Attached files

| file | filename |

|---|---|

| EX-99.(31)(2) - CERTIFICATION OF CHIEF FINANCIAL OFFICER - Goldman Sachs BDC, Inc. | d112304dex99312.htm |

| EX-99.(31)(1) - CERTIFICATION OF CHIEF EXECUTIVE OFFICER - Goldman Sachs BDC, Inc. | d112304dex99311.htm |

| EX-99.(32)(1) - CERTIFICATION OF CHIEF EXECUTIVE OFFICER AND CHIEF FINANCIAL OFFICER - Goldman Sachs BDC, Inc. | d112304dex99321.htm |

| EX-99.(21)(1) - SUBSIDIARIES OF GOLDMAN SACHS BDC, INC. - Goldman Sachs BDC, Inc. | d112304dex99211.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 814-00998

Goldman Sachs BDC, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware (State or Other Jurisdiction |

46-2176593 (I.R.S. Employer | |

| 200 West Street, New York, New York | 10282 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s Telephone Number, Including Area Code: (212) 902-0300

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock, par value $0.001 per share | The New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ¨ NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer: |

¨ |

Accelerated filer: |

¨ | |||

| Non-accelerated filer: |

x (Do not check if a smaller reporting company) |

Smaller reporting company: |

¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO x

The aggregate market value of the registrant’s common stock at June 30, 2015 (based upon the closing sale price of the common stock on the New York Stock Exchange on June 30, 2015) held by those persons deemed by the registrant to be non-affiliates was approximately $718.67 million. Shares of the registrant’s common stock held by each executive officer and director and by each entity or person that, to the registrant’s knowledge, owned 10% or more of the registrant’s outstanding common stock as of June 30, 2015 have been excluded from this number in that these persons may be deemed affiliates of the registrant. This determination of possible affiliate status for purposes of this computation is not necessarily a conclusive determination for other purposes.

There were 36,306,882 shares of the registrant’s common stock outstanding as of March 2, 2016.

1

GOLDMAN SACHS BDC, INC.

Index to Annual Report on Form 10-K for

Year Ended December 31, 2015

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements that involve substantial risks and uncertainties. You can identify these statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology. You should read statements that contain these words carefully because they discuss our plans, strategies, prospects and expectations concerning our business, operating results, financial condition and other similar matters. We believe that it is important to communicate our future expectations to our investors. Our forward-looking statements include information in this report regarding general domestic and global economic conditions, our future financing plans, our ability to operate as a business development company (“BDC”) and the expected performance of, and the yield on, our portfolio companies. There may be events in the future, however, that we are not able to predict accurately or control. The factors listed under “Risk Factors” as well as any cautionary language in this report, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. The occurrence of the events described in these risk factors and elsewhere in this report could have a material adverse effect on our business, results of operation and financial position. Any forward-looking statement made by us in this report speaks only as of the date of this report. Factors or events that could cause our actual results to differ from our forward-looking statements may emerge from time to time, and it is not possible for us to predict all of them. You are advised to consult any additional disclosures that we may make directly to you or through reports that we in the future may file with the U.S. Securities and Exchange Commission (the “SEC”), including annual reports on Form 10-K, registration statements on Form N-2, quarterly reports on Form 10-Q and current reports on Form 8-K. Under Section 21E(b)(2)(B) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 do not apply to statements made in periodic reports we file under the Exchange Act, such as this annual report on Form 10-K.

The following factors are among those that may cause actual results to differ materially from our forward-looking statements:

| • | our future operating results; |

| • | changes in political, economic or industry conditions, the interest rate environment or conditions affecting the financial and capital markets; |

| • | uncertainty surrounding the strength of the U.S. economic recovery; |

| • | our business prospects and the prospects of our portfolio companies; |

| • | the impact of investments that we expect to make; |

| • | the impact of increased competition; |

| • | our contractual arrangements and relationships with third parties; |

| • | the dependence of our future success on the general economy and its impact on the industries in which we invest; |

| • | the ability of our prospective portfolio companies to achieve their objectives; |

| • | the relative and absolute performance of our investment adviser; |

| • | our expected financings and investments; |

| • | the use of borrowed money to finance a portion of our investments; |

| • | our ability to make distributions; |

| • | the adequacy of our cash resources and working capital; |

| • | the timing of cash flows, if any, from the operations of our portfolio companies; |

| • | the impact of future acquisitions and divestitures; |

| • | the effect of changes in tax laws and regulations and interpretations thereof; |

| • | our ability to maintain our status as a BDC and a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”); |

| • | actual and potential conflicts of interest with Goldman Sachs Asset Management, L.P. (“GSAM”) and its affiliates; |

| • | general price and volume fluctuations in the stock market; |

| • | the ability of GSAM to attract and retain highly talented professionals; and |

| • | the impact on our business of new legislation. |

3

Unless indicated otherwise in this Annual Report or the context so requires, the terms “GS BDC,” “Company,” “we,” “us” or “our” refer to Goldman Sachs BDC, Inc. or, for periods prior to our conversion from a limited liability company to a corporation (the “Conversion”), Goldman Sachs Liberty Harbor Capital, LLC. The terms “GSAM,” our “adviser” or our “investment adviser” refer to Goldman Sachs Asset Management, L.P., a Delaware limited partnership. The term “Group Inc.” refers to The Goldman Sachs Group, Inc. The term “Goldman Sachs” refers to Group Inc., together with Goldman, Sachs & Co., GSAM and its other subsidiaries and affiliates.

The Company

We are a specialty finance company focused on lending to middle-market companies. We are a closed-end management investment company that has elected to be regulated as a BDC under the Investment Company Act of 1940, as amended (the “Investment Company Act”). In addition, we have elected to be treated as a RIC under Subchapter M of the Code commencing with our taxable year ended December 31, 2013. Since our formation in 2012 through December 31, 2015, we have originated more than $1.60 billion in aggregate principal amount of debt and equity investments prior to any subsequent exits and repayments. We seek to generate current income and, to a lesser extent, capital appreciation primarily through direct originations of secured debt, including first lien, first lien/last-out unitranche (“unitranche”) and second lien debt, unsecured debt, including mezzanine debt, as well as through select equity investments. Unitranche loans are first lien loans that may extend deeper in a company’s capital structure than traditional first lien debt and may provide for a waterfall of cash flow priority between different lenders in the unitranche loan. We use the term “mezzanine” to refer to debt that ranks senior only to a borrower’s equity securities and ranks junior in right of payment to all of such borrower’s other indebtedness. We may make multiple investments in the same portfolio company.

We invest primarily in U.S. middle-market companies, which we believe are underserved by traditional providers of capital such as banks and the public debt markets. In this report, we generally use the term “middle market companies” to refer to companies with earnings before interest, taxes, depreciation and amortization (“EBITDA”) of between $5 million and $75 million annually. However, we may from time to time invest in larger or smaller companies. We generate revenues primarily through receipt of interest income from the investments we hold. In addition, we generate income from various loan origination and other fees, dividends on direct equity investments and capital gains on the sales of investments. The companies in which we invest use our capital for a variety of purposes, including to support organic growth, fund acquisitions, make capital investments or to refinance indebtedness.

Investment Strategy

Our investment strategy is to leverage the unique capabilities of Goldman Sachs, to originate proprietary loans that generate attractive risk adjusted returns for our shareholders. We believe Goldman Sachs has an extensive reach into the U.S. middle market, resulting from its longstanding relationships with private equity sponsors focused on middle market investments and its proprietary network of relationships with family, founder and entrepreneur owned businesses often forged by wealth advisors in its ultra-high net worth private wealth management business. This network and set of relationships provides our investment advisor, GSAM, with direct access to the owners of U.S. middle market companies and enables us to access proprietary investment opportunities. Furthermore, we utilize GSAM’s expertise to underwrite, negotiate and structure our investments. GSAM focuses on leading the negotiation and structuring of the loans or securities in which we invest and we generally hold the investments in our portfolio to maturity or early prepayment. Where there are multiple participants in an investment, GSAM generally seeks to control or obtain significant influence over the rights of investors in the loan or security in which we invest. We generally seek to make investments that have maturities between three and ten years and range in size between $10 million and $75 million, although we may make larger or smaller investments on occasion. In addition, part of our strategy involves a joint venture with the Regents of the University of California (“Cal Regents”) in Senior Credit Fund, LLC (the “Senior Credit Fund”). The Senior Credit Fund’s principal purpose is to make investments, either directly or indirectly through its wholly owned subsidiary, Senior Credit Fund SPV I, LLC (“SPV I”), primarily in senior secured loans to middle-market companies.

4

Investment Portfolio

As of December 31, 2015 and 2014, our portfolio (excluding our investment in a money market fund managed by an affiliate of Group Inc. of $10.12 million and $29.57 million, respectively) consisted of the following:

| As of | ||||||||||||||||

| December 31, 2015 | December 31, 2014 | |||||||||||||||

| Investment Type |

Fair Value | Percentage of Total Portfolio at Fair Value |

Fair Value | Percentage of Total Portfolio at Fair Value |

||||||||||||

| ($ in millions) | ($ in millions) | |||||||||||||||

| 1st Lien/Senior Secured Debt |

$ | 420.10 | 38.9 | % | $ | 235.20 | 25.7 | % | ||||||||

| 1st Lien/Last-Out Unitranche |

305.72 | 28.3 | 275.57 | 30.2 | ||||||||||||

| 2nd Lien/Senior Secured Debt |

285.47 | 26.4 | 351.56 | 38.4 | ||||||||||||

| Preferred Stock |

24.87 | 2.3 | 26.36 | 2.9 | ||||||||||||

| Common Stock |

– | – | 0.63 | 0.1 | ||||||||||||

| Investment Funds & Vehicles |

44.90 | 4.1 | 24.63 | 2.7 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments |

$ | 1,081.06 | 100.0 | % | $ | 913.95 | 100.0 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

As of December 31, 2015, our portfolio consisted of 46 investments in 39 portfolio companies across 27 different industries. The largest industries in our portfolio, based on fair value as of December 31, 2015, were Internet Software & Services, Real Estate Management & Development, Health Care Technology, and Diversified Telecommunication Services which represented 9.1%, 7.8%, 6.5% and 6.4%, respectively, of our portfolio at fair value.

As of December 31, 2015, on a fair value basis, 87.0% of our debt investments bore interest at a floating rate, typically subject to interest rate floors. Approximately 13.0% of our debt investments (including producing preferred stock investments) bore interest at a fixed rate.

The geographic composition of our portfolio at fair value at December 31, 2015 was United States 98.2%, Germany 1.4% and Canada 0.4%. The geographic composition is determined by several factors including the location of the corporate headquarters of the portfolio company.

As of December 31, 2015, the weighted average yield of our total portfolio (excluding our investment in a money market fund managed by an affiliate of Group Inc.) at amortized cost and fair value (both of which include interest income and amortization of fees and discounts) was 10.9% and 11.7%, respectively. At December 31, 2015, no investments in our portfolio were on non-accrual status. As of December 31, 2015, the weighted average net debt to EBITDA and the weighted average interest coverage ratio of our portfolio companies was 4.3 times and 3.1 times, respectively. The weighted average net debt to EBITDA represents the last dollar attachment point of our debt investments (net of cash) in our portfolio companies as a multiple of our portfolio companies’ EBITDA. The weighted average interest coverage ratio (EBITDA to total interest expense) of our portfolio companies reflects our portfolio companies’ EBITDA as a multiple of their interest expense. Portfolio company statistics have been calculated as a percentage of debt investments and income producing preferred investments, including the underlying debt investments in the Senior Credit Fund and excluding collateral loans where net debt to EBITDA may not be the appropriate measure of credit risk. Portfolio company statistics are derived from the most recently available financial statements of each portfolio company as of the reported year ended date.

As of December 31, 2015, we and Cal Regents each had contributed $46.17 million to the Senior Credit Fund. As of December 31, 2015, the Senior Credit Fund had 23 investments in 22 portfolio companies with an aggregate fair value of $285.59 million (excluding the investment in a money market fund managed by an affiliate of Group Inc.). As of December 31, 2015, 87.0% of the Senior Credit Fund’s portfolio investments was in U.S. domiciled companies. As of December 31, 2015, based on fair value, 100.0% of the portfolio was in investments bearing a floating interest rate with an interest rate floor.

As of December 31, 2015, the Senior Credit Fund was invested across 17 different industries. The largest industries in the Senior Credit Fund’s portfolio, based on fair value as of December 31, 2015, were Capital Markets, Communications Equipment, IT Services, and Software, which represented 11.7%, 10.2%, 8.2% and 7.8%, respectively, of the Senior Credit Fund’s portfolio at fair value.

5

Formation Transactions and Initial Public Offering

Our predecessor company was formed on September 26, 2012 and commenced operations on November 15, 2012, with seed capital contributions from Group Inc. On March 29, 2013, we elected to be treated as a BDC under the Investment Company Act. On April 1, 2013, we converted from a Delaware limited liability company to a Delaware corporation named Goldman Sachs BDC, Inc. For the year ended December 31, 2013, we closed offerings of 25,260,470 shares of our common stock in private placements totaling approximately $505.43 million, of which Group Inc. acquired 701,760 shares of our common stock totaling approximately $14.08 million. In addition to the shares acquired in the 2013 private placements, as part of the Conversion, Group Inc. received 5,379,354 shares of our common stock in exchange for its limited liability company interests totaling approximately $107.59 million on April 1, 2013. We have elected to be treated, and intend to qualify annually, as a RIC under Subchapter M of the Code, commencing with our taxable year ended December 31, 2013. On March 18, 2015, our common stock began trading on The New York Stock Exchange (“NYSE”) under the symbol “GSBD.” On March 23, 2015, we closed the initial public offering (“IPO”) of our common stock, issuing 6,000,000 shares of common stock at a public offering price of $20.00 per share. Net of offering and underwriting costs, we received cash proceeds of $114.57 million. On April 21, 2015, we issued an additional 900,000 shares of common stock pursuant to the exercise of the underwriters’ over-allotment option in connection with the IPO. Net of underwriting costs, we received additional cash proceeds of $17.27 million. As a result of the Conversion, the aforementioned private placements, subsequent share repurchases and IPO, as of December 31, 2015, Group Inc. owned approximately 16.67% of our common stock.

Our Investment Adviser

GSAM serves as our investment adviser and has been registered as an investment adviser with the SEC since 1990. Subject to the supervision of our Board of Directors, a majority of which is made up of independent directors (including an independent Chairman), GSAM manages our day-to-day operations and provides us with investment advisory and management services and certain administrative services. GSAM is a subsidiary of Group Inc., a public company that is a bank holding company, financial holding company and a world-wide, full-service financial services organization. GSAM has been providing financial solutions for investors since 1988 and had approximately $1.08 trillion of assets under supervision as of December 31, 2015.

The Private Credit Group of GSAM (the “GSAM Private Credit Group”) is responsible for identifying investment opportunities, conducting research and due diligence on prospective investments, negotiating and structuring our investments and monitoring and servicing our investments. As of December 31, 2015, the GSAM Private Credit Group was comprised of 15 investment professionals, all of whom are predominantly dedicated to your investment strategy. These professionals are supported by an additional 17 investment professionals who are primarily focused on investment strategies in syndicated, liquid credit (together with the GSAM Private Credit Group, “GSAM Credit Alternatives,”). These individuals may have additional responsibilities other than those relating to us, but generally allocate a portion of their time in support of our business and our investment objective as a whole. In addition, GSAM has risk management, legal, accounting, tax, information technology and compliance personnel, among others, who provide services to us. We benefit from the expertise provided by these personnel in our operations.

The GSAM Private Credit Group is dedicated primarily to private corporate credit investment opportunities in North America, and utilizes a bottom-up, fundamental research approach to lending. The senior members of the GSAM Private Credit Group have been working together since 2006 and have an average of over 16 years of experience in leveraged finance and private transactions.

The GSAM Private Credit Group has an investment committee comprised of five voting members, including our Chief Executive Officer, Brendan McGovern, two senior investment professionals, Salvatore Lentini and Scott Turco, our Head of Research, David Yu, and our Chief Operating Officer, Jon Yoder, as well as three non-voting members with operational and legal expertise. See “Directors, Executive Officers and Corporate Governance” for a description of the experience of each of the individual voting members of our investment committee. The investment committee is responsible for approving all of our investments. The investment committee also monitors investments in our portfolio and approves all asset dispositions and loan amendments or modifications. The investment committee engages in each stage of the investment process in order to prioritize and direct the underwriting of each potential investment opportunity. The extensive and varied experience of the investment professionals serving on our investment committee includes expertise in privately originated and publicly traded leveraged credit, stressed and distressed debt, bankruptcy, mergers and acquisitions and private equity. This diverse skill set provides a range of perspectives in the evaluation of each investment opportunity. The voting members of our investment committee collectively have over 50 years of experience in middle-market investing and activities related to middle-market investing.

6

Allocation of Opportunities

The GSAM Private Credit Group is currently the only business unit of GSAM that is primarily engaged in pursuing middle-market direct lending opportunities. We define “middle-market direct lending opportunities” to be comprised of opportunities to underwrite and fund loans to operating middle-market companies. Middle-market direct lending opportunities do not include opportunities to purchase loans from other underwriters or in secondary market transactions, or lending opportunities backed by real property or a personal guarantee collateralized by personal cash, securities or other personal assets. In some cases, due to information barriers that are in place, other Goldman Sachs funds or accounts may compete with the Company for specific investment opportunities generally without the relevant investment professionals being aware that they are competing against each other.

In addition to the GSAM Private Credit Group’s significant resources, including dedicated employees committed to sourcing middle-market direct lending opportunities, the Investment Management Division of Goldman Sachs currently has in place a practice designed to refer all middle-market direct lending opportunities sourced by Goldman Sachs’ Private Wealth Management business to the GSAM Private Credit Group. From time to time, other business units of GSAM and other divisions of Goldman Sachs, including the Investment Banking Division, the Securities Division and the Merchant Banking Division, may refer middle-market direct lending opportunities to the GSAM Private Credit Group; however, there are currently no procedures or practices in place designed to do so and in most cases the GSAM Private Credit Group will not receive referrals of middle-market direct lending opportunities from these other business units or divisions. Whether sourced by the GSAM Private Credit Group or referred to the GSAM Private Credit Group by another business unit or division of Goldman Sachs, determinations regarding the allocation of middle-market direct lending opportunities to the Company will be made on a case-by-case basis in accordance with GSAM’s allocation policies and procedures.

Competitive Advantages

The Goldman Sachs Platform: Goldman Sachs is a leading global financial institution that provides a wide range of financial services to a substantial and diversified client base, including companies and high net worth individuals, among others. The firm is headquartered in New York and maintains offices across the United States and in all major financial centers around the world. Group Inc.’s asset management subsidiary, GSAM, is one of the world’s leading investment managers with over 800 investment professionals and approximately $1.08 trillion of assets under supervision as of December 31, 2015. GSAM’s investment teams, including the GSAM Private Credit Group, capitalize on the relationships, market insights, risk management expertise, technology and infrastructure of Goldman Sachs. We believe the Goldman Sachs platform delivers a meaningful competitive advantage to us in the following ways:

| • | Origination of Investment Opportunities: Goldman Sachs has a preeminent network of relationships and the ability to provide valued intellectual, as well as financial, capital to middle-market borrowers which we believe significantly enhances our origination capability. We believe that many borrowers prefer to do business with Goldman Sachs and its advised funds because of its ability to offer further services to middle-market companies as they grow in their life cycle, including financial advice, acquisition opportunities and capital markets expertise. The GSAM Private Credit Group is also able to leverage the Goldman Sachs platform to provide middle-market companies with access to Goldman Sachs’ broad client network, which can be utilized to find new customers and partners as the GSAM Private Credit Group seeks to grow and execute its strategic plans. |

| • | Evaluation of Investment Opportunities: The GSAM Private Credit Group is comprised of seasoned professionals with significant private credit investing experience. The team draws on a diverse array of skill sets, spanning fundamental credit and portfolio management, as well as legal and transactional structuring expertise. The GSAM Private Credit Group is trained in, and utilizes, proprietary investment practices and procedures developed over many decades by Goldman Sachs, including those related to performing due diligence on prospective portfolio investments and reviewing the backgrounds of potential partners. Further, Goldman Sachs is an active participant in a wide array of industries, both in service to clients operating in many different industries and acting as a principal or customer in such industries. Accordingly, Goldman Sachs houses a tremendous amount of industry knowledge and experience. The GSAM Private Credit Group is able to draw upon these industry insights and expertise as it evaluates investment opportunities. |

| • | Risk Monitoring of Investments: The GSAM Private Credit Group has significant processes and procedures in place, including proprietary information technology systems, to monitor and evaluate the performance of its investments at the asset level. In addition, we benefit from Goldman Sachs’ extensive risk management capabilities, which have been developed and honed over many investment cycles. Our portfolio is regularly reviewed and stressed under various scenarios by senior risk management personnel within Goldman Sachs. |

7

| These scenarios are drawn from the expertise developed by Goldman Sachs for its own balance sheet. This risk monitoring is designed to minimize the risk of capital loss and maintain an investment portfolio that is expected to perform in a broad range of economic conditions. |

| • | Financing of Portfolio: As one of the world’s largest asset management firms, GSAM is a significant counterparty to many providers of capital. In addition, GSAM has a world-class asset management infrastructure, including significant resources in operations, legal, compliance and other support functions. This scale, combined with the institutional infrastructure to support it, gives capital providers an incentive to do business with GSAM and confidence that their capital will be well guarded. Accordingly, we believe that we are able to obtain favorable terms from financing providers, including attractive interest rates, advance rates, durations and covenants. We believe that we will continue to benefit from GSAM’s scale and infrastructure through attractive financing terms as we seek additional sources of capital in the future. |

Existing Portfolio of Performing, Predominantly Senior, Floating Rate Loans: Since our inception, we have originated a sizable investment portfolio. As of December 31, 2015, we had 46 investments in 39 portfolio companies with an aggregate fair value of $1,081.06 million. We believe that this portfolio will generate attractive risk adjusted levels of income that will support dividend payments to our stockholders.

Strategic Joint Venture: On July 18, 2014, we agreed to co-invest with Cal Regents through the Senior Credit Fund, an unconsolidated Delaware limited liability company. The objective of the Senior Credit Fund is to generate attractive rates of return by investing primarily in first lien loans to middle-market companies through a vehicle capitalized in part with debt that is non-recourse to the Company. While the loans in the Senior Credit Fund typically bear interest rates lower than the loans held directly on our balance sheet, the return on our investment in the Senior Credit Fund is targeted to be higher than our direct investments, reflecting the impact of the Senior Credit Fund’s financing strategy. The Senior Credit Fund is expected to have a debt-to-equity ratio of approximately 2 to 1. The Senior Credit Fund is managed by a six-member board of managers, on which we and Cal Regents each have equal representation. Investment decisions generally must be unanimously approved by a quorum of the board of managers. Establishing a quorum for the Senior Credit Fund’s board of managers requires at least four members to be present at a meeting, including at least two of our representatives and two of Cal Regents’ representatives. If there are five members present at a meeting, all three representatives of Cal Regents must be present to constitute a quorum. Each of we and Cal Regents has a 50% economic ownership of the Senior Credit Fund and each has subscribed to fund $100.00 million. As of December 31, 2015, we and Cal Regents each had contributed $46.17 million to the Senior Credit Fund. Our objective is to increase the weighted average yield on our portfolio as the capital we contribute to the Senior Credit Fund is deployed. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Senior Credit Fund, LLC.”

Broad Existing Shareholder Base: We believe that the breadth of our shareholder base and our proven ability to attract investors will continue to support our future growth plans.

Market Opportunity

According to the National Center for the Middle Market and the CIA World Fact Book, the U.S. middle market is comprised of approximately 200,000 companies that collectively produce a gross domestic product of approximately $4.30 trillion annually. This makes the U.S. middle market equivalent to the world’s fifth largest global economy on a stand-alone basis. The GSAM Private Credit Group believes that existing market conditions and regulatory changes have combined to create an attractive investment environment for non-bank lenders to provide loans to U.S. middle market companies. Specifically:

| • | Recent changes in the regulatory capital charges imposed on the banking sector for unrated, illiquid assets have caused banks to reduce their lending activities to middle-market companies. Stakeholders in banks, including their shareholders, lenders and regulators, continue to exert pressure to contain the amount of illiquid, unrated assets held on bank balance sheets. Examples of this include moves to codify the BASEL III accords in the United States, which would increase the regulatory capital charge for lower rated and unrated assets in most instances, and continued investor focus on the amount of illiquid assets whose fair value cannot be determined by using observable measures, or “Level 3 assets,” held on bank balance sheets. As a result, the GSAM Private Credit Group believes that many banks have been forced to reduce their lending to middle-market companies, creating an opportunity for alternative lenders such as us to fill the void. |

8

| • | Changes in business strategy by banks have further reduced the supply of capital to middle-market companies. The trend of consolidation of regional banks into money center banks has reduced the focus of these businesses on middle-market lending. Money center banks traditionally focus on lending and providing other services to large corporate clients to whom they can deploy larger amounts of capital more efficiently. The GSAM Private Credit Group believes that this has resulted in fewer bank lenders to U.S. middle-market companies and reduced the availability of debt capital to the companies we target. |

| • | The capital markets have been unable to fill the void in middle-market finance left by banks. While underwritten bond and syndicated loan markets have been robust in recent years, middle-market companies are rarely able to access these markets as participants are generally highly focused on the liquidity characteristics of the bond or loan being issued. For example, mutual funds and exchange traded funds (“ETFs”) are significant buyers of underwritten bonds. However, mutual funds and ETFs generally require the ability to liquidate their investments quickly in order to fund investor redemptions. Accordingly, the existence of an active secondary market for bonds is an important consideration in the initial investment decision. Because there is typically no active secondary market for the debt of U.S. middle-market companies, mutual funds and ETFs generally do not provide capital to U.S. middle-market companies. The GSAM Private Credit Group believes that this is likely to be a persistent problem for the capital markets and creates an advantage for investors like us who have a stable capital base and can therefore invest in illiquid assets. |

| • | It is difficult for new lending platforms to enter the middle market and fill the capital void because it is very fragmented. While the middle market is a very large component of the U.S. economy, it is a highly fragmented space with thousands of companies operating in many different geographies and industries. Typically, companies that need capital find lenders and investors based on preexisting relationships, referrals and word of mouth. Developing the many relationships required and wide-spread recognition as a source of capital to the middle market is a time consuming, highly resource-intensive endeavor. As a result, the GSAM Private Credit Group believes that it is difficult for new lending platforms to successfully enter the middle market, thereby providing insulation from rapid shifts in the supply of capital to the middle market that might otherwise disrupt pricing of capital. |

Investments

We seek to create a portfolio that includes primarily direct originations of secured debt, including first lien, first lien/last-out unitranche and second lien debt, and unsecured debt, including mezzanine debt, as well as through select equity investments. We expect to make investments through both primary originations and open-market secondary purchases. We currently do not limit our focus to any specific industry. If we are successful in achieving our investment objective, we believe that we will be able to provide our stockholders with consistent dividend distributions and attractive risk adjusted total returns.

Over time, we expect that our portfolio will continue to include secured debt, including first lien, first lien/last-out unitranche and second lien debt, unsecured debt (including mezzanine debt) and, to a lesser extent, equities. In addition to investments in U.S. middle-market companies, we may invest a portion of our capital in opportunistic investments, such as in large U.S. companies, foreign companies, stressed or distressed debt, structured products or private equity. Such investments are intended to enhance our risk adjusted returns to stockholders, and the proportion of these types of investments will change over time given our views on, among other things, the economic and credit environment in which we are operating, although these types of investments generally will constitute less than 30% of our total assets.

In the future, we may also securitize a portion of our investments in any or all of our assets. We expect that our primary use of funds will be to make investments in portfolio companies, distribute cash to holders of our common stock and pay our operating expenses, including debt service to the extent we borrow or issue senior securities to fund our investments.

We and our investment adviser have applied for an exemptive order from the SEC that would permit us and certain of our controlled affiliates to co-invest with other funds managed by the GSAM Credit Alternatives investment team in a manner consistent with our investment objectives, positions, policies, strategies and restrictions as well as regulatory requirements and other pertinent factors. Any such order, if issued, will be subject to certain terms and conditions and there can be no assurance that such order will be granted by the SEC. Additionally, if our investment adviser forms other funds in the future, we may co-invest on a concurrent basis with such other affiliates, subject to compliance with applicable regulations and regulatory guidance, as well as applicable allocation procedures. In certain circumstances, negotiated co-investments may be made only if we receive an order from the SEC permitting us to do so.

9

Investment Committee

All investment decisions are made by the Investment Committee of GSAM Private Credit Group which consists of five voting members, Brendan McGovern, Salvatore Lentini, Jon Yoder, David Yu and Scott Turco, as well as three non-voting members with operational or legal expertise. Our investment committee is responsible for approving all of our investments. Our investment committee also monitors investments in our portfolio and approves all asset dispositions. We expect to benefit from the extensive and varied relevant experience of the investment professionals serving on our investment committee, which includes expertise in privately originated and publicly traded leveraged credit, stressed and distressed debt, bankruptcy, mergers and acquisitions and private equity.

The purpose of our investment committee is to evaluate and approve, as deemed appropriate, all investments by our investment adviser. Our investment committee process is intended to bring the diverse experience and perspectives of our investment committee’s members to the analysis and consideration of every investment. Our investment committee also serves to provide investment consistency and adherence to our investment adviser’s investment philosophies and policies. Our investment committee also determines appropriate investment sizing and suggests ongoing monitoring requirements.

In addition to reviewing investments, our investment committee meetings serve as a forum to discuss credit views and outlooks. Potential transactions and investment opportunities are also reviewed on a regular basis. Members of our investment adviser’s investment team are encouraged to share information and views on credits with our investment committee early in their analysis. This process improves the quality of the analysis and assists the deal team members to work more efficiently.

Investment Criteria

We are committed to a value-oriented philosophy implemented by our investment adviser, which manages our portfolio and seeks to minimize the risk of capital loss without foregoing the potential for capital appreciation. We have identified several criteria, discussed below, that GSAM believes are important in identifying and investing in prospective portfolio companies.

These criteria provide general guidelines for our investment decisions. However, not all of these criteria will be met by each prospective portfolio company in which we choose to invest. Generally, we seek to use our experience and access to market information to identify investment candidates and to structure investments quickly and effectively.

| • | Value orientation and positive cash flow. Our investment philosophy places a premium on fundamental analysis and has a distinct value orientation. We focus on companies in which we can invest at relatively low multiples of operating cash flow and that are profitable at the time of investment on an operating cash flow basis. Typically, we do not expect to invest in start-up companies or companies having speculative business plans. |

| • | Experienced management and established financial sponsor relationships. We generally require that our portfolio companies have an experienced management team. We also require the portfolio companies to have proper incentives in place to induce management to succeed and to act in concert with our interests as investors. In addition, we focus our investments in companies backed by strong financial sponsors that have a history of creating value and with whom members of our investment adviser have an established relationship. |

| • | Strong and defensible competitive market position. We seek to invest in target companies that have developed leading market positions within their respective markets and are well-positioned to capitalize on growth opportunities. We also seek companies that demonstrate significant competitive advantages versus their competitors, which should help to protect their market position and profitability while enabling us to protect our principal and avoid capital losses. |

| • | Viable exit strategy. We seek to invest in companies that GSAM believes will provide a steady stream of cash flow to repay our loans and reinvest in their respective businesses. We expect that such internally generated cash flow, leading to the payment of interest on, and the repayment of the principal of, our investments in portfolio companies to be a key means by which we exit from our investments over time. In addition, we also seek to invest in companies whose business models and expected future cash flows offer attractive exit possibilities. These companies include candidates for strategic acquisition by other industry participants and companies that may repay our investments through an initial public offering of common stock or other capital markets transactions. |

10

| • | Due diligence. Our investment adviser takes a bottom-up, fundamental research approach to our potential investments. It believes it is critical to conduct extensive due diligence on investment targets and in evaluating new investments. Our investment adviser conducts a rigorous due diligence process that is applied to prospective portfolio companies and draws from its experience, industry expertise and network of contacts. In conducting due diligence, our investment adviser uses information provided by companies, financial sponsors and publicly available information as well as information from relationships with former and current management teams, consultants, competitors and investment bankers. |

Our due diligence typically includes:

| • | review of historical and prospective financial information; |

| • | review of the capital structure; |

| • | analysis of the business and industry in which the company operates; |

| • | on-site visits; |

| • | interviews with management, employees, customers and vendors of the potential portfolio company; |

| • | review of loan documents; |

| • | background checks; and |

| • | research relating to the portfolio company’s management, industry, markets, products and services and competitors. |

Upon the completion of due diligence and a decision to proceed with an investment in a company, the team leading the investment presents the investment opportunity to our investment committee. This committee determines whether to pursue the potential investment. All new investments are required to be reviewed by the investment committee. The members of the investment committee are employees of our investment adviser and they do not receive separate compensation from us or our investment adviser for serving on the investment committee.

Additional due diligence with respect to any investment may be conducted on our behalf (and at our expense) by attorneys and independent auditors prior to the closing of the investment, as well as other outside advisers, as appropriate.

Investment Structure

Once we determine that a prospective portfolio company is suitable for investment, we work with the management of that company and its other capital providers, including senior, junior and equity capital providers, to structure an investment. We negotiate among these parties and use creative and flexible approaches to structure our investment relative to the other capital in the portfolio company’s capital structure.

We expect our secured debt to have terms of three to ten years. We generally obtain security interests in the assets of our portfolio companies that will serve as collateral in support of the repayment of this debt. This collateral may take the form of first or second priority liens on the assets of a portfolio company.

We use the term “mezzanine” to refer to debt that ranks senior only to a borrower’s equity securities and ranks junior in right of payment to all of such borrower’s other indebtedness. Mezzanine debt typically has interest-only payments in the early years, payable in cash or in-kind, with amortization of principal deferred to the later years of the mezzanine debt. In some cases, we may enter into mezzanine debt that, by its terms, converts into equity (or is issued along with warrants for equity) or additional debt securities or defers payments of interest for the first few years after our investment. Typically, our mezzanine debt investments have maturities of three to ten years.

We also invest in unitranche loans, which are loans that combine features of first-lien, second-lien and mezzanine debt, generally in a first-lien position.

In the case of our secured debt and unsecured debt, including mezzanine debt investments, we seek to tailor the terms of the investments to the facts and circumstances of the transactions and the prospective portfolio companies, negotiating a structure that protects our rights and manages our risk while creating incentives for the portfolio companies to achieve their business plan and improve their profitability. For example, in addition to seeking a senior

11

position in the capital structure of our portfolio companies, we seek to limit the downside potential of our investments by:

| • | requiring a total return on our investments (including both interest and potential equity appreciation) that compensates us for credit risk; |

| • | incorporating “put” rights and call protection into the investment structure; and |

| • | negotiating covenants in connection with our investments that afford our portfolio companies as much flexibility in managing their businesses as possible, consistent with preservation of our capital. Such restrictions may include affirmative and negative covenants, default penalties, lien protection, change of control provisions and board rights, including either observation or participation rights. |

Our investments may include equity features, such as direct investments in the equity or convertible securities of portfolio companies or warrants or options to buy a minority interest in a portfolio company. Any warrants we may receive with our debt securities generally require only a nominal cost to exercise, so as a portfolio company appreciates in value, we may achieve additional investment return from these equity investments. We may structure the warrants to provide provisions protecting our rights as a minority-interest holder, as well as puts, or rights to sell such securities back to the company, upon the occurrence of specified events. In many cases, we may also obtain registration rights in connection with these equity investments, which may include demand and “piggyback” registration rights.

We expect to hold most of our investments to maturity or repayment, but may sell certain investments earlier if a liquidity event takes place, such as the sale or refinancing of a portfolio company. We also may turn over our investments to better position the portfolio as market conditions change.

Ongoing relationships with portfolio companies

Monitoring

Our investment adviser monitors our portfolio companies on an ongoing basis. It monitors the financial trends of each portfolio company to determine if they are meeting their respective business plans and to assess the appropriate course of action for each company. Our investment adviser has several methods of evaluating and monitoring the performance and fair value of our investments, which may include the following:

| • | assessment of success in adhering to the portfolio company’s business plan and compliance with covenants; |

| • | periodic or regular contact with portfolio company management and, if appropriate, the financial or strategic sponsor, to discuss financial position, requirements and accomplishments; |

| • | comparisons to our other portfolio companies in the industry, if any; |

| • | attendance at and participation in board meetings or presentations by portfolio companies; and |

| • | review of monthly and quarterly financial statements and financial projections of portfolio companies. |

Our investment adviser also employs an investment rating system to categorize our investments. In addition to various risk management and monitoring tools, our investment adviser grades the credit risk of all investments on a scale of 1 to 4 no less frequently than quarterly. This system is intended primarily to reflect the underlying risk of a portfolio investment relative to our initial cost basis in respect of such portfolio investment (i.e., at the time of origination or acquisition), although it may also take into account under certain circumstances the performance of the portfolio company’s business, the collateral coverage of the investment and other relevant factors. Under this system, investments with a grade of 1 involve the least amount of risk to our initial cost basis. The trends and risk factors for this investment since origination or acquisition are generally favorable, which may include the performance of the portfolio company or a potential exit. Investments graded 2 involve a level of risk to our cost basis that is similar to the risk to our initial cost basis at the time of origination or acquisition. This portfolio company is generally performing as expected and the risk factors to our ability to ultimately recoup the cost of our investment are neutral to favorable. All investments or acquired investments in new portfolio companies are initially assessed a grade of 2. Investments graded 3 indicate that the risk to our ability to recoup the initial cost basis of such investment has increased materially since origination or acquisition, including as a result of factors such as declining performance and non-compliance with debt covenants; however, payments are generally not more than 120 days past due. An investment grade of 4 indicates that the risk to our ability to recoup the initial cost basis of such investment has substantially increased since origination or acquisition, and the portfolio company likely has materially declining performance. For debt investments with an investment grade of 4, most or all of the debt covenants are out of

12

compliance and payments are substantially delinquent. For investments graded 4, it is anticipated that we will not recoup our initial cost basis and may realize a substantial loss of our initial cost basis upon exit. For investments graded 3 or 4, our investment adviser enhances its level of scrutiny over the monitoring of such portfolio company. Our investment adviser grades the investments in our portfolio at least each quarter and it is possible that the grade of a portfolio investment may be reduced or increased over time.

The following table shows the distribution of our investments (excluding our investment in a money market fund managed by an affiliate of Group Inc.) on the 1 to 4 grading scale as of December 31, 2015 and 2014.

| As of | ||||||||||||||||

| December 31, 2015 | December 31, 2014 | |||||||||||||||

| Investment Performance Grade |

Fair Value | Percentage of Total Portfolio at Fair Value |

Fair Value | Percentage of Total Portfolio at Fair Value |

||||||||||||

| ($ in millions) | ($ in millions) | |||||||||||||||

| Grade 1 |

$ | 108.80 | 10.1 | % | $ | 11.44 | 1.2 | % | ||||||||

| Grade 2 |

797.09 | 73.7 | 843.44 | 92.3 | ||||||||||||

| Grade 3 |

175.17 | 16.2 | 59.07 | 6.5 | ||||||||||||

| Grade 4 |

– | – | – | – | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments |

$ | 1,081.06 | 100.0 | % | $ | 913.95 | 100.0 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

As of December 31, 2015 and 2014, the weighted average grade of the investments in our portfolio at fair value was 2.06 and 2.05, respectively. As of December 31, 2015, no investments were on non-accrual status.

Managerial Assistance

As a BDC, we must offer, and must provide upon request, significant managerial assistance to certain of our eligible portfolio companies within the meaning of Section 55 of the Investment Company Act. This assistance could involve, among other things, monitoring the operations of our portfolio companies, participating in board and management meetings, consulting with and advising officers of portfolio companies and providing other organizational and financial guidance. Our investment adviser or an affiliate thereof may provide such managerial assistance on our behalf to portfolio companies that request such assistance. We may receive fees for these services. See “Business—Regulation.”

Competition

Our primary competitors provide financing to middle-market companies and include other BDCs, commercial and investment banks, commercial financing companies, collateralized loan obligations, private funds, including hedge funds, and, to the extent they provide an alternative form of financing, private equity funds. Some of our existing and potential competitors are substantially larger and have considerably greater financial, technical and marketing resources than we do. For example, some competitors may have a lower cost of funds and access to funding sources that are not available to us.

In addition, some of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of investments and establish more relationships than us. Furthermore, many of our competitors are not subject to the regulatory restrictions that the Investment Company Act imposes on us as a BDC.

While we expect to use the industry information of GSAM’s investment professionals to which we have access to assess investment risks and determine appropriate pricing for our investments in portfolio companies, we do not seek to compete primarily based on the interest rates we offer and GSAM believes that some of our competitors may make loans with interest rates that are comparable to or lower than the rates we offer. Rather, we compete with our competitors based on our reputation in the market, our existing investment platform, the seasoned investment professionals of our investment adviser, our experience and focus on middle-market companies, our disciplined investment philosophy, our extensive industry focus and relationships and our flexible transaction structuring.

Staffing

We do not currently have any employees. Our day-to-day operations are managed by our investment adviser. Our investment adviser has hired and expects to continue to hire professionals with skills applicable to our business plan, including experience in middle-market investing, leveraged finance and capital markets.

13

Properties

We do not own any real estate or other properties materially important to our operations. Our principal executive offices are located at 200 West Street, New York, New York 10282. We believe that our office facilities are suitable and adequate for our business as it is contemplated to be conducted.

Legal Proceedings

We and our investment adviser are not currently subject to any material legal proceedings, although we may, from time to time, be involved in litigation arising out of operations in the normal course of business or otherwise.

Our Administrator

Pursuant to our Administration Agreement, our administrator is responsible for providing various accounting and administrative services to us. Our administrator is entitled to fees as described in “Management.” To the extent that our administrator outsources any of its functions, the administrator will pay any compensation associated with such functions. See “Business—Management Agreements—Administration Agreement.”

Dividend Reinvestment Plan

We have adopted a dividend reinvestment plan, pursuant to which we will reinvest all cash distributions declared by our Board of Directors on behalf of investors who do not elect to receive their cash distributions in cash as provided below. As a result, if our Board of Directors declares a cash distribution, then our stockholders who have not elected to “opt out” of our dividend reinvestment plan will have their cash distributions automatically reinvested in additional shares of our common stock as described below. We intend to continue to pay quarterly distributions to our stockholders out of assets legally available for distribution. Future quarterly distributions, if any, will be determined by our Board of Directors. All future distributions will be subject to lawfully available funds therefor, and no assurance can be given that we will be able to declare such distributions in future periods.

Each registered stockholder may elect to have distributions distributed in cash rather than participate in the plan. For any registered stockholder that does not so elect, distributions on such stockholder’s shares will be reinvested by State Street Bank and Trust Company, as the plan agent, in additional shares. The number of shares to be issued to the stockholder will be determined based on the total dollar amount of the cash distribution payable, net of applicable withholding taxes. The plan agent will maintain all participants’ accounts in the plan and furnish written confirmation of all transactions in the accounts. Shares in the account of each participant will be held by the plan agent on behalf of the participant in book entry form in the plan agent’s name or the plan agent’s nominee. Those stockholders whose shares are held through a broker or other nominee may receive cash distributions in cash by notifying their broker or nominee of their election.

The shares will be acquired by the plan agent for the participants’ accounts either through (i) newly issued shares or (ii) by purchase of outstanding shares on the open market. If, on the payment date for any distribution, the most recently computed net asset value (“NAV”) per share is equal to or less than the closing market price plus estimated per share fees (which include any applicable brokerage commissions the plan agent is required to pay) (such condition often referred to as a “premium”), the plan agent will invest the distribution amount in newly issued shares on behalf of the participants. The number of newly issued shares to be credited to a participant’s account will be determined by dividing the dollar amount of the distribution by the most recently computed NAV per share; provided that, if the NAV is less than or equal to 95% of the then current market price per share, the dollar amount of the distribution will be divided by 95% of the closing market price per share on the payment date. If, on the payment date for any distribution, the NAV per share is greater than the closing market price per share plus per share fees (such condition referred to as a “market discount”), the plan agent will invest the dividend amount in shares acquired on behalf of the participants by purchasing outstanding shares on the open market. In the event of a market discount on the payment date for any distribution, the plan agent or its broker will have until the last business day before the next date on which the shares trade on an “ex-dividend” basis or 30 days after the payment date for such distribution, whichever is sooner, to invest the distribution amount in shares acquired in open-market purchases. Open-market purchases may be made on any securities exchange where shares are traded, in the over-the-counter market or in negotiated transactions, and may be on such terms as to price, delivery and otherwise as the plan agent will determine. Shares purchased in open market transactions by the plan agent will be allocated to a participant based on the average purchase price, excluding any brokerage charges or other charges, of all shares purchased in the open market with respect to any such distribution. If, before the plan agent has completed its open-market purchases, the market price per share exceeds the NAV per share, the average per share purchase price paid by the plan agent may exceed the NAV of the shares, resulting in the acquisition of fewer shares than if the distribution had been paid in

14

newly issued shares on the distribution payment date. Because of the foregoing difficulty with respect to open-market purchases, the plan provides that if the plan agent is unable to invest the full distribution amount in open-market purchases during the purchase period or if the market discount shifts to a market premium during the purchase period, the plan agent may cease making open-market purchases and may invest the uninvested portion of the distribution amount in newly issued shares at the most recently computed NAV per share provided that, if the NAV is less than or equal to 95% of the then current market price per share; the dollar amount of the distribution will be divided by 95% of the market price on the payment date. The number of shares of our common stock to be outstanding after giving effect to payment of the distribution cannot be established until the value per share at which additional shares will be issued has been determined and elections of our stockholders have been tabulated.

If a participant elects by written notice to the plan agent to have the plan agent sell all or a part of his or her shares and remit the proceeds to the participant, the plan agent will process all sale instructions received no later than five business days after the date on which the order is received. Such sale will be made through the plan agent’s broker on the relevant market and the sale price will not be determined until such time as the broker completes the sale. In each case, the price to each participant will be the weighted average sale price obtained by the plan agent’s broker net of fees for each aggregate order placed by the plan agent and executed by the broker.

The plan agent’s fees for the handling of the reinvestment of distributions will be paid by us. However, each participant will pay a per share fee incurred in connection with open market purchases. If a participant elects by written notice to the plan agent to have the plan agent sell all or a part of his or her shares and remit the proceeds to the participant, the plan agent is authorized to deduct a per share brokerage commission from such proceeds. All per share fees include any applicable brokerage commissions the plan agent is required to pay.

Participation in the plan is completely voluntary and may be terminated or resumed at any time without penalty. Participants may terminate their accounts under the plan by notifying the plan agent in writing prior to the distribution record date. Such termination will be effective immediately if received by the plan administrator prior to any distribution record date; otherwise such termination or resumption will be effective with respect to any subsequently declared dividend or other distribution.

A stockholder who does not opt out of the dividend reinvestment plan will generally be subject to the same U.S. federal, state and local tax consequences as a stockholder who elects to receive its distributions in cash and, for this purpose, a stockholder receiving a distribution in the form of stock will generally be treated as receiving a distribution equal to the fair market value of the stock received through the plan; however, because a stockholder that participates in the dividend reinvestment plan will not actually receive any cash, such a stockholder will not have such cash available to pay any applicable taxes on the deemed distribution. A stockholder that participates in the dividend reinvestment plan and thus is treated as having invested in additional shares of our stock will have a basis in such additional shares of stock equal to the total dollar amount treated as a distribution for U.S. federal income tax purposes. The stockholder’s holding period for such stock will commence on the day following the day on which the shares are credited to the stockholder’s account.

We reserve the right to amend or terminate the plan upon notice in writing to each participant at least 30 days prior to any record date for the payment of any dividend or distribution by us. There is no direct service charge to participants with regard to purchases in the plan; however, we reserve the right to amend the plan to include a service charge payable by the participants. Notice will be sent to participants of any amendments as soon as practicable after such action by us.

All correspondence concerning the plan should be directed to the plan agent by mail at State Street Corporation, Attention: Transfer Agent, 100 Huntington Ave, Copley Place Tower 2, Floor 3, Mail Code: CPH0255, Boston, MA 02116. Participants who hold their shares through a broker or other nominee should direct correspondence or questions concerning the dividend reinvestment plan to their broker or nominee.

The dividend reinvestment plan does not apply to investors who purchased shares of our common stock prior to our IPO with respect to such pre-IPO shares. Additionally, investors holding any shares of our common stock through private wealth management accounts with Goldman, Sachs & Co. will not be able to participate in our dividend reinvestment plan with respect to such shares. Due to regulatory considerations, Group Inc. has opted out of the dividend reinvestment plan, and Goldman, Sachs & Co. has opted out of the dividend reinvestment plan in respect of any shares of our common stock acquired through our 10b5-1 plan (the “10b5-1 Plan”).

15

Management Agreements

Investment Management Agreement

Our initial investment management agreement with our investment adviser was entered into as of November 15, 2012 and subsequently amended and restated as of April 1, 2013 (as amended and restated as of April 1, 2013, the “Initial Investment Management Agreement”). Our Board of Directors determined at an in person meeting held in November 2014 to approve certain changes to the Initial Investment Management Agreement and to submit the investment management agreement (as amended and restated, the “Investment Management Agreement”), which included such changes, for stockholder approval as required by the provisions of the Investment Company Act. At a special meeting of stockholders held in January 2015, our stockholders approved the Investment Management Agreement. The Investment Management Agreement became effective as of January 1, 2015.

Management Services

Pursuant to the terms of our Investment Management Agreement, GSAM, subject to the overall supervision of our Board of Directors, manages our day-to-day investment-related operations and provides investment management services to us.

Subject to compliance with applicable law and published SEC guidance, nothing contained in the Investment Management Agreement in any way precludes, restricts or limits the activities of our investment adviser or any of its respective subsidiaries or affiliated parties.

Management Fee and Incentive Fee

We pay our investment adviser for its services to us a management fee (the “Management Fee”) and an incentive fee (the “Incentive Fee”) as set forth in the Investment Management Agreement. We will make any payments due under the Investment Management Agreement to our investment adviser (or to its designees as it may otherwise direct).

Management Fee

The Management Fee is calculated at an annual rate of 1.50% (0.375% per quarter) of the average value of our gross assets (excluding cash or cash equivalents but including assets purchased with borrowed amounts) at the end of each of the two most recently completed calendar quarters (and, in the case of our first quarter, our gross assets as of such quarter-end). The Management Fee is payable quarterly in arrears. The Management Fee for any partial quarter will be appropriately prorated.

Incentive Fee

The Incentive Fee consists of two components that are determined independent of each other, with the result that one component may be payable even if the other is not. The calculation of our incentive fee pursuant to our Investment Management Agreement has been modified from the method used to calculate the Incentive Fee payable for the periods ending after January 1, 2015.

A portion of the Incentive Fee is based on our income and a portion is based on our capital gains, each as described below. Our investment adviser is entitled to receive the Incentive Fee based on income from us if our Ordinary Income (as defined below) exceeds a quarterly “hurdle rate” of 1.75%. For this purpose, the hurdle is computed by reference to our NAV and does not take into account changes in the market price of our common stock.

Beginning with the calendar quarter that commenced on January 1, 2015, the Incentive Fee based on income is determined and paid quarterly in arrears at the end of each calendar quarter by reference to our aggregate net investment income, as adjusted as described below, from the calendar quarter then ending and the eleven preceding calendar quarters (or if shorter, the number of quarters that have occurred since January 1, 2015). We refer to such period as the “Trailing Twelve Quarters.” The Incentive Fee based on capital gains is determined and paid annually in arrears at the end of each calendar year by reference to an “Annual Period,” which means the period beginning on January 1 of each calendar year and ending on December 31 of the calendar year or, in the case of our first and last year, the appropriate portion thereof.

The hurdle amount for the Incentive Fee based on income is determined on a quarterly basis and is equal to 1.75% multiplied by our NAV at the beginning of each applicable calendar quarter comprising the relevant Trailing Twelve Quarters. The hurdle amount is calculated after making appropriate adjustments for subscriptions (which includes all issuances by us of shares of our common stock, including issuances pursuant to our dividend

16

reinvestment plan) and distributions that occurred during the relevant Trailing Twelve Quarters. The Incentive Fee for any partial period will be appropriately prorated.

Quarterly Incentive Fee Based on Income. For the portion of the Incentive Fee based on income, we pay our investment adviser a quarterly Incentive Fee based on the amount by which (A) aggregate net investment income (“Ordinary Income”) in respect of the relevant Trailing Twelve Quarters exceeds (B) the hurdle amount for such Trailing Twelve Quarters. The amount of the excess of (A) over (B) described in this paragraph for such Trailing Twelve Quarters is referred to as the “Excess Income Amount.” For the avoidance of doubt, Ordinary Income is net of all fees and expenses, including the Management Fee but excluding any Incentive Fee.

The Incentive Fee based on income for each quarter is determined as follows:

| • | No Incentive Fee based on income is payable to our investment adviser for any calendar quarter for which there is no Excess Income Amount; |

| • | 100% of the Ordinary Income, if any, that exceeds the hurdle amount, but is less than or equal to an amount, which we refer to as the “Catch-up Amount,” determined as the sum of 2.1875% multiplied by our NAV at the beginning of each applicable calendar quarter comprising the relevant Trailing Twelve Quarters is included in the calculation of the Incentive Fee based on income; and |

| • | 20% of the Ordinary Income that exceeds the Catch-up Amount is included in the calculation of the Incentive Fee based on income. |

The amount of the Incentive Fee based on income that is paid to our investment adviser for a particular quarter is equal to the excess of the Incentive Fee so calculated minus the aggregate Incentive Fees based on income that were paid in respect of the first eleven calendar quarters (or the portion thereof) included in the relevant Trailing Twelve Quarters but not in excess of the Incentive Fee Cap (as described below).

The Incentive Fee based on income that is paid to our investment adviser for a particular quarter is subject to a cap (the “Incentive Fee Cap”). The Incentive Fee Cap for any quarter is an amount equal to (a) 20% of the Cumulative Net Return (as defined below) during the relevant Trailing Twelve Quarters minus (b) the aggregate Incentive Fees based on income that were paid in respect of the first eleven calendar quarters (or the portion thereof) included in the relevant Trailing Twelve Quarters.

“Cumulative Net Return” means (x) the Ordinary Income in respect of the relevant Trailing Twelve Quarters minus (y) any Net Capital Loss, if any, in respect of the relevant Trailing Twelve Quarters. If, in any quarter, the Incentive Fee Cap is zero or a negative value, we will pay no Incentive Fee based on income to our investment adviser for such quarter. If, in any quarter, the Incentive Fee Cap for such quarter is a positive value but is less than the Incentive Fee based on income that is payable to our investment adviser for such quarter (before giving effect to the Incentive Fee Cap) calculated as described above, we will pay an Incentive Fee based on income to our investment adviser equal to the Incentive Fee Cap for such quarter. If, in any quarter, the Incentive Fee Cap for such quarter is equal to or greater than the Incentive Fee based on income that is payable to our investment adviser for such quarter (before giving effect to the Incentive Fee Cap) calculated as described above, we will pay an Incentive Fee based on income to our investment adviser equal to the Incentive Fee calculated as described above for such quarter without regard to the Incentive Fee Cap.

“Net Capital Loss” in respect of a particular period means the difference, if positive, between (i) aggregate capital losses, whether realized or unrealized, in such period and (ii) aggregate capital gains, whether realized or unrealized, in such period.

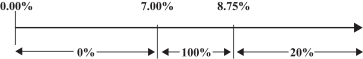

The following is a graphical representation of the calculation of the Incentive Fee based on income:

Incentive Fee based on Income

Percentage of Ordinary Income comprising the Incentive Fee based on Income

(expressed as an annualized rate(1) of return on the value of net assets as of the beginning

of each of the quarters included in the Trailing Twelve Quarters)