Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 000-55195

GI DYNAMICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 84-1621425 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) | |

| 320 Congress Street, 3rd Floor | ||

| Boston, Massachusetts | 02210 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

(781) 357-3300

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act: Common Stock, $0.01 par value per share

| Title of each class | Trading symbol(s) | Name

of each non-U.S. exchange on which registered | ||

| Common Stock, par value $0.01 | GID.ASX | Australia Securities Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files): Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Accelerated filer ☐ | |

| Large accelerated filer ☐ | Smaller reporting company ☒ |

| Non-accelerated filer ☒ | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): ☐ Yes ☒ No

The aggregate market value of the registrant’s common stock, in the form of CHESS Depositary Interests (“CDI” in singular, “CDIs” in plural, each CDI representing 1/50th of one share of common stock), held by non-affiliates of the registrant (without admitting that any person whose shares are not included in such calculation is an affiliate), computed by reference to the price at which the CDIs were last sold on June 28 2019, the last business day of the registrant’s most recently completed second quarter, as reported on the Australian Securities Exchange, was $19,603,047 (A$27,952,442).

The registrant’s common stock is publicly traded on the ASX in the form of CDIs convertible at the option of the holders into shares of the registrant’s common stock on a 1-for-50 basis. The total number of shares of the registrant’s common stock outstanding on March 12, 2020, including shares of common stock underlying CDIs, was 36,598,291.

DOCUMENTS INCORPORATED BY REFERENCE

The registrant intends to file with the Securities and Exchange Commission a proxy statement pursuant to Regulation 14A or an amendment to this report filed under cover of Form 10-K/A containing the information required to be disclosed under Part III of Form 10-K within 120 days of the end of its fiscal year ended December 31, 2019. Portions of such proxy statement or Form 10-K/A are incorporated by reference into Part III of this Annual Report on Form 10-K.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements as defined in Section 27A of the United States Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. Throughout this Annual Report on Form 10-K, all references to the “Company” or “GI Dynamics,” unless where the context requires otherwise, refers to the consolidated entity of GI Dynamics, Inc. These forward-looking statements concern the Company’s business, operations, financial performance and condition as well as plans, objectives and expectations for the Company’s business, operations and financial performance and condition. Any statements contained in this Annual Report on Form 10-K that are not of historical facts may be deemed to be forward-looking statements. The forward-looking statements are contained principally in the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Forward-looking statements include, but are not limited to, statements about the Company’s:

| ● | expectations with respect to the Company’s intellectual property position; |

| ● | expectations with respect to clinical trials for EndoBarrier®; |

| ● | expectations with respect to regulatory submissions and receipt and maintenance of regulatory approvals; |

| ● | ability to commercialize products; |

| ● | ability to develop and commercialize new products; |

| ● | expectation with regard to product manufacture and inventory; and |

| ● | estimates regarding capital requirements and need for additional financing. |

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “predicts,” “aims,” “assumes,” “goal,” “intends,” “objective,” “potential,” “positioned,” “target,” “continue,” “seek,” “vision,” or the negative thereof and similar expressions intended to identify forward-looking statements.

These forward-looking statements are based on current expectations, estimates, forecasts and projections about the Company’s business and the industry in which it operates and management’s beliefs and assumptions. These forward-looking statements are not guarantees of future performance or development and involve known and unknown risks, uncertainties and other factors that are in some cases beyond the Company’s control. As a result, any or all forward-looking statements in this Annual Report on Form 10-K may later become inaccurate. The Company may not actually achieve the plans, intentions or expectations disclosed in any forward-looking statements, and actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements made by the Company. The Company has included important factors in the cautionary statements included in this Annual Report on Form 10-K, particularly in the “Risk Factors” section, that could cause actual results or events to differ materially from the forward-looking statements made.

You are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on the forward-looking statements. You should read this Annual Report on Form 10-K and the documents that the Company has filed as exhibits to the GI Dynamics Form 10-K completely and with the understanding that actual future results may be materially different from what the Company expects. These forward-looking statements speak only as at the date of this Annual Report on Form 10-K. Unless required by law, the Company does not intend to publicly update or revise any forward-looking statements to reflect new information or future events or otherwise. You should, however, review the factors and risks described in the reports the Company will file from time to time with the SEC after the date of this Annual Report on Form 10-K.

i

GI DYNAMICS, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2019

TABLE OF CONTENTS

ii

Overview

GI Dynamics, Inc. (“GI Dynamics” or “the Company”) is a clinical stage medical device company focused on the development and commercialization of EndoBarrier, a medical device system intended for treatment of patients with type 2 diabetes and reduction of obesity. EndoBarrier is a medical implant designated for the treatment of type 2 diabetes and the reduction of obesity with nearly 4,000 implants since inception and is the subject of an approved FDA pivotal trial in the United States under which the Company initiated patient implant procedures in January 2020. The Company believes that EndoBarrier represents a paradigm-breaking approach to traditional management of type 2 diabetes, which has focused historically solely on lifestyle intervention and diabetes medications. According to the article “Challenges in Diabetes Management: Glycemic Control, Medication Adherence, and Healthcare Costs,” published in the American Journal of Managed Care in 2017, these historical treatments for type 2 diabetes are limited in efficacy, with approximately 40% of patients achieving glycemic control.

EndoBarrier represents the first material departure from this historical approach. The Company believes that EndoBarrier offers an adjunct to non-insulin diabetes pharmacotherapy, while providing patients a chance to significantly reduce or eliminate insulin and increase the likelihood of avoiding invasive and permanent bariatric or metabolic surgery. EndoBarrier is designed to mimic the mechanism of action of the duodenal-jejunal exclusion currently created by gastric bypass surgery (which is referred to as Roux-en-Y Gastric Bypass, or RYGB), as explained in the article “EndoBarrier: A Safe and Effective Novel Treatment for Obesity and Type 2 Diabetes?”, published in Obesity Surgery in 2018 by Nisha Patel. After implanting EndoBarrier, the patient’s food that exits the stomach will flow through the inside of the EndoBarrier Liner, and therefore will not contact the wall of the upper intestine (duodenum and jejunum). The food will also not mix with fluids from the pancreas and bile duct until these fluids and the food reach the far end of the EndoBarrier Liner. It is believed that, in a similar fashion to RYGB, shunting the food to a more distant location in the upper intestines triggers hormonal responses that regulate key factors that help control hunger, satiety, and insulin sensitivity, which is also explained in the article by Nisha Patel.

EndoBarrier has been shown in multiple independent clinical studies to lower blood sugar levels (as measured by hemoglobin A1c or HbA1c), reduce excess body weight, increase insulin sensitivity, and positively affect other health metrics and comorbidities. Because it has been utilized in approximately 4,000 procedures, EndoBarrier has a thoroughly characterized benefit-risk profile. A recent independent meta-analysis published in 2018 by Pichamol Jirapinyo in American Diabetes Association (ADA) Diabetes Care, “Effects of the Duodenal-Jejunal Bypass Liner on Glycemic Control in Patients with Type 2 Diabetes with Obesity: A Meta-Analysis with Secondary Analysis on Weight Loss and Hormonal Changes,” provides the most comprehensive review and meta-analysis of EndoBarrier clinical data to date. In addition, two ongoing EndoBarrier registries in the UK and Germany have captured and reported clinical results on more than 800 patients between the two databases. These registries as well as other investigator-initiated trials continue to release clinical data on an annual basis, largely centered around the annual meetings hosted by DDW (Digestive Disease Week) in May, ADA (American Diabetes Association) in June, EASD (European Association for the Study of Diabetes) in October, and Obesity Week in November.

Business Strategy

The Company’s goal is to become the leading provider of alternative options for treating type 2 diabetes and concurrently reducing obesity. The Company’s corporate priorities include:

| 1) | US Clinical Operations: Conduct Stage 1 of the STEP-1 EndoBarrier pivotal trial in the United States. |

The Company is focused on the successful execution of the STEP-1 pivotal trial in the United States. In August 2018, GI Dynamics received notification from the FDA that it had approved the Investigational Device Exemption (“IDE”) application for EndoBarrier, pending Institutional Review Board (IRB) approval, which was received in February 2019. The approved EndoBarrier IDE represents the pivotal clinical trial for EndoBarrier.

The STEP-1 clinical trial is a randomized, controlled, double blinded trial with 3:1 randomization between patients who receive the EndoBarrier implant (3) and the control group made up of patients who will receive a sham procedure and not receive the EndoBarrier implant (1). Both arms will maintain pharmacotherapy within ADA guidelines and will receive lifestyle and nutritional counseling consistent with ADA guidelines. The primary endpoint of the trial is reduction of HbA1c from baseline to removal of the EndoBarrier at twelve months as compared to the control group. The study includes numerous secondary endpoints, including changes in weight, cardiovascular risk metrics, as well as health metrics related to NAFLD (non-alcoholic fatty liver disease) and NASH (non-alcoholic steatohepatitis), and CKD (chronic kidney disease).

1

The STEP-1 clinical trial consists of two stages. The first stage consists of 50 EndoBarrier patients and approximately 17 control patients. At the end of stage 1, the Company will submit four DMC (Data Monitoring Committee) reports to the FDA for review. Upon a successful completion of the stage 1 review, the Company will submit a request to the FDA to complete the study by conducting stage 2, which the Company anticipates will be comprised of 130 EndoBarrier patients and approximately 43 control patients for a study total of 240 patients (180 EndoBarrier and 60 control patients). There is no guarantee that this will be the final composition of the study, as the number of remaining stages or remaining patients may vary based on the stage 1 clinical data and the outcome of the stage 1 review with FDA. In addition to the multiple staged study, the FDA has mandated certain stopping rules which, if triggered, could result in the STEP-1 study having enrollment or treatment delayed or stopped.

On January 27, 2020, the first patient was randomized into the STEP-1Trial Protocol. The Company is focused on continuous recruitment and patient management of patients within the STEP-1 trial.

If the Company does not have adequate funds to ensure the complete treatment course of all patients to be enrolled in the STEP-1 clinical trial, the Company reserves funds at the time of implant, on a per implanted patient basis, to ensure the Company has adequate cash available to ensure patient safety through the completion of the patient care and patient safety monitoring course as detailed in the protocol. On the completion of sufficient financing to ensure funds will be available to ensure completion of the STEP-1 trial protocol for any patients implanted as part of the Step-1 study, these individual patient reserves will be returned to general operating funds. The Company expects to complete the enrollment of Stage 1 by the end of 2020.

| 2) | India Partnership: Conduct the I-STEP EndoBarrier pivotal trial in India as part of the Apollo Sugar partnership. |

GI Dynamics is focused on the successful execution of the EndoBarrier trial in India as part of its partnership with Apollo Sugar, which was announced on November 27, 2018.

The I-STEP study is also a randomized, controlled, double blinded trial with 3:1 randomization between patients who receive the EndoBarrier implant (3) and the control group made up of patients who will not receive the EndoBarrier implant (1). The primary endpoint of the trial is reduction of HbA1c from baseline to removal of the EndoBarrier at twelve months as compared to the control group. The study includes numerous secondary endpoints, including changes in weight and reduction in cardiovascular risk metrics. The study includes 100 patients in total, which consists of 75 patients who will receive the EndoBarrier implant and 25 control patients. Up to five clinical sites in India will participate in the study.

Apollo Sugar is a collaboration between Apollo Health & Lifestyle Limited and Sanofi. Apollo Sugar is a division of Apollo Hospitals Group (Apollo) focused on the treatment of metabolic disorders and operates an integrated network of centers of excellence for diabetes, obesity and endocrinology. Apollo is the largest private hospital system in India and has emerged as Asia’s foremost integrated healthcare services provider, maintaining a robust presence of hospitals, pharmacies, primary care and diagnostic clinics across the healthcare ecosystem. Since its inception, Apollo has treated over 65 million patients from 141 countries.

Management anticipates that the Company and Apollo Sugar will file a pre-trial application with the Central Drugs Standards Control Organization (CDSCO) in India to obtain approval to initiate the I-STEP trial. The Company expects to receive approval and initiate the trial prior to the end of the third quarter of 2020. The partners anticipate enrollment will take less than 12 months.

GI Dynamics and Apollo Sugar leadership are working to finalize the terms of the GI Dynamics-Apollo Sugar partnership that will focus on the marketing, distribution and clinical support of EndoBarrier to appropriate patients in India, Southeast Asia and the Middle East. Final terms of the proposed collaboration are subject to negotiation and will be disclosed upon completion.

| 3) | Gain CE Mark: Work with new Notified Body to gain EndoBarrier CE mark. |

CE Marking of a product is a manufacturer’s declaration that a product meets the applicable health, safety, and environmental requirements outlined in the appropriate European product legislation and has undergone the relevant conformity assessment procedure. A CE Mark is required before the Company can market EndoBarrier in the EU and certain Middle Eastern countries.

2

GI Dynamics previously announced that it was working with Intertek, a Notified Body headquartered in London, UK. GI Dynamics has ended this relationship and is working with a different Notified Body. A notified body evaluates the conformity of products and the associated quality systems for manufacturers that seek to sell products in Europe. The Company’s new Notified Body has initiated the process of working through EndoBarrier clinical data and the Company’s Quality Management System. The Company will release the name of the new Notified Body when the final agreement between GI Dynamics and the new Notified Body has been completed. Management believes that the attainment of CE Mark is achievable by the end of 2020.

| 4) | Ongoing clinical data: Support continued release of clinical data from registries and investigator-initiated clinical trials. |

GI Dynamics continues to support the ongoing efforts of multiple clinicians as they develop new EndoBarrier clinical data. Multiple investigator-initiated clinical trials released clinical data in 2019. It is expected that these clinical trials will continue to release data into 2020 and beyond.

GI Dynamics also supports two primary registries that continue to release clinical data. The Association of British Clinical Diabetologists (ABCD) Worldwide EndoBarrier Registry contains over 500 patient data points with the goal of analyzing and releasing clinical data for more than 1,000 patients. The German EndoBarrier Registry contains over 300 patient data points. The patients within these two registries are non-overlapping. Both registries are expected to continue releasing clinical data highlighting the EndoBarrier treatment effect on an annual basis.

The release of clinical data has historically focused and is expected to continue focusing on the annual clinical data releases at the following scientific meetings: Digestive Disease Week (DDW) in May, American Diabetes Association (ADA) in June, European Association for the Study of Diabetes (EASD) in October, and Obesity Week in November.

| 5) | Development of Intellectual Property: Continue developing the Company’s intellectual property and protecting its patents. |

GI Dynamics will continue to invest in expanding its intellectual property portfolio. The Company’s current patent portfolio is composed of 84 issued and pending U.S. and non-U.S. patents. The Company has 33 granted U.S. patents and 15 pending U.S. patent applications. The Company has also sought intellectual property protection outside the U.S. and has 8 issued patents in Germany and the United Kingdom and 28 pending patent applications across China, the European Patent Convention region, Hong Kong, Israel and India.

The Company’s current issued patents expire between 2023 and 2035. GI Dynamics also actively monitors its intellectual property by regularly reviewing new developments to identify extensions to the patent portfolio. The Company employs external patent attorneys to assist in managing the Company’s intellectual property portfolio.

Summary

In summary, GI Dynamics believes that EndoBarrier represents the most effective new treatment option in a market dominated by pharmaceutical companies generating annual revenue in excess $40 billion. The Company believes that EndoBarrier is poised to have a transformative and disruptive effect on the type 2 diabetes market. EndoBarrier is one of the few treatment options that treats type 2 diabetes, concurrently reduces obesity, and continues to show lasting treatment effects post treatment in many patients. As the duration of the EndoBarrier treatment effect continues to increase in published literature and because, to date, there has been minimal observed clinical risk after EndoBarrier removal, the EndoBarrier risk-benefit balance continues to evolve in an increasingly positive manner.

Background of the Disease

Diabetes mellitus type 2 (also known as type 2 diabetes) is a long-term progressive metabolic disorder characterized by high blood sugar, insulin resistance, and reduced insulin production. People with type 2 diabetes represent 90-95% of the worldwide diabetes population; only 5-10% of this population is diagnosed with type 1 diabetes (a form of diabetes mellitus wherein little to no insulin is produced).

Being overweight is a condition where the patient’s body mass index (BMI) is greater than 25 (kg/m2); obesity is a condition where the patient’s BMI is greater than 30, with some countries applying a lower metric to both definitions. Obesity and its comorbidities contribute to the progression of type 2 diabetes. Many experts believe obesity contributes to higher levels of insulin resistance, which creates a feedback loop that increases the severity of type 2 diabetes for many patients.

3

When considering treatment for type 2 diabetes, it is optimal to address obesity concurrently with diabetes. According to the article “Mechanisms of Insulin Resistance in Obesity,” published in Frontiers of Medicine in 2013 by Jianping Ye, absent the concurrent reduction of obesity with the treatment of type 2 diabetes, obesity will likely continue to contribute to the progressive nature of type 2 diabetes. It is the Company’s belief that the inability of the current pharmacologic options to fully treat type 2 diabetes is due to the fact that diabetes medications generally treat blood sugar levels only and do not contribute substantially to weight loss.

Current Treatment Options

According to the American Diabetes Association 2018 Standards of Medical Care in Diabetes, the current treatment paradigm for type 2 diabetes is lifestyle therapy combined with pharmacological treatment, whereby treating clinicians prescribe a treatment regimen of one to four concurrent medications that could include insulin. Insulin usage carries a significant risk of increased mortality and may contribute to weight gain, which in turn may lead to higher levels of insulin resistance and increased levels of blood sugar, as explained in the article “Insulin-associated weight gain in diabetes--causes, effects and coping strategies,” by Russel-Jones, D. Only 40% of patients treated pharmacologically for type 2 diabetes are adequately managed, meaning that medication does not lower blood sugar adequately and does not halt the progressive nature of diabetes for these patients, as explained in the article “Adherence to Therapies in Patients with Type 2 Diabetes,” by Luis-Emilio Garcia-Perez.

The current pharmacological treatment algorithms for type 2 diabetes fall short of ideal, creating a large and unfilled efficacy gap. GI Dynamics believes that EndoBarrier, which is designed to mimic the mechanism of action of duodenal-jejunal exclusion currently created by RYGB gastric bypass surgery and operates in a relatively similar manner by reducing both weight and long-term blood sugar levels, can fill this gap by treating type 2 diabetes and reducing obesity in a unique minimally invasive and reversible manner.

Market Opportunity

Unmet Clinical Needs in the Treatment of Type 2 Diabetes and Obesity.

In 2019, the International Diabetes Federation estimated there were approximately 463 million people with type 2 diabetes worldwide. Diabetes is the leading cause of cardiovascular disease, kidney failure, blindness, and lower-limb amputation in almost all countries.

Three years after initial diagnosis, over half of patients with type 2 diabetes require multiple drug therapies. Studies have shown that only 40% of the type 2 diabetes population is adequately managed pharmacologically, as explained in the article “Challenges in Diabetes Management: Glycemic Control, Medication Adherence, and Healthcare Costs,” published in the American Journal of Managed Care in 2017. At ten years post diagnosis, most patients, despite insulin use in many, struggle to reach their hemoglobin A1c (HbA1c) treatment goals. HbA1c is a glycosylated hemoglobin molecule found in the bloodstream that is formed when red blood cells are exposed to blood glucose. HbA1c has become the generally accepted gold standard biomarker for measuring levels of diabetes control in clinical practice and in human trials.

Many patients and health care systems struggle to meet the financial burden imposed by the numerous concurrent medications required to attempt to control the progressive nature of type 2 diabetes.

According to the World Health Organization, in 2016 more than 1.9 billion adults 18 and older were overweight. Of these, 650 million people worldwide are diagnosed with obesity (BMI ³ > 30 kg/m 2), a condition often leading to serious health consequences such as cardiovascular disease, diabetes, musculoskeletal disorders, and some cancers.

Those suffering from both type 2 diabetes and obesity, also referred to as diabesity, total more than 169 million worldwide, represent a significant public health problem not only in the United States (US) but also globally, as explained in the article “Epidemiology of Obesity and Diabetes and Their Cardiovascular Complications,” published in the Circulation Research in 2016 by Shilpa Bhupathiraju. GI Dynamics believes that the unchecked worldwide rate of growth of the type 2 diabetes and obesity patient population represents one of the greatest unmanaged health risks in all of health care.

4

GI Dynamics believes EndoBarrier can treat patients with type 2 diabetes and reduce obesity in a safe, effective, nonpharmacological, and nonpermanent manner.

The Efficacy Gap

The Company’s intent in developing and seeking regulatory approval for EndoBarrier is to help clinicians deliver a unique treatment option to those patients suffering from type 2 diabetes, a disease state that sorely lacks innovative and broadly effective new treatment options.

GI Dynamics and its scientific advisors feel there must be a change in how the medical establishment currently treats obese patients suffering from type 2 diabetes because current treatment options are not effective. According to the International Diabetes Federation, the number of obese patients progressing to later stages of type 2 diabetes continues to grow at an alarming rate. Yet less than half of all type 2 diabetes patients are adequately managed by pharmacotherapy, and insulin carries serious risks and may in many cases contribute to the further progression of obesity. At the extreme end of the treatment spectrum, the treatment options are limited to different types of bariatric or metabolic surgery, which are highly invasive and irreversible procedures. Less than 1% of patients who are eligible for bariatric or metabolic surgery opt to undergo the procedure, as explained in the article “Recent advances in clinical practice challenges and opportunities in the management of obesity,” published by Andres Acosta in 2015 in the Gut .

The graphic above illustrates the multiple treatment options during the course of progression of type 2 diabetes:

| ● | Risk associated with treatment increases from left to right. |

| ● | Progression of diabetes and obesity health risk and cost increase vertically. |

| ● | Lifestyle therapy (lifestyle counseling including nutrition and exercise) is the first line of defense against the progression of type 2 diabetes and obesity. |

| ● | Pharmacotherapy |

| o | Oral monotherapy follows lifestyle therapy, often with metformin as the first line of treatment. |

| o | Multiple combinations may then be administered, as recommended by the American Diabetes Association and other diabetes associations around the world. |

| o | Ultimately, as disease progression continues, injected insulin may be prescribed. |

| ● | Bariatric or metabolic gastric bypass surgery may represent a final option. |

5

A significant and rapidly growing patient population falls into the efficacy gap, wherein the patient is inadequately managed by medication yet unwilling to undergo gastric bypass surgery. For patients who elect to undergo bariatric or metabolic surgery, the clinical gains may not be permanent, while the risk associated with the procedure is permanent. These risks include, but are not limited to, excessive bleeding, blood clots, infection and in some cases death. GI Dynamics believes that because EndoBarrier is minimally invasive, can mimic the effects of gastric bypass, and has minimal side-effects, EndoBarrier can uniquely fill this efficacy gap, as explained in the article “EndoBarrier: A Safe and Effective Novel Treatment for Obesity and Type 2 Diabetes?” published in Obesity Surgery in 2018 by Nisha Patel.

The EndoBarrier Solution

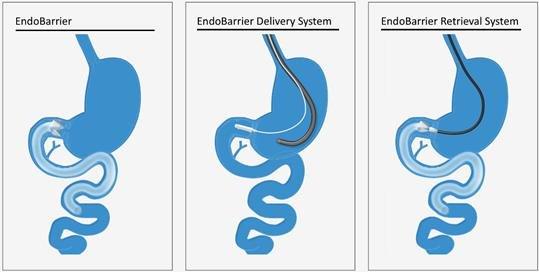

EndoBarrier is intended for the treatment of type 2 diabetes and the reduction of obesity in a minimally invasive and reversible manner. EndoBarrier is designed to mimic the mechanism of action of duodenal-jejunal exclusion created by gastric bypass surgery. The EndoBarrier System is provided sterile and consists of an EndoBarrier Liner preloaded, packaged and sterilized within the EndoBarrier Delivery System. The EndoBarrier Delivery System is utilized to deliver the EndoBarrier Liner to the proximal small intestine. The EndoBarrier Liner is removed using the EndoBarrier Retrieval System.

The EndoBarrier System consists of three primary components:

| ● | EndoBarrier — The EndoBarrier or EndoBarrier Liner is a 60-cm-long implant consisting of a thin, flexible, impermeable fluoropolymer liner coupled to a proprietary nitinol Anchor Mechanism. A gastroenterologist implants the EndoBarrier Liner into the patient’s duodenum in a minimally invasive manner using the EndoBarrier Delivery System and standard gastroscope. The EndoBarrier Liner is placed endoscopically (through the mouth and esophagus and into the stomach without cutting tissue). Once the EndoBarrier Liner is properly positioned in the patient’s duodenal bulb, the area within the duodenum just below the stomach, the EndoBarrier Delivery System is removed and the EndoBarrier Liner remains, held in place by a proprietary Anchor Mechanism. The EndoBarrier Liner remains in the body for a maximum intended duration of twelve months until removal, again via a minimally invasive endoscopic procedure using the EndoBarrier Retrieval System. |

6

| ● | EndoBarrier Delivery System — The EndoBarrier Liner is delivered using the Company’s proprietary sterile, single-use EndoBarrier Delivery System. This includes a custom-made Outer Catheter that is sufficiently flexible to allow for insertion through the patient’s mouth, through the stomach, and into the intestine without kinking. The EndoBarrier Liner is pre-assembled during manufacturing into a collapsed position inside the Capsule, which is located at the end of the Outer Catheter. The clinician uses the EndoBarrier Delivery System to advance the Capsule into the duodenum and deploy the EndoBarrier Liner from the Capsule. The delivery procedure is typically an outpatient procedure, during which the patient is under anesthesia or semi-sedation. |

| ● | EndoBarrier Removal System — The EndoBarrier Liner is removed at the end of the treatment period via a minimally invasive endoscopic procedure using the Company’s proprietary Retrieval System which is passed by the clinician through a standard gastroscope. The Hook of the EndoBarrier Removal System is used to pull either of two drawstrings located in the Anchor Mechanism. As the drawstring is pulled, the Anchor Mechanism is collapsed inward and disengages from the wall of the duodenum. The Hood, pre-placed on the end of a gastroscope, allows the EndoBarrier anchor assembly to be pulled and collapsed into the Hood with the Hood positioned to cover portions of the anchor. The EndoBarrier Liner is then safely removed through the patient’s stomach, esophagus, and mouth. The retrieval procedure is typically an outpatient procedure, during which the patient is under anesthesia or semi-sedation. |

EndoBarrier has been shown in multiple company-sponsored and independent clinical studies to lower blood sugar levels (hemoglobin A1c or HbA1c), reduce excess body weight, and positively affect other health metrics and comorbidities.

EndoBarrier is not currently approved or commercially available in any jurisdiction. In August 2018, GI Dynamics received notification from the FDA that it had approved its IDE application, pending IRB approval which was received in February 2019. To gain regulatory approval to commercialize EndoBarrier in the United States, the Company must submit a pre-market authorization (PMA) application for review and approval by the FDA. In January 2020, GI Dynamics initiated treatment of patients in the STEP-1 pivotal clinical trial, which is the registration trial for the PMA application.

The EndoBarrier Effect

Obesity has been shown to exacerbate insulin resistance and contribute to the progression of type 2 diabetes. In situations where lifestyle modification and pharmacotherapy have failed and surgery is not an option or is considered a therapy of last resort, EndoBarrier is intended to reduce blood sugar and weight. In clinical trials in both the United States and outside of the United States, EndoBarrier has been shown to:

| ● | significantly lower glucose levels; |

| ● | significantly lower body weight; |

| ● | lower cardiovascular-related risk factors. |

EndoBarrier utilization accomplishes this in many patients by affecting key hormones involved in insulin sensitivity, glucose metabolism, satiety, and food intake. (See the section titled “How EndoBarrier Works: EndoBarrier Mechanism of Action.”)

The Company’s intent in positioning EndoBarrier to fill the type 2 diabetes efficacy gap with concurrent reduction of obesity is to help patients and clinicians avoid the initiation of insulin therapy by helping many patients maintain lower HbA1c levels and slow or halt the progression of type 2 diabetes. Furthermore, for those patients whose type 2 diabetes has progressed to the point where insulin therapy is necessary, EndoBarrier has been shown in many cases to lower HbA1c levels to the point where insulin dosage can be reduced, or insulin is no longer needed. Finally, if the progression of type 2 diabetes is severe enough to warrant gastric bypass surgery, the Company expects that EndoBarrier either may serve as an opportunity to control type 2 diabetes so that surgery may not be needed, or at least better prepare the patient for bariatric surgery by lowering weight and helping control other comorbidities prior to surgery.

How EndoBarrier Works: EndoBarrier Mechanism of Action

The EndoBarrier mechanism of action is thought to be based on its functional similarities in many ways to RYGB. Once the EndoBarrier is implanted into the duodenum and proximal jejunum, ingested food passing through the EndoBarrier during the normal digestive process is prevented from interacting with the epithelium, microbiota, mucosal layer, or biliopancreatic secretions within the duodenum and proximal jejunum. In addition, EndoBarrier acts as a physical barrier that prevents the interaction of food with pancreatic enzymes and bile until reaching the end of the EndoBarrier Liner. Pancreatic enzymes and bile pass outside EndoBarrier and mix with the food at the distal end of the liner, where absorption ultimately takes place in the intestine. Thus, EndoBarrier creates a functional and reversible bypass of the upper intestine. Unlike RYGB surgery, EndoBarrier does not require an invasive and permanent surgical procedure or permanent physical modification of the stomach and exclusion of the distal stomach from the alimentary flow.

7

The Company’s scientific team and advisors have postulated the following EndoBarrier mechanisms of action, based on scientific evidence from such articles as “Effects of the Duodenal-Jejunal Bypass Liner on Glycemic Control in Patients with Type 2 Diabetes with Obesity: A Meta-Analysis with Secondary Analysis on Weight Loss and Hormonal Changes,” published in Diabetes Care in 2018 by Pichamol Jirapinyo and “The EndoBarrier: Duodenal-Jejunal Bypass Liner for Diabetes and Weight Loss,” published in Hindawi in 2018 by Aruchuna Ruban.:

Exclusion of the duodenum — This may offset an abnormality of gastrointestinal physiology responsible for insulin resistance and type 2 diabetes.

| ● | Increased nutrient delivery to the distal small bowel — Additional findings suggest that the exclusion of the proximal intestine (foregut theory) and increase in nutrient delivery to the distal small bowel (hindgut theory) created by EndoBarrier likely induce neuro-hormonal changes and nutrient sensing that affect energy balance and glucose homeostasis. |

| ● | Secretion of GLP-1 — Partially digested nutrients reach the distal ileum, which stimulates the secretion of GLP-1 by L-cells located in this area. GLP-1 is known to regulate insulin secretion and action. |

| ● | Increase in gut hormones — This contributes to the restoration of energy and glucose homeostasis. |

| ● | Elevated GLP-1 and PYY levels — Both levels are elevated as quickly as one-week post-implantation. Both hormones may play a role in satiety and body weight control. |

There is no known evidence of occurrence of clinically significant caloric malabsorption with EndoBarrier. EndoBarrier covers only 60 cm of duodenal and proximal jejunal mucosa, which most likely represents less than 10% of the length of the small intestine and leaves almost the entire jejunum and ileum for digestion and absorption.

Operations and Financing

GI Dynamics began selling EndoBarrier in Europe and South America in 2010 and in Australia in 2011. Since inception, the Company has distributed almost 4,000 units of EndoBarrier and generated a total of $7.8 million in revenue. The Company has incurred net losses in each year since its inception.

The Company has five subsidiaries: GI Dynamics Securities Corporation, a Massachusetts-incorporated nontrading entity; GID Europe Holding B.V., a Netherlands-incorporated nontrading holding company; GID Europe B.V., a Netherlands-incorporated company that conducts certain European business operations; GID Germany GmbH, a German-incorporated company that conducts certain European business operations; and GI Dynamics Australia Pty Ltd, an Australia-incorporated company that conducts Australian business operations.

GI Dynamics has raised net proceeds of approximately $273 million through sales of the Company’s equity and placement of debt, of which $9.3 million was received in 2019 as a result of the Company’s 2019 financings. Historically, the Company generated $75.7 million in proceeds, net of expenses, through the sale of convertible preferred stock to a number of US venture capital firms, two global medical device manufacturers, and qualified individual investors prior to going public. In June 2011, the Company issued convertible term promissory notes to several of its stockholders totaling $6 million. In September 2011, the Company conducted an Initial Public Offering (“IPO”) in Australia and simultaneously conducted a private placement of CDIs to accredited investors in the United States. Net proceeds from these financings approximated $72.5 million, net of expenses and repayment of the June 2011 notes. In connection with the IPO, all existing shares of preferred stock were converted into common stock.

In July and August 2013, GI Dynamics raised approximately $52.5 million, net of expenses, in an offering of the Company’s CDIs to qualified investors in Australia, the United States, and certain other jurisdictions. In May 2014, the Company raised approximately $30.8 million, net of expenses, in an offering of the Company’s CDIs to qualified investors in Australia, Hong Kong, the United Kingdom, and certain other jurisdictions.

8

In December 2016, GI Dynamics raised approximately $1 million, net of expenses, in an offering of the Company’s CDIs to qualified investors in Australia and certain other jurisdictions.

In January 2017, GI Dynamics raised approximately $0.2 million, net of expenses, in an offering of the Company’s CDIs under a Security Purchase Plan (“SPP”) available to security holders having a registered address in Australia or New Zealand.

In June 2017, GI Dynamics placed a Convertible Secured Term Promissory Note (the “2017 Note”) financing with Crystal Amber Fund Limited (“Crystal Amber”, the Company’s largest stockholder and a Related Party for ASX purposes) for a gross amount of $5 million. The 2017 Note accrues interest at 5% per annum, compounded annually. In December 2018, the maturity date of the 2017 Note was extended from December 31, 2018 to March 31, 2019 in exchange for payment of the total accrued interest on the 2017 Note at December 31, 2018, which approximated $394 thousand. The maturity date of the 2017 Note was extended four additional times in 2019, with the most recent being the August 21 extension of the maturity date from September 1, 2019 to March 31, 2020.

In July 2017, GI Dynamics signed a manufacturing agreement with its contract manufacturing partner Proven Process Medical Devices (“PPMD”).

In February and March 2018, GI Dynamics raised approximately $1.6 million in an offering of the Company’s CDIs to qualified investors, including certain existing investors, in Australia, the United States and the United Kingdom.

In May 2018, GI Dynamics placed a Convertible Term Promissory Note and Warrant (the “2018 Note and Warrant”) with Crystal Amber for a note principal amount of $1.75 million. The 2018 Note accrues interest at 10% per annum, compounded annually, and could be converted to CDIs at $0.018 per CDI until maturity on May 30, 2023. The warrants conferred the right to purchase 97,222,200 CDIs for $0.018 per CDI with anti-dilution protections.

In September and November 2018, GI Dynamics raised approximately $5 million in an offering of the Company’s CDIs to qualified investors, including certain existing investors, in Australia, the United States and the United Kingdom.

In October 2018, GI Dynamics announced that it signed an agreement with its new notified body Intertek to pursue CE marking of EndoBarrier in Europe. The Company has since suspended its relationship with Intertek and is working with a different notified body whose identity will be announced when the service agreement is finalized.

In November 2018, the Company signed a clinical trial agreement and a memorandum of understanding with its clinical and potential commercial partner Apollo Sugar, a division of Apollo Hospitals Group located in India.

In December 2018, GI Dynamics announced the appointment of Charles Carter, a consultant, as the Company’s Chief Financial Officer and Secretary. Mr. Carter became an employee of the Company on September 1, 2019.

In March 2019, the Company completed a Note Purchase Agreement (“March 2019 NPA”) detailing a convertible term promissory note (the “March 2019 Note”) and warrant (the “March 2019 Warrant”) financing with Crystal Amber for a gross amount of $1 million. The March 2019 Note compounded interest annually at 10% and, subject to Stockholder Approval required under ASX Listing Rules, Crystal Amber was conferred the right to optionally convert all unpaid principal and interest to CDIs at $0.0127 per CDI before the Note Maturity date in March 2024. Per the March 2019 NPA, the Company agreed to issue a warrant (the “March 2019 Warrant”) to Crystal Amber, pending stockholder approval, to purchase 78,984,823 CDIs (representing 1,579,696 shares of common stock) at an initial exercise price of $0.0127 per CDI. The issue of the March 2019 Warrant required the approval of stockholders and was not exercisable until its issue was approved on June 30, 2019. (See Note 9 of the Consolidated Financial Statements for a more complete description of the terms and conditions of the financing).

9

In March 2019, the maturity date of the 2017 Note was extended to May 1, 2019. In April 2019, the maturity date of the 2017 Note was extended to July 1, 2019.

In May 2019, the Company completed a convertible term promissory note (the “May 2019 Note”) and warrant (the “May 2019 Warrant”) financing with Crystal Amber for a gross amount of $3 million. The May 2019 Note compounded interest annually at 10% and, subject to Stockholder Approval required under ASX Listing Rules, Crystal Amber was conferred the right to optionally convert all unpaid principal and interest to CDIs at $0.0127 per CDI before the Note Maturity date in May 2024. Per the May 2019 NPA, the Company contingently issued a warrant (the “May 2019 Warrant”) to Crystal Amber, pending stockholder approval, to purchase 236,220,472 CDIs (representing 4,724,409 shares of common stock) at an initial exercise price of $0.0127 per CDI. The issue of the May 2019 Warrant required the approval of stockholders and was not exercisable until its issue was approved on June 30, 2019. (See Note 9 of the Consolidated Financial Statements for a more complete description of the terms and conditions of the financing).

In June 2019, the maturity date of the 2017 Note was extended to October 1, 2019.

On June 30, 2019, Crystal Amber elected to convert the 2018 Note, the March 2019 Note and the May 2019 Note into CDIs. Under the terms of the respective notes, an aggregate of 453,609,963 CDIs (representing approximately 9,072,197 shares of common stock) were subscribed but unissued on conversion and concurrent cancellation of the 2018 Note, the March 2019 Note and the May 2019 Note. The CDIs were issued on July 3, 2019.

On August 21, 2019, the Company and Crystal Amber entered into a securities purchase agreement for a total funding of up to approximately $10 million (the “August 2019 SPA”). The initial $5.4 million was comprised of existing warrant exercises scheduled between August 25, 2019 and November 15, 2019. Exercises included the 2018 Warrant, the March 2019 Warrant, and the May 2019 Warrant issued to Crystal Amber, as further detailed above. The remaining amount of the August 2019 funding was represented by a Convertible Term Promissory Note (“August 2019 Note”) of up to approximately $4.6 million and a related Warrant (“August 2019 Warrant”) in substantially the same form as the March 2019 and May 2019 convertible term promissory note. Under the terms of the August 2019 SPA and 2019 Note, the Company, at its sole discretion, elected to request the entire $4.6 million to be funded before December 6, 2019, but then amended the election to allow funding in tranches at Crystal Amber’s election before January 15, 2020. The conversion feature allows the conversion of the August 2019 Note unpaid principal and interest at $0.02 per CDI and the August 2019 Warrant, upon its issue, allowed the purchase for $0.02 per CDI of that number of CDIs represented by the August 2019 Note principal divided by $0.02 per CDI. (See Note 9 of the Consolidated Financial Statements for a more complete description of the terms and conditions of the financing).

On August 21, 2019, the maturity date of the 2017 Note was extended to March 31, 2020.

On August 25, 2019, Crystal Amber exercised the 2018 Warrant and a portion of the March 2019 Warrant in accordance with the terms of the August 2019 SPA. For an aggregate cash payment of $2 million, 97,222,200 CDIs (representing approximately 1,944,444 shares of common stock) were issued at $0.0144 per CDI under the 2018 Warrant and 47,244,119 CDIs (representing approximately 944,882 shares of common stock) were issued at $0.0127 per CDI under the March 2019 Warrant.

On September 30, 2019, Crystal Amber exercised the remaining portion of the March 2019 Warrant and a portion of the May 2019 Warrant in accordance with the August 2019 SPA. For an aggregate cash payment of $2 million, 31,740,704 CDIs (representing approximately 634,814 shares of common stock) were issued at $0.0127 per CDI under the March 2019 Warrant and 125,739,610 CDIs (representing approximately 2,514,792 shares of common stock) were issued on October 4, 2019 at $0.0127 per CDI under the May 2019 Warrant. As of September 30, 2019, this was recorded as a subscription receivable from a related party and the cash was received on October 1, 2019.

On October 31, 2019, Crystal Amber exercised another portion of the May 2019 Warrant in accordance with the August 2019 SPA. For an aggregate cash payment of $1 million, 78,740,157 CDIs (representing approximately 1,574,803 shares of common stock) were issued on November 4, 2019 at $0.0127 per CDI under the May 2019 Warrant. Cash was received on October 31, 2019.

10

On November 15, 2019, Crystal Amber exercised the final portion of the May 2019 Warrant in accordance with the August 2019 SPA. For an aggregate cash payment of approximately $0.4 million, 31,740,748 CDIs (representing approximately 634,814 shares of common stock) were issued on November 18, 2019 at $0.0127 per CDI under the May 2019 Warrant. Cash was received on November 15, 2019.

On December 2, 2019, GI Dynamics provided notice to Crystal Amber that the Company elected to place the August 2019 Note at the full amount, on or before December 6, 2019. In December, the Company and Crystal Amber agreed to confer the right to tranche the funding of the August 2019 Note in amounts and per timing chosen solely by Crystal Amber, provided the August 2019 Note total was funded on or before January 15, 2020.

On December 16, 2019, GI Dynamics stockholders approved the August 2019 Note conversion feature and the issuance of the August 2019 Warrant, pending funding of the August 2019 Note by Crystal Amber.

On January 13, 2020, GI Dynamics received approximately $4.6 million in cash representing the full funding of the August 2019 Note. As stockholder approval had been obtained in December 2019, the August 2019 Note became convertible at Crystal Amber’s sole discretion until maturity in August 2024. Additionally, the August 2019 Warrant was issued to Crystal Amber, providing for the purchase of up to 229,844,650 CDIs (representing 4,596,893 shares of common stock) at $0.02 per CDI.

The rights of the Company’s stockholders are governed by Delaware general corporation law.

GI Dynamics is headquartered in Boston, Massachusetts, where the majority of the Company’s employees work. The Company has subsidiaries in the Netherlands, Germany, and Australia, with employees in Germany and Australia.

2019 in Review

2019 was a year primarily focused on 4 operational priorities:

| 1. | STEP-1 US Pivotal Trial |

| 2. | I-STEP India Pivotal Trial with Apollo Sugar |

| 3. | CE Mark |

| 4. | Raising capital to finance operations |

The Company’s lead priority was the STEP-1 (Single Therapy Euglycemic Procedure) pivotal trial. The year was spent focusing on final training of clinical sites, study committee selection and running the STEP-1 Investigator Meeting. Additional focus was on selection, design, testing and deployment of multiple clinical trial management systems. Finally, the focus of efforts shifted to site initiations and initiation of patient recruitment efforts. The Company announced that the first patient was randomized in the STEP-1 trial in January 2020. Management expects that enrollment of Stage 1 (~67 patients; 50 EndoBarrier, ~17 control) will be enrolled by end of year 2020.

The Company, in concert with Apollo Sugar, has focused on preparation for initiation of the I-STEP (India Single Therapy Euglycemic Procedure) pivotal trial. The year was spent working with Apollo and CDSCO (Central Drugs Standard Control) and DCGI (Drugs Controller General of India) to receive approval to commence enrollment in the I-STEP study. In addition, the Company focused on conducting clinical site qualifications, software selection and design and integration to the Apollo Sugar patient management app. Management expects to begin enrollment in Q3 2020 and to be completely enrolled within 9 months, currently projected to be completely enrolled by the end of Q1 2021.

The Company is working with its new notified body towards receiving CE Mark designation. The Company previously announced that it was working with Intertek as its notified body. The Company terminated that relationship and has been working with a different notified body which will be announced in 2020 when the relationship is formalized under contract. Management is seeking CE Mark approval by the end of 2020; however, there is no assurance that CE Mark approval will be granted in the time frame anticipated by management or granted at any time in the future.

Finally, the Company focused on raising capital to adequately finance operations. Through a series of financings, management has been able to focus on reducing cash burn while decreasing risk, continuing to develop the Company’s intellectual property, and continuing to support the release of statistically significant clinical data from independent investigator-initiated trials and two registries.

GI Dynamics hired key staff and moved to a new office location in Boston, Massachusetts in 2019.

11

Strategic Focus in 2020: The Path Forward

The Company’s goal is to become the leading provider of alternative options for treating type 2 diabetes and concurrently reducing obesity. GI Dynamics intends to do this by conducting the following activities:

| 1) | U.S. clinical operations and pivotal trial: | Complete enrollment in Stage 1 of the STEP-1 pivotal trial in the US. | |

| 2) | India partnership and pivotal trial: | Initiate enrollment in the I-STEP pivotal trial in India. | |

| 3) | Gain CE Mark: | Work with the Company’s notified body to gain the EndoBarrier CE mark. | |

| 4) | Ongoing clinical data: | Support continued release of clinical data from registries and investigator- initiated clinical trials. | |

| 5) | Continued development of Intellectual Property: | Continue developing the Company’s intellectual property and protecting its patents. |

The Company will need to raise additional capital in 2020.

As of December 31, 2019, the Company’s primary source of liquidity is its cash, cash equivalents and restricted cash balances. GI Dynamics is currently focused primarily on its clinical trials, which will support future regulatory submissions and potential commercialization activities. Until GI Dynamics is successful in gaining regulatory approvals, the Company is unable to sell its product in any market at this time. Without revenues, GI Dynamics is reliant on funding obtained from investment in the Company to maintain business operations until the Company can generate positive cash flows from operations. The Company cannot predict the extent of its future operating losses and accumulated deficit, and it may never generate sufficient revenues to achieve or sustain profitability.

The Company has incurred operating losses since inception and at December 31, 2019, had an accumulated deficit of approximately $284 million and a working capital deficit of $3.4 million. The Company expects to incur significant operating losses for the next several years. At December 31, 2019, the Company had approximately $2.5 million in cash, cash equivalents and restricted cash.

The Company will need to restructure the terms of the 2017 Note before March 31, 2020 and raise additional capital before May 1, 2020 in order to continue to pursue its current business objectives as planned and to continue to fund its operations. The Company and Crystal Amber are currently in final discussions regarding the 2017 Note maturity extension. The Company is looking to raise additional funds through any combination of additional equity and debt financings or from other sources. However, the Company has no guarantee that the 2017 Note will not mature on March 31, 2020 and has no guaranteed source of capital that will accommodate repayment of the 2017 Note and sustain operations past March 31, 2020. If the 2017 Note terms are restructured, the Company anticipates operating cash being exhausted by May 1, 2020 and therefore requires additional financing. There can be no assurance that any such potential financing opportunities will be available on acceptable terms, if at all. If the Company is unable to raise sufficient capital on the Company’s required timelines and on acceptable terms to stockholders and the Board of Directors, it could be forced to cease operations, including activities essential to support regulatory applications to commercialize EndoBarrier. If access to capital is not achieved in the near term, it will materially harm the Company’s business, financial condition and results of operations to the extent that the Company may be required to cease operations altogether, file for bankruptcy, or undertake any combination of the foregoing. These factors raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date that these consolidated financial statements are issued.

In addition, if the Company does not meet its payment obligations to third parties as they become due, the Company may be subject to litigation claims and its credit worthiness would be adversely affected. Even if the Company is successful in defending these claims, litigation could result in substantial costs and would be a distraction to management and may have other unfavorable results that could further adversely impact the Company’s financial condition.

As a result of the factors described above, the Company’s consolidated financial statements include a going-concern disclosure. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources” for further information regarding the Company’s funding requirements.

Implications of Being a Smaller Reporting Company

Section Rule 12b-2 of the Securities Exchange Act of 1934, as amended, (“the Exchange Act”), establishes a class of company called a “smaller reporting company,” which effective September 10, 2018, was amended to include companies with a public float of less than $250 million as of the last business day of its most recently completed fiscal quarter or, if such public float is less than $700 million, had annual revenues of less than $100 million during the most recently completed fiscal year for which audited financial statements are available. For the year ended December 31, 2019, the Company qualifies as a smaller reporting company.

12

As a smaller reporting company, the Company may take advantage of specified reduced disclosure and other requirements that are otherwise generally applicable to public companies that do not qualify for this classification. The provisions include:

| ● | Any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and financial statements, commonly known as an “auditor discussion and analysis”; | |

| ● | Allowance to report two years, instead of three, of audited financial statements; | |

| ● | Reduced disclosure about executive compensation arrangements; | |

| ● | Exemption from the auditor attestation requirement in the assessment of the Company’s internal control over financial reporting. |

For as long as GI Dynamics continues to be a smaller reporting company, the Company expects that it will take advantage of the reduced disclosure obligations available to it as a result of such classification. The Company will remain a smaller reporting company until it has a public float of $250 million or more as of the last business day of its most recently completed fiscal quarter, and the Company could retain its smaller reporting company status indefinitely depending on the size of its public float.

Employees

As of March 12, 2020, GI Dynamics has 15 full-time employees, 12 of whom are in the United States. None of the Company employees are represented by labor unions or covered by collective bargaining agreements.

Available Information

Financial and other information about GI Dynamics is available on the Company website, whose address is www.gidynamics.com. The Company makes available on its website, free of charge, copies of its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after the Company electronically files such material with, or furnishes it to, the U.S. Securities and Exchange Commission (SEC) and the Australian Securities Exchange (ASX). The information contained in the Company website is not intended to be part of this filing.

The Company’s business faces many risks. The Company believes the risks described below are the material risks that it faces. However, the risks described below may not be the only risks that it faces. Additional unknown risks or risks that are currently considered immaterial, may also impair the Company’s business operations. If any of the events or circumstances described below actually occur, the Company’s business, financial condition or results of operations could suffer, and the trading price of its CDIs could decline significantly. You should consider the specific risk factors discussed below together with the cautionary statements under the caption “Forward-Looking Statements” and the other information and documents that the Company files from time to time with the Securities and Exchange Commission (SEC) and the Australian Securities Exchange (ASX).

Risks Related to the Company’s Business

GI Dynamics will need substantial additional funding and may be unable to raise capital when needed, which could force the Company to delay, reduce, or eliminate planned activities or result in its inability to operate as a going concern.

As of December 31, 2019, the Company’s primary source of liquidity is its cash, cash equivalents and restricted balances. GI Dynamics is currently focused primarily on its clinical trials, which will support future regulatory submissions and potential commercialization activities. Until the Company is successful in gaining regulatory approvals, it is unable to sell the Company’s product in any market at this time. Without revenues, GI Dynamics is reliant on funding obtained from investment in the Company to maintain business operations until the Company can generate positive cash flows from operations. The Company cannot predict the extent of future operating losses and accumulated deficit, and it may never generate sufficient revenues to achieve or sustain profitability.

The Company has incurred operating losses since inception and at December 31, 2019, had an accumulated deficit of approximately $284 million and a working capital deficit of $3.4 million. The Company expects to incur significant operating losses for the next several years. At December 31, 2019, the Company had approximately $2.5 million in cash, cash equivalents and restricted cash.

13

The Company will need to restructure the terms of the 2017 Note before March 31, 2020 and raise additional capital before May 1, 2020 in order to continue to pursue its current business objectives as planned and to continue to fund its operations. The Company and Crystal Amber are currently in final discussions regarding the 2017 Note maturity extension. The Company is looking to raise additional funds through any combination of additional equity and debt financings or from other sources. However, the Company has no guarantee that the 2017 Note will not mature on March 31, 2020 and has no guaranteed source of capital that will accommodate repayment of the 2017 Note and sustain operations past March 31, 2020. If the 2017 Note terms are restructured, the Company anticipates operating cash being exhausted by May 1, 2020 and therefore requires additional financing. There can be no assurance that any such potential financing opportunities will be available on acceptable terms, if at all. If the Company is unable to raise sufficient capital on the Company’s required timelines and on acceptable terms to stockholders and the Board of Directors, it could be forced to cease operations, including activities essential to support regulatory applications to commercialize EndoBarrier. If access to capital is not achieved in the near term, it will materially harm the Company’s business, financial condition and results of operations to the extent that the Company may be required to cease operations altogether, file for bankruptcy, or undertake any combination of the foregoing. These factors raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date that these consolidated financial statements are issued.

In addition, if the Company does not meet its payment obligations to third parties as they become due, the Company may be subject to litigation claims and its credit worthiness would be adversely affected. Even if the Company is successful in defending these claims, litigation could result in substantial costs and would be a distraction to management and may have other unfavorable results that could further adversely impact the Company’s financial condition.

As a result of the factors described above, the Company’s consolidated financial statements include a going-concern disclosure.

The terms of the Company’s indebtedness, in particular the terms of the 2017 Note, may result in the liquidation or winding down of the business, which would have a negative impact on holders of the Company CDIs and common stock.

In June 2017, GI Dynamics completed its 2017 Note secured financing with Crystal Amber for a gross amount of $5.0 million that accrues annually compounded interest of 5% per annum. In December 2018, the maturity date of the 2017 Note was extended from December 31, 2018 to March 31, 2019 in exchange for payment of approximately $394 thousand, which was the total accrued interest on the 2017 Note at December 31, 2018. In 2019, the maturity of the 2017 Note was extended multiple times, most recently to March 31, 2020.

As of March 12, 2020, the Company had outstanding debt obligations of $9.9 million, including accrued interest. Approximately $5.3 million of this amount is due and payable on or before March 31, 2020 under the terms of the 2017 Note, unless (i) the 2017 Note is converted to equity prior to March 31, 2020 or (ii) the 2017 Note is restructured to extend the maturity date, as was last done in August 2019. The Company’s debt obligations are secured by all of the Company’s assets such that upon an event of default, the Company may be forced to sell some or all of its assets in order to make payment against the debt obligation when due. The proceeds from the sale of all of the Company’s assets may be insufficient to satisfy its debt obligations in full. As a result, it is unlikely that any proceeds would be available for distribution to holders of the Company’s CDIs or common stock on a sale of the Company’s assets or on a liquidation or winding down of the business.

Failure to achieve a positive outcome in the U.S. clinical trial of EndoBarrier could negatively impact the Company’s ability to raise additional capital and obtain regulatory approval in other countries.

GI Dynamics is conducting the U.S. pivotal trial of EndoBarrier under the FDA’s IDE. The Company refers to this trial as the GI Dynamics STEP-1 clinical trial in its statements and filings. Failure to achieve a positive outcome in this clinical trial could result in the failure of EndoBarrier to gain regulatory approval in the U. S. This outcome could negatively impact the Company’s ability to raise additional capital and obtain regulatory approval in other countries.

In order to complete the STEP-1 clinical trial, GI Dynamics will need to enroll patients that ultimately complete the trial protocol. If the Company is unable to enroll patients, if the enrollment pace is slower than anticipated, or if a number of enrolled patients do not complete the study protocol, it could have a negative effect on the Company’s ability to complete the clinical trial, which could adversely affect the Company’s business, operating results and prospects.

Conducting successful clinical studies will require the enrollment of patients, and suitable patients may be difficult to identify and recruit. Patient enrollment in clinical trials and completion of patient participation and follow-up depends on many factors, including the size of the patient population, the nature of the trial protocol, the desirability of, or the discomforts and risks associated with, the treatments received by enrolled subjects, the availability of appropriate clinical trial investigators and support staff, the proximity of patients to clinical sites, the ability of patients to comply with the eligibility and exclusion criteria for participation in the clinical trial and patient compliance. For example, patients may be discouraged from enrolling in the Company’s clinical trials if the trial protocol requires them to undergo extensive post-treatment procedures or follow-up to assess the safety and effectiveness of the Company’s product or if they determine that the treatments received under the trial protocols are not desirable or involve unacceptable risk or discomfort.

Development of sufficient and appropriate clinical protocols to demonstrate safety and efficacy are required and GI Dynamics may not adequately develop such protocols to support clearance or approval. Further, the FDA may require the Company to submit data on a greater number of patients than originally anticipated and/or for a longer follow-up period or change the data collection requirements or data analysis applicable to the Company’s clinical trials. Delays in patient enrollment or failure of patients to continue to participate in a clinical trial may cause an increase in costs and delays in the approval or clearance and attempted commercialization of the Company’s product or result in the failure of the clinical trial. In addition, despite considerable time and expense invested in clinical trials, the FDA may not consider the Company’s data adequate to demonstrate safety and efficacy. Such increased costs and delays or failures could adversely affect the Company’s business, operating results and prospects.

14

GI Dynamics or third parties upon whom it depends may be adversely affected by natural disasters and/or health epidemics, and the Company’s business, financial condition and results of operations could be adversely affected.

Natural disasters and/or health epidemics could severely disrupt the Company’s operations and have a material adverse effect on the Company’s business operations. If a natural disaster, health epidemic, or other event beyond the Company’s control occurred that prevented the Company or third parties on which GI Dynamics relies from using appropriate office, manufacturing, or warehouse space, that damaged critical infrastructure, negatively impacted the manufacturing capabilities of the Company’s third-party contract manufacturers, disabled broadband systems such that communication and access to records was impaired, or that otherwise disrupted operations, it may be difficult for GI Dynamics to continue its business for a substantial period of time. In December 2019, a novel strain of coronavirus was reported to have surfaced in Wuhan, China. In January 2020, this coronavirus spread to other parts of the world, including the United States and Europe, and efforts to contain the spread of this coronavirus intensified. In March 2020, the World Health Organization declared the Coronavirus outbreak a “pandemic.” The extent to which the coronavirus impacts the Company’s results will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of the coronavirus and the actions to contain the coronavirus or treat its impact, among others.

Should the coronavirus continue to spread in the United States and Europe, GI Dynamics business operations could be delayed or interrupted. For instance, the Company’s clinical trials may be impacted by containment policies enacted by the clinical practice, the respective state or the Federal government. This could result in lower than anticipated patient registration or enrollment and GI Dynamics may be forced to temporarily delay or pause ongoing trials. Further, if the spread of the coronavirus continues and the Company’s operations are impacted, GI Dynamics risks a delay, default and/or nonperformance under existing agreements arising from force majeure. If any of the foregoing were to occur, it could materially adversely affect the Company’s financial condition.

The FDA has mandated certain stopping rules in the STEP-1 clinical trial. If the stopping rules are triggered or other unanticipated adverse issues occur during the STEP-1 clinical trial, the FDA may not permit the trial to continue. If that were to happen, the Company’s business, operating results and prospects would be materially and adversely affected.

Clinical trials involve the administration of the biological product candidate to patients under the supervision of qualified investigators, generally physicians not employed by or under the trial sponsor’s control. Clinical trials are conducted under protocols detailing, among other things, the objectives of the clinical trial, dosing procedures, subject selection and exclusion criteria, and the parameters to be used to monitor subject safety, including stopping rules that assure a clinical trial will be stopped if certain adverse events should occur. In the context of the GI Dynamics STEP-1 clinical trial, hepatic bleeding is an example of an adverse event that would be investigated and could trigger such stopping rules.

If, during the STEP-1 clinical trial, the stopping rules are triggered or other unanticipated adverse issues occur, the FDA may prevent the Company from enrolling additional patients in the clinical trial or may not permit the clinical trial to be completed. If that were to happen, the Company’s business, operating results and prospects would be materially and adversely affected.

In order to commercialize the Company’s product in the U.S. and certain other countries, GI Dynamics will need to obtain regulatory and other approvals. The Company’s inability to achieve, or a delay in achieving, such approvals could lead to the denial of marketing approval for EndoBarrier® or any of its other products.

At present, GI Dynamics has no regulatory approvals for the marketing and sale of EndoBarrier. In November 2017, the Company received notification from SGS, the Company’s now former notified body in Europe, that they were withdrawing the Certificate of Conformity for EndoBarrier. The Certificate of Conformity is required for the sale of any product under CE marking. As a result, GI Dynamics is not permitted to supply the EndoBarrier, EndoBarrier Delivery System and EndoBarrier Retrieval System in Europe.