Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Inovalon Holdings, Inc. | inov8-k1142020.htm |

Inovalon JPMorgan Healthcare Conference 2020 January 14, 2020

Cautionary Note Regarding Forward-Looking Statement Certain statements contained in this presentation constitute forward-looking statements within the meaning of, and are intended to be covered by the safe harbor provisions of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements contained in this presentation other than statements of historical fact, including but not limited to statements regarding the roll-out of any product or capability, the timing, performance characteristics and utility of any such product or capability, and the impact of any such product or capability on the healthcare industry, future results of operations and financial position, business strategy and plans, market growth, and objectives for future operations, are forward- looking statements. The words “believe,” “may,” “see,” “will,” “estimate,” “continue,” “anticipate,” “assume,” “intend,” “expect,” “project,” “look forward,” “promise” and similar expressions are intended to identify forward-looking statements. Forward-looking statements in this presentation include, but are not limited to, statements regarding the expected benefits and impact of the combination of Inovalon and ABILITY, including the expected accretive effect of the merger on Inovalon’s financial results, expectations about future business plans, prospective performance and opportunities, strategies and business plans, expectations regarding future results, expectations regarding the size of our datasets, expectations regarding implementation timeframes, our ability to meet financial guidance for the fourth quarter 2019 and full years 2019 and 2020, our ability to pay down outstanding indebtedness, expectations regarding tax rates, and statements with respect to visibility, revenue retention, and recurring revenue, including ACV. Inovalon has based these forward-looking statements largely on current expectations and projections about future events and trends that may affect financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs as of the date of this presentation. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, which could cause the future events and trends discussed in this presentation not to occur and could cause actual results to differ materially and adversely from those anticipated or implied in the forward-looking statements. These risks, uncertainties, and assumptions include, among others: the Company’s ability to continue and manage growth, including successfully integrating acquisitions, including ABILITY; ability to grow the client base, retain and renew the existing client base and maintain or increase the fees and activity with existing clients; the effect of the concentration of revenue among top clients; the ability to innovate new services and adapt platforms and toolsets; the ability to successfully implement growth strategies, including the ability to expand into adjacent verticals, such as direct to consumer, growing channel partnerships, expanding internationally and successfully pursuing acquisitions; the ability to successfully integrate our acquisitions and the ability of the acquired business to perform as expected; the successful implementation and adoption of new platforms and solutions, including the Inovalon ONE® Platform, ScriptMed ® Cloud, Clinical Data Extraction as a Service (CDEaaS™), Natural Language Processing as a Service (NLPaaS™), and Elastic Container Technology (ECT™); the possibility of technical, logistical or planning issues in connection with the Company’s investment in and successful deployment of the Company’s products, services and technological advancements; the ability to enter into new agreements with existing or new platforms, products and solutions in the timeframes expected, or at all; the impact of pending M&A activity in the managed care industry, including potential positive or negative impact on existing contracts or the demand for new contracts; the effects of and costs associated with compliance with regulations applicable to the Company, including regulations relating to data protection and data privacy; the effects of changes in tax laws in the jurisdictions in which we operate; the ability to protect the privacy of clients’ data and prevent security breaches; the effect of competition on the business; the timing, size and effect of business realignment and restructuring charges; and the efficacy of the Company’s platforms and toolsets. Additional information is also set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018, filed with the SEC on February 20, 2019, included under the heading Item 1A, “Risk Factors,” and in subsequent filings with the SEC. In addition, graphics, images or illustrations pertaining to or demonstrating our products, data, services and/or technology that may be used herein are intended for illustrative purposes only unless otherwise noted. The Company is under no duty to, and disclaims any obligation to, update any of these forward-looking statements after the date of this presentation or conform these statements to actual results or revised expectations, except as required by law. Non-GAAP Financial Measures This presentation contains certain non-GAAP measures. These non-GAAP measures are in addition to, not a substitute for or necessarily superior to, measures of financial performance in accordance with U.S. GAAP. The GAAP measure most closely comparable to each non-GAAP measure used or discussed, and a reconciliation of the differences between each non-GAAP measure and the comparable GAAP measure, is available herein and within our public filings with the SEC. All data provided is as of September 30, 2019 unless stated otherwise. INOV Investor Presentation (1.14.20) v1.0.0 2

Contents 1 Overview 2 Financials JPMorgan Healthcare Conference 2020 3 Conclusion 4 Appendix INOV Investor Presentation (1.14.20) v1.0.0 3

Strong Performance 59% Revenue Growth of Primary-Source 21% to 22% In 2019… On an as reported basis, with Datasets Growth to Organic 48 Billion Revenue Growth of Medical Events, compounded With Strong annually from Q3 2016 to Q3 2019 13% to 14% Momentum Continuing Adj EBITDA Growth of Operating In 2020… 38% to 42% to Cash Flow increase of $209M to $215M Representing a 44% to 60% to 33% $130M to $145M * All numbers refer to year-over-year change to 2019 guidance as provided by the Adjusted EBITDA Margin Company on October 30, 2019, unless otherwise stated. INOV Investor Presentation (1.14.20) v1.0.0 4

Payers Pharmacies Pharmaceuticals Devices Diagnostics The Inovalon ONE® Platform Inovalon is a leading provider of cloud- based platforms empowering data-driven healthcare. Inovalon provides cloud-based, real-time Massive Advanced Intervention Data connectivity, analytics, intervention, and Data Assets Analytics Toolsets Visualization data visualization solutions for hundreds of the nation’s leading health plans, pharmacy organizations, life sciences companies, and more than 50,000 acute, post-acute, and ambulatory provider sites with capabilities informed by the data of more than 287 million patients and more than 48 billion medical events. Home Care SNF Hospice Acute Providers Post-Acute Providers Ambulatory Providers Patients Note: Patient and medical event counts do not yet fully include data from ABILITY. INOV Investor Presentation (1.14.20) v1.0.0 5

Empowering Data-Driven Healthcare In Scale The reach of Inovalon’s platform has grown to touch the vast majority of the United States, able to empower the market’s largest data-driven healthcare initiatives. 100s Health Plans, Providers, Life Sciences, Pharmacy, and Diagnostics Organizations 287M+ Patients* 60K+ Provider Sites INOV Investor Presentation (1.14.20) v1.0.0 6

Cloud-Based Platform Approach Inovalon provides its solutions to the marketplace through the Inovalon ONE® Platform: an integrated, real-time cloud native platform which brings together the capabilities of extensive healthcare ecosystem connectivity, massive scale datasets, advanced analytics, and data-driven intervention tools. Together, the capabilities of the platform enable both the efficient determination of highly meaningful insights and the reliable achievement of meaningful impact in the quality and economics of healthcare. Clients/Partners Inovalon & Commercial Cloud Interactive Connectivity Payer Provider Pharmacy Life Sciences Applications Applications Applications Applications Application Connectivity Data Analytics API (Traditional Methodologies, Machine Learning, Artificial Intelligence, Deep Learning) Gateway Data Data Aggregation and Access Shared Services Exchange • Diagnosis, lab, • Eligibility and The MORE2 Registry® procedure, and Enrollment data pharmacy claims • DME usage data • 287M Unique Patients • Lab results data • Electronic Health • 48B Medical Events • Provider data Record (EHR) • 980,000 Physicians clinical data • Facility census and staffing data ™ • Patient-reported data iPORT HD • 546,000 Clinical Facilities • Cost data • Demographic data Customer-Specific Data Stores • Socioeconomic data INOV Investor Presentation (1.14.20) v1.0.0 7

Massive Data 49 2 ® 48 MORE REGISTRY DATASET GROWTH Assets 47 46 45 Patient Count Medical Event Count 44 43 42 Inovalon leverages massive datasets to 41 40 deliver differentiated capabilities to its clients. 39 38 37 36 These datasets are expanding rapidly. As of the 35 2 ® 34 end of Q3 2019, the MORE Registry dataset 33 59% 32 31 contained more than 287 million unique patient (millions) Count Patient 30 Medical Event 29 290 counts and 48 billion medical event counts, 28 Count Expansion 280 27 270 increases of 10% and 20%, respectively, 26 (3Q16 - 3Q19 CAGR) 260 25 250 24 240 compared with September 30, 2018. 23 230 22 220 21 210 20 200 One of the industry’s largest independent healthcare 19 190 18 180 datasets, with more than 287M patients and more 17 170 16 160 than 48B medical events 15 150 14 140 Medical Event CountEvent Medical (billions) 13 130 Primary-sourced, fully linkable, longitudinally-matched 12 120 11 110 data from all major U.S. healthcare programs 10 100 9 90 8 80 Contains EHR, claims, scripts, labs, provider, 7 70 6 60 demographic data and more 5 50 4 40 3 30 Qualified Entity (QE) containing CMS’ Fee for Service 2 20 1 10 Medicare Data 0 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 3Q19 Empowers and informs our industry-leading analytics and artificial intelligence, creating meaningful differentiation and client value Data resulting from the integration with ABILITY Network is not yet fully reflected within the MORE2 Registry® dataset and is therefore not fully reflected within the aforementioned data metrics as of this date. INOV Investor Presentation (1.14.20) v1.0.0 8

Benefits of Inovalon’s Massive Primary-Source Dataset The significant size, extensive breadth of data types, historical duration, recency timeliness, and fully linkable primary-sourced nature of Inovalon’s datasets provides a uniquely rich, longitudinally matched real-world dataset able to empower highly differentiated and highly valued capabilities. Training Advanced Artificial Intelligence Algorithms Informing Patient-Specific & Consumer Solutions Key to the development, training, and improvement of Healthcare is moving in a direction of increasing patient-specific AI, ML, and DL algorithms is the depth, breadth, engagements and consumerism focused offerings. The breadth, timeline duration, and timeliness of training datasets. depth, and primary source nature of Inovalon’s datasets is highly As a result of Inovalon’s unique datasets, the valuable and uniquely able to empower and deliver highly Company is able to apply a wide array of advanced granular patient-specific consumer-focused insights, details, and machine learning, artificial intelligence, and deep empowerment, bringing to life what is believed to be the largest learning algorithms to achieve highly differentiated, transformation segment of healthcare in the years ahead. high-value impact within the Company’s applications. Further, patient-specific data eliminates time-delays and operational costs otherwise caused today within the market when additional or confirmatory information is needed with respect to a specific patient or case. Enabling Outcomes-Based and Relative-Performance Analytics Supporting Large-Scale Real World Evidence (RWE) All value-based engagements, outcomes-based contracts, risk-based payment Research and Insights models, and all quality incentive programs are based on relative performance – Inovalon’s very-large scale RWE datasets empowers the graded on a dynamic curve. Without knowing how the relevant comparative Company to deliver solutions of great value to the population is performing today, healthcare organizations are shooting in the dark, pharmaceutical, device manufacturer, and research potentially wasting critical resources on the wrong issues. marketplace. RWE enables the healthcare ecosystem to make highly informed models, algorithms and decisions for numerous use cases including diagnosis and treatment protocol = Healthcare Organization determination tools, clinical trial design and execution, medication formulary optimization, outcomes-based contract structuring and honing, payment model design, and many other use cases. INOV Investor Presentation (1.14.20) v1.0.0 9

Highly Differentiated Within the Market A leader in providing cloud-based tools to support data-driven healthcare, Inovalon empowers clients to achieve their clinical quality and financial goals by bringing highly differentiated capabilities to bear – unavailable from any other platform provider. Breadth of Connectivity: Market’s Largest Primary-Source 287M+ Inovalon has achieved wide Dataset Enabling Meaningful Patients connectivity with hundreds of Insight and Impact: thousands of physicians, payers, Deep data informs the most advanced EHRs, HIEs and the data algorithms and translates into highly 980K+ pertaining to hundreds of millions differentiated insights that help to Providers of patients. This connectivity achieve the most advanced impact. allows for real-time data capture, Availability of data further reduces time- real-time application of resulting to-care, operational costs, and human 48B+ insights – driving real-time impact error rates. Medical Events and achievement of value. Industry-Leading Analytics: Scale, Speed & The Power of The extensive array of highly data-trained and time- Compute: tested algorithms developed and honed by Inovalon Sophisticated proprietary cloud provide for many steps within the inherently complex architectures and massive cloud-based processes of real-world healthcare operations to be compute environments allow for highly improved – thus achieving a superior, multi-faced advanced analyses of large datasets in real approach to improve care outcomes and economics. time, allowing clients to garner and apply The ongoing flow of data and access to outcomes the most advanced insights quickly - to feedback inherent to Inovalon’s platform further impact strategy, clinical care, and financial translates into a cycle of continuous improvement that has performance – allowing clients to win within meaningfully demonstrated substantive differentiation of Inovalon’s their highly competitive environments. analytics versus alternatives. INOV Investor Presentation (1.14.20) v1.0.0 10

Large Growing Market Opportunity The market for data-driven healthcare solutions continues to expand, now estimated to be approximately $161Bn in 2020. The expansion of Inovalon’s capabilities over the same period has resulted in a near tripling of the portion that the Company’s capabilities can serve today from approximately $10.6Bn to $27Bn over these four years. 2016 2018 2020 Payers $17.3Bn Payers $15.6Bn Providers Payers Providers Current $40.1Bn Current Payer $18.7Bn $40.6Bn Payer Providers Products Products Current $36.2Bn $16.3Bn Current $14.7Bn Payer Providers Products Current Providers Current Products $11.9Bn Providers $6.8Bn Products Products $6.5Bn Pharmacy/Life $5.1Bn Pharmacy/Life Sciences Sciences Pharmacy/Life $46.6Bn $51.4Bn Sciences $63.5Bn Consumer Consumer Current Current $33.2Bn Pharmacy/Life $18.7Bn Consumer Sciences Pharmacy/Life Current $37.9Bn Products Sciences $5.8Bn Pharmacy/Life Products Sciences $7.0Bn Products $8.5Bn Independent industry top-down market spend on software and information technology services in healthcare Bottoms-up application of existing Inovalon capabilities to respective market segment opportunity (note: 2020 removes legacy solutions) Notes: Gartner, IDC, Research and Markets and Inovalon INOV Investor Presentation (1.14.20) v1.0.0 11

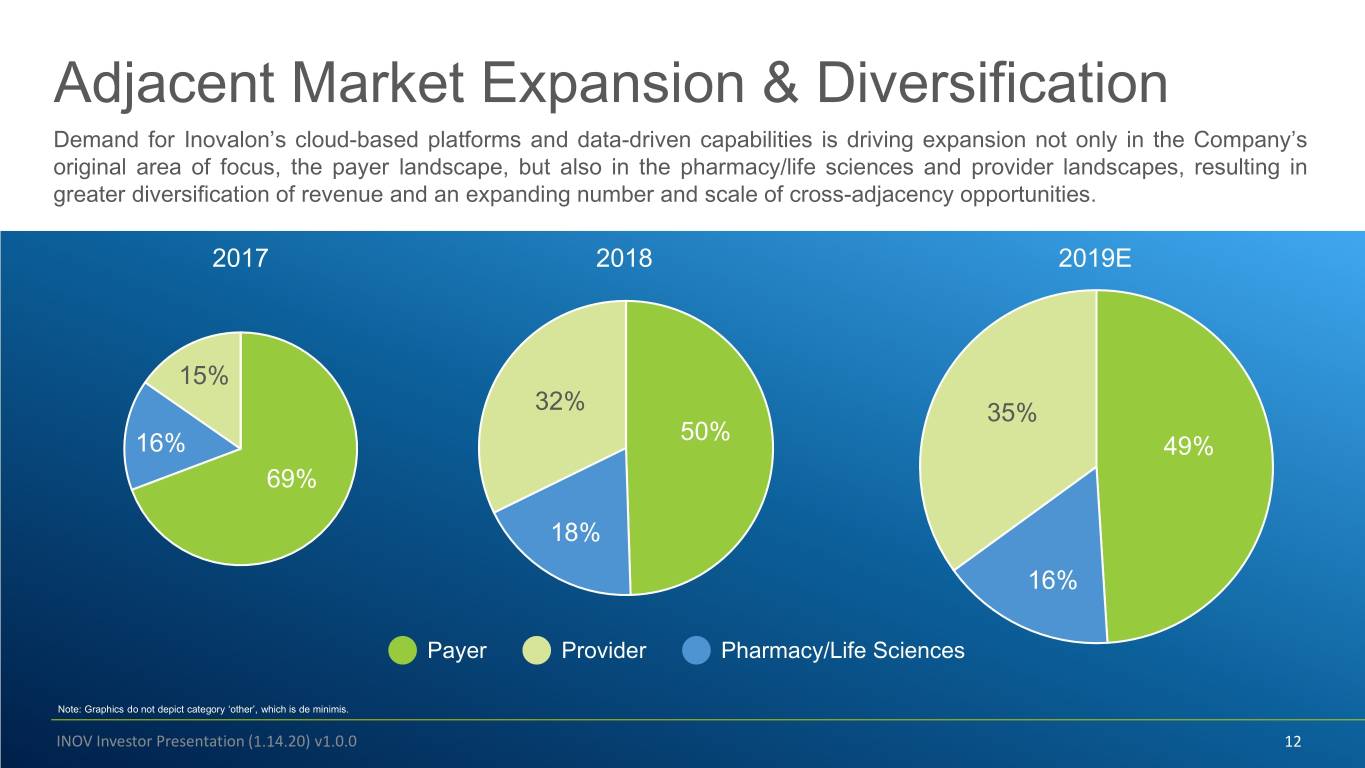

Adjacent Market Expansion & Diversification Demand for Inovalon’s cloud-based platforms and data-driven capabilities is driving expansion not only in the Company’s original area of focus, the payer landscape, but also in the pharmacy/life sciences and provider landscapes, resulting in greater diversification of revenue and an expanding number and scale of cross-adjacency opportunities. 2017 2018 2019E 15% 32% 35% 50% 16% 49% 69% 18% 16% Payer Provider Pharmacy/Life Sciences Note: Graphics do not depict category ‘other’, which is de minimis. INOV Investor Presentation (1.14.20) v1.0.0 12

Leading Client Presence Across Verticals Reflecting Inovalon’s differentiated capabilities, the Company’s significant client base includes 24 of the Top 25 health plans by size in the nation, 22 of the Top 25 global pharma companies, 19 of the Top 25 healthcare provider systems, and more than 50,000 U.S. provider sites. Top 25 U.S. Total U.S. Top 25 U.S. Healthcare Top-25 Global Pharma / Life Sciences Health Plans Health Plans Provider Systems Pharma Companies Companies 24 103 19 22 130 1 4 5 of 25 of 490 2 of 25 3 of 25 of 1,842 1) Top 25 health plans based on AIS 2018 directory and CMS data; 2) Total U.S. health plans based on AIS 2018 directory; 3) Sites of care as of September 2018 based on CMS data; combined Inovalon and ABILITY site count of >50,000; 4) Top 25 pharma companies based on PharmExec's Top 50 Companies 2018; 5) Avalere client database. ABILITY Network data is not yet fully included in the metrics above. INOV Investor Presentation (1.14.20) v1.0.0 13

Growing Network Effect of Business Model Inovalon’s business model is comprised predominantly (83%) of cloud-based subscription-based engagements with healthcare enterprises. Fees are charged predominantly in a Per Member Per Month (PMPM) manner or other monthly manner related to patient volume, use, and activity on the Platform. The more Modules of the Inovalon ONE® Platform engaged, generally the higher the fee charged across the relevant patient base. Once an organization starts using the Platform, it is easy to expand to additional capability Modules (raising the “P”) or to additional patient memberships (raising the “Q”). Additionally, there is a cross-entity synergy and network effect. The more health plans that are engaged, the more appealing certain Modules are to pharmacy organizations, for example. This virtuous cycle of client value expansion drives a network effect of value to clients and to Inovalon. Denotes Inter-Client Network Effect Synergy of connectivity into and utilization of the Inovalon ONE® Platform begetting greater value for clients and incremental business expansion for Inovalon Platform Platform ® ® ONE Inovalon in the Inovalon ONE Inovalon thethe in in Number of Solutions Utilizing Utilizing Utilizing Modules Modules Solutions Solutions of of Number Number Payer Clients Provider Clients Pharmacy Clients Life Sciences Clients INOV Investor Presentation (1.14.20) v1.0.0 14

Continued Innovation & Market Leadership Through 2019, Inovalon continued to expand its arsenal of cloud-based offerings through expanded capabilities within existing offerings, new Modules offered within the Inovalon ONE® Platform, and new configurations of the Platform to service the growing needs of the marketplace. Cloud-Based Pharmacy Platform Cloud-Based Natural Language Processing Cloud-Based Clinical Data Extraction as a Service Cloud-native-based enterprise platform supporting end-to- Automated ability to ingest, convert, analyze, and clearly Automated ability to identify and aggregate clinical record end pharmacy operations with advanced analytics, present structured and unstructured medical record data data from Electronic Medical Record (EMR) and Health extensive connectivity, and multi-stakeholder coordination, content in near real time Information Exchange (HIE) systems in near real time reducing time-to-fill, improving patient care, and enhancing financial performance Real-Time Data Supplementation Elastic Container Technology (ECT™) Cloud-Based Healthcare Data Lakes Elastic Capacity A ground-breaking real-time capability initiative that Multi-tenancy cloud native compute architecture that Provides clients with an industry-leading single-source-of- provides for patient-specific data supplementation to enables high density leveraging of aggregated cloud truth aggregation of the client’s otherwise disparate datasets, reduces time and costs otherwise required to gather environment infrastructure, enabling significant increases in supporting translation of structured and unstructured data, disparate data – allowing faster diagnosis, treatment, and speed, resiliency, and operating cost efficiency and data supplementation from the industry’s largest service and lowering operating costs. healthcare dataset, the MORE2 Registry®, empowering clients to unlock the value of their own data assets. INOV Investor Presentation (1.14.20) v1.0.0 15

Continued Investment in Go-To-Market Processes Through 2019, Inovalon continued to significantly improved its go-to-market processes: investing in streamlining sales processes, improving account profiling, revamping digital marketing materials and content, and focusing on the client and their success. Streamlining of Sales Processes (Project “Simplify”) Revamping of Digital Marketing Materials Improved Account Profiling Focus on the Client XXXX: Redacted numbers for the purpose of confidentiality INOV Investor Presentation (1.14.20) v1.0.0 16

Continued Salesforce Expansion Through 2018 and 2019, Inovalon has significantly increased the scale and sophistication of its salesforce. Key to the transition has been not only the increase in personnel count, but also the personnel types and the nature of approach. Now, instead of leading sales from a healthcare subject matter-led mindset, sales are driven by technology sales leads, supported by healthcare subject matter expert support personnel. = Technology Sales Leads Q3 2019 FTEs = 251+ = Healthcare Subject Matter Experts Sales Leads = Sales Support Q1 2017 FTEs = 79 Q1 2015 FTEs = 15 Q4 2018 FTEs = 210+ 2015 2016 2017 2018 2019 2020 Driven by Healthcare Subject Matter Experts Sales Leads Driven by Technology Sales Leads Note: Figure intended to be illustrative INOV Investor Presentation (1.14.20) v1.0.0 17

Strong Growth Market demand for the capabilities empowered by the Inovalon ONE® Platform, in combination with the continued expansion and growing sophistication of the Company’s go-to-market capabilities and operational efficiencies of Inovalon’s business model, have translated into strong financial performance. The graphics below compare the resulting Q3 2019 TTM to Q3 2018 TTM for revenue, Adjusted EBITDA, Non-GAAP net income per share (EPS) and Free Cash Flow generation (inclusive of cash interest, ABILITY transaction and integration spend, and CAPEX outflows). Revenue Adjusted EBITDA Non-GAAP EPS Free Cash Flow1 $0.43 $45.0 $605.2 $191.9 20% 38% 65% 1,304% $506.0 $138.6 $0.26 $3.2 Q3 2018 Q3 2019 Q3 2018 Q3 2019 Q3 2018 Q3 2019 Q3 2018 Q3 2019 TTM TTM TTM TTM TTM TTM TTM TTM 1Free Cash Flow is defined as net cash provided by operating activities less purchases of property and equipment and less investment in capitalized software. INOV Investor Presentation (1.14.20) v1.0.0 18

Multifaceted Strategic/Tuck-in acquisitions Growth Drivers Strategic/Tuck- of customers, technologies and In M&A geographic expansion opportunities further support Inovalon’s growth is supported by five growth. Inovalon continues to introduce significant drivers. new platform capabilities for New existing clients and an Technologies and expanding array of adjacent Adjacent Markets markets. Inovalon continues to pursue new logos including payers, New Clients providers, pharmacy organizations, and life sciences companies. Inovalon has a strong history of up-selling and Cross-Selling and cross-selling into the Up-Selling Within company’s existing client Existing Client Base base. Underlying demographic The Expansion and societal trends growing of Patient Populations organic covered patient Under Contract lives by approximately 5% per year. INOV Investor Presentation (1.14.20) v1.0.0 19

Contents 1 Overview 2 Financials JPMorgan Healthcare Conference 2020 3 Conclusion 4 Appendix INOV Investor Presentation (1.14.20) v1.0.0 20

Revenue The following full-year revenue actual and guidance through 2020 was provided as of October 30, 2019, and reiterated today, January 14, 2020. $698 - $718 $638 - $643 2016 – 2020G 11% CAGR $528 $449 $428 2016 2017 2018 2019G 2020G Note: CAGR calculations undertaken to the mid-point of 2020 Guidance. All numbers in millions. Graphic drawn at midpoint of guidance range. INOV Investor Presentation (1.14.20) v1.0.0 21

Strong Subscription-Based Platform Adoption The graphic below illustrates the revenue offering mix, which is expanded to include the Company’s 2020 guidance range as of October 30, 2019, and reiterated today, January 14, 2020. $698 - $718 $638 - $643 ~10% 2016 – 2020G ~10% ~6% Subscription-Based CAGR 27% $527.7 ~7% 11% $449.4 $427.6 9% 12% 15% 19% 34% ~84% ~83% 80% 66% 54% 2016 2017 2018 2019G 2020G Subscription-Based Platform Offerings Legacy Solutions Services All numbers in millions. INOV Investor Presentation (1.14.20) v1.0.0 22

Increasing Efficiency The Company’s transition to higher-valued cloud-based offerings leveraging increased connectivity, software automation, SaaS- based, and subscription-based offerings has witnessed a substantial corresponding decrease in headcount while concurrently expanding revenue and profitability. Reflecting this, headcount for the period year-end 2015 through Q3 2019 decreased by over 1,300, and TTM Adjusted EBITDA per headcount increased by 52% during the period. 16% Total Headcount Decrease From Year-End 2015 to Q3 2019 52% Increase in TTM Adjusted EBITDA 774 Per Headcount of 3,323 1,322 $69,142 2,775 TTM Adjusted EBITDA Per Headcount of $45,628 * Total net decrease in headcount includes a gross increase of 774 headcount from acquisitions during the period, and gross headcount efficiency reductions of 1,322. Q4 Headcount Headcount Q3 2015 Acquired Efficiency 2019 Note: Acquisition of Avalere Health occurred prior to year-end 2015 INOV Investor Presentation (1.14.20) v1.0.0 23

Adjusted EBITDA The following full-year Adjusted EBITDA actual and guidance through 2020 was provided as of October 30, 2019, and reiterated today, January 14, 2020. $231 - $241 $209 - $215 2016 – 2020G 19% CAGR $152 $109 $100 33% 33% 29% 23% 24% 2016 2017 2018 2019G 2020G % of Revenue Note: CAGR calculations undertaken to the mid-point of 2020 Guidance. All numbers in millions. Graphic drawn at midpoint of guidance range. INOV Investor Presentation (1.14.20) v1.0.0 24

Cash Flow From Operations The following full-year Cash Flow From Operations actual and guidance through 2020 was provided as of October 30, 2019, and reiterated today, January 14, 2020. $145 - $160 $130 - $145 2016 – 2020G CAGR 11% $1041 $98 $93 $90 22% 22% 22% 21% 17% 2016 2017 2018 2019G 2020G % of Revenue Note: CAGR calculations undertaken to the mid-point of 2020 Guidance. All numbers in millions. Graphic drawn at midpoint of guidance range. 1 Net cash provided by operating activities was $90.4M in 2018. Incorporated within this number was the negative impact of acquisition-related transaction cash outflows of $6.6M and integration cash outflows of $6.8M. Normalizing for these one-time items, the non-GAAP cash flow from operations would have been $104 million as represented by the green dotted line. INOV Investor Presentation (1.14.20) v1.0.0 25

CAPEX Returning Towards Historical Levels During the period Q3 2016 through Q1 2018, the Company elected to invest more than $40M into incremental development towards the launch of the Inovalon ONE® Platform. The period of this disproportional investment is now substantially complete and is increasingly being harvested through the successful engagement of clients for highly-differentiated platform offerings. As a result, the Company sees the capital investments of the Company returning towards historical levels (as a percentage of revenue) in 2020. $65.5 $65.0 $6.4 $52 - $58 $52 - $58 $28.1 $39.1 15% $45.8 $7.8 12% $39 - $44 $39 - $44 $26.4 9% $22.7 8% - 9% 7% - 8% $28.5 $18.8 6% 6% 6% $23.2 $13.2 $20.2 $25.2 $12.8 $13 - $14 $13 - $14 $8.1 $8.9 $5.6 $2.5 $1.2 2013 2014 2015 2016 2017 2018 2019G 2020G Maintenance Capital Expenditure Innovation Capital Expenditure (incl. Cap. Software) Inovalon ONE® Platform Buildout Capital Expenditure % Of Revenue Capital Expenditure (CAPEX) is defined as the sum of Purchases of property and equipment and Investment in capitalized software. All numbers in millions. INOV Investor Presentation (1.14.20) v1.0.0 26

Covenant-Lite Debt Leverage On April 2, 2018, the Company put in place a $980M seven-year term debt facility and $100M revolving debt facility. Proceeds were used to pay off all of the Company’s existing debt obligations of $225M as well as to provide the financing necessary to fund a portion of the consideration paid for the ABILITY Network acquisition. Following the ABILITY acquisition, the Company’s financial position remains strong, with significant liquidity, strong cash flow, and balance sheet flexibility. The debt facility’s maturity schedule provides financial flexibility with 93.7% of principal due in 2025, and the Term Loan does not contain any standing financial covenants. Additionally, the Company’s interest rate swaps fix $700M, or 76.3%, of the debt facility’s principal amount. The Company expects to apply its strong cash flow to pay down its debt to achieve a Net Debt Leverage Ratio of less than 3.00x. 4.23x No Standing Financial 6.05% Current Senior Secured Weighted Average Net Debt Leverage Ratio5 Covenants Interest Rate 1 Debt Maturity Profile 1, 2 Interest Rate 3 Net Debt 1 $917.8 $218.8 $824.7 Floating $868.8 76.3% of the term $700.0 debt interest 4 3 $100.0 rate is fixed $0.0 $9.8 $9.8 $9.8 $9.8 $9.8 2019 2020 2021 2022 2023 2024 2025 Term Facility Current Term Facility Revolving Facility * All numbers in millions. 1 As of December 31, 2019. 2 Debt maturity includes all mandatory and fixed principal payments. 3 In 2018, the Company entered into four interest rate swaps, each of which mature in March 2025. The interest rate swaps fix the LIBOR rate component of interest on $700.0 million of the 2018 debt facility at a weighted average rate of approximately 2.8%. 4 As of January 14, 2020, the Company has not drawn any amount under its available $100 million revolver. If the Company draws on the revolver, a maximum senior secured net leverage ratio of 7-to-1 (or better) is required to be maintained across the senior secured debt and revolver. The revolver, if drawn, must be repaid by 2023. 5 As of September 30, 2019. INOV Investor Presentation (1.14.20) v1.0.0 27

Financial Guidance The Company’s full-year 2019 and 2020 guidance was provided as of October 30, 2019, and is being reiterated today, January 14, 2020. 2019 2020 YOY Financial Metric Financial Guidance Financial Guidance Change2 Revenue $638 million to $643 million $698 million to $718 million 9% to 12% Net Income1 $9 million to $13 million $22 million to $28 million 100% to 155% Non-GAAP net income1 $74 million to $78 million $86 million to $91 million 13% to 20% Adjusted EBITDA $209 million to $215 million $231 million to $241 million 9% to 14% Net Cash Provided By Operating Activities $130 million to $145 million $145 million to $160 million 5% to 16% Capital Expenditures $52 million to $58 million $52 million to $58 million --- Diluted Net Income Per Share1 $0.06 to $0.09 $0.15 to $0.19 100% to 153% Non-GAAP diluted net income per share1 $0.50 to $0.52 $0.57 to $0.61 12% to 20% (1) The Company is assuming 149 million weighted average diluted shares and an effective tax rate of approximately 28% for the full year 2019, and 150 million weighted average diluted shares and an effective tax rate of approximately 28% for the full year 2020. (2) YOY Change is presented as the percentage increase of the low-end and high-end range of 2020 Guidance from the mid-point of the corresponding 2019 Guidance. INOV Investor Presentation (1.14.20) v1.0.0 28

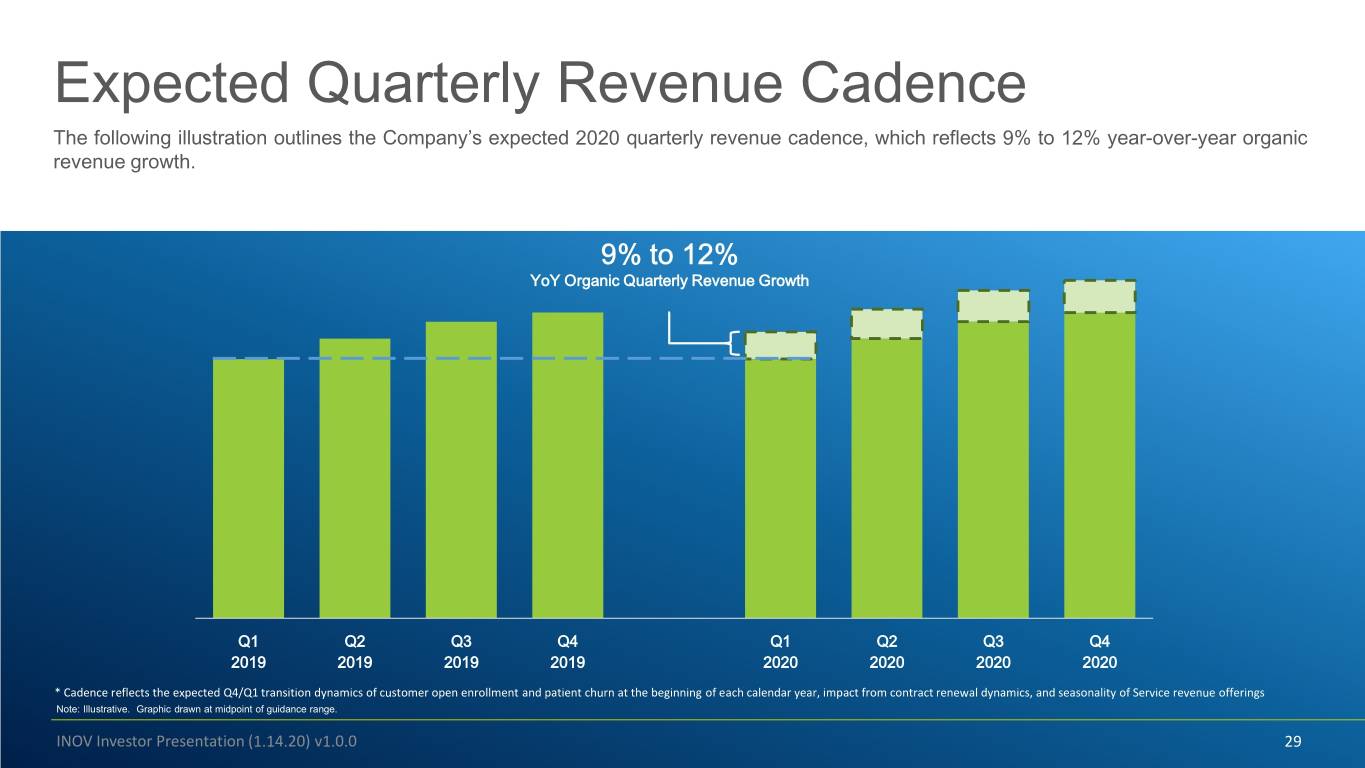

Expected Quarterly Revenue Cadence The following illustration outlines the Company’s expected 2020 quarterly revenue cadence, which reflects 9% to 12% year-over-year organic revenue growth. 9% to 12% YoY Organic Quarterly Revenue Growth Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2019 2019 2019 2019 2020 2020 2020 2020 * Cadence reflects the expected Q4/Q1 transition dynamics of customer open enrollment and patient churn at the beginning of each calendar year, impact from contract renewal dynamics, and seasonality of Service revenue offerings Note: Illustrative. Graphic drawn at midpoint of guidance range. INOV Investor Presentation (1.14.20) v1.0.0 29

Contents 1 Overview 2 Financials JPMorgan Healthcare Conference 2020 3 Conclusion 4 Appendix INOV Investor Presentation (1.14.20) v1.0.0 30

Market Leadership Strong Continuing Continued as the industry’s largest cloud- based provider of data-driven Organic Revenue solutions to the healthcare Strength in 2020 ecosystem with primary-source datasets of Growth The Company is pleased with its continued expansion in scale, reach, 9% to 12% and sophistication of its connectivity, >287M for 2020 analytics, and value-impact, resulting Patients in what is being seen as a strong continued market differentiation, very positive sales growth, client retention rates, revenue and profitability Significant Strong Operating expansion. Profitability of Cash Flow of $231M to $241M $145M to $160M Adjusted EBITDA, or a Representing 33% 21% to 22% of Projected 2020 Revenue Adjusted EBITDA Margin * All numbers refer to 2020 guidance provided by the Company on October 30, 2019, or numbers as of September 30, 2019. for 2020 INOV Investor Presentation (1.14.20) v1.0.0 31

Comparable Valuations The following is provided for comparable valuation consideration purposes. NMF NMF NMF: Not Meaningful Source: NASDAQ IR Insight as of January 3, 2020 Business model peers have been selected based upon having similar SaaS and subscription-based business models similar to that of Inovalon. INOV Investor Presentation (1.14.20) v1.0.0 32

Contents 1 Overview 2 Financials JPMorgan Healthcare Conference 2020 3 Conclusion 4 Appendix • Case Study Examples • Reconciliations and Definitions INOV Investor Presentation (1.14.20) v1.0.0 33

Case Study Examples INOV Investor Presentation (1.14.20) v1.0.0 34

Providing Cloud-Based Tools That Empower Data-Driven Healthcare For Pharmacy For Life Sciences For Payers… For Providers… Organizations… Companies… Operational Clinical Quality Quality Point-of-Care Automate Reduce Operational Health Economics Optimal Treatment Transparency Metrics of Care Analytics Referrals Costs and Outcomes Protocols Research Risk Score Patient Administrative Clinical Operational Streamline Order Improve Commercialization Outcomes-Based Accuracy Engagement Improvement Efficiency Workflow Patient Care Strategies Contracting Patient Financial Patient Provider Medical Claims Patient Market Payer Outcomes Performance Outcomes Engagement Processing Outcomes Access Operations INOV Investor Presentation (1.14.20) v1.0.0 35

The Inovalon ONE® Platform Within the Inovalon ONE® Platform, there are nearly 100 individual proprietary application toolsets, or “Modules”, able to be rapidly configured to empower the operationalization of very large-scale data-driven healthcare initiatives that are highly differentiated, efficient, modular, and flexible. The graphic below depicts some of these application toolsets. INOV Investor Presentation (1.14.20) v1.0.0 36

Payer Platform Offering Example I For payer clients utilizing Inovalon’s clinical quality analysis and improvement solutions, sophisticated analytics identify patients with meaningful quality gaps, while connectivity into EHRs, decision support platforms, and data-driven intervention platforms empower their improvement. The result is greater quality scores and significant incentive payment benefits with strong ROIs. $75M Regional Health Plan Quality Bonus 140K Members Payment Recieved1 * Quality bonuses received by the health plan equates to an incremental payment to the plan $10M Inovalon Cost Year2013 1 | Year 2014 2 | Year 2015 3 | Year 2016 4 Inovalon Engagement ROI = 7.5 : 1 1 QBP Equation: 140K members x incremental $44.64 per patient per month quality bonus payment for 12 months INOV Investor Presentation (1.14.20) v1.0.0 37

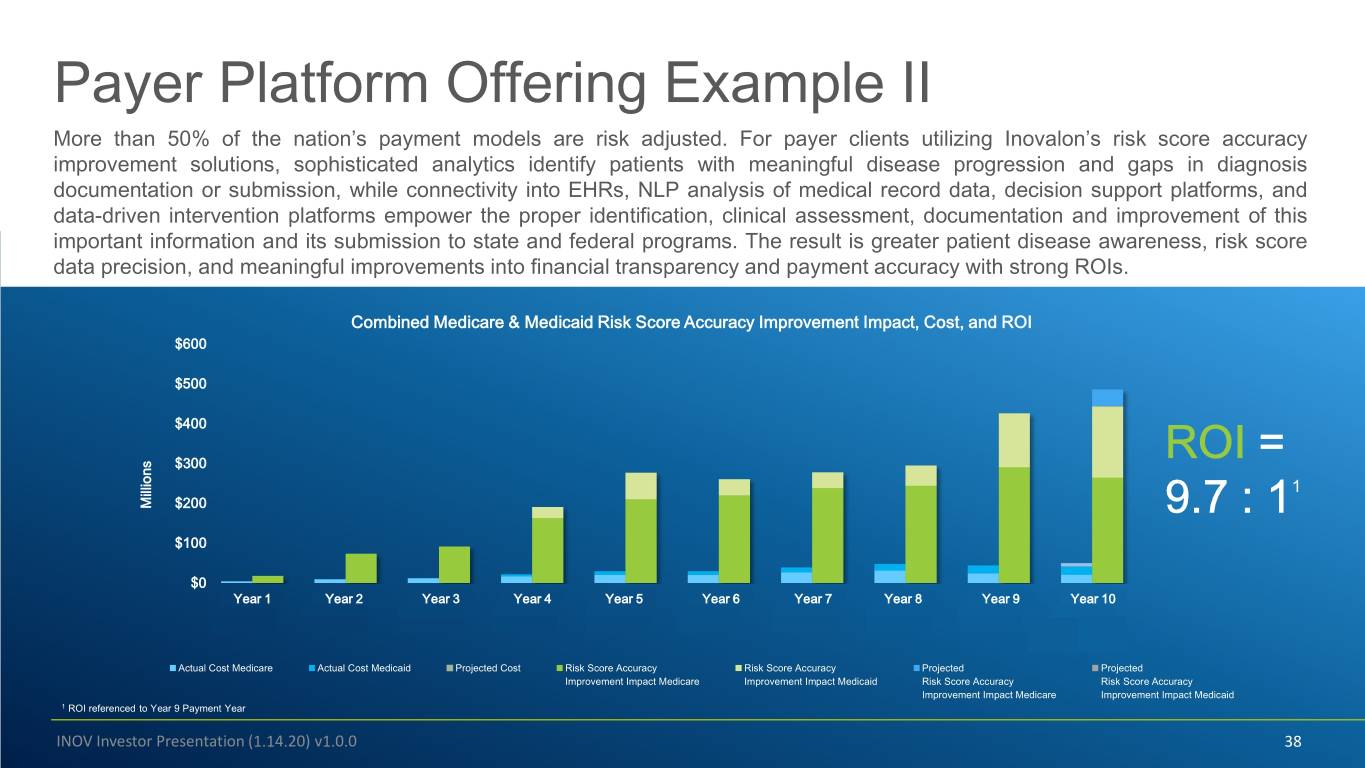

Payer Platform Offering Example II More than 50% of the nation’s payment models are risk adjusted. For payer clients utilizing Inovalon’s risk score accuracy improvement solutions, sophisticated analytics identify patients with meaningful disease progression and gaps in diagnosis documentation or submission, while connectivity into EHRs, NLP analysis of medical record data, decision support platforms, and data-driven intervention platforms empower the proper identification, clinical assessment, documentation and improvement of this important information and its submission to state and federal programs. The result is greater patient disease awareness, risk score data precision, and meaningful improvements into financial transparency and payment accuracy with strong ROIs. Combined Medicare & Medicaid Risk Score Accuracy Improvement Impact, Cost, and ROI $600 $500 $400 $300 ROI = 1 Millions $200 9.7 : 1 $100 $0 2009Year 1 2010Year 2 2011Year 3 2012Year 4 2013Year 5 2014Year 6 2015Year 7 2016Year 8 2017Year 9 2018Year 10 Payment Payment Payment Payment Payment Payment Payment Payment Payment Payment Year Year Year Year Year Year Year Year Year Year Actual & Forecast Actual Cost Medicare Actual Cost Medicaid Projected Cost Risk Score Accuracy Risk Score Accuracy Projected Projected Improvement Impact Medicare Improvement Impact Medicaid Risk Score Accuracy Risk Score Accuracy Improvement Impact Medicare Improvement Impact Medicaid 1 ROI referenced to Year 9 Payment Year INOV Investor Presentation (1.14.20) v1.0.0 38

Provider Platform Offering Example Over 41,000 provider sites utilize Inovalon’s myABILITY® Platform to improve the quality of care, workforce efficiency, and many elements of financial performance within their acute, post-acute, and ambulatory facilities. Through the utilization of a portfolio of toolsets, providers improve their operational efficiency, reimbursement accuracy, and strength of cash flow, positioning them for success in this challenging environment. Increased Improved Delivering Revenue Monthly Cash 5.0% Capture Flow Increased 99.0% Revenue Small to Mid-Sized First Pass Approval $144,031 $1,188,287 1 Hospital2 Capture Claims Rate Post-Acute Facility $17,210 $139,564 Per Physician $373 $3,080 2.44 ROI = DSO Improvement 8.9 : 1 1 Based on MGMA denial benchmarks, April 2018 2 Based on Definitive Health, Average Annual Revenue Hospitals 25-238 Beds * Results based on the utilization of the myABILITY® EASE All-Payer portfolio solution INOV Investor Presentation (1.14.20) v1.0.0 39

Pharmacy Platform Offering Example Inovalon’s ScriptMed® Cloud empowers a 15% to 17% reduction in cost to serve per script versus current industry-standard enterprise platform solutions supporting the Specialty Pharmacy marketplace. Applied to an industry benchmark of $60.15 per specialty pharmacy script, this reduction translates into approximately $9.02 to $10.21 in savings per fill. In the setting of a specialty pharmacy processing 1 million scripts per year, this accumulates to approximately $9.0 to $10.2 million in savings per year. Reduced Referral cost reduction of 9.7% from: Cost to Serve by • Auto data prefilling reducing time and costs vs. manual entry 15% to 17% Referral • Improved data accuracy reducing error correction time and process delays • Automation reducing labor • Electronic connections replacing phone and fax time and costs Clinical cost reduction of 4.9% from: • Expanded data-driven clinical capabilities Cost to • Direct-connect with EHRs Clinical Serve • Improved patient adherence Order cost reduction of 0.5% from: 15% to 17% • Lowered re-work rates Reduction in Order • Improved processing of order exceptions Cost to Serve Fulfillment cost reduction of 0.5% from: Fulfillment • Lowered re-work and return rates • Optimization of shipping and routing Revenue Cycle RCM cost reduction of 0.5% from: • Reduced labor and improved medical Contracts claims and payment processing Inventory Overhead cost reduction of 1.0% from: • Operational & performance visibility tools Overhead • Simplified training, skill requirements, and job aids INOV Investor Presentation (1.14.20) v1.0.0 40

Pharmaceutical Platform Offering Example For clients utilizing Inovalon’s Outcomes-Based Contracting (OBC) Platform: payers benefit from reductions in overall costs; patients benefit from improved outcomes; providers benefit from support for their patients; and pharmaceutical manufacturers benefit from greater unit sales of their medications. While the cost of a medication by itself may be Total Healthcare Cost Reduction Achieved with more expensive than an Inovalon’s OBC Platform alternative or predecessor in the market, deep analysis of Medication Cost optimal patient identification and data-driven enablement Additional 32.3% of patient-specific monitoring Medical Total Healthcare 1 and intervention support can Costs Cost Reduction result in significant overall cost reductions while also achieving superior clinical quality outcomes. Market Standard Inovalon OBC State Platform State 1 Study performed by Inovalon pharmaceutical manufacturer client. 134,599 patients on standard care vs. 2,122 patients on specified medication showing opportunity for PPPY improvement in setting of specific medication and adherence. Illustrative. INOV Investor Presentation (1.14.20) v1.0.0 41

Differentiated Subject Matter Expertise Life Sciences Outcomes Reimbursement Market Access Capabilities for Strategy Research & Revenue Cycle Clinical Decision Clinical Predictive Clinical Analytics Life Sciences Support Interoperability Analytics Health Plan Healthcare Technical Pharmacy Operations Economics Architecture Leveraging Inovalon’s massive data assets, deep subject matter expertise, Large-Scale Real-World MORE2 Registry® Data Registry and the advanced technologies of the Inovalon ONE® Platform, life sciences clients benefit from not only data empowered advisory services able to 287 Million 48 Billion 980,000 546,000 Patients Clinical Events Physicians Clinical Facilities inform strategy and commercialization, but also inform the configuration of Advanced Technologies Platform Inovalon ONE® Platform configurations that support outcomes-based contracting, improved compliance and persistence, and advanced business models. Massive Advanced Intervention Data Data Assets Analytics Toolsets Visualization INOV Investor Presentation (1.14.20) v1.0.0 42

Reconciliations and Definitions INOV Investor Presentation (1.14.20) v1.0.0 43

Reconciliation of Forward-Looking Guidance Adjusted EBITDA Inovalon defines Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA) as net income or loss calculated in accordance with GAAP, adjusted for the impact of depreciation and amortization, other expense, net, interest income, interest expense, provision for income taxes, stock-based compensation, acquisition costs, restructuring expense, tax on equity exercises, and other non-comparable items. Adjusted EBITDA margin is defined as Adjusted EBITDA as a percentage of revenue. A reconciliation of net income to Adjusted EBITDA follows: Guidance Range Three Months Ending Year Ending Year Ending December 31, 2019 December 31, 2019 December 31, 2020 (In millions) Low High Low High Low High Reconciliation of Forward-Looking Guidance Net (loss) income to Adjusted EBITDA: Net (loss) income $ 6 $ 10 $ 9 $ 13 $ 22 $ 28 Depreciation and amortization 27 27 108 108 109 109 Interest expense 16 16 66 66 63 64 Interest income (1) (1) (3) (3) (3) (3) Provision for income taxes (1) 2 3 (1) — 9 11 EBITDA 50 55 179 184 200 209 Stock‑based compensation 6 6 20 20 27 28 Acquisition costs: Transaction costs — — 1 1 — — Integration costs — — 5 5 — — Contingent consideration — — — — — — Other non-comparable items (2) — 1 4 5 4 4 Adjusted EBITDA $ 56 $ 62 $ 209 $ 215 $ 231 $ 241 Adjusted EBITDA margin 33.1% 35.6% 32.8% 33.4% 33.1% 33.6% (1) A 28% statutory tax rate is assumed in order to approximate the Company's effective corporate tax rate. (2) Other “non-comparable items” include items that are not comparable across reporting periods or items that do not otherwise relate to the Company’s ongoing financial results, such as certain employee related expenses attributable to advancements in automation and operational efficiencies, and legal expenses beyond those in the normal course of business. Non-comparable items are excluded from Adjusted EBITDA in order to more effectively assess the Company’s period over period and ongoing operating performance. INOV Investor Presentation (1.14.20) v1.0.0 44

Reconciliation of Forward-Looking Guidance Non-GAAP Net Income Inovalon defines Non-GAAP net income as net income or loss calculated in accordance with GAAP, adjusted to exclude tax-affected stock-based compensation expense, acquisition costs, restructuring expense, amortization of acquired intangible assets, amortization of debt issuance costs and debt discount, tax on equity exercises, and other non-comparable items. The Company defines Non-GAAP diluted net income per share as Non-GAAP net income divided by diluted weighted average shares outstanding. A reconciliation of net income to Non-GAAP net income follows: Guidance Range Three Months Ending Year Ending Year Ending December 31, 2019 December 31, 2019 December 31, 2020 (In millions, except per share amounts) Low High Low High Low High Reconciliation of Forward-Looking Guidance Net (loss) income to Non-GAAP net income: Net (loss) income $ 6 $ 10 $ 9 $ 13 $ 22 $ 28 Stock‑based compensation 6 6 20 20 27 28 Acquisition costs: Transaction costs — — 1 1 — — Integration costs — — 5 5 — — Contingent consideration — — — — — — Amortization of acquired intangible assets 13 13 52 52 52 52 Amortization of debt issuance costs and debt discount 1 1 4 4 4 4 Other non-comparable items (1) — 1 4 5 4 4 Tax impact of add-back items (2) (8) (9) (21) (22) (23) (25) Non-GAAP net income $ 18 $ 22 $ 74 $ 78 $ 86 $ 91 GAAP diluted net income per share $ 0.04 $ 0.07 $ 0.06 $ 0.09 $ 0.15 $ 0.19 Non-GAAP diluted net income per share $ 0.12 $ 0.15 $ 0.50 $ 0.52 $ 0.57 $ 0.61 Weighted average shares of common stock outstanding - diluted 149 149 149 149 150 150 (1) Other “non-comparable items” include items that are not comparable across reporting periods or items that do not otherwise relate to the Company’s ongoing financial results, such as certain employee related expenses attributable to advancements in automation and operational efficiencies, and legal expenses beyond those in the normal course of business. Non-comparable items are excluded from Non-GAAP net income in order to more effectively assess the Company’s period over period and ongoing operating performance. (2) 28% statutory tax rate is assumed in order to approximate the Company's effective corporate tax rate. INOV Investor Presentation (1.14.20) v1.0.0 45

Balance Sheet Detail In the setting of continued strong cash flows from operations in excess of the operating needs of the business, on October 4, 2019, the Company voluntarily initiated an accelerated pay-down of its outstanding debt under the 2018 Term Facility with a $50 million cash payment. The payment was made from excess cash flow from operations, which exceeded the Company's working capital needs, and was in addition to the Company's existing repayment obligation of $2.5 million per quarter. The Company continues to maintain significant liquidity and credit capacity. Sept 30, 2019 Cash, Cash Equivalents and Short-Term Investments $ 133.6 Accounts Receivable 127.4 Other Current Assets 26.0 Other Assets 1,656.2 Total Assets $1,943.2 Current Liabilities (excl. Debt and Finance Leases) $ 107.3 Total Debt (incl. Finance Leases) 966.7 Other Liabilities 195.2 Stockholders’ Equity 674.0 Total Liabilities and Stockholders’ Equity $1,943.2 All dollars shown in millions. Amounts may not add exactly due to rounding. Current liabilities exclude the current portion of Long-Term Debt and Finance Lease Obligations, which were $9.8 million and $2.4 million, respectively, as of September 30, 2019. Debt reflected on the balance sheet as of September 30, 2019 is net of issuance discounts and deferred financing fees and does not reflect the accelerated pay down of debt initiated with $50 million cash payment made October 4, 2019. INOV Investor Presentation (1.14.20) v1.0.0 46

Definitions 1 Annual Recurring Revenue is defined as subscription-based revenue from existing clients plus outstanding intra-year renewals valued at an amount agreed upon in principal. 2 Annual Revenue Retention is defined as the percentage of revenue from engagements with existing clients in the prior year present in the current year. For example, Annual Revenue Retention would be less than 100% if there was a net loss of revenue from existing clients who either downsized or exited existing engagements, and would be more than 100% if on a net basis existing clients expanded existing engagements. 3 Annualized Contract Value (ACV) is defined as a metric reflecting the sum of the first 12 months of revenue expected from contracts signed during a specific period (such as a quarter or year). 4 Coverage is defined as the sum of Annual Recurring Revenue, Legacy revenue under contract, and expected Services revenue, divided by the specified year's revenue guidance. INOV Investor Presentation (1.14.20) v1.0.0 47

ACV, TCV and Bookings Inovalon’s sales have significantly expanded and accelerated, supporting strong growth going forward. The Company started reporting its sales performance in 2018 by providing Annual Contract Value (ACV) data for new sales, a metric reflecting the sum of the first 12 months of revenue expected from new contracts signed during a specific period (such as a quarter or year). Inovalon first reported this metric with the release of Inovalon’s Q3 2018 results on November 7, 2018. Of note, due to the fact that the bulk of the Company’s contracts (also referred to as a “Statements of Work” or “SOWs”) are multi-year in their contracted term (or contracted duration), the “bookings” or “Total Contract Value” (TCV) pertaining to the ACV is significantly larger than the ACV. For example, if the ACV for a period was $X, the corresponding total Bookings or TCV of the underlying sales would be perhaps $2X to $3X, depending on the average contract term signed within the group of underlying sales in the period. Importantly, while the Company is providing ACV sales data to provide insight into the accelerated nature of the Company’s sales in a comparable (e.g., year-over-year) fashion, the corresponding total sales, bookings, or TCV is even more significant. ACV * Contracts depicted are Illustrative only to support discussion of ACV Executed SOWs Executed Illustrative Dollar Equivalency 12 Months 24 Months 36 Months Etc. Initial Contract / SOW Term Illustrative only. Please see definitions on slide 48. INOV Investor Presentation (1.14.20) v1.0.0 48

Healthcare Empowered® © 2018 by Inovalon. All rights reserved.