Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ARC Group, Inc. | tv511461_ex99-1.htm |

| 8-K - FORM 8-K - ARC Group, Inc. | tv511461_8-k.htm |

Investor Presentation January 2019 OTCQB: ARCK Exhibit 99.2

Safe Harbor This presentation contains "forward - looking statements" within the meaning of the Private Securities Litigation Reform Act of 19 95, as amended, that are intended to be covered by the safe harbor created thereby. All statements other than statements of hist ori cal fact contained herein, including, without limitation, statements regarding ARC Group, Inc.’s (the “Company”) future financial po sition, business strategy, plans and objectives, are forward - looking statements. Forward - looking statements generally can be identified by the use of forward - looking terminology such as "may," "will," "expects," "intends," "plans," "projects," "estimates," "anticipat es," or "believes" or the negative thereof or any variation thereon or similar terminology or expressions. Forward - looking statements a re subject to risks and uncertainties that could cause actual results to differ materially from results proposed in such stateme nts . Although the Company believes that the expectations reflected in such forward - looking statements are reasonable, it can provide no assurance that such expectations will prove to have been correct. Important factors that could cause actual results to diffe r materially from the Company's expectations include, but are not limited to, those factors set forth in the Company's Annual R epo rt on Form 10 - K for the year ended December 31, 2017 and its other filings and submissions with the SEC. Readers are cautioned not to place undue reliance on these forward - looking statements, which speak only as of the date made. Except as required by law, the Company assumes no obligation to update or revise any forward - looking statements. This presentation is not an offer to sell nor a solicitation of an offer to buy securities. Any offer or sale of securities w oul d be made by means of an offer memorandum containing detailed information about the company, management and the securities. In addition, n o offer, sale or solicitation is being made in any jurisdiction in which such offer, sale or solicitation would be prohibited. Acceptance of the opportunity to continue to review this presentation constitutes agreement with the following: Any reproduct ion or distribution of these materials, or any related materials, in whole or in part, or any of their contents, to any other person , i s prohibited. Additionally, you acknowledge that you are aware of the restrictions and liabilities imposed by the federal secur iti es laws and regulations of the United States on persons possessing material non - public information about the Company, and your agreement to comply with, and cause your representatives to comply with, all such laws, including, without limitation, laws prohibiting an y person who has received material non - public information concerning an issuer or its affiliates from purchasing or selling securi ties of such issuer or from communicating such information to any other person under circumstances in which it is reasonably foreseea ble that such person is likely to purchase or sell such securities. You understand and agree that directly or indirectly trading in the Company’s common stock or securities deriving their value from the price of the Company’s common stock is specifically prohib ite d. 2 OTC: ARCK

About ARC Group • Restaurant management company with a focus on diversified, full service restaurants and brands • Parent company of Dick’s Wings and Grill ® • Family - oriented regional restaurant chain with locations in FL and GA • 4 company - owned restaurants (2 of which are currently operating) & 3 company - owned concession stands • 17 franchise locations • 18 full - time employees and 142 part - time employees 1 • 4 full - time employees and 4 part - time employees at our corporate office • Recently acquired the Fat Patty’s ® franchise • Family - friendly restaurant – gourmet burgers and other casual dining meals • 4 locations – all corporate owned & operated • Regionally focused in WV and KY • 20 full - time employees and 321 part - time employees 1 • Announced plans to acquire Tilted Kilt Pub and Eatery ® franchise • Celtic - themed atmosphere featuring Kilt Girls® • 30 restaurants – 2 company - owned and 28 franchise locations • 14 states including NY, NJ, PA, NV, CA, and TX and Canada • 17 full - time employees and 39 part - time employees at ARC’s current Tilted Kilt company owned restaurants 1 3 OTC: ARCK (1) Employee figures do not include individuals employed by franchisees.

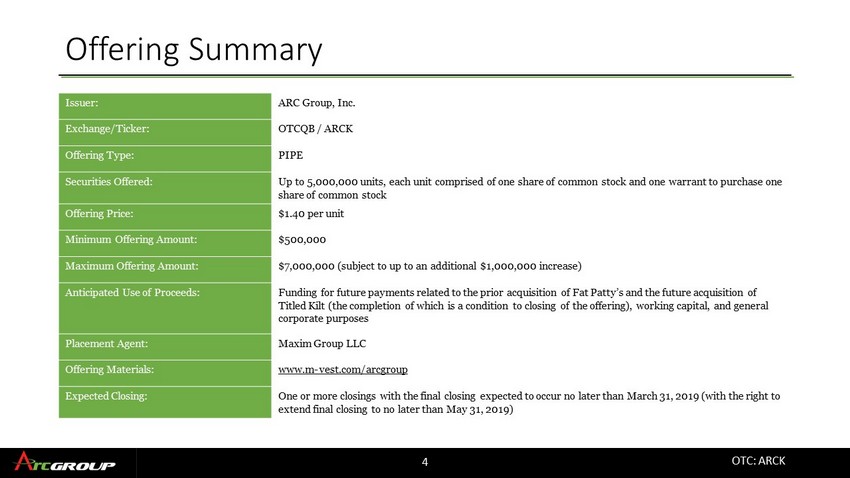

Offering Summary 4 OTC: ARCK Issuer: ARC Group, Inc. Exchange/Ticker : OTCQB / ARCK Offering Type: PIPE Securities Offered : Up to 5,000,000 units, each unit comprised of one share of common stock and one warrant to purchase one share of common stock Offering Price: $1.40 per unit Minimum Offering Amount: $500,000 Maximum Offering Amount: $7,000,000 (subject to up to an additional $1,000,000 increase) Anticipated Use of Proceeds: Funding for future payments related to the prior acquisition of Fat Patty’s and the future acquisition of Titled Kilt (the completion of which is a condition to closing of the offering) , working capital, and general corporate purposes Placement Agent: Maxim Group LLC Offering Materials: www.m - vest.com/arcgroup Expected Closing: One or more closings with the final closing expected to occur no later than March 31, 2019 (with the right to extend final closing to no later than May 31, 2019)

Senior Management Team Seenu G . Kasturi, Chairman, CEO & CFO . Mr . Kasturi has served as our Chief Executive Officer since January 2 , 2019 and has served as our Chief Financial Officer and Chairman of our board of directors since January 2017 . He served as our President from January 2017 to January 2 , 2019 . He has served as the Vice President and Controller of Tilted Kilt Franchise Operating, LLC, the franchisor of the Tilted Kilt, since June 2018 and as the President and Chief Executive Officer of Blue Victory Holdings, Inc . , an asset development firm focused primarily on the ownership and management of branded restaurants, since October 2009 . He has also served as the President, Treasurer and Secretary of DWG Acquisitions, LLC, a Louisiana limited liability company (“DWG Acquisitions”) which is our largest franchisee with four Dicks Wings and Grill restaurants under ownership, since February 2013 . From June 2005 to October 2009 , Mr . Kasturi served as the President of K&L Investment Realty, an owner and manager of restaurants and real estate properties . Prior to that, he served as a certified financial planner, a registered broker and an investment advisor . Mr . Kasturi earned a Bachelor of Arts degree from Andhra University in Visakhapatnam, India . Richard Akam, COO & Secretary . Mr . Akam has served as our Chief Operating Officer since January 2013 and has served as our Secretary since July 2013 . Mr . Akam served as our Chief Executive Officer from July 2013 to January 2 , 2019 , and served as our Chief Financial Officer from July 2013 to August 2013 . He has also served as the President of Tilted Kilt Franchise Operating, LLC, the franchisor of the Tilted Kilt, since June 2018 . Prior to joining us, Mr . Akam served as the Chief Operating Officer of Ker’s Winghouse from September 2012 to January 2013 . From May 2011 to July 2012 , he served as the Chief Operating Officer of Twin Peaks Restaurants . Mr . Akam served as the Chief Operating Officer of First Watch Restaurants from February 2005 to December 2008 and as the Chief Operating Officer of Raving Brands from October 2003 to February 2005 . Prior to that, he served in various roles with Hooters of America for approximately 20 years, including serving as its President and Chief Executive Officer from 1995 to 2003 . Mr . Akam is also the founding member of Akam & Associates, LLC, a restaurant consulting firm that has provided consulting services to the restaurant industry since 2009 . Mr . Akam earned a Bachelor of Arts degree from the University of Louisville . Ketan B . Pandya, Director & VP of Marketing . Mr . Pandya has served as a member of our Board of Directors since August 2013 . Mr . Pandya also serves as our Vice President of Marketing . He has served as the Vice President of Franchise Relations of Tilted Kilt Franchise Operating, LLC, the franchisor of the Tilted Kilt, since June 2018 , and as a Principal Consultant to the Pro Tech Group, a consulting company since January 2010 . Mr . Pandya served as a Senior Director of National Account Sales for SMART Technologies, a developer of Web - based integrated customer relationship solutions, from March 2012 to November 2013 . Prior to that, he served as the Director of Marketing/Sales for Advanced Micro Devices, a multinational semiconductor company, from March 2010 to December 2011 , and served as the Senior Manager for Product Marketing and Retail Sales Support for Dell Technologies, a multinational computer technology company, from September 1999 to February 2010 . Mr . Pandya earned a B . S . in Electrical Engineering from the University of Louisiana and an MBA with a concentration in marketing from the University of Texas . 5 OTC: ARCK “Our mission is to take care of our guests with love and as guests in our home, and treat our team members as family and co - owners.” – Seenu Kasturi

Market Overview – Casual Dining • In order to compete effectively and increase market share, we believe we need to focus on: x Expanding the customer demographic x Elevating the dining experience x Expanding To Go and Delivery opportunities x Improving service, delivered by competent, trained staff x Innovative menu planning, which meets demand for healthier options x The use of technology to streamline and automate processes (e.g. tablets for ordering) 6 OTC: ARCK ARC Group has a proven track record of refreshing, growing and streamlining legacy brands and chains • Total restaurant - industry sales reached almost $800 billion in 2017 (1) • Restaurant sales accounted for 4 percent of the U.S. GDP in 2017 (2) • Casual dining is the most common of all restaurant types, comprising one - third of all venues in the U.S. (2) • The market has been driven by an explosion of new concepts and menus, especially within the limited - service segment (3) (1) Data from 2017 National Restaurant Association, Restaurant Industry Outlook (2) Data from “ The Future of Casual Dining: What to Expect ” by HVS (3) Information from Grand View Research, Market Research Report

Holding Structure/Value Proposition • Diversified portfolio of growing brands • Ability to leverage franchising, marketing, operational, logistics and financial expertise across brands • Disciplined focus on driving sales, reducing costs and expanding margins • Increased purchasing power • Economies of scale on back - office services • Reinvesting cash flow into what we believe to be high yield and cash flowing properties • Accretive acquisition strategy • Increased access to potentially more favorable debt financing 7 OTC: ARCK

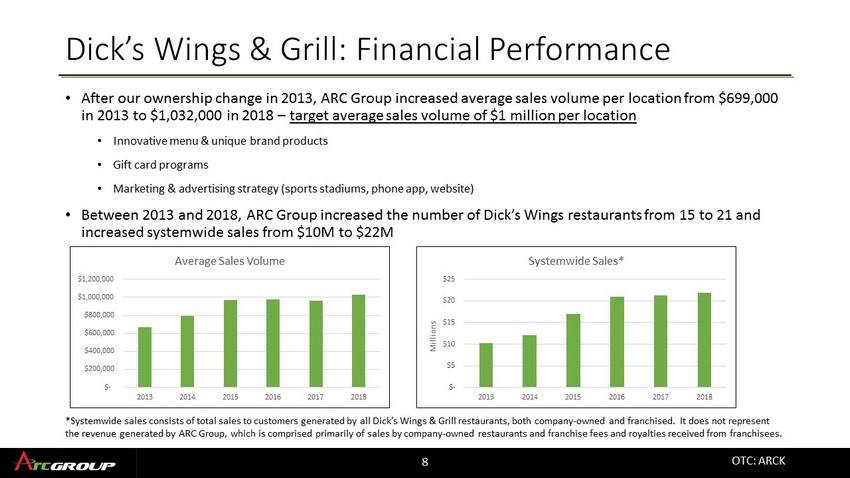

Dick’s Wings & Grill: Financial Performance • After our ownership change in 2013, ARC Group increased average sales volume per location from $699,000 in 2013 to $1,032,000 in 2018 – target average sales volume of $1 million per location • Innovative menu & unique brand products • Gift card programs • Marketing & advertising strategy (sports stadiums, phone app, website) • Between 2013 and 2018, ARC Group increased the number of Dick’s Wings restaurants from 15 to 21 and increased systemwide sales from $10M to $22M 8 OTC: ARCK *Systemwide sales consists of total sales to customers generated by all Dick’s Wings & Grill restaurants, both company - owned and franchised. It does not represent the revenue generated by ARC Group, which is comprised primarily of sales by company - owned restaurants and franchise fees and ro yalties received from franchisees. $- $5 $10 $15 $20 $25 2013 2014 2015 2016 2017 2018 Millions Systemwide Sales* $- $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 2013 2014 2015 2016 2017 2018 Average Sales Volume

Multi - Pronged Growth Strategy • Utilize proven strategies to drive sales growth • Open new company - owned restaurant locations o Focus on key markets and what we believe to be most profitable brands for those markets • Employ aggressive marketing campaign to drive growth in new franchise locations o Hire new franchise sales team o Focus on advertising with high ROI • Aggressively seek strategically attractive acquisition targets o Targeting growing, profitable businesses and underperforming businesses that could benefit from our experienced management, training programs, business model and partnerships o Active discussions/negotiations underway with prospective targets 9 OTC: ARCK

Acquisition Strategy • Intend to focus on growing, profitable businesses and underperforming businesses that could benefit from our experienced management team, training business programs, business model and partnerships • We believe the middle - market provides attractive multiples: targeting 3 - 6X EV/EBITDA • Ability to leverage existing assets, cash flow and equity as part of consideration • Seek synergies among the existing managers / owners of the target and our experienced management team 10 OTC: ARCK

Fat Patty’s Acquisition • Completed acquisition of Fat Patty’s in August 2018 • Own and operate 4 locations in West Virginia and Kentucky • Offers a number of specialty burgers and sandwiches, wings, appetizers, salads, wraps, and steak and chicken dinners in a family friendly, casual dining environment. • Each restaurant has a full bar and several large, flat - screen televisions • Fat Patty’s franchise reported more than $1M in revenue and $52K in NI during the period of August 30, 2018 (the date ARC Group acquired Fat Patty’s) to September 30, 2018 • Acquired for gross purchase price of $12.35M. Net purchase price of $850K after the immediate sale - leaseback of all real estate acquired in the transaction for $11.5M 11 OTC: ARCK

Tilted - Kilt Acquisition • Announced plans to acquire Tilted Kilt Pub and Eatery® • Goal to close in Q1 2019 • 30 locations in operation in 14 states and Canada • The Tilted Kilt franchise generated almost $14 million in revenue during 2017 • Requires us to raise approximately $2 million prior to closing • Closing of the Tilted Kit acquisition is a condition to the closing of this offering 12 OTC: ARCK ARC Group agreed to acquire Tilted Kilt for approximately $2 million of assumed debt, future payment obligations of approximately $750,000, and approximately 1.4 million shares of common stock

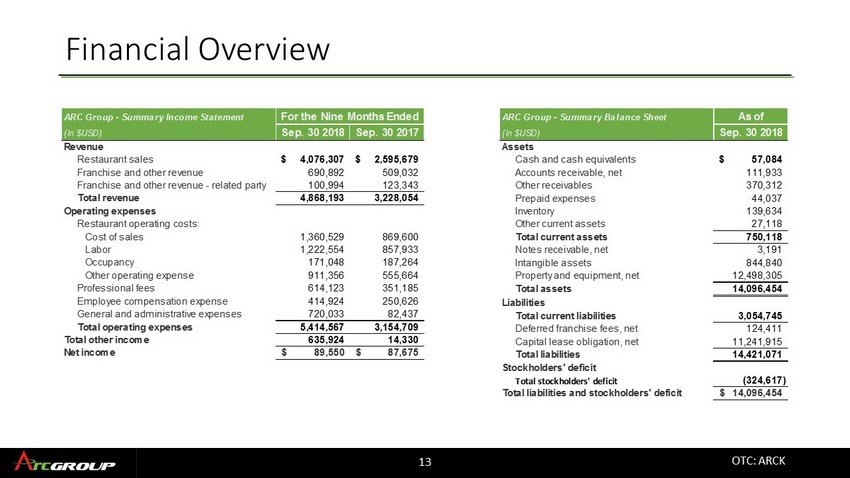

Financial Overview 13 OTC: ARCK Sep. 30 2018 Sep. 30 2017 Restaurant sales 4,076,307$ 2,595,679$ Franchise and other revenue 690,892 509,032 Franchise and other revenue - related party 100,994 123,343 Total revenue 4,868,193 3,228,054 Operating expenses Cost of sales 1,360,529 869,600 Labor 1,222,554 857,933 Occupancy 171,048 187,264 Other operating expense 911,356 555,664 Professional fees 614,123 351,185 Employee compensation expense 414,924 250,626 General and administrative expenses 720,033 82,437 5,414,567 3,154,709 Total other income 635,924 14,330 Net income 89,550$ 87,675$ ARC Group - Summary Income Statement For the Nine Months Ended Total operating expenses (In $USD) Revenue Restaurant operating costs: As of Sep. 30 2018 Cash and cash equivalents 57,084$ Accounts receivable, net 111,933 Other receivables 370,312 Prepaid expenses 44,037 Inventory 139,634 Other current assets 27,118 Total current assets 750,118 Notes receivable, net 3,191 Intangible assets 844,840 Property and equipment, net 12,498,305 Total assets 14,096,454 Liabilities Total current liabilities 3,054,745 Deferred franchise fees, net 124,411 Capital lease obligation, net 11,241,915 Total liabilities 14,421,071 Stockholders' deficit Total stockholders' deficit (324,617) Total liabilities and stockholders' deficit 14,096,454$ ARC Group - Summary Balance Sheet (In $USD) Assets

Investment Highlights 14 OTC: ARCK Established brands Senior management team with significant experience in the restaurant industry Steady growth in revenue and increasing restaurant locations Track record of successful acquisitions and pipeline of future attractive targets Net income and positive CFFO in 2017 and 9 months ended September 30, 2018

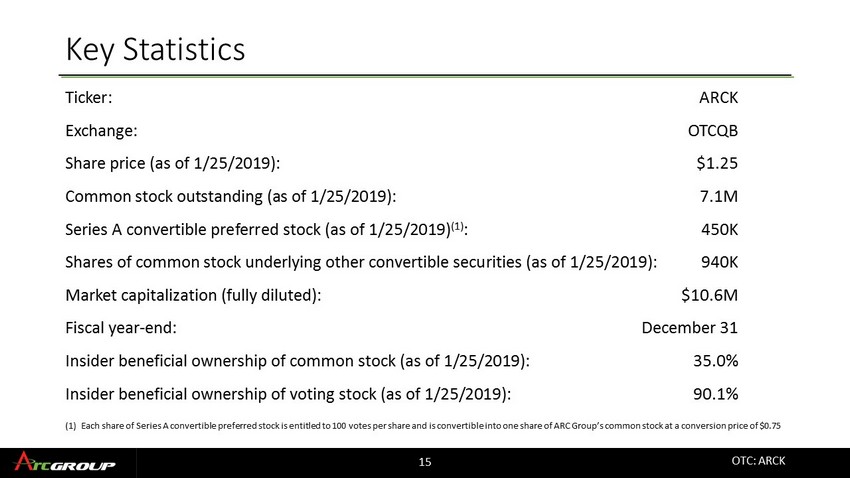

Key Statistics Ticker: ARCK Exchange: OTCQB Share price (as of 1/25/2019): $1.25 Common stock outstanding (as of 1/25/2019): 7.1M Series A convertible preferred stock (as of 1/25/2019) (1) : 450K Shares of common stock underlying other convertible securities (as of 1/25/2019): 940K Market capitalization (fully diluted): $10.6M Fiscal year - end: December 31 Insider beneficial ownership of common stock (as of 1/25/2019): 35.0% Insider beneficial ownership of voting stock (as of 1/25/2019): 90.1% 15 OTC: ARCK (1) Each share of Series A convertible preferred stock is entitled to 100 votes per share and is convertible into one share of AR C G roup’s common stock at a conversion price of $0.75

Thank you. For additional information: Crescendo Communications, LLC David K Waldman/ Natalya Rudman Tel: 212 - 671 - 1021 Email: ARCK@crescendo - ir.com OTC: ARCK 16