Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Federal Home Loan Bank of Pittsburgh | d831998d8k.htm |

Membership Update: COVID-19 Impact April 7, 2020 Exhibit 99.1

Agenda State of the Bank and Operations Winthrop Watson, President and CEO Credit and Collateral Update Mike Rizzo, Chief Risk Officer Mortgage Partnership Finance® (MPF®) Program Mark Evanco, Senior Director, Business Development and Strategy Government Stimulus Update Dana Yealy, Chief Strategic Initiatives Officer Community Investment Product Update John Bendel, Senior Director, Community Investment Closing Comments and Questions Winthrop Watson, President and CEO “Mortgage Partnership Finance,” “MPF” and “MPF Xtra” are registered trademarks of the Federal Home Loan Bank of Chicago.

In these challenging times, we hope for the well-being of our members, their staff, their families and the communities that they serve.

State of the Bank and Operations We are a reliable liquidity source focused on members’ business Strong liquidity position to satisfy member demand Nearly 100 percent of our staff is working remotely Repository for our updates: www.fhlb-pgh.com/Coronavirus-Updates Focus of today’s call is business operations Evolving credit and collateral practices MPF Program changes Community investment product flexibility Meeting the dynamic needs of our membership First quarter financial performance press release on April 29, followed by member earnings call on May 5 Continue to be well-capitalized Total advances grew $12 billion, or 19 percent MPF Program fundings exceeded $300 million

Forward-Looking Statements Disclaimer: The prior slide reflects unaudited preliminary financial information, prepared as of April 7, 2020, in advance of the formal closing of the Bank’s quarter-end financial books. It is not intended as a full business or financial review. Statements contained in this document may be “forward-looking statements.” The Bank cautions that, by their nature, forward-looking statements involve risk or uncertainty and that actual results could differ materially.

Credit and Collateral Update

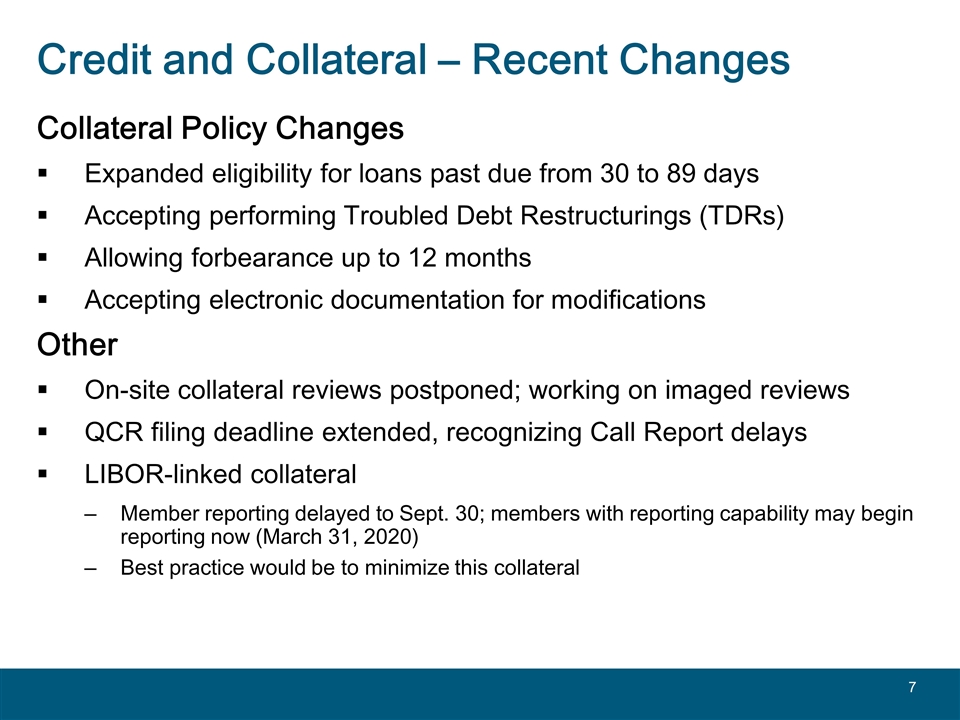

Credit and Collateral – Recent Changes Collateral Policy Changes Expanded eligibility for loans past due from 30 to 89 days Accepting performing Troubled Debt Restructurings (TDRs) Allowing forbearance up to 12 months Accepting electronic documentation for modifications Other On-site collateral reviews postponed; working on imaged reviews QCR filing deadline extended, recognizing Call Report delays LIBOR-linked collateral Member reporting delayed to Sept. 30; members with reporting capability may begin reporting now (March 31, 2020) Best practice would be to minimize this collateral

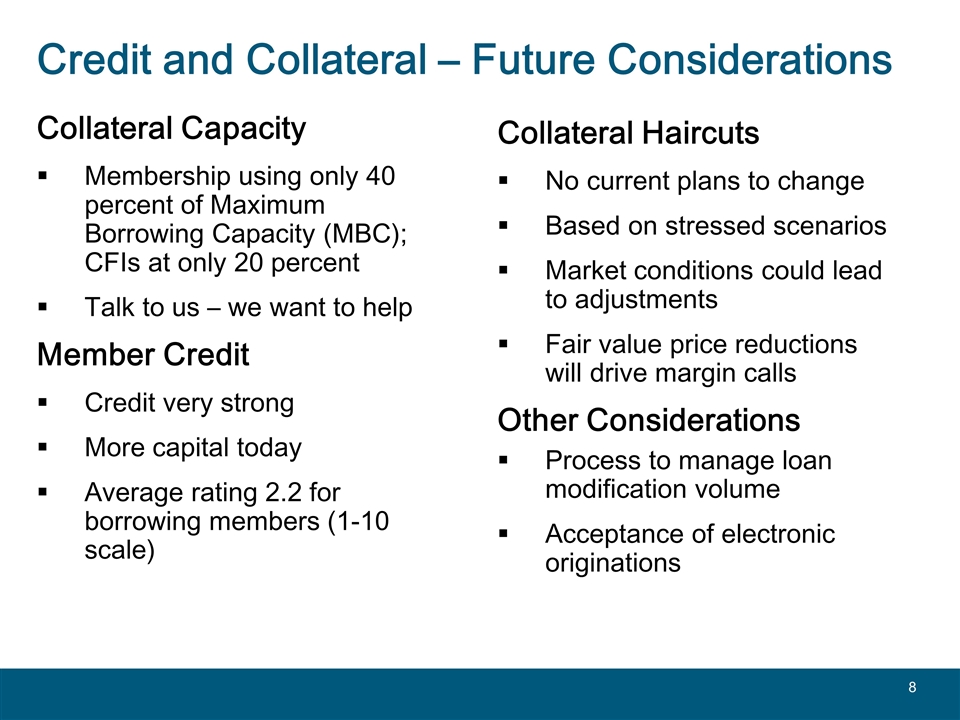

Credit and Collateral – Future Considerations Collateral Capacity Membership using only 40 percent of Maximum Borrowing Capacity (MBC); CFIs at only 20 percent Talk to us – we want to help Member Credit Credit very strong More capital today Average rating 2.2 for borrowing members (1-10 scale) Collateral Haircuts No current plans to change Based on stressed scenarios Market conditions could lead to adjustments Fair value price reductions will drive margin calls Other Considerations Process to manage loan modification volume Acceptance of electronic originations

MPF Program Update

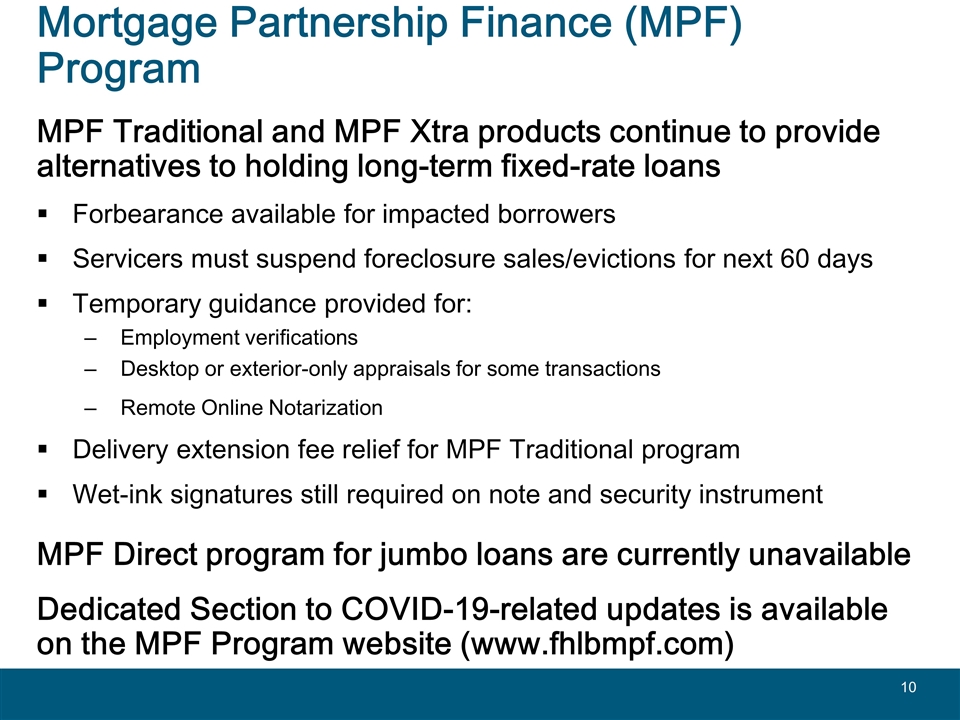

Mortgage Partnership Finance (MPF) Program MPF Traditional and MPF Xtra products continue to provide alternatives to holding long-term fixed-rate loans Forbearance available for impacted borrowers Servicers must suspend foreclosure sales/evictions for next 60 days Temporary guidance provided for: Employment verifications Desktop or exterior-only appraisals for some transactions Remote Online Notarization Delivery extension fee relief for MPF Traditional program Wet-ink signatures still required on note and security instrument MPF Direct program for jumbo loans are currently unavailable Dedicated Section to COVID-19-related updates is available on the MPF Program website (www.fhlbmpf.com)

MPF Program – Future Considerations Additional relief for impacted borrowers being assessed Enhance forbearance terms Additional underwriting guidance likely to match other GSEs MPF team available to provide support

Government Stimulus Update

Evolving U.S. Federal Government Stimulus CARES Act Title I - Paycheck Protection Program SBA Guarantee loans Not currently eligible collateral The Bank will lend against other eligible collateral Title IV - Main Street Lending Facility Federal Reserve facility Facility direct with member banks Rules not published yet COVID-19 – Number 4 Expected later in April Five FHLBank provisions proposed SBA Guarantee applies to FHLBanks Expand CFI Asset level to $10 billion Letters of credit for tax-exempt bonds Expand normal letter of credit authority Government-guaranteed loans as collateral Situation remains very fluid – State trade associations have been providing timely resources and updates to our members

Community Investment Update

Community Investment Offering existing products on schedule with no disruption Community Lending Program - $500M First Front Door - $11M Banking On Business (BOB) - $2.6M Supporting small businesses through BOB Processing 30 BOB loan repayment deferral requests Providing flexibility to members and end-recipients Product details available in the Member Resources section of this presentation

Community Investment – Future Considerations Accelerating and restructuring $4.8M Home4Good to meet immediate needs for people who are homeless or at risk of homelessness Monitoring existing product use for possible reallocation of funds Assessing additional funding for existing and/or new products

Closing Comments and Questions

Closing Comments and Questions Our highest priorities: The health and safety of our staff Remaining a reliable and readily available liquidity provider Supporting the communities that our members serve Assisting our members in this dynamic and challenging environment We are here to help Join us on May 5 to discuss our first quarter financial results (Questions received in advance and open questions)

Member Resources

Contact Information Member Services (8 a.m. to 5 p.m., Monday through Friday) 800-288-3400, option 2 member.services@fhlb-pgh.com Business Development Managers Jeff Acquafondata (MPF Program) jeffa@fhlb-pgh.com Fred Bañuelos (Community Investment) fred.banuelos@fhlb-pgh.com Fred Duncan fred.duncan@fhlb-pgh.com Bill McGettigan william.mcgettigan@fhlb-pgh.com Vince Moye vincent.moye@fhlb-pgh.com Tom Westerlund tom.westerlund@fhlb-pgh.com Leadership Team Winthrop Watson winthrop.watson@fhlb-pgh.com Dave Paulson david.paulson@fhlb-pgh.com Mike Rizzo michael.rizzo@fhlb-pgh.com Dana Yealy dana.yealy@fhlb-pgh.com John Bendel john.bendel@fhlb-pgh.com Mark Evanco mark.evanco@fhlb-pgh.com

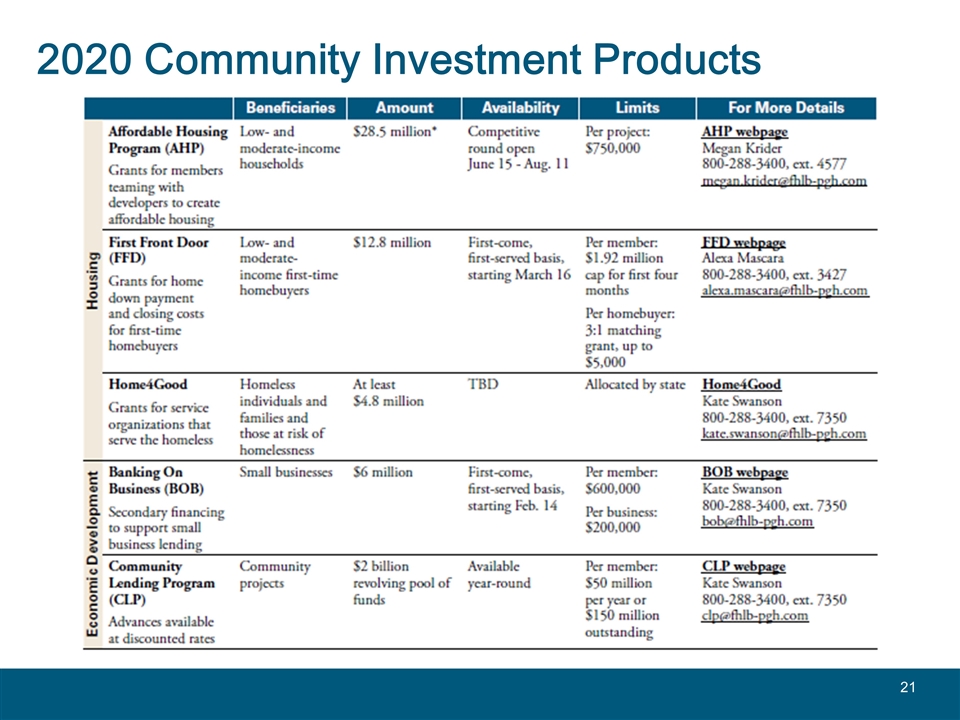

2020 Community Investment Products