Attached files

| file | filename |

|---|---|

| EX-32.2 - Inovalon Holdings, Inc. | exhibit322-12312017.htm |

| EX-32.1 - Inovalon Holdings, Inc. | exhibit321-12312017.htm |

| EX-31.2 - Inovalon Holdings, Inc. | exhibit312-12312017.htm |

| EX-31.1 - Inovalon Holdings, Inc. | exhibit311-12312017.htm |

| EX-23.1 - Inovalon Holdings, Inc. | exhibit231-12312017.htm |

| EX-21.1 - Inovalon Holdings, Inc. | exhibit211-12312017.htm |

| EX-10.24 - Inovalon Holdings, Inc. | exhibit1024-12312017.htm |

| EX-10.23 - Inovalon Holdings, Inc. | exhibit1023-12312017.htm |

| EX-10.22 - Inovalon Holdings, Inc. | exhibit1022-12312017.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One) | ||

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2017

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to

Commission file number: 001-36841

INOVALON HOLDINGS, INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware (State or Other Jurisdiction of Incorporation or Organization) | 47-1830316 (IRS Employer Identification No.) |

4321 Collington Road Bowie, Maryland (Address of Principal Executive Offices) | 20716 (Zip Code) |

(301) 809-4000

Registrant’s Telephone Number, Including Area Code

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name Of Each Exchange On Which Registered | |

Class A Common Stock, $0.000005 par value per share | NASDAQ Global Select Market | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o Emerging growth company o | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

As of June 30, 2017, the last business day of the registrant’s most recently completed second fiscal quarter, aggregate market value of the voting stock (common stock) held by non-affiliates of the registrant was approximately $683.2 million.

As of February 9, 2018, the registrant had 63,445,573 shares of Class A common stock outstanding and 80,957,495 shares of Class B common stock outstanding.

Documents Incorporated by Reference

The information required by Part III (Items 10, 11, 12, 13 and 14) will be incorporated by reference from the Registrant’s definitive proxy statement relating to its 2018 annual meeting of stockholders (the “2018 Proxy Statement”). The 2018 Proxy Statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

INOVALON HOLDINGS, INC.

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017

TABLE OF CONTENTS

F-1 | ||

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements contained in this Annual Report other than statements of historical fact, including but not limited to statements regarding our future results of operations and financial position, our business strategy and plans, market growth, and our objectives for future operations, are forward-looking statements. The words “believe,” “may,” “see,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives and financial needs. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this Annual Report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

Factors that may cause actual results to differ from expected results include, among others:

• | our future financial performance, including our ability to continue and manage our growth; |

• | our ability to retain our client base and sell additional services to them; |

• | the effect of the concentration of our revenue among our top clients; |

• | our ability to innovate and adapt our platforms and toolsets; |

• | the effects of regulations applicable to us, including regulations relating to data protection and data privacy; |

• | the effects of consolidation in the healthcare industry; |

• | the ability to successfully integrate our acquisitions and the ability of the acquired business to perform as expected; |

• | the ability to enter into new agreements with existing or new platforms, products, and solutions in the timeframes expected, or at all; |

• | the successful implementation and adoption of new platforms, products and solutions; |

• | the effects of changes in tax legislation for jurisdictions within which we operate, including recent changes in U.S. tax laws; |

• | the ability to protect the privacy of our clients’ data and prevent security breaches; |

• | the effect of current or future litigation; |

• | the effect of competition on our business; and |

• | the efficacy of our platforms and toolsets. |

Forward-looking statements are only current predictions and are subject to known and unknown risks, uncertainties, and other factors that may cause our actual results, levels of activity, performance, or achievements to be materially different from those anticipated by such statements. These factors include, among other factors, those set forth in Part I, Item 1A, “Risk Factors.”

You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. We are under no duty to, and we disclaim any obligation to, update any of these forward-looking statements after the date of this Annual Report or to conform these statements to actual results or revised expectations.

ii

PART I

Explanatory Note Regarding Market Information: This Annual Report on Form 10-K includes market data and forecasts with respect to the healthcare industry. Although we are responsible for all of the disclosure contained in this Annual Report, in some cases we rely on and refer to market data and certain industry forecasts that were obtained from third party surveys, market research, consultant surveys, publicly available information and industry publications and surveys that we believe to be reliable.

Item 1. Business.

Our Company

We are a leading technology company providing cloud-based platforms empowering a data-driven transformation from volume-based to value-based models throughout the healthcare industry. Through the Inovalon ONE™ Platform, Inovalon brings to the marketplace a national-scale capability to interconnect with the healthcare ecosystem on a very large scale, aggregate and analyze data in petabyte volumes to arrive at sophisticated insights in real-time, drive impact wherever it is analytically identified best to intervene, and intuitively visualize data and information to inform business strategy and execution. Leveraging its platform capabilities, large proprietary data sets, and industry-leading subject matter expertise, Inovalon enables the assessment and improvement of clinical and quality outcomes and financial performance across the healthcare ecosystem. From health plans and provider organizations, to pharmaceutical, medical device, and diagnostics companies, Inovalon’s unique achievement of value is delivered through the effective progression of “Turning Data into Insight, and Insight into Action®.” Providing technology that supports a client base approaching 500 healthcare organizations, Inovalon’s platforms are informed by data pertaining to more than 932,000 physicians, 455,000 clinical facilities, 240 million individuals, and 37 billion medical events.

We generate the substantial majority of our revenue through the sale or subscription licensing of our cloud-based data analytics, intervention and reporting platforms and related support services.

On September 17, 2014, Inovalon, Inc. implemented a holding company reorganization, pursuant to which Inovalon Holdings, Inc. became the new parent company of Inovalon, Inc. and Inovalon, Inc. became the direct, wholly owned subsidiary of the Company. The Company was incorporated in the state of Delaware on September 11, 2014. Inovalon, Inc. was incorporated in the state of Delaware on November 18, 2005. In this Annual Report, unless we indicate otherwise or the context requires, references to the “Company,” “Inovalon,” “we,” “our,” “ours,” and “us” refer to Inovalon Holdings, Inc. and its consolidated subsidiaries.

Industry Overview and Demand Drivers

The Company believes that healthcare is increasingly becoming data-driven in nature, transactional in design, real-time in speed, and ultimately consumer-centric in focus. Driven by the first waves of disease-burden based reimbursement models and quality incentive programs, data has gained an increasing role in the U.S. healthcare system. Data is increasingly a competitive differentiator, as its aggregation, analysis, validation, and associated connectivity can be leveraged to identify individual patients’ unique needs, refine care plans, speed drug discovery and commercialization, reduce waste, expand the value proposition of medications and medical devices, and streamline healthcare workflows and supply chains. As transparency into the many facets of healthcare increases, the Company believes the pace of the industry’s transformation will accelerate, ultimately placing the consumer at the center as they play an increasingly active role in their care.

We believe that demand for our offerings is driven by the confluence of a number of fundamental healthcare industry trends, including:

Shift to Value-Based Healthcare. The healthcare industry is undergoing a significant transformation, driven by a shift from volume-based models to value-based and outcome-based models. The traditional fee-for-service reimbursement model in healthcare has played a major role in elevating both the level and growth rate of healthcare spending. In response, both the public and private sectors are shifting away from the historical fee-for-service (volume-based) models toward value-based, capitated payment models that are designed to incentivize value and quality at an individual patient level. The number of Americans covered by capitated payment programs (care programs wherein an organization is financially responsible for the healthcare of a population of patients for which the total compensation is fixed other than adjustments for factors including specifically how sick individual patients are, how much resource is needed to be applied or spent on each patient, what is the quality of the clinical care, and other demographic factors) continues to increase, according to industry sources and our internal estimates. This increase is expected to further drive the critical importance to accurately measure, analyze, report, and improve patient disease and comorbidity conditions, utilization rates, and clinical quality outcomes. Further, this shift from volume-based to value-based and outcome-based models is increasingly impacting other segments of the healthcare industry, including pharmaceutical companies, healthcare providers, medical device manufacturers, and diagnostics companies. For example, pharmaceutical companies are increasingly pursuing outcomes-based contracting (“OBC”) arrangements with health plans in

1

order to leverage data and analytics to demonstrate value and improve care outcomes. This is particularly true as a large number of new, complex, and expensive specialty treatments are expected to enter the market over the coming years.

Digitization of Healthcare Information. Across the healthcare landscape, a significant amount of data is being created every day, driven by patient care, payment systems, regulatory compliance, and record keeping. These data include information within patient health records, clinical trials, pharmacy benefit programs, imaging systems, sensors and monitoring platforms, laboratory results, patient reported information, hospital and physician performance programs, and billing and payment processing. However, despite significant investments by public and private sources within the industry, the digitized healthcare data remain largely stored in “walled gardens”—data that is static and not easily shared or interpreted. As the amount of data in healthcare continues to grow, we believe that it will be critical for participants across the healthcare industry to be able to analyze this disparate data and apply insights in a targeted manner in order to better achieve the goals of higher quality and more efficient care.

Healthcare Becoming Increasingly Consumer-centric. Increasingly, the patient (the consumer of healthcare) wants to take a more active and informed role in how their own individual healthcare is delivered - how to select their health plan and based on what information, how to select and interact with a physician, how to determine whether or not to have a particular surgical procedure or whether or not to take a particular medication, etc. Similar to other industries including financial services, retail, and entertainment, the healthcare marketplace is becoming increasingly consumer-centric. This transformation means that interactions in healthcare are becoming increasingly data-driven, transactional, and real-time in nature, all of which require increasingly sophisticated data ingestion and analytical capabilities, extensive industry connectivity, and high-speed, scalable, and secure compute infrastructures.

Increasing Complexity. The healthcare industry is on a course of dramatically progressive complexity. As technology employed in the healthcare space has become increasingly sophisticated, new diagnostics and treatments have been introduced, the pool of clinical research has expanded, and the paradigms dictating payment and regulatory oversight have multiplied. This expanding complexity drives a growing and continuous need for the aggregation, analysis, and targeted application of the underlying and resulting data.

Unsustainable Rise in Healthcare Costs. According to the 2017 National Health Expenditure Projections prepared by the Centers for Medicare and Medicaid Services (“CMS”), healthcare spending in the U.S. is projected to have increased 4.6% on a year-over-year basis to $3.5 trillion in 2017, representing 17.9% of U.S. Gross Domestic Product (“GDP”). CMS projects healthcare spending in the U.S. to increase to approximately 20% of GDP by 2026. To address this expected significant rise in healthcare costs, the U.S. healthcare market is seeking more efficient and effective methods of delivering care. This same trend is playing out across modernized nations around the globe.

Our Market Opportunity

We believe that our market opportunity is significant and growing. The ability to aggregate, integrate, and analyze data on a massive scale and apply garnered insights in a manner that achieves meaningful impact is crucial for healthcare payers (e.g., health plans and integrated health delivery systems), healthcare providers (e.g., hospitals, accountable care organizations (“ACOs”), post-acute care providers, and physicians), pharmaceutical companies (e.g., medication discovery and manufacturers, specialty pharmacies, retail pharmacies, pharmacy benefit management companies), medical device manufacturers, diagnostics companies, and consumers.

2

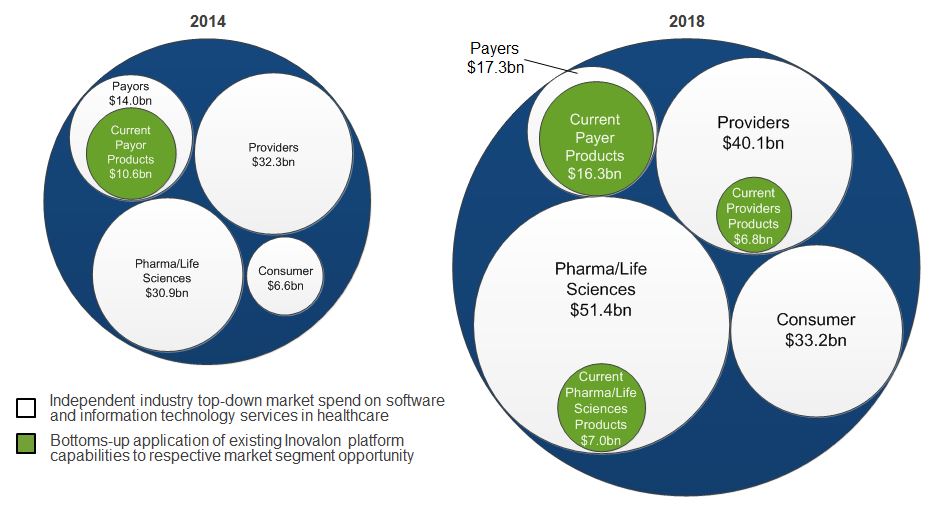

According to third-party industry estimates, the addressable market for software and related services capabilities serving these healthcare constituents is approximately $142 billion in 2018, up from approximately $84 billion in 2014. According to industry sources, the market for software and related services is approximately $17.3 billion within the U.S. payer market. We believe that as analytics continue to demonstrate greater value within the U.S. payer landscape, the market will expand commensurately. We believe that the market opportunity for our current offerings within the payer market, the historical focus of our Company, is approximately $16.3 billion. As we continue to build and launch new capabilities, we believe analytics will provide a significantly larger value opportunity within this same payer space. For providers, industry sources estimate that software and related services represent a $40.1 billion U.S. market size. We believe that the market opportunity for our current offerings within the provider market is approximately $6.8 billion. In the pharmaceutical and life-sciences market, industry sources estimate a $51.4 billion market size for total software and related services spend. We believe that the market opportunity for our current offerings within the pharmaceutical and life-sciences market is approximately $7.0 billion, largely driven by our acquisitions of Avalere Health, Inc. (“Avalere”), a leading provider of data-driven advisory services and business intelligence solutions in the pharmaceutical and life sciences industry, in 2015, and Creehan Holding Co., Inc. (“Creehan”), a leader in specialty pharmacy software platforms, in 2016. In the consumer market, industry sources estimate a $33.2 billion global market size for mobile health applications and solutions. We believe that, over time, analytics will also drive a significant opportunity expansion in the consumer market, as consumers seek to take a more active and informed role in how their healthcare is delivered.

_______________________________________

Source: Gartner, IDC, Research and Markets and Inovalon (with methodology validated by HMA).

In addition, the pressures that face the U.S. healthcare market are not unique, as other communities around the world are facing aging populations and growing pressures in the sustainable affordability of healthcare. We believe that our capabilities are highly applicable to other developed and developing countries around the globe, which we believe represents a sizable related future opportunity for our Company.

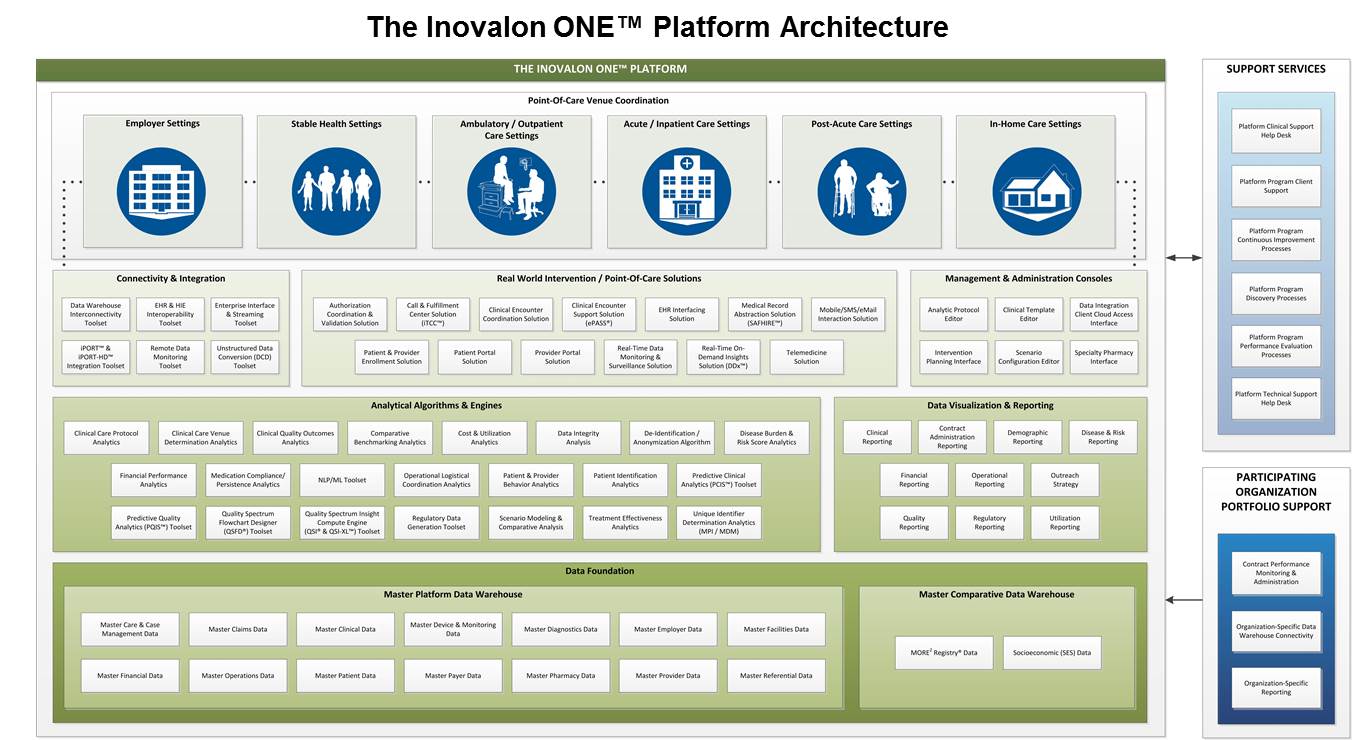

The Inovalon ONE™ Platform

Inovalon provides a technology platform that enables healthcare organizations to implement highly sophisticated value-based initiatives in very large scale. At the core of value-based initiatives is the need to aggregate and analyze data, garner meaningful insight from the results, and use these insights to drive material change to outcomes and economics. To achieve this, four competencies are needed: 1) large-scale data connectivity, integration, and validation capabilities, 2) advanced predictive analytics and high-speed compute, 3) toolsets to translate resulting insights into real-world impact, and 4) purpose-built data visualization and reporting. To inform and enable these competencies, Inovalon brings to bear large-scale datasets, expansive connectivity, robust technology infrastructure, and industry-leading subject matter expertise.

3

The Inovalon ONE™ Platform is an integrated native cloud-based platform of more than 80 individual proprietary toolsets. Each toolset is referred to as a “Component,” with each supporting critical healthcare ecosystem functional needs. Components are configured into integrated sets identified as “Modules,” each of which share cohesive interoperability and common data management. The Inovalon ONE™ Platform brings to the marketplace a highly extensible, national-scale capability to interconnect with the healthcare ecosystem on a very large scale, aggregate and analyze data in petabyte volumes, arrive at sophisticated insights in real-time, and drive impact wherever it is analytically identified best to intervene.

Platform Capabilities

Data Integration. Throughout the healthcare industry, data is captured from many different sources, and while standards for exchanging information between healthcare applications are emerging, much of the data associated with population health remains in disparate silos, in various formats, on paper, and is both interchanged and processed without automation. Where investments have been made in the digitization of health data, many of the resulting solutions remain “walled gardens” of information—data that is static and not easily shared or interpreted.

Our data integration platform capability was designed and developed to address these challenges. This capability enables integration of any data source, on any hardware platform, in any data format at extremely high speeds. Our data integration platform receives information from external sources through a number of channels, including secure FTP, web services, and direct connections to external systems. Our data integration platform loads data into our “data lake” in its native format, which ensures that we maintain all data as it is received and allows users to query the data directly in its structured or unstructured format. Processing data in its raw format, however, presents many technological challenges. We have developed interactive data mapping technologies to support the mapping of the raw data files to staging structures used by our platform to convert data from its native format into a structured format that can be used by all processes on our platform. Once mapped, the data is run through multiple processes to standardize the data and perform data verification and integrity checks so that values are uniform across our entire platform.

We believe that our enterprise-scale data integration and management capability enables us to receive, integrate, and process extremely large-scale data flows at industry-leading speeds, and is a critical capability in achieving material improvement in clinical quality outcomes and financial performance in healthcare, creating a material market differentiator and value creator for us and our clients. We integrate data seamlessly and securely into our systems through our proprietary Extract, Transform, Load tools and processes. This system manages the process of defining and configuring thousands of industry data feeds from our clients and partners (such as electronic health records (“EHR”), laboratory, pharmacy, patient reported, claims, paper based medical records, biometric, and hospital data feeds respectively), manages the data processing workflow, and monitors the ongoing provision and quality of data through the application of more than 2,000 data integrity checks.

4

Our big data technology has been created through the use of internally developed software coupled with industry-leading technology frameworks that are vendor-agnostic. We leverage modern big data frameworks such as Hadoop and the Hadoop Distributed File System, which enable us to store structured and unstructured data while making it readily accessible by our analytics engine. Our big data processing capabilities enable dramatic improvements in data integration and analytical cycle speed to value recognition to empower improvements for intelligent product development through the “real world” functional application. Our big data technology lays the foundation of the data fabric allowing integration into our analytical capabilities.

Advanced Analytics. We have developed, honed, and scaled a broad portfolio of sophisticated analytics. Applying our subject matter expertise in computer processing, data architecture, statistics, medical sciences, healthcare policy, and leveraging the billions of medical events within our significant propriety datasets, we believe that we have developed one of the most advanced analytical platforms in the industry, as well as a culture and set of analytical toolsets that serve to rapidly innovate and expand our platform capabilities. In addition, by leveraging technologies such as Optical Character Recognition, Natural Language Processing and Machine Learning, we are able to further enhance our analytical capabilities, improve efficiency, and accelerate processing capacity and client value delivery.

Intervention Systems. In order to translate analytical insights into tangible impact, interventions at the point of care are critical. We are able to translate our analytical insights into meaningful impact through data-driven, multi-channel intervention platforms, which include toolsets and services that enable our clients to take the insights derived from our analytics and implement solutions that achieve meaningful impact at the patient and provider level. Our intervention capabilities include direct connectivity with many leading EHR systems, hard copy and electronic mail, and interactions via telephone, in patients’ homes, through mobile devices, at dedicated patient centers, through web-enabled decision support tools, in retail pharmacies, and in traditional clinical locations.

Business Processing. Our business processing capability consists of a powerful business intelligence system and comprehensive data warehousing to provide historical and current data insight, reporting, and benchmarking to support multiple client business needs such as government-mandated data filings, financial planning, and compliance requirements. We have also implemented an integrated platform of data visualization, allowing clients and their downstream users and operators to access data and analytical results from the population-level down to sophisticated individual drill-down details in real-time.

Data Sets

Datasets and the management of data are part of our core strengths, which give us insight into how a patient, provider, or population is doing. Our datasets grant us both relative and absolute insight, and inform the construction of new analytics capabilities, predictive models, and impact predictions. Further, data management speeds our time to client impact, decreases the burden on clients choosing to do business with us, and empowers our achievement of mission and results.

In addition to being maintained and tagged within client-specific data lakes, data we receive in the course of providing our services are statistically de-identified and stored in our MORE2 Registry®. The MORE2 Registry® goes beyond just claims data to include information about demographics, enrollment, diagnoses, procedures, pharmacy, laboratory results, and deep medical record clinical data and presents a significant representative mix of commercial, HIX Marketplace, Medicare Advantage, and managed Medicaid care plan patients. As of December 31, 2017, our MORE2 Registry® dataset contained data pertaining to more than 932,000 physicians, 455,000 clinical facilities, 240 million individuals, and 37 billion medical events. The following is a sample of components within our MORE2 Registry®:

• Patient Demographic Data | • Benefits Data | |

• Medical Record Documentation | • Encounter and Procedural Data | |

• Operating Room, Procedure, | • Pharmacy Data | |

Discharge Summary, | • Imaging Report Data | |

Emergency Room Records | • Laboratory & Pathology Data | |

• Electronic Health Record Data | • Durable Medical Equipment Data | |

• Health Risk Assessment Data | • Self-Reported Data | |

• Practitioner Profile Data | • Social History Data | |

• Claim Diagnostic Data | • Activities of Daily Living (ADL) | |

• Eligibility and Enrollment Data | • Cost Data | |

5

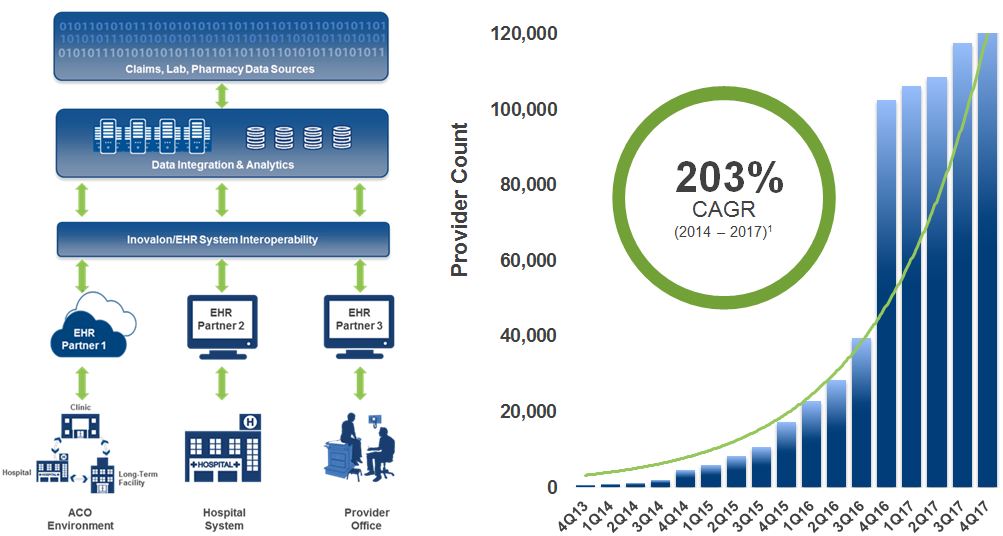

Connectivity

We have developed technology that enables real-time, bi-directional data aggregation and point-of-care intervention through many leading EHR systems, which drives positive impact and efficiency for clients, clinicians, patients, and the Company.

Inovalon’s Interoperability Platform facilitates the two-way exchange of clinical data with both cloud and non-cloud based EHR and Integrating the Healthcare Enterprise systems, connecting thousands of physicians in an effective, efficient, secure and scalable fashion while minimizing disruption. Our Interoperability Platform automatically requests and retrieves necessary clinical data, which is then analyzed by our advanced predictive analytics to identify gaps in patient care, and then embeds those insights directly into the clinical workflow to inform targeted interventions at the point-of-care.

______________________________________

(1) | The 2014 and 2017 figures are as of December 31 for each respective year. |

6

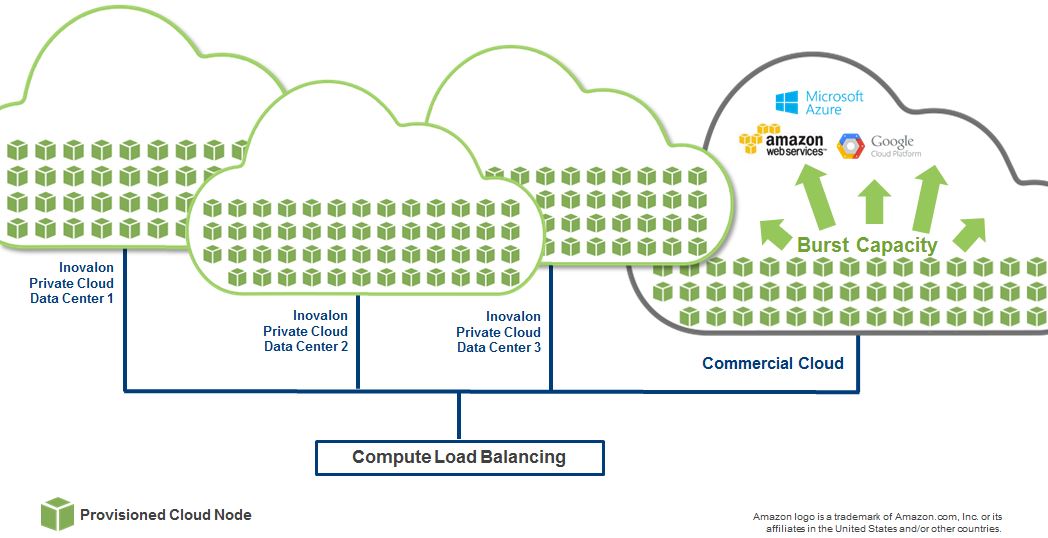

Technology Infrastructure

We believe that our track record of service is the result of our commitment to excellence and our devotion to maintaining one of the industry’s most sophisticated technology infrastructures. We have made significant investments over the past decade to build an industry-leading enterprise-scale infrastructure capable of managing the heavy computing and storage requirements of our cloud-based data-driven business. Today, we employ a combination of owned, virtualized data centers along with hosted facilities to enable seamless, secure, and scalable solutions nationwide.

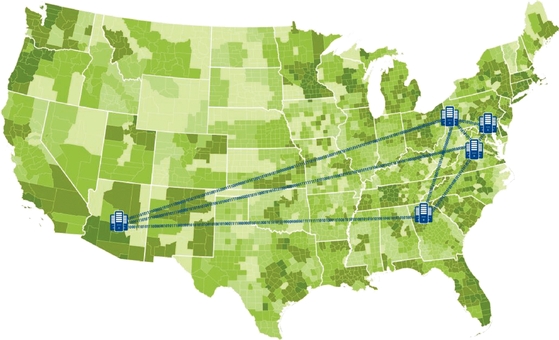

Our physical converged compute and storage infrastructure is deployed with a hybrid approach to cloud computing. Leveraging heavily virtualized infrastructure together with orchestration and automation tools, we have achieved significant capabilities within our private cloud environment. The following diagram provides a high level overview of our key infrastructure elements.

_______________________________________

Our data and compute capacity is maintained within an interconnected set of infrastructure sets made up of owned and co-located data centers. The three principal datacenters owned by Inovalon are located in the Washington D.C. metro area, Atlanta metro region and the Pittsburgh metro region. Our co-located datacenter facilities are located in Northern Virginia and in Phoenix, Arizona. Each datacenter supports the ability to interconnect agnostically to third-party cloud capacity providers. This macro architecture provides us a significant ability to maintain both enterprise-level capacity and redundancy, while also achieving significant flexibility and cost effectiveness for burst capacity needs.

We have a proven track record of implementing virtualization as our current datacenters are over 85% virtualized using VMware technologies. Operations of the virtualization technologies are streamlined by the orchestration, automation, and reporting capabilities provided by our private cloud and integration with public cloud service providers. These technologies are used to provide computing, storage, and networking components to the hosting environment and provide operational efficiencies and cost optimization for the corporation.

We have implemented a sophisticated hybrid cloud and service based application stack design, enabling “burst” capacity architecture to allow provider-agnostic utilization of public cloud capacity if such capacity is required. Our virtualization technology has been integrated with automation and orchestration technology to create a cloud environment that provides both Infrastructure and Platform as a Service capabilities. These service based capabilities allow us to dynamically expand our compute capacity in real time and provide the business with a cost effective and nimble platform. By leveraging both private and public cloud offerings, we can provide efficient, elastic, and cost effective compute resources based on the operational needs of our clients. We believe we are leaders in the use of big data technology and high performance compute technology stack at the point of care in our industry.

7

Our platform is built utilizing an innovative enterprise infrastructure platform enabling robust performance scaling, strong security, high availability, and advanced business continuity options. The building blocks of this infrastructure consist of the following:

• | Multiple data centers connected by redundant high-speed WAN connections; |

• | High competency and utilization of virtualization technologies; |

• | Rapid provisioning of computing capabilities to support the dynamic elasticity needed to support the variable computing needs of the application; |

• | Measured service to optimize resource utilization and provide transparency of the utilized services; and |

• | Available hosting facilities providing physical structure compliance with Federal Information Security Management Act (“FISMA”) standards. |

Disaster Recovery. Our contingency program is designed to provide response and subsequent recovery from unplanned business disruptions. Supported by our data centers, our contingency program provides a coordinated emergency response foundation across the organization. The program includes business continuity, emergency occupant, pandemic planning, security incident response, and disaster recovery plans that encompass all areas of our technology and business operations. These interrelated processes align to provide significant protection and risk mitigation. In addition to company-wide plans, specific details on event response and subsequent business recovery actions and activities are included within each respective business unit plan.

_______________________________________

Business continuity and disaster recovery are an important part of our technology platform. Through significant investment in hardware, software, and application design, Inovalon provides solutions that support mission critical, business critical, and business important products and services through our nationwide enterprise data center presence.

Network Operations Center. We maintain a central network operations center (“NOC”) where systems are monitored to ensure proper operation and capacity utilization. The NOC monitors and collects information about a multitude of technology operating metrics regarding system load and status. In conjunction with the rapid provisioning capability, automation, and standardization, the NOC provides us with the automated capabilities to oversee and manage our technology resources in order to meet business demands.

Privacy Management and Data Security. Protected health information is a sensitive component of personal information. It is highly important that information about an individual’s healthcare is properly and thoroughly protected from any inappropriate access, use and disclosure. Given the industry vertical in which we operate, we realize the importance of the safety and sensitivity of personal health information. We have been a trusted partner to our clients and are committed to the security and privacy of our client data, enterprise data, and our systems through the application of highly trained personnel, robust processes, and technology. Our privacy and security management includes:

• | governance, frameworks, and models to promote good decision making and accountability. Our comprehensive privacy and security program is based on industry practices including those of the National Institute of Standards and |

8

Technology, the Control Objectives for Information and Related Technology, Defense Information Systems Agency, and FISMA;

• | an internal security council, which advises on and prioritizes the development of information security initiatives, projects, and policies; |

• | a layered approach to privacy and security management to avoid single points of failure; |

• | a defense in depth protection model that addresses the network, platform, application, and file and data layers; |

• | ongoing evaluation of privacy and security practices to promote continuous improvement; |

• | use of safeguards and controls including: administrative, technical, and physical safeguards; |

• | collaboration with our clients on best security and privacy practices; and |

• | working closely with leading researchers, thought leaders, and policy makers. |

Platform Modularity

Our platform has been created through the use of internally-developed software coupled with industry-leading technology frameworks that are vendor-agnostic. Because we have designed and developed our own software, we have built significant flexibility and modularity into our platform components. This enables us to not only enhance our existing products as our clients’ needs evolve, but also to increase our addressable market opportunity by rapidly developing new product offerings and expanding into adjacent markets in the healthcare industry. Our acquisitions of Avalere and Creehan further enhance this process through the additional capabilities, technologies, client relationships, and industry expertise that they bring. Our large, deep proprietary data sets in the MORE2 Registry® also enable and support this flexibility and modularity, as the depth and breadth of the data allows its analysis and application in the context of many situations across the healthcare industry-not just for payers, but also providers, pharmaceutical companies, device manufacturers, diagnostics companies, etc. For example, within the set of Inovalon ONE™ Platform Components that would typically enable our Quality Measurement and Reporting offering for a national health plan, a certain subset of these Components could be combined with an additional new set of Components to enable our OBC offering with a global pharmaceutical company.

Our Clients

For over 18 years, we have provided quality services to our clients. During that time, we have built a leading position and have become a true thought leader and innovator in our industry. We have achieved significant scale, and we believe that we play a key role in the U.S. healthcare market.

Our clients renew existing client agreements throughout the year. The renewal rates of existing clients for the years ended December 31, 2017, 2016 and 2015 were approximately 88%, 93% and 93%, respectively. The renewal rate is representative of clients with engagements exceeding $0.1 million in revenue.

For the year ended December 31, 2017, Anthem (formerly known as WellPoint) accounted for approximately 12% of our total revenue, and no other clients represented greater than 10% of our revenue. See Note 2, “Summary of Significant Accounting Policies,” under the heading “Concentrations of Credit Risk,” of the notes to our audited consolidated financial statements included elsewhere within this Annual Report on Form 10-K for more information.

Sales and Marketing

We believe that our sales and marketing initiatives are key to capitalizing on our significant market and growth opportunities. While we have successfully leveraged our sales and marketing as we have grown, we believe that additional strategic investments in sales and marketing capacity and capabilities will enable us to increasingly seize on the healthcare industry’s need for data analytics and data-driven intervention services, and empower the healthcare industry’s transformation from volume-based models to value-based models.

We sell our offerings primarily through three avenues:

• | Business development led by product and management personnel: We benefit significantly from the subject matter expertise, market credibility, thought leadership, and relationships of our executives, senior management, and product leaders within the industry. They have played, and are expected to continue to play, a significant role in the establishment and ongoing development of our client relationships. |

• | Business development led by dedicated sales personnel: We have a dedicated, direct sales team, which is comprised of focused field sales professionals who are organized principally by geography and product type. Our dedicated sales personnel are supported by a sales operations staff, including product technology experts, lead generation personnel, and sales data personnel. |

9

• | Business development led by strategic channel relationships: We increasingly are developing and expanding our use of strategic partnerships and channel relationships for the establishment and development of new and existing clients. |

Our marketing and communications strategies are centered on initiatives that drive awareness of our Company and capabilities. These initiatives include: educating the market about our Company broadly; hosting industry-focused events and speaking engagements; disseminating articles discussing data trends and metrics, and strategic interfacing with key business and trade media personnel. We employ a broad array of specific events to facilitate these initiatives, including but not limited to:

• | Sponsorship and partnership of key industry conferences; |

• | Client-focused events and programs; |

• | Hosting our annual Client Congress highlighted by healthcare leaders, industry icons and senior government officials sharing best practices, strategies, and trends; |

• | Web and social properties, digital and video content marketing, creative online advertising, and blogs; and |

• | Hosted webinars, direct mail, analyst relations, and media relations. |

In addition, in order to enhance our value proposition, our sales and marketing staff develops best practices tools, case studies, and educational materials to drive deeper client engagement, understanding, and utilization.

Operations

Our operations are divided into two groups. Our IT Operations Group manages the process steps from data receipt through to the generation of analytical outputs. Our Services Operations Group manages the process steps applied to achieve impact through our data-driven intervention platforms.

IT Operations Group

We achieve excellence in the operation of our technology based on a foundation of service management aligned with data integration, data provisioning, system support, and security operations. These operational processes are measured clearly through a framework of key performance indicators, which seek to provide an optimal level of transparency and control.

We have implemented a rigorous command and control structure for maintaining availability of production systems and ensuring the security of technology infrastructure. Our NOC is responsible for monitoring network and systems, security incident response, and management and communication as well as the oversight of planned system maintenance. The personnel of the NOC are also responsible for invoking our business continuity plan when appropriate.

The security operations within our NOC maintain the confidentiality, integrity, and availability of our production systems and technology infrastructure by maintaining security situational awareness, as well as coordinating security incident response and proactively protecting sensitive data. The security operations team utilizes a variety of tools and techniques to identify, contain, remediate, and gather intelligence on both known and emerging technology threats. Reports are tracked through automated event management triggers and communicated to leadership through our business service management layer.

We have a comprehensive framework for managing change control, problem management, incident and event management, service management, and production operations. We use a defined quality change control management system for managing technology changes.

Product support integration across all of our solutions enables commonality of processes—allowing our clients to benefit from increased technology operational efficiencies. Regardless of the efficiencies achieved, we are continuously enhancing our technology product operations through the dedication of the process automation and performance assurance team focused on designing and deploying zero-touch capabilities.

Services Operations Group

Many of our clients utilize the analytical outputs of our platform to feed into their own internal systems to achieve value within the provider and patient base. Other clients license our data-driven intervention platforms to facilitate the realization of value from our analytics. For still other clients, our service support personnel operate our data-driven intervention platforms to deliver end-to-end value realization. For these clients, through the implementation of our sophisticated platforms, we leverage our analytical output to provide data-driven intervention support services at the varying points of care necessary to achieve the goals of our clients. This unique end-to-end approach implements the solutions necessary to turn insight generated through our advanced analytics into meaningful impact and realized value for our clients on a national scale.

One of the centerpieces of our services operations is our strong management systems, which serve as vehicles to drive transparency, ownership and execution. Our management systems enable general managers and operational leaders the ability

10

to “see around the corner” and be ambidextrous in how they balance achieving efficiency gains while also focusing on exceptional client value delivery.

Competition

We compete with a broad and diverse set of businesses. We believe the competitive landscape is highly fragmented with no single competitor offering similarly expansive capabilities and solution offerings in healthcare data analytics and data-driven interventions. Our primary competitive challenge is to demonstrate to our existing and potential clients the value of utilizing our platforms rather than developing or assembling their own alternative capabilities. We believe that the combination of our competitive strengths and successful culture of innovation, including our large proprietary datasets, advanced data integration technologies, sophisticated predictive analytics, extensive industry connectivity, data-driven intervention platforms, and the deep subject matter expertise of our associates, make it time- and cost-prohibitive for our clients to replace or replicate all that we offer. In addition, we believe the combination of these attributes differentiates us from our competition.

The competitive landscape can be characterized by the following categories of companies that provide capabilities or solutions that compete with one or more offerings of our platform:

• | Large-scale healthcare-specific solutions providers, such as Optum, Change Healthcare (formerly Change Healthcare Holdings, Inc. and McKesson Technology Solutions), Verscend Technologies (formerly Verisk Health), and IQVIA (formerly QuintilesIMS); |

• | Providers of enterprise-scale, industry agnostic IT solutions, such as Oracle, Dell, SAP, SAS, and IBM; |

• | Large-scale IT consultants and third-party service providers, such as Accenture and Deloitte Consulting; and |

• | Point solution providers, such as Change Healthcare, DST Systems, edifecs, and Silverlink. |

Intellectual Property

We generally rely on copyright, trademark, and trade secret laws as well as confidentiality agreements, licenses, and other agreements with employees, consultants, vendors, and customers. We also seek to control access to and distribution of our proprietary software, confidential information and know-how, technology, and other intellectual property. Historically, because our initial technological innovations were primarily algorithmic in nature, these innovations were well suited to trade secret protection. Accordingly, and due to the complex, time intensive, and costly patent process, with somewhat limited utility for business processes, the use of patents has not historically been compelling for us. However, beginning in the second quarter of 2015, we filed a limited number of provisional and non-provisional patent applications. We expect to continue to seek patents in the future.

We own and use trademarks in connection with our applications and services, including both unregistered common law marks and issued trademark registrations in the United States. Our material trademarks, service marks and other marks include: CAAS™, CARA®, Caresync Advantage®, CCS Advantage®, CEDI™, ChaseWise™, Data-Driven Improvements in Health Care™, Distributed Analytics®, EMR Acceleration™, eCAAS Advantage®, ePASS®, Healthcare Empowered®, Healthier Members, Healthier Business®, HEDIS Advantage, HCC Surveillance®, HIX Foundation®, iDCT™, INDICES®, Inovalon®, Inovalon-US, Inovalon-EU, Inovalon Healthcare Empowered (and Spiral Design to left)-EU, Inovalon (and Spiral Design on top), Inovalon (and Spiral Design to left), Inovalon Healthcare Empowered (and Spiral Design on top), Inovalon Healthcare Empowered (and Spiral Design to left)-US, Inovalon Healthcare Empowered (wordmark), Insights: a business intelligence solution™, iPORT™, iTCC™, MORE2 Registry®, PCIS™, Prospective Advantage®, QSCL™, QSFD®, QSI®, SRSA™, Star Advantage®, Turning Data into Insight and Insight into Action®, We See Solutions™, Data Diagnostics®, DDx™ and the Inovalon ONE™ Platform. We also have trademark applications pending to register marks in the United States and European Union.

While our intellectual property rights are important to our success, we believe that our business as a whole is not materially dependent on any particular patent, trademark, license or other intellectual property right.

Our Employees

As of December 31, 2017, we had a total of 2,480 associates across the following areas: Technology, Innovation and Product, Data-driven Client Services, and Selling, General and Administrative. There were 1,758 full-time associates and 722 part-time associates. None of our associates are represented by a labor union; all of our associates currently work in the U.S. and its territories (Puerto Rico), and we consider our current relations with our associates to be good.

Requirements Regarding the Privacy and Security of Personal Information

HIPAA and Other Privacy and Security Requirements. There are numerous U.S. federal and state laws and regulations related to the privacy and security of personal information. In particular, regulations promulgated pursuant to the Health Insurance Portability and Accountability Act of 1996 (“HIPPA”), as amended, and its implementing regulations, establish

11

privacy and security standards that limit the use and disclosure of Protected Health Information (“PHI”) and require the implementation of administrative, physical, and technical safeguards to ensure the confidentiality, integrity, and availability of individually identifiable health information in electronic form. Our health plan customers, as well as healthcare clearinghouses and certain providers with which we may have or may establish business relationships, are covered entities that are regulated under HIPAA. The Health Information Technology for Economic and Clinical Health Act (“HITECH”) which became effective on February 17, 2010, and an implementing regulation known as the Omnibus Final Rule, which became effective on September 23, 2013, significantly expanded HIPAA’s privacy and security requirements. Among other things, HITECH and the Omnibus Final Rule make HIPAA’s privacy and security standards directly applicable to “business associates,” which are independent contractors or agents of covered entities that create, receive, maintain, or transmit PHI in connection with providing a service for or on behalf of a covered entity. Under HIPAA and our contractual agreements with our customers, we are considered a “business associate” to our customers and thus are directly subject to HIPAA’s privacy and security standards. In order to provide our covered entity clients with services that involve the use or disclosure of PHI, HIPAA requires our clients to enter into business associate agreements with us. Such agreements must, among other things, require us to:

• | limit how we will use and disclose PHI; |

• | implement reasonable administrative, physical, and technical safeguards to protect such information from misuse; |

• | enter into similar agreements with our agents and subcontractors that have access to the information; |

• | report security incidents, breaches, and other inappropriate uses or disclosures of the information; and |

• | assist the customer in question with certain of its duties under the privacy standards. |

In addition to HIPAA, HITECH, and their implementing regulations, we may be subject to other state and federal privacy laws, including laws that prohibit unfair privacy and security practices and deceptive statements about privacy and security and laws that place specific requirements on certain types of activities, such as data security and texting. We may also be subject to state medical record privacy laws, which may be more strict than HIPAA, including the laws of the state of California.

Data Protection and Breaches. In recent years, there have been a number of well-publicized data breaches involving the improper use and disclosure of individuals’ personal information. Many states have responded to these incidents by enacting laws requiring holders of personal information to maintain safeguards and to take certain actions in response to a data breach, such as providing prompt notification of the breach to affected individuals and state officials. In addition, under HIPAA and pursuant to our business associate agreement obligations, we must report breaches of unsecured PHI to our contractual partners following discovery of the breach. Notification must also be made in certain circumstances to affected individuals, HHS and the media.

We have implemented and maintain physical, technical, and administrative safeguards intended to protect individually identifiable health information and have processes in place to assist us in complying with all applicable laws, regulations, and contractual requirements regarding the protection of these data and properly responding to any security breaches or incidents. Furthermore, in many cases, applicable state laws, including breach notification requirements, are not preempted by the HIPAA privacy and security standards and are subject to interpretation by various courts and other governmental authorities, thereby complicating our compliance efforts. Where a state law is not preempted by HIPAA, we may also be subject to that state law’s requirements, in addition to our obligations under HIPAA, HITECH, and their implementing regulations. Additionally, state and federal laws regarding deceptive practices may apply to public assurances we give to individuals about the security of services we provide on behalf of our contractual customers.

Other Requirements. In addition to HIPAA, numerous other U.S. state and federal laws govern the collection, dissemination, use, access to, and confidentiality of individually identifiable health information and healthcare provider information. Some states also are considering new laws and regulations that further protect the confidentiality, privacy, and security of medical records or other types of medical information. Further, Congress and a number of states have considered or are considering prohibitions or limitations on the disclosure of medical or other information to individuals or entities located outside of the United States.

Seasonality

The nature of our customers’ end-market results in seasonality reflected in both revenue and cost of revenue differences during the year. Regulatory impact of data submission deadlines in, for example, March, June, September, and January drive timing of analytics and data processing activity variances from quarter to quarter. Further, regulatory clinical encounter deadlines of June 30th and December 31st drive intervention concentration variances from quarter to quarter. The timing of these factors results in analytical and intervention activity mix variances which impact financial performance from quarter to quarter. Finally, quarter to quarter financial performance may increasingly vary from historical seasonal trends as we further expand into adjacent markets and increase the portion of our revenue generated from new offerings.

12

Corporate Information

Our executive offices are located at 4321 Collington Road, Bowie, Maryland 20716. Our telephone number at our executive offices is (301) 809-4000 and our corporate website is www.inovalon.com. The information on, or accessible through, our website is not incorporated into and does not constitute a part of this Annual Report on Form 10-K or any other report or document we file with or furnish to the Securities and Exchange Commission (“SEC”). Our Class A common stock is listed on the NASDAQ Global Select Market under the symbol “INOV.”

Available Information

We file our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports with the SEC. You may obtain copies of these documents by visiting the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549, by calling the SEC at 1-800-SEC-0330 or by accessing the SEC’s website at www.sec.gov. In addition, as soon as reasonably practicable after such materials are furnished to the SEC, we make copies of these documents available to the public free of charge through our website or by contacting our Secretary at the address set forth above under “—Corporate Information.”

Our Board of Directors Corporate Governance Charter, Code of Business Conduct and Ethics, and the charters of our audit committee, compensation committee, nominating and corporate governance committee and security and compliance committee are all available in the Governance Documents section of the Corporate Information section of our website.

Financial Information

For required financial information related to our operations, please refer to our consolidated financial statements, including the notes thereto, included with this Annual Report on Form 10-K.

Item 1A. Risk Factors.

Set forth below are the risks that we believe are material to our stockholders. You should carefully consider the following risks in evaluating our Company and our business. The occurrence of any of the following risks could materially adversely impact our financial condition, results of operations, cash flow, the market price of shares of our common stock and our ability to, among other things, satisfy our debt service obligations and to make distributions to our stockholders, which in turn could cause our stockholders to lose all or a part of their investment. Some statements in this report including statements in the following risk factors constitute forward-looking statements. Please refer to the section entitled “Special Note Regarding Forward-Looking Statements” at the beginning of this Annual Report on Form 10-K.

Risks Related to Our Business

We may not grow at the rates we historically have achieved or at all, even if our key metrics may indicate growth, which could have a material adverse effect on the market price of our Class A common stock.

We have experienced significant growth since 2013, with total revenues growing from approximately $295.8 million for the year ended December 31, 2013 to approximately $449.4 million for the year ended December 31, 2017. Future revenues may not grow at these same rates or may decline, such as the approximate 2% revenue decline from the year ended December 31, 2015 to the year ended December 31, 2016. Our future growth will depend, in part, on our ability to grow our revenue from existing clients, to complete sales to potential new clients, to expand our client base in adjacent industry segments such as the life sciences industry and with provider organizations, to develop new services and capabilities including direct-to-consumer services, and to expand internationally. We can provide no assurances that we will be successful in executing on these growth strategies or that, even if our key metrics, such as trailing 12 month Patient Analytics Months (“PAM”), would indicate future growth, we will continue to grow our revenue, margins or net income. Our ability to execute on our existing sales pipeline, create additional sales opportunities, and expand our client base depends on, among other things, the attractiveness of our services relative to those offered by our competitors, our ability to demonstrate the value of our existing and future services, and our ability to attract and retain a sufficient number of qualified sales and marketing leadership and support personnel. In addition, clients in certain industries in which we have a more limited presence, such as the life sciences industry, may be slower to adopt our services than we currently anticipate, which could adversely affect our results of operations and growth prospects.

If our existing clients do not renew their agreements with us, renew at lower fee levels, decline to purchase additional services from us, choose to purchase fewer services from us, or terminate their agreements with us, and we are unable to replace any lost revenue, our business and operating results could suffer.

We historically have derived, and expect in the future to derive, a significant portion of our revenue from renewals of existing client agreements and sales of additional services to existing clients. As a result, achieving a high renewal rate of our client agreements and selling additional services to existing clients is critical to our future operating results. It is difficult to

13

predict our client renewal rate, and we may experience significantly more difficulty than we anticipate in renewing existing client agreements. Factors that may affect the renewal rate for our services and our ability to sell additional services include:

• | the price, performance and functionality of our services; |

• | the availability, price, performance and functionality of competing services; |

• | our clients’ perceived ability to develop and perform the services that we offer using their internal resources; |

• | our ability to develop complementary services; |

• | our continued ability to access the data necessary to enable us to effectively develop and deliver new services to clients; |

• | the stability and security of our platform; |

• | changes in healthcare laws, regulations or trends; and |

• | the business environment of our clients, in particular, reductions in our clients’ membership populations and budgetary constraints affecting our clients. |

Contracts with our clients generally have stated terms of two to five years. However, our clients have no obligation to renew their contracts for our services after the term expires. In addition, a high renewal rate in any particular year does not necessarily correlate to recurring or increasing revenue from our existing clients, as our clients may negotiate terms less advantageous to us upon renewal, may renew for fewer services, may choose to discontinue one or more services under an existing contract, may exercise flexibilities within their contracts to adjust service volumes, or which could reduce our revenue from these clients. Accordingly, annual renewal rate metrics have inherent limitations and renewal rates should not be used as a key metric to evaluate the Company’s results of operations. Our future operating results also depend, in part, on our ability to sell new services to our existing clients. If our clients fail to renew their agreements, renew their agreements upon less favorable terms, at lower fee levels or for fewer services, fail to purchase new services from us, or terminate their agreements with us, and we are unsuccessful in generating significant revenue from new clients to replace any lost revenue, our revenues may decline and our future revenue growth may be constrained.

If a client fails to fulfill its obligations under its agreements with us, or permanently terminates certain services or its agreement in its entirety prior to its expected completion date, whether or not in our view permitted by the terms of the agreement, and revenue and cash flows expected from a client are not realized in the time period expected or at all, our business, operating results and financial condition could be adversely affected.

Our top clients account for a significant portion of our revenues and, as a result, the loss of one or more of these clients could materially and adversely affect our business and operating results.

Our largest client, Anthem (formerly known as WellPoint), represented approximately 12% of our revenues for the year ended December 31, 2017. No other clients represented greater than 10% of our revenue. Our top ten clients accounted for approximately 53% of our revenues for the year ended December 31, 2017. The engagement between these clients and us generally is covered through multiple separate statements of work (“SOWs”), each often with different and/or staggered terms which are all multi-year in their duration, ranging typically from two to five years. We can provide no assurance that these clients will renew their existing contracts or all SOWs with us upon expiration or that any such failure to renew will not have a material adverse effect on our revenue. If we lose one or more of our top clients, or if one or more of these clients significantly decreases its use of our services, our business and operating results could be materially and adversely affected.

If we do not develop new services that are adopted by clients, or fail to provide high quality support services to our clients, our growth prospects, revenues and operating results could be materially and adversely affected.

Our longer-term operating results and revenue growth will depend in part on our ability to successfully develop and sell new services that existing and potential clients want and are willing to purchase. We must continue to invest significant resources in research and development in order to enhance our existing services and introduce new high-quality services that clients and prospective clients will want. If we are unable to predict or adapt to changes in user preferences or industry or regulatory changes, or if we are unable to modify our services on a timely basis in response to those changes, clients may not renew their agreements with us, and our services may become less attractive than services offered by our competitors. Our operating results could also suffer if our innovations are not responsive to the needs of our clients, are not appropriately timed with market opportunity, or are not effectively brought to market. Our success also depends on successfully providing high-quality support services to resolve any issues related to our services. High-quality education and client support is important for the successful marketing and sale of our services and for the renewal of existing clients. If we do not help our clients quickly resolve issues and provide effective ongoing support, our ability to sell additional services to existing clients would suffer and our reputation with existing or potential clients would be harmed.

14

We cannot assure you that we will be able to manage our growth effectively, which could have a material adverse effect on our business, results of operations and growth prospects.

If we are successful in expanding our client base and growing our business, our existing services may not be as scalable as we anticipate, and we may need to expend significant resources to enhance our IT infrastructure, financial and accounting systems, and controls, and also hire a significant number of qualified client support personnel, professional services personnel, software engineers, technical personnel, and management personnel in order to provide services to those new clients. As a result, our expenses may increase more than expected, which could adversely affect our results of operations and net income. In addition, identifying and recruiting qualified personnel and training them in the use of our services requires significant time, expense, and attention, and our business may be adversely affected if our efforts to expand and train qualified personnel do not generate a corresponding increase in revenues. If our existing services are not as scalable as we anticipate or if we are unable to manage our growth and the cost thereof effectively, the quality of our services and our reputation may suffer, which could adversely affect our business, results of operations and growth prospects.

If our security measures fail or are breached and unauthorized access to a client’s data is obtained, our services may be perceived as insecure, we may incur significant liabilities, our reputation may be harmed, and we could lose sales and clients.

Our services involve the storage and transmission of clients’ proprietary information, sensitive or confidential data, including valuable intellectual property and personal information of employees, clients and others, as well as protected health information, or PHI, of our clients’ patients. Because of the extreme sensitivity of the information we store and transmit, the security features of our computer, network, and communications systems infrastructure are critical to the success of our business. A breach or failure of our security measures could result from a variety of circumstances and events, including third-party action, employee negligence or error, malfeasance, computer viruses, cyber-attacks by computer hackers, failures during the process of upgrading or replacing software and databases, power outages, hardware failures, telecommunication failures, user errors, or catastrophic events. Information security risks have generally increased in recent years because of the proliferation of new technologies and the increased sophistication and activities of perpetrators of cyber-attacks, including, for example, the recent Spectre and Meltdown threats which, rather than acting as viruses, were design flaws in many CPUs that allowed programs to steal data stored in the memory of other running programs and required patch software to correct. As cyber threats continue to evolve, we may be required to expend additional resources to further enhance our information security measures and/or to investigate and remediate any information security vulnerabilities. If our security measures fail or are breached, it could result in unauthorized persons accessing sensitive client or patient data (including PHI), a loss of or damage to our data, an inability to access data sources, or process data or provide our services to our clients. Such failures or breaches of our security measures, or our inability to effectively resolve such failures or breaches in a timely manner, could severely damage our reputation, adversely affect client or investor confidence in us, and reduce the demand for our services from existing and potential clients. In addition, we could face litigation, damages for contract breach, monetary penalties, or regulatory actions for violation of applicable laws or regulations, and incur significant costs for remedial measures to prevent future occurrences and mitigate past violations. Although we maintain insurance covering certain security and privacy damages and claim expenses, we may not carry insurance or maintain coverage sufficient to compensate for all liability and in any event, insurance coverage would not address the reputational damage that could result from a security incident.

We may experience cyber-security and other breach incidents that remain undetected for an extended period. Because techniques used to obtain unauthorized access or to sabotage systems change frequently and generally are not recognized until launched, we may be unable to anticipate these techniques or to implement adequate preventive measures. In addition, in the event that our clients authorize or enable third parties to access their information and data that are stored on our systems, we cannot ensure the complete integrity or security of such data in our systems as we would not control access. If an actual or perceived breach of our security occurs, or if we are unable to effectively resolve such breaches in a timely manner, the market perception of the effectiveness of our security measures could be harmed and we could lose sales and clients, which could have a material adverse effect on our business, operations, and financial results.

Data protection, privacy and similar laws restrict access, use, and disclosure of information, and failure to comply with or adapt to changes in these laws could materially and adversely harm our business.

We are subject to data privacy and security regulation by both the federal government and the states in which we conduct our business. HIPAA established uniform federal standards for certain “covered entities,” which include healthcare providers and health plans, governing the conduct of specified electronic healthcare transactions and protecting the security and privacy of PHI. HITECH and the Omnibus Final Rule, which became effective on September 23, 2013, make HIPAA’s privacy and security standards directly applicable to “business associates,” which are independent contractors or agents of covered entities that create, receive, maintain, or transmit PHI in connection with providing a service for or on behalf of a covered entity. HITECH also increased the civil and criminal penalties that may be imposed against covered entities, business associates, and

15

other persons, and gave state attorneys general new authority to file civil actions for damages or injunctions in federal courts to enforce HIPAA’s requirements and seek attorney’s fees and costs associated with pursuing federal civil actions.

A portion of the data that we obtain and handle for or on behalf of our clients is considered PHI and subject to HIPAA because our clients are covered entities under HIPAA and we act as their business associate. Under HIPAA and our contractual agreements with our HIPAA-covered entity health plan clients, we are considered a “business associate” to those clients, and are required to maintain the privacy and security of PHI in accordance with HIPAA and the terms of our agreements with clients, including by implementing HIPAA-required administrative, technical, and physical safeguards. We have incurred, and will continue to incur, significant costs to establish and maintain these safeguards and, if additional safeguards are required to comply with HIPAA or our clients’ requirements, our costs could increase further, which would negatively affect our operating results. Furthermore, if we fail to maintain adequate safeguards, or we use or disclose PHI in a manner not permitted by HIPAA or our agreements with our clients, or if the privacy or security of PHI that we obtain and handle is otherwise compromised, we could be subject to significant liabilities and consequences, including, without limitation:

• | breach of our contractual obligations to clients, which may cause our clients to terminate their relationship with us and may result in potentially significant financial obligations to our clients; |

• | investigation by the federal regulatory authorities empowered to enforce HIPAA, which include the U.S. Department of Health and Human Services, or HHS, the Federal Trade Commission, and investigation by the state attorneys general empowered to enforce comparable state laws, and the possible imposition of civil and criminal penalties; |

• | private litigation by individuals adversely affected by any violation of HIPAA, HITECH, or comparable state laws to which we are subject; and |

• | negative publicity, which may decrease the willingness of current and potential future clients to work with us and negatively affect our sales and operating results. |