Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - Inovalon Holdings, Inc. | a2223845zex-32_2.htm |

| EX-32.1 - EX-32.1 - Inovalon Holdings, Inc. | a2223845zex-32_1.htm |

| EX-23.1 - EX-23.1 - Inovalon Holdings, Inc. | a2223845zex-23_1.htm |

| EX-31.1 - EX-31.1 - Inovalon Holdings, Inc. | a2223845zex-31_1.htm |

| EX-31.2 - EX-31.2 - Inovalon Holdings, Inc. | a2223845zex-31_2.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

INOVALON HOLDINGS, INC. INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One) |

||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2014 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period

from to |

||

Commission file number 001-36841

INOVALON HOLDINGS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

47-1830316 (IRS Employer Identification No.) |

|

4321 Collington Road Bowie, Maryland (Address of Principal Executive Offices) |

20716 (Zip Code) |

(301) 809-4000

Registrant's Telephone Number, Including Area Code

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name Of Each Exchange On Which Registered | |

|---|---|---|

Class A Common Stock, $0.000005 par value per share |

NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No ý

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o |

Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

As of June 30, 2014, the last business day of the registrant's most recently completed second fiscal quarter, the registrant's equity was not listed on a domestic exchange or over-the-counter market. The registrant's Class A common stock began trading on the NASDAQ Global Select Market on February 12, 2015.

As of March 31, 2015, the registrant had 25,364,803 shares of Class A common stock outstanding and 122,257,145 shares of Class B common stock outstanding.

Documents Incorporated by Reference

None

INOVALON HOLDINGS, INC.

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014

TABLE OF CONTENTS

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). All statements contained in this Annual Report other than statements of historical fact, including but not limited to statements regarding our future results of operations and financial position, our business strategy and plans, market growth, and our objectives for future operations, are forward-looking statements. The words "believe," "may," "will," "estimate," "continue," "anticipate," "intend," "expect," and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in Item 1A—Risk Factors. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this Annual Report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

Factors that may cause actual results to differ from expected results include, among others:

- •

- our future financial performance, including our ability to continue and manage our growth;

- •

- our ability to retain our client base;

- •

- the effect of the concentration of our revenue among our top clients;

- •

- our ability to innovate and adapt our platforms and toolsets;

- •

- the effects of regulations applicable to us, including regulations relating to data protection and data privacy;

- •

- the ability to protect the privacy of our clients' data and prevent security breaches;

- •

- the effect of competition on our business; and

- •

- the efficacy of our platforms and toolsets.

You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. We are under no duty to, and we disclaim any obligation to, update any of these forward-looking statements after the date of this Annual Report or to conform these statements to actual results or revised expectations.

ii

Our Company

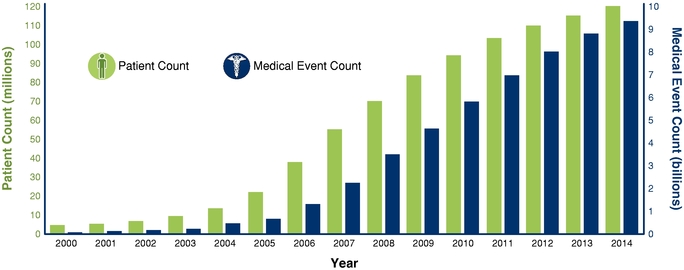

We are a leading technology company that combines advanced cloud-based data analytics and data-driven intervention platforms to achieve meaningful insight and improvement in clinical and quality outcomes, utilization, and financial performance across the healthcare landscape. Our powerful platform drives high-value impact, improving quality and economics for health plans, hospitals, physicians, patients, pharmaceutical companies, and researchers. The value we deliver to our clients is achieved by turning data into insights and those insights into action. Through our large proprietary datasets, advanced integration technologies, sophisticated predictive analytics, and deep subject matter expertise, we deliver seamless, end-to-end platforms that bring the benefits of big data and large-scale analytics to the point of care. Our analytics identify gaps in care, quality, data integrity, and financial performance, while providing clients with differentiated capabilities to resolve these gaps. During 2014, we provided these services to more than 100 clients representing approximately 200 patient populations, providing analytics informed by our data and insight on more than 754,000 physicians, 248,000 clinical facilities, 120 million unique patients (covering approximately 98.2% of all U.S. counties and Puerto Rico), and 9.2 billion medical events, a number that has been increasing at a rate of approximately 3.0% compounding monthly, or 42.6% annually, since 2000.

Healthcare costs in the United States have been increasing significantly for many years, currently approaching almost $3 trillion annually. This rise in healthcare costs has driven a broad transition from consumption-based payment models to value-based payment models across the healthcare landscape. As a result, the specific disease and comorbidity status, clinical and quality outcomes, resource utilization, and care details of the individual patient have become increasingly relevant to the various constituents of the healthcare delivery system. Concurrently, the count and complexity of diseases, diagnostics, and treatments—let alone payment models and regulatory oversight requirements—have soared. In this setting, granular data has become critical to determining and improving quality and financial performance in healthcare.

We believe that the opportunity before us is substantial as data increasingly becomes the lynchpin in healthcare—from clinical quality outcomes and financial performance, to the consumer experience and drug discovery. A January 2013 McKinsey report estimates that utilizing data analytics could drive improvements in healthcare resulting in a beneficial economic impact of $300 billion to $450 billion annually. As a reflection of the increasing need for data analytics, in the last several years, our advanced analytics and data-driven intervention platforms have been driving significant economic impact through improvements in clinical and quality outcomes, disease and comorbidity data accuracy, and utilization, achieving hundreds of millions of dollars per year in quantified beneficial financial improvement for our clients.

At the core of our enabling capabilities is a long history of innovation and profitable growth, positioning us to deliver value to our clients and capitalize on the confluence of recent changes in the healthcare industry that many describe as historically unprecedented. Our ability to rapidly innovate is enabled by the depth and breadth of our industry expertise, large-scale proprietary datasets, advanced analytical prowess, highly flexible platform components, a common native code base, and experience across the entire healthcare landscape.

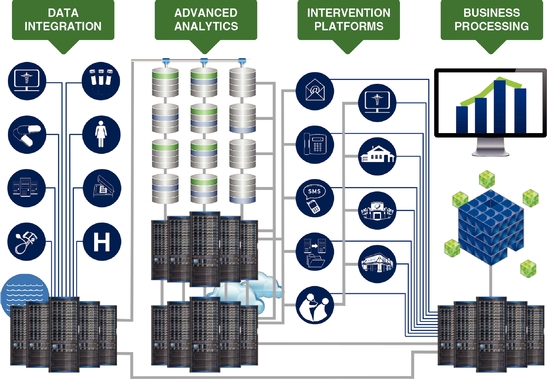

The value we deliver to our clients through our data analytics and intervention platforms are comprised of four primary components:

- •

- Data Integration: Highly efficient and effective data assimilation of structured and unstructured healthcare data in any format from highly disparate and disconnected sources;

1

- •

- Advanced Analytics: Data analysis using big-data

processing to yield highly actionable insights identifying gaps in care, quality, data integrity, and financial performance;

- •

- Intervention Platforms: Software and services that allow

our clients to take the insights derived from our analytics to address and resolve the identified gaps in care, quality, data integrity, and financial performance;

- •

- Business Processing: Powerful business intelligence tools that summarize key analytics and benchmarking information as well as a comprehensive claims data warehouse that helps our clients comply with government mandated reporting requirements.

Our ability to deliver value to our clients through our advanced analytics and intervention platforms has allowed us to achieve significant growth since our company's organization. For the year ended December 31, 2014, our revenue was $361.5 million, representing 22% growth over the year ended December 31, 2013. In this same period, we generated Adjusted EBITDA of $133.6 million, representing 37% of revenue and 86% growth over the same period in the prior year. Net income for the year ended December 31, 2014 was $65.4 million, representing 18% of revenue and a 100% increase over the same period in 2013. Non-GAAP Net Income for the year ended December 31, 2014 was $70.2 million, representing 19% of revenue and a 88% increase over the same period in 2013. Adjusted EBITDA and Non-GAAP Net Income are measures that are not presented in accordance with accounting principles generally accepted in the United States (GAAP). For a reconciliation of net income to Adjusted EBITDA and Non-GAAP Net Income, see "Non-GAAP Financial Measures," provided in Item 6—Selected Financial Data.

In this Annual Report, unless we indicate otherwise or the context requires, references to the "company," "Inovalon," "we," "our," "ours," and "us" refer to Inovalon Holdings, Inc. and its consolidated subsidiaries.

Recent Developments

On February 18, 2015, we completed our initial public offering (the "IPO") of 22,222,222 shares of Class A common stock and, upon the underwriters' exercise of their option to purchase additional shares, issued an additional 3,142,581 shares of Class A common stock for a total of 25,364,803 shares issued. All of the shares issued in the IPO were primary shares offered by us as none of our stockholders sold any shares in the IPO. The offering price of the shares sold in the IPO was $27.00 per share, resulting in net proceeds to us, after underwriters' discounts and commissions and other expenses payable by us, of approximately $639.4 million.

Industry Overview

We believe that the increasing demand for our platform is driven by the confluence of four fundamental healthcare industry trends:

Unsustainable Rise in Healthcare Costs. Healthcare spending in the U.S. was almost $3 trillion in 2012 according to the 2012 National Health Expenditure Highlights prepared by the Centers for Medicare and Medicaid Services, or CMS, representing more than 17% of U.S. Gross Domestic Product, or GDP. The 2014 set of healthcare cost projections from the Congressional Budget Office, or the CBO, indicate national healthcare spending will rise to 22% of GDP by 2039. To address this expected significant rise in healthcare costs, the U.S. healthcare market is seeking more efficient and effective methods of delivering care. This same trend is playing out across modernized nations around the globe.

Shift to Value-Based Healthcare. The traditional fee-for-service reimbursement model in healthcare has played a major role in elevating both the level and growth rate of healthcare spending. In response, both the public and private sectors are shifting away from the historical fee-for-service models toward

2

value-based, capitated payment models that are designed to incentivize value and quality at an individual patient level. As seen in the figure below, the number of Americans covered by capitated payment programs (care programs wherein an organization is financially responsible for the healthcare of a population of patients for which the total compensation is fixed other than adjustments for factors including specifically how sick individual patients are, how much resource is needed to be applied or spent on each patient, what is the quality of the clinical care, and other demographic factors) has been increasing rapidly and, according to industry sources and our internal estimates, is anticipated to increase from approximately 80 million at the start of 2014 to over 150 million by 2019. This increase is expected to further drive the critical importance to accurately measure, analyze, report, and improve patient disease and comorbidity conditions, utilization rates, and clinical quality outcomes.

Digitization of Healthcare Information. Across the healthcare landscape, a significant amount of data is being created every day driven by patient care, payment systems, regulatory compliance, and record keeping. These data include information within patient health records, clinical trials, pharmacy benefit programs, imaging systems, sensors and monitoring platforms, laboratory results, patient reported information, hospital and physician performance programs, and billing and payment processing. Despite significant investments by public and private sources within the industry, however, the digitized healthcare data remain largely stored in "walled gardens"—data that is static and not easily shared or interpreted. As the amount of data in healthcare continues to grow, we believe that it will be critical for the healthcare industry to be able to use this disparate data to better achieve the goals of higher quality and more efficient care.

Increasing Complexity. The healthcare industry is on a course of dramatically progressive complexity. As technology employed in the healthcare space has become increasingly sophisticated, new diagnostics and treatments have been introduced, the pool of clinical research has expanded, and the paradigms dictating payment and regulatory oversight have multiplied. This expanding complexity drives a growing and continuous need for analysis of the underlying and resulting data.

Problems Our Clients Face

As the U.S. healthcare market continues to transform, the aforementioned industry trends are driving fundamental changes in payment and delivery models, as well as technology requirements. These changes have set into motion a number of significant challenges faced by our clients. We believe that we are well-positioned and have the solutions to help clients not only adapt to, but thrive within, the new healthcare landscape.

Understanding and Improving Clinical Quality Outcomes. Quality and value-based, capitated programs are directly tied to clinical and quality outcomes which need to be measured at the individual patient level. These outcome requirements are designed to monitor a populations' compliance with industry accepted healthcare processes and healthcare outcomes goals, patients' satisfaction with the healthcare that they receive, and the effective operation of healthcare practice groups. Clinical and quality outcomes measurement programs require the detailed and highly granular reporting of the care sought and delivered to each patient within an overall population to allow for the accurate calculation of population quality metrics. Industry accreditation organizations such as NCQA, Utilization Review Accreditation Committee, or URAC, Pharmacy Quality Alliance, or PQA, National Quality Forum, or NQF, and medical societies looking to provide thought leadership on behalf of their patients, produce quality measures utilized by the industry. These measures have been adopted directly or in modified versions by federal and state regulations, private sector employers, and in shared-risk and accountable care contracts, in ways that drive significant financial incentives and consequences in the setting of strong positive or negative performance respectively. The results of these quality measurements drive significant incentives and consequences, influencing more than an estimated $3 billion in quality-related payments annually.

3

Understanding the True Health Status of Patients. The ability to establish the appropriate treatment protocol among multiple physicians, ensure that patients are supported with the correct care resources, monitor for the proper patient-relevant quality metrics, and determine the overall population risk is contingent on the ability to become accurately aware of a patients' disease and comorbidity status. Additionally, inaccuracies in disease status awareness impede resource planning, provider network design efforts, and financial projections. Furthermore, new payment models are designed to adjust the payments based upon the overall population illness burden of the patients in any particular plan. This is known as risk adjustment payments. There are multiple risk adjustment payment models across Medicare Advantage, managed Medicaid, ACA Health Insurance Exchanges, or HIX, and private sector contracts. Risk adjustment also impacts ACO shared savings calculations. Risk adjustment payments are governed by a complex set of rules using thousands of diagnosis and procedure codes, depending on the specific risk adjustment model. All together, having detailed and highly granular reporting of the disease and comorbidities of each patient is essential for care, quality, and financial performance today.

Understanding and Improving Utilization. Utilization, which is the cost incurred in the delivery of care, has increasingly become a focus in healthcare. Within fixed payment models, the ability to pass cost increases onto customers has materially decreased or altogether disappeared. Under new legislation, health plans are required to submit data on the percentage of revenue collected from health insurance premiums that is spent on clinical services and quality improvement, which is also more commonly known as the MLR. The MLR rules are designed to ensure that premiums received by insurers are primarily spent towards patient care and not directed towards administrative activities or excess profit. If health plans fail to meet the MLR thresholds, they are required to rebate the customer. If the cost of care exceeds the MLR threshold, however, health plans must absorb the shortfall. Given the importance of accurately reporting the MLR and managing the underlying healthcare costs, many health plans enter into complex arrangements with key providers in their networks through shared risk arrangements and performance bonus programs to help manage costs, to drive improvements in patient health, and to achieve long-term utilization containment and quality goals. As a result, the MLR rules impact multiple constituents of the healthcare community, from payors and providers to pharmaceutical companies, PBMs, and other cost-center elements of the healthcare landscape.

Complying with Increasingly Complex Regulatory Requirements. Federal and state regulation and compliance is increasing and becoming ever more complex. The regulatory obligations are impacting the entire healthcare delivery landscape, from individual practice groups and payors, to process and technology support vendors, all with the responsibility to adequately protect the privacy of patients and the manner in which services are provided, payments are made, and data is utilized, among other goals. This regulatory burden is intense, with agencies at nearly every level of government regulating the activities of organizations participating within the healthcare marketplace. The breadth, complexity, and intensity of regulation require these organizations to focus nearly every activity through a compliance lens in order to meet the data-intensive regulatory reporting requirements.

Enabling and Empowering the Consumer. Historically, insurance companies did not offer healthcare plans directly to the consumer, but typically through larger programs sponsored by an employer or government agency. That has changed where now individuals can buy coverage, select clinicians and hospitals, and directly research implications of specific medications, procedures, and treatment courses. As a result, new solutions are put in place to assist the consumer. For example, the U.S. government has created a Five-Star Quality Rating system designed specifically to help consumers compare the quality of the different types of services a healthcare plan offers in order to make a more informed purchasing decision. Payors are now incentivized to engage with customers on an individual level and use the increasingly granular data around personal demographics and preferences to design new plans. Physicians and hospitals are now incentivized to pay attention to quality, cost, and outcome

4

metrics which are increasingly available to consumers. In addition, through the advancement of technology, individuals are increasingly participating in the quantified-self movement in which they can self-monitor their key health metrics, creating immense amounts of new health data that can assist in providing higher quality care. This shift to a more informed and engaged consumer is resulting in new challenges and opportunities for how practice groups, payors, employers, pharmaceutical companies, retail pharmacies, and other healthcare constituents interact with consumers.

Unlocking the Value of Data through Actionable Interventions. The key commonality among the changes in the healthcare landscape is the importance of highly granular data. However, data by itself has limited usefulness without the right technology and systems in place to analyze and act on it and drive meaningful action. We believe that the leveraging of data is the critical differentiator for deriving meaningful insight and turning that insight into action to drive valuable impact across the healthcare landscape. However, in today's healthcare technology environment, much of this data goes unrecorded in a structured or meaningful way in paper based and electronic medical record systems, unintegrated with other pertinent data related to the patient's events or conditions, and unanalyzed for the purposes of driving improvements in care and affordability.

Easily Deploying and Interoperating Platforms at Scale. The ability to receive, seamlessly integrate, and accurately process extremely large-scale data flows efficiently and at high speeds is increasingly important and necessary for the healthcare industry. Data integration and processing in massive scale within the healthcare landscape is plagued by issues of highly disparate and "dirty" data characteristics. This is a significant barrier which prevents the various components of the healthcare landscape from effectively communicating and coordinating with one another to deliver higher quality care. For example, hospitals and insurance companies which have business across different states and markets face an increasingly uphill task of establishing an infrastructure and capability to assimilate, integrate and process all the disparate healthcare data they are generating. Despite billions of dollars in investment, the data and information systems resident within hospitals, physician practices, pharmacy benefit programs, urgent care centers, laboratory systems, and the other components of the healthcare landscape remain largely disconnected from each other. Interoperability frequently requires systems that add additional cost, time delay, or actions outside of the ordinary workflow. Overcoming this in scale is integral to managing large patient populations efficiently and effectively.

The need to fully aggregate, organize, integrate, and analyze healthcare data—and translate the resulting insight into actionable and meaningful impact—is a critical challenge that the healthcare industry will continue to face for years to come. Our platform provides a solution to help address our clients' challenges and drive meaningful improvements in the clinical quality outcomes and financial performance across a wide expanse of our society's healthcare landscape.

Our Market Opportunity

We believe that our opportunity is significant and growing. According to a January 2013 McKinsey report, utilizing data analytics could reduce healthcare costs in the United States by $300 billion to $450 billion, or 12% to 17% of total U.S. healthcare costs today.

The ability to aggregate, integrate, and analyze data in massive scale and apply garnered insights in a manner that achieves meaningful impact is crucial for healthcare payors (e.g., health plans and integrated health delivery systems), clinical providers (e.g., hospitals, ACOs, and physicians), pharmaceutical and life sciences companies, and consumers. We estimate that our addressable market for these capabilities serving these healthcare constituents to be approximately $83.8 billion. We believe that the market opportunity for our current platform offering within the payor market, the historical focus of our company, is approximately $10.6 billion. According to industry sources, the market for software and related services is approximately $14.0 billion within the U.S. payor market. We believe that as analytics continue to demonstrate greater value within the U.S. payor landscape, the market will

5

expand commensurately. As we continue to build and launch new capabilities, we believe it will provide a significantly larger value opportunity within this same payor space. For providers, industry sources estimate that software and related services represent a $32.3 billion U.S. market size. In the global pharmaceutical and life-sciences market, International Data Corporation, or IDC, in a 2013 report, estimates a $30.9 billion market size for total software and services spend in 2013. In the consumer market, an October 2013 Research and Markets report estimated a $6.6 billion global market size for mobile health applications and solutions. As with our other market segments, we believe that analytics will also drive a significant expansion in the consumer market.

In addition, the pressures that face the U.S. healthcare market are not unique, as other communities around the world are facing aging populations and growing pressures in the sustainable affordability of healthcare. We believe that our capabilities are highly applicable to other developed and developing countries around the globe, which we believe represents a sizable related future opportunity for us.

Our Platforms

Our platforms are informed by deep clinical insights through our combination of industry-leading subject matter expertise and extensive proprietary datasets. Through the application of our platforms, we help our clients achieve large-scale insight and meaningful improvement in clinical and quality outcomes, utilization, and financial performance.

In deploying our technology, our clients want us to synthesize opaque, convoluted, and disparate data into actionable information aligned with individualized goals and, in turn, empower a patient and provider intervention platform that achieves the realization of their goals in a measurable way. The diagram below illustrates the components of our technology platforms.

Our platforms' capabilities are currently engaged by nearly 100 clients supporting approximately 200 patient populations that leverage our ability to analyze and improve clinical and quality outcomes and financial performance. These platforms are applied in a variety of environments with many additional applications of the technologies being planned.

6

Data Integration. Datasets and the management of data are part of our core strengths, which give us insight into how a patient, provider, or population is doing. It grants us both relative and absolute insight, and informs the construction of new capabilities, predictive models, and impact predictions. It speeds our time to client impact, decreases the burden on clients choosing to do business with us, and empowers our achievement of mission and results.

We believe that our enterprise-scale data integration and management processes are a critical capability in achieving a material improvement in clinical quality outcomes and financial performance in healthcare. We integrate data seamlessly and securely into our systems through our proprietary ETL tools and processes. This system manages the process of defining and configuring thousands of industry data feeds from our clients and partners (depicted in the diagram above as electronic health records ("EHR"), laboratory, pharmacy, patient reported, claims, paper based medical records, biometric, and hospital data feeds respectively, as examples), manages the data processing workflow, and monitors the ongoing provision and quality of data through the application of more than 2,000 data integrity checks.

In addition to being maintained and tagged within client-specific data lakes, data we receive in the course of providing our services are statistically de-identified and stored in our MORE2 Registry®. As of December 31, 2014, this registry contained more than 9.2 billion medical events from more than 120 million unique patients, 754,000 physicians, and 248,000 clinical facilities, touching 98.2% of all U.S. counties and Puerto Rico and growing at a rate of approximately 42.6% annually since 2000. The MORE2 Registry® goes beyond just claims data to include information about demographics, enrollment, diagnoses, procedures, pharmacy, laboratory results, and deep medical record clinical data and presents a significant representative mix of commercial, HIX Marketplace, Medicare Advantage, and managed Medicaid care plan patients. The following is a sample of various components within our MORE2 Registry®.

• Patient Demographic Data |

• Benefits Data |

|

• Medical Record Documentation |

• Encounter and Procedural Data |

|

• Operating Room, Procedure, |

• Pharmacy Data |

|

Discharge Summary, |

• Imaging Report Data |

|

Emergency Room Records |

• Laboratory & Pathology Data |

|

• Electronic Health Record Data |

• Durable Medical Equipment Data |

|

• Health Risk Assessment Data |

• Self-Reported Data |

|

• Practitioner Profile Data |

• Social History Data |

|

• Claim Diagnostic Data |

• Activities of Daily Living (ADL) |

|

• Eligibility and Enrollment Data |

• Cost Data |

Advanced Analytics. For years we have developed, honed, and scaled a portfolio of sophisticated analytics. Applying our team's deep subject matter expertise in compute processing, data architecture, statistics, medical sciences, healthcare policy, and leveraging the billions of medical events within our significant propriety datasets, we believe that we have developed one of the most advanced analytical platforms within the industry, as well as a culture and set of analytical toolsets that serve to rapidly innovate and expand our platform. Examples of the innovative analytics powered by this combination of data and processing capabilities include:

- •

- Disease and comorbidity presence and closure probability determination analytics: Arriving at an accurate understanding, documentation, and codification of the disease states of patients is critical. In addition, through a proper understanding of each patient's needs, care can be more effectively guided and delivered, quality achieved, and financial implications understood. In order to guide the efficient use of resources to clarify the disease state of each patient across the landscape of tens of thousands of codes, analytics are employed to predictively determine whether a disease or comorbidity is being overlooked or is progressing at a rate or severity otherwise not noted. Analytics that transcend a single point in time, location, or point of view to

7

- •

- Clinical and quality outcomes gap presence and closure probability determination

analytics: Every patient, whether healthy or acutely, or chronically ill, needs a specific set of preventative or treatment-based

healthcare services in periods specific to each patient's clinical profile. Additionally, patients with specific conditions, such as diabetes, need specific elements of care such as blood sugar

testing, medication compliance, and examinations to detect complications of diabetes. Standards within the industry around quality of care have been created by organizations such as NCQA, URAC, PQA,

NQF, and medical societies looking to provide thought leadership on behalf of their patients. In order to help guide patients and their physicians in addressing the preventative care and treatment

needs of each patient, our predictive analytics are employed to determine each patient's clinical profile, their compliance with treatment protocols and quality measure standards, and how these match

up to established quality standards. Further, our analytics are not only focused on determining accurate quality measure profiles, but also on predicting which measures that are unfulfilled today will

become resolved on their own by the actions of the patient or provider independent of any new intervention. Not only do these analytics empower better quality care, but they make care more cost

effective, by suggesting the avoidance of unnecessary testing, diagnostics, or treatment, that may not benefit the patient or change the patient's clinical course based upon historical patient

behavior.

- •

- Medication compliance and persistence analytics: Critical

management of many chronic conditions is the effective utilization of prescription drugs to stabilize disease progression, ease symptoms, and facilitate healing. However, many barriers exist to

patients reliably filling their prescriptions and taking the medications that their physician has prescribed, including the cost of treatment, the side effects of treatment, and the patient's

engagement in the treatment process. In order to determine which patients are the most likely to achieve compliance with their prescribed treatment, the least likely, and susceptible to influence, we

apply predictive models that examine patients against their historical behavior patterns and clinical profiles to guide the right resources to the right patient in order to maximize medication

compliance and persistence.

- •

- Principally Relevant Provider (PRP) determination

analytics: In order to best engage a patient with the healthcare delivery system, it is important to identify the physician whom the

patient considers to be his or her PRP with respect to specific issues needing attention. Particularly important for patients with chronic conditions or complex issues that see multiple physicians,

the determination of which physician possesses the greatest bond can make a significant difference when seeking to assist the patient with resolution of an identified concern. In some cases, for

instance, the patient's health plan assigned primary care provider may or may not be the physician that has established a trusted care provider relationship with the patient. Rather, a patient's key

specialist may be most applicable to address the patient's needs and to engage the patient in effective self-management. We analyze utilization patterns, follow-up patterns, treatment compliance

patterns, and other patient behaviors to help identify the provider that is most relevant to address specific issues which the patient may need addressed within their care plan.

- •

- Targeted intervention timing optimization analytics: While the clinical lives of patients always present opportunities for improvement, the presence of a gap does not necessarily mean that such gap should be acted upon with high intensity, or even acted upon at all depending upon

take into consideration a more holistic view both in absolute terms (i.e. solely with the patient data in mind) and relative terms (i.e. taking into consideration millions of other similar and different cases) can be achieved. In addition to determining the potential presence of specific disease and comorbidities, our analytics can be applied to determine the statistical probability of successfully confirming and resolving such a potential gap between known and suspected disease conditions. In this way, resource prioritization can be achieved.

8

- •

- Targeted intervention venue and logistics optimization

analytics: For those patients who have been identified with a gap that needs to be addressed, in order to cost effectively deliver the

appropriate care and achieve gap closure, the right intervention tool must be selected and deployed to effectively address the specific patient and their needs. This avoids deploying a low cost

activity, such as a message or phone call, when such an intervention has little or no likely or predictable ability to achieve gap closure, while also avoiding deploying high cost activities, such as

a home visit or emergency room visit, when the gap could have been easily addressed through a scheduled appointment at a convenient retail clinic or provider office. Applying analytics to

determine the right venue for gap closure, sensitive to the cost profile and effectiveness of each, is critical for achieving cost effective and high quality healthcare.

- •

- Gap resolution valuation determination and prioritization

analytics: Because patients have multiple gaps and needs, particularly those patients with chronic conditions, it is important to

prioritize which gaps need to be understood by the patient and addressed in a manner that increases their engagement and self-management capability, without overwhelming the patient or provider. As

such, analytics must be employed throughout the year to evaluate the unresolved gaps of each patient and prioritize the resolution of such gaps based upon the combined likelihood of closure and the

ultimate value of closure to the patient and their health plan. By understanding the context of each gap in light of the patient's full clinical profile and by understanding the patient's situation in

light of the health plan's quality metrics and financial performance, gaps can be valued and prioritized to make sure that the most important gaps are known and addressed at the right time for each

patient.

- •

- Population simulation analytics: We apply analytical

processes to create propensity-matched patient cohorts from our MORE2 Registry® to simulate the characteristics of patients, their behavior, their providers, and how these

factors translate into their utilization of healthcare resources, financial performance, and the achievement of clinical quality and outcomes goals. This simulation process allows us to effectively

provide a control group for demonstrating the outcomes trajectory of such patients in comparison to populations that we manage to highlight performance variations. This simulation process also allows

us to understand these populations and design effective tools for improving their quality of care and clinical outcomes. Additionally, these simulations allow us to bring new technology capabilities

and associated products to market more quickly, accurately, and cost effectively. Lastly, these simulations allow us to gain insight into how a potential client population may perform, enabling us to

have an additional differentiator during a sales process.

- •

- Relative Comparative Analytics: An increasing number of measurement, incentive, shared savings and reimbursement programs are based upon "budget neutral," "zero sum games," and other relative or comparative models. Using our data and analytics capabilities, we can inform the

the historical utilization patterns of the patient. Through predictive models that examine the historical behavior patterns of the patient in combination with the gaps that need to be addressed, optimal intervention timing can be achieved to allow the patient to address his or her gap without external intervention based upon their preferences in utilizing the healthcare system, suggesting the intervention occur only after the patient would have been expected to act on their own. Often watchful waiting may be the most appropriate recommendation. By watchfully waiting and evaluating the patient's self-management of his or her issue, resources can be applied only after the patient has demonstrated a failure or delay in acting themselves. Through successful intervention timing analytics, multiple goals can be achieved: cost avoidance (by not undertaking costly interventions that may not have been needed), confusion and frustration avoidance (by not accidently directing a patient or provider to undergo an intervention when the same was imminently being done), and resource planning (by having insight into when during a year an intervention is most likely expected to be needed).

9

relative comparison of population and cohort performance levels to assist in guiding strategic investment decisions. More importantly, we can perform these analytics during a relevant date of service period so that our clients can gain insight into how they are performing and how they can make changes within their patient and provider groups to improve their outcomes while there is still time within the relevant date of service period to achieve improvement. In the absence of comparative analytics, many organizations would otherwise use a previous year's results to guide changes—a set of data that often does not even become available until well into a year, let alone representing information that is long outdated and largely irrelevant when performance is not only based upon how one is doing, but moreover based upon how one is doing in comparison to others.

Intervention Platforms. Our data-driven intervention platforms are toolsets and services that enable our clients to take the insights derived from our analytics and implement solutions at the patient and provider level (depicted in the diagram above as being via hard copy and electronic mail, interconnected EHR systems, telephonic interactions, in patients' homes, through mobile devices, at dedicated patient centers, through web-enabled decision support tools, in retail pharmacies, and in traditional clinical locations, as examples) in order to achieve meaningful impact with the patient and provider. Some clients utilize our analytical outputs to achieve value on their own. Others license our data-driven intervention platform to support their ability to achieve data-driven impact. Yet others engage us to not only license our data-driven intervention platform, but also provide the personnel services necessary to leverage these toolsets and actually achieve the patient and provider-level impact. Examples of our data-driven intervention platform tools include:

- •

- point of care tools that provide patient-level insight to the healthcare provider, which guides the provider through precise

data-driven topics, issues, and decision support to aid in the assessment, documentation, and care of a specific respective patient. For example, our analytics may identify that a patient's diabetes

has potentially progressed—possibly due to a non-compliance with their medications. Our decision support tools provide a mechanism for this information to be made known to a provider in

such a way as to help them know that a patient visit may be warranted, aid them during the patient clinical encounter to efficiently determine the situation with the patient, support proper

documentation, reporting, and outcomes measurement;

- •

- communication tools that support a wide range of notifications and interactions with patients and providers via phone calls, mail, SMS

messages, e-mails, etc., at the appropriate level of implied education and language to aid in the process of achieving patient and provider actions. It also may include education outreach which

coordinates the communications with health plan patients regarding their health issues and to support self-management of their conditions by guiding them to supplemental resources, coaching and health

literacy;

- •

- supplemental patient encounter tools that facilitate the coordination of data-driven patient encounters for those who are unable to

participate in traditional office encounter venues; and

- •

- medical record data tools that facilitate electronic medical record data pulls, remote accessing, and clinical facility communications for site, scheduling, medical record data collection, abstraction, review, quality control, archiving, and process tracking—regardless of the underlying medical record data medium (e.g., digital or paper).

Business Processing. Our business processing toolsets are made up of a powerful business intelligence system and comprehensive data warehousing to provide historical and current data insight, reporting, and benchmarking to support multiple client business needs such as government-mandated

10

data filings, financial planning, and compliance requirements. Examples of our business processing tools include:

- •

- Data Warehousing and Business Intelligence. We provide

toolsets that enable comprehensive warehousing and management of healthcare data in raw, native formats as well as processed, high-integrity data. We provide the flexibility and accommodation for

healthcare practice groups who have varying levels of data sophistication—from advanced electronic connectivity (i.e. remote medical practices) to onsite digitization and

collection, to self-provision of medical records via fax, mail and electronic mail allowing for clinical data collection throughout the U.S. These datasets are presented to our clients' users through

business intelligence systems that include flexible dashboards, parameterized reports, and ad hoc querying capabilities for summarizing key analytics, allowing for the investigation of data trends and

deeper data segregation and analyses, and access to key benchmarking information. These data warehousing and business intelligence toolsets are built on industry-leading technologies to integrate our

clients' data (e.g., provider, facility, patient, enrollment, benefits, lab results, pharmacy, claims, quality scores, financial metrics, performance forecasts, etc.) and the data results and

benchmark information from our MORE2 Registry®. We are able to provide our clients with the ability to gain insight into both their own data and their own data in comparison

to our large integrated dataset to help improve the quality of care provided to patients, drive financial performance, and aid in strategic business processes of the client organization.

- •

- Data Management and Submission. Leveraging our data warehousing toolsets, our solutions help our clients to manage their data and translate their data into the formats necessary for, among other needs, submission to government entities in support of quality and outcomes measurement and revenue determinations, and provision to their various internal and external business processes. These data management solutions address the formulation of data submission files in summary and patient level-data format as required by regulatory bodies, as well as the workflow processes to receive submission response files to support the reconciliation of data submissions, corrections to data submitted with response issues, and resubmission processes. These processes operate in an integrated manner with our business intelligence solutions to provide our clients visibility into the details of their data submissions at the population level, the patient level, the attributed provider level, and for user defined custom cohorts.

Illustrative Workflow and Patient Case Study

The following is an illustrative workflow of how a healthcare organization (whether a public or private health plan, integrated healthcare delivery system, independent physician or practice association, or other provider/patient organization) may leverage our platforms.

- •

- Stage 1: Data Integration. Following the engagement of a new healthcare organization client, large amounts of data are integrated from multiple disparate sources within the healthcare organization related to patients, physicians, quality, payments, regulatory files, and clinical facilities. Other data sources are interconnected from sources such as hospitals, laboratories, pharmacy benefit plans, EHRs, and physicians. The initial data feeds typically "backfill" (i.e. provide for data pertaining to prior periods of time) for several years. Our platform facilitates rapid initial integration of this data, applying more than 1,100 data integrity checks. The data integrity analyses compare the potential erroneous presence, accidental absence, and potential errors within the data to our large scale comparative data sources containing billions of medical events from thousands of current and historical sources to aid in improving data quality and identifying potential gaps and errors within the new client data flows. Once integrated, data flows are scheduled at standard intervals thereafter. Some data are scheduled for monthly updates while other data flows update transactionally, whenever a data source event occurs such as a patient clinical encounter. All data connecting through our data integration platform, both

11

- •

- Stage 2: Advanced Analytics. With data resident

within our data lake, a series of analytical processes are applied. Key analytics begin determining the current disease status, comorbidity status, quality status, and utilization status of the

patient, provider, facility, or population based on actual available data (referred to as the known current state of the patient, provider, facility, or population). A set of predictive analytics is

then applied to derive models for where the broader datasets suggest the patient, provider, facility, or population have progressed to outside of the otherwise obvious data indications (referred to as

the predicted current state of the patient, provider, facility, or population). Informed by our broader datasets, yet another set of predictive analytics is then applied to derive models suggesting

where the patient, provider, facility, or population will progress to with respect to the analyzed conditions or issues (referred to as the predicted future state of the patient, provider, facility,

or population). Examining differences between known current state, predicted current state, predicted future state, and what is referred to as the desired state pertaining to the respective goal,

allows for gaps between those various states to be identified. Each gap between a current or predicted state and a desired state can then be analyzed further. To do this, for each gap, a series of

analytics is undertaken to determine the (i) probability that the gap is a real gap, (ii) the value of the gap being resolved, (iii) the way through which the gap would be most

likely able to be resolved, (iv) the venue at which the gap would best be resolved, (v) the timing which would be best for resolving the gap, and (vi) the predictability of the

gap being able to be resolved. By undertaking these various analytical processes, not only can the field of opportunities for improvement be identified and the concrete approaches to their resolution

be weighed, but also the business rules pertaining to prioritization and return on investment, or ROI, thresholds can be calculated and applied.

- •

- Stage 3: Intervention Platforms. With gaps

identified for resolution and concrete approaches to their resolution determined, a series of platforms can then support the resolution process. For some clients this stage may be handled through

their in-house resources, while for others, the client requests us to leverage our intervention platforms to achieve the realization of impact value sought by the analytical processes. For these,

guided by the insights garnered from the various analytical processes, the appropriate intervention platforms can be employed to interface the right resources with the patient, provider, facility, or

population to achieve the desired goal within the business rules pertaining to prioritization and ROI thresholds.

- •

- Stage 4: Business Processes. With actions taken by the various intervention platforms (or, in some cases, by the client's resources), resulting outcome data is then re-combined with the data resulting from all stages of our processes to inform business intelligence platforms, regulatory data submission processes, financial reporting processes, and other business processes that ultimately reflect the value achieved and complete the process initially sought by the client.

structured and unstructured, drop into our data repository, which we call our data lake, where they can easily be accessed by all of our platforms—analytical platform, intervention platform, and business processes platform.

The following is an illustrative example of how this translates to an individual patient.

Applying the stages of our platforms, a client engaged us for the improvement of quality and financial performance within their managed Medicaid population. Following data integration, our analytics identify that a patient's diabetes is believed to be worsening rapidly. Analytics predict that the diabetes is now likely out of control and has likely progressed to where there is concern for kidney, eye, and nerve complications. Unfortunately, the analytics also identify that there is no significant evidence that these predicted comorbidities have yet been identified or addressed by the physicians within the health plan's physician network.

12

Our models gain a high level of confidence that these concerns are valid and that the value to the patient, physician, and health plan is significant. Further analytics determine that historical care patterns and the patient's activities strongly suggest that the patient has the strongest relationship for diabetes-related matters with their OB/GYN (and not their endocrinologist, dermatologist, internist, or cardiologist). The information is sent to our data-driven intervention platforms. The platforms rely on analytical outputs which predicted that this patient would respond best to a phone call encouraging a physician visit with her OB/GYN while the information is concurrently made available within ePASS®, our provider portal for patient clinical encounters. Alternatively, the patient could have been seen at a retail pharmacy with a walk-in clinic utilizing our technology platform or the physician could have received notification and accessed the information within their EHRs. During the encounter, a patient profile constructed by our data and analytics provides the OB/GYN with past medical history, medications, laboratory results, and the analytical outputs determined by our analytical platform indicating the specific areas for assessment concern, pointing out gaps in quality measures, indicating and supporting important relevant screening.

Supported by the data and insights of our platform, the patient's diabetes progression is diagnosed. Additional goals set by the health plan around quality, screening, and patient education are achieved. A care plan is put into place. The patient gains an increased bond with his or her provider and health plan. The patient's data continues to be analyzed in the days, weeks, and months that follow. The impact results are made available to the healthcare organization showing the decreased use of the emergency room and hospital admissions by the patient, improved quality scores, and greater risk score data accuracy. The resulting decreased utilization costs, improved premium payments, incremental quality incentive payments, and improved patient retention drive material financial impact for the healthcare organization—allowing them to improve benefits, lower premiums, and, together with enhanced patient quality scores, better succeed in competitive marketing.

While the illustrative example was focused upon managed care client applications, our platforms also support multiple additional client examples as presented below in shorter form:

- •

- Pharmaceutical Industry. For the pharmaceutical company

seeking to successfully transition from the consumption-based industry model to the performance-based industry model, our platforms can assist in empowering pharmaceutical companies to construct

highly focused programs specifically aimed at patients who are failing to be identified as candidates for improved diagnostics or treatments; are at high risk of complications or poor outcomes; or are

non-compliant on specific treatment programs.

- •

- Research. For the contract research organization, or CRO, seeking to increase its speed, efficiency, and capabilities in a highly competitive marketplace, our platforms provide a deep and unique data source for research, clinical trial design modeling, and physician identification. Our intervention platforms can support Phase 3 and Phase 4 clinical trial processes, highly granular clinical data abstraction, directed clinical encounter activities, and a network of near-real time data aggregation that can dramatically differentiate a CRO.

Our Competitive Strengths

We believe that our operational and financial success is based on the following key strengths:

Industry-Leading Analytics. We have over a decade of demonstrated performance and leadership in disease and comorbidity identification analytics, predictive model analytics, patient and provider intervention prioritization analytics, quality outcomes analytics, and a host of additional analytical and data-driven processes. Based on our experience in the industry and our interactions with existing and prospective clients, we believe that very few other organizations, if any, are able to offer the depth and breadth of data-driven analytical insights, tools, and actionable interventions that our platforms are able to offer.

13

Industry-Leading Data Asset. We maintain one of the industry's largest independent datasets in our MORE2 Registry®, representing, as of December 31, 2014, more than 120 billion medical events from more than 9.2 million unique patients, 754,000 physicians, and 248,000 clinical facilities, touching 98.2% of all U.S. counties and Puerto Rico. The primary source nature of the contributing data, the clinical content depth of certain elements, the analytically-derived enrichments, the significant data integrity, and the ability to maintain accurate identification of entries and patient matching over time regardless of data source and chronology (a valuable characteristic within our datasets known as longitudinal matching)—all combine to create a unique and valuable asset. We believe that these datasets serve as a significant differentiator, informing analytical and product strength design, population simulations, health outcomes research, patient engagement, and both speed-to-market and speed-to-impact capabilities. As of December 31, 2014, our MORE2 Registry® has expanded at a rate of approximately 3.0% compounding monthly, or 42.6% annually, since 2000 as illustrated below.

MORE2 REGISTRY® GROWTH

Fully Integrated End-To-End Solution Delivery. Our platform is able to turn data into insights and insights into actionable interventions. Our platform covers a comprehensive range of services for our clients turning raw data into meaningful impact and allowing our clients to realize intervention benefits immediately following integration of our platform. The ability of our platform to integrate disparate and highly complex data to derive impactful and actionable insights has enabled us to bridge the gap from analytics to practical applications on a vast scale.

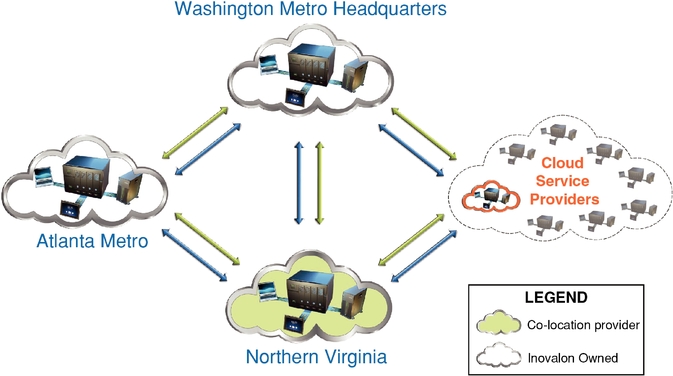

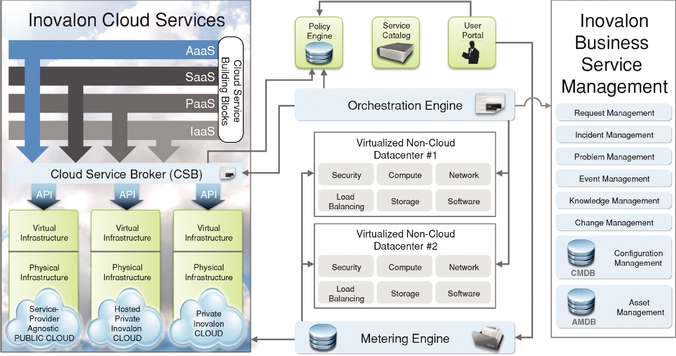

Scale of Organically Developed Platform. We have developed a highly efficient and scalable data and analytics platform that has successfully scaled to serve many of the nation's largest health plans as well as hundreds of separate patient populations concurrently. This platform has been developed on one common code base, supporting strong interoperability within our platform, efficiency in association with innovating and expanding our platform capabilities, and establishing both beneficial predictability and reliability when operated at high levels of load. We operate enterprise-grade datacenters complemented by a cloud technology based architecture that allows massive, on-demand capacity expansion and speed of execution. We integrate directly with the EHRs of many clinical facilities, bringing analytics and insight to the point of care and decreasing the process burden on providers and clinical facilities. We have a leading nationwide intervention platform services footprint and are able to support our client partners in more than 98.2% of all U.S. counties and Puerto Rico, as of December 31, 2014.

14

Subject Matter Expertise. We have, and plan to continue to cultivate, a culture of fostering domain expertise. We maintain a dedicated research team comprised of industry experts and thought leaders, including physicians, as well as clinical, statistical, economical, and data research scientists, and field practitioners who focus on next-generation healthcare solutions and data applications. In addition, we empower our product groups with their own industry experts who focus on research and development in their respective product domains. This subject matter expertise and leading research capabilities position us to stay at the forefront of industry innovations in data-driven healthcare interventions. This concentration of highly relevant subject matter expertise is uncommon in the market, and contributes to both our capabilities and our being called upon by clients, partners, and industry-leaders to address challenging and important questions.

Industry Innovator and Thought-Leader. We invest considerable time and resources to produce ground-breaking research and strategically share it through industry publications, peer presentations, strategic relationships, and the media. Leveraging our MORE2 Registry®, we provide healthcare insights for diverse audiences, thus driving visibility and credibility, and providing significant recognition for our toolsets, capabilities and innovation. Our MORE2 Registry® is routinely featured at high-profile industry events and within influential publications, which we believe further reinforces our brand as an industry innovator and thought-leader.

Long, Successful, Profitable Operating History. We have been delivering value to our clients while gaining scale and profitability since 2006, the year of our reorganization as a C corporation. This scale and profitability has provided organizational stability, an empowerment to invest in ongoing research and development, an element of reassurance for existing clients and potential clients, and ready access to resources to meet our clients' needs. We have been able to accomplish this in a manner conducive to client partnership through a variety of means, including the self-financing of individual client upfront project integration and start-up fees.

Trusted, Independent, and Unbiased Partner. We are not owned or influenced by a health plan or private equity organization. As a result, our data and analyses remain truly independent, not biased to any single patient base, we are incentivized to be transparent with our clients, and we believe our goals are more fully aligned with the success of our clients.

We have grown by attracting clients, accumulating larger and more robust datasets, and developing more advanced analytics from this growing dataset that deliver increasingly valuable insights and impact. By providing increasingly valuable insights and performing increasingly effective patient and provider interventions we are able to deliver greater value to our clients. As our data asset continues to grow, our analytics and intervention solutions become even more effective and our clients realize even more value from our solutions. This in turn results in greater demand for our solutions and attracts new clients. We believe that this virtuous cycle provides us with a competitive position that cannot be easily replicated.

Growth Strategies

Our objective is to continue to provide leading analytics and interventions platforms across the healthcare landscape while continuing to grow profitably. We intend to achieve this objective through the following key strategies:

Deliver Increasing Value to Existing Clients. We enjoy long term client relationships which entail multiple separate product engagements demonstrated by our average 4.9-year tenure for our top 10 clients with an aggregate of 80 separate statements of work as of December 31, 2014. Additionally, we have approximately 90 client organizations that currently have only a limited number of services with us. Frequently we see clients that started with just one service with us realize the value that we are delivering and then expand their business with us to add additional services. We believe that we have a

15

significant opportunity to deliver increasing value to our existing clients and this, in turn, will drive continued growth for us. As our clients recognize value and success as a result of working with our platforms, we frequently see them grow in their patient count and increase the number of products engaged with us—both of which result in our mutual success and growth. As we continue to deliver value to our clients, we plan to increase revenue from our existing clients by expanding their use of our platform, selling to other parts of their organizations, and selling additional analytical toolsets and services to them. Our pricing model allows us to grow incrementally along with our clients' growth. We are also able to introduce new healthcare plans that require additional functionality and insights as the healthcare market becomes more complex and the regulatory environment evolves, providing us with a substantial opportunity to increase the value of our client relationships.

Continue to Grow Our Client Base. We believe that we are still in the early stages of realizing our substantial opportunity to grow our client base. We intend to leverage our expertise and experience from the existing large client base to gain new clients through increased investment in our sales force and marketing efforts. In addition, by leveraging our sector expertise and thought leadership, we believe that we can increasingly become the partner of choice for our existing clients. The network effect created by delivering increasing client value and consequently expanding our brand and service value, coupled with our industry expertise, is also driving substantial inbound client interest.

Continue to Innovate. Our strength in applying advanced, big data, cloud-based data analytics and our proprietary datasets enable us to achieve increasingly more impactful results for our clients. In order to continue delivering meaningful results in clinical and quality outcomes, utilization, and financial performance across the healthcare landscape, we intend to continue to invest in research and development to further enhance our data analytics and intervention platforms. For example, we recently announced the acceleration of big data processing empowering our QSI® platform, enabling a significant functionality expansion in our clinical quality outcomes measurement capabilities supporting accelerated performance for HEDIS, Stars, QARR and other measurement and reporting standards. This advancement will also support the acceleration of our related predictive analytics capabilities. As a result, we expect our clients to experience significantly reduced cycle times, allowing for complex measure calculations at speeds which are more than 10 times faster than any other comparable solution which we are aware of in the healthcare industry.

Continue Expanding into Adjacent Verticals. We believe the application of advanced analytics and data extends well beyond our current market opportunities and provides additional adjacent market verticals for growth which include:

- •

- Providers: Physicians, practice groups, hospitals, and

combinations of such providers are making a transition from a fee-for-service based healthcare model environment to a quality and value based healthcare model environment. As part of this, providers

are entering into shared savings, shared risk, and other forms of arrangements with private and government payors. They are investing in the technology infrastructure needed to compete and survive in

the changing healthcare environment. Many of the forces being applied to healthcare payors are being pushed downstream to the provider marketplace directly through contractual arrangements, and

indirectly through traditional competitive forces. Our business intelligence platforms assist providers and provider organizations to understand the current status and projected implications of the

complex arrangements that are increasingly governing their marketplace. In addition, our datasets, analytical tools, and clinical encounter engagement platforms can be applied to assist these

providers and provider organizations to focus on delivery of high quality care and to succeed under the increasing pressure of these market forces.

- •

- Pharmaceutical and Life Sciences: The significant investment in drug and treatment development pipelines creates pressure within life sciences companies to focus on the areas of greatest need and opportunity, while growing their presence in the treatment process, from simply the creation

16

- •

- Employer and Private Exchanges: The growing cost of

healthcare is putting pressure on employers to find creative ways to control costs while continuing to offer competitive benefits and attractive healthcare options to their employees. Our capabilities

in analytics supporting the advancement of quality of care and cost effectiveness in healthcare can be applied to assisting employers in understanding and improving their populations' utilization of

healthcare services to advance the design of innovative plan benefit packages, provider networks, and population management support programs.

- •

- Direct-To-Consumer: As consumers become increasingly interested in quantifying and improving their health, our capabilities can help them understand their relevant data and empower their ability to make better decisions in a broad range of health-related areas from informing and managing their own health-related decisions to selecting physicians, hospitals, and treatments that best fit their individual needs. Further, our datasets and connectivity with the payor and provider landscape can provide a valuable element to the consumer's increasing desire to monitor and manage their holistic healthcare profile.

of treatments, to the ongoing delivery and support of treatments that achieve desired outcomes. Our deep and growing healthcare datasets, analytical tools, and clinical encounter engagement platforms can be applied to assist life science companies in advancing their missions to improve healthcare by providing them the insights necessary for them to provide safe, effective, and affordable treatments for individuals and populations, informing the growth of their treatment portfolios and assisting in the delivery of treatment programs.

Expand Reach through Growing our Channel Partnerships. While we have been successful in growing our business through our direct sales efforts, we believe there is a significant opportunity that exists for us to further expand our reach through channel partnerships. There are many organizations in the healthcare space outside of the traditional payor and provider space that have meaningful impact on the quality of healthcare, such as retail clinics, pharmaceutical companies, CROs, large technology solution providers, and consulting firms. We believe our platform is well positioned to empower these organizations with powerful data-driven analytics and intervention insights, which can benefit their end consumers through improved care and better outcomes. For example, we launched a partnership with Walgreens, the nation's largest drugstore chain. This partnership has allowed us to leverage our proprietary data assets and distinctive analytics capabilities to bolster Walgreens' Clinics point-of-care solutions by providing clinicians with access to predictive insights about a patient's health status and data-driven intervention considerations, resulting in more efficient and higher quality standard of patient care while reducing the cost of care.

Continue to Leverage our Technology Partnerships. The healthcare industry has traditionally lagged behind the technology innovation curve. Big data and high-performance analytics frameworks have not yet been widely adopted by the healthcare industry. We have been a leader in the use of these high-performance technologies and analytics in the healthcare industry. We have been closely collaborating with EMC and their federated companies of VMware and Pivotal on numerous infrastructure projects to integrate and enable modern high-performance compute and storage frameworks at the point of care. Our advanced data processing and analytics capabilities, coupled with infrastructure thought leadership from leading vendors such as EMC has enabled us to empower our clients with powerful data-driven solution offerings and further transform the use case of modern technologies across the evolving IT healthcare landscape.

Expand Internationally. Governments, corporations, and consumers worldwide face similar pressures as within the U.S. with respect to their healthcare systems. We believe that our capabilities are highly applicable to other countries around the world and we intend to invest in replicating our success in the U.S. market to other strategic countries and regions.

17

Selectively Pursue Acquisitions. We plan to selectively pursue acquisitions of complementary businesses, technologies, and teams that we expect to allow us to add new features and functionalities to our platform and accelerate the pace of our innovation and expansion into adjacent market spaces beyond what we can achieve organically.