Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - REGENERON PHARMACEUTICALS, INC. | a19-1325_1ex99d3.htm |

| EX-99.1 - EX-99.1 - REGENERON PHARMACEUTICALS, INC. | a19-1325_1ex99d1.htm |

| 8-K - 8-K - REGENERON PHARMACEUTICALS, INC. | a19-1325_18k.htm |

JP Morgan 2019 January 7th Leonard S. Schleifer MD, PhD President & CEO George D. Yancopoulos MD, PhD President & CSO

2 Note regarding FORWARD-LOOKING STATEMENTs and non-gaap financial measures This presentation includes forward-looking statements that involve risks and uncertainties relating to future events and the future performance of Regeneron Pharmaceuticals, Inc. (“Regeneron” or the “Company”), and actual events or results may differ materially from these forward-looking statements. Words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “estimate,” variations of such words, and similar expressions are intended to identify such forward-looking statements, although not all forward-looking statements contain these identifying words. These statements concern, and these risks and uncertainties include, among others, the nature, timing, and possible success and therapeutic applications of Regeneron’s products, product candidates, and research and clinical programs now underway or planned, including without limitation EYLEA® (aflibercept) Injection, Dupixent® (dupilumab) Injection, Praluent® (alirocumab) Injection, Kevzara® (sarilumab) Injection, Libtayo® (cemiplimab) Injection, fasinumab, evinacumab, Regeneron’s immuno-oncology programs (including its costimulatory bispecific portfolio), Regeneron’s earlier-stage product candidates, and the use of human genetics in Regeneron’s research programs; the extent to which the results from Regeneron’s research programs or preclinical testing may lead to advancement of product candidates to clinical trials or therapeutic applications; unforeseen safety issues resulting from the administration of products and product candidates in patients, including serious complications or side effects in connection with the use of Regeneron’s product candidates in clinical trials; the likelihood and timing of possible regulatory approval and commercial launch of Regeneron’s late-stage product candidates and new indications for marketed products, including without limitation EYLEA, Dupixent, Praluent, Kevzara, Libtayo, fasinumab, and evinacumab; the likelihood and timing of achieving any of the anticipated milestones described in this presentation; the extent to which the results from the research and development programs conducted by Regeneron or its collaborators may be replicated in other studies and lead to therapeutic applications; ongoing regulatory obligations and oversight impacting Regeneron’s marketed products (such as EYLEA, Dupixent, Praluent, Kevzara, and Libtayo), research and clinical programs, and business, including those relating to patient privacy; determinations by regulatory and administrative governmental authorities which may delay or restrict Regeneron’s ability to continue to develop or commercialize Regeneron’s products and product candidates; competing drugs and product candidates that may be superior to Regeneron’s products and product candidates; uncertainty of market acceptance and commercial success of Regeneron’s products and product candidates and the impact of studies (whether conducted by Regeneron or others and whether mandated or voluntary) on the commercial success of Regeneron's products and product candidates; the availability and extent of reimbursement of the Company’s products from third-party payers, including private payer healthcare and insurance programs, health maintenance organizations, pharmacy benefit management companies, and government programs such as Medicare and Medicaid; coverage and reimbursement determinations by such payers and new policies and procedures adopted by such payers; the ability of Regeneron to manufacture and manage supply chains for multiple products and product candidates; the ability of Regeneron’s collaborators, suppliers, or other third parties to perform filling, finishing, packaging, labeling, distribution, and other steps related to Regeneron’s products and product candidates; unanticipated expenses; the costs of developing, producing, and selling products; the ability of Regeneron to meet any of its sales or other financial projections or guidance and changes to the assumptions underlying those projections or guidance, including financial guidance relating to Sanofi collaboration revenue, non-GAAP unreimbursed R&D, non-GAAP SG&A, effective tax rate, and capital expenditures; risks associated with intellectual property of other parties and pending or future litigation relating thereto, including without limitation the patent litigation proceedings relating to EYLEA, Dupixent, and Praluent, the ultimate outcome of any such litigation proceeding, and the impact any of the foregoing may have on Regeneron’s business, prospects, operating results, and financial condition; and the potential for any license or collaboration agreement, including Regeneron’s agreements with Sanofi, Bayer, and Teva Pharmaceutical Industries Ltd. (or their respective affiliated companies, as applicable), to be cancelled or terminated without any further product success. A more complete description of these and other material risks can be found in Regeneron’s filings with the U.S. Securities and Exchange Commission, including its Form 10-K for the fiscal year ended December 31, 2017 and its Form 10-Q for the quarterly period ended September 30, 2018, including in each case in the section thereof captioned “Item 1A. Risk Factors.” Any forward-looking statements are made based on management’s current beliefs and judgment, and the reader is cautioned not to rely on any forward-looking statements made by Regeneron. Regeneron does not undertake any obligation to update publicly any forward-looking statement, including without limitation any financial projection or guidance, whether as a result of new information, future events, or otherwise. This presentation uses non-GAAP unreimbursed R&D and non-GAAP SG&A, which are financial measures that are not calculated in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). These non-GAAP financial measures are computed by excluding certain non-cash and other items from the related GAAP financial measure. Non-GAAP adjustments also include the income tax effect of reconciling items. The Company makes such adjustments for items the Company does not view as useful in evaluating its operating performance. For example, adjustments may be made for items that fluctuate from period to period based on factors that are not within the Company’s control, such as the Company’s stock price on the dates share-based grants are issued. Management uses these and other non-GAAP measures for planning, budgeting, forecasting, assessing historical performance, and making financial and operational decisions, and also provides forecasts to investors on this basis. Additionally, such non-GAAP measures provide investors with an enhanced understanding of the financial performance of the Company’s core business operations. However, there are limitations in the use of these and other non-GAAP financial measures as they exclude certain expenses that are recurring in nature. Furthermore, the Company’s non-GAAP financial measures may not be comparable with non-GAAP information provided by other companies. Any non-GAAP financial measure presented by Regeneron should be considered supplemental to, and not a substitute for, measures of financial performance prepared in accordance with GAAP. A reconciliation of the Company's full year 2019 non-GAAP to GAAP financial guidance is provided on slide 12.

Proven Innovation WHERE WE ARE

4 KEY milestones and achievements RESEARCH & DEVELOPMENT COMMERCIAL Key Regulatory Approvals* LIBTAYO Advanced CSCC DUPIXENT Moderate-to-severe Asthma EYLEA Q12 week dosing in wAMD after one year of effective therapy Key Regulatory Filings EYLEA Diabetic Retinopathy DUPIXENT Atopic Dermatitis in adolescents PRALUENT Cardiovascular Risk Reduction Clinical Trial Readouts DUPIXENT Ph3 Chronic Rhinosinusitis with Nasal Polyps LIBTAYO Ph1 Non Small Cell Lung Cancer REGN1979 (CD20xCD3) PoC in Follicular Lymphoma & Diffuse Large B-Cell Lymphoma Fasinumab (NGF) Ph3 Osteoarthritis Pozelimab (C5) Ph1 in Healthy Volunteers Ph2 and Ph3 Trial Initiations DUPIXENT Ph2/3 Eosinophilic Esophagitis Ph2 Grass Allergy Ph2 Peanut Allergy Ph2/3 AD in peds (6 mo – 5 yr) REGN3500 (IL-33) Ph2 Chronic Obstructive Pulmonary Disease Ph2 Asthma Ph2 Atopic Dermatitis KEVZARA Ph3 Polymyalgia Rheumatica Ph3 Giant Cell Arthritis INDs & Ph1 Trial Initiations REGN4018 (MUC16xCD3) Ovarian Cancer REGN5458 (BCMAxCD3) Multiple Myeloma REGN4659 (CTLA-4) Cancer REGN5069 (GFRα3) Pain REGN4461 (LEPR) Metabolic Disease Infectious Disease Delivered REGN-EB3 to the Democratic Republic of the Congo for use in Ebola patients Genetics Sequenced 500k human exomes to date New Partnerships/Collaborations UK Biobank consortium, bluebird bio, Alnylam, Zoetis US EYLEA Net sales of ~$4.07 Billion†; ~10% year-over-year growth DUPIXENT Annualizing in excess of $1.0 Billion, based on 3Q18 worldwide net sales; Atopic Dermatitis launch continues to accelerate; Asthma launch progressing well, particularly among allergists LIBTAYO Physician interest and market uptake are encouraging PRALUENT Working with payers to improve access and lower cost to patients * Please see full Prescribing Information for all approved products † Based on preliminary unaudited fiscal 2018 results; preliminary unaudited 4Q18 U.S. EYLEA net sales of $1.07 Billion This slide includes pipeline drug candidates currently undergoing clinical testing in a variety of diseases. The safety and efficacy of these drug candidates have not been evaluated by any regulatory authorities for the disease categories described here.

EYLEA®: Strengthening market leadership position U.S. Net Sales†, $Billion Building on leadership position in wAMD and diabetic eye disease, both of which are increasing in prevalence Label expansions and line extensions Innovating next generation therapeutics Our strategy is to maximize EYLEA growth opportunities and develop next generation therapeutics * Based on preliminary unaudited fiscal 2018 results; preliminary, unaudited 4Q18 U.S. EYLEA net sales of $1.07 Billion † Outside the United States, EYLEA net product sales comprise sales by Bayer in countries other than Japan and sales by Santen Pharmaceutical Co., Ltd. in Japan under a co-promotion agreement with an affiliate of Bayer * 5 We believe there are no near-term potential agents that can provide substantially different dosing flexibility, duration or visual gains than are already achievable with EYLEA

EYLEA®: Leading ophthalmology innovation 6 Opportunities in Diabetic Eye Diseases Diabetic Macular Edema (DME) Targeted commercial strategy to increase anti-VEGF penetration Diabetic Retinopathy (DR) without DME – PDUFA date May 13, 2019 Phase 3 PANORAMA study shows potential to change clinical practice 65-80% of EYLEA-treated patients experienced > two-step improvement from baseline on the Diabetic Retinopathy Severity Scale (DRSS) vs. 15% sham (p<0.0001) 72-76% reduction in vision-threatening complications (VTCs) and center-involved diabetic macular edema (CI-DME): (10-11% EYLEA vs. 41% sham, p<0.001) Of the 3.5M people in the U.S. with DR without DME, ~1M individuals have moderate-to-severe disease and are at greatest risk Our strategy is to make even better treatments than our market-leading anti-VEGF therapy, EYLEA High Dose Formulation of EYLEA Other new molecular entities and gene therapies Next Generation Strategy This slide includes pipeline drug candidates currently undergoing clinical testing in a variety of diseases. The safety and efficacy of these drug candidates have not been evaluated by any regulatory authorities for the disease categories described here.

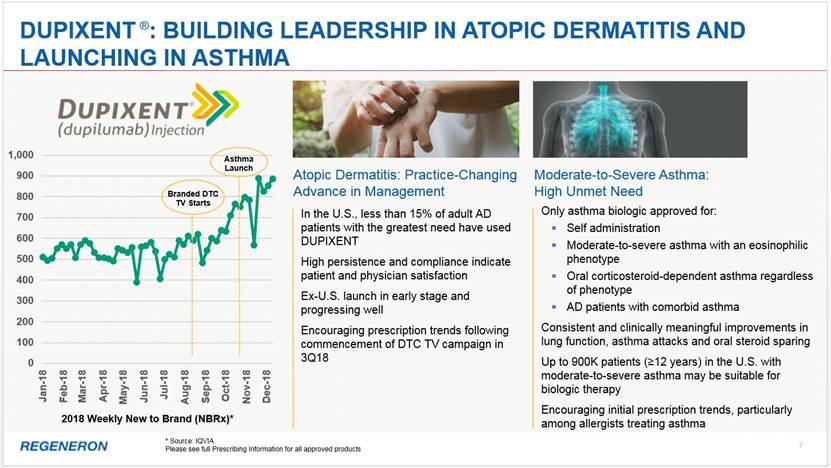

Dupixent ®: Building leadership in ATOPIC DERMATITIS and Launching in Asthma 7 2018 Weekly New to Brand (NBRx)* Atopic Dermatitis: Practice-Changing Advance in Management In the U.S., less than 15% of adult AD patients with the greatest need have used DUPIXENT High persistence and compliance indicate patient and physician satisfaction Ex-U.S. launch in early stage and progressing well Encouraging prescription trends following commencement of DTC TV campaign in 3Q18 Moderate-to-Severe Asthma: High Unmet Need Only asthma biologic approved for: Self administration Moderate-to-severe asthma with an eosinophilic phenotype Oral corticosteroid-dependent asthma regardless of phenotype AD patients with comorbid asthma Consistent and clinically meaningful improvements in lung function, asthma attacks and oral steroid sparing Up to 900K patients (>12 years) in the U.S. with moderate-to-severe asthma may be suitable for biologic therapy Encouraging initial prescription trends, particularly among allergists treating asthma * Source: IQVIA Please see full Prescribing Information for all approved products 0 100 200 300 400 500 600 700 800 900 1,000 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Branded DTC TV Starts Asthma Launch

DUPIXENT ®: DELIVERING on The “pipeline in a product” promise 8 Atopic Dermatitis Approved in Adults Moderate-to-Severe Asthma Approved in Adults and Adolescents Pediatric Asthma (6-11 years) Ph3 ongoing Food Allergies Ph2 in Peanut Allergy initiated; more planned Airborne Allergies Ph2 in Grass Allergy initiated Combinations with REGN3500 (IL-33) Ph2 initiated in AD and Asthma APPROVED INDICATIONS NEAR-TERM OPPORTUNITIES longer-term opportunities Atopic Dermatitis in Adolescents (12-17 years) sBLA submitted, PDUFA date March 11, 2019 Atopic Dermatitis in Pediatrics (6-11 years) Ph3 readout expected in 2019 Chronic Rhinosinusitis with Nasal Polyps (CRSwNP) Two Positive Ph3 studies reported 2H18 sBLA filing expected in 1Q19 Eosinophilic Esophagitis Positive Ph2 results; Pivotal trial initiated 3Q18 Chronic Obstructive Pulmonary Disease (COPD) Initiate Ph2/3 in 2019 This slide includes pipeline drug candidates currently undergoing clinical testing in a variety of diseases. The safety and efficacy of these drug candidates have not been evaluated by any regulatory authorities for the disease categories described here.

9 LIBTAYO®: new hope for patients with advanced CScc LIBTAYO is now the only approved treatment option for advanced CSCC, a life-threatening condition June 2018 NEJM publication details pivotal Phase 2 study results in 59 metastatic CSCC patients: Primary endpoint: 47.5% Overall Response Rate by independent review Durable Disease Control Rate of 61% Median duration of response and progression-free survival have not been reached LIBTAYO was associated with adverse events similar to other PD-1 inhibitors An 83-year-old patient who had undergone multiple surgeries for CSCC, at baseline and after 8 weeks of treatment with LIBTAYO Cutaneous squamous cell carcinoma (CSCC) is the second most common form of skin cancer (after Basal Cell Carcinoma) and is responsible for an estimated 7,000 deaths per year in the U.S.; prior to LIBTAYO there were no approved therapies for advanced disease Please see full Prescribing Information for all approved products Despite thousands of trials by others, Regeneron is the first to identify advanced CSCC as perhaps the most responsive solid tumor to immunotherapy

2019 Goals and milestones KEY REGULATORY APPROVALS & SUBMISSIONS EYLEA FDA decision on sBLA for the treatment of Diabetic Retinopathy (PDUFA date May 13, 2019); re-submission of Prior-Approval Supplement (PAS) for pre-filled syringe DUPIXENT FDA decision on sBLA for expanded Atopic Dermatitis indication in adolescent patients 12–17 years of age (PDUFA date March 11, 2019); EMA decision on regulatory application for Asthma; file sBLA for Chronic Rhinosinusitis with Nasal Polyps (CRSwNP) LIBTAYO EMA decision for advanced cutaneous squamous cell carcinoma (CSCC) PRALUENT FDA (PDUFA date April 28, 2019) and EMA decisions on applications for Cardiovascular Risk Reduction; FDA decision on sBLA for first-line treatment of Hyperlipidemia (PDUFA date April 29, 2019) KEY DATA READOUTS DUPIXENT Report results from Ph3 study for Atopic Dermatitis in pediatric patients 6–11 years of age REGN3500 (IL-33) Report results from Ph2 Asthma study Trevogrumab (GDF8) + Garetosmab (Activin-A) Report results from multi-dose portion of Ph1 study CLINICAL PROGRESS EYLEA Initiate a study of higher dose formulations of aflibercept DUPIXENT Continue enrollment in pivotal eosinophilic esophagitis (EoE) study; Initiate Ph2/3 program in Chronic Obstructive Pulmonary Disease (COPD) LIBTAYO Continue enrollment in NSCLC and various other studies REGN1979 (CD20xCD3) Initiate potentially pivotal Ph2 study in Follicular Lymphoma (FL) and potentially pivotal Ph2 study in Diffuse Large B-Cell Lymphoma (DLBCL) Fasinumab (NGF) Continue patient enrollment in Ph3 long-term safety study and Ph3 efficacy studies in Osteoarthritis Pozelimab (C5) Initiate Ph2 in Paroxysmal Nocturnal Hemoglobinuria (PNH) NEW INDs Expect to advance 4-6 new molecules into clinical development (including more CD3 & CD28 bispecifics) 10 This slide includes pipeline drug candidates currently undergoing clinical testing in a variety of diseases. The safety and efficacy of these drug candidates have not been evaluated by any regulatory authorities for the disease categories described here.

11 2019 financial Guidance* * As of January 7, 2019. The guidance does not assume the completion of any significant business development transaction that had not been completed as of the date of the guidance. Regeneron does not undertake any obligation to update publicly any financial projection or guidance, whether as a result of new information, future events, or otherwise Sanofi Collaboration Revenue: Reimbursement of Regeneron Commercialization-Related Expenses $510 – 560MM Non-GAAP unreimbursed R&D† $1,590 – 1,710MM Non-GAAP SG&A† $1,500 – 1,600MM Effective Tax Rate 14 – 16% Capital Expenditures $410 – 490MM † Please refer to slide 2 for important information regarding non-GAAP financial measures and to slide 12 for a reconciliation of these measures to GAAP financial measures

12 Reconciliation of full year 2019 Non-GAAP to GAAP Financial guidance * Unreimbursed R&D represents R&D expenses reduced by R&D expense reimbursements from the Company's collaborators and/or customers Projected Range (in millions) Low High GAAP unreimbursed R&D* $ 1,855 $ 2,000 R&D: Non-cash share-based compensation expense (265) (290) Non-GAAP unreimbursed R&D $ 1,590 $ 1,710 GAAP SG&A $ 1,700 $ 1,830 SG&A: Non-cash share-based compensation expense (200) (230) Non-GAAP SG&A $ 1,500 $ 1,600

PORTFOLIO & pipeline PHASE 1 PHASE 2 REGN-EB3 (Ebola virus) REGN3767 (LAG-3) REGN1908-1909 (Feld1) Cemiplimab* (PD-1) Sarilumab* (IL-6R) Dupilumab* (IL-4R) Cemiplimab* (PD-1) Fasinumab† (NGF) Aflibercept (VEGF Trap) Dupilumab* (IL-4R) Alirocumab* (PCSK9) Pozelimab (C5) Cemiplimab* (PD-1) REGN4461 (LEPR) REGN3500* (IL-33) REGN3048-3051 (MERS virus) REGN4018* (MUC16xCD3 bispecific) REGN4659 (CTLA-4) REGN5069 (GFRα3) Sarilumab* (IL-6R) * IN COLLABORATION WITH SANOFI † IN COLLABORATION WITH TEVA AND MITSUBISHI TANABE Evinacumab (ANGPTL3) Trevogrumab (GDF8) + Garetosmab (Activin-A) Evinacumab (ANGPTL3) Garetosmab (Activin-A) Immunology & Inflammatory Diseases Cardiovascular/ Metabolic diseases Oncology Infectious Diseases Ophthalmology Pain Rare Diseases PHASE 3 13 REGN5458* (BCMAxCD3 bispecific) This slide includes pipeline drug candidates currently undergoing clinical testing in a variety of diseases. The safety and efficacy of these drug candidates have not been evaluated by any regulatory authorities for the disease categories described here. REGN1979 (CD20xCD3 bispecific)

Adolescent and pediatric atopic dermatitis – high disease burden with limited treatment options 14 Patient had significantly improved overall disease severity, skin clearing and reduced itching IGA: Investigator’s Global Assessment, EASI: Eczema Area and Severity Index Overall rate of treatment-emergent adverse events was comparable between the dupilumab group (72%) and placebo (69%). The rate of overall infections and infestations was numerically lower in the dupilumab group (11%) vs. placebo (20%) No SAEs or events leading to discontinuation in the treatment group Adolescent Atopic Dermatitis (Ages 12 – 17 years) *co-primary endpoints; p< 0.0001 Prior treatments included cycles of prednisone, oral anti-Staph antibiotics, triamcinolone and chronic daily sedating antihistamines Before DUPIXENT This slide includes pipeline drug candidates currently undergoing clinical testing in a variety of diseases. The safety and efficacy of these drug candidates have not been evaluated by any regulatory authorities for the disease categories described here. For illustrative purposes only. Results are not representative of all patients; and individual results vary. Positive Ph3 data reported; PDUFA date March 11, 2019 DUPIXENT ®: DELIVERING on The “pipeline in a product” promise After DUPIXENT

Driven by discovery Regeneron’s IO Strategy

Regeneron’s IO Strategy is built on a Deep Foundation of Science and Technology 619 manuscripts published, 9,351 patent applications filed and 4,945 patents issued over the last 10 years Rapid, automated and high-scale manipulation of mouse DNA to identify and validate therapeutic targets Genetically altered mice derived from modified embryonic stem cells High-throughput screening of antibodies and rapid generation of production cell lines Genetically-humanized immune system in a mouse, producing a diverse range of fully human monoclonal antibodies Fully human T-cell receptors (TCR) against tumor and viral antigens Proprietary method that uses VelocImmune with proprietary antibody manufacturing processes to generate full-length human bispecific antibodies VELOCISUITE® 500,000 exomes sequenced by Regeneron Genetics Center (RGC) 16 ® ® ® ® VELOCI-Bi TM TM

LIBTAYO®: the Foundation of Our IO strategy 17 Combinations DEVELOPMENT STRATEGY CSCC: THE FIRST OF MANY POTENTIAL APPROVALS Additional Solid & Liquid Tumor Indications Pediatric Glioblastoma (GBM) – Ph1/2 initiated 1L Classical Hodgkin Lymphoma – Ph1 anticipated in 2019 HPV Positive Cancers 2L Cervical Cancer – Ph3 ongoing Non Small Cell Lung Cancer (NSCLC) 1L NSCLC Monotherapy (>50% PD-L1) (n=700) – Ph3 ongoing 1L NSCLC Combination therapy (non-squamous and squamous, stratified by PD-L1 status) – Ph3 amended LIBTAYO + Chemo vs. Chemo Maximize Skin Cancer Opportunity 2L Basal Cell Carcinoma (BCC) – Ph2 (potentially pivotal) ongoing CSCC – Ph3 adjuvant trial to start in 1H19; neo-adjuvant studies to follow Melanoma – regulatory discussions anticipated in 1H19 Immune modulators, vaccines, cell therapies, kinase inhibitors, chemotherapy and bispecifics LIBTAYO is the first and only FDA-approved therapy for patients with advanced CSCC; potentially pivotal study in BCC ongoing We plan to be a major player in indications where PD-1 inhibition has shown activity We have a comprehensive and differentiated IO strategy with LIBTAYO at the core This slide includes pipeline drug candidates currently undergoing clinical testing in a variety of diseases. The safety and efficacy of these drug candidates have not been evaluated by any regulatory authorities for the disease categories described here.

LIBTAYO 18 Regeneron’s IO strategy connects multiple individual pieces Kinase Inhibitors CD3 bispecifics Costimulatory bispecifics Chemo Vaccines Tcell Rx GITR LAG-3 CTLA-4

GITR LIBTAYO 19 Logically and rationally into a cohesive whole ...like pieces in a puzzle, bringing order to chaos Kinase Inhibitors CD3 bispecifics Costimulatory bispecifics Chemo Vaccines Tcell Rx LAG-3 Regeneron’s IO puzzle is evolving and not yet complete; based on science and experimental data, the shape, components and configuration may change CTLA-4

20 Regeneron’s cd3 & COstimulatory Bispecifics are off-the-shelf drugs with potential to turn patients’ T cells into CAR-T-like cancer killers CAR-T CD3ζ PD-1 scFv Costim Signal 2 Signal 1 + Costimulatory bispecific CD3 bispecific PD-L1/2 Signal 1 Signal 2 + Costim Tumor Target CD3γ CD3ε CD3ε CD3δ TCRα TCRβ CD3ζ CD3ζ CAR-T Mechanism Bispecific/Costimulatory Mechanism The combination of CD3 and costimulatory bispecifics has the potential to activate T cells into highly effective, targeted cancer killers PD-1 PD-L1/2 Tumor Target Tumor Target Tumor Target T cell activation can be inhibited by PD-1 signaling T cell activation can be inhibited by PD-1 signaling

21 CAR-T CD3ζ PD-1 scFv Costim Signal 2 Signal 1 + Costimulatory bispecific CD3 bispecific PD-L1/2 Signal 1 Signal 2 + Costim CD3γ CD3ε CD3ε CD3δ TCRα TCRβ CD3ζ CD3ζ CAR-T Mechanism Bispecific/Costimulatory Mechanism PD-1 PD-L1/2 Tumor Target Tumor Target Tumor Target LIBTAYO LIBTAYO blocks the stop signal LIBTAYO Regeneron’s cd3 & COstimulatory Bispecifics are off-the-shelf drugs with potential to turn patients’ T cells into CAR-T-like cancer killers LIBTAYO blocks the stop signal Using LIBTAYO to block PD-1 signaling can further enhance the efficacy of CD3 and costimulatory bispecifics

anti-PD-1 22 Adding COSTIMs to cd3 BISPECIFICs or to ANTI-PD-1 shows synergy in preclinical tumor models Unlike superagonist CD28 mAbs, our CD28 bispecifics have no toxicity, and little or no activity on their own, but when clustered on cells expressing their target, activate signal 2 and synergize with signal 1 (via CD3 bispecific) and/or anti-PD-1 In 2019, Regeneron plans to advance two distinct CD28 bispecific antibodies into clinical development anti-PD-1 + TSA2xCD28 in vivo syngeneic humanized TSA2 mouse model TSA = Tumor Specific Antigen This slide includes pipeline drug candidates currently undergoing clinical testing in a variety of diseases. The safety and efficacy of these drug candidates have not been evaluated by any regulatory authorities for the disease categories described here. TSA1xCD3 + TSA1xCD28 in vivo xenogeneic humanized TSA1 mouse model Control xCD3 TSA1xCD28 TSA1xCD3 TSA1xCD3 + TSA1xCD28 Control xCD3 TSA1xCD28 TSA1xCD3 + TSA1xCD28 TSA1xCD3 Control anti-PD-1 + TSA2xCD28 TSA2xCD28

Anti-PD-1 Responsive Tumors TCR binds tumor MHC/peptide Anti-PD-1 Unresponsive Tumors TCR does not recognize tumor MHC/peptide Additional Strategic Opportunities Block T cell inhibition with LIBTAYO (anti-PD-1) monotherapy Enhance with combinations: chemotherapy, other immune modulators (e.g., CTLA-4, LAG-3, GITR), kinase inhibitors, vaccines, costimulatory bispecifics, etc. Initiate immune response with a CD3 bispecific targeting tumor specific antigens (e.g., neoantigens bound to MHC) or tumor associated antigens on cells that are safe to ablate (e.g., CD20) Enhance response with anti-PD-1 and/or costimulatory bispecific directed against a tumor target Major collaboration with bluebird bio to empower and extend CAR-T therapies with novel tumor targeting moieties such as TCRs or reagents that bind peptide/ MHC complexes Can complement with soluble reagents such as anti-PD-1 and CD3 or costimulatory bispecifics Regeneron’s IO Strategy is based on rational combinations Anti-PD-1 mAb monotherapy or combination CD3 bispecific alone, or in combination with PD-1 and/or costims CAR-T therapies alone or in combination 23 This slide includes pipeline drug candidates currently undergoing clinical testing in a variety of diseases. The safety and efficacy of these drug candidates have not been evaluated by any regulatory authorities for the disease categories described here.

Putting theory into practice: REGN1979, Our exclusively-owned cd20xcd3 bispecific antibody, demonstrates high orr/cr In our dose escalation Ph1 study, treatment with >5 mg of REGN1979 demonstrated 100% ORR and 80% CR in 10 pts with R/R FL At higher doses in R/R DLBCL we are seeing response rates that make us optimistic about achieving activity comparable to CAR-Ts At doses tested, REGN1979 was well-tolerated in B-NHL: 75% patients had Grade 3/4/5 AEs, no DLTs, 3% discontinued due to AE, no discontinuations due to CRS or immune-related events, no clinically significant neurotoxicity (no seizures/ encephalopathy), 1 death due to related AE* Safety and toxicity profile is encouraging and supports further dose escalation Relapsed/ Refractory Diffuse Large B-Cell Lymphoma (R/R DLBCL) Relapsed/ Refractory Follicular Lymphoma (R/R FL) Grade 1-3a REGN1979 dose groups <5 mg (n=7) >5-<12 mg (n=5) >18-<40 mg (n=5) ORR 1/7 (14%) 5/5 (100%) 5/5 (100%) CR 1/7 (14%) 4/5 (80%) 4/5 (80%) PR 0/7 (0%) 1/5 (20%) 1/5 (20%) Responding patients who did not progress during study treatment, n/N (% of responders) 1/1 (100%) 4/5 (80%) 5/5 (100%) REGN1979 dose groups <5 mg (n=15) >5-<12 mg (n=11) >18-<40 mg (n=10) ORR 3/15 (20%) 2/11 (18%) 6/10 (60%) CR 0/15 (0%) 1/11 (9%) 2/10 (20%) PR 3/15 (20%) 1/11 (9%) 4/10 (40%) Responding patients who did not progress during study treatment, n/N (% of responders) 1/3 (33%) 1/2 (50%) 3/6 (50%) 24 Initiating potentially pivotal studies in 2019 This slide includes pipeline drug candidates currently undergoing clinical testing in a variety of diseases. The safety and efficacy of these drug candidates have not been evaluated by any regulatory authorities for the disease categories described here. * gastric perforation in patient with gastric wall lymphoma Data presented at the 2018 American Society of Hematology (ASH) Annual Meeting

BROADENING OUR IMMUNO-ONCOLOGY PIPELINE Approved LIBTAYO CSCC LIBTAYO Potential Indications LIBTAYO NSCLC, Cervical, BCC, Pediatric LIBTAYO + REGN1979 (CD20xCD3) B-Cell NHL Clinical Development REGN1979 (CD20xCD3) B-Cell NHL REGN5458 (BCMAxCD3) Multiple Myeloma REGN4018 (MUC16xCD3) Ovarian Cancer REGN4659 (CTLA-4) NSCLC REGN3767 (LAG-3) Solid/hematologic malignancies Pre-IND TSAxCD28 Solid Tumor TSAxCD28 B cell malignancy GITR Solid tumors And More To Come HLA/peptide (tumor and viral), etc. 25 TSA = Tumor Specific Antigen This slide includes pipeline drug candidates currently undergoing clinical testing in a variety of diseases. The safety and efficacy of these drug candidates have not been evaluated by any regulatory authorities for the disease categories described here.

PD-1/L1 PD-1/L1 MANY COMPANIES CAN DO ONE THING... CD3 bispecifics Costimulatory bispecifics CTLA-4, LAG-3, GITR 26

PD-1/L1 PD-1/L1 few can do many things is one of the few CD3 bispecifics Costimulatory bispecifics CTLA-4, LAG-3, GITR 27

Thank you