Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CenterState Bank Corp | csfl-8k_20200506.htm |

Exhibit 99.1

Forward Looking Statements Some of the statements made in this communication are “forward-looking statements” within the meaning of the Securities Act of 1933 (the “Securities Act”) and the Securities Exchange Act of 1934 (the “Exchange Act”). Forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates, intentions and future performance and involve known and unknown risks, uncertainties and other factors, many of which may be beyond our control and which may cause the actual results, performance or achievements of the Company to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. All forward-looking statements are subject to risks, uncertainties and other factors that may cause the actual results, performance or achievements of South State or CenterState to differ materially from any results expressed or implied by such forward-looking statements. Such factors include, among others, (1) the risk that the cost savings and any revenue synergies from the merger may not be fully realized or may take longer than anticipated to be realized, (2) disruption to the parties’ businesses as a result of the announcement and pendency of the merger, (3) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, (4) the risk that the integration of each party’s operations will be materially delayed or will be more costly or difficult than expected or that the parties are otherwise unable to successfully integrate each party’s businesses into the other’s businesses, (5) the failure to obtain the necessary approvals by the shareholders of South State or CenterState, (6) the amount of the costs, fees, expenses and charges related to the merger, (7) the ability by each of South State and CenterState to obtain required governmental approvals of the merger (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction), (8) reputational risk and the reaction of each company’s customers, suppliers, employees or other business partners to the merger, (9) the failure of the closing conditions in the merger agreement to be satisfied, or any unexpected delay in closing the merger, (10) the possibility that the merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (11) the dilution caused by South State’s issuance of additional shares of its common stock in the merger, (12) a material adverse change in the financial condition of South State or CenterState, (13) general competitive, economic, political and market conditions, (14) major catastrophes such as earthquakes, floods or other natural or human disasters, including infectious disease outbreaks, including the recent outbreak of a novel strain of coronavirus, a respiratory illness, the related disruption to local, regional and global economic activity and financial markets, and the impact that any of the foregoing may have on South State or CenterState and its customers and other constituencies, and (15) other factors that may affect future results of CenterState and South State including changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer borrowing, repayment, investment and deposit practices; the impact, extent and timing of technological changes; capital management activities; and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms; and other factors discussed in our filings with the Securities and Exchange Commission under the Exchange Act. All written or oral forward-looking statements that are made by or are attributable to us are expressly qualified in their entirety by this cautionary notice. Our forward-looking statements apply only as of the date of this report or the respective date of the document from which they are incorporated herein by reference. We have no obligation and do not undertake to update, revise or correct any of the forward-looking statements after the date of this report, or after the respective dates on which such statements otherwise are made, whether as a result of new information, future events or otherwise. Important Information About the Merger and Where to Find It South State has filed a registration statement on Form S-4 and an amendment thereto with the SEC to register the shares of South State’s common stock that will be issued to CenterState’s shareholders in connection with the transaction. The registration statement contains a joint proxy statement of South State and CenterState that also constitutes a prospectus of South State. The registration statement on Form S-4, as amended, was declared effective by the SEC on April 20, 2020, and South State and CenterState commenced mailing the definitive joint proxy statement/prospectus to their respective shareholders on or about April 20, 2020. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS (AS WELL ANY OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS) BECAUSE SUCH DOCUMENTS CONTAIN IMPORTANT INFORMATION REGARDING THE PROPOSED MERGER AND RELATED MATTERS. Investors and security holders may obtain free copies of these documents and other documents filed with the SEC by South State or CenterState through the website maintained by the SEC at http://www.sec.gov or by contacting the investor relations department of South State or CenterState at: Participants in Solicitation South State, CenterState and certain of their directors and executive officers may be deemed participants in the solicitation of proxies from the shareholders of each of South State and CenterState in connection with the merger. Information regarding the directors and executive officers of South State and CenterState and other persons who may be deemed participants in the solicitation of the shareholders of South State or of CenterState in connection with the merger is contained in the definitive joint proxy statement/prospectus related to the proposed merger. Information about the directors and executive officers of South State and their ownership of South State common stock can also be found in South State’s definitive proxy statement in connection with its 2019 annual meeting of shareholders, as filed with the SEC on March 6, 2019, and other documents subsequently filed by South State with the SEC, including, but not limited to, Amendment No. 1 to South State’s Annual Report on Form 10-K/A, as filed with the SEC on March 6, 2020. Information about the directors and executive officers of CenterState and their ownership of CenterState common stock can also be found in CenterState’s definitive proxy statement in connection with its 2020 annual meeting of shareholders, as filed with the SEC on March 10, 2020, and other documents subsequently filed by CenterState with the SEC. Additional information regarding the interests of such participants is included in the definitive joint proxy statement/prospectus and other relevant documents regarding the merger filed with the SEC. South State Corporation CenterState Bank Corporation 520 Gervais Street 1101 First Street South, Suite 202 Columbia, SC 29201-3046 Winter Haven, FL 33880 Attention: Investor Relations Attention: Investor Relations (800) 277-2175 (863) 293-4710

COVID-19 Response Employees Over 90% of non-branch employees working remotely Increased paid leave for employees unable to work due to lack of child or dependent care Branches restricted to drive through traffic Additional compensation for employees with essential in-office jobs Customers Began offering loan payment deferrals, fee waivers for ATMs and CD withdrawals Increased mobile deposit limits PPP loan ramp up for our small business clients

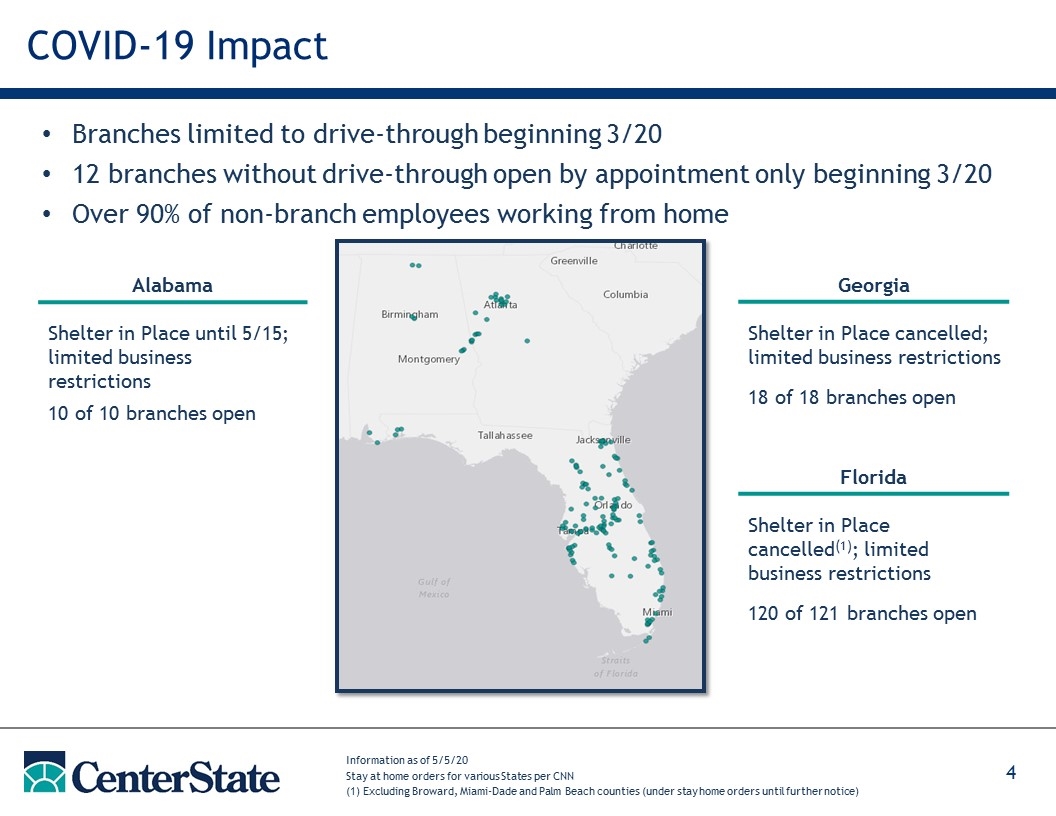

COVID-19 Impact Alabama Shelter in Place until 5/15; limited business restrictions 10 of 10 branches open Georgia Shelter in Place cancelled; limited business restrictions 18 of 18 branches open Florida Shelter in Place cancelled(1); limited business restrictions 120 of 121 branches open Branches limited to drive-through beginning 3/20 12 branches without drive-through open by appointment only beginning 3/20 Over 90% of non-branch employees working from home Information as of 5/5/20 Stay at home orders for various States per CNN (1) Excluding Broward, Miami-Dade and Palm Beach counties (under stay home orders until further notice)

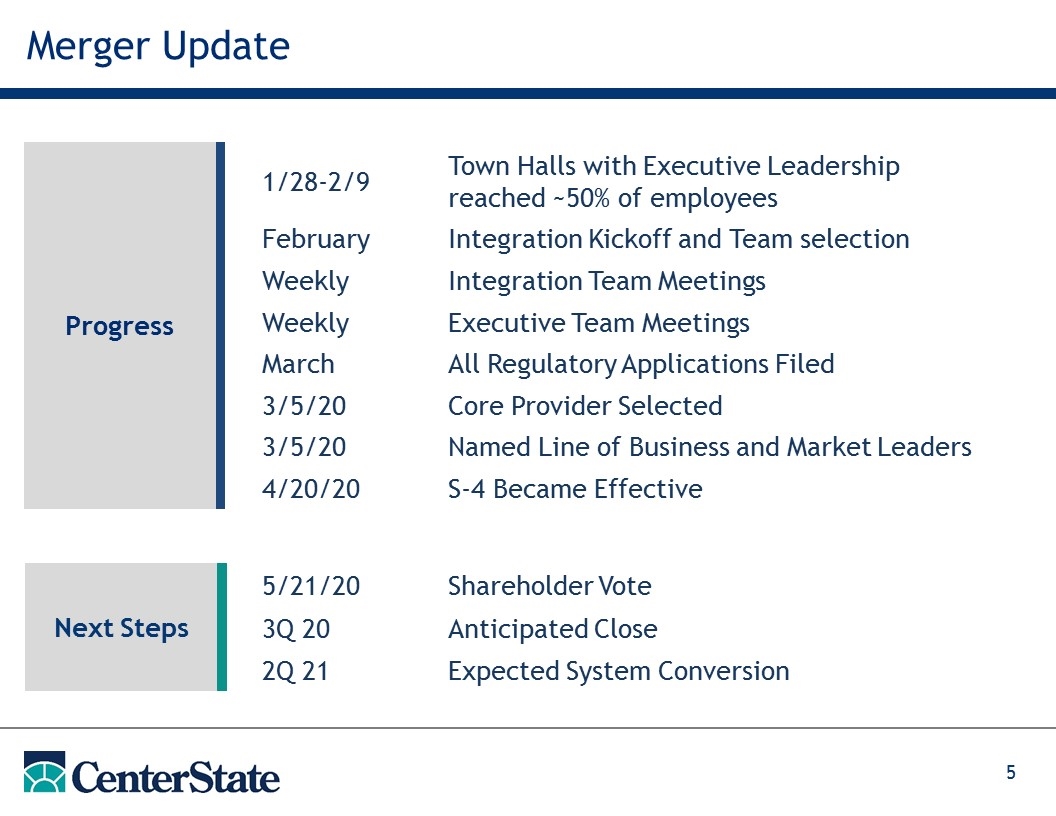

Merger Update Progress Next Steps 1/28-2/9 Town Halls with Executive Leadership reached ~50% of employees February Integration Kickoff and Team selection Weekly Integration Team Meetings Weekly Executive Team Meetings March All Regulatory Applications Filed 3/5/20 Core Provider Selected 3/5/20 Named Line of Business and Market Leaders 4/20/20 S-4 Became Effective 5/21/20 Shareholder Vote 3Q 20 Anticipated Close 2Q 21 Expected System Conversion

Credit Update

Payroll Protection Program (PPP) Secured SBA PPP funding for over 9,600 loans totaling $1.3 billion(1) Funding for PPP through liquidity on hand, deposit growth, and potential use of FRB PPP facility Capacity to accommodate additional demand should program be expanded (1) As of 5/4/20

Loan Portfolio Summary Actively managing exposures in Lodging, Restaurants, and Retail Less than 1% total exposure to SNC’s, Leveraged Lending, Oil & Gas, and Aviation 99% of loan portfolio is in footprint Granular loan portfolio with average loan size of $230,000

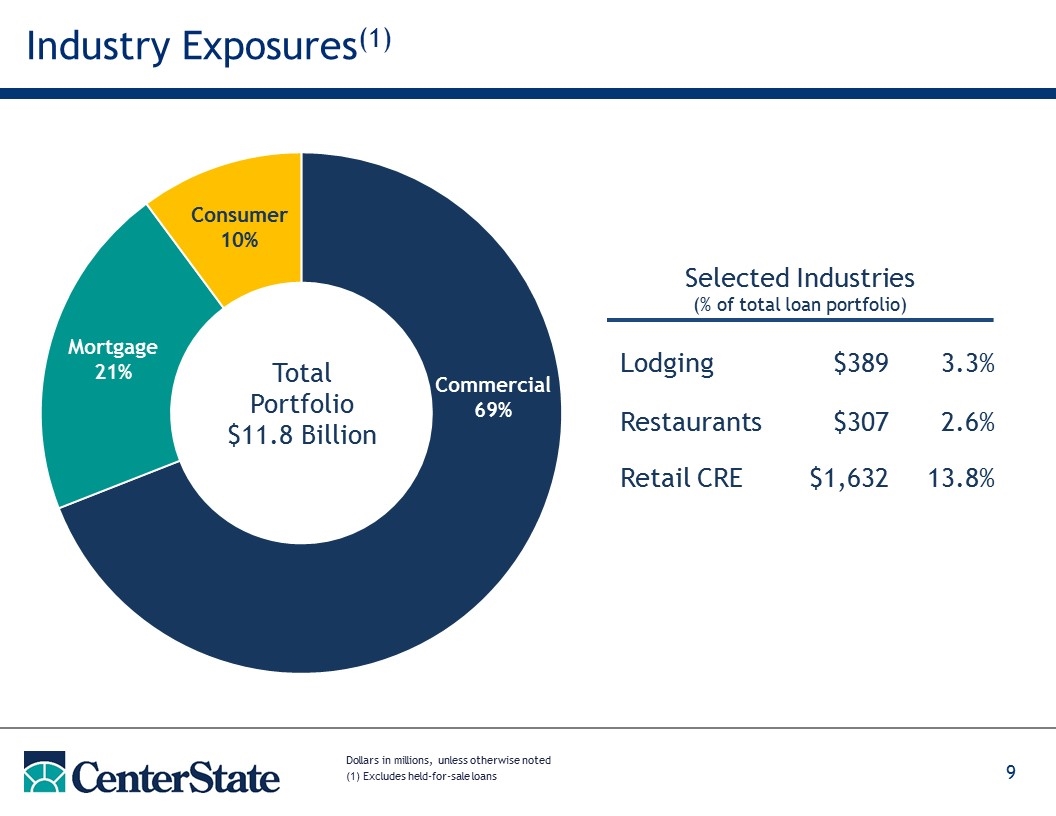

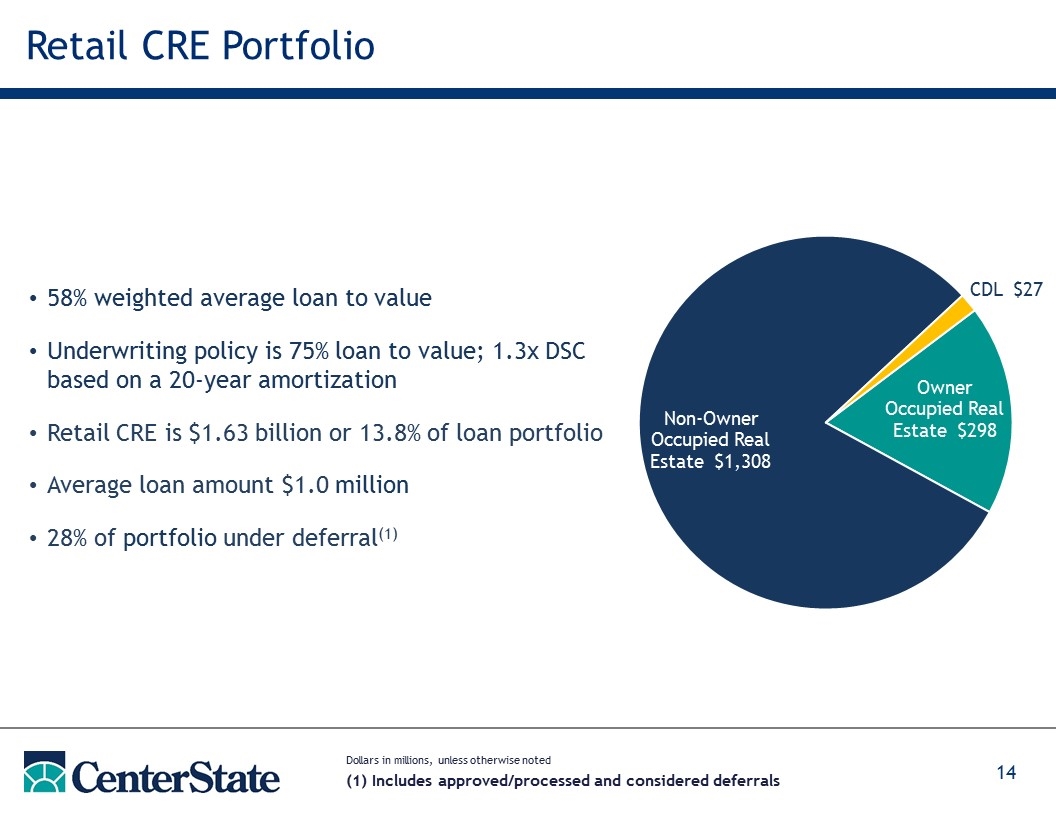

Industry Exposures(1) Dollars in millions, unless otherwise noted (1) Excludes held-for-sale loans Selected Industries (% of total loan portfolio) Lodging $389 3.3% Restaurants $307 2.6% Retail CRE $1,632 13.8%

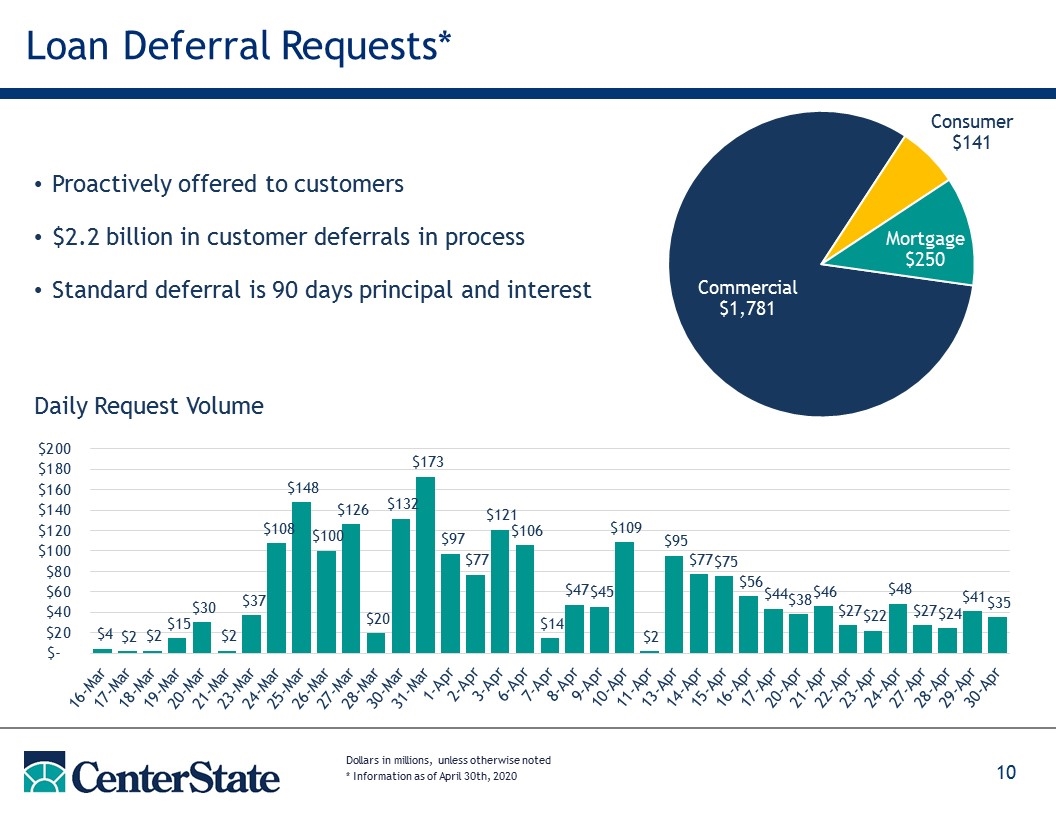

Loan Deferral Requests* Dollars in millions, unless otherwise noted * Information as of April 30th, 2020 Proactively offered to customers $2.2 billion in customer deferrals in process Standard deferral is 90 days principal and interest Daily Request Volume

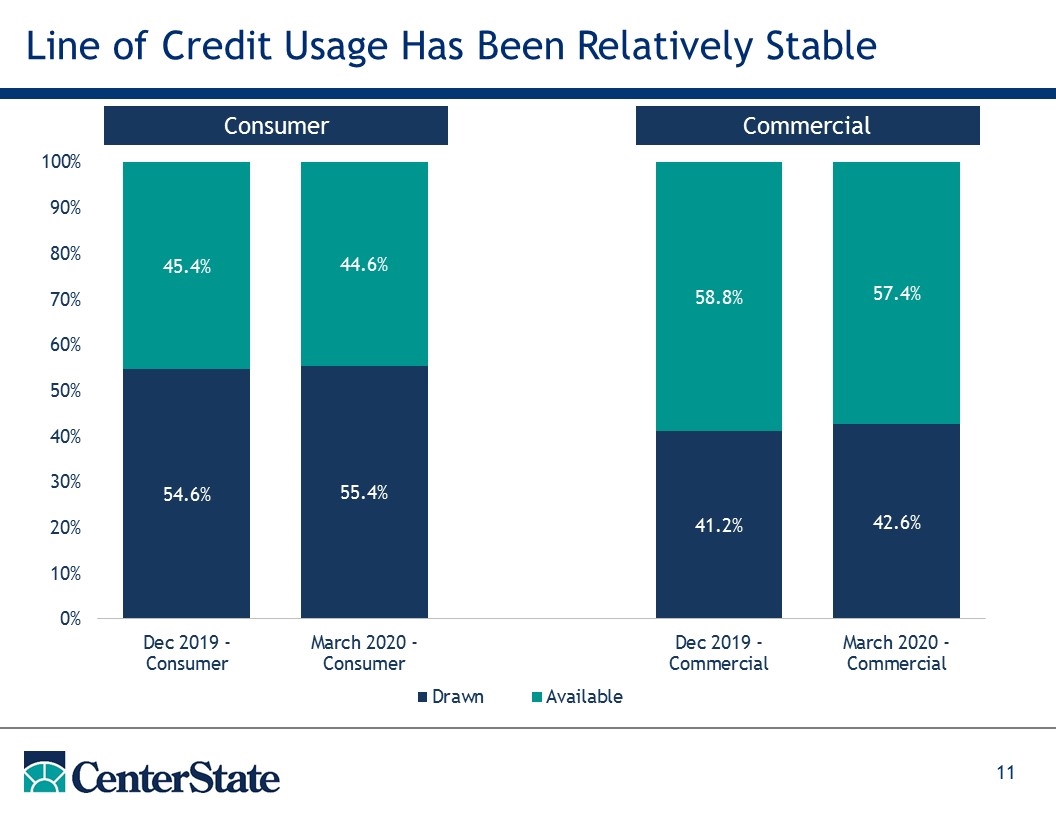

Line of Credit Usage Has Been Relatively Stable Consumer Commercial

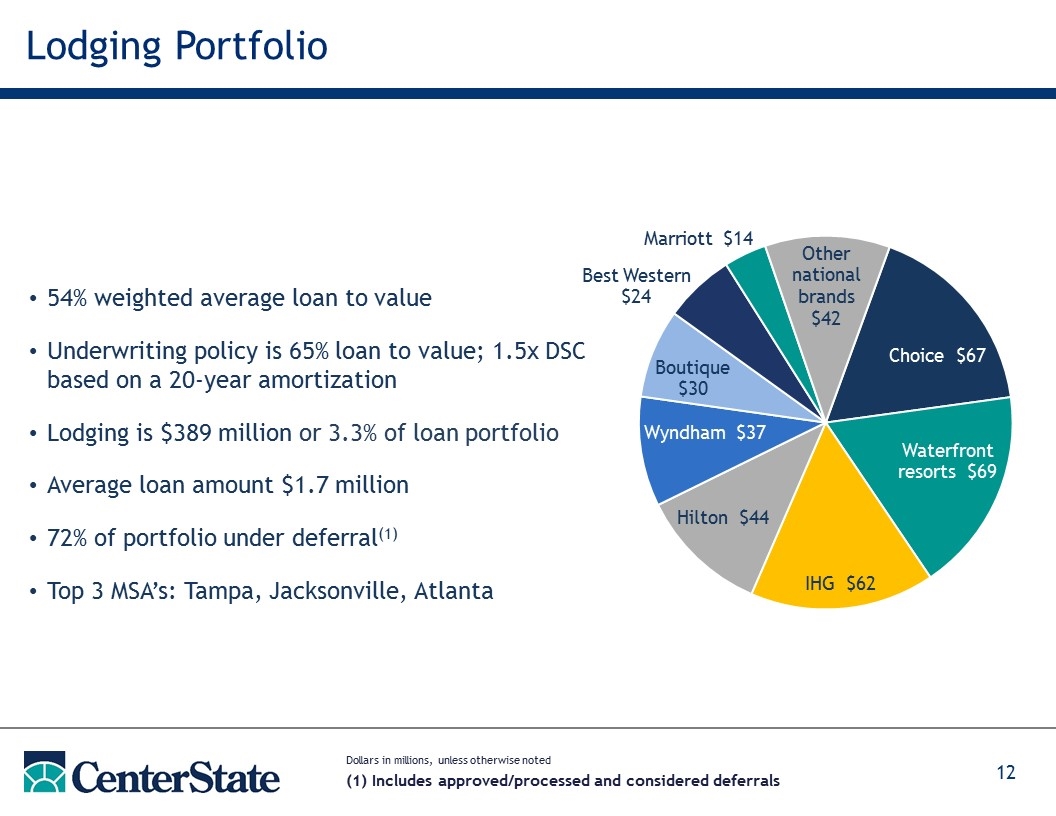

Lodging Portfolio Dollars in millions, unless otherwise noted (1) Includes approved/processed and considered deferrals 54% weighted average loan to value Underwriting policy is 65% loan to value; 1.5x DSC based on a 20-year amortization Lodging is $389 million or 3.3% of loan portfolio Average loan amount $1.7 million 72% of portfolio under deferral(1) Top 3 MSA’s: Tampa, Jacksonville, Atlanta

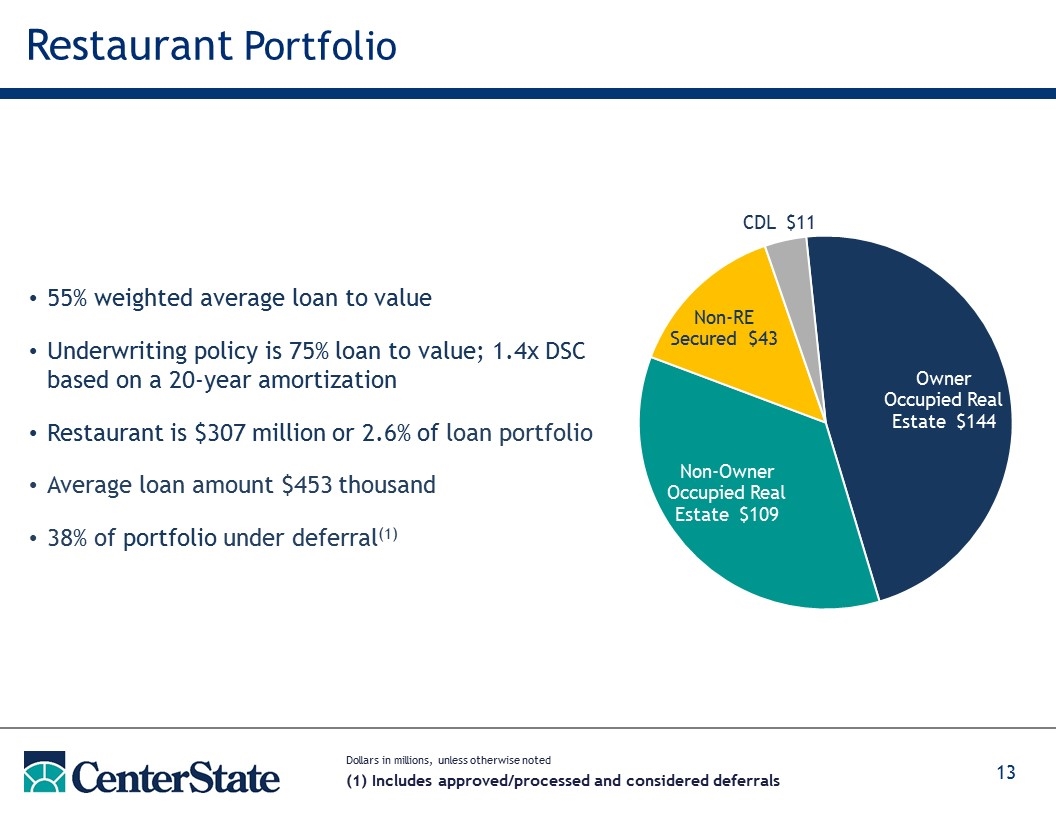

Restaurant Portfolio 55% weighted average loan to value Underwriting policy is 75% loan to value; 1.4x DSC based on a 20-year amortization Restaurant is $307 million or 2.6% of loan portfolio Average loan amount $453 thousand 38% of portfolio under deferral(1) Dollars in millions, unless otherwise noted (1) Includes approved/processed and considered deferrals

Retail CRE Portfolio 58% weighted average loan to value Underwriting policy is 75% loan to value; 1.3x DSC based on a 20-year amortization Retail CRE is $1.63 billion or 13.8% of loan portfolio Average loan amount $1.0 million 28% of portfolio under deferral(1) Dollars in millions, unless otherwise noted (1) Includes approved/processed and considered deferrals

1Q20 Financial Highlights

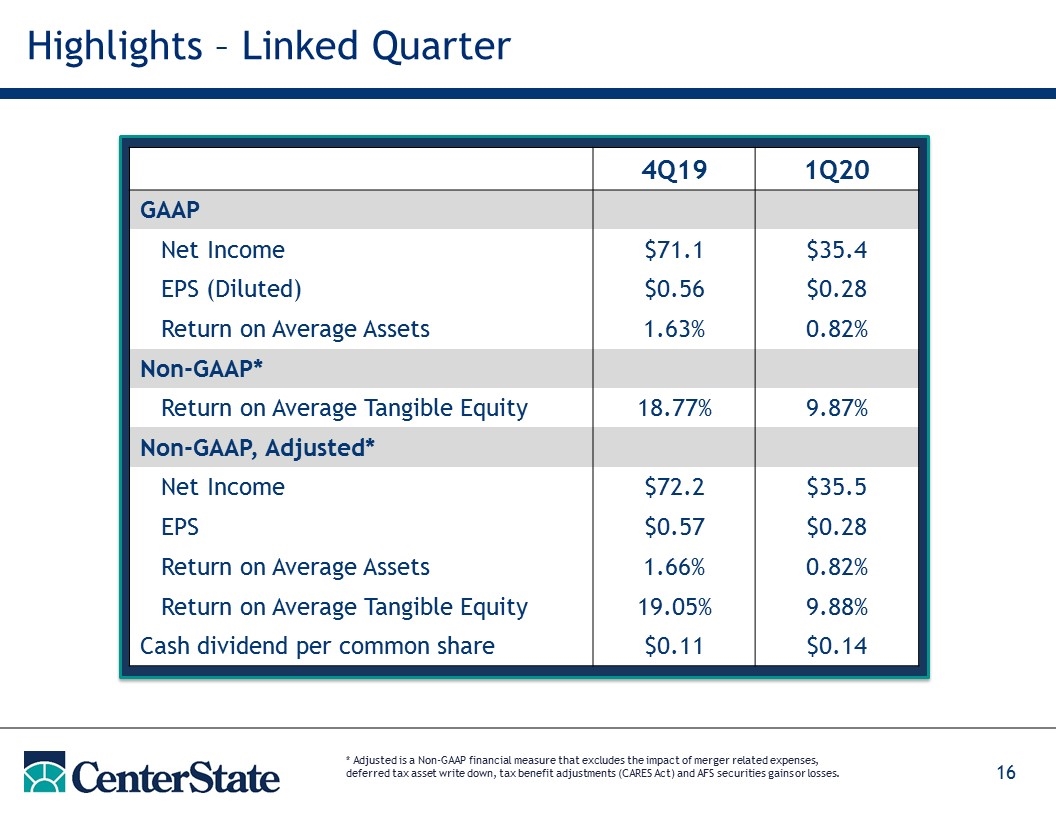

Highlights – Linked Quarter * Adjusted is a Non-GAAP financial measure that excludes the impact of merger related expenses, deferred tax asset write down, tax benefit adjustments (CARES Act) and AFS securities gains or losses. 4Q19 1Q20 GAAP Net Income $71.1 $35.4 EPS (Diluted) $0.56 $0.28 Return on Average Assets 1.63% 0.82% Non-GAAP* Return on Average Tangible Equity 18.77% 9.87% Non-GAAP, Adjusted* Net Income $72.2 $35.5 EPS $0.57 $0.28 Return on Average Assets 1.66% 0.82% Return on Average Tangible Equity 19.05% 9.88% Cash dividend per common share $0.11 $0.14

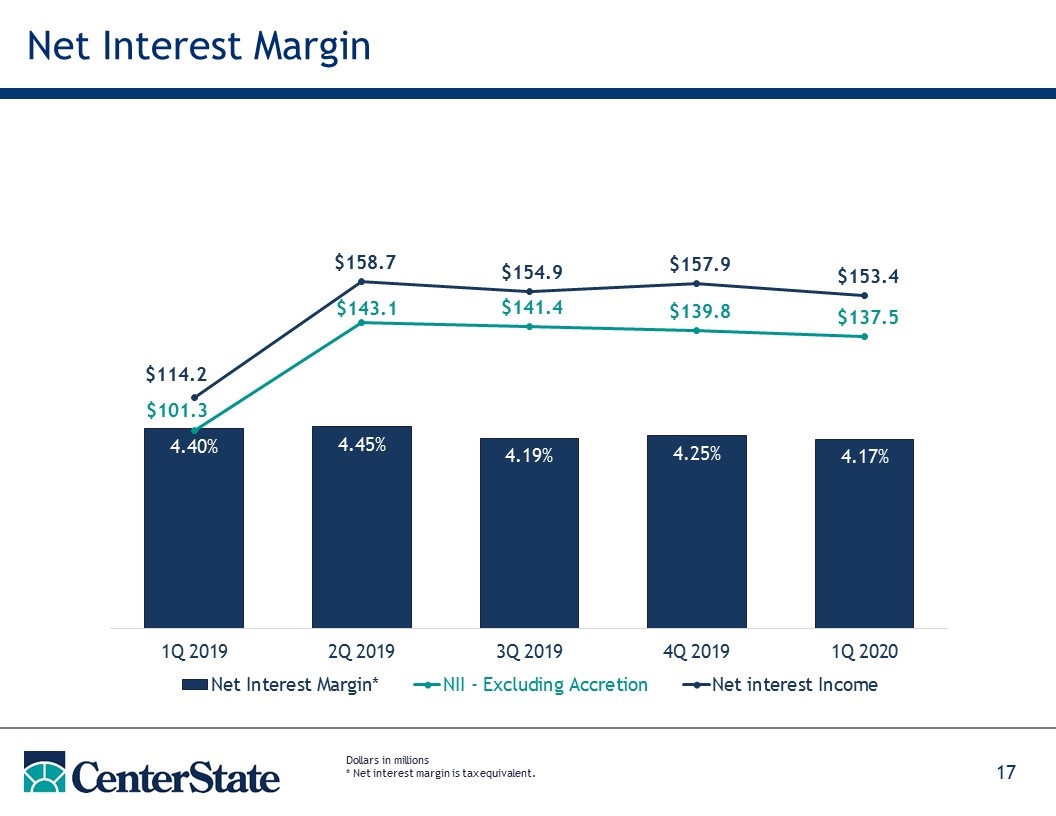

Net Interest Margin Dollars in millions * Net interest margin is tax equivalent.

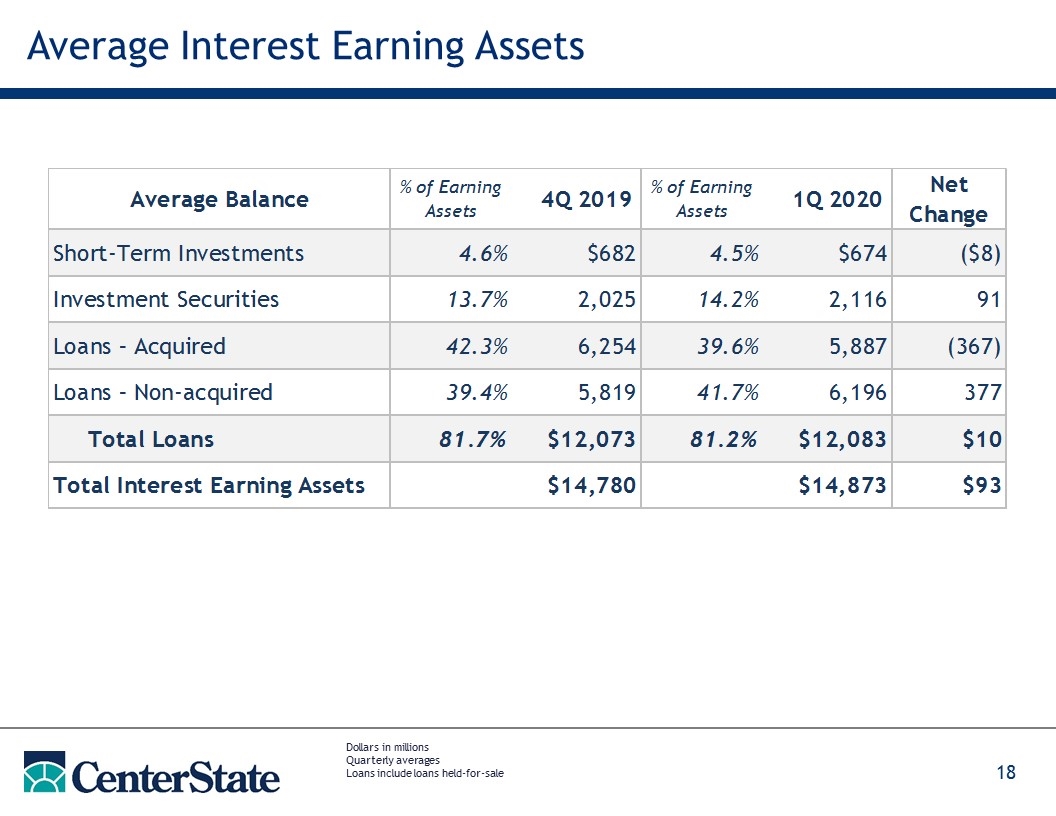

Average Interest Earning Assets Dollars in millions Quarterly averages Loans include loans held-for-sale

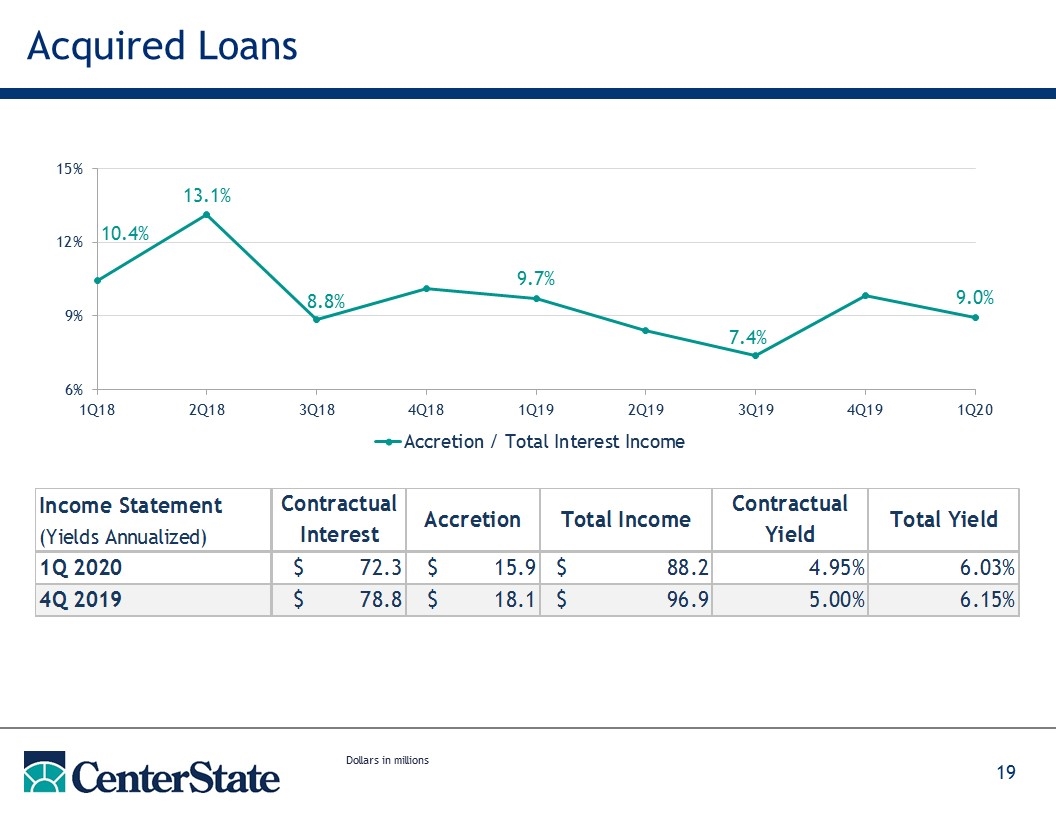

Acquired Loans Dollars in millions

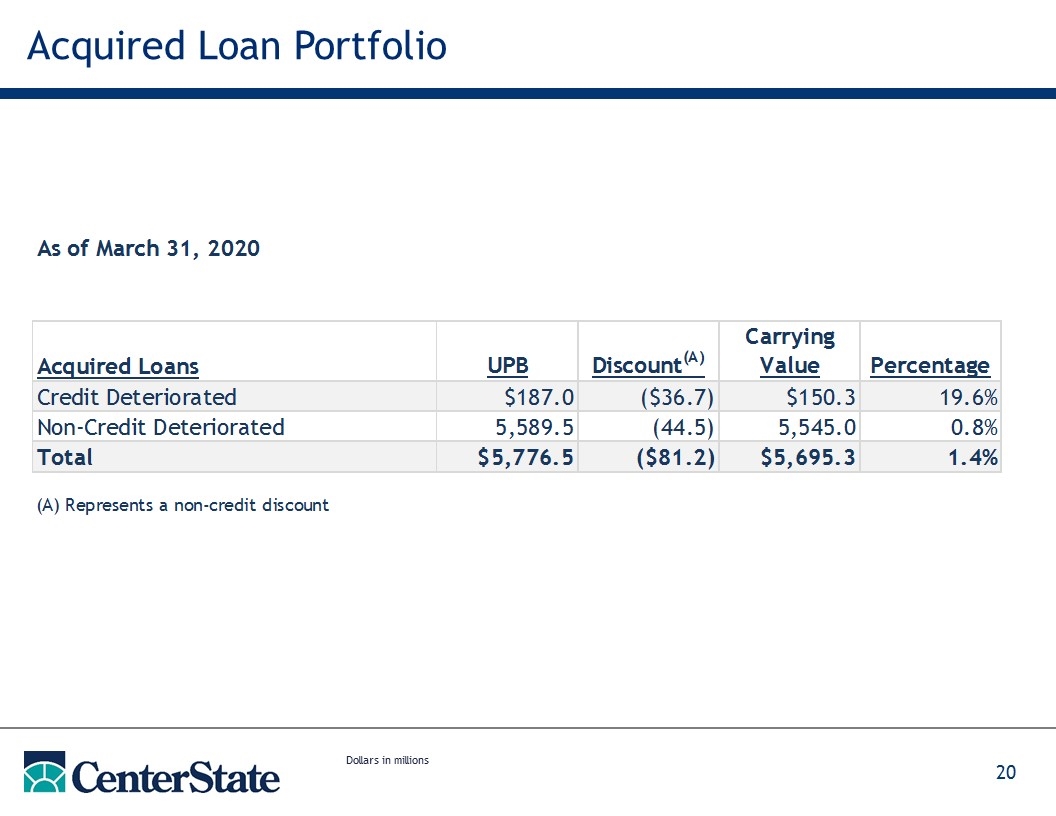

Acquired Loan Portfolio Dollars in millions

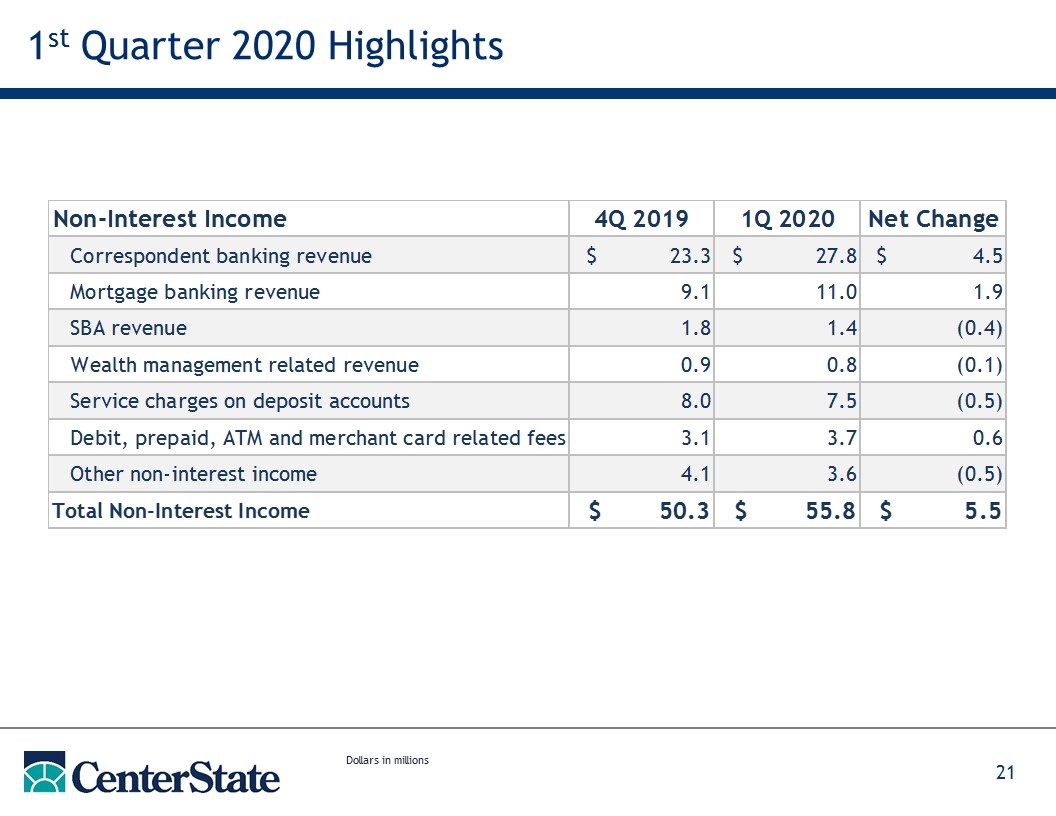

1st Quarter 2020 Highlights Dollars in millions

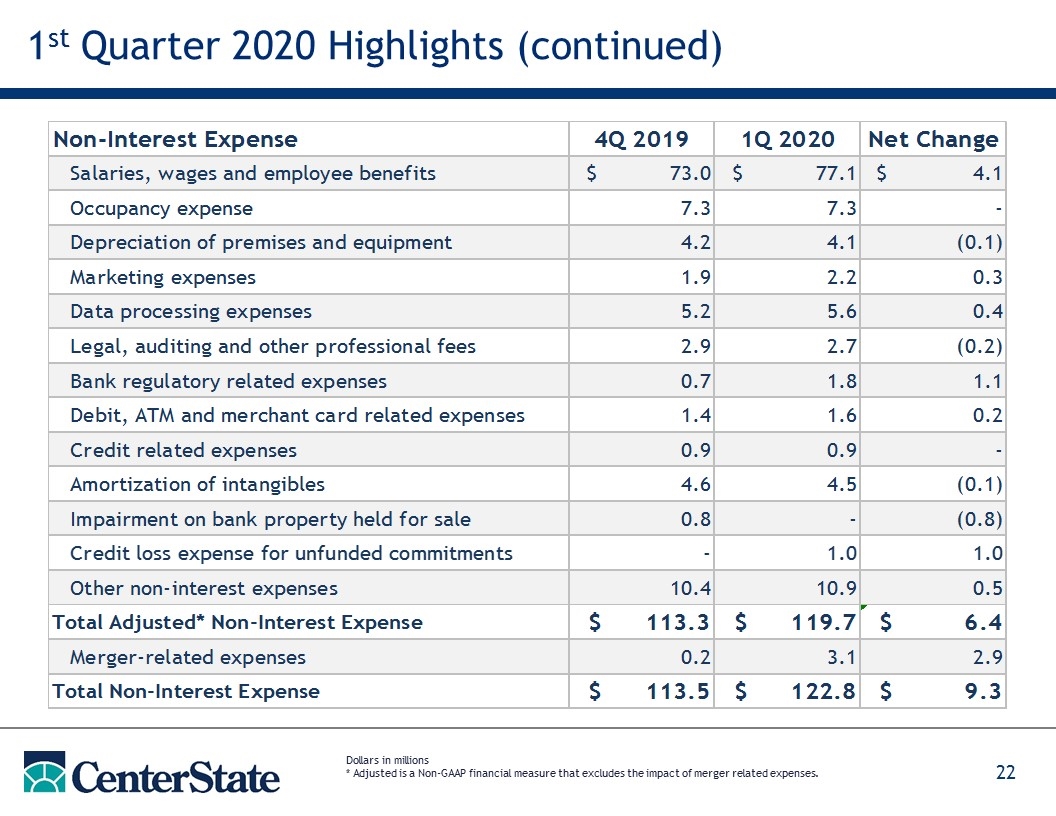

1st Quarter 2020 Highlights (continued) Dollars in millions * Adjusted is a Non-GAAP financial measure that excludes the impact of merger related expenses.

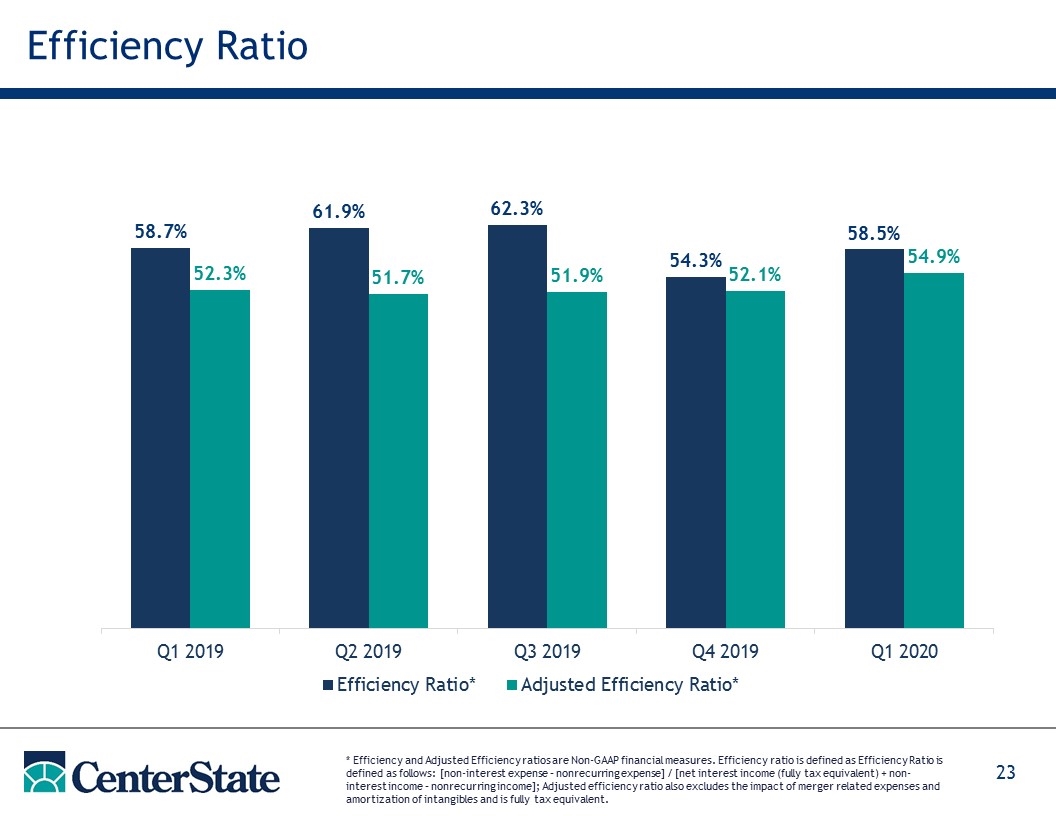

Efficiency Ratio * Efficiency and Adjusted Efficiency ratios are Non-GAAP financial measures. Efficiency ratio is defined as Efficiency Ratio is defined as follows: [non-interest expense – nonrecurring expense] / [net interest income (fully tax equivalent) + non-interest income – nonrecurring income]; Adjusted efficiency ratio also excludes the impact of merger related expenses and amortization of intangibles and is fully tax equivalent.

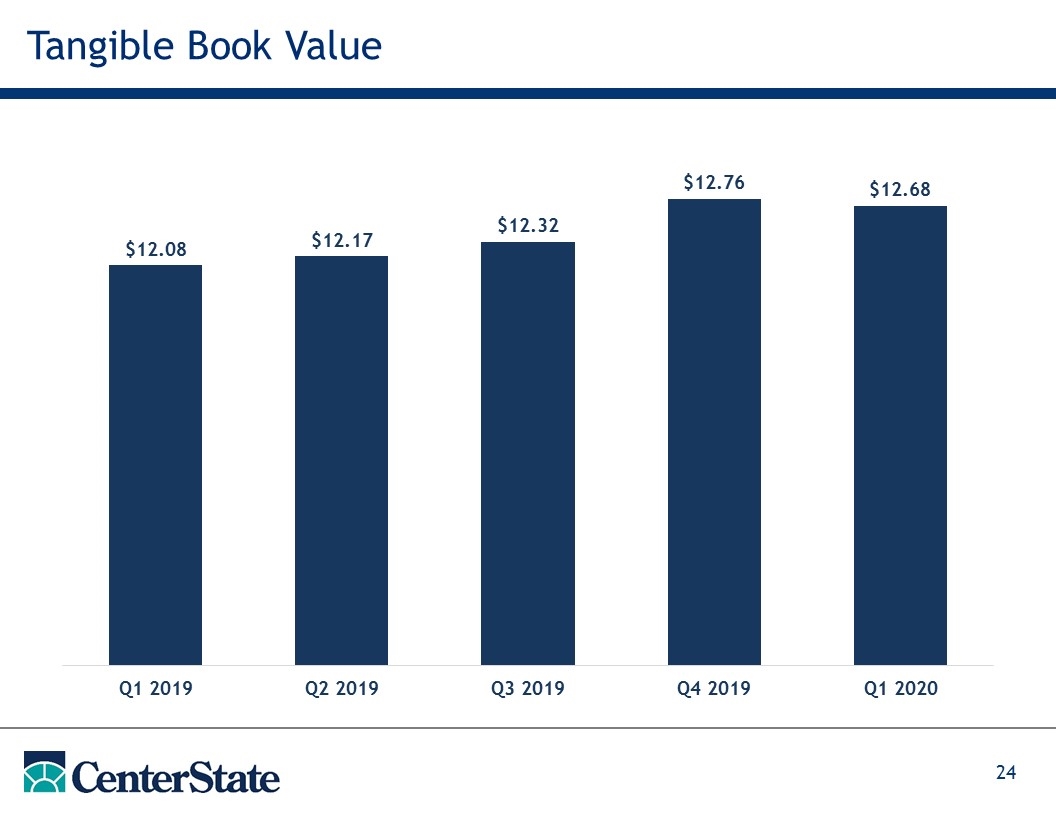

Tangible Book Value

John C. Corbett Chief Executive Officer CenterState Bank Corporation William E. Matthews V Chief Financial Officer CenterState Bank Corporation Stephen D. Young Chief Operating Officer CenterState Bank Corporation Dan Bockhorst Chief Credit Officer CenterState Bank Richard Murray IV Chief Executive Officer CenterState Bank