Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Ault Global Holdings, Inc. | ex99_1.htm |

| 8-K - Ault Global Holdings, Inc. | p182018k.htm |

Exhibit 99.2

DPW Holdings, Inc Investor Update Presentation January 2020

SAFE HARBOR STATEMENT This presentation and other written or oral statements made from time to time by representatives of DPW Holdings, Inc. (somet ime s referred to as “DPW”) contain “forward - looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21 E of the Securities Exchange Act of 1934. Forward - looking statements reflect the current view about future events. Statements that are not historical in natu re, such as forecasts for the industry in which we operate, and which may be identified by the use of words like “expects,” “assumes,” “projects,” “anticip ate s,” “estimates,” “we believe,” “could be,” "future" or the negative of these terms and other words of similar meaning, are forward - looking statements . Such statements include, but are not limited to, statements contained in this presentation relating to our business, business strategy, expansion, growth, pr oducts and services we may offer in the future and the timing of their development, sales and marketing strategy and capital outlook. Forward - looking statements are based on management’s current expectations and assumptions regarding our business, the economy and other future conditions and are subject to inherent risks, uncertainties and changes of circumstances that are difficult to predict and may cause actual results to differ materially from those contemplated or expressed. We caution you therefore against relying on any of these forward - looking statements. These risks and uncertainties include those risk factors d iscussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10 - K for the fiscal year ended December 31, 2018 (the “2018 Annual Report”) and other info rmation contained in subsequently filed current and periodic reports, each of which is available on our website and on the Securities and Exchange Co mmission’s website ( www.sec.gov ). Any forward - looking statements are qualified in their entirety by reference to the factors discussed in the 2018 Annual Repor t. Should one or more of these risks or uncertainties materialize (or in certain cases fail to materialize), or should the underlying assumpti ons prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned. Important factors that could cause actual results to differ materially from those in the forward looking statements include: a d ecline in general economic conditions nationally and internationally; decreased demand for our products and services; market acceptance of our products; th e ability to protect our intellectual property rights; impact of any litigation or infringement actions brought against us; competition from other pro vid ers and products; risks in product development; inability to raise capital to fund continuing operations; changes in government regulation, the ability to compl ete customer transactions and capital raising transactions. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us t o p redict all of them. We cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward - looking statements to conform these statements to actual results. All forecasts are provided by management in this presentation and are based on information available to us at this time and m ana gement expects that internal projections and expectations may change over time. In addition, the forecasts are based entirely on management’s best estimate of our future financial performance given our current contracts, current backlog of opportunities and conversations with new and existing customers a bou t our products.

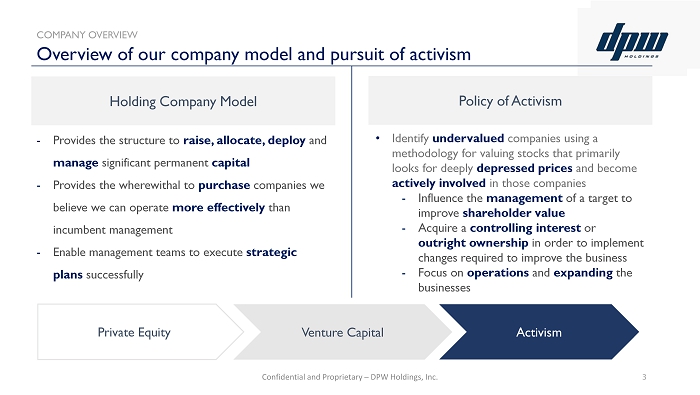

Overview of our company model and pursuit of activism Venture Capital Activism Private Equity COMPANY OVERVIEW Holding Company Model Policy of Activism • Identify undervalued companies using a methodology for valuing stocks that primarily looks for deeply depressed prices and become actively involved in those companies - Influence the management of a target to improve shareholder value - Acquire a controlling interest or outright ownership in order to implement changes required to improve the business - Focus on operations and expanding the businesses - Provides the structure to raise, allocate, deploy and manage significant permanent capital - Provides the wherewithal to purchase companies we believe we can operate more effectively than incumbent management - Enable management teams to execute strategic plans successfully 3 Confidential and Proprietary – DPW Holdings, Inc.

Who We Are: • Milton “Todd” Ault III – Chairman and CEO • William Horne – CFO • Henry Nisser – EVP and General Counsel • Darren Magot – Head of Operations • Ken Cragun – Chief Accounting Officer • David Katzoff – Senior VP of Finance • Joe Spaziano – CTO DPW Holdings, Inc. Gresham Worldwide (CEO JR Read) Microphase Corporation Gresham Power Electronics Ltd. Enertec Systems 2001 Ltd. Coolisys (CEO Amos Kohn) Digital Power Corporation DPW Financial Group Digital Power Lending I.AM Hospitality Digital Farms ItsLikeFashion Breakdown of DPW Holdings, Inc. COMPANY OVERVIEW 4 What It Is: DPW is a holding company managed by a team of seasoned Wall Street professionals with over 75 years of cumulative experience in Private Equity, Venture Capital and Activism Why DPW Holdings, Inc: We are a diversified holding company acquiring undervalued assets and disruptive technologies with a global impact

• Provides high quality, ultra - reliable bespoke technology solutions for mission critical applications • Value - added services and “designed in” custom components/systems to deliver competitive advantage for providers of turnkey platforms and solutions • Narrows field of competition with elegant designs and high - quality products that limit exposure to commodity markets and support enhanced operating margins • Strong, long term relationships with “blue chip” customers in defense, aerospace and commercial sectors across the globe • Customers include Governments and top military contractors • Servicing global customers with global presence : Arizona, Washington D.C. , Connecticut, U.K. and Israel Overview of Gresham Worldwide products and customers “Blue - Chip” Customers Mission Critical Applications High - quality Solutions GRESHAM WORLDWIDE OVERVIEW Products and Solutions Customers and Relationships 5

DPW Holdings, Inc. (NYSE American: DPW) Gresham Worldwide (CEO Jonathan Read) Microphase Corporation Gresham Power Electronics Ltd. Enertec Systems 2001 Ltd. New Gresham Worldwide brand and organizational structure GRESHAM WORLDWIDE OVERVIEW 6 “Gresham Worldwide” new brand for consolidated companies : • Strong name – solid “feel” • Unique – no other “Gresham” U.S. Company • Available – have acquired 50 URLs • Distinctive logo – 3 - legged lion Retain individual sub - brands as appropriate: • Customer relationships • Safety certifications • Security clearances • Market recognition Global launch: • Update websites, social media, collateral and earned media • Transition over time, as appropriate

7 Scope of Influence Headquartered in Phoenix, Arizona Global Footprint European defense, naval and power solutions through Gresham Power Electronics Limited, located in Salisbury, UK 1 2 3 5 4 Israel defense & aerospace combat solutions and medical technology through Enertec Systems 2001 Ltd., located in Karmiel, Israel North America defense & aerospace and telecommunication solutions through Microphase Corp., located in Shelton, Connecticut North America strategic development office in Washington D.C. Phoenix, AZ Washington D.C. Shelton, CT Karmiel, Israel Salisbury, UK An overview of Gresham Worldwide global presence GRESHAM WORLDWIDE OVERVIEW

Notable Gresham Worldwide Customers GRESHAM WORLDWIDE OVERVIEW 8 Navy Hellenic Daewoo Shipyard

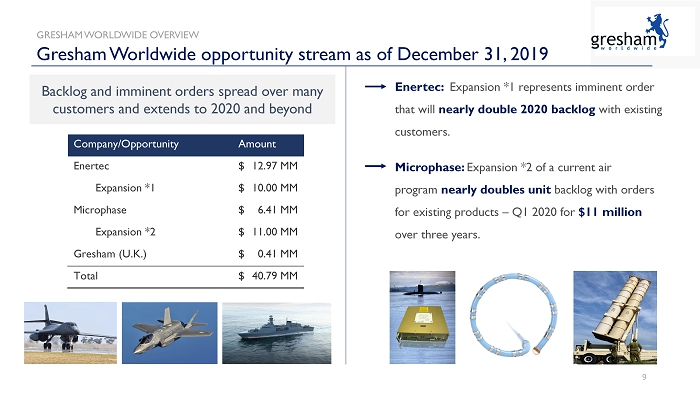

Gresham Worldwide opportunity stream as of December 31, 2019 GRESHAM WORLDWIDE OVERVIEW 9 Enertec: Expansion *1 represents imminent order that will nearly double 2020 backlog with existing customers. Microphase: Expansion *2 of a current air program nearly doubles unit backlog with orders for existing products – Q1 2020 for $11 million over three years. Backlog and imminent orders spread over many customers and extends to 2020 and beyond Company/Opportunity Amount Enertec 12.97 MM$ Expansion *1 10.00 MM$ Microphase 6.41 MM$ Expansion *2 11.00 MM$ Gresham (U.K.) 0.41 MM$ Total 40.79 MM$

Gresham Worldwide revenue projections GRESHAM WORLDWIDE OVERVIEW 10 $0 $5,000,000 $10,000,000 $15,000,000 $20,000,000 $25,000,000 $30,000,000 $35,000,000 $40,000,000 $45,000,000 $50,000,000 2017 2018 2019E 2020E 2021E 2022E Gresham Worldwide Revenue Projections Enertec Microphase Gresham All forecasts are provided by management in this presentation and are based on information available to us at this time and m ana gement expects that internal projections and expectations may change over time. In addition, the forecasts are based entirely on management’s best estima te of our future financial performance given our current contracts, current backlog of opportunities and conversations with new and existing customers a bou t our products.

Gresham Worldwide summary GRESHAM WORLDWIDE OVERVIEW 11 • Gresham Worldwide consolidates established firms with solid track record on innovation, elegant design and responsiveness to deliver bespoke technology solutions that meet mission critical needs of defense, medical and industrial markets x Strong, enduring customer relationships and substantial backlog on which to build x Global footprint and enduring brands x Significant strategic opportunities for rapid growth Jonathan Read, Chief Executive Officer Seasoned CEO with experience running Global Business Operations with specific expertise in raising capital, strengthening brands and building businesses. Timothy Long, Chief Operating Officer Versatile Executive with 40 years experience building businesses large and small with specific expertise in defense and aerospace sectors, operations management, corporate development, strategic communications, business planning, marketing and law. David Katzoff, SVP Finance Experienced financial executive with meticulous attention to detail with specific expertise in sound fiscal management, risk mitigation, financial reporting and resource development. Summary Executive Team

Defense Power Solutions Financial Services Blockchain An overview of DPW’s current holdings and strategic goals COMPANY OVERVIEW 12 Hospitality Category : Ultra - reliable technology solutions for defense, medical, telecom Strategy : Raise c apital to execute on significant backlog. Moving forward with previously announced plans to seek access to public markets. Companies : Category : Power electronics products Strategy : Continue providing value added solutions and expand distribution capabilities for power supplies and power related electronics. Companies/Brands : Category : Licensed California Finance Lender Strategy : DPW Filed $50M Reg A+ note offering to fund lending activity. Expand MonthlyInterest.com. Announced acquisitions by DPW Financial at risk, pending regulatory approval. Companies/Initiatives : Category : Restaurants Strategy : Restaurant acquisitions in the pipeline. Expand Prep Kitchen brand. Exploring strategic alternatives including expansion into Cloud Kitchen concept. Companies/Brands : Category : Data centers and blockchain mining Strategy : Plans include a cquiring data center, but the announced spin - off on hold due to uncertainties regarding crypto currency market volatility. Companies : Retail Apparel Category : E - Commerce and “pop up” r etail of discounted luxury items Strategy : Membership - only business selling excess inventory from retailers via e - commerce and “pop - up” sales locations including apparel, bags, purses, shoes and accessories. Companies :

Biotech Healthcare Advanced Textiles An overview of DPW’s strategic investments COMPANY OVERVIEW 13 Real Estate Category : Developing two treatments for Alzheimer’s Background : Alzheimer’s Disease is the 6 th leading cause of the death in the U. S. Alzamend Neuro is dedicated to researching, developing, and commercializing treatment for Alzheimer’s and bringing two patented therapeutics into the clinical and commercialization stages. Company : Category : Medical products for bodily fluid analysis Background : I nnovative technology and healthcare tools bringing the point of care closer to the patient related to bodily fluid analyses including blood analysis and male fertility testing. Company : Category : Revolutionary technology for Textiles Background : Advanced textile processing using Multiplexed Laser Surface Enhancement. Treats textiles in a cost effective and environmentally sustainable manner. Impact: 99% less energy consumed, 95% reduced chemical usage and 75% less water consumption. Company : Category : Luxury Hotel development in NYC Background : Development of a 5 - Star ultra luxury hotel operated by a group who are very well known and successful in the real estate and hospitality business. Located in the in the charming and highly sought - after, landmarked Northern TriBeCa district. Company : 456 L UX H OTEL

An overview of DPW’s financial highlights FINANCIAL HIGHLIGHTS 1. December 31, 2019 backlog of $68.9 million, including $46.0 million in related party backlog (related - party backlog is delinquent in the production schedule) 2. September 30, 2019 reported $47.4 million in assets 3. Through Q3 2019, current liabilities reduced by $5.6 million or 18% from year - end 2018, excluding the $741,433 operating lease liability related to the new lease accounting rules implemented in 2019 4. Interest expense for Q3 2019 saw a reduction of $1.1 million from the prior - year quarter 5. 9 - months 2019 gross profit up 7% from prior year period 6. Microphase seeing significant financial improvement Financial Highlights 14 2016 2017 2018 2019E $7.1M $10.2M $27.2M $27.0M Annual Revenue Trend 2019 Revenue est. $26 - 28 million

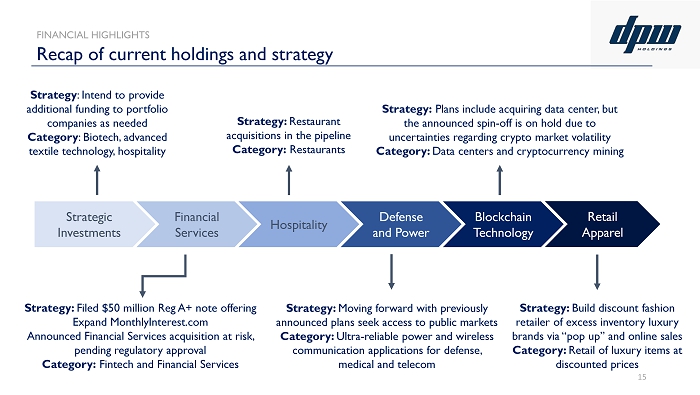

Strategic Investments Hospitality Defense and Power Blockchain Technology Financial Services Strategy: Filed $50 million Reg A+ note offering Expand MonthlyInterest.com Announced Financial Services acquisition at risk, pending regulatory approval Category: Fintech and Financial Services Strategy: Plans include acquiring data center, but the announced spin - off is on hold due to uncertainties regarding crypto market volatility Category: Data centers and cryptocurrency mining Strategy: Restaurant acquisitions in the pipeline Category: Restaurants Strategy: Moving forward with previously announced plans seek access to public markets Category: Ultra - reliable power and wireless communication applications for defense, medical and telecom Strategy : Intend to provide additional funding to portfolio companies as needed Category : Biotech, advanced textile technology, hospitality Recap of current holdings and strategy FINANCIAL HIGHLIGHTS 15 Retail Apparel Strategy: Build discount fashion retailer of excess inventory luxury brands via “pop up” and online sales Category: Retail of luxury items at discounted prices

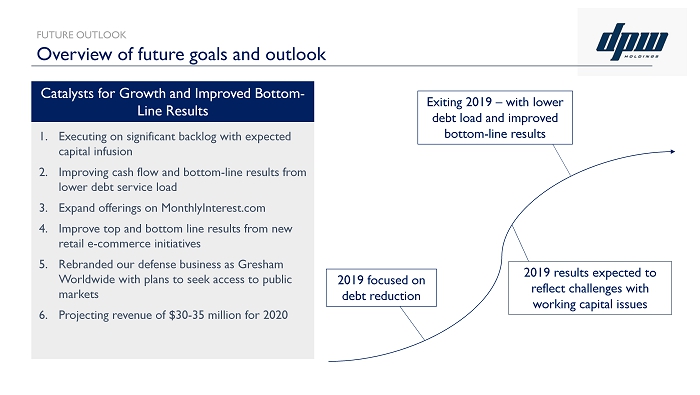

2019 focused on debt reduction Exiting 2019 – with lower debt load and improved bottom - line results 2019 results expected to reflect challenges with working capital issues 1. Executing on significant backlog with expected capital infusion 2. Improving cash flow and bottom - line results from lower debt service load 3. Expand offerings on MonthlyInterest.com 4. Improve top and bottom line results from new retail e - commerce initiatives 5. Rebranded our defense business as Gresham Worldwide with plans to seek access to public markets 6. Projecting revenue of $30 - 35 million for 2020 Catalysts for Growth and Improved Bottom - Line Results Overview of future goals and outlook FUTURE OUTLOOK

Thank you! Comments/Questions? January 2020