Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - AMERICAN CAMPUS COMMUNITIES INC | ex991-q22020earningsre.htm |

| 8-K - 8-K - AMERICAN CAMPUS COMMUNITIES INC | a2020q2earningsrelease.htm |

Q2 Supplemental Package July 20, 2020 Table of Contents Financial Highlights S-1 Consolidated Balance Sheets S-2 Consolidated Statements of Comprehensive Income S-3 Consolidated Statements of Funds from Operations S-4 Owned Properties Results of Operations S-5 Same Store Owned Properties Operating Expenses S-6 Seasonality of Operations S-7 COVID-19 Leasing Update S-8 Investment Update S-9 Owned Development Update S-10 Third-Party Development Update S-11 Management Services Update S-12 Capital Structure S-13 Interest Coverage S-14 Capital Allocation – Long Term Funding Plan (2020-2023) S-15 Detail of Property Groupings S-16 Definitions S-17 Investor Information S-19

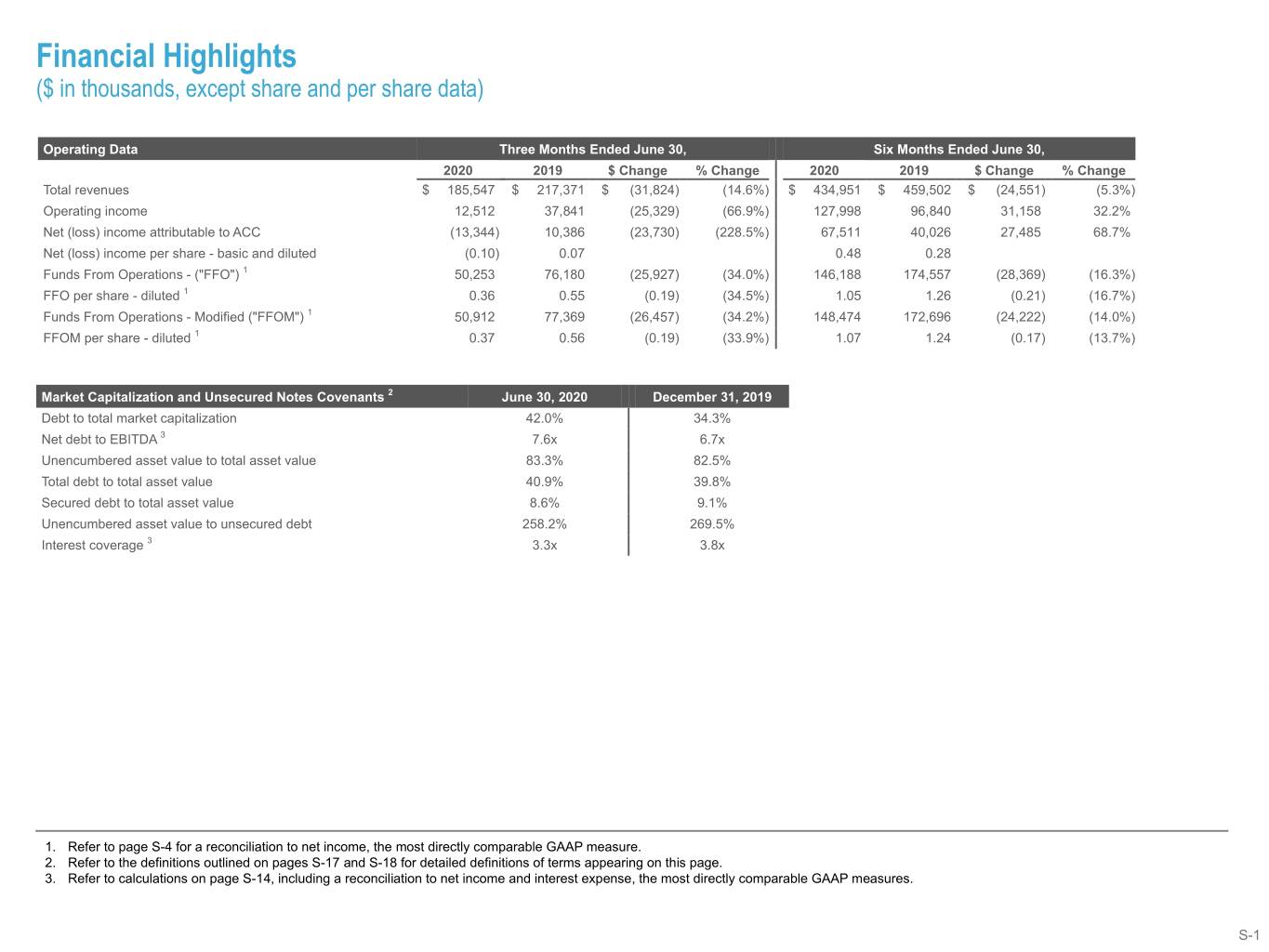

Financial Highlights ($ in thousands, except share and per share data) Operating Data Three Months Ended June 30, Six Months Ended June 30, 2020 2019 $ Change % Change 2020 2019 $ Change % Change Total revenues $ 185,547 $ 217,371 $ (31,824) (14.6%) $ 434,951 $ 459,502 $ (24,551) (5.3%) Operating income 12,512 37,841 (25,329) (66.9%) 127,998 96,840 31,158 32.2% Net (loss) income attributable to ACC (13,344) 10,386 (23,730) (228.5%) 67,511 40,026 27,485 68.7% Net (loss) income per share - basic and diluted (0.10) 0.07 0.48 0.28 Funds From Operations - ("FFO") 1 50,253 76,180 (25,927) (34.0%) 146,188 174,557 (28,369) (16.3%) FFO per share - diluted 1 0.36 0.55 (0.19) (34.5%) 1.05 1.26 (0.21) (16.7%) Funds From Operations - Modified ("FFOM") 1 50,912 77,369 (26,457) (34.2%) 148,474 172,696 (24,222) (14.0%) FFOM per share - diluted 1 0.37 0.56 (0.19) (33.9%) 1.07 1.24 (0.17) (13.7%) Market Capitalization and Unsecured Notes Covenants 2 June 30, 2020 December 31, 2019 Debt to total market capitalization 42.0% 34.3% Net debt to EBITDA 3 7.6x 6.7x Unencumbered asset value to total asset value 83.3% 82.5% Total debt to total asset value 40.9% 39.8% Secured debt to total asset value 8.6% 9.1% Unencumbered asset value to unsecured debt 258.2% 269.5% Interest coverage 3 3.3x 3.8x 1. Refer to page S-4 for a reconciliation to net income, the most directly comparable GAAP measure. 2. Refer to the definitions outlined on pages S-17 and S-18 for detailed definitions of terms appearing on this page. 3. Refer to calculations on page S-14, including a reconciliation to net income and interest expense, the most directly comparable GAAP measures. S-1

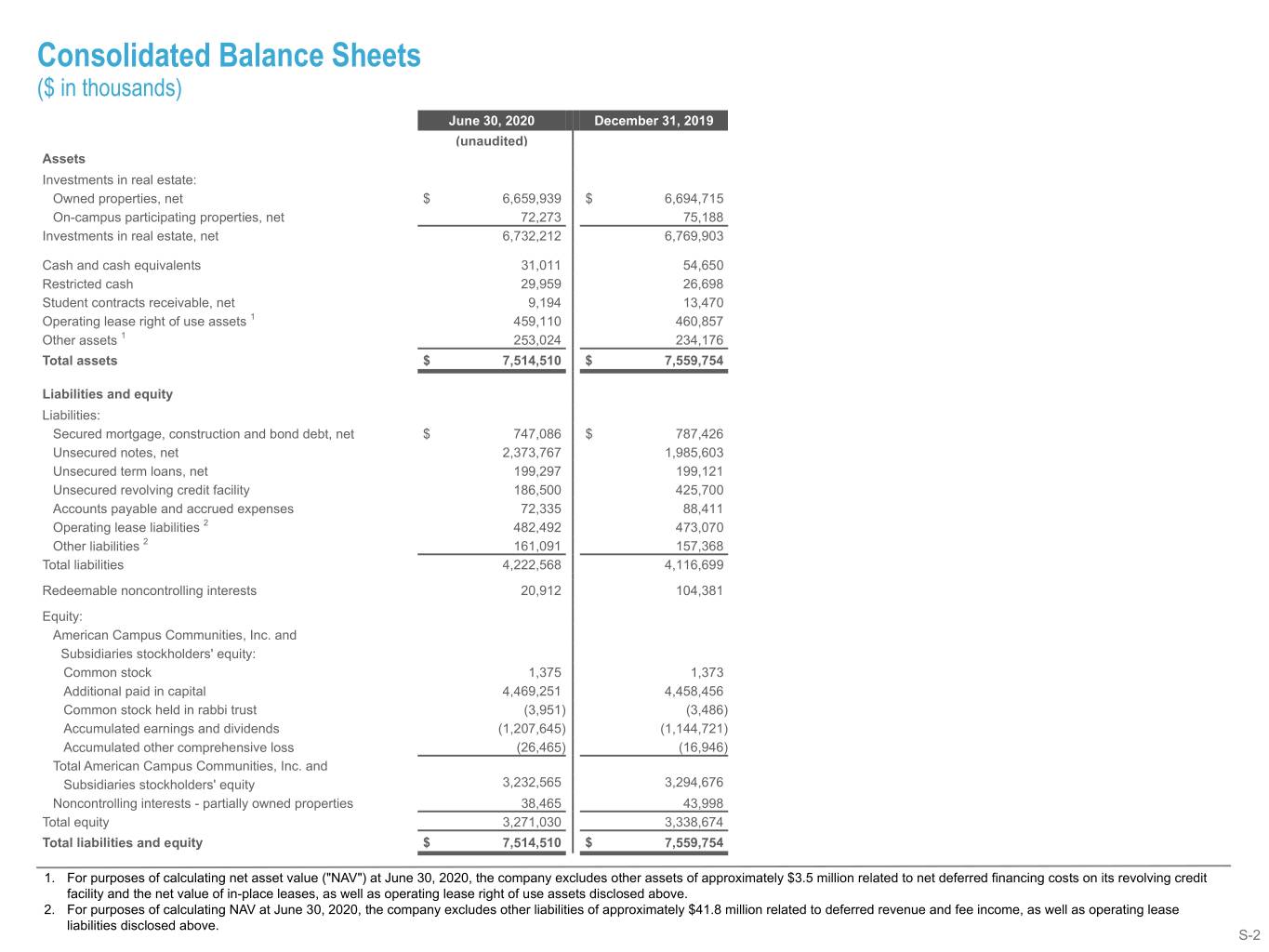

Consolidated Balance Sheets ($ in thousands) June 30, 2020 December 31, 2019 (unaudited) Assets Investments in real estate: Owned properties, net $ 6,659,939 $ 6,694,715 On-campus participating properties, net 72,273 75,188 Investments in real estate, net 6,732,212 6,769,903 Cash and cash equivalents 31,011 54,650 Restricted cash 29,959 26,698 Student contracts receivable, net 9,194 13,470 Operating lease right of use assets 1 459,110 460,857 Other assets 1 253,024 234,176 Total assets $ 7,514,510 $ 7,559,754 Liabilities and equity Liabilities: Secured mortgage, construction and bond debt, net $ 747,086 $ 787,426 Unsecured notes, net 2,373,767 1,985,603 Unsecured term loans, net 199,297 199,121 Unsecured revolving credit facility 186,500 425,700 Accounts payable and accrued expenses 72,335 88,411 Operating lease liabilities 2 482,492 473,070 Other liabilities 2 161,091 157,368 Total liabilities 4,222,568 4,116,699 Redeemable noncontrolling interests 20,912 104,381 Equity: American Campus Communities, Inc. and Subsidiaries stockholders' equity: Common stock 1,375 1,373 Additional paid in capital 4,469,251 4,458,456 Common stock held in rabbi trust (3,951) (3,486) Accumulated earnings and dividends (1,207,645) (1,144,721) Accumulated other comprehensive loss (26,465) (16,946) Total American Campus Communities, Inc. and Subsidiaries stockholders' equity 3,232,565 3,294,676 Noncontrolling interests - partially owned properties 38,465 43,998 Total equity 3,271,030 3,338,674 Total liabilities and equity $ 7,514,510 $ 7,559,754 1. For purposes of calculating net asset value ("NAV") at June 30, 2020, the company excludes other assets of approximately $3.5 million related to net deferred financing costs on its revolving credit facility and the net value of in-place leases, as well as operating lease right of use assets disclosed above. 2. For purposes of calculating NAV at June 30, 2020, the company excludes other liabilities of approximately $41.8 million related to deferred revenue and fee income, as well as operating lease liabilities disclosed above. S-2

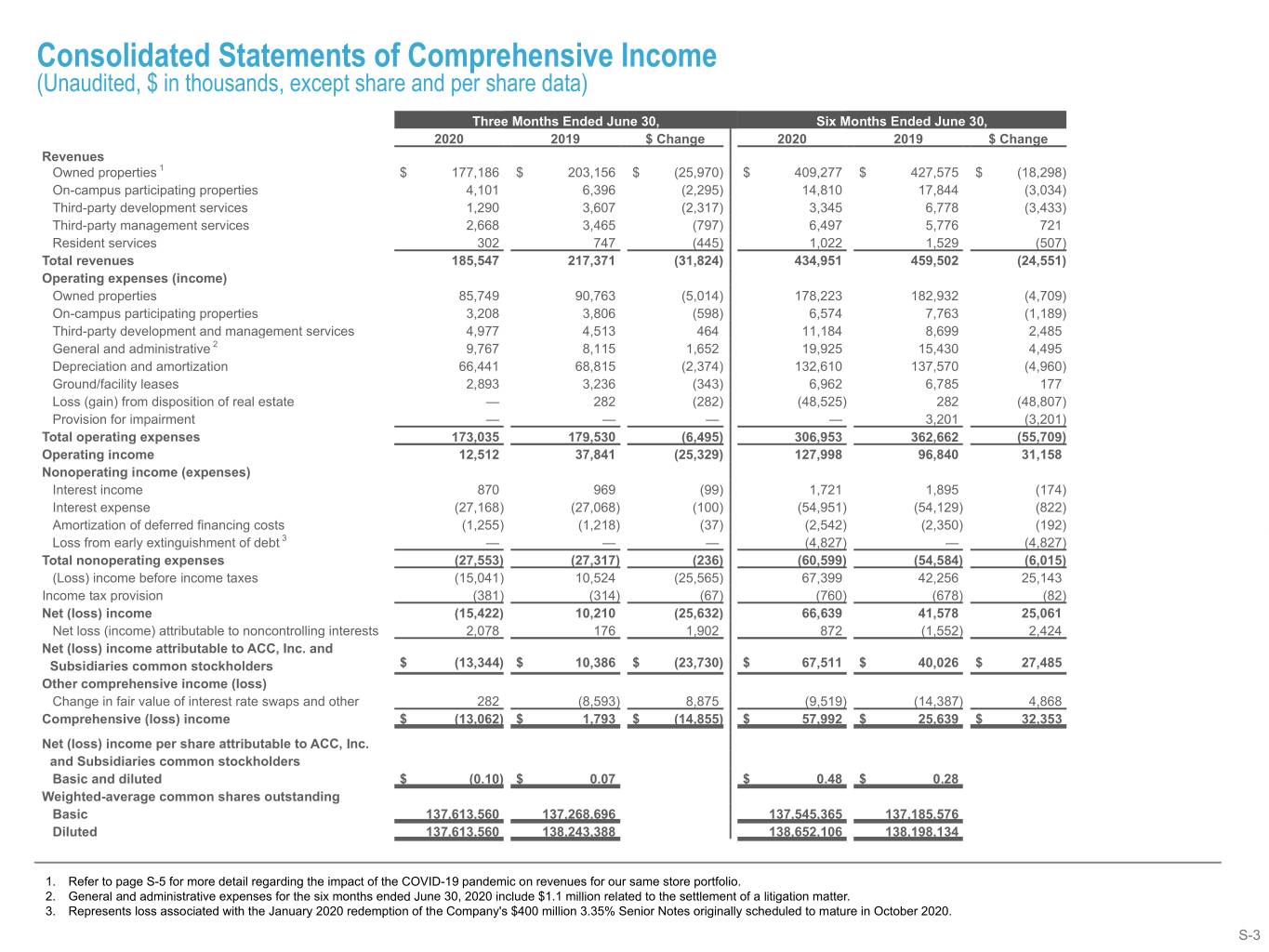

Consolidated Statements of Comprehensive Income (Unaudited, $ in thousands, except share and per share data) Three Months Ended June 30, Six Months Ended June 30, 2020 2019 $ Change 2020 2019 $ Change Revenues Owned properties 1 $ 177,186 $ 203,156 $ (25,970) $ 409,277 $ 427,575 $ (18,298) On-campus participating properties 4,101 6,396 (2,295) 14,810 17,844 (3,034) Third-party development services 1,290 3,607 (2,317) 3,345 6,778 (3,433) Third-party management services 2,668 3,465 (797) 6,497 5,776 721 Resident services 302 747 (445) 1,022 1,529 (507) Total revenues 185,547 217,371 (31,824) 434,951 459,502 (24,551) Operating expenses (income) Owned properties 85,749 90,763 (5,014) 178,223 182,932 (4,709) On-campus participating properties 3,208 3,806 (598) 6,574 7,763 (1,189) Third-party development and management services 4,977 4,513 464 11,184 8,699 2,485 General and administrative 2 9,767 8,115 1,652 19,925 15,430 4,495 Depreciation and amortization 66,441 68,815 (2,374) 132,610 137,570 (4,960) Ground/facility leases 2,893 3,236 (343) 6,962 6,785 177 Loss (gain) from disposition of real estate — 282 (282) (48,525) 282 (48,807) Provision for impairment — — — — 3,201 (3,201) Total operating expenses 173,035 179,530 (6,495) 306,953 362,662 (55,709) Operating income 12,512 37,841 (25,329) 127,998 96,840 31,158 Nonoperating income (expenses) Interest income 870 969 (99) 1,721 1,895 (174) Interest expense (27,168) (27,068) (100) (54,951) (54,129) (822) Amortization of deferred financing costs (1,255) (1,218) (37) (2,542) (2,350) (192) Loss from early extinguishment of debt 3 — — — (4,827) — (4,827) Total nonoperating expenses (27,553) (27,317) (236) (60,599) (54,584) (6,015) (Loss) income before income taxes (15,041) 10,524 (25,565) 67,399 42,256 25,143 Income tax provision (381) (314) (67) (760) (678) (82) Net (loss) income (15,422) 10,210 (25,632) 66,639 41,578 25,061 Net loss (income) attributable to noncontrolling interests 2,078 176 1,902 872 (1,552) 2,424 Net (loss) income attributable to ACC, Inc. and Subsidiaries common stockholders $ (13,344) $ 10,386 $ (23,730) $ 67,511 $ 40,026 $ 27,485 Other comprehensive income (loss) Change in fair value of interest rate swaps and other 282 (8,593) 8,875 (9,519) (14,387) 4,868 Comprehensive (loss) income $ (13,062) $ 1,793 $ (14,855) $ 57,992 $ 25,639 $ 32,353 Net (loss) income per share attributable to ACC, Inc. and Subsidiaries common stockholders Basic and diluted $ (0.10) $ 0.07 $ 0.48 $ 0.28 Weighted-average common shares outstanding Basic 137,613,560 137,268,696 137,545,365 137,185,576 Diluted 137,613,560 138,243,388 138,652,106 138,198,134 1. Refer to page S-5 for more detail regarding the impact of the COVID-19 pandemic on revenues for our same store portfolio. 2. General and administrative expenses for the six months ended June 30, 2020 include $1.1 million related to the settlement of a litigation matter. 3. Represents loss associated with the January 2020 redemption of the Company's $400 million 3.35% Senior Notes originally scheduled to mature in October 2020. S-3

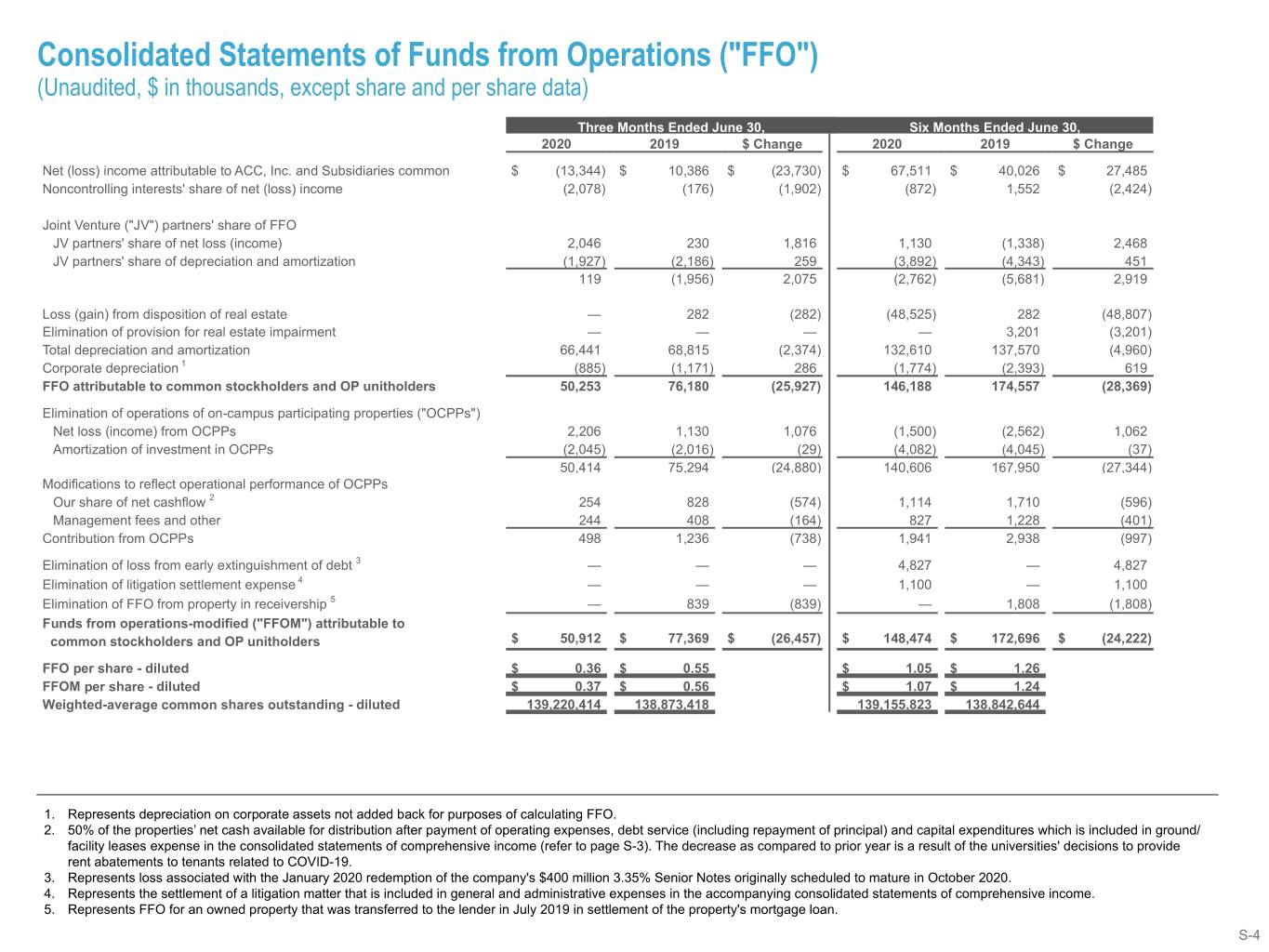

Consolidated Statements of Funds from Operations ("FFO") (Unaudited, $ in thousands, except share and per share data) Three Months Ended June 30, Six Months Ended June 30, 2020 2019 $ Change 2020 2019 $ Change Net (loss) income attributable to ACC, Inc. and Subsidiaries common $ (13,344) $ 10,386 $ (23,730) $ 67,511 $ 40,026 $ 27,485 Noncontrolling interests' share of net (loss) income (2,078) (176) (1,902) (872) 1,552 (2,424) Joint Venture ("JV") partners' share of FFO JV partners' share of net loss (income) 2,046 230 1,816 1,130 (1,338) 2,468 JV partners' share of depreciation and amortization (1,927) (2,186) 259 (3,892) (4,343) 451 119 (1,956) 2,075 (2,762) (5,681) 2,919 Loss (gain) from disposition of real estate — 282 (282) (48,525) 282 (48,807) Elimination of provision for real estate impairment — — — — 3,201 (3,201) Total depreciation and amortization 66,441 68,815 (2,374) 132,610 137,570 (4,960) Corporate depreciation 1 (885) (1,171) 286 (1,774) (2,393) 619 FFO attributable to common stockholders and OP unitholders 50,253 76,180 (25,927) 146,188 174,557 (28,369) Elimination of operations of on-campus participating properties ("OCPPs") Net loss (income) from OCPPs 2,206 1,130 1,076 (1,500) (2,562) 1,062 Amortization of investment in OCPPs (2,045) (2,016) (29) (4,082) (4,045) (37) 50,414 75,294 (24,880) 140,606 167,950 (27,344) Modifications to reflect operational performance of OCPPs Our share of net cashflow 2 254 828 (574) 1,114 1,710 (596) Management fees and other 244 408 (164) 827 1,228 (401) Contribution from OCPPs 498 1,236 (738) 1,941 2,938 (997) Elimination of loss from early extinguishment of debt 3 — — — 4,827 — 4,827 Elimination of litigation settlement expense 4 — — — 1,100 — 1,100 Elimination of FFO from property in receivership 5 — 839 (839) — 1,808 (1,808) Funds from operations-modified ("FFOM") attributable to common stockholders and OP unitholders $ 50,912 $ 77,369 $ (26,457) $ 148,474 $ 172,696 $ (24,222) FFO per share - diluted $ 0.36 $ 0.55 $ 1.05 $ 1.26 FFOM per share - diluted $ 0.37 $ 0.56 $ 1.07 $ 1.24 Weighted-average common shares outstanding - diluted 139,220,414 138,873,418 139,155,823 138,842,644 1. Represents depreciation on corporate assets not added back for purposes of calculating FFO. 2. 50% of the properties’ net cash available for distribution after payment of operating expenses, debt service (including repayment of principal) and capital expenditures which is included in ground/ facility leases expense in the consolidated statements of comprehensive income (refer to page S-3). The decrease as compared to prior year is a result of the universities' decisions to provide rent abatements to tenants related to COVID-19. 3. Represents loss associated with the January 2020 redemption of the company's $400 million 3.35% Senior Notes originally scheduled to mature in October 2020. 4. Represents the settlement of a litigation matter that is included in general and administrative expenses in the accompanying consolidated statements of comprehensive income. 5. Represents FFO for an owned property that was transferred to the lender in July 2019 in settlement of the property's mortgage loan. S-4

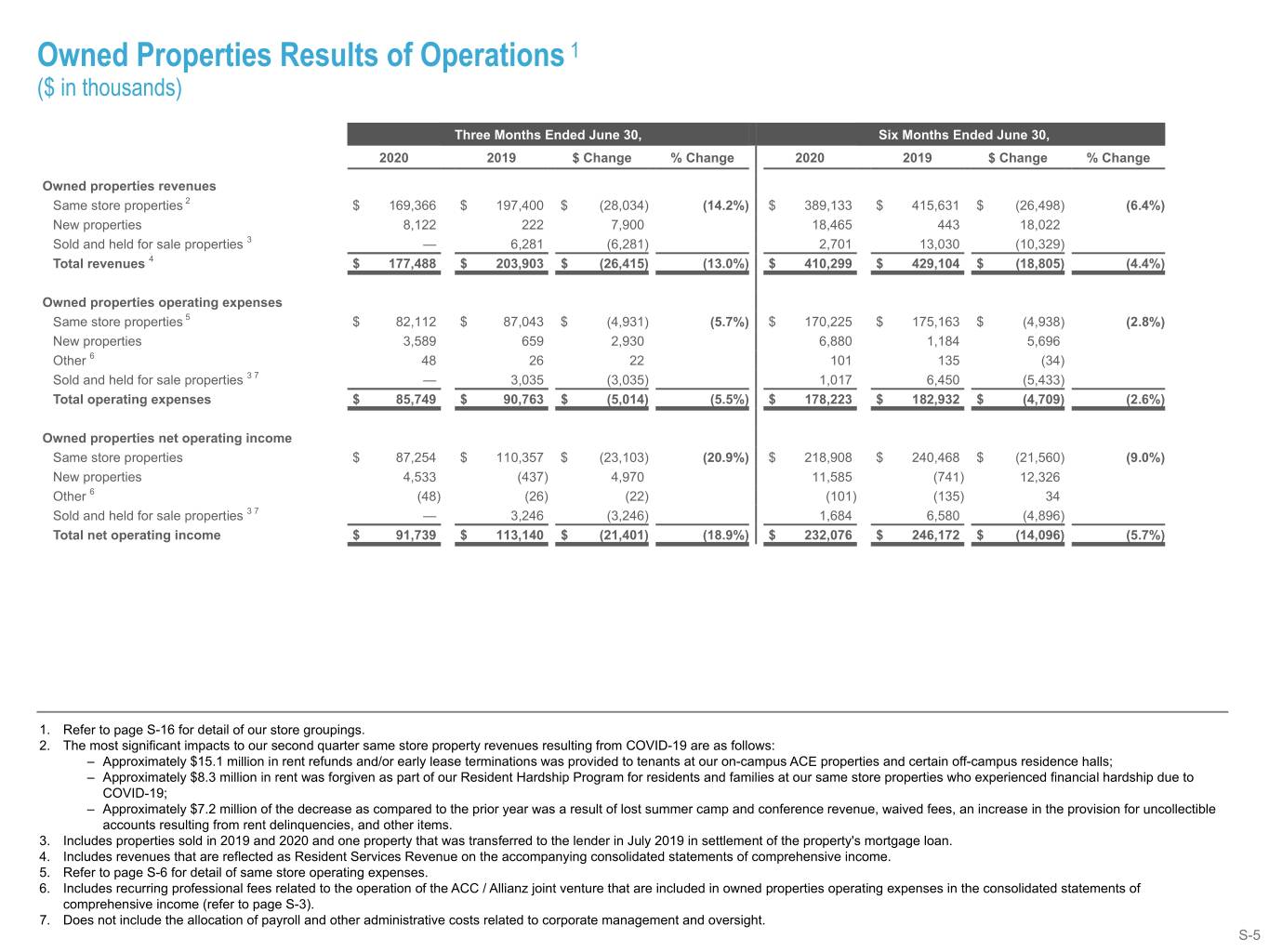

Owned Properties Results of Operations 1 ($ in thousands) Three Months Ended June 30, Six Months Ended June 30, 2020 2019 $ Change % Change 2020 2019 $ Change % Change Owned properties revenues Same store properties 2 $ 169,366 $ 197,400 $ (28,034) (14.2%) $ 389,133 $ 415,631 $ (26,498) (6.4%) New properties 8,122 222 7,900 18,465 443 18,022 Sold and held for sale properties 3 — 6,281 (6,281) 2,701 13,030 (10,329) Total revenues 4 $ 177,488 $ 203,903 $ (26,415) (13.0%) $ 410,299 $ 429,104 $ (18,805) (4.4%) Owned properties operating expenses Same store properties 5 $ 82,112 $ 87,043 $ (4,931) (5.7%) $ 170,225 $ 175,163 $ (4,938) (2.8%) New properties 3,589 659 2,930 6,880 1,184 5,696 Other 6 48 26 22 101 135 (34) Sold and held for sale properties 3 7 — 3,035 (3,035) 1,017 6,450 (5,433) Total operating expenses $ 85,749 $ 90,763 $ (5,014) (5.5%) $ 178,223 $ 182,932 $ (4,709) (2.6%) Owned properties net operating income Same store properties $ 87,254 $ 110,357 $ (23,103) (20.9%) $ 218,908 $ 240,468 $ (21,560) (9.0%) New properties 4,533 (437) 4,970 11,585 (741) 12,326 Other 6 (48) (26) (22) (101) (135) 34 Sold and held for sale properties 3 7 — 3,246 (3,246) 1,684 6,580 (4,896) Total net operating income $ 91,739 $ 113,140 $ (21,401) (18.9%) $ 232,076 $ 246,172 $ (14,096) (5.7%) 1. Refer to page S-16 for detail of our store groupings. 2. The most significant impacts to our second quarter same store property revenues resulting from COVID-19 are as follows: – Approximately $15.1 million in rent refunds and/or early lease terminations was provided to tenants at our on-campus ACE properties and certain off-campus residence halls; – Approximately $8.3 million in rent was forgiven as part of our Resident Hardship Program for residents and families at our same store properties who experienced financial hardship due to COVID-19; – Approximately $7.2 million of the decrease as compared to the prior year was a result of lost summer camp and conference revenue, waived fees, an increase in the provision for uncollectible accounts resulting from rent delinquencies, and other items. 3. Includes properties sold in 2019 and 2020 and one property that was transferred to the lender in July 2019 in settlement of the property's mortgage loan. 4. Includes revenues that are reflected as Resident Services Revenue on the accompanying consolidated statements of comprehensive income. 5. Refer to page S-6 for detail of same store operating expenses. 6. Includes recurring professional fees related to the operation of the ACC / Allianz joint venture that are included in owned properties operating expenses in the consolidated statements of comprehensive income (refer to page S-3). 7. Does not include the allocation of payroll and other administrative costs related to corporate management and oversight. S-5

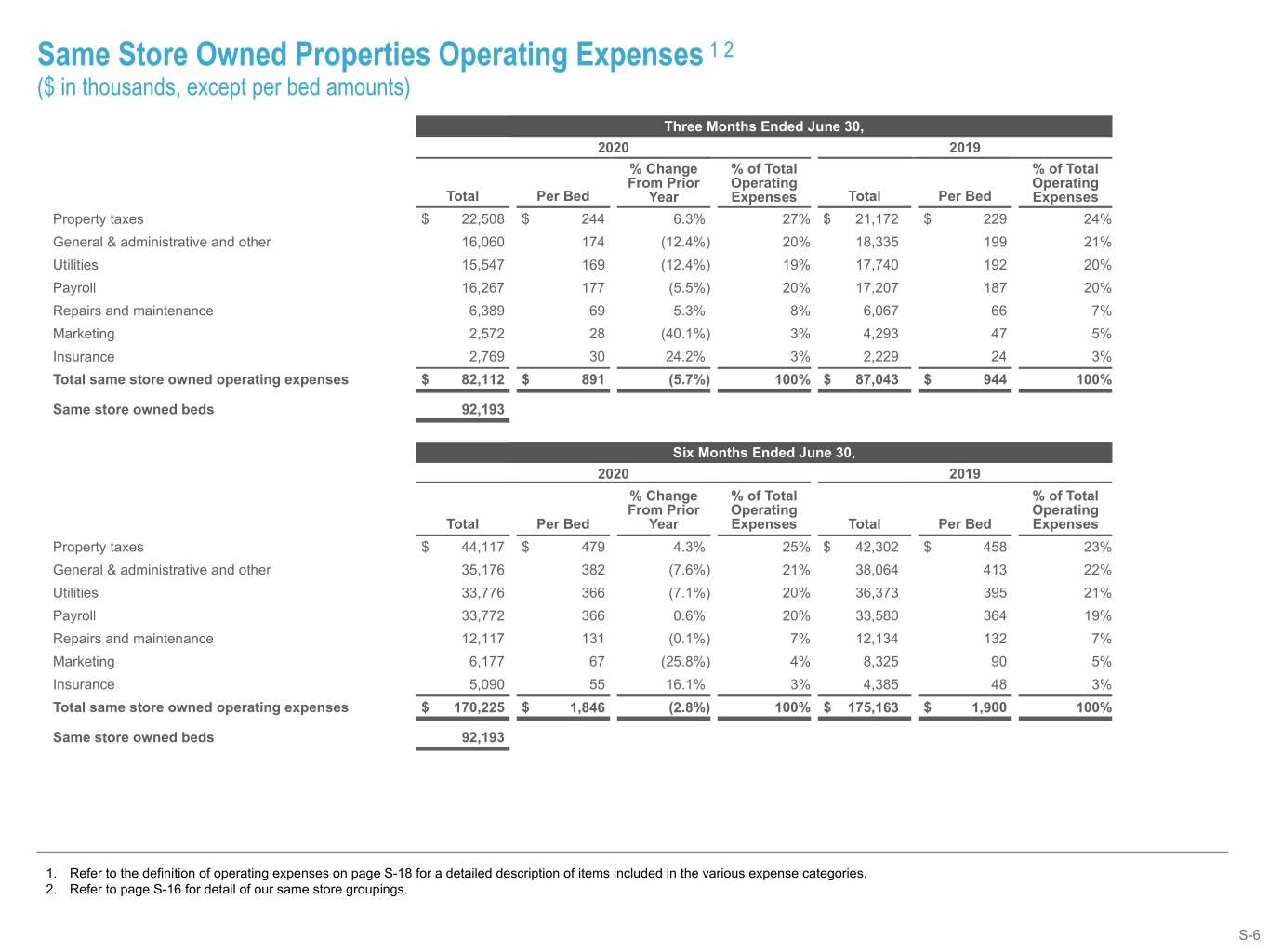

Same Store Owned Properties Operating Expenses 1 2 ($ in thousands, except per bed amounts) Three Months Ended June 30, 2020 2019 % Change % of Total % of Total From Prior Operating Operating Total Per Bed Year Expenses Total Per Bed Expenses Property taxes $ 22,508 $ 244 6.3% 27% $ 21,172 $ 229 24% General & administrative and other 16,060 174 (12.4%) 20% 18,335 199 21% Utilities 15,547 169 (12.4%) 19% 17,740 192 20% Payroll 16,267 177 (5.5%) 20% 17,207 187 20% Repairs and maintenance 6,389 69 5.3% 8% 6,067 66 7% Marketing 2,572 28 (40.1%) 3% 4,293 47 5% Insurance 2,769 30 24.2% 3% 2,229 24 3% Total same store owned operating expenses $ 82,112 $ 891 (5.7%) 100% $ 87,043 $ 944 100% Same store owned beds 92,193 Six Months Ended June 30, 2020 2019 % Change % of Total % of Total From Prior Operating Operating Total Per Bed Year Expenses Total Per Bed Expenses Property taxes $ 44,117 $ 479 4.3% 25% $ 42,302 $ 458 23% General & administrative and other 35,176 382 (7.6%) 21% 38,064 413 22% Utilities 33,776 366 (7.1%) 20% 36,373 395 21% Payroll 33,772 366 0.6% 20% 33,580 364 19% Repairs and maintenance 12,117 131 (0.1%) 7% 12,134 132 7% Marketing 6,177 67 (25.8%) 4% 8,325 90 5% Insurance 5,090 55 16.1% 3% 4,385 48 3% Total same store owned operating expenses $ 170,225 $ 1,846 (2.8%) 100% $ 175,163 $ 1,900 100% Same store owned beds 92,193 1. Refer to the definition of operating expenses on page S-18 for a detailed description of items included in the various expense categories. 2. Refer to page S-16 for detail of our same store groupings. S-6

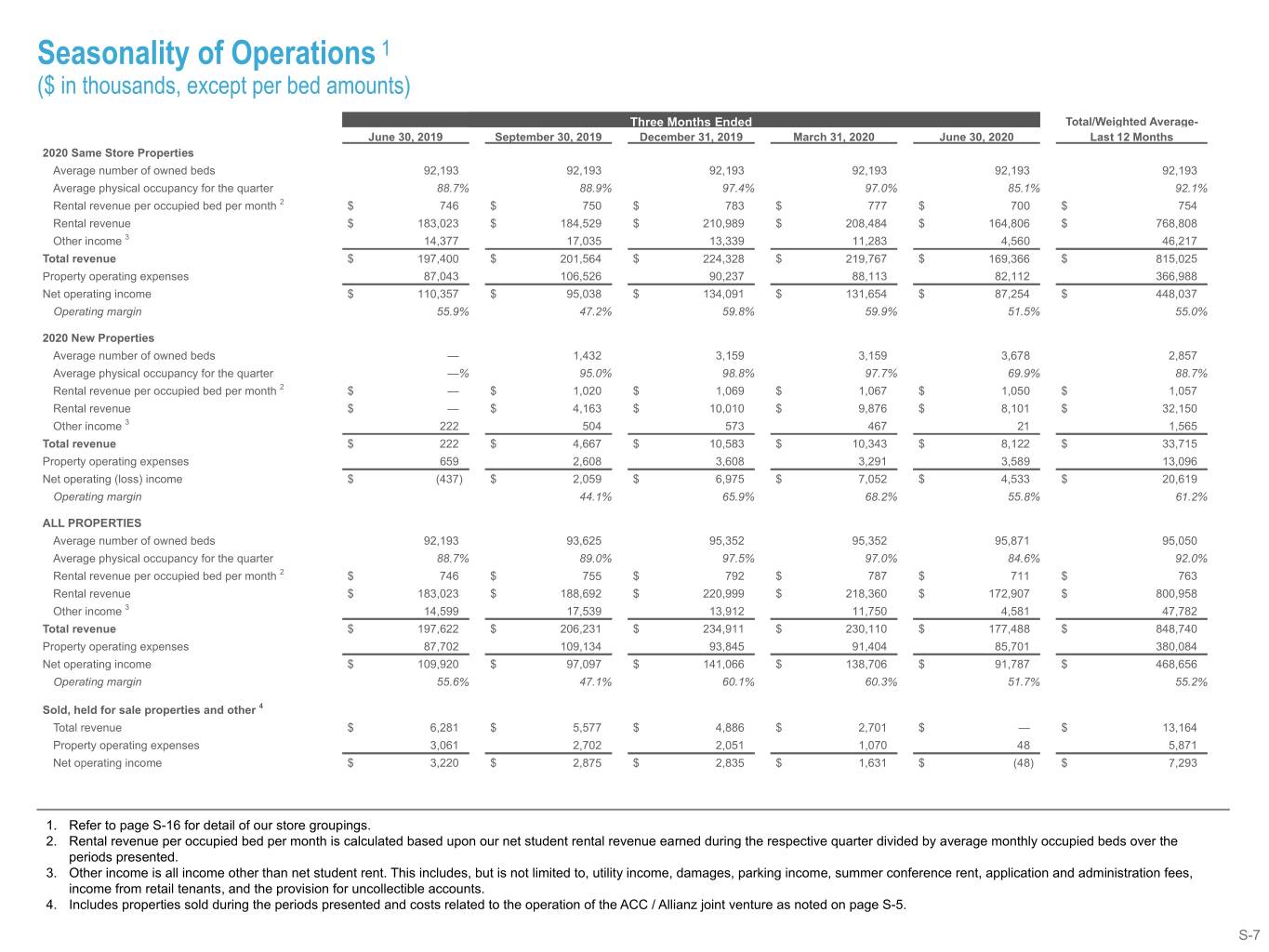

Seasonality of Operations 1 ($ in thousands, except per bed amounts) Three Months Ended Total/Weighted Average- June 30, 2019 September 30, 2019 December 31, 2019 March 31, 2020 June 30, 2020 Last 12 Months 2020 Same Store Properties Average number of owned beds 92,193 92,193 92,193 92,193 92,193 92,193 Average physical occupancy for the quarter 88.7% 88.9% 97.4% 97.0% 85.1% 92.1% Rental revenue per occupied bed per month 2 $ 746 $ 750 $ 783 $ 777 $ 700 $ 754 Rental revenue $ 183,023 $ 184,529 $ 210,989 $ 208,484 $ 164,806 $ 768,808 Other income 3 14,377 17,035 13,339 11,283 4,560 46,217 Total revenue $ 197,400 $ 201,564 $ 224,328 $ 219,767 $ 169,366 $ 815,025 Property operating expenses 87,043 106,526 90,237 88,113 82,112 366,988 Net operating income $ 110,357 $ 95,038 $ 134,091 $ 131,654 $ 87,254 $ 448,037 Operating margin 55.9% 47.2% 59.8% 59.9% 51.5% 55.0% 2020 New Properties Average number of owned beds — 1,432 3,159 3,159 3,678 2,857 Average physical occupancy for the quarter —% 95.0% 98.8% 97.7% 69.9% 88.7% Rental revenue per occupied bed per month 2 $ — $ 1,020 $ 1,069 $ 1,067 $ 1,050 $ 1,057 Rental revenue $ — $ 4,163 $ 10,010 $ 9,876 $ 8,101 $ 32,150 Other income 3 222 504 573 467 21 1,565 Total revenue $ 222 $ 4,667 $ 10,583 $ 10,343 $ 8,122 $ 33,715 Property operating expenses 659 2,608 3,608 3,291 3,589 13,096 Net operating (loss) income $ (437) $ 2,059 $ 6,975 $ 7,052 $ 4,533 $ 20,619 Operating margin 44.1% 65.9% 68.2% 55.8% 61.2% ALL PROPERTIES Average number of owned beds 92,193 93,625 95,352 95,352 95,871 95,050 Average physical occupancy for the quarter 88.7% 89.0% 97.5% 97.0% 84.6% 92.0% Rental revenue per occupied bed per month 2 $ 746 $ 755 $ 792 $ 787 $ 711 $ 763 Rental revenue $ 183,023 $ 188,692 $ 220,999 $ 218,360 $ 172,907 $ 800,958 Other income 3 14,599 17,539 13,912 11,750 4,581 47,782 Total revenue $ 197,622 $ 206,231 $ 234,911 $ 230,110 $ 177,488 $ 848,740 Property operating expenses 87,702 109,134 93,845 91,404 85,701 380,084 Net operating income $ 109,920 $ 97,097 $ 141,066 $ 138,706 $ 91,787 $ 468,656 Operating margin 55.6% 47.1% 60.1% 60.3% 51.7% 55.2% Sold, held for sale properties and other 4 Total revenue $ 6,281 $ 5,577 $ 4,886 $ 2,701 $ — $ 13,164 Property operating expenses 3,061 2,702 2,051 1,070 48 5,871 Net operating income $ 3,220 $ 2,875 $ 2,835 $ 1,631 $ (48) $ 7,293 1. Refer to page S-16 for detail of our store groupings. 2. Rental revenue per occupied bed per month is calculated based upon our net student rental revenue earned during the respective quarter divided by average monthly occupied beds over the periods presented. 3. Other income is all income other than net student rent. This includes, but is not limited to, utility income, damages, parking income, summer conference rent, application and administration fees, income from retail tenants, and the provision for uncollectible accounts. 4. Includes properties sold during the periods presented and costs related to the operation of the ACC / Allianz joint venture as noted on page S-5. S-7

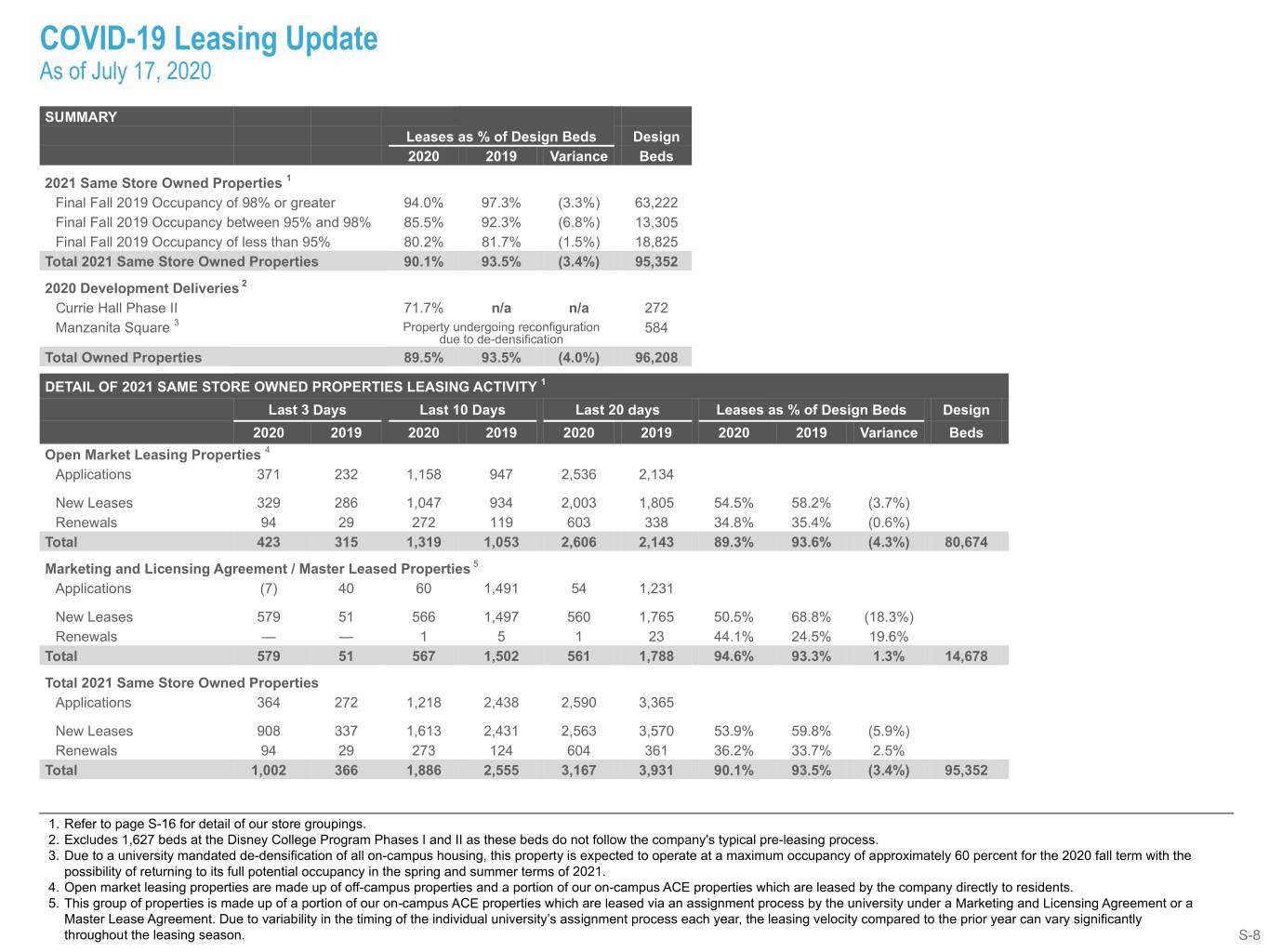

COVID-19 Leasing Update As of July 17, 2020 SUMMARY Leases as % of Design Beds Design 2020 2019 Variance Beds 2021 Same Store Owned Properties 1 Final Fall 2019 Occupancy of 98% or greater 94.0% 97.3% (3.3%) 63,222 Final Fall 2019 Occupancy between 95% and 98% 85.5% 92.3% (6.8%) 13,305 Final Fall 2019 Occupancy of less than 95% 80.2% 81.7% (1.5%) 18,825 Total 2021 Same Store Owned Properties 90.1% 93.5% (3.4%) 95,352 2020 Development Deliveries 2 Currie Hall Phase II 71.7% n/a n/a 272 Manzanita Square 3 Property undergoing reconfiguration 584 due to de-densification Total Owned Properties 89.5% 93.5% (4.0%) 96,208 DETAIL OF 2021 SAME STORE OWNED PROPERTIES LEASING ACTIVITY 1 Last 3 Days Last 10 Days Last 20 days Leases as % of Design Beds Design 2020 2019 2020 2019 2020 2019 2020 2019 Variance Beds Open Market Leasing Properties 4 Applications 371 232 1,158 947 2,536 2,134 New Leases 329 286 1,047 934 2,003 1,805 54.5% 58.2% (3.7%) Renewals 94 29 272 119 603 338 34.8% 35.4% (0.6%) Total 423 315 1,319 1,053 2,606 2,143 89.3% 93.6% (4.3%) 80,674 Marketing and Licensing Agreement / Master Leased Properties 5 Applications (7) 40 60 1,491 54 1,231 New Leases 579 51 566 1,497 560 1,765 50.5% 68.8% (18.3%) Renewals — — 1 5 1 23 44.1% 24.5% 19.6% Total 579 51 567 1,502 561 1,788 94.6% 93.3% 1.3% 14,678 Total 2021 Same Store Owned Properties Applications 364 272 1,218 2,438 2,590 3,365 New Leases 908 337 1,613 2,431 2,563 3,570 53.9% 59.8% (5.9%) Renewals 94 29 273 124 604 361 36.2% 33.7% 2.5% Total 1,002 366 1,886 2,555 3,167 3,931 90.1% 93.5% (3.4%) 95,352 1. Refer to page S-16 for detail of our store groupings. 2. Excludes 1,627 beds at the Disney College Program Phases I and II as these beds do not follow the company's typical pre-leasing process. 3. Due to a university mandated de-densification of all on-campus housing, this property is expected to operate at a maximum occupancy of approximately 60 percent for the 2020 fall term with the possibility of returning to its full potential occupancy in the spring and summer terms of 2021. 4. Open market leasing properties are made up of off-campus properties and a portion of our on-campus ACE properties which are leased by the company directly to residents. 5. This group of properties is made up of a portion of our on-campus ACE properties which are leased via an assignment process by the university under a Marketing and Licensing Agreement or a Master Lease Agreement. Due to variability in the timing of the individual university’s assignment process each year, the leasing velocity compared to the prior year can vary significantly throughout the leasing season. S-8

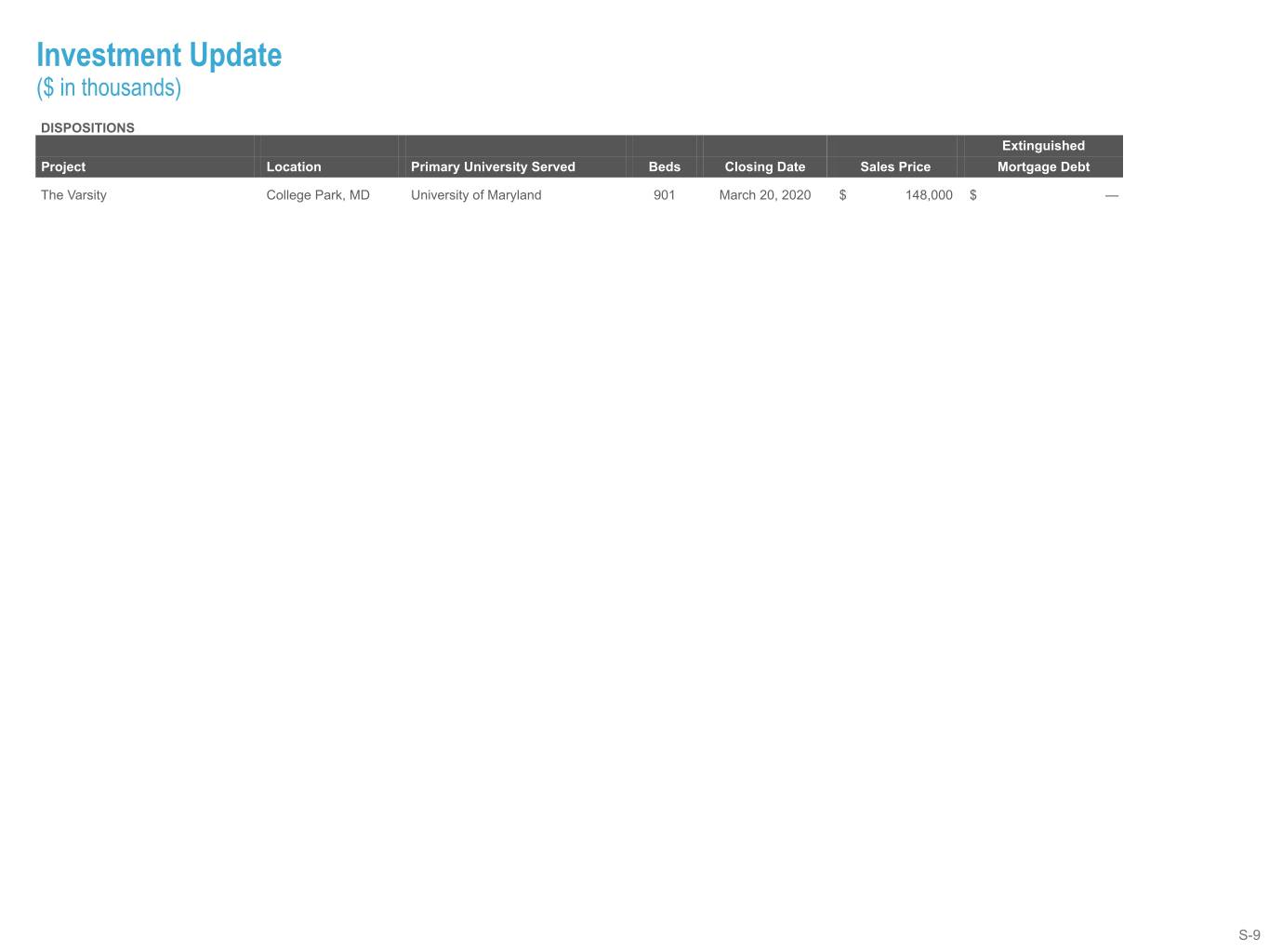

Investment Update ($ in thousands) DISPOSITIONS Extinguished Project Location Primary University Served Beds Closing Date Sales Price Mortgage Debt The Varsity College Park, MD University of Maryland 901 March 20, 2020 $ 148,000 $ — S-9

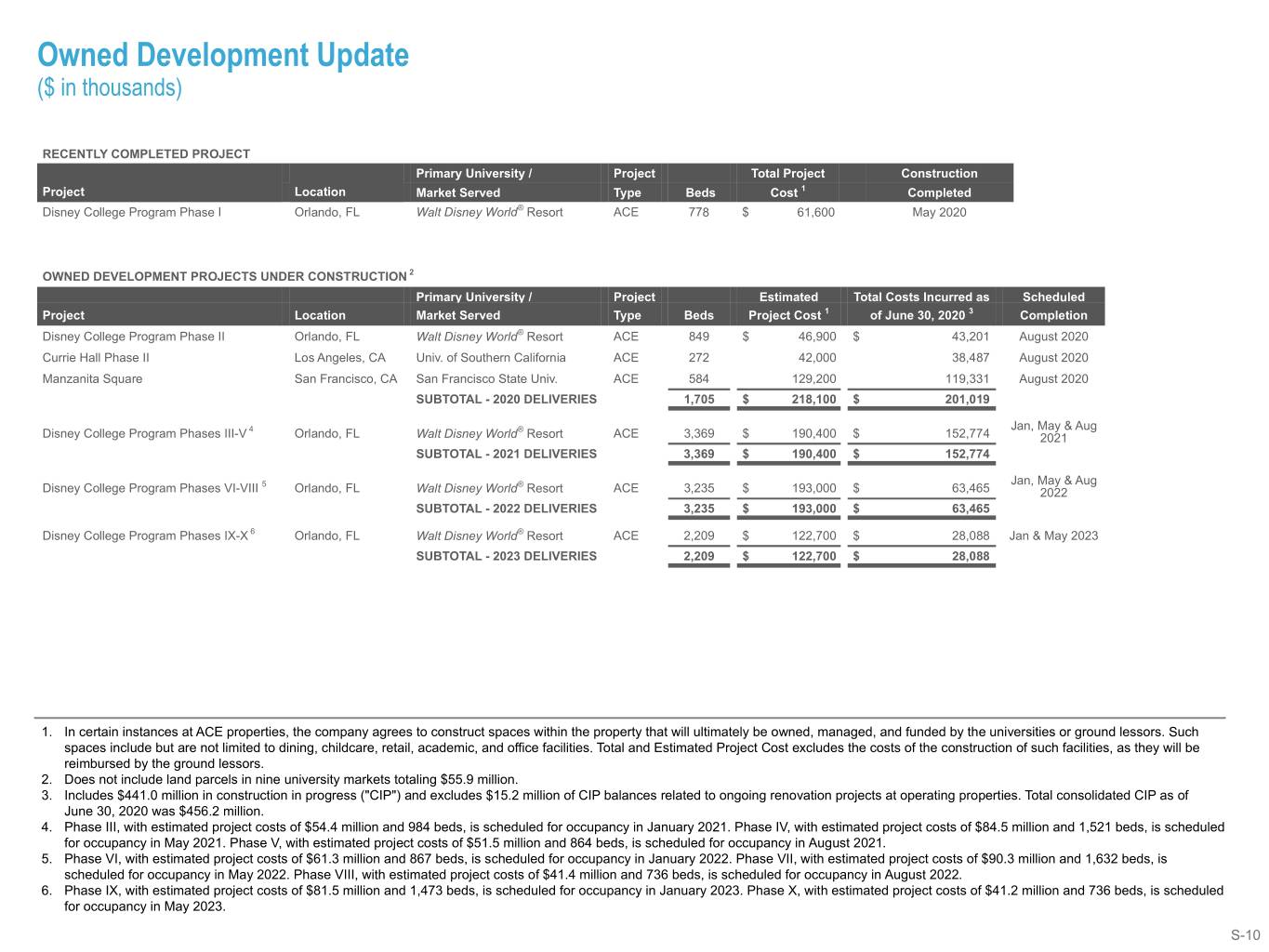

Owned Development Update ($ in thousands) RECENTLY COMPLETED PROJECT Primary University / Project Total Project Construction Project Location Market Served Type Beds Cost 1 Completed Disney College Program Phase I Orlando, FL Walt Disney World® Resort ACE 778 $ 61,600 May 2020 OWNED DEVELOPMENT PROJECTS UNDER CONSTRUCTION 2 Primary University / Project Estimated Total Costs Incurred as Scheduled Project Location Market Served Type Beds Project Cost 1 of June 30, 2020 3 Completion Disney College Program Phase II Orlando, FL Walt Disney World® Resort ACE 849 $ 46,900 $ 43,201 August 2020 Currie Hall Phase II Los Angeles, CA Univ. of Southern California ACE 272 42,000 38,487 August 2020 Manzanita Square San Francisco, CA San Francisco State Univ. ACE 584 129,200 119,331 August 2020 SUBTOTAL - 2020 DELIVERIES 1,705 $ 218,100 $ 201,019 4 ® Jan, May & Aug Disney College Program Phases III-V Orlando, FL Walt Disney World Resort ACE 3,369 $ 190,400 $ 152,774 2021 SUBTOTAL - 2021 DELIVERIES 3,369 $ 190,400 $ 152,774 5 ® Jan, May & Aug Disney College Program Phases VI-VIII Orlando, FL Walt Disney World Resort ACE 3,235 $ 193,000 $ 63,465 2022 SUBTOTAL - 2022 DELIVERIES 3,235 $ 193,000 $ 63,465 Disney College Program Phases IX-X 6 Orlando, FL Walt Disney World® Resort ACE 2,209 $ 122,700 $ 28,088 Jan & May 2023 SUBTOTAL - 2023 DELIVERIES 2,209 $ 122,700 $ 28,088 1. In certain instances at ACE properties, the company agrees to construct spaces within the property that will ultimately be owned, managed, and funded by the universities or ground lessors. Such spaces include but are not limited to dining, childcare, retail, academic, and office facilities. Total and Estimated Project Cost excludes the costs of the construction of such facilities, as they will be reimbursed by the ground lessors. 2. Does not include land parcels in nine university markets totaling $55.9 million. 3. Includes $441.0 million in construction in progress ("CIP") and excludes $15.2 million of CIP balances related to ongoing renovation projects at operating properties. Total consolidated CIP as of June 30, 2020 was $456.2 million. 4. Phase III, with estimated project costs of $54.4 million and 984 beds, is scheduled for occupancy in January 2021. Phase IV, with estimated project costs of $84.5 million and 1,521 beds, is scheduled for occupancy in May 2021. Phase V, with estimated project costs of $51.5 million and 864 beds, is scheduled for occupancy in August 2021. 5. Phase VI, with estimated project costs of $61.3 million and 867 beds, is scheduled for occupancy in January 2022. Phase VII, with estimated project costs of $90.3 million and 1,632 beds, is scheduled for occupancy in May 2022. Phase VIII, with estimated project costs of $41.4 million and 736 beds, is scheduled for occupancy in August 2022. 6. Phase IX, with estimated project costs of $81.5 million and 1,473 beds, is scheduled for occupancy in January 2023. Phase X, with estimated project costs of $41.2 million and 736 beds, is scheduled for occupancy in May 2023. S-10

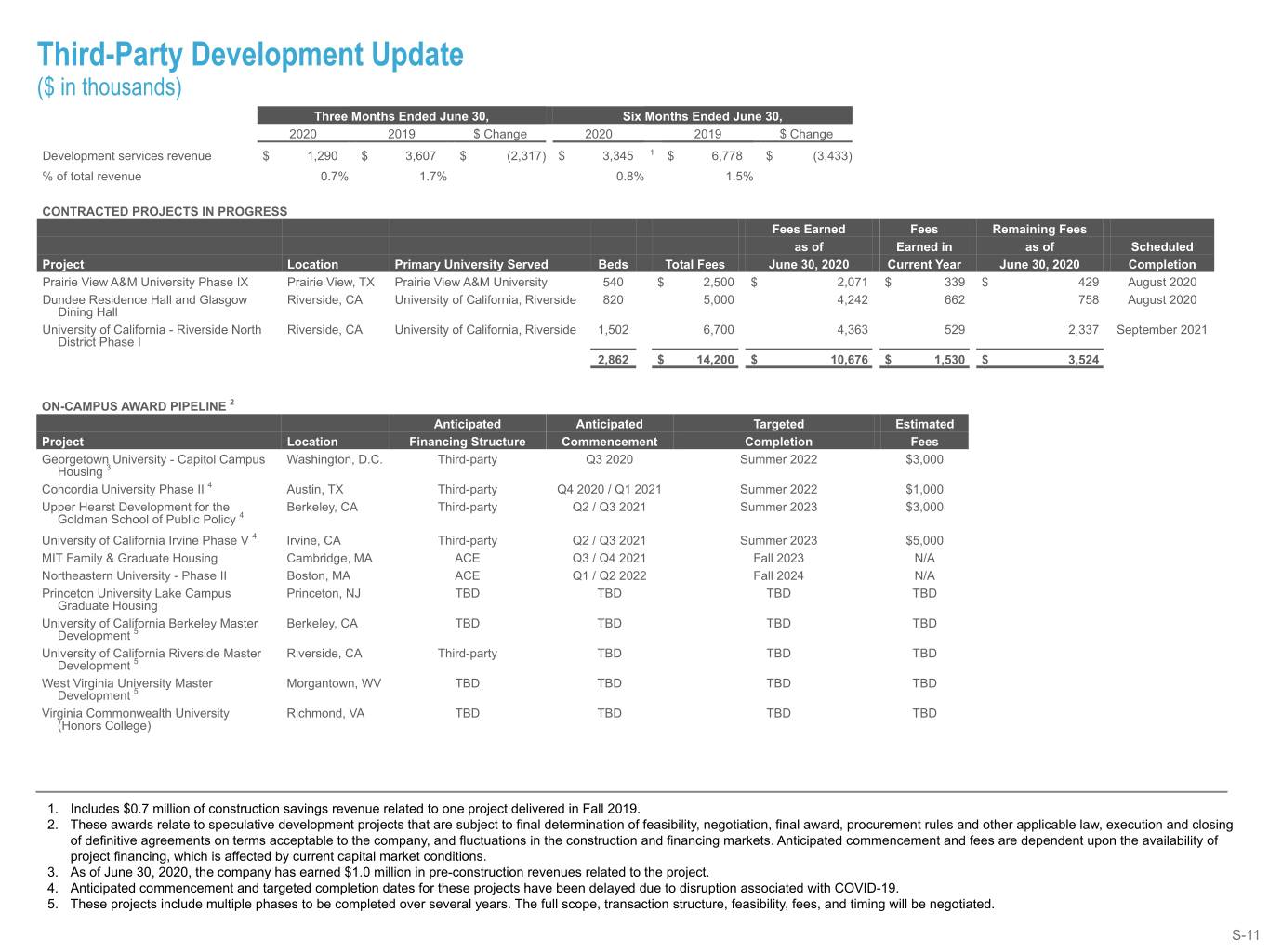

Third-Party Development Update ($ in thousands) Three Months Ended June 30, Six Months Ended June 30, 2020 2019 $ Change 2020 2019 $ Change Development services revenue $ 1,290 $ 3,607 $ (2,317) $ 3,345 1 $ 6,778 $ (3,433) % of total revenue 0.7% 1.7% 0.8% 1.5% CONTRACTED PROJECTS IN PROGRESS Fees Earned Fees Remaining Fees as of Earned in as of Scheduled Project Location Primary University Served Beds Total Fees June 30, 2020 Current Year June 30, 2020 Completion Prairie View A&M University Phase IX Prairie View, TX Prairie View A&M University 540 $ 2,500 $ 2,071 $ 339 $ 429 August 2020 Dundee Residence Hall and Glasgow Riverside, CA University of California, Riverside 820 5,000 4,242 662 758 August 2020 Dining Hall University of California - Riverside North Riverside, CA University of California, Riverside 1,502 6,700 4,363 529 2,337 September 2021 District Phase I 2,862 $ 14,200 $ 10,676 $ 1,530 $ 3,524 ON-CAMPUS AWARD PIPELINE 2 Anticipated Anticipated Targeted Estimated Project Location Financing Structure Commencement Completion Fees Georgetown University - Capitol Campus Washington, D.C. Third-party Q3 2020 Summer 2022 $3,000 Housing 3 Concordia University Phase II 4 Austin, TX Third-party Q4 2020 / Q1 2021 Summer 2022 $1,000 Upper Hearst Development for the Berkeley, CA Third-party Q2 / Q3 2021 Summer 2023 $3,000 Goldman School of Public Policy 4 University of California Irvine Phase V 4 Irvine, CA Third-party Q2 / Q3 2021 Summer 2023 $5,000 MIT Family & Graduate Housing Cambridge, MA ACE Q3 / Q4 2021 Fall 2023 N/A Northeastern University - Phase II Boston, MA ACE Q1 / Q2 2022 Fall 2024 N/A Princeton University Lake Campus Princeton, NJ TBD TBD TBD TBD Graduate Housing University of California Berkeley Master Berkeley, CA TBD TBD TBD TBD Development 5 University of California Riverside Master Riverside, CA Third-party TBD TBD TBD Development 5 West Virginia University Master Morgantown, WV TBD TBD TBD TBD Development 5 Virginia Commonwealth University Richmond, VA TBD TBD TBD TBD (Honors College) 1. Includes $0.7 million of construction savings revenue related to one project delivered in Fall 2019. 2. These awards relate to speculative development projects that are subject to final determination of feasibility, negotiation, final award, procurement rules and other applicable law, execution and closing of definitive agreements on terms acceptable to the company, and fluctuations in the construction and financing markets. Anticipated commencement and fees are dependent upon the availability of project financing, which is affected by current capital market conditions. 3. As of June 30, 2020, the company has earned $1.0 million in pre-construction revenues related to the project. 4. Anticipated commencement and targeted completion dates for these projects have been delayed due to disruption associated with COVID-19. 5. These projects include multiple phases to be completed over several years. The full scope, transaction structure, feasibility, fees, and timing will be negotiated. S-11

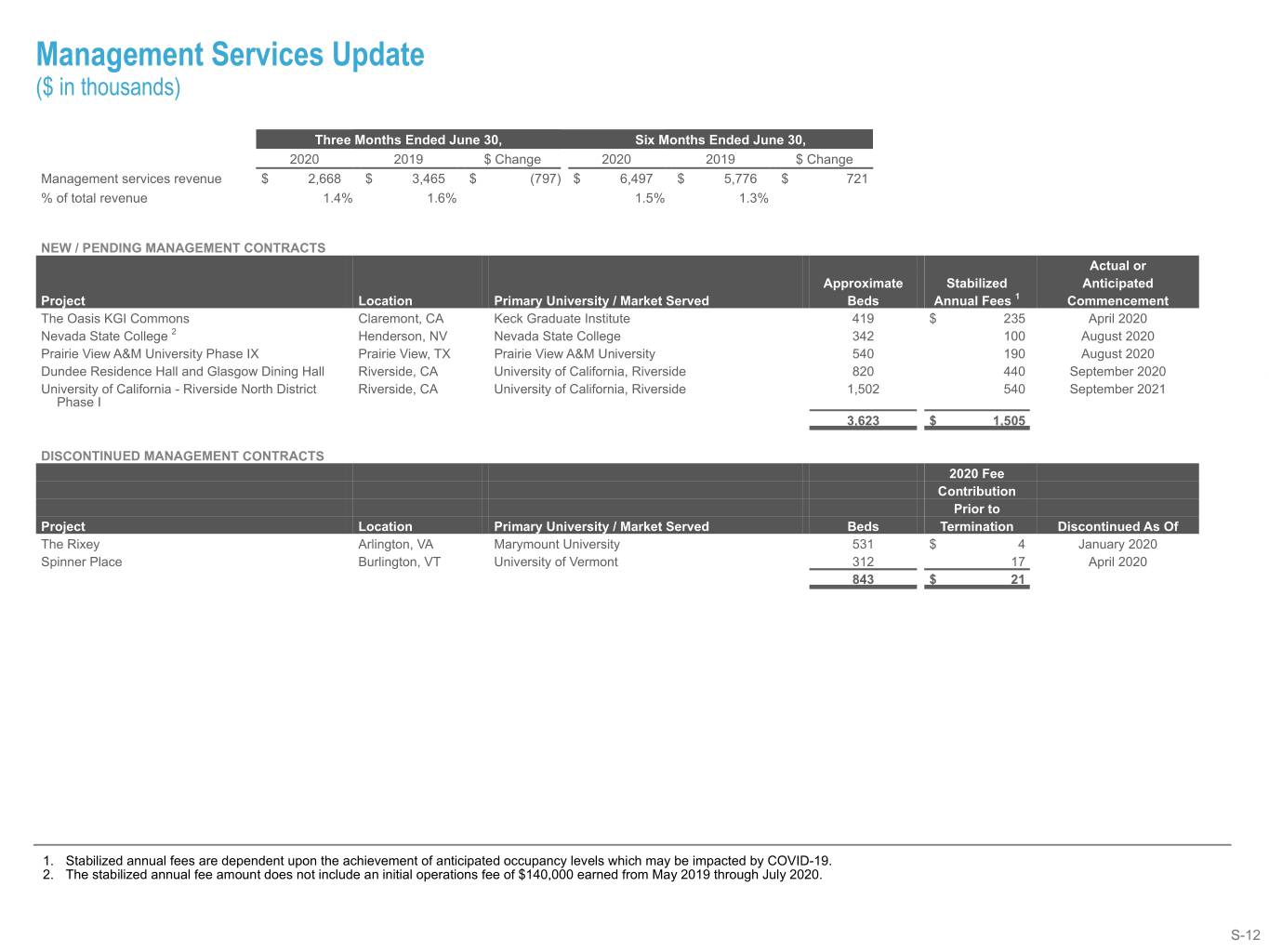

Management Services Update ($ in thousands) Three Months Ended June 30, Six Months Ended June 30, 2020 2019 $ Change 2020 2019 $ Change Management services revenue $ 2,668 $ 3,465 $ (797) $ 6,497 $ 5,776 $ 721 % of total revenue 1.4% 1.6% 1.5% 1.3% NEW / PENDING MANAGEMENT CONTRACTS Actual or Approximate Stabilized Anticipated Project Location Primary University / Market Served Beds Annual Fees 1 Commencement The Oasis KGI Commons Claremont, CA Keck Graduate Institute 419 $ 235 April 2020 Nevada State College 2 Henderson, NV Nevada State College 342 100 August 2020 Prairie View A&M University Phase IX Prairie View, TX Prairie View A&M University 540 190 August 2020 Dundee Residence Hall and Glasgow Dining Hall Riverside, CA University of California, Riverside 820 440 September 2020 University of California - Riverside North District Riverside, CA University of California, Riverside 1,502 540 September 2021 Phase I 3,623 $ 1,505 DISCONTINUED MANAGEMENT CONTRACTS 2020 Fee Contribution Prior to Project Location Primary University / Market Served Beds Termination Discontinued As Of The Rixey Arlington, VA Marymount University 531 $ 4 January 2020 Spinner Place Burlington, VT University of Vermont 312 17 April 2020 843 $ 21 1. Stabilized annual fees are dependent upon the achievement of anticipated occupancy levels which may be impacted by COVID-19. 2. The stabilized annual fee amount does not include an initial operations fee of $140,000 earned from May 2019 through July 2020. S-12

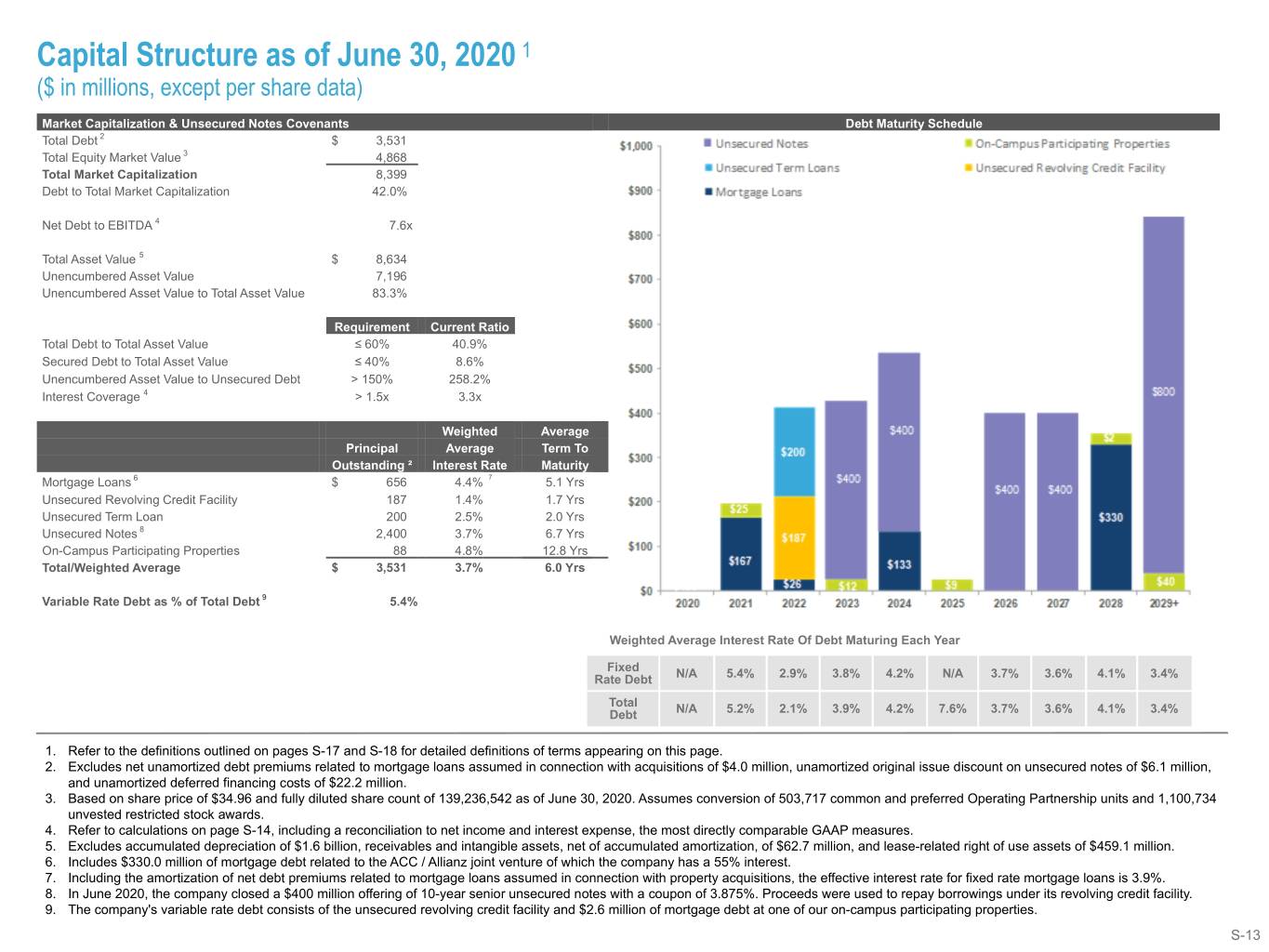

Capital Structure as of June 30, 2020 1 ($ in millions, except per share data) Market Capitalization & Unsecured Notes Covenants Debt Maturity Schedule Total Debt 2 $ 3,531 Total Equity Market Value 3 4,868 Total Market Capitalization 8,399 Debt to Total Market Capitalization 42.0% Net Debt to EBITDA 4 7.6x Total Asset Value 5 $ 8,634 Unencumbered Asset Value 7,196 Unencumbered Asset Value to Total Asset Value 83.3% Requirement Current Ratio Total Debt to Total Asset Value ≤ 60% 40.9% Secured Debt to Total Asset Value ≤ 40% 8.6% Unencumbered Asset Value to Unsecured Debt > 150% 258.2% Interest Coverage 4 > 1.5x 3.3x Weighted Average Principal Average Term To Outstanding ² Interest Rate Maturity Mortgage Loans 6 $ 656 4.4% 7 5.1 Yrs Unsecured Revolving Credit Facility 187 1.4% 1.7 Yrs Unsecured Term Loan 200 2.5% 2.0 Yrs Unsecured Notes 8 2,400 3.7% 6.7 Yrs On-Campus Participating Properties 88 4.8% 12.8 Yrs Total/Weighted Average $ 3,531 3.7% 6.0 Yrs Variable Rate Debt as % of Total Debt 9 5.4% Weighted Average Interest Rate Of Debt Maturing Each Year Fixed Rate Debt N/A 5.4% 2.9% 3.8% 4.2% N/A 3.7% 3.6% 4.1% 3.4% Total Debt N/A 5.2% 2.1% 3.9% 4.2% 7.6% 3.7% 3.6% 4.1% 3.4% 1. Refer to the definitions outlined on pages S-17 and S-18 for detailed definitions of terms appearing on this page. 2. Excludes net unamortized debt premiums related to mortgage loans assumed in connection with acquisitions of $4.0 million, unamortized original issue discount on unsecured notes of $6.1 million, and unamortized deferred financing costs of $22.2 million. 3. Based on share price of $34.96 and fully diluted share count of 139,236,542 as of June 30, 2020. Assumes conversion of 503,717 common and preferred Operating Partnership units and 1,100,734 unvested restricted stock awards. 4. Refer to calculations on page S-14, including a reconciliation to net income and interest expense, the most directly comparable GAAP measures. 5. Excludes accumulated depreciation of $1.6 billion, receivables and intangible assets, net of accumulated amortization, of $62.7 million, and lease-related right of use assets of $459.1 million. 6. Includes $330.0 million of mortgage debt related to the ACC / Allianz joint venture of which the company has a 55% interest. 7. Including the amortization of net debt premiums related to mortgage loans assumed in connection with property acquisitions, the effective interest rate for fixed rate mortgage loans is 3.9%. 8. In June 2020, the company closed a $400 million offering of 10-year senior unsecured notes with a coupon of 3.875%. Proceeds were used to repay borrowings under its revolving credit facility. 9. The company's variable rate debt consists of the unsecured revolving credit facility and $2.6 million of mortgage debt at one of our on-campus participating properties. S-13

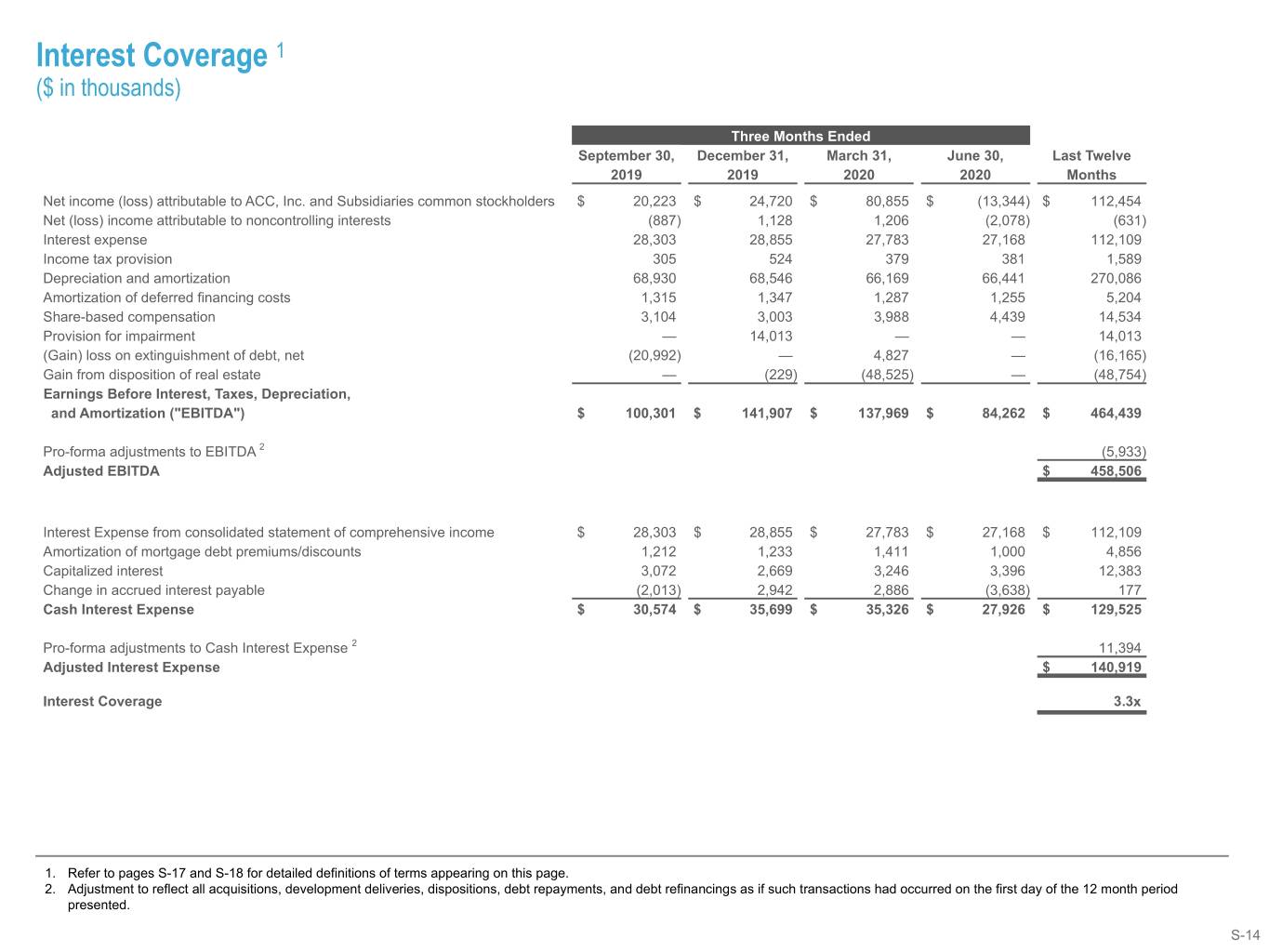

Interest Coverage 1 ($ in thousands) Three Months Ended September 30, December 31, March 31, June 30, Last Twelve 2019 2019 2020 2020 Months Net income (loss) attributable to ACC, Inc. and Subsidiaries common stockholders $ 20,223 $ 24,720 $ 80,855 $ (13,344) $ 112,454 Net (loss) income attributable to noncontrolling interests (887) 1,128 1,206 (2,078) (631) Interest expense 28,303 28,855 27,783 27,168 112,109 Income tax provision 305 524 379 381 1,589 Depreciation and amortization 68,930 68,546 66,169 66,441 270,086 Amortization of deferred financing costs 1,315 1,347 1,287 1,255 5,204 Share-based compensation 3,104 3,003 3,988 4,439 14,534 Provision for impairment — 14,013 — — 14,013 (Gain) loss on extinguishment of debt, net (20,992) — 4,827 — (16,165) Gain from disposition of real estate — (229) (48,525) — (48,754) Earnings Before Interest, Taxes, Depreciation, and Amortization ("EBITDA") $ 100,301 $ 141,907 $ 137,969 $ 84,262 $ 464,439 Pro-forma adjustments to EBITDA 2 (5,933) Adjusted EBITDA $ 458,506 Interest Expense from consolidated statement of comprehensive income $ 28,303 $ 28,855 $ 27,783 $ 27,168 $ 112,109 Amortization of mortgage debt premiums/discounts 1,212 1,233 1,411 1,000 4,856 Capitalized interest 3,072 2,669 3,246 3,396 12,383 Change in accrued interest payable (2,013) 2,942 2,886 (3,638) 177 Cash Interest Expense $ 30,574 $ 35,699 $ 35,326 $ 27,926 $ 129,525 Pro-forma adjustments to Cash Interest Expense 2 11,394 Adjusted Interest Expense $ 140,919 Interest Coverage 3.3x 1. Refer to pages S-17 and S-18 for detailed definitions of terms appearing on this page. 2. Adjustment to reflect all acquisitions, development deliveries, dispositions, debt repayments, and debt refinancings as if such transactions had occurred on the first day of the 12 month period presented. S-14

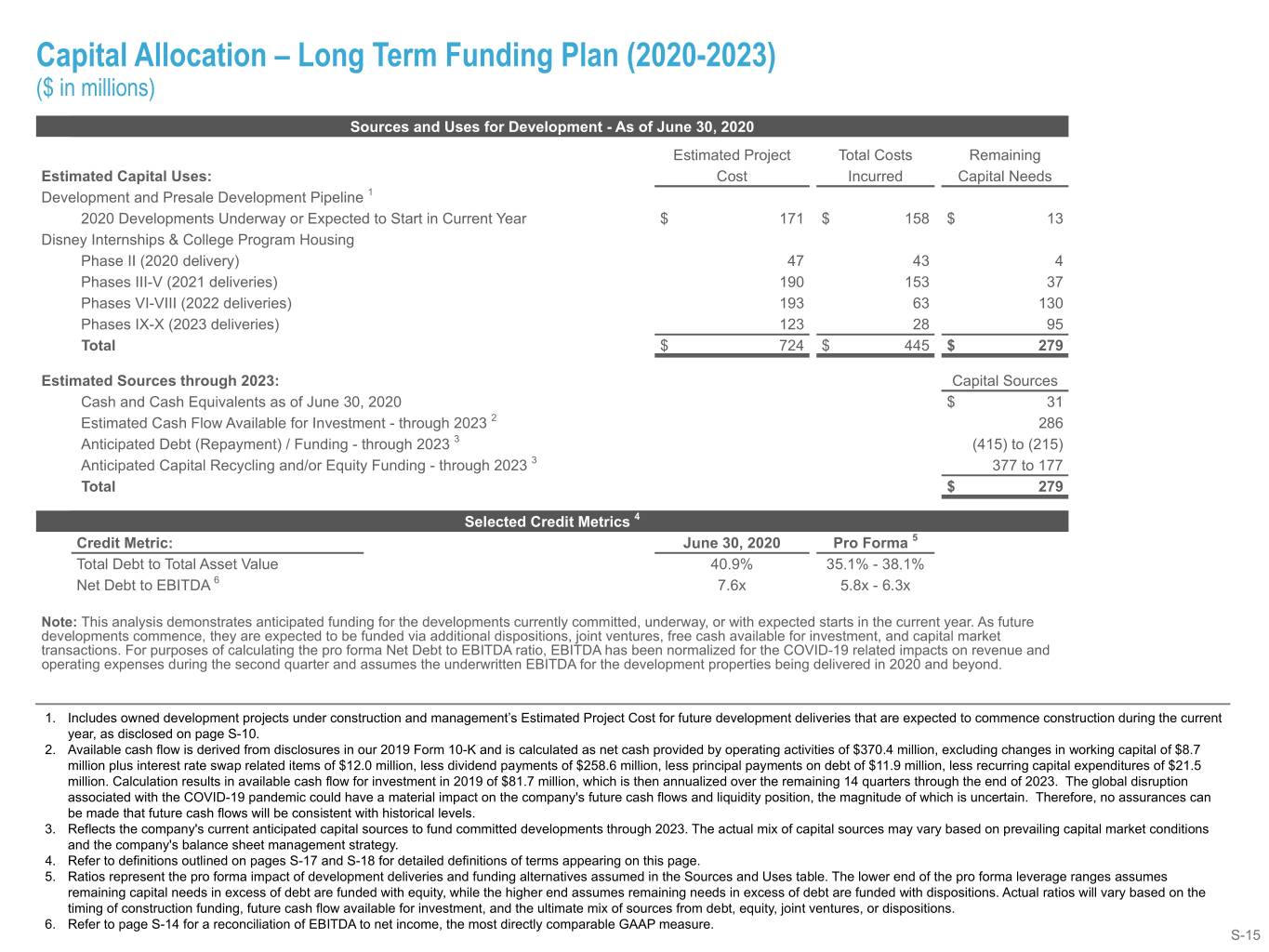

Capital Allocation – Long Term Funding Plan (2020-2023) ($ in millions) Sources and Uses for Development - As of June 30, 2020 Estimated Project Total Costs Remaining Estimated Capital Uses: Cost Incurred Capital Needs Development and Presale Development Pipeline 1 2020 Developments Underway or Expected to Start in Current Year $ 171 $ 158 $ 13 Disney Internships & College Program Housing Phase II (2020 delivery) 47 43 4 Phases III-V (2021 deliveries) 190 153 37 Phases VI-VIII (2022 deliveries) 193 63 130 Phases IX-X (2023 deliveries) 123 28 95 Total $ 724 $ 445 $ 279 Estimated Sources through 2023: Capital Sources Cash and Cash Equivalents as of June 30, 2020 $ 31 Estimated Cash Flow Available for Investment - through 2023 2 286 Anticipated Debt (Repayment) / Funding - through 2023 3 (415) to (215) Anticipated Capital Recycling and/or Equity Funding - through 2023 3 377 to 177 Total $ 279 Selected Credit Metrics 4 Credit Metric: June 30, 2020 Pro Forma 5 Total Debt to Total Asset Value 40.9% 35.1% - 38.1% Net Debt to EBITDA 6 7.6x 5.8x - 6.3x Note: This analysis demonstrates anticipated funding for the developments currently committed, underway, or with expected starts in the current year. As future developments commence, they are expected to be funded via additional dispositions, joint ventures, free cash available for investment, and capital market transactions. For purposes of calculating the pro forma Net Debt to EBITDA ratio, EBITDA has been normalized for the COVID-19 related impacts on revenue and operating expenses during the second quarter and assumes the underwritten EBITDA for the development properties being delivered in 2020 and beyond. 1. Includes owned development projects under construction and management’s Estimated Project Cost for future development deliveries that are expected to commence construction during the current year, as disclosed on page S-10. 2. Available cash flow is derived from disclosures in our 2019 Form 10-K and is calculated as net cash provided by operating activities of $370.4 million, excluding changes in working capital of $8.7 million plus interest rate swap related items of $12.0 million, less dividend payments of $258.6 million, less principal payments on debt of $11.9 million, less recurring capital expenditures of $21.5 million. Calculation results in available cash flow for investment in 2019 of $81.7 million, which is then annualized over the remaining 14 quarters through the end of 2023. The global disruption associated with the COVID-19 pandemic could have a material impact on the company's future cash flows and liquidity position, the magnitude of which is uncertain. Therefore, no assurances can be made that future cash flows will be consistent with historical levels. 3. Reflects the company's current anticipated capital sources to fund committed developments through 2023. The actual mix of capital sources may vary based on prevailing capital market conditions and the company's balance sheet management strategy. 4. Refer to definitions outlined on pages S-17 and S-18 for detailed definitions of terms appearing on this page. 5. Ratios represent the pro forma impact of development deliveries and funding alternatives assumed in the Sources and Uses table. The lower end of the pro forma leverage ranges assumes remaining capital needs in excess of debt are funded with equity, while the higher end assumes remaining needs in excess of debt are funded with dispositions. Actual ratios will vary based on the timing of construction funding, future cash flow available for investment, and the ultimate mix of sources from debt, equity, joint ventures, or dispositions. 6. Refer to page S-14 for a reconciliation of EBITDA to net income, the most directly comparable GAAP measure. S-15

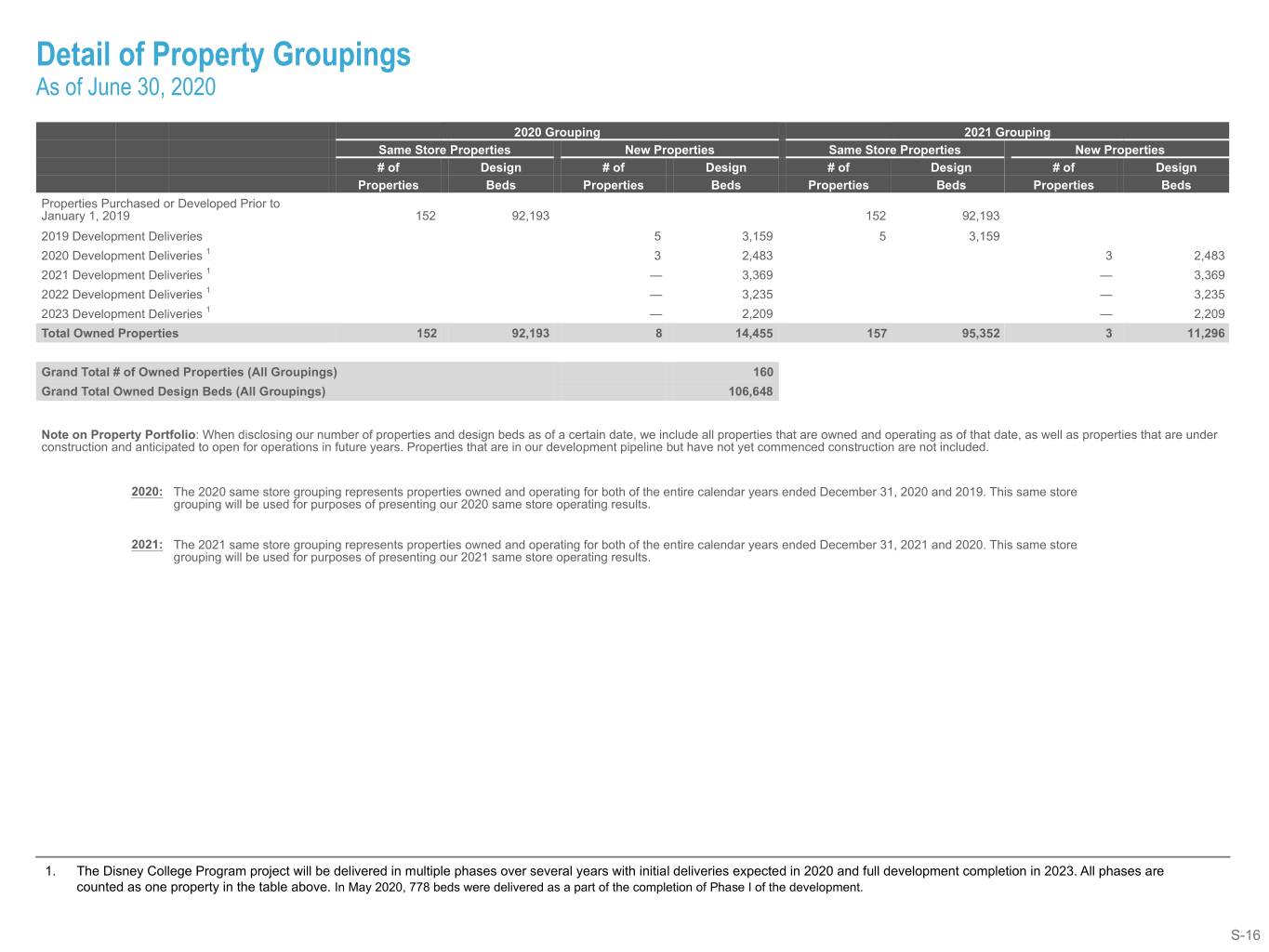

Detail of Property Groupings As of June 30, 2020 2020 Grouping 2021 Grouping Same Store Properties New Properties Same Store Properties New Properties # of Design # of Design # of Design # of Design Properties Beds Properties Beds Properties Beds Properties Beds Properties Purchased or Developed Prior to January 1, 2019 152 92,193 152 92,193 2019 Development Deliveries 5 3,159 5 3,159 2020 Development Deliveries 1 3 2,483 3 2,483 2021 Development Deliveries 1 — 3,369 — 3,369 2022 Development Deliveries 1 — 3,235 — 3,235 2023 Development Deliveries 1 — 2,209 — 2,209 Total Owned Properties 152 92,193 8 14,455 157 95,352 3 11,296 Grand Total # of Owned Properties (All Groupings) 160 Grand Total Owned Design Beds (All Groupings) 106,648 Note on Property Portfolio: When disclosing our number of properties and design beds as of a certain date, we include all properties that are owned and operating as of that date, as well as properties that are under construction and anticipated to open for operations in future years. Properties that are in our development pipeline but have not yet commenced construction are not included. 2020: The 2020 same store grouping represents properties owned and operating for both of the entire calendar years ended December 31, 2020 and 2019. This same store grouping will be used for purposes of presenting our 2020 same store operating results. 2021: The 2021 same store grouping represents properties owned and operating for both of the entire calendar years ended December 31, 2021 and 2020. This same store grouping will be used for purposes of presenting our 2021 same store operating results. 1. The Disney College Program project will be delivered in multiple phases over several years with initial deliveries expected in 2020 and full development completion in 2023. All phases are counted as one property in the table above. In May 2020, 778 beds were delivered as a part of the completion of Phase I of the development. S-16

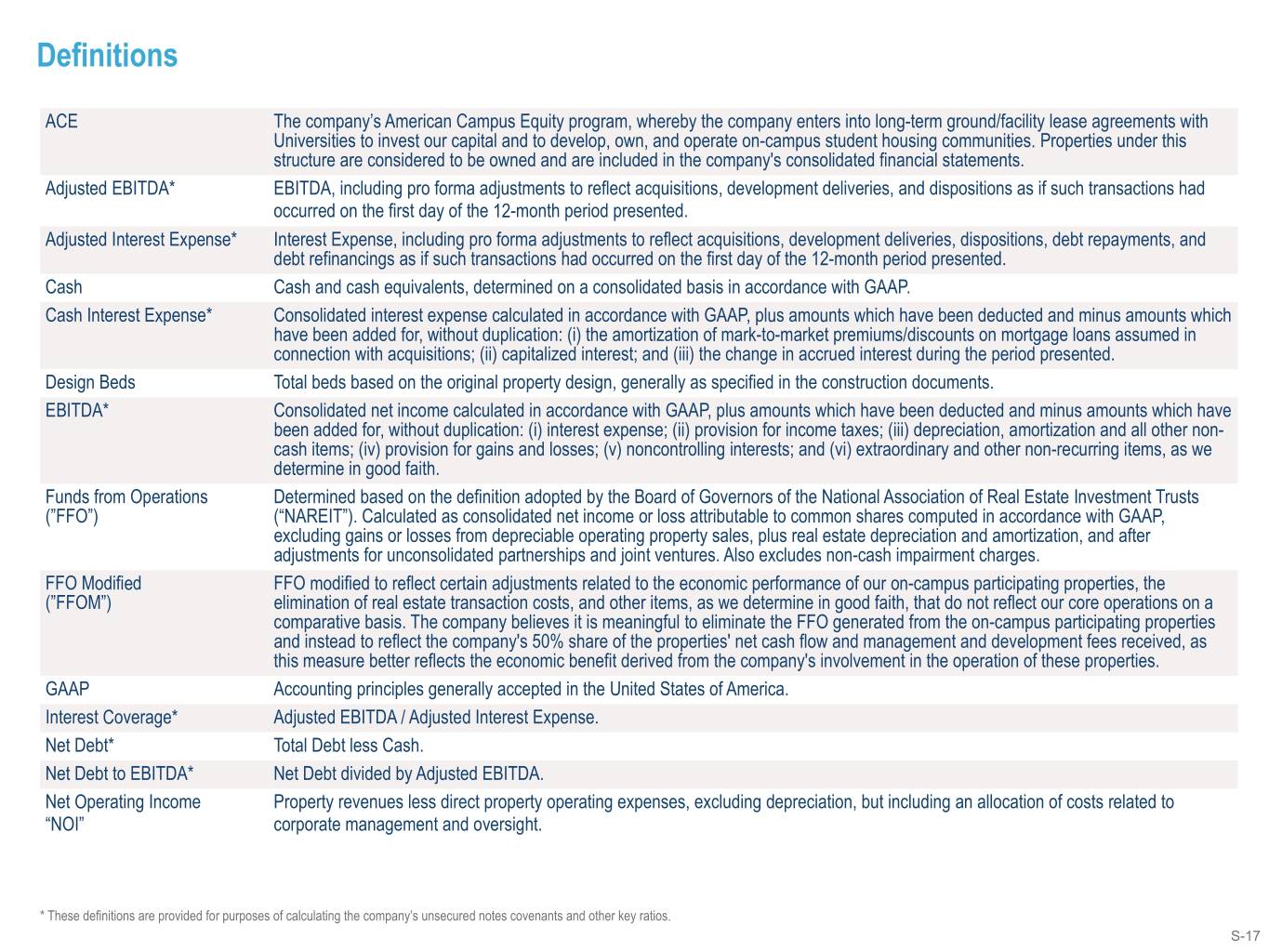

Definitions ACE The company’s American Campus Equity program, whereby the company enters into long-term ground/facility lease agreements with Universities to invest our capital and to develop, own, and operate on-campus student housing communities. Properties under this structure are considered to be owned and are included in the company's consolidated financial statements. Adjusted EBITDA* EBITDA, including pro forma adjustments to reflect acquisitions, development deliveries, and dispositions as if such transactions had occurred on the first day of the 12-month period presented. Adjusted Interest Expense* Interest Expense, including pro forma adjustments to reflect acquisitions, development deliveries, dispositions, debt repayments, and debt refinancings as if such transactions had occurred on the first day of the 12-month period presented. Cash Cash and cash equivalents, determined on a consolidated basis in accordance with GAAP. Cash Interest Expense* Consolidated interest expense calculated in accordance with GAAP, plus amounts which have been deducted and minus amounts which have been added for, without duplication: (i) the amortization of mark-to-market premiums/discounts on mortgage loans assumed in connection with acquisitions; (ii) capitalized interest; and (iii) the change in accrued interest during the period presented. Design Beds Total beds based on the original property design, generally as specified in the construction documents. EBITDA* Consolidated net income calculated in accordance with GAAP, plus amounts which have been deducted and minus amounts which have been added for, without duplication: (i) interest expense; (ii) provision for income taxes; (iii) depreciation, amortization and all other non- cash items; (iv) provision for gains and losses; (v) noncontrolling interests; and (vi) extraordinary and other non-recurring items, as we determine in good faith. Funds from Operations Determined based on the definition adopted by the Board of Governors of the National Association of Real Estate Investment Trusts (”FFO”) (“NAREIT”). Calculated as consolidated net income or loss attributable to common shares computed in accordance with GAAP, excluding gains or losses from depreciable operating property sales, plus real estate depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Also excludes non-cash impairment charges. FFO Modified FFO modified to reflect certain adjustments related to the economic performance of our on-campus participating properties, the (”FFOM”) elimination of real estate transaction costs, and other items, as we determine in good faith, that do not reflect our core operations on a comparative basis. The company believes it is meaningful to eliminate the FFO generated from the on-campus participating properties and instead to reflect the company's 50% share of the properties' net cash flow and management and development fees received, as this measure better reflects the economic benefit derived from the company's involvement in the operation of these properties. GAAP Accounting principles generally accepted in the United States of America. Interest Coverage* Adjusted EBITDA / Adjusted Interest Expense. Net Debt* Total Debt less Cash. Net Debt to EBITDA* Net Debt divided by Adjusted EBITDA. Net Operating Income Property revenues less direct property operating expenses, excluding depreciation, but including an allocation of costs related to “NOI” corporate management and oversight. * These definitions are provided for purposes of calculating the company’s unsecured notes covenants and other key ratios. S-17

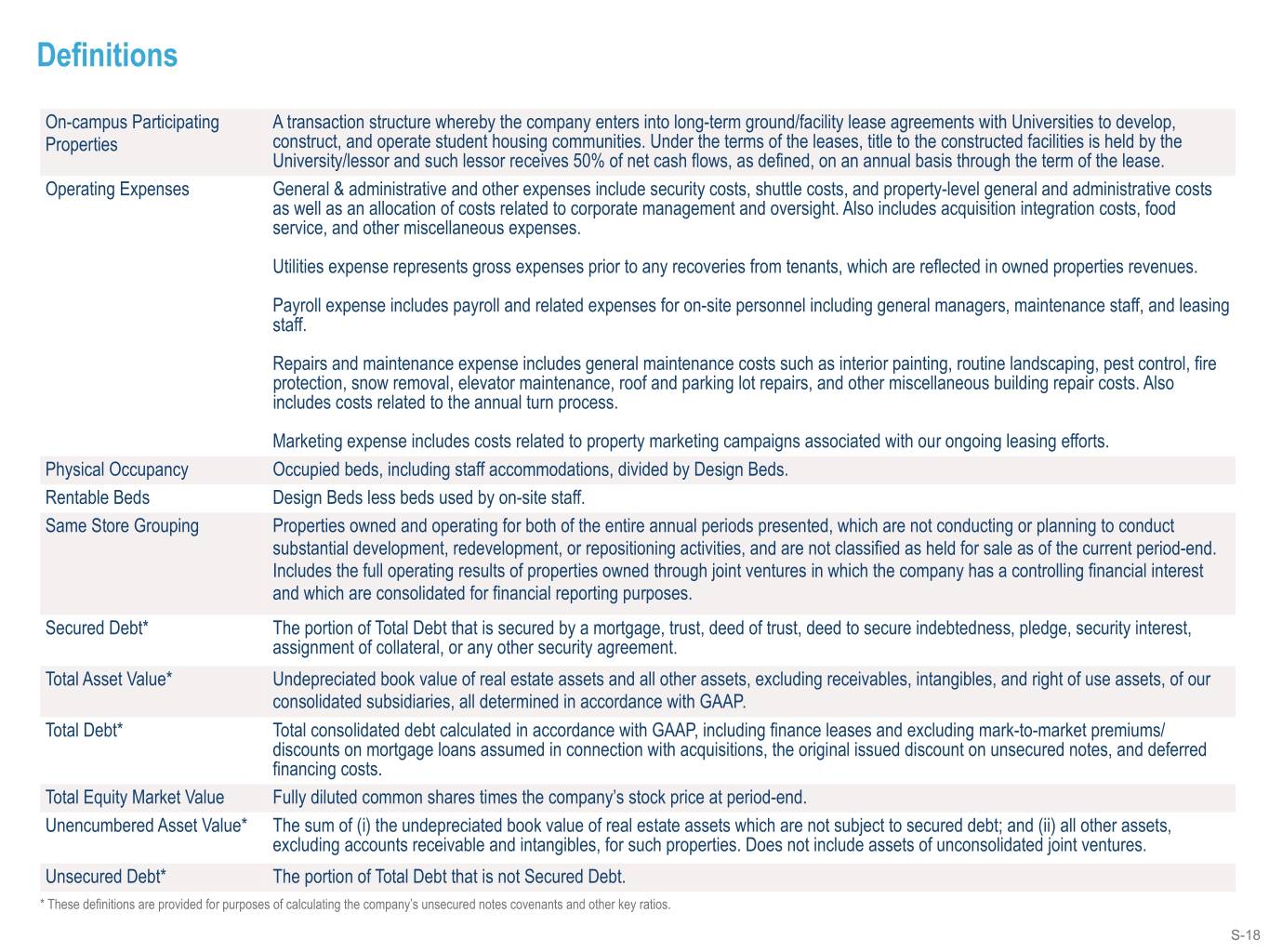

Definitions On-campus Participating A transaction structure whereby the company enters into long-term ground/facility lease agreements with Universities to develop, Properties construct, and operate student housing communities. Under the terms of the leases, title to the constructed facilities is held by the University/lessor and such lessor receives 50% of net cash flows, as defined, on an annual basis through the term of the lease. Operating Expenses General & administrative and other expenses include security costs, shuttle costs, and property-level general and administrative costs as well as an allocation of costs related to corporate management and oversight. Also includes acquisition integration costs, food service, and other miscellaneous expenses. Utilities expense represents gross expenses prior to any recoveries from tenants, which are reflected in owned properties revenues. Payroll expense includes payroll and related expenses for on-site personnel including general managers, maintenance staff, and leasing staff. Repairs and maintenance expense includes general maintenance costs such as interior painting, routine landscaping, pest control, fire protection, snow removal, elevator maintenance, roof and parking lot repairs, and other miscellaneous building repair costs. Also includes costs related to the annual turn process. Marketing expense includes costs related to property marketing campaigns associated with our ongoing leasing efforts. Physical Occupancy Occupied beds, including staff accommodations, divided by Design Beds. Rentable Beds Design Beds less beds used by on-site staff. Same Store Grouping Properties owned and operating for both of the entire annual periods presented, which are not conducting or planning to conduct substantial development, redevelopment, or repositioning activities, and are not classified as held for sale as of the current period-end. Includes the full operating results of properties owned through joint ventures in which the company has a controlling financial interest and which are consolidated for financial reporting purposes. Secured Debt* The portion of Total Debt that is secured by a mortgage, trust, deed of trust, deed to secure indebtedness, pledge, security interest, assignment of collateral, or any other security agreement. Total Asset Value* Undepreciated book value of real estate assets and all other assets, excluding receivables, intangibles, and right of use assets, of our consolidated subsidiaries, all determined in accordance with GAAP. Total Debt* Total consolidated debt calculated in accordance with GAAP, including finance leases and excluding mark-to-market premiums/ discounts on mortgage loans assumed in connection with acquisitions, the original issued discount on unsecured notes, and deferred financing costs. Total Equity Market Value Fully diluted common shares times the company’s stock price at period-end. Unencumbered Asset Value* The sum of (i) the undepreciated book value of real estate assets which are not subject to secured debt; and (ii) all other assets, excluding accounts receivable and intangibles, for such properties. Does not include assets of unconsolidated joint ventures. Unsecured Debt* The portion of Total Debt that is not Secured Debt. * These definitions are provided for purposes of calculating the company’s unsecured notes covenants and other key ratios. S-18

Investor Information Executive Management Bill Bayless Chief Executive Officer Jim Hopke President Jennifer Beese Chief Operating Officer Daniel Perry Chief Financial Officer William Talbot Chief Investment Officer Kim Voss Chief Accounting Officer Research Coverage Jacob Kilstein Argus Research Company (646) 747-5447 jkilstein@argusresearch.com Jeffery Spector Bank of America / Merrill Lynch (646) 855-1363 jeff.spector@baml.com Neil Malkin Capital One (571) 633-8191 neil.malkin@capitalone.com Michael Bilerman / Nick Joseph Citigroup Equity Research (212) 816-1383 / (212) 816-1909 michael.bilerman@citi.com / nicholas.joseph@citi.com Derek Johnston / Tom Hennessy Deutsche Bank Securities, Inc. (212) 250-5683 / (212) 250-4063 derek.johnston@db.com / tom.hennessy@db.com Steve Sakwa / Samir Khanal Evercore ISI (212) 446-9462 / (212) 888-3796 steve.sakwa@evercoreisi.com / samir.khanal@evercoreisi.com Richard Skidmore Goldman Sachs & Co. (801) 741-5459 richard.skidmore@gs.com John Pawlowski / Alan Peterson Green Street Advisors (949) 640-8780 / (949) 640-8780 jpawlowski@greenstreetadvisors.com / apeterson@greenstreetadvisors.com Aaron Hecht JMP Securities (415) 835-3963 ahecht@jmpsecurities.com Anthony Paolone / Nikita Bely J.P. Morgan Securities (212) 622-6682 / (212) 622-0695 anthony.paolone@jpmorgan.com / nikita.bely@jpmorgan.com Jordan Sadler / Austin Wurschmidt KeyBanc Capital Markets (917) 368-2280 / (917) 368-2311 jsadler@key.com / awurschmidt@key.com Alexander Goldfarb / Daniel Santos Piper Sandler & Co. (212) 466-7937 / (212) 466-7927 alexander.goldfarb@psc.com / daniel.santos@psc.com American Campus Communities, Inc. is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding American Campus Communities, Inc.'s performance made by such analysts are theirs alone and do not represent the opinions, forecasts or predictions of the company or its management. American Campus Communities, Inc. does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions or recommendations. Corporate Headquarters Investor Relations American Campus Communities, Inc. Tel: (512) 732-1000 Ryan Dennison (512) 732-1000 12700 Hill Country Blvd., Suite T-200 Fax: (512) 732-2450 SVP, Capital Markets and Investor Relations rdennison@americancampus.com Austin, Texas 78738 www.americancampus.com S-19

Forward-looking Statements and Non-GAAP Financial Measures In addition to historical information, this press release contains forward-looking statements under the applicable federal securities law. These statements are based on management’s current expectations and assumptions regarding markets in which American Campus Communities, Inc. (the “Company”) operates, operational strategies, anticipated events and trends, the economy, and other future conditions. Forward- looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. These risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward looking-statements include those related to the COVID-19 pandemic, about which there are still many unknowns, including the duration of the pandemic and the extent of its impact, and those discussed in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2019 under the heading “Risk Factors” and under the heading “Business - Forward-looking Statements” and subsequent quarterly reports on Form 10-Q. We undertake no obligation to publicly update any forward-looking statements, including our expected 2020 operating results, whether as a result of new information, future events, or otherwise. This presentation contains certain financial information not derived in accordance with United States generally accepted accounting principles (“GAAP”). These items include earnings before interest, tax, depreciation and amortization (“EBITDA”), net operating income (“NOI”), funds from operations (“FFO”) and FFO-Modified (“FFOM”). Refer to Definitions for a detailed explanation of terms appearing in the supplement. The Company presents this financial information because it considers each item an important supplemental measure of its operating performance and believes it is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs. These measures should not be considered as alternatives to net income or loss computed in accordance with GAAP as an indicator of the Company's financial performance or to cash flow from operating activities computed in accordance with GAAP as an indicator of its liquidity, nor are these measures indicative of funds available to fund its cash needs, including its ability to pay dividends or make distributions.