Attached files

| file | filename |

|---|---|

| EX-10.7 - LOAN AGREEMENT DATED MAY 4, 2016 BY AND BETWEEN JET KEY LIMITED AND MOXIAN MALAY - Moxian, Inc. | f10k2016ex10vii_moxianinc.htm |

| EX-32.2 - CERTIFICATION - Moxian, Inc. | f10k2016ex32ii_moxianinc.htm |

| EX-32.1 - CERTIFICATION - Moxian, Inc. | f10k2016ex32i_moxianinc.htm |

| EX-31.2 - CERTIFICATION - Moxian, Inc. | f10k2016ex31ii_moxianinc.htm |

| EX-31.1 - CERTIFICATION - Moxian, Inc. | f10k2016ex31i_moxianinc.htm |

| EX-23 - CONSENT OF CENTURION ZD CPA LTD. (FKA DCAW (CPA) LTD. AS SUCCESSOR TO DOMINIC K. - Moxian, Inc. | f10k2016ex23_moxianinc.htm |

| EX-10.27 - SCHEDULE OF LOAN AGREEMENTS SUBSTANTIALLY IDENTICAL IN ALL MATERIAL RESPECTS TO - Moxian, Inc. | f10k2016ex10xxvii_moxianinc.htm |

| EX-10.26 - LOAN AGREEMENT BY AND BETWEEN THE MOXIAN TECHNOLOGIES (SHENZHEN) CO., LTD. AND S - Moxian, Inc. | f10k2016ex10xxvi_moxianinc.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2016

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File No. 000-55017

| MOXIAN, INC. | ||

| (Exact Name of Registrant as Specified in its Charter) | ||

| Nevada | 27-3729742 | |

| (State or Other Jurisdiction

of Incorporation or Organization) |

(I.R.S. Employer

Identification No.) |

| Block A, 9/F, Union Plaza, 5022 Binjiang Avenue, Futian District Shenzhen City, Guangdong Province, China | Tel: +86 (0) 755-66803251 | |

| (Address of Principal Executive Offices and Zip Code) | (Registrant’s Telephone Number, Including Area Code) |

Securities registered pursuant to Section 12(b) of the Securities Exchange Act: None

Securities registered pursuant to Section 12(g) of the Securities Exchange Act: Common Stock, par value $0.001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ☐ No ☒

The aggregate market value of the voting common equity held by non-affiliates based upon the price at which Common Stock was last sold as of March 31, 2016, the last business day of the registrant’s most recently completed second fiscal quarter was approximately $49,953,632.

As of December 19, 2016, the number of shares of the registrant’s common stock outstanding was 66,507,199.

FORM 10-K

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2016

TABLE OF CONTENTS

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

| ● | The availability and adequacy of our cash flow to meet our requirements; |

| ● | Changes or developments in laws, regulations or taxes in our industry; |

| ● | Competition in our industry; |

| ● | The loss of or failure to obtain any license or permit necessary or desirable in the operation of our business; |

| ● | Changes in our business strategy, capital improvements or development plans; |

| ● | The availability of additional capital to support capital improvements and development; and |

| ● | Other risks identified in this report and in our other filings with the Securities and Exchange Commission or the SEC. |

This report should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Defined Terms

Except as otherwise indicated by the context, references in this report to:

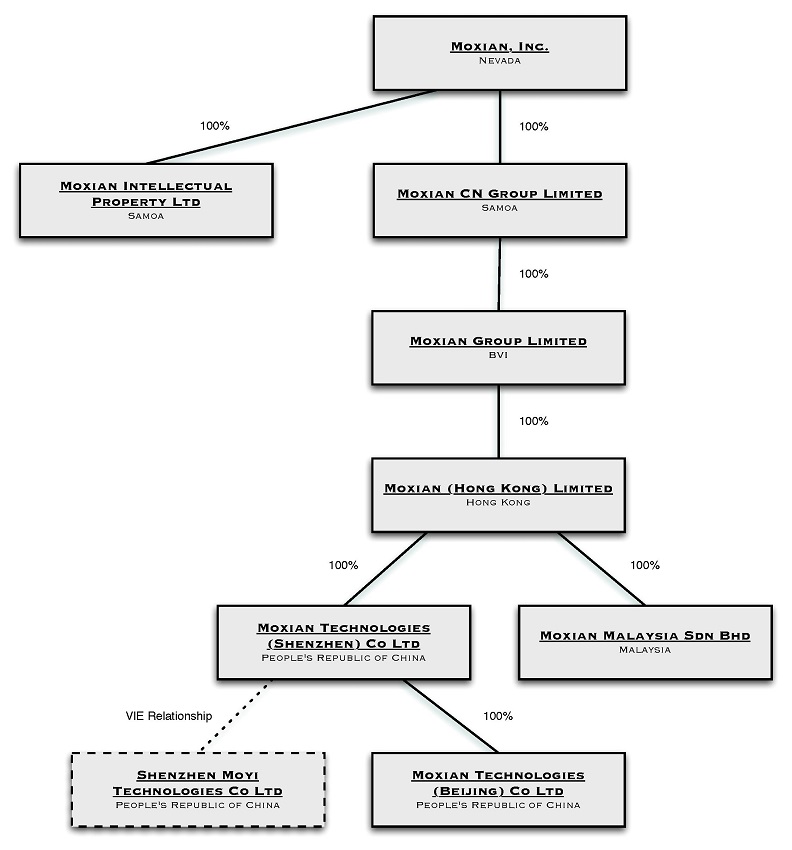

| ● | The “Company,” “we,” “us,” “our” or “Moxian” are references to the combined business of the (i) Moxian, Inc., a company incorporated under the laws of Nevada; (ii) Moxian CN Group Limited, a company incorporated under the laws of Independent State of Samoa (“Moxian CN Samoa”), (iii) Moxian Intellectual Property Limited, a company incorporated under the laws of Independent State of Samoa (“Moxian IP Samoa”); (iv) Moxian Group Limited, a company incorporated under the laws of British Virgin Islands (“Moxian BVI”), (v) Moxian (Hong Kong) Limited, a limited liability company incorporated under the laws of Hong Kong (“Moxian HK”), (vi) Moxian Technologies (Shenzhen) Co., Ltd., a company incorporated under the laws of People’s Republic of China (“Moxian Shenzhen”), (vii) Moxian Malaysia SDN BHD (“Moxian Malaysia”), a company incorporated under the laws of Malaysia (“Moxian Malaysia”), (viii) Moxian Technologies (Beijing) Co., Ltd., a company incorporated under the laws of People’s Republic of China (“Moxian Beijing”) and (ix) Shenzhen Moyi Technologies Co. Ltd., a contractually controlled affiliate of Moxian Shenzhen formed under the laws of People’s Republic of China (“Moyi”). |

| ● | “Common Stock” refers to the Company’s common stock, par value $0.001; |

| ● | “PRC” refers to the People’s Republic of China; |

| ● | “HK” refers to Hong Kong; |

| ● | “U.S. dollar,” “$” and “US$” refer to the legal currency of the United States; |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended; and |

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended. |

Unless otherwise noted, all currency figures in this filing are in U.S. dollars. References to "yuan" or "RMB" are to the Chinese yuan (also known as the Renminbi).

ii

Corporate History and Corporate Structure

Moxian, Inc. (the “Company,” “Moxian,” “we,” “us,” or “our”) was incorporated in the State of Nevada on October 12, 2010 and was formerly known as SECURE NetCheckIn Inc. We previously engaged in the business of offering a cloud-based scheduling and notification product targeted to urgent care facilities and medical offices to increase the satisfaction of patients in the scheduling and timing of appointments.

On February 17, 2014, the Company incorporated Moxian CN Samoa under the laws of the Independent State of Samoa.

On February 21, 2014, we acquired Moxian BVI, together with its subsidiaries, Moxian HK, Moxian Shenzhen, and Moxian Malaysia through our wholly owned subsidiary, Moxian CN Samoa from Rebel Group, Inc. (“REBL”), a company incorporated in the State of Florida and of which our Chief Executive Officer, James Mengdong Tan, is a promoter as the term is defined under Rule 405 of Regulation C promulgated under the Securities Act, by entering into a License and Acquisition Agreement (the “License and Acquisition Agreement”) in consideration of $1,000,000 (“Moxian BVI Purchase Price”). As a result, Moxian BVI, together with its subsidiaries, Moxian HK, Moxian Shenzhen, and Moxian Malaysia, became our subsidiaries. Under the License and Acquisition Agreement, REBL also agreed to grant us the exclusive right to use REBL’s intellectual property rights (collectively, the “IP Rights”) in Mainland China, Malaysia, and other countries and regions where REBL conducts its business (the “Licensed Territory”), and the exclusive right to solicit, promote, distribute and sell REBL products and services in the Licensed Territory for five years (the “License,”) and in consideration of such License, the Company agreed to pay to REBL (i) $1,000,000 as license maintenance royalty each year commencing on the first anniversary of the date of the License Agreement; and (ii) 3% of the gross profits resulting from the distribution and sale of the products and services on behalf of the Company as an earned royalty.

Moxian BVI was incorporated on July 3, 2012 under the laws of the British Virgin Islands.

Moxian HK was incorporated on January 18, 2013 and became Moxian BVI’s subsidiary on February 14, 2013. Moxian HK is currently engaged in the business of online social media and plans to launch its business in China.

Moxian Shenzhen was invested in and wholly owned by Moxian HK. Moxian Shenzhen was incorporated on April 8, 2013 and is engaged in the business of internet technology, computer software, and commercial information consulting.

Moxian Malaysia was incorporated on March 1, 2013 and became Moxian HK’s subsidiary on April 2, 2013. Moxian Malaysia is conducting its business in the IT Services and Media Advertising industries.

Shenzhen Moyi Technologies Co., Ltd. (“Moyi”) was incorporated on July 19, 2013 under the laws of the People’s Republic of China and became a variable interest entity (“VIE”) of Moxian Shenzhen since July 15, 2014. Moxian Shenzhen controls Moyi through arrangement that absorbs operations risk, as if Moyi were a wholly-owned subsidiary of Moxian Shenzhen.

Moxian Technologies (Beijing) Co., Ltd. (“Moxian Beijing”) was incorporated on December 10, 2015 under the laws of the People’s Republic of China and was a wholly-owned subsidiary of Moxian Shenzhen. Moxian Beijing is engaged in the business of internet technology, computer software, and commercial information consulting.

On February 17, 2014, Moxian IP Samoa was incorporated in the State of Samoa as a wholly-owned subsidiary of REBL. On February 19, 2014, Moxian HK and Moxian Shenzhen entered into an Assignment and Assumption Agreement with Moxian IP Samoa, whereby Moxian HK and Moxian Shenzhen assigned and transferred all of the intellectual property rights that they respectively owned in connection with the Moxian business to Moxian IP Samoa in consideration of $1,000,000.

On January 30, 2015, the Company entered into an Equity Transfer Agreement (the “Equity Transfer Agreement,” such transaction, the “Equity Transfer Transaction”) with REBL, to acquire from REBL 100% of the equity interests of Moxian IP Samoa for $6,782,000 (the “Moxian IP Samoa Purchase Price”). Moxian IP Samoa owns all the intellectual property rights relating to the operation, use and marketing of the Moxian Platform, including all of the trademarks, patents and copyrights that are used in the Company’s business. As a result of the Equity Transfer Transaction, Moxian IP Samoa became a wholly-owned subsidiary of the Company.

In addition, under the Equity Transfer Agreement, the Company and REBL agreed to terminate the License and Acquisition Agreement. Immediately prior to the execution of the Equity Transfer Agreement, the Moxian BVI Purchase Price was not yet paid and no license maintenance royalty or earned royalty under the License and Acquisition Agreement had accrued.

Under the Equity Transfer Agreement, the Company and REBL agreed to extinguish all of the Company’s liabilities owed to REBL under the License and Acquisition Agreement, other than the Moxian BVI Purchase Price.

The Company agreed to issue to REBL a convertible promissory note for $7,782,000 (the “Rebel Note”), representing the sum of the Moxian IP Samoa Purchase Price and the Moxian BVI Purchase Price. The Rebel Note was due and payable on October 30, 2015 without any interest. The Company had the option to cause REBL to convert any and all amounts due under the Rebel Note into shares of the Company’s Common Stock at the conversion price of $1.00 per share (the “Conversion Price”), if the volume weighted average price (the “VWAP”) of the Company’s Common Stock for a period of 30 trading days immediately prior to the date of conversion was higher than the Conversion Price. The Company also had a right of first refusal to purchase the shares issuable upon conversion of the Rebel Note at the price of 80% of the VWAP for 30 trading days immediately prior to the date of the proposed repurchase by the Company.

On August 14, 2015, the VWAP of the Company’s Common Stock for 30 trading days prior to August 14, 2015 was higher than $1.00, which triggered the conversion of the Rebel Note. The Company notified REBL that it elected to cause it to convert $3,891,000 of the Rebel Note into 3,891,000 shares of its Common Stock (the “August Conversion”). As a result of the August Conversion, the remaining amount of the Rebel Note was $3,891,000.

| 1 |

On September 30, 2015, the Company notified REBL that it elected to cause it to convert the remainder of the Rebel Note into 3,891,000 shares of the Company’s Common Stock (the “September Conversion”). After the August Conversion and September Conversion, the entire balance of the Rebel Note was converted into total of 7,782,000 shares of the Company’s Common Stock.

On November 14, 2016, the Company announced the completion of a public offering of 2,501,250 shares of its common stock at a public offering price of $4.00 per share. The net proceeds from the offering is approximately $8.5 million after deducting placement agents' commissions and other estimated offering expenses. In connection with the offering, the Company's common stock began trading on the NASDAQ Capital Market on November 15, 2016 under the symbol "MOXC".

The following diagram sets forth the structure of the Company as of the date of this report:

Our web site address is www.moxian.com. Information contained on our web site is not part of this report on Form 10-K or our other filings with the Securities and Exchange Commission (“SEC”).

| 2 |

Overview

We are in the O2O (“Online-to-Offline”) business. With respect to our business, O2O means providing an online platform for small and medium sized enterprises (“SMEs”) with brick and mortar businesses that allows them to conduct business, interact with existing customers and obtain new customers online. We refer to our customers as “Merchant Clients” and we use the term “Users,” to refer to those existing and potential customers of our Merchant Clients who use our mobile application and platform. Through the features, products and services offered on our platform, we seek to create interactions between Users and Merchant Clients, which will allow Merchant Clients to study consumer behavior. Our platform has five main components that allow Merchant Clients to conduct targeted advertising campaigns and promotions, which we believe are effective because they are geared to the customers that a Merchant Client wishes to attract. Our platform is also designed and built to encourage Users to return and refer new Users, each of which is a potential customer for our Merchant Clients.

We believe we are different from other companies in that our plan is to sign up merchants first and build our user base utilizing their customers. Many companies utilize a different strategy of building up a user base and then signing up paid merchants and other clients to access that user base.

The current version of our platform is called “Moxian+” which consists of our user mobile application (the “App” and collectively the “Apps”) called the Moxian+ User App and a separate App for our Merchant Clients called the Moxian+ Business App. Both versions of the App are currently available in the Google Play Store and the Apple App Store. There is no charge to download either App. We also have a website that can be accessed at www.moxian.com where either App can also be downloaded.

Moxian principally operates in mainland China with its headquarters in Shenzhen, China. We launched Moxian version 1.0 which only consists of the User component App in Malaysia in June 2013 and subsequently in China in July 2014. During 2014 to 2015, we developed the Apps as part of “Moxian+,” the successor to Moxian version 1.0 which was officially launched in October 2015 in China only. In December 2015, we opened our Beijing office. We are currently operating in both Shenzhen and Beijing.

We are currently in the process of expanding our operations to Shanghai and Guangzhou.

Market Opportunities

China currently has more than 850 million users actively utilizing mobile applications (http://news.xinhuanet.com/english/2015-11/10/c_134802668.htm). In 2014, the China Internet Network Information Center reported that there were approximately 618 million internet users throughout Asian countries, representing a penetration rate of approximately 46 percent. Among these internet users, over 90 percent have a social media account. For comparison, just 67 percent of U.S. internet users engage in social media. However, the opportunity in China extends beyond the ability to reach a large target audience. According to the Data Center of China Internet, 38 percent of users claim they are more likely to buy items recommended by other social media users (Statistical Report on Internet Development in China by China Internet Network Information Center, 2014).

O2O platforms serve to substantially enhance marketing and commerce performance for brands and retailers compared to traditional digital marketing approaches. O2O refers to any and all activities that originate online and eventually result in a shopper going to a physical store. Forrester Research predicts that by 2016, more than half of the $3.5 trillion spent in offline US retail will be influenced by the websites (Forrester’s US Cross-Channel Retail Forecast, 2011 To 2016).

According to official statistics, China’s O2O market reached 98.7 billion yuan (approximately US$9 billion) in 2011. Industry analysts anticipate that the China O2O market will quadruple to 418 billion yuan (approximately US$67 billion) in 2016 (http://www.prnewswire.com/news-releases/chinas-o2o-market-the-path-to-success-is-not-uni-directional-201906281.html). Moxian believes it will be able to capture a share in this market by offering its platform to merchants. Our platform allows users to be aware of their interested merchants’ on-going promotions so as to attract them to make purchases offline.

Products and Services

Subscription Packages for Moxian+ Business App Merchant Clients

The Moxian+ Business App is solely for use by Merchant Clients. Moxian+ Business App allows them to manage their presence within the Moxian+ platform, plan a campaign, offer discounts, manage payments and receive analytics. We offer free and paid subscription packages to use the Moxian+ Business App. We have three subscription levels. Our basic account is free, our gold account is $1,200 per year and our diamond account is offered at $2,000 per year.

With a basic account subscription, Merchant Clients get a “Do It Yourself” webpage and they can use different modules in their account, including the business address, business phone number and list up to 5 products that they can offer for sale through our e-commerce feature. The following benefits are available to Merchant Clients that have a basic account:

| ● | A webpage to create an online shop | |

| ● | Ability to interact with customers through MO-Talk, a voice chat service | |

| ● | Receive basic analytics reports | |

| ● | Provide rewards to Users |

| 3 |

When a Merchant Client purchases one of our paid subscription packages, in addition to the features provided in the basic account, Merchant Clients also have access to a more extensive set of tools on our platform, which allows them to

| ● | Send out messages to targeted customers | |

| ● | Receive more detailed analytics reports | |

| ● | Social Customer Relationship Management (“SCRM”) | |

| ● | Fan rewards | |

| ● | Events Hosting | |

| ● | Vouchers and Product Listing | |

| ● | Features for multiple store locations |

Moxian+ User App for Users

Our Users are referred to as “MO-Pals” within the User App. They can download and use the User App for free. Users provide basic information to sign up for a Moxian+ account and then they can invite friends and family members to join Moxian+, search and join different interest groups, and participate in social media by sharing activities, stories, photos and videos, sending micro-blog messages, playing online games in Moxian+’s game center, and earning MO-Coins, a virtual currency similar to credit card reward points which are explained further below.

The Moxian+ User App has a variety of features to attract and retain Users. The Moxian+ User App also provides access to a social media platform with a package of services to provide interaction with other Users and Merchant Clients:

| ● | Interact with other Users through MO-Talk; | |

| ● | News Center with daily news items under “Hot Topics,” “Hot Events” and “Nearby People;” | |

| ● | Game Center to earn MO-Points; | |

| ● | Shop at Merchants’ Online Stores by credit card or MO-Coins; and | |

| ● | MO-Shake allows Users to shake their phone to win: vouchers; MO-Coins or MO-Points; and coupons, discounts or admission to other events hosted by Merchant Clients which are in the vicinity of the User. |

Services for Merchant Clients

Social Customer Relationship Management (“SCRM”)

Our SCRM is built to allow Merchant Clients to input their customer details into the system. The SCRM can then follow the customers’ activities and allows Merchant Clients to send promotional messages and advertisements to Users through our platform.

Targeted Marketing

Our Targeted Marketing tool is offered to paid Merchant Clients only. Its feature allows our Merchant Clients to contact their targeted Users directly by sending messages, promotions and vouchers to a specific range of customers, such as customers who have visited their store in the past week or month or customers who have upcoming birthdays. Merchant Clients can send Users discounts or messages and target people by age, gender or other criteria. We also provide targeted marketing to assist Merchant Clients to reach customers more efficiently. For example, we can generate a list of customers who have browsed a Merchant Client’s products over the past two months more than once, but not made a purchase, and a discount can be offered to them for certain products. In addition, Merchants Clients can find Users near their physical shops (within 1,000 meters) and invite them to their stores.

Analytics Reports

Detailed reports are provided to paid Merchant Clients. These reports allow Merchant Clients to see the number of followers they have, the number of points redeemed and rewarded, and the number of vouchers purchased or redeemed offline. Merchant Clients with a free account receive only basic analytics, such as how many MO-points have been distributed. However, for paid accounts, Merchant Clients receive more detailed analytics regarding the buying patterns and likes of current and potential customers.

Merchant Clients can provide rewards to customers by including their customer’s mobile number. Customers who have installed the Moxian+ User App can then receive rewards on the platform in the form of MO-Points or discount vouchers. Customers who do not have the Moxian+ User App installed will receive a text message informing them of their rewards and that they can download the Moxian+ User App to redeem them.

Event Hosting

Merchant Clients can host events through the platform and invite Users within a selected range, such as by proximity, common interest, or gender to participate in the event.

| 4 |

Vouchers and Product Listings

Merchant Clients can customize coupons or vouchers on the platform, daily or with whatever frequency they wish, or list available products.

Multiple store features

For those Merchant Clients which have multiple stores in different locations, our platform allows different stores to access to the same account. Moreover, different stores may be differentiated for which information they can access to by entering their location in the app.

Webpage to Create an Online Shop

We provide a Do it Yourself Webpage to create an online shop. The Merchant Client can include its logo, its product/service category, telephone number, and other information that is relevant to the business. The Shop will appear in the Moxian+ User App. A Merchant Client can manage its own shop by adding more information, posting events, offers, and discounts.

Our Platform

There are five components to our Moxian+ platform, which is the backend of our application. The Moxian+ platform includes the social media engine, the e-commerce engine, the rewards engine, the gamification engine, and the analytical engine.

Social Media Engine

Our data use policy governs the use of information that users have chosen to share and present. We also design our products to include robust safety tools. These tools are coupled with partnerships with online safety experts to offer protection for all users, particularly teenagers. We work with law enforcement to help promote the safety of our users as required by law. To the extent permissible, and with prior consent from the Users, we analyze User’s information to understand the User’s behavior.

E-Commerce

Utilizing our e-commerce features, Merchant Clients are able to conduct business by posting products, offering coupons and sales as well as creating events and blogs through the Moxian+ Business App. On the other hand, Users can shop at the Merchant Clients’ shops like at any other e-commerce platform by ordering online and receiving the products by express delivery.

Rewards

Users are rewarded with MO-Points and MO-Coins. MO-Points are points granted to Users when they shop at Merchant Clients, play games on our platform or engage in other activities sponsored by the Merchant Clients. MO-Points can be redeemed at the Merchant Clients’ shops as determined by the Merchant Clients, or can be redeemed for MO-Coins which are virtual currency and can be used at any Merchant Client’s stores. MO-Coins are backed by cash paid by Merchant Clients which is held in an escrow account. They can be redeemed for cash, or used to purchase more MO-Points. The ratio of MO-Coins to actual currency is currently set at 1:1. A Merchant Client who pays for MO-Coins can also redeem them for cash.

MO-Points and MO-Coins are traceable and trackable on the Moxian+ platform through designated serial number so that we can see exactly what Users do with them and use that information to assist our Merchant Clients to determine customer behaviors.

From time to time, we may also give away MO-Points or MO-Coins as a promotion to increase our User base. We also plan to have our own “shopping mall” with merchandise that Users can purchase with MO-Points and MO-Coins in the upcoming year.

Gamification

Together with outside contractors we develop games for Users to earn MO-Points and MO-Coins and other rewards which may be specific to a certain Merchant Client. Users can use MO-Points to play games offered in our game center.

Analytical Engine

Moxian provides analytics to each Merchant Client for the consumer behavior Moxian learns through its platform to assist our Merchant Clients to better design their promotions and reach their target audience. We analyze consumer behavior through “likes” of posts by certain merchants or the places they tend to “check-in” to, to determine their usual hang out.

News Center

On “Hot Topics,” the most popular topics and related blogs, news, and journals being discussed among Users will be displayed, so that Users can stay informed in real time. “Hot Events” provide information about events to be hosted by Merchant Clients, and they are categorized by different interests. In addition, Users will be able to see the list of other nearby Users, with information that a User may be willing to have displayed.

| 5 |

Advertisements

On December 31, 2015, the Company entered into an Exclusive Partnership Agreement with Xinhua New Media Culture Communication Co. Ltd. (“Xinhua New Media”), pursuant to which the Company is engaged to operate and resell the advertisement space for the Xinhua New Media App.

The Company plans to expand its sales force to include an advertisement sales team to promote the Xinhua New Media App advertisement space. In addition to selling the Xinhua Advertisement space, the sales team will also be selling our own advertisement space on Moxian platform.

We believe that we will benefit from the partnership with Xinhua New Media in two ways:

Firstly, Traction and growth of users. Users of the Xinhua New Media App will be rewarded with Mo-Coins and Mo-Points when engaging in interactive activities, such as clicking on any advertisements, within the platform. These Xinhua New Media App users are expected to then log into Moxian Platform to redeem their Mo-Coins and Mo-Points. This will allow us to grow our user base.

Secondly, Cross-Selling. We will bundle our Moxian+ Merchant App with the advertisement space on the Xinhua New Media App and offer a package deal to merchants. The package deals will only be offered to large-scale customers who have chain-shops based in China.

In addition, we are also the exclusive operator and partner for the gaming platform included in the Xinhua New Media App. Moxian charges a fee for operating the gaming platform, which generate revenues from advertisement, sponsorship and profit sharing arrangements with gaming companies.

Transaction Fees

All transactions carried across our platform is done through our virtual currency. We charge a fee for any transaction carried on our platform within a range of 3% to 5% of the transaction price.

White-Label Solution

We offer large scale merchants the option to “white label” our Moxian+ Merchant and User App. We charge a yearly fee to the merchants. White-label merchants sell Moxian+ Merchant and User App in their own names. We also offer customization of Moxian+ Merchant and User App at the request of merchants for an additional fee.

Marketing Strategy

Our success is dependent upon signing up paid Merchant Clients. The Merchant Clients, in turn, build up our base of Users by encouraging their customers to download our User App and they can offer MO-Points and MO-Coins to attract people to download our App. In order to attract more Merchant Clients, we also need to have an established base of Users. Therefore, we are currently making efforts to sign up more Merchant Clients, as well as attempting to get more Users to download our User App.

We initially marketed to merchants in Shenzhen, China only where we launched Moxian version 1.0. Although this was a beta test, we were able to get 30,000 merchants to sign up. We are currently targeting these same merchants for Moxian+ and expanding the user base.

We currently have a sales force of 20 people based in Shenzhen, China. In addition, we opened an office in Beijing and plan to have a sales force of 80 people there by the beginning of 2017.

We are currently scheduling sales events in Shenzhen for the Christmas and Chinese New Year seasons to promote our products and services to our initial Merchant Clients and give away MO-Points and MO-Coins.

In the future, we also plan to utilize third party distributors with an existing base of merchants to market our products.

Competition

Although major global social network platform providers have the advantage of an existing user base, we believe Moxian has a unique social business model and social media features that enable us to stand out among the competition. Other major social networking platforms usually focus on personal photo sharing, video sharing, chat features, group chatting, micro-blogging, following groups’ online activities, rating and commenting on products and services. What we believe makes Moxian stand out is that our Merchant Clients have: (i) their own promotion pages, (ii) local event programs for their customer Users, (iii) location-based promotion information, (iv) mobile chat applications, (v) free prizes for the Users, (vi) advertising on Moxian’s social pages, (vii) a social customer relationship management systems, (viii) a loyalty program using MO-Points and MO-Coins, and (ix) customized online games to promote merchants’ brands and group sales promotions. Therefore, by establishing our Merchant Client base first, we believe that our user acquisition will be easier to build up.

| 6 |

In China, we face stiff competition. Our major competitor in China is Dazhong Dianping (“Dianping”). Dianping targets merchant clients as we do. In addition, Dianping also offers merchants a customized page, location based promotion information and a relationship management tool. The other principal competitors are Nuomi, Meituan and WeChat.

However, we believe Moxian+ is superior for SMEs because our SCRM offers Merchant Clients the ability to interact with their customers via instant messenger. In addition, we offer virtual currencies that can entice and encourage repeated visits by the Users.

Our Technology

Technology is the key to our success in achieving efficiency for our business, improving the user experience and enabling innovation. We employ a team of over 80 engineering and data analytics personnel to build our technology platform and develop new online and mobile products. Key components of our technology include:

Data Science

Our data science technology serves various types of data-intensive computational needs, including deep learning, high-volume batch processing and multi-variable and multi-dimensional real-time analytics. Data mining and transaction, payment and behavioral data science capabilities are used extensively in numerous applications such as search and online marketing.

Security

We take various steps to ensure the security of the Moxian+ platform and the personal information of users of the platform, as well as the ecommerce transactions conducted on the platform. We conduct daily testing and have engaged an outside security consultant to conduct further testing and make recommendations as to additional security measures.

| 7 |

Foreign Operations

Substantially all of our business operations are conducted in Mainland China. Accordingly, our results of operations, financial condition and prospects are subject to a significant degree to economic, political and legal developments in the PRC. We also have operations in Hong Kong. Operating in foreign countries involves substantial risk. For example, our business activities subject us to a number of Chinese laws and regulations, such as anti-corruption laws, tax laws, foreign exchange controls and cash repatriation restrictions, data privacy and security requirements, labor laws, intellectual property laws, privacy laws, and anti-competition regulations, which have uncertainties. Any failure to comply with the PRC laws and regulations could subject us to fines and penalties, make it more difficult or impossible to do business in China and harm our reputation.

Operating in foreign countries also subjects us to risk from currency fluctuations. Our primary exposure to movements in foreign currency exchange rates relates to non-U.S. dollar denominated sales and operating expenses. The weakening of foreign currencies relative to the U.S. dollar adversely affects the U.S. dollar value of our foreign currency-denominated sales and earnings. This could either reduce the U.S. dollar value of our prices or, if we raise prices in the local currency, it could reduce the overall demand for our offerings. Either could adversely affect our revenue. Conversely, a rise in the price of local currencies relative to the U.S. dollar could adversely impact our profitability because it would increase our costs denominated in those currencies, thus adversely affecting gross margins.

Research and Development

There are 60 people in the Research & Development department, which is responsible for developing and improving the mobile application, Moxian platform and customer experience in using our products. During the past two fiscal years, we spent approximately $2.6 million and $1.5 million on research and development for the years ended September 30, 2016 and 2015, respectively.

Employees

We have a total of 160 employees, of which we have 21 employees in the product team, 60 employees in research and development team, 26 employees in sales and marketing department, 17 employees in customer and technical support team and the remaining in the administrative department. We consider our employee relations to be good, and to date have not experienced a work stoppage due to a labor dispute.

PRC Law

Overview

Extensive regulatory schemes governing the operation of business with respect to telecommunications and Internet information services were published by the Chinese government. Besides the Ministry of Industry and Information Technology and State Administration of Radio, Film and Television, which regulates radio and television stations in China (“SARFT”), the various services of the PRC Internet industry are also regulated by various other governmental authorities, such as the State Council Information Office (“SCIO”), the General Administration for Press and Publication (“GAPP”), and the Ministry of Public Security.

Among all the regulations, the Telecommunications Regulations of the People’s Republic of China, promulgated on September 25, 2000, is the primary governing law. The Telecom Regulations set out the general framework under which domestic Chinese companies such as the Company’s subsidiaries and VIE may engage in various types of telecommunications services in the PRC. They reiterate the long-standing principle that telecommunications service providers need to obtain operating licenses as a mandatory precondition to begin operation.

The Chinese government restricts foreign investment in Internet-related businesses. Accordingly, we operate our Internet-related businesses in China through Moyi, our VIE operating in Shenzhen, China.

Internet Information Services

The governing law for Internet information service is the Measures for the Administration of Internet Information Services, or the Internet Content Provider (“ICP”) Measures, which went into effect on September 25, 2000. Under the ICP Measures, any entity that provides information to online Internet users must obtain an operating license from Ministry of Industry and Information Technology (“MIIT”) or its local branch at the provincial level in accordance with the Telecom Regulations described above. The ICP Measures further stipulate that entities providing online information services in areas of news, publishing, education, medicine, health, pharmaceuticals and medical equipment must obtain permission from responsible national authorities prior to applying for an operating license from MIIT or its local branch at the provincial or municipal level. Moreover, ICPs must display their operating license numbers in a conspicuous location on their websites. ICPs must police their websites to remove categories of harmful content that are broadly defined.

Currently, Moyi holds an ICP license which was issued on January 22, 2014.

| 8 |

Online Privacy

Chinese law does not prohibit internet service providers from collecting and analyzing personal information from their users if the users agree to do so. The PRC government, however, has the power and authority to order internet service providers to submit personal information of an internet user if such user posts any prohibited content or engages in illegal activities on the internet.

Under the Several Provisions on Regulating the Market Order of Internet Information Services (“Order”) promulgated by the MIIT which became effective on March 15, 2012, internet service providers may not, without a user’s consent, collect the user’s personal information that can be used, alone or in combination with other information, to identify the user, and may not provide any user’s personal information to third parties without the prior consent of the user. Internet service providers may only collect users’ personal information necessary to provide their services and must expressly inform the users of the method, scope and purpose of the collection and processing of such information. They are also required to ensure the proper security of users’ personal information, and take immediate remedial measures if such information is suspected to have been inappropriately disclosed. When a User registers to our application, we require our users to accept a user agreement whereby they agree to provide certain personal information to us. We will take other measures as necessary to comply with these provisions.

ICPs are also required to establish and publish their rules relating to personal information collection or use, keep any collected information strictly confidential, and take technological and other measures to maintain the security of such information. ICP operators are required to cease any collection or use of the user personal information, and de-register the relevant user account, when a given user stops using the relevant Internet service. ICP operators are further prohibited from divulging, distorting or destroying any such personal information, or selling or providing such information unlawfully to other parties. In addition, if an ICP operator appoints an agent to undertake any marketing and technical services that involve the collection or use of personal information, the ICP operator is still required to supervise and manage the protection of the information. As to penalties, in very broad terms, the Order states that violators may face warnings, fines, and disclosure to the public and, in most severe cases, criminal liability.

Currently, our collection of the information from the Users is agreed to by the Users when they sign up. In addition, any data mining or analyzing of the user data is for internal use only. We also take steps to ensure that the data collected is stored securely.

Internet Publishing

On June 27, 2002, SPPA and MIIT jointly released the Provisional Rules for the Administration of Internet Publishing, or the Internet Publishing Rules, which define “Internet publications” as works that are either selected or edited to be published on the Internet or transmitted to end-users through the Internet for the purposes of browsing, reading, using or downloading by the general public. Such works mainly include content or articles formally published by press media such as: (i) books, newspapers, periodicals, audio-visual products and electronic publications; and (ii) literature, art and articles on natural science, social science, engineering and other topics that have been edited.

According to the Internet Publishing Rules, web portals like Moxian are required to apply to and register with GAPP before distributing Internet publications. Moxian plants to apply this license at the beginning of 2017.

Online Games

On May 10, 2003, the Provisional Regulations for the Administration of Online Culture were issued by the Ministry of Culture (“MCPRC”) and went into effect on July 1, 2003 (these regulations were revised by MCPRC on July 1, 2004). According to these regulations, commercial entities are required to apply to the relevant local branch of MCPRC for an Online Culture Operating Permit to engage in online games services.

On July 27, 2004, GAPP and the State Copyright Bureau jointly promulgated the Notice on Carrying out the Decision from the State Council Regarding the Approval of Electronic and Online Games Publications, or the Games Notice. According to the Games Notice, the Internet Publications Distribution License is required for publishing online games.

Currently, Moxian holds the appropriate license which was issued by the Administration of Online Culture on November 25, 2015.

| 9 |

Encryption Software

On October 7, 1999, the State Encryption Administration Commission published the Regulations for the Administration of Commercial Encryption, followed by the first Notice of the General Office of the State Encryption Administration Commission on November 8, 1999. Both of these regulations address the use of software in China with encryption functions. According to these regulations, purchase of encryption products must be reported. Violation of the encryption regulations may result in a warning, penalty, confiscation of the encryption product, or criminal liabilities.

On March 18, 2000, the Office of the State Commission for the Administration of Cryptography issued a public announcement regarding the implementation of those regulations. The announcement clarifies the encryption regulations as below:

| ● | Only specialized hardware and software, the core functions of which are encryption and decoding, fall within the administrative scope of the regulations as “encryption products and equipment containing encryption technology.” Other products such as wireless telephones, Windows software and browsers do not fall within the scope of this regulation. |

| ● | The PRC government has already begun to study the laws in question in accordance with WTO rules and China’s external commitments, and will make revisions wherever necessary. The Administrative Regulations on Commercial Encryption will also be subject to such scrutiny and revision. |

In late 2005, the Administration Bureau of Cryptography further issued a series of regulations to regulate the development, production and sales of commercial encryption products, which all came into effect on January 1, 2006.

We believe that the Company is in proper compliance with these requirements.

Foreign Exchange

Foreign exchange regulation in China is primarily governed by the following regulations:

| ● | Foreign Exchange Administration Rules, or the Exchange Rules of the PRC, promulgated by the State Council on January 29, 1996, which was amended on January 14, 1997 and on August 5, 2008 respectively; and |

| ● | Administration Rules of the Settlement, Sale and Payment of Foreign Exchange, or the Administration Rules promulgated by China People’s Bank on June 20, 1996. |

Under the Exchange Rules of the PRC, Renminbi is convertible for current account items, including the distribution of dividends, interest payments, trade and service-related foreign exchange transactions. As for capital account items, such as direct investments, loans, security investments and the repatriation of investment returns, however, the reservation or conversion of foreign currency incomes is still subject to the approval of SAFE or its competent local branches; while for the foreign currency payments for capital account items, the SAFE approval is not necessary for the conversion of Renminbi except as otherwise explicitly provided by laws and regulations.

Under the Administration Rules, enterprises may only buy, sell or remit foreign currencies at banks that are authorized to conduct foreign exchange business after the enterprise provides valid commercial documents and relevant supporting documents and, in the case of certain capital account transactions, after obtaining approval from SAFE or its competent local branches. Capital investments by enterprises outside of China are also subject to limitations, which include approvals by the SAFE and the National Development and Reform Commission, or their respective competent local branches.

On October 21, 2005, SAFE issued the Circular on Several Issues concerning Foreign Exchange Administration for Domestic Residents to Engage in Financing and in Return Investments via Overseas Special Purpose Companies, or Circular No. 75, which went into effect on November 1, 2005. Circular No. 75 provides that if PRC residents use assets or equity interests in their PRC entities to establish offshore companies or inject assets or equity interests of their PRC entities into offshore companies for the purpose of overseas capital financing, they must register with local SAFE branches with respect to their investments in offshore companies. Circular No. 75 also requires PRC residents to file changes to their registration if their special purpose companies undergo material events such as capital increase or decrease, share transfer or exchange, merger or division, long-term equity or debt investments, provision of guaranty to a foreign party, etc. SAFE further promulgated the Implementing Rules for Circular No. 75, or Circular No. 106, clarifying and supplementing the concrete operating rules that shall be followed during the implementation and application of Circular No. 75.

| 10 |

On August 29, 2008, the Notice of the General Affairs Department of the State Administration of Foreign Exchange on the Relevant Operating Issues concerning the Improvement of the Administration of Payment and Settlement of Foreign Currency Capital of Foreign-funded Enterprises, or the Improvement Notice, was promulgated by SAFE. Pursuant to the Improvement Notice, the foreign currency capital of Foreign Investment Entities, after being converted to Renminbi, can only be used for doing business within the business scope approved by relevant governmental authorities, and shall not be used for domestic equity investment except as otherwise explicitly provided by laws and regulations.

On July 14, 2014, SAFE issued a new Circular on Several Issues concerning Foreign Exchange Administration for Domestic Residents to Engage in Investing and Financing and in Return Investments via Overseas Special Purpose Companies, or Circular No. 37, which enlarges the definition of SPV comparing to the Circular No. 75, which can invest in China under Circular No. 37. The method of investment include forming a new entity in China and through merging or acquiring a domestic company in China.

Hong Kong Law

Our website is maintained through a server in Hong Kong. Therefore, our data usage policy and regular terms of service for both our users and merchants must comply with the applicable rules and regulations in Hong Kong SAR. As information from our Merchant Clients and Users are preserved in Hong Kong, the law applicable to the Company is the Hong Kong Personal Data (Privacy) Ordinance (Cap 486). Non-compliance of such rules in Hong Kong may result in a fines of up to HKD $500,000. Directors of Moxian Hong Kong may also be personally liable for the Company’s violation of Hong Kong Personal Data (Privacy) Ordinance.

We believe we are in compliance with the laws in Hong Kong.

Intellectual Property

Trademarks

We have registered or applied to register the following trademarks in Mainland China, Hong Kong, and the U.S.:

| Mark | Country of Registration | Application Number | Class/Description | Current Owner | Status | |||||

|

Hong Kong | 302534274 | Class 9: Magnetic data carries, recording discs, data processing equipment and computers Class 35: Advertising, business management, business administration Class 38: Telecommunications Class 40: Treatment of materials Class 41: Entertainment Class 42: Design and development of computer hardware and software | Moxian (Hong Kong) Limited | Registered | |||||

|

America | 85931344 | Class 009: Magnetic data carries, recording discs, data processing equipment and computers Class 035: Advertising, business management, business administration Class 038: Telecommunications Class 040: Treatment of materials Class 041: Entertainment Class 042: Design and development of computer hardware and software | Moxian (Hong Kong) Limited | Registered | |||||

|

China | 13460852 | Class 9: Magnetic data carries, recording discs, data processing equipment and computers | Moxian Shenzhen Technologies Co Ltd | Registered | |||||

| 魔线 | China | 13461178 | Class 38: Telecommunications | Moxian Shenzhen Technologies Co Ltd | Registered | |||||

|

China | 13460714 | Class 42: Design and development of computer hardware and software | Moxian Shenzhen Technologies Co Ltd | Pending | |||||

|

China | 10624504 | Class 42: Design and development of computer hardware and software | Moxian Shenzhen Technologies Co Ltd | Pending |

| 11 |

Patents

The patents we applied are listed as follows:

| Patent | Country of Registration | Application Number | Description | Application Date | Status | |||||

| A business promotion method based on internet platform for users to access the information independently | China | 201310734492.2 | Including background identifying steps giving feedbacks on the demands sent by terminal application steps, access end-user's real-time location information and search nearby merchants, push merchant's information and free rewards to users | 27th December 2013 | Pending | |||||

| A method based on internet platform to achieve interactive information through QR code | China | 201410235257.5 | Including terminal application steps, start the application terminal of internet platform, access the merchant's ID and IP on the platform through scanned QR code | 30th May 2014 | Pending | |||||

| The method and system of pushing targeted advertising based on consumption patterns | China

| 201510628706.7 | Including access user's chat session content, analyze and abstract user's interested information, send the corresponding targeted advertising to users through data analysis | 28th September 2015 | Pending | |||||

| The method and system of pushing targeted advertising based on chat session | China | 201510628708.6 | Including access user's consumption record, analyze and understand user's consumption mode, send the corresponding targeted advertising to users through data analysis | 28th September 2015 | Pending |

| 12 |

Copyright

A copyright application for Moxian’s mascot “Moya” was submitted by Moxian Shenzhen on December 2, 2013 (Application No. 201330592230.8). Moya is a mascot representing the Moxian Platform. Below are some pictures of Moya with different expressions:

|

|

|

|

|

Available Information

The Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Exchange Act, are filed with the SEC. The Company is subject to the informational requirements of the Exchange Act and files or furnishes reports, proxy statements, and other information with the SEC. Such reports and other information filed by the Company with the SEC are available via the Company’s website at www.moxian.com when such reports are available on the SEC’s website at www.sec.gov. The public may read and copy any materials filed by the Company with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Room 1580, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. The contents of these websites are not incorporated into this filing. Further, the Company’s references to the URLs for these websites are intended to be inactive textual references only.

Executive Office

Our principal executive offices are located at Block A, 9/F, Union Plaza, 5022 Binjiang Avenue, Futian District, Shenzhen City, Guangdong Province, China. Our telephone number is +86 (0) 755-66803251. We maintain a website at www.moxian.com. The information contained on our website is not, and should not be interpreted to be, a part of this report.

Disclosure in response to this item is not required of a smaller reporting company.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Disclosure in response to this item is not required of a smaller reporting company. Nevertheless, the Company does not have any unresolved Staff comments as of the date of this report.

The Company currently does not own any real property. We are currently renting office space in Shenzhen and Beijing. The total monthly rent is RMB 372,815 (or approximately $57,070 per month). The Company believes that such office space is sufficient for its current needs.

As of the date hereof, we know of no material pending legal proceedings against to which we or any of our subsidiaries is a party or of which any of our property is the subject. There are no proceedings in which any of our directors, executive officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest. From time to time, we may be subject to various claims, legal actions and regulatory proceedings arising in the ordinary course of business.

ITEM 4. MINE SAFETY DISCLOSURES

None.

| 13 |

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock was quoted under the symbol “MOXC” on the OTCQB until November 14, 2016. The Company's common stock began trading on the NASDAQ Capital Market on November 15, 2016 under the symbol "MOXC".

For the periods indicated, the following table sets forth the high and low bid prices per share of common stock. The following quotations reflect the high and low bids for our shares of common stock based on inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

| High | Low | |||||||

| Fiscal Year 2016 | Bid | Bid | ||||||

| First Quarter | $ | 10.9 | $ | 8.0 | ||||

| Second Quarter | $ | 10.4 | $ | 8.0 | ||||

| Third Quarter | $ | 8.2 | $ | 7.2 | ||||

| Fourth Quarter | $ | 8.2 | $ | 5.7 | ||||

| High | Low | |||||||

| Fiscal Year 2015 | Bid | Bid | ||||||

| First Quarter | $ | 11.7 | $ | 10.5 | ||||

| Second Quarter | $ | 11.8 | $ | 10.2 | ||||

| Third Quarter | $ | 12.6 | $ | 11.4 | ||||

| Fourth Quarter | $ | 13.0 | $ | 11.4 | ||||

Holders

As of September 30, 2016 and December 22, 2016, we had 64,005,949 and 66,507,199 shares of our common stock issued and outstanding, respectively. There were approximately 342 registered owners of our common stock as December 19, 2016.

Transfer Agent

The transfer agent for our capital stock is Island Stock Transfer, located at 15500 Roosevelt Boulevard, Suite 301, Clearwater, FL 33760. Their telephone number is 727-289-0010 and fax number is 727-289-0069.

Dividend Policy

Any future determination as to the declaration and payment of dividends on shares of our Common Stock will be made at the discretion of our board of directors out of funds legally available for such purpose. We are under no contractual obligations or restrictions to declare or pay dividends on our shares of Common Stock. In addition, we currently have no plans to pay such dividends. Our board of directors currently intends to retain all earnings for use in the business for the foreseeable future.

| 14 |

Equity Compensation Plan Information

Currently, there is no equity compensation plan in place.

Unregistered Sales of Equity Securities

The information below lists all of the securities sold by us during the past three years that were not registered under the Securities Act:

On October 31, 2014 and November 30, 2014, Moxian Shenzhen received RMB 630,000 (approximately $102,942) and RMB 90,000 (approximately $14,486), respectively, as loans (the “MCL Shenzhen Loans”) from Moxian China Limited. The term of such loans is twelve months and they bear no interest. On December 31, 2014, the Company, Moxian China Limited and Moxian Shenzhen entered into a Loan Agreement, where the Company agreed to issue a convertible promissory note (the “Note”) to Moxian China Limited for the repayment of the MCL Shenzhen Loans.

On October 31, 2014 and November 30, 2014, Moxian Malaysia received a loan in the amount of MYR 118,800 (approximately $34,032) and MYR 23,100 (approximately $6,605), respectively, from Moxian China Limited (the “MCL Malaysia Loans”). The term of such loans is twelve months and they bear no interest. On December 31, 2014, the Company, Moxian China Limited and Moxian Malaysia entered into a Loan Agreement, where the Company agreed to issue a Note to Moxian China Limited for the repayment of the MCL Malaysia Loans.

On November 30, 2014, Moxian HK received HKD $500,000 (approximately $64,437) as a loan from Moxian China Limited (the “MCL HK Loan”). The term of such loan is twelve months and it bears no interest. On December 31, 2014, the Company, Moxian China Limited and Moxian HK entered into a Loan Agreement, where the Company agreed to issue a Note to Moxian China Limited for the repayment of the MCL HK Loan.

On January 30, 2015, we issued a convertible note in the principal amount of $7,782,000 to REBL for the acquisitions of Moxian IP Samoa and Moxian BVI.

On May 30, 2015, the Company, Moxian HK, and Jet Key entered into an Amended and Restated Loan Agreement (“Moxian HK-Jet Key Loan Agreement”) to document the total loan of $223,416 that Jet Key has advanced to Moxian HK in different tranches by May 30, 2015, and in exchange, the Company agreed to issue a 12-month convertible interest free promissory note of $223,416 (“Moxian HK-Jet Key Note”) to Jet Key. Under the Moxian HK-Jet Key Note, all or any portion of the Moxian HK-Jet Key Note is convertible into shares of Common Stock of the Company at the conversion price equal to the purchase price of the securities sold in the Qualified Financing. If no Qualified Financing is consummated before the maturity date, Jet Key shall have the right to convert any and all of the Moxian HK-Jet Key Note into shares of Common Stock of the Company at the 20 day trading VWAP as reported by Bloomberg, L.P.

On May 30, 2015, the Company, Moxian HK, and Ace Keen entered into an Amended and Restated Loan Agreement (“Moxian HK-Ace Keen Loan Agreement”) to document the total loan of $761,379 that Ace Keen has advanced to Moxian HK in different tranches by May 30, 2015, and in exchange, the Company agreed to issue a 12-month convertible interest free promissory note of $761,379 (“Moxian HK-Ace Keen Note”) to Ace Keen. Under the Moxian HK-Ace Keen Note, all or any portion of the Moxian HK-Ace Keen Note is convertible into Company’s Common Stock at a price equal to the purchase price of the securities sold in a qualified financing for gross proceeds of more than $5,000,000 (a “Qualified Financing”). If no Qualified Financing is consummated before the maturity date, Ace Keen shall have the right to convert any and all of the Moxian HK-Ace Keen Note into shares of Common Stock at the 20 day trading Volume Weighted Average Price (“VWAP”) as reported by Bloomberg, L.P.

On May 30, 2015, the Company, Moxian HK, and Moxian China Limited (“MCL”) entered into an Amended and Restated Loan Agreement (“Moxian HK-MCL Loan Agreement”) to document the total loan of $709,941 that MCL has advanced to Moxian HK in different tranches by May 30, 2015, and in exchange, the Company agreed to issue a 12-month convertible interest free promissory note of $709,941 (“Moxian HK-MCL Note”) to MCL. Under the Moxian HK-MCL Note, all or any portion of the Moxian HK-MCL Note is convertible into shares of Common Stock of the Company at the conversion price equal to the purchase price of the securities sold in the Qualified Financing. If no Qualified Financing is consummated before the maturity date, MCL shall have the right to convert any and all of the Moxian HK-MCL Note into shares of Common Stock of the Company at the 20 day trading VWAP as reported by Bloomberg, L.P.

| 15 |

On May 30, 2015, the Company, Moxian Malaysia, and Ace Keen entered into an Amended and Restated Loan Agreement (“Moxian Malaysia-Ace Keen Loan Agreement”) to document the total loan of $228,937 that Ace Keen has advanced to Moxian Malaysia in different tranches by May 30, 2015, and in exchange, the Company agreed to issue a 12-month convertible interest free promissory note of $228,937 (“Moxian Malaysia-Ace Keen Note”) to Ace Keen. Under the Moxian Malaysia-Ace Keen Note, all or any portion of the Moxian Malaysia-Ace Keen Note is convertible into Common Stock of the Company at the conversion price equal to the purchase price of the securities sold in the Qualified Financing. If no Qualified Financing is consummated before the maturity date, Ace Keen shall have the right to convert any and all of the Moxian Malaysia-Ace Keen Note into shares of Common Stock of the Company at the 20 day trading VWAP as reported by Bloomberg, L.P.

On May 30, 2015, the Company, Moxian Malaysia, and Morolling International HK Limited (“Morolling;” name changed to Vertical Venture Capital Group Limited on July 6, 2015) entered into an Amended and Restated Loan Agreement (“Moxian Malaysia-Morolling Loan Agreement”) to document the total loan of $765,768 that Morolling has advanced to Moxian Malaysia in different tranches by May 30, 2015, and in exchange, the Company agreed to issue a 12-month convertible interest free promissory note of $765,768 (“Moxian Malaysia-Morolling Note”) to Morolling with no interest and a term of repayment of 12 months. Under the Moxian Malaysia-Morolling Note, all or any portion of the Moxian Malaysia-Morolling Note is convertible into shares of Common Stock of the Company at the conversion price equal to the purchase price of the securities sold in the Qualified Financing. If no Qualified Financing is consummated before the maturity date, Morolling shall have the right to convert any and all of the Moxian Malaysia-Morolling Note into shares of Common Stock of the Company at the 20 day trading VWAP as reported by Bloomberg, L.P.

On May 30, 2015, the Company, Moxian Malaysia, and MCL entered into an Amended and Restated Loan Agreement (“Moxian Malaysia-MCL Loan Agreement”) to document the total loan of $2,680,221 that MCL has advanced to Moxian Malaysia in different tranches by May 30, 2015, and in exchange, the Company agreed to issue a 12-month convertible interest free promissory note of $2,680,221 (“Moxian Malaysia-MCL Note”). Under the Moxian Malaysia-MCL Note, all or any portion of the Moxian Malaysia-MCL Note is convertible into shares of Common Stock of the Company at the conversion price equal to the purchase price of the securities sold in the Qualified Financing. If no Qualified Financing is consummated before the maturity date, MCL shall have the right to convert any and all of the Moxian Malaysia-MCL Note into shares of Common Stock of the Company at the 20 day trading VWAP as reported by Bloomberg, L.P.

On June 30, 2015, the Company, Moxian Shenzhen, and Shenzhen Bayi Consulting Co., Ltd (“Bayi”) entered into an Amended and Restated Loan Agreement to document the loan of $3,215,282 that Bayi has advanced to Moxian Shenzhen by May 30, 2015, and in exchange, the Company agreed to issue a 12-month convertible interest free promissory note of $3,215,282 (“Moxian Shenzhen-Bayi Note”). Under the Moxian Shenzhen-Bayi Note, all or any portion of the Moxian Shenzhen-Bayi Note is convertible into shares of Common Stock of the Company at the conversion price equal to the purchase price of the securities in the Qualified Financing. If no Qualified Financing is consummated before the maturity date, Bayi shall have the right to convert any and all of the Moxian Shenzhen-Bayi Note into shares of Common Stock of the Company at the 20 day trading VWAP as reported by Bloomberg, L.P.

The Notes issued to Moxian China Limited by the Company in consideration of the MCL Shenzhen Loans, the MCL Malaysia Loans and the MCL HK Loan are of substantially similar terms. The Notes will be due and payable in one year and bears no interest. Upon consummation of a financing that generates at least $5,000,000 by the Company (“Qualified Financing”), the Notes shall automatically convert into shares of the Company’s Common Stock at a conversion price equal to the price of the Company’s securities sold in the Qualified Financing. If no Qualified Financing is consummated prior to the maturity date of Notes and as long as there remains any outstanding principal or interest of the Notes, holders of the Notes shall have the option to convert the Notes within 30 days after the maturity date at a conversion price that is equal to the volume weighted average price of Common Stock during a 20-day trading period prior to the conversion of the Notes.

On August 14, 2015, the Company issued 4,292,472 shares of Common Stock to Moxian China Limited, Jet Key Limited, Ace Keen Limited, Morolling and Shenzhen Bayi Consulting Co Ltd as a result of the conversion of $8,584,944 of convertible promissory notes held by Moxian China Limited, Jet Key Limited, Ace Keen Limited, Morolling and Shenzhen Bayi Consulting Co Ltd at that moment at $1.00 per share.

On August 14, 2015, $3,891,000 of such note was converted into 1,945,500 shares of our common stock.

On September 30. 2015, we issued an additional 1,945,500 shares of our common stock to REBL upon conversion of the remainder portion of the note.

On June 4, 2015, we agreed to sell Beijing Xinhua Huifeng Equity Investment Center (Limited Partnership) (“Xinhua”), an aggregate of 4,095,000 shares our common stock at a per share price of $2.00 for gross proceeds of $8,190,000 (approximately RMB50,000,000), and to issue to Xinhua, for no additional consideration, a warrant to purchase in the aggregate of 16,000,000 shares of our common stock at an exercise price of $4.00 per share, exercisable on or prior to July 31, 2015. The closing date of the transaction, and the expiration date of the warrant, were both extended to December 31, 2015. On February 28, 2016, the Company closed the transaction and issued 4,095,010 shares of the Company Common Stock to Xinhua for an aggregate purchase price of $8,190,020, or $2.00 per share, of which $5,505,915 was received by the Company in fiscal 2015.

The above issuances were made pursuant to the exemption from registration contained in Section 4(2) of the Securities Act and/or Regulation S promulgated under the Securities Act as a transaction by an issuer not involving a public offering.

Purchases of Equity Securities by the Registrant and Affiliated Purchasers

We have not repurchased any shares of our common stock during the fiscal year ended September 30, 2016.

| 16 |

ITEM 6. SELECTED FINANCIAL DATA

Disclosure in response to this item is not required of a smaller reporting company.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Introduction

The following discussion of our financial condition and results of operations should be read in conjunction with our audited consolidated financial statements and the notes to those consolidated financial statements appearing elsewhere in this report.

Certain statements in this report constitute forward-looking statements. These forward-looking statements include statements, which involve risks and uncertainties, regarding, among other things, (a) our projected sales, profitability, and cash flows, (b) our growth strategy, (c) anticipated trends in our industry, (d) our future financing plans, and (e) our anticipated needs for, and use of, working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipate,” “estimate,” “plan,” “potential,” “project,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend,” or the negative of these words or other variations on these words or comparable terminology. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. You should not place undue reliance on these forward-looking statements.

The forward-looking statements speak only as of the date on which they are made, and, except to the extent required by federal securities laws, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events.

The “Company,” “we,” “us,” “our” or “Moxian” are references to the combined business of the (i) Moxian, Inc., a company incorporated under the laws of Nevada; (ii) Moxian CN Group Limited, a company incorporated under the laws of Independent State of Samoa (“Moxian CN Samoa”), (iii) Moxian Intellectual Property Limited, a company incorporated under the laws of Independent State of Samoa (“Moxian IP Samoa”); (iv) Moxian Group Limited, a company incorporated under the laws of British Virgin Islands (“Moxian BVI”), (v) Moxian (Hong Kong) Limited, a limited liability company incorporated under the laws of Hong Kong (“Moxian HK”), (vi) Moxian Technologies (Shenzhen) Co., Ltd., a company incorporated under the laws of People’s Republic of China (“Moxian Shenzhen”), (vii) Moxian Malaysia SDN BHD (“Moxian Malaysia”), a company incorporated under the laws of Malaysia (“Moxian Malaysia”), (viii) Moxian Technologies (Beijing) Co., Ltd., a company incorporated under the laws of People’s Republic of China (“Moxian Beijing”) and (ix) Shenzhen Moyi Technologies Co. Ltd., a contractually controlled affiliate of Moxian Shenzhen formed under the laws of People’s Republic of China (“Moyi”).

Overview

We are in the O2O (“Online-to-Offline”) business. While there are many definitions of O2O, with respect to our business, O2O means providing an online platform for small and medium sized enterprises (“SMEs”) with physical stores to conduct business online, interact with existing customers and obtain new customers. We refer to our customers as “Merchant Clients” and the users of our platform that are their existing and potential customers as “Users.” Through our platform and the products and services offered through it, we seek to create interaction between our Users and Merchant Clients by allowing Merchant Clients to study consumer behavior. Our products and services are designed to allow Merchant Clients to conduct targeted advertising campaigns and promotions which we believe are more effective because they are geared for the customers that a Merchant Client wishes to reach. Our platform is also designed and built to encourage Users to return and obtain new Users, each of which is a potential customer for our Merchant Clients.

We believe we are different from other companies in that our plan is to sign up merchants first and build our user base utilizing their customers. Many companies utilize a different strategy of building up a user base and then signing up paying merchants and other clients to access that user base.

The current version of our platform is called “Moxian+” which consists of our user mobile application (“App”) called the Moxian+ User App and a separate App for our Merchant Clients called the Moxian+ Business App. Both versions of the App are currently available in the Google Play Store and the Apple App Store. There is no charge to download either App. We also have a website that can be accessed at www.moxian.com where either App can also be downloaded.

| 17 |

Moxian principally operates in mainland China with its headquarters in Shenzhen, China. We launched Moxian version 1.0 which only consists of the User component App in Malaysia in June 2013 and subsequently in China in July 2014. During 2014 to 2015, we developed the Apps as part of “Moxian+,” the successor to Moxian version 1.0 which was officially launched in October 2015 in China only. In December 2015, we opened our Beijing office. We are currently operating in both Shenzhen and Beijing.