can modify the base silica and surface chemistry for analytical, preparative and process-scale customers in order to enhance our product performance for their unique applications.

Our products compete on the basis of product quality, distinct technology and customer support. Competition for these products is highly fragmented with a large number of companies that sell their products on a global and regional basis, although a number of companies, such as Waters Corporation, Agilent Technologies and Thermo-Fisher, have a substantial global position and a relatively large installed customer base.

Manufacturing

Our Grace Davison products are manufactured by a network of globally-coordinated plants that are positioned to service our customers regionally. Our packaging products are manufactured in both large facilities to permit economies of scale and a network of smaller operations that enable customization to local market conditions. Our integrated planning organization is responsible for the effective utilization of our manufacturing capabilities. Our Discovery Sciences product line has its own integrated planning organization.

Marketing and Sales

We use a global organization of technical professionals with extensive experience in refining processes, catalyst development, and catalyst applications to market our Refining Technologies catalysts and additives. These professionals work to tailor our technology to the needs of each specific customer. We generally negotiate prices for our refining catalysts because our formulations are specific to the needs of each customer and each customer receives individual attention and

10

technical service. We generally sell our hydroprocessing catalysts through multiple-year supply agreements with our geographically diverse customer base.

We use country-based direct sales forces that are dedicated to each product line and backed by application-specific technical customer service teams to market our Materials Technologies and Discovery Sciences products. Our sales force seeks to develop long-term relationships with our customers and focuses on consultative sales, technical support and key account growth programs. To ensure full geographic coverage, our direct sales organization is further supplemented, especially with respect to our Discovery Sciences products, by a network of agents and distributors.

We use a global direct sales force for our other Specialty Catalysts and Process Technologies products that seeks to maintain close working relationships with our customers. These relationships enable us to cooperate with major polymer and chemical producers to develop catalyst technologies that complement their process developments. We have geographically distributed our sales and technical service professionals to make them responsive to the needs of our geographically diverse customers. We typically operate under long-term contracts with our customers.

Our marketing and research and development functions operate globally. We offer web-based support, including technical service, literature access, customer feedback tools, and process design formulas to assist our specialty catalysts and process technologies customers in determining their needs for our products.

Seasonality does not have a significant overall effect on our Grace Davison operating segment. However, sales of FCC catalysts tend to be lower in the first calendar quarter prior to the shift in production by refineries from home heating oil for the winter season to gasoline production for the summer season. FCC catalysts and ebullating-bed hydroprocessing catalysts are consumed at a relatively steady rate and are replaced regularly. Fixed-bed hydroprocessing catalysts are consumed over a period of years and are replaced in bulk in an irregular pattern. Since our customers periodically shut down their refining processes to replace fixed-bed hydroprocessing catalysts in bulk, our hydroprocessing catalyst sales to any customer can vary substantially over the course of a year and between years based on that customer's catalyst replacement schedule. Our packaging products and some of our construction-related products such as insulated glass desiccants are affected by seasonal and weather-related factors including the consumption of beverages, the size and quality of food crops and the level of construction activity. These impacts are mitigated by the global nature of this product line.

Raw Materials

The principal raw materials for Grace Davison products include caustic soda, alumina, rare earths, nickel, aluminum, cobalt, kaolin, molybdenum, sodium aluminate, sodium silicate, resins, rubber and lattices (including certain food-grade raw materials). Multiple suppliers are generally available for each of these materials; however some of our raw materials may be provided by single sources of supply. We seek to mitigate the risk of using single source suppliers by identifying and qualifying alternative suppliers or, for unique materials, by using alternative formulations from other suppliers or by passing price increases on to customers. In some instances, we produce our own raw materials and intermediates.

Prices for many of our raw materials, including metals and petroleum-based specialty and commodity materials such as resins and solvents, have been volatile in recent years. As in many chemical businesses, we consume significant quantities of natural gas in the production of Grace Davison products. World events and other economic factors have caused volatility in the price of natural gas. Increases or decreases in the cost of natural gas and raw materials can have a significant impact on our operating margins. Since we manufacture a substantial portion of our packaging products in developing countries using raw materials from suppliers in the U.S., Europe

11

and other developed economies, changes in the values of the currencies of these developing countries versus the U.S. dollar and the Euro may adversely affect our raw material costs and the prices we may charge for our products.

Grace Construction Products Operating Segment

Our Grace Construction Products, or GCP, products include specialty construction chemicals and specialty building materials. GCP manages its business under a geographic organizational structure that focuses on the following regions:

- •

- GCP Americas includes products sold to customers in North, Central and

South America;

- •

- GCP Europe includes products sold to customers in Eastern and Western

Europe, the Middle East, Africa and India; and

- •

- GCP Asia Pacific includes products sold to customers in Asia (excluding India), Australia and New Zealand.

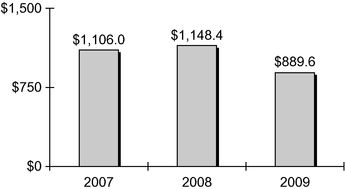

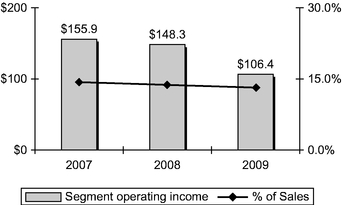

The following table sets forth GCP sales by region as a percentage of GCP total revenue.

| |

2009 | 2008 | 2007 | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Sales | % of GCP Revenue |

Sales | % of GCP Revenue |

Sales | % of GCP Revenue |

|||||||||||||

| |

(In millions) |

||||||||||||||||||

GCP Americas |

$ | 458.4 | 51.5 | % | $ | 595.0 | 51.8 | % | $ | 587.1 | 53.1 | % | |||||||

GCP Europe* |

296.6 | 33.3 | % | 407.1 | 35.5 | % | 380.6 | 34.4 | % | ||||||||||

GCP Asia Pacific |

134.6 | 15.2 | % | 146.3 | 12.7 | % | 138.3 | 12.5 | % | ||||||||||

Total GCP Revenue |

$ | 889.6 | 100.0 | % | $ | 1,148.4 | 100.0 | % | $ | 1,106.0 | 100.0 | % | |||||||

- *

- Includes the Middle East, Africa and India.

The following table sets forth GCP sales of similar products as a percentage of Grace total revenue.

| |

2009 | 2008 | 2007 | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Sales | % of Grace Revenue |

Sales | % of Grace Revenue |

Sales | % of Grace Revenue |

|||||||||||||

| |

(In millions) |

||||||||||||||||||

Specialty Construction Chemicals |

$ | 578.1 | 20.5 | % | $ | 741.3 | 22.4 | % | $ | 744.3 | 23.9 | % | |||||||

Specialty Building Materials |

311.5 | 11.0 | % | 407.1 | 12.3 | % | 361.7 | 11.6 | % | ||||||||||

Total GCP Revenue |

$ | 889.6 | 31.5 | % | $ | 1,148.4 | 34.7 | % | $ | 1,106.0 | 35.5 | % | |||||||

We are a supplier to the nonresidential (commercial and infrastructure) construction industry, and to a lesser extent, the residential construction and repair and restoration industries. The

12

following table shows our principal specialty construction chemicals and specialty building materials products:

Products

|

Uses | Customers | Key Brands | |||

|---|---|---|---|---|---|---|

| Concrete admixtures | Concrete admixtures and polymeric fibers are used to reduce the production and in-place costs of concrete, increase the performance of concrete and improve the life cycle cost of the structure. | Ready-mix and precast concrete producers, engineers and specifiers | ADVA®, STRUX®, PolarSet®, Eclipse® | |||

Additives for cement processing |

Cement additives added to the grinding stage of the cement manufacturing process improve the energy efficiency of the plant and enhance the performance of the finished cement. Chromium reducing additives help cement manufacturers in Europe meet environmental regulations. |

Cement manufacturers |

CBA®, Synchro®, HEA2®, TDA® |

|||

Products for architectural concrete |

Products for architectural concrete include surface retarders, coatings, pigments and release agents used by concrete producers and contractors to enhance the surface appearance and aesthetics of concrete. |

Precast concrete producers and architects |

Pieri® |

|||

Admixtures for masonry concrete |

Products for masonry concrete are used by block and paver producers for process efficiency and to improve the appearance, durability and water resistance of finished concrete masonry units. |

Masonry block manufacturers |

Dry-Block®, Optec®, Quantec® |

|||

Specialty vermiculite products |

Specialty vermiculite products are used in a wide range of applications making use of vermiculite's insulating properties and its ability to absorb nutrients, primarily in the horticultural, construction, and automotive industries. |

Manufacturers of a variety of products, including potting soils, animal feeds, brakes, clutches and fire-rated products |

MicroLite®, Verxite™, FRSV™ |

|||

Structural waterproofing, vapor and air barrier systems |

Structural waterproofing and air barrier systems prevent water, vapor and/or air infiltration in commercial structures. Products include self-adhered sheet and liquid membranes, joint sealing materials, drainage composites and waterstops. |

Architects and structural engineers; specialty waterproofing and general contractors; specialty waterproofing distributors |

Bituthene®, Procor®, Preprufe®, Perm-A-Barrier®, Adprufe® |

13

Products

|

Uses | Customers | Key Brands | |||

|---|---|---|---|---|---|---|

| Residential building materials | Specialty roofing membranes and flexible flashings for windows, doors, decks and detail areas include fully-adhered roofing underlayments, synthetic underlayments and self-adhered flashing. | Roofing contractors, home builders and remodelers; specialty roofing distributors, lumberyards and home centers; homeowners; architects and specifiers | Ice & Water Shield®, Tri-Flex®, Bondera®, Vycor® | |||

Fire protection |

Fire protection products are spray-applied to the structural steel frame, encasing and insulating the steel and protecting the building in the event of fire. |

Local contractors and specialty subcontractors and applicators; building materials distributors; industrial manufacturers; architects and structural engineers |

Monokote® |

In view of this diversity of customers and customer requirements, and because specialty construction chemicals and specialty building materials require intensive sales and customer service efforts, we maintain a direct sales and technical support team with sales personnel based in more than 35 countries worldwide. This sales and support team sells products under global contracts, under U.S. or regional contracts, and on a job-by-job basis. We also use distributors in both domestic and overseas markets. We compete globally with several large construction materials suppliers, and regionally and locally with numerous smaller competitors. In recent years, the cement and concrete industry has experienced some consolidation, thereby increasing the importance of serving well our global customers. For some customer groups, such as producers and contractors, operational efficiency and total applied cost are key factors in making purchasing decisions, while for others, such as architects and engineers, product performance and design versatility are more important.

Competition for our construction products is based on product performance, technical support and service, brand name recognition in the construction industry and price. Our major global specialty construction chemicals competitors are BASF and Sika.

We seek to improve our products, adapt them for new applications and add new products through our growth and innovation processes that focus on understanding the needs of our customers, key performance indicators and research and development. We also seek to extend our product portfolio and geographic reach through acquisitions.

In addition to new product introductions, product enhancements and acquisitions, we look for growth opportunities in developing countries where increasing construction activity, improvement in building codes, and sophistication of construction practices can accelerate demand for our construction products. We continue to expand our commercial and manufacturing capabilities in these geographic areas.

The key raw materials used in our specialty construction products are obtained from a variety of suppliers, including commodity chemical producers, petroleum companies and paper manufacturers. The majority of our raw materials are olefins and organic chemicals; we also make significant

14

purchases of inorganic materials such as gypsum, as well as specialty materials including specialty films, papers, membranes and fibers. In most instances, these materials are available from multiple sources. Global supply and demand factors, changes in currency valuations against the U.S. dollar and petroleum prices significantly impacted the price and availability of key raw materials in recent years.

The construction business is cyclical in response to economic conditions and construction demand. The construction business is also seasonal and dependent on favorable weather conditions, with a decrease in construction activity during the winter months. Demand for our specialty construction products is primarily impacted by global non-residential construction activity and U.S. residential construction activity. We seek to increase profitability and minimize the impact of cyclical downturns in regional economies by introducing technically advanced high-performance products and expanding geographically. Although in recent years these strategies have been successful in reducing the impact of cyclicality, a decline in U.S. and European construction activity in 2007 through 2009 has had a negative impact on our sales in North America and Western Europe.

FINANCIAL INFORMATION ABOUT INDUSTRY SEGMENTS AND GEOGRAPHIC AREAS

Disclosure of financial information about industry segments and geographic areas for 2009, 2008 and 2007 is provided in this Report in Item 8 (Financial Statements and Supplementary Data) in the Financial Supplement under Note 21 (Operating Segment Information) to the Consolidated Financial Statements which disclosure is incorporated herein by reference. Disclosure of risks attendant to our foreign operations is provided in this Report in Item 1A (Risk Factors).

INTELLECTUAL PROPERTY; RESEARCH ACTIVITIES

Competition in the specialty chemicals and specialty materials industry is often based on technological superiority and innovation. Our ability to maintain our margins and effectively compete with other suppliers depends on our ability to introduce new products based on innovative technology, as well as our ability to obtain patent or other intellectual property protection. Our research and development programs emphasize development of new products and processes, improvement of existing products and processes and application of existing products and processes to new industries and uses. We conduct research in all regions, with North America and Europe accounting for the most activity.

We routinely file applications to obtain world-wide patents to protect our investments in innovation, research, and product development. Numerous patents and patent applications protect our products, formulations, manufacturing processes, equipment, and improvements. We also benefit from the use of trade secret information, including know-how and other proprietary information relating to many of our products and processing technologies. There can be no assurance, however, that our patents, patent applications and precautions to protect trade secrets and know-how will provide sufficient protection for our intellectual property. In addition, other companies may independently develop systems or processes that could circumvent our patents or may acquire patent rights applicable to our business.

Research and development expenses were approximately $70 million, $83 million, and $80 million in 2009, 2008, and 2007, respectively. These amounts include depreciation and amortization expenses related to research and development and expenses incurred in funding external research projects. The amount of research and development expenses relating to government- and customer-sponsored projects (rather than projects that we sponsor) was not material during these periods.

15

ENVIRONMENT, HEALTH AND SAFETY MATTERS

We are subject, along with other manufacturers of specialty chemicals, to stringent regulations under numerous U.S. federal, state and local and foreign environment, health and safety laws and regulations relating to the generation, storage, handling, discharge, disposition and stewardship of hazardous wastes and other materials. Environmental laws require that certain responsible parties, as defined in the relevant statute, fund remediation actions regardless of legality of original disposal or ownership of a disposal site. We are involved in remediation actions to address hazardous wastes or other materials as required by U.S. federal, state and local and foreign laws. During the Chapter 11 proceeding, we generally are not participating in the funding of investigation and remediation at sites that we do not own. Our ultimate liability with respect to many of these sites will be determined as part of the Chapter 11 proceeding.

We have expended substantial funds to comply with environmental laws and regulations and expect to continue to do so in the future. The following table sets forth our expenditures in the past three years, and our estimated expenditures in 2010 and 2011, for (i) the operation and maintenance of manufacturing facilities and the disposal of wastes; (ii) capital expenditures for environmental control facilities; and (iii) site remediation:

Year

|

Operation of Facilities and Waste Disposal |

Capital Expenditures |

Site Remediation |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

(In $ millions) |

|||||||||

2007 |

62 | 9 | 9 | |||||||

2008 |

51 | 5 | 257 | (a) | ||||||

2009 |

47 | 7 | 8 | |||||||

2010 |

47 | 6 | 16 | (b) | ||||||

2011 |

49 | 6 | 8 | (b) | ||||||

- (a)

- Includes

$252 million payment to the U.S. Government to satisfy all past and future response costs related to the Libby, Montana Superfund Site

(excluding the Grace-owned Libby vermiculite mine, see disclosure provided in this Report in Item 8 (Financial Statements and Supplementary Data) in the Financial Supplement under

Note 13 (Commitments and Contingent Liabilities) to the Consolidated Financial Statements).

- (b)

- For 2010 and 2011, amounts are current estimates of ongoing site remediation costs and exclude payments of claims in our Chapter 11 proceeding.

Additional information about our environmental remediation activities is provided in this Report in Item 3 (Legal Proceedings).

We continuously seek to improve our environmental, health and safety performance. To the extent applicable, we extend the basic elements of the American Chemistry Council's Responsible Care® program to all our locations worldwide, embracing specific performance objectives in the key areas of management systems, product stewardship, employee health and safety, community awareness and emergency response, distribution, process safety and pollution prevention. We have implemented key elements of the new Responsible Care® Security Code for our operations and systems. We have completed a review of our existing security (including cyber-security) vulnerability and have taken actions to enhance our security systems and protect our assets. We have undertaken certain activities to comply with the Department of Homeland Security (DHS) Chemical Facility Anti-Terrorism Standards, including identifying facilities subject to the standards, conducting security vulnerability assessments and developing site security plans, as necessary.

16

EMPLOYEE RELATIONS

As of December 31, 2009, we employed approximately 5,940 persons, of whom approximately 2,650 were employed in the United States. Of our total employees, approximately 3,615 work in Grace Davison facilities, approximately 1,565 work in Grace Construction Products facilities, and approximately 760 are dedicated to corporate activities and/or are shared through globally managed professional groups such as finance, legal services, human resources, information technology, supply chain and environment, health and safety.

Approximately 755 of our manufacturing employees in the United States are represented for collective bargaining purposes by nine different local collective bargaining groups. We have operated without a labor work stoppage for more than 10 years.

We have works councils representing the majority of our European sites serving approximately 1,765 employees.

RISK MANAGEMENT

We have programs in place to address the following significant risks to Grace:

- •

- Disasters—We have disaster recovery plans in effect at key

sites, and we have built a certain amount of redundancy into our production plants where feasible. We also have a formalized risk management program, which includes several types and layers of

insurance. We are advised by risk management professionals and brokers who are familiar with recent trends in the insurance markets worldwide. The level of insurance carried, and other related aspects

such as deductibles, self-insurance levels and policy terms, are monitored by management on a regular basis.

- •

- Environmental—We are committed to the heath and safety of all

employees and to protecting the environment from damage through the use or production of our products. Our Environment, Health and Safety (EH&S) organization is global in scope and is charged with

assuring that we live up to our commitments in this important area. The group performs EH&S audits of our facilities and regularly monitors local laws and regulations. Where appropriate, we use

outside consultants and experts to augment our in-house staff. We continue to implement our EHS management system in our facilities worldwide. Our EHS management system is designed to

enable us to apply "best practices" and "continual improvement" principles across our business.

- •

- Ethics and Fraud—We insist that our employees maintain the

highest standards of ethical behavior. We have preventative and investigatory programs in place to maintain these standards, as follows:

- •

- We have established online ethics and compliance training programs in several languages.

- •

- All U.S. employees and many employees outside the U.S. must sign an annual ethics statement in which they renew their

commitment to operate ethically and according to the Grace code of conduct. They must also report any actual or potential conflicts of interest for evaluation by management and, if necessary,

remediation.

- •

- We have an anonymous toll-free telephone line to report fraudulent or unethical behavior to our Chief Ethics Officer. The direct line is available to all employees worldwide where local law allows such a facility. Any allegation of fraud is required to be reported to the Audit Committee of the Board of Directors.

17

- •

- Our Internal Audit Department is independent of management and reports functionally to the Chairman of the Audit Committee

of the Board of Directors. The department conducts investigations in collaboration with the Chief Ethics Officer when alleged frauds have accounting, financial reporting or fiscal aspects.

- •

- We provide training to personnel in key positions covering topics such as the U.S. Foreign Corrupt Practices Act, the Sarbanes Oxley Act of 2002, and other laws and regulations relating to ethical or legal matters.

AVAILABILITY OF REPORTS AND OTHER DOCUMENTS

We maintain an Internet website at www.grace.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, are available, free of charge, on our website as soon as reasonably practicable after such reports are electronically filed with, or furnished to, the Securities and Exchange Commission, or SEC. These reports may be accessed through our website's investor information page.

In addition, the charters for the Audit, Compensation, Nominating and Governance, and Corporate Responsibility Committees of our Board of Directors, our corporate governance guidelines and code of ethics are available, free of charge, on our website at www.grace.com/About/Leadership/Governance/. Printed copies of the charters, governance guidelines and code of ethics may be obtained free of charge by contacting Grace Shareholder Services at 410-531-4167.

The information on our website is not, and shall not be deemed to be, a part of this report or incorporated into any other filings we make with the SEC.

Our Chief Executive Officer and Chief Financial Officer have submitted certifications to the SEC pursuant to the Sarbanes Oxley Act of 2002 as exhibits to this Report.

EXECUTIVE OFFICERS

See Part III, Item 10 of this Report for information about our Executive Officers.

This Report, including the Financial Supplement, contains, and our other public communications may contain, projections or other "forward-looking" information, that is, information related to future, not past, events. Such information generally includes the words "believes," "plans," "intends," "targets," "will," "expects," "anticipates," or similar expressions and includes all statements regarding our Chapter 11 proceeding, expected financial position, results of operations, cash flows, financing plans, business strategy, budgets, capital and other expenditures, competitive positions, growth opportunities for existing products, benefits from new technology and cost reduction initiatives, plans and objectives of management and markets for securities. For these statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Like other businesses, we are subject to risks and uncertainties that could cause our actual results to differ materially from our projections or that could cause other forward-looking information to prove incorrect. Factors that could cause actual events to materially differ from those contained in the forward-looking statements include those factors set forth below and elsewhere in this Annual Report on Form 10-K. Further, our reported results should not be considered as an indication of our future performance. Readers are cautioned not to place undue reliance on our projections and forward-looking information, which speak only as of the date thereof. We undertake no obligation to publicly release any revisions to the projections and forward-

18

looking information contained in this document, or to update them to reflect events or circumstances occurring after the date of this document.

In addition to general economic, business and market conditions, we are subject to other risks and uncertainties, including, without limitation, the following:

COMPANY RISKS

Our proposed joint plan of reorganization, if confirmed and effective, may substantially impact the value of currently outstanding shares of Grace common stock.

On February 27, 2009, supported by the Official Committee of Equity Security Holders, the Official Committee of Asbestos Personal Injury Claimants and the legal representative of future asbestos personal injury claimants, as co-proponents, we filed an amended proposed joint plan of reorganization, as further amended, the Joint Plan, with the bankruptcy court that is designed to address all pending and future asbestos-related claims and all other pre-petition claims as outlined therein. The Joint Plan may, if confirmed and effective, substantially impact the value of the ownership interests of holders of currently outstanding Grace common stock. Although it is supported by the parties thereto, other parties-in-interest in our Chapter 11 case have objected to several provisions of the Joint Plan. As a result, it is possible that the Joint Plan will not be confirmed by the bankruptcy court or the district court or become effective. Further, the effectiveness of the Joint Plan is subject to the fulfillment of numerous conditions that may not ultimately be fulfilled. One of these conditions is that we raise sufficient funds to pay certain claims in cash. We expect to require up to $850 million in new financing to fund the Joint Plan. If we are unable to obtain the necessary financing on acceptable terms, our emergence from Chapter 11 may be delayed. Until an ultimate plan of reorganization is confirmed and effective, the interests of the holders of Grace common stock remain subject to substantial dilution or cancellation. Accordingly, the value of Grace common stock is highly speculative and any investment in Grace common stock poses a high degree of risk.

If our proposed joint plan of reorganization is not confirmed or does not become effective, the outcome of our Chapter 11 cases could result in the substantial dilution or cancellation of Grace's currently outstanding common stock.

If our proposed joint plan of reorganization is not confirmed or does not become effective, the outcome of our Chapter 11 cases would depend primarily upon the resolution of our asbestos-related and other contingent liabilities. We would likely return to the bankruptcy court estimation trial that was suspended in April 2008 due to the personal injury settlement. We expect that the estimate resulting from this process would form the basis for a plan of reorganization that would provide for the funding of one or more trusts to which all pending and future asbestos-related claims would be channeled. If the amount of asbestos-related liabilities, as determined through estimation or otherwise, and other liabilities exceeded the assets available for funding, then we likely would issue additional shares of Grace common stock to satisfy such liabilities. The number of shares to be issued could substantially dilute the interests of current shareholders or result in a recapitalization of Grace that would cancel the shares of current shareholders and issue new shares to asbestos and other creditors. Because of this risk of substantial dilution or cancellation, the value of Grace common stock is highly speculative and any investment in Grace common stock poses a high degree of risk.

19

If objections to the Joint Plan are resolved adversely to Grace and the other proponents of the Joint Plan or if rulings resolving objections favorably to the proponents of the Joint Plan are appealed, conditions to the effectiveness of the Joint Plan may not be satisfied and the timing and terms of our emergence from Chapter 11 could be materially affected.

The Bankruptcy Court required parties-in-interest who object to the Joint Plan to submit their objections by May 20, 2009. The objections filed generally relate to demands for interest at rates higher than provided for in the Joint Plan, assertions that the Joint Plan impairs insurers' contractual rights, assertions that the Joint Plan discriminates against Libby, Montana personal injury claimants, and the classification and treatment of claims under the Joint Plan. We believe that the Joint Plan complies with the requirements for confirmation under the Bankruptcy Code and we intend to vigorously defend the Joint Plan against these and all other objections. If certain objections were resolved adversely to the Joint Plan proponents, or if rulings by the Bankruptcy Court resolving certain objections favorably to the Joint Plan proponents were appealed, certain conditions to the effectiveness of the Joint Plan, including for example, payments pursuant to the Sealed Air Settlement and the Fresenius Settlement, might not be satisfied and potential lenders might not be willing to provide the new financing that Grace expects to require to fund the Joint Plan. The resolution of these objections and any related appeals could have a material effect on the terms and timing of our emergence from Chapter 11.

The bankruptcy process may disrupt our business.

We have attempted to minimize the adverse effect of our Chapter 11 reorganization on our relationships with our employees, suppliers, customers and other parties. Nonetheless, our relationships with our customers, suppliers and employees may be adversely impacted and our operations could be materially and adversely affected. In addition, the continuation of our reorganization could negatively affect our ability to attract new employees and retain existing high performing employees.

Chapter 11 limits the flexibility of our management team in running our business.

While we operate our businesses as debtor-in-possession under supervision by the bankruptcy court, we are required to obtain the approval of the bankruptcy court prior to engaging in activities or transactions outside the ordinary course of business. For example, our strategic plan includes the acquisition of businesses in the specialty chemicals and specialty building materials industries. Such acquisitions generally require bankruptcy court approval if made by the company or its U.S. subsidiaries and affiliates that are parties to the Chapter 11 cases. Bankruptcy court approval of non-ordinary course activities entails preparation and filing of appropriate motions with the bankruptcy court, negotiation with the various creditors' committees and other parties in interest and one or more hearings. The various creditors' committees and other parties in interest may be heard at any bankruptcy court hearing and may raise objections with respect to these motions. This process delays major decisions and limits our ability to respond quickly to opportunities and events in the marketplace. Furthermore, in the event the bankruptcy court does not approve a proposed activity or transaction, we would be prevented from engaging in activities and transactions that we believe are beneficial to Grace.

20

Our financial statements do not reflect the terms of the proposed Joint Plan.

Our financial statements include estimates of asbestos-related liabilities that are based on the conditions precedent to the amended plan of reorganization that we filed in 2005, the Prior Plan, rather than the Joint Plan. The Prior Plan and the Joint Plan would result in substantially different amounts of the asbestos-related liabilities in our financial statements. When we adjust our financial statements based on the Joint Plan or another plan that is filed and/or confirmed, such adjustments could be material to our consolidated financial position and results of operations.

The proforma and prospective financial information that we filed with the bankruptcy court as an exhibit to the Joint Plan has not been and may not be fully updated to reflect events that occur after that filing and is subject to numerous assumptions.

We provided proforma and prospective financial information in the exhibits to the Joint Plan filed with the bankruptcy court in compliance with the requirements of the U.S. Bankruptcy Code. That information is not included in or incorporated into this Report. Though we have and may continue from time to time to update some of the information set forth in the proforma and prospective financial information to reflect events that occur after the filing of the Joint Plan with the bankruptcy court, we would not expect to fully update all such information unless required to do so by the U.S. Bankruptcy Code or the bankruptcy court. Further, this information is prepared in a format that may not be comparable to information in our financial statements included in this Report or other Reports filed with the SEC and is subject to numerous assumptions that may not be correct. As a result, investors in Grace common stock should not rely upon the proforma and prospective financial information filed with the bankruptcy court in connection with the Joint Plan.

We may not be able to collect all asbestos-related insurance payments that may be due to us.

We have insurance coverage for a portion of the asbestos-related claims against us. Under the Joint Plan, insurance policies that provide coverage for asbestos-related claims and proceeds, including interest, received after the date of the personal injury settlement, would be assigned to the personal injury trust established under the Joint Plan. We estimate that, assuming an ultimate payout of asbestos-related claims equal to the $1,700 million of asbestos-related liabilities recorded on our balance sheet, we should be entitled to approximately $500 million of insurance recovery. Accordingly, our December 31, 2009 balance sheet includes a long-term asset for estimated asbestos-related insurance of $500 million. Although this amount pertains only to insurance carriers with which we have asbestos settlement agreements, and/or which are currently solvent, we cannot be sure that all these amounts will be collected. We have entered into a settlement agreement with an underwriter of a portion of our excess insurance coverage. The insurer funded an escrow account for the benefit of the holders of claims that holds approximately $93.5 million, including interest earned on the account as of December 31, 2009. The settlement agreement, as amended in July 2009, provides that unless we confirm a plan of reorganization by December 31, 2013, at the option of the underwriter, exercisable at any time prior to April 30, 2014, the escrow amount with interest must be returned to the underwriter. The timing and amount of future payments from our insurers depends on their continued solvency and the resolution of disputes regarding coverage under the insurance policies as well as the nature and timing of actual claims paid. Because of the significance of our future asbestos-related payments, the receipt of timely and complete payments from our insurers will be important to the success of our reorganization. Under the Joint Plan, insurance policies that provide coverage for asbestos-related claims and proceeds from those policies, including interest, received after the date of the personal injury settlement, would be assigned to the personal injury trust established under the Joint Plan.

21

We are subject to environmental clean-up fines, penalties and damage claims that have been and continue to be costly.