Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 EARNINGS RELEASE Q2-20 - CrossAmerica Partners LP | capl-ex991_6.htm |

| 8-K - 8-K EARNINGS RELEASE Q2-20 - CrossAmerica Partners LP | capl-8k_20200806.htm |

August 2020 Second Quarter 2020 Earnings Call Exhibit 99.2

Forward Looking Statements Statements contained in this presentation that state the Partnership’s or management’s expectations or predictions of the future are forward-looking statements. The words “believe,” “expect,” “should,” “intends,” “anticipates,” “estimates,” “target” and other similar expressions identify forward-looking statements. It is important to note that actual results could differ materially from those projected in such forward-looking statements. For more information concerning factors that could cause actual results to differ from those expressed or forecasted, see CrossAmerica’s annual reports on Form 10-K, quarterly reports on Form 10-Q and other reports filed with the Securities and Exchange Commission and available on the Partnership’s website at www.crossamericapartners.com. If any of these factors materialize, or if our underlying assumptions prove to be incorrect, actual results may vary significantly from what we projected. Any forward-looking statement you see or hear during this presentation reflects our current views as of the date of this presentation with respect to future events. We assume no obligation to publicly update or revise these forward-looking statements for any reason, whether as a result of new information, future events, or otherwise.

CrossAmerica Business Overview Charles Nifong, CEO & President

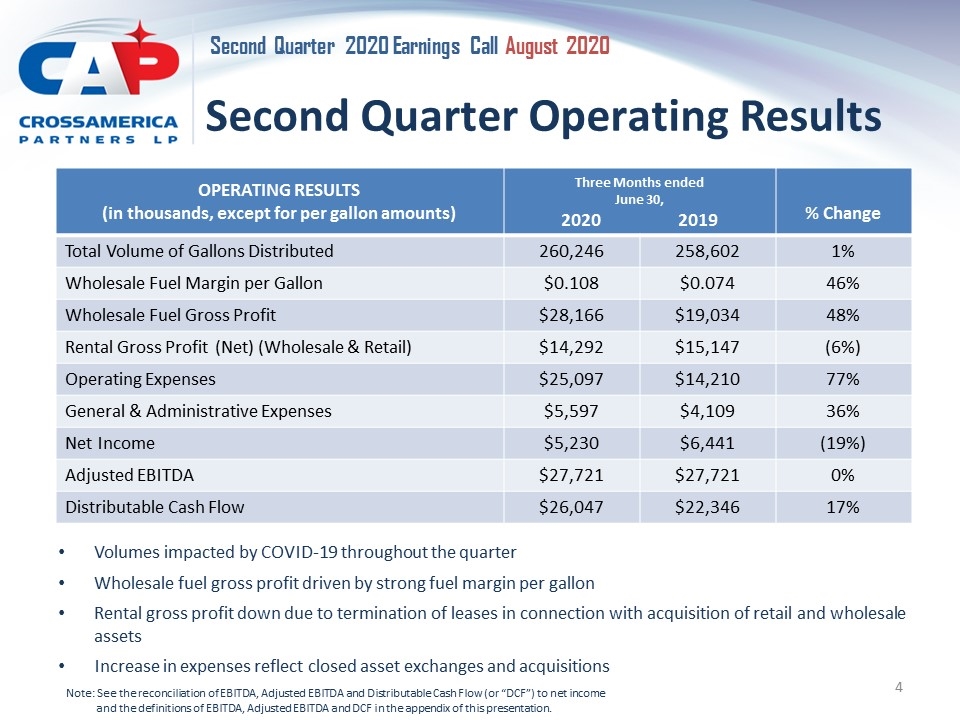

Second Quarter Operating Results OPERATING RESULTS (in thousands, except for per gallon amounts) Three Months ended June 30, 2020 2019 % Change Total Volume of Gallons Distributed 260,246 258,602 1% Wholesale Fuel Margin per Gallon $0.108 $0.074 46% Wholesale Fuel Gross Profit $28,166 $19,034 48% Rental Gross Profit (Net) (Wholesale & Retail) $14,292 $15,147 (6%) Operating Expenses $25,097 $14,210 77% General & Administrative Expenses $5,597 $4,109 36% Net Income $5,230 $6,441 (19%) Adjusted EBITDA $27,721 $27,721 0% Distributable Cash Flow $26,047 $22,346 17% Volumes impacted by COVID-19 throughout the quarter Wholesale fuel gross profit driven by strong fuel margin per gallon Rental gross profit down due to termination of leases in connection with acquisition of retail and wholesale assets Increase in expenses reflect closed asset exchanges and acquisitions Note: See the reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and the definitions of EBITDA, Adjusted EBITDA and DCF in the appendix of this presentation.

Second Quarter Update Completed the acquisition of retail/wholesale assets that was announced on January 15, 2020* Includes retail operations at 169 sites (154 company operated sites and 15 commission sites) Transaction closed on April 14, 2020 Wholesale fuel supply to 110 sites, including 53 third-party wholesale dealer contracts Leasehold interest at 62 sites Continue to work through the remaining asset exchange with Couche-Tard/Circle K Entered into an asset exchange agreement as of 12/17/18#: Expect to complete the final exchange of assets in the second half of 2020 Continue with real estate rationalization effort Divested seven properties during the second quarter for a total of $4.4 million *Additional details regarding the definitive agreement to acquire retail/wholesale assets from entities affiliated with Joe Topper, Chairman of CrossAmerica, are included in a press release and Form 8-K filings, issued on January 15 and 16 and April 17, 2020, respectively, and available on the CrossAmerica website at www.crossamericapartners.com. #Additional details regarding the asset exchange agreement are included in a joint (Couche-Tard and CrossAmerica) press release and Form 8-K filing, both issued on December 17, 2018, and available on the CrossAmerica website at www.crossamericapartners.com.

CrossAmerica Financial Overview Jon Benfield, Interim Chief Financial Officer

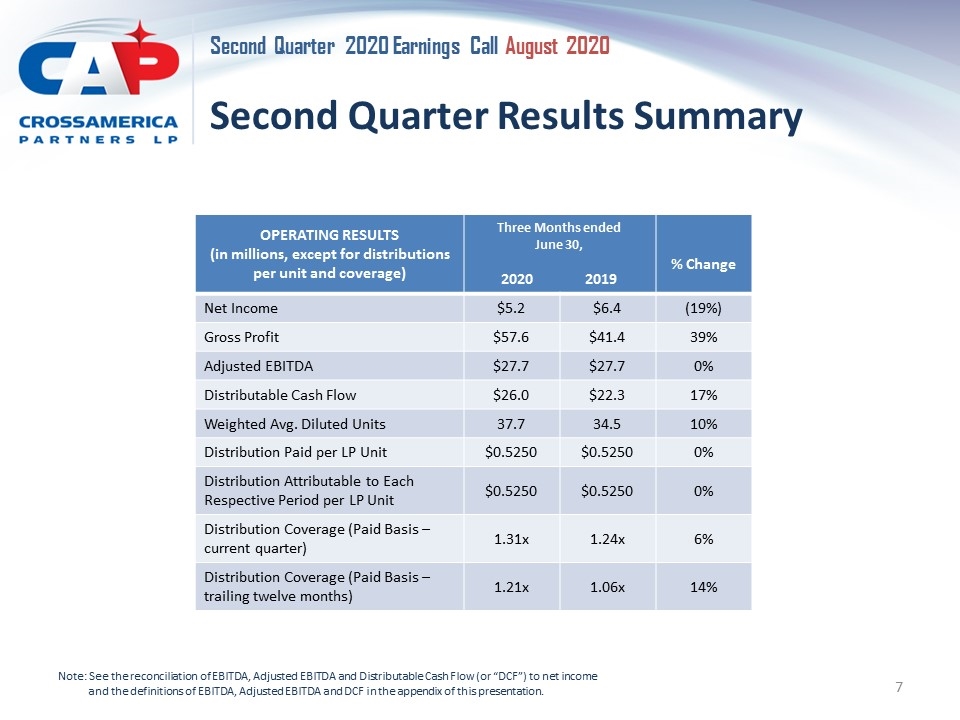

Second Quarter Results Summary OPERATING RESULTS (in millions, except for distributions per unit and coverage) Three Months ended June 30, 2020 2019 % Change Net Income $5.2 $6.4 (19%) Gross Profit $57.6 $41.4 39% Adjusted EBITDA $27.7 $27.7 0% Distributable Cash Flow $26.0 $22.3 17% Weighted Avg. Diluted Units 37.7 34.5 10% Distribution Paid per LP Unit $0.5250 $0.5250 0% Distribution Attributable to Each Respective Period per LP Unit $0.5250 $0.5250 0% Distribution Coverage (Paid Basis – current quarter) 1.31x 1.24x 6% Distribution Coverage (Paid Basis – trailing twelve months) 1.21x 1.06x 14% Note: See the reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and the definitions of EBITDA, Adjusted EBITDA and DCF in the appendix of this presentation.

Capital Strength Leverage, as defined under our credit facility, was 3.96X as of June 30, 2020 Increase in credit facility availability Maintain Distribution Rate Distributable Cash Flow of $26.0 million for the three-month period ended June 30, 2020 Distribution rate of $0.5250 per unit ($2.10 per unit annualized) attributable to the second quarter of 2020 TTM coverage ratio to 1.21 times for period ending 06/30/20 from 1.06 times in for the TTM ending 06/30/19 Financial Position Leverage and coverage Credit facility availability Modest amount of capital expenditures Note: See the reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and the definitions of EBITDA, Adjusted EBITDA and DCF in the appendix of this presentation.

Appendix Second Quarter 2020 Earnings Call

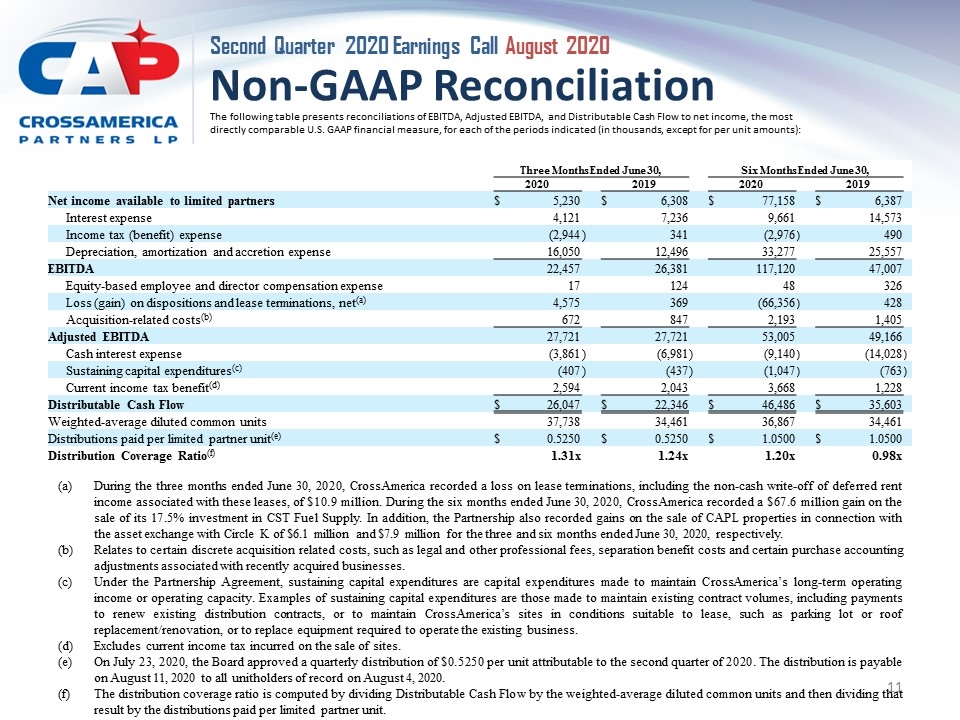

Non-GAAP Financial Measures We use the non-GAAP financial measures EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio. EBITDA represents net income available to us before deducting interest expense, income taxes and depreciation, amortization and accretion, which includes certain impairment charges. Adjusted EBITDA represents EBITDA as further adjusted to exclude equity-based employee and director compensation expense, gains or losses on dispositions and lease terminations, certain acquisition related costs, such as legal and other professional fees and separation benefit costs, and certain other non-cash items arising from purchase accounting. Distributable Cash Flow represents Adjusted EBITDA less cash interest expense, sustaining capital expenditures and current income tax expense. The Distribution Coverage Ratio is computed by dividing Distributable Cash Flow by the weighted average diluted common units and then dividing that result by the distributions paid per limited partner unit. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio are used as supplemental financial measures by management and by external users of our financial statements, such as investors and lenders. EBITDA and Adjusted EBITDA are used to assess our financial performance without regard to financing methods, capital structure or income taxes and the ability to incur and service debt and to fund capital expenditures. In addition, Adjusted EBITDA is used to assess our operating performance of our business on a consistent basis by excluding the impact of items which do not result directly from the wholesale distribution of motor fuel, the leasing of real property, or the day to day operations of our retail site activities. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio are also used to assess our ability to generate cash sufficient to make distributions to our unit-holders. We believe the presentation of EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio provides useful information to investors in assessing our financial condition and results of operations. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio should not be considered alternatives to net income or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio have important limitations as analytical tools because they exclude some but not all items that affect net income. Additionally, because EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio may be defined differently by other companies in our industry, our definitions may not be comparable to similarly titled measures of other companies, thereby diminishing their utility.

Non-GAAP Reconciliation The following table presents reconciliations of EBITDA, Adjusted EBITDA, and Distributable Cash Flow to net income, the most directly comparable U.S. GAAP financial measure, for each of the periods indicated (in thousands, except for per unit amounts): During the three months ended June 30, 2020, CrossAmerica recorded a loss on lease terminations, including the non-cash write-off of deferred rent income associated with these leases, of $10.9 million. During the six months ended June 30, 2020, CrossAmerica recorded a $67.6 million gain on the sale of its 17.5% investment in CST Fuel Supply. In addition, the Partnership also recorded gains on the sale of CAPL properties in connection with the asset exchange with Circle K of $6.1 million and $7.9 million for the three and six months ended June 30, 2020, respectively. Relates to certain discrete acquisition related costs, such as legal and other professional fees, separation benefit costs and certain purchase accounting adjustments associated with recently acquired businesses. Under the Partnership Agreement, sustaining capital expenditures are capital expenditures made to maintain CrossAmerica’s long-term operating income or operating capacity. Examples of sustaining capital expenditures are those made to maintain existing contract volumes, including payments to renew existing distribution contracts, or to maintain CrossAmerica’s sites in conditions suitable to lease, such as parking lot or roof replacement/renovation, or to replace equipment required to operate the existing business. Excludes current income tax incurred on the sale of sites. On July 23, 2020, the Board approved a quarterly distribution of $0.5250 per unit attributable to the second quarter of 2020. The distribution is payable on August 11, 2020 to all unitholders of record on August 4, 2020. The distribution coverage ratio is computed by dividing Distributable Cash Flow by the weighted-average diluted common units and then dividing that result by the distributions paid per limited partner unit. Three Months Ended June 30, Six Months Ended June 30, 2020 2019 2020 2019 Net income available to limited partners $ 5,230 $ 6,308 $ 77,158 $ 6,387 Interest expense 4,121 7,236 9,661 14,573 Income tax (benefit) expense (2,944 ) 341 (2,976 ) 490 Depreciation, amortization and accretion expense 16,050 12,496 33,277 25,557 EBITDA 22,457 26,381 117,120 47,007 Equity-based employee and director compensation expense 17 124 48 326 Loss (gain) on dispositions and lease terminations, net(a) 4,575 369 (66,356 ) 428 Acquisition-related costs(b) 672 847 2,193 1,405 Adjusted EBITDA 27,721 27,721 53,005 49,166 Cash interest expense (3,861 ) (6,981 ) (9,140 ) (14,028 ) Sustaining capital expenditures(c) (407 ) (437 ) (1,047 ) (763 ) Current income tax benefit(d) 2,594 2,043 3,668 1,228 Distributable Cash Flow $ 26,047 $ 22,346 $ 46,486 $ 35,603 Weighted-average diluted common units 37,738 34,461 36,867 34,461 Distributions paid per limited partner unit(e) $ 0.5250 $ 0.5250 $ 1.0500 $ 1.0500 Distribution Coverage Ratio(f) 1.31x 1.24x 1.20x 0.98x