Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - BUILD-A-BEAR WORKSHOP INC | a52158070ex99_1.htm |

| 8-K - BUILD-A-BEAR WORKSHOP, INC. 8-K - BUILD-A-BEAR WORKSHOP INC | a52158070.htm |

Exhibit 99.2

Build-A-Bear Workshop2020 ICR Conference

Forward looking and cautionary statements This presentation contains certain statements that are, or

may be considered to be, “forward-looking statements” for the purpose of federal securities laws, including, but not limited to, statements that reflect our current views with respect to future events and financial performance. We generally

identify these statements by words or phrases such as “may,” “might,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “intend,” “predict,” “future,” “potential” or “continue,” the negative or any derivative of these terms and

other comparable terminology. Forward-looking statements are based on current expectation and assumptions that are subject to risks and uncertainties which may cause results to differ materially from the forward-looking statements. We undertake

no obligation to update or revise publicly any forward-looking statements, whether because of new information, future events or otherwise. Risks and uncertainties to which our forward-looking statements are subject include: (1) general global

economic conditions may decline, which could lead to disproportionately reduced consumer demand for our products, which represent relatively discretionary spending; (2) we may not be able to operate our international corporately managed

locations profitably; (3) a decline in mall traffic could adversely affect our financial performance and profitability; (4) we may be unable to generate interest in and demand for our interactive retail experience and products, including being

able to identify and respond to consumer preferences in a timely manner; (5) our merchandise is manufactured by foreign manufacturers and we transact business in various foreign countries, and the availability and costs of our products, as well

as our product pricing, may be negatively affected by risks associated with international manufacturing and trade and foreign currency fluctuations; (6) we may be unable to renew, renegotiate or replace our store leases, or enter into leases

for new stores on favorable terms, or we may violate the terms of our current leases; (7) consumer interests change rapidly, and our success depends on the ongoing effectiveness of our marketing and online initiatives to build consumer affinity

for our brand and drive consumer demand for key products and services; (8) we may suffer disruptions, failures or security breaches of our information technology infrastructure or we may improperly obtain or be unable to protect our data or

violate privacy or security laws or expectations; (9) we may not be able to operate successfully if we lose key personnel, are unable to hire qualified additional personnel, or experience turnover of our management team; (10) we are subject to

risks associated with technology and digital operations; (11) we may not be able to evolve our store locations to align with market trends, successfully diversify our store models and formats, or otherwise effectively manage our overall

portfolio of stores; (12) we rely on a few global supply chain vendors to supply substantially all of our merchandise, and significant price increases or disruption in their ability to deliver merchandise could harm our ability to source

products and supply inventory to our stores; (13) our company-owned distribution center and our third-party distribution center providers may experience disruptions in their ability to support our stores or they may operate inefficiently; (14)

we may be unable to effectively manage our international franchises, attract new franchisees or laws relating to international franchises may change; (15) we may fail to renew, register or otherwise protect our trademarks or other intellectual

property and may be sued by third parties for infringement or misappropriation of their proprietary rights; (16) we may suffer negative publicity or be sued if the manufacturers of our merchandise or Build-A-Bear branded merchandise sold by our

licensees ship products that do not meet current safety standards or production requirements or if such products are recalled or cause injuries; (17) we may suffer negative publicity or be sued if the manufacturers of our merchandise violate

labor laws or engage in practices that consumers believe are unethical; (18) our profitability could be adversely impacted by fluctuations in petroleum products prices; (19) our business may be adversely impacted by a significant variety of

competitive threats; (20) we may suffer negative publicity or a decrease in sales or profitability if the products from other companies that we sell in our stores do not meet our quality standards or fail to achieve our sales expectations; (21)

we may be unsuccessful in acquiring businesses or engaging in other strategic transactions; (22) fluctuations in our operating results could reduce our cash flow and we may be unable to repurchase shares at all or at the times or in the amounts

we desire or the results of the share repurchase program may not be as beneficial as we would like; (23) fluctuations in our quarterly results of operations could cause the price of our common stock to substantially decline; (24) the market

price of our common stock is subject to volatility which could attract the interest of activist shareholders; (25) provisions of our corporate governing documents and Delaware law may prevent or frustrate attempts to replace or remove our

management by our stockholders, even if such replacement or removal may be in our stockholders’ best interests. For additional information concerning factors that could cause actual results to materially differ from those projected herein,

please refer to our most recent reports on Form 10-K, Form 10-Q and Form 8-K.

Over 20 Years in the Making BBW 2019 3 *As of fiscal 2019 3nd quarter ending November 2, 2019**Q4-2017

through Q4-2019; Includes preliminary projected results for Q4-2019 Estd. 1997Make-Your-Own Stuffed Animal Mall Retailer 2004IPO 2020Diversified Retailer with Evolving Business Model 2013Business Turnaround 371 Corporately-Managed

Stores 54 Third-party Retail Locations 104 International Franchise Stores 2020 Snapshot: 3,500+ Associates Rapidly growing e-commerce9 consecutive qtrs of dbl-digit growth** 200 MM Furry Friends Sold Nearly Known, emotional

and leverageable brand equity Global retail with over 500 locations* Multi-generational Diversified channels Skilled Talent Pool Powerful Brand

FY2019 Preliminary Expectations 4 We expect FY2019 to show an improvement over the prior year as well

as an improvement over our most recently stated guidance on key metrics: ($ in millions) Projected 2019 2018 Varianceto midpoint of range Total Revenue $334-338 $336 ~flat Pre Tax

Income $0.1-2.0 ($18.5) ~+$19.5 EBITDA $14-$15 ($2.4) ~+$17 Capex $12-$13 $11.3 ~+$1.2 Cash $25-$30 $17.9 ~+$10 Inventory <$58 $58.4 less than LY In addition, we expect to finish the year with no debt under our revolving

credit facility *EBITDA Non-GAAP reconciliation: 2018 Pre-tax loss ($18.5 million), add back interest expense ($0.1 million) and depreciation and amortization expense ($16.0 million), for 2018 EBIDTA loss of $2.4 million.

FY2019 Preliminary Expectations 5 With a backdrop of ongoing macro-consumer and economic uncertainty,

FY2019 is expected to benefit from an end-of-year push in our current fourth quarter:While the year included ongoing and new pressure on several fronts (mall traffic challenges, geo-political global instability, Brexit uncertainty, movie

properties below our expectations, delay in opening of a key tourist location), positive momentum in Q4 is leading us to increase our previously stated annual guidance.Q4 total revenue is now expected to be flat to slightly positive. We believe

there are several variables contributing to our trend shift including:Shift in Retail Traffic Patterns: Consumer shopping patterns continue to skew to later in the season: US retail traffic declined in November and the first three weeks of

December* compared to the prior year, then turned positive, a trend that has continued, with BBW outpacing national trendsDigital First Approach: An aggressive shift to digital marketing allowed us to reach consumers on devices and in settings

in which they frequently engage benefiting both our eCommerce and in-store business segments Bonus Club Activation: Targeted communications through improved segmentation models have improved efficiency, relevance and visit activation of loyalty

program membershipConsumer Demand for Experiences: Sales of BBW gift cards in-store, online and through third parties - the “gift of experience” - increased in the pre-Christmas time frame, contributing to higher redemption levels

post-holidayPersonalized Gifting: Positive results from a focus on gifting - both online and in storesLicensed Products: Notably, sales of licensed products associated with movies increased during the period, however, we do not believe they

have been the key driver of the improvement in trend *Source: Shoppertrak

6 Why BBW? We have a proven experiential retail concept with diverse optionality that can operate in a

wide range of retail, tourist and seasonal settings We have a differentiated brand with untapped equity and are taking bold steps to monetize our brand assets funded by cash from operations We are executing against our strategic plans to

diversify our retail portfolio and evolve our business model with a goal to deliver long-term sustainable profitable growth Over 95% of NA corporately-managed stores have positive four-wall contribution**Over 70% of leases have options

within the next three yearsThird-party retail growth to 54 locations (Q3-2019) from 34 locations (Q3-2018) Investment in digital platforms and capabilities is delivering consistent eCommerce growth 9th consecutive quarter of double-digit

eCommerce growth since platform upgrade* Solid balance sheet projected to fund strategic initiatives with no borrowings under our revolving credit facilityOutbound licensing, wholesale and entertainment opportunities; 2019 agreements with

major players in entertainment industries *Based on current projected preliminary FY2019 forecast; platform upgrade was made in 2017**Based on TTM ending with Q3-2019, the period ending November 2, 2019

Monetizable Powerful Brand 7 Aided Brand AwarenessUS Moms of Kids ages 2-12 90%+ Build-A-Bear is a

brand that Moms TRUST and Kids LOVE Over 80% of Moms say BAB is “a brand they trust” and over 80% of kids say BAB is “fun to visit” 12% 22% 15% 25% 26% Age range 1/3 Male 2/3 Female With Broad Demographic Appeal… …and a Loyal,

Passionate Consumer Base Source: C&R Research 2017 Over 7MM total Bonus Club loyalty members and 8MM opted-in email accounts

8 The Business Model Continued focus on the evolution of our Strategic Plan to monetize the

Build-A-Bear brand across channels, geographies, consumers and categories. 2020 priorities:eCommerce and digital commerce growthExpanded retail diversification and accessibility through expansion in 3rd party retail as well as management of

corporate portfolio to optimize profitability; improve conversion and dollars per transaction while further investing in the on-going evolution of marketing spend to social and digital media to drive store visits and enhance and add programs to

drive store traffic.Revenue diversification through outbound licensing and entertainmentWith the objective to deliver Long-Term Sustained PROFITABLE Growth Corporately-managed stores E-commerce 3rd Party Retail Intl Franchising Net

Retail Sales Intl Franchise Reported in: Wholesale / Corporate Outbound Licensing Entertainment Reported in: Commercial Revenue Commercial Rev

9 A Model of Continuous Engagement ConsumerConnection “Retail” Experience Marketing Benefit A

continuous circle of engagement can build a more powerful and profitable business model IP Engagement Over 20 outbound licenses and categories Channel and category-agnostic retail transactions

2020 Retail Priorities: eCommerce and Digital 10 Expect to leverage trends to online shopping as well

as our own current momentum to continue to fuel growthFocus on secondary store segments of gift givers and affinity that prefer to shop online has driven growth without cannibalizing traditional retailOpportunity to expand adult gifting

merchandise categoriesAffinity segments connect with limited edition and web-exclusive productsExpect to expand omni-channel modelContinue to refine digital marketing Expect to leverage rich data from engaged Bonus Club membership to drive

incremental purchasesOver 7 million total Bonus Club members and 8 million opted-in email accounts for marketing Opportunity to further develop segmentation and consumer journey modelsImplementation of enhanced site features to personalize

offers and drive traffic and productivity Opportunity to grow with third party marketplaces (e.g. Amazon) as well as primary store shopping segment (families with children)Prime certified, branded shopfront on Amazon.com starting to deliver

revenue growthOpportunity to add innovative digital shopping experiences to engage consumers seeking experience (over convenience) * Q4-2017 through Q4-2019; Includes preliminary projected results for Q4-2019

2020 Retail Priorities: Store Locations 11 FY2019 US National Retail Traffic Trends Expect mall

traffic to continue to be challengingOn a monthly basis national retail traffic in US declined every month from Feb-Dec 2019 Follows 5 years of traffic declines in which traditional mall traffic is estimated to have declined by 50% cumulatively

Expect to leverage high level of strategic lease optionalityOver 70% of leases have options in next 3 yearsAs leases come due, priority is to optimize profitability and maintain site through aggressive rent negotiationPotential to close up to

20 stores that could be unprofitable in 2020 across geographies Expect to strategically add locations that expand consumer accessibilityExpect to partially offset the impact of store closures by opening new locations that expand consumer

accessibility to our conceptTourist locations, Walmart shop-in-shops, seasonal, etcTotal square footage should decrease but key metrics (sales and profit per square foot) should improve Source: Shoppertrak By the end of FY2020, expect

~50% of stores to be in Discovery format In FY2020, expect corporately-managed portfolio to have less total square footage with higher productivity per square foot

2020 Retail Priorities: 3rd Party Store Locations 12 Expect growth from existing partners as well as

annualization of partners added in 2019Locations tend to be in tourist and family-centric settings that are expected to see consistent or growing traffic patterns Established partners include Carnival Cruise Lines and Great Wolf Lodge which

will annualize multiple locations in 2020. Other partners include Landry’s, Cooks, Beaches, Yankee Candle Expect conversion of some partners currently in test mode into expanded locationsCurrently in test mode or expect to implement tests in a

number of sitesMilitary basesChuck E CheeseMarriott Resorts 3rd Party Retail model benefits BBW as well as retail partnersAdvantages to BBW:Little to no startup capital to open storesNo direct operational overhead (rent, labor, etc)Access to

desirable tourist and family-centric settingsAdvantages to partnerLeverage existing space and often talent poolPower of BABW brand offering and proprietary service model 3rd party retail sales captured in our Commercial Revenue segment which

was +100% over prior year in FY2019 through Q3-2019) The 3rd party retail model reports revenue based on wholesale pricing requiring minimal capital and reducing operational risk while efficiently and strategically expanding our retail

footprint

2020 Priorities: Non-Retail Commercial Revenue 13 Wholesale Entertainment Outbound Licensing In

addition to 3rd Party Retail, we expect other areas in Commercial revenue to contribute to the business We expect to benefit from initiatives to leverage the power of our brand and intellectual properties as we become a strong branded company

with a diversified business model The Build-A-Bear brand is stretchable to a broad range of categories beyond “make-your-own” plush. We have agreements in place for over 20 outbound licenses and categoriesFor example, the Build-A-Bear stuffing

station was named to Walmart’s “Top Rated by Kids” toy list in 2019 and had strong sales across a diverse range of retail chains A new warehouse management system is expected to be implemented in FY2020 giving us additional capabilities that

are needed to drive wholesale opportunities including direct sales of pre-stuffed plush product to other retailers and mass merchandisers In FY2019, several deals were finalized that are expected to expand our entertainment and content

offerings. In FY2020, we expect to have radio, music, films and tv programming in market Holiday TV movie Initial Sony movie Always On: Radio Initial BAB music CD 2nd BAB music CD February 2020

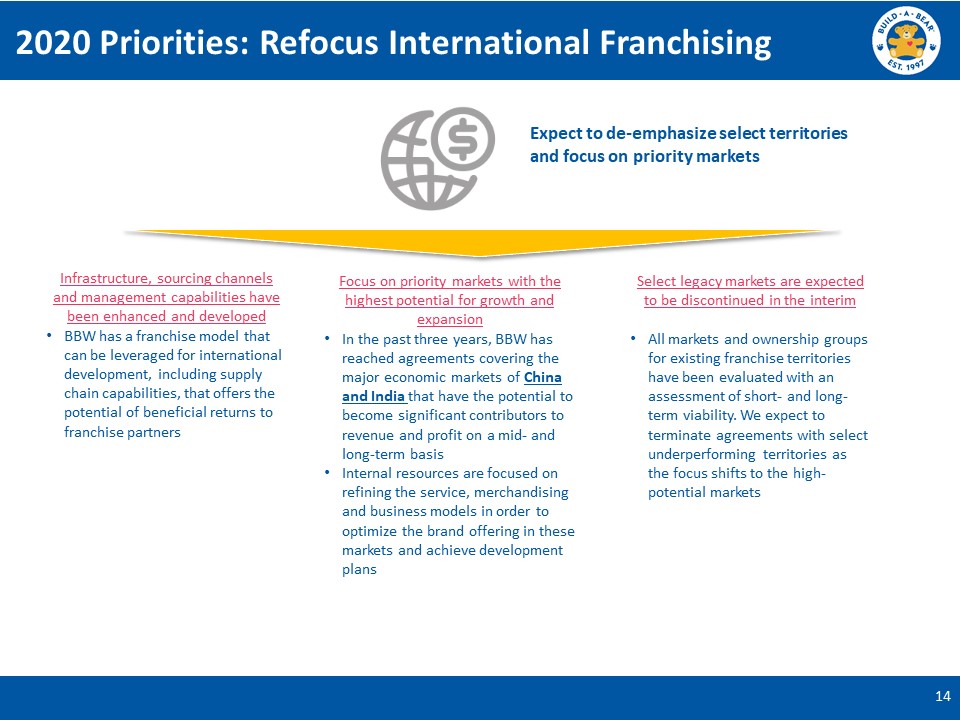

2020 Priorities: Refocus International Franchising 14 Expect to de-emphasize select territories and

focus on priority markets Select legacy markets are expected to be discontinued in the interim All markets and ownership groups for existing franchise territories have been evaluated with an assessment of short- and long-term viability. We

expect to terminate agreements with select underperforming territories as the focus shifts to the high-potential markets Focus on priority markets with the highest potential for growth and expansionIn the past three years, BBW has reached

agreements covering the major economic markets of China and India that have the potential to become significant contributors to revenue and profit on a mid- and long-term basisInternal resources are focused on refining the service,

merchandising and business models in order to optimize the brand offering in these markets and achieve development plans Infrastructure, sourcing channels and management capabilities have been enhanced and developedBBW has a franchise model

that can be leveraged for international development, including supply chain capabilities, that offers the potential of beneficial returns to franchise partners

Solid Balance Sheet Supports Ongoing Evolution Cash from operations has funded - and is

expected to continue to fund - ongoing strategic initiativesProjected uses of capital reflect strategic priorities: eCommerce and digital, opportunistic stores, systems and infrastructure, maintenance #1eCommerce and Digital

Platforms #2Opportunistic store openings #4Maintenance #3System and infrastructure upgrades 15

16 In Summary Our proven experiential retail concept has been and remains a key tenant of the strong,

emotional relationship that we enjoy with our guests. Our broad lease optionality and wide array of concepts, including 3rd party retail, enable operations in a variety of retail, tourist and seasonal settings beyond the traditional mall. We

have a line of site to evolve our footprint to be more aligned where families now want to go for shopping, fun and entertainment. We have a differentiated brand with 20+ year of history of valuable equity and are taking bold steps to monetize

our brand assets funded by cash from operations We are executing against our strategic plans to diversify our business model and create revenue streams to leverage the brand and deliver long term sustainable profitable growth We are

leveraging our on-line success and aggressively investing in digital platforms and capabilities to more robustly participate in changing consumer shopping habits including gifting and e-commerce growth We have taken important steps and

created key relationships to leverage the brand beyond traditional channels

Buildabear.com#celeBEARate