Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - PACIFIC PREMIER BANCORP INC | ex991-prfeb2020kbwwint.htm |

| 8-K - 8-K - PACIFIC PREMIER BANCORP INC | a8-kfeb2020kbwwinterfi.htm |

Exhibit 99.2 Filed by Pacific Premier Bancorp, Inc. Pursuant to Rule 425 under the Securities Act of 1933 Subject Company: Opus Bank SEC Registration Statement No.: 333- Investor Presentation Fourth Quarter 2019 Steve Gardner Chairman, President & Chief Executive Officer sgardner@ppbi.com 949-864-8000

FORWARD LOOKING STATEMENTS AND WHERE TO FIND MORE INFORMATION Forward Looking Statements This investor presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans and the future performance of Pacific Premier Bancorp, Inc. (“PPBI”), including its wholly-owned subsidiary Pacific Premier Bank (“Pacific Premier”), Opus Bank (“Opus”), including its wholly-owned subsidiary PENSCO Trust Company (“PENSCO”), and the proposed acquisition. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “could,” “may,” “should,” “will” or other similar words and expressions are intended to identify these forward-looking statements. These forward-looking statements are based on PPBI’s and Opus’s current expectations and assumptions regarding PPBI’s and Opus’s businesses, the economy, and other future conditions. Because forward- looking statements relate to future results and occurrences, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Many possible events or factors could affect PPBI’s or Opus’s future financial results and performance and could cause actual results or performance to differ materially from anticipated results or performance. Such risks and uncertainties include, among others: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive agreement and plan of reorganization by and among PPBI, Pacific Premier and Opus, the outcome of any legal proceedings that may be instituted against PPBI or Opus, delays in completing the transaction, the failure to obtain necessary regulatory approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction) and shareholder approvals or to satisfy any of the other conditions to the transaction on a timely basis or at all, the possibility that the anticipated benefits of the transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where PPBI and Opus do business, the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events, diversion of management’s attention from ongoing business operations and opportunities, potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction, the ability to complete the transaction and integration of Pacific Premier and Opus successfully, and the dilution caused by PPBI’s issuance of additional shares of its capital stock in connection with the transaction. Except to the extent required by applicable law or regulation, each of PPBI and Opus disclaims any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments. Further information regarding PPBI, Opus and factors which could affect the forward-looking statements contained herein can be found in PPBI’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018, its Quarterly Reports on Form 10-Q for the periods ended March 31, 2019, June 30, 2019 and September 30, 2019, and its other filings with the SEC, and in Opus’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018, its Quarterly Reports on Form 10-Q for the periods ended March 31, 2019, June 30, 2019 and September 30, 2019, and its other filings with the Federal Deposit Insurance Corporation (“FDIC”). Additional Information About the Merger and Where to Find It In connection with the proposed acquisition transaction, a registration statement on Form S-4 will be filed with the SEC that will include a joint proxy statement/prospectus filed with the SEC and the FDIC to be distributed to the shareholders of Opus and PPBI in connection with their votes on the acquisition. INVESTORS AND SECURITY HOLDERS ARE ENCOURAGED TO READ THE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS WHEN THEY BECOME AVAILABLE (AND ANY OTHER DOCUMENTS FILED WITH THE SEC OR THE FDIC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE JOINT PROXY STATEMENT/PROSPECTUS) BECAUSE SUCH DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION REGARDING THE PROPOSED MERGER AND RELATED MATTERS. The final joint proxy statement/prospectus will be mailed to shareholders of Opus and PPBI. Investors and security holders will be able to obtain the documents, and any other documents PPBI has filed with the SEC, free of charge at the SEC’s website, www.sec.gov or by accessing PPBI’s website at www.ppbi.com under the “Investors” link and then under the heading “SEC Filings”. Investors and security holders will be able to obtain the documents, and any other documents Opus has filed with the FDIC, free of charge at Opus’s website at www.opusbank.com under the tab “Investor Relations” and then under the heading “Presentations & Filings”. In addition, documents filed with the SEC by PPBI or with the FDIC by Opus will be available free of charge by (1) writing PPBI at 17901 Von Karman Avenue, Suite 1200, Irvine, CA 92614, Attention: Investor Relations, or (2) writing Opus at 19900 MacArthur Boulevard, 12th Floor, Irvine, CA 92612, Attention: Investor Relations. Before making any voting or investment decision, shareholders of PPBI and Opus are urged to read carefully the entire registration statement and joint proxy statement/prospectus when they become available, including any amendments thereto, because they will contain important information about the proposed transaction, PPBI and Opus. Free copies of these documents may be obtained as described above. The directors, executive officers and certain other members of management and employees of PPBI may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction from the shareholders of PPBI. Information about PPBI’s directors and executive officers is included in the proxy statement for its 2019 annual meeting of PPBI’s shareholders, which was filed with the SEC on April 9, 2019. The directors, executive officers and certain other members of management and employees of Opus may also be deemed to be participants in the solicitation of proxies in connection with the proposed transaction from the shareholders of Opus. Information about the directors and executive officers of Opus is included in the proxy statement for its 2019 annual meeting of Opus shareholders, which was filed with the FDIC on March 14, 2019. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the joint proxy statement/prospectus regarding the proposed acquisition when it becomes available. Free copies of this document may be obtained as described© 2019 Pacificabove Premier. Bancorp, Inc. | All rights reserved 2

CORPORATE OVERVIEW Headquarters Irvine, CA Exchange/Listing NASDAQ: PPBI Market Cap $1.81 Billion(1) Average Daily Volume 344,440 Shares(2) Outstanding Shares 59,528,249(1) Dividend Yield 3.29%(1)(3) # of Research Analysts 6 Analysts Focus Small & Mid-Market Businesses Total Assets $11.78 Billion(4) Branch Network 41 Full-Service Branch Locations 1. Market data as of February 6, 2020 2. 3-month average as of February 6, 2020 3. Annualized 4. As of 12/31/2019 © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 3

GEOGRAPHIC FOOTPRINT Premier banking franchise in the Western U.S. – well-positioned for further expansion Franchise Footprint 36 branches 3 branches Southern California and Arizona (Phoenix and Central Coast California Tucson) 1 1 branch branch Las Vegas, Nevada Vancouver, Washington California Footprint © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 4

HIGHLIGHTS – Q4 2019 Strong, consistent financial returns and profile • Net income of $41.1 million or $0.69 per diluted share • ROAA of 1.42%, and ROATCE of 15.89% Earnings • Efficiency ratio of 51.9% (1) • Net interest margin of 4.33%; core net interest margin of 4.10% (2) • Loan portfolio of $8.7 billion, a decrease of $35.2 million, or 0.4%, from Q3 2019 • New loan commitments of $556.3 million for the quarter at a 4.77% weighted average rate Loans and • Total delinquency as a percent of loans held for investment of 0.22% Asset Quality • Nonperforming assets as a percent of total assets of 0.08% • Classified assets to total assets of 0.39% • Total deposits of $8.9 billion, non-maturity deposits equal 88% of total deposits, NIBD represent 43% • Non-maturity deposit growth of $335.3 million or 18% annualized Deposits • Cost of funds decreased to 0.71% from 0.86% in Q3 2019 • Cost of deposits decreased to 0.58% from 0.71% in Q3 2019 • Cost of deposits at December 31, 2019 of 0.53% • Tangible book value per share of $18.84, 11% increase over 12/31/18 Capital • Increased quarterly cash dividend from $0.22 per share to $0.25 per share, payable in Q1 2020 • Announced a new $100 million buy-back authorization in Q4 2019 1. Represents the ratio of noninterest expense less other real estate owned operations, core deposit intangible amortization and merger-related expenses to the sum of net interest income before provision for loan losses and total noninterest income, less gain / (loss) on sales of securities, OTTI impairment, gain / (loss) of other real estate owned, and gain / (loss) from debt extinguishment 2. Please refer to non-U.S. GAAP reconciliation in appendix © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 5

VALUE CREATION STRATEGY Increase EPS and TBV by growing scale and operating leverage Expand our market presence through disciplined organic and acquisitive growth • Target ROAA of 1.50% • Target ROATCE of 17% - 18% Organic Growth Acquisitive Growth Focus on small and middle market Target commercial banks and commercial businesses specialized lines of business • Revenues of $5 - $250 million • Complementary geography / relationship focused / product • Emphasis on full banking relationships expansion • Full suite of commercial and SMID business products and • Attractive deposit profile with emphasis on non-maturity services deposits • Complementary business centric nationwide lines • Disciplined acquisition criteria: of business: – Accretive to EPS 1st full year – HOA Management, QSR Franchise, SBA – < 2 years TBV dilution payback • Disciplined sales process utilizing our customized – +15% IRR Salesforce technology • Solid track record of delivering value for shareholders © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 6

ACQUISITION HISTORY PPBI acquisitions have consistently enhanced franchise value • Over the last 6 years, TBVPS has grown 13% compounded annually • Assets have grown 38% compounded annually since 2013 Acquisition Timeline Total April 2017 and TBV/ July 2018 November 2017 Acquired Grandpoint Assets Acquired Heritage Share Capital, Inc. $18.84 Oaks Bancorp ($3.2B assets) $19.00 January 2014 ($2.0B assets) $14,000 Acquired Infinity January 2015 January 2016 and Plaza Bancorp Franchise Holdings Acquired Acquired Security ($1.3B assets) ($80MM assets), Independence Bank California Bancorp $16.97 March 2013 and a specialty finance ($422MM assets) ($715MM assets) $12,000 February 2011 April 2012 June 2013 company $11,487 $11,776 Acquired Canyon Acquired Palm Acquired First $16.50 National Bank Desert National Bank Associations Bank $15.26 ($192MM assets) in ($103MM assets) in ($424MM assets) and $10,000 FDIC-assisted deal FDIC-assisted deal San Diego Trust Bank ($211MM assets) $8,025 $14.00 $8,000 $12.51 $11.17 $6,000 $11.50 $10.12 $9.65 $4,036 $4,000 $9.08 $8.19 $2,790 $9.00 $2,038 $2,000 $1,714 $961 $1,174 $- $6.50 2011 2012 2013 2014 2015 2016 2017 2018 2019 Non-Acquired Acquired TBV/Share Note: All dollars in millions, except per share data © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 7

ACQUISITION EXECUTION The company has a well established and successful track record of executing on acquisitions Organic growth driven by dynamic and disciplined sales culture Geographic expansion through highly accretive FDIC-assisted acquisitions 2008-2012 • Canyon National Bank (“CNB”) - $192 million in assets, closed on 2/11/2011 (FDIC-Assisted) • Palm Desert National Bank (“PDNB”) - $103 million in assets, closed on 4/27/2012 (FDIC-Assisted) Build out of commercial banking platform through acquisitions • First Associations Bank (“FAB”) - $424 million in assets, closed on 3/15/2013 (151 days) • San Diego Trust Bank (“SDTB”) - $211 million in assets, closed on 6/25/2013 (110 days) • Infinity Franchise Holdings (“IFH”) - $80 million in assets, closed on 1/30/2014 (73 days) 2013-2019 • Independence Bank (“IDPK”) - $422 million in assets, closed on 1/26/2015 (96 days) • Security California Bancorp (“SCAF”) - $715 million in assets, closed 1/31/2016 (120 days) • Heritage Oaks Bancorp (“HEOP”) - $2 billion in assets, closed on 4/1/2017 (109 days) • Plaza Bancorp (“PLZZ”) - $1.3 billion in assets, closed on 11/1/2017 (84 days) • Grandpoint Capital, Inc. (“GPNC”) - $3.2 billion in assets, closed on 7/1/2018 (139 days) • Produce EPS growth from scale, efficiency and balance sheet leverage 2020 and • Disciplined organic and acquisitive growth, increasing franchise and shareholder value Beyond • Effective capital management • Board and management regularly assess strategic direction–Buy, Sell or Hold © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 8

STRONG EARNINGS PERFORMANCE The company has consistently delivered leading earnings growth and shareholder value Total Revenue and Efficiency Ratio Net Income and Earnings Per Share $200.0 $600.0 $2.63 $180.0 $2.50 $2.50 75.0% $2.60 $500.0 $482.5 $2.26 $160 $160 $160.0 $2.05 $423.7 $136 $2.00 64.7% $140.0 $400.0 65.0% $123 61.3% $120.0 $1.58 $1.56 $1.34 $1.50 $300.0 55.9% $100.0 $278.6 $1.46 53.6% 55.0% $1.04 $79 Net Income ($MM) Income Net $80.0 $1.19 $1.00 Earnings per Share ($) $200.0 $0.80 $60 $172.7 51.6% 51.0% 50.8% $60.0 $0.96 $43 $120.7 $40 45.0% $40.0 $29 $0.50 $100.0 $87.0 $67.3 $0.54 $26 $17$18 $20.0 $13 $9 $0.0 35.0% $0.0 $0.00 2013 2014 2015 2016 2017 2018 2019 2013 2014 2015 2016 2017 2018 2019 (1) Reported Net Income Operating Net Income Total Revenue Efficiency Ratio Reported Diluted EPS Operating Diluted EPS (1) Note: All dollars in millions 1. Please refer to non-U.S. GAAP reconciliation in appendix © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 9

NET INTEREST MARGIN Strong asset yield and low cost deposits – NIM ranks in the top quartile(3) • Net interest income has grown 40% compounded annually since 2013 Loan Portfolio Reported Yields, Core Yields(1), and Total Deposit Costs Reported and Core Net Interest Margin(2) 6.00% 6.00% 5.20% 5.50% 5.59% 5.56% 5.57% 5.59% 5.52% 5.45% 5.44% 5.50% 5.39% 5.00% 5.32% 5.31% 4.20% 4.48% 4.43% 4.44% 5.37% 4.37% 4.36% 4.33% 5.34% 5.31% 4.50% 4.25% 4.28% 5.26% 5.28% 4.18% 4.21% 5.17% 5.17% 5.17% 3.20% 5.00% 5.11% 4.00% 4.20% 4.24% 4.21% 5.02% 4.18% 4.12% Loan Yields 4.09% 4.06% 4.08% 4.10% Cost of Deposits Cost 3.93% 2.20% 3.50% 4.50% 3.00% 1.20% 0.63% 0.73% 0.71% 0.51% 0.58% 2.50% 0.34% 0.34% 0.32% 0.28% 0.28% 4.00% 0.20% 2013 2014 2015 2016 2017 2018 1Q'19 2Q'19 3Q'19 4Q'19 2.00% 2013 2014 2015 2016 2017 2018 1Q'19 2Q'19 3Q'19 4Q'19 Portfolio Core Loan Yields (1) Portfolio Reported Loan Yields Cost of Total Deposits Reported Net Interest Margin Core Net Interest Margin (2) 1. Core loan yields exclude accretion and other one-time adjustments 2. Please refer to non-U.S. GAAP reconciliation in appendix 3. Source: SNL Financial – 3Q’19 PPBI ranked 92nd percentile of KRX banks © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 10

CAPITAL RATIOS & CAPITAL MANAGEMENT Capital management is a key focus of the Board and Management • Increased quarterly cash dividend from $0.22 per share to $0.25 per share • Returned $153 million to shareholders in 2019 • Announced a new $100 million stock repurchase authorization in Q4 2019 Holding Company Capital Ratios Q4 2019 Q3 2019 Q4 2018 Tangible Common Equity Ratio 10.30% 10.01% 10.02% Leverage Ratio 10.54% 10.34% 10.38% Common Equity Tier 1 Ratio (CET -1) 11.35% 10.93% 10.88% Tier 1 Ratio 11.42% 11.04% 11.13% Risk Based Capital Ratio 13.81% 13.40% 12.39% Bank Level Capital Ratios Q4 2019 Q3 2019 Q4 2018 Leverage Ratio 12.39% 12.20% 11.06% Common Equity Tier 1 Ratio (CET -1) 13.43% 13.01% 11.87% Tier 1 Ratio 13.43% 13.01% 11.87% Risk Based Capital Ratio 13.83% 13.41% 12.28% © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 11

ATTRACTIVE DEPOSIT PORTFOLIO 88% non-maturity deposit composition with 43% in non-interest bearing reflects strong client relationship-based business model Interest-Bearing Demand 7% As of Cost of (dollars in thousands) 12/31/2019 Deposits(1) Certificates Deposits of Deposit, 12% Non-interest bearing demand $ 3,857,660 0.00% Interest-bearing demand 586,019 0.45% Money market and savings 3,406,988 0.79% Total non-maturity deposits 7,850,667 0.38% Money Market & Savings Non-interest Bearing Retail certificates of deposit 973,465 1.70% 38% Demand 43% Wholesale brokered certificates of deposit 74,377 2.42% Total certificates of deposit 1,047,842 1.83% Total deposits $ 8,898,509 0.58% 1. Quarterly average cost © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 12

LOAN PORTFOLIO COMPOSITION Well diversified, high yielding commercial loan portfolio Farmland 1-4 Family 2% Other 3% 1% As of Weighted (1) (dollars in thousands) 12/31/2019 Average Rates Business loans Const. & Land Commercial and Commercial and industrial $1,265,185 5.22% 5% Industrial 14% Franchise 916,875 5.58% Commercial owner occupied 1,674,092 4.85% SBA 175,815 6.82% Multi-family Agribusiness 127,834 4.92% 18% Commercial Owner Occupied Total business loans $4,159,801 5.21% 19% Real estate loans Commercial non-owner occupied $2,072,374 4.61% Multi-family 1,576,870 4.30% One-to-four family 254,779 4.78% Commercial Non- owner Occupied Franchise Construction 410,065 5.99% 24% 11% Farmland 175,997 4.71% Land 31,090 5.45% Total real estate loans $4,521,175 4.65% Consumer loans $50,922 3.97% Agribusiness SBA Gross loans held for investment $8,731,898 4.91% 1% 2% 1. As of 12/31/19 and excluding the impact of fees, discounts and premiums © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 13

HIGH QUALITY LOAN PORTFOLIO Diversified across the spectrum of business types with a high level of granularity Distribution of C&I Portfolio by Industry (1) CRE Property Type as a Percent of Total CRE Construction, 10% 10% 15% Real Estate, and Rental and Leasing, 10% 10% Manufacturing, 11% 6% Health Care and Social Assistance, 10% Finance and Insurance, 7% 8% 10% Other Services (except Public Administration), 9% Retail Trade, 9% 6% Professional, Scientific, and Technical Services, 6% 10% Accommodation and Food Services, 8% 9% 7% Wholesale Trade, 6% 9% All Other, 15% 1 Distribution by North American Industry Classification System (NAICS) Includes C&I, Owner Occupied CRE, SBA and Agribusiness loans. Excludes Franchise loans. Geographic Distribution of Loan Portfolio Distribution of Franchise Concepts 2% California, 75% Domino's Pizza Other 19% Texas, 2% 3% Burger King 6% 20% Jack In The 2% Arizona, 6% Box 3% 4% 1% Nevada, 2% Dunkin 75% Washington/Oregon, 4% Denny's 1% 3% 15% 9% New York, 1% Zaxby's Real New Jersey, 1% Chicken Sonic 4% Wendy's Drive-In Other, 9% 5% KFC 12% Popeyes 9% 7% * California peer group consists of all insured California institutions, from SNL Financial. *Other category includes 19 different concepts, none of which represents more than 3% © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 14

CREDIT RISK MANAGEMENT The Company has a long running history of outperforming peers on asset quality • Loan delinquencies to loans held for investment of 0.22% as of 12/31/2019 • Nonperforming assets to total assets of 0.08% at 12/31/2019 Nonperforming Assets to Total Assets Comparison PPBI Peers * 5.00 4.39 4.50 4.26 4.30 4.24 4.23 4.29 4.11 4.06 3.96 4.04 4.00 3.77 3.62 3.48 3.39 3.50 CNB 3.26 3.21 2.93 Acquisition 2.96 3.00 2/11/11 PDNB Acquisition 2.50 4/27/12 2.00 1.70 1.66 1.67 1.58 1.62 1.56 1.36 1.31 1.50 1.24 1.18 1.04 1.08 1.10 1.05 0.91 0.80 1.00 0.76 0.74 0.69 0.74 0.58 0.59 0.58 0.53 0.48 0.48 0.50 0.49 0.46 0.44 0.42 0.42 0.38 0.33 0.41 0.41 0.36 0.38 0.37 0.33 0.50 0.21 0.21 0.40 0.55 0.15 0.20 0.20 0.14 0.12 0.12 0.190.18 0.18 0.17 0.13 0.17 0.04 0.11 0.08 0.07 0.11 0.07 0.08 0.02 0.01 0.01 0.04 0.04 0.07 - Footer 1Q'16 2Q'16 3Q'16 4Q'16 1Q'17 2Q'17 3Q'17 4Q'17 1Q'18 2Q'18 3Q'18 4Q'18 1Q'19 2Q'19 3Q'19 4Q'19 1Q '09 1Q '09 2Q '09 3Q '09 4Q '10 1Q '10 2Q '10 3Q '10 4Q '11 1Q '11 2Q '11 3Q '11 4Q '12 1Q '12 2Q '12 3Q '12 4Q '13 1Q '13 2Q '13 3Q '13 4Q '14 1Q '14 2Q '14 3Q '14 4Q '15 1Q '15 2Q '15 3Q '15 4Q © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 15

ASSET QUALITY MEASURES Highly disciplined credit risk management, proactive loss mitigation strategies • Well-positioned to absorb the anticipated CECL transitionary impact • Anticipated ACL will increase $45 to $60 million from year-end 2019 levels in 1Q 2020 Total Delinquent Loans to Loans Held for Investment Annualized Net Charge Offs to Average Loans 1.00% 1.00% 0.80% 0.80% 0.60% 0.60% 0.40% 0.40% 0.22% 0.15% 0.18% 0.15% 0.16% 0.20% 0.13% 0.20% 0.11% 0.06% 0.01% 0.01% 0.00% 0.00% 4Q'18 1Q'19 2Q'19 3Q'19 4Q'19 4Q'18 1Q'19 2Q'19 3Q'19 4Q'19 Nonperforming Loans to Loans Held for Investment Allowances for Loan Losses + Discount to Loans Held for Investment 0.50% 1.20% 1.10% 1.07% 0.99% 1.00% 0.93% 0.40% 0.88% 0.80% 0.30% 0.60% 0.41% 0.43% 0.40% 0.40% 0.41% 0.20% 0.40% 0.15% 0.09% 0.09% 0.10% 0.20% 0.10% 0.05% 0.00% 0.00% 4Q'18 1Q'19 2Q'19 3Q'19 4Q'19 4Q'18 1Q'19 2Q'19 3Q'19 4Q'19 ALLL to LHFI ALLL + Discount Acquired Loans to LHFI Notes: At December 31, 2019, 37% of loans held for investment include a fair value net discount of $40.7 million or 0.47% of loans held for investment. © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 16

CRE TO CAPITAL CONCENTRATION RATIO Experience in managing CRE concentrations well in excess of 300% • CRE concentrations are well-managed across the organization, and semi annually stress tested CRE as a Percent of Total Capital 1000% Annualized Net Charge-Offs (1) Commercial Real Estate 0.10% Multi-Family 0.05% 800% 627% Managed Growth 600% Decreased 499% Grandpoint 415% Acquisition 389% 400% 372% 362% 365% 376% 356% 349% 336% 352% 340% 336% 341% 342% 332% 310% 316% 326% 306% 287% 287% 275% 200% 0% 2008 2009 2010 2011 2012 2013 2014 2015 1Q'16 2Q'16 3Q'16 4Q'16 1Q'17 2Q'17 3Q'17 4Q'17 1Q'18 2Q'18 3Q'18 4Q'18 1Q'19 2Q'19 3Q'19 4Q'19 1. January 1, 2009 – September 30, 2019 © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 17

EXPANDING OUR CAPABILITIES Key business initiatives enhancing products and processes to drive additional revenue and balance sheet growth Product Enhancements • Expanded International Banking Group Technology Enabled Foreign • Streamlined Foreign Currency Processing Currency Business Development • Improved Client Experience • M&A Transactions Significant investment in customizing • Capital Investments the Salesforce platform • Contractor Retention • Manage and monitor all facets of Third Party • Disbursement/Fund Control client relationship Escrow • Qualified Escrow Accounts • Enhanced analytics to consistently drive lead • Large Asset Acquisition generation and new client acquisition • Dissolution of Assets • Robust monitoring and reporting capabilities • Productivity tracking and performance • Enhanced Account Analysis Platform management • Expanded Lockbox Services Treasury • Improved ACH Capabilities Management • Invoice to Pay • Check Printing Service © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 18

PACIFIC PREMIER API BANKINGSM & DATAVAULT® Modernizing the exchange of data between clients and the Bank • Pacific Premier API Banking allows software developers, corporate clients, and FinTechs to partner with Pacific Premier to create powerful applications and long lasting relationships Technology Advancements Industry Accounting Platforms Pacific Premier Bank Pacific Premier Bank Expanded Market Data Services DataVault® API Opportunities • Core Banking Services • HOA Software Partners • Check Images • FinTech Partners FinTech Application • Statement Images • Accounting Software • Transaction Details Partners • Account Transfers • Subscription Companies • Electronic Payments • Healthcare • Alternate lending models Corporate Clients Data flows through Bank systems to reach the client securely and directly © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 19

ENVIRONMENTAL, SOCIAL, GOVERNANCE Corporate giving and We believe in doing our part to strengthen our communities through responsible employee business practices, robust responsibility is a pillar of corporate governance and shareholder friendly policies. our business culture 2019 Highlights(1): Our employees are leaders working with our 300+ community partners: #1 Rating ISS Composite QualityScore for Governance $2,961,972 Charitable Community Support Serve on Boards Provide financial and Promote community and committees technical expertise development missions 5,196 Volunteer Hours 3,959 466 2019 Recycling By shredding Trees Barrels of Oil 465,765 233 and recycling Pounds Tons we have saved: 699 1,630,176 Cubic Yards Gallons of Water of Landfill 1. Data from 1/1/2019-12/31/2019 © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 20

Acquisition of Opus Bank

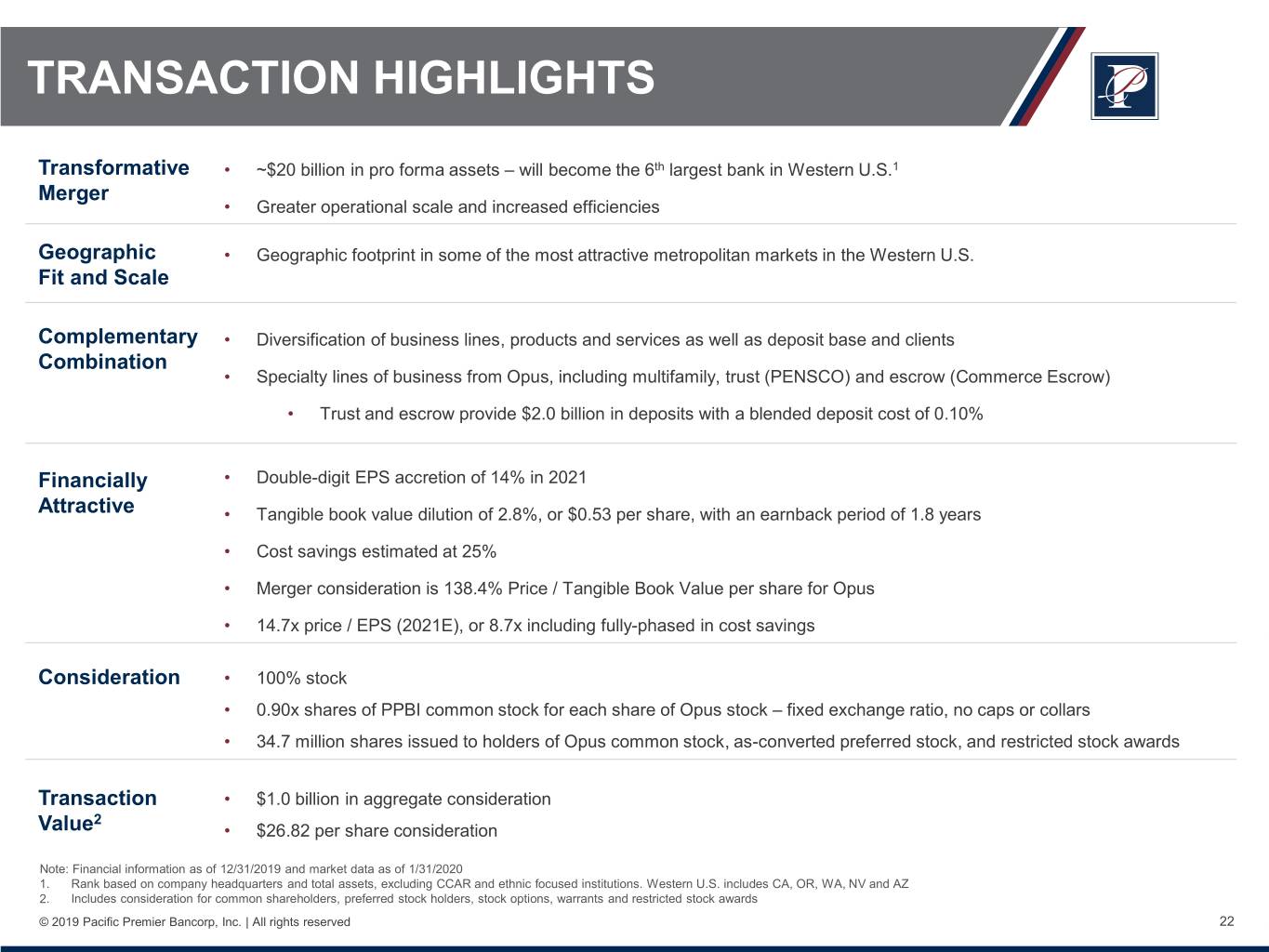

TRANSACTION HIGHLIGHTS Transformative • ~$20 billion in pro forma assets – will become the 6th largest bank in Western U.S.1 Merger • Greater operational scale and increased efficiencies Geographic • Geographic footprint in some of the most attractive metropolitan markets in the Western U.S. Fit and Scale Complementary • Diversification of business lines, products and services as well as deposit base and clients Combination • Specialty lines of business from Opus, including multifamily, trust (PENSCO) and escrow (Commerce Escrow) • Trust and escrow provide $2.0 billion in deposits with a blended deposit cost of 0.10% Financially • Double-digit EPS accretion of 14% in 2021 Attractive • Tangible book value dilution of 2.8%, or $0.53 per share, with an earnback period of 1.8 years • Cost savings estimated at 25% • Merger consideration is 138.4% Price / Tangible Book Value per share for Opus • 14.7x price / EPS (2021E), or 8.7x including fully-phased in cost savings Consideration • 100% stock • 0.90x shares of PPBI common stock for each share of Opus stock – fixed exchange ratio, no caps or collars • 34.7 million shares issued to holders of Opus common stock, as-converted preferred stock, and restricted stock awards Transaction • $1.0 billion in aggregate consideration 2 Value • $26.82 per share consideration Note: Financial information as of 12/31/2019 and market data as of 1/31/2020 1. Rank based on company headquarters and total assets, excluding CCAR and ethnic focused institutions. Western U.S. includes CA, OR, WA, NV and AZ 2. Includes consideration for common shareholders, preferred stock holders, stock options, warrants and restricted stock awards © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 22

OVERVIEW OF OPUS BANK Overview Branch Network • Opus is a commercial bank headquartered in Irvine, California with $8.0 billion in assets, $5.9 billion in loans and $6.5 billion in deposits 16 Washington Primarily in Seattle MSA (15) Business Lines 1 Oregon • Opus is one of the leading multifamily lenders in the Western U.S. Portland • Full suite of commercial banking products focused on small to middle market businesses, including C&I, owner-occupied CRE, and SBA loans • PENSCO is a wholly-owned subsidiary of Opus and IRA custodian for alternative assets offering attractive, low-cost deposit funding and fee income 3 Northern California San Francisco (3) • Commerce Escrow division is a Los Angeles-based escrow company and 1031 exchange accommodator - increasing specialty deposit capability 25 Southern California and fee income Los Angeles-Orange (20) San Diego (3) Branch Footprint Riverside-San Bernardino (2) 1 • 7 of 9 geographic regions will rank in top-10 for deposit market share 1 Arizona Scottsdale Mitigated Risk Pro Forma Deposits by Region Top-10 % of • Simplified business model over the last few years – de-risked balance Region Branches Rank1 Deposits ($B) Total sheet Los Angeles-Orange MSA 32 $9.1 60% Central Coast California3 11 $1.8 12% Riverside-San Bernardino MSA 11 $1.3 8% • Management exited Enterprise Value Loans, Healthcare Practice 3 Loans, and Technology Banking Seattle MSA 16 $1.2 8% San Diego MSA 8 $0.8 5% Arizona 4 $0.6 4% Portland MSA 2 $0.2 1% Las Vegas MSA 1 $0.1 1% Note: All dollars in millions. Financial information as of 12/31/2019 San Francisco MSA 3 $0.1 1% 1. Rank excludes CCAR designated banks and foreign owned subsidiaries Total 88 $15.2 100% © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 23

DIVERSIFYING PPBI’S REVENUE STREAM Non-Interest Income ($MM) • 2.6x increase in PPBI’s pro forma non-interest income to $100 0.41% 0.45% ~$79 million $90 0.40% $80 $70 $79 0.35% • 12% of pro forma operating revenue from non-interest $60 income 0.26% 0.30% $50 0.25% $40 $50 • $2.0 billion in deposits with a blended deposit cost of $30 0.20% 0.10% from PENSCO and Commerce Escrow divisions $20 $30 0.15% $10 $- 0.10% • Meaningful opportunities to expand both lines of business PPBI OPB Pro Forma (1) over time Non-Interest Income Non-Interest Income / Avg. Assets Specialized Lines of Business Pro Forma Operating Revenue Opus Non-Interest Income Mix (% of Total) (% of Total) PENSCO Trust Commerce Escrow A division of Opus Bank A division of Opus Bank PENSCO 30.0% Fees Gain on 24% 56% Sale • IRA custodian for alternative assets, • Escrow company with 1031 exchange 25.0% 2% such as private equity or real estate practice held in retirement accounts 20.0% • Synergies with PPBI’s existing escrow $50MM • $14 billion in assets under custody deposit business 15.0% 12% BOLI • 46,000 customer accounts • Provides the bank with $650 million in 10.0% 8% deposits at 0.25% cost of funds 7% • Stable source of low-cost core deposits • $6 million in fee income for 2019 5.0% Escrow & • $28 million in fee income for 2019 Other • Acquired by Opus in 2015 0.0% Exchange Deposit Fees 10% • Acquired by Opus in 2016 PPBI OPB Pro 12% 12% Forma (1) Note: All dollars in millions. Financial information for twelve months ended 12/31/2019 1. Pro forma includes $1.0 million reduction in interchange fees due to Durbin Amendment © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 24

ATTRACTIVE FUNDING PROFILE Pro Forma IB Demand 7% IB IB Demand 21% Demand MMDA & MMDA & 41% Savings NIB Savings 34% MMDA & Demand 38% Savings 43% NIB 36% Demand 30% NIB Time Deposits Time Deposits Time Deposits Demand 13% 12% 12% 12% Total Deposits: $8.9 Billion Total Deposits: $6.5 Billion Total Deposits: $15.4 Billion Cost of Deposits: 0.58% Cost of Deposits: 1.01% Cost of Deposits: 0.76% • $2.0 billion in deposits with a blended deposit cost of • Greater deposit diversification 0.10% from PENSCO and Commerce Escrow divisions • Ability to run-off and replace Opus’ higher-cost funding • Strong pro forma core deposit franchise with core deposits at PPBI Note: S&P Global Market Intelligence, financial information as of 12/31/2019 © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 25

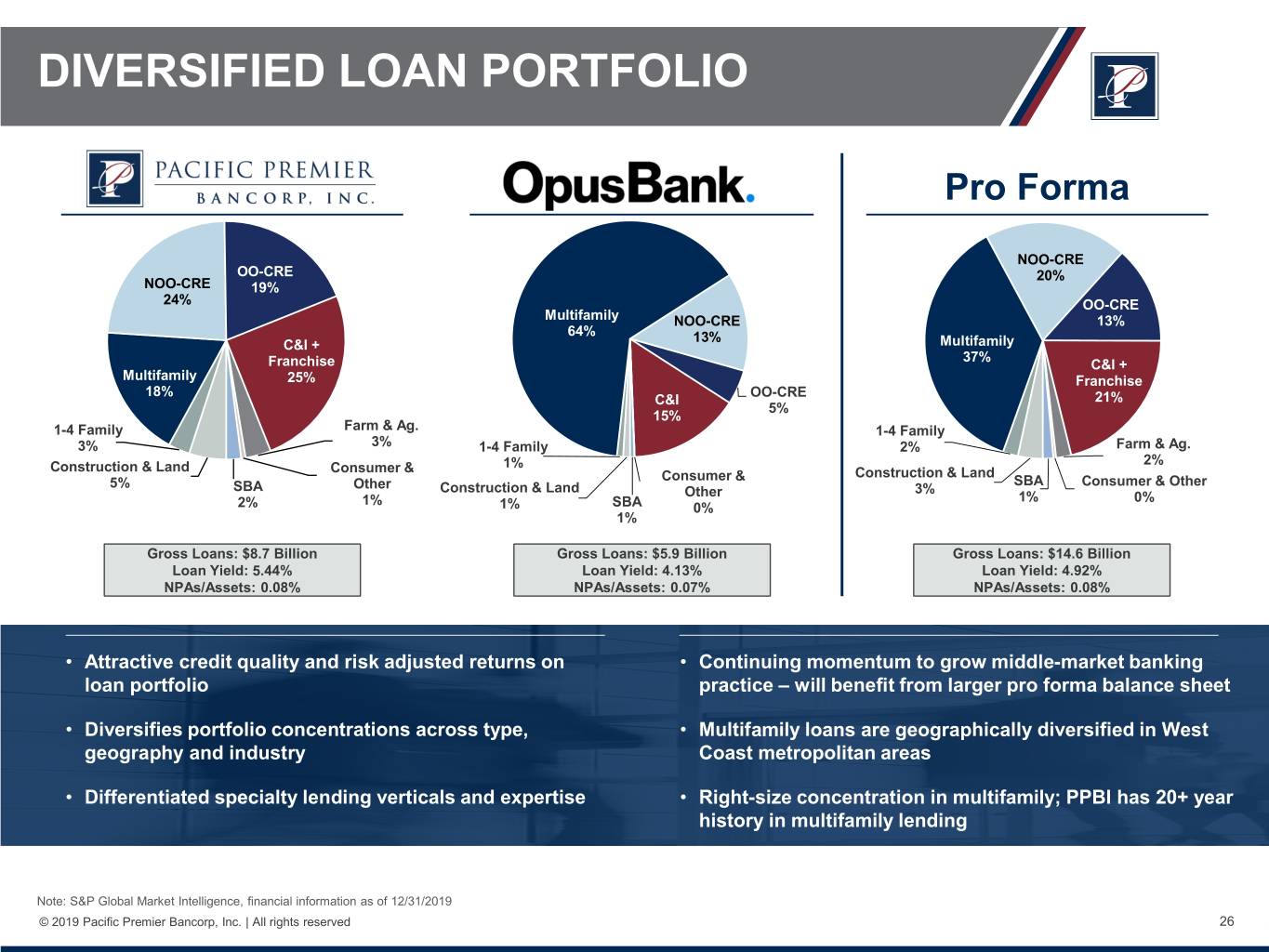

DIVERSIFIED LOAN PORTFOLIO Pro Forma NOO-CRE OO-CRE 20% NOO-CRE 19% 24% OO-CRE Multifamily NOO-CRE 13% 64% 13% C&I + Multifamily 37% Franchise C&I + Multifamily 25% Franchise 18% OO-CRE C&I 21% 5% 15% 1-4 Family Farm & Ag. 1-4 Family 3% 3% 1-4 Family 2% Farm & Ag. 2% Construction & Land Consumer & 1% Consumer & Construction & Land 5% Other SBA Consumer & Other SBA Construction & Land Other 3% 1% 1% 0% 2% 1% SBA 0% 1% Gross Loans: $8.7 Billion Gross Loans: $5.9 Billion Gross Loans: $14.6 Billion Loan Yield: 5.44% Loan Yield: 4.13% Loan Yield: 4.92% NPAs/Assets: 0.08% NPAs/Assets: 0.07% NPAs/Assets: 0.08% • Attractive credit quality and risk adjusted returns on • Continuing momentum to grow middle-market banking loan portfolio practice – will benefit from larger pro forma balance sheet • Diversifies portfolio concentrations across type, • Multifamily loans are geographically diversified in West geography and industry Coast metropolitan areas • Differentiated specialty lending verticals and expertise • Right-size concentration in multifamily; PPBI has 20+ year history in multifamily lending Note: S&P Global Market Intelligence, financial information as of 12/31/2019 © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 26

INSTITUTIONAL OWNERSHIP OPB Ownership, PPBI Ownership, PPBI Ownership, Pre-Deal PPBI Shares Pre-Deal Pro Forma Rank Name Shares % Own* Issued Shares % Own Shares % Own 1 BlackRock Inc. 3,512,229 9.1% 3,161,006 8,740,229 14.7% 11,901,235 12.6% 2 Vanguard Group Inc. 1,587,721 4.1% 1,428,949 6,222,334 10.5% 7,651,283 8.1% 3 Dimensional Fund Advisors LP 2,765,538 7.2% 2,488,984 3,277,962 5.5% 5,766,946 6.1% 4 Janus Henderson Group PLC - - - 4,623,366 7.8% 4,623,366 4.9% 5 Fortress Investment Group LLC* 5,121,275 13.3% 4,609,148 - - 4,609,148 4.9% 6 T. Rowe Price Group Inc. - - - 3,614,106 6.1% 3,614,106 3.8% 7 Elliott Management Corp. 3,620,950 9.4% 3,258,855 - - 3,258,855 3.5% 8 Starwood Capital Operations LLC 3,390,250 8.8% 3,051,225 - - 3,051,225 3.2% 9 State Street Global Advisors Inc. 834,351 2.2% 750,916 2,054,630 3.5% 2,805,546 3.0% 10 FJ Capital Management LLC 1,618,354 4.2% 1,456,519 937,000 1.6% 2,393,519 2.5% 11 Aristotle Capital Boston LLC 2,179,867 5.7% 1,961,880 - - 1,961,880 2.1% 12 Columbia Management Investment Advisers LLC 919,801 2.4% 827,821 1,004,430 1.7% 1,832,251 1.9% 13 Emerald Advisers LLC - - - 1,680,381 2.8% 1,680,381 1.8% 14 Goldman Sachs Asset Management LP 112,160 0.3% 100,944 1,190,699 2.0% 1,291,643 1.4% 15 Manulife Asset Management - - - 1,212,353 2.0% 1,212,353 1.3% 16 Cardinal Capital Management L.L.C. - - - 1,180,244 2.0% 1,180,244 1.3% 17 RBC Global Asset Management Inc. 471,927 1.2% 424,734 713,721 1.2% 1,138,455 1.2% 18 Northern Trust Global Investments 294,247 0.8% 264,822 862,296 1.4% 1,127,118 1.2% 19 Geode Capital Management LLC 313,151 0.8% 281,836 790,036 1.3% 1,071,872 1.1% 20 BNY Asset Management 324,748 0.8% 292,273 758,349 1.3% 1,050,622 1.1% 21 Brown Advisory Inc. - - - 1,033,703 1.7% 1,033,703 1.1% 22 Endeavour Capital Advisors Inc. 1,028,268 2.7% 925,441 - - 925,441 1.0% 23 GW&K Investment Management LLC - - - 881,010 1.5% 881,010 0.9% 24 Stieven Capital Advisors LP 396,579 1.0% 356,921 521,042 0.9% 877,963 0.9% 25 Principal Global Investors LLC 170,684 0.4% 153,616 503,648 0.8% 657,264 0.7% Source: S&P Global Market Intelligence. Ownership data as of 9/30/2019 company filings. *Includes conversion of preferred stock and vesting of restricted stock © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 27

SCARCITY VALUE IN SOUTHERN CALIFORNIA PPBI is the 3rd largest publicly traded bank headquartered in Southern California(1) Total Market Price to Price to Assets Cap. Earnings TBV Company Name State Ticker Exchange ($M) ($M) (x) (%) 1 PacWest Bancorp CA PACW NASDAQ $26,771 $4,311 9.4 185 2 Pro Forma PPBI+Opus Bank (2) CA PPBI NASDAQ 19,682 -- -- -- 2 Axos Financial Inc. NV AX NYSE 12,269 1,758 10.9 171 3 Pacific Premier Bancorp, Inc. CA PPBI NASDAQ 11,776 1,810 11.0 161 4 CVB Financial Corp. CA CVBF NASDAQ 11,282 3,061 14.8 238 5 Opus Bank CA OPB NASDAQ 7,992 1,001 17.0 142 6 Banc of California, Inc. CA BANC NYSE 7,828 852 NM 129 7 Farmers & Merchants Bank of Long Beach CA FMBL OTCQB 7,606 999 11.9 92 8 First Foundation Inc. CA FFWM NASDAQ 6,314 766 13.7 148 9 American Business Bank CA AMBZ OTCQX 2,402 283 13.2 137 10 Pacific Mercantile Bancorp CA PMBC NASDAQ 1,416 166 29.4 - 11 Malaga Financial Corporation CA MLGF OTC Pink 1,248 168 11.0 - 12 Provident Financial Holdings, Inc. CA PROV NASDAQ 1,107 167 30.9 135 Median $7,828 $925 13.2 145 Market data as of February 6, 2020. Financial data for the most recently reported quarter. Peer P/E ratio uses LTM EPS. Source: SNL Financial 1. Defined as banks with shares listed on the NYSE, NASDAQ or OTC exchanges, excludes ethnically focused banking institutions sorted by total assets 2. Total assets shown as of pro forma December 31, 2019 and are inclusive of merger adjustments © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 28

SCARCITY VALUE IN THE WESTERN U.S. Listed below are banks headquartered in the West with assets between $5B and $25B(1) • PPBI ranks 3rd when measured by total assets for banks headquartered in Southern California… and 9th more broadly across the continental Western U.S. Total Market Price to Price to Assets Cap. Earnings TBV Company Name State Ticker Exchange ($M) ($M) (x) (%) 1 Western Alliance Bancorporation AZ WAL NYSE $26,822 $5,906 12.0 219 2 PacWest Bancorp CA PACW NASDAQ 26,771 4,311 9.4 185 3 Pro Forma PPBI+Opus Bank (2) CA PPBI NASDAQ 19,682 -- -- -- 3 Washington Federal, Inc. WA WAFD NASDAQ 16,423 2,728 12.5 157 4 First Interstate BancSystem, Inc. MT FIBK NASDAQ 14,644 1,713 14.1 199 5 Columbia Banking System, Inc. WA COLB NASDAQ 14,080 2,877 15.1 214 6 Glacier Bancorp, Inc. MT GBCI NASDAQ 13,684 4,123 18.8 286 7 Banner Corporation WA BANR NASDAQ 12,604 1,963 13.2 165 8 Axos Financial Inc. NV AX NYSE 12,269 1,758 10.9 171 9 Pacific Premier Bancorp, Inc. CA PPBI NASDAQ 11,776 1,810 11.0 161 10 CVB Financial Corp. CA CVBF NASDAQ 11,282 3,061 14.8 238 11 Opus Bank CA OPB NASDAQ 7,992 1,001 17.0 142 12 Banc of California, Inc. CA BANC NYSE 7,828 852 NM 129 13 HomeStreet, Inc. WA HMST NASDAQ 6,812 768 49.4 119 14 Westamerica Bancorporation CA WABC NASDAQ 5,620 1,808 22.4 297 Median $12,604 $1,887 14.1 178 Market data as of February 6, 2020. Financial data for the most recently reported quarter. Peer P/E ratio uses LTM EPS. Source: SNL Financial 1. Defined as banks headquartered in AZ, CA, ID, OR, MT, WA and WY with shares listed on the NYSE or NASDAQ exchanges, excludes ethnically focused banking institutions, sorted by total assets 2. Total assets shown as of pro forma December 31, 2019 and are inclusive of merger adjustments © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 29

KEY INVESTMENT HIGHLIGHTS Building Long-term Franchise Value Proven track record of executing on acquisitions and organic growth Continuous improvement to drive economies of scale and operating leverage Strong profitability and returns drive capital return to shareholders Accelerating capital generation and growing dividend – enhancing shareholder value ~$20 billion asset franchise with meaningful presence in desirable Western U.S. metropolitan markets Expanded strategic flexibility for technology investment, organic growth and acquisition opportunities © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 30

Appendix Material

CONSOLIDATED QUARTERLY FINANCIAL HIGHLIGHTS December 31, March 31, June 30, September 30, December 31, 2018 2019 2019 2019 2019 Summary Balance Sheet Total Assets $11,487,387 $11,580,495 $11,783,781 $11,811,497 $11,776,012 Loans Held for Investment 8,836,818 8,865,855 8,771,938 8,757,476 8,722,311 Total Deposits 8,658,351 8,715,175 8,861,922 8,859,288 8,898,509 Loans Held for Investment/Total Deposits 102.1% 101.7% 99.0% 98.9% 98.0% Summary Income Statement Total Revenue $124,516 $119,087 $116,965 $123,765 $122,720 Total Noninterest Expense 67,239 63,577 63,936 65,336 66,216 Provision for Credit Losses 2,258 1,526 334 1,562 2,297 Net Income 39,643 38,718 38,527 41,375 41,098 Diluted EPS $0.63 $0.62 $0.62 $0.69 $0.69 Performance Ratios Return on Average Assets (4) 1.37% 1.34% 1.33% 1.44% 1.42% Return on Average Tangible Common Equity (4) 16.7% 15.5% 15.2% 16.3% 15.9% Efficiency Ratio (1)* 48.3% 49.3% 51.1% 50.9% 51.9% Net Interest Margin 4.49% 4.37% 4.28% 4.36% 4.33% Asset Quality Delinquent Loans to Loans Held for Investment 0.15% 0.18% 0.15% 0.13% 0.22% Allowance for Loan Losses to Loans Held for Investment 0.41% 0.43% 0.40% 0.40% 0.41% Nonperforming Loans to Loans Held for Investment 0.05% 0.15% 0.09% 0.09% 0.10% Nonperforming Assets to Total Assets (2) 0.04% 0.11% 0.07% 0.07% 0.08% Classified Assets to Total Risk-Based Capital (3) 4.98% 4.03% 2.81% 2.96% 3.34% Classified Assets to Total Assets (3) 0.54% 0.44% 0.32% 0.33% 0.39% Capital Ratios Tangible Common Equity/Tangible Assets * 10.02% 10.32% 9.96% 10.01% 10.30% Tangible Book Value Per Share * $16.97 $17.56 $17.92 $18.41 $18.84 Common Equity Tier 1 Risk-based Capital Ratio 10.88% 11.08% 10.82% 10.93% 11.35% Tier 1 Risk-based Ratio 11.13% 11.32% 11.07% 11.04% 11.42% Risk-based Capital Ratio 12.39% 12.58% 13.54% 13.40% 13.81% 1. Represents the ratio of noninterest expense less other real estate owned operations, core deposit intangible amortization and merger-related expenses to the sum of net interest income before provision for loan losses and total noninterest income, less gain / (loss) on sales of securities, OTTI impairment, gain / (loss) of other real estate owned, and gain / (loss) from debt extinguishment 2. Nonperforming assets excludes nonperforming investment securities. 3. Classified assets includes substandard loans, doubtful, substandard investment securities, and OREO. 4. Annualized *Please refer to non-U.S. GAAP reconciliation in appendix Note: All dollars in thousands, except per share data © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 32

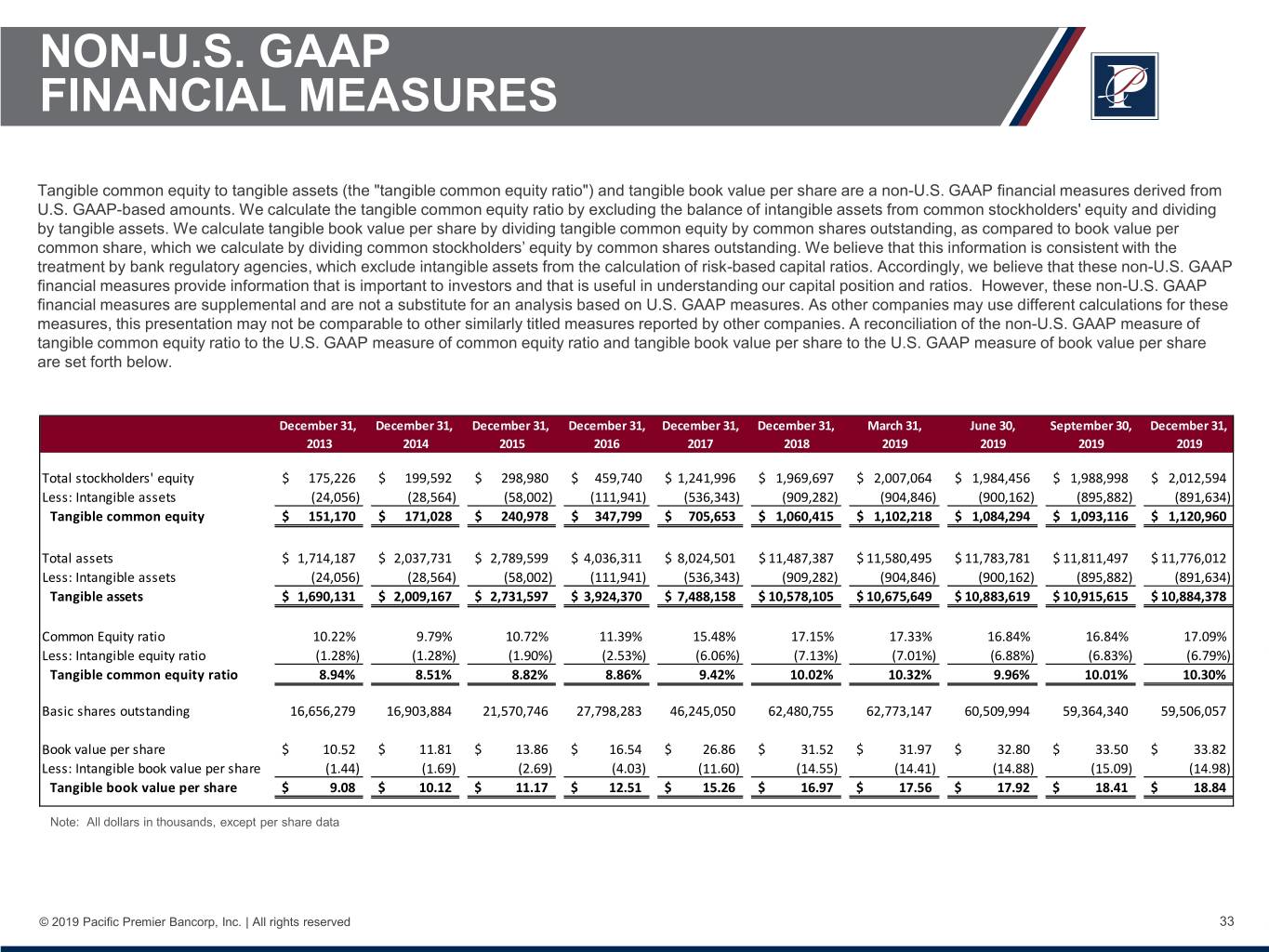

NON-U.S. GAAP FINANCIAL MEASURES Tangible common equity to tangible assets (the "tangible common equity ratio") and tangible book value per share are a non-U.S. GAAP financial measures derived from U.S. GAAP-based amounts. We calculate the tangible common equity ratio by excluding the balance of intangible assets from common stockholders' equity and dividing by tangible assets. We calculate tangible book value per share by dividing tangible common equity by common shares outstanding, as compared to book value per common share, which we calculate by dividing common stockholders’ equity by common shares outstanding. We believe that this information is consistent with the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of risk-based capital ratios. Accordingly, we believe that these non-U.S. GAAP financial measures provide information that is important to investors and that is useful in understanding our capital position and ratios. However, these non-U.S. GAAP financial measures are supplemental and are not a substitute for an analysis based on U.S. GAAP measures. As other companies may use different calculations for these measures, this presentation may not be comparable to other similarly titled measures reported by other companies. A reconciliation of the non-U.S. GAAP measure of tangible common equity ratio to the U.S. GAAP measure of common equity ratio and tangible book value per share to the U.S. GAAP measure of book value per share are set forth below. December 31, December 31, December 31, December 31, December 31, December 31, March 31, June 30, September 30, December 31, 2013 2014 2015 2016 2017 2018 2019 2019 2019 2019 Total stockholders' equity $ 175,226 $ 199,592 $ 298,980 $ 459,740 $ 1,241,996 $ 1,969,697 $ 2,007,064 $ 1,984,456 $ 1,988,998 $ 2,012,594 Less: Intangible assets (24,056) (28,564) (58,002) (111,941) (536,343) (909,282) (904,846) (900,162) (895,882) (891,634) Tangible common equity $ 151,170 $ 171,028 $ 240,978 $ 347,799 $ 705,653 $ 1,060,415 $ 1,102,218 $ 1,084,294 $ 1,093,116 $ 1,120,960 Total assets $ 1,714,187 $ 2,037,731 $ 2,789,599 $ 4,036,311 $ 8,024,501 $ 11,487,387 $ 11,580,495 $ 11,783,781 $ 11,811,497 $ 11,776,012 Less: Intangible assets (24,056) (28,564) (58,002) (111,941) (536,343) (909,282) (904,846) (900,162) (895,882) (891,634) Tangible assets $ 1,690,131 $ 2,009,167 $ 2,731,597 $ 3,924,370 $ 7,488,158 $ 10,578,105 $ 10,675,649 $ 10,883,619 $ 10,915,615 $ 10,884,378 Common Equity ratio 10.22% 9.79% 10.72% 11.39% 15.48% 17.15% 17.33% 16.84% 16.84% 17.09% Less: Intangible equity ratio (1.28%) (1.28%) (1.90%) (2.53%) (6.06%) (7.13%) (7.01%) (6.88%) (6.83%) (6.79%) Tangible common equity ratio 8.94% 8.51% 8.82% 8.86% 9.42% 10.02% 10.32% 9.96% 10.01% 10.30% Basic shares outstanding 16,656,279 16,903,884 21,570,746 27,798,283 46,245,050 62,480,755 62,773,147 60,509,994 59,364,340 59,506,057 Book value per share $ 10.52 $ 11.81 $ 13.86 $ 16.54 $ 26.86 $ 31.52 $ 31.97 $ 32.80 $ 33.50 $ 33.82 Less: Intangible book value per share (1.44) (1.69) (2.69) (4.03) (11.60) (14.55) (14.41) (14.88) (15.09) (14.98) Tangible book value per share $ 9.08 $ 10.12 $ 11.17 $ 12.51 $ 15.26 $ 16.97 $ 17.56 $ 17.92 $ 18.41 $ 18.84 Note: All dollars in thousands, except per share data © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 33

NON-U.S. GAAP FINANCIAL MEASURES For quarter period presented below, adjusted net income and adjusted diluted earnings per share are non-U.S. GAAP financial measures derived from U.S. GAAP-based amounts. We calculate these figures by excluding merger related expenses and DTA revaluations in the period results. Management believes that the exclusion of such items from these financial measures provides useful information to an understanding of the operating results of our core business. For the quarter period presented below, adjusted net income for return on average tangible common equity and average tangible common equity are non-U.S. GAAP financial measures derived from U.S. GAAP-based amounts. We calculate return on average tangible common equity by adjusting net income for the effect of CDI amortization and exclude the average CDI and average goodwill from the average stockholders' equity during the period. We calculate adjusted return on average tangible common equity by adjusting net income for the effect of CDI amortization and merger related expense and exclude the average CDI and average goodwill from the average stockholders' equity during the period. We believe that this is consistent with the treatment by bank regulatory agencies, which exclude intangible assets from the calculation of risk-based capital ratios. Accordingly, we believe that these non-U.S. GAAP financial measures provide information that is important to investors and that is useful in understanding our capital position and ratios. However, these non-U.S. GAAP financial measures are supplemental and are not a substitute for an analysis based on U.S. GAAP measures. As other companies may use different calculations for these adjusted measures, this presentation may not be comparable to other similarly titled adjusted measures reported by other companies. A reconciliation of the non-U.S. GAAP measures of return on average tangible common equity and adjusted return on average tangible common equity to the U.S. GAAP measure of return on common stockholders’ equity is set forth below. March 31, June 30, September 30, December 31, 2019 2019 2019 2019 Net income $38,718 $38,527 $41,375 $41,098 Add: Merger-related expense 655 5 (4) - Less: Merger-related expense tax adjustment 190 1 (1) - Operating net income $39,183 $38,531 $41,372 $41,098 Less: Net income allocated to participating securities 347 444 432 426 Operating net income for earnings per share(2) $38,836 $38,087 $40,940 $40,672 Weighted average shares outstanding - diluted 62,285,783 61,661,773 59,670,855 59,182,054 Diluted earnings per share $0.62 $0.62 $0.69 $0.69 Average assets $11,563,529 $11,585,973 $11,461,841 $11,577,092 Operating return on average assets(1) 1.36% 1.33% 1.44% 1.42% Operating net income $39,183 $38,531 $41,372 $41,098 Add: CDI amortization 4,436 4,281 4,281 4,247 Less: CDI amortization expense tax adjustment 1,288 1,240 1,240 1,218 Operating net income for return on average tangible common equity $42,331 $41,572 $44,413 $44,127 Average stockholders' equity $1,991,861 $1,999,986 $1,990,311 $2,004,815 Less: Average core deposit intangible 98,984 94,460 90,178 85,901 Less: Average goodwill 808,726 808,778 808,322 808,322 Average tangible common equity $1,084,151 $1,096,748 $1,091,811 $1,110,592 Operating return on average tangible common equity(1) 15.62% 15.16% 16.27% 15.89% Note: All dollars in thousands, except per share data 1. Annualized 2. EPS presented using the two-class method beginning Q1 2019 © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 34

NON-U.S. GAAP FINANCIAL MEASURES For periods presented below, efficiency ratio is a non-U.S. GAAP financial measure derived from U.S. GAAP-based amounts. This figure represents the ratio of noninterest expense less other real estate owned operations, core deposit intangible amortization and merger-related expense to the sum of net interest income before provision for loan losses and total noninterest income, less gains/(loss) on sale of securities, OTTI impairment - securities, gain/(loss) on sale of other real estate owned, and gain / (loss) from debt extinguishment. Management believes that the exclusion of such items from this financial measures provides useful information to gain an understanding of the operating results of our core business. FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 Total noninterest expense $ 50,815 $ 54,993 $ 73,538 $ 98,583 $ 167,958 $ 249,905 $ 259,065 Less: CDI amortization 764 75 1,350 2,039 6,144 13,594 17,245 Less: Merger-related expense 6,926 1,014 4,799 4,388 21,002 18,454 656 Less: Other real estate owned operations, net 618 1,490 121 385 72 4 160 Noninterest expense, adjusted $ 42,507 $ 52,414 $ 67,268 $ 91,771 $ 140,740 $ 217,853 $ 241,004 Net interest income $ 58,444 $ 73,635 $ 106,299 $ 153,075 $ 247,502 $ 392,711 $ 447,301 Add: Total noninterest income (loss) 8,811 13,377 14,388 19,602 31,114 31,027 35,236 Less: Net gain (loss) from investment securities 1,544 1,547 290 1,797 2,737 1,399 8,571 Less: OTTI impairment - securities (4) (29) - (205) 1 4 2 Less: Net gain (loss) from other real estate owned - - - - 46 281 52 Less: Net gain (loss) from debt extinguishment - - - - - - (612) Revenue, adjusted $ 65,715 $ 85,494 $ 120,397 $ 171,085 $ 275,832 $ 422,054 $ 474,524 Efficiency Ratio 64.7% 61.3% 55.9% 53.6% 51.0% 51.6% 50.8% September 30, December 31, March 31, June 30, September 30, December 31, 2018 2018 2019 2019 2019 2019 Total noninterest expense $ 82,782 $ 67,239 $ 63,577 $ 63,936 $ 65,336 $ 66,216 Less: CDI amortization 4,693 4,631 4,436 4,281 4,281 4,247 Less: Merger-related expense 13,978 2,597 655 5 (4) - Less: Other real estate owned operations, net - 1 3 62 64 31 Noninterest expense, adjusted $ 64,111 $ 60,010 $ 58,483 $ 59,588 $ 60,995 $ 61,938 Net interest income $ 112,713 $ 117,546 $ 111,406 $ 110,641 $ 112,335 $ 112,919 Add: Total noninterest income (loss) 8,240 6,970 7,681 6,324 11,430 9,801 Less: Net gain (loss) from investment securities 1,063 - 427 212 4,261 3,671 Less: OTTI impairment - securities - - - - 2 - Less: Net gain (loss) from other real estate owned (6) 305 - 72 (20) - Less: Net gain (loss) from debt extinguishment - - - - (214) (398) Revenue, adjusted $ 119,896 $ 124,211 $ 118,660 $ 116,681 $ 119,736 $ 119,447 Efficiency Ratio 53.5% 48.3% 49.3% 51.1% 50.9% 51.9% Note: All dollars in thousands © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 35

NON-U.S. GAAP FINANCIAL MEASURES Core net interest income and core net interest margin are non-GAAP financial measures derived from GAAP-based amounts. We calculate core net interest income by excluding scheduled accretion income, accelerated accretion income, CD mark-to market amortization and nonrecurring nonaccrual interest paid from net interest income. The core net interest margin is calculated as the ratio of core net interest income to average interest-earning assets. Management believes that the exclusion of such items from this financial measure provides useful information to gain an understanding of the operating results of our core business. March 31, June 30, September 30, December 31, 2013 2014 2015 2016 2017 2018 2019 2019 2019 2019 Net interest income $58,444 $73,635 $106,299 $153,075 $247,502 $392,711 $111,406 $110,641 $112,335 $112,919 Less accretion income 3,241 1,927 4,387 9,178 12,901 16,082 3,805 4,950 6,026 5,828 Less CD mark-to-market 139 143 200 411 969 1,551 201 124 124 72 Less nonrecurring nonaccrual interest paid - - - - - - 161 107 37 168 Core net interest income $55,064 $71,565 $101,712 $143,486 $233,632 $375,078 $107,239 $105,460 $106,148 $106,851 Average interest-earning assets $1,399,806 $1,750,871 $2,503,009 $3,414,847 $5,583,774 $8,836,075 $10,339,248 $10,363,988 $10,228,878 $10,347,009 Net interest margin 4.18% 4.21% 4.25% 4.48% 4.43% 4.44% 4.37% 4.28% 4.36% 4.33% Core net interest margin 3.93% 4.09% 4.06% 4.20% 4.18% 4.24% 4.21% 4.08% 4.12% 4.10% Note: All dollars in thousands © 2019 Pacific Premier Bancorp, Inc. | All rights reserved 36