Attached files

|

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

|

Washington,

D.C. 20549

FORM

10-K

(Mark

One)

|

|

þ

|

ANNUAL REPORT PURSUANT TO

SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For

the Fiscal Year Ended December 31, 2009

or

|

|

¨

|

TRANSITION REPORT PURSUANT TO

SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For

the transition period

from to

Commission

File Number 1-8036

WEST

PHARMACEUTICAL SERVICES, INC.

(Exact

name of registrant as specified in its charter)

|

Pennsylvania

|

23-1210010

|

|

(State

or other jurisdiction of incorporation or organization)

|

(I.R.S.

Employer Identification Number)

|

|

101

Gordon Drive, PO Box 645, Lionville, PA

|

19341-0645

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: 610-594-2900

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

Name

of each exchange on which registered

|

|

Common

Stock, par value $.25 per share

|

New

York Stock Exchange

|

Securities registered pursuant to

Section 12 (g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes þ No o

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act.

Yes o No þ

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes þ No o

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such

files). Yes o No o

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

|

Large

accelerated filer

|

þ

|

Accelerated

filer

|

o

|

|

|

Non-accelerated

filer

|

o

|

(Do

not check if a smaller reporting company)

|

Smaller

reporting company

|

o

|

Indicate

by check mark whether the registrant is a shell company (as defined in rule

12b-2 of the Exchange Act). Yes o No þ

The

aggregate market value of the voting stock held by non-affiliates of the

registrant as of June 30, 2009 was approximately $1,145,638,234 based on the

closing price as reported on the New York Stock Exchange.

As of

January 31, 2010, there were 33,103,281 shares of the registrant’s common stock

outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE

|

Document

|

Parts

Into Which Incorporated

|

|

Proxy

Statement for the Annual Meeting of Shareholders to be held May 4,

2010

|

Part

III

|

TABLE

OF CONTENTS

|

PART I

|

Page

|

|

ITEM 1. BUSINESS

|

3

|

|

3

3

3

4

4

6

6

7

7

7

8

8

8

8

9

9

9

10

10

|

|

|

ITEM 1A. RISK FACTORS

|

10

|

|

ITEM 1B. UNRESOLVED STAFF COMMENTS

|

15

|

|

ITEM 2. PROPERTIES

|

16

|

|

ITEM 3. LEGAL PROCEEDINGS

|

17

|

|

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY

HOLDERS

|

17

|

|

17

|

|

|

PART II

|

|

|

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED

STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY

SECURITIES

|

19

|

|

ITEM 6. SELECTED FINANCIAL DATA

|

21

|

|

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

23

|

|

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT

MARKET RISK

|

41

|

|

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY

DATA

|

43

|

|

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON

ACCOUNTING AND FINANCIAL DISCLOSURE

|

78

|

|

ITEM 9A. CONTROLS AND PROCEDURES

|

78

|

|

ITEM 9B. OTHER INFORMATION

|

78

|

|

PART III

|

|

|

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE

GOVERNANCE

|

79

|

|

ITEM 11. EXECUTIVE COMPENSATION

|

79

|

|

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

79

|

|

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED

TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

80

|

|

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

80

|

|

PART IV

|

|

|

ITEM 15. EXHIBITS AND FINANCIAL STATEMENT

SCHEDULES

|

81

|

2

PART I

ITEM 1. BUSINESS.

West

Pharmaceutical Services, Inc. (which may be referred to as West, the Company, we, us or our) is a manufacturer of

components and systems for injectable drug delivery and plastic packaging, as

well as delivery system components for the pharmaceutical, healthcare and

consumer products industries. Our products include stoppers and seals for vials,

closures and components used in syringe, intravenous and blood collection

systems, prefillable syringe components, and safety and administration systems.

Our customers include the leading global producers and distributors of

pharmaceuticals, biologics, medical devices and personal care products. The

Company was incorporated under the laws of the Commonwealth of Pennsylvania on

July 27, 1923.

All

trademarks and registered trademarks used in this report are the property of

West Pharmaceutical Services, Inc., unless noted otherwise. Exubera® is a

registered trademark of Pfizer, Inc. Teflon® is a registered trademark of E.I.

DuPont de Nemours and Company. Crystal Zenith® is a registered trademark of

Daikyo Seiko, Ltd.

On July

6, 2009, we acquired certain business assets of Plastef Investissements SA

(“Plastef”), a France-based developer and manufacturer of drug delivery devices.

For additional details regarding this acquisition, see Note 2, Acquisition, to our

consolidated financial statements.

West

maintains a website at www.westpharma.com. Our

Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on

Form 8-K and amendments to those reports filed or furnished pursuant to Section

13(a) or 15(d) of the Securities Exchange Act of 1934 are available on our

website under the Investors –

SEC Filings caption as soon as reasonably practical after we

electronically file the material with, or furnish it to, the Securities and

Exchange Commission (SEC). These filings are also available to the public over

the Internet at the SEC’s website at www.sec.gov. You may also

read and copy any document we file at the SEC’s Public Reference Room at 100 F.

Street, N.E., Washington, D.C. 20549. Please call the SEC at

1-800-SEC-0330 for further information on the Public Reference

Room.

Throughout

this Form 10-K, we “incorporate by reference” certain information from parts of

other documents filed with the SEC and from our Proxy Statement for the 2010

Annual Meeting of Shareholders (“2010 Proxy Statement”), which will be filed

with the SEC within 120 days following the end of our 2009 fiscal

year. Our 2010 Proxy Statement will be available on our website on or

about March 31, 2010, under the caption Investors — Proxy

Materials.

Information

about our corporate governance, including our Corporate Governance Principles

and Code of Business Conduct, as well as information about our Directors, Board

Committees, Committee Charters, and instructions on how to contact the Board is

available on our website under the Investors — Corporate Governance

caption. Information relating to the West Pharmaceutical Services

Dividend Reinvestment Plan is also available on our website under the Investors — Dividend Reinvestment

Program caption. We will provide any of the foregoing

information without charge upon written request to John R. Gailey III, Vice

President, General Counsel and Secretary, West Pharmaceutical Services, Inc.,

101 Gordon Drive, Lionville, PA 19341.

3

Business Segments

During

the years presented, our business was conducted through two reportable segments:

Pharmaceutical Systems and Tech Group. Comparative segment revenues

and related financial information for 2009, 2008 and 2007 are presented in a

table contained in Note 6,

Segment Information, to our consolidated financial statements and are

discussed within Results of

Operations in the Management’s Discussion and Analysis

of Financial Condition and Results of Operations section of this 2009

Form 10-K. Intersegment sales are eliminated in consolidation.

Pharmaceutical Systems Segment

Our

Pharmaceutical Systems segment designs, manufactures and sells a variety of

packaging components and systems used in parenteral drug delivery for the

pharmaceutical, biopharmaceutical and generic industries. The primary

components we manufacture are subject to regulatory oversight within our

customers’ manufacturing facilities. We have manufacturing facilities

in North and South America, Europe and Asia Pacific, with affiliated companies

in Mexico and Japan. See Item 2, Properties, for additional

information on our manufacturing sites.

Our

Pharmaceutical Systems segment consists of two operating segments — Americas and

Europe/Asia Pacific — which are aggregated for reporting purposes because they

have similar economic characteristics, as well as similar products,

manufacturing processes, customer objectives, distribution procedures and

regulatory requirements.

Our

Pharmaceutical Systems business is composed of the following product

lines:

Pharmaceutical

packaging

|

·

|

Elastomeric

stoppers and discs, which serve as primary closures for pharmaceutical

vials.

|

|

·

|

Secondary

closures for pharmaceutical vials called Flip-Off® aluminum seals,

consisting of an aluminum seal and a removable plastic button, and in some

applications, just an aluminum

seal.

|

|

·

|

Elastomeric

plungers, needle shields and tip caps to fit most standard prefilled

syringes and combination seals for dental cartridges and pen delivery

systems.

|

|

·

|

Pharmaceutical

containers, closures and dispensers, including the West Ready Pack™

system.

|

|

·

|

Enhanced

component processing: NovaPure™, Envision™, VeriSure™, Westar® RS

(ready-to-sterilize) and Westar® RU

(ready-to-use).

|

|

·

|

Daikyo

Crystal Zenith® RU prefillable syringe

system.

|

Disposable medical

components

|

·

|

Elastomeric

components for blood collection systems, as well as flashback bulbs and

sleeve stoppers for intravenous dispensing

systems.

|

|

·

|

Elastomer

and co-molded elastomer/plastic components for infusion and intravenous

systems.

|

|

·

|

Non-filled

syringe components.

|

|

·

|

Dropper

bulbs for applications such as eye, ear and nasal drops, diagnostic

products and dispensing systems.

|

Safety and administration

systems

|

·

|

Sterile

devices for the reconstitution, transfer and administration of drug

products, including patented products such as the Mixject™, Mix2Vial™ and

vial adapters.

|

4

|

·

|

NovaGuard™

passive safety needle system.

|

Laboratory and other

services

|

·

|

Extractables

and leachables testing, package/container testing, method

development/validation, stability testing, process development and problem

resolution.

|

Sales of

pharmaceutical packaging components represented approximately 60%, 59% and 57%

of consolidated net sales for 2009, 2008 and 2007, respectively. Disposable

medical components sales, as a percent of consolidated net sales, were 10%, 10%

and 12% for 2009, 2008 and 2007, respectively.

Products

and services recently brought to market are the Daikyo Crystal Zenith luer lock

syringe, Envisionand the West Ready Pack system. The Daikyo Crystal Zenith

syringe is the market’s first silicone-free, ready-to-use prefillable syringe

that offers pharmaceutical and biopharmaceutical companies a total system

solution that can mitigate the risks associated with glass syringes. Crystal

Zenith technology is licensed from Daikyo Seiko, Ltd. West’s Envision components

(plungers and stoppers) are inspected by an automated vision inspection system

to ensure they meet enhanced quality specifications for visible and subvisible

particulate and contamination. The West Ready Pack system is a one-source

solution ideal for pharmaceutical research and development and clinical work.

Each system comes with West stoppers, Flip-Off seals and vials conveniently

packaged in small volumes. Because the components are delivered ready-to-use,

component preparation is eliminated from the customer’s processing, saving them

time and money.

Our

tamper-evident Flip-Off seals consist of a metal overseal and a molded plastic

cap that is removed in order to permit needle access to the drug-vial

contents. These are sold in a wide range of sizes and colors to meet

customers’ needs for product identification and differentiation. The seals can

be provided using proprietary printing and embossing technology for multiple

layers of protection, such as point-of-use instructions, item-level information

such as vial contents, drug dosage and strength, and cautionary statements that

can serve as counterfeiting deterrence.

Elastomeric

components are offered in a variety of standard and customer-specific

configurations and formulations and are available with advanced barrier films

and coatings to enhance their performance. West FluroTec® coating is a film that

is applied using a patented molding process to reduce the risk of product loss

by contamination, enhance seal integrity and protect the shelf life of packaged

drugs. We also apply a Teflon® coating to the surface of stoppers and plungers

to improve compatibility between the closure and the drug. B2-Coating is a

coating applied to the surface of stoppers and plungers using a patented process

that eliminates the need for conventional silicone application. It helps

manufacturers reduce product rejections due to trace levels of silicone

molecules found in non-coated packaged drug compounds. FluroTec and B2-Coating

technologies are licensed from Daikyo Seiko, Ltd.

Our

VeriSure components are an example of how laboratory services can be combined

with a product offering. These components allow pharmaceutical and

biopharmaceutical companies to navigate the complex task of extractables

identification and the related analysis for qualifying a drug product’s

container/closure system more efficiently. The customer will receive a

Certificate of Analysis with each shipment of components. Also, with a known

extractables profile, customers can begin the design of leachables studies on a

quicker basis, a process which our analytical laboratory services can

support.

In

addition, our post-manufacturing processes, Westar RS and Westar RU, are

documented and fully validated procedures for washing and siliconizing stoppers

and syringe components to remove biological materials and endotoxins. Westar RS

prepares components for introduction into the customer’s sterilizer and Westar

RU provides sterilized components. The Westar processes increase the overall

efficiency of injectable drug production by outsourcing component processing,

thereby eliminating steps otherwise required in each of our customers’

manufacturing processes, and assure compliance with the latest regulatory

requirements for component preparation.

5

Medimop

Medical Projects, Ltd. (“Medimop”), one of our wholly owned subsidiaries, is a

leader in the world market for transfer, mixing and administration systems for

injectable pharmaceuticals. Many injectable drug products are produced as

freeze-dried powders in order to preserve product efficacy during shipment and

storage. These products must be reconstituted, typically by diluting the powder

with sterile water or other diluent at the point of use. All Medimop

products marketed in the United States are cleared by the U.S. Food and Drug

Administration (FDA). In addition, many Medimop products are protected by

patents.

As an

adjunct to our Pharmaceutical Systems products, we offer contract analytical

laboratory services for testing and evaluating primary drug packaging components

and their compatibility with the contained drug formulation. West Analytical

Services provides us and our customers with in-depth knowledge and analysis of

the interaction and compatibility of drug products with elastomer, glass and

plastic packaging components. Our analytical laboratories also provide

specialized testing for complete drug delivery systems.

Tech Group Segment

Our Tech

Group segment is a global custom injection molder with over 40 years of

experience, offering contract manufacturing solutions for the healthcare and

consumer industries. This segment has manufacturing operations in the U.S.,

Puerto Rico and Ireland. See Item 2, Properties, for additional

information on our manufacturing sites.

Our Tech

Group segment consists of two operating segments — Americas and Europe — which

are aggregated for reporting purposes because they have similar economic

characteristics, as well as similar products, manufacturing processes, customer

objectives, distribution procedures and regulatory requirements.

The Tech

Group is committed to producing the highest quality injection molded components

and devices, which include unique components for surgical, ophthalmic,

diagnostic and drug delivery systems, such as contact lens storage kits, pill

dispensers and disposable blood collection systems, as well as various personal

care and consumer products. The Tech Group’s record of success includes

manufacturing and assembly of systems and devices used for nasal, oral,

pulmonary and injectable delivery of drugs used to treat diseases affecting

people around the world.

Sales of

healthcare devices represent approximately 17%, 16% and 18% of consolidated net

sales for 2009, 2008 and 2007, respectively.

The Tech

Group segment also has expertise in product design and development, including

in-house mold design and construction, an engineering center for developmental

and prototype tooling, process design and validation and high-speed automated

assemblies. Technologies include multi-component molding, in-mold

labeling, ultrasonic welding and clean room molding and device

assembly.

Our

ConfiDose® auto-injector system enhances patient compliance and safety. With

ConfiDose, the needle remains shielded at all times and retracts automatically

after the injection. The system eliminates preparation steps and automates the

injection of drugs, providing patients with a sterile, single-use disposable

system that can be readily used at home. The Tech Group segment is responsible

for manufacturing and assembling commercial quantities of this

system.

2010 Business Operations Realignment

On

December 15, 2009, our Board of Directors approved a realignment of our business

operations into two new divisions, “Pharmaceutical Packaging Systems” and

“Pharmaceutical Delivery Systems,” effective January 1, 2010. Pharmaceutical

Packaging Systems will focus on primary container solutions, including

components for drug packaging and prefillable syringe systems. The division will

consist of our core pharmaceutical packaging products, disposable medical

components, and laboratory and other services. The growth strategy for the

Pharmaceutical Packaging Systems division includes organic growth through market

segmentation, new-product innovation, strategic acquisitions and geographic

expansion.

6

The

Pharmaceutical Delivery Systems division will focus on safety and administration

systems and multi-component systems for drug administration. It will consist of

the injection-molding and assembly business from the current Tech Group segment,

advanced injection systems and other innovation-related products and businesses.

We intend to pursue growth in the Pharmaceutical Delivery Systems division

through the development and commercialization of proprietary multi-component

systems for injectable drug administration and other healthcare

applications.

Restructuring Initiatives

In

December 2007, our Board of Directors approved a restructuring plan for the Tech

Group in an effort to align our plant capacity and workforce with the revised

business outlook and longer-term strategy of focusing the business on

proprietary products. As part of this plan, we implemented a series of

initiatives to reduce operating costs and increase the manufacturing efficiency

of the segment. We incurred a total of $7.5 million in restructuring and related

charges, as part of this plan, through its completion in June 2009.

In

November 2009, we announced restructuring plans for certain business operations

and support functions affecting both of our reporting segments. The

Pharmaceutical Systems plan involves exiting certain specialized laboratory

service offerings due to a change in market demand, reducing support personnel

primarily associated with information technology applications and discontinuing

other non-core initiatives and disposing of the associated assets. The Tech

Group plan is intended to better align our available production capacity with

expected levels of contract manufacturing activity by consolidating

manufacturing operations and support functions. We expect to incur approximately

$9.0 million in restructuring charges and eliminate an estimated 100 positions

as part of these plans. During 2009, Pharmaceutical Systems incurred actual

charges of $7.0 million and Tech Group incurred charges of $0.6 million, with

the balance expected to be incurred through 2010 as the associated activities

are completed. For additional details, see Note 4, Restructuring and Other

Items, to our consolidated financial statements.

We have

significant operations outside the U.S. They are managed through the

same business segments as our U.S. operations – Pharmaceutical Systems and Tech

Group. Sales outside of the U.S. account for approximately 52% of

consolidated net sales. For a geographic breakdown of sales, see the table in

Note 6, Segment

Information, to the consolidated financial statements.

Although

the general business processes are similar to the domestic business,

international operations are exposed to additional risks. These risks

include currency fluctuations relative to the U.S. dollar, multiple tax

jurisdictions and, particularly in Latin and South America and Israel, political

and social issues that could destabilize local markets and affect the demand for

our products.

Depending

on the direction of change relative to the U.S. dollar, foreign currency values

can increase or decrease the reported dollar value of our net assets and results

of operations. See the discussion under the caption Summary of Significant Accounting

Policies - Foreign Currency Translation in Note 1 to our consolidated

financial statements. We also have exposure to the impact of changes in currency

exchange rates on assets and liabilities that are not denominated in the

functional currency of the respective subsidiary. We attempt to minimize some of

our exposure to these exchange rate fluctuations through the use of forward

exchange contracts and foreign currency denominated debt. This

activity is generally discussed in Note 1 under the caption Summary of Significant Accounting

Policies – Financial Instruments and in Note 14, Derivative Financial

Instruments, to our consolidated financial statements in this 2009 Form

10-K.

Raw Materials

We use

three basic raw materials in the manufacture of our products: elastomers,

aluminum and plastic. Elastomers include both natural and synthetic materials.

We have access to adequate supplies of these raw materials to meet our

production needs through agreements with suppliers.

7

We employ

a supply-chain management strategy in our reporting segments, which involves

purchasing from integrated suppliers that control their own sources of supply.

This strategy has reduced the number of our raw material suppliers. Due to

regulatory control over our production processes, and the cost and time involved

in qualifying suppliers, we rely on single-source suppliers for many critical

raw materials. This strategy increases the risk that our supply lines may be

interrupted in the event of a supplier production problem. These risks are

managed, where possible, by selecting suppliers with multiple manufacturing

sites, rigid quality control systems, surplus inventory levels and other methods

of maintaining supply in case of an interruption in production, and therefore we

foresee no significant availability problems in the near future.

Intellectual Property Rights

Patents

and other proprietary rights are important to our business. We own or license

numerous patents and have patent applications pending in the U.S. and in other

countries that relate to various aspects of our products. In addition, key

value-added and proprietary products and processes are licensed from our

Japanese affiliate, Daikyo Seiko Ltd. Our patents and other proprietary rights

have been useful in establishing our market share and in the growth of our

business, and are expected to continue to be of value in the future, as we

continue to develop proprietary products. Although important in the aggregate,

we do not consider our business to be materially dependent on any individual

patent.

We also

rely heavily on trade secrets, manufacturing know-how and continuing

technological innovations, as well as in-licensing opportunities, to maintain

and further develop our competitive position, particularly in the area of

formulation development and tooling design.

Although

our Pharmaceutical Systems business is not inherently seasonal, sales and

operating profit in the second half of the year are typically lower than the

first half primarily due to scheduled plant shutdowns in conjunction with our

customers’ production schedules and the year-end impact of holidays on

production. During the shutdown periods, maintenance procedures are performed

and vacations are taken by production employees.

Working Capital

We are

required to carry significant amounts of inventory to meet customer

requirements. Other agreements also require us to purchase inventory in bulk

orders, which increases inventory levels but decreases the risk of supply

interruption. Levels of inventory are also influenced by the seasonal patterns

addressed above. For a more detailed discussion of working capital, please see

the discussion in Management’s

Discussion and Analysis of Financial Condition and Results of Operations

under the caption Financial Condition, Liquidity and

Capital Resources.

Our

Pharmaceutical Systems customers include practically every major branded

pharmaceutical, generic and biopharmaceutical company in the world.

Pharmaceutical Systems components and other products are sold to major

pharmaceutical, biotechnology and hospital supply/medical device companies,

which incorporate them into their products for distribution to the ultimate

end-user.

With

extensive experience in contract manufacturing, our Tech Group segment sells to

many of the world’s largest medical device and pharmaceutical companies and to

large customers in the personal care and food-and-beverage industries. Tech

Group components generally are incorporated into our customers’ manufacturing

lines for further processing or assembly. West’s products and services are

distributed primarily through our own sales force and distribution network, with

limited use of contract sales agents and regional distributors.

Our ten

largest customers accounted for 38.3% of our consolidated net sales in 2009, but

not one of these customers individually accounted for more than 10% of net

sales.

8

Order Backlog

At

December 31, 2009, our order backlog was $238.7 million, most of which is

expected to be filled during fiscal year 2010. The order backlog was $230.1

million at the end of 2008. The increase is primarily due to foreign currency

translation. Order backlog includes firm orders placed by customers for

manufacture over a period of time according to their schedule or upon

confirmation by the customer. We also have contractual arrangements with a

number of our customers, and products covered by these contracts are included in

our backlog only as orders are received.

We

compete with several companies across our Pharmaceutical Systems product lines.

However, we believe that we supply a major portion of the U.S. market for

pharmaceutical elastomer and metal packaging components and have a significant

share of the European market for these components. Because of the special nature

of our pharmaceutical packaging components and our long-standing participation

in the market, competition is based primarily on product design and performance,

although total cost is becoming increasingly important as pharmaceutical

companies continue with aggressive cost-control programs across their

operations.

We

differentiate ourselves from our competition as a "full-service, value-added"

global supplier that can provide pre-sale formula and engineering development,

analytical services, regulatory expertise and post-manufacturing technologies,

as well as after-sale technical support. Customers also appreciate the global

scope of West’s manufacturing capability and our ability to produce many

products at multiple sites.

Our Tech

Group business is in very competitive markets for both healthcare and consumer

products. The competition varies from smaller regional companies to large global

molders that command significant market shares. There are extreme cost pressures

and many of our customers look off-shore to reduce cost. We differentiate

ourselves by leveraging our global capability and by employing new technologies

such as high-speed automated assembly, insert-molding, multi-shot molding and

expertise with multiple-piece closure systems. Because of the more demanding

regulatory requirements in the medical device component area, there are a

smaller number of other competitors, mostly large-scale companies. We compete

for this market on the basis of our reputation for quality and reliability in

engineering and project management, diverse contract manufacturing capabilities

and knowledge of and experience in complying with FDA requirements.

Research and Development Activities

We

maintain our own research-scale production facilities and laboratories for

developing new products and offer contract engineering design and development

services to assist customers with new product development. Our quality control,

regulatory and laboratory testing capabilities are used to ensure compliance

with applicable manufacturing and regulatory standards for primary and secondary

pharmaceutical packaging components. The engineering departments are responsible

for product and tooling design and testing, and for the design and construction

of processing equipment. The primary responsibility of our innovation group is

seeking new opportunities in injectable packaging and delivery systems, most of

which will be manufactured by our Tech Group segment and marketed by our

Pharmaceutical Systems segment. Research and development spending will continue

to increase as we pursue innovative strategic platforms in prefillable syringe,

injectable container, advanced injection and safety and administration

systems.

We spent

$18.0 million in 2009, $17.2 million in 2008 and $14.0 million in 2007 on

research and development for the Pharmaceutical Systems segment. The Tech Group

segment incurred research and development expenses of $1.9 million, $1.5

million, and $2.1 million in the years 2009, 2008 and 2007,

respectively.

Commercial

development of our new products and services for medical and pharmaceutical

applications commonly requires several years. New products that we develop may

require separate approval as medical devices, and products that are intended to

be used in packaging and delivery of pharmaceutical products will be subject to

both customer acceptance of our products and regulatory approval of the

customer’s products following our development period.

9

Environmental Regulations

We are

subject to various federal, state and local provisions regulating the discharge

of materials into the environment or otherwise relating to the protection of the

environment. Our compliance with these laws and regulations has not had a

material impact on our financial position or results of operations. There were

no material capital expenditures for environmental control facilities in fiscal

year 2009 and there are no material expenditures planned for such purposes in

fiscal year 2010.

As of

December 31, 2009, we employed 6,408 people in our operations throughout the

world.

ITEM 1A. RISK FACTORS.

The

statements in this section describe major risks to our business and should be

considered carefully. In addition, these statements constitute our cautionary

statements under the Private Securities Litigation Reform Act of

1995.

Our

disclosure and analysis in this 2009 Form 10-K contains some forward-looking

statements that are based on management’s beliefs and assumptions, current

expectations, estimates and forecasts. We also provide forward-looking

statements in other materials we release to the public as well as oral

forward-looking statements. Such statements give our current expectations or

forecasts of future events. They do not relate strictly to historical or current

facts. We have attempted, wherever possible, to identify forward-looking

statements by using words such as “estimate,” “expect,” “intend,” “believe,”

“plan,” “anticipate” and other words and terms of similar meaning. In

particular, these include statements relating to future actions, business plans

and prospects, new products, future performance or results of current or

anticipated products, sales efforts, expenses, interest rates, foreign-exchange

rates, economic effects, the outcome of contingencies, such as legal

proceedings, and financial results.

Many

of the factors that will determine our future results are beyond our ability to

control or predict. Achievement of future results is subject to known or unknown

risks or uncertainties, and therefore, actual results could differ materially

from past results and those expressed or implied in any forward-looking

statement. You should bear this in mind as you consider forward-looking

statements.

We

undertake no obligation to publicly update forward-looking statements, whether

as a result of new information, future events or otherwise. We also refer you to

further disclosures we make on related subjects in our Quarterly Reports on Form

10-Q and 8-K reports to the Securities and Exchange Commission.

Our

operating results may be adversely affected by unfavorable economic and market

conditions.

The

current uncertainty in the global economy, including the continuing effects of

recession or slow economic growth in the U.S., Europe and Asia, may negatively

affect our operating results. Examples of the effects of these continuing global

economic challenges include: our suppliers’ and our customers’ inability to

access the credit markets at commercially reasonable rates; reduction in sales

due to customers decreasing their inventories in the near-term or long-term or

due to liquidity difficulties; reduction in sales due to shortages of materials

we purchase from our suppliers; reduction in research and development efforts

and expenditures by our customers; our inability to hedge our currency and raw

material risks sufficiently or at commercially reasonable prices; insolvency of

suppliers or customers; inflationary pressures on our supplies or our products;

and increased expenses due to growing taxation of corporate profits or revenues.

Our operating results in one or more geographic regions may also be affected by

uncertain or changing economic conditions within that region. If global economic

and market conditions, or economic conditions in the U.S., Europe or Asia remain

uncertain or weaken further, we may experience material adverse impacts on our

business, financial condition and results of operations.

10

We

are exposed to credit risk on accounts receivable and certain prepayments made

in the normal course of business. This risk is heightened during periods when

economic conditions worsen.

A

substantial majority of our outstanding trade receivables are not covered by

collateral or credit insurance. In addition, we have made prepayments associated

with insurance premiums and other advances in the normal course of business.

While we have procedures to monitor and limit exposure to credit risk on trade

receivables and other current assets, there can be no assurance such procedures

will effectively limit our credit risk and avoid losses, which could have a

material adverse effect on our financial condition and operating

results.

We

are exposed to fluctuations in the market values and the risk of loss of our

investment portfolio.

Our

available cash and cash equivalents are held in bank deposits, money market

funds and other short-term investments. We have funds in our operating accounts

that are with third-party financial institutions. These balances in the U.S. may

exceed the FDIC (Federal Deposit Insurance Corporation) insurance limits. While

we monitor the cash balances in our operating accounts, and adjust the balances

as appropriate, we could lose this cash or be unable to withdraw it in a timely

manner if the underlying financial institutions fail. Although we have not

recognized any material losses on our cash, cash equivalents and other cash

investments, future declines in their market values or other unexpected losses

could have a material adverse effect on our financial condition and operating

results.

Our

sales and profitability depend to a large extent on the sale of drug products

delivered by injection. If the products developed by our customers in the future

use another delivery system, our sales and profitability could

suffer.

Our

business depends to a substantial extent on customers' continued sales and

development of products that are delivered by injection. If our customers fail

to continue to sell, develop and deploy new injectable products or we are unable

to develop new products that assist in the delivery of drugs by alternative

methods, our sales and profitability may suffer.

If

we are unable to provide comparative value advantages, timely fulfillment of

customer orders, or resist pricing pressure, we will have to reduce our prices,

which may negatively impact our profit margins.

We

compete with several companies across our major product lines. Because of the

special nature of these products, competition is based primarily on product

design and performance, although total cost is becoming increasingly important

as pharmaceutical companies continue with aggressive cost control programs

across their entire operations. Competitors often compete on the basis of price.

We differentiate ourselves from our competition as a "full-service value-added"

supplier that is able to provide pre-sale compatibility studies and other

services and sophisticated post-sale technical support on a global basis.

However, we face continued pricing pressure from our customers and competitors.

If we are unable to resist or to offset the effects of continued pricing

pressure through our value-added services, improved operating efficiencies and

reduced expenditures, or if we have to reduce our prices, our sales and

profitability may suffer.

If we are

unable to expand our production capacity at our European and Asian facilities,

there may be a delay in fulfilling or we may be unable to fulfill customer

orders and this could potentially reduce our sales and our profitability may

suffer.

We

have significant indebtedness and debt service payments which could negatively

impact our liquidity.

We owe

substantial debts and have to commit significant cash flow to debt service

requirements. The level of our indebtedness, among other things,

could:

|

·

|

make

it difficult for us to obtain any necessary future financing for working

capital, capital expenditures, debt service requirements or other

purposes;

|

11

|

·

|

limit

our flexibility in planning for, or reacting to changes in, our business;

and

|

|

·

|

make

our financial results and share value more vulnerable in the event of a

downturn in our business.

|

Our

ability to meet our debt service obligations and to reduce our total

indebtedness depends on the results of our product development efforts, our

future operating performance, our ability to generate cash flow from the sale of

our products and on general economic, financial, competitive, legislative,

regulatory and other factors affecting our operations. Many of these factors are

beyond our control and our future operating performance could be adversely

affected by some or all of these factors.

If we

incur new indebtedness in the future, the related risks that we now face could

intensify. Whether we are able to make required payments on our outstanding

indebtedness and satisfy any other future debt obligations will depend on our

future operating performance and our ability to obtain additional debt or equity

financing.

Our

intellectual property assets may not prevent competitive offerings.

Our

patents, trademarks and other intellectual property may not prevent competitors

from independently developing products and services similar to or duplicative to

ours, nor can there be any assurance that the resources invested by us to

protect our intellectual property will be sufficient or that our intellectual

property portfolio will adequately deter misappropriation or improper use of our

technology. In addition, we may be the target of aggressive enforcement of

patents held by third parties. Any litigation regarding our intellectual

property rights could be time-consuming and costly and the results could be

unpredictable.

We

are subject to regulation by governments around the world, and if these

regulations are not complied with, existing and future operations may be

curtailed, and we could be subject to liability.

The

design, development, manufacturing, marketing and labeling of certain of our

products and our customers’ products that incorporate our products are subject

to regulation by governmental authorities in the U.S., Europe and other

countries, including the FDA and the European Medicines Agency. The regulatory

process can result in required modification or withdrawal of existing products

and a substantial delay in the introduction of new products. Also, it is

possible that regulatory approval may not be obtained for a new product. In

addition, our analytical laboratories perform certain contract services for drug

manufacturers and are subject to the FDA's current good manufacturing practices

regulations. We must also register as a contract laboratory with the FDA and are

subject to periodic inspections by the FDA. The Drug Enforcement Administration

has licensed our contract analytical laboratories to handle and store controlled

substances. Failure to comply with applicable regulatory requirements can result

in actions that could adversely affect our business and financial

performance.

Our

business may be adversely affected by changes in the regulation of drug products

and devices.

An effect

of the governmental regulation of our customers’ drug products, devices, and

manufacturing processes is that compliance with regulations makes it costly and

time-consuming for customers to substitute or replace components and devices

produced by one supplier with those from another. In general terms, regulation

of our customers’ products that incorporate our components and devices has

increased over time. However, if the applicable regulations were to

be modified in a way that reduced the cost and time involved for customers to

substitute one supplier’s components or devices for those made by another, it is

likely that the competitive pressure on us would increase and adversely affect

our sales and profitability.

12

Our

business may be adversely affected by risks typically encountered in

international operations.

We

conduct business in most of the major pharmaceutical markets in the world. Sales

outside the U.S. account for approximately 52% of consolidated net sales.

Virtually all of these sales and related operating costs are denominated in the

currency of the local country and translated into U.S. dollars, which can result

in significant increases or decreases in the amount of those sales or earnings.

The main currencies, to which we are exposed, besides the U.S. dollar, are the

Euro, British Pound, Danish Krone and Singapore Dollar. The exchange rates

between these currencies and the U.S. dollar in recent years have fluctuated

significantly and may continue to do so in the future. In addition to

translation risks, we incur currency transaction gains or losses when we or one

of our subsidiaries enters into a purchase or sales transaction in a currency

other than that entity’s local currency.

International

operations are also exposed to the following risks: transportation delays and

interruptions; political and economic instability and disruptions; imposition of

duties and tariffs; import and export controls; the risks of divergent business

expectations or cultural incompatibility inherent in establishing and

maintaining operations in foreign countries; difficulties in staffing and

managing multi-national operations; labor strikes and/or disputes; and

potentially adverse tax consequences. Limitations on our ability to enforce

legal rights and remedies with third parties or our joint venture partners

outside of the U.S. could also create exposure. In addition, we may not be able

to operate in compliance with foreign laws and regulations, or comply with

applicable customs, currency exchange control regulations, transfer pricing

regulations or any other laws or regulations to which we may be subject, in the

event that these laws or regulations change.

Any of

these events could have an adverse effect on our international operations in the

future by reducing the demand for our products, decreasing the prices at which

we can sell our products or otherwise have an adverse effect on our financial

condition, results of operations and cash flows.

Raw

material and energy prices have a significant impact on our profitability. If

raw material and/or energy prices increase, and we cannot pass those price

increases on to our customers, our profitability and financial condition may

suffer.

We use

three basic raw materials in the manufacture of our products: elastomers (which

include synthetic and natural material), aluminum and plastic. In addition, our

manufacturing facilities consume a wide variety of energy products to fuel, heat

and cool our operations. Supply and demand factors, which are beyond our

control, generally affect the price of our raw materials and utility costs. If

we are unable to pass along increased raw material prices and energy costs to

our customers, our profitability, and thus our financial condition, may be

adversely affected. The prices of many of these raw materials and utilities are

cyclical and volatile. For example, the prices of certain commodities,

particularly petroleum-based raw materials, have in the recent past exhibited

rapid changes, increasing the cost of synthetic elastomers and plastic. While we

generally attempt to pass along increased costs to our customers in the form of

sales price increases, historically there has been a time delay between raw

material and/or energy price increases and our ability to increase the prices of

our products. In some circumstances, we may not be able to increase the prices

of our products due to competitive pressure and other factors.

Disruptions

in the supply of key raw materials and difficulties in the supplier

qualification process, could adversely impact our operations.

We employ

a supply chain management strategy in our reporting segments, which involves

purchasing from integrated suppliers that control their own sources of supply.

This strategy has reduced the number of raw material suppliers used by us. This

increases the risk that our supply lines may be interrupted in the event of a

supplier production problem or financial difficulties. If one of our suppliers

is unable to supply materials needed for our products or our strategies for

managing these risks are unsuccessful, we may be unable to complete the process

of qualifying new replacement materials for some programs in time to meet future

production needs. Prolonged disruptions in the supply of any of our key raw

materials, difficulty completing qualification of new sources of supply, or in

implementing the use of replacement materials or new sources of supply could

have a material adverse effect on our operating results, financial condition or

cash flows.

13

Our

operations must comply with environmental statutes and regulations, and any

failure to comply could result in extensive costs which would harm our

business.

The

manufacture of some of our products involves the use, transportation, storage

and disposal of hazardous or toxic materials and is subject to various

environmental protection and occupational health and safety laws and regulations

in the countries in which we operate. This has exposed us in the past, and could

expose us in the future, to risks of accidental contamination and events of

non-compliance with environmental laws. Any such occurrences could result in

regulatory enforcement or personal injury and property damage claims or could

lead to a shutdown of some of our operations, which could have an adverse effect

on our business and results of operations. We currently incur costs to comply

with environmental laws and regulations and these costs may become more

significant.

A

loss of key personnel or highly skilled employees could disrupt our

operations.

Our

executive officers are critical to the management and direction of our

businesses. Our future success depends, in large part, on our ability to retain

these officers and other capable management personnel. With the exception of our

chief executive officer, in general, we do not enter into employment agreements

with our executive officers. We have entered into severance agreements with our

officers that allow those officers to terminate their employment under

particular circumstances, such as a change of control affecting our company.

Although we believe that we will be able to attract and retain talented

personnel and replace key personnel should the need arise, our inability to do

so could disrupt the operations of the unit affected or our overall operations.

In addition, because of the complex nature of many of our products and programs,

we are generally dependent on an educated and highly skilled engineering staff

and workforce. Our operations could be disrupted by a shortage of available

skilled employees.

The

disruption of our normal business activities as a result of the implementation

of our new enterprise resource planning system and updates to shop floor systems

could have an adverse effect on our business and results of

operations.

During

the second quarter of 2008, we successfully replaced our financial reporting,

cash disbursement and order-to-cash systems in our North American operations

with a new enterprise resource planning (“ERP”) system. Phase two of the ERP

project, which focused on the replacement of planning and manufacturing systems,

as well as updates to shop floor systems, commenced in late 2008 and was

completed in the fourth quarter of 2009.

Our ERP

system is critical to our ability to accurately and efficiently maintain our

books and records, record transactions, provide critical information to our

management and prepare our financial statements. We have invested significant

capital and human resources in the design and implementation of this system. The

inability of the ERP and shop floor systems to work as anticipated could

adversely affect our ability to process and ship orders, provide services and

customer support, bill and track customers, fulfill contractual obligations and

file quarterly or annual reports with the SEC in a timely manner. The resulting

disruptions to our business could adversely affect our results of operations,

financial condition and cash flows.

Our

acquisition strategy may not yield the expected benefits.

We are

always analyzing our prospects for growth by acquisition of companies or other

entities with developing technology and other assets that we believe would be

helpful to our growth and profit. The integration of any or all completed or

planned acquisitions may not be successful. The tax and other benefits expected

from the acquisitions that we have entered into or may enter into may not

materialize due to changes in applicable laws or regulations, uncertainties in

the application of laws or regulations or the inability to achieve expected

levels of sales and operating profit.

14

Our

recent realignment of our business units may not deliver the expected

growth.

Effective

January 1, 2010, we realigned our business operations into two divisions,

“Pharmaceutical Packaging Systems” and “Pharmaceutical Delivery Systems.” Our

new Pharmaceutical Delivery Systems division plans to pursue growth through the

development and commercialization of proprietary multi-component systems for

injectable drug administration and other healthcare applications. Although we

believe that this effort will be successful, this division’s growth could suffer

if proprietary systems cannot be developed quickly enough or on a cost-efficient

basis or if they are not of sufficient commercial value. Growth in this division

could also suffer as a result of soft demand by our customers or if anticipated

markets for these products do not develop. Additionally, our Pharmaceutical

Delivery Systems division will be subject to further regulatory oversight than

our business has historically been subject to, and there can be no guarantee

that we will be able to successfully meet the new regulatory obligations in a

commercially reasonable manner.

The

uncertain effects of potential climate change legislation could lead to

significantly increased costs.

If

legislation or regulations are enacted or promulgated in the U.S., Europe or

Asia or any other jurisdictions in which we do business that limit or reduce

allowable greenhouse gas emissions and other emissions, such restrictions could

have a significant effect on our operating and financial decisions, including

those involving capital expenditures to reduce emissions, and our results of

operations. Our manufacturing operations may not be able to operate as planned

if we are not able to comply with new legal and regulatory legislation around

climate change, or it may become too costly to operate in a profitable manner.

Additionally, suppliers’ added expenses could be passed on to us in the form of

higher prices and we may not be able to pass on such expenses to our customers

through price increases.

The

uncertain effects of potential healthcare legislation in the U.S. could lead to

significantly increased costs and other unforeseen consequences.

Political,

economic and regulatory influences are subjecting the healthcare industry in the

U.S. to potential fundamental changes. The effects of this potential legislation

and any regulations that emanate from it are uncertain at this time. However,

based on drafts of the legislation that have passed in the U.S. Senate and the

U.S. House of Representatives and proposals put forth by the Obama

Administration, we expect that this potential reform could result in significant

costs for us and also for our customers. One proposal, an excise tax on medical

device companies, may result in a significant increase in the tax burden on our

new Pharmaceutical Delivery Systems division. In addition, this reform may

impose enhanced benefit requirements for our employees which could increase our

labor costs significantly. Until legislation is final, however, the full range

of consequences stemming from this reform is difficult to predict.

As of the

filing of this annual report on Form 10-K, there were no unresolved comments

from the Staff of the Securities and Exchange Commission.

15

ITEM 2. PROPERTIES.

Our

corporate headquarters are located in a leased building at 101 Gordon Drive,

Lionville, Pennsylvania. This building also houses our North American

sales and marketing, administrative support and customer service

functions.

The

following table summarizes production facilities by segment and geographic

region. All facilities shown are owned except where otherwise

noted.

|

Pharmaceutical Systems

|

|

|

Manufacturing:

|

Contract

Analytical Laboratory:

|

|

North

American Operations

|

North

American Operations

|

|

United

States

Clearwater,

FL (1)

Jersey

Shore, PA

Kearney,

NE

Kinston,

NC

Lititz,

PA

St.

Petersburg, FL

South

American Operations

Brazil

Sao

Paulo

European

Operations

Denmark

Horsens

England

St.

Austell

France

Le

Nouvion

Le

Vaudreuil (2)

Germany

Eschweiler (1)

Stolberg

Serbia

Kovin

Asia

Pacific Operations

China

Shanghai

Singapore

Jurong

|

United States

Lionville, PA (2)

Maumee, OH

Mold-and-Die

Tool Shops:

North

American Operations

United

States

Upper Darby, PA (2)

European Operations

England

Bodmin (2)

Tech Group

Manufacturing:

North

American Operations

United

States

Frankfort,

IN (2)

Grand

Rapids, MI

Montgomery,

PA (2)

Phoenix,

AZ (2)

Scottsdale,

AZ (2)

(3)

Tempe,

AZ (2)

Williamsport,

PA

Puerto

Rico

Cayey

European

Operations

Ireland

Dublin (2)

Mold-and-Die

Tool Shop:

European

Operations

Denmark

Roskilde (2)

|

|

(1)

|

This

manufacturing facility is also used for research and development

activities.

|

|

(2)

|

This

facility is leased in whole or in

part.

|

|

(3)

|

This

manufacturing facility is also used for mold and die

production.

|

Our

Pharmaceutical Systems segment also owns facilities located in Ra’anana, Israel

and Athens, Texas used for research and development activities. Sales offices in

various locations are leased under short-term arrangements.

16

Our

manufacturing production facilities are well maintained and are operating

generally on two or three shifts. During the last two years, we made

significant strides in increasing our plant capacity in Germany, Serbia, France,

Singapore and the U.S. As part of our effort to increase manufacturing capacity,

we continue to move forward in establishing a manufacturing presence in the

Peoples Republic of China. During 2009, we completed construction of our China

plastic components facility and started commercial production. We continue to

evaluate opportunities for constructing rubber manufacturing facilities in China

and India.

ITEM

3. LEGAL

PROCEEDINGS.

None.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY

HOLDERS.

None.

EXECUTIVE OFFICERS OF THE COMPANY

The

executive officers of the Company are set forth in this table. Each holds the

offices indicated until his successor is chosen and qualified at the regular

meeting of the board of directors to be held immediately following the 2010

Annual Meeting of Shareholders.

|

Name

|

Age

|

Position

|

|

Joseph

E. Abbott

|

57

|

Vice

President since March 2002 and Corporate Controller since July

2000. He was Director of Internal Audit from June 1997 to July

2000.

|

|

Michael

A. Anderson

|

54

|

Vice

President and Treasurer since June 2001. He was Finance

Director, Drug Delivery Systems Division from October 1999 to June 2001,

Vice President, Business Development from July 1997 to October 1999 and

Director of Taxes from July 1992 to April 1997.

|

|

Steven

A. Ellers

|

59

|

President

since June 2005 and Chief Operating Officer since February

2010. Previously, he served as Chief Operating Officer from

June 2005 through July 2008, Executive Vice President from June 2001 to

June 2005 and Chief Financial Officer from April 1998 to July 2000, and he

held numerous positions in operations prior thereto.

|

|

William

J. Federici

|

50

|

Vice

President and Chief Financial Officer since joining the Company in August

2003. He was National Industry Director for Pharmaceuticals of

KPMG LLP (accounting firm) from June 2002 until August 2003 and prior

thereto, an audit partner with Arthur Andersen, LLP.

|

|

John

R. Gailey III

|

55

|

Vice

President since December 1995, General Counsel since May 1994 and

Secretary since November 1991. He served as Corporate Counsel

from 1991 until his appointment as General Counsel.

|

17

|

Heino

Lennartz

|

44

|

President,

Pharmaceutical Packaging Systems Europe Region since February 2010 and,

prior thereto, President, Europe, Pharmaceutical Systems since July

2009. He was Vice President Finance, MIS & Purchasing for

Europe & Asia Pacific from December 2006 until July

2009. Mr. Lennartz was Vice President Corporate Finance of

AIXTRON AG, a leading semiconductor equipment company, from 2003 to 2006

and, prior thereto, held various positions, including Director Business

Systems Europe, at GDX Automotive, a rubber and plastic car body sealing

system supplier.

|

|

Richard

D. Luzzi

|

58

|

Vice

President, Human Resources since June 2002. He served as Vice

President, Human Resources of GS Industries, a steel manufacturer, from

1998 to 2002, Vice President, Human Resources of Lukens Steel from 1993 to

1998, and Vice President, Human Resources of Rockwell International, from

1990 to 1993.

|

|

Donald

A. McMillan

|

51

|

President,

Pharmaceutical Packaging Systems Americas Region since February 2010, and,

prior thereto, President, Americas, Pharmaceutical Systems since July

2008. He was President, North America, Pharmaceutical Systems

Division from October 2005 to July 2008 and held numerous positions of

increasing responsibility prior thereto, including Vice President,

Marketing, North America from September 2002 to October 2005 and Americas

Regional Director from July 1997 to September 2000.

|

|

Donald

E. Morel, Jr., Ph.D.

|

52

|

Chairman

of the Board of the Company since March 2003 and our Chief Executive

Officer since April 2002. He was our President from April 2002

to June 2006 and Chief Operating Officer from May 2001 to April

2002. He was Division President, Drug Delivery Systems from

October 1999 to May 2001, and prior thereto, Group President.

|

|

John

Paproski

|

53

|

President,

Pharmaceutical Delivery Systems since December 2009. He was

Vice President of Innovation, from January 2005 to December 2009 and Vice

President, Global Product Development from August 1996 to January

2005. He has held numerous other operations and engineering

positions within the Company, including Vice President of Rubber

Operations from August 1993 to January 2005 and Director of Manufacturing

Engineering from 1991 to 1993.

|

|

Ron

van Dijk

|

49

|

President,

Pharmaceutical Packaging Systems Asia Pacific Region since February 2010

and, prior thereto, President, Asia Pacific, Pharmaceutical Systems since

July 2009. He has served in a variety of capacities with

increasing responsibility since 1997, including as Manager, Financial

Planning and Analysis Europe from March 1997 to December 2002, Director of

Finance, Europe and Asia Pacific from January 2003 to March 2005, Vice

President Finance and MIS for Europe and Asia Pacific from April 2005 to

September 2006 and Managing Director and Vice President Asia Pacific from

October 2006 to June 2009.

|

18

PART II

ITEM

5. MARKET

FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES

OF EQUITY SECURITIES.

Our

common stock is listed on the New York Stock Exchange. The high and low prices

for the stock for each calendar quarter in 2009 and 2008 and full year 2009 and

2008 were as follows:

|

First

Quarter

|

Second

Quarter

|

Third

Quarter

|

Fourth

Quarter

|

Year

|

||||||||||||||||||||||||||||||||||||

|

High

|

Low

|

High

|

Low

|

High

|

Low

|

High

|

Low

|

High

|

Low

|

|||||||||||||||||||||||||||||||

|

2009

|

38.50 | 27.85 | 35.19 | 31.28 | 41.22 | 31.65 | 41.77 | 36.65 | 41.77 | 27.85 | ||||||||||||||||||||||||||||||

|

2008

|

45.47 | 36.96 | 48.92 | 43.04 | 52.00 | 42.26 | 49.60 | 29.52 | 52.00 | 29.52 | ||||||||||||||||||||||||||||||

As of

January 31, 2010, we had 1,210 shareholders of record. There were also 2,741

holders of shares registered in nominee names. Our common stock paid

a quarterly dividend of $0.14 per share in each of the first three quarters of

2008; $0.15 per share in the fourth quarter of 2008 and each of the first three

quarters of 2009; and $0.16 per share in the fourth quarter of

2009.

Issuer

Purchases of Equity Securities

The

following table shows information with respect to purchases of our common stock

made during the three months ended December 31, 2009 by us or any of our

“affiliated purchasers” as defined in Rule 10b-18(a)(3) under the Exchange

Act:

|

Period

|

Total

number of shares purchased (1)(2)(3)

|

Average

price paid per share

|

Total

number of shares purchased as part of publicly announced plans or

programs

|

Maximum

number of shares that may yet be purchased under the plans or

programs

|

||||||||||||

|

October

1 – 31, 2009

|

- | $ | - | - | - | |||||||||||

|

November

1 – 30, 2009

|

575 | 37.44 | - | - | ||||||||||||

|

December

1 – 31, 2009

|

15,111 | 39.57 | - | - | ||||||||||||

|

Total

|

15,686 | $ | 39.49 | - | - | |||||||||||

(1) Includes

654 shares purchased on behalf of employees enrolled in the Non-Qualified

Deferred Compensation Plan for Designated Officers (Amended and Restated

Effective January 1, 2008). Under the plan, Company match

contributions are delivered to the plan’s investment administrator, who upon

receipt, purchases shares in the open market and credits the shares to

individual plan accounts.

(2) Includes

8,223 shares of common stock acquired from employees who tendered already-owned

shares to satisfy the exercise price on option exercises as part of our 2007

Omnibus Incentive Compensation Plan (the “2007 Plan”).

(3) Includes

6,809 shares of common stock acquired from employees who tendered already-owned

shares to satisfy withholding tax obligations on option exercises, as part of

the 2007 Plan.

19

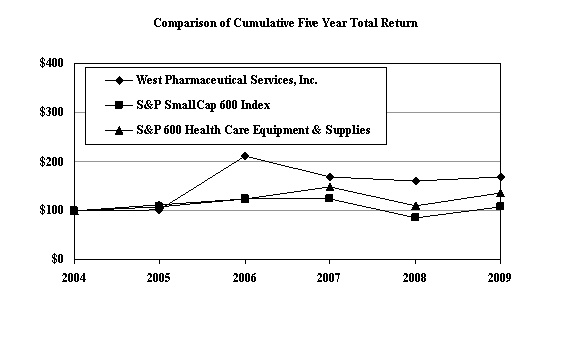

Performance

Graph

The

following graph compares the cumulative total return to holders of our common

stock with the cumulative total return of the Standard & Poor’s SmallCap 600

Index and the Standard & Poor’s 600 Health Care Equipment & Supplies

Industry for the five years ended December 31, 2009. Cumulative total return to

shareholders is measured by dividing total dividends (assuming dividend

reinvestment) plus the per-share price change for the period by the share price

at the beginning of the period. The Company’s cumulative shareholder return is

based on an investment of $100 on December 31, 2004 and is compared to the

cumulative total return of the SmallCap 600 Index and the 600 Health Care

Equipment & Supplies Industry over the period with a like amount

invested.

20

ITEM

6. SELECTED FINANCIAL DATA.

FIVE-YEAR

SUMMARY

West

Pharmaceutical Services, Inc. and Subsidiaries

|

(in

millions, except per share data)

|

2009

|

2008

|

2007

|

2006

|

2005

|

|||||||||||||||

|

SUMMARY

OF OPERATIONS

|

||||||||||||||||||||

|

Net

sales

|

$ | 1,055.7 | $ | 1,051.1 | $ | 1,020.1 | $ | 913.3 | $ | 699.7 | ||||||||||

|

Operating

profit

|

97.5 | 124.1 | 94.9 | 101.0 | 73.4 | |||||||||||||||

|

Income

from continuing operations

|

72.6 | 86.6 | 71.7 | 61.8 | 46.1 | |||||||||||||||

|

(Loss)

income from discontinued operations

|

- | - | (0.5 | ) | 5.6 | 0.4 | ||||||||||||||

|

Net

income

|

72.6 | 86.6 | 71.2 | 67.4 | 46.5 | |||||||||||||||

|

Less:

net income attributable to noncontrolling interests

|

- | 0.6 | 0.5 | 0.3 | 0.1 | |||||||||||||||

|

Net

income attributable to common shareholders

|

$ | 72.6 | $ | 86.0 | $ | 70.7 | $ | 67.1 | $ | 46.4 | ||||||||||

|

Income

per share attributable to common shareholders from continuing

operations:

|

||||||||||||||||||||

|

Basic

(1)

|

$ | 2.21 | $ | 2.65 | $ | 2.18 | $ | 1.91 | $ | 1.48 | ||||||||||

|

Diluted

(2)

|

2.12 | 2.50 | 2.06 | 1.83 | 1.41 | |||||||||||||||

|

(Loss)

income per share attributable to common shareholders from discontinued

operations:

|