Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - Manning & Napier, Inc. | exhibit311_q419form10-k.htm |

| EX-32.2 - EXHIBIT 32.2 - Manning & Napier, Inc. | exhibit322_q419form10-k.htm |

| EX-32.1 - EXHIBIT 32.1 - Manning & Napier, Inc. | exhibit321_q419form10-k.htm |

| EX-31.2 - EXHIBIT 31.2 - Manning & Napier, Inc. | exhibit312_q419form10-k.htm |

| EX-23.1 - EXHIBIT 23.1 - Manning & Napier, Inc. | exhibit231_q42019form10-k.htm |

| EX-21.1 - EXHIBIT 21.1 - Manning & Napier, Inc. | exhibit211_q42019form10-k.htm |

| EX-10.9 - EXHIBIT 10.9 - Manning & Napier, Inc. | exhibit109_q42019form10-k.htm |

| EX-4.2 - EXHIBIT 4.2 - Manning & Napier, Inc. | exhibit42_q419form10-k.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

___________________________________

FORM 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-35355

___________________________________

MANNING & NAPIER, INC.

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 45-2609100 (I.R.S. Employer Identification No.) | |

290 Woodcliff Drive Fairport, New York | 14450 | |

(Address of principal executive offices) | (Zip code) | |

(585) 325-6880

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange in which registered |

Class A common stock, $0.01 par value per share | MN | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

___________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or Section 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ¨ | |

Non-accelerated filer | x | Smaller reporting company | x | |

Emerging growth company | ¨ | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes ¨ No ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant's common equity held by non-affiliates of the registrant (assuming for purposes of this computation only that the directors and executive officers may be affiliates) at June 28, 2019, which was the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $25.9 million based on the closing price of $1.75 for one share of Class A common stock, as reported on the New York Stock Exchange on that date.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

Class | Outstanding at March 9, 2020 | |

Class A common stock, $0.01 par value per share | 16,269,857 | |

TABLE OF CONTENTS

Page | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

Item 16. | ||

In this Annual Report on Form 10-K for the fiscal year ended December 31, 2019 (the "Annual Report"), “we,” “our,” “us,” the “Company,” “Manning & Napier” and the “Registrant” refers to Manning & Napier, Inc. and, unless the context otherwise requires, its direct and indirect subsidiaries and predecessors on a consolidated basis.

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), which reflect the views of Manning & Napier, Inc. ("we," "our," or "us") with respect to, among other things, our future operations and financial performance. Words like "believes," "expects," "may," "estimates," "will," "should," "could," "intends," "likely," "plans," or "anticipates" or the negative thereof or other variations thereon or comparable terminology, are used to identify forward-looking statements, although not all forward-looking statements contain these words. Although we believe that we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know about our business and operations, there can be no assurance that our actual results will not differ materially from what we expect or believe. Some of the factors that could cause our actual results to differ materially from our expectations or beliefs are disclosed in the “Risk Factors” section, as well as other sections of this report which include, without limitation: changes in securities or financial markets or general economic conditions; a decline in the performance of our products; client sales and redemption activity; any loss of an executive officer or key personnel; changes in our business related to strategic acquisitions and other transactions; our ability to successfully deploy new technology platforms and upgrades; and changes of government policy or regulations. All forward-looking statements speak only as of the date on which they are made and we undertake no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

ii

PART I

Item 1. Business.

Overview

Manning & Napier, Inc. is an independent registered investment advisor that provides clients with a broad range of financial solutions and investment strategies, including wealth management services. Founded in 1970 and headquartered in Fairport, New York, we serve a diversified client base of high-net-worth individuals and institutions, including 401(k) plans, pension plans, Taft-Hartley plans, endowments and foundations.

Our objective is to create and develop financial solutions to help our clients meet their needs. We believe our differentiation is based on delivering comprehensive solutions, high-touch service, and attractive investment strategies in a custom-tailored, highly integrated manner.

We have built a diverse client base of high-net-worth individuals, small business owners, middle market institutions, larger institutions, defined contribution plans, and unions, as well as clients via investment consultants or other intermediaries. Although our client base is national, we are primarily focused in certain targeted geographic regions. Clients access our solutions and strategies via separately managed accounts, mutual funds, and collective investment trusts.

Our investment strategies are powered by multiple research engines, employing traditional and quantitative approaches, and are offered as both single- and multi-asset class portfolios. While the mechanics of these processes may differ depending on the strategy, all of our strategies work from the underlying belief that active management is the best investment approach for meeting long-term client objectives. All of our strategies fully incorporate active asset allocation processes, and most strategies deliver active security selection as well.

We believe personalized financial advice is necessary to retain existing relationships and attract new clients. Our service teams include internal subject matter experts specific to areas beyond investments, including financial planning, endowment and foundation consulting, qualified plan and pension plan services, and custody and trust advice and administration. We believe these consultative services, combined with competitive long-term investment performance, have allowed us to achieve a high average annual separate account retention rate.

Over the course of our 50-year history, we view our team-based, client-centric approach as imperative to success and distinct within the industry. As of December 31, 2019, we have 32 publicly-available mutual fund share classes rated with four or five stars by Morningstar, and a number of our investment strategies have built value-added track records over multiple decades.

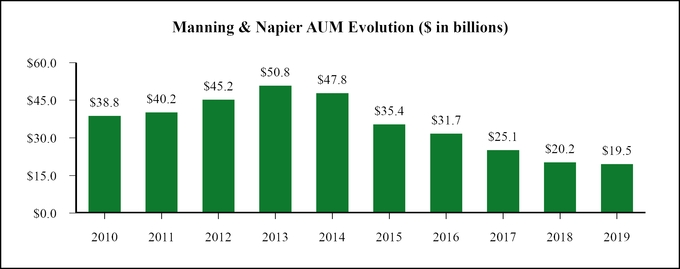

Performance challenges from 2014-2016, along with the trend toward passive investing, especially among institutional investors, have resulted in declines in assets under management ("AUM") in recent years. Our active approach can cause us to be out of favor relative to benchmarks and/or peers over shorter time periods, and these short-term deviations can lead to changes in AUM trends over time. The following chart reflects our AUM as of December 31 for each of the last 10 years:

1

As of December 31, 2019, our investment management offerings include 47 distinct separate account composites and 44 mutual funds and collective investment trusts. We believe we have cultivated a robust menu of actively managed strategies that allow us to address client needs.

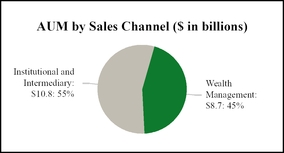

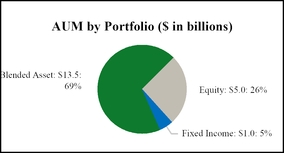

Our AUM as of December 31, 2019 by investment vehicle and portfolio were as follows:

2

The following table summarizes the annualized returns for several of our key investment strategies and relevant benchmarks. Since inception and over long-term periods, we believe our strategies have generated attractive returns on both an absolute and relative basis. We recognize, however, that some key strategies have mixed track records over the past decade. These key strategies are used across separate account, mutual fund and collective investment trust vehicles, and represent approximately 74% of our AUM as of December 31, 2019. This table is provided for illustrative purposes only. The performance reflected in the table below is not necessarily indicative of the future results of our investment strategies.

Key Strategies | AUM as of December 31, 2019 (in millions) | Inception Date | Annualized Returns as of December 31, 2019 (1) | |||||||||||

One Year | Three Year | Five Year | Ten Year | Inception | ||||||||||

Long-Term Growth (30%-80% Equity Exposure) | $ | 5,523.9 | 1/1/1973 | 18.6% | 9.7% | 5.8% | 7.5% | 9.5% | ||||||

Blended Index (3) | 19.5% | 9.3% | 6.9% | 8.0% | 8.8% | |||||||||

Core Non-U.S. Equity | $ | 680.7 | 10/1/1996 | 27.8% | 9.5% | 5.0% | 4.3% | 7.4% | ||||||

Benchmark: ACWIxUS Index | 21.5% | 9.9% | 5.5% | 5.0% | 5.3% | |||||||||

Growth with Reduced Volatility (20%-60% Equity Exposure) | $ | 2,482.0 | 1/1/1973 | 15.3% | 7.8% | 4.7% | 6.2% | 8.7% | ||||||

Blended Index (4) | 16.6% | 7.9% | 5.9% | 7.0% | 8.5% | |||||||||

Equity-Oriented (70%-100% Equity Exposure) | $ | 1,422.0 | 1/1/1993 | 26.6% | 14.2% | 8.1% | 9.3% | 10.0% | ||||||

Blended Benchmark: 65% Russell 3000® / 20% ACWIxUS / 15% Bloomberg Barclays U.S. Aggregate Bond | 25.7% | 12.1% | 9.0% | 10.4% | 8.7% | |||||||||

Equity-Focused Blend (50%-90% Equity Exposure) | $ | 1,009.7 | 4/1/2000 | 22.6% | 11.4% | 6.7% | 8.4% | 7.2% | ||||||

Blended Benchmark: 53% Russell 3000/ 17% ACWIxUS/ 30% Bloomberg Barclays U.S. Aggregate Bond | 22.6% | 10.7% | 8.0% | 9.2% | 5.8% | |||||||||

Core Equity-Unrestricted (90%-100% Equity Exposure) | $ | 559.8 | 1/1/1995 | 31.0% | 16.4% | 9.5% | 10.8% | 11.3% | ||||||

Blended Benchmark: 80% Russell 3000® / 20% ACWIxUS | 29.1% | 13.7% | 10.1% | 11.7% | 9.3% | |||||||||

Core U.S. Equity | $ | 174.3 | 7/1/2000 | 34.2% | 18.2% | 11.2% | 11.7% | 8.4% | ||||||

Benchmark: Russell 3000® Index | 31.0% | 14.6% | 11.2% | 13.4% | 6.5% | |||||||||

Conservative Growth (5%-35% Equity Exposure) | $ | 477.7 | 4/1/1992 | 10.4% | 5.2% | 3.3% | 4.4% | 5.9% | ||||||

Blended Benchmark:15% Russell 3000/ 5% ACWIxUS/ 80% Bloomberg Barclays U.S. Intermediate Aggregate Bond | 10.9% | 5.4% | 4.1% | 4.9% | 6.1% | |||||||||

Aggregate Fixed Income | $ | 167.3 | 1/1/1984 | 8.3% | 3.7% | 2.9% | 3.6% | 7.1% | ||||||

Benchmark: Bloomberg Barclays U.S. Aggregate Bond | 8.7% | 4.0% | 3.1% | 3.8% | 7.0% | |||||||||

Rainier International Small Cap | $ | 824.0 | 3/28/2012 | 24.7% | 0.9% | 9.3% | N/A (2) | 11.6% | ||||||

Benchmark: MSCI ACWIxUS Small Cap Index | 22.4% | 0.1% | 7.0% | N/A (2) | 6.9% | |||||||||

Disciplined Value US (5) | $ | 1,128.4 | 11/1/2003 | 24.3% | 13.6% | 10.9% | N/A (2) | 14.7% | ||||||

Benchmark: Russell 1000 Value | 26.5% | 9.7% | 8.3% | N/A (2) | 14.1% | |||||||||

__________________________

(1) | Key investment strategy returns are presented net of fees. Benchmark returns do not reflect any fees or expenses. |

(2) | Performance not available given the product's inception date. |

(3) | Benchmark shown uses the 55/45 Blended Index from 01/01/1973-12/31/1987 and the 40/15/45 Blended Index from 01/01/1988-12/31/2019. The 55/45 Blended Index is represented by 55% S&P 500 Total Return Index ("S&P 500") and 45% Bloomberg Barclays U.S. Government/Credit Bond Index ("BGCB"). The 40/15/45 Blended Index is 40% Russell 3000 Index ("Russel 3000"), 15% MSCI ACWI ex USA Index ("ACWxUS"), and 45% Bloomberg Barclays U.S. Aggregate Bond Index ("BAB"). |

(4) | Benchmark shown uses the 40/60 Blended Index from 01/01/1973-12/31/1987 and the 30/10/60 Blended Index from 01/01/1988-12/31/2019. The 40/60 Blended Index is represented by 40% S&P 500 and 60% BGCB. The 30/10/60 Blended Index is represented by 30% Russell 3000, 10% ACWxUS, and 60% BAB. |

(5) | Beginning with this Annual Report, we are presenting the performance of Disciplined Value US in place of Disciplined Value Unrestricted. The inception date for Disciplined Value US is January 1, 2013. |

3

Our Strategy

Our mission is to provide financial solutions that enable clients to achieve their long-term goals and objectives. Our success will be measured by the success of our clients. We must effectively execute in delivering investment results, financial advice, and a superior client experience in order to retain business and attract new business.

Our strategy is focused on continuous refinement and improvement in two key areas: investment excellence and a superior client experience. This includes the performance of our investment strategies, the comprehensiveness of our financial advice, and the quality of our client service. These key areas form the foundation of our business and require constant evolution.

In early 2019 upon the appointment of our new Chief Executive Officer, Marc Mayer, we commenced a comprehensive strategic review of our business, which focused on the evolution of our distribution strategy, our suite of investment offerings, and our technology initiatives. During the year we made important changes to our leadership team, implemented key governance and operating committees, revamped our distribution strategies, put in place definitive plans to overhaul and modernize our information technology systems and associated business processes, consolidated numerous offerings and solutions, eliminated sub-scale offerings, and reduced ongoing costs. Also see "Item 7. Management's Discussion and Analysis" in this Form 10-K for discussion on our strategic review.

Investments

We believe that active management, in all of its many forms, is the most appropriate and relevant investment approach to achieving client goals across changing market environments. Whether investing in a country, industry, or individual company, we hold a strong belief that price matters across all of our strategies. We are focused on helping our clients avoid permanent loss of capital over long time horizons, which is different than managing day-to-day volatility.

All of our research engines deploy investment processes that are team-based in nature. By focusing on research teams instead of individuals, we are better able to emphasize repeatable processes instead of star personalities, while helping protect clients from staff turnover. Additionally, our investment processes are designed to allow teams to collaborate and combine top-down, bottom-up, and quantitative research.

We believe our research department of over 50 primarily home-grown investment professionals enhance the consistency of our investment processes. As warranted, we may add to or supplement our research teams with additional investment professionals through corporate development activities. The most recent example of this is the Rainier International Small Cap Team that was added as part of our acquisition of Rainier Investment Management, LLC ("Rainier") in 2016.

Dynamic financial markets and an onerous regulatory environment results in a fast changing industry. We recognize the need for our investment strategies to continuously evolve. We regularly review seeded portfolios to ensure that we are supporting competitive strategies that resonate with clients, while simultaneously closing portfolios that are no longer viable. As of December 31, 2019, we have approximately $9.4 million invested in seed capital with our research teams in new strategy concepts and expect to continue to deploy capital to support innovation in the future.

Client Experience

Our business is based on confidence and trust. We believe we must deliver a client experience that communicates clearly, is collaborative, and is accountable to clients. We view our clients as our partners, and we recognize that successful client-partners lead to a natural expansion of our business.

As of December 31, 2019, we have over 30 client-facing professionals, who are responsible for maintaining existing relationships and cultivating new business. Referrals are also an important source of new business, further highlighting the importance of our comprehensive client service and solutions.

Our client-facing professionals have a deep multi-channel structure, enabling greater focus and expertise on certain types of client relationships. Our Wealth Management group specializes in individuals and middle market relationships using a team-approach organized by region. Our Intermediary and Institutional team covers wider territories and concentrates on distribution to larger institutions and Taft-Hartley relationships, as well as through third party intermediaries. Our Portfolio Strategies Group specializes in consultant relations, as well as providing support for all of our client-facing professionals.

Alongside these professionals, we incorporate consultative services from internal subject-matter experts designed to create holistic solutions specific to individual client needs. Our experts have capabilities ranging from estate, tax and trust review for families, asset/liability modeling for defined benefit pension plans, retirement and health plan design analysis for employers, and donor relations and planned giving services for endowments and foundations.

Our marketing strategy is focused on finding new ways to connect and engage with clients and prospects via targeted content on products, services, and topics that are most relevant to our various audiences. We have dedicated resources creating engaging and relevant content that positions Manning & Napier as a thought leader and a trusted resource. This content strategy focuses on educating investors, and it mirrors the consultative nature of our firm. We disseminate content in various ways, including through print publications, email, webinars, live events, our website, and social media.

4

In order for our investment teams and client-centric personnel to be most effective, we must also have excellence in middle- and back-office functions. These include our technology, operations, facilities, human resources, and compliance functions, each of which play a critical role in forming the foundation of business success.

In particular, our technological strategy is focused on using "software as a service" solutions while retaining in-house capabilities as needed. We believe that by leveraging the robust expertise of external providers, we can improve the nimbleness and efficiency of our organization. This approach provides the most update-to-date technology enabling a superior client experience, improving the employee experience, and streamlining operational processes.

Competition

Historically, we have competed to attract business on the basis of:

• | the breadth of financial solutions we offer clients in an integrated manner; |

• | the investment excellence and long-term track records of our strategies; |

• | the consultative advice we provide addressing clients’ unique challenges and needs; |

• | the quality of the client experience and the duration of our relationships with them; and |

• | the pricing of our solutions compared to competitors. |

Our ability to continue to compete effectively will depend upon our ability to retain our current investment and client-facing professionals and employees, as well as to attract highly qualified new professionals and employees. We compete in all aspects of our business with a large number of investment management firms, commercial banks, broker-dealers, insurance companies and other financial institutions.

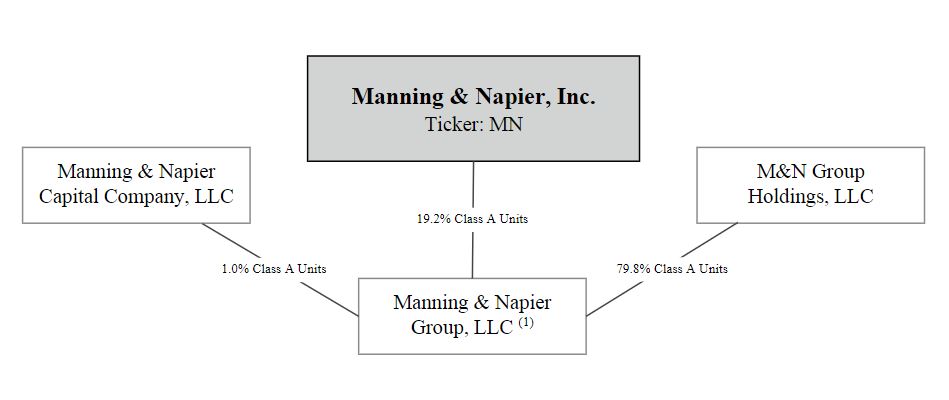

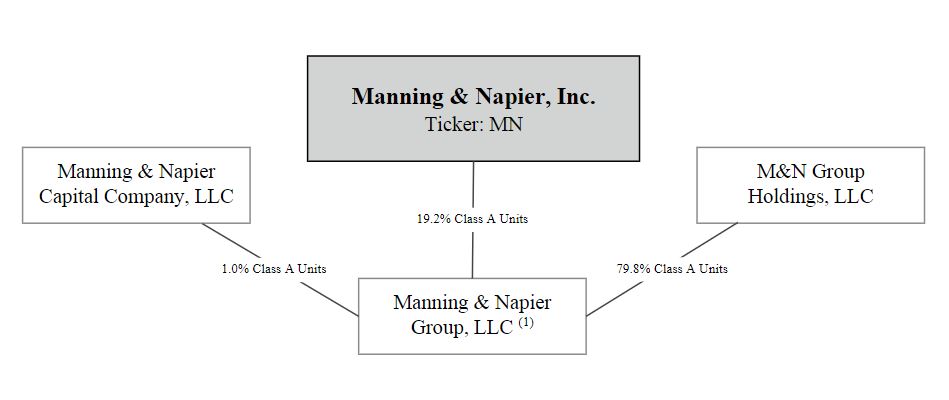

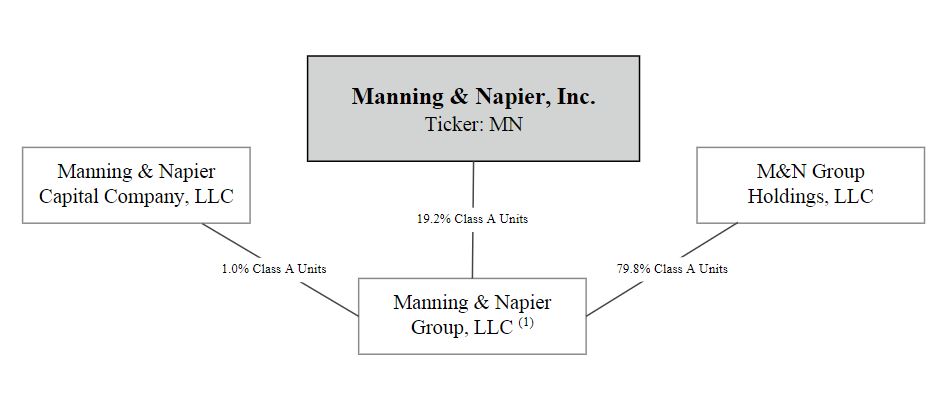

Structure

The Company was incorporated in 2011 as a Delaware corporation, and is the sole managing member of Manning & Napier Group, LLC and its subsidiaries (“Manning & Napier Group”), a holding company for the investment management businesses conducted by its operating subsidiaries. The diagram below depicts our organizational structure as of December 31, 2019.

______________________

(1) | The consolidated operating subsidiaries of Manning & Napier Group include Manning & Napier Advisors, LLC ("MNA"), Manning & Napier Investor Services, Inc., Exeter Trust Company and Rainier |

As of December 31, 2019, we had 307 employees, most of whom are based in Fairport, New York. Collectively, William Manning, our co-founder and Chairman of the Board, current employee-owners and former employee owners own approximately 80.8% of Manning & Napier Group and our operating subsidiaries. We believe that our culture of employee ownership aligns our interests with those of our clients and stockholders by delivering strong long-term investment performance and solutions.

5

Regulation

Our business is subject to extensive regulation in the United States at the federal level and, to a lesser extent, the state level and by self-regulatory organizations. We are also subject to regulations outside of the United States. Under certain of these laws and regulations, agencies that regulate investment advisers have broad administrative powers, including the power to limit, restrict or prohibit an investment adviser from carrying on its business in the event that it fails to comply with such laws and regulations. Possible sanctions that may be imposed include the suspension of individual employees, limitations on engaging in certain lines of business for specified periods of time, revocation of investment adviser and other registrations, censures and fines.

SEC Regulation

MNA and Rainier are registered with the U.S. Securities and Exchange Commission, (the "SEC"), as an investment adviser under the U.S. Investment Advisers Act of 1940, as amended, (the "Advisers Act"). Additionally, the Manning & Napier Fund, Inc., (the "Fund"), which is managed by MNA except for the Rainier International Discovery Series, for which Rainier serves as the sub-advisor, is registered under the U.S. Investment Company Act of 1940, (the "1940 Act"). The Advisers Act and the 1940 Act, together with the SEC’s regulations and interpretations thereunder, impose substantive and material restrictions and requirements on the operations of advisers and mutual funds. The SEC is authorized to institute proceedings and impose sanctions for violations of the Advisers Act and the 1940 Act, ranging from fines and censures to termination of an adviser’s registration.

As an investment adviser, we have fiduciary duties to our clients that are broad and apply to our entire relationship with our clients. These duties require us to serve the best interest of our clients and not subordinate the client's interest to our own. The SEC has interpreted these duties to impose standards, requirements and limitations on, among other things:

• | trading for proprietary, personal and client accounts; |

• | allocations of investment opportunities among clients; |

• | use of soft dollars; |

• | execution of transactions; and |

• | recommendations to clients. |

We manage accounts for a majority of our clients on a discretionary basis, which typically affords us the authority to buy and sell securities for each portfolio, select broker-dealers to execute trades and negotiate brokerage commission rates. In connection with designated trade executions, we receive soft dollar credits from broker-dealers, which effectively reduces certain of our expenses. We believe all of our soft dollar arrangements comply with the safe harbor provided by Section 28(e) of the U.S. Securities Exchange Act of 1934, as amended (the "Exchange Act"). Constraints on our ability to use soft dollars as a result of statutory amendments or new regulations would increase our operating expenses and potentially hamper our investment process by limiting or eliminating access to vital research.

As a registered adviser, we are subject to many additional requirements that cover, among other things:

• | disclosure of information about our business to clients; |

• | maintenance of formal policies and procedures; |

• | maintenance of extensive books and records; |

• | restrictions on the types of fees we may charge; |

• | custody of client assets; |

• | client privacy; |

• | advertising; and |

• | solicitation of clients. |

The SEC has authority to inspect any investment adviser and typically inspects a registered adviser periodically to determine whether the adviser is conducting its activities (i) in accordance with applicable laws, (ii) consistent with disclosures made to clients and (iii) with adequate policies, procedures and systems to ensure compliance.

For the year ended December 31, 2019, 20% of our revenues were derived from our advisory services to investment companies registered under the 1940 Act, including 18% derived from our advisory services to the Fund. The 1940 Act imposes significant requirements and limitations on a registered fund, including with respect to its capital structure, investments and transactions. While we exercise broad discretion over the day-to-day management of the business and affairs and investment

6

portfolios of the Fund and the investment portfolios of the funds we sub-advise, our own operations are subject to oversight and management by each fund’s board of directors. Under the 1940 Act, a majority of the directors must not be “interested persons” with respect to us (sometimes referred to as the “independent director” requirement). The responsibilities of the board include, among other things, approving our investment management agreement with the Fund; approving other service providers; determining the method of valuing assets; and monitoring transactions involving affiliates. Our investment management agreements with the Fund may be terminated by the funds on not more than 60 days’ notice, and are subject to annual renewal by the Fund board after their initial term.

The 1940 Act also imposes on the investment adviser to a mutual fund a fiduciary duty with respect to the receipt of the adviser’s investment management fees. That fiduciary duty may be enforced by the SEC through administrative action or litigation by investors in the fund pursuant to a private right of action.

Under the Advisers Act, our investment management agreements may not be assigned without the client’s consent. Under the 1940 Act, investment management agreements with registered funds (such as the mutual funds we manage) terminate automatically upon assignment. The term “assignment” is broadly defined and includes direct assignments as well as assignments that may be deemed to occur upon the transfer, directly or indirectly, of a controlling interest in us.

Manning & Napier Investor Services, Inc. ("MNBD"), our SEC-registered broker-dealer subsidiary is the distributor for the Fund and is subject to SEC rules and regulations, including the Uniform Net Capital Rule, which requires MNBD to maintain a certain level of liquid assets. MNBD complied with its net capital requirements during the year ended December 31, 2019. MNBD will be subject to the full scope of Regulation Best Interest, which will require its associated persons to adhere to a higher standard of care and ensure that security, strategy or account type recommendations are in the customer's best interest at the time of the recommendation.

FINRA Regulation

MNBD is a member of the Financial Industry Regulatory Authority ("FINRA") and as such is subject to the various industry and professional regulations, standards, and reporting requirements established by FINRA.

ERISA-Related Regulation

We are a fiduciary under the Employee Retirement Income Security Act of 1974, as amended ("ERISA"), with respect to assets that we manage for benefit plan clients subject to ERISA. ERISA, regulations promulgated thereunder and applicable provisions of the Internal Revenue Code of 1986, as amended (the "IRC"), impose certain duties on persons who are fiduciaries under ERISA, prohibit certain transactions involving ERISA plan clients and provide monetary penalties for violations of these prohibitions.

The fiduciary duties under ERISA may be enforced by the U.S. Department of Labor by administrative action or litigation and by our benefit plan clients pursuant to a private right of action. The IRS may also assess excise taxes against us if we engage in prohibited transactions on behalf of or with our benefit plan clients.

New Hampshire Banking Regulation

Exeter Trust Company is a state-chartered non-depository trust company subject to the laws of the State of New Hampshire and the regulations promulgated thereunder by the New Hampshire Bank Commissioner.

Non-U.S. Regulation

Our sales and trading practices also subject us to certain foreign regulations. We have claimed an exemption from registration in Canada but are subject to those provincial regulations that apply to our limited operations in select Canadian provinces. Additionally, we invest globally and must adhere to country specific equity ownership reporting requirements in those foreign jurisdictions in which we invest. Our relationship with foreign domiciled clients or our sales and marketing efforts also could subject us to certain foreign regulations. We expect this trend to persist as such regulations increasingly have transnational application.

Employees

As of December 31, 2019, we had 307 employees, 297 of which are full-time, and most of whom are based in Fairport, New York.

Available Information

All annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and amendments to those reports, we file or furnish with the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act are available free of charge from the SEC’s website at http://www.sec.gov/.

7

We also make the documents listed above available without charge through the Investor Relations section of our website at http://ir.manning-napier.com/. Such documents are available as soon as reasonably practicable after the electronic filing of the material with the SEC. The contents of our website are not incorporated by reference into this Annual Report.

Item 1A. Risk Factors.

Risks Related to our Business

Our revenues are dependent on the market value and composition of our AUM, which are subject to significant fluctuations.

We derive the majority of our revenue from investment management fees, typically calculated as a percentage of the market value of our AUM. As a result, our revenues are dependent on the value and composition of our AUM, all of which are subject to fluctuation due to many factors, including:

• | Declines in prices of securities in our portfolios. The prices of the securities held in the portfolios we manage may decline due to any number of factors beyond our control, including, among others, declining stock or commodities markets, changes in interest rates, a general economic downturn, political uncertainty, pandemics or other health crises such as the recent outbreak of novel coronavirus (COVID-19), or acts of terrorism. The U.S. and global financial markets continue to be subject to uncertainty and instability. Such factors could cause an unusual degree of volatility and price declines for securities in the portfolios we manage; |

• | Redemptions and other withdrawals. Our clients generally may withdraw their funds at any time, on very short notice and without any significant penalty. A substantial portion of our revenue is derived from investment advisory agreements that are terminable by clients upon short notice or no notice and investors in the mutual funds we advise can redeem their investments in those funds at any time without prior notice. Also, new clients and portfolios may not have the same client retention characteristics as we have experienced in the past. In a declining stock market, the pace of redemptions could accelerate; |

• | Investment performance. Our ability to deliver strong investment performance depends in large part on our ability to identify appropriate investment opportunities in which to invest client assets. If we are unable to identify sufficient appropriate investment opportunities for existing and new client assets on a timely basis, our investment performance could be adversely affected. The risk that sufficient appropriate investment opportunities may be unavailable is influenced by a number of factors including general market conditions. If our portfolios perform poorly, even over the short-term, as compared with our competitors or applicable third-party benchmarks, or the rankings of mutual funds we manage decline, we may lose existing AUM and have difficulty attracting new assets; and |

• | Competition from passive strategies. There has been an increasing preference for passive investment products, such as index and exchange-traded funds ("ETFs") over active strategies managed by asset managers. If this market preference continues, existing and prospective clients may choose to invest in passive investment products, our growth strategy may be impaired and our AUM may be negatively impacted. |

If any of these factors cause a decline in our AUM, it would result in lower investment management revenues. If our revenues decline without a commensurate reduction in our expenses, our net income will be reduced and our business will be adversely affected.

We derive substantially all of our revenues from contracts and relationships that may be terminated upon short or no notice.

We derive substantially all of our revenues from investment advisory and sub-advisor agreements, all of which are terminable by clients upon short notice or no notice and without any significant penalty.

Our mutual fund and collective investment trust relationships may be terminated or not renewed for any number of reasons. Our investment management agreements with mutual funds, as required by law, are generally terminable by the funds’ board of directors or a vote of the majority of the funds’ outstanding voting securities on not more than 60 days’ written notice. After an initial term, each fund’s investment management agreement must be approved and renewed annually by such fund’s board, including by its independent members. Similarly, our investment management agreements with the collective investment trusts may be terminated at any time by Exeter Trust Company's board of directors, which includes independent members. As of December 31, 2019, mutual fund and collective investment trust relationships represent 30% of our AUM and 31% of our revenue for the year ended December 31, 2019.

The decrease in revenues that could result from the termination of a material client relationship or group of client relationships could have an adverse effect on our business. During the fiscal year ended December 31, 2019, other than our relationship with the Fund, there were no customers that provided over 10 percent of our total revenue.

8

We may not realize the expected benefits from our restructuring plan and other operational improvement initiatives relating

to our strategic review of our business.

We commenced a strategic review of our business upon the appointment of our new Chief Executive, Marc Mayer, in early 2019. Our comprehensive review resulted in changes to our overall distribution strategy, our suite of investment offerings, and our operational platform. The objective of this review was to improve financial results for stockholders and investment results for clients by more clearly prioritizing our strengths, eliminating distractions and sub-scale offerings, and increasing productivity across the firm through improved technology. As a result of this strategic review, we incurred approximately

$11.1 million of strategic restructuring and transaction costs (excluding a $2.9 million gain on the sale of PPI). These charges

consisted of $3.4 million of employee severance costs and $7.7 million of other operating costs, which included approximately $6.3 million of impairment charges stemming from the write-off of existing contracts that we will not be utilizing as we move forward with a new third-party service provider to leverage its platform in an effort to expand our digital capabilities. We will likely incur additional costs in the future as a result of this strategic review. There can be no assurance that the costs of undertaking our operational improvement initiatives will be offset by future earnings that may result from the improvements, and it is possible that we will not realize the expected benefits from our operational improvement initiatives to the extent we anticipate or at all.

Our portfolios may not obtain attractive returns under certain market conditions or at all.

The goal of our investment process is to provide competitive absolute returns over full market cycles. Accordingly, our portfolios may not perform well compared to benchmarks or other investment managers’ strategies during certain periods of time, under certain market conditions, or after specific market shocks. Underperformance may negatively affect our ability to retain clients and attract new clients. We are likely to be most out of favor when the markets are running on positive or negative price momentum and market prices become disconnected from underlying investment fundamentals. During and shortly following such periods of relative under performance, we are likely to see our highest levels of client turnover, even if our absolute returns are positive. Loss of client assets and the failure to attract new clients could adversely affect our revenues and growth.

Difficult market conditions can adversely affect our strategies in many ways, including by negatively impacting their performance and reducing their ability to raise or deploy capital, which could materially reduce our revenues and adversely affect our business, financial condition or results of operations.

Significant disruptions and volatility in the global financial markets and economies could impair the investment performance of our strategies. Although we seek to generate consistent, positive, absolute returns across all market cycles, our strategies have been and may be materially affected by conditions in the global financial markets and economic conditions. The global market and economic climate may become increasingly uncertain due to numerous factors beyond our control, including but not limited to, concerns related to unpredictable global market and economic factors, uncertainty in U.S. federal fiscal, tax, trade or regulatory policy and the fiscal, tax, trade or regulatory policy of foreign governments, rising interest rates, inflation or deflation, the availability of credit, performance of financial markets, terrorism, natural or biological catastrophes, public health emergencies including the current coronavirus outbreak, or political uncertainty.

A general market downturn, a specific market dislocation or deteriorating economic conditions may cause a material reduction in our revenues and adversely affect our business, financial condition or results of operations by causing:

• | A decline in AUM, resulting in lower management fees and incentive income. |

• | An increase in the cost of financial instruments, executing transactions or otherwise doing business. |

• | Lower or negative investment returns, which may reduce AUM and potential incentive income. |

• | Reduced demand for assets held by our funds, which would negatively affect our funds’ ability to realize value from such assets. |

• | Increased investor redemptions or greater demands for enhanced liquidity or other terms, resulting in a reduction in AUM, lower revenues and potential increased difficulty in raising new capital. |

Furthermore, while difficult market and economic conditions and other factors can potentially increase investment opportunities over the long term, such conditions and factors also increase the risk of increased investment losses and additional regulation, which may impair our business model and operations. Our strategies may also be adversely affected by difficult market conditions if we fail to assess the adverse effect of such conditions, which would likely result in significant reductions in the returns of those strategies. Moreover, challenging market conditions may prompt industry-wide reductions in fees. In response to competitive pressures or for any other reason, we may reduce or change our fee structures, which could reduce the amount of fees and income that we may earn relative to AUM.

An investment in our Class A common stock is not an alternative to investing in our strategies, and the returns of our strategies should not be considered as indicative of any returns expected on our Class A common stock, although if our

9

strategies perform poorly, our revenue could be materially adversely impacted, which may in turn impact the returns on our Class A common stock.

The returns on our Class A common stock are not directly linked to the historical or future performance of our investment strategies. Even if our strategies experience positive performance and our AUM increases, holders of our Class A common stock may not experience a corresponding positive return on their Class A common stock.

However, poor performance of our strategies could cause a decline in our revenues, and may therefore have a negative effect on our performance and the returns on our Class A common stock. If we fail to meet the expectations of our clients or otherwise experience poor performance, whether due to difficult economic and financial conditions or otherwise, our ability to retain existing AUM and attract new clients could be materially adversely affected. In turn, the fees that we would earn would be reduced and our business, financial condition or results of operations would suffer, thus negatively impacting the price of our Class A common stock. Furthermore, even if the investment performance of our strategies is positive, our business, financial condition or results of operations and the price of our Class A common stock could be materially adversely affected if we are unable to attract and retain additional AUM consistent with our past experience, industry trends or investor and market expectations.

The loss of key investment and sales professionals, members of our senior management team, or difficulty integrating new executives, could have an adverse effect on our business.

We depend on the skills, expertise and institutional knowledge of our key employees, including qualified investment and sales professionals and members of our senior management team, and our success depends on our ability to retain such key employees. Our investment professionals possess substantial experience in investing and have been primarily responsible for the historically attractive investment performance we have achieved. We particularly depend on our executive officers as well as senior members of our research department. In 2019, we experienced a headcount reduction from 366 to 307 employees as part of our restructuring plan relating to our strategic review of our business. This and any future reductions to headcount may result in the loss of expertise and institutional knowledge and could adversely affect our business.

We have had significant changes in executive leadership and more could occur. Changes to strategic or operating goals, which can occur with the appointment of new executives, can create uncertainty, and may ultimately be unsuccessful. In addition, executive leadership transition periods, including adding new personnel, could be difficult as new executives gain an understanding of our business and strategy. Difficulty integrating new executives, or the loss of key individuals could limit our ability to successfully execute our business strategy and could have an adverse effect on our overall financial condition.

Competition for qualified investment, sales and top level management professionals is intense. Attracting qualified personnel, including top level management, may take time and we may fail to attract and retain qualified personnel including top level management in the future. Our ability to attract and retain our executive officers and other key employees will depend heavily on our business strategy, corporate culture and the amount and structure of compensation. We have historically utilized a compensation structure that uses a combination of cash and equity-based incentives as appropriate. However, our compensation may not be effective to recruit and retain the personnel we need if our overall compensation packages are not competitive in the marketplace. Any cost-reduction initiative or adjustments or reductions to compensation could negatively impact our ability to retain key personnel, as could changes to our management structure, corporate culture and corporate governance arrangements.

We may be required to reduce the fees we charge, or our fees may decline due to changes in our AUM composition, which could have an adverse effect on our profit margins and results of operations.

Our current fee structure may be subject to downward pressure due to a variety of factors, including a trend in recent years toward lower fees in the investment management industry. We may be required to reduce fees with respect to both the separate accounts we manage and the mutual funds and collective trust funds we advise. We may charge lower fees in order to attract future new business, which may result in us having to also reduce our fees with respect to our existing business. During the first quarter of 2019, we completed the effort of restructuring fees for many of our mutual funds and collective trust vehicles. Given the overall pressure on fees that all active managers are facing, we believe that bringing our fund fees to a more competitive level will enhance our ability to attract additional business in the future. The fee restructuring reduced the management fees on our existing business, and may fail to attract additional business sufficient to offset any reduction in related operating expenses. Any further fee reductions on existing or future new business could have an adverse effect on our profit margins and results of operations.

10

Our AUM may be concentrated in certain strategies.

Client purchase and redemption activity may result in AUM concentrations with certain of our investment strategies. As a result, a substantial portion of our operating results may depend upon the performance of these strategies. If we sustain poor investment performance or adverse market conditions, clients may withdraw their investments or terminate their investment management agreements. These conditions would result in a reduction in our revenues from these strategies, which could have an adverse effect on our earnings and financial condition.

Our business is primarily focused in certain targeted geographic regions making us vulnerable to risks associated with having geographically concentrated operations.

Although our client base is national, we are primarily focused in certain targeted geographic regions, including the northeastern and southeastern regions of the United States. Furthermore, our review of our intermediary and institutional distribution strategy resulted in changes to our territory coverage and servicing efforts in order to more effectively service our existing clients with our team, while concentrating on geographies with the greatest chances for growth. This could have the effect of increasing the risks associated with having geographically concentrated operations. Our business, financial condition and results of operations may be susceptible to regional economic downturns and other regional factors.

Several of our portfolios involve investing principally in the securities of non-U.S. companies, which involve foreign currency exchange risk, and tax, political, social and economic uncertainties and risks.

As of December 31, 2019, approximately 23% of our AUM across all of our portfolios was invested in securities of non-U.S. companies. Fluctuations in foreign currency exchange rates could negatively affect the returns of our clients who are invested in these strategies. An increase in the value of the U.S. dollar relative to non-U.S. currencies is likely to result in a decrease in the U.S. dollar value of our AUM, which, in turn, could result in lower revenue since we report our financial results in U.S. dollars.

Investments in non-U.S. issuers may also be affected by tax positions taken in countries or regions in which we are invested as well as political, social and economic uncertainty. Declining tax revenues may cause governments to assert their ability to tax the local gains and/or income of foreign investors (including our clients), which could adversely affect clients’ interests in investing outside their home markets. Many financial markets are not as developed, or as efficient, as the U.S. financial markets, and as a result, those markets may have limited liquidity and higher price volatility and may lack established regulations. Liquidity may also be adversely affected by political or economic events, government policies, social or civil unrest within a particular country, and our ability to dispose of an investment may also be adversely affected if we increase the size of our investments in smaller non-U.S. issuers. Non-U.S. legal and regulatory environments, including financial accounting standards and practices, may also be different, and there may be less publicly available information about such companies. These risks could adversely affect the performance of our strategies that are invested in securities of non-U.S. issuers and may be particularly acute in the emerging or less developed markets in which we invest.

The historical returns of our existing portfolios may not be indicative of their future results or of the portfolios we may develop in the future.

The historical returns of our portfolios and the ratings and rankings we or the mutual funds that we advise have earned in the past should not be considered indicative of the future results of these portfolios or of any other portfolios that we may develop in the future. The investment performance we achieve for our clients varies over time and the variance can be wide. The ratings and rankings we or the mutual funds we advise have earned are typically revised monthly. The historical performance and ratings and rankings included in this report are as of December 31, 2019 and for periods then ended except where otherwise stated. The performance we have achieved and the ratings and rankings earned at subsequent dates and for subsequent periods may be higher or lower and the difference could be material. Our portfolios’ returns have benefited during some periods from investment opportunities and positive economic and market conditions. In other periods, general economic and market conditions have negatively affected our portfolios’ returns. These negative conditions may occur again, and in the future we may not be able to identify and invest in profitable investment opportunities within our current or future portfolios.

Support provided to new products may reduce fee income, increase expenses and expose us to potential loss on invested capital.

We may support the development of new investment products by waiving all or a portion of the fees we receive for managing such products, by subsidizing expenses or by making seed capital investments. Seed investments in new products utilize Company capital that would otherwise be available for general corporate purposes and expose us to capital losses to the extent that realized investment losses are not offset by hedging gains. The risk of loss may be greater for seed capital investments that are not hedged, or if an intended hedge does not perform as expected. Failure to have or devote sufficient capital to support new products could have on adverse impact on our future growth.

11

Assets influenced by third-party intermediaries have a higher risk of redemption and are subject to changes in fee structures, which could reduce our revenues.

Investments in our mutual funds made through third-party intermediaries, as opposed to mutual fund investments resulting from sales by our own representatives can be more easily moved to investments in funds other than ours. Third-party intermediaries are attractive to investors because of the ease of accessibility to a variety of funds, but this causes the investments to be more sensitive to fluctuations in performance, especially in the short-term. If we were unable to retain the assets of our mutual funds held through third-party intermediaries, our AUM would be reduced. As a result, our revenues could decline and our business, results of operations and financial condition could be materially adversely affected.

We may elect to pursue growth in the United States and abroad through acquisitions or joint ventures, which would expose us to risks inherent in assimilating new operations, expanding into new jurisdictions, and making non-controlling minority investments in other entities.

In order to maintain and enhance our competitive position, we may review and pursue acquisition and joint venture opportunities. We cannot assure we will identify and consummate any such transactions on acceptable terms or have sufficient resources to accomplish such a strategy. Any strategic transaction can involve a number of risks, including:

• | additional demands on our staff; |

• | unanticipated problems regarding integration of investor account and investment security recordkeeping, operating facilities and technologies, and new employees; |

• | adverse effects in the event acquired intangible assets or goodwill become impaired; |

• | the existence of liabilities or contingencies not disclosed to or otherwise known by us prior to closing such a transaction; and |

• | dilution to our public stockholders if we issue shares of our Class A common stock, or units of Manning & Napier Group with exchange rights, in connection with future acquisitions. |

A portion of our separate account business, mutual funds, and collective investment trusts are distributed through intermediaries, platforms, and consultants. Changes in key distribution relationships could reduce our revenues and adversely affect our profitability.

Given that a portion of our product offerings are distributed through intermediaries, platforms, and investment consultants, a share of our success is dependent on access to these various distribution systems. These distributors are not contractually required to distribute or consider our products for placement within advisory programs, on platforms’ approved lists, or in active searches conducted by investment consultants. Additionally, these intermediaries typically offer their clients various investment products and services, in addition to and in competition with our products and services. If we are unable to cultivate and build strong relationships within these distribution channels, the sales of our products could lead to a decline in revenues and profitability. Additionally, increasing competition for these distribution channels could cause our distribution costs to rise, which could have an adverse effect on our profitability.

Our efforts to establish new portfolios or new products or services may be unsuccessful and could negatively impact our results of operations and our reputation.

As part of our growth strategy, we may seek to take advantage of opportunities to develop new portfolios consistent with our philosophy of managing portfolios to meet our clients’ objectives and using a team-based investment approach. The initial costs associated with establishing a new portfolio likely will exceed the revenues that the portfolio generates. If any such new portfolio performs poorly or fails to attract sufficient assets to manage, our results of operations could be negatively impacted. Further, a new portfolio’s poor performance may negatively impact our reputation and the reputation of our other portfolios within the investment community. We have developed and may seek from time to time to develop new products and services to take advantage of opportunities involving technology, insurance, participant and plan sponsor education and other products beyond investment management. The development of these products and services could involve investment of financial and management resources and may not be successful in developing client relationships, which could have an adverse effect on our business. The cost to develop these products initially will likely exceed the revenue they generate and additional investment in these products could negatively impact short term financial results. If establishing new portfolios or offering new products or services requires hiring new personnel, to the extent we are unable to recruit and retain sufficient personnel, we may not be successful in further diversifying our portfolios, client assets and business, which could have an adverse effect on our business and future prospects.

Our failure to comply with investment guidelines set by our clients and limitations imposed by applicable law, could result in damage awards against us and a loss of our AUM, either of which could adversely affect our reputation, results of operations or financial condition.

12

When clients retain us to manage assets on their behalf, they generally specify certain guidelines regarding investment allocation that we are required to follow in managing their portfolios. We are also required to invest the mutual funds’ assets in accordance with limitations under the 1940 Act, and applicable provisions of the IRC. Other clients, such as plans subject to ERISA, or non-U.S. funds, require us to invest their assets in accordance with applicable law. Our failure to comply with any of these guidelines and other limitations could result in losses to clients or investors in our products which, depending on the circumstances, could result in our obligation to make clients whole for such losses. If we believed that the circumstances did not justify a reimbursement, or clients believed the reimbursement we offered was insufficient, clients could seek to recover damages from us, withdraw assets from our products or terminate their investment management agreement with us. Any of these events could harm our reputation and adversely affect our business.

A change of control of our company could result in termination of our investment advisory agreements.

Under the 1940 Act, each of the investment advisory agreements for SEC registered mutual funds that our affiliate, MNA, advises automatically terminates in the event of its assignment, as defined under the 1940 Act. If such an assignment were to occur, MNA could continue to act as adviser to any such fund only if that fund’s board of directors and stockholders approved a new investment advisory agreement, except in the case of certain of the funds that we sub-advise for which only board approval would be necessary. Under the Advisers Act each of the investment advisory agreements for the separate accounts we manage may not be assigned without the consent of the client. An assignment may occur under the 1940 Act and the Advisers Act if, among other things, MNA undergoes a change of control. In certain other cases, the investment advisory agreements for the separate accounts we manage require the consent of the client for any assignment. If such an assignment occurs, we cannot be certain that MNA will be able to obtain the necessary approvals from the boards and stockholders of the mutual funds that it advises or the necessary consents from separate account clients.

Operational risks may disrupt our business, result in losses or limit our growth.

We are heavily dependent on the capacity and reliability of the communications, information and technology systems supporting our operations, whether developed, owned and operated by us or by third parties. Operational risks such as trading or operational errors or interruption of our financial, accounting, trading, compliance and other data processing systems, whether caused by fire, natural disaster or pandemic, power or telecommunications failure, act of terrorism or war or otherwise, could result in a disruption of our business, liability to clients, regulatory intervention or reputational damage, and thus adversely affect our business. Some types of operational risks, including, for example, trading errors, may be increased in periods of increased volatility, which can magnify the cost of an error. Although we have back-up systems in place, our back-up procedures and capabilities in the event of a failure or interruption may not be adequate, and the fact that we operate our business out of multiple physical locations may make such failures and interruptions difficult to address on a timely and adequate basis.

We depend on our headquarters in Fairport, New York, where a majority of our employees, administration and technology resources are located, for the continued operation of our business. Any significant disruption to our headquarters could have an adverse effect on our business.

A failure to effectively maintain, enhance and modernize our information technology systems, and effectively develop and deploy new technologies, could adversely affect our business.

Our success depends on our ability to maintain effective information technology systems, to enhance those systems to better support our business in an efficient and cost-effective manner and to develop new technologies and capabilities in pursuit of our long-term strategy. We recently selected InvestCloud to lead our digital transformation, and will utilize InvestCloud's full suite of applications in order to deliver what we believe will be the best possible experience for our clients and partners. The multi-phased conversion will focus on enhancing the digital client experience, streamlining back-office processes, and centralizing performance data and reporting. Additionally, as part of the InvestCloud implementation, we will substantially re-engineer many of our business processes.

Some technology development initiatives are long-term in nature, may negatively impact our financial results as we invest in the initiatives, may cost more than anticipated to complete, or may not be completed. Additionally, our technology initiatives may be more costly or time-consuming than anticipated, may not deliver the expected benefits upon completion, and may need to be replaced or become obsolete more quickly than expected, which could result in accelerated recognition of expenses. If we fail to maintain or enhance our existing information technology systems or if we were to experience failure in developing and implementing new technologies, our relationships, reputation, ability to do business with our clients and our competitive position may be adversely affected. We could also experience other adverse consequences, including additional costs or write-offs of capitalized costs, unfavorable underwriting and reserving decisions, internal control deficiencies, and information security breaches resulting in loss or inappropriate disclosure of data. We have been required to make significant capital expenditures to update our technology infrastructure, and we may incur the costs described above as we deploy this new technology.

13

Failure to implement effective information and cyber security policies, procedures and capabilities, or cybersecurity breaches of software applications and other technologies on which we rely, could disrupt operations and cause financial losses that could result in a decrease in earnings and reputational harm.

We are dependent on the effectiveness of our, and third party software vendors', information and cybersecurity policies, procedures and capabilities to protect our computer and telecommunications systems and the data that reside on or are transmitted through them. As part of our normal operations, we maintain and transmit confidential information about our clients and employees as well as proprietary information relating to our business operations. We maintain a system of internal controls designed to provide reasonable assurance that fraudulent activity, including misappropriation of assets, fraudulent financial reporting and unauthorized access to sensitive or confidential data is either prevented or detected on a timely basis. Nevertheless, all technology systems remain vulnerable to unauthorized access and may be corrupted by cyberattacks, computer viruses or other malicious software code, the nature of which threats are constantly evolving and becoming increasingly sophisticated. Breach or other failure of our technology systems, including those of third parties with which we do business, or failure to timely and effectively identify and respond to any such breach or failure, could result in the loss of valuable information, liability for stolen assets or information, remediation costs to repair damage caused by the incident, additional security costs to mitigate against future incidents, increased insurance premiums, and litigation costs resulting from the incident. Moreover, loss of confidential customer information could harm our reputation, result in the termination of contracts by our existing customers and subject us to liability under laws that protect confidential personal data, resulting in increased costs or loss of revenues. Ultimately, a cyberattack can damage our competitiveness, stock price and long-term stockholder value. Recent well-publicized security breaches at other companies have led to enhanced government and regulatory scrutiny of the measures taken by companies to protect against cyberattacks, and may in the future result in heightened cybersecurity requirements, including additional regulatory expectations for oversight of vendors and service providers.

We depend on third-party service providers for services that are important to our business, and an interruption or cessation of such services by any such service providers could have an adverse effect on our business.

We depend on a number of service providers, including custodial and clearing firms, and vendors of communications and networking products and services. We cannot assure that these providers will be able to continue to provide these services in an efficient manner or that they will be able to adequately expand their services to meet our needs. An interruption or malfunction in or the cessation of an important service by any third-party and our inability to make alternative arrangements in a timely manner, or at all, could have an adverse impact on our business, financial condition and operating results.

Employee misconduct could expose us to significant legal liability and reputational harm.

We operate in an industry in which integrity and the confidence of our clients are of critical importance. Accordingly, if any of our employees engage in illegal or suspicious activities or other misconduct, we could be subject to regulatory sanctions and suffer serious harm to our reputation, financial condition, client relationships and ability to attract new clients. For example, our business often requires that we deal with confidential information. If our employees were to improperly use or disclose this information, even if inadvertently, we could suffer serious harm to our reputation, financial condition and current and future business relationships. It is not always possible to deter employee misconduct, and the precautions we take to detect and prevent this activity may not always be effective. Misconduct by our employees, or even unsubstantiated allegations of misconduct, could result in an adverse effect on our reputation and our business.

Failure to properly address conflicts of interest could harm our reputation, business and results of operations.

We must monitor and address any conflicts between our interests and those of our clients. The SEC and other regulators scrutinize potential conflicts of interest, and we have implemented procedures and controls that we believe are reasonably designed to address these issues. However, appropriately dealing with conflicts of interest is complex, and if we fail, or appear to fail, to deal appropriately with conflicts of interest, we could face reputational damage, litigation or regulatory proceedings or penalties, any of which could adversely affect our reputation, business and results of operations.

If our techniques for managing risk are ineffective, we may be exposed to material unanticipated losses.

In order to manage the significant risks inherent in our business, we must maintain effective policies, procedures and systems that enable us to identify, monitor and control our exposure to operational, legal and reputational risks. Our risk management methods may prove to be ineffective due to their design or implementation, or as a result of the lack of adequate, accurate or timely information or otherwise. If our risk management efforts are ineffective, we could suffer losses that could have an adverse effect on our financial condition or operating results. Additionally, we could be subject to litigation, particularly from our clients, and sanctions or fines from regulators. Our techniques for managing risks in client portfolios may not fully mitigate the risk exposure in all economic or market environments, or against all types of risk, including risks that we might fail to identify or anticipate.

The cost of insuring our business is substantial and may increase.

14

While we carry insurance in amounts and under terms that we believe are appropriate, we cannot guarantee that our insurance will cover all liabilities and losses to which we may be exposed or, if covered, that such liabilities and losses will not exceed the limits of available insurance coverage, or that our insurers will remain solvent and meet their obligations. We cannot guarantee that our insurance policies will continue to be available at current terms and fees.

We believe our insurance costs are reasonable but they could fluctuate significantly from year to year. Certain insurance coverage may not be available or may only be available at prohibitive costs. As we renew our insurance policies, we may be subject to additional costs resulting from rising premiums, the assumption of higher deductibles or co-insurance liability and, to the extent certain of our mutual funds purchase separate director and officer or errors and omissions liability coverage, an increased risk of insurance companies disputing responsibility for joint claims. Higher insurance costs and incurred deductibles, as with any expense, would reduce our net income.

Risks Related to our Industry

We are subject to extensive regulation.

We are subject to extensive regulation for our investment management business and operations, including regulation by the SEC under the 1940 Act and the Advisers Act, by the U.S. Department of Labor under ERISA, and by FINRA. The U.S. mutual funds we advise are registered with and regulated by the SEC as investment companies under the 1940 Act. The Advisers Act imposes numerous obligations on investment advisers including record keeping, advertising and operating requirements, disclosure obligations and prohibitions on fraudulent activities. The 1940 Act imposes similar obligations, as well as additional detailed operational requirements, on registered investment companies, which must be adhered to by their investment advisers. The U.S. mutual funds that we advise and our broker-dealer subsidiary are each subject to the USA PATRIOT Act of 2001, which requires them to know certain information about their clients and to monitor their transactions for suspicious financial activities, including money laundering. The U.S. Office of Foreign Assets Control, ("OFAC"), has issued regulations requiring that we refrain from doing business, or allow our clients to do business through us, in certain countries or with certain organizations or individuals on a list maintained by the U.S. government.

Our failure to comply with applicable laws or regulations could result in fines, censure, suspensions of personnel or other sanctions, including revocation of our registration as an investment adviser. Even if a sanction imposed against us or our personnel is small in monetary amount, the adverse publicity arising from the imposition of sanctions against us by regulators could harm our reputation, result in withdrawal by our clients from our products and impede our ability to retain clients and develop new client relationships, which may reduce our revenues.

We face the risk of significant intervention by regulatory authorities, including extended investigation and surveillance activity, adoption of costly or restrictive new regulations and judicial or administrative proceedings that may result in substantial penalties. Among other things, we could be fined or be prohibited from engaging in some of our business activities. The requirements imposed by our regulators are designed to ensure the integrity of the financial markets and to protect customers and other third parties who deal with us, and are not designed to protect our stockholders. Accordingly, these regulations often serve to limit our activities, including through net capital, customer protection and market conduct requirements.

The regulatory environment in which we and our clients operate is subject to continual change, and regulatory developments designed to increase oversight could adversely affect our business.

The legislative and regulatory environment in which we operate undergoes continuous change and we believe that this trend will intensify, subjecting industry participants to additional, more costly and potentially more punitive regulation. New laws or regulations, or changes in the enforcement of existing laws or regulations, applicable to us and our clients could adversely affect our business. Any or all of the regulators who oversee us could adopt new rules or rule amendments that could substantially impact how we operate and may necessitate significant expenditures in order to adapt and comply.

Our ability to function in an uncertain and ever-changing regulatory environment will depend on our ability to constantly monitor and promptly react to legislative and regulatory changes, which inevitably result in intangible costs and resource drains. The compliance burden resulting from regulatory changes and uncertainty is likely to increase, particularly as regulators grow more technologically advanced and more reliant on data analytics. As a result, we may be forced to divert resources and expenditures to information technology in order to analyze data and risk in the same manner as regulators and to be able to provide regulators with the data output they may expect going forward.