Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - WINNEBAGO INDUSTRIES INC | a2019q1exh322.htm |

| EX-32.1 - EXHIBIT 32.1 - WINNEBAGO INDUSTRIES INC | a2019q1exh321.htm |

| EX-31.2 - EXHIBIT 31.2 - WINNEBAGO INDUSTRIES INC | a2019q1exh312.htm |

| EX-31.1 - EXHIBIT 31.1 - WINNEBAGO INDUSTRIES INC | a2019q1exh311.htm |

| EX-10.F - EXHIBIT 10.F - WINNEBAGO INDUSTRIES INC | a2019q1exh10fcic.htm |

| EX-10.E - EXHIBIT 10.E - WINNEBAGO INDUSTRIES INC | a2019q1exh10ersudirector.htm |

| EX-10.D - EXHIBIT 10.D - WINNEBAGO INDUSTRIES INC | a2019q1exh10dpsu.htm |

| EX-10.C - EXHIBIT 10.C - WINNEBAGO INDUSTRIES INC | a2019q1exh10crsuexecutives.htm |

| EX-10.B - EXHIBIT 10.B - WINNEBAGO INDUSTRIES INC | a2019q1exh10boptions.htm |

| 10-Q - 10-Q - WINNEBAGO INDUSTRIES INC | a2019q110q.htm |

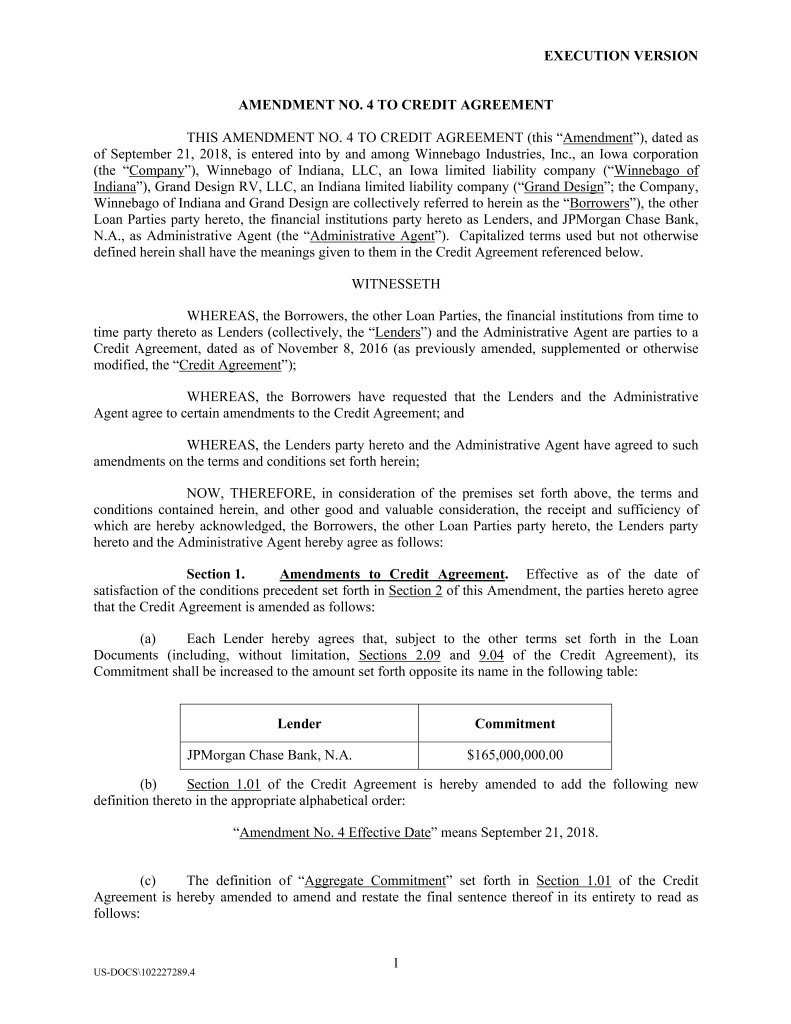

EXECUTION VERSION AMENDMENT NO. 4 TO CREDIT AGREEMENT THIS AMENDMENT NO. 4 TO CREDIT AGREEMENT (this “Amendment”), dated as of September 21, 2018, is entered into by and among Winnebago Industries, Inc., an Iowa corporation (the “Company”), Winnebago of Indiana, LLC, an Iowa limited liability company (“Winnebago of Indiana”), Grand Design RV, LLC, an Indiana limited liability company (“Grand Design”; the Company, Winnebago of Indiana and Grand Design are collectively referred to herein as the “Borrowers”), the other Loan Parties party hereto, the financial institutions party hereto as Lenders, and JPMorgan Chase Bank, N.A., as Administrative Agent (the “Administrative Agent”). Capitalized terms used but not otherwise defined herein shall have the meanings given to them in the Credit Agreement referenced below. WITNESSETH WHEREAS, the Borrowers, the other Loan Parties, the financial institutions from time to time party thereto as Lenders (collectively, the “Lenders”) and the Administrative Agent are parties to a Credit Agreement, dated as of November 8, 2016 (as previously amended, supplemented or otherwise modified, the “Credit Agreement”); WHEREAS, the Borrowers have requested that the Lenders and the Administrative Agent agree to certain amendments to the Credit Agreement; and WHEREAS, the Lenders party hereto and the Administrative Agent have agreed to such amendments on the terms and conditions set forth herein; NOW, THEREFORE, in consideration of the premises set forth above, the terms and conditions contained herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Borrowers, the other Loan Parties party hereto, the Lenders party hereto and the Administrative Agent hereby agree as follows: Section 1. Amendments to Credit Agreement. Effective as of the date of satisfaction of the conditions precedent set forth in Section 2 of this Amendment, the parties hereto agree that the Credit Agreement is amended as follows: (a) Each Lender hereby agrees that, subject to the other terms set forth in the Loan Documents (including, without limitation, Sections 2.09 and 9.04 of the Credit Agreement), its Commitment shall be increased to the amount set forth opposite its name in the following table: Lender Commitment JPMorgan Chase Bank, N.A. $165,000,000.00 (b) Section 1.01 of the Credit Agreement is hereby amended to add the following new definition thereto in the appropriate alphabetical order: “Amendment No. 4 Effective Date” means September 21, 2018. (c) The definition of “Aggregate Commitment” set forth in Section 1.01 of the Credit Agreement is hereby amended to amend and restate the final sentence thereof in its entirety to read as follows: 1 US-DOCS\102227289.4

Subject to the other terms set forth herein, as of the Amendment No. 4 Effective Date, the Aggregate Commitment is $165,000,000. (d) The definition of “FCCR Test Period” set forth in Section 1.01 of the Credit Agreement is hereby amended to replace the figure “$12,500,000” with the figure “$16,500,000” each time such figure appears therein. (e) The definition of “Monthly Reporting Period” set forth in Section 1.01 of the Credit Agreement is hereby amended to replace the figure “$40,000,000” with the figure “$50,000,000”. (f) The definition of “Payment Condition” set forth in Section 1.01 of the Credit Agreement is hereby amended to (i) replace the figure “$25,000,000” set forth therein with the figure “$33,000,000” and (ii) replace the figure “$18,750,000” set forth therein with the figure “$24,750,000.” (g) The definition of “Weekly Reporting Period” set forth in Section 1.01 of the Credit Agreement is hereby amended to replace the figure “$12,500,000” with the figure “$16,500,000” each time such figure appears therein. (h) Section 2.14(b) of the Credit Agreement is hereby amended and restated as follows: (b) If at any time the Administrative Agent determines (which determination shall be conclusive absent manifest error) that (i) the circumstances set forth in clause (a)(i) have arisen and such circumstances are unlikely to be temporary or (ii) the circumstances set forth in clause (a)(i) have not arisen but either (w) the supervisor for the administrator of the LIBO Screen Rate has made a public statement that the administrator of the LIBO Screen Rate is insolvent (and there is no successor administrator that will continue publication of the LIBO Screen Rate), (x) the administrator of the LIBO Screen Rate has made a public statement identifying a specific date after which the LIBO Screen Rate will permanently or indefinitely cease to be published by it (and there is no successor administrator that will continue publication of the LIBO Screen Rate), (y) the supervisor for the administrator of the LIBO Screen Rate has made a public statement identifying a specific date after which the LIBO Screen Rate will permanently or indefinitely cease to be published or (z) the supervisor for the administrator of the LIBO Screen Rate or a Governmental Authority having jurisdiction over the Administrative Agent has made a public statement identifying a specific date after which the LIBO Screen Rate may no longer be used for determining interest rates for loans, then the Administrative Agent and the Borrower Representative shall endeavor to establish an alternate rate of interest to the LIBO Rate that gives due consideration to the then prevailing market convention for determining a rate of interest for syndicated loans in the United States at such time, and shall enter into an amendment to this Agreement to reflect such alternate rate of interest and such other related changes to this Agreement as may be applicable (but for the avoidance of doubt, such related changes shall not include a reduction of the Applicable Rate). Notwithstanding anything to the contrary in Section 9.02, such amendment shall become effective without any further action or consent of any other party to this Agreement so long as the Administrative Agent shall not have received, within five (5) Business Days of the date notice of such alternate rate of interest is provided to the Lenders, a written notice from the Required Lenders stating that such Required Lenders object to such amendment. Until an alternate rate of interest shall be determined in accordance with this clause (b) (but, in the case of the circumstances described in clause (ii) of the first sentence of this Section 2.14(b), only to the extent the LIBO Screen Rate for such Interest Period is not available or published at such time on a current basis), (x) any Interest Election Request that requests 2

the conversion of any Borrowing to, or continuation of any Borrowing as, a Eurodollar Borrowing shall be ineffective and any such Eurodollar Borrowing shall be repaid or converted into an ABR Borrowing on the last day of the then current Interest Period applicable thereto, and (y) if any Borrowing Request requests a Eurodollar Borrowing, such Borrowing shall be made as an ABR Borrowing; provided that, if such alternate rate of interest shall be less than zero, such rate shall be deemed to be zero for the purposes of this Agreement. (i) Section 3.15 of the Credit Agreement is hereby amended to replace the reference to the “Effective Date” contained therein with a reference to the “Amendment No. 4 Effective Date.” (j) Section 3.18 of the Credit Agreement is hereby amended to replace each reference to the “Effective Date” contained therein with a reference to the “Amendment No. 4 Effective Date.” (k) Section 5.11 of the Credit Agreement is hereby amended to: (x) amend and restate clause (i) of the proviso set forth in the final sentence therein as follows: (i) an Inventory appraisal may be conducted during any calendar year at the sole expense of the Loan Parties if the Aggregate Availability is less than $50,000,000 at any time during such calendar year, and (y) replace the figure “$12,500,000” set forth therein with the figure “$16,500,000.” (l) Section 5.12 of the Credit Agreement is hereby amended to replace the figure “$12,500,000” set forth therein with the figure “$16,500,000.” (m) Article VIII of the Credit Agreement is hereby amended to add the following provisions to the end of such Article: Each Lender (x) represents and warrants, as of the date such Person became a Lender party hereto, to, and (y) covenants, from the date such Person became a Lender party hereto to the date such Person ceases being a Lender party hereto, for the benefit of, the Administrative Agent and its Affiliates, and not, for the avoidance of doubt, to or for the benefit of any Borrower or any other Loan Party, that at least one of the following is and will be true: (a) such Lender is not using “plan assets” (within the meaning of the Plan Asset Regulations) of one or more Benefit Plans in connection with the Loans, the Letters of Credit or the Commitments, (b) the transaction exemption set forth in one or more PTEs, such as PTE 84- 14 (a class exemption for certain transactions determined by independent qualified professional asset managers), PTE 95-60 (a class exemption for certain transactions involving insurance company general accounts), PTE 90-1 (a class exemption for certain transactions involving insurance company pooled separate accounts), PTE 91-38 (a class exemption for certain transactions involving bank collective investment funds) or PTE 96-23 (a class exemption for certain transactions determined by in-house asset managers), is applicable with respect to such Lender’s entrance into, participation in, administration of and performance of the Loans, the Letters of Credit, the Commitments and this Agreement, and the conditions for 3

exemptive relief thereunder are and will continue to be satisfied in connection therewith, (c) (i) such Lender is an investment fund managed by a “Qualified Professional Asset Manager” (within the meaning of Part VI of PTE 84-14), (ii) such Qualified Professional Asset Manager made the investment decision on behalf of such Lender to enter into, participate in, administer and perform the Loans, the Letters of Credit, the Commitments and this Agreement, (iii) the entrance into, participation in, administration of and performance of the Loans, the Letters of Credit, the Commitments and this Agreement satisfies the requirements of sub- sections (b) through (g) of Part I of PTE 84-14 and (D) to the best knowledge of such Lender, the requirements of subsection (a) of Part I of PTE 84-14 are satisfied with respect to such Lender’s entrance into, participation in, administration of and performance of the Loans, the Letters of Credit, the Commitments and this Agreement, or (d) such other representation, warranty and covenant as may be agreed in writing between the Administrative Agent, in its sole discretion, and such Lender. In addition, unless the immediately preceding clause (a) is true with respect to a Lender or such Lender has not provided another representation, warranty and covenant as provided in the immediately preceding clause (d), such Lender further (x) represents and warrants, as of the date such Person became a Lender party hereto, to, and (y) covenants, from the date such Person became a Lender party hereto to the date such Person ceases being a Lender party hereto, for the benefit of, the Administrative Agent and its Affiliates, and not, for the avoidance of doubt, to or for the benefit of any Borrower or any other Loan Party, that: (a) none of the Administrative Agent or any of its Affiliates is a fiduciary with respect to the assets of such Lender (including in connection with the reservation or exercise of any rights by the Administrative Agent under this Agreement, any Loan Document or any documents related to hereto or thereto), (b) the Person making the investment decision on behalf of such Lender with respect to the entrance into, participation in, administration of and performance of the Loans, the Letters of Credit, the Commitments and this Agreement is independent (within the meaning of 29 CFR § 2510.3-21, as amended from time to time) and is a bank, an insurance carrier, an investment adviser, a broker-dealer or other person that holds, or has under management or control, total assets of at least $50 million, in each case as described in 29 CFR §2510.3-21(c)(1)(i)(A)-(E), (c) the Person making the investment decision on behalf of such Lender with respect to the entrance into, participation in, administration of and performance of the Loans, the Letters of Credit, the Commitments and this Agreement is capable of evaluating investment risks independently, both in general and with regard to particular transactions and investment strategies (including in respect of the Obligations), (d) the Person making the investment decision on behalf of such Lender with respect to the entrance into, participation in, administration of and performance of the Loans, the Letters of Credit, the Commitments and this Agreement is a fiduciary 4

under ERISA or the Code, or both, with respect to the Loans, the Letters of Credit, the Commitments and this Agreement and is responsible for exercising independent judgment in evaluating the transactions hereunder, and (e) no fee or other compensation is being paid directly to the Administrative Agent or any of its Affiliates for investment advice (as opposed to other services) in connection with the Loans, the Letters of Credit, the Commitments or this Agreement. The Administrative Agent hereby informs the Lenders that it is not undertaking to provide impartial investment advice, or to give advice in a fiduciary capacity, in connection with the transactions contemplated hereby, and that it has a financial interest in the transactions contemplated hereby in that it or an Affiliate of it (i) may receive interest or other payments with respect to the Loans, the Letters of Credit, the Commitments and this Agreement, (ii) may recognize a gain if it extended the Loans, the Letters of Credit or the Commitments for an amount less than the amount being paid for an interest in the Loans, the Letters of Credit or the Commitments by such Lender or (iii) may receive fees or other payments in connection with the transactions contemplated hereby, the Loan Documents or otherwise, including structuring fees, commitment fees, arrangement fees, facility fees, upfront fees, underwriting fees, ticking fees, agency fees, administrative agent or collateral agent fees, utilization fees, minimum usage fees, letter of credit fees, fronting fees, deal-away or alternate transaction fees, amendment fees, processing fees, term out premiums, banker’s acceptance fees, breakage or other early termination fees or fees similar to the foregoing. (n) Schedules 3.15 and 3.18 to the Credit Agreement are hereby amended and restated in their entirety to read as set forth on Exhibit A hereto. Section 2. Conditions of Effectiveness. The effectiveness of this Amendment is subject to the conditions precedent that the Administrative Agent shall have received: (a) counterparts to this Amendment, duly executed by each of the Borrowers, the other Loan Parties, the Lenders and the Administrative Agent; (b) payment and reimbursement of the Administrative Agent’s and its affiliates’ fees and expenses (including, to the extent invoiced, reasonable fees and expenses of counsel for the Administrative Agent) in connection with this Amendment and the other Loan Documents; and (c) such other opinions, instruments and documents as are reasonably requested by the Administrative Agent. Section 3. Representations and Warranties of the Loan Parties. Each Loan Party hereby represents and warrants as follows: (a) This Amendment has been duly executed and delivered by it and constitutes its legal, valid and binding obligations, enforceable in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium or other laws affecting creditors’ rights generally and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law. 5

(b) Immediately after giving effect to this Amendment, the representations and warranties of the Loan Parties set forth in the Loan Documents shall be true and correct in all material respects (provided that any representation or warranty that is qualified by materiality, Material Adverse Effect or similar language shall be true and correct in all respects) on and as of the date hereof, except to the extent that such representations and warranties specifically refer to an earlier date, in which case they shall be true and correct in all material respects (provided that any representation or warranty that is qualified by materiality, Material Adverse Effect or similar language shall be true and correct in all respects) as of such earlier date. (c) Immediately after giving effect to this Amendment, no Default or Event of Default shall have occurred and be continuing. Section 4. Reaffirmation. Except as specifically set forth in this Amendment, the Loan Documents shall remain in full force and effect and are hereby reaffirmed, ratified and confirmed. To the extent that any provision of this Amendment conflicts with any terms or conditions set forth in the Loan Documents, the provisions of this Amendment shall supersede and control. Except as expressly provided herein, the execution and delivery of this Amendment shall not: (i) constitute an extension, modification, or waiver of any aspect of the Loan Documents or any right or remedy thereunder; (ii) extend the terms of the Loan Documents or the due date of any of the loans set forth therein; (iii) establish a course of dealing between the Administrative Agent, the Issuing Bank and/or the Lenders and the Loan Parties or give rise to any obligation on the part of the Administrative Agent, the Issuing Bank and/or any Lender to extend, modify or waive any term or condition of the Loan Documents; or (iv) give rise to any defenses or counterclaims to the Administrative Agent’s, the Issuing Bank’s and/or any Lender’s right to compel payment of any loan or to otherwise enforce its rights and remedies under the Loan Documents. Each of the Loan Parties restates, acknowledges and agrees that the Secured Obligations are outstanding without claim, offset, counterclaim, defense or affirmative defense of any kind and the Secured Obligations remain the continuing and individual obligations of the Loan Parties, until the termination of all Commitments, payment and satisfaction in full in cash of all Secured Obligations (other than Unliquidated Obligations), and the cash collateralization of all Unliquidated Obligations in a manner satisfactory to the Administrative Agent. Section 5. Effect on Credit Agreement. Upon the effectiveness of this Amendment, on and after the date hereof, each reference in the Credit Agreement to “this Agreement,” “hereunder,” “hereof,” “herein” or words of like import shall mean and be a reference to the Credit Agreement, as amended and modified hereby. Section 6. GOVERNING LAW. THIS AMENDMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK. Section 7. Headings. Section headings in this Amendment are included herein for convenience of reference only and shall not constitute a part of this Amendment for any other purpose. Section 8. Counterparts. This Amendment may be executed by one or more of the parties to this Amendment on any number of separate counterparts and all of said counterparts taken together shall be deemed to constitute one and the same instrument. A facsimile or PDF copy of any signature hereto shall have the same effect as the original thereof. [The remainder of this page is intentionally blank.] 6

Exhibit A [see attached]

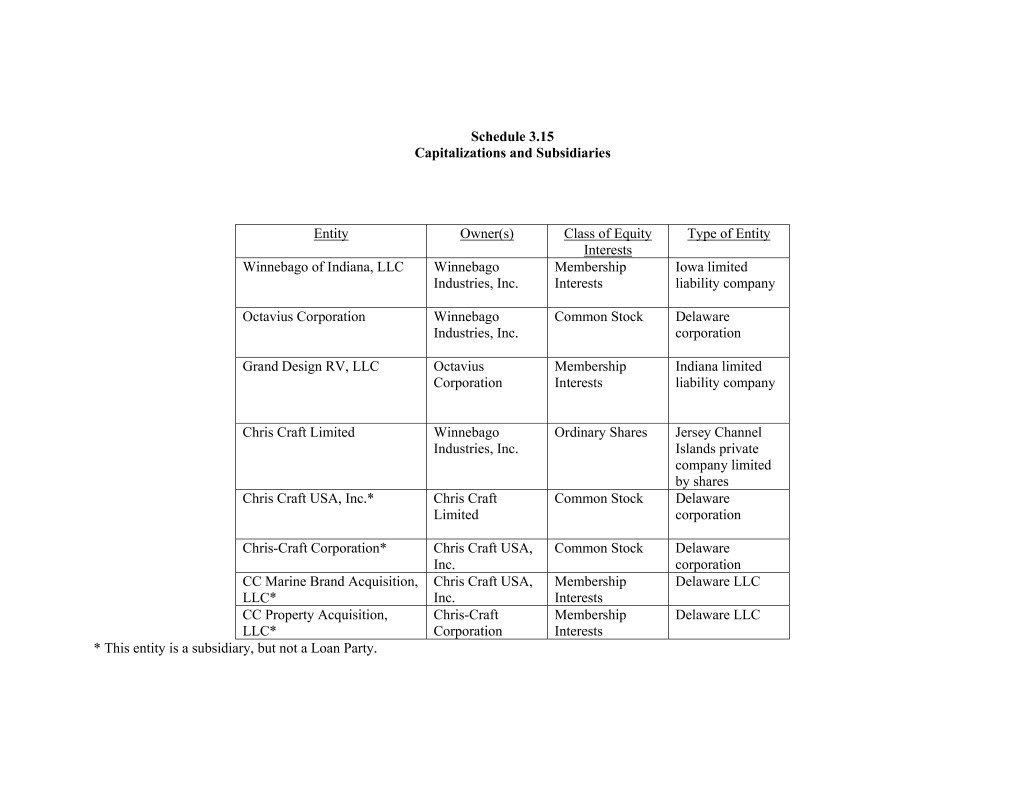

Schedule 3.15 Capitalizations and Subsidiaries Entity Owner(s) Class of Equity Type of Entity Interests Winnebago of Indiana, LLC Winnebago Membership Iowa limited Industries, Inc. Interests liability company Octavius Corporation Winnebago Common Stock Delaware Industries, Inc. corporation Grand Design RV, LLC Octavius Membership Indiana limited Corporation Interests liability company Chris Craft Limited Winnebago Ordinary Shares Jersey Channel Industries, Inc. Islands private company limited by shares Chris Craft USA, Inc.* Chris Craft Common Stock Delaware Limited corporation Chris-Craft Corporation* Chris Craft USA, Common Stock Delaware Inc. corporation CC Marine Brand Acquisition, Chris Craft USA, Membership Delaware LLC LLC* Inc. Interests CC Property Acquisition, Chris-Craft Membership Delaware LLC LLC* Corporation Interests * This entity is a subsidiary, but not a Loan Party.

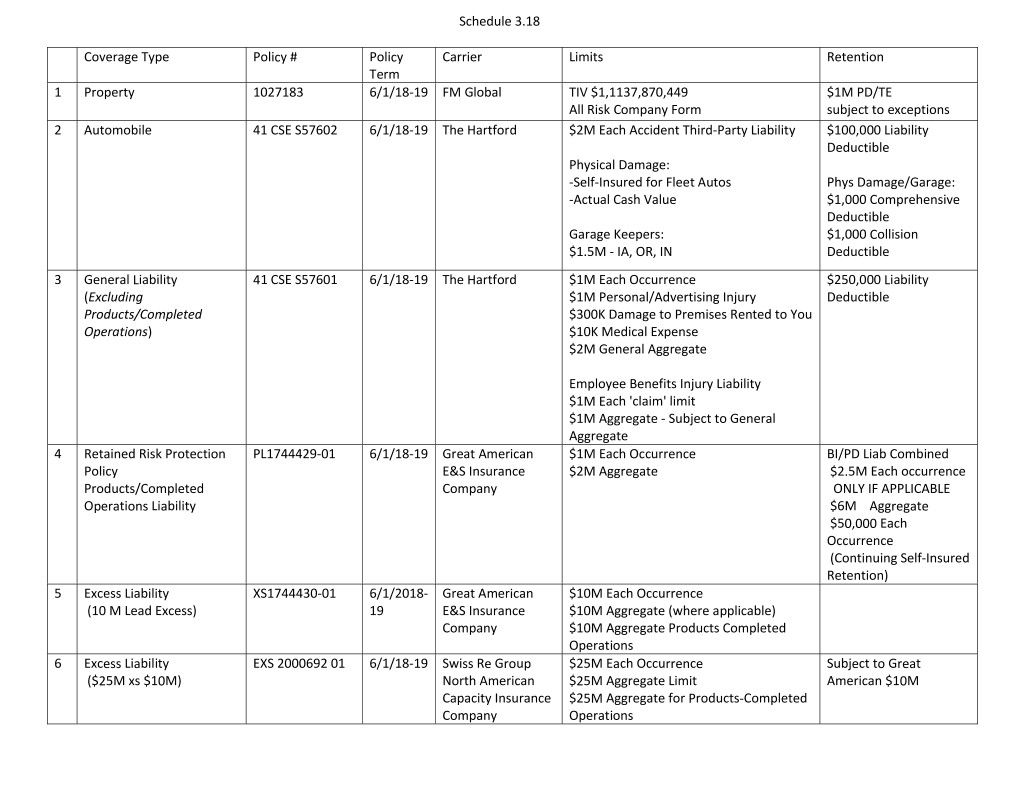

Schedule 3.18 Coverage Type Policy # Policy Carrier Limits Retention Term 1 Property 1027183 6/1/18-19 FM Global TIV $1,1137,870,449 $1M PD/TE All Risk Company Form subject to exceptions 2 Automobile 41 CSE S57602 6/1/18-19 The Hartford $2M Each Accident Third-Party Liability $100,000 Liability Deductible Physical Damage: -Self-Insured for Fleet Autos Phys Damage/Garage: -Actual Cash Value $1,000 Comprehensive Deductible Garage Keepers: $1,000 Collision $1.5M - IA, OR, IN Deductible 3 General Liability 41 CSE S57601 6/1/18-19 The Hartford $1M Each Occurrence $250,000 Liability (Excluding $1M Personal/Advertising Injury Deductible Products/Completed $300K Damage to Premises Rented to You Operations) $10K Medical Expense $2M General Aggregate Employee Benefits Injury Liability $1M Each 'claim' limit $1M Aggregate - Subject to General Aggregate 4 Retained Risk Protection PL1744429-01 6/1/18-19 Great American $1M Each Occurrence BI/PD Liab Combined Policy E&S Insurance $2M Aggregate $2.5M Each occurrence Products/Completed Company ONLY IF APPLICABLE Operations Liability $6M Aggregate $50,000 Each Occurrence (Continuing Self-Insured Retention) 5 Excess Liability XS1744430-01 6/1/2018- Great American $10M Each Occurrence (10 M Lead Excess) 19 E&S Insurance $10M Aggregate (where applicable) Company $10M Aggregate Products Completed Operations 6 Excess Liability EXS 2000692 01 6/1/18-19 Swiss Re Group $25M Each Occurrence Subject to Great ($25M xs $10M) North American $25M Aggregate Limit American $10M Capacity Insurance $25M Aggregate for Products-Completed Company Operations

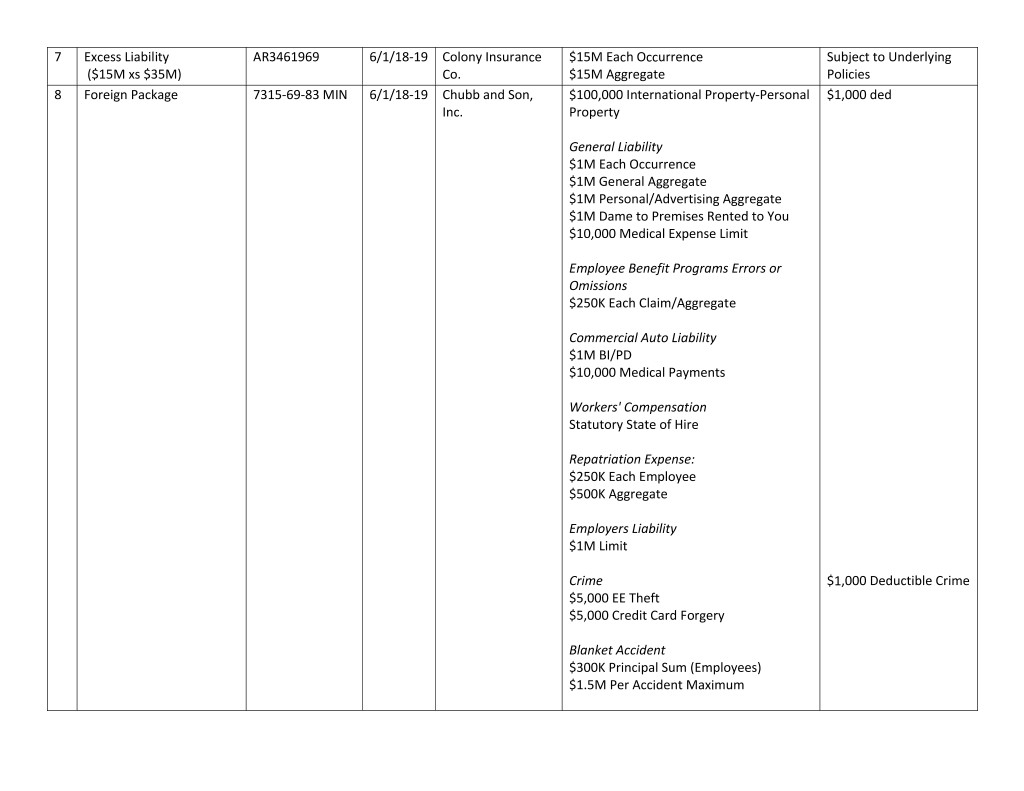

7 Excess Liability AR3461969 6/1/18-19 Colony Insurance $15M Each Occurrence Subject to Underlying ($15M xs $35M) Co. $15M Aggregate Policies 8 Foreign Package 7315-69-83 MIN 6/1/18-19 Chubb and Son, $100,000 International Property-Personal $1,000 ded Inc. Property General Liability $1M Each Occurrence $1M General Aggregate $1M Personal/Advertising Aggregate $1M Dame to Premises Rented to You $10,000 Medical Expense Limit Employee Benefit Programs Errors or Omissions $250K Each Claim/Aggregate Commercial Auto Liability $1M BI/PD $10,000 Medical Payments Workers' Compensation Statutory State of Hire Repatriation Expense: $250K Each Employee $500K Aggregate Employers Liability $1M Limit Crime $1,000 Deductible Crime $5,000 EE Theft $5,000 Credit Card Forgery Blanket Accident $300K Principal Sum (Employees) $1.5M Per Accident Maximum

Kidnap/Ranson and Extortion $100,000 Limit 9 Crime 106747087 6/1/18-19 Travelers $5M Each Occurrence $100,000 Retention Each Loss 10 Commercial Liquor CPS2827467 6/1/18-19 Scottsdale $1M Each Common Cause Limit Insurance $2M Aggregate Company 11 Directors & Officers 106535745 6/1/18-19 Travelers $10M Aggregate $750,000 all Securities Primary Retention $500,000 All Other Claims Retention

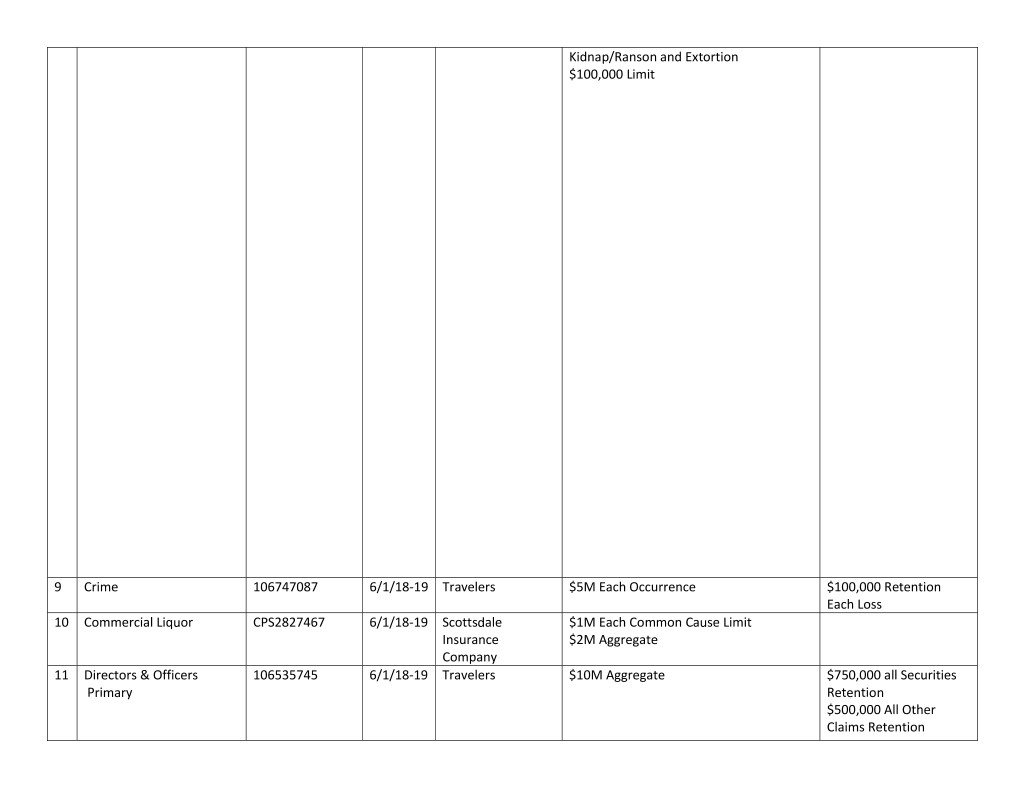

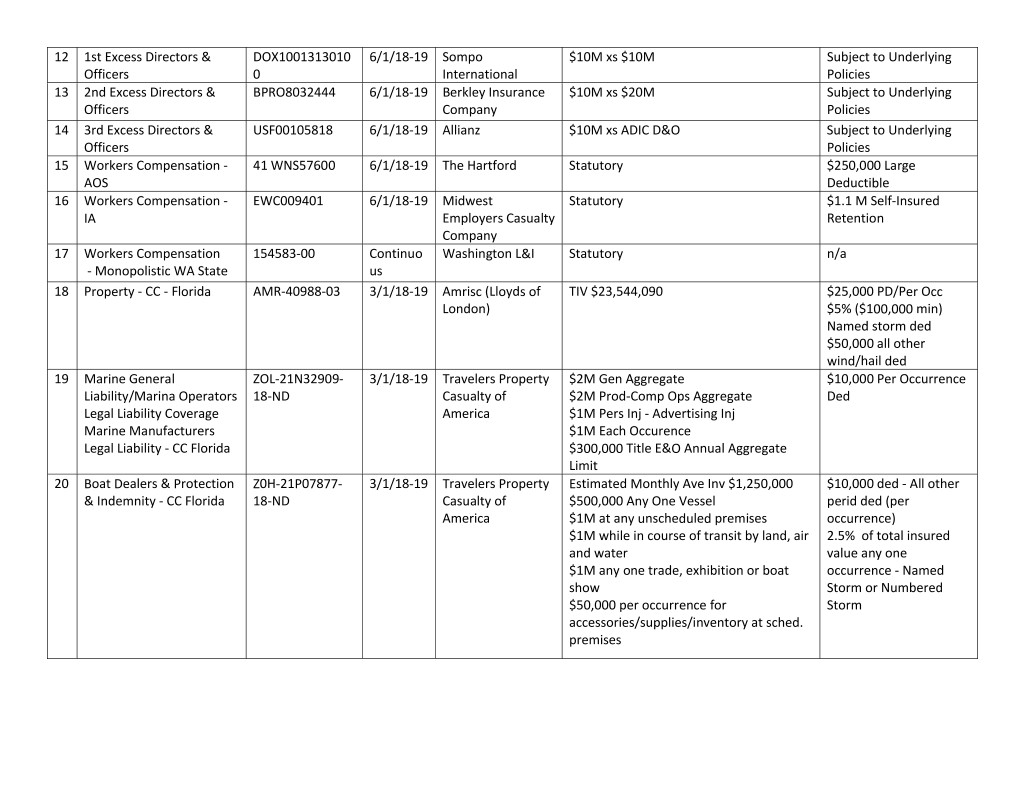

12 1st Excess Directors & DOX1001313010 6/1/18-19 Sompo $10M xs $10M Subject to Underlying Officers 0 International Policies 13 2nd Excess Directors & BPRO8032444 6/1/18-19 Berkley Insurance $10M xs $20M Subject to Underlying Officers Company Policies 14 3rd Excess Directors & USF00105818 6/1/18-19 Allianz $10M xs ADIC D&O Subject to Underlying Officers Policies 15 Workers Compensation - 41 WNS57600 6/1/18-19 The Hartford Statutory $250,000 Large AOS Deductible 16 Workers Compensation - EWC009401 6/1/18-19 Midwest Statutory $1.1 M Self-Insured IA Employers Casualty Retention Company 17 Workers Compensation 154583-00 Continuo Washington L&I Statutory n/a - Monopolistic WA State us 18 Property - CC - Florida AMR-40988-03 3/1/18-19 Amrisc (Lloyds of TIV $23,544,090 $25,000 PD/Per Occ London) $5% ($100,000 min) Named storm ded $50,000 all other wind/hail ded 19 Marine General ZOL-21N32909- 3/1/18-19 Travelers Property $2M Gen Aggregate $10,000 Per Occurrence Liability/Marina Operators 18-ND Casualty of $2M Prod-Comp Ops Aggregate Ded Legal Liability Coverage America $1M Pers Inj - Advertising Inj Marine Manufacturers $1M Each Occurence Legal Liability - CC Florida $300,000 Title E&O Annual Aggregate Limit 20 Boat Dealers & Protection Z0H-21P07877- 3/1/18-19 Travelers Property Estimated Monthly Ave Inv $1,250,000 $10,000 ded - All other & Indemnity - CC Florida 18-ND Casualty of $500,000 Any One Vessel perid ded (per America $1M at any unscheduled premises occurrence) $1M while in course of transit by land, air 2.5% of total insured and water value any one $1M any one trade, exhibition or boat occurrence - Named show Storm or Numbered $50,000 per occurrence for Storm accessories/supplies/inventory at sched. premises

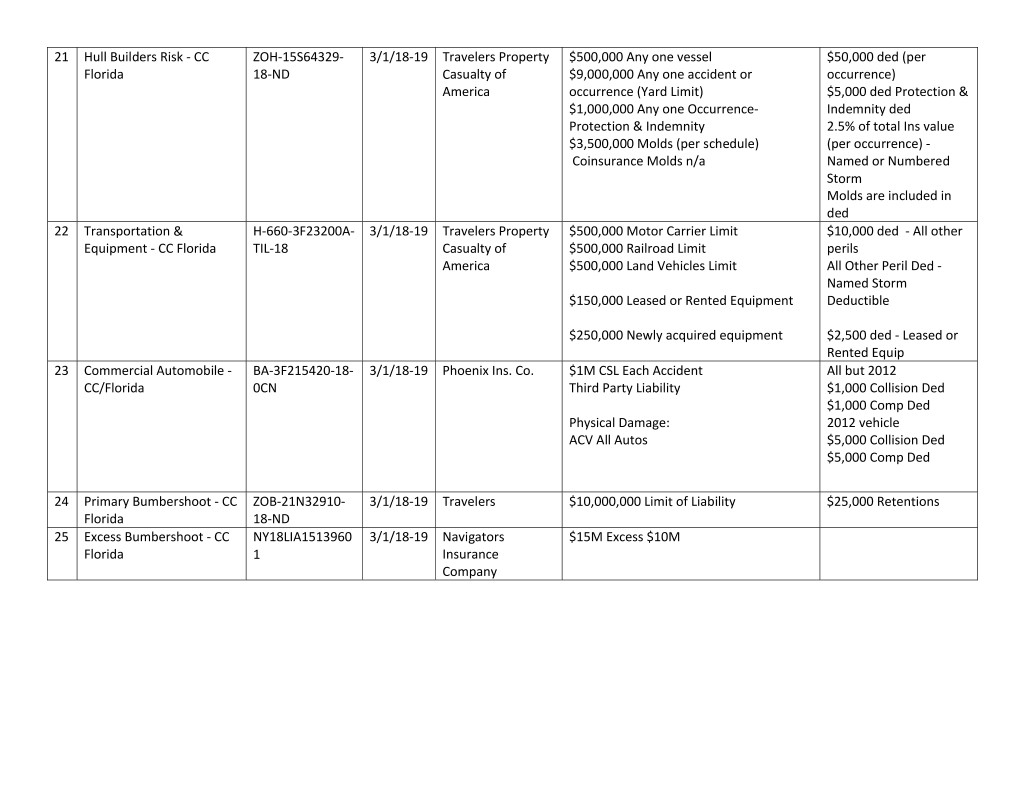

21 Hull Builders Risk - CC ZOH-15S64329- 3/1/18-19 Travelers Property $500,000 Any one vessel $50,000 ded (per Florida 18-ND Casualty of $9,000,000 Any one accident or occurrence) America occurrence (Yard Limit) $5,000 ded Protection & $1,000,000 Any one Occurrence- Indemnity ded Protection & Indemnity 2.5% of total Ins value $3,500,000 Molds (per schedule) (per occurrence) - Coinsurance Molds n/a Named or Numbered Storm Molds are included in ded 22 Transportation & H-660-3F23200A- 3/1/18-19 Travelers Property $500,000 Motor Carrier Limit $10,000 ded - All other Equipment - CC Florida TIL-18 Casualty of $500,000 Railroad Limit perils America $500,000 Land Vehicles Limit All Other Peril Ded - Named Storm $150,000 Leased or Rented Equipment Deductible $250,000 Newly acquired equipment $2,500 ded - Leased or Rented Equip 23 Commercial Automobile - BA-3F215420-18- 3/1/18-19 Phoenix Ins. Co. $1M CSL Each Accident All but 2012 CC/Florida 0CN Third Party Liability $1,000 Collision Ded $1,000 Comp Ded Physical Damage: 2012 vehicle ACV All Autos $5,000 Collision Ded $5,000 Comp Ded 24 Primary Bumbershoot - CC ZOB-21N32910- 3/1/18-19 Travelers $10,000,000 Limit of Liability $25,000 Retentions Florida 18-ND 25 Excess Bumbershoot - CC NY18LIA1513960 3/1/18-19 Navigators $15M Excess $10M Florida 1 Insurance Company

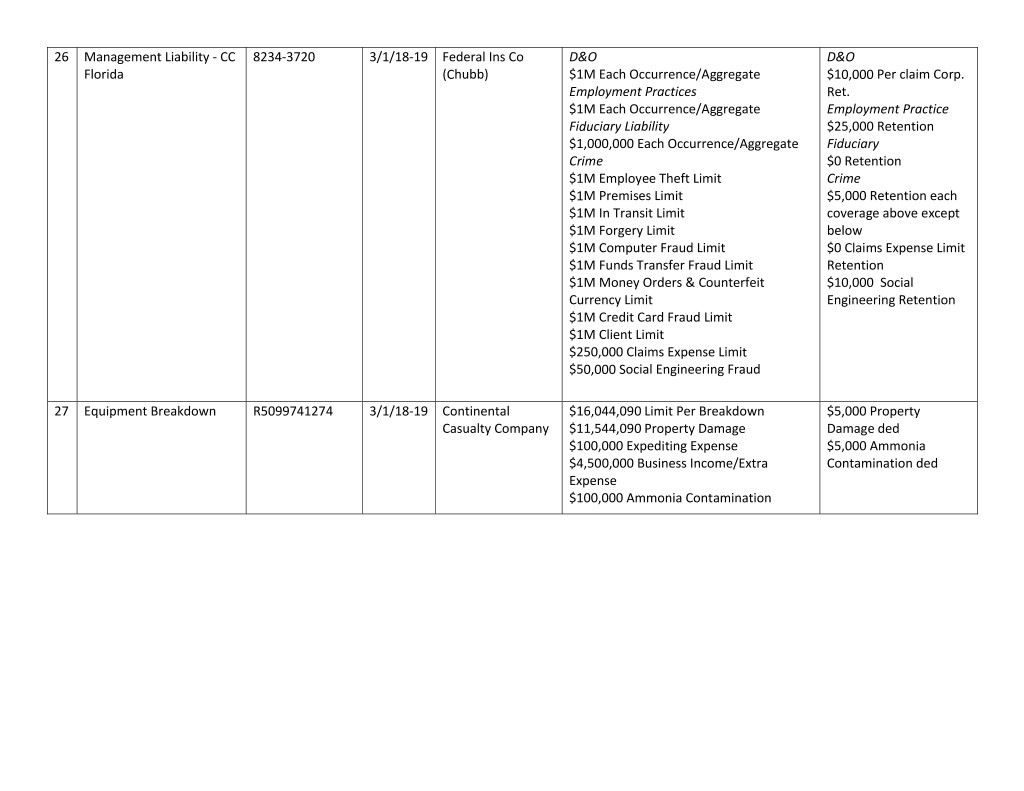

26 Management Liability - CC 8234-3720 3/1/18-19 Federal Ins Co D&O D&O Florida (Chubb) $1M Each Occurrence/Aggregate $10,000 Per claim Corp. Employment Practices Ret. $1M Each Occurrence/Aggregate Employment Practice Fiduciary Liability $25,000 Retention $1,000,000 Each Occurrence/Aggregate Fiduciary Crime $0 Retention $1M Employee Theft Limit Crime $1M Premises Limit $5,000 Retention each $1M In Transit Limit coverage above except $1M Forgery Limit below $1M Computer Fraud Limit $0 Claims Expense Limit $1M Funds Transfer Fraud Limit Retention $1M Money Orders & Counterfeit $10,000 Social Currency Limit Engineering Retention $1M Credit Card Fraud Limit $1M Client Limit $250,000 Claims Expense Limit $50,000 Social Engineering Fraud 27 Equipment Breakdown R5099741274 3/1/18-19 Continental $16,044,090 Limit Per Breakdown $5,000 Property Casualty Company $11,544,090 Property Damage Damage ded $100,000 Expediting Expense $5,000 Ammonia $4,500,000 Business Income/Extra Contamination ded Expense $100,000 Ammonia Contamination