Attached files

| file | filename |

|---|---|

| EX-95 - EXHIBIT 95 - W R GRACE & CO | a2q18exhibit95.htm |

| EX-32 - EXHIBIT 32 - W R GRACE & CO | a2q18exhibit32.htm |

| EX-31.(I).2 - EXHIBIT 31(I).2 - W R GRACE & CO | a2q18exhibit31i2.htm |

| EX-31.(I).1 - EXHIBIT 31(I).1 - W R GRACE & CO | a2q18exhibit31i1.htm |

| EX-15 - EXHIBIT 15 - W R GRACE & CO | a2q18exhibit15.htm |

| EX-10.5 - EXHIBIT 10.5 - W R GRACE & CO | a2q18exhibit105.htm |

| EX-10.4 - EXHIBIT 10.4 - W R GRACE & CO | a2q18exhibit104.htm |

| EX-10.3 - EXHIBIT 10.3 - W R GRACE & CO | a2q18exhibit103.htm |

| EX-10.2 - EXHIBIT 10.2 - W R GRACE & CO | a2q18exhibit102.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the Quarterly Period Ended June 30, 2018 | ||

or | ||

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

Commission File Number 1-13953 | ||

W. R. GRACE & CO.

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 65-0773649 (I.R.S. Employer Identification No.) |

7500 Grace Drive, Columbia, Maryland 21044-4098

(Address of principal executive offices) (Zip code)

(410) 531-4000

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ý | Accelerated filer o | |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o | |

Emerging growth company o | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ý No o

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Class | Outstanding at July 31, 2018 | |

Common Stock, $0.01 par value per share | 67,238,067 shares | |

TABLE OF CONTENTS

_______________________________________________________________________________

GRACE®, the GRACE® logo and, except as otherwise indicated, the other trademarks, service marks or trade names used in the text of this Report are trademarks, service marks, or trade names of operating units of W. R. Grace & Co. or its subsidiaries and/or affiliates. Unless the context indicates otherwise, in this Report the terms “Grace,” “we,” “us,” or “our” mean W. R. Grace & Co. and/or its consolidated subsidiaries and affiliates, and the term the “Company” means W. R. Grace & Co. Unless otherwise indicated, the contents of websites mentioned in this report are not incorporated by reference or otherwise made a part of this Report.

The Financial Accounting Standards Board® is referred to in this Report as the “FASB.” The FASB issues, among other things, the FASB Accounting Standards Codification® (“ASC”) and Accounting Standards Updates (“ASU”). The U.S. Internal Revenue Service is referred to in this Report as the “IRS.”

2

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

Review by Independent Registered Public Accounting Firm

With respect to the interim consolidated financial statements included in this Quarterly Report on Form 10-Q for the quarter ended June 30, 2018, PricewaterhouseCoopers LLP, the Company’s independent registered public accounting firm, has applied limited procedures in accordance with professional auditing standards for a review of such information. Their report on the interim consolidated financial statements, which follows, states that they did not audit and they do not express an opinion on the unaudited interim consolidated financial statements. Accordingly, the degree of reliance on their report on the unaudited interim consolidated financial statements should be restricted in light of the limited nature of the review procedures applied. This report is not considered a “report” within the meaning of Sections 7 and 11 of the Securities Act of 1933, and, therefore, the independent accountants’ liability under Section 11 does not extend to it.

3

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of W. R. Grace & Co.:

Results of Review of Financial Statements

We have reviewed the accompanying consolidated balance sheet of W. R. Grace & Co. and its subsidiaries as of June 30, 2018, and the related consolidated statements of operations and comprehensive income (loss) for the three-month and six-month periods ended June 30, 2018 and 2017 and the consolidated statements of equity and of cash flows for the six-month periods ended June 30, 2018 and 2017, including the related notes (collectively referred to as the “interim financial statements”). Based on our reviews, we are not aware of any material modifications that should be made to the accompanying interim financial statements for them to be in conformity with accounting principles generally accepted in the United States of America.

We have previously audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheet of the Company as of December 31, 2017, and the related consolidated statements of operations, of comprehensive income, of equity, and of cash flows for the year then ended (not presented herein), and in our report dated February 22, 2018, we expressed an unqualified opinion on those consolidated financial statements. In our opinion, the information set forth in the accompanying consolidated balance sheet information as of December 31, 2017, is fairly stated, in all material respects, in relation to the consolidated balance sheet from which it has been derived.

Basis for Review Results

These interim financial statements are the responsibility of the Company’s management. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our review in accordance with the standards of the PCAOB. A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with the standards of the PCAOB, the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

/s/ PricewaterhouseCoopers LLP

Baltimore, Maryland

August 8, 2018

4

W. R. Grace & Co. and Subsidiaries

Consolidated Statements of Operations (unaudited)

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

(In millions, except per share amounts) | 2018 | 2017 | 2018 | 2017 | |||||||||||

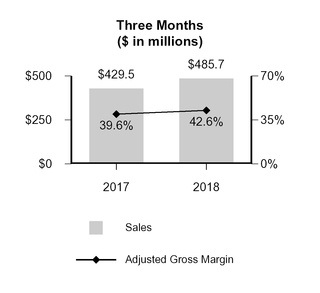

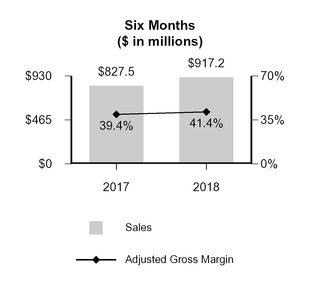

Net sales | $ | 485.7 | $ | 429.5 | $ | 917.2 | $ | 827.5 | |||||||

Cost of goods sold | 287.0 | 262.3 | 549.0 | 507.1 | |||||||||||

Gross profit | 198.7 | 167.2 | 368.2 | 320.4 | |||||||||||

Selling, general and administrative expenses | 82.2 | 69.3 | 151.5 | 134.8 | |||||||||||

Research and development expenses | 16.1 | 13.6 | 30.8 | 27.5 | |||||||||||

Provision for environmental remediation, net | 0.5 | 13.2 | 0.6 | 13.2 | |||||||||||

Equity in earnings of unconsolidated affiliate | (8.2 | ) | (6.1 | ) | (13.6 | ) | (13.1 | ) | |||||||

Restructuring and repositioning expenses | 18.8 | 5.4 | 24.4 | 7.7 | |||||||||||

Interest expense and related financing costs | 19.9 | 20.1 | 39.2 | 39.6 | |||||||||||

Other (income) expense, net | 5.8 | (11.4 | ) | 3.5 | (13.3 | ) | |||||||||

Total costs and expenses | 135.1 | 104.1 | 236.4 | 196.4 | |||||||||||

Income (loss) before income taxes | 63.6 | 63.1 | 131.8 | 124.0 | |||||||||||

(Provision for) benefit from income taxes | (25.0 | ) | (19.6 | ) | (49.8 | ) | (37.6 | ) | |||||||

Net income (loss) | 38.6 | 43.5 | 82.0 | 86.4 | |||||||||||

Less: Net (income) loss attributable to noncontrolling interests | 0.2 | 0.4 | 0.4 | 0.4 | |||||||||||

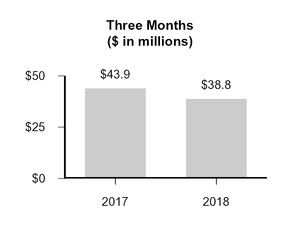

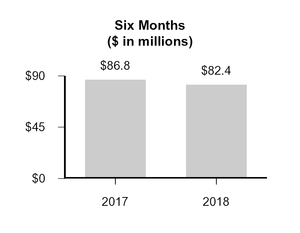

Net income (loss) attributable to W. R. Grace & Co. shareholders | $ | 38.8 | $ | 43.9 | $ | 82.4 | $ | 86.8 | |||||||

Earnings Per Share Attributable to W. R. Grace & Co. Shareholders | |||||||||||||||

Basic earnings per share: | |||||||||||||||

Net income (loss) | $ | 0.58 | $ | 0.64 | $ | 1.22 | $ | 1.27 | |||||||

Weighted average number of basic shares | 67.3 | 68.3 | 67.4 | 68.3 | |||||||||||

Diluted earnings per share: | |||||||||||||||

Net income (loss) | $ | 0.58 | $ | 0.64 | $ | 1.22 | $ | 1.27 | |||||||

Weighted average number of diluted shares | 67.4 | 68.4 | 67.5 | 68.5 | |||||||||||

Dividends per common share | $ | 0.24 | $ | 0.21 | $ | 0.48 | $ | 0.42 | |||||||

The Notes to Consolidated Financial Statements are an integral part of these statements.

5

W. R. Grace & Co. and Subsidiaries

Consolidated Statements of Comprehensive Income (Loss) (unaudited)

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

(In millions) | 2018 | 2017 | 2018 | 2017 | |||||||||||

Net income (loss) | $ | 38.6 | $ | 43.5 | $ | 82.0 | $ | 86.4 | |||||||

Other comprehensive income (loss), net of income taxes: | |||||||||||||||

Defined benefit pension and other postretirement plans | (0.2 | ) | (0.4 | ) | (0.4 | ) | (0.7 | ) | |||||||

Currency translation adjustments | 37.9 | (8.3 | ) | 19.7 | (9.7 | ) | |||||||||

Gain (loss) from hedging activities | (5.2 | ) | (0.2 | ) | (3.4 | ) | 0.5 | ||||||||

Total other comprehensive income (loss) | 32.5 | (8.9 | ) | 15.9 | (9.9 | ) | |||||||||

Comprehensive income (loss) | 71.1 | 34.6 | 97.9 | 76.5 | |||||||||||

Less: comprehensive (income) loss attributable to noncontrolling interests | 0.2 | 0.4 | 0.4 | 0.4 | |||||||||||

Comprehensive income (loss) attributable to W. R. Grace & Co. shareholders | $ | 71.3 | $ | 35.0 | $ | 98.3 | $ | 76.9 | |||||||

The Notes to Consolidated Financial Statements are an integral part of these statements.

6

W. R. Grace & Co. and Subsidiaries

Consolidated Statements of Cash Flows (unaudited)

Six Months Ended June 30, | |||||||

(In millions) | 2018 | 2017 | |||||

OPERATING ACTIVITIES | |||||||

Net income (loss) | $ | 82.0 | $ | 86.4 | |||

Reconciliation to net cash provided by (used for) operating activities: | |||||||

Depreciation and amortization | 50.9 | 54.2 | |||||

Equity in earnings of unconsolidated affiliate | (13.6 | ) | (13.1 | ) | |||

Costs related to legacy product, environmental and other claims | 4.3 | 17.0 | |||||

Cash paid for legacy product, environmental and other claims | (12.6 | ) | (44.2 | ) | |||

Provision for (benefit from) income taxes | 49.8 | 37.6 | |||||

Cash paid for income taxes | (16.7 | ) | (31.3 | ) | |||

Income tax refunds received | 0.1 | 29.7 | |||||

Loss on early extinguishment of debt | 4.8 | — | |||||

Interest expense and related financing costs | 39.2 | 39.6 | |||||

Cash paid for interest | (39.6 | ) | (34.3 | ) | |||

Defined benefit pension expense | 7.8 | 8.2 | |||||

Cash paid under defined benefit pension arrangements | (57.9 | ) | (7.8 | ) | |||

Changes in assets and liabilities, excluding effect of currency translation and acquisitions: | |||||||

Trade accounts receivable | 14.8 | 4.3 | |||||

Inventories | (50.8 | ) | (3.9 | ) | |||

Accounts payable | 34.0 | 7.4 | |||||

All other items, net | 22.5 | (9.3 | ) | ||||

Net cash provided by (used for) operating activities | 119.0 | 140.5 | |||||

INVESTING ACTIVITIES | |||||||

Capital expenditures | (90.8 | ) | (59.1 | ) | |||

Business acquired, net of cash acquired | (420.9 | ) | — | ||||

Other investing activities | 12.7 | 0.3 | |||||

Net cash provided by (used for) investing activities | (499.0 | ) | (58.8 | ) | |||

FINANCING ACTIVITIES | |||||||

Borrowings under credit arrangements | 983.2 | 98.8 | |||||

Repayments under credit arrangements | (541.8 | ) | (61.5 | ) | |||

Cash paid for debt financing costs | (11.8 | ) | (0.2 | ) | |||

Cash paid for repurchases of common stock | (49.8 | ) | (30.0 | ) | |||

Proceeds from exercise of stock options | 6.4 | 12.2 | |||||

Dividends paid to shareholders | (32.4 | ) | (28.7 | ) | |||

Other financing activities | (3.5 | ) | (3.8 | ) | |||

Net cash provided by (used for) financing activities | 350.3 | (13.2 | ) | ||||

Effect of currency exchange rate changes on cash, cash equivalents, and restricted cash | (1.0 | ) | 3.5 | ||||

Net increase (decrease) in cash and cash equivalents | (30.7 | ) | 72.0 | ||||

Cash, cash equivalents, and restricted cash, beginning of period | 163.5 | 100.6 | |||||

Cash, cash equivalents, and restricted cash, end of period | $ | 132.8 | $ | 172.6 | |||

Supplemental disclosure of cash flow information | |||||||

Capital expenditures in accounts payable | $ | 38.7 | $ | 17.8 | |||

The Notes to Consolidated Financial Statements are an integral part of these statements.

7

W. R. Grace & Co. and Subsidiaries

Consolidated Balance Sheets (unaudited)

(In millions, except par value and shares) | June 30, 2018 | December 31, 2017 | |||||

ASSETS | |||||||

Current Assets | |||||||

Cash and cash equivalents | $ | 131.5 | $ | 152.8 | |||

Restricted cash and cash equivalents | 1.3 | 10.7 | |||||

Trade accounts receivable, less allowance of $11.7 (2017—$11.7) | 277.5 | 285.2 | |||||

Inventories | 307.4 | 230.9 | |||||

Other current assets | 70.7 | 49.0 | |||||

Total Current Assets | 788.4 | 728.6 | |||||

Properties and equipment, net of accumulated depreciation and amortization of $1,482.4 (2017—$1,463.4) | 955.9 | 799.1 | |||||

Goodwill | 541.2 | 402.4 | |||||

Technology and other intangible assets, net | 364.5 | 255.4 | |||||

Deferred income taxes | 535.4 | 556.5 | |||||

Investment in unconsolidated affiliate | 138.7 | 125.9 | |||||

Other assets | 78.1 | 39.1 | |||||

Total Assets | $ | 3,402.2 | $ | 2,907.0 | |||

LIABILITIES AND EQUITY | |||||||

Current Liabilities | |||||||

Debt payable within one year | $ | 23.3 | $ | 20.1 | |||

Accounts payable | 262.5 | 210.3 | |||||

Other current liabilities | 217.3 | 217.8 | |||||

Total Current Liabilities | 503.1 | 448.2 | |||||

Debt payable after one year | 1,963.3 | 1,523.8 | |||||

Underfunded and unfunded defined benefit pension plans | 452.2 | 502.4 | |||||

Other liabilities | 188.7 | 169.3 | |||||

Total Liabilities | 3,107.3 | 2,643.7 | |||||

Commitments and Contingencies—Note 8 | |||||||

Equity | |||||||

Common stock issued, par value $0.01; 300,000,000 shares authorized; outstanding: 67,235,786 (2017—67,780,410) | 0.7 | 0.7 | |||||

Paid-in capital | 472.1 | 474.8 | |||||

Retained earnings | 625.5 | 573.1 | |||||

Treasury stock, at cost: shares: 10,220,841 (2017—9,676,217) | (865.7 | ) | (832.1 | ) | |||

Accumulated other comprehensive income (loss) | 55.8 | 39.9 | |||||

Total W. R. Grace & Co. Shareholders’ Equity | 288.4 | 256.4 | |||||

Noncontrolling interests | 6.5 | 6.9 | |||||

Total Equity | 294.9 | 263.3 | |||||

Total Liabilities and Equity | $ | 3,402.2 | $ | 2,907.0 | |||

The Notes to Consolidated Financial Statements are an integral part of these statements.

8

W. R. Grace & Co. and Subsidiaries

Consolidated Statements of Equity (unaudited)

(In millions) | Common Stock and Paid-in Capital | Retained Earnings | Treasury Stock | Accumulated Other Comprehensive Income (Loss) | Noncontrolling Interests | Total Equity | |||||||||||||||||

Balance, December 31, 2016 | $ | 488.0 | $ | 619.3 | $ | (804.9 | ) | $ | 66.4 | $ | 3.6 | $ | 372.4 | ||||||||||

Net income (loss) | — | 86.8 | — | — | (0.4 | ) | 86.4 | ||||||||||||||||

Repurchase of common stock | — | — | (30.0 | ) | — | — | (30.0 | ) | |||||||||||||||

Payments to taxing authorities in consideration of employee tax obligations related to stock-based compensation arrangements | (2.4 | ) | — | — | — | — | (2.4 | ) | |||||||||||||||

Stock-based compensation | 5.4 | — | — | — | — | 5.4 | |||||||||||||||||

Exercise of stock options | (17.0 | ) | — | 28.8 | — | — | 11.8 | ||||||||||||||||

Shares issued | 0.7 | — | — | — | — | 0.7 | |||||||||||||||||

Other comprehensive (loss) income | — | — | — | (9.9 | ) | — | (9.9 | ) | |||||||||||||||

Dividends declared | — | (28.8 | ) | — | — | — | (28.8 | ) | |||||||||||||||

Balance, June 30, 2017 | $ | 474.7 | $ | 677.3 | $ | (806.1 | ) | $ | 56.5 | $ | 3.2 | $ | 405.6 | ||||||||||

Balance, December 31, 2017 | $ | 475.5 | $ | 573.1 | $ | (832.1 | ) | $ | 39.9 | $ | 6.9 | $ | 263.3 | ||||||||||

Net income (loss) | — | 82.4 | — | — | (0.4 | ) | 82.0 | ||||||||||||||||

Repurchase of common stock | — | — | (49.8 | ) | — | — | (49.8 | ) | |||||||||||||||

Payments to taxing authorities in consideration of employee tax obligations related to stock-based compensation arrangements | (3.0 | ) | — | — | — | — | (3.0 | ) | |||||||||||||||

Stock-based compensation | 9.6 | — | — | — | — | 9.6 | |||||||||||||||||

Exercise of stock options | (4.1 | ) | — | 10.2 | — | — | 6.1 | ||||||||||||||||

Shares issued | (5.2 | ) | — | 6.0 | — | — | 0.8 | ||||||||||||||||

Dividends declared | — | (32.5 | ) | — | — | — | (32.5 | ) | |||||||||||||||

Other comprehensive (loss) income | — | — | — | 15.9 | — | 15.9 | |||||||||||||||||

Adjustment to retained earnings for adoption of ASC 606 | — | 2.5 | — | — | — | 2.5 | |||||||||||||||||

Balance, June 30, 2018 | $ | 472.8 | $ | 625.5 | $ | (865.7 | ) | $ | 55.8 | $ | 6.5 | $ | 294.9 | ||||||||||

The Notes to Consolidated Financial Statements are an integral part of these statements.

9

Notes to Consolidated Financial Statements

1. Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies

W. R. Grace & Co., through its subsidiaries, is engaged in specialty chemicals and specialty materials businesses on a global basis through two reportable segments: Grace Catalysts Technologies, which includes catalysts and related products and technologies used in refining, petrochemical and other chemical manufacturing applications; and Grace Materials Technologies, which includes specialty materials, including silica-based and silica-alumina-based materials, used in coatings, consumer, industrial, and pharmaceutical applications.

W. R. Grace & Co. conducts all of its business through a single wholly owned subsidiary, W. R. Grace & Co.–Conn. (“Grace–Conn.”). Grace–Conn. owns all of the assets, properties and rights of W. R. Grace & Co. on a consolidated basis, either directly or through subsidiaries.

As used in these notes, the term “Company” refers to W. R. Grace & Co. The term “Grace” refers to the Company and/or one or more of its subsidiaries and, in certain cases, their respective predecessors.

Basis of Presentation The interim Consolidated Financial Statements presented herein are unaudited and should be read in conjunction with the Consolidated Financial Statements presented in the Company’s 2017 Annual Report on Form 10-K. Such interim Consolidated Financial Statements reflect all adjustments that, in the opinion of management, are necessary for a fair statement of the results of the interim periods presented; all such adjustments are of a normal recurring nature except for the impacts of adopting new accounting standards as discussed below. All significant intercompany accounts and transactions have been eliminated.

The results of operations for the six-month interim period ended June 30, 2018, are not necessarily indicative of the results of operations to be attained for the year ending December 31, 2018.

Use of Estimates The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the Consolidated Financial Statements, and the reported amounts of revenues and expenses for the periods presented. Actual amounts could differ from those estimates, and the differences could be material. Changes in estimates are recorded in the period identified. Grace’s accounting measurements that are most affected by management’s estimates of future events are:

• | Realization values of net deferred tax assets, which depend on projections of future taxable income; |

• | Pension and postretirement liabilities, which depend on assumptions regarding participant life spans, future inflation, discount rates and total returns on invested funds (see Note 6); |

• | Carrying values of goodwill and other intangible assets, which depend on assumptions of future earnings and cash flows; and |

• | Contingent liabilities, which depend on an assessment of the probability of loss and an estimate of ultimate obligation, such as litigation and environmental remediation (see Note 8). |

Reclassifications Certain amounts in prior years’ Consolidated Financial Statements have been reclassified to conform to the current year presentation. Such reclassifications have not materially affected previously reported amounts in the Consolidated Financial Statements.

Long-Lived Assets During the 2018 first quarter, Grace, with the assistance of an outside accounting firm, completed a study to evaluate the useful lives of its operating machinery and equipment, including a review of historical asset retirement data as well as review and analysis of relevant industry practices. As a result of this study, effective January 1, 2018, Grace revised the accounting useful lives of certain machinery and equipment, which was determined to be a change in accounting estimate and is being applied prospectively. As a result of this change in accounting estimate, Grace’s depreciation expense with respect to such machinery and equipment was reduced by $6.2 million, resulting in an increase to net income of $4.8 million or $0.07 per diluted share, for the three months ended June 30, 2018. For the six months ended June 30, 2018, depreciation expense with respect to such machinery and equipment was reduced by $8.9 million, resulting in an increase to net income of $6.8 million or $0.10 per diluted share. Estimated useful lives for operating machinery and equipment, which previously ranged from 3 to 10 years, now range from 5 to 25 years.

10

Notes to Consolidated Financial Statements (Continued)

1. Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies (Continued)

Recently Issued Accounting Standards In February 2016, the FASB issued ASU 2016-02 “Leases (Topic 842).” This update is intended to increase transparency and comparability among organizations by recognizing lease assets and lease liabilities on the balance sheet and disclosing key information about leasing arrangements. The core principle of Topic 842 is that a lessee should recognize the assets and liabilities that arise from leases. A lessee should recognize in the statement of financial position a liability to make lease payments (the lease liability) and a right-of-use asset representing its right to use the underlying asset for the lease term, including optional payments where they are reasonably certain to occur. Currently, as a lessee, Grace is a party to a number of leases which, under existing guidance, are classified as operating leases and not recorded on the balance sheet but expensed as incurred. Under the new standard, many of these leases will be recorded on the Consolidated Balance Sheets. Grace will adopt the standard in the 2019 first quarter. Grace has begun its implementation of the new standard and at this time cannot reasonably estimate the effect of adoption.

In January 2017, the FASB issued ASU 2017-04 “Intangibles—Goodwill and Other (Topic 350).” This update modifies the concept of impairment from the condition that exists when the carrying amount of goodwill exceeds its implied fair value to the condition that exists when the carrying amount of a reporting unit exceeds its fair value. An entity no longer will determine goodwill impairment by calculating the implied fair value of goodwill by assigning the fair value of a reporting unit to all of its assets and liabilities as if that reporting unit had been acquired in a business combination (“Step 2”). Because these amendments eliminate Step 2 from the goodwill impairment test, they should reduce the cost and complexity of evaluating goodwill for impairment. Grace is required to adopt the amendments in this update on January 1, 2020. Early adoption is permitted. Grace is currently evaluating the timing of adoption and does not expect the update to have a material effect on the Consolidated Financial Statements.

In January 2018, the FASB issued ASU 2018-01 “Leases (Topic 842): Land Easement Practical Expedient for Transition to Topic 842.” This update provides an optional transition practical expedient that allows an entity to elect not to evaluate under Topic 842 existing or expired land easements not previously accounted for as leases. All land easements entered into or modified after the adoption of Topic 842 must be evaluated under Topic 842. Grace, which typically does not account for easements under current lease accounting, will use the transition practical expedient when adopting Topic 842 in the 2019 first quarter and at this time cannot reasonably estimate the effect of adoption.

In February 2018, the FASB issued ASU 2018-02 “Income Statement—Reporting Comprehensive Income (Topic 220).” This update addresses the revaluation of deferred tax assets and liabilities due to the Tax Cuts and Jobs Act of 2017 impacting income from continuing operations, even if the initial income tax effects were recognized in other comprehensive income. The update allows entities to reclassify the tax effects that were originally in other comprehensive income from accumulated other comprehensive income to retained earnings. The update requires entities to disclose whether the election was made and a description of the income tax effects. The update can be: (a) applied to the period of adoption, or (b) applied retrospectively to each period in which the Tax Cuts and Jobs Act of 2017 is in effect. Grace is required to adopt the amendments in this update on January 1, 2019, with early adoption permitted. Grace is currently evaluating the timing and effect of adoption.

Recently Adopted Accounting Standards In November 2016, the FASB issued ASU 2016-18 “Statement of Cash Flows (Topic 230): Restricted Cash,” which requires that a statement of cash flows explain the change during the period in the total of cash, cash equivalents, and amounts generally described as restricted cash or restricted cash equivalents. Therefore, amounts generally described as restricted cash and restricted cash equivalents should be included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period total amounts shown on the statement of cash flows. Grace adopted the update in the 2018 first quarter. The table below presents the effect of the adoption of ASU 2016-18 on previously reported amounts.

11

Notes to Consolidated Financial Statements (Continued)

1. Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies (Continued)

Six Months Ended June 30, 2017 | |||||||||||

(In millions) | Previously Reported | Revised | Effect of Change | ||||||||

Other investing activities | $ | (0.5 | ) | $ | 0.3 | $ | 0.8 | ||||

Net cash provided by (used for) investing activities | (59.6 | ) | (58.8 | ) | 0.8 | ||||||

Cash, cash equivalents, and restricted cash, beginning of period | 90.6 | 100.6 | 10.0 | ||||||||

Cash, cash equivalents, and restricted cash, end of period | 161.8 | 172.6 | 10.8 | ||||||||

In January 2017, the FASB issued ASU 2017-01 “Business Combinations (Topic 805),” which provides a screen to determine when an integrated set of assets and activities is not a business. The screen requires that when substantially all of the fair value of the gross assets acquired (or disposed of) is concentrated in a single identifiable asset or a group of similar identifiable assets, the set is not a business. This screen reduces the number of transactions that need to be further evaluated. If the screen is not met, the amendments in this update (1) require that to be considered a business, a set must include, at a minimum, an input and a substantive process that together significantly contribute to the ability to create output, and (2) remove the evaluation of whether a market participant could replace missing elements. The amendments in this update also narrow the definition of the term “output” so that the term is consistent with how outputs are described in ASC 606. Grace adopted the update in the 2018 first quarter and applied the new definition of a business to the acquisition completed during the 2018 second quarter.

In May 2017, the FASB issued ASU 2017-09 “Compensation—Stock Compensation (Topic 718).” This update clarifies the existing definition of the term “modification,” which is currently defined as “a change in any of the terms or conditions of a share-based payment award.” The update requires entities to account for modifications of share-based payment awards unless the (1) fair value, (2) vesting conditions, and (3) classification as an equity instrument or a liability instrument of the modified award are the same as the original award before modification. Grace adopted the update in the 2018 first quarter, and it did not have an effect on the Consolidated Financial Statements.

Revenue Recognition

In May 2014, the FASB issued ASU 2014-09 “Revenue from Contracts with Customers (Topic 606)” (“ASC 606”). This update was intended to remove inconsistencies and weaknesses in revenue requirements; provide a more robust framework for addressing revenue issues; improve comparability of revenue recognition practices across entities, industries, jurisdictions and capital markets; provide more useful information to users of financial statements through improved disclosure requirements; and simplify the preparation of financial statements by reducing the number of requirements to which an entity must refer. Grace adopted ASC 606 with a date of initial application of January 1, 2018. Grace applied the standard to all customer contracts. As a result, Grace has changed its accounting policy for revenue recognition as detailed below.

Grace applied ASC 606 using the modified retrospective method, that is, by recognizing the cumulative effect of initially applying ASC 606 as an adjustment to “retained earnings” at the date of initial application. Results for periods beginning after December 31, 2017, are presented under ASC 606, while the comparative information has not been adjusted and continues to be reported in accordance with Grace’s historical accounting under ASC 605 “Revenue Recognition” (“ASC 605”).

Grace generates revenues predominantly from sales of manufactured products to customers and in part from licensing of technology. Under ASC 606, revenue from customer arrangements is recognized when control is transferred to the customer.

Product Sales Revenue Recognition

In its implementation of ASC 606, Grace assessed its customer arrangements at the operating segment level, and based on the similarity of arrangements, Grace elected to use the portfolio method practical expedient.

12

Notes to Consolidated Financial Statements (Continued)

1. Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies (Continued)

Based on the promises made to customers in product sales arrangements, Grace determined that it has a performance obligation to manufacture and deliver products to its customers. Grace makes certain other promises in its customer arrangements that are immaterial in the context of the contracts. Revenue is recognized at amounts based on agreed upon prices in sales contracts and/or purchase orders. Grace offers various incentives to its product sales customers that result in variable consideration, including but not limited to volume discounts, which reward bulk purchases by lowering the price for future purchases, and volume rebates, which encourage customers to purchase volume levels that would reduce their current prices. These incentives are immaterial in the context of the contracts.

For product sales, control is transferred at the point in time at which risk of loss and title have transferred to the customer, which is determined based on shipping terms. Terms of delivery and terms of payment are generally included in customer contracts of sale, order confirmation documents, and invoices. Payment is generally due within 30 to 60 days of invoicing. Grace defers revenue recognition until no other significant Grace obligations remain. Grace’s customer arrangements do not contain significant acceptance provisions.

Taxes that Grace collects that are assessed by a governmental authority, and that are both imposed on and concurrent with any of its revenue-producing activities, are excluded from revenue. Grace considers shipping and handling activities that it performs as activities to fulfill the sales of its products. Amounts billed for shipping and handling are included in net sales, while costs incurred for shipping and handling are included in cost of sales, in accordance with the practical expedient provided by ASC 606.

Technology Licensing Revenue Recognition

For Grace’s technology licensing business, Grace determined that the customer arrangements contain multiple deliverables to enable licensees to realize the full benefit of the technology. These deliverables include licensing the technology itself; developing engineering design packages; and providing training, consulting, and technical services. Under these arrangements, the license grant is not a distinct performance obligation, as the licensee only can benefit from the license in conjunction with other integral services such as development of the engineering design package, training, consulting, or technical services provided over the contract period. Therefore, Grace accounts for the license grant and integral services as a single performance obligation. Certain deliverables and services not included in the core bundled deliverables are accounted for as separate performance obligations.

The transaction price is specified in the technology licensing agreements and is substantially fixed. Some services are priced on a per-diem basis, but these are not material in the context of the contracts. Grace invoices its technology licensing customers as certain project milestones are achieved. Payment terms are similar to those of Grace’s product sales.

Revenue for each performance obligation is recognized when control is transferred to the customer, which is generally over a period of time. As a result, Grace generally recognizes revenue for each performance obligation ratably over the period of the contract, which is up to seven years, depending on the scope of the licensee’s project. Based on the timing of payments, Grace records deferred revenue related to these agreements. See Note 13.

Impact of Adoption

Except for the changes below, Grace has consistently applied its accounting policy for revenue recognition to all periods presented in the Consolidated Financial Statements.

Grace recorded a net increase to “retained earnings” of $2.5 million as of January 1, 2018, which represents the cumulative impact of adopting ASC 606, with a $3.2 million reduction to “other liabilities” and a $0.7 million reduction to “deferred income taxes.” The cumulative adjustment results from a change in accounting for contingent revenue related to technology licensing arrangements. Under ASC 605, certain revenue was not realized until a contractual contingency was resolved. Upon adoption of ASC 606, Grace estimates all forms of

13

Notes to Consolidated Financial Statements (Continued)

1. Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies (Continued)

variable consideration, including contingent amounts, at the inception of the arrangement and recognizes it over the period of performance.

The tables below present the effect of the adoption of ASC 606 on Grace’s Consolidated Statements of Operations and Consolidated Balance Sheets.

Consolidated Statements of Operations

Three months ended June 30, 2018 | |||||||||||

(In millions) | Under ASC 605 | As Reported (ASC 606) | Effect of Change | ||||||||

Net sales | $ | 485.4 | $ | 485.7 | $ | 0.3 | |||||

Gross profit | 198.4 | 198.7 | 0.3 | ||||||||

Income (loss) before income taxes | 63.3 | 63.6 | 0.3 | ||||||||

Provision for income taxes | (24.9 | ) | (25.0 | ) | (0.1 | ) | |||||

Net income (loss) | 38.4 | 38.6 | 0.2 | ||||||||

Net income (loss) attributable to W. R. Grace & Co. Shareholders | 38.6 | 38.8 | 0.2 | ||||||||

Six Months Ended June 30, 2018 | |||||||||||

(In millions) | Under ASC 605 | As Reported (ASC 606) | Effect of Change | ||||||||

Net sales | $ | 916.8 | $ | 917.2 | $ | 0.4 | |||||

Gross profit | 367.8 | 368.2 | 0.4 | ||||||||

Income (loss) before income taxes | 131.4 | 131.8 | 0.4 | ||||||||

Provision for income taxes | (49.7 | ) | (49.8 | ) | (0.1 | ) | |||||

Net income (loss) | 81.7 | 82.0 | 0.3 | ||||||||

Net income (loss) attributable to W. R. Grace & Co. Shareholders | 82.1 | 82.4 | 0.3 | ||||||||

Consolidated Balance Sheets

June 30, 2018 | |||||||||||

(In millions) | Under ASC 605 | As Reported (ASC 606) | Effect of Change | ||||||||

Deferred income taxes | $ | 536.2 | $ | 535.4 | $ | (0.8 | ) | ||||

Other liabilities | 192.3 | 188.7 | (3.6 | ) | |||||||

Retained earnings | 622.7 | 625.5 | 2.8 | ||||||||

ASU 2017-07 “Compensation—Retirement Benefits (Topic 715)”

In March 2017, the FASB issued ASU 2017-07 “Compensation—Retirement Benefits (Topic 715).” This update requires that the service cost component of net benefit cost be presented with other compensation costs arising from services rendered. The remaining net benefit cost is either presented as a line item in the statement of operations outside of a subtotal for income from operations, if presented, or disclosed separately. In addition, only the service cost component of net benefit cost can be capitalized. Grace adopted the update in the 2018 first quarter.

The changes in classification of net benefit costs within the Consolidated Statements of Operations have been retrospectively applied to all periods presented. The change in costs capitalizable into inventory was applied

14

Notes to Consolidated Financial Statements (Continued)

1. Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies (Continued)

prospectively in accordance with the update. The tables below present the effect of the adoption of ASU 2017-07 on previously reported amounts.

Consolidated Statements of Operations

Three Months Ended June 30, 2017 | |||||||||||

(In millions) | Previously Reported | Revised | Effect of Change | ||||||||

Cost of goods sold | $ | 260.2 | $ | 262.3 | $ | 2.1 | |||||

Gross profit | 169.3 | 167.2 | (2.1 | ) | |||||||

Selling, general and administrative expenses | 70.3 | 70.8 | 0.5 | ||||||||

Research and development expenses | 12.9 | 13.6 | 0.7 | ||||||||

Other (income) expense | (9.6 | ) | (12.9 | ) | (3.3 | ) | |||||

Six Months Ended June 30, 2017 | |||||||||||

(In millions) | Previously Reported | Revised | Effect of Change | ||||||||

Cost of goods sold | $ | 505.0 | $ | 507.1 | $ | 2.1 | |||||

Gross profit | 322.5 | 320.4 | (2.1 | ) | |||||||

Selling, general and administrative expenses | 136.8 | 137.8 | 1.0 | ||||||||

Research and development expenses | 26.1 | 27.5 | 1.4 | ||||||||

Other (income) expense | (11.8 | ) | (16.3 | ) | (4.5 | ) | |||||

2. Inventories

Inventories are stated at the lower of cost or net realizable value, and cost is determined using FIFO. Inventories consisted of the following at June 30, 2018, and December 31, 2017:

(In millions) | June 30, 2018 | December 31, 2017 | |||||

Raw materials | $ | 60.3 | $ | 48.8 | |||

In process | 56.8 | 33.0 | |||||

Finished products | 161.3 | 124.7 | |||||

Other | 29.0 | 24.4 | |||||

Total inventory | $ | 307.4 | $ | 230.9 | |||

15

Components of Debt

(In millions) | June 30, 2018 | December 31, 2017 | |||||

2018 U.S. dollar term loan, net of unamortized debt issuance costs of $9.7 | $ | 940.3 | $ | — | |||

5.125% senior notes due 2021, net of unamortized debt issuance costs of $5.0 (2017—$5.8) | 695.0 | 694.2 | |||||

5.625% senior notes due 2024, net of unamortized debt issuance costs of $3.2 (2017—$3.5) | 296.8 | 296.5 | |||||

Debt payable to unconsolidated affiliate | 46.3 | 42.4 | |||||

2014 U.S. dollar term loan, net of unamortized debt issuance costs and discounts (2017—$4.3) | — | 404.1 | |||||

2014 Euro term loan, net of unamortized debt issuance costs and discounts (2017—$1.0) | — | 94.0 | |||||

Other borrowings(1) | 8.2 | 12.7 | |||||

Total debt | 1,986.6 | 1,543.9 | |||||

Less debt payable within one year | 23.3 | 20.1 | |||||

Debt payable after one year | $ | 1,963.3 | $ | 1,523.8 | |||

Weighted average interest rates on total debt | 3.8 | % | 4.7 | % | |||

___________________________________________________________________________________________________________________

(1) Represents borrowings under various lines of credit and other borrowings, primarily by non-U.S. subsidiaries.

On April 3, 2018, Grace entered into a Credit Agreement (the “Credit Agreement”), which provides for new senior secured credit facilities, consisting of:

(a) | a $950 million term loan due in 2025, with interest at LIBOR +175 basis points, and |

(b) | a $400 million revolving credit facility due in 2023, with interest at LIBOR +175 basis points. |

The term loan will amortize in equal quarterly installments in aggregate annual amounts equal to 1.00% of the original principal amount thereof, with the first payment due on December 31, 2018.

The Credit Agreement contains customary affirmative covenants, including, but not limited to: (i) maintenance of existence, and compliance with laws; (ii) delivery of consolidated financial statements and other information; (iii) payment of taxes; (iv) delivery of notices of defaults and certain other material events; and (v) maintenance of adequate insurance. The Credit Agreement also contains customary negative covenants, including but not limited to restrictions on: (i) dividends on, and redemptions of, equity interests and other restricted payments; (ii) liens; (iii) loans and investments; (iv) the sale, transfer or disposition of assets and businesses; (v) transactions with affiliates; and (vi) a maximum first lien leverage ratio.

Events of default under the Credit Agreement include, but are not limited to: (i) failure to pay principal, interest, fees or other amounts under the Credit Agreement when due, taking into account any applicable grace period; (ii) any representation or warranty proving to have been incorrect in any material respect when made; (iii) failure to perform or observe covenants or other terms of the Credit Agreement subject to certain grace periods; (iv) a cross-default and cross-acceleration with certain other material debt; (v) bankruptcy events; (vi) certain defaults under ERISA; and (vii) the invalidity or impairment of security interests.

To secure its obligations under the Credit Agreement, Grace and certain of its U.S. subsidiaries have granted security interests in substantially all equity and debt interests in Grace–Conn. or any other Grace subsidiary owned by them and in substantially all their non-real estate assets and property.

The foregoing is a summary of the Credit Agreement. Grace has filed the full text of the Credit Agreement with the Securities and Exchange Commission (the “SEC”), which is readily available on the internet at www.sec.gov.

16

Grace used a portion of the proceeds to repay in full the borrowings outstanding under its 2014 credit agreement, which was terminated, as well as to make a voluntary $50.0 million accelerated contribution to its U.S. qualified pension plans. In connection with the repayment of debt, Grace recorded a $4.8 million loss on early extinguishment of debt. As of June 30, 2018, the available credit under the revolving credit facility was reduced to $364.3 million by outstanding letters of credit.

See Note 4 for a discussion of the fair value of Grace’s debt.

The principal maturities of debt outstanding at June 30, 2018, were as follows:

(In millions) | |||

2018 | $ | 14.0 | |

2019 | 19.1 | ||

2020 | 17.9 | ||

2021 | 711.4 | ||

2022 | 15.5 | ||

Thereafter | 1,208.7 | ||

Total debt | $ | 1,986.6 | |

4. Fair Value Measurements and Risk

Certain of Grace’s assets and liabilities are reported at fair value on a gross basis. ASC 820 “Fair Value Measurements and Disclosures” defines fair value as the value that would be received at the measurement date in the principal or “most advantageous” market. Grace uses principal market data, whenever available, to value assets and liabilities that are required to be reported at fair value.

Grace has identified the following financial assets and liabilities that are subject to the fair value analysis required by ASC 820:

Fair Value of Debt and Other Financial Instruments Debt payable is recorded at carrying value. Fair value is determined based on Level 2 inputs, including expected future cash flows (discounted at market interest rates), estimated current market prices and quotes from financial institutions.

At June 30, 2018, the carrying amounts and fair values of Grace’s debt were as follows:

June 30, 2018 | December 31, 2017 | ||||||||||||||

(In millions) | Carrying Amount | Fair Value | Carrying Amount | Fair Value | |||||||||||

2018 U.S. dollar term loan(1) | $ | 940.3 | $ | 939.1 | $ | — | $ | — | |||||||

5.125% senior notes due 2021(2) | 695.0 | 709.2 | 694.2 | 728.7 | |||||||||||

5.625% senior notes due 2024(2) | 296.8 | 311.3 | 296.5 | 321.3 | |||||||||||

U.S. dollar term loan(3) | — | — | 404.1 | 409.7 | |||||||||||

Euro term loan(3) | — | — | 94.0 | 93.7 | |||||||||||

Other borrowings | 54.5 | 54.5 | 55.1 | 55.1 | |||||||||||

Total debt | $ | 1,986.6 | $ | 2,014.1 | $ | 1,543.9 | $ | 1,608.5 | |||||||

___________________________________________________________________________________________________________________

(1) | Carrying amounts are net of unamortized debt issuance costs and discounts of $9.7 million as of June 30, 2018. |

(2) | Carrying amounts are net of unamortized debt issuance costs of $5.0 million and $3.2 million as of June 30, 2018, and $5.8 million and $3.5 million as of December 31, 2017, related to the 5.125% senior notes due 2021 and 5.625% senior notes due 2024, respectively. |

(3) | Carrying amounts are net of unamortized debt issuance costs and discounts of $4.3 million and $1.0 million as of December 31, 2017, related to the U.S. dollar term loan and euro term loan, respectively. |

17

Notes to Consolidated Financial Statements (Continued)

4. Fair Value Measurements and Risk (Continued)

At June 30, 2018, the recorded values of other financial instruments such as cash equivalents and trade receivables and payables approximated their fair values, based on the short-term maturities and floating rate characteristics of these instruments.

Currency Derivatives Because Grace operates and/or sells to customers in over 60 countries and in over 30 currencies, its results are exposed to fluctuations in currency exchange rates. Grace seeks to minimize exposure to these fluctuations by matching sales in volatile currencies with expenditures in the same currencies, but it is not always possible to do so. From time to time, Grace uses financial instruments such as currency forward contracts, options, swaps, or combinations thereof to reduce the risk of certain specific transactions. However, Grace does not have a policy of hedging all exposures, because management does not believe that such a level of hedging would be cost-effective. Forward contracts with maturities of not more than 36 months are used and designated as cash flow hedges of forecasted repayments of intercompany loans. The effective portion of gains and losses on these currency hedges is recorded in “accumulated other comprehensive income (loss)” and reclassified into “other (income) expense, net” to offset the remeasurement of the underlying hedged loans. Excluded components (forward points) on these hedges are amortized to income on a systematic basis.

Grace also enters into foreign currency forward contracts to hedge a portion of its net outstanding monetary assets and liabilities. These forward contracts are not designated as hedging instruments under applicable accounting guidance, and therefore all changes in the fair value of the forward contracts are recorded in “other (income) expense, net,” in the Consolidated Statements of Operations. These forward contracts are intended to offset the foreign currency gains or losses associated with the underlying monetary assets and liabilities.

The valuation of Grace’s currency exchange rate forward contracts and swaps is determined using an income approach. Inputs used to value currency exchange rate forward contracts consist of: (1) spot rates, which are quoted by various financial institutions; (2) forward points, which are primarily affected by changes in interest rates; and (3) discount rates used to present value future cash flows, which are based on the London Interbank Offered Rate (LIBOR) curve or overnight indexed swap rates. Total notional amounts for forward contracts outstanding as of June 30, 2018, were $67.1 million.

Cross-Currency Swap Agreements Grace uses cross-currency swaps designated as cash flow hedges to manage fluctuations in currency exchange rates and interest rates on variable rate debt. The effective portion of gains and losses on these cash flow hedges is recorded in “accumulated other comprehensive income (loss)” and reclassified into “other (income) expense, net” and “interest expense and related financing costs” during the hedged interest period.

In April 2018, in connection with the Credit Agreement (see Note 3), Grace entered into new cross-currency swaps beginning on April 3, 2018, and maturing on March 31, 2023, to synthetically convert $600.0 million of U.S. dollar-denominated floating rate debt into €490.1 million of euro-denominated debt fixed at 2.0231%. The valuation of these cross-currency swaps is determined using an income approach, using LIBOR and EURIBOR swap curves, currency basis spreads, and euro/U.S. dollar exchange rates.

Debt and Interest Rate Swap Agreements Grace uses interest rate swaps designated as cash flow hedges to manage fluctuations in interest rates on variable rate debt. The effective portion of gains and losses on these interest rate cash flow hedges is recorded in “accumulated other comprehensive income (loss)” and reclassified into “interest expense and related financing costs” during the hedged interest period.

In connection with its emergence financing, Grace entered into interest rate swaps beginning on February 3, 2015, and maturing on February 3, 2020, fixing the LIBOR component of the interest on $250.0 million of Grace’s term debt at a rate of 2.393%. These interest rate swaps were de-designated and terminated in April 2018 in connection with Grace’s entry into a new credit agreement.

In connection with the Credit Agreement (see Note 3), Grace entered into new interest rate swaps beginning on April 3, 2018, and maturing on March 31, 2023, fixing $100.0 million of term debt at 2.775%. The valuation of these interest rate swaps is determined using an income approach, using prevailing market interest rates and discount rates to present value future cash flows based on the forward LIBOR yield curves. Credit risk is also incorporated into derivative valuations.

18

Notes to Consolidated Financial Statements (Continued)

4. Fair Value Measurements and Risk (Continued)

The following tables present the fair value hierarchy for financial assets and liabilities measured at fair value on a recurring basis as of June 30, 2018, and December 31, 2017:

Fair Value Measurements at June 30, 2018, Using | |||||||||||||||

(In millions) | Total | Quoted Prices in Active Markets for Identical Assets or Liabilities (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | |||||||||||

Assets | |||||||||||||||

Currency derivatives | $ | 4.0 | $ | — | $ | 4.0 | $ | — | |||||||

Interest rate derivatives | 0.5 | — | 0.5 | — | |||||||||||

Variable-to-fixed cross-currency derivatives | 21.4 | — | 21.4 | — | |||||||||||

Total Assets | $ | 25.9 | $ | — | $ | 25.9 | $ | — | |||||||

Liabilities | |||||||||||||||

Interest rate derivatives | $ | 0.2 | $ | — | $ | 0.2 | $ | — | |||||||

Currency derivatives | 20.9 | — | 20.9 | — | |||||||||||

Total Liabilities | $ | 21.1 | $ | — | $ | 21.1 | $ | — | |||||||

Fair Value Measurements at December 31, 2017, Using | |||||||||||||||

(In millions) | Total | Quoted Prices in Active Markets for Identical Assets or Liabilities (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | |||||||||||

Assets | |||||||||||||||

Currency derivatives | $ | 3.1 | $ | — | $ | 3.1 | $ | — | |||||||

Total Assets | $ | 3.1 | $ | — | $ | 3.1 | $ | — | |||||||

Liabilities | |||||||||||||||

Interest rate derivatives | $ | 1.8 | $ | — | $ | 1.8 | $ | — | |||||||

Currency derivatives | 23.8 | — | 23.8 | — | |||||||||||

Total Liabilities | $ | 25.6 | $ | — | $ | 25.6 | $ | — | |||||||

19

Notes to Consolidated Financial Statements (Continued)

4. Fair Value Measurements and Risk (Continued)

The following tables present the location and fair values of derivative instruments included in the Consolidated Balance Sheets as of June 30, 2018, and December 31, 2017:

June 30, 2018 (In millions) | Asset Derivatives | Liability Derivatives | |||||||||

Balance Sheet Location | Fair Value | Balance Sheet Location | Fair Value | ||||||||

Derivatives designated as hedging instruments under ASC 815: | |||||||||||

Currency contracts | Other current assets | $ | 3.3 | Other current liabilities | $ | — | |||||

Interest rate contracts | Other current assets | — | Other current liabilities | 0.2 | |||||||

Variable-to-fixed cross-currency swaps | Other current assets | 12.5 | Other current liabilities | — | |||||||

Currency contracts | Other assets | 0.1 | Other liabilities | 19.1 | |||||||

Interest rate contracts | Other assets | 0.5 | Other liabilities | — | |||||||

Variable-to-fixed cross-currency swaps | Other assets | 8.9 | Other liabilities | — | |||||||

Derivatives not designated as hedging instruments under ASC 815: | |||||||||||

Currency contracts | Other current assets | 0.6 | Other current liabilities | 1.8 | |||||||

Total derivatives | $ | 25.9 | $ | 21.1 | |||||||

December 31, 2017 (In millions) | Asset Derivatives | Liability Derivatives | |||||||||

Balance Sheet Location | Fair Value | Balance Sheet Location | Fair Value | ||||||||

Derivatives designated as hedging instruments under ASC 815: | |||||||||||

Currency contracts | Other current assets | $ | 2.7 | Other current liabilities | $ | 1.4 | |||||

Interest rate contracts | Other current assets | — | Other current liabilities | 1.3 | |||||||

Currency contracts | Other assets | — | Other liabilities | 22.2 | |||||||

Interest rate contracts | Other assets | — | Other liabilities | 0.5 | |||||||

Derivatives not designated as hedging instruments under ASC 815: | |||||||||||

Currency contracts | Other current assets | 0.4 | Other current liabilities | 0.2 | |||||||

Total derivatives | $ | 3.1 | $ | 25.6 | |||||||

The following tables present the location and amount of gains and losses on derivative instruments included in the Consolidated Statements of Operations or, when applicable, gains and losses initially recognized in other comprehensive income (loss) (“OCI”) for the three and six months ended June 30, 2018 and 2017:

Three Months Ended June 30, 2018 (In millions) | Amount of Gain (Loss) Recognized in OCI on Derivatives | Location of Gain (Loss) Reclassified from Accumulated OCI into Income | Amount of Gain (Loss) Reclassified from OCI into Income | ||||||

Derivatives in ASC 815 cash flow hedging relationships: | |||||||||

Interest rate contracts | $ | 0.3 | Interest expense | $ | 0.1 | ||||

Currency contracts(1) | 10.4 | Other expense | 10.2 | ||||||

Variable-to-fixed cross-currency swaps | 3.1 | Interest expense | 3.1 | ||||||

Variable-to-fixed cross-currency swaps | 18.3 | Other expense | 29.3 | ||||||

Total derivatives | $ | 32.1 | $ | 42.7 | |||||

___________________________________________________________________________________________________________________

(1) | Amount of gain (loss) recognized in OCI includes $0.4 million excluded from the assessment of effectiveness for which the difference between changes in fair value and periodic amortization is recorded in OCI. |

20

Notes to Consolidated Financial Statements (Continued)

4. Fair Value Measurements and Risk (Continued)

Six Months Ended June 30, 2018 (In millions) | Amount of Gain (Loss) Recognized in OCI on Derivatives | Location of Gain (Loss) Reclassified from Accumulated OCI into Income | Amount of Gain (Loss) Reclassified from OCI into Income | ||||||

Derivatives in ASC 815 cash flow hedging relationships: | |||||||||

Interest rate contracts | $ | 1.8 | Interest expense | $ | (0.1 | ) | |||

Currency contracts(1) | 3.8 | Other expense | 4.1 | ||||||

Variable-to-fixed cross-currency swaps | 3.1 | Interest expense | 3.1 | ||||||

Variable-to-fixed cross-currency swaps | 18.3 | Other expense | 29.3 | ||||||

Total derivatives | $ | 27.0 | $ | 36.4 | |||||

___________________________________________________________________________________________________________________

(1) | Amount of gain (loss) recognized in OCI includes $(0.4) million excluded from the assessment of effectiveness for which the difference between changes in fair value and periodic amortization is recorded in OCI. |

Three Months Ended June 30, 2017 (In millions) | Amount of Gain (Loss) Recognized in OCI on Derivatives | Location of Gain (Loss) Reclassified from Accumulated OCI into Income | Amount of Gain (Loss) Reclassified from OCI into Income | ||||||

Derivatives in ASC 815 cash flow hedging relationships: | |||||||||

Interest rate contracts | $ | (1.1 | ) | Interest expense | $ | (0.8 | ) | ||

Currency contracts | — | Other expense | (0.1 | ) | |||||

Total derivatives | $ | (1.1 | ) | $ | (0.9 | ) | |||

Six Months Ended June 30, 2017 (In millions) | Amount of Gain (Loss) Recognized in OCI on Derivatives | Location of Gain (Loss) Reclassified from Accumulated OCI into Income | Amount of Gain (Loss) Reclassified from OCI into Income | ||||||

Derivatives in ASC 815 cash flow hedging relationships: | |||||||||

Interest rate contracts | $ | (1.0 | ) | Interest expense | $ | (1.7 | ) | ||

Currency contracts | (0.1 | ) | Other expense | (0.1 | ) | ||||

Total derivatives | $ | (1.1 | ) | $ | (1.8 | ) | |||

The following tables present the total amounts of income and expense line items presented in the Consolidated Statements of Operations in which the effects of cash flow hedges are reported.

Three Months Ended June 30, | |||||||||||||||

2018 | 2017 | ||||||||||||||

(In millions) | Interest expense | Other income (expense) | Interest expense | Other income (expense) | |||||||||||

Total amounts of income and expense line items in the Consolidated Statements of Operations in which the effects of cash flow hedges are recorded | $ | (19.9 | ) | $ | (5.8 | ) | $ | (20.1 | ) | $ | 11.4 | ||||

Gain (loss) on cash flow hedging relationships in ASC 815 | |||||||||||||||

Interest rate contracts | |||||||||||||||

Amount of gain (loss) reclassified from accumulated OCI into income | $ | 0.1 | $ | — | $ | (0.8 | ) | $ | — | ||||||

Variable-to-fixed cross-currency swaps | |||||||||||||||

Amount of gain (loss) reclassified from accumulated OCI into income | 3.1 | 29.3 | — | — | |||||||||||

Currency contracts | |||||||||||||||

Amount of gain (loss) reclassified from accumulated OCI into income | — | 10.2 | — | (0.1 | ) | ||||||||||

Amount excluded from effectiveness testing recognized in earnings based on amortization approach (included in above) | — | 0.3 | — | — | |||||||||||

21

Notes to Consolidated Financial Statements (Continued)

4. Fair Value Measurements and Risk (Continued)

Six Months Ended June 30, | |||||||||||||||

2018 | 2017 | ||||||||||||||

(In millions) | Interest expense | Other income (expense) | Interest expense | Other income (expense) | |||||||||||

Total amounts of income and expense line items in the Consolidated Statements of Operations in which the effects of cash flow hedges are recorded | $ | (39.2 | ) | $ | (3.5 | ) | $ | (39.6 | ) | $ | 13.3 | ||||

Gain (loss) on cash flow hedging relationships in ASC 815 | |||||||||||||||

Interest rate contracts | |||||||||||||||

Amount of gain (loss) reclassified from accumulated OCI into income | $ | (0.1 | ) | $ | — | $ | (1.7 | ) | $ | — | |||||

Variable-to-fixed cross-currency swaps | |||||||||||||||

Amount of gain (loss) reclassified from accumulated OCI into income | 3.1 | 29.3 | — | — | |||||||||||

Currency contracts | |||||||||||||||

Amount of gain (loss) reclassified from accumulated OCI into income | — | 4.1 | — | (0.1 | ) | ||||||||||

Amount excluded from effectiveness testing recognized in earnings based on amortization approach (included in above) | — | 1.1 | — | — | |||||||||||

Net Investment Hedges Grace uses cross-currency swaps as derivative hedging instruments in certain net investment hedges of its non-U.S. subsidiaries. The effective portion of gains and losses attributable to these net investment hedges is recorded net of tax to “currency translation adjustments” within “accumulated other comprehensive income (loss)” to offset the change in the carrying value of the net investment being hedged. Recognition in earnings of amounts previously recorded to “currency translation adjustments” is limited to circumstances such as complete or substantially complete liquidation of the net investment in the hedged foreign operation. At June 30, 2018, the notional amount of €170.0 million of Grace’s cross-currency swaps was designated as a hedging instrument of its net investment in its European subsidiaries.

Grace also uses foreign currency-denominated debt and deferred intercompany royalties as non-derivative hedging instruments in certain net investment hedges. At June 30, 2018, €22.5 million of Grace’s deferred intercompany royalties was designated as a hedging instrument of its net investment in its European subsidiaries. In April 2018, in connection with the Credit Agreement, Grace de-designated and repaid its euro-denominated term loan principal that had been designated as a hedge of its net investment in its European subsidiaries.

The following table presents the amount of gains and losses on derivative and non-derivative instruments designated as net investment hedges, recorded to “currency translation adjustments” within “accumulated other comprehensive income (loss)” for the three and six months ended June 30, 2018 and 2017. There were no reclassifications of the effective portion of net investment hedges out of OCI and into earnings for the periods presented in the tables below.

Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

(In millions) | 2018 | 2017 | 2018 | 2017 | |||||||||||

Derivatives in ASC 815 net investment hedging relationships: | |||||||||||||||

Cross-currency swap | $ | 13.3 | $ | (6.1 | ) | $ | 2.0 | $ | (8.6 | ) | |||||

Non-derivatives in ASC 815 net investment hedging relationships: | |||||||||||||||

Foreign currency denominated debt | $ | — | $ | (4.9 | ) | $ | (4.4 | ) | $ | (7.2 | ) | ||||

Foreign currency denominated deferred intercompany royalties | 1.9 | (2.9 | ) | 0.2 | (4.4 | ) | |||||||||

$ | 1.9 | $ | (7.8 | ) | $ | (4.2 | ) | $ | (11.6 | ) | |||||

Credit Risk Grace is exposed to credit risk in its trade accounts receivable. Customers in the petroleum refining industry represent the greatest exposure. Grace’s credit evaluation policies mitigate credit risk exposures, and it has a history of minimal credit losses. Grace does not generally require collateral for its trade accounts

22

Notes to Consolidated Financial Statements (Continued)

4. Fair Value Measurements and Risk (Continued)

receivable but may require a bank letter of credit in certain instances, particularly when selling to customers in cash-restricted countries.

Grace may also be exposed to credit risk in its derivatives contracts. Grace monitors counterparty credit risk and currently does not anticipate nonperformance by counterparties to its derivatives. Grace’s derivative contracts are with internationally recognized commercial financial institutions.

5. Income Taxes

The provision for income taxes for the six months ended June 30, 2018 and 2017, was $49.8 million and $37.6 million, respectively. The $12.2 million increase is primarily due to the Tax Cuts and Jobs Act of 2017 (the “Act”) Global Intangible Low Taxed Income (“GILTI”) 2018 tax charge of $12.0 million, partially offset by a $6.3 million benefit from the change in the federal tax rate under the Act. The 2017 first quarter also included $3.1 million in share-based compensation deductions that did not repeat in 2018.

The provision for income taxes for the three months ended June 30, 2018 and 2017, was $25.0 million and $19.6 million, respectively. The $5.4 million increase was primarily due to the $6.1 million GILTI tax charge and a $1.9 million net increase in discrete charges primarily related to stock compensation. These charges were partially offset by a $4.4 million benefit from the change in the federal tax rate.

On December 22, 2017, the Act was signed into law, making significant changes to the Internal Revenue Code. Changes include a federal corporate tax rate decrease from 35% to 21% for tax years beginning after December 31, 2017, the transition of U.S. international taxation from a worldwide tax system to a territorial system, and a one-time transition tax on the mandatory deemed repatriation of foreign earnings.

On December 22, 2017, the SEC issued Staff Accounting Bulletin No. 118 (“SAB 118”) to address the application of U.S. GAAP in situations when a registrant does not have the necessary information available, prepared, or analyzed (including computations) in reasonable detail to complete the accounting for certain income tax effects of the Act. In accordance with SAB 118, Grace recorded the provisional income tax effects of the Act. Additional detailed analyses are needed in order to complete the accounting for certain income tax aspects of the Act. Any subsequent adjustment to these amounts will be recorded to current tax expense in the quarter during which the analysis is completed, which is expected to be during the second half of 2018. In January 2018, the FASB released guidance on the accounting for tax on the GILTI provisions of the Act. Grace has not completed its analysis in order to make a policy decision on accounting for GILTI.

No material adjustments have been recorded to Grace’s provisional SAB 118 tax expense as of June 30, 2018. Further detailed analyses are needed in order to complete the accounting for certain income tax aspects of the Act. Any subsequent adjustment to these amounts will be recorded to current tax expense in the quarter during which the analysis is completed, which is expected to be during the second half of 2018.

6. Pension Plans and Other Postretirement Benefit Plans

Pension Plans The following table presents the funded status of Grace’s pension plans:

(In millions) | June 30, 2018 | December 31, 2017 | |||||

Overfunded defined benefit pension plans | $ | 4.2 | $ | — | |||

Underfunded defined benefit pension plans | (63.4 | ) | (110.5 | ) | |||

Unfunded defined benefit pension plans | (388.8 | ) | (391.9 | ) | |||

Total underfunded and unfunded defined benefit pension plans | (452.2 | ) | (502.4 | ) | |||

Pension liabilities included in other current liabilities | (14.8 | ) | (15.0 | ) | |||

Net funded status | $ | (462.8 | ) | $ | (517.4 | ) | |

23

Notes to Consolidated Financial Statements (Continued)

6. Pension Plans and Other Postretirement Benefit Plans (Continued)

Underfunded plans include a group of advance-funded plans that are underfunded on a projected benefit obligation (“PBO”) basis. Unfunded plans include several plans that are funded on a pay-as-you-go basis, and therefore, the entire PBO is unfunded.

The following tables present the components of net periodic benefit cost (income).

Three Months Ended June 30, | |||||||||||||||

2018 | 2017 | ||||||||||||||

(In millions) | U.S. | Non-U.S. | U.S. | Non-U.S. | |||||||||||

Service cost | $ | 4.9 | $ | 2.5 | $ | 4.3 | $ | 2.0 | |||||||

Interest cost | 10.3 | 1.2 | 10.5 | 1.1 | |||||||||||

Expected return on plan assets | (14.6 | ) | (0.2 | ) | (14.4 | ) | (0.2 | ) | |||||||

Amortization of prior service credit | (0.1 | ) | — | (0.1 | ) | — | |||||||||

Net periodic benefit cost (income) | $ | 0.5 | $ | 3.5 | $ | 0.3 | $ | 2.9 | |||||||

Six Months Ended June 30, | |||||||||||||||

2018 | 2017 | ||||||||||||||

(In millions) | U.S. | Non-U.S. | U.S. | Non-U.S. | |||||||||||

Service cost | $ | 9.7 | $ | 4.9 | $ | 8.6 | $ | 4.0 | |||||||

Interest cost | 20.6 | 2.5 | 21.0 | 2.1 | |||||||||||

Expected return on plan assets | (29.1 | ) | (0.5 | ) | (28.8 | ) | (0.4 | ) | |||||||

Amortization of prior service credit | (0.3 | ) | — | (0.2 | ) | — | |||||||||

Net periodic benefit cost (income) | $ | 0.9 | $ | 6.9 | $ | 0.6 | $ | 5.7 | |||||||

Plan Contributions and Funding Grace intends to satisfy its funding obligations under the U.S. qualified pension plans and to comply with all of the requirements of the Employee Retirement Income Security Act of 1974 (“ERISA”). For ERISA purposes, funded status is calculated on a different basis than under U.S. GAAP. On April 6, 2018, Grace contributed $50.0 million to its U.S. qualified pension plans.

Grace intends to fund non-U.S. pension plans based on applicable legal requirements and actuarial recommendations.

Defined Contribution Retirement Plan Grace sponsors a defined contribution retirement plan for its employees in the United States. This plan is qualified under section 401(k) of the U.S. tax code. Currently, Grace contributes an amount equal to 100% of employee contributions, up to 6% of an individual employee’s salary or wages. Grace’s cost related to this benefit plan for the three and six months ended June 30, 2018, was $3.3 million and $6.1 million compared with $3.0 million and $5.7 million for the corresponding prior-year periods.

The U.S. salaried pension plan is closed to new entrants after January 1, 2017. U.S. salaried employees and certain U.S. hourly employees hired on or after January 1, 2017, and employees in Germany hired on or after January 1, 2016, will participate in enhanced defined contribution plans instead of defined benefit pension plans.

24

Notes to Consolidated Financial Statements (Continued)

7. Other Balance Sheet Accounts

(In millions) | June 30, 2018 | December 31, 2017 | |||||

Other Current Liabilities | |||||||

Accrued compensation | $ | 45.2 | $ | 60.7 | |||

Deferred revenue | 26.0 | 19.5 | |||||

Environmental contingencies | 22.7 | 23.5 | |||||

Income taxes payable | 20.3 | 12.2 | |||||

Pension liabilities | 14.8 | 15.0 | |||||

Accrued interest | 13.3 | 16.5 | |||||

Other accrued liabilities | 75.0 | 70.4 | |||||

$ | 217.3 | $ | 217.8 | ||||

Accrued compensation includes salaries and wages as well as estimated current amounts due under the annual and long-term incentive programs.

(In millions) | June 30, 2018 | December 31, 2017 | |||||

Other Liabilities | |||||||

Liability to unconsolidated affiliate | $ | 56.0 | $ | 32.7 | |||

Environmental contingencies | 38.5 | 46.8 | |||||

Deferred revenue | 22.3 | 14.9 | |||||

Fair value of currency and interest rate contracts | 19.1 | 22.7 | |||||

Asset retirement obligation | 9.1 | 10.4 | |||||

Deferred income taxes | 8.0 | 8.2 | |||||

Postemployment liability | 4.9 | 5.2 | |||||

Other noncurrent liabilities | 30.8 | 28.4 | |||||

$ | 188.7 | $ | 169.3 | ||||

8. Commitments and Contingent Liabilities

Over the years, Grace operated numerous types of businesses that are no longer part of its business portfolio. As Grace divested or otherwise ceased operating these businesses, it retained certain liabilities and obligations, which Grace refers to as legacy liabilities. The principal legacy liabilities are product and environmental liabilities. Although the outcome of each of the matters discussed below cannot be predicted with certainty, Grace has assessed its risk and has made accounting estimates as required under U.S. GAAP.

Legacy Product and Environmental Liabilities

Legacy Product Liabilities Grace emerged from an asbestos-related Chapter 11 bankruptcy on February 3, 2014 (the “Effective Date”). Under its plan of reorganization, all pending and future asbestos-related claims are channeled for resolution to either a personal injury trust (the “PI Trust”) or a property damage trust (the “PD Trust”). The trusts are the sole recourse for holders of asbestos-related claims. The channeling injunctions issued by the bankruptcy court prohibit holders of asbestos-related claims from asserting such claims directly against Grace.

Grace has satisfied all of its financial obligations to the PI Trust. Grace has contingent financial obligations remaining to the PD Trust. With respect to property damage claims related to Grace’s former Zonolite attic insulation product installed in the U.S. (“ZAI PD Claims”), the PD Trust was funded with $34.4 million on the Effective Date and $30.0 million on February 3, 2017. Grace is also obligated to make up to 10 contingent deferred payments of $8 million per year to the PD Trust in respect of ZAI PD Claims during the 20-year period beginning on the fifth anniversary of the Effective Date, with each such payment due only if the assets of the PD

25

Notes to Consolidated Financial Statements (Continued)

8. Commitments and Contingent Liabilities (Continued)

Trust in respect of ZAI PD Claims fall below $10 million during the preceding year. Grace has not accrued for the 10 additional payments as Grace does not have sufficient information to conclude that they are probable. Grace is not obligated to make additional payments to the PD Trust in respect of ZAI PD Claims beyond the payments described above. Grace has satisfied all of its financial obligations with respect to Canadian ZAI PD Claims.