Attached files

| file | filename |

|---|---|

| 8-K - 8-K - R1 RCM INC. | achi-20200603.htm |

Exhibit 99.1 Investor Presentation June 3, 2020

Forward-Looking Statements and Non-GAAP Financial Measures This presentation includes information that may constitute “forward-looking statements,” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements relate to future, not past, events and often address our expected future growth, plans and performance or forecasts. These forward-looking statements are often identified by the use of words such as “anticipate,” “believe,” “designed,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “will,” or “would,” and similar expressions or variations, although not all forward-looking statements contain these identifying words. These forward-looking statements include, among other things, statements about the potential impacts of the COVID-19 pandemic, our strategic initiatives, our capital plans, our costs, our ability to successfully deliver on our commitments to our customers, our ability to deploy new business as planned, our ability to successfully implement new technologies, our future financial performance and our liquidity, and also include statements about the proposed acquisition of the RevWorks business, the expected timing of the proposed acquisition of the RevWorks business and the anticipated benefits of the proposed acquisition of the RevWorks business and the acquisition of SCI. Such forward-looking statements are based on management’s current expectations about future events as of the date hereof and involve many risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in our forward-looking statements. Subsequent events and developments, including actual results or changes in our assumptions, may cause our views to change. We do not undertake to update our forward-looking statements except to the extent required by applicable law. Readers are cautioned not to place undue reliance on such forward-looking statements. All forward-looking statements included herein are expressly qualified in their entirety by these cautionary statements. Our actual results and outcomes could differ materially from those included in these forward-looking statements as a result of various factors, including, but not limited to, the severity, magnitude and duration of the COVID-19 pandemic; responses to the pandemic by the government and healthcare providers and the direct and indirect impacts of the pandemic on our customers and personnel; the disruption of national, state and local economies as a result of the pandemic; the impact of the pandemic on our financial results, including possible lost revenue and increased expenses; risks related to the satisfaction of the conditions to closing the acquisition of the RevWorks business in the anticipated timeframe or at all; risks that the expected benefits from the proposed acquisition of the RevWorks business or the acquisition of SCI will not be realized or will not be realized within the expected time period; the risk that acquired businesses will not be integrated successfully; significant transaction costs; unknown or understated liabilities; and the factors discussed under the heading “Risk Factors” in our annual report on Form 10-K for the year ended December 31, 2019, our quarterly reports on Form 10-Q and any other periodic reports that the Company files with the Securities and Exchange Commission. This presentation includes the following non-GAAP financial measure: Adjusted EBITDA. Please refer to the Appendix located at the end of this presentation for a reconciliation of the non-GAAP financial measure to the most directly comparable GAAP financial measure. 2

R1 Investment Highlights Strong Profit Unique Large Multiple Growth Trajectory Value Market Drivers with High Underpinned by Proposition Opportunity Recurring Revenue Tech Investment Operating Model $110B 14% $168M Robust & Proven Acute & Physician RCM Average Quarterly Adjusted EBITDA in 2019 Scale Leverage Market Revenue Growth From $57M in 2018 Proprietary Technology Since 2016 Leading, end-to-end revenue cycle platform with a compelling financial model 3

Significant Improvements for Integrated Health Systems NEED VALUE ADD RESULTS Growing • Lower costs pressure to run revenue cycle We plug into • Faster collections more efficiently health providers’ • Higher revenue existing • Higher patient satisfaction IT systems OPERATING MODEL Proprietary Experienced Analytics Global Shared Proven Technology Talent and Alerts Services Results 4

Comprehensive Revenue Cycle Capabilities for Providers Care Settings Emergency Physician Acute Post-Acute Revenue Cycle Phases Order to Intake Care to Claim Claim to Payment Solutions address the full spectrum of needs and Payment Models operations Fee-for-service Patient Self-pay Value-based Transforming revenue cycle performance across all care settings and payment models 5

Acquisition of RevWorks ▪ Further establishes R1 footprint across acute and ambulatory markets Strategic ▪ Valuable commercial partner in Cerner, speaking to R1’s best-in-class capabilities Rationale ▪ Access to high quality experienced team to support scaled growth ▪ Supports our commitment to R1 technology interoperability with all host systems ▪ Transaction valued at $30 million inclusive of working capital, financed with cash on balance sheet Transaction ▪ Payments to Cerner in three installments between closing and second anniversary of closing Terms ▪ Expected to close in Q3 2020 ▪ Approximately $80 million in annual revenue across 150+ customers Financial ▪ Steady-state adjusted EBITDA margin of 25-30% Contribution ▪ Accretive to earnings within first year ▪ Minimal effect on R1 leverage levels and net debt/EBITDA ratio Attractive valuation underpinned by high degree of confidence in execution 6

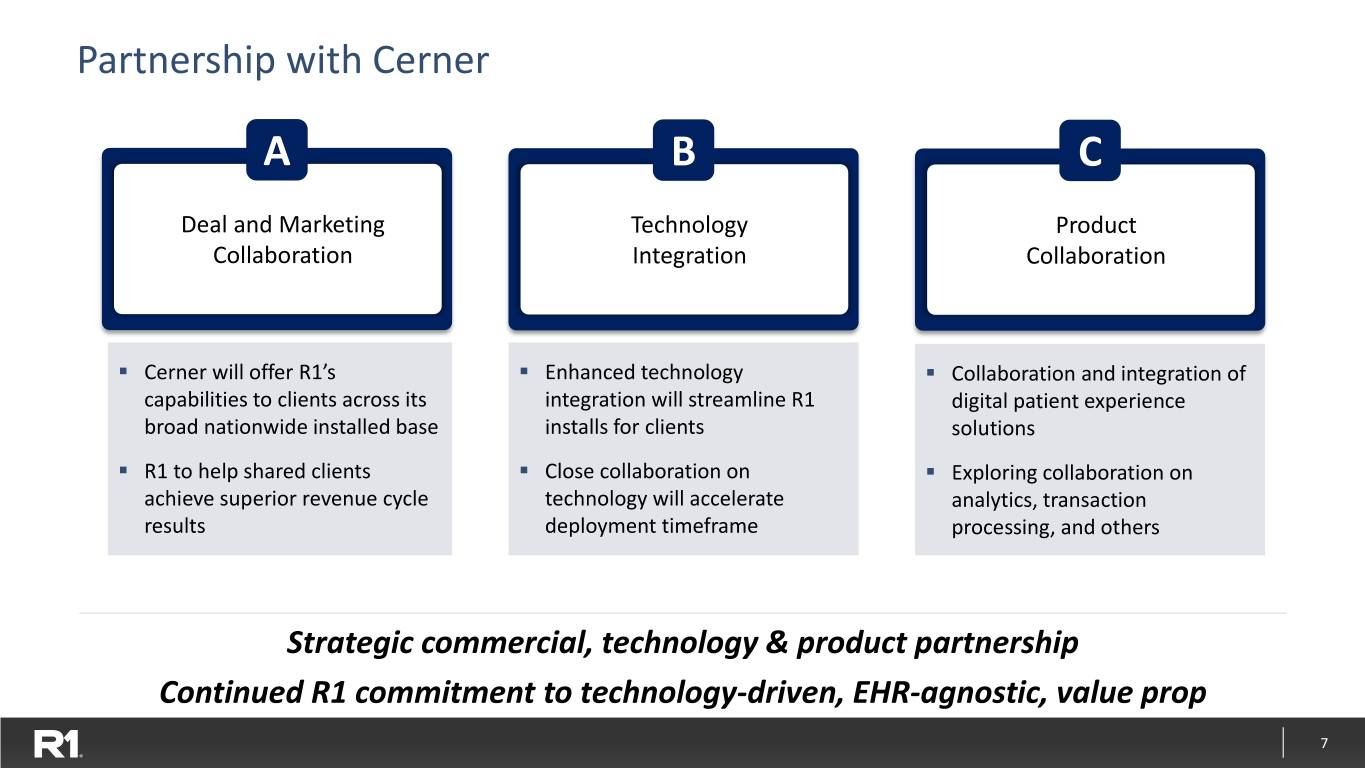

Partnership with Cerner A B C Deal and Marketing Technology Product Collaboration Integration Collaboration ▪ Cerner will offer R1’s ▪ Enhanced technology ▪ Collaboration and integration of capabilities to clients across its integration will streamline R1 digital patient experience broad nationwide installed base installs for clients solutions ▪ R1 to help shared clients ▪ Close collaboration on ▪ Exploring collaboration on achieve superior revenue cycle technology will accelerate analytics, transaction results deployment timeframe processing, and others Strategic commercial, technology & product partnership Continued R1 commitment to technology-driven, EHR-agnostic, value prop 7

SCI Transaction Rationale ▪ Delivers most comprehensive solution to drive patient engagement for health systems Enhances Growth ▪ Expands R1 addressable market and supports commercialization of PX modular offering Trajectory ▪ Further differentiates R1’s value proposition in end-to-end opportunities Accelerates ▪ Advances R1’s capability set and provides greater control of technology architecture Technology ▪ Comprehensive automation of patient intake including pre-auth process increases DTO use case Roadmap ▪ Adds innovative culture and high-performing team ▪ Estimated $30M in synergies, with ~$20M from margin expansion on contracted base (expect $10M Unlocks Significant in synergies to phase-in in 2021, with remainder in 2022 and 2023) Synergies ▪ Adds high margin SaaS Offering to revenue mix that fuels R1 margin upside ▪ Potential for meaningful growth upside above synergy assumption via PX commercialization Accretive to ▪ Accretive to earnings within first year Earnings Strategic technology that meaningfully increases R1’s value proposition and unlocks significant synergies 8

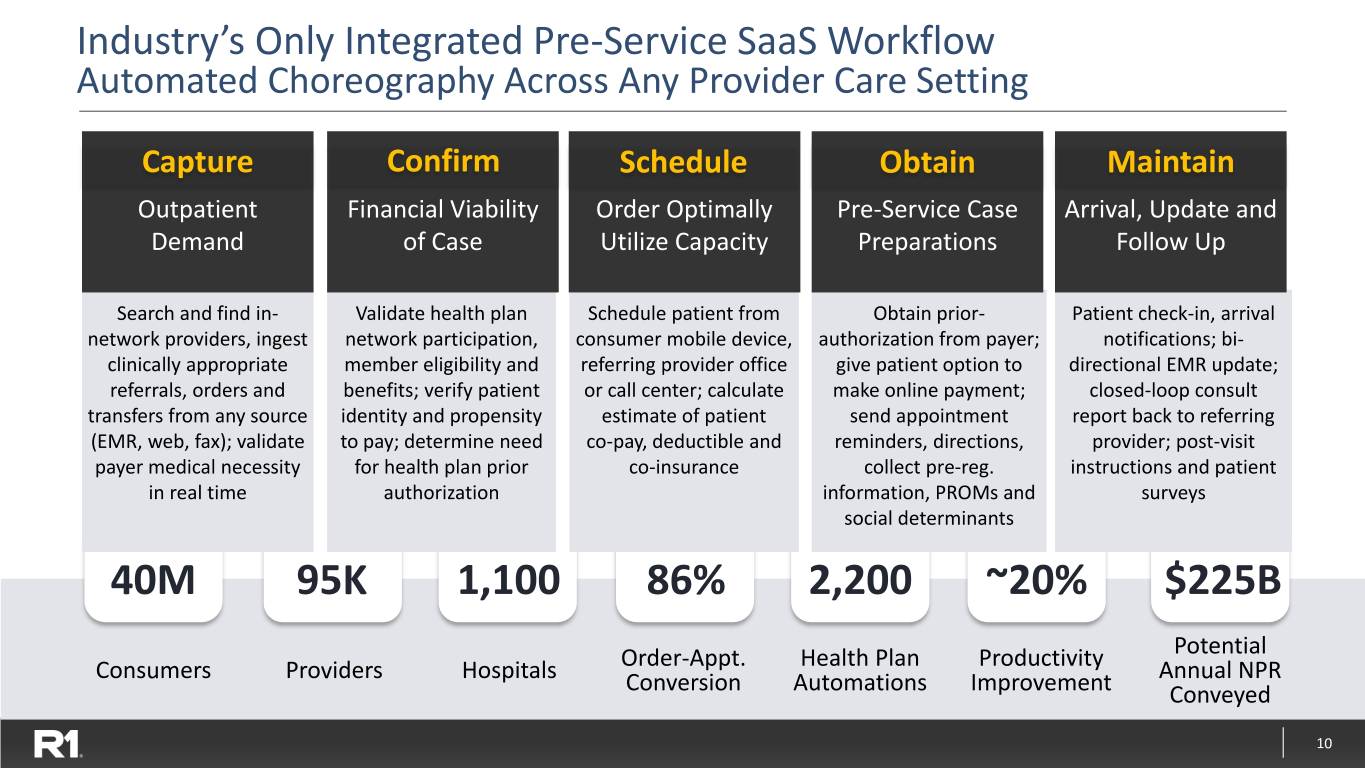

Industry’s Only Integrated Pre-Service SaaS Workflow Automated Choreography Across Any Provider Care Setting SCI Core Product Offerings 1 2 3 4 Provider Network Schedule Digital Patient Intake Experience (PNX) Maximizer Experience (DPX) Analytics Capture Confirm Schedule Obtain Maintain Outpatient Financial Viability Order Optimally Pre-Service Case Arrival, Update and Demand of Case Utilize Capacity Preparations Follow Up 40M 95K 1,100 86% 2,200 ~20% $225B Potential Consumers Providers Hospitals Order-Appt. Health Plan Productivity Annual NPR Conversion Automations Improvement Conveyed 9

Industry’s Only Integrated Pre-Service SaaS Workflow Automated Choreography Across Any Provider Care Setting Capture Confirm Schedule Obtain Maintain Outpatient Financial Viability Order Optimally Pre-Service Case Arrival, Update and Demand of Case Utilize Capacity Preparations Follow Up Search and find in- Validate health plan Schedule patient from Obtain prior- Patient check-in, arrival network providers, ingest network participation, consumer mobile device, authorization from payer; notifications; bi- clinically appropriate member eligibility and referring provider office give patient option to directional EMR update; referrals, orders and benefits; verify patient or call center; calculate make online payment; closed-loop consult transfers from any source identity and propensity estimate of patient send appointment report back to referring (EMR, web, fax); validate to pay; determine need co-pay, deductible and reminders, directions, provider; post-visit payer medical necessity for health plan prior co-insurance collect pre-reg. instructions and patient in real time authorization information, PROMs and surveys social determinants 40M 95K 1,100 86% 2,200 ~20% $225B Potential Consumers Providers Hospitals Order-Appt. Health Plan Productivity Annual NPR Conversion Automations Improvement Conveyed 10

R1 Strategic Priorities with SCI Acquisition 1 2 3 Solidify and Extend Our Integrate R1 and SCI Lead as the Most Enable High-Performing Technology to Transform Comprehensive Digital Marketplace for Scheduling and Pre- Patient Experience Healthcare Services Registration Process Solution in the Market ▪ Drives margin expansion ▪ Unlocks growth via PX ▪ Significantly increases our ▪ Increases returns for Offering customers’ revenue stream customers ▪ Establishes high margin SaaS via efficient online access to patient and referring ▪ Further differentiates end- revenue stream provider demand to-end offering ▪ Solves high-value customer pain points 11

Integrate R1 and SCI Technology to Transform Scheduling and 1 Pre-Registration Process Illustrative Order Scheduling & Referral Workflow How We Will Leverage This Technology in Our Operations Auth & Order/ Estimate Schedule Financial Pre-Reg Referral and Pay 1 Transformative Operational Benefits Clearance ▪ Provide patients and providers with a superior, efficient experience Primary Care ▪ Drives significant cost reduction through waste elimination ▪ Drives yield via up-front defect resolution, price transparency & payment Specialist Referral 2 Comprehensive Authorization Automation Diagnostic ▪ All data elements from order fully codified and digitized & Ancillary Care Settings Care ▪ Standardized, structured data fundamentally enables automation Acute 3 Strategic Analytics Offering for Clients Out-Patient ▪ Enable forecasting and visibility into demand Technology SCI SCI R1 R1/SCI R1 ▪ Visually monitor and holistically drive utilization of capacity Significant value created by comprehensive solution architecture 12

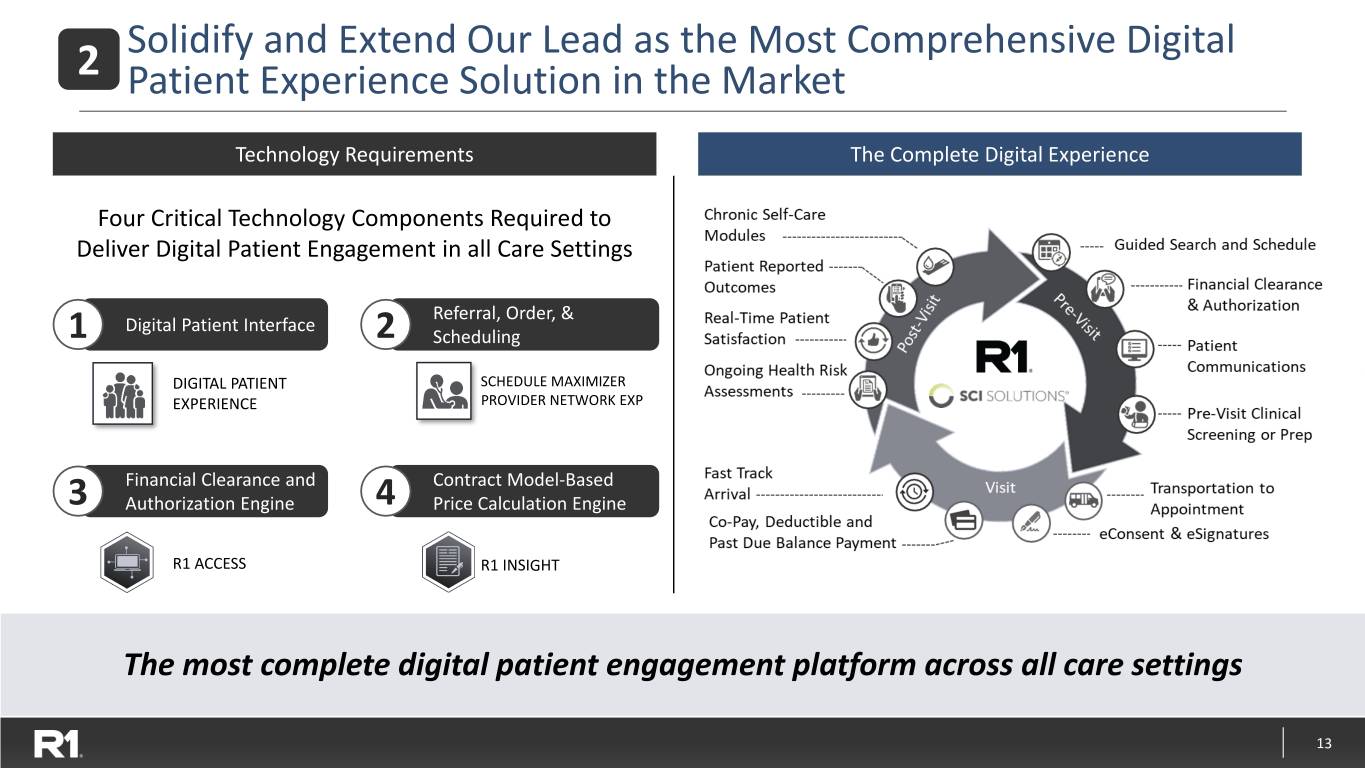

Solidify and Extend Our Lead as the Most Comprehensive Digital 2 Patient Experience Solution in the Market Technology Requirements The Complete Digital Experience Four Critical Technology Components Required to Chronic Self-Care Guided Search and Schedule Modules Deliver Digital Patient Engagement in all Care Settings Patient Reported Financial Clearance & Outcomes t P Referral, Order, & i r Authorization Digital Patient Interface is e V -V 1 2 - Scheduling t is s i Real-Time Patient o t Patient P DIGITAL PATIENT SCHEDULE MAXIMIZERSatisfaction Communication(s) EXPERIENCE PROVIDER NETWORK EXP Ongoing Health Risk Pre-Visit Clinical Assessments Screening or Prep Financial Clearance and Contract Model-Based 3 Authorization Engine 4 Price Calculation Engine Visit Fast Track Arrival Transportation to Appointment R1 ACCESS R1 INSIGHT Co-Pay, Deductible and Past Due Balance Payment eConsent & eSignatures The most complete digital patient engagement platform across all care settings 13

3 Enable High-Performing Marketplace for Healthcare Services Multi-Sided Marketplace Overview Why R1/SCI are in unique position Match Supply and Demand ▪ Digitizing Scheduling & Order Referral enables efficient matching of qualified demand to supply Referring Health Patients Providers Plans ▪ Scale & Market Presence as a result of R1 ~$35B Captive NPR Provider Consumer- Optimize Demand Online Directed member-to- ▪ Exceptional User Experience, Drives Retention, Expanded Ordering & Online provider Scheduling Scheduling matching Use/Uptake, and Marketplace Preference ▪ By Covering Constituents’ Entire End to End Journey, We are in position to amplify Network Effects Rendering Provider Organizations ▪ Nature of R1 Operating Partner Commercial Engagement we Supply are in position to support Customers Growth Strategy Service Delivery Resources Codified & Digitized Already launched in pilot markets and driving results... structural combination accelerates scaling and technology roadmap 14

R1 Investment Highlights 1. Large, Underpenetrated Market 2. Differentiated Value Proposition 3. Multiple Growth & Profit Drivers 4. Strong Financial Trajectory 15

Market Dynamics Play to Our Strengths Hospital Implications Need for Market Dynamics for Hospitals Sustainable Solutions ▪ Sub-optimal collections rate ▪ Financial pressures ▪ Weakening margins ▪ Increasing complexity ▪ Infrastructure not delivering ▪ Industry consolidation scale advantages ▪ Capital constraints ▪ Falling behind in technology Best value ▪ Consumer demands ▪ Transform from a wholesale proposition to retail mindset 16

Large, Growing and Underpenetrated Market $110B RCM Market1 External RCM Spend R1 Revenue Growth Growing Steadily2 $70B Acute-Care $40B Physician $110B Total TAM External TARGET Spend MARKET ~$30B Internal 16% Spend 12% ~$80B CAGR First Quarter 2020 Projected through 2022 year-on-year growth Market dynamics support strong incremental growth 1 Note : CMS NHE Projections and R1 estimates. 17 Note2: Research and Markets Global Forecast to 2022, published January 2018.

R1 Investment Highlights 1. Large, Underpenetrated Market 2. Differentiated Value Proposition 3. Multiple Growth & Profit Drivers 4. Strong Financial Trajectory 18

Comprehensive Transformation WORKFLOW PATIENT ACCESS UTILIZATION, CHARGE & CODE CLAIMS & REIMBURSEMENT 1 2 3 4 5 6 7 8 9 10 11 12 13 Phys. Pre-Reg. / Financial Check-in Level of Case Mgmt. Charge Coding & Billing & Denials Customer Patient Pay / Under- Order & Financial Counseling /Arrival Care / Utilization Compliance Acuity Follow-up Mgmt. Service Pre-Collect payments Scheduling Clearance Review Capture ANALYTICS VISIBILITY + ACTIONABLE INTELLIGENCE + PERFORMANCE MANAGEMENT DELIVERY DEPLOYMENT + CENTRALIZED OPERATIONS + TALENT + GLOBAL NETWORK TECHNOLOGY EXTENSIVE & FLEXIBLE PLATFORM + AUTOMATION SOLUTIONS + SECURITY OPERATING SYSTEM PROVEN METHODS + STANDARDIZATION + OPERATING RHYTHM + QUALITY + COMPLIANCE UP TO 5% 20% 30% Improved healthcare provider economics Increase in Reduction in Reduction in net revenue A/R days cost to collect 19

Broad Portfolio of Technology Tools PATIENT ACCESS & EXPERIENCE YIELD & DENIAL MITIGATION ANALYTICS AUTOMATION Clinical and Scoring and Predictive Technical Personalization Analytics Appeals Actionable Order Integrated Yield-Based Web Service Performance Management Bill Pay Follow-Up Integration Monitoring Simple and Documentation Digital Scheduling Complex Management Self-Service Coding Natural Digital Financial Claim Status Alerts and Language Check-In Counseling Triage Messaging Processing Revenue Price Dimensional Omni-Channel Capture and Estimation Visualization Communications Integrity Robotic Denial Financial Process Cognitive Detection Clearance Automation Automation and Triage (RPA) Patient Access & Experience Yield & Denial Mitigation Analytics Automation PATIENT EXPERIENCE CONTACT DECISION ANALYTICS AUTOMATE LINK INSIGHT ePARS PROVIDER AWARENESS ACCESS CONTRACT Foundational 20

Scalable Infrastructure, Broadest RCM Capabilities High Major end-to-end Scalability Competitors Niche Competitors Low Single-focus Revenue Cycle Capabilities End-to-End 21

R1 Investment Highlights 1. Large, Underpenetrated Market 2. Differentiated Value Proposition 3. Multiple Growth & Profit Drivers 4. Strong Financial Trajectory 22

Multi-faceted Approach to Growth Contracted Provides EBITDA growth visibility beyond 2021 Business Rollout Digital Margin expansion through automation and digitizing patient experience Transformation Expansion of Selectively pursue acquisitions and fund internal initiatives Capabilities End-to-end co-managed or operating partner deals New Commercial Modular services wins Wins Cross-sell into physician advisory services installed base 23

Contracted Business Drives Margin Expansion End-to-End Customers Deployment Schedule and Margin Progression Penn State Health ($2.2B NPR) Quorum Health, Physician Group1, and RUSH ($4.1B NPR) AMITA and Ascension Medical Group ($6B NPR) Intermountain ($5B NPR) Ascension Phase-2 and Wisconsin ($5B NPR) Ascension Phase-1 ($3B NPR) 2016 2017 2018 2019 2020 2021 Year 1: Onboarding phase Year 2: Margin-ramp phase Year 3+: Steady-state phase $17B of NPR in margin-ramp phase exiting 2020 Note1: $700M NPR End-to-End Operating Partner Physician Group signed in Q3 2019. 24

Digital Transformation Set to Deliver Margin Expansion 3 Key Levers Year One Results Future Roadmap Automation Center of Excellence developed and Continue to rapidly deploy automations Robotic Process across both new client and new use cases Automation implemented automations resulting in digitizing the equivalent of ~1000 workers with the goal of doubling our digital workforce within the next 12-15 months Improved patient experience through digital self Expand R1’s digital front door strategy Digital Self Service & service registration across 260+ Host System through the scaling of our digital Scheduling Patient Experience Integrations addressing a previously difficult to solution and continued scaling of self-service improve operational footprint registration to additional patient types Cognitive and Leveraged R1’s built-for-purpose machine Expand machine learning across multiple Machine Learning learning approach to across several pilot domains to expand automation use case projects in the Accounts Receivable domain potential and enhance manual workflow Overall impact: $15-20M contribution to adjusted EBITDA in 2020 25

R1’s Physician Group RCM Capabilities & Scale Significant $7B+ 30M Scale Net Patient Revenue Patient Encounters Under Management Annually Employed Deep Specialty 27,000+ 80+ and Independent Expertise Providers Specialties Physician Groups Hospital-Based and Office-Based Broad Host System Practice Capabilities End-to-End Coverage Agnostic Technology Management Large, diversified physician revenue cycle footprint 26

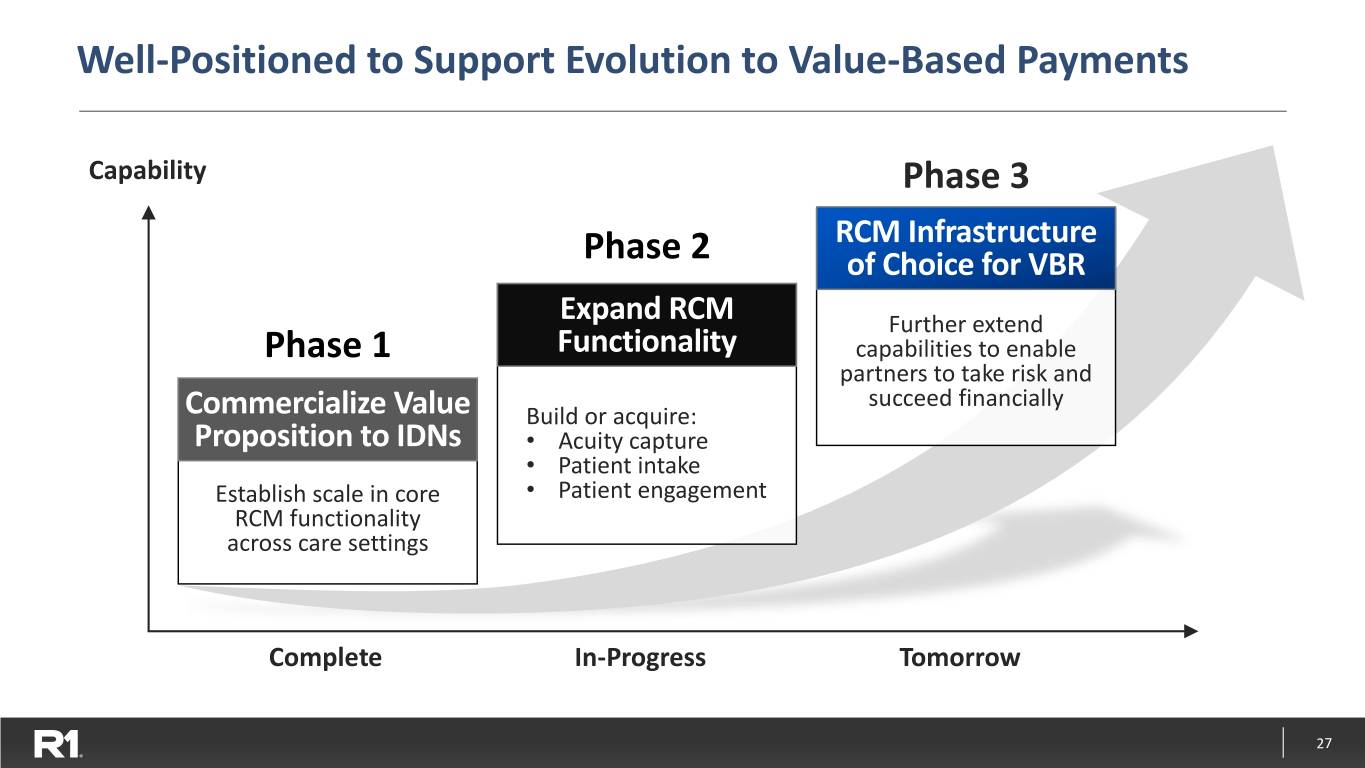

Well-Positioned to Support Evolution to Value-Based Payments Capability Phase 3 RCM Infrastructure Phase 2 of Choice for VBR Expand RCM Further extend Phase 1 Functionality capabilities to enable partners to take risk and succeed financially Commercialize Value Build or acquire: Proposition to IDNs • Acuity capture • Patient intake Establish scale in core • Patient engagement RCM functionality across care settings Complete In-Progress Tomorrow 27

R1 Investment Highlights 1. Large, Underpenetrated Market 2. Differentiated Value Proposition 3. Multiple Growth & Profit Drivers 4. Strong Financial Trajectory 28

Demonstrated Recurring Revenue Momentum Quarterly Revenue – $Millions $314M $321M $295 $301M $276 $263 $250 $208 $140 $147 $123 $87 $99 Q1'17 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 Q3'18 Q4'18 Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 29

Appendix 30

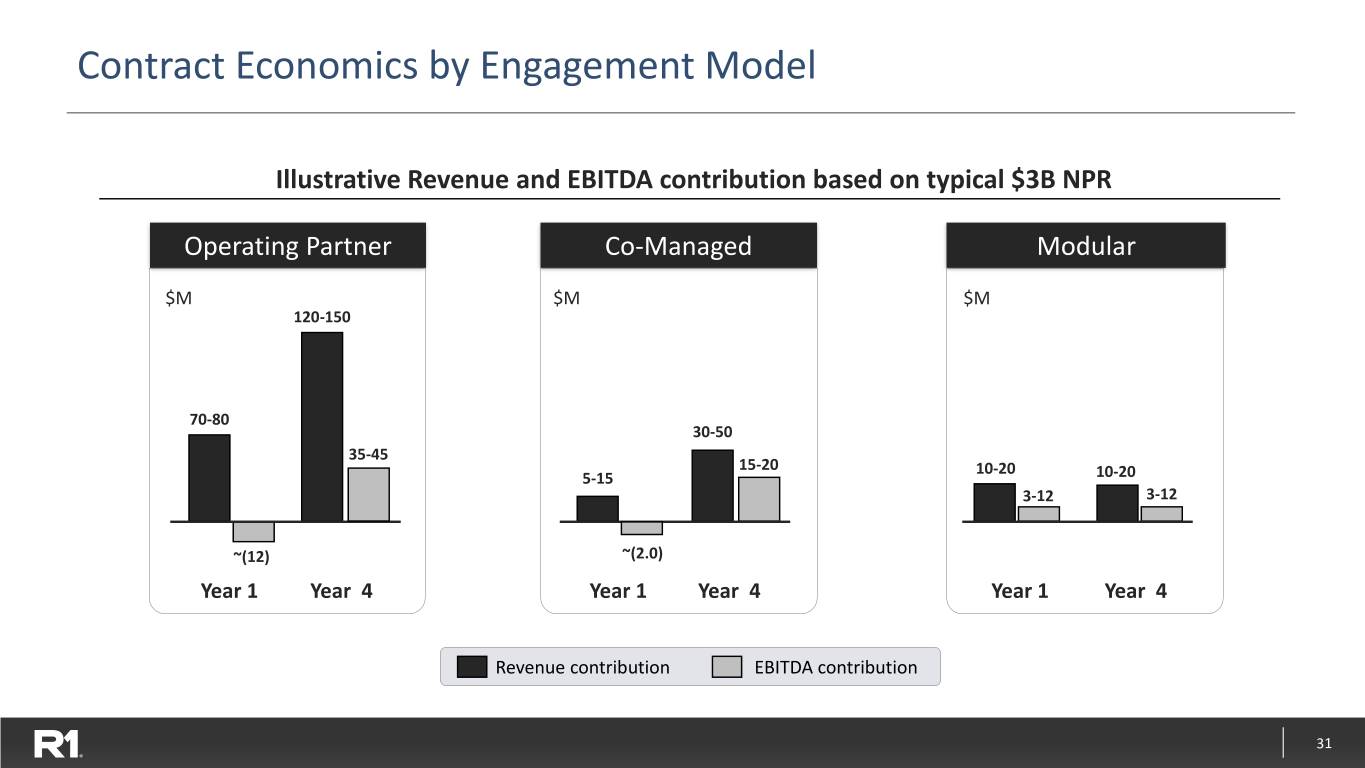

Contract Economics by Engagement Model Illustrative Revenue and EBITDA contribution based on typical $3B NPR Operating Partner Co-Managed Modular $M $M $M 120-150 70-80 30-50 35-45 15-20 10-20 5-15 10-20 3-12 3-12 ~(12) ~(2.0) Year 1 Year 4 Year 1 Year 4 Year 1 Year 4 Revenue contribution EBITDA contribution 31

Financial Model for Operating Partner Model Illustrative Contribution from $3B NPR Customer Launch Growth Steady State 0 – 12 Months 12 – 36 Months 36+ Months ▪ Deploy transition resources ▪ Finalize employee transitions ▪ Continuous optimization: ▪ Perform financial ▪ Transfers to Shared Services − KPI metric improvement assessment ▪ Complete standardization − Technology advancement ▪ Invest in infrastructure ▪ Steady state org structure − Productivity improvement ▪ Implement technology Mid-Point Mid-Point Mid-Point Financial Impact – $M of Range Financial Impact – $M of Range Financial Impact – $M of Range Revenue 75 Revenue 120 Revenue 135 Adj. EBITDA contribution (12) Adj. EBITDA contribution 20 Adj. EBITDA contribution 40 Adj. EBITDA contribution % (16%) Adj. EBITDA contribution % 17% Adj. EBITDA contribution % 30% 32

Financial Model for Co-Managed Partner Model Illustrative Contribution from $3B NPR Customer Launch Growth Steady State 0 – 12 Months 12 – 36 Months 36+ Months ▪ Deploy transition resources ▪ Complete standardization ▪ Continuous optimization: ▪ Perform financial ▪ Workflow optimization − KPI metric improvement assessment ▪ Rationalize third-party − Technology advancement ▪ Invest in infrastructure vendors − Productivity improvement ▪ Implement technology Mid-Point Mid-Point Mid-Point Financial Impact – $M of Range Financial Impact – $M of Range Financial Impact – $M of Range Revenue 10 Revenue 25 Revenue 40 Adj. EBITDA contribution (2) Adj. EBITDA contribution 7 Adj. EBITDA contribution 18 Adj. EBITDA contribution % (20%) Adj. EBITDA contribution % 28% Adj. EBITDA contribution % 45% 33

Capital Structure Data as of latest earnings call Cash $107 million in cash and cash equivalents as of 3/31/20 Debt $580 million 169.6 million diluted common shares consisting of: ▪ 114.4 million basic common shares, plus Diluted Common ▪ Dilutive effect of: Shares − Employee stock options − Ascension/TowerBrook warrant to purchase 60 million common shares at $3.50 per share − Intermountain Healthcare warrant to purchase 1.5 million common shares at $6.00 per share Convertible Equivalent to 110.9 million common shares in Q2’20 ▪ 200,000 shares issued in Feb. 2016 (equivalent to 80 million common shares at issuance) Preferred ▪ 8% annual dividend payable in kind on a quarterly basis for 7 years, and cash or kind Stock thereafter 34