Attached files

| file | filename |

|---|---|

| EX-32.4 - EXHIBIT 32.4 - AMERICAN CAMPUS COMMUNITIES INC | exhibit3246302018.htm |

| EX-32.3 - EXHIBIT 32.3 - AMERICAN CAMPUS COMMUNITIES INC | exhibit3236302018.htm |

| EX-32.2 - EXHIBIT 32.2 - AMERICAN CAMPUS COMMUNITIES INC | exhibit3226302018.htm |

| EX-32.1 - EXHIBIT 32.1 - AMERICAN CAMPUS COMMUNITIES INC | exhibit3216302018.htm |

| EX-31.4 - EXHIBIT 31.4 - AMERICAN CAMPUS COMMUNITIES INC | exhibit3146302018.htm |

| EX-31.3 - EXHIBIT 31.3 - AMERICAN CAMPUS COMMUNITIES INC | exhibit3136302018.htm |

| EX-31.2 - EXHIBIT 31.2 - AMERICAN CAMPUS COMMUNITIES INC | exhibit3126302018.htm |

| EX-31.1 - EXHIBIT 31.1 - AMERICAN CAMPUS COMMUNITIES INC | exhibit3116302018.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

ý Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended June 30, 2018.

o Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Transition Period From ______________________ to _________________________

Commission file number 001-32265 (American Campus Communities, Inc.)

Commission file number 333-181102-01 (American Campus Communities Operating Partnership, L.P.)

AMERICAN CAMPUS COMMUNITIES, INC.

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P.

(Exact name of registrant as specified in its charter)

Maryland (American Campus Communities, Inc.) Maryland (American Campus Communities Operating Partnership, L.P.) | 76-0753089 (American Campus Communities, Inc.) 56-2473181 (American Campus Communities Operating Partnership, L.P.) | |

(State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification No.) | |

12700 Hill Country Blvd., Suite T-200 Austin, TX (Address of Principal Executive Offices) | 78738 (Zip Code) | |

(512) 732-1000

Registrant’s telephone number, including area code

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

American Campus Communities, Inc. | Yes x No o |

American Campus Communities Operating Partnership, L.P. | Yes x No o |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

American Campus Communities, Inc. | Yes x No o |

American Campus Communities Operating Partnership, L.P. | Yes x No o |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

American Campus Communities, Inc.

Large accelerated filer x | Accelerated Filer o |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Emerging growth company o | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

American Campus Communities Operating Partnership, L.P.

Large accelerated filer o | Accelerated Filer o |

Non-accelerated filer x (Do not check if a smaller reporting company) | Smaller reporting company o |

Emerging growth company o | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

American Campus Communities, Inc. | Yes o No x |

American Campus Communities Operating Partnership, L.P | Yes o No x |

There were 137,028,742 shares of the American Campus Communities, Inc.’s common stock with a par value of $0.01 per share outstanding as of the close of business on July 27, 2018.

EXPLANATORY NOTE

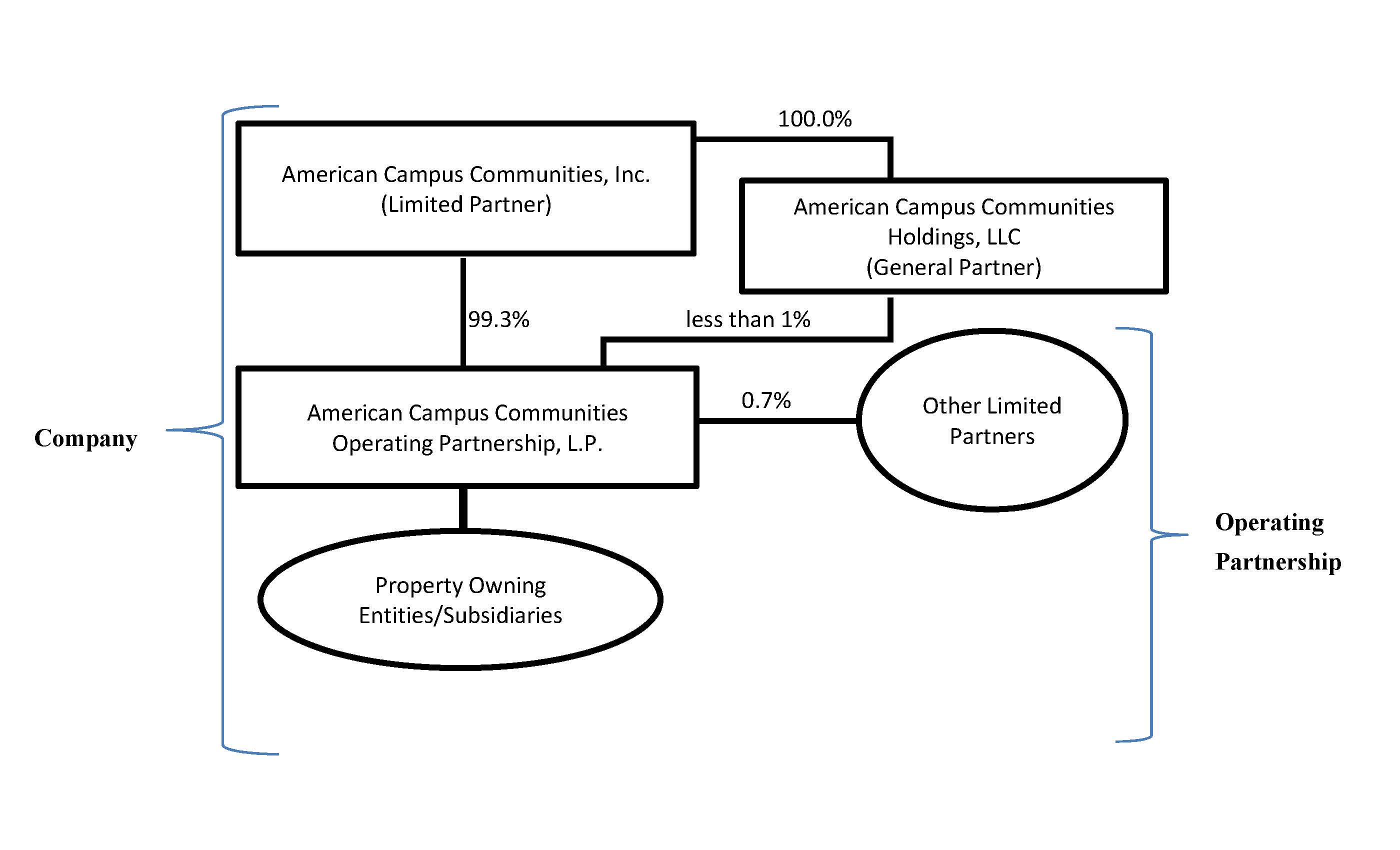

This report combines the reports on Form 10-Q for the quarterly period ended June 30, 2018 of American Campus Communities, Inc. and American Campus Communities Operating Partnership, L.P. Unless stated otherwise or the context otherwise requires, references to “ACC” mean American Campus Communities, Inc., a Maryland corporation that has elected to be treated as a real estate investment trust (“REIT”) under the Internal Revenue Code, and references to “ACCOP” mean American Campus Communities Operating Partnership, L.P., a Maryland limited partnership. References to the “Company,” “we,” “us” or “our” mean collectively ACC, ACCOP and those entities/subsidiaries owned or controlled by ACC and/or ACCOP. References to the “Operating Partnership” mean collectively ACCOP and those entities/subsidiaries owned or controlled by ACCOP. The following chart illustrates the Company’s and the Operating Partnership’s corporate structure:

The general partner of ACCOP is American Campus Communities Holdings, LLC (“ACC Holdings”), an entity that is wholly-owned by ACC. As of June 30, 2018, ACC Holdings held an ownership interest in ACCOP of less than 1%. The limited partners of ACCOP are ACC and other limited partners consisting of current and former members of management and nonaffiliated third parties. As of June 30, 2018, ACC owned an approximate 99.3% limited partnership interest in ACCOP. As the sole member of the general partner of ACCOP, ACC has exclusive control of ACCOP’s day-to-day management. Management operates the Company and the Operating Partnership as one business. The management of ACC consists of the same members as the management of ACCOP. The Company is structured as an umbrella partnership REIT (“UPREIT”) and ACC contributes all net proceeds from its various equity offerings to the Operating Partnership. In return for those contributions, ACC receives a number of units of the Operating Partnership (“OP Units,” see definition below) equal to the number of common shares it has issued in the equity offering. Contributions of properties to the Company can be structured as tax-deferred transactions through the issuance of OP Units in the Operating Partnership. Based on the terms of ACCOP’s partnership agreement, OP Units can be exchanged for ACC’s common shares on a one-for-one basis. The Company maintains a one-for-one relationship between the OP Units of the Operating Partnership issued to ACC and ACC Holdings and the common shares issued to the public. The Company believes that combining the reports on Form 10-Q of ACC and ACCOP into this single report provides the following benefits:

(1) | enhances investors’ understanding of the Company and the Operating Partnership by enabling investors to view the business as a whole in the same manner as management views and operates the business; |

(2) | eliminates duplicative disclosure and provides a more streamlined and readable presentation since a substantial portion of the disclosure applies to both the Company and the Operating Partnership; and |

(3) | creates time and cost efficiencies through the preparation of one combined report instead of two separate reports. |

ACC consolidates ACCOP for financial reporting purposes, and ACC essentially has no assets or liabilities other than its investment in ACCOP. Therefore, the assets and liabilities of the Company and the Operating Partnership are the same on their respective financial statements. However, the Company believes it is important to understand the few differences between the Company and the Operating Partnership in the context of how the entities operate as a consolidated company. All of the Company’s property ownership, development and related business operations are conducted through the Operating Partnership. ACC also issues public equity from time to time and guarantees certain debt of ACCOP, as disclosed in this report. ACC does not have any indebtedness, as all debt is incurred by the Operating Partnership. The Operating Partnership holds substantially all of the assets of the Company, including the Company’s ownership interests in its joint ventures. The Operating Partnership conducts the operations of the business and is structured as a partnership with no publicly traded equity. Except for the net proceeds from ACC’s equity offerings, which are contributed to the capital of ACCOP in exchange for OP Units on a one-for-one common share per OP Unit basis, the Operating Partnership generates all remaining capital required by the Company’s business. These sources include, but are not limited to, the Operating Partnership’s working capital, net cash provided by operating activities, borrowings under its credit facility, the issuance of unsecured notes, and proceeds received from the disposition of certain properties. Noncontrolling interests, stockholders’ equity, and partners’ capital are the main areas of difference between the consolidated financial statements of the Company and those of the Operating Partnership. The noncontrolling interests in the Operating Partnership’s financial statements consist of the interests of unaffiliated partners in various consolidated joint ventures. The noncontrolling interests in the Company’s financial statements include the same noncontrolling interests at the Operating Partnership level and OP Unit holders of the Operating Partnership. The differences between stockholders’ equity and partners’ capital result from differences in the equity issued at the Company and Operating Partnership levels.

To help investors understand the significant differences between the Company and the Operating Partnership, this report provides separate consolidated financial statements for the Company and the Operating Partnership. A single set of consolidated notes to such financial statements is presented that includes separate discussions for the Company and the Operating Partnership when applicable (for example, noncontrolling interests, stockholders’ equity or partners’ capital, earnings per share or unit, etc.). A combined Management’s Discussion and Analysis of Financial Condition and Results of Operations section is also included that presents discrete information related to each entity, as applicable. This report also includes separate Part I, Item 4 Controls and Procedures sections and separate Exhibits 31 and 32 certifications for each of the Company and the Operating Partnership in order to establish that the requisite certifications have been made and that the Company and the Operating Partnership are compliant with Rule 13a-15 or Rule 15d-15 of the Securities Exchange Act of 1934 and 18 U.S.C. §1350.

In order to highlight the differences between the Company and the Operating Partnership, the separate sections in this report for the Company and the Operating Partnership specifically refer to the Company and the Operating Partnership. In the sections that combine disclosure of the Company and the Operating Partnership, this report refers to actions or holdings as being actions or holdings of the Company. Although the Operating Partnership is generally the entity that directly or indirectly enters into contracts and joint ventures and holds assets and debt, reference to the Company is appropriate because the Company operates its business through the Operating Partnership. The separate discussions of the Company and the Operating Partnership in this report should be read in conjunction with each other to understand the results of the Company on a consolidated basis and how management operates the Company.

FORM 10-Q

FOR THE QUARTER ENDED June 30, 2018

TABLE OF CONTENTS

PAGE NO. | ||

PART I. | ||

Item 1. | Consolidated Financial Statements of American Campus Communities, Inc. and Subsidiaries: | |

Consolidated Balance Sheets as of June 30, 2018 (unaudited) and December 31, 2017 | ||

Consolidated Statements of Comprehensive Income for the three and six months ended June 30, 2018 and 2017 (all unaudited) | ||

Consolidated Statement of Changes in Equity for the six months ended June 30, 2018 (unaudited) | ||

Consolidated Statements of Cash Flows for the six months ended June 30, 2018 and 2017 (all unaudited) | ||

Consolidated Financial Statements of American Campus Communities Operating Partnership, L.P. and Subsidiaries: | ||

Consolidated Balance Sheets as of June 30, 2018 (unaudited) and December 31, 2017 | ||

Consolidated Statements of Comprehensive Income for the three and six months ended June 30, 2018 and 2017 (all unaudited) | ||

Consolidated Statement of Changes in Capital for the six months ended June 30, 2018 (unaudited) | ||

Consolidated Statements of Cash Flows for the six months ended June 30, 2018 and 2017 (all unaudited) | ||

Notes to Consolidated Financial Statements of American Campus Communities, Inc. and Subsidiaries and American Campus Communities Operating Partnership, L.P. and Subsidiaries (unaudited) | ||

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

Item 3. | Quantitative and Qualitative Disclosure about Market Risk | |

Item 4. | Controls and Procedures | |

PART II. | ||

Item 1. | Legal Proceedings | |

Item 1A. | Risk Factors | |

Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | |

Item 3. | Defaults Upon Senior Securities | |

Item 4. | Mine Safety Disclosures | |

Item 5. | Other Information | |

Item 6. | Exhibits | |

SIGNATURES | ||

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

June 30, 2018 | December 31, 2017 | |||||||

(Unaudited) | ||||||||

Assets | ||||||||

Investments in real estate: | ||||||||

Owned properties, net | $ | 6,432,739 | $ | 6,450,364 | ||||

On-campus participating properties, net | 79,433 | 81,804 | ||||||

Investments in real estate, net | 6,512,172 | 6,532,168 | ||||||

Cash and cash equivalents | 52,608 | 41,182 | ||||||

Restricted cash | 34,596 | 23,590 | ||||||

Student contracts receivable, net | 7,827 | 9,170 | ||||||

Other assets | 297,814 | 291,260 | ||||||

Total assets | $ | 6,905,017 | $ | 6,897,370 | ||||

Liabilities and equity | ||||||||

Liabilities: | ||||||||

Secured mortgage, construction and bond debt, net | $ | 990,216 | $ | 664,020 | ||||

Unsecured notes, net | 1,587,148 | 1,585,855 | ||||||

Unsecured term loans, net | 198,593 | 647,044 | ||||||

Unsecured revolving credit facility | 51,300 | 127,600 | ||||||

Accounts payable and accrued expenses | 66,430 | 53,741 | ||||||

Other liabilities | 195,886 | 187,983 | ||||||

Total liabilities | 3,089,573 | 3,266,243 | ||||||

Commitments and contingencies (Note 13) | ||||||||

Redeemable noncontrolling interests | 131,309 | 132,169 | ||||||

Equity: | ||||||||

American Campus Communities, Inc. and Subsidiaries stockholders’ equity: | ||||||||

Common stock, $0.01 par value, 800,000,000 shares authorized, 136,615,244 and 136,362,728 shares issued and outstanding at June 30, 2018 and December 31, 2017, respectively | 1,366 | 1,364 | ||||||

Additional paid in capital | 4,507,453 | 4,326,910 | ||||||

Common stock held in rabbi trust, 69,603 and 63,778 shares at June 30, 2018 and December 31, 2017, respectively | (3,092 | ) | (2,944 | ) | ||||

Accumulated earnings and dividends | (889,524 | ) | (837,644 | ) | ||||

Accumulated other comprehensive loss | (2,056 | ) | (2,701 | ) | ||||

Total American Campus Communities, Inc. and Subsidiaries stockholders’ equity | 3,614,147 | 3,484,985 | ||||||

Noncontrolling interests - partially owned properties | 69,988 | 13,973 | ||||||

Total equity | 3,684,135 | 3,498,958 | ||||||

Total liabilities and equity | $ | 6,905,017 | $ | 6,897,370 | ||||

Consolidated variable interest entities’ assets and debt included in the above balances: | ||||||||

Investments in real estate, net | $ | 952,334 | $ | 438,670 | ||||

Cash, cash equivalents and restricted cash | $ | 41,469 | $ | 12,812 | ||||

Other assets | $ | 6,120 | $ | 3,134 | ||||

Secured mortgage and construction debt, net | $ | 441,698 | $ | 50,993 | ||||

Accounts payable, accrued expenses and other liabilities | $ | 53,721 | $ | 25,200 | ||||

See accompanying notes to consolidated financial statements.

1

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(unaudited, in thousands, except share and per share data)

Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

2018 | 2017 | 2018 | 2017 | |||||||||||||

Revenues: | ||||||||||||||||

Owned properties | $ | 189,488 | $ | 169,156 | $ | 395,020 | $ | 347,987 | ||||||||

On-campus participating properties | 6,182 | 6,171 | 16,625 | 16,329 | ||||||||||||

Third-party development services | 2,202 | 675 | 3,048 | 1,131 | ||||||||||||

Third-party management services | 2,452 | 2,288 | 5,183 | 4,902 | ||||||||||||

Resident services | 735 | 718 | 1,592 | 1,597 | ||||||||||||

Total revenues | 201,059 | 179,008 | 421,468 | 371,946 | ||||||||||||

Operating expenses (income): | ||||||||||||||||

Owned properties | 86,136 | 75,172 | 174,196 | 150,129 | ||||||||||||

On-campus participating properties | 3,730 | 3,892 | 7,155 | 7,157 | ||||||||||||

Third-party development and management services | 3,544 | 3,827 | 7,742 | 7,910 | ||||||||||||

General and administrative | 13,173 | 9,782 | 19,872 | 16,516 | ||||||||||||

Depreciation and amortization | 63,537 | 55,943 | 128,316 | 108,266 | ||||||||||||

Ground/facility leases | 2,733 | 2,465 | 5,575 | 4,822 | ||||||||||||

Provision for real estate impairment | — | 15,317 | — | 15,317 | ||||||||||||

Other operating income | (2,648 | ) | — | (2,648 | ) | — | ||||||||||

Total operating expenses | 170,205 | 166,398 | 340,208 | 310,117 | ||||||||||||

Operating income | 30,854 | 12,610 | 81,260 | 61,829 | ||||||||||||

Nonoperating income (expenses): | ||||||||||||||||

Interest income | 1,243 | 1,232 | 2,466 | 2,464 | ||||||||||||

Interest expense | (23,338 | ) | (14,573 | ) | (47,022 | ) | (29,290 | ) | ||||||||

Amortization of deferred financing costs | (2,214 | ) | (1,023 | ) | (3,628 | ) | (2,051 | ) | ||||||||

Gain (loss) from disposition of real estate | 42,314 | (632 | ) | 42,314 | (632 | ) | ||||||||||

Loss from early extinguishment of debt | (784 | ) | — | (784 | ) | — | ||||||||||

Total nonoperating income (expenses) | 17,221 | (14,996 | ) | (6,654 | ) | (29,509 | ) | |||||||||

Income (loss) before income taxes | 48,075 | (2,386 | ) | 74,606 | 32,320 | |||||||||||

Income tax provision | (2,085 | ) | (267 | ) | (2,366 | ) | (524 | ) | ||||||||

Net income (loss) | 45,990 | (2,653 | ) | 72,240 | 31,796 | |||||||||||

Net loss (income) attributable to noncontrolling interests | 19 | (109 | ) | (304 | ) | (508 | ) | |||||||||

Net income (loss) attributable to ACC, Inc. and Subsidiaries common stockholders | $ | 46,009 | $ | (2,762 | ) | $ | 71,936 | $ | 31,288 | |||||||

Other comprehensive income | ||||||||||||||||

Change in fair value of interest rate swaps and other | 180 | 155 | 645 | 639 | ||||||||||||

Comprehensive income (loss) | $ | 46,189 | $ | (2,607 | ) | $ | 72,581 | $ | 31,927 | |||||||

Net income (loss) per share attributable to ACC, Inc. and Subsidiaries common stockholders | ||||||||||||||||

Basic and diluted | $ | 0.33 | $ | (0.02 | ) | $ | 0.52 | $ | 0.23 | |||||||

Weighted-average common shares outstanding | ||||||||||||||||

Basic | 136,677,255 | 134,614,418 | 136,599,816 | 133,837,748 | ||||||||||||

Diluted | 137,576,366 | 134,614,418 | 137,536,368 | 134,745,192 | ||||||||||||

Distributions declared per common share | $ | 0.46 | $ | 0.44 | $ | 0.90 | $ | 0.86 | ||||||||

See accompanying notes to consolidated financial statements.

2

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(unaudited, in thousands, except share data)

Common Shares | Par Value of Common Shares | Additional Paid in Capital | Common Shares Held in Rabbi Trust | Common Shares Held in Rabbi Trust at Cost | Accumulated Earnings and Dividends | Accumulated Other Comprehensive Loss | Noncontrolling Interests – Partially Owned Properties | Total | ||||||||||||||||||||||||||

Equity, December 31, 2017 | 136,362,728 | $ | 1,364 | $ | 4,326,910 | 63,778 | $ | (2,944 | ) | $ | (837,644 | ) | $ | (2,701 | ) | $ | 13,973 | $ | 3,498,958 | |||||||||||||||

Adjustments to reflect redeemable noncontrolling interests at fair value | — | — | 100 | — | — | — | — | — | 100 | |||||||||||||||||||||||||

Amortization of restricted stock awards and vesting of restricted stock units | 24,630 | — | 7,047 | — | — | — | — | — | 7,047 | |||||||||||||||||||||||||

Vesting of restricted stock awards | 165,263 | 1 | (2,758 | ) | — | — | — | (2,757 | ) | |||||||||||||||||||||||||

Distributions to common and restricted stockholders | — | — | — | — | — | (123,816 | ) | — | — | (123,816 | ) | |||||||||||||||||||||||

Contributions by noncontrolling interests - partially owned properties | — | — | — | — | — | — | — | 207,536 | 207,536 | |||||||||||||||||||||||||

Distributions to noncontrolling interests - partially owned properties | — | — | — | — | — | — | — | (151,271 | ) | (151,271 | ) | |||||||||||||||||||||||

Change in ownership of consolidated subsidiary | — | — | 175,529 | — | — | — | — | — | 175,529 | |||||||||||||||||||||||||

Conversion of common and preferred operating partnership units to common stock | 68,448 | 1 | 477 | — | — | — | — | — | 478 | |||||||||||||||||||||||||

Change in fair value of interest rate swaps and other | — | — | — | — | — | — | 645 | — | 645 | |||||||||||||||||||||||||

Deposits to deferred compensation plan, net of withdrawals | (5,825 | ) | — | 148 | 5,825 | (148 | ) | — | — | — | — | |||||||||||||||||||||||

Net income (loss) | — | — | — | — | — | 71,936 | — | (250 | ) | 71,686 | ||||||||||||||||||||||||

Equity, June 30, 2018 | 136,615,244 | $ | 1,366 | $ | 4,507,453 | 69,603 | $ | (3,092 | ) | $ | (889,524 | ) | $ | (2,056 | ) | $ | 69,988 | $ | 3,684,135 | |||||||||||||||

See accompanying notes to consolidated financial statements.

3

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in thousands)

Six Months Ended June 30, | ||||||||

2018 | 2017 | |||||||

Operating activities | ||||||||

Net income | $ | 72,240 | $ | 31,796 | ||||

Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

(Gain) loss from disposition of real estate | (42,314 | ) | 632 | |||||

Loss from early extinguishment of debt | 784 | — | ||||||

Provision for real estate impairment | — | 15,317 | ||||||

Depreciation and amortization | 128,316 | 108,266 | ||||||

Amortization of deferred financing costs and debt premiums/discounts | 979 | (1,806 | ) | |||||

Share-based compensation | 7,047 | 8,902 | ||||||

Income tax provision | 2,366 | 524 | ||||||

Amortization of interest rate swap terminations and other | 204 | 204 | ||||||

Changes in operating assets and liabilities: | ||||||||

Student contracts receivable, net | 886 | 1,239 | ||||||

Other assets | (5,703 | ) | (13,814 | ) | ||||

Accounts payable and accrued expenses | 10,060 | (16,020 | ) | |||||

Other liabilities | (5,407 | ) | (4,413 | ) | ||||

Net cash provided by operating activities | 169,458 | 130,827 | ||||||

Investing activities | ||||||||

Proceeds from disposition of properties | 242,284 | 24,462 | ||||||

Cash paid for acquisition of operating and under development properties | — | (157,967 | ) | |||||

Cash paid for land acquisitions | — | (16,955 | ) | |||||

Capital expenditures for owned properties | (29,822 | ) | (36,026 | ) | ||||

Investments in owned properties under development | (253,333 | ) | (240,702 | ) | ||||

Capital expenditures for on-campus participating properties | (1,524 | ) | (870 | ) | ||||

Purchase of corporate furniture, fixtures and equipment | (2,007 | ) | (3,562 | ) | ||||

Net cash used in investing activities | (44,402 | ) | (431,620 | ) | ||||

Financing activities | ||||||||

Proceeds from sale of common stock | — | 189,757 | ||||||

Offering costs | — | (2,354 | ) | |||||

Pay-off of mortgage and construction loans | (55,892 | ) | — | |||||

Defeasance costs related to early extinguishment of debt | (2,726 | ) | — | |||||

Pay-off of unsecured term loans | (450,000 | ) | — | |||||

Proceeds from unsecured term loan | — | 200,000 | ||||||

Proceeds from revolving credit facility | 458,300 | 478,600 | ||||||

Paydowns of revolving credit facility | (534,600 | ) | (435,614 | ) | ||||

Proceeds from construction loans | 61,550 | 1,037 | ||||||

Proceeds from mortgage loans | 330,000 | — | ||||||

Scheduled principal payments on debt | (4,256 | ) | (4,915 | ) | ||||

Debt issuance and assumption costs | (656 | ) | (5,840 | ) | ||||

Contributions by noncontrolling interests | 374,405 | 8,158 | ||||||

Taxes paid on net-share settlements | (2,757 | ) | (4,283 | ) | ||||

Distributions to common and restricted stockholders | (123,816 | ) | (115,811 | ) | ||||

Distributions to noncontrolling interests | (152,176 | ) | (1,104 | ) | ||||

Net cash (used in) provided by financing activities | (102,624 | ) | 307,631 | |||||

Net change in cash, cash equivalents, and restricted cash | 22,432 | 6,838 | ||||||

Cash, cash equivalents, and restricted cash at beginning of period | 64,772 | 46,957 | ||||||

Cash, cash equivalents, and restricted cash at end of period | $ | 87,204 | $ | 53,795 | ||||

Reconciliation of cash, cash equivalents, and restricted cash to the consolidated balance sheets | ||||||||

Cash and cash equivalents | $ | 52,608 | $ | 25,476 | ||||

Restricted cash | 34,596 | 28,319 | ||||||

Total cash, cash equivalents, and restricted cash at end of period | $ | 87,204 | $ | 53,795 | ||||

See accompanying notes to consolidated financial statements.

4

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in thousands)

Six Months Ended June 30, | ||||||||

2018 | 2017 | |||||||

Supplemental disclosure of non-cash investing and financing activities | ||||||||

Conversion of common and preferred operating partnership units to common stock | $ | 478 | $ | — | ||||

Non-cash contribution from noncontrolling interest | $ | 8,729 | $ | 3,000 | ||||

Non-cash consideration exchanged in purchase of land parcel | $ | — | $ | (3,071 | ) | |||

Change in accrued construction in progress | $ | 15,174 | $ | 25,214 | ||||

Change in fair value of derivative instruments, net | $ | 441 | $ | 435 | ||||

Change in fair value of redeemable noncontrolling interests | $ | 100 | $ | 2,092 | ||||

Change in ownership of consolidated subsidiary | $ | (175,529 | ) | $ | — | |||

Supplemental disclosure of cash flow information | ||||||||

Cash paid for interest, net of amounts capitalized | $ | 49,728 | $ | 32,925 | ||||

See accompanying notes to consolidated financial statements.

5

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands, except unit data)

June 30, 2018 | December 31, 2017 | |||||||

(Unaudited) | ||||||||

Assets | ||||||||

Investments in real estate: | ||||||||

Owned properties, net | $ | 6,432,739 | $ | 6,450,364 | ||||

On-campus participating properties, net | 79,433 | 81,804 | ||||||

Investments in real estate, net | 6,512,172 | 6,532,168 | ||||||

Cash and cash equivalents | 52,608 | 41,182 | ||||||

Restricted cash | 34,596 | 23,590 | ||||||

Student contracts receivable, net | 7,827 | 9,170 | ||||||

Other assets | 297,814 | 291,260 | ||||||

Total assets | $ | 6,905,017 | $ | 6,897,370 | ||||

Liabilities and capital | ||||||||

Liabilities: | ||||||||

Secured mortgage, construction and bond debt, net | $ | 990,216 | $ | 664,020 | ||||

Unsecured notes, net | 1,587,148 | 1,585,855 | ||||||

Unsecured term loans, net | 198,593 | 647,044 | ||||||

Unsecured revolving credit facility | 51,300 | 127,600 | ||||||

Accounts payable and accrued expenses | 66,430 | 53,741 | ||||||

Other liabilities | 195,886 | 187,983 | ||||||

Total liabilities | 3,089,573 | 3,266,243 | ||||||

Commitments and contingencies (Note 13) | ||||||||

Redeemable limited partners | 131,309 | 132,169 | ||||||

Capital: | ||||||||

Partners’ capital: | ||||||||

General partner - 12,222 OP units outstanding at both June 30, 2018 and December 31, 2017 | 62 | 67 | ||||||

Limited partner - 136,672,625 and 136,414,284 OP units outstanding at June 30, 2018 and December 31, 2017, respectively | 3,616,141 | 3,487,619 | ||||||

Accumulated other comprehensive loss | (2,056 | ) | (2,701 | ) | ||||

Total partners’ capital | 3,614,147 | 3,484,985 | ||||||

Noncontrolling interests - partially owned properties | 69,988 | 13,973 | ||||||

Total capital | 3,684,135 | 3,498,958 | ||||||

Total liabilities and capital | $ | 6,905,017 | $ | 6,897,370 | ||||

Consolidated variable interest entities’ assets and debt included in the above balances: | ||||||||

Investments in real estate, net | $ | 952,334 | $ | 438,670 | ||||

Cash, cash equivalents and restricted cash | $ | 41,469 | $ | 12,812 | ||||

Other assets | $ | 6,120 | $ | 3,134 | ||||

Secured mortgage and construction debt, net | $ | 441,698 | $ | 50,993 | ||||

Accounts payable, accrued expenses and other liabilities | $ | 53,721 | $ | 25,200 | ||||

See accompanying notes to consolidated financial statements.

6

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(unaudited, in thousands, except unit and per unit data)

Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

2018 | 2017 | 2018 | 2017 | |||||||||||||

Revenues: | ||||||||||||||||

Owned properties | $ | 189,488 | $ | 169,156 | $ | 395,020 | $ | 347,987 | ||||||||

On-campus participating properties | 6,182 | 6,171 | 16,625 | 16,329 | ||||||||||||

Third-party development services | 2,202 | 675 | 3,048 | 1,131 | ||||||||||||

Third-party management services | 2,452 | 2,288 | 5,183 | 4,902 | ||||||||||||

Resident services | 735 | 718 | 1,592 | 1,597 | ||||||||||||

Total revenues | 201,059 | 179,008 | 421,468 | 371,946 | ||||||||||||

Operating expenses (income): | ||||||||||||||||

Owned properties | 86,136 | 75,172 | 174,196 | 150,129 | ||||||||||||

On-campus participating properties | 3,730 | 3,892 | 7,155 | 7,157 | ||||||||||||

Third-party development and management services | 3,544 | 3,827 | 7,742 | 7,910 | ||||||||||||

General and administrative | 13,173 | 9,782 | 19,872 | 16,516 | ||||||||||||

Depreciation and amortization | 63,537 | 55,943 | 128,316 | 108,266 | ||||||||||||

Ground/facility leases | 2,733 | 2,465 | 5,575 | 4,822 | ||||||||||||

Provision for real estate impairment | — | 15,317 | — | 15,317 | ||||||||||||

Other operating income | (2,648 | ) | — | (2,648 | ) | — | ||||||||||

Total operating expenses | 170,205 | 166,398 | 340,208 | 310,117 | ||||||||||||

Operating income | 30,854 | 12,610 | 81,260 | 61,829 | ||||||||||||

Nonoperating income (expenses): | ||||||||||||||||

Interest income | 1,243 | 1,232 | 2,466 | 2,464 | ||||||||||||

Interest expense | (23,338 | ) | (14,573 | ) | (47,022 | ) | (29,290 | ) | ||||||||

Amortization of deferred financing costs | (2,214 | ) | (1,023 | ) | (3,628 | ) | (2,051 | ) | ||||||||

Gain (loss) from disposition of real estate | 42,314 | (632 | ) | 42,314 | (632 | ) | ||||||||||

Loss from early extinguishment of debt | (784 | ) | — | (784 | ) | — | ||||||||||

Total nonoperating income (expenses) | 17,221 | (14,996 | ) | (6,654 | ) | (29,509 | ) | |||||||||

Income (loss) before income taxes | 48,075 | (2,386 | ) | 74,606 | 32,320 | |||||||||||

Income tax provision | (2,085 | ) | (267 | ) | (2,366 | ) | (524 | ) | ||||||||

Net income (loss) | 45,990 | (2,653 | ) | 72,240 | 31,796 | |||||||||||

Net loss (income) attributable to noncontrolling interests – partially owned properties | 366 | (97 | ) | 252 | (202 | ) | ||||||||||

Net income (loss) attributable to American Campus Communities Operating Partnership, L.P. | 46,356 | (2,750 | ) | 72,492 | 31,594 | |||||||||||

Series A preferred unit distributions | (31 | ) | (31 | ) | (62 | ) | (62 | ) | ||||||||

Net income (loss) attributable to common unitholders | $ | 46,325 | $ | (2,781 | ) | $ | 72,430 | $ | 31,532 | |||||||

Other comprehensive income | ||||||||||||||||

Change in fair value of interest rate swaps and other | 180 | 155 | 645 | 639 | ||||||||||||

Comprehensive income (loss) | $ | 46,505 | $ | (2,626 | ) | $ | 73,075 | $ | 32,171 | |||||||

Net income (loss) per unit attributable to common unitholders | ||||||||||||||||

Basic and diluted | $ | 0.33 | $ | (0.02 | ) | $ | 0.52 | $ | 0.23 | |||||||

Weighted-average common units outstanding | ||||||||||||||||

Basic | 137,615,938 | 135,643,549 | 137,547,575 | 134,866,879 | ||||||||||||

Diluted | 138,515,049 | 135,643,549 | 138,484,127 | 135,774,323 | ||||||||||||

Distributions declared per Common Unit | $ | 0.46 | $ | 0.44 | $ | 0.90 | $ | 0.86 | ||||||||

See accompanying notes to consolidated financial statements.

7

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CHANGES IN CAPITAL

(unaudited, in thousands, except unit data)

Accumulated | Noncontrolling | |||||||||||||||||||||||||

Other | Interests - | |||||||||||||||||||||||||

General Partner | Limited Partner | Comprehensive | Partially Owned | |||||||||||||||||||||||

Units | Amount | Units | Amount | Loss | Properties | Total | ||||||||||||||||||||

Capital, December 31, 2017 | 12,222 | $ | 67 | 136,414,284 | $ | 3,487,619 | $ | (2,701 | ) | $ | 13,973 | $ | 3,498,958 | |||||||||||||

Adjustments to reflect redeemable limited partners’ interest at fair value | — | — | — | 100 | — | — | 100 | |||||||||||||||||||

Amortization of restricted stock awards and vesting of restricted stock units | — | — | 24,630 | 7,047 | — | — | 7,047 | |||||||||||||||||||

Vesting of restricted stock awards | — | — | 165,263 | (2,757 | ) | — | — | (2,757 | ) | |||||||||||||||||

Distributions | — | (11 | ) | — | (123,805 | ) | — | — | (123,816 | ) | ||||||||||||||||

Contributions by noncontrolling interests - partially owned properties | — | — | — | — | — | 207,536 | 207,536 | |||||||||||||||||||

Distributions to noncontrolling interests - partially owned properties | — | — | — | — | — | (151,271 | ) | (151,271 | ) | |||||||||||||||||

Change in ownership of consolidated subsidiary | — | — | — | 175,529 | — | — | 175,529 | |||||||||||||||||||

Conversion of common and preferred operating partnership units to common stock | — | — | 68,448 | 478 | — | — | 478 | |||||||||||||||||||

Change in fair value of interest rate swaps and other | — | — | — | — | 645 | — | 645 | |||||||||||||||||||

Net income (loss) | — | 6 | — | 71,930 | — | (250 | ) | 71,686 | ||||||||||||||||||

Capital, June 30, 2018 | 12,222 | $ | 62 | 136,672,625 | $ | 3,616,141 | $ | (2,056 | ) | $ | 69,988 | $ | 3,684,135 | |||||||||||||

See accompanying notes to consolidated financial statements.

8

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in thousands)

Six Months Ended June 30, | ||||||||

2018 | 2017 | |||||||

Operating activities | ||||||||

Net income | $ | 72,240 | $ | 31,796 | ||||

Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

(Gain) loss from disposition of real estate | (42,314 | ) | 632 | |||||

Loss from early extinguishment of debt | 784 | — | ||||||

Provision for real estate impairment | — | 15,317 | ||||||

Depreciation and amortization | 128,316 | 108,266 | ||||||

Amortization of deferred financing costs and debt premiums/discounts | 979 | (1,806 | ) | |||||

Share-based compensation | 7,047 | 8,902 | ||||||

Income tax provision | 2,366 | 524 | ||||||

Amortization of interest rate swap terminations and other | 204 | 204 | ||||||

Changes in operating assets and liabilities: | ||||||||

Student contracts receivable, net | 886 | 1,239 | ||||||

Other assets | (5,703 | ) | (13,814 | ) | ||||

Accounts payable and accrued expenses | 10,060 | (16,020 | ) | |||||

Other liabilities | (5,407 | ) | (4,413 | ) | ||||

Net cash provided by operating activities | 169,458 | 130,827 | ||||||

Investing activities | ||||||||

Proceeds from disposition of properties | 242,284 | 24,462 | ||||||

Cash paid for acquisition of operating and under development properties | — | (157,967 | ) | |||||

Cash paid for land acquisitions | — | (16,955 | ) | |||||

Capital expenditures for owned properties | (29,822 | ) | (36,026 | ) | ||||

Investments in owned properties under development | (253,333 | ) | (240,702 | ) | ||||

Capital expenditures for on-campus participating properties | (1,524 | ) | (870 | ) | ||||

Purchase of corporate furniture, fixtures and equipment | (2,007 | ) | (3,562 | ) | ||||

Net cash used in investing activities | (44,402 | ) | (431,620 | ) | ||||

Financing activities | ||||||||

Proceeds from issuance of common units in exchange for contributions, net | — | 187,403 | ||||||

Pay-off of mortgage and construction loans | (55,892 | ) | — | |||||

Defeasance costs related to early extinguishment of debt | (2,726 | ) | — | |||||

Pay-off of unsecured term loans | (450,000 | ) | — | |||||

Proceeds from unsecured term loan | — | 200,000 | ||||||

Proceeds from revolving credit facility | 458,300 | 478,600 | ||||||

Paydowns of revolving credit facility | (534,600 | ) | (435,614 | ) | ||||

Proceeds from construction loans | 61,550 | 1,037 | ||||||

Proceeds from mortgage loans | 330,000 | — | ||||||

Scheduled principal payments on debt | (4,256 | ) | (4,915 | ) | ||||

Debt issuance and assumption costs | (656 | ) | (5,840 | ) | ||||

Contributions by noncontrolling interests | 374,405 | 8,158 | ||||||

Taxes paid on net-share settlements | (2,757 | ) | (4,283 | ) | ||||

Distributions paid to common and preferred unitholders | (123,838 | ) | (115,902 | ) | ||||

Distributions paid on unvested restricted stock awards | (883 | ) | (857 | ) | ||||

Distributions paid to noncontrolling interests - partially owned properties | (151,271 | ) | (156 | ) | ||||

Net cash (used in) provided by financing activities | (102,624 | ) | 307,631 | |||||

Net change in cash, cash equivalents, and restricted cash | 22,432 | 6,838 | ||||||

Cash, cash equivalents, and restricted cash at beginning of period | 64,772 | 46,957 | ||||||

Cash, cash equivalents, and restricted cash at end of period | $ | 87,204 | $ | 53,795 | ||||

Reconciliation of cash, cash equivalents, and restricted cash to the consolidated balance sheets | ||||||||

Cash and cash equivalents | $ | 52,608 | $ | 25,476 | ||||

Restricted cash | 34,596 | 28,319 | ||||||

Total cash, cash equivalents, and restricted cash at end of period | $ | 87,204 | $ | 53,795 | ||||

See accompanying notes to consolidated financial statements.

9

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in thousands)

Six Months Ended June 30, | ||||||||

2018 | 2017 | |||||||

Supplemental disclosure of non-cash investing and financing activities | ||||||||

Conversion of common and preferred operating partnership units to common stock | $ | 478 | $ | — | ||||

Non-cash contribution from noncontrolling interest | $ | 8,729 | $ | 3,000 | ||||

Non-cash consideration exchanged in purchase of land parcel | $ | — | $ | (3,071 | ) | |||

Change in accrued construction in progress | $ | 15,174 | $ | 25,214 | ||||

Change in fair value of derivative instruments, net | $ | 441 | $ | 435 | ||||

Change in fair value of redeemable noncontrolling interests | $ | 100 | $ | 2,092 | ||||

Change in ownership of consolidated subsidiary | $ | (175,529 | ) | $ | — | |||

Supplemental disclosure of cash flow information | ||||||||

Cash paid for interest, net of amounts capitalized | $ | 49,728 | $ | 32,925 | ||||

See accompanying notes to consolidated financial statements.

10

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

1. Organization and Description of Business

American Campus Communities, Inc. (“ACC”) is a real estate investment trust (“REIT”) that commenced operations effective with the completion of an initial public offering (“IPO”) on August 17, 2004. Through ACC’s controlling interest in American Campus Communities Operating Partnership, L.P. (“ACCOP”), ACC is one of the largest owners, managers and developers of high quality student housing properties in the United States in terms of beds owned and under management. ACC is a fully integrated, self-managed and self-administered equity REIT with expertise in the acquisition, design, financing, development, construction management, leasing and management of student housing properties. ACC’s common stock is publicly traded on the New York Stock Exchange (“NYSE”) under the ticker symbol “ACC.”

The general partner of ACCOP is American Campus Communities Holdings, LLC (“ACC Holdings”), an entity that is wholly-owned by ACC. As of June 30, 2018, ACC Holdings held an ownership interest in ACCOP of less than 1%. The limited partners of ACCOP are ACC and other limited partners consisting of current and former members of management and nonaffiliated third parties. As of June 30, 2018, ACC owned an approximate 99.3% limited partnership interest in ACCOP. As the sole member of the general partner of ACCOP, ACC has exclusive control of ACCOP’s day-to-day management. Management operates ACC and ACCOP as one business. The management of ACC consists of the same members as the management of ACCOP. ACC consolidates ACCOP for financial reporting purposes, and ACC does not have significant assets other than its investment in ACCOP. Therefore, the assets and liabilities of ACC and ACCOP are the same on their respective financial statements. References to the “Company” means collectively ACC, ACCOP and those entities/subsidiaries owned or controlled by ACC and/or ACCOP. References to the “Operating Partnership” mean collectively ACCOP and those entities/subsidiaries owned or controlled by ACCOP. Unless otherwise indicated, the accompanying Notes to the Consolidated Financial Statements apply to both the Company and the Operating Partnership.

As of June 30, 2018, the Company’s property portfolio contained 168 properties with approximately 103,500 beds. The Company’s property portfolio consisted of 131 owned off-campus student housing properties that are in close proximity to colleges and universities, 32 American Campus Equity (“ACE®”) properties operated under ground/facility leases with 15 university systems and five on-campus participating properties operated under ground/facility leases with the related university systems. Of the 168 properties, 15 were under development as of June 30, 2018, and when completed will consist of a total of approximately 10,100 beds. The Company’s communities contain modern housing units and are supported by a resident assistant system and other student-oriented programming, with many offering resort-style amenities.

Through one of ACC’s taxable REIT subsidiaries (“TRSs”), the Company also provides construction management and development services, primarily for student housing properties owned by colleges and universities, charitable foundations, and others. As of June 30, 2018, also through one of ACC’s TRSs, the Company provided third-party management and leasing services for 34 properties that represented approximately 28,400 beds. Third-party management and leasing services are typically provided pursuant to management contracts that have initial terms that range from one to five years. As of June 30, 2018, the Company’s total owned and third-party managed portfolio included 202 properties with approximately 131,900 beds.

2. Summary of Significant Accounting Policies

Basis of Presentation and use of Estimates

The accompanying consolidated financial statements, presented in U.S. dollars, are prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). GAAP requires the Company to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities as of the date of the financial statements, and revenue and expenses during the reporting periods. The Company’s actual results could differ from those estimates and assumptions. All material intercompany transactions among consolidated entities have been eliminated. All dollar amounts in the tables herein, except share, per share, unit and per unit amounts, are stated in thousands unless otherwise indicated.

11

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Principles of Consolidation

The Company’s consolidated financial statements include its accounts and the accounts of other subsidiaries and joint ventures (including partnerships and limited liability companies) over which it has control. Investments acquired or created are evaluated based on the accounting guidance relating to variable interest entities (“VIEs”), which requires the consolidation of VIEs in which the Company is considered to be the primary beneficiary. If the investment is determined not to be a VIE, then the investment is evaluated for consolidation using the voting interest model.

Recently Issued Accounting Pronouncements

In February 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update 2016-02 (“ASU 2016-02”), “Leases (Topic 842): Amendments to the FASB Accounting Standards Codification.” ASU 2016-02 amends the existing accounting standards for lease accounting, including requiring lessees to recognize most leases on their balance sheets and making targeted changes to lessor accounting. The new standard requires a modified retrospective transition approach for all leases existing at, or entered into after, the date of initial application, with an option to use certain transition relief. The guidance is effective for public business entities for fiscal years beginning after December 15, 2018 and interim periods within those fiscal years. Early adoption is permitted. Subsequent to the issuance of ASU 2016-02, the FASB issued an additional Accounting Standards Update clarifying aspects of the new lease accounting standard, which will be effective upon adoption of ASU 2016-02. The Company plans to adopt ASU 2016-02 as of January 1, 2019. While the Company is still evaluating the effect that the updated standard will have on its consolidated financial statements and related disclosures, it expects to recognize right-of-use assets and related lease liabilities on its consolidated balance sheets related to ground leases under which it is the lessee.

In addition, the Company does not expect the following accounting pronouncements to have a material effect on its consolidated financial statements:

Accounting Standards Update | Effective Date | |

ASU 2018-02, “Income Statement - Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income.” | January 1, 2019 | |

ASU 2017-12, “Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities” | January 1, 2019 | |

ASU 2016-13, “Financial Instruments-Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments” | January 1, 2020 | |

Recently Adopted Accounting Pronouncements

Accounting Standards Update 2016-18 (“ASU 2016-18”), “Statement of Cash Flows: Restricted Cash”

On January 1, 2018, the Company adopted ASU 2016-18. The amendments in this update require the change in restricted cash to be reported with cash and cash equivalents when reconciling between beginning and ending amounts in the statements of cash flows. The Company applied the amendments retrospectively to each period presented in the consolidated statements of cash flows of the Company.

Prior to the adoption of ASU 2016-18, the Company reported the change in restricted cash within operating, investing, and financing activities in its consolidated statement of cash flows. As a result of the Company’s adoption of this standard and the retrospective application, cash and cash equivalents in the consolidated statements of cash flows as of June 30, 2017 increased by approximately $28.3 million to reflect the inclusion of the restricted cash balance at the end of the period, net cash provided by operating activities for the six months ended June 30, 2017 increased by approximately $2.2 million, net cash used in investing activities increased by approximately $0.3 million, and net cash provided by financing activities increased by approximately $1.6 million.

Accounting Standards Update 2014-09 (“ASU 2014-09”), “Revenue From Contracts With Customers (Topic 606)”

On January 1, 2018, the Company adopted ASU 2014-09 and all related clarifying Accounting Standards Updates associated with ASU 2014-09. ASU 2014-09 provides a single comprehensive revenue recognition model for contracts with customers (excluding certain contracts, such as lease contracts) to improve comparability within industries. ASU 2014-09 requires an entity to recognize revenue to reflect the transfer of goods or services to customers at an amount the entity expects to be paid in exchange for those

12

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

goods and services and provide enhanced disclosures, all to provide more comprehensive guidance for transactions such as service revenue and contract modifications.

The Company adopted the new revenue standard using the modified retrospective approach, and elected to apply the practical expedient to only assess the recognition of revenue for open contracts during the transition period. The effect of adoption did not have a material impact on the Company’s consolidated financial statements and there was no adjustment to the opening balance of retained earnings at January 1, 2018. The comparative information has not been restated and continues to be reported under the accounting standards in effect for that period.

Under the new standard there was a change in the way the Company determines the unit of account for its third-party development projects. Under the previous guidance, the Company segmented revenue recognition between the development and construction phases of its contracts, recognizing each using the proportional performance method and the percentage of completion method, respectively. Under the new guidance, the entire development and construction contract represents a single performance obligation comprised of a series of distinct services to be satisfied over time, and a single transaction price to be recognized over the life of the contract using a time-based measure of progress. Any variable consideration included in the transaction price is estimated using the expected value approach and is only included to the extent that a significant revenue reversal is not likely to occur. The adoption of ASU 2014-09 resulted in differences in the timing and pattern of revenue recognition for such third-party development and construction management contracts; however, the change did not have a material impact on the Company’s consolidated financial statements. Third-party management services revenues consist of base fees earned as a result of managing all aspects of the property’s day-to-day operations, and incentive fees based on the managed property’s operating measures. There was no change in the Company’s recognition of base management fees. Incentive management fees were previously recognized when the incentive criteria had been met. Under the new guidance, incentive fees are estimated using the expected value approach and are included in the transaction price only to the extent that a significant revenue reversal is not likely to occur; however, the change did not have a material impact on the Company’s consolidated financial statements. There was no change to the Company’s revenue recognition methods for ancillary services and other non-lease related revenues as a result of the adoption of ASU 2014-09.

Rental income from leasing arrangements is specifically excluded from ASU 2014-09, and is being evaluated as part of the adoption of the lease accounting standard, ASU 2016-02, discussed above.

Accounting Standards Update 2017-05 (“ASU 2017-05”), “Other Income-Gains and Losses from the Derecognition of Nonfinancial Assets (Subtopic 610-20): Clarifying the Scope of Asset Derecognition Guidance and Accounting for Partial Sales of Nonfinancial Assets”

On January 1, 2018, in conjunction with the adoption of ASU 2014-09, discussed above, the Company adopted ASU 2017-05. The purpose of this ASU is to eliminate the diversity in practice in accounting for derecognition of a nonfinancial asset and in-substance nonfinancial assets (only when the asset or asset group does not meet the definition of a business or the transaction is not a sale to a customer). The adoption of ASU 2017-05 did not have a material impact on the consolidated financial statements given the simplicity of the Company’s historical disposition transactions.

Other

In addition, on January 1, 2018, the Company adopted the following accounting pronouncements which did not have a material effect on the Company’s consolidated financial statements:

• | ASU 2017-09, “Compensation—Stock Compensation (Topic 718): Scope of Modification Accounting” |

• | ASU 2016-15, “Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments.” |

Interim Financial Statements

The accompanying interim financial statements are unaudited, but have been prepared in accordance with GAAP for interim financial information and in conjunction with the rules and regulations of the Securities and Exchange Commission. Accordingly, they do not include all disclosures required by GAAP for complete financial statements. In the opinion of management, all adjustments (consisting solely of normal recurring matters) necessary for a fair presentation of the financial statements of the Company for these interim periods have been included. Because of the seasonal nature of the Company’s operations, the results of operations and cash flows for any interim period are not necessarily indicative of results for other interim periods or for the full year. These financial statements should be read in conjunction with the financial statements and the notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017.

13

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Investments in Real Estate

Investments in real estate are recorded at historical cost. Major improvements that extend the life of an asset are capitalized and depreciated over the remaining useful life of the asset. The cost of ordinary repairs and maintenance are charged to expense when incurred. Depreciation and amortization are recorded on a straight-line basis over the estimated useful lives of the assets as follows:

Buildings and improvements | 7-40 years | |

Leasehold interest - on-campus participating properties | 25-34 years (shorter of useful life or respective lease term) | |

Furniture, fixtures and equipment | 3-7 years | |

Project costs directly associated with the development and construction of an owned real estate project, which include interest, property taxes, and amortization of deferred financing costs, are capitalized as construction in progress. Upon completion of the project, costs are transferred into the applicable asset category and depreciation commences. Interest totaling approximately $4.0 million and $5.7 million was capitalized during the three months ended June 30, 2018 and 2017, respectively, and interest totaling approximately $7.0 million and $10.1 million was capitalized during the six months ended June 30, 2018 and 2017, respectively.

Management assesses whether there has been an impairment in the value of the Company’s investments in real estate whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Impairment is recognized when estimated expected future undiscounted cash flows are less than the carrying value of the property, or when a property meets the criteria to be classified as held for sale, at which time an impairment charge is recognized for any excess of the carrying value of the property over the expected net proceeds from the disposal. The estimation of expected future net cash flows is inherently uncertain and relies on assumptions regarding current and future economics and market conditions. If such conditions change, then an adjustment to the carrying value of the Company’s long-lived assets could occur in the future period in which the conditions change. To the extent that a property is impaired, the excess of the carrying amount of the property over its estimated fair value is charged to earnings. The Company believes that there were no impairments of the carrying values of its investments in real estate as of June 30, 2018.

The Company evaluates each acquisition to determine if the integrated set of assets and activities acquired meet the definition of a business. If either of the following criteria is met, the integrated set of assets and activities acquired would not qualify as a business:

• | Substantially all of the fair value of the gross assets acquired is concentrated in either a single identifiable asset or a group of similar identifiable assets; or |

• | The integrated set of assets and activities is lacking, at a minimum, an input and a substantive process that together significantly contribute to the ability to create outputs (i.e. revenue generated before and after the transaction). |

Property acquisitions deemed to qualify as a business are accounted for as business combinations, and the related acquisition costs are expensed as incurred. The Company allocates the purchase price of properties acquired in business combinations to net tangible and identified intangible assets based on their fair values. Fair value estimates are based on information obtained from a number of sources, including independent appraisals that may be obtained in connection with the acquisition or financing of the respective property, the Company’s own analysis of recently acquired and existing comparable properties in the Company’s portfolio, and other market data. Information obtained about each property, as a result of due diligence, marketing, and leasing activities, is also considered. The value allocated to land is generally based on the actual purchase price if acquired separately, or market research/comparables if acquired as part of an existing operating property. The value allocated to building is based on the fair value determined on an “as-if vacant” basis, which is estimated using a replacement cost approach that relies upon assumptions that the Company believes are consistent with current market conditions for similar properties. The value allocated to furniture, fixtures, and equipment is based on an estimate of the fair value of the appliances and fixtures inside the units. The Company has determined these estimates are primarily based upon unobservable inputs and therefore are considered to be Level 3 inputs within the fair value hierarchy.

14

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Acquisitions of properties that do not meet the definition of a business are accounted for as asset acquisitions. The accounting model for asset acquisitions is similar to the accounting model for business combinations except that the acquisition consideration (including transaction costs) is allocated to the individual assets acquired and liabilities assumed on a relative fair value basis. The relative fair values used to allocate the cost of an asset acquisition are determined using the same methodologies and assumptions as those utilized to determine fair value in a business combination.

Long-Lived Assets–Held for Sale

Long-lived assets to be disposed of are classified as held for sale in the period in which all of the following criteria are met:

a. | Management, having the authority to approve the action, commits to a plan to sell the asset. |

b. | The asset is available for immediate sale in its present condition subject only to terms that are usual and customary for sales of such assets. |

c. | An active program to locate a buyer and other actions required to complete the plan to sell the asset have been initiated. |

d. | The sale of the asset is probable, and transfer of the asset is expected to qualify for recognition as a completed sale, within one year. |

e. | The asset is being actively marketed for sale at a price that is reasonable in relation to its current fair value. |

f. | Actions required to complete the plan indicate that it is unlikely that significant changes to the plan will be made or that the plan will be withdrawn. |

Concurrent with this classification, the asset is recorded at the lower of cost or fair value less estimated selling costs, and depreciation ceases. The Company did not have any properties classified as held for sale as of June 30, 2018.

Restricted Cash

Restricted cash consists of funds held in trust and invested in low risk investments, generally consisting of government backed securities, as permitted by the indentures of trusts, which were established in connection with three bond issues for the Company’s on-campus participating properties. Additionally, restricted cash includes escrow accounts held by lenders and resident security deposits, as required by law in certain states. Restricted cash also consists of escrow deposits made in connection with potential property acquisitions and development opportunities. These escrow deposits are invested in interest-bearing accounts at federally-insured banks. Realized and unrealized gains and losses are not material for the periods presented.

Consolidated VIEs

The Company has investments in various entities that qualify as VIEs for accounting purposes and for which the Company is the primary beneficiary and therefore includes the entities in its consolidated financial statements. These VIEs include the Operating Partnership, six joint ventures that own a total of 12 operating properties and three in-process development properties, three properties subject to presale arrangements, and five properties owned under the on-campus participating property structure.

Third-Party Development Services Costs

Pre-development expenditures such as architectural fees, permits, and deposits associated with the pursuit of third-party and owned development projects are expensed as incurred, until such time that management believes it is probable that the contract will be executed and/or construction will commence, at which time the Company capitalizes the costs. Because the Company frequently incurs these pre-development expenditures before a financing commitment and/or required permits and authorizations have been obtained, the Company bears the risk of loss of these pre-development expenditures if financing cannot ultimately be arranged on acceptable terms or the Company is unable to successfully obtain the required permits and authorizations. As such, management evaluates the status of third-party and owned projects that have not yet commenced construction on a periodic basis and expenses any deferred costs related to projects whose current status indicates the commencement of construction is unlikely and/or the costs may not provide future value to the Company in the form of revenues. Such write-offs are included in third-party development and management services expenses (in the case of third-party development projects) or general and administrative expenses (in

15

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

the case of owned development projects) on the accompanying consolidated statements of comprehensive income. As of June 30, 2018, the Company has deferred approximately $8.9 million in pre-development costs related to third-party and owned development projects that have not yet commenced construction. Such costs are included in other assets on the accompanying consolidated balance sheets.

Earnings per Share – Company

Basic earnings per share is computed using net income attributable to common stockholders and the weighted average number of shares of the Company’s common stock outstanding during the period. Diluted earnings per share reflects common shares issuable from the assumed conversion of American Campus Communities Operating Partnership Units (“OP Units”) and common share awards granted. Only those items having a dilutive impact on basic earnings per share are included in diluted earnings per share.

The following potentially dilutive securities were outstanding for the three and six months ended June 30, 2018 and 2017, but were not included in the computation of diluted earnings per share because the effects of their inclusion would be anti-dilutive.

Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||

2018 | 2017 | 2018 | 2017 | |||||||||

Common OP Units (Note 9) | 938,683 | 1,029,131 | 947,759 | 1,029,131 | ||||||||

Preferred OP Units (Note 9) | 77,513 | 77,513 | 77,513 | 77,513 | ||||||||

Unvested restricted stock awards (Note10) | — | 881,306 | — | — | ||||||||

Total potentially dilutive securities | 1,016,196 | 1,987,950 | 1,025,272 | 1,106,644 | ||||||||

The following is a summary of the elements used in calculating basic and diluted earnings per share:

Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

2018 | 2017 | 2018 | 2017 | |||||||||||||

Numerator – basic and diluted earnings per share: | ||||||||||||||||

Net income (loss) | $ | 45,990 | $ | (2,653 | ) | $ | 72,240 | $ | 31,796 | |||||||

Net loss (income) attributable to noncontrolling interests | 19 | (109 | ) | (304 | ) | (508 | ) | |||||||||

Net income (loss) attributable to common stockholders | 46,009 | (2,762 | ) | 71,936 | 31,288 | |||||||||||

Amount allocated to participating securities | (377 | ) | (389 | ) | (883 | ) | (857 | ) | ||||||||

Net income (loss) attributable to common stockholders | $ | 45,632 | $ | (3,151 | ) | $ | 71,053 | $ | 30,431 | |||||||

Denominator: | ||||||||||||||||

Basic weighted average common shares outstanding | 136,677,255 | 134,614,418 | 136,599,816 | 133,837,748 | ||||||||||||

Unvested restricted stock awards (Note 10) | 899,111 | — | 936,552 | 907,444 | ||||||||||||

Diluted weighted average common shares outstanding | 137,576,366 | 134,614,418 | 137,536,368 | 134,745,192 | ||||||||||||

Earnings per share: | ||||||||||||||||

Net income (loss) attributable to common stockholders - basic and diluted | $ | 0.33 | $ | (0.02 | ) | $ | 0.52 | $ | 0.23 | |||||||

16

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Earnings per Unit – Operating Partnership

Basic earnings per OP Unit is computed using net income attributable to common unitholders and the weighted average number of common units outstanding during the period. Diluted earnings per OP Unit reflects the potential dilution that could occur if securities or other contracts to issue OP Units were exercised or converted into OP Units or resulted in the issuance of OP Units and then shared in the earnings of the Operating Partnership.

The following is a summary of the elements used in calculating basic and diluted earnings per unit:

Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

2018 | 2017 | 2018 | 2017 | |||||||||||||

Numerator – basic and diluted earnings per unit: | ||||||||||||||||

Net income (loss) | $ | 45,990 | $ | (2,653 | ) | $ | 72,240 | $ | 31,796 | |||||||

Net loss (income) attributable to noncontrolling interests – partially owned properties | 366 | (97 | ) | 252 | (202 | ) | ||||||||||

Series A preferred unit distributions | (31 | ) | (31 | ) | (62 | ) | (62 | ) | ||||||||

Amount allocated to participating securities | (377 | ) | (389 | ) | (883 | ) | (857 | ) | ||||||||

Net income (loss) attributable to common unitholders | $ | 45,948 | $ | (3,170 | ) | $ | 71,547 | $ | 30,675 | |||||||

Denominator: | ||||||||||||||||

Basic weighted average common units outstanding | 137,615,938 | 135,643,549 | 137,547,575 | 134,866,879 | ||||||||||||

Unvested restricted stock awards (Note 10) | 899,111 | — | 936,552 | 907,444 | ||||||||||||

Diluted weighted average common units outstanding | 138,515,049 | 135,643,549 | 138,484,127 | 135,774,323 | ||||||||||||

Earnings per unit: | ||||||||||||||||

Net income (loss) attributable to common unitholders - basic and diluted | $ | 0.33 | $ | (0.02 | ) | $ | 0.52 | $ | 0.23 | |||||||

3. Acquisitions

Presale Development Projects: During the six months ended June 30, 2018, the Company entered into two presale agreements to purchase two properties under development. The Company is obligated to purchase the properties for approximately $107.3 million, which includes the contractual purchase price and the cost of elected upgrades, as long as the developer meets certain construction completion deadlines and other closing conditions.

Property | Location | Primary University Served | Project Type | Beds | Scheduled Completion | |||||

The Flex at Stadium Centre | Tallahassee, FL | Florida State University | Off-campus | 340 | August 2019 | |||||

959 Franklin (1) | Eugene, OR | University of Oregon | Off-campus | 443 | September 2019 | |||||

783 | ||||||||||

(1) | As part of the presale agreement, the Company provided $15.6 million of mezzanine financing to the project. |

Land Acquisitions: During the six months ended June 30, 2017, the Company purchased four land parcels for a total purchase price of approximately $11.1 million. Total cash consideration was approximately $8.0 million. The difference between the fair value of the land and the cash consideration represents non-cash consideration. In addition, the Company made an initial investment of $9.0 million in a joint venture that holds a land parcel with fair value of $12.0 million.

17

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Property Acquisitions: During the six months ended June 30, 2017, the Company acquired the following wholly-owned properties for a total purchase price of approximately $158.5 million. Total cash consideration was approximately $158.0 million. The difference between the contracted purchase price and the cash consideration is due to other assets and liabilities that were not part of the contractual purchase price, but were acquired in the transactions, as well as transaction costs capitalized as part of the acquisitions.

Property | Location | Primary University Served | Acquisition Date | Beds | ||||

The Arlie | Arlington, TX | University of Texas Arlington | April 2017 | 598 | ||||

TWELVE at U District | Seattle, WA | University of Washington | June 2017 | 384 | ||||

982 | ||||||||

4. Property Dispositions

Property Dispositions:

In May 2018, the Company sold the following portfolio of three owned properties for approximately $245.0 million, resulting in net proceeds of approximately $242.3 million. The combined net gain on the portfolio disposition totaled approximately $42.3 million.

Property | Location | Primary University Served | Beds | |||

Icon Plaza | Los Angeles, CA | University of Southern California | 253 | |||

West 27th Place | Los Angeles, CA | University of Southern California | 475 | |||

The Standard | Athens, GA | University of Georgia | 610 | |||

1,338 | ||||||

During the six months ended June 30, 2017, the Company sold The Province - Dayton, an owned property located near Wright State University in Dayton, Ohio, containing 657 beds for $25.0 million, resulting in net proceeds of approximately $24.5 million. The net loss on this disposition totaled approximately $0.6 million. Concurrent with the classification of this property as held for sale in December 2016, the Company reduced the property’s carrying amount to its estimated fair value less estimated selling costs, and recorded an impairment charge of $4.9 million.

Joint Venture Activity:

In May 2018, the Company executed an agreement to enter into a joint venture arrangement with Allianz Real Estate (the “ACC / Allianz Joint Venture Transaction”). The transaction included the sale of a partial ownership interest in a portfolio of seven owned properties, containing 4,611 beds, through a joint venture arrangement. The joint venture transaction involved the joint venture partner making a cash contribution of approximately $373.1 million in exchange for a 45% ownership interest. As part of the transaction, the joint venture issued $330 million of secured mortgage debt. For further discussion refer to Note 7.

The joint venture was determined to be a VIE. As the Company retained control of the properties after the joint venture transaction, it was deemed the primary beneficiary. As such, the Company’s contribution of the properties to the joint venture was recorded at net book value, and the joint venture is included in the Company’s consolidated financial statements contained herein. The joint venture partner’s ownership interest in the joint venture is accounted for as noncontrolling interest. For further discussion refer to Note 9. The difference between the joint venture partner’s cash contribution and its proportional share of the net book value of the properties was recorded in additional paid in capital in the Company’s consolidated balance sheets and consolidated statement of changes in equity.

18

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

5. Investments in Owned Properties

Owned properties, both wholly-owned and those owned through investments in VIEs, consisted of the following:

June 30, 2018 | December 31, 2017 | |||||||

Land (1) | $ | 626,991 | $ | 646,991 | ||||

Buildings and improvements | 5,915,120 | 6,096,527 | ||||||

Furniture, fixtures and equipment | 348,579 | 348,828 | ||||||

Construction in progress | 664,098 | 393,045 | ||||||

7,554,788 | 7,485,391 | |||||||

Less accumulated depreciation | (1,122,049 | ) | (1,035,027 | ) | ||||

Owned properties, net | $ | 6,432,739 | $ | 6,450,364 | ||||

(1) | The land balance above includes undeveloped land parcels with book values of approximately $38.0 million as of June 30, 2018 and December 31, 2017. It also includes land totaling approximately $34.7 million and $29.9 million as of June 30, 2018 and December 31, 2017, respectively, related to properties under development. |

6. On-Campus Participating Properties

On-campus participating properties are as follows:

Historical Cost | ||||||||||||