Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FLOTEK INDUSTRIES INC/CN/ | a2020q18-k.htm |

FLOTEK ANNOUNCES FIRST QUARTER EARNINGS RESULTS Adjusted EBITDA Loss Narrows Strong Balance Sheet Acquisition of JP3 Positions the Company for Accelerated Growth HOUSTON, May 18, 2020 – Flotek Industries, Inc. ("Flotek" or the "Company") (NYSE: FTK) today announced results for the three months ended March 31, 2020. John W. Gibson, Jr., Chairman, President, and Chief Executive Officer stated: “Today’s environment is unprecedented as we face difficult challenges with COVID-19, coupled with an oversupply of crude oil resulting in a sharp reduction in prices. We would like to thank our employees for their hard work and dedication to our business during this crisis, and we will continue to focus on the health and safety of our employees as we manage through this pandemic. Given the volatile environment, we are focusing on new opportunities to diversify our business and better serve our customers amidst accelerating digital transformation in the energy industry. With today’s announcement of the acquisition of JP3, a leading data and analytics technology company, we believe that we will be well-positioned for accelerated growth and reduced cyclicality.” First Quarter Financial Results Flotek generated first quarter 2020 revenue of $19.4 million for three months ended March 31, 2020 compared to $43.3 million in the first quarter 2019 and declined 0.6% from $19.5 million on a sequential basis. Reported a loss from continuing operations for the first quarter 2020 of $64.0 million, or a loss of $1.07 per diluted share, compared to a loss from continuing operations in the first quarter 2019 of $15.2 million, or a loss of $0.26 per diluted share. The loss of $64.0 million included a nonrecurring charge of $57.5 million related to the impairment of property, plant, and equipment, right-of-use assets, and intangible assets. Operating expenses were $22.8 million in the first quarter 2020 compared to $44.0 million in the same period last year, primarily reflecting lower fixed and variable costs, partially offset by a non- recurring charge of $2.3 million during the first quarter of 2020, which is comprised of $0.8 million related to a loss on terpene purchase commitments and $1.5 million related to an incremental reserve against terpene inventory on hand. Corporate general and administrative expense for the first quarter of 2020 was $4.5 million compared to $7.3 million for the first quarter of 2019. Included in the first quarter was $0.5 million of severance versus $1.6 million in the first quarter of the prior year. Adjusted EBITDA for the first quarter 2020 was a loss of $6.5 million versus a loss of $7.6 million for the first quarter of 2019, and improved 15% on a sequential basis driven by headcount and expense reductions in freight, equipment rentals, and travel and entertainment. Balance Sheet and Liquidity As of March 31, 2020, the Company had cash and equivalents of $80.3 million, no outstanding debt and $6.6 million in escrowed funds on the balance sheet, reflecting Flotek’s estimate of its claim to the remaining balance of the indemnity escrow related to the sale of Florida Chemical Corporation (“FCC”) to Archer- Daniels-Midland (“ADM”) and $6.6 million in taxes receivable, reflecting a $6.1 million tax refund applied for

pursuant to the CARES Act extended net operating loss carryback provisions. As previously reported, in February 2020, the Company paid $15.8 million to ADM in exchange for reduced purchase commitments and pricing in the amendment to its terpene supply agreement. Also previously reported in February 2020, as a result of the post-closing working capital dispute resolution determined by a third party, Flotek paid $1.5 million to ADM, in addition to releasing Flotek’s remaining claim to funds in post-closing working capital adjustment escrow. On April 16, 2020, the Company was funded on a $4.8 million promissory note pursuant to the Paycheck Protection Program administered by the United States Small Business Administration as part of the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”). Flotek’s Response to COVID-19 and Current Energy Market Conditions In response to COVID-19 and volatile energy market conditions, the Company has taken numerous actions to improve its financial flexibility which include the following: Lowered base salary in exchange for restricted stock for each of the other executive officers by 10% and for Gibson by 20% Decreased compensation to the Board of Directors by 20% Reduced the workforce by 35% Cut back discretionary spending across all business operations of $4 million on an annualized basis Expanded our products and services to meet the current market environment including well shut- in activities Implemented new protocols related to shifts for manufacturing Mandated full-facility cleaning procedures Instituted work from home procedures for a majority of the workforce Applied for a $6.1 million tax refund pursuant to the CARES Act extended net operating loss (“NOL”) carryback provisions Finalized plans in Q1 2020 to consolidate office space in Q2 2020, while maintaining presence in key markets, most notably, relocating Houston corporate headquarters personnel to its Houston- based Global Research and Innovation facility. In connection with these plans, in Q2 2020, the Company was successful in negotiating a termination of its corporate headquarters lease in exchange for a payment of $1 million, which will eliminate approximately $2.7 million of future lease costs that would have otherwise been incurred between mid-2020 and mid-2023. During this challenging period, Flotek utilized excess manufacturing capacity to produce 12,000 gallons of alcohol-based hand sanitizers to donate to first responders, hospitals, schools, homeless shelters, and senior residential communities. Acquisition of JP3 On May 18, 2020, the Company separately announced its acquisition of 100% ownership of JP3 Measurement, LLC (“JP3”), a privately held, leading data and analytics technology company, in exchange for cash-and-stock valued at approximately $34.4 million and the assumption of approximately $1.3 million of debt. Conference Call Details Flotek will host a conference call on Tuesday, May 19, 2020, at 9:00 AM CT (10:00 AM ET) to discuss its operating results for the three months ended March 31, 2020. To participate in the call, participants should dial 844-835-9986 approximately five minutes prior to the start of the call. The call can also be accessed from Flotek’s website at www.flotekind.com. An archived edition of the earnings webcast will also be posted on the Company’s website later that day and will remain available to interested parties via the same link. The conference call may contain forward-looking statements in addition to statements of historical fact. The actual achievement of any forecasted results or the unfolding of future economic or business developments

in a way anticipated or projected by the Company involves numerous risks and uncertainties that may cause the Company’s actual performance to be materially different from that stated or implied in the forward- looking statements. Such risks and uncertainties include, among other things, risks discussed within the “Risk Factors” section of the Company’s most recent Forms 10-Q and 10-K and subsequent 8-Ks. Non-GAAP Financial Measures The Company’s accounting and reporting policies conform to United States generally accepted accounting principles, or GAAP. The Company’s management also evaluates performance based on certain additional non-GAAP financial measures. The Company classifies a financial measure as being a non-GAAP financial measure if that financial measure excludes or includes amounts, or is subject to adjustments that have the effect of excluding or including amounts, that are not included or excluded in the most directly comparable measure calculated and presented in accordance with GAAP as in effect from time to time in the United States in our statements of income, balance sheets or statements of cash flows. This earnings release, our investor conference calls and other filings with the Securities and Exchange Commission contain certain non-GAAP financial measures such as “EBITDA” and “adjusted EBITDA” which are supplemental measures that are not required by, or are not presented in accordance with, GAAP. Non- GAAP financial measures do not include operating, other statistical measures or ratios calculated using exclusively financial measures calculated in accordance with GAAP. Non-GAAP financial measures should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. Moreover, the way we calculate the non-GAAP financial measures may differ from that of other companies reporting measures with similar names, which may limit these measures’ usefulness as a comparative measure. Please refer to the table titled “Unaudited Reconciliation of Non-GAAP Items and Non-Cash Items Impacting Earnings” at the end of this earnings release for a reconciliation of these non-GAAP financial measures. About Flotek Industries, Inc. Flotek empowers the energy industry to maximize the value of their hydrocarbon streams and improve return on invested capital through data-driven platforms and chemistry technologies. Flotek serves downstream, midstream and upstream customers, both domestic and international. Flotek is a publicly traded company headquartered in Houston, Texas, and its common shares are traded on the New York Stock Exchange under the ticker symbol "FTK." For additional information, please visit Flotek's web site at www.flotekind.com. Forward-Looking Statements Certain statements set forth in this press release constitute forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934) regarding Flotek Industries, Inc.’s business, financial condition, results of operations and prospects. Words such as will, well-positioned, strong position, guidance, looking forward, continue, expects, anticipates, intends, plans, believes, seeks, estimates and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this press release. Forward-looking statements in this press release are not historical facts, but reflect the good faith judgment of management and current assumptions and beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside the Company’s control. Such statements include estimates, projections, and statements related to the Company’s business plan, objectives, expected operating results, and assumptions upon which those statements are based. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. Further information about the risks and uncertainties that may impact the Company are set forth in the Company’s most recent filing with the Securities and Exchange Commission on Form 10-K

(including, without limitation, in the "Risk Factors" section thereof), and in the Company’s other SEC filings and publicly available documents. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company undertakes no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this press release. Investor Inquiries, contact: Elizabeth Wilkinson Chief Financial Officer E: Ewilkinson@flotekind.com P: (713) 726-5325 Media Inquiries, contact: Danielle Allen Senior Vice President, Chief of Staff E: DAllen@flotekind.com P: (713) 726-5322

Flotek Industries, Inc. Unaudited Condensed Consolidated Statements of Operations (in thousands, except per share data) Three Months Ended 3/31/2020 3/31/2019 12/31/2019 Revenue $ 19,416 $ 43,256 $ 19,526 Costs and expenses: Operating expenses (excluding depreciation and amortization) 22,841 43,968 42,390 Corporate general and administrative 4,493 7,281 8,955 Depreciation and amortization 2,191 2,260 2,028 Research and development 2,555 2,285 2,205 (Gain) loss on disposal of long-lived assets (33) 1,097 354 Impairment of fixed and long-lived assets 57,454 — — Total costs and expenses 89,501 56,891 55,932 Loss from operations (70,085) (13,635) (36,406) Other (expense) income: Interest expense (4) (1,998) (4) Other (expense) income, net (47) 110 469 Total other (expense) income (51) (1,888) 465 Loss before income taxes (70,136) (15,523) (35,941) Income tax benefit (expense) 6,169 311 (956) Loss from continuing operations (63,967) (15,212) (36,897) Income (loss) from discontinued operations, net of tax — 46,074 (2,425) Net (loss) income (63,967) 30,862 (39,322) Amounts attributable to Flotek shareholders: Loss from continuing operations $ (63,967) $ (15,212) $ (36,897) Income (loss) from discontinued operations, net of tax — 46,074 (2,425) Net (loss) income attributable to Flotek $ (63,967) $ 30,862 $ (39,322) Basic earnings (loss) per common share: Continuing operations $ (1.07) $ (0.26) $ (0.64) Discontinued operations, net of tax — $ 0.79 $ (0.04) Basic earnings (loss) per common share $ (1.07) $ 0.53 $ (0.68) Diluted earnings (loss) per common share: Continuing operations $ (1.07) $ (0.26) $ (0.64) Discontinued operations, net of tax — $ 0.79 (0.04) Diluted earnings (loss) per common share $ (1.07) $ 0.53 $ (0.68) Weighted average common shares: Weighted average common shares used in computing basic 59,836 58,373 58,403 earnings (loss) per common share Weighted average common shares used in computing diluted 59,836 58,373 58,403 earnings (loss) per common share (1) Results of the Company’s Consumer and Industrial Chemistry Technologies (“CICT”) segment are presented as discontinued operations for all periods. (2) Prior periods presented for 2019 have been adjusted to reflect revisions to results determined not to be material to those prior periods. The adjustments include a pretax $2.8M reduction of gain on the sale of Florida Chemical, Inc. related to the transfer of trademarks and brand names not previously reflected for discontinued operations and pretax expense reductions to previously reported cost of sales of $0.6M in Q1 2019 and $0.2M in Q4 2019 for continuing operations.

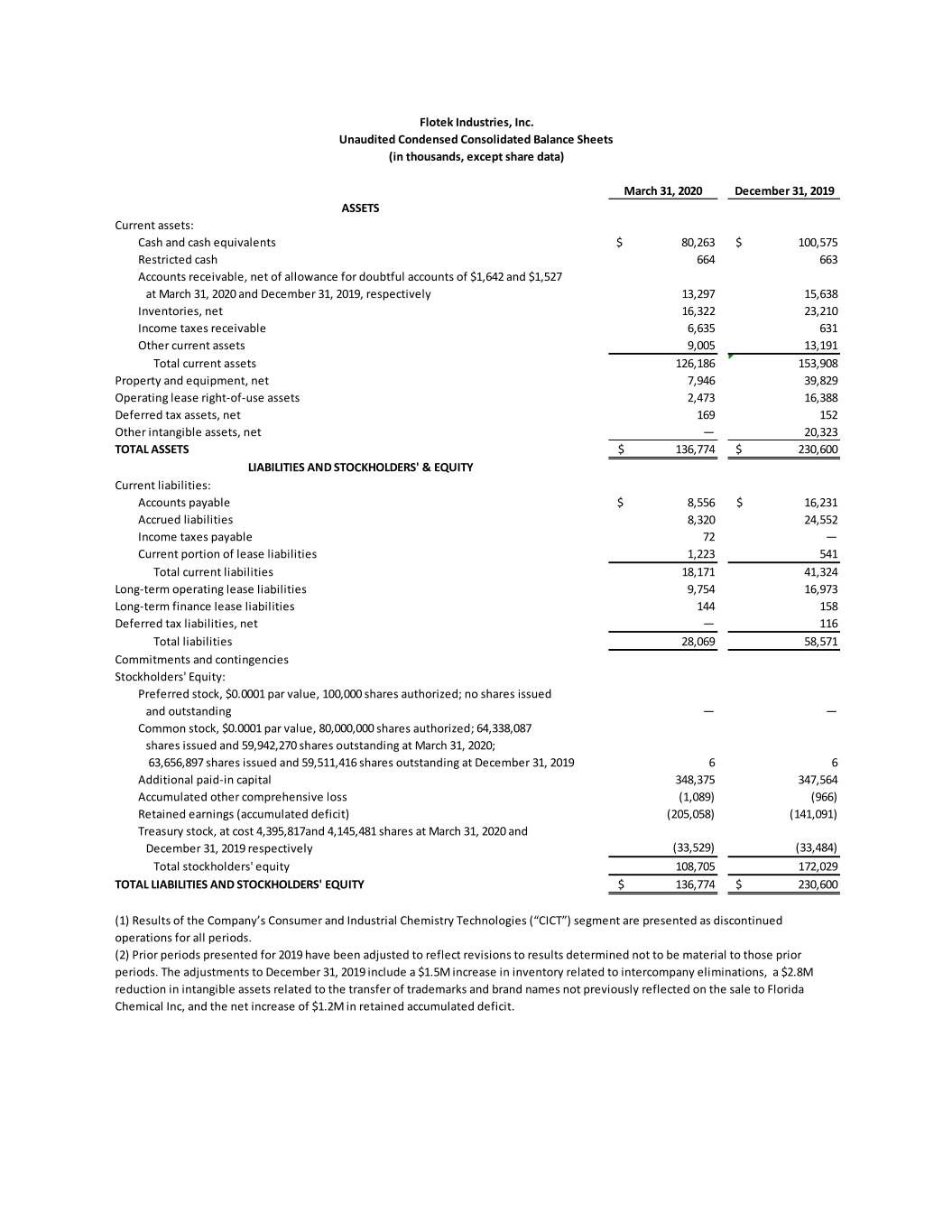

Flotek Industries, Inc. Unaudited Condensed Consolidated Balance Sheets (in thousands, except share data) March 31, 2020 December 31, 2019 ASSETS Current assets: Cash and cash equivalents $ 80,263 $ 100,575 Restricted cash 664 663 Accounts receivable, net of allowance for doubtful accounts of $1,642 and $1,527 at March 31, 2020 and December 31, 2019, respectively 13,297 15,638 Inventories, net 16,322 23,210 Income taxes receivable 6,635 631 Other current assets 9,005 13,191 Total current assets 126,186 153,908 Property and equipment, net 7,946 39,829 Operating lease right-of-use assets 2,473 16,388 Deferred tax assets, net 169 152 Other intangible assets, net — 20,323 TOTAL ASSETS $ 136,774 $ 230,600 LIABILITIES AND STOCKHOLDERS' & EQUITY Current liabilities: Accounts payable $ 8,556 $ 16,231 Accrued liabilities 8,320 24,552 Income taxes payable 72 — Current portion of lease liabilities 1,223 541 Total current liabilities 18,171 41,324 Long-term operating lease liabilities 9,754 16,973 Long-term finance lease liabilities 144 158 Deferred tax liabilities, net — 116 Total liabilities 28,069 58,571 Commitments and contingencies Stockholders' Equity: Preferred stock, $0.0001 par value, 100,000 shares authorized; no shares issued and outstanding — — Common stock, $0.0001 par value, 80,000,000 shares authorized; 64,338,087 shares issued and 59,942,270 shares outstanding at March 31, 2020; 63,656,897 shares issued and 59,511,416 shares outstanding at December 31, 2019 6 6 Additional paid-in capital 348,375 347,564 Accumulated other comprehensive loss (1,089) (966) Retained earnings (accumulated deficit) (205,058) (141,091) Treasury stock, at cost 4,395,817and 4,145,481 shares at March 31, 2020 and December 31, 2019 respectively (33,529) (33,484) Total stockholders' equity 108,705 172,029 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 136,774 $ 230,600 (1) Results of the Company’s Consumer and Industrial Chemistry Technologies (“CICT”) segment are presented as discontinued operations for all periods. (2) Prior periods presented for 2019 have been adjusted to reflect revisions to results determined not to be material to those prior periods. The adjustments to December 31, 2019 include a $1.5M increase in inventory related to intercompany eliminations, a $2.8M reduction in intangible assets related to the transfer of trademarks and brand names not previously reflected on the sale to Florida Chemical Inc, and the net increase of $1.2M in retained accumulated deficit.

Flotek Industries, Inc. Unaudited Reconciliation of Non-GAAP Items and Non-Cash Items Impacting Earnings (in thousands) GAAP Loss from Continuing Operations and Reconciliation to Adjusted EBITDA (Non-GAAP) Three Months Ended 3/31/2020 3/31/2019 12/31/2019 Loss from Continuing Operations (GAAP) $ (63,967) $ (15,212) $ (36,897) Interest Expense 4 1,998 4 Interest Income (269) (226) (405) Income Tax (Benefit) Expense (6,169) (311) 956 Depreciation and Amortization 2,191 2,260 2,028 Impairment of Fixed and Long Lived Assets 57,454 - - EBITDA (Non-GAAP) $ (10,756) $ (11,491) $ (34,314) Stock Compensation Expense 462 456 1,409 Severance and Retirement 1,538 1,721 3,753 Shareholder-Related Activities - 581 - (Gain) loss on Disposal of Assets (33) 1,097 355 Inventory Write-Down 1,468 - 4,438 Supply Chain Contract Commitment 825 - 15,750 Adjusted EBITDA (Non-GAAP) $ (6,496) $ (7,636) $ (8,609) (1) Management believes that adjusted EBITDA for the three months ended March 31, 2020, December 31, 2019 and March 31, 2019, is useful to investors to assess and understand operating performance, especially when comparing those results with previous and subsequent periods. Management views the expenses noted above to be outside of the Company's normal operating results. Management analyzes operating results without the impact of the above items as an indicator of performance, to identify underlying trends in the business and cash flow from continuing operations, and to establish operational goals. 2) Results of the Company’s Consumer and Industrial Chemistry Technologies (“CICT”) segment are presented as discontinued operations for all periods. (3) Prior periods presented for 2019 have been adjusted to reflect revisions to results determined not to be material to those prior periods. The adjustments include a pretax $2.8M reduction of gain on the sale of Florida Chemical, Inc. related to the transfer of trademarks and brand names not previously reflected for discontinued operations and pretax expense reductions to previously reported cost of sales in Q1 2019 of $0.6M and in Q4 2019 of $0.2M for continuing operations. ###