Attached files

| file | filename |

|---|---|

| EX-99.1 - JOINT PRESS RELEASE OF GS BDC, INC. AND GS MIDDLE MARKET LENDING CORP. - Goldman Sachs BDC, Inc. | d922165dex991.htm |

| EX-2.1 - AMENDED AND RESTATED AGREEMENT AND PLAN OF MERGER - Goldman Sachs BDC, Inc. | d922165dex21.htm |

| 8-K - GOLDMAN SACHS BDC, INC. - Goldman Sachs BDC, Inc. | d922165d8k.htm |

Goldman Sachs BDC, Inc. (NYSE: GSBD) Update to Previously Announced Merger of GSBD and MMLC www.goldmansachsbdc.com June 11, 2020 Goldman Sachs Middle Market Lending Corp. (“MMLC”) Exhibit 99.2

Disclaimer and Forward-Looking Statement This investor presentation may contain forward-looking statements that involve substantial risks and uncertainties. You can identify these statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “target,” “estimate,” “intend,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. You should read statements that contain these words carefully because they discuss our plans, strategies, prospects and expectations concerning our business, operating results, financial condition and other similar matters. These statements represent the belief of Goldman Sachs BDC, Inc. (the “Company” or “GSBD”) regarding certain future events that, by their nature, are uncertain and outside of the Company’s control. Any forward-looking statement made by us in this presentation speaks only as of the date on which we make it. Factors or events that could cause our actual results to differ, possibly materially from our expectations, include, but are not limited to, the ability of the parties to consummate the merger contemplated by the amended and restated agreement and plan of merger (the “Merger Agreement”) by and among GSBD, Goldman Sachs Middle Market Lending Corp. (“MMLC”), Evergreen Merger Sub Inc. and Goldman Sachs Asset Management, L.P. (“GSAM”) on the expected timeline, or at all, failure of GSBD or MMLC to obtain the requisite stockholder approval for the Proposals (as defined below) as set forth in the Proxy Statement (as defined below), the ability to realize the anticipated benefits of the merger, effects of disruption on the business of GSBD and MMLC from the proposed merger, the effect that the announcement or consummation of the merger may have on the trading price of GSBD’s common stock on the New York Stock Exchange, the combined company’s plans, expectations, objectives and intentions as a result of the merger, any decision by MMLC to pursue continued operations, any termination of the Merger Agreement, future operating results of GSBD or MMLC, the business prospects of GSBD and MMLC and the prospects of their portfolio companies, actual and potential conflicts of interests with GSAM and other affiliates of Goldman Sachs (as defined below), general economic and political trends and other factors, the dependence of GSBD’s and MMLC’s future success on the general economy and its effect on the industries in which they invest, future changes in laws or regulations and interpretations thereof, and the risks, uncertainties and other factors we identify in the sections entitled “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements” in filings we make with the Securities and Exchange Commission ("SEC"), including those contained in the Proxy Statement, when such documents become available, and it is not possible for us to predict or identify all of them. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. This presentation does not constitute a prospectus and should under no circumstances be understood as an offer to sell or the solicitation of an offer to buy our common stock or any other securities nor will there be any sale of the common stock or any other securities referred to in this presentation in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction. Nothing in these materials should be construed as a recommendation to invest in any securities that may be issued by GSBD or as legal, accounting or tax advice. An investment in securities of the type described herein presents certain risks. GSBD is managed by GSAM, a wholly owned subsidiary of The Goldman Sachs Group, Inc. (“Goldman Sachs”). Nothing contained herein shall be relied upon as a promise or representation whether as to the past or future performance. The information contained in this presentation is summary information that is intended to be considered in the context of other public announcements that we may make, by press release or otherwise, from time to time. We undertake no duty or obligation to publicly update or revise the information contained in this presentation, except as required by law. These materials contain information about GSBD, certain of its personnel and affiliates and its historical performance. You should not view information related to the past performance of GSBD as indicative of GSBD’s future results, the achievement of which cannot be assured. Further, an investment in GSBD is discrete from, and does not represent an interest in, any other Goldman Sachs entity.

Disclaimer and Forward-Looking Statement Additional Information and Where to Find It This communication relates to a proposed business combination involving GSBD and MMLC, along with related proposals for which stockholder approval will be sought (collectively, the “Proposals”). In connection with the Proposals, each of GSBD and MMLC intend to file relevant materials with the SEC, including a registration statement on Form N-14, which will include a joint proxy statement of GSBD and MMLC and a prospectus of GSBD (the “Proxy Statement”). This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. STOCKHOLDERS OF EACH OF GSBD AND MMLC ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT WHEN IT BECOMES AVAILABLE, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS THERETO, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT GSBD, MMLC, THE MERGER AND THE PROPOSALS. Investors and security holders will be able to obtain the documents filed with the SEC free of charge at the SEC’s web site, http://www.sec.gov or, for documents filed by GSBD, from GSBD’s website at http://www. https://www.goldmansachsbdc.com. Participants in the Solicitation GSBD and MMLC and their respective directors, executive officers and certain other members of management and employees of GSAM and its affiliates, may be deemed to be participants in the solicitation of proxies from the stockholders of GSBD and MMLC in connection with the Proposals. Information about the directors and executive officers of GSBD is set forth in its proxy statement for its 2020 annual meeting of stockholders, which was filed with the SEC on May 12, 2020. Information about the directors and executive officers of MMLC is set forth in its Annual Report on Form 10-K for the year ended December 31, 2019, which was filed with the SEC on February 27, 2020 and its proxy statement for its 2019 annual meeting of stockholders, which was filed with the SEC on September 11, 2019. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the GSBD and MMLC stockholders in connection with the Proposals will be contained in the Proxy Statement when such document becomes available. This document may be obtained free of charge from the sources indicated above.

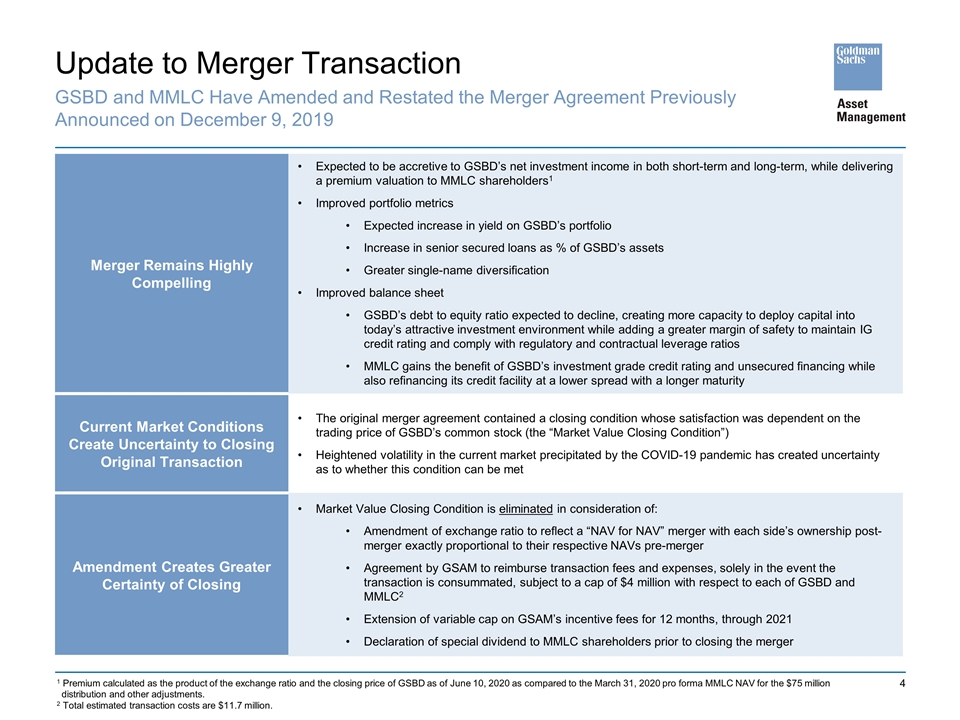

Update to Merger Transaction GSBD and MMLC Have Amended and Restated the Merger Agreement Previously Announced on December 9, 2019 Merger Remains Highly Compelling Expected to be accretive to GSBD’s net investment income in both short-term and long-term, while delivering a premium valuation to MMLC shareholders1 Improved portfolio metrics Expected increase in yield on GSBD’s portfolio Increase in senior secured loans as % of GSBD’s assets Greater single-name diversification Improved balance sheet GSBD’s debt to equity ratio expected to decline, creating more capacity to deploy capital into today’s attractive investment environment while adding a greater margin of safety to maintain IG credit rating and comply with regulatory and contractual leverage ratios MMLC gains the benefit of GSBD’s investment grade credit rating and unsecured financing while also refinancing its credit facility at a lower spread with a longer maturity Current Market Conditions Create Uncertainty to Closing Original Transaction The original merger agreement contained a closing condition whose satisfaction was dependent on the trading price of GSBD’s common stock (the “Market Value Closing Condition”) Heightened volatility in the current market precipitated by the COVID-19 pandemic has created uncertainty as to whether this condition can be met Amendment Creates Greater Certainty of Closing Market Value Closing Condition is eliminated in consideration of: Amendment of exchange ratio to reflect a “NAV for NAV” merger with each side’s ownership post-merger exactly proportional to their respective NAVs pre-merger Agreement by GSAM to reimburse transaction fees and expenses, solely in the event the transaction is consummated, subject to a cap of $4 million with respect to each of GSBD and MMLC2 Extension of variable cap on GSAM’s incentive fees for 12 months, through 2021 Declaration of special dividend to MMLC shareholders prior to closing the merger 1 Premium calculated as the product of the exchange ratio and the closing price of GSBD as of June 10, 2020 as compared to the March 31, 2020 pro forma MMLC NAV for the $75 million distribution and other adjustments. 2 Total estimated transaction costs are $11.7 million.

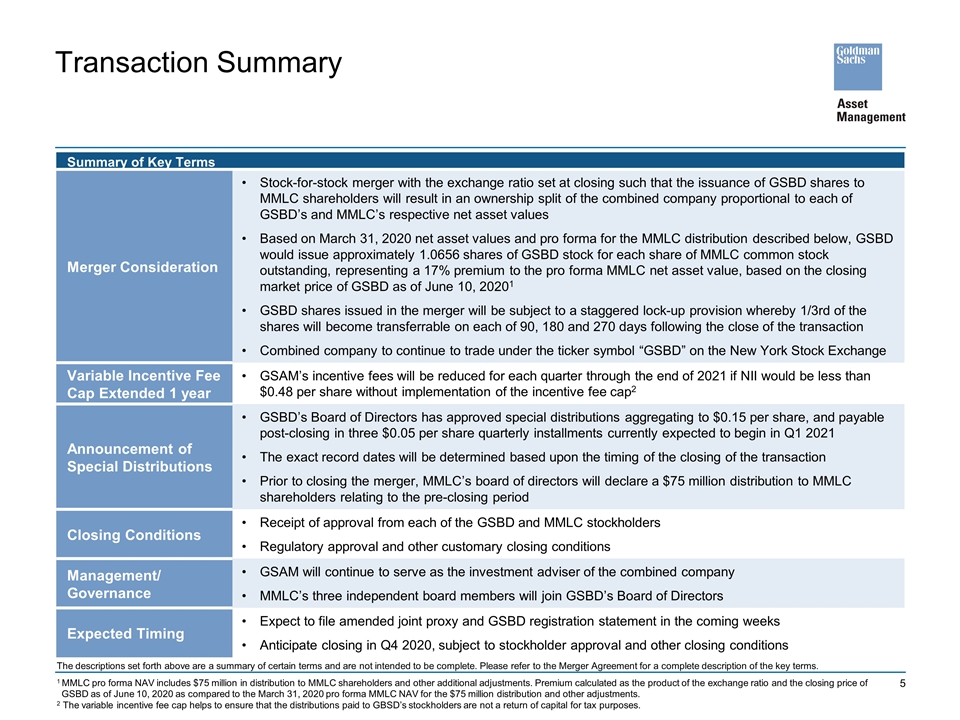

Transaction Summary Summary of Key Terms Merger Consideration Stock-for-stock merger with the exchange ratio set at closing such that the issuance of GSBD shares to MMLC shareholders will result in an ownership split of the combined company proportional to each of GSBD’s and MMLC’s respective net asset values Based on March 31, 2020 net asset values and pro forma for the MMLC distribution described below, GSBD would issue approximately 1.0656 shares of GSBD stock for each share of MMLC common stock outstanding, representing a 17% premium to the pro forma MMLC net asset value, based on the closing market price of GSBD as of June 10, 20201 GSBD shares issued in the merger will be subject to a staggered lock-up provision whereby 1/3rd of the shares will become transferrable on each of 90, 180 and 270 days following the close of the transaction Combined company to continue to trade under the ticker symbol “GSBD” on the New York Stock Exchange Variable Incentive Fee Cap Extended 1 year GSAM’s incentive fees will be reduced for each quarter through the end of 2021 if NII would be less than $0.48 per share without implementation of the incentive fee cap2 Announcement of Special Distributions GSBD’s Board of Directors has approved special distributions aggregating to $0.15 per share, and payable post-closing in three $0.05 per share quarterly installments currently expected to begin in Q1 2021 The exact record dates will be determined based upon the timing of the closing of the transaction Prior to closing the merger, MMLC’s board of directors will declare a $75 million distribution to MMLC shareholders relating to the pre-closing period Closing Conditions Receipt of approval from each of the GSBD and MMLC stockholders Regulatory approval and other customary closing conditions Management/ Governance GSAM will continue to serve as the investment adviser of the combined company MMLC’s three independent board members will join GSBD’s Board of Directors Expected Timing Expect to file amended joint proxy and GSBD registration statement in the coming weeks Anticipate closing in Q4 2020, subject to stockholder approval and other closing conditions 1 MMLC pro forma NAV includes $75 million in distribution to MMLC shareholders and other additional adjustments. Premium calculated as the product of the exchange ratio and the closing price of GSBD as of June 10, 2020 as compared to the March 31, 2020 pro forma MMLC NAV for the $75 million distribution and other adjustments. 2 The variable incentive fee cap helps to ensure that the distributions paid to GBSD’s stockholders are not a return of capital for tax purposes. The descriptions set forth above are a summary of certain terms and are not intended to be complete. Please refer to the Merger Agreement for a complete description of the key terms.

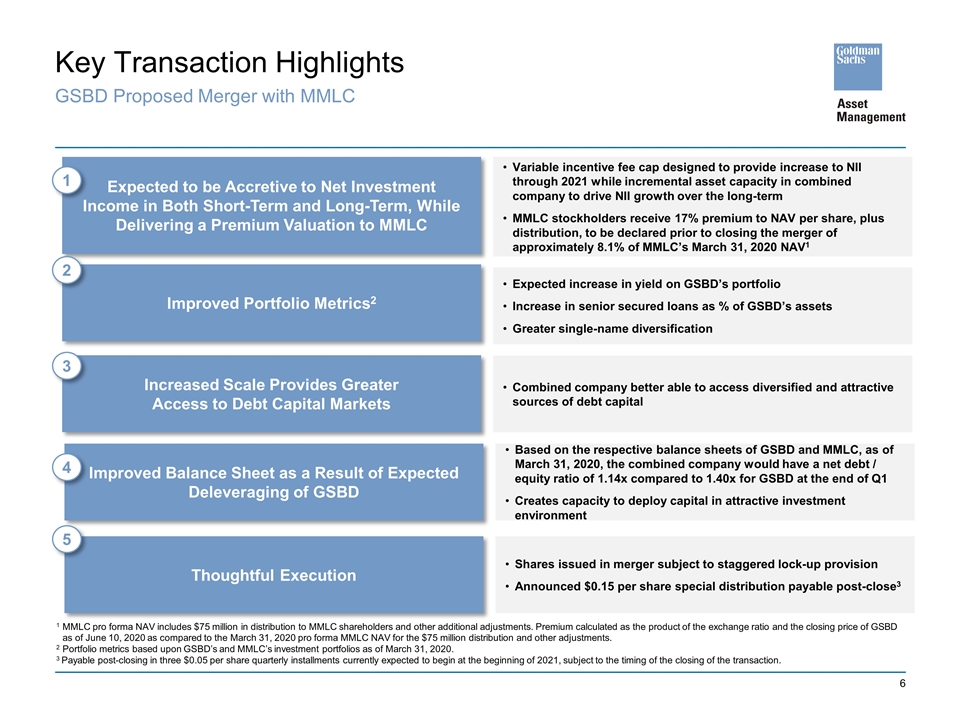

Key Transaction Highlights GSBD Proposed Merger with MMLC Expected to be Accretive to Net Investment Income in Both Short-Term and Long-Term, While Delivering a Premium Valuation to MMLC 1 Variable incentive fee cap designed to provide increase to NII through 2021 while incremental asset capacity in combined company to drive NII growth over the long-term MMLC stockholders receive 17% premium to NAV per share, plus distribution, to be declared prior to closing the merger of approximately 8.1% of MMLC’s March 31, 2020 NAV1 Improved Portfolio Metrics2 2 Expected increase in yield on GSBD’s portfolio Increase in senior secured loans as % of GSBD’s assets Greater single-name diversification Increased Scale Provides Greater Access to Debt Capital Markets 3 Combined company better able to access diversified and attractive sources of debt capital Improved Balance Sheet as a Result of Expected Deleveraging of GSBD 4 Based on the respective balance sheets of GSBD and MMLC, as of March 31, 2020, the combined company would have a net debt / equity ratio of 1.14x compared to 1.40x for GSBD at the end of Q1 Creates capacity to deploy capital in attractive investment environment 1 MMLC pro forma NAV includes $75 million in distribution to MMLC shareholders and other additional adjustments. Premium calculated as the product of the exchange ratio and the closing price of GSBD as of June 10, 2020 as compared to the March 31, 2020 pro forma MMLC NAV for the $75 million distribution and other adjustments. 2 Portfolio metrics based upon GSBD’s and MMLC’s investment portfolios as of March 31, 2020. 3 Payable post-closing in three $0.05 per share quarterly installments currently expected to begin at the beginning of 2021, subject to the timing of the closing of the transaction. Thoughtful Execution Shares issued in merger subject to staggered lock-up provision Announced $0.15 per share special distribution payable post-close3 5

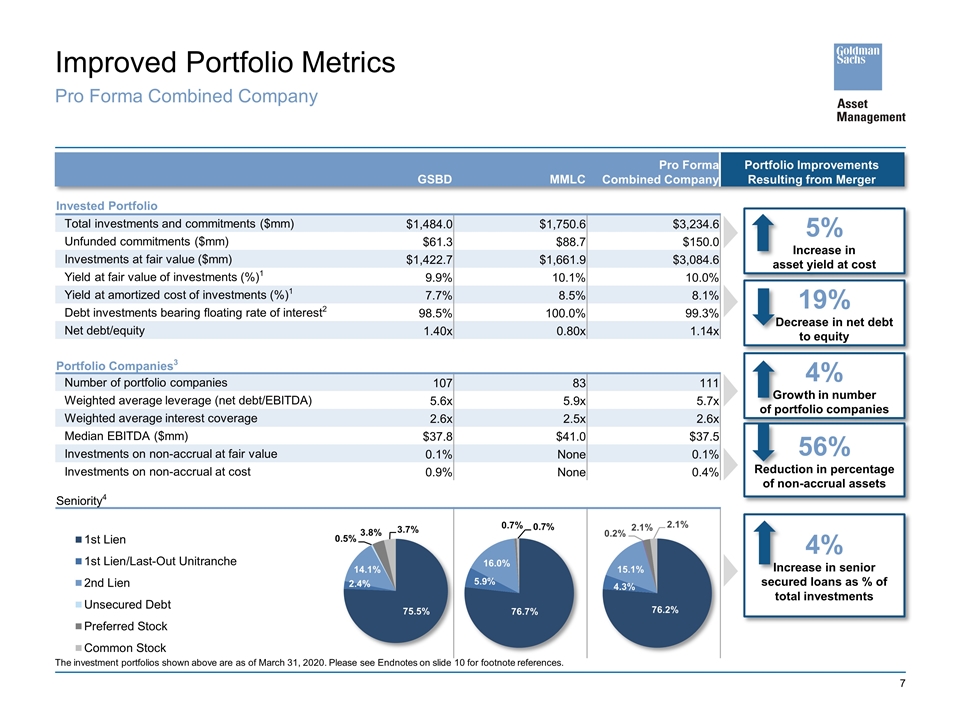

GSBD MMLC Pro Forma Combined Company Portfolio Improvements Resulting from Merger Invested Portfolio Total investments and commitments ($mm) $1,484.0 $1,750.6 $3,234.6 Unfunded commitments ($mm) $61.3 $88.7 $150.0 Investments at fair value ($mm) $1,422.7 $1,661.9 $3,084.6 Yield at fair value of investments (%)1 9.9% 10.1% 10.0% Yield at amortized cost of investments (%)1 7.7% 8.5% 8.1% Debt investments bearing floating rate of interest2 98.5% 100.0% 99.3% Net debt/equity 1.40x 0.80x 1.14x Portfolio Companies3 Number of portfolio companies 107 83 111 Weighted average leverage (net debt/EBITDA) 5.6x 5.9x 5.7x Weighted average interest coverage 2.6x 2.5x 2.6x Median EBITDA ($mm) $37.8 $41.0 $37.5 Investments on non-accrual at fair value 0.1% None 0.1% Investments on non-accrual at cost 0.9% None 0.4% Seniority4 Improved Portfolio Metrics The investment portfolios shown above are as of March 31, 2020. Please see Endnotes on slide 10 for footnote references. Pro Forma Combined Company GSBD MMLC Pro Forma Combined Company Portfolio Improvements Resulting from Merger 5% Increase in asset yield at cost 4% Growth in number of portfolio companies 56% Reduction in percentage of non-accrual assets 4% Increase in senior secured loans as % of total investments 19% Decrease in net debt to equity

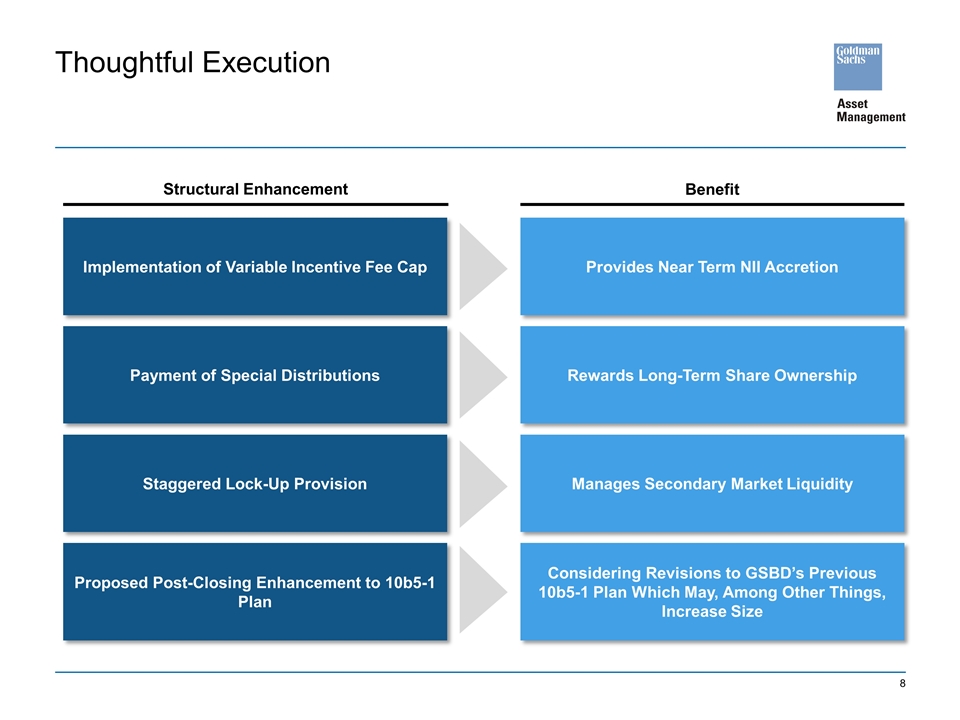

Thoughtful Execution Implementation of Variable Incentive Fee Cap Staggered Lock-Up Provision Payment of Special Distributions Provides Near Term NII Accretion Manages Secondary Market Liquidity Rewards Long-Term Share Ownership Structural Enhancement Benefit Proposed Post-Closing Enhancement to 10b5-1 Plan Considering Revisions to GSBD’s Previous 10b5-1 Plan Which May, Among Other Things, Increase Size

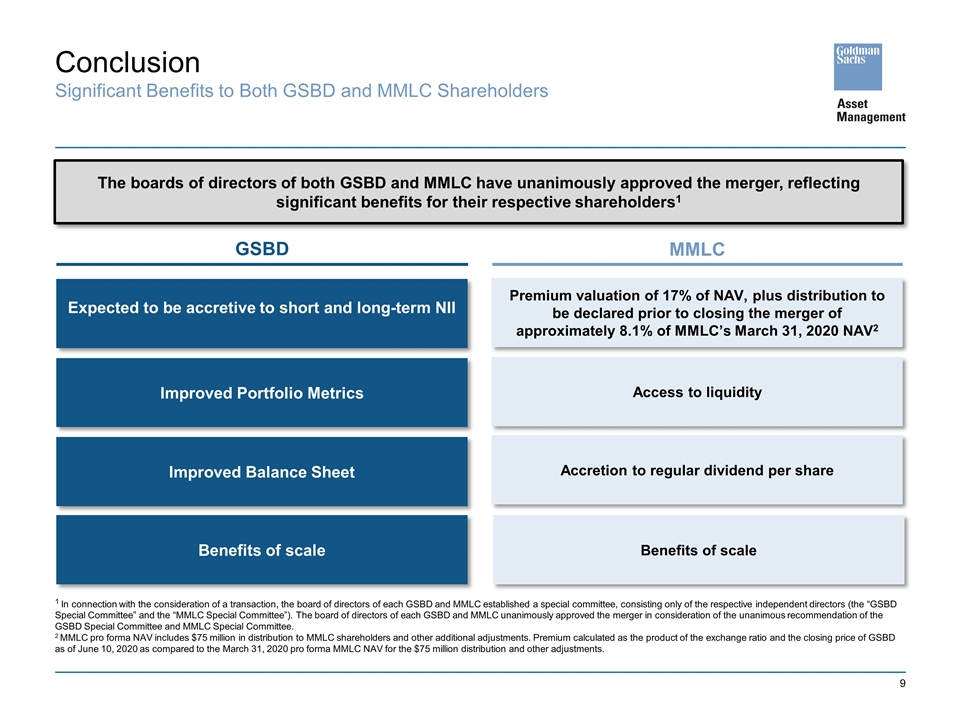

Conclusion Significant Benefits to Both GSBD and MMLC Shareholders 1 In connection with the consideration of a transaction, the board of directors of each GSBD and MMLC established a special committee, consisting only of the respective independent directors (the “GSBD Special Committee” and the “MMLC Special Committee”). The board of directors of each GSBD and MMLC unanimously approved the merger in consideration of the unanimous recommendation of the GSBD Special Committee and MMLC Special Committee. 2 MMLC pro forma NAV includes $75 million in distribution to MMLC shareholders and other additional adjustments. Premium calculated as the product of the exchange ratio and the closing price of GSBD as of June 10, 2020 as compared to the March 31, 2020 pro forma MMLC NAV for the $75 million distribution and other adjustments. Expected to be accretive to short and long-term NII Improved Portfolio Metrics Improved Balance Sheet Benefits of scale Premium valuation of 17% of NAV, plus distribution to be declared prior to closing the merger of approximately 8.1% of MMLC’s March 31, 2020 NAV2 Access to liquidity Accretion to regular dividend per share The boards of directors of both GSBD and MMLC have unanimously approved the merger, reflecting significant benefits for their respective shareholders1 GSBD MMLC Benefits of scale

Disclosures Endnotes Slide 7: The discussion of the investment portfolio excludes an investment in a money market fund managed by an affiliate of The Goldman Sachs Group, Inc. 1 Computed based on the (a) annual actual interest rate or yield earned plus amortization of fees and discounts on the performing debt and other income producing investments, divided by (b) the total investments (including investments on non-accrual and non-incoming producing investments) at amortized cost or fair value, respectively. 2 The fixed versus floating composition has been calculated as a percentage of performing debt investments, measured on a fair value basis including income producing preferred stock investments. Excludes investments, if any, placed on non-accrual. 3 For a particular portfolio company, EBITDA typically represents net income before net interest expense, income tax expense, depreciation and amortization. The net debt to EBITDA represents the ratio of a portfolio company’s total debt (net of cash) and excluding debt subordinated to GSBD’s, MMLC’s or the pro-forma combined company’s investment in a portfolio company, to a portfolio company’s EBITDA. The interest coverage ratio represents the ratio of a portfolio company’s EBITDA as a multiple of a portfolio company’s interest expense. Weighted average net debt to EBITDA is weighted based on the fair value of GSBD’s, MMLC’s or the pro-forma combined company’s debt investments, excluding investments where net debt to EBITDA may not be the appropriate measure of credit risk, such as cash collateralized loans and investments that are underwritten and covenanted based on recurring revenue. Weighted average interest coverage is weighted based on the fair value of GSBD’s, MMLC’s or the pro-forma combined company’s performing debt investments, excluding investments where EBITDA may not be the appropriate measure of credit risk, such as cash collateralized loans and investments that are underwritten and covenanted based on recurring revenue. Median EBITDA is based on GSBD’s, MMLC’s or the pro-forma combined company’s debt investments, excluding investments where EBITDA may not be the appropriate measure of credit risk, such as cash collateralized loans and investments that are underwritten and covenanted based on recurring revenue. As of March 31, 2020, investments where EBITDA may not be the appropriate measure of credit risk represented 29.2%, 33.8% and 31.7% of total debt investments at fair value for GSBD, MMLC and the pro-forma combined company, respectively. Portfolio company statistics are derived from the most recently available financial statements of each portfolio company as of the respective reported end date. Portfolio company statistics have not been independently verified by us and may reflect a normalized or adjusted amount. 4 Measured on a fair value basis.