Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - WEST PHARMACEUTICAL SERVICES INC | exh991q42019earningsre.htm |

| 8-K - 8-K - WEST PHARMACEUTICAL SERVICES INC | wst-20200213.htm |

West Pharmaceutical Services, Inc. Fourth Quarter 2019 Analyst Conference Call 9 a.m. Eastern Time, February 13, 2020 ▪ A webcast of today’s call can be accessed in the “Investors” section of the Company’s website: www.westpharma.com Speakers: ▪ To participate on the call, please dial: Eric M. Green − 877-930-8295 (U.S.) President and Chief Executive Officer − 253-336-8738 (International) − The conference ID is 5587337 Bernard J. Birkett Senior Vice President and Chief Financial Officer ▪ An online archive of the broadcast will be available at the website three hours after the live call and will be available through Thursday, February 20, 2020, by dialing: − 855-859-2056 (U.S.) − 404-537-3406 (International) − The conference ID is 5587337 These presentation materials are intended to accompany today’s press release announcing the Company’s results for the fourth- quarter and full-year 2019 and management’s discussion of those results during today’s conference call. 1 WST Q4 2019 Earnings

Safe Harbor Statement Cautionary Statement Under the Private Securities Litigation Reform Act of 1995 This presentation and any accompanying management commentary contain “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about product development and operational performance. Each of these statements is based on preliminary information, and actual results could differ from any preliminary estimates. We caution investors that the risk factors listed under “Cautionary Statement” in our press releases, as well as those set forth under the caption "Risk Factors" in our most recent Annual Report on Form 10-K as filed with the Securities and Exchange Commission and as revised or supplemented by our quarterly reports on Form 10-Q, could cause our actual results to differ materially from those estimated or predicted in the forward-looking statements. You should evaluate any statement in light of these important factors. Except as required by law or regulation, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise. Non-U.S. GAAP Financial Measures Certain financial measures included in these presentation materials, or which may be referred to in management’s discussion of the Company’s results and outlook, have not been calculated in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”), and therefore are referred to as non-U.S. GAAP financial measures. Non-U.S. GAAP financial measures should not be considered in isolation or as an alternative to such measures determined in accordance with U.S. GAAP. Please refer to “Reconciliation of Non-U.S. GAAP Financial Measures” at the end of these materials for more information. Trademarks Registered trademarks used in this report are the property of West Pharmaceutical Services, Inc. or its subsidiaries, in the United States and other jurisdictions, unless noted otherwise. Daikyo® is a registered trademark of Daikyo Seiko, Ltd. 2 WST Q4 2019 Earnings

2019 Fourth-Quarter and Full-Year Results and 2020 Guidance • Q4 2019 net sales of $470.6 million grew 11.4%, organic sales growth was 12.7% • Full-year 2019 net sales of $1.840 billion grew 7.1%; organic sales growth was 10.0% • Q4 2019 reported-diluted EPS of $0.84 increased 22%; Full-year 2019 reported- diluted EPS of $3.21 increased 17% • Q4 2019 adjusted-diluted EPS of $0.82 increased 12%; Full-year 2019 adjusted- diluted EPS of $3.24 increased 15% (1) • Company introducing full-year 2020 net sales guidance in a range of $1.95 billion to $1.97 billion. Full-year 2020 reported-diluted EPS guidance is in a range of $3.45 to $3.55 (1) (1) Please refer to “Notes to Non-U.S. GAAP Financial Measures” on slides 15-20 and “Non-U.S. GAAP Financial Measures” in today’s press release, for additional information regarding adjusted-diluted EPS. 3 WST Q4 2019 Earnings

Organic Sales Growth Q4 2019 FY 2019 Overall Organic Proprietary Products Q4 2019 organic sales growth of 14.7%, 13% 10% Sales Growth led by sales of high-value products, which grew double digits Q4 2019 sales led by high-value products, including Daikyo®, Biologics DD DD BIOLOGICS Westar® and Flurotec® components Q4 2019 sales led by sales of Westar components and self- Generics DD HSD GENERICS injection delivery platforms Q4 2019 sales led by high-value products and services and Pharma DD LSD favorable year-over-year comparison due to the impact of a PHARMA previously-reported voluntary recall of our Vial2Bag® product Contract Q4 2019 organic sales growth of 7.2%, led by sales of CONTRACT HSD DD MFG Manufacturing healthcare-related injection and diagnostic devices Abbreviations: LSD – low-single digit; MSD – mid-single digit; HSD – high-single digit; DD – double digit 4 WST Q4 2019 Earnings

High-Value Products Fueling Growth in Support of Market Trends Biologic Drug Increased Regulations Injectable Drug Generics Growing in Molecules Increasing for Combination Drugs Market Growing Key Emerging Regions Advanced Elastomer 4040/40 5 WST Q4 2019 Earnings

“One West” Global Management System Driving Improved Performance One Global Approach Across All Sites Manufacturing 0.7 Strategy RIR One 25 RECORDABLE MANUFACTURING INJURY RATE West Supply Chain Global FACILITIES Decreased by Management AROUND THE 66% Since Process Excellence System WORLD 2015 >100 Advanced <0.07 Million PARTS PER Manufacturing COMPONENTS MILLION OF Engineering MANUFACTURED OUT-OF-SPEC DAILY PARTS Digital Transformation 6 WST Q4 2019 Earnings

Significant Presence in Asia Pacific Region Established West’s Acquisition of GIS Increased Equity stake in Digital Technology Korea Ltd. Daikyo partnership Center in India 7 WST Q4 2019 Earnings

West is Driving Sustainable Business Practices Investor’s Business Daily Six Pillars 2019 Best ESG Companies 9.7% waste to landfill REDUCTION Employer of the Year Environmental Kearney, NE Sustainability energy efficiency improvement CSR Initiative Award, 1.5% Compliance Dublin, IE & Ethics of West’s C-suite executive team comprised Quality 44% of women and/or U.S. minorities Gold Standard Health & Safety in recordable injury rate 15% Decrease (RIR) over 2018 Diversity & Talent Newsweek America’s Most Responsible Companies 2020 $2.1M in corporate CHARITABLE GIVING in 2019 Philanthropy Corporate President’s Award 8 WST Q4 2019 Earnings

Fourth-Quarter 2019 Summary Results ($ millions, except earnings-per-share (EPS) data) Three Months Ended December 31, 2019 2018 Reported Net Sales $470.6 $422.5 Gross Profit Margin 32.5% 31.5% Reported Operating Profit $78.1 $65.8 Adjusted Operating Profit (1) $73.1 $67.1 Reported Operating Profit Margin 16.6% 15.6% Adjusted Operating Profit Margin (1) 15.5% 15.9% Reported-Diluted EPS $0.84 $0.69 Adjusted-Diluted EPS(1) $0.82 $0.73 (1) “Adjusted Operating Profit”, “Adjusted Operating Profit Margin” and “Adjusted-Diluted EPS” are Non-U.S. GAAP financial measures. See slides 15-20 and the discussion under the heading “Non-U.S. GAAP Financial Measures” in today’s press release for an explanation and reconciliation of these items. 9 WST Q4 2019 Earnings

Change in Consolidated Net Sales Fourth-quarter 2018 to 2019 ($ millions) 10 WST Q4 2019 Earnings

Gross Profit Update ($ millions) Three Months Ended December 31, 2019 2018 Proprietary Products Gross Profit $134.1 $115.0 Proprietary Products Gross Profit Margin 38.0% 37.0% Contract-Manufactured Products Gross Profit $19.3 $18.2 Contract-Manufactured Products Gross Profit Margin 16.4% 16.4% Consolidated Gross Profit $153.2 $133.2 Consolidated Gross Profit Margin 32.5% 31.5% 11 WST Q4 2019 Earnings

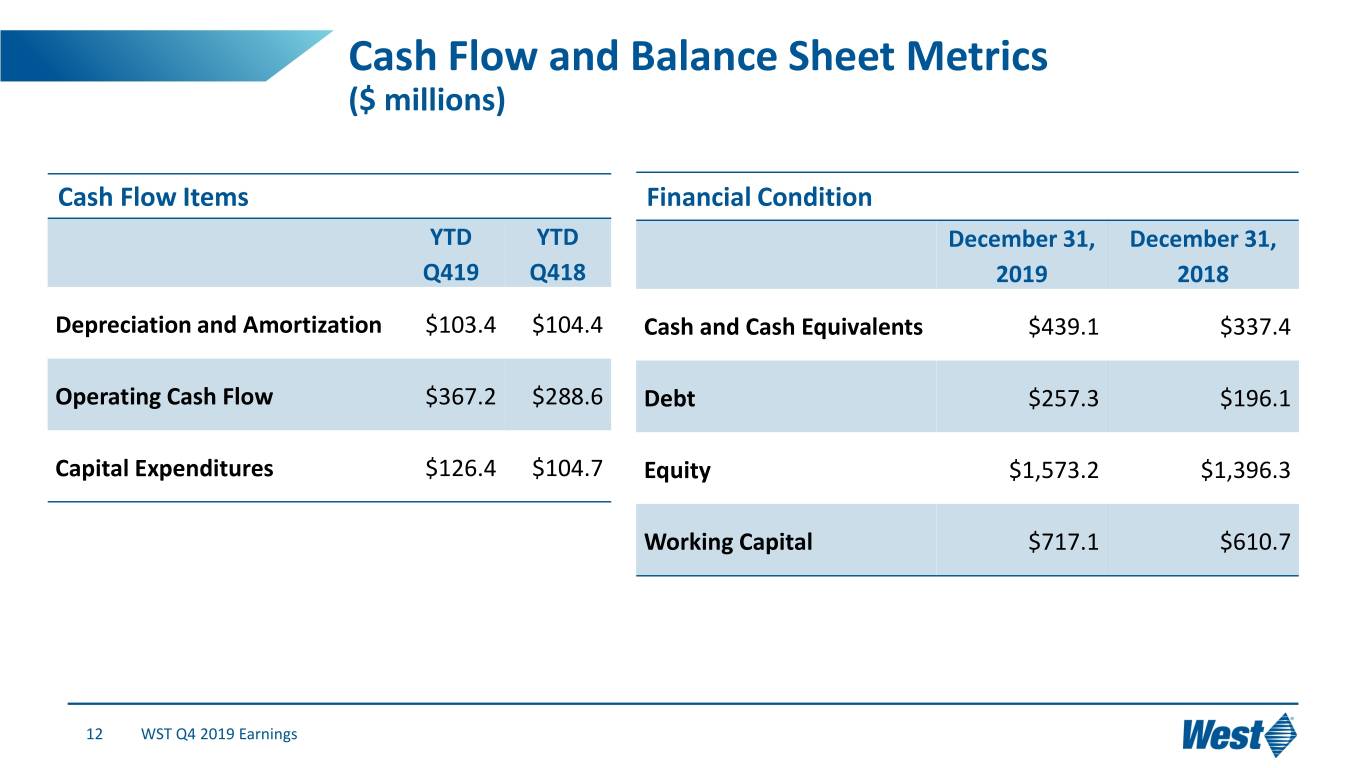

Cash Flow and Balance Sheet Metrics ($ millions) Cash Flow Items Financial Condition YTD YTD December 31, December 31, Q419 Q418 2019 2018 Depreciation and Amortization $103.4 $104.4 Cash and Cash Equivalents $439.1 $337.4 Operating Cash Flow $367.2 $288.6 Debt $257.3 $196.1 Capital Expenditures $126.4 $104.7 Equity $1,573.2 $1,396.3 Working Capital $717.1 $610.7 12 WST Q4 2019 Earnings

2020 Full-Year Guidance 2020 Full-Year Guidance(1,2) Consolidated Net Sales $1.95 - $1.97 billion Reported-Diluted EPS $3.45 - $3.55 Capital Spending Approximately 7% of Consolidated Net Sales (1) Please refer to “Notes to Non-U.S. GAAP Financial Measures” on slides 15-20 and “Non-U.S. GAAP Financial Measures” in today’s press release, for additional information regarding adjusted-diluted EPS. (2) The reported-diluted EPS guidance range does not include potential tax benefits from stock-based compensation. Any tax benefits associated with stock-based compensation received in 2020 would provide a positive adjustment to this guidance range. 13 WST Q4 2019 Earnings

SHARED West OUR innovation INDUSTRY MAINTAINED A delivered THOUGHT GOLD STANDARD 4 NEW PRODUCT LEADERSHIP FROM ECOVADIS, SOLUTIONS at key meetings, in A leader in supplier scientific publications sustainability ratings, and through 90+ placing us in the top published blogs in 2019 5% of reporting companies 2019Slide 12 INDUSTRY 154 InnovatingTitle for AWARDS PATENTS Our Purpose to acknowledge ISSUED our impact on to fuel future innovation customers, & patients and the Our People community WST Q4 2019 Earnings

Notes to Non-U.S. GAAP Financial Measures For additional details, please see today’s press release & Safe Harbor Statement ▪ For the purpose of aiding the comparison of our year-over-year results, we may refer to net sales and other financial results excluding the effects of changes in foreign currency exchange rates. ▪ Organic net sales exclude the impact from acquisitions and/or divestitures and translates the current-period reported sales of subsidiaries whose functional currency is other than the U.S. Dollar at the applicable foreign exchange rates in effect during the comparable prior-year period. ▪ We may also refer to financial results excluding the effects of unallocated items. ▪ The re-measured results excluding effects from currency translation, the impact from acquisitions and/or divestitures, and the effects of unallocated items are not in conformity with U.S. GAAP and should not be used as a substitute for the comparable U.S. GAAP financial measures. ▪ The non-U.S. GAAP financial measures are incorporated into our discussion and analysis as management uses them in evaluating our results of operations and believes that this information provides users a valuable insight into our overall performance and financial position. ▪ A reconciliation of these adjusted Non-U.S. GAAP financial measures to the comparable U.S. GAAP financial measures is included in the accompanying tables. 15 WST Q4 2019 Earnings

Notes to Non-U.S. GAAP Financial Measures RECONCILIATION OF NON-U.S. GAAP FINANCIAL MEASURES (UNAUDITED) See “Notes to Non-U.S. GAAP Financial Measures” (Slides 15-20), “Cautionary Statement” (Slide 2) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Reported and Adjusted Operating Profit, Net Income and Diluted EPS ($ millions, except EPS data) Operating Income tax Net Diluted Three months ended December 31, 2019 profit expense income EPS Reported (U.S. GAAP) $78.1 $16.5 $63.9 $0.84 Restructuring and related charges 1.1 0.3 0.8 0.02 Gain on restructuring-related sale of assets (1.7) (0.4) (1.3) (0.02) Pension settlement - 0.2 0.6 0.01 Argentina currency devaluation - (0.3) 0.3 - Tax recovery (4.4) (1.5) (2.9) (0.04) Tax law changes - (0.7) 0.7 0.01 Adjusted (Non-U.S. GAAP) $73.1 $14.1 $62.1 $0.82 16 WST Q4 2019 Earnings

Notes to Non-U.S. GAAP Financial Measures RECONCILIATION OF NON-U.S. GAAP FINANCIAL MEASURES (UNAUDITED) See “Notes to Non-U.S. GAAP Financial Measures” (Slides 15-20), “Cautionary Statement” (Slide 2) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Reported and Adjusted Operating Profit, Net Income and Diluted EPS ($ millions, except EPS data) Operating Income tax Net Diluted Twelve months ended December 31, 2019 profit expense income EPS Reported (U.S. GAAP) $296.6 $59.0 $241.7 $3.21 Restructuring and related charges 4.9 1.2 3.7 0.04 Gain on restructuring-related sale of assets (1.7) (0.4) (1.3) (0.02) Pension settlement - 0.8 2.7 0.04 Argentina currency devaluation 1.0 - 1.0 0.01 Tax recovery (4.4) (1.5) (2.9) (0.04) Tax law changes - 0.3 (0.3) - Adjusted (Non-U.S. GAAP) $296.4 $59.4 $244.6 $3.24 17 WST Q4 2019 Earnings

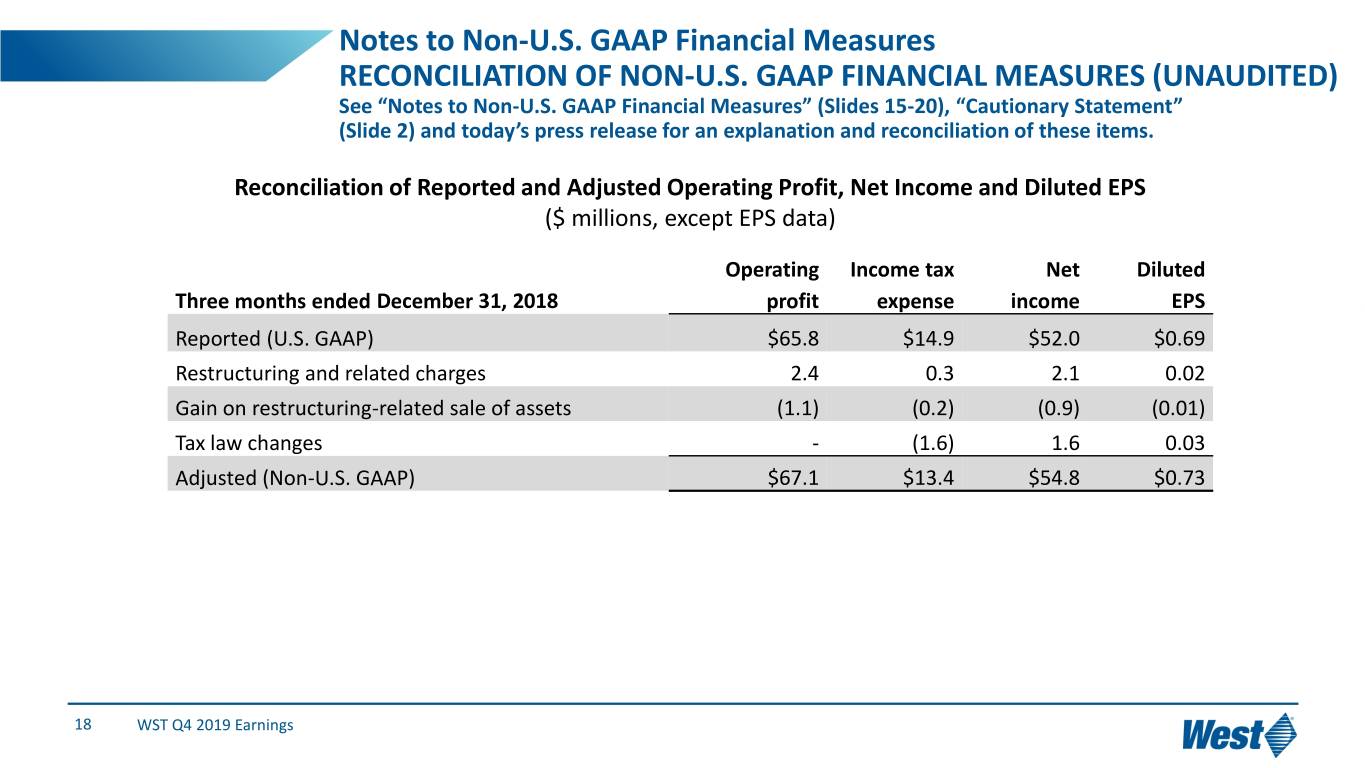

Notes to Non-U.S. GAAP Financial Measures RECONCILIATION OF NON-U.S. GAAP FINANCIAL MEASURES (UNAUDITED) See “Notes to Non-U.S. GAAP Financial Measures” (Slides 15-20), “Cautionary Statement” (Slide 2) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Reported and Adjusted Operating Profit, Net Income and Diluted EPS ($ millions, except EPS data) Operating Income tax Net Diluted Three months ended December 31, 2018 profit expense income EPS Reported (U.S. GAAP) $65.8 $14.9 $52.0 $0.69 Restructuring and related charges 2.4 0.3 2.1 0.02 Gain on restructuring-related sale of assets (1.1) (0.2) (0.9) (0.01) Tax law changes - (1.6) 1.6 0.03 Adjusted (Non-U.S. GAAP) $67.1 $13.4 $54.8 $0.73 18 WST Q4 2019 Earnings

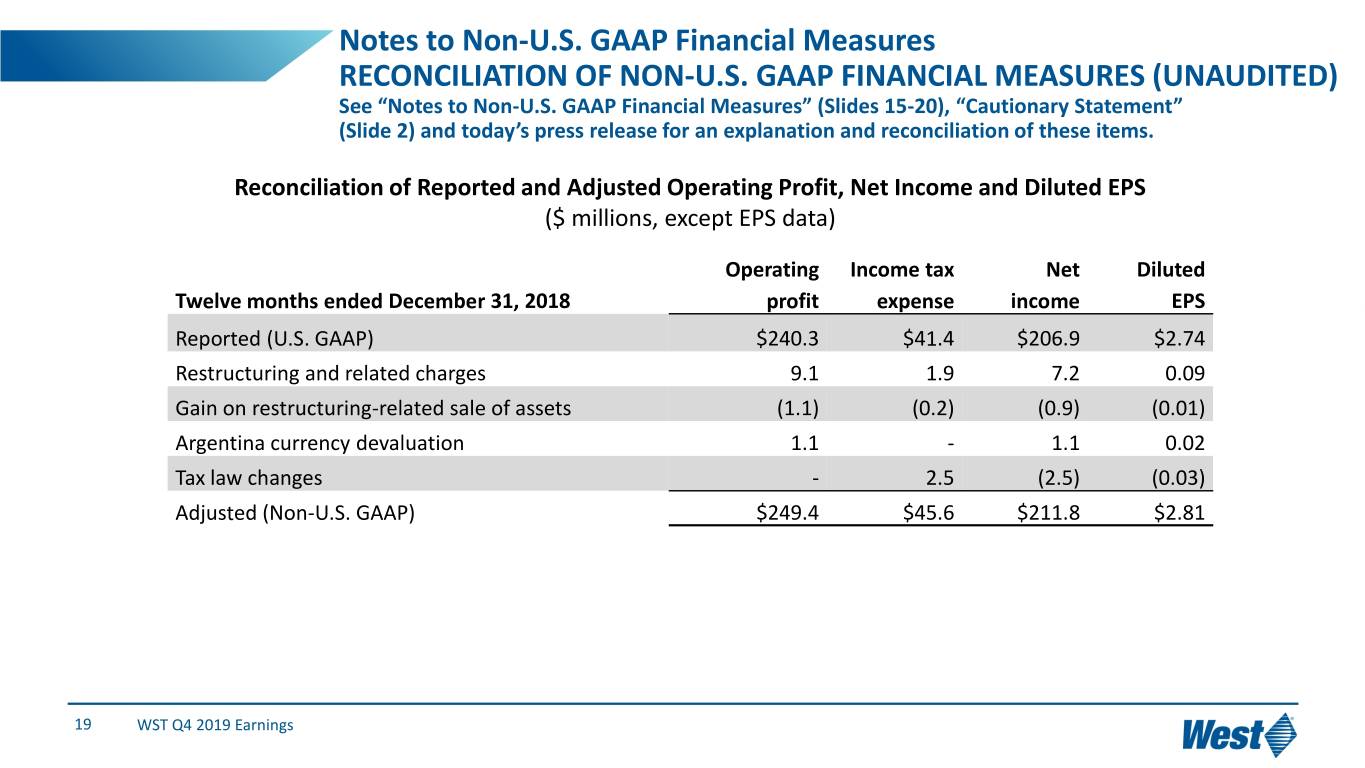

Notes to Non-U.S. GAAP Financial Measures RECONCILIATION OF NON-U.S. GAAP FINANCIAL MEASURES (UNAUDITED) See “Notes to Non-U.S. GAAP Financial Measures” (Slides 15-20), “Cautionary Statement” (Slide 2) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Reported and Adjusted Operating Profit, Net Income and Diluted EPS ($ millions, except EPS data) Operating Income tax Net Diluted Twelve months ended December 31, 2018 profit expense income EPS Reported (U.S. GAAP) $240.3 $41.4 $206.9 $2.74 Restructuring and related charges 9.1 1.9 7.2 0.09 Gain on restructuring-related sale of assets (1.1) (0.2) (0.9) (0.01) Argentina currency devaluation 1.1 - 1.1 0.02 Tax law changes - 2.5 (2.5) (0.03) Adjusted (Non-U.S. GAAP) $249.4 $45.6 $211.8 $2.81 19 WST Q4 2019 Earnings

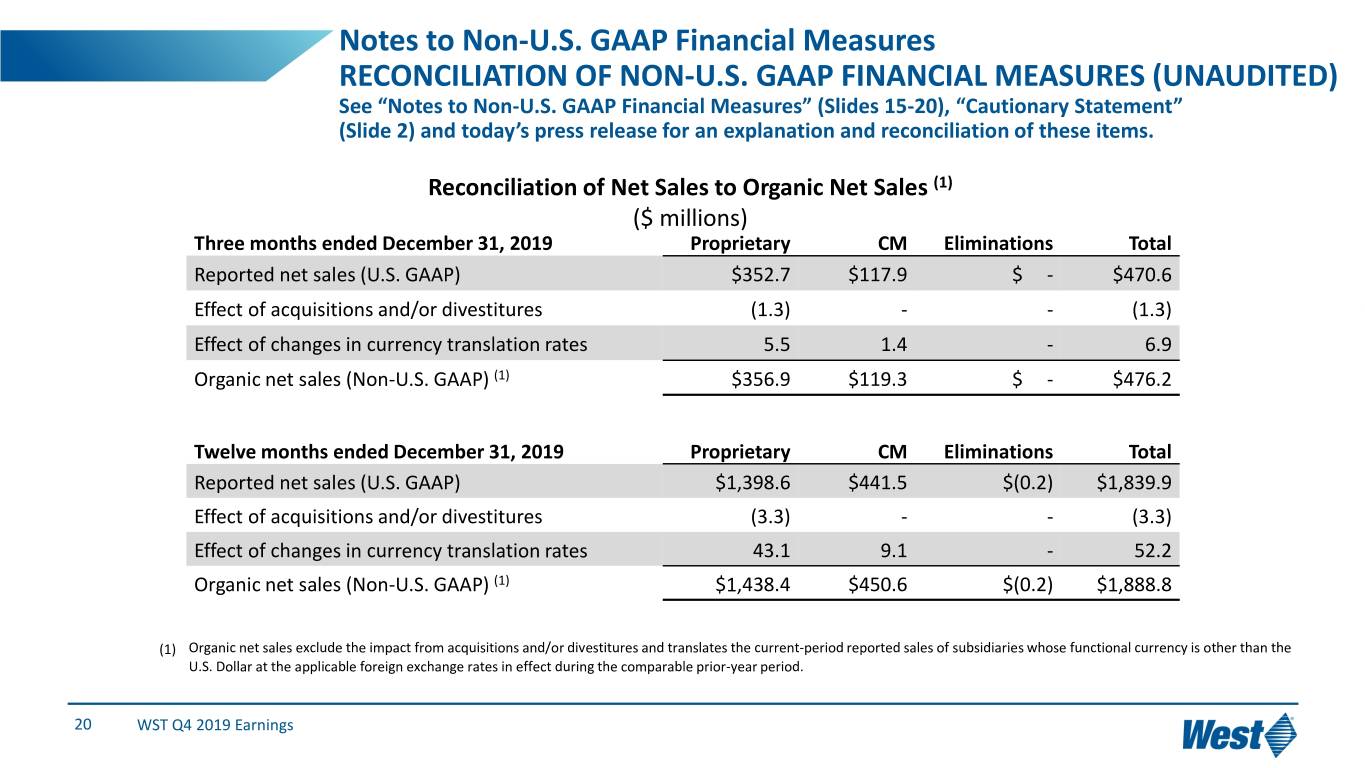

Notes to Non-U.S. GAAP Financial Measures RECONCILIATION OF NON-U.S. GAAP FINANCIAL MEASURES (UNAUDITED) See “Notes to Non-U.S. GAAP Financial Measures” (Slides 15-20), “Cautionary Statement” (Slide 2) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Net Sales to Organic Net Sales (1) ($ millions) Three months ended December 31, 2019 Proprietary CM Eliminations Total Reported net sales (U.S. GAAP) $352.7 $117.9 $ - $470.6 Effect of acquisitions and/or divestitures (1.3) - - (1.3) Effect of changes in currency translation rates 5.5 1.4 - 6.9 Organic net sales (Non-U.S. GAAP) (1) $356.9 $119.3 $ - $476.2 Twelve months ended December 31, 2019 Proprietary CM Eliminations Total Reported net sales (U.S. GAAP) $1,398.6 $441.5 $(0.2) $1,839.9 Effect of acquisitions and/or divestitures (3.3) - - (3.3) Effect of changes in currency translation rates 43.1 9.1 - 52.2 Organic net sales (Non-U.S. GAAP) (1) $1,438.4 $450.6 $(0.2) $1,888.8 (1) Organic net sales exclude the impact from acquisitions and/or divestitures and translates the current-period reported sales of subsidiaries whose functional currency is other than the U.S. Dollar at the applicable foreign exchange rates in effect during the comparable prior-year period. 20 WST Q4 2019 Earnings