Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Moxian, Inc. | tv509703_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Moxian, Inc. | tv509703_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Moxian, Inc. | tv509703_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Moxian, Inc. | tv509703_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2018

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File No. 000-55017

| MOXIAN, INC. | ||

| (Exact Name of Registrant as Specified in its Charter) | ||

| Nevada | 27-3729742 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

| Units 9B&C,

Block D, Fuhua Tower, 8 Chaomenyang North Street, Chaoyang District, Beijing 100027, China |

Tel: +86 (0) 010 5332 0602 | |

| (Address of Principal Executive Offices and Zip Code) | (Registrant’s Telephone Number, Including Area Code) |

Securities registered pursuant to Section 12(b) of the Securities Exchange Act: None

Securities registered pursuant to Section 12(g) of the Securities Exchange Act: Common Stock, par value $0.001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |

| Non-accelerated filer | x | Smaller reporting company | x | |

| Emerging growth Company | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ¨ No x

The aggregate market value of the voting common equity held by non-affiliates based upon the price at which Common Stock was last sold as of March 31, 2018, the last business day of the registrant’s most recently completed second fiscal quarter was approximately $46 million.

As of December 19, 2018, the number of shares of the registrant’s common stock outstanding was 67,357,222.

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2018

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

| ● | The availability and adequacy of our cash flow to meet our requirements; |

| ● | Changes or developments in laws, regulations or taxes in our industry; |

| ● | Competition in our industry; |

| ● | The loss of or failure to obtain any license or permit necessary or desirable in the operation of our business; |

| ● | Changes in our business strategy, capital improvements or development plans; |

| ● | The availability of additional capital to support capital improvements and development; and |

| ● | Other risks identified in this report and in our other filings with the Securities and Exchange Commission or the SEC. |

This report should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward-looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Defined Terms

Except as otherwise indicated by the context, references in this report to:

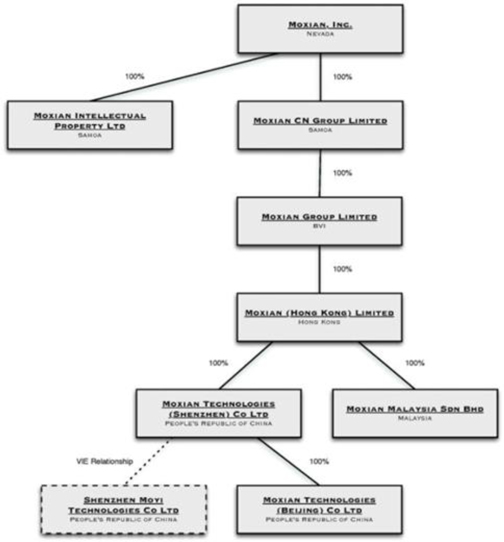

| ● | The “Company,” “we,” “us,” “our” or “Moxian” are references to the combined business of |

| (i) | Moxian, Inc., a company incorporated under the laws of Nevada, | |

| (ii) | Moxian CN Group Limited, a company incorporated under the laws of Independent State of Samoa (“Moxian CN Samoa”), | |

| (iii) | Moxian Intellectual Property Limited, a company incorporated under the laws of Independent State of Samoa (“Moxian IP Samoa”); | |

| (iv) | Moxian Group Limited, a company incorporated under the laws of the British Virgin Islands (“Moxian BVI”), | |

| (v) | Moxian (Hong Kong) Limited, a limited liability company incorporated under the laws of Hong Kong (“Moxian HK”), | |

| (vi) | Moxian Technologies (Shenzhen) Co., Ltd., a company incorporated under the laws of People’s Republic of China (“Moxian Shenzhen”), | |

| (vii) | Moxian Malaysia Sdn. Bhd. (“Moxian Malaysia”), a company incorporated under the laws of Malaysia (“Moxian Malaysia”), | |

| (viii) | Moxian Technologies (Beijing) Co., Ltd., a company incorporated under the laws of People’s Republic of China (“Moxian Beijing”), | |

| (ix) | Moxian Technologies (Shanghai) Co. Ltd., a company under the laws of the People’s Republic of China (“Moxian Shanghai”) and | |

| (x) | Shenzhen Moyi Technologies Co. Ltd., a contractually controlled affiliate of Moxian Shenzhen formed under the laws of People’s Republic of China (“Moyi”). |

| ● | “Common Stock” refers to the Company’s common stock, par value $0.001; |

| ● | “PRC” refers to the People’s Republic of China; |

| ● | “HK” refers to Hong Kong; |

| ● | “U.S. dollar,” “$” and “US$” refer to the legal currency of the United States; |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended; and |

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended. |

Unless otherwise noted, all currency figures in this filing are in U.S. dollars. References to “yuan” or “RMB” are to the Chinese yuan (also known as the Renminbi).

Corporate History and Corporate Structure

Moxian, Inc. (“the Company”) was incorporated in the State of Nevada on October 12, 2010 and was formerly known as SECURE NetCheckIn Inc. in the business of offering a cloud-based scheduling and notification product for the medical industry. The Company changed its name to Moxian China, Inc. on December 13, 2013 and to Moxian, Inc. on July 19, 2015.

On February 17, 2014, the Company incorporated Moxian CN Samoa under the laws of Samoa.

On February 21, 2014, the Company acquired Moxian BVI, together with its subsidiaries, Moxian HK, Moxian Shenzhen, and Moxian Malaysia through its wholly owned subsidiary, Moxian CN Samoa from Rebel Group, Inc. (“REBL”), a company incorporated in the State of Florida and of which our then Chief Executive Officer, James Mengdong Tan, was a promoter as the term is defined under Rule 405 of Regulation C promulgated under the Securities Act, by entering into a License and Acquisition Agreement (the “License and Acquisition Agreement”) in consideration of $1,000,000 (“Moxian BVI Purchase Price”).

As a result, Moxian BVI, together with its subsidiaries, Moxian HK, Moxian Shenzhen, and Moxian Malaysia, became our subsidiaries. Under the License and Acquisition Agreement, REBL also agreed to grant us the exclusive right to use REBL’s intellectual property rights (collectively, the “IP Rights”) in Mainland China, Malaysia, and other countries and regions where REBL conducts its business (the “Licensed Territory”), and the exclusive right to solicit, promote, distribute and sell REBL products and services in the Licensed Territory for five years (the “License,”) and in consideration of such License, the Company agreed to pay to REBL (i) $1,000,000 as license maintenance royalty each year commencing on the first anniversary of the date of the License Agreement; and (ii) 3% of the gross profits resulting from the distribution and sale of the products and services on behalf of the Company as an earned royalty.

Moxian BVI was incorporated on July 3, 2012 under the laws of the British Virgin Islands.

Moxian HK was incorporated on January 18, 2013 and became Moxian BVI’s subsidiary on February 14, 2013.

Moxian Shenzhen was incorporated on April 8, 2013 as a wholly-owned subsidiary of Moxian HK and is engaged in the business of internet technology, computer software, and commercial information consulting.

Moxian Malaysia was incorporated on March 1, 2013 and became Moxian HK’s subsidiary on April 2, 2013.

Shenzhen Moyi Technologies Co., Ltd. (“Moyi”) was incorporated on July 19, 2013 under the laws of the People’s Republic of China. On July 15, 2014, Moxian Shenzhen entered into a series of agreements with Shenzhen Moyi Technologies Co., Ltd., a company incorporated under the laws of People’s Republic of China (“Moyi”), and its shareholders which permit us to operate Moyi and the right to purchase all of its equity interests from its shareholders as described below (the “Moyi Agreements”).

On December 18, 2017, the Company entered into a Tripartite Agreement with the original shareholders of Moyi and the new shareholders of Moyi wherein the Company agrees to the transfer o the equity interests of Moyi and all related rights, liabilities and obligations under the Moyi Agreements such that the new shareholders stand in place of the old shareholders in all aspects of the Moyi Agreements.

Moyi, which is owned solely by Chinese shareholders, is granted an Internet Content Provider license (“ICP License”). Businesses in China that are engaged in the business of Internet information services, including online advertisement and e-commerce services, are required to obtain an ICP License. Due to Chinese regulatory restrictions on foreign investments in the Internet sector, we operate our marketing platform and conduct our business through Moyi pursuant to the Moyi Agreements. Under the Moyi Agreements, Moyi will be treated as a variable interest entity in which the Company does not have direct or controlling equity interest but the historical financial results of such entity will be consolidated in our financial statements in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”).

Due to the transfer of interests from the Original Moyi Shareholders to the New Moyi Shareholders, the Company’s Board of Directors determined that it was appropriate to terminate such Moyi Agreements as the original Moyi Agreements had executed and to execute substantially similar Moyi Agreements with the New Moyi Shareholders. Because the Exclusive Business Cooperation Agreement did not include the Original Moyi Shareholders as a party, it has not been terminated. The Share Pledge Agreement, Power of Attorney and Exclusive Option Agreement were officially terminated as to the Original Moyi Shareholders as of January 8, 2018 and new Share Pledge Agreement, Power of Attorney and Exclusive Option Agreement were entered into with the New Moyi Shareholders at the same date. The parties’ intent throughout has been to maintain control of Moyi by Shenzhen Moxian and, by extension, the Company.

| 1 |

Moxian Technologies (Beijing) Co., Ltd. (“Moxian Beijing”) was incorporated on December 10, 2015 under the laws of the People’s Republic of China as a wholly-owned subsidiary of Moxian Shenzhen. Moxian Beijing is engaged in the business of internet technology, computer software, and commercial information consulting.

On February 17, 2014, Moxian IP Samoa was incorporated in Samoa as a wholly-owned subsidiary of REBL. On February 19, 2014, Moxian HK and Moxian Shenzhen entered into an Assignment and Assumption Agreement with Moxian IP Samoa, whereby Moxian HK and Moxian Shenzhen assigned and transferred all of the intellectual property rights that they respectively owned in connection with the Moxian business to Moxian IP Samoa in consideration of $1,000,000.

On January 30, 2015, the Company entered into an Equity Transfer Agreement (the “Equity Transfer Agreement,” such transaction, the “Equity Transfer Transaction”) with REBL, to acquire from REBL 100% of the equity interests of Moxian IP Samoa for $6,782,000 (the “Moxian IP Samoa Purchase Price”). Moxian IP Samoa owns all the intellectual property rights relating to the operation, use and marketing of the Moxian Platform, including all of the trademarks, patents and copyrights that are used in the Company’s business. As a result of the Equity Transfer Transaction, Moxian IP Samoa became a wholly-owned subsidiary of the Company.

| 2 |

In addition, under the Equity Transfer Agreement, the Company and REBL agreed to terminate the License and Acquisition Agreement. Immediately prior to the execution of the Equity Transfer Agreement, the Moxian BVI Purchase Price was not yet paid and no license maintenance royalty or earned royalty under the License and Acquisition Agreement had accrued.

Under the Equity Transfer Agreement, the Company and REBL agreed to extinguish all of the Company’s liabilities owed to REBL under the License and Acquisition Agreement, other than the Moxian BVI Purchase Price.

The Company agreed to issue to REBL a convertible promissory note for $7,782,000 (the “Rebel Note”), representing the sum of the Moxian IP Samoa Purchase Price and the Moxian BVI Purchase Price. The Rebel Note was due and payable on October 30, 2015 without any interest. The Company had the option to cause REBL to convert any and all amounts due under the Rebel Note into shares of the Company’s Common Stock at the conversion price of $1.00 per share (the “Conversion Price”), if the volume weighted average price (the “VWAP”) of the Company’s Common Stock for a period of 30 trading days immediately prior to the date of conversion was higher than the Conversion Price. The Company also had a right of first refusal to purchase the shares issuable upon conversion of the Rebel Note at the price of 80% of the VWAP for 30 trading days immediately prior to the date of the proposed repurchase by the Company.

On August 14, 2015, the VWAP of the Company’s Common Stock for 30 trading days prior to August 14, 2015 was higher than $1.00, which triggered the conversion of the Rebel Note. The Company notified REBL that it elected to cause it to convert $3,891,000 of the Rebel Note into 3,891,000 shares of its Common Stock (the “August Conversion”). As a result of the August Conversion, the remaining amount of the Rebel Note was $3,891,000.

On September 30, 2015, the Company notified REBL that it elected to cause it to convert the remainder of the Rebel Note into 3,891,000 shares of the Company’s Common Stock (the “September Conversion”). After the August Conversion and September Conversion, the entire balance of the Rebel Note was converted into a total of 7,782,000 shares of the Company’s Common Stock.

On November 14, 2016, the Company announced the completion of a public offering of 2,501,250 shares of its common stock at a public offering price of $4.00 per share. The net proceeds from the offering were approximately $8.5 million after deducting placement agents’ commissions and other estimated offering expenses. In connection with the offering, the Company’s common stock began trading on the NASDAQ Capital Market on November 15, 2016 under the symbol “MOXC”.

| 3 |

The following diagram sets forth the structure of the Company as of the date of this report:

Our web site address is www.moxian.com. Information contained on our web site is not part of this report on Form 10-K or our other filings with the Securities and Exchange Commission (“SEC”).

Overview

We are in the O2O (“Online-to-Offline”) business. While there are many definitions of O2O, with respect to our business, O2O means providing an online platform for small and medium sized enterprises (“SMEs”) with physical stores to conduct business online, interact with existing customers and obtain new customers. We refer to our customers as “Merchant Clients” and the existing and potential users of our platform as “Users.” Through our platform and the products and services offered through it, we seek to create interaction between our Users and Merchant Clients by allowing Merchant Clients to study consumer behavior. Our products and services are designed to allow Merchant Clients to conduct targeted advertising campaigns and promotions which are more effective because they are geared for those customers that a Merchant Client wishes to reach. Our platform is designed to encourage Users to return and to recruit new Users, each of which is a potential customer for our Merchant Clients.

We believe we are different from other companies in that our plan is to sign up merchants first and build our user base utilizing their customers.

The current version of our platform is called “Moxian+” which consists of our user mobile application (“App”) called the Moxian+ User App and a separate App for our Merchant Clients called the Moxian+ Business App. Both versions of the App are currently available in the Google Play Store and the Apple App Store and can be downloaded free of charge. We also have a website that can be accessed at www.moxian.com where either App can also be downloaded.

| 4 |

Moxian principally operates in Shenzhen and Beijing.

As of September 30, 2018, and September 30, 2017, our accumulated deficiency was approximately $47.3 million and $38.6 million, respectively. We have not generated any significant recurrent revenue since we started operations and our losses have grown to a level where the Company is unlikely to continue operations unless we have a fresh injection of capital or new funding.

Going Concern

In assessing the Company’s liquidity and its ability to continue as a going concern, the Company monitors and analyzes its cash and cash equivalents and its operating and capital expenditure commitments. The Company’s liquidity needs are to meet its working capital requirements, operating expenses and capital expenditure obligations. As of September 30, 2018, the Company’s current liabilities exceeded the current assets by approximately $10 million, The Company has stopped its sales operations for the time being while it reviews its options going forward.

In November 2016, the Company completed its initial public offering, (“IPO”) with net proceeds of $8.5 million but by September 30, 2017 it had substantially utilized these proceeds and had to resort to further funding.

On November 10, 2017, the Company and Ms. Liu Shu Juan (“Ms. Liu”), a director of the Company, entered into a convertible loan agreement for a line of credit of $1,000,000 or RMB equivalent. In March 2018, pursuant to the loan agreement, Moxian issued an unsecured convertible promissory note, bearing interest at the rate of 4.75% per annum, which note Ms. Liu converted in May 2018. She converted the total outstanding due to her of $1,008,008 into 350,003 ordinary shares of common stock at a conversion price of $2.88 per share.

In May 2018, Ms. Liu granted a further US$4 million facility to the Company bearing interest at the rate of 4.75% per annum and repayable after two years. and due in two years. In the course of fiscal 2018, the Company has principally relied on a draw-down of this facility to continue its operations.

Ms. Liu is the controlling shareholder of Shanghai Shewn Wine Co. Ltd. (“Shanghai Shewn”) which is in the business of distributing red wine and related accessories to retailers in various provinces in China. In November 2017, Ms. Liu seconded her General Manager, Yin Yi Jun (“Ethan Yin”) to work with Moxian in integrating the products and operations of both companies. Ethan Yin was appointed the Chief Executive Officer of Moxian in February 2018.

By the end of September 2018, although a $5.0 million loan had been approved by the Board, Ms. Liu did not proceed with further funding and Ethan Yin resigned as the CEO a month later in November 2018. The $4 million facility has been fully utilized and the Company is in need for further funding in order to continue its normal operations. Because certain staff have not been paid their salary arrears and long-service compensation, they reported their claims to the Shenzhen Labor Tribunal. As a result, the licenses of the Shenzhen Moxian and Moyi have been suspended by the Commerce Bureau and their bank accounts have been frozen. This matter has now been resolved. See Note 11 and 12 in the accompanying notes to the financial statements for further details.

If the Company is unable to obtain the additional funding in the immediate future, it will have to cease operations on a permanent basis. The consolidated financial statements for the years ended September 30, 2018 and 2017 have been prepared on a going concern basis and do not include any adjustments to reflect the possible future effects on the recoverability and classifications of assets or the amounts and classifications of liabilities that may result from the inability of the Company to continue as a going concern.

| 5 |

Market Opportunities

The Company is in the business of mobile applications.

It is estimated that China currently has more than 850 million users actively utilizing mobile applications as a result of the growth of the use of smart-phones, largely due to the availability of low-cost models produced by home-grown manufacturers such as Huawei, Vivo and Oppo.

O2O platforms link online users to physical stores and incorporate mobile payments as a key feature of their applications. Mobile payments are increasingly more popular and prevalent, with many consumers bypassing the use of debit and credit cards. As a result, store-based O2O commerce has experienced rapid growth with total sales of over $100 billion in 2017 and is projected to exceed US$140 billion by 2019.

Moxian has existed on the basis that the mobile application it has developed will be able to capture a share of this market by concentrating on the small and medium-sized enterprises in China that have limited budgets for advertising and marketing and may find that an online platform offers many advantages.

Products and Services

Moxian+ Business App Merchant Clients

The Moxian+ Business App is solely for use by Merchant Clients. The Moxian+ Business App allows them to manage their presence within the Moxian+ platform, plan a campaign, offer discounts, manage payments and receive analytics.

Our Targeted Marketing tools allow our Merchant Clients to send messages, promotions and advertisements to a specific group of Users and receive detailed analysis regarding buying patterns and customer preferences.

Moxian+ User App for Users

Our Users are referred to as “MO-Pals” within the User App. When they sign up for a Moxian+ account, they have to provide basic information and can then invite friends and family members to join Moxian+ as well.

The Moxian+ User App has a variety of features to attract and retain Users. The Moxian+ User App also provides access to a social media platform with a package of services to provide interaction with other Users and Merchant Clients. These services include MO-Talk, News Center with daily updates under “Hot Topics,” , Game Center and MO-Shake, which allows Users to win vouchers, discounts etc by shaking their phones.

Our Platform

The Moxian Platform is at the heart of our business. There are five components to our Moxian+ platform, which is the backend of our application, namely the social media engine, the e-commerce engine, the rewards engine, the gamification engine, and the analytical engine.

Social Media Engine

Our data use policy governs the use of information that users have chosen to share and present. We also design our products to include robust safety tools. We have worked with online safety experts to offer protection for all users, particularly teenagers. We work with law enforcement to help promote the safety of our users as required by law. To the extent permissible, and with prior consent from the Users, we analyze User’s information to understand the User’s behavior.

E-Commerce

Utilizing our e-commerce features, Merchant Clients are able to conduct business by posting products, offering coupons and sales as well as creating events and blogs through the Moxian+ Business App. On the other hand, Users can shop at the Merchant Clients’ shops like at any other e-commerce platform by ordering online and receiving the products by express delivery.

| 6 |

Rewards

Users are rewarded with MO-Points.. MO-Points are points granted to Users when they shop at Merchant Clients, play games on our platform or engage in other activities sponsored by the Merchant Clients. MO-Points can be redeemed at the Merchant Clients’ shops as determined by the Merchant Clients, or can be redeemed for MO-Coins which are a form of virtual currency and can be used at any Merchant Client’s stores.

MO-Points and MO-Coins are traceable and trackable on the Moxian+ platform through designated serial number so that we can see exactly what Users do with them and use that information to assist our Merchant Clients to determine customer behaviors.

From time to time, we may also give away MO-Points or MO-Coins as a promotion to increase our User base. We also plan to have our own “shopping mall” with merchandise that Users can purchase with MO-Points and MO-Coins in the upcoming year.

Gamification

Together with outside contractors, we develop games for Users to earn MO-Points and MO-Coins and other rewards which may be specific to a certain Merchant Client. Users can use MO-Points to play games offered in our game center.

Analytical Engine

Moxian provides analytics to each Merchant Client for the consumer behavior Moxian learns through its platform to assist our Merchant Clients to better design their promotions and reach their target audience. We analyze consumer behavior through “likes” of posts by certain merchants or the places they tend to “check-in” to, to determine their usual hang out.

Advertisements

On December 31, 2015, the Company entered into an Exclusive Partnership Agreement with Xinhua New Media Culture Communication Co. Ltd. (“Xinhua New Media”). Xinhua New Media is part of the Xinhua News Agency, the official news agency of the Peoples” Republic of China. It has developed an App that has a user population in the region of 120 million, many of whom are government employees and senior executives of quasi-government bodies and agencies.

Under the Agreement, the Company has the exclusive rights to operate the gaming channel on the Xinhua New Media app and can sell advertisement space on any part of the app.

The revenue from the sale of advertisement space forms the second part of our revenue.

Competition

In China, competition is stiff with industry giants like Baidu, Alibaba and Ten Cent that have well-established positions and are constantly upgrading their products. In addition, the growth of the O2O industry in recent years has seen the sprouting of many platform-based companies offering products for businesses and consumers. Such competitors, including Shou Qian Ba, La Shou and Le Hui have had varying degrees of success.

However, we believe that China is a huge market and there remain many opportunities for other players, particularly those catering for small and medium-sized enterprises or those that have specialized industry verticals.

Foreign Operations

All our business operations are in Mainland China. Accordingly, our results of operations, financial condition and prospects are subject to a significant degree to economic, political and legal developments in the PRC. For example, our business activities subject us to a number of Chinese laws and regulations, such as anti-corruption laws, tax laws, foreign exchange controls and cash repatriation restrictions, data privacy and security requirements, labor laws, intellectual property laws, privacy laws, and anti-competition regulations, which have uncertainties. Any failure to comply with the PRC laws and regulations could subject us to fines and penalties, make it more difficult or impossible to do business in China and harm our reputation.

| 7 |

Operating in foreign countries also subjects us to risk from currency fluctuations. Our primary exposure to movements in foreign currency exchange rates relates to non-U.S. dollar denominated sales and operating expenses. The weakening of foreign currencies relative to the U.S. dollar adversely affects the U.S. dollar value of our foreign currency-denominated sales and earnings.

Research and Development

Our research and development department is responsible for developing and improving the mobile application, Moxian platform and customer experience in using our products. The Company has invested heavily in research and development efforts, spending over $2 million in each of the years ended September 30, 2018 and September 2017.

Employees

As of September 30, 2018, we had a total of 34 employees, Because of a shortage of funds, the Company has been unable to pay the salaries of some of its employees. They have since gone to report their cases to the Labor Tribunal in Shenzhen for arbitration. Please refer to Note 12 to the accompanying financial statements for details.

PRC Law

Overview

The telecommunications and internet industry in China is highly regulated through various government agencies such as the Ministry of Industry and Information Technology (“MIIT”) and the State Administration of Press, Publication, Radio, Film and Television (“SAPPRFT”), the State Council Information Office (“SCIO”), the General Administration for Press and Publication (“GAPP”), and the Ministry of Public Security.

Among all the regulations, the Telecommunications Regulations of the People’s Republic of China, promulgated on September 25, 2000, is the primary governing law. The Telecom Regulations set out the general framework under which domestic Chinese companies such as the Company’s subsidiaries and VIE may engage in various types of telecommunications services in the PRC. They reiterate the long-standing principle that telecommunications service providers need to obtain operating licenses as a mandatory precondition to begin operation.

The Chinese government restricts foreign investment in Internet-related businesses. Accordingly, we operate our Internet-related businesses in China through Moyi, our VIE operating in Shenzhen, China.

Internet Information Services

The governing law for Internet information service is the Measures for the Administration of Internet Information Services, or the Internet Content Provider (“ICP”) Measures, which went into effect on September 25, 2000. Under the ICP Measures, any entity that provides information to online Internet users must obtain an operating license from Ministry of Industry and Information Technology (“MIIT”) or its local branch at the provincial level in accordance with the Telecom Regulations described above. The ICP Measures further stipulate that entities providing online information services in areas of news, publishing, education, medicine, health, pharmaceuticals and medical equipment must obtain permission from responsible national authorities prior to applying for an operating license from MIIT or its local branch at the provincial or municipal level. Moreover, ICPs must display their operating license numbers in a conspicuous location on their websites. ICPs must police their websites to remove categories of harmful content. Many of these requirements mirror Internet content restrictions that have been announced previously by PRC measures such as the MIIT and the SAPPRFT that derive their authority from the State Council.

Currently, Moyi holds an ICP license that was issued on January 22, 2014.

Online Privacy

Chinese law does not prohibit internet service providers from collecting and analyzing personal information from their users if the users agree to do so. The PRC government, however, has the power and authority to order internet service providers to submit personal information of an internet user if such user posts any prohibited content or engages in illegal activities on the internet.

| 8 |

Under the Several Provisions on Regulating the Market Order of Internet Information Services (“Order”) promulgated by the MIIT which became effective on March 15, 2012, internet service providers may not, without a user’s consent, collect the user’s personal information that can be used, alone or in combination with other information, to identify the user, and may not provide any user’s personal information to third parties without the prior consent of the user. Internet service providers may only collect users’ personal information necessary to provide their services and must expressly inform the users of the method, scope and purpose of the collection and processing of such information. They are also required to ensure the proper security of users’ personal information, and take immediate remedial measures if such information is suspected to have been inappropriately disclosed. When a User registers to our application, we require our users to accept a user agreement whereby they agree to provide certain personal information to us. We will take other measures as necessary to comply with these provisions.

ICPs are also required to establish and publish their rules relating to personal information collection or use, keep any collected information strictly confidential, and take technological and other measures to maintain the security of such information. ICP operators are required to cease any collection or use of the user personal information, and de-register the relevant user account, when a given user stops using the relevant Internet service. ICP operators are further prohibited from divulging, distorting or destroying any such personal information, or selling or providing such information unlawfully to other parties. In addition, if an ICP operator appoints an agent to undertake any marketing and technical services that involve the collection or use of personal information, the ICP operator is still required to supervise and manage the protection of the information. As to penalties, in very broad terms, the Order states that violators may face warnings, fines, and disclosure to the public and, in most severe cases, criminal liability.

Currently, our collection of the information from the Users is agreed to by the Users when they sign up. In addition, any data mining or analyzing of the user data is for internal use only. We also take steps to ensure that the data collected is stored securely.

Internet Publishing

On February 4, 2016, the SAPPRFT and MIIT jointly issued the Rules for the Administration for Internet Publishing Services, or the Internet Publishing Rules, which took effect on March 10, 2016, to replace the Provisional Rules for the Administration of Internet Publishing that had been jointly issued by the SAPPRFT and MIIT on June 27, 2002. The Internet Publishing Rules define “Internet publications” as digital works that are edited, produced or processed to be published and provided to the public through the Internet, including (a) original digital works, such as pictures, maps, games and comics; (b) digital works with content that is consistent with the type of content that, prior to the Internet age, typically was published in media such as books, newspapers, periodicals, audio-visual products and electronic publications; (c) digital works in the form of online databases complied by selecting, arranging and compiling other types of digital works; and (d) types of digital works identified by the SAPPRFT. Under the Internet Publishing Rules, Internet operators distributing such Internet publications via information network are required to apply for an Internet publishing license with the relevant governmental authorities and submit the application, if approved, to the SAPPRFT for approval before distributing Internet publications. Moxian plans to apply for an Internet publishing license.

Online Games

On May 10, 2003, the Provisional Regulations for the Administration of Online Culture were issued by the Ministry of Culture (“MCPRC”) and went into effect on July 1, 2003 (these regulations were revised by MCPRC on July 1, 2004). According to these regulations, commercial entities are required to apply to the relevant local branch of MCPRC for an Online Culture Operating Permit to engage in online games services.

On July 27, 2004, GAPP and the State Copyright Bureau jointly promulgated the Notice on Carrying out the Decision from the State Council Regarding the Approval of Electronic and Online Games Publications, or the Games Notice. According to the Games Notice, the Internet Publications Distribution License is required for publishing online games.

From year 2004 to 2016, MCPRC had issued several measures or regulations regulating the Online Games industry and thus we are subject to more strict regulations.

Currently, Moxian holds the appropriate license that was issued by the Administration of Online Culture on November 25, 2015.

| 9 |

Encryption Software

On October 7, 1999, the State Encryption Administration Commission published the Regulations for the Administration of Commercial Encryption, followed by the first Notice of the General Office of the State Encryption Administration Commission on November 8, 1999. Both these regulations address the use of software in China with encryption functions. According to these regulations, purchase of encryption products must be reported. Violation of the encryption regulations may result in a warning, penalty, confiscation of the encryption product, or criminal liabilities.

On March 18, 2000, the Office of the State Commission for the Administration of Cryptography issued a public announcement regarding the implementation of those regulations. The announcement clarifies the encryption regulations as below:

| ● | Only specialized hardware and software, the core functions of which are encryption and decoding, fall within the administrative scope of the regulations as “encryption products and equipment containing encryption technology.” Other products such as wireless telephones, Windows software and browsers do not fall within the scope of this regulation. |

| ● | The PRC government has already begun to study the laws in question in accordance with WTO rules and China’s external commitments, and will make revisions wherever necessary. The Administrative Regulations on Commercial Encryption will also be subject to such scrutiny and revision. |

In late 2005, the Administration Bureau of Cryptography further issued a series of regulations to regulate the development, production and sales of commercial encryption products, which all came into effect on January 1, 2006.

We believe that the Company is in proper compliance with these requirements.

Foreign Exchange

Foreign exchange regulation in China is primarily governed by the following regulations:

| ● | Foreign Exchange Administration Rules, or the Exchange Rules of the PRC, promulgated by the State Council on January 29, 1996, which was amended on January 14, 1997 and on August 5, 2008 respectively; and |

| ● | Administration Rules of the Settlement, Sale and Payment of Foreign Exchange, or the Administration Rules promulgated by China People’s Bank on June 20, 1996. |

Under the Exchange Rules of the PRC, Renminbi is convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions. Conversion of Renminbi for capital account items, such as direct investment, loans, securities investment and repatriation of investment, however, is still generally subject to the approval or verification of SAFE.

Under the Administration Rules, enterprises may only buy, sell or remit foreign currencies at banks that are authorized to conduct foreign exchange business after the enterprise provides valid commercial documents and relevant supporting documents and, in the case of certain capital account transactions, after obtaining approval from SAFE or its competent local branches. Capital investments by enterprises outside of China are also subject to limitations, which include approvals by the Ministry of Commerce, SAFE and the National Development and Reform Commission, or their respective competent local branches.

| 10 |

On October 21, 2005, SAFE issued the Circular on Several Issues concerning Foreign Exchange Administration for Domestic Residents to Engage in Financing and in Return Investments via Overseas Special Purpose Companies, or Circular No. 75, which went into effect on November 1, 2005. Circular No. 75 provides that if PRC residents use assets or equity interests in their PRC entities to establish offshore companies or inject assets or equity interests of their PRC entities into offshore companies for the purpose of overseas capital financing, they must register with local SAFE branches with respect to their investments in offshore companies. Circular No. 75 also requires PRC residents to file changes to their registration if their special purpose companies undergo material events such as capital increase or decrease, share transfer or exchange, merger or division, long-term equity or debt investments, provision of guaranty to a foreign party, etc. SAFE further promulgated the Implementing Rules for Circular No. 75, or Circular No. 106, clarifying and supplementing the concrete operating rules that shall be followed during the implementation and application of Circular No. 75.

On August 29, 2008, the Notice of the General Affairs Department of the State Administration of Foreign Exchange on the Relevant Operating Issues concerning the Improvement of the Administration of Payment and Settlement of Foreign Currency Capital of Foreign-funded Enterprises, or the Improvement Notice, was promulgated by SAFE. Pursuant to the Improvement Notice, the foreign currency capital of Foreign Investment Entities, after being converted to Renminbi, can only be used for doing business within the business scope approved by relevant governmental authorities, and shall not be used for domestic equity investment except as otherwise explicitly provided by laws and regulations.

On July 14, 2014, SAFE issued a new Circular on Several Issues concerning Foreign Exchange Administration for Domestic Residents to Engage in Investing and Financing and in Return Investments via Overseas Special Purpose Companies, or Circular No. 37, which enlarges the definition of SPV comparing to the Circular No. 75, which can invest in China under Circular No. 37. The method of investment include forming a new entity in China and through merging or acquiring a domestic company in China.

In March 2015, SAFE released the Circular on Reforming the Management Approach regarding the Foreign Exchange Capital Settlement of Foreign-invested Enterprises, or FIEs, or the Foreign Exchange Capital Settlement Circular, which became effective from June 1, 2015. This circular replaced SAFE’s previous related circulars, including the Circular on Issues Relating to the Improvement of Business Operation with Respect to the Administration of Foreign Exchange Capital Payment and Settlement of Foreign Invested Enterprises. The Foreign Exchange Capital Settlement Circular clarifies that FIEs may settle a specified proportion of their foreign exchange capital in banks at their discretion, and may choose the timing for such settlement. The proportion of foreign exchange capital to be settled at FIEs’ discretion for the time being is 100% and the SAFE may adjust the proportion in due time based on the situation of international balance of payments. The circular also stipulates that FIEs’ usage of capital and settled foreign exchange capital shall comply with relevant provisions concerning foreign exchange control and be subject to the management of a negative list. The FIEs’ capital and Renminbi capital gained from the settlement of foreign exchange capital may not be directly or indirectly used for expenditure beyond the business scope of the FIEs or as prohibited by laws and regulations of the PRC. Such capital also may not be directly or indirectly used for issuing Renminbi entrusted loans except as permitted by the business scope of the FIE, for repaying inter-enterprise borrowings including any third party advance, or for repaying the bank loans denominated in RMB that have been sub-lent to a third party.

On June 9, 2016, SAFE issued the Circular on Reform and Regulating of the Administrative Policy of the Settlement under Capital Accounts, or SAFE Circular 16, which became effective on the same date. Pursuant to SAFE Circular 16, FIEs may either continue to follow the current payment-based foreign currency settlement system or choose to follow the “conversion-at-will” system for foreign currency settlement. Where a foreign-invested enterprise elects the conversion-at-will system for foreign currency settlement, it may convert, in part or in whole, the amount of the foreign currency in its capital account into Renminbi at any time. The converted Renminbi will be kept in a designated account labeled as settled but pending payment, and if such FIE needs to make payment from such designated account, it does not need to go through a lengthy approval process, but instead is only required to declare its intended use for such converted Renminbi. Although Circular 16 effectively simplifies the administrative process for converting foreign currencies into Renminbi for settlement of capital account items, the Notice on Further Promoting the Reform of Foreign Exchange Administration and Improving Authenticity and Compliance Review (Hui Fa [2017] No.3), or the Notice of No.3, released by SAFE on January 26, 2017, requires a domestic company to provide explanations to the banks through which it seeks to exchange currency of the sources of funds for investment and the intended use of such funds. Under Notice No.3, submission of relevant corporate documents, including board resolutions and relevant contracts is also required to support a domestic company’s claim of intended use.

| 11 |

Hong Kong Law

Our website is maintained through a server in the Special Administrative Region of Hong Kong (“HKSAR”). Therefore, our data usage policy and regular terms of service for both our users and merchants must comply with the applicable rules and regulations in HKSAR. As information from our Merchant Clients and Users are preserved in the HKSAR, the law applicable to the Company is the Hong Kong Personal Data (Privacy) Ordinance (Cap 486). Non-compliance of such rules in Hong Kong may result in a fines of up to HKD 500,000. Directors of Moxian Hong Kong may also be personally liable for the Company’s violation of Hong Kong Personal Data (Privacy) Ordinance.

We believe we are in compliance with the laws in the HKSAR.

Intellectual Property

Trademarks

We have registered or applied to register the following trademarks in Mainland China, Hong Kong, and the U.S.:

| Mark | Country of Registration |

Application Number |

Class/Description | Current Owner |

Status | |||||

|

Hong Kong | 302534274 | Class 9: Magnetic data carries, recording discs, data processing equipment and computers Class 35: Advertising, business management, business administration Class 38: Telecommunications Class 40: Treatment of materials Class 41: Entertainment Class 42: Design and development of computer hardware and software | Moxian (Hong Kong) Limited | Registered | |||||

|

America | 85931344 | Class 009: Magnetic data carries, recording discs, data processing equipment and computers Class 035: Advertising, business management, business administration Class 038: Telecommunications Class 040: Treatment of materials Class 041: Entertainment Class 042: Design and development of computer hardware and software | Moxian (Hong Kong) Limited | Registered | |||||

|

China | 13460852 | Class 9: Magnetic data carries, recording discs, data processing equipment and computers | Moxian Shenzhen Technologies Co Ltd | Registered | |||||

| 魔线 | China | 13461178 | Class 38: Telecommunications | Moxian Shenzhen Technologies Co Ltd | Registered | |||||

|

China | 13460714 | Class 42: Design and development of computer hardware and software | Moxian Shenzhen Technologies Co Ltd | Registered | |||||

|

China | 10624504 | Class 42: Design and development of computer hardware and software | Moxian Shenzhen Technologies Co Ltd | Registered |

12

Patents

The Company has terminated its applications for the patents which have previously been reported.

Available Information

The Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Exchange Act, are filed with the SEC. The Company is subject to the informational requirements of the Exchange Act and files or furnishes reports, proxy statements, and other information with the SEC. Such reports and other information filed by the Company with the SEC are available via the Company’s website at www.moxian.com when such reports are available on the SEC’s website at www.sec.gov. The public may read and copy any materials filed by the Company with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Room 1580, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. The contents of these websites are not incorporated into this filing. Further, the Company’s references to the URLs for these websites are intended to be inactive textual references only.

Executive Office

Our principal executive offices are located at Units 9B&C, Block D, Fuhua Tower, 8 Chaomenyang North Street, Chaoyang District, Beijing 100027, China. We maintain a website at www.moxian.com. The information contained on our website is not, and should not be interpreted to be, a part of this report.

Disclosure in response to this item is not required of a smaller reporting company.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Disclosure in response to this item is not required of a smaller reporting company. Nevertheless, the Company does not have any unresolved Staff comments as of the date of this report.

The Company currently does not own any real property. We are currently renting office space in Beijing. The total monthly rent is RMB 144,000 (approximately $21,000 per month). The Company believes that such office space is sufficient for its current needs.

As of the date hereof, we know of no material pending legal proceedings to which we, or any of our subsidiaries, are a party other than as disclosed under “Staff Relations” and in Note 12 to the accompanying notes to the financial statements.

There are no proceedings in which any of our directors, executive officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest. From time to time, we may be subject to various claims, legal actions and regulatory proceedings arising in the ordinary course of business.

ITEM 4. MINE SAFETY DISCLOSURES

None.

13

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock was quoted under the symbol “MOXC” on the OTCQB until November 14, 2016. The Company’s common stock began trading on the NASDAQ Capital Market on November 15, 2016 under the symbol “MOXC”.

For the periods indicated, the following table sets forth the high and low prices per share of common stock. For the period when our common stock was quoted on the OTCQB, the quotations reflect the high and low bids for our shares of common stock based on inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

| Fiscal Year 2018 | High | Low | ||||||

| First Quarter | $ | 3.81 | $ | 2.41 | ||||

| Second Quarter | $ | 3.85 | $ | 2.45 | ||||

| Third Quarter | $ | 3.27 | $ | 1.70 | ||||

| Fourth Quarter | $ | 2.60 | $ | 0.76 | ||||

| High | Low | |||||||

| Fiscal Year 2017 | Bid | Bid | ||||||

| First Quarter * | $ | 4.51 | $ | 2.60 | ||||

| Second Quarter | $ | 3.30 | $ | 2.53 | ||||

| Third Quarter | $ | 3.69 | $ | 2.17 | ||||

| Fourth Quarter | $ | 3.83 | $ | 2.67 | ||||

Holders

As of September 30, 2018 and 2017, we had 67,357,222 and 67,007,199 shares of our common stock issued and outstanding, respectively. There were approximately 400 registered owners of our common stock as December 19, 2018.

Transfer Agent

The transfer agent for our capital stock is Island Stock Transfer, located at 15500 Roosevelt Boulevard, Suite 301, Clearwater, FL 33760. Their telephone number is 727-289-0010 and fax number is 727-289-0069.

Dividend Policy

Any future determination as to the declaration and payment of dividends on shares of our Common Stock will be made at the discretion of our board of directors out of funds legally available for such purpose. We are under no contractual obligations or restrictions to declare or pay dividends on our shares of Common Stock. In addition, we currently have no plans to pay such dividends. Our board of directors currently intends to retain all earnings for use in the business for the foreseeable future.

14

Equity Compensation Plan Information

Currently, there is no equity compensation plan in place.

Unregistered Sales of Equity Securities

On May 8, 2018, we issued in aggregate 350,003 shares of our common stock upon conversion of the US$1 million promissory note due to Ms. Liu. Because the shares were issued in exercise of the notes, we did not receive any proceeds from the sale but instead saw a cancellation of the related debt as a result. The above issuances were made pursuant to the exemption from registration contained in Section 4(a)(2) of the Securities Act and/or Regulation S promulgated under the Securities Act.

Purchases of Equity Securities by the Registrant and Affiliated Purchasers

We have not repurchased any shares of our common stock during the fiscal year ended September 30, 2018.

ITEM 6. SELECTED FINANCIAL DATA

Disclosure in response to this item is not required of a smaller reporting company.

15

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Introduction

The following discussion of our financial condition and results of operations should be read in conjunction with our audited consolidated financial statements and the notes to those consolidated financial statements appearing elsewhere in this report.

Certain statements in this report constitute forward-looking statements. These forward-looking statements include statements, which involve risks and uncertainties, regarding, among other things, (a) our projected sales, profitability, and cash flows, (b) our growth strategy, (c) anticipated trends in our industry, (d) our future financing plans, and (e) our anticipated needs for, and use of, working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipate,” “estimate,” “plan,” “potential,” “project,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend,” or the negative of these words or other variations on these words or comparable terminology. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. You should not place undue reliance on these forward-looking statements.

The forward-looking statements speak only as of the date on which they are made, and, except to the extent required by federal securities laws, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events.

The “Company,” “we,” “us,” “our” or “Moxian” are references to the combined business of the (i) Moxian, Inc., a company incorporated under the laws of Nevada; (ii) Moxian CN Group Limited, a company incorporated under the laws of Independent State of Samoa (“Moxian CN Samoa”), (iii) Moxian Intellectual Property Limited, a company incorporated under the laws of Independent State of Samoa (“Moxian IP Samoa”); (iv) Moxian Group Limited, a company incorporated under the laws of British Virgin Islands (“Moxian BVI”), (v) Moxian (Hong Kong) Limited, a limited liability company incorporated under the laws of Hong Kong (“Moxian HK”), (vi) Moxian Technologies (Shenzhen) Co., Ltd., a company incorporated under the laws of People’s Republic of China (“Moxian Shenzhen”), (vii) Moxian Malaysia Sdn.Bhd. (“Moxian Malaysia”), a company incorporated under the laws of Malaysia (“Moxian Malaysia”), (viii) Moxian Technologies (Beijing) Co., Ltd., a company incorporated under the laws of People’s Republic of China (“Moxian Beijing”), (ix) Moxian Technologies (Shanghai) Co. Ltd., (“Shanghai Moxian”) and (x) Shenzhen Moyi Technologies Co. Ltd., a contractually controlled affiliate of Moxian Shenzhen formed under the laws of People’s Republic of China (“Moyi”).

Overview

The current version of our platform is called “Moxian+” which consists of our user mobile application (“App”) called the Moxian+ User App and a separate App for our Merchant Clients called the Moxian+ Business App. Both versions of the App are currently available in the Google Play Store and the Apple App Store and can be downloaded free of charge. We also have a website that can be accessed at www.moxian.com where either App can also be downloaded.

Moxian principally operates in Shenzhen and Beijing.

16

Financial Condition

As of September 30, 2018, and September 30, 2017, our accumulated deficiency was approximately $47.3 million and $38.6 million, respectively. The consolidated financial statements for the years ended September 30, 2018 and 201 have been prepared on a going concern basis. They do not include any adjustments to reflect the possible future effects on the recoverability and classifications of assets, or the amounts and classifications of liabilities that may result from the inability of the Company to continue as a going concern.

Results of Operations

For the year ended September 30, 2018 compared with the year ended September 30, 2017

Overview

In November 2017, the Company entered into a convertible loan agreement with Ms. Liu, who is a non-independent director of the Company and also the controlling shareholder of Shanghai Shewn. Shanghai Shewn has an established operation based in Shanghai which distributes red wine and related accessories to the neighboring provinces. Shanghai Shewn and Moxian were to collaborate in their marketing and research and development efforts to promote each other’s products for a greater penetration into the market, especially in the provinces of Jiangsu, Zhejiang Hunan and Guangdong.

Shanghai Shewn seconded Yin Yi Jun (“Ethan Yin”) to work with Moxian, initially as a manager but was appointed as the Chief Executive Officer in February 2018 to spearhead these efforts. Over the course of the fiscal year 2018, Ethan Yin began to integrate the research and development efforts of the two companies and concentrated on marketing efforts in the Shanghai Metropolitan region where Shanghai Shewn has a strong base. To enable better coordination between the marketing and the payment of suppliers, some staff were based in the offices of Shanghai Shewn in the Bund area in Shanghai.

A new company, Shanghai Moxian was also incorporated in January 2018.

Gross Revenues

The Company had sales of $339,947 for the year ended September 30, 2018 compared to $92,205 in the year ended September 30, 2017. The higher level of revenue reflects the new sales exposure in Shanghai where the Shewn operations has an established base of small retailers. There was also a maiden contribution of about $52,000 from the sale of advertising space in the Moxian platform.

Operating Expenses

Operating expenses for the years ended September 30, 2018 and 2017 were $8.9 million and $13.7 million, respectively and comprised two major items: research and development expenses and selling, general and administrative charges. In 2017, there was also a charge of $3.0 million taken for the impairment in intangible assets.

Research and development expenses in 2018, at $2.2 million, were marginally higher than the $2.1 million recorded in 2017. In 2018, the Company made a conscious effort to deploy outside consultants to accelerate the development work instead of relying on local full-time staff. This has the advance of a quicker response to the market but also increased related costs in travelling as the outside consultants are based in the United States.

Selling, general and administrative costs in 2018 amounted to $4.8 million lower than the $6.6 million charge as a result of a reduction in advertisement agency fees payable to Xinhua New Media. In fiscal year 2018, the Company shifted its primary focus on sales to research and development as Shanghai Shewn already had a strong sales force so those counterparts in Shenzhen were gradually released through voluntary attrition. In 2017, there were also one-off costs relating to investor relations and the IPO in the first quarter of that fiscal year which explained part of the reduction.

17

Also of note for the decrease in operating expenses were the lower $0.7 million charge for depreciation and amortization against the $1.1 million taken in 2017. This is due to the fact that many of the fixed assets in Shenzhen have been gradually fully provided for as the Company has been in business for more than three years since it commenced its operations inception.

Net Loss

The Company registered a net loss of $8.5 million in 2018 against $13.6 million in 2017. While this apparently reflects an improvement, the revenue base is still weak and cannot sustain the operating costs of the Company even at this lower level.

The O2O landscape in China is extremely competitive and developing at an accelerated level with major players, having established a stronger footing in the market over the last three years, can deliver the momentum in both the merchants’ expectations and the consumers’ demand. It is increasingly difficult for start-up operations to keep pace with industry changes.

Liquidity and Capital Resources

18

Net cash provided by financing activities for the year ended September 30, 2018 was approximately $6.5 million compared with $8.5 million for the year ended September 30, 2017. The Company obtained a $4.0 million credit facility from Ms. Liu in May 2018 and over the course of the next few quarters, drew down on this facility. In addition, the Company also converted the previous $1.0 million convertible loan into equity.

During the year ended September 30, 2017, the Company completed a public offering with gross proceeds of approximately $10 million. After deducting placement agents’ commissions and other offering expenses of approximately $1.0 million, the net proceeds was $9.0 million, of which $500,000 was placed in an indemnification escrow account. In addition, during the year ended September 30, 2017, the Company also received proceeds of approximately $5.8 million from various related party loans and repaid the bulk of such related party loans of approximately $5.9 million with the IPO proceeds.

As of the date of this report, the Company is relying on financial support from its shareholders and a related party. The Company does not envisage a significant improvement in financial condition and is exploring various strategic options which may involve issuing more securities to public or private investors.

If the Company is unable to obtain the necessary additional capital on a timely basis and on acceptable terms, it will have to cause a temporary halt in its operations. Such an action will have a material adverse effect on its business, prospects, financial condition and results of operations and cast substantial doubts about the ability of the Company to continue as a going concern. The accompanying audited consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Foreign Operations

All our business operations are in Mainland China. Accordingly, our results of operations, financial condition and prospects are subject to a significant degree to economic, political and legal developments in the PRC. Operating in the PRC involves substantial risk. For example, our business activities subject us to a number of Chinese laws and regulations, such as anti-corruption laws, tax laws, foreign exchange controls and cash repatriation restrictions, data privacy and security requirements, labor laws, intellectual property laws, privacy laws, and anti-competition regulations. Any of these could change and with immediate effect.. A failure to comply with the PRC laws and regulations could subject us to fines and penalties, make it more difficult or impossible to do business in China and harm our reputation.

19

Critical Accounting Policies and Estimates

Fair value of financial instruments

The Company follows the provisions of ASC 820, “Fair Value Measurements and Disclosures.” ASC 820 clarifies the definition of fair value, prescribes methods for measuring fair value, and establishes a fair value hierarchy to classify the inputs used in measuring fair value as follows:

Level 1-Observable inputs such as unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date.

Level 2-Inputs other than quoted prices that are observable for the asset or liability in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, inputs other than quoted prices that are observable, and inputs derived from or corroborated by observable market data.

Level 3-Inputs are unobservable inputs that reflect management’s assumptions based on the best available information.

The carrying value of cash and cash equivalents, prepayments, deposits and other receivables, accruals and other payables, loans from related parties and unrelated party approximate their fair values because of the short-term nature of these instruments.

Use of estimates

The preparation of the consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the accompanying consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Significant estimates required to be made by management include but not limited to, useful lives of property and equipment, intangible assets valuation, inventory valuation and deferred tax assets. Actual results could differ from those estimates.

Deferred offering costs

Deferred offering costs consisted principally of legal, underwriting and registration costs in connection with the IPO of the Company’s ordinary shares. Such costs are deferred until the closing of the offering, at which time the deferred costs are offset against the offering proceeds.

Impairment of long-lived Assets

The Company classifies its long-lived assets into: (i) computer and office equipment; (ii) furniture and fixtures, (iii) leasehold improvements, and (iv) finite – lived intangible assets.

Long-lived assets held and used by the Company are reviewed for impairment whenever events or changes in circumstances indicate that the carrying value of such assets may not be fully recoverable. It is possible that these assets could become impaired as a result of technology, economy or other industry changes. If circumstances require a long-lived asset or asset group to be tested for possible impairment, the Company first compares undiscounted cash flows expected to be generated by that asset or asset group to its carrying value. If the carrying value of the long-lived asset or asset group is not recoverable on an undiscounted cash flow basis, an impairment is recognized to the extent that the carrying value exceeds its fair value. Fair value is determined through various valuation techniques, including discounted cash flow models, relief from royalty income approach, quoted market values and third-party independent appraisals, as considered necessary.

The Company makes various assumptions and estimates regarding estimated future cash flows and other factors in determining the fair values of the respective assets. The assumptions and estimates used to determine future values and remaining useful lives of long-lived assets are complex and subjective. They can be affected by various factors, including external factors such as industry and economic trends, and internal factors such as the Company’s business strategy and its forecasts for specific market expansion.

20

Revenue recognition

The Company currently recognizes revenue from the sale of merchandise through its online platforms. Revenue is recognized when persuasive evidence of an arrangement exists; delivery has occurred or services have been rendered; the price is fixed or determinable; and collectability is reasonably assured. Revenue was recorded on a gross basis, net of surcharges and value added tax (“VAT”) of gross sales. The Company recorded revenue on a gross basis because the Company has the following indicators for gross reporting: it is the primary obligor of the sales arrangements, is subject to inventory risks of physical loss, has latitude in establishing prices, has discretion in suppliers’ selection and assumes credit risks on receivables from customers.

Revenue from advertising is recognized as advertisements are displayed. Revenue from software development services comprises revenue from time and material and fixed price contracts. Revenue from time and material contracts are recognized as related services are performed. Revenue on fixed price contracts is recognized in accordance with percentage of completion method of accounting.

Foreign currency transactions and translation

The reporting currency of the Company is United States Dollars (the “USD”). The functional currency of Moxian Shenzhen, Moyi and Moxian Beijing is the Renminbi (the “RMB”). The functional currency of Moxian HK is Hong Kong Dollar (the “HKD”), and the functional currency of Moxian Malaysia is Malaysia Ringgit (the “RM”).

For financial reporting purposes, the financial statements of Moxian Shenzhen, Moyi, Moxian Beijing, Moxian HK and Moxian Malaysia, which are prepared using their respective functional currencies, are translated into the reporting currency, United States dollar (“U.S. dollar”) so to be consolidated with the Company’s. Monetary assets and liabilities denominated in currencies other than the reporting currency are translated into the reporting currency at the rates of exchange ruling at the balance sheet date. Revenues and expenses are translated using average rates prevailing during the reporting period. Adjustments resulting from the translation are recorded as a separate component of accumulated other comprehensive loss in stockholders’ deficiency. A translation loss of $42,522 and a translation gain of $108,710 are recognized in the statements of operations and comprehensive loss for the year ended September 30, 2017 and 2016, respectively.

The exchange rates applied are as follows:

| Balance sheet items, except for equity accounts | September 30, 2018 | September 30, 2017 | ||||||

| RMB:USD | 6.8686 | 6.6549 | ||||||

| HKD:USD | 7.8259 | 7.8116 | ||||||

| RM:USD | 4.1370 | 4.2225 | ||||||

Items in the statements of operations and comprehensive loss, and statements cash flows

| Years Ended September 30, | ||||||||

| 2018 | 2017 | |||||||

| RMB:USD | 6.5368 | 6.8135 | ||||||

| HKD:USD | 7.8324 | 7.7799 | ||||||

| RM:USD | 4.0288 | 4.3418 | ||||||

21

Recently Issued Accounting Pronouncements

On October 2, 2017, the FASB has issued Accounting Standards Update (ASU) No. 2017-13, “Revenue Recognition (Topic 605), Revenue from Contracts with Customers (Topic 606), Leases (Topic 840), and Leases (Topic 842): Amendments to SEC Paragraphs Pursuant to the Staff Announcement at the July 20, 2017 EITF Meeting and Rescission of Prior SEC Staff Announcements and Observer Comments.” The ASU adds SEC paragraphs to the new revenue and leases sections of the Codification on the announcement the SEC Observer made at the 20 July 2017 Emerging Issues Task Force (EITF) meeting. The SEC Observer said that the SEC staff would not object if entities that are considered public business entities only because their financial statements or financial information is required to be included in another entity’s SEC filing use the effective dates for private companies when they adopt ASC 606, Revenue from Contracts with Customers, and ASC 842, Leases. This would include entities whose financial statements are included in another entity’s SEC filing because they are significant acquirees under Rule 3-05 of Regulation S-X, significant equity method investees under Rule 3-09 of Regulation S-X and equity method investees whose summarized financial information is included in a registrant’s financial statement notes under Rule 4-08(g) of Regulation S-X. The ASU also supersedes certain SEC paragraphs in the Codification related to previous SEC staff announcements and moves other paragraphs, upon adoption of ASC 606 or ASC 842. The Company does not expect that the adoption of this guidance will have a material impact on its unaudited condensed consolidated financial statements.

On November 22, 2017, the FASB ASU No. 2017-14, “Income Statement—Reporting Comprehensive Income (Topic 220), Revenue Recognition (Topic 605), and Revenue from Contracts with Customers (Topic 606): Amendments to SEC Paragraphs Pursuant to Staff Accounting Bulletin No. 116 and SEC Release 33-10403.” The ASU amends various paragraphs in ASC 220, Income Statement — Reporting Comprehensive Income; ASC 605, Revenue Recognition; and ASC 606, Revenue From Contracts With Customers, that contain SEC guidance. The amendments include superseding ASC 605-10-S25-1 (SAB Topic 13) as a result of SEC Staff Accounting Bulletin No. 116 and adding ASC 606-10-S25-1 as a result of SEC Release No. 33-10403. The Company does not expect that the adoption of this guidance will have a material impact on its unaudited condensed consolidated financial statements.

In February 2018, the FASB issued ASU No. 2018-02, “Reclassification of Certain Tax Effects From Accumulated Other Comprehensive Income.” The ASU amends ASC 220, Income Statement — Reporting Comprehensive Income, to “allow a reclassification from accumulated other comprehensive income to retained earnings for stranded tax effects resulting from the Tax Cuts and Jobs Act.” In addition, under the ASU, an entity will be required to provide certain disclosures regarding stranded tax effects. The ASU is effective for all entities for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. The Company does not expect that the adoption of this guidance will have a material impact on its unaudited condensed consolidated financial statements.