Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K JULY 2020 MOR - IMH Financial Corp | form8-kmonthlyoperatingrep.htm |

UNITED STATES BANKRUPTCY COURT REGION 3 DISTRICT OF DELAWARE In re: IMH Financial Corporation Case No. 20-11858 (CSS) Debtor Reporting Period: July 2020 MONTHLY OPERATING REPORT File with Court and submit copy to United States Trustee within 20 days after end of month. Submit copy of report to any official committee appointed in the case. Document Explanation Affidavit/Supplement REQUIRED DOCUMENTS Form No. Attached Attached Attached Schedule of Cash Receipts and Disbursements MOR-1 X Not applicable Bank Reconciliation (or copies of debtor's bank reconciliations) MOR-1a X Not applicable Schedule of Professional Fees Paid MOR-1b X Not applicable Copies of bank statements X Not applicable Cash disbursements journals X Not applicable Statement of Operations MOR-2 X Not applicable Balance Sheet MOR-3 X Not applicable Status of Postpetition Taxes MOR-4 X Not applicable Copies of IRS Form 6123 or payment receipt NA Not applicable Copies of tax returns filed during reporting period NA Not applicable Summary of Unpaid Postpetition Debts MOR-4 X Not applicable Listing of aged accounts payable MOR-4 X Not applicable Accounts Receivable Reconciliation and Aging MOR-5 X Not applicable Debtor Questionnaire MOR-5 X Not applicable I declare under penalty of perjury (28 U.S.C. Section 1746) that this report and the attached documents are true and correct to the best of my knowledge and belief. Signature of Debtor Date Not Applicable Not Applicable Signature of Joint Debtor Date /s/ Samuel J. Montes 08/19/2020 Signature of Authorized Individual* Date Samuel J. Montes Chief Financial Officer Printed Name of Authorized Individual Title of Authorized Individual *Authorized individual must be an officer, director or shareholder if debtor is a corporation; a partner if debtor is a partnership; a manager or member if debtor is a limited liability company. MOR (04/07) Docket No. 143 8/19/20

UNITED STATES BANKRUPTCY COURT REGION 3 DISTRICT OF DELAWARE In re: IMH Financial Corporation Case No. 20-11858 (CSS) Debtor Reporting Period: July 2020 SCHEDULE OF CASH RECEIPTS AND DISBURSEMENTS Amounts reported should be per the debtor's books, not the bank statement. The beginning cash should be the ending cash from the prior month or, if this is the first report, the amount should be the balance on the date the petition was filed. The amounts reported in the "CURRENT MONTH - ACTUAL" column must equal the sum of the four bank account columns. The amounts reported in the "PROJECTED" columns should be taken from the SMALL BUSINESS INITIAL REPORT (FORM IR-1). Attach copies of the bank statements and the cash disbursements journal. The total disbursements listed in the disbursements journal must equal the total disbursements reported on this page. A bank reconciliation must be attached for each account. [See MOR-1 (CON'T)] Bank Accounts Current Month Cumulative Filing to Date Operating Payroll Disbursement Utility Actual Projected Actual Projected Cash Beginning of Period $ 22,646 $ 5,969 $ 192,895 $ - $ 221,510 $ 221,664 $ 221,510 $ 221,664 RECEIPTS Cash Sales - - - - - - - - Accounts Receivable - - 861 - 861 - 861 - Loans and Advances 721,845 80,000 1,000,000 3,095 1,804,940 1,804,940 1,804,940 1,804,940 Sale of Assets - - - - - - - - Mortgage investment income - - - - - - - - Other - Release of Lender Restricted Funds - - - - - - - - TOTAL RECEIPTS 721,845 80,000 1,000,861 3,095 1,805,801 1,804,940 1,805,801 1,804,940 DISBURSEMENTS Net Payroll - 76,351 - - 76,351 75,000 76,351 75,000 Payroll Taxes - - - - - - - - Sales, Use and Other Taxes - - - - - - - - Inventory Purchases - - - - - - - - Secured/Rental/Leases - - - - - - - - Insurance - - 4,500 - 4,500 - 4,500 - Administrative & Selling - - - - - - - - Professional Fees (ordinary course) - - - - - 65,048 - 65,048 Other - MacArthur deficit funding and Cap Ex - - - - - - - - Other - Hotel Fund Preferred Member Distributions - - - - - - - - Other - MacArthur Debt Service - - - - - - - - Other - Preferred Shareholder Redemption - - - - - - - - Other - Common Shareholder Redemption - - - - - - - - Professional Fees - Restructuring - - 604,970 - 604,970 666,095 604,970 666,095 US Trustee Fees - - - - - - - - Court Costs - - - - - - - - TOTAL DISBURSEMENTS - 76,351 609,470 - 685,821 806,143 685,821 806,143 NET CASH FLOW 721,845 3,649 391,391 3,095 1,119,980 998,797 1,119,980 998,797 (Receipts Less Disbursements) Cash End of Period $ 744,491 $ 9,618 $ 584,286 $ 3,095 $ 1,341,490 $ 1,220,461 $ 1,341,490 $ 1,220,461 FORM MOR-3 (04/07)

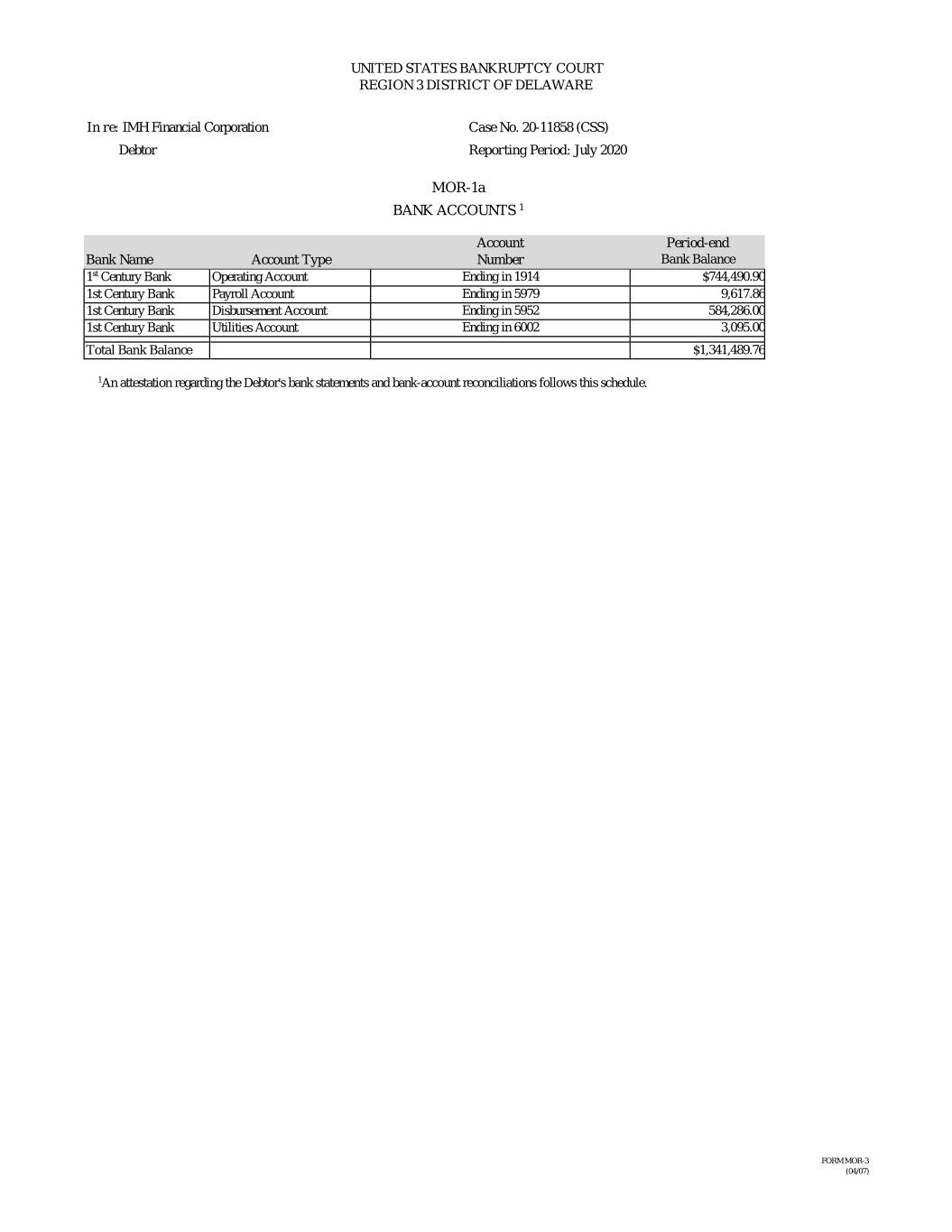

UNITED STATES BANKRUPTCY COURT REGION 3 DISTRICT OF DELAWARE In re: IMH Financial Corporation Case No. 20-11858 (CSS) Debtor Reporting Period: July 2020 MOR-1a BANK ACCOUNTS 1 Account Period-end Bank Name Account Type Number Bank Balance 1st Century Bank Operating Account Ending in 1914 $744,490.90 1st Century Bank Payroll Account Ending in 5979 9,617.86 1st Century Bank Disbursement Account Ending in 5952 584,286.00 1st Century Bank Utilities Account Ending in 6002 3,095.00 T otal Bank Balance $1,341,489.76 1An attestation regarding the Debtor's bank statements and bank-account reconciliations follows this schedule. FORM MOR-3 (04/07)

UNITED STATES BANKRUPTCY COURT REGION 3 DISTRICT OF DELAWARE In re: IMH Financial Corporation Case No. 20-11858 (CSS) Debtor Reporting Period: July 2020 MOR-1a ATTESTATION REGARDING BANK ACCOUNTS The above-captioned Debtor hereby submits this attestation regarding disbursement journals and bank-account reconciliations in lieu of providing copies of bank statements and account reconciliations. I attest that each of the bank accounts listed in the preceding schedule is reconciled to monthly bank statements. The Debtor's standard practice is to ensure that each bank account is reconciled to monthly bank statements for each calendar month within 20 days after month end. /s/ Samuel J. Montes 08/19/2020 Signature of Authorized Individual Date Samuel J. Montes Chief Financial Officer Printed Name of Authorized Individual Title of Authorized Individual FORM MOR-3 (04/07)

UNITED STATES BANKRUPTCY COURT REGION 3 DISTRICT OF DELAWARE In re: IMH Financial Corporation Case No. 20-11858 (CSS) Debtor Reporting Period: July 2020 SCHEDULE OF PROFESSIONAL FEES AND EXPENSES PAID This schedule is to include all retained professional payments from case inception to current month. Expense Distribution (Paid Only) .allpe Period: From 07/2020 to 07/2020 Account Code Account Name Payee Code Payee Name Payable Control Batch Property Invoice # Invoice Date Period Payment method Amount Check Control Check # Check Date No t e s 173500-1010 Retainers Consulting donli001 Donlin, Recan & Company, Inc. P-19887 3507 imhf c 1454-1 7/24/2020 07-2020 Check -670.50 K-13358 20200724 7/24/2020 Retainer - Notice & consent Solicitation Agent in BK Case Total 173500-1010 -670.50 612000-7000 Consulting Restructuring donli001 Donlin, Recan & Company, Inc. P-19887 3507 imhf c 1454-1 7/24/2020 07-2020 Check 670.50 K-13358 20200724 7/24/2020 Pre-petition Services in connection with Chapter 11 Filing-Programming & Consulting Fees Total 612000-7000 670.50 613000-7000 Legal Restructuring hahnh001 Hahn & Hessen LLP P-19747 3484 imhf c 183238 7/29/2020 07-2020 Check 58,403.35 K-13353 20200729 7/29/2020 JPM Debtor-In-Possession Legal Restructure Expense hahnh001 Hahn & Hessen LLP P-19893 3509 imhf c 183414 7/23/2020 07-2020 Check 327,657.84 K-13354 20200729 7/29/2020 Negotiating/Documenting Restructuring Support Agreement/Debtor-In_Possession Financing Arrangements landi001 Landis Rath & Cobb LLP P-19894 3509 imhf c 20200723 7/23/2020 07-2020 Check 218,908.59 K-13355 20200729 7/29/2020 Draft, Review, Revise and Analyze First Day Operational Pleadings Total 613000-7000 604,969.78 Grand Total 604,969.78 FORM MOR-3 (04/07)

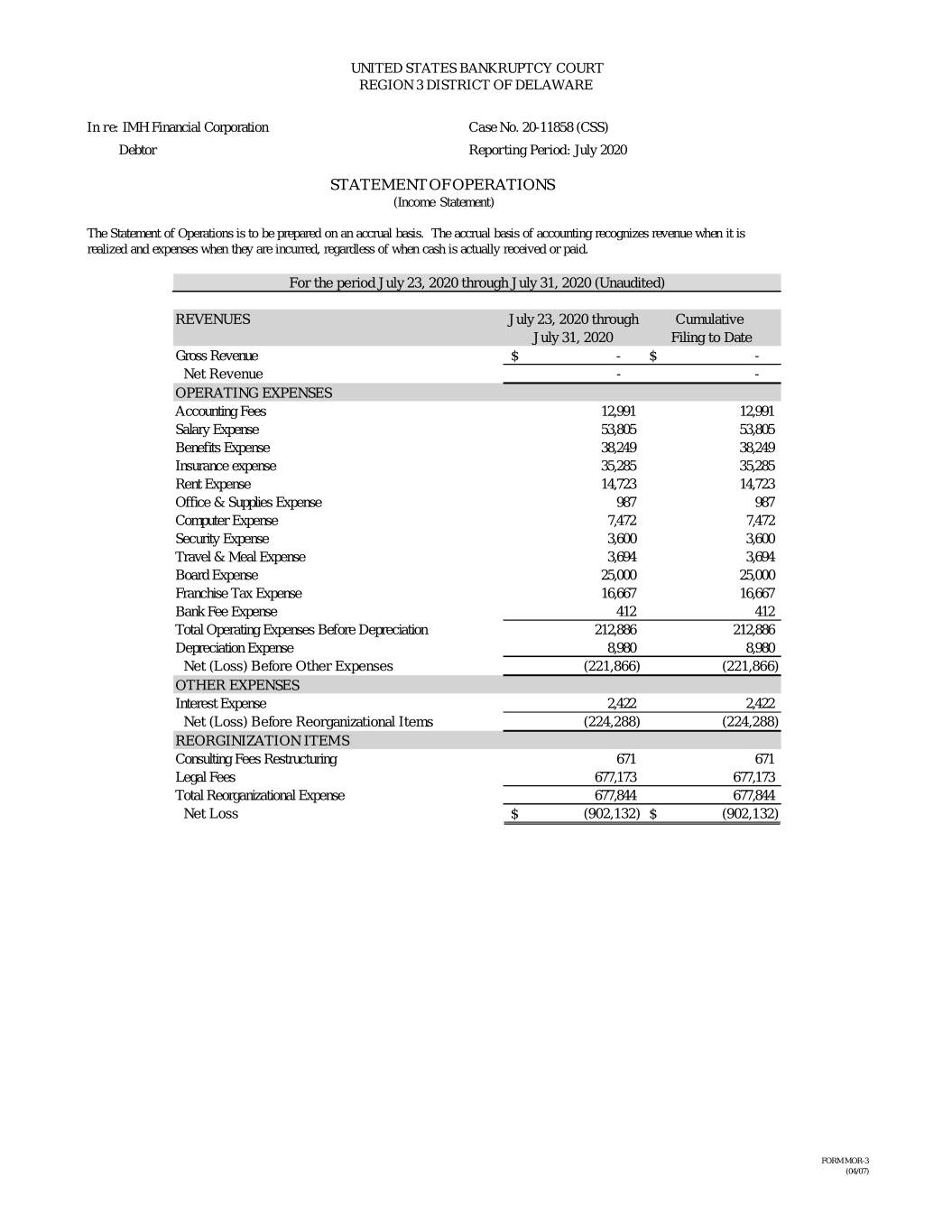

UNITED STATES BANKRUPTCY COURT REGION 3 DISTRICT OF DELAWARE In re: IMH Financial Corporation Case No. 20-11858 (CSS) Debtor Reporting Period: July 2020 STATEMENT OF OPERATIONS (Income Statement) The Statement of Operations is to be prepared on an accrual basis. The accrual basis of accounting recognizes revenue when it is realized and expenses when they are incurred, regardless of when cash is actually received or paid. For the period July 23, 2020 through July 31, 2020 (Unaudited) REVENUES July 23, 2020 through Cumulative July 31, 2020 Filing to Date Gross Revenue $ - $ - Net Revenue - - OPERATING EXPENSES Accounting Fees 12,991 12,991 Salary Expense 53,805 53,805 Benefits Expense 38,249 38,249 Insurance expense 35,285 35,285 Rent Expense 14,723 14,723 Office & Supplies Expense 987 987 Computer Expense 7,472 7,472 Security Expense 3,600 3,600 Travel & Meal Expense 3,694 3,694 Board Expense 25,000 25,000 Franchise Tax Expense 16,667 16,667 Bank Fee Expense 412 412 Total Operating Expenses Before Depreciation 212,886 212,886 Depreciation Expense 8,980 8,980 Net (Loss) Before Other Expenses (221,866) (221,866) OTHER EXPENSES Interest Expense 2,422 2,422 Net (Loss) Before Reorganizational Items (224,288) (224,288) REORGINIZATION ITEMS Consulting Fees Restructuring 671 671 Legal Fees 677,173 677,173 Total Reorganizational Expense 677,844 677,844 Net Loss $ (902,132) $ (902,132) FORM MOR-3 (04/07)

UNITED STATES BANKRUPTCY COURT REGION 3 DISTRICT OF DELAWARE In re: IMH Financial Corporation Case No. 20-11858 (CSS) Debtor Reporting Period: July 2020 BALANCE SHEET As of July 31, 2020 BOOK VALUE BOOK VALUE ASSETS AT END OF CURRENT ON PETITION DATE REPORTING MONTH July 23, 2020 Unrestricted Cash and Equivalents $ 1,341,490 $ 271,592 Prepaid Insurance & Deposits 374,671 681,469 Professional Retainers 24,330 55,000 Other Assets 81,819 70,655 Right of Use Office Rent Lease Asset, Net 543,461 562,780 2,365,771 1,641,496 PROPERTY AND EQUIPMENT Furniture, Fixtures, and Office Equipment 197,304 197,304 Leasehold Improvements 389,499 389,499 Software 669,136 669,136 Less: Accumulated Depreciation (1,015,058) (1,006,117) TOTAL PROPERTY AND EQUIPMENT 240,882 249,822 TOTAL ASSETS $ 2,606,652 $ 1,891,319 LIABILITIES AND OWNERS EQUITY LIABILITIES NOT SUBJECT TO COMPROMISE (Postpetition) Accounts Payable $ 47,988 $ - Accrued Expenses 33,278 - Office Rent Lease Liability - - Accrued Payroll and Related Liabilities 380,500 - Interest Payable 2,422 - PPP SBA Loan Note Payable - - Debtor-In-Posession Credit Facility 1,804,940 - Dividends Payable 339,167 - TOTAL POSTPETITION LIABLITIES 2,608,296 - LIABILITIES SUBJECT TO COMPROMISE (Pre-Petition) Accounts Payable $ 94,239 94,239 Accrued Expenses 1,472,682 2,077,651 Office Rent Lease Liability 621,358 643,043 Accrued Payroll and Related Liabilities 524,884 524,884 Interest Payable 950 950 PPP SBA Loan Note Payable 444,000 444,000 Debtor-In-Posession Credit Facility - - Dividend Payable 3,992,961 3,992,961 TOTAL PREPETITION LIABLITIES 7,151,073 7,777,728 TOTAL LIABLITIES 9,759,369 7,777,728 SHAREHOLDERS' AND OWNER EQUITY Series B Preferred Stock 55,127,432 55,015,221 Series A Preferred Stock 21,837,993 21,833,126 Common Stock 190,844 190,844 Treasury Stock (7,285,688) (7,285,688) Paid-in Capital 701,085,419 701,085,419 Retained Earnings (Deficit) - Pre-Petition (777,206,585) (776,725,332) Retained Earnings (Deficit) - Post-Petition (902,132) - NET OWNER EQUITY (7,152,717) (5,886,410) Total Liabilities and Owners Equity $ 2,606,652 $ 1,891,319 *"Insider" is defined in 11 U.S.C. Section 101(31). FORM MOR-3 (04/07)

UNITED STATES BANKRUPTCY COURT REGION 3 DISTRICT OF DELAWARE In re: IMH Financial Corporation Case No. 20-11858 (CSS) Debtor Reporting Period: July 2020 STATUS OF POSTPETITION TAXES July 23, 2020 through July 31, 2020 (Unaudited) The Debtor believes that the only taxes incurred Post-Petition are Payroll related in nature. For the Court’s benefit, the Debtors’ payroll processor, Oasis Outsourcing, A PAYCHEX Company, withholds all applicable payroll taxes. As such, the Debtors believe that they are current on all Post-Petition tax obligations. FORM MOR-4 (04/07)

UNITED STATES BANKRUPTCY COURT REGION 3 DISTRICT OF DELAWARE In re: IMH Financial Corporation Case No. 20-11858 (CSS) Debtor Reporting Period: July 2020 SUMMARY OF UNPAID POSTPETITION DEBTS Attach aged listing of accounts payable. Payables Aging Report imhf c imhms imhdisb Period: 07/2020 As of : 08/01/2020 Property Code Property Name Payee Code Payee Name Current Owed 0-30 Owed 31-60 Owed 61-90 Owed Over 90 Owed imhf c IMH Financial Corporation 1cbvi001 1CB Visa -11,801.98 -9,301.98 -2,500.00 0.00 0.00 bulle001 Bulletproof Securities Inc. 3,600.00 3,600.00 0.00 0.00 0.00 centu001 CenturyLink (Office Phone) 1,556.23 1,556.23 0.00 0.00 0.00 cisco001 Cisco 25.00 25.00 0.00 0.00 0.00 compu001 ComputerShare 7,733.88 7,733.88 0.00 0.00 0.00 delaw002 Delaware Secretary of State (LLC Tax) 40,000.00 40,000.00 0.00 0.00 0.00 gibso003 Gibson, Dunn & Crutcher LLP 32,258.76 0.00 14,935.76 17,323.00 0.00 holla001 Holland & Knight LLP 19,164.50 0.00 19,164.50 0.00 0.00 ironm001 Iron Mountain 1,142.77 0.00 1,142.77 0.00 0.00 maris001 Marisol Marketing 150.00 150.00 0.00 0.00 0.00 neust001 Neustar 135.00 0.00 135.00 0.00 0.00 phoen005 PHOENIX NAP, LLC 466.35 466.35 0.00 0.00 0.00 proco001 ProCopy Office Solutions, INC. 47.71 47.71 0.00 0.00 0.00 squir002 Squire Patton Boggs (US) LLP 23,665.42 0.00 0.00 0.00 23,665.42 stapl001 Staples Contract & Commercial 120.23 120.23 0.00 0.00 0.00 ulmer001 Ulmer Berne, LLP 22,342.89 13,540.60 8,802.29 0.00 0.00 veriz001 Verizon 1,577.87 1,577.87 0.00 0.00 0.00 Total imhfc 142,184.63 59,515.89 41,680.32 17,323.00 23,665.42 imhms IMH Management Services, LLC cimpl001 Cimplx. 42.73 0.00 42.73 0.00 0.00 Total imhms 42.73 0.00 42.73 0.00 0.00 Grand Total 142,227.36 59,515.89 41,723.05 17,323.00 23,665.42 *"Insider" is defined in 11 U.S.C. Section 101(31). FORM MOR-5 (04/07)

UNITED STATES BANKRUPTCY COURT REGION 3 DISTRICT OF DELAWARE In re: IMH Financial Corporation Case No. 20-11858 (CSS) Debtor Reporting Period: July 2020 ACCOUNTS RECEIVABLE RECONCILIATION AND AGING – Not Applicable Accounts Receivable Reconciliation Amount Total Accounts Receivable at the beginning of the reporting period + Amounts billed during the period - Amounts collected during the period Total Accounts Receivable at the end of the reporting period Accounts Receivable Aging Amount 0 - 30 days old 31 - 60 days old 61 - 90 days old 91+ days old Total Accounts Receivable Amount considered uncollectible (Bad Debt) Accounts Receivable (Net) DEBTOR QUESTIONNAIRE Must be completed each month Yes No 1. Have any assets been sold or transferred outside the normal course of business X this reporting period? If yes, provide an explanation below. 2. Have any funds been disbursed from any account other than a debtor in possession X account this reporting period? If yes, provide an explanation below. 3. Have all postpetition tax returns been timely filed? If no, provide an explanation N/A below. 4. Are workers compensation, general liability and other necessary insurance X coverages in effect? If no, provide an explanation below. 5. Has any bank account been opened during the reporting period? If yes, provide X documentation identifying the opened account(s). If an investment account has been opened provide the required documentation pursuant to the Delaware Local Rule 4001-3.

CERTIFICATE OF SERVICE I, Stacy L. Newman, hereby certify that, on August 19, 2020, I caused one copy of the foregoing to be served upon the party below via electronic mail. Office of the United States Trustee Benjamin A. Hackman 844 King Street, Suite 2207 Lockbox 35 Wilmington, DE 19801 Email: Benjamin.A.Hackman@usdoj.gov /s/ Stacy L. Newman Stacy L. Newman (#5044) {01594906;v1 }

8/19/2020 Internal CM/ECF Live Database Miscellaneous: 20-11858-CSS IMH Financial Corporation Type: bk Chapter: 11 v Office: 1 (Delaware) Assets: y Judge: CSS Case Flag: LeadSC, CLMSAGNT, MEGA U.S. Bankruptcy Court District of Delaware Notice of Electronic Filing The following transaction was received from Stacy L. Newman entered on 8/19/2020 at 4:31 PM EDT and filed on 8/19/2020 Case Name: IMH Financial Corporation Case Number: 20-11858-CSS Document Number: 143 Docket Text: Debtor-In-Possession Monthly Operating Report for Filing Period July 2020 Filed by IMH Financial Corporation. (Attachments: # (1) Certificate of Service) (Newman, Stacy) The following document(s) are associated with this transaction: Document description:Main Document Original filename:01599112.PDF Electronic document Stamp: [STAMP bkecfStamp_ID=983460418 [Date=8/19/2020] [FileNumber=16578346-0 ] [5240990263414fbbac913cf3d56b215492735152b10c1c7a2a5d8fb0593e8c29df3 268a4144dc49a455fee43903aa94510d21c93689768df247b77724804b134]] Document description:Certificate of Service Original filename:C:\fakepath\01599113.PDF Electronic document Stamp: [STAMP bkecfStamp_ID=983460418 [Date=8/19/2020] [FileNumber=16578346-1 ] [6ce8388e6d57a6c9b09abe67938637453646974255b8741686229444ca47e67b692 76981b682a8cd9d7e67e3d001d685f7fdd9b40eb373dce0414abfe88ea940]] 20-11858-CSS Notice will be electronically mailed to: William Pierce Bowden on behalf of Debtor IMH Financial Corporation wbowden@ashby-geddes.com Richard Scott Cobb on behalf of Interested Party JPMorgan Chase Funding Inc. cobb@lrclaw.com, ramirez@lrclaw.com;rogers@lrclaw.com;snyder@lrclaw.com;dellose@lrclaw.com;snyder@lrclaw.com Donlin, Recano & Company, Inc. ljordan@donlinrecano.com Katharina Earle on behalf of Debtor IMH Financial Corporation kearle@ashbygeddes.com W. Keith Fendrick on behalf of Interested Party The Special Committee of IMH Financial Corporation https://ecf.deb.uscourts.gov/cgi-bin/Dispatch.pl?701194029660359 1/4