Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - FORD MOTOR CREDIT CO LLC | exhibit992tofordcreditja.htm |

| 8-K - 8-K - FORD MOTOR CREDIT CO LLC | earnings8-kdated01x23x2019.htm |

Ford Motor Company Reports Fourth Quarter and Full Year 2018 Results • Revenue up in the fourth quarter and full year; net income, adjusted EBIT and margin lower • North America EBIT margin of 7.6% in the quarter and 7.9% in the full year • Continued strong results at Ford Credit, with best full-year earnings before taxes in eight years • Balance sheet remains strong with cash and liquidity balances above targets DEARBORN, Mich., Jan. 23, 2019 – Ford Motor Company today released its preliminary fourth-quarter and full-year 2018 financial results. Company revenue increased from the prior year in both periods, while net income and company adjusted EBIT were both lower. North America delivered a fourth-quarter EBIT margin of 7.6 percent and a full-year margin of 7.9 percent. Ford Credit had strong results in the quarter and its best full year earnings before taxes in eight years. The company ended the year with cash and liquidity balances that were above its targets of $20 billion and $30 billion, respectively. “We have consistently laid the foundation for the global redesign of our business, clearly investing to sharpen our competitiveness so we can better serve customers and invest for the future,” said Jim Hackett, Ford president and CEO. “Ford enters 2019 with a clear vision, a solid plan, and we are now in execution mode.” 2018 FOURTH QUARTER & FULL YEAR FINANCIAL RESULTS* Fourth-quarter company revenue rose 1 percent, due to improved mix and higher net pricing. Company net loss of $0.1 billion included a negative $0.9 billion non-cash pre-tax mark-to-market adjustment for global pension and OPEB plans. Company adjusted EBIT of $1.5 billion was driven by North America, which posted fourth-quarter EBIT of $2.0 billion and an EBIT margin of 7.6 percent. Ford Credit continued its strong performance with fourth- GAAP quarter EBT of $663 million. Cash Auto operations outside of North America generated an Net Flows EBIT loss of $828 million in the fourth quarter, down $692 Income Net from Op. Revenue EPS Margin million, driven by China and Europe . Income Activities In the full year, net income was $3.7 billion and company adjusted EBIT was $7 billion, driven by North America, with 4Q 2018 $41.8B $(0.1)B $(0.03) (0.3)% $1.4B an EBIT margin of 7.9 percent, and Ford Credit EBT of $2.6 billion, its highest in eight years. B/(W) 4Q 2017 $0.5B $(2.6)B $(0.66) (6.4) ppts $(1.8)B While auto operations reported a lower EBIT than a year ago, driven by China and Europe, all regions continued to FY 2018 $160.3B $3.7B $0.92 2.3% $15.0B focus on improving operational fitness while building on core company strengths. In Europe, Ford posted record SUV B/(W) sales, while Ranger was the region’s best-selling pick up, FY 2017 $3.5B $(4.1)B $(1.01) (2.6) ppts $(3.1)B and Ford once again was the best-selling commercial vehicle brand. In the Asia Pacific region, India and Thailand achieved record full-year sales, and Lincoln set a new annual sales record for the fourth consecutive year in China. NON-GAAP “While 2018 was a challenging year, we put in place key Company Company Adj. Op. building blocks to build a more resilient and competitive Company Adjusted Adj. EBIT Cash Adj. EBIT EPS Margin business model that can thrive no matter the economic Flow environment,” said Bob Shanks, Ford CFO. “We are confident in our plan to transform our business.” 4Q 2018 $1.5B $0.30 3.5% $1.5B Shanks said the company balance sheet remains strong, with $23.1 billion of cash and $34.2 billion of liquidity. B/(W) 4Q 2017 $(0.6)B $(0.09) (1.4) ppts $(0.7)B Shanks said Ford expects to be able to fully fund its business needs and capital plans in 2019, while maintaining cash and liquidity levels at or above its target levels. He FY 2018 $7.0B $1.30 4.4% $2.8B added Ford sees the potential for year-over-year improvement in the company’s key financial metrics as it B/(W) FY 2017 $(2.6)B $(0.48) (1.7) ppts $(1.4)B works to close the gaps versus targets. *See endnote on page 5 All comparisons are year-over-year unless noted otherwise. Ford Motor Company: 4Q / FY January 23, 2019

AUTOMOTIVE SEGMENT RESULTS Wholesales Revenue Market Share EBIT EBIT Margin 4Q 2018 1,474K $38.7B 5.9% $1.1B 2.9% B/(W) 4Q 2017 (275)K $0.2B (0.7) ppts $(0.5)B (1.4) ppts FY 2018 5,982K $148.3B 6.3% $5.4B 3.7% B/(W) FY 2017 (625)K $2.6B (0.7) ppts $(2.7)B (1.9) ppts Market EBIT Wholesales Revenue EBIT Share Margin North America ƒ 4Q NA revenue and bottom-line metrics improved YoY; volume-related metrics lower 4Q 2018 738K $25.8B 12.8% $2.0B 7.6% ƒ 4Q EBIT at $2B, up $188M YoY B/(W) (1)K $1.7B (0.8) ppts $0.2B 0.3 ppts ƒ NA and U.S. SAAR down 2% and 1%, respectively 4Q 2017 ƒ Healthy improvement in market factors due to favorable mix and higher net pricing FY 2018 2,920K $96.6B 13.4% $7.6B 7.9% ƒ 2018 profit sharing for eligible hourly full-time UAW- represented employees is approximately $7,600 on a B/(W) FY 2017 (47)K $3.1B (0.5) ppts $(0.5)B (0.7) ppts full-year basis and will be paid on March 14, 2019 South America All 4Q SA metrics down YoY except SAAR ƒ 4Q 2018 89K $1.2B 7.6% $(199)M (16.4)% ƒ SA SAAR up 2% with growth of 17% in Brazil and a reduction of 44% in Argentina; Brazil higher for the 7th B/(W) (18)K $(0.5)B (1.3) ppts $(10)M (5.3) ppts consecutive quarter 4Q 2017 ƒ SA market share down in all major markets, except Peru ƒ Volume decline driven by Argentina with revenue down FY 2018 365K $5.3B 8.3% $(678)M (12.8)% due to weaker currencies B/(W) FY 2017 (8)K $(0.5)B (0.6) ppts $75M 0.1 ppts Europe ƒ All 4Q Europe metrics lower YoY except market 4Q 2018 361K $7.4B 7.3% $(199)M (2.7)% share, which was unchanged Europe SAAR down 8%, including Turkey down B/(W) ƒ 4Q 2017 (55)K $(0.7)B - ppts $(288)M (3.8) ppts 50%, resulting in lower volume and revenue ƒ Highest 4Q commercial vehicle market share since 1994 FY 2018 1,533K $31.3B 7.2% $(398)M (1.3)% Lower EBIT due to higher cost, adverse exchange ƒ B/(W) (49)K $1.6B (0.3) ppts $(765)M (2.5) ppts and lower volume FY 2017 Middle East & Africa 4Q MEA top-line metrics lower YoY; EBIT and EBIT ƒ 4Q 2018 32K $0.7B 3.0% $(49)M (7.0)% margin higher ƒ MEA SAAR up 5%, though down 9% in markets B/(W) (3)K $(0.1)B (1.3) ppts $17M 1.3 ppts where Ford participates 4Q 2017 ƒ Market share lower in most major markets – key driver of lower volume FY 2018 109K $2.7B 3.0% $(7)M (0.3)% ƒ Revenue down because of lower volume B/(W) FY 2017 (10)K $0.1B (0.8) ppts $239M 9.0 ppts Asia Pacific All 4Q AP metrics down YoY driven by China ƒ 4Q 2018 254K $3.6B 2.2% $(381)M (10.7)% ƒ Revenue decline of 5% due to unfavorable exchange and lower volume B/(W) 4Q 2017 (198)K $(0.2)B (1.2) ppts $(411)M (11.5) ppts ƒ AP market share lower due to China performance ƒ Lower volume driven by China JVs FY 2018 1,055K $12.4B 2.5% $(1,102)M (8.9)% B/(W) FY 2017 (511)K $(1.7)B (0.9) ppts $(1,761)M (13.6) ppts 2 Ford Motor Company: 4Q / FY January 23, 2019

MOBILITY AND FORD CREDIT SEGMENT RESULTS EBIT Mobility Segment Results ƒ 4Q Mobility EBIT loss due to planned investments in mobility 4Q 2018 $(195)M services and autonomous vehicle business development B/(W) 2017 $(95)M FY 2018 $(674)M B/(W) 2017 $(375)M EBT Ford Credit Segment Results ƒ Strong 4Q and best FY EBT in eight years 4Q 2018 $663M ƒ 4Q improvement reflects favorable lease residual performance and favorable volume and mix B/(W) 2017 $53M FY 2018 $2.6B B/(W) 2017 $0.3B 3 Ford Motor Company: 4Q / FY January 23, 2019

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS Statements included or incorporated by reference herein may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on expectations, forecasts, and assumptions by our management and involve a number of risks, uncertainties, and other factors that could cause actual results to differ materially from those stated, including, without limitation: • Ford’s long-term competitiveness depends on the successful execution of fitness actions; • Industry sales volume, particularly in the United States, Europe, or China, could decline if there is a financial crisis, recession, or significant geopolitical event; • Ford’s new and existing products and mobility services are subject to market acceptance; • Ford’s results are dependent on sales of larger, more profitable vehicles, particularly in the United States; • Ford may face increased price competition resulting from industry excess capacity, currency fluctuations, or other factors; • Fluctuations in commodity prices, foreign currency exchange rates, and interest rates can have a significant effect on results; • With a global footprint, Ford’s results could be adversely affected by economic, geopolitical, protectionist trade policies, or other events; • Ford’s production, as well as Ford’s suppliers’ production, could be disrupted by labor disputes, natural or man-made disasters, financial distress, production difficulties, or other factors; • Ford’s ability to maintain a competitive cost structure could be affected by labor or other constraints; • Pension and other postretirement liabilities could adversely affect Ford’s liquidity and financial condition; • Economic and demographic experience for pension and other postretirement benefit plans (e.g., discount rates or investment returns) could be worse than Ford has assumed; • Ford’s vehicles could be affected by defects that result in delays in new model launches, recall campaigns, or increased warranty costs; • Safety, emissions, fuel economy, and other regulations affecting Ford may become more stringent; • Ford could experience unusual or significant litigation, governmental investigations, or adverse publicity arising out of alleged defects in products, perceived environmental impacts, or otherwise; • Ford’s receipt of government incentives could be subject to reduction, termination, or clawback; • Operational systems, security systems, and vehicles could be affected by cyber incidents; • Ford Credit’s access to debt, securitization, or derivative markets around the world at competitive rates or in sufficient amounts could be affected by credit rating downgrades, market volatility, market disruption, regulatory requirements, or other factors; • Ford Credit could experience higher-than-expected credit losses, lower-than-anticipated residual values, or higher-than-expected return volumes for leased vehicles; • Ford Credit could face increased competition from banks, financial institutions, or other third parties seeking to increase their share of financing Ford vehicles; and • Ford Credit could be subject to new or increased credit regulations, consumer or data protection regulations, or other regulations. We cannot be certain that any expectation, forecast, or assumption made in preparing forward-looking statements will prove accurate, or that any projection will be realized. It is to be expected that there may be differences between projected and actual results. Our forward-looking statements speak only as of the date of their initial issuance, and we do not undertake any obligation to update or revise publicly any forward-looking statement, whether as a result of new information, future events, or otherwise. For additional discussion, see “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2017, as updated by subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. 4 Ford Motor Company: 4Q / FY January 23, 2019

CONFERENCE CALL DETAILS Ford Motor Company [NYSE:F] and Ford Motor Credit Company will release their preliminary 2018 fourth quarter and full year financial results at 4:15 p.m. EST today. Following the release, Jim Hackett, Ford president and chief executive officer, and Bob Shanks, Ford chief financial officer, and members of Ford’s senior management team will host a conference call at 5:30 p.m. EST to discuss the results. The presentation and supporting materials are available at www.shareholder.ford.com . Representatives of the investment community and the news media will have the opportunity to ask questions on the call. Access Information – Wednesday, January 23, 2019 Ford Earnings Call: 5:30 p.m. EST Toll-Free: 1.877.870.8664 International: 1.970.297.2423 Passcode: Ford Earnings Web: www.shareholder.ford.com REPLAY (Available after 11 p.m. EST the day of the event through Jan. 30, 2019) Web: www.shareholder.ford.com Toll-Free: 1.855.859.2056 International: 1.404.537.3406 Conference ID: 6299017 About Ford Motor Company Ford Motor Company is a global company based in Dearborn, Michigan. The company designs, manufactures, markets and services a full line of Ford cars, trucks, SUVs, electrified vehicles and Lincoln luxury vehicles, provides financial services through Ford Motor Credit Company and is pursuing leadership positions in electrification, autonomous vehicles and mobility solutions. Ford employs approximately 199,000 people worldwide. For more information regarding Ford, its products and Ford Motor Credit Company, please visit www.corporate.ford.com . * The following applies to the information throughout this release: ƒ The financial results discussed herein are presented on a preliminary basis. Ford and Ford Credit’s Annual Report on Form 10-K for the year ended Dec. 31, 2018, will include audited financial results. ƒ See tables later in this release for the nature and amount of special items, and reconciliations of the non-GAAP financial measures designated as “adjusted” to the most comparable financial measures calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). ƒ Wholesale unit sales and production volumes include Ford brand and Jiangling Motors Corporation (“JMC”) brand vehicles produced and sold in China by our unconsolidated affiliates; revenue does not include these sales. See materials supporting the January 23, 2019, conference call at www.shareholder.ford.com for further discussion of wholesale unit volumes. 5 Ford Motor Company: 4Q / FY January 23, 2019

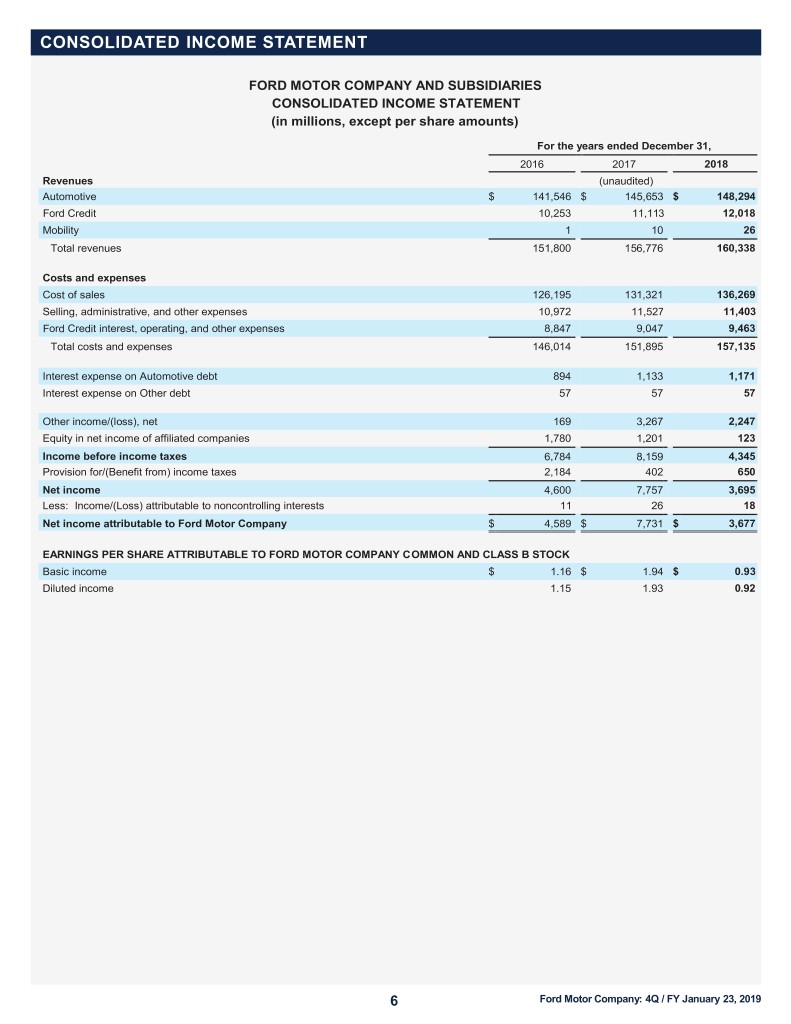

CONSOLIDATED INCOME STATEMENT FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED INCOME STATEMENT (in millions, except per share amounts) For the years ended December 31, 2016 2017 2018 Revenues (unaudited) Automotive $ 141,546 $ 145,653 $ 148,294 Ford Credit 10,253 11,1133 12,018 Mobility 1 10 26 Total revenues 151,800 156,776 160,338 Costs and expenses Cost of sales 126,195 131,321 136,269 Selling, administrative, and other expenses 10,972 11,527 11,403 Ford Credit interest, operating, and other expenses 8,847 9,047 9,463 Total costs and expenses 146,014 151,895 157,135 Interest expense on Automotive debt 894 1,133 1,171 Interest expense on Other debt 57 57 57 Other income/(loss), net 169 3,267 2,247 Equity in net income of affiliated companies 1,780 1,201 123 Income before income taxes 6,784 8,159 4,345 Provision for/(Benefit from) income taxes 2,184 402 650 Net income 4,600 7,757 3,695 Less: Income/(Loss) attributable to noncontrolling interests 11 26 18 Net income attributable to Ford Motor Company $ 4,589 $ 7,731 $ 3,677 EARNINGS PER SHARE ATTRIBUTABLE TO FORD MOTOR COMPANY COMMON AND CLASS B STOCK Basic income $ 1.16 $ 1.94 $ 0.93 Diluted income 1.15 1.93 0.92 6 Ford Motor Company: 4Q / FY January 23, 2019

CONSOLIDATED BALANCE SHEET FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEET (in millions) December 31, December 31, 2017 2018 ASSETS (unaudited) Cash and cash equivalents $ 18,492 $ 16,718 Marketable securities 20,435 17,233 Ford Credit finance receivables, net 52,210 53,289 Trade and other receivables, less allowances of $412 and $94 10,599 11,195 Inventories 11,176 11,220 Other assets 3,889 3,930 Total current assets 116,801 113,585 Ford Credit finance receivables, net 56,182 56,608 Net investment in operating leases 28,235 29,119 Net property 35,327 36,178 Equity in net assets of affiliated companies 3,085 2,709 Deferred income taxes 10,762 10,412 Other assets 8,104 7,929 Total assets $ 258,496 $ 256,540 LIABILITIES Payables $ 23,282 $ 21,520 Other liabilities and deferred revenue 19,697 20,556 Automotive debt payable within one year 3,356 2,314 Ford Credit debt payable within one year 48,265 51,179 Total current liabilities 94,600 95,569 Other liabilities and deferred revenue 24,711 23,588 Automotive long-term debt 12,575 11,233 Ford Credit long-term debt 89,492 88,887 Other long-term debt 599 600 Deferred income taxes 815 597 Total liabilities 222,792 220,474 Redeemable noncontrolling interest 98 100 EQUITY Common Stock, par value $.01 per share (4,000 million shares issued of 6 billion authorized) 40 40 Class B Stock, par value $.01 per share (71 million shares issued of 530 million authorized) 1 1 Capital in excess of par value of stock 21,843 22,006 Retained earnings 21,906 22,668 Accumulated other comprehensive income/(loss) (6,959 ) (7,366 ) Treasury stock (1,253 ) (1,417 ) Total equity attributable to Ford Motor Company 35,578 35,932 Equity attributable to noncontrolling interests 28 34 Total equity 35,606 35,966 Total liabilities and equity $ 258,496 $ 256,540 7 Ford Motor Company: 4Q / FY January 23, 2019

CONSOLIDATED STATEMENT OF CASH FLOWS FORD MOTOR COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENT OF CASH FLOWS (in millions) For the years ended December 31, 2016 2017 2018 Cash flows from operating activities (unaudited) Net income $ 4,600 $ 7,757 $ 3,695 Depreciation and tooling amortization 9,023 9,122 9,280 Other amortization (306 ) (669 ) (972 ) Provision for credit and insurance losses 672 717 609 Pension and other postretirement employee benefits (“OPEB”) expense/(income) 2,667 (608 ) 400 Equity investment (earnings)/losses in excess of dividends received (178 ) 240 206 Foreign currency adjustments 283 (403 ) 529 Net (gain)/loss on changes in investments in affiliates (139 ) (7 ) (42 ) Stock compensation 210 246 191 Net change in wholesale and other receivables (1,449 ) (836 ) (2,408 ) Provision for deferred income taxes 1,473 (350 ) (197 ) Decrease/(Increase) in accounts receivable and other assets (2,855 ) (2,297 ) (2,239 ) Decrease/(Increase) in inventory (803 ) (970 ) (828 ) Increase/(Decrease) in accounts payable and accrued and other liabilities 6,595 6,089 6,781 Other 57 65 17 Net cash provided by/(used in) operating activities 19,850 18,096 15,022 Cash flows from investing activities Capital spending (6,992 ) (7,049 ) (7,785 ) Acquisitions of finance receivables and operating leases (56,007 ) (59,354 ) (62,924 ) Collections of finance receivables and operating leases 38,834 44,641 50,880 Purchases of marketable and other securities (31,428 ) (27,567 ) (17,140 ) Sales and maturities of marketable and other securities 29,354 29,898 20,527 Settlements of derivatives 825 100 358 Other 112 (29 ) (177 ) Net cash provided by/(used in) investing activities (25,302 ) (19,360 ) (16,261 ) Cash flows from financing activities Cash dividends (3,376 ) (2,584 ) (2,905 ) Purchases of common stock (145 ) (131 ) (164 ) Net changes in short-term debt 3,864 1,229 (2,819 ) Proceeds from issuance of long-term debt 45,961 45,801 50,130 Principal payments on long-term debt (38,797 ) (40,770 ) (44,172 ) Other (107 ) (151 ) (192 ) Net cash provided by/(used in) financing activities 7,400 3,394 (122 ) Effect of exchange rate changes on cash, cash equivalents, and restricted cash (265 ) 489 (370 ) Net increase/(decrease) in cash, cash equivalents, and restricted cash $ 1,683 $ 2,619 $ (1,731 ) Cash, cash equivalents, and restricted cash at January 1 $ 14,336 $ 16,019 $ 18,638 Net increase/(decrease) in cash, cash equivalents, and restricted cash 1,683 2,619 (1,731 ) Cash, cash equivalents, and restricted cash at December 31 $ 16,019 $ 18,638 $ 16,907 8 Ford Motor Company: 4Q / FY January 23, 2019

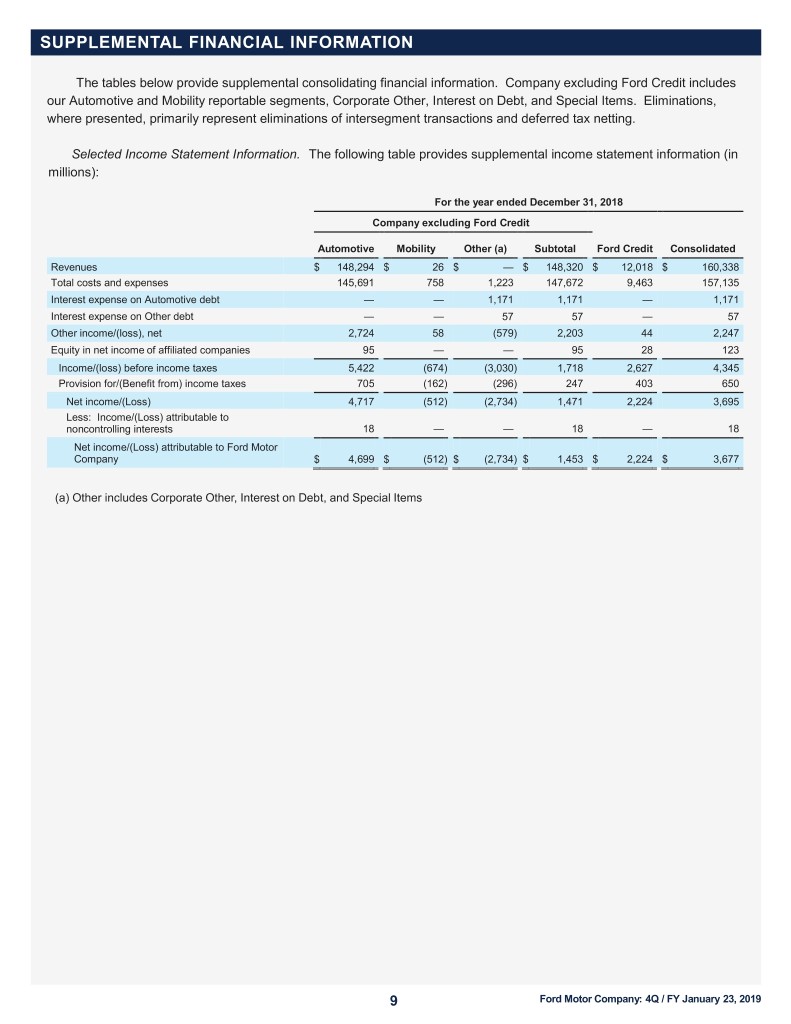

SUPPLEMENTAL FINANCIAL INFORMATION The tables below provide supplemental consolidating financial information. Company excluding Ford Credit includes our Automotive and Mobility reportable segments, Corporate Other, Interest on Debt, and Special Items. Eliminations, where presented, primar ily represent eliminations of intersegment transactions and deferred tax netting. Selected Income Statement Information. The following table provides supplemental income statement information (in millions): For the year ended December 31, 2018 Company excluding Ford Credit Automotive Mobility Other (a) Subtotal Ford Credit Consolidated Revenues $ 148,294 $ 26 $ — $ 148,320 $ 12,018 $ 160,338 Total costs and expenses 145,691 758 1,223 147,672 9,463 157,135 Interest expense on Automotive debt — — 1,171 1,171 — 1,171 Interest expense on Other debt — — 57 57 — 57 Other income/(loss), net 2,724 58 (579 ) 2,203 44 2,247 Equity in net income of affiliated companies 95 — — 95 28 123 Income/(loss) before income taxes 5,422 (674 ) (3,030 ) 1,718 2,627 4,345 Provision for/(Benefit from) income taxes 705 (162 ) (296 ) 247 403 650 Net income/(Loss) 4,717 (512 ) (2,734 ) 1,471 2,224 3,695 Less: Income/(Loss) attributable to noncontrolling interests 18 — — 18 — 18 Net income/(Loss) attributable to Ford Motor Company $ 4,699 $ (512 ) $ (2,734 ) $ 1,453 $ 2,224 $ 3,677 (a) Other includes Corporate Other, Interest on Debt, and Special Items 9 Ford Motor Company: 4Q / FY January 23, 2019

SUPPLEMENTAL FINANCIAL INFORMATION Selected Balance Sheet Information. The following tables provide supplemental balance sheet information (in millions): December 31, 2018 Company excluding Assets Ford Credit Ford Credit Eliminations Consolidated Cash and cash equivalents $ 7,111 $ 9,607 $ — $ 16,718 Marketable securities 15,925 1,308 — 17,233 Ford Credit finance receivables, net — 53,289 — 53,289 Trade and other receivables, less allowances 3,698 7,497 — 11,195 Inventories 11,220 — — 11,220 Other assets 2,567 1,363 — 3,930 Receivable from other segments 1,054 2,470 (3,524 ) — Total current assets 41,575 75,534 (3,524 ) 113,585 Ford Credit finance receivables, net — 56,608 — 56,608 Net investment in operating leases 1,705 27,414 — 29,119 Net property 35,986 192 — 36,178 Equity in net assets of affiliated companies 2,595 114 — 2,709 Deferred income taxes 12,293 216 (2,097 ) 10,412 Other assets 6,343 1,586 — 7,929 Receivable from other segments 166 14 (180 ) — Total assets $ 100,663 $ 161,678 $ (5,801 ) $ 256,540 Liabilities Payables $ 20,426 $ 1,094 $ — $ 21,520 Other liabilities and deferred revenue 18,868 1,688 — 20,556 Automotive debt payable within one year 2,314 — — 2,314 Ford Credit debt payable within one year — 51,179 — 51,179 Payable to other segments 3,524 — (3,524 ) — Total current liabilities 45,132 53,961 (3,524 ) 95,569 Other liabilities and deferred revenue 22,491 1,097 — 23,588 Automotive long-term debt 11,233 — — 11,233 Ford Credit long-term debt — 88,887 — 88,887 Other long-term debt 600 — — 600 Deferred income taxes 99 2,595 (2,097 ) 597 Payable to other segments 17 163 (180 ) — Total liabilities $ 79,572 $ 146,703 $ (5,801 ) $ 220,474 10 Ford Motor Company: 4Q / FY January 23, 2019

SUPPLEMENTAL FINANCIAL INFORMATION Selected Cash Flow Information. The following tables provide supplemental cash flow information (in millions): For the year ended December 31, 2018 Company excluding Cash flows from operating activities Ford Credit Ford Credit Eliminations Consolidated Net income $ 1,471 $ 2,224 $ — $ 3,695 Depreciation and tooling amortization 5,384 3,896 — 9,280 Other amortization 100 (1,072 ) — (972 ) Provision for credit and insurance losses — 609 — 609 Pension and OPEB expense/(income) 400 — — 400 Equity investment (earnings)/losses in excess of dividends received 231 (25 ) — 206 Foreign currency adjustments 528 1 — 529 Net (gain)/loss on changes in investments in affiliates (39 ) (3 ) — (42 ) Stock compensation 183 8 — 191 Net change in wholesale and other receivables — (2,408 ) — (2,408 ) Provision for deferred income taxes 573 (770 ) — (197 ) Decrease/(Increase) in intersegment receivables/payables (558 ) 558 — — Decrease/(Increase) in accounts receivable and other assets (1,999 ) (240 ) — (2,239 ) Decrease/(Increase) in inventory (828 ) — — (828 ) Increase/(Decrease) in accounts payable and accrued and other liabilities 6,521 260 — 6,781 Other 89 (72 ) — 17 Interest supplements and residual value support to Ford Credit (5,205 ) 5,205 — — Net cash provided by/(used in) operating activities $ 6,851 $ 8,171 $ — $ 15,022 Cash flows from investing activities Capital spending $ (7,737 ) $ (48 ) $ — $ (7,785 ) Acquisitions of finance receivables and operating leases — (62,924 ) — (62,924 ) Collections of finance receivables and operating leases — 50,880 — 50,880 Purchases of marketable and other securities (13,508 ) (3,632 ) — (17,140 ) Sales and maturities of marketable and other securities 15,356 5,171 — 20,527 Settlements of derivatives 132 226 — 358 Other (174 ) (3 ) — (177 ) Investing activity (to)/from other segments 2,711 154 (2,865 ) — Net cash provided by/(used in) investing activities $ (3,220 ) $ (10,176 ) $ (2,865 ) $ (16,261 ) Cash flows from financing activities Cash dividends $ (2,905 ) $ — $ — $ (2,905 ) Purchases of common stock (164 ) — — (164 ) Net changes in short-term debt (543 ) (2,276 ) — (2,819 ) Proceeds from issuance of long-term debt 176 49,954 — 50,130 Principal payments on long-term debt (1,642 ) (42,530 ) — (44,172 ) Other (42 ) (150 ) — (192 ) Financing activity to/(from) other segments (154 ) (2,711 ) 2,865 — Net cash provided by/(used in) financing activities $ (5,274 ) $ 2,287 $ 2,865 $ (122 ) Effect of exchange rate changes on cash, cash equivalents, and restricted cash $ (153 ) $ (217 ) $ — $ (370 ) 11 Ford Motor Company: 4Q / FY January 23, 2019

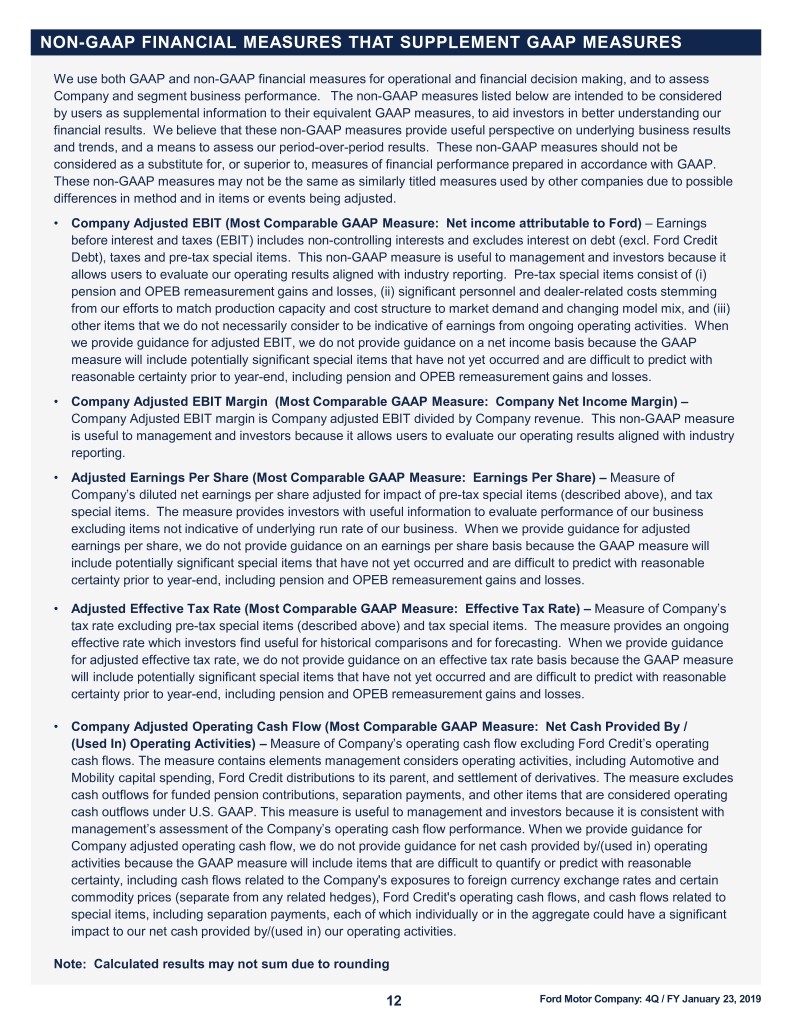

NON-GAAP FINANCIAL MEASURES THAT SUPPLEMENT GAAP MEASURES We use both GAAP and non-GAAP financial measures for operational and financial decision making, and to assess Company and segment business performance. The non-GAAP measures listed below are intended to be considered by users as supplemental information to their equivalent GAAP measures, to aid investors in better understanding our financial results. We believe that these non-GAAP measures provide useful perspective on underlying business results and trends, and a means to assess our period-over-period results. These non-GAAP measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP measures may not be the same as similarly titled measures used by other companies due to possible differences in method and in items or events being adjusted. • Company Adjusted EBIT (Most Comparable GAAP Measure: Net income attributable to Ford) – Earnings before interest and taxes (EBIT) includes non-controlling interests and excludes interest on debt (excl. Ford Credit Debt), taxes and pre-tax special items. This non-GAAP measure is useful to management and investors because it allows users to evaluate our operating results aligned with industry reporting. Pre-tax special items consist of (i) pension and OPEB remeasurement gains and losses, (ii) significant personnel and dealer-related costs stemming from our efforts to match production capacity and cost structure to market demand and changing model mix, and (iii) other items that we do not necessarily consider to be indicative of earnings from ongoing operating activities. When we provide guidance for adjusted EBIT, we do not provide guidance on a net income basis because the GAAP measure will include potentially significant special items that have not yet occurred and are difficult to predict with reasonable certainty prior to year-end, including pension and OPEB remeasurement gains and losses. • Company Adjusted EBIT Margin (Most Comparable GAAP Measure: Company Net Income Margin) – Company Adjusted EBIT margin is Company adjusted EBIT divided by Company revenue. This non-GAAP measure is useful to management and investors because it allows users to evaluate our operating results aligned with industry reporting. • Adjusted Earnings Per Share (Most Comparable GAAP Measure: Earnings Per Share) – Measure of Company’s diluted net earnings per share adjusted for impact of pre-tax special items (described above), and tax special items. The measure provides investors with useful information to evaluate performance of our business excluding items not indicative of underlying run rate of our business. When we provide guidance for adjusted earnings per share, we do not provide guidance on an earnings per share basis because the GAAP measure will include potentially significant special items that have not yet occurred and are difficult to predict with reasonable certainty prior to year-end, including pension and OPEB remeasurement gains and losses. • Adjusted Effective Tax Rate (Most Comparable GAAP Measure: Effective Tax Rate) – Measure of Company’s tax rate excluding pre-tax special items (described above) and tax special items. The measure provides an ongoing effective rate which investors find useful for historical comparisons and for forecasting. When we provide guidance for adjusted effective tax rate, we do not provide guidance on an effective tax rate basis because the GAAP measure will include potentially significant special items that have not yet occurred and are difficult to predict with reasonable certainty prior to year-end, including pension and OPEB remeasurement gains and losses. • Company Adjusted Operating Cash Flow (Most Comparable GAAP Measure: Net Cash Provided By / (Used In) Operating Activities) – Measure of Company’s operating cash flow excluding Ford Credit’s operating cash flows. The measure contains elements management considers operating activities, including Automotive and Mobility capital spending, Ford Credit distributions to its parent, and settlement of derivatives. The measure excludes cash outflows for funded pension contributions, separation payments, and other items that are considered operating cash outflows under U.S. GAAP. This measure is useful to management and investors because it is consistent with management’s assessment of the Company’s operating cash flow performance. When we provide guidance for Company adjusted operating cash flow, we do not provide guidance for net cash provided by/(used in) operating activities because the GAAP measure will include items that are difficult to quantify or predict with reasonable certainty, including cash flows related to the Company's exposures to foreign currency exchange rates and certain commodity prices (separate from any related hedges), Ford Credit's operating cash flows, and cash flows related to special items, including separation payments, each of which individually or in the aggregate could have a significant impact to our net cash provided by/(used in) our operating activities. Note: Calculated results may not sum due to rounding 12 Ford Motor Company: 4Q / FY January 23, 2019

COMPANY NET INCOME RECONCILIATION TO ADJUSTED EBIT (MILS) 4Q FY 2017 2018 2017 2018 Net income / (Loss) attributable to Ford (GAAP)$ 2,520 $ (116) $ 7,731 $ 3,677 Income / (Loss) attributable to non-controlling interests 4 4 26 18 Net income / (Loss) $2,524 $ (112) $ 7,757 $ 3,695 Less: (Provision for) / Benefit from income taxes 652 (95) (402) (650) Income / (Loss) before income taxes$ 1,872 $ (17) $ 8,159 $ 4,345 Less: Special items pre-tax 152 (1,179) (289) (1,429) Income / (Loss) before special items pre-tax$ 1,720 $ 1,162 $ 8,448 $ 5,774 Less: Interest on debt (308) (295) (1,190) (1,228) Adjusted EBIT (Non-GAAP)$ 2,028 $ 1,457 $ 9,638 $ 7,002 Memo: Revenue (Bils) $41.3 $ 41.8 $ 156.8 $ 160.3 Net income margin (GAAP) (Pct) 6.1% (0.3)% 4.9% 2.3% Adjusted EBIT Margin (Pct) 4.9% 3.5% 6.1% 4.4% COMPANY EARNINGS PER SHARE RECONCILIATION TO ADJUSTED EARNINGS PER SHARE 4Q FY 2017 2018 2017 2018 Diluted After-Tax Results (Mils) Diluted after-tax results (GAAP) $2,520 $ (116) $ 7,731 $ 3,677 Less: Impact of pre-tax and tax special items 971 (1,320) 608 (1,517) Adjusted net income – diluted (Non-GAAP) $1,549 $ 1,204 $ 7,123 $ 5,194 Basic and Diluted Shares (Mils) Basic shares (average shares outstanding) 3,973 3,970 3,975 3,974 Net dilutive options, unvested restricted stock units and restricted stock 27 27 23 24 Diluted shares 4,000 3,997 3,998 3,998 Earnings per share – diluted (GAAP)* $0.63 $ (0.03) $ 1.93 $ 0.92 Less: Net impact of adjustments 0.24 (0.33) 0.15 (0.38) Adjusted earnings per share – diluted (Non-GAAP) $0.39 $ 0.30 $ 1.78 $ 1.30 * The 2018 fourth quarter calculation of Earnings Per Share - Diluted (GAAP) excludes the 27 million shares of net dilutive options, unvested restricted stock units and restricted stock due to their antidilutive effect 13 Ford Motor Company: 4Q / FY January 23, 2019

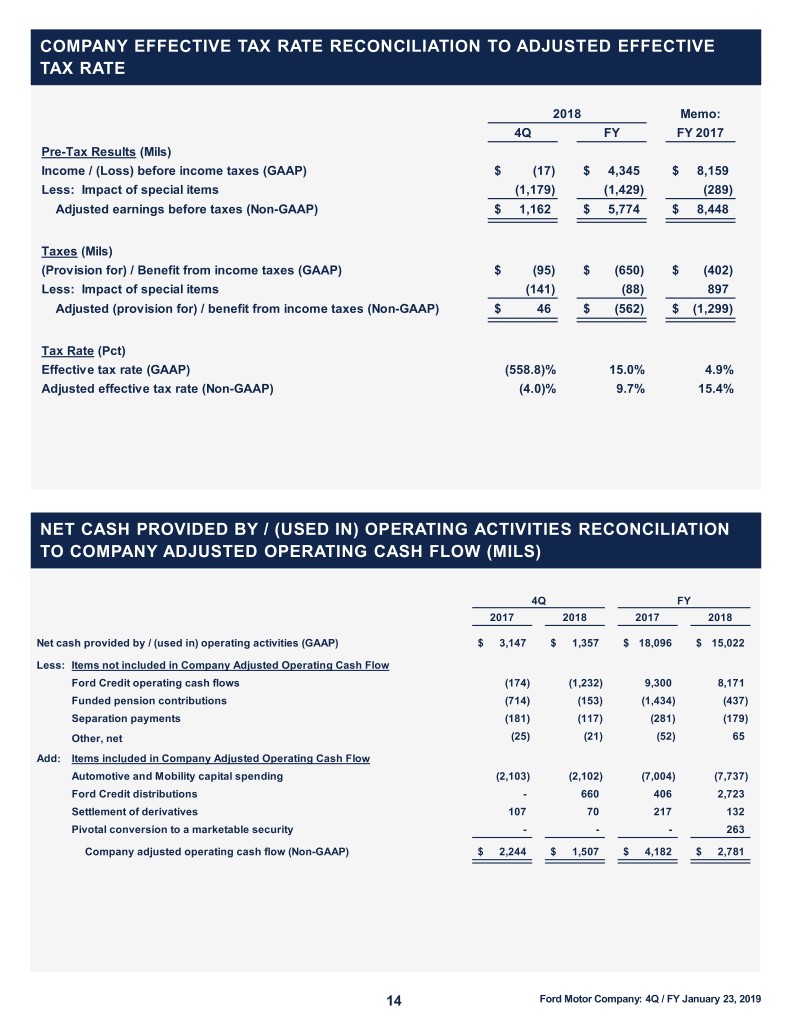

COMPANY EFFECTIVE TAX RATE RECONCILIATION TO ADJUSTED EFFECTIVE TAX RATE 2018 Memo: 4Q FY FY 2017 Pre-Tax Results (Mils) Income / (Loss) before income taxes (GAAP) $(17) $ 4,345 $ 8,159 Less: Impact of special items (1,179) (1,429) (289) Adjusted earnings before taxes (Non-GAAP) $1,162 $ 5,774 $ 8,448 Taxes (Mils) (Provision for) / Benefit from income taxes (GAAP)$ (95) $ (650) $ (402) Less: Impact of special items (141) (88) 897 Adjusted (provision for) / benefit from income taxes (Non-GAAP)$ 46 $ (562) $ (1,299) Tax Rate (Pct) Effective tax rate (GAAP) (558.8)% 15.0% 4.9% Adjusted effective tax rate (Non-GAAP) (4.0)% 9.7% 15.4% NET CASH PROVIDED BY / (USED IN) OPERATING ACTIVITIES RECONCILIATION TO COMPANY ADJUSTED OPERATING CASH FLOW (MILS) 4Q FY 2017 2018 2017 2018 Net cash provided by / (used in) operating activities (GAAP)$ 3,147 $ 1,357 $ 18,096 $ 15,022 Less: Items not included in Company Adjusted Operating Cash Flow Ford Credit operating cash flows (174) (1,232) 9,300 8,171 Funded pension contributions (714) (153) (1,434) (437) Separation payments (181) (117) (281) (179) Other, net (25) (21) (52) 65 Add: Items included in Company Adjusted Operating Cash Flow Automotive and Mobility capital spending (2,103) (2,102) (7,004) (7,737) Ford Credit distributions - 660 406 2,723 Settlement of derivatives 107 70 217 132 Pivotal conversion to a marketable security - - - 263 Company adjusted operating cash flow (Non-GAAP)$ 2,244 $ 1,507 $ 4,182 $ 2,781 14 Ford Motor Company: 4Q / FY January 23, 2019

COMPANY SPECIAL ITEMS (MILS) 4Q FY 2017 2018 2017 2018 Pension and OPEB gain / (loss) Year end net pension and OPEB remeasurement$ (162) $ (877) $ (162) $ (877) Other pension remeasurement - - - 26 Pension curtailment 354 - 354 15 Total pension and OPEB gain / (loss)$ 192 $ (877) $ 192 $ (836) Separation-related actions $ (38) $(262) $ (297) $ (537) Other items San Luis Potosi plant cancellation $- $ - $ 41 $ - Next-generation Focus footprint change (2) - (225) (9) Focus Active cancellation - - - (7) Chariot closure - (40) - (40) Total other items $ (2) $(40) $ (184) $ (56) Total pre-tax special items $152 $ (1,179) $ (289) $ (1,429) 15 Ford Motor Company: 4Q / FY January 23, 2019

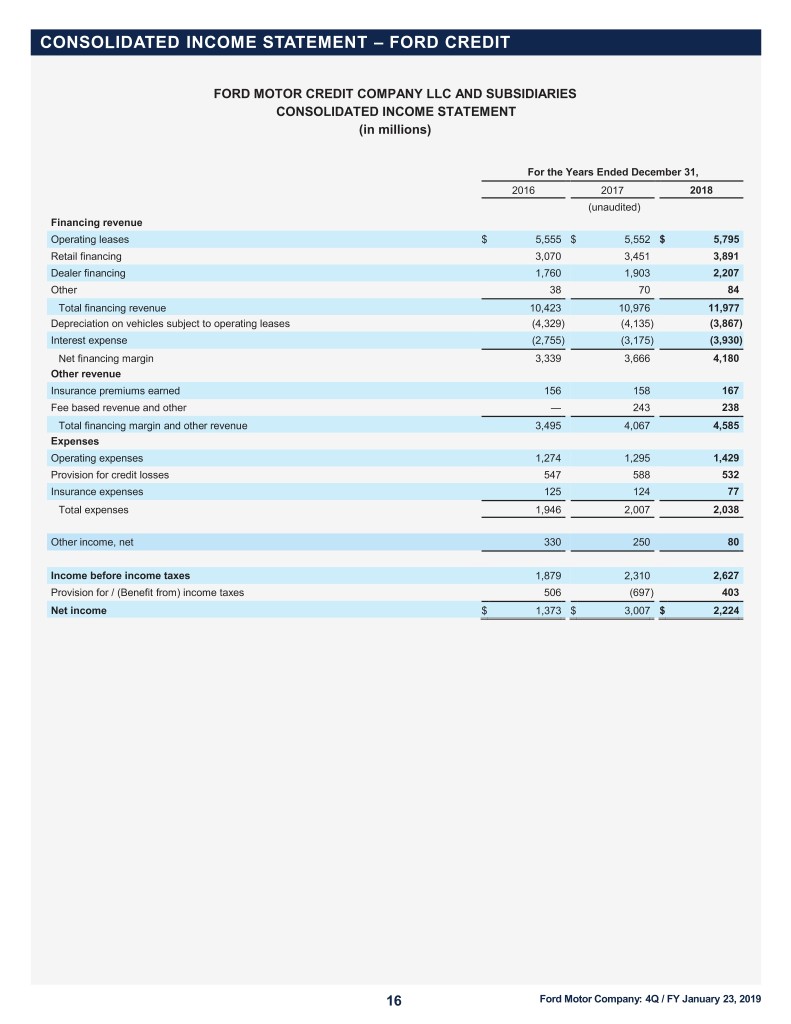

CONSOLIDATED INCOME STATEMENT – FORD CREDIT FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES CONSOLIDATED INCOME STATEMENT (in millions) For the Years Ended December 31, 2016 2017 2018 (unaudited) Financing revenue Operating leases $ 5,555 $ 5,552 $ 5,795 Retail financing 3,070 3,451 3,891 Dealer financing 1,760 1,903 2,207 Other 38 70 84 Total financing revenue 10,423 10,976 11,977 Depreciation on vehicles subject to operating leases (4,329 ) (4,135 ) (3,867 ) Interest expense (2,755 ) (3,175 ) (3,930 ) Net financing margin 3,339 3,666 4,180 Other revenue Insurance premiums earned 156 158 167 Fee based revenue and other — 243 238 Total financing margin and other revenue 3,495 4,067 4,585 Expenses Operating expenses 1,274 1,295 1,429 Provision for credit losses 547 588 532 Insurance expenses 125 124 77 Total expenses 1,946 2,007 2,038 Other income, net 330 250 80 Income before income taxes 1,879 2,310 2,627 Provision for / (Benefit from) income taxes 506 (697 ) 403 Net income $ 1,373 $ 3,007 $ 2,224 16 Ford Motor Company: 4Q / FY January 23, 2019

CONSOLIDATED BALANCE SHEET – FORD CREDIT FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES CONSOLIDATED BALANCE SHEET (in millions) December 31, December 31, 2017 2018 (unaudited) ASSETS Cash and cash equivalents $ 9,558 $ 9,607 Marketable securities 2,881 1,308 Finance receivables, net 116,003 118,814 Net investment in operating leases 26,661 27,449 Notes and accounts receivable from affiliated companies 1,076 905 Derivative financial instruments 935 670 Other assets 3,329 3,456 Total assets $ 160,443 $ 162,209 LIABILITIES Accounts payable Customer deposits, dealer reserves, and other $ 1,171 $ 1,097 Affiliated companies 592 426 Total accounts payable 1,763 1,523 Debt 137,828 140,146 Deferred income taxes 2,386 2,595 Derivative financial instruments 310 663 Other liabilities and deferred income 2,272 2,307 Total liabilities 144,559 147,234 SHAREHOLDER’S INTEREST Shareholder’s interest 5,227 5,227 Accumulated other comprehensive income / (loss) (419 ) (829 ) Retained earnings 11,076 10,577 Total shareholder’s interest 15,884 14,975 Total liabilities and shareholder’s interest $ 160,443 $ 162,209 17 Ford Motor Company: 4Q / FY January 23, 2019

CONSOLIDATED STATEMENT OF CASH FLOWS – FORD CREDIT FORD MOTOR CREDIT COMPANY LLC AND SUBSIDIARIES CONSOLIDATED STATEMENT OF CASH FLOWS (in millions) For the Years Ended December 31, 2016 2017 2018 (unaudited) Cash flows from operating activities Net income $ 1,373 $ 3,007 $ 2,224 Adjustments to reconcile net income to net cash provided by operations Provision for credit losses 547 588 532 Depreciation and amortization 5,121 4,928 4,735 Amortization of upfront interest supplements (1,341 ) (1,686 ) (2,041 ) Net change in deferred income taxes 340 (923 ) 259 Net change in other assets (413 ) (606 ) (276 ) Net change in other liabilities 462 480 115 All other operating activities 142 (123 ) 155 Net cash provided by / (used in) operating activities 6,231 5,665 5,703 Cash flows from investing activities Purchases of finance receivables (37,494 ) (43,232 ) (44,384 ) Principal collections of finance receivables 30,924 37,277 42,553 Purchases of operating lease vehicles (14,441 ) (12,780 ) (14,306 ) Proceeds from termination of operating lease vehicles 7,920 8,538 9,223 Net change in wholesale receivables and other short-duration receivables (1,499 ) (874 ) (2,661 ) Purchases of marketable securities (7,289 ) (5,899 ) (3,632 ) Proceeds from sales and maturities of marketable securities 6,756 6,316 5,171 Settlements of derivatives 215 (117 ) 226 All other investing activities (105 ) (30 ) 102 Net cash provided by / (used in) investing activities (15,013 ) (10,801 ) (7,708 ) Cash flows from financing activities Proceeds from issuances of long-term debt 42,971 44,994 49,954 Principal payments on long-term debt (38,000 ) (39,372 ) (42,530 ) Change in short-term debt, net 3,403 1,195 (2,263 ) Cash distributions to parent — (406 ) (2,723 ) All other financing activities (103 ) (105 ) (151 ) Net cash provided by / (used in) financing activities 8,271 6,306 2,287 Effect of exchange rate changes on cash, cash equivalents, and restricted cash (246 ) 327 (217 ) Net increase / (decrease) in cash, cash equivalents, and restricted cash $ (757 ) $ 1,497 $ 65 Cash, cash equivalents and restricted cash at January 1 $ 8,942 $ 8,185 $ 9,682 Net increase / (decrease) in cash, cash equivalents and restricted cash (757 ) 1,497 65 Cash, cash equivalents and restricted cash at December 31 $ 8,185 $ 9,682 $ 9,747 18 Ford Motor Company: 4Q / FY January 23, 2019