Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Federal Home Loan Bank of Pittsburgh | d879734d8k.htm |

Full Year 2019 Member Conference Call Feb. 25, 2020 Exhibit 99.1

Winthrop Watson President and CEO

Agenda Board and executive changes 2019 financial highlights 2019 review Business highlights Historical trends Dividends Outlook Financial drivers LIBOR transition Collateral considerations Important dates/events

Board and Executive Changes Board of Directors Chair, Brad Ritchie Vice Chair, Louise Herrle Executive Chief Operating Officer, David Paulson Chief Technology and Operations Officer, John Cassidy

Ted Weller Chief Accounting Officer

Statements contained in this document, including statements describing the objectives, projections, estimates, or predictions of the future of the Federal Home Loan Bank of Pittsburgh (the Bank), may be “forward-looking statements.” These statements may use forward-looking terms, such as “anticipates,” “believes,” “could,” “estimates,” “may,” “should,” “will,” or their negatives or other variations on these terms. The Bank cautions that, by their nature, forward-looking statements involve risk or uncertainty and that actual results could differ materially from those expressed or implied in these forward-looking statements or could affect the extent to which a particular objective, projection, estimate, or prediction is realized. These forward-looking statements involve risks and uncertainties including, but not limited to, the following: economic and market conditions, including, but not limited to real estate, credit and mortgage markets; volatility of market prices, rates, and indices related to financial instruments, including, but not limited to, the possible discontinuance of the London Interbank Offered Rate (LIBOR) and the related effect on the Bank’s LIBOR-based financial products, investments and contracts; political, legislative, regulatory, litigation, or judicial events or actions; risks related to mortgage-backed securities (MBS); changes in the assumptions used to estimate credit losses; changes in the Bank’s capital structure; changes in the Bank’s capital requirements; changes in expectations regarding the Bank’s payment of dividends; membership changes; changes in the demand by Bank members for Bank advances; an increase in advances’ prepayments; competitive forces, including the availability of other sources of funding for Bank members; changes in investor demand for consolidated obligations and/or the terms of interest rate exchange agreements and similar agreements; changes in the Federal Home Loan Bank (FHLBank) System’s debt rating or the Bank’s rating; the ability of the Bank to introduce new products and services to meet market demand and to manage successfully the risks associated with new products and services; the ability of each of the other FHLBanks to repay the principal and interest on consolidated obligations for which it is the primary obligor and with respect to which the Bank has joint and several liability; applicable Bank policy requirements for retained earnings and the ratio of the market value of equity to par value of capital stock; the Bank’s ability to maintain adequate capital levels (including meeting applicable regulatory capital requirements); business and capital plan adjustments and amendments; technology and cyber-security risks; and timing and volume of market activity. This presentation is not intended as a full business or financial review and should be viewed in the context of all other information made available by the Bank in its filings with the Securities and Exchange Commission. Cautionary Statement Regarding Forward-Looking Information

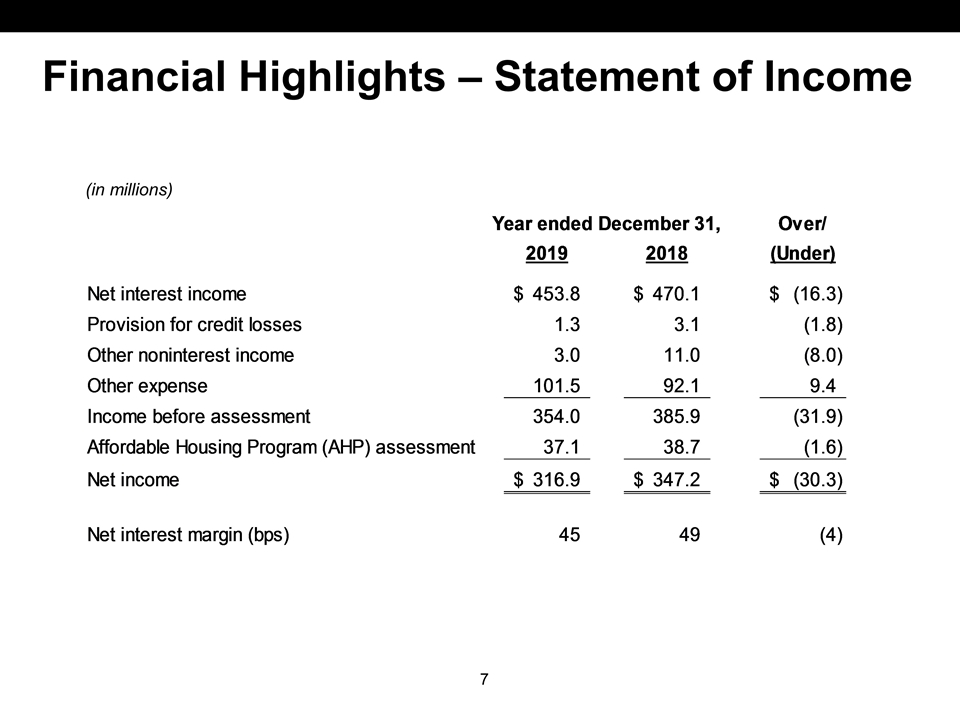

Financial Highlights – Statement of Income (in millions)

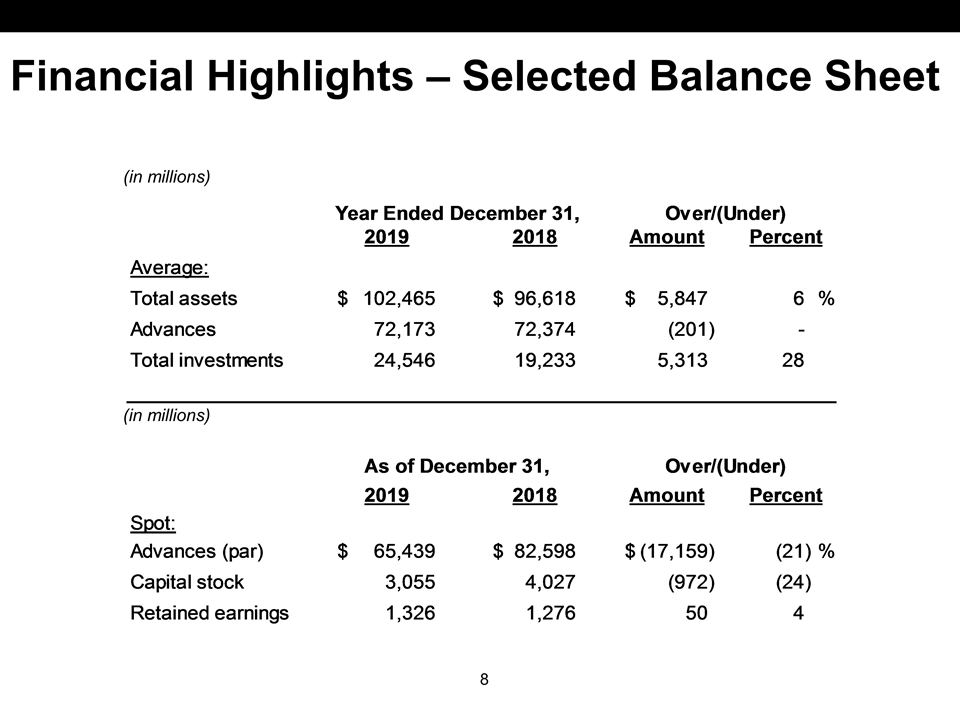

Financial Highlights – Selected Balance Sheet (in millions) (in millions)

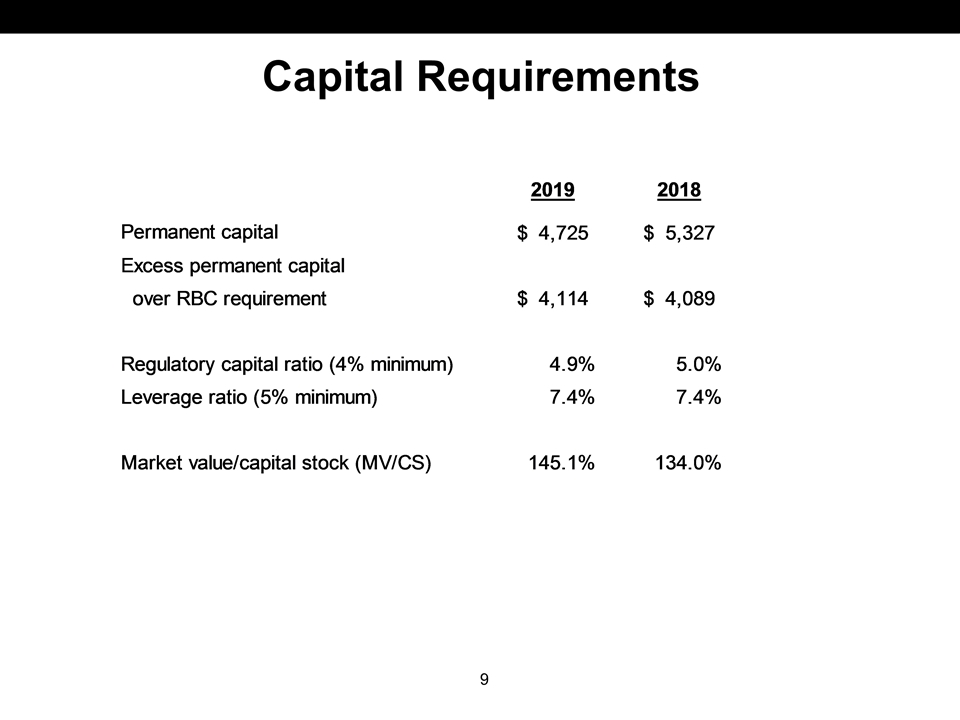

Capital Requirements

Winthrop Watson President and CEO

2019 Review

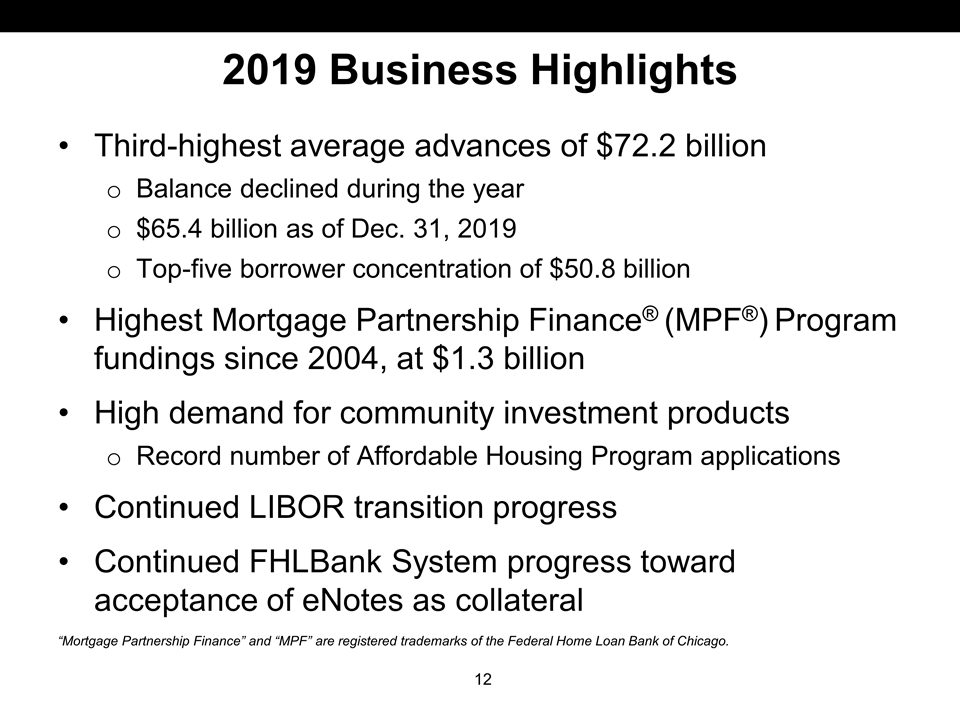

2019 Business Highlights Third-highest average advances of $72.2 billion Balance declined during the year $65.4 billion as of Dec. 31, 2019 Top-five borrower concentration of $50.8 billion Highest Mortgage Partnership Finance® (MPF®) Program fundings since 2004, at $1.3 billion High demand for community investment products Record number of Affordable Housing Program applications Continued LIBOR transition progress Continued FHLBank System progress toward acceptance of eNotes as collateral “Mortgage Partnership Finance” and “MPF” are registered trademarks of the Federal Home Loan Bank of Chicago.

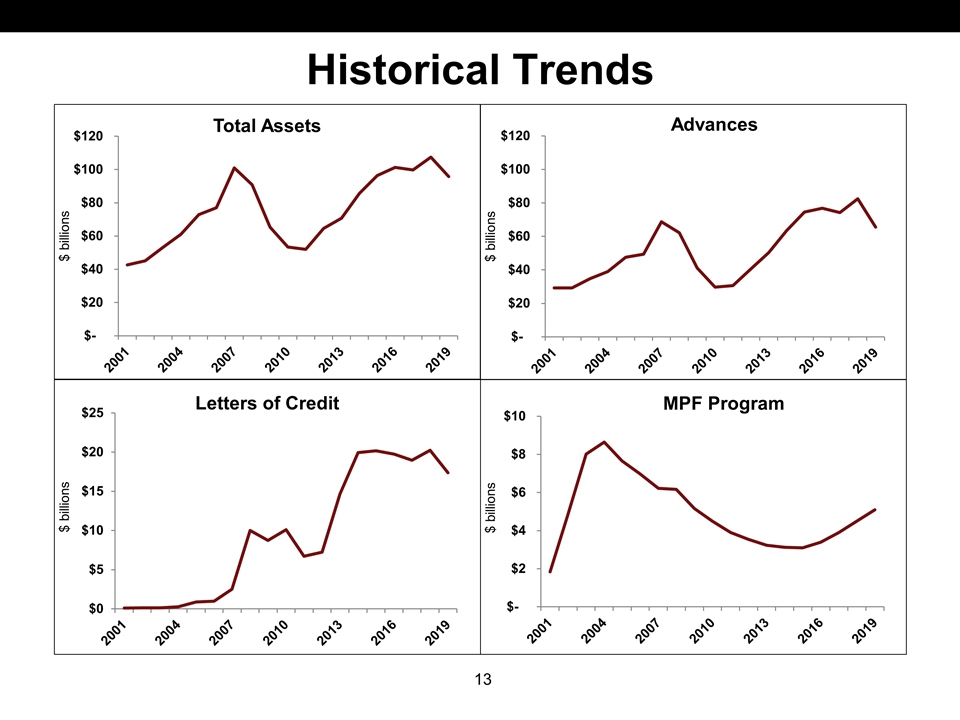

Historical Trends

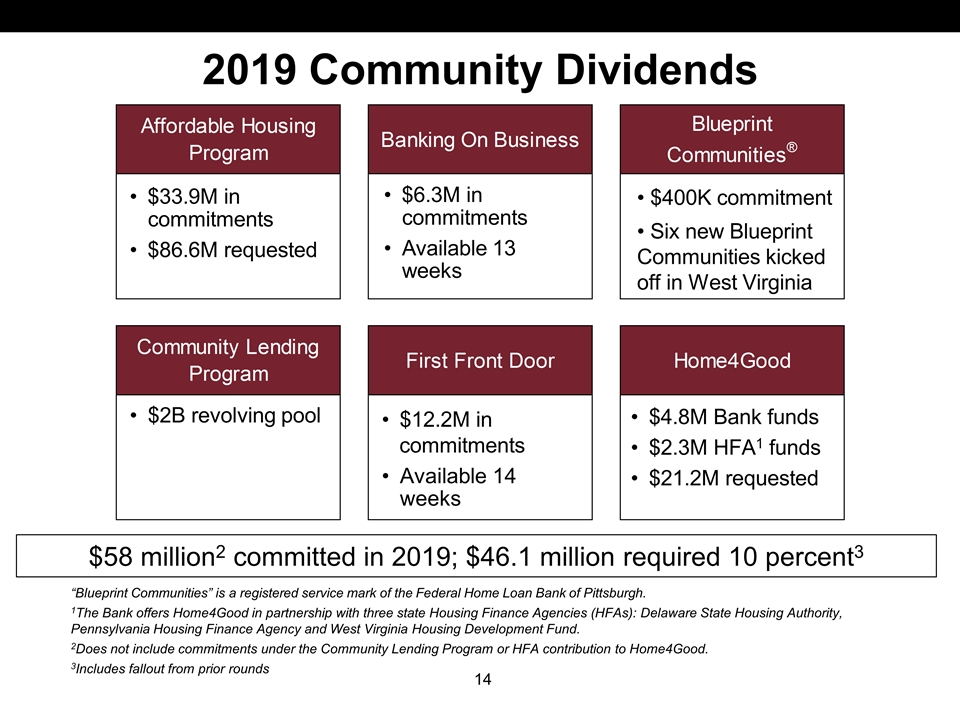

2019 Community Dividends “Blueprint Communities” is a registered service mark of the Federal Home Loan Bank of Pittsburgh. 1The Bank offers Home4Good in partnership with three state Housing Finance Agencies (HFAs): Delaware State Housing Authority, Pennsylvania Housing Finance Agency and West Virginia Housing Development Fund. 2Does not include commitments under the Community Lending Program or HFA contribution to Home4Good. 3Includes fallout from prior rounds $58 million2 committed in 2019; $46.1 million required 10 percent3 • $6.3M in commitments Available 13 weeks • $400K commitment • Six new Blueprint Communities kicked off in West Virginia $2B revolving pool • $33.9M in commitments • $86.6M requested • $12.2M in commitments Available 14 weeks $4.8M Bank funds $2.3M HFA1 funds $21.2M requested Affordable Housing Program Banking On Business BlueprintCommunities® Community Lending Program First Front Door Home4Good

Outlook

Financial Performance Drivers Interest rate movement Member activity levels Primarily advances Performance of the Bank’s mortgage investments MPF Program portfolio yields

Financial Performance Outlook Lower interest rates Interest rate decline will result in lower net income Lower member advance volume Continuation of late-2019 trend Continued paydown of high-yielding investments Agency and private-label mortgage-backed securities (MBS) Sustained paydowns within MPF Program portfolio Increasing expenses

Dividend Outlook For 2020, we anticipate maintaining similar dividend levels, subject to market conditions Lower interest rates and advance levels, along with mortgage paydowns, could contribute to: Strong, yet lower, financial performance The potential for lower dividend capacity in 2021 Lower Affordable Housing Program contribution We will continue to assess potential impact of the performance drivers throughout the year; membership update will be provided during a future member conference call The above reflects forward-looking information based on management’s expectations regarding economic and market conditions and the Bank’s financial condition and operating results. Refer to Cautionary-Statement Regarding Forward-Looking Information on slide 6 of this presentation.

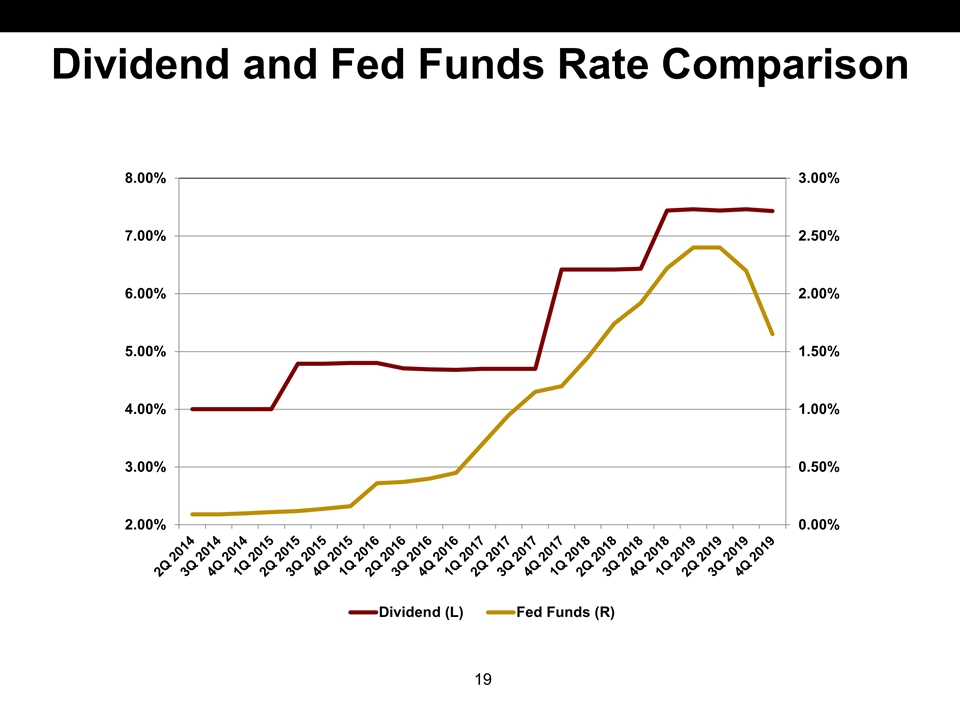

Dividend and Fed Funds Rate Comparison

LIBOR Transition FHLBank System continues to participate in industry-wide efforts to facilitate an orderly transition to the Secured Overnight Financing Rate (SOFR) Over $160 billion of debt indexed to SOFR issued1 FHLBank Pittsburgh efforts focused on: Participating in System’s SOFR-indexed debt issuance Ensuring operational preparedness, including fallback language Offering SOFR-indexed advances Managing our balance sheet Assessing member collateral 1FHLBanks Office of Finance Investor Presentation, January 2020

Other Collateral Considerations eNotes System continues to evaluate eNotes as eligible collateral Engaged with industry participants and advisors, as well as an eRegistry vendor eNote acceptance standards have been developed and shared For more information, visit our website and refer to the “Resources” dropdown menu Market Valuation Program Collateral weightings reviewed and approved semiannually Market Valuation Program use growing

Important Dates/Events Biennial member satisfaction survey Feb. 24: Survey opens Community investment product key dates: Feb. 14: Banking On Business opened March 16: First Front Door opens April 28-29: Affordable Housing Program (AHP) workshops June 15: AHP funding round opens Member reporting: March: Annual minimum stock certification available May: Bank4Banks® semiannual user certification May 15: 1Q 2020 QCR due (new LIBOR fields) “Bank4Banks” is a registered trademark of the Federal Home Loan Bank of Pittsburgh.

Important Dates/Events June: Member Regional Meetings June 1: Wilmington, Delaware, and Philadelphia, Pennsylvania June 4: Roanoke, West Virginia June 24: Scranton and Harrisburg, Pennsylvania June 25: Pittsburgh, Pennsylvania Continued work to enhance our transactional website

Full Year 2019 Member Conference Call Feb. 25, 2020