Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

|

|

|

(Mark One) |

|

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 for the fiscal year ended August 29, 2009; or |

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR

15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 for the

transition period from ___________________ to _______________________ |

|

|

|

|

WINNEBAGO INDUSTRIES, INC. |

|

|

(Exact name of registrant as specified in its charter) |

|

|

|

|

|

|

Iowa |

|

42-0802678 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

incorporation or organization) |

|

Identification No.) |

|

|

|

|

|

P.O. Box 152, Forest City, Iowa |

|

50436 |

|

(Address of Principal executive offices) |

|

(Zip Code) |

|

|

|

|

|

Registrant’s telephone number, including area code: (641) 585-3535 |

|

|

Securities registered pursuant to Section 12(b) of the Act: |

|

|

|

|

|

TITLE OF EACH CLASS |

|

NAME OF EACH EXCHANGE ON |

|

Common Stock ($.50 par value) |

|

The New York Stock Exchange, Inc. |

|

and Preferred Share Purchase Rights |

|

Chicago Stock Exchange, Inc. |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by

check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes o

No x

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by

check mark whether the registrant has submitted electronically and posted on

its corporate Web Site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K o.

Indicate by

check mark whether the registrant is a shell company (as defined in Rule 12b-2

of the Exchange Act).

Yes o

No x

Aggregate market value of the common stock held by nonaffiliates of the registrant: $114,636,623 (28,305,339 shares at the closing price on the New York Stock Exchange of $4.05 on February 27, 2009).

Common stock outstanding on October 6, 2009: 29,088,144 shares.

Winnebago

Industries, Inc.

2009 Form 10-K Annual Report

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

Page |

||

|

|

|

|

|

|

|

|

Item 1. |

|

|

1 |

|

|

|

Item 1A. |

|

|

6 |

|

|

|

Item 1B. |

|

|

8 |

|

|

|

Item 2. |

|

|

9 |

|

|

|

Item 3. |

|

|

9 |

|

|

|

Item 4. |

|

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 5. |

|

|

11 |

|

|

|

Item 6. |

|

|

13 |

|

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

14 |

|

|

Item 7A. |

|

|

24 |

|

|

|

Item 8. |

|

|

25 |

|

|

|

Item 9. |

|

Changes In and Disagreements with Accountants on Accounting and Financial Disclosure |

|

50 |

|

|

Item 9A. |

|

|

50 |

|

|

|

Item 9B. |

|

|

50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 10. |

|

|

50 |

|

|

|

Item 11. |

|

|

51 |

|

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

51 |

|

|

Item 13. |

|

Certain Relationships and Related Transactions and Director Independence |

|

51 |

|

|

Item 14. |

|

|

51 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 15. |

|

|

51 |

|

|

WINNEBAGO INDUSTRIES, INC.

FORM 10-K

Report for the Fiscal Year Ended August 29, 2009

Forward-Looking Information

Certain of the matters discussed in this Annual Report on Form 10-K are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which involve risks and uncertainties. A number of factors could cause actual results to differ materially from these statements, including, but not limited to, interest rates and availability of credit, low consumer confidence, significant increase in repurchase obligations, inadequate liquidity or capital resources, availability and price of fuel, a further or continued slowdown in the economy, availability of chassis and other key component parts, sales order cancellations, slower than anticipated sales of new or existing products, new product introductions by competitors, the effect of global tensions and other factors which may be disclosed throughout this Annual Report on Form 10-K. Although we believe that the expectations reflected in the “forward-looking statements” are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Undue reliance should not be placed on these “forward-looking statements,” which speak only as of the date of this report. We undertake no obligation to publicly update or revise any “forward-looking statements,” whether as a result of new information, future events or otherwise, except as required by law or the rules of the New York Stock Exchange.

General

The “Company,” “we,” “our” and “us” are used interchangeably to refer to Winnebago Industries, Inc. as appropriate in the context. At August 29, 2009, we had no subsidiaries.

Winnebago Industries, Inc., headquartered in Forest City, Iowa, is the leading United States manufacturer of motor homes which are self-contained recreation vehicles (RV) used primarily in leisure travel and outdoor recreation activities. We sell motor homes through independent dealers under the Winnebago, Itasca and ERA brand names. Other products manufactured by us consist primarily of original equipment manufacturing (OEM) parts, including extruded aluminum and other component products for other manufacturers and commercial vehicles.

We were incorporated under the laws of the state of Iowa on February 12, 1958, and adopted our present name on February 28, 1961. Our executive offices are located at 605 West Crystal Lake Road in Forest City, Iowa. Our telephone number is (641) 585-3535.

Available Information

Our Web Site, located at www.winnebagoind.com, provides additional information about us. On our Web Site, you can obtain, free of charge, this and prior year Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all of our other filings with the Securities and Exchange Commission. Our recent press releases are also available on our Web Site. Our Web Site also contains important information regarding our corporate governance practices. Information contained on our Web Site is not incorporated into this Annual Report on Form 10-K.

1

Principal Products

Net revenues by major product classes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended (1) |

||||||||||||||||||||||||||

|

(In thousands) |

|

|

Aug. 29, |

|

% |

|

|

Aug. 30, |

|

% |

|

Aug. 25, |

|

% |

|

Aug. 26, |

|

% |

|

Aug. 27, |

|

% |

|

|||||

|

Motor homes |

|

|

$ |

178,619 |

|

84.5 |

|

|

$ |

555,671 |

|

91.9 |

|

$ |

815,895 |

|

93.8 |

|

$ |

808,715 |

|

93.6 |

|

$ |

946,350 |

|

95.4 |

|

|

Motor home parts and services |

|

|

|

12,559 |

|

5.9 |

|

|

|

16,923 |

|

2.8 |

|

|

16,413 |

|

1.9 |

|

|

15,901 |

|

1.8 |

|

|

16,401 |

|

1.7 |

|

|

Other manufactured products |

|

|

|

20,341 |

|

9.6 |

|

|

|

31,758 |

|

5.3 |

|

|

37,844 |

|

4.3 |

|

|

39,787 |

|

4.6 |

|

|

29,224 |

|

2.9 |

|

|

Total net revenues |

|

|

$ |

211,519 |

|

100.0 |

|

|

$ |

604,352 |

|

100.0 |

|

$ |

870,152 |

|

100.0 |

|

$ |

864,403 |

|

100.0 |

|

$ |

991,975 |

|

100.0 |

|

|

|

|

|

(1) The fiscal year ended August 30, 2008 contained 53 weeks; all other fiscal years contained 52 weeks. |

|

Motor Homes

A motor home is a self-propelled mobile dwelling used primarily as temporary living quarters during vacation and camping trips, or to support some other active lifestyle. The Recreation Vehicle Industry Association (RVIA) classifies motor homes into three types which are defined as follows:

|

|

|

|

|

Class A models are conventional motor homes constructed directly on medium- and heavy-duty truck chassis, which include the engine and drivetrain components. The living area and driver’s compartment are designed and produced by the motor home manufacturer. We manufacture Class A motor homes with gas and diesel engines. |

|

|

|

|

|

Class B models are panel-type trucks to which sleeping, kitchen, and/or toilet facilities are added. These models may also have a top extension to provide more headroom. We manufacture Class B motor homes with diesel engines. |

|

|

|

|

|

Class C models are mini motor homes built on van-type chassis onto which the motor home manufacturer constructs a living area with access to the driver’s compartment. We manufacture Class C motor homes with gas and diesel engines. |

We manufacture and sell Class A and C motor homes under the Winnebago and Itasca brand names and Class B motor homes under the ERA brand name. Our product offerings for the 2010 model year are as follows:

|

|

|

|

|

|

|

|

|

Type |

|

Winnebago |

|

Itasca |

|

ERA |

|

|

||||||

|

Class A (gas) |

|

Vista, Sightseer, Adventurer |

|

Sunstar, Sunova, Suncruiser |

|

|

|

Class A (diesel) |

|

Via, Journey, Journey Express, Tour |

|

Reyo, Meridian, Meridian V Class, Ellipse |

|

|

|

Class B (diesel) |

|

|

|

|

|

ERA |

|

Class C |

|

Access, Outlook, Aspect, View, View Profile |

|

Impulse, Cambria, Navion, Navion iQ |

|

|

Models in our 2009 model year lineup that have been discontinued in the 2010 lineup are as follows: Destination, Latitude, Spirit, Vectra and Horizon.

These motor homes generally provide living accommodations for up to seven people and include kitchen, dining, sleeping and bath areas, and in some models, a lounge. Optional equipment accessories include, among other items, generators, home theater systems, king-size beds, and UltraLeather upholstery and a wide selection of interior equipment. With the purchase of any new Class A, B or C motor home, we offer a comprehensive 12-month/15,000-mile warranty on the coach and a 3-year/36,000-mile structural warranty on sidewalls and floors of the Class A and C motor homes.

Our Class A, B and C motor homes are sold by dealers in the retail market with manufacturer’s suggested retail prices ranging from approximately $65,000 to $317,000, depending on size and model, plus optional equipment and delivery charges. Our motor homes range in length from 22 to 42 feet.

2

Unit sales of our recreation vehicles for the last five fiscal years were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended (1) |

|||||||||||||||||||

|

Unit Sales |

|

Aug. 29, |

|

% |

|

Aug. 30, |

|

% |

|

Aug. 25, |

|

% |

|

Aug. 26, |

|

% |

|

Aug. 27, |

|

% |

|

|

Class A |

|

822 |

|

37.4 |

|

3,029 |

|

47.3 |

|

5,031 |

|

53.1 |

|

4,455 |

|

45.3 |

|

6,674 |

|

62.7 |

|

|

Class B |

|

149 |

|

6.8 |

|

140 |

|

2.2 |

|

- - - |

|

- - - |

|

- - - |

|

- - - |

|

- - - |

|

- - - |

|

|

Class C |

|

1,225 |

|

55.8 |

|

3,238 |

|

50.5 |

|

4,438 |

|

46.9 |

|

5,388 |

|

54.7 |

|

3,963 |

|

37.3 |

|

|

Total motor homes |

|

2,196 |

|

100.0 |

|

6,407 |

|

100.0 |

|

9,469 |

|

100.0 |

|

9,843 |

|

100.0 |

|

10,637 |

|

100.0 |

|

(1) The fiscal year ended August 30, 2008 contained 53 weeks; all other fiscal years contained 52 weeks.

The primary use of recreation vehicles for leisure travel and outdoor recreation has historically led to a peak retail selling season concentrated in the spring and summer months. Our sales of recreation vehicles are generally influenced by this pattern in retail sales, but can also be affected by the level of dealer inventory. Our products are generally manufactured against orders from dealers.

Motor Home Parts and Services

Motor home parts and service activities represent revenues generated by service work we perform for retail customers at our Forest City, Iowa facility and parts we sell to our dealers. As of August 29, 2009, our parts inventory was approximately $2.5 million and is located in a 450,000-square foot warehouse with what we believe to be the most sophisticated distribution and tracking system in the industry. Our competitive strategy is to provide proprietary manufactured parts through our dealer network, which we believe increases customer satisfaction and the value of our motor homes.

Other Manufactured Products

We manufacture aluminum extrusions which are sold to approximately 70 customers. To a limited extent, we manufacture other component parts sold to outside manufacturers. We also manufacture commercial vehicles which are motor home shells, primarily custom designed for the buyer’s special needs and requirements, such as law enforcement command centers and mobile medical and dental clinics. These commercial vehicles are sold through our dealer network.

Production

We generally produce motor homes to order from dealers. We have the ability to increase our capacity by scheduling overtime and/or hiring additional production employees or to decrease our capacity through the use of shortened workweeks and/or reducing head count.

Our Forest City facilities have been designed to provide vertically integrated production line manufacturing. As of August 29, 2009, we also operated a fiberglass manufacturing facility in Hampton, Iowa, and a Class B motor home assembly plant and a cabinet products manufacturing facility in Charles City, Iowa. On June 11, 2009, we announced the decision to close the Hampton facility and to relocate a portion of the production capabilities for fiberglass components to our Forest City facilities with the balance to be outsourced. This transition is expected to be completed during the first quarter of Fiscal 2010. Our motor home bodies are made from various materials and structural components which are typically laminated into rigid, lightweight panels. Body designs are developed with computer design and analysis and subjected to a variety of tests and evaluations to meet our standards and requirements. We manufacture a number of components utilized in our motor homes, with the principal exceptions being chassis, engines, generators and appliances.

Most of our raw materials such as steel, aluminum, fiberglass and wood products are obtainable from numerous sources. Certain parts, especially motor home chassis, are available from a small group of suppliers. We are currently purchasing Class A and C chassis from Ford Motor Company, Class A chassis from Freightliner Custom Chassis Corporation (a Daimler company) and Workhorse Custom Chassis, LLC (a Navistar Company) and Class A, B and C chassis from Chrysler Motors LLC. In Fiscal 2009, only one vendor, Chrysler Motors LLC, individually, accounted for more than 10 percent (11.6 percent) of our raw material purchases.

Backlog

As of August 29, 2009, we had a backlog for our motor homes of 940 units with an approximate revenue value of $86.6 million. In comparison as of August 30, 2008, our backlog was 596 units with an approximate revenue value of $50.6 million.

3

Distribution and Financing

We market our recreation vehicles on a wholesale basis to a diversified independent dealer organization located throughout the United States and, to a limited extent, in Canada. Foreign sales, including Canada, were less than 8 percent of net revenues during each of the past three fiscal years. As of August 29, 2009 and August 30, 2008, our motor home dealer organization in the United States and Canada included approximately 245 and 280 dealer locations, respectively. The contraction in our dealer locations during Fiscal 2009 was a direct result of the challenging market conditions. We have a number of dealers that carry our Winnebago, Itasca and ERA brands; we count each dealer location only once no matter how many of our brands are offered at each such dealer location. During Fiscal 2009, four dealer organizations accounted for approximately 25 percent of our net revenues. One of our dealer organizations, FreedomRoads, LLC, accounted for 13 percent of our net revenue, as they sold our products in 27 of their dealership locations across 18 U.S. states.

We have sales and service agreements with dealers which generally have a term of ten years but are subject to annual review. Many of the dealers are also engaged in other areas of business, including the sale of automobiles, and many dealers carry one or more competitive lines of motor homes. We continue to place high emphasis on the capability of our dealers to provide complete service for our recreation vehicles. Dealers are obligated to provide full service for owners of our recreation vehicles or, in lieu thereof, to secure such service at their own expense from other authorized providers.

We advertise and promote our products through national RV magazines, the distribution of product brochures, the Go RVing national advertising campaign sponsored by RVIA, direct-mail advertising campaigns, various national promotional opportunities and on a local basis through trade shows, television, radio and newspapers, primarily in connection with area dealers.

Recreation vehicle sales to dealers are made on cash terms. Most dealers are financed on a “floorplan” basis under which a bank or finance company lends the dealer all, or substantially all, of the purchase price, collateralized by a security interest in the merchandise purchased. As is customary in the recreation vehicle industry, we typically enter into a repurchase agreement with a lending institution financing a dealer’s purchase of our product upon the lending institution’s request and after completion of a credit check of the dealer involved. Our repurchase agreements provide that for up to 18 months after a unit is financed, in the event of default by the dealer on the agreement to pay the lending institution and repossession of the unit(s) by the lending institution, we will repurchase the financed merchandise. Our maximum exposure for repurchases varies significantly from time to time, depending upon general economic conditions, seasonal shipments, competition, dealer organization, gasoline availability and access to and the cost of bank financing. (See Note 10 to the Consolidated Financial Statements.)

Competition

The recreation vehicle market is highly competitive with more than 20 other manufacturers selling products which compete directly with our products. The competition in the motor home industry is based upon design, price, quality and service of the products. We believe our principal competitive advantages are our brand strength, product quality and our service after the sale. We believe that our products command a price premium as a result of these competitive advantages.

There have been significant changes within the motor home industry during the past year, as follows:

|

|

|

|

§ |

In December 2008, Coachmen Industries, Inc. sold their RV assets to Forest River, Inc., a subsidiary of Berkshire Hathaway, Inc., for approximately $41 million. |

|

§ |

In February 2009, Rexhall Industries, Inc. filed for Chapter 11 bankruptcy protection. |

|

§ |

In March 2009, three additional RV manufacturing companies filed for Chapter 11 bankruptcy protection: Country Coach, LLC, Monaco Coach Corporation (Monaco) and Fleetwood Enterprises, Inc. (Fleetwood). |

|

§ |

In June 2009, certain RV assets of Monaco were purchased by Navistar International Corp. for approximately $47 million and a new company named Monaco RV, LLC was established. |

|

§ |

In July 2009, certain motor home assets of Fleetwood were purchased by American Industrial Partners Capital Fund IV, L.P. for approximately $35 million and a new company named Fleetwood RV, Inc. was established. |

Due to the market disruption caused by the actions as described above of some of our larger competitors, we believe that we have unique opportunity in the current market environment to increase our market share, shelf space and points of distribution.

4

As evidenced by the following table, we are the largest combined Class A and C motor home manufacturer in the U.S. in terms of retail registrations as reported by Statistical Surveys, Inc. (Statistical Surveys) for the eight months ended August 31, 2009.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 Months Ended August 31, 2009 |

||||||||||||||||||||||||

|

|

|

|

Class A |

|

Class C |

|

Total Class A |

|

|||||||||||||||||||

|

|

|

|

Gas |

|

% of |

|

Diesel |

|

% of |

|

Total |

|

% of |

|

Units |

|

% of |

|

Units |

|

% of |

|

|||||

|

1. |

Winnebago Industries, Inc. |

|

840 |

|

23.2 |

|

|

453 |

|

10.8 |

|

|

1,293 |

|

16.5 |

|

|

1,313 |

|

22.5 |

|

|

2,606 |

|

19.1 |

|

|

|

2. |

Thor Industries, Inc. |

|

823 |

|

22.7 |

|

|

335 |

|

8.0 |

|

|

1,158 |

|

14.8 |

|

|

1,222 |

|

21.0 |

|

|

2,380 |

|

17.4 |

|

|

|

3. |

Fleetwood RV, Inc. (1) |

|

746 |

|

20.6 |

|

|

719 |

|

17.1 |

|

|

1,465 |

|

18.7 |

|

|

675 |

|

11.6 |

|

|

2,140 |

|

15.7 |

|

|

|

4. |

Forest River, Inc. (2) |

|

438 |

|

12.1 |

|

|

224 |

|

5.3 |

|

|

662 |

|

8.5 |

|

|

1,040 |

|

17.8 |

|

|

1,702 |

|

12.5 |

|

|

|

5. |

Monaco RV, LLC (3) |

|

285 |

|

7.9 |

|

|

994 |

|

23.6 |

|

|

1,279 |

|

16.3 |

|

|

257 |

|

4.4 |

|

|

1,536 |

|

11.2 |

|

|

|

6. |

Tiffin Motor Homes, Inc. |

|

189 |

|

5.2 |

|

|

704 |

|

16.7 |

|

|

893 |

|

11.4 |

|

|

1 |

|

- - - |

|

|

894 |

|

6.5 |

|

|

|

7. |

Gulfstream Coach |

|

96 |

|

2.6 |

|

|

156 |

|

3.7 |

|

|

252 |

|

3.2 |

|

|

397 |

|

6.8 |

|

|

649 |

|

4.8 |

|

|

|

8. |

Jayco, Inc. |

|

1 |

|

- - - |

|

|

25 |

|

0.6 |

|

|

26 |

|

0.3 |

|

|

601 |

|

10.3 |

|

|

627 |

|

4.6 |

|

|

|

9. |

Newmar Corporation |

|

116 |

|

3.2 |

|

|

291 |

|

6.9 |

|

|

407 |

|

5.2 |

|

|

- - - |

|

- - - |

|

|

407 |

|

3.0 |

|

|

|

10. |

Other |

|

89 |

|

2.5 |

|

|

304 |

|

7.3 |

|

|

393 |

|

5.1 |

|

|

325 |

|

5.6 |

|

|

718 |

|

5.2 |

|

|

|

Total |

|

3,623 |

|

100.0 |

|

|

4,205 |

|

100.0 |

|

|

7,828 |

|

100.0 |

|

|

5,831 |

|

100.0 |

|

|

13,659 |

|

100.0 |

|

|

|

(1) Includes all Fleetwood retail

registrations.

(2) Includes Coachmen retail registrations.

(3) Includes all Monaco retail registrations.

Backlog

Our order backlog for motor homes is included in Item 7, “Management’s Discussion and Analysis of Financial Condition and Company and Business Outlook” below.

Regulations, Trademarks and Patents

We are subject to a variety of federal, state and local laws and regulations, including the National Traffic and Motor Vehicle Safety Act, under which the National Highway Traffic Safety Administration may require manufacturers to recall recreation vehicles that contain safety-related defects, and numerous state consumer protection laws and regulations relating to the operation of motor vehicles, including so-called “Lemon Laws.” We are also subject to regulations established by the Occupational Safety and Health Administration (OSHA). Our facilities are periodically inspected by federal and state agencies, such as OSHA. We believe that our products and facilities comply in all material respects with the applicable vehicle safety, consumer protection, RVIA and OSHA regulations and standards. Amendments to any of these regulations or the implementation of new regulations, however, could significantly increase the cost of manufacturing, purchasing, operating or selling our products and could have a material adverse effect on our results of operations. Our failure to comply with present or future regulations could result in fines being imposed on us, potential civil and criminal liability, suspension of sales or production or cessation of operations. In addition, a major product recall could have a material adverse effect on our results of operations.

Our operations are subject to a variety of federal and state environmental laws and regulations relating to the use, generation, storage, treatment, emission and disposal of hazardous materials and wastes and noise pollution. Although we believe that we currently are in material compliance with applicable environmental regulations, the failure by us to comply with present or future laws and regulations could result in fines being imposed on us, potential civil and criminal liability, suspension of production or operations, alterations to the manufacturing process or costly cleanup or capital expenditures.

We have several registered trademarks which include: Adventurer, Aspect, Cambria, Destination, Ellipse, ERA, Horizon, Impulse, Itasca, Journey, Latitude, Meridian, Navion, Outlook, Sightseer, Spirit, Suncruiser, Sunova, Sunrise, Sunstar, Tour, Vectra, View, Vista, Voyage, and Winnebago. We believe that our trademarks and trade names are significant to our business and we will vigorously protect them against infringement. We are not dependent upon any patents or technology licenses for the conduct of our business.

5

Research and Development

Research and development expenditures are expensed as incurred. During Fiscal 2009, 2008 and 2007, we spent approximately $3.3 million, $4.1 million and $4.3 million, respectively on research and development activities.

Human Resources

At the end of Fiscal 2009, 2008 and 2007, we employed approximately 1,630, 2,250 and 3,310 persons, respectively. None of our employees are covered under a collective bargaining agreement. We believe our relations with our employees are good.

ITEM 1A. Risk Factors

The following risk factors should be considered carefully in addition to the other information contained in this Annual Report on Form 10-K. The risks and uncertainties described below are not the only ones we face, but represent some of the most significant risk factors that we believe may adversely affect the RV industry and our business, operations or financial position.

Interest Rates and Credit Availability

Our business is affected by the availability and terms of the financing to dealers. Generally, recreation vehicle dealers finance their purchases of inventory with financing provided by lending institutions. The decrease in the availability of this type of wholesale financing has prevented many dealers from carrying adequate levels of inventory, which limits product offerings and leads to reduced demand. Two financial flooring institutions held 53 percent of our total financed dealer inventory dollars that were outstanding at August 29, 2009.

Our business is also affected by the availability and terms of financing to retail purchasers. Customers purchasing a motor home may elect to finance their purchase through the dealership or a financial institution of their choice. Substantial increases in interest rates and decreases in the general availability of credit have also had an adverse impact upon our business and results of operations in the past and may continue to do so in the future. In particular, the current credit availability crisis has had and may continue to have a significant impact on our business.

General Economic Conditions and Certain Other External Factors

Companies within the recreation vehicle industry are subject to volatility in operating results due primarily to general economic conditions. Specific factors affecting the recreation vehicle industry include:

|

|

|

|

|

|

• |

overall consumer confidence and the level of discretionary consumer spending; |

|

|

• |

employment trends; |

|

|

• |

the adverse impact of global tensions on consumer spending and travel-related activities; and |

|

|

• |

adverse impact on margins of increases in raw material costs which we are unable to pass on to customers without negatively affecting sales. |

Maintaining Adequate Liquidity and Capital Resources

Although we have historically generated revenues from our operations to pay operating expenses, make capital expenditures, buy back stock and pay cash dividends, our ability to continue to meet our cash requirements over the long term may be substantially more difficult. As a result of the financial crisis and the global recession, our revenues generated from motor home sales have been significantly reduced and our ability to liquidate our auction rate securities investments has been limited, further constraining our liquidity and capital resources. We have taken a number of steps, as discussed in “Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations – Analysis of Financial Condition, Liquidity and Resources” below, to increase our cash position and ensure adequate liquidity. However, the continuation of reduced demand for our products could weaken the Company’s liquidity position and materially adversely affect net revenues available for the Company’s anticipated cash needs. To the extent the initiatives we have undertaken are not successful or we are unable to successfully implement other alternative actions, our ability to cover both short-term and long-term operation requirements would be significantly adversely affected.

6

Cyclicality and Seasonality

The recreation vehicle industry has been characterized by cycles of growth and contraction in consumer demand, reflecting prevailing economic and demographic conditions, which affect disposable income for leisure-time activities. Consequently, the results for any prior period may not be indicative of results for any future period.

Seasonal factors, over which we have no control, also have an effect on the demand for our products. Demand in the recreation vehicle industry generally declines over the winter season, while sales are generally highest during the spring and summer months. Also, unusually severe weather conditions in some markets may impact demand.

Competition

The market for recreation vehicles is very competitive. Competition in this industry is based upon price, design, value, quality and service. There can be no assurance that existing or new competitors will not develop products that are superior to our recreation vehicles or that achieve better consumer acceptance, thereby adversely affecting market share, sales volume and profit margins.

Potential Repurchase Liabilities

In accordance with customary practice in the recreation vehicle industry, we enter into formal repurchase agreements with lending institutions pursuant to which we agree, in the event of a default by an independent retailer in its obligation to a lender and repossession of the unit(s) by the lending institution, we will repurchase units at declining prices over the term of the agreements, which can last up to 18 months. The difference between the gross repurchase price and the price at which the repurchased product can then be resold, which is typically at a discount to the gross repurchase price, represents a potential expense to us. Our maximum potential exposure under these formal repurchase agreements was approximately $90.6 million at August 29, 2009.

In certain instances, we also repurchase inventory from our dealers due to state law or regulatory requirements that govern voluntary or involuntary terminations. Incremental repurchase exposure beyond repurchase agreements was approximately $3.1 million at August 29, 2009.

Prior to Fiscal 2009, our losses associated with repurchases have not been material. However, the substantial decrease in retail demand for recreation vehicles in the past 12 months and tightened credit standards by lenders resulted in a significant increase in defaults by our dealers. If we are obligated to repurchase a larger number of motor homes in the future, this would increase our costs and could be material. (See Note 10 to the Consolidated Financial Statements.)

Fuel Availability and Prices

Gasoline or diesel fuel is required for the operation of motorized recreation vehicles. There can be no assurance that the supply of these petroleum products will continue uninterrupted or that the price or tax on these petroleum products will not significantly increase in the future. Fuel shortages and substantial increases in fuel prices have had a material adverse effect on the recreation vehicle industry as a whole in the past and could have a material adverse effect on us in the future.

Dependence on Chassis Suppliers

Most RV components are readily available from numerous sources. However, decisions by suppliers to decrease production, utilize production internally or shortages, production delays or work stoppages by the employees of such suppliers could have a material adverse effect on our ability to produce motor homes and ultimately, on the results of operations. A few components are produced by only a small group of quality suppliers that have the capacity to supply large quantities on a national basis. This is especially true in the case of motor home chassis where Ford Motor Company, Freightliner Custom Chassis Corporation, Workhorse Custom Chassis and Chrysler Motors LLC are our major suppliers. Our relationship with our chassis suppliers is similar to our other supplier relationships in that no special contractual commitments are engaged in by either party. Historically, chassis suppliers resort to an industry-wide allocation system during periods when supply is restricted. These allocations have been based on the volume of chassis previously purchased. Sales of motor homes rely on chassis and are affected accordingly. If economic conditions improve and dealers begin to replenish their inventory, there may be a shortage of chassis for a period of time, which would adversely affect our production capacity and results of operations.

7

Warranty Claims

We receive warranty claims from our dealers in the ordinary course of our business. Although we maintain reserves for such claims, which to date have been adequate, there can be no assurance that warranty expense levels will remain at current levels or that such reserves will continue to be adequate. A significant increase in warranty claims exceeding our current warranty expense levels could have a material adverse effect on our results of operations, financial condition and cash flows.

In addition to the costs associated with the contractual warranty coverage provided on our motor homes, we also occasionally incur costs as a result of additional service actions not covered by our warranties, including product recalls and customer satisfaction actions. Although we estimate and reserve for the cost of these service actions, there can be no assurance that expense levels will remain at current levels or such reserves will continue to be adequate.

Product Liability

We are involved in legal proceedings in the ordinary course of business, including a variety of warranty, “Lemon Law” and product liability claims typical in the recreation vehicle industry. We have an insurance policy covering product liability, however, we are self-insured for a portion of product liability claims. Self-insurance retention liability for at least the past five fiscal years was $2.5 million per occurrence and $6.0 million in aggregate per policy year. In the event that the annual aggregate of the self-insured retention is exhausted by payment of claims and defense expenses, a deductible of $1.0 million, excluding defense expenses, is applicable to each claim covered under this insurance policy. We cannot be certain that our insurance coverage will be sufficient to cover all future claims against us, which may have a material adverse effect on our results of operations and financial condition. In addition, if these claims rise to a level of frequency or size that are significantly higher than similar claims made against our competitors, our reputation and business may be harmed.

Government Regulation

We are subject to numerous federal, state and local regulations governing the manufacture and sale of our products, including the provisions of the National Traffic and Motor Vehicle Safety Act (“Motor Vehicle Act”), and the safety standards for recreation vehicles and components which have been established under the Motor Vehicle Act by the Department of Transportation. The Motor Vehicle Act authorizes the National Highway Traffic Safety Administration to require a manufacturer to recall and repair vehicles which contain certain hazards or defects. Any recalls of our vehicles, voluntary or involuntary, could have a material adverse effect on our results of operations, financial condition and cash flows.

We are also subject to federal and numerous state consumer protection and unfair trade practice laws and regulations relating to the sale, transportation and marketing of motor vehicles, including so-called “Lemon Laws.” Federal and state laws and regulations also impose upon vehicle operators various restrictions on the weight, length and width of motor vehicles, including motor homes that may be operated in certain jurisdictions or on certain roadways. Certain jurisdictions also prohibit the sale of vehicles exceeding length restrictions.

Finally, federal and state authorities also have various environmental control standards relating to air, water, noise pollution and hazardous waste generation and disposal which affect us and our operations. Failure to comply with any of the foregoing laws or regulations could have an adverse impact on our results of operations, financial condition and cash flows.

ITEM 1B. Unresolved Staff Comments

None

8

Our principal manufacturing, maintenance and service operations are conducted in multibuilding complexes owned by us. The following sets forth our material facilities as of August 29, 2009:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location |

|

Facility Type/Use |

|

No. of |

|

Owned or Leased |

|

Square |

|

||

|

|

|

|

|

|

|

|

|

|

|

||

|

Forest City, Iowa |

|

Manufacturing, maintenance, service and office |

|

31 |

|

|

Owned |

|

1,593,000 |

|

|

|

Forest City, Iowa |

|

Warehouse |

|

4 |

|

|

Owned |

|

702,000 |

|

|

|

Charles City, Iowa |

|

Manufacturing |

|

2 |

|

|

Owned |

|

161,000 |

|

|

|

Charles City, Iowa |

|

Assets Held for Sale (Manufacturing Facility) |

|

3 |

|

|

Owned |

|

191,000 |

|

|

|

Hampton, Iowa |

|

Assets Held for Sale (Manufacturing Facility) |

|

2 |

|

|

Owned |

|

135,000 |

|

|

|

|

|

|

|

42 |

|

|

|

|

2,782,000 |

|

|

Our facilities in Forest City are located on approximately 500 acres of land, all owned by us. We lease 244,000 square feet of our warehouse facilities in Forest City to others. Most of our buildings are of steel or steel and concrete construction and are protected from fire with high-pressure sprinkler systems, dust collector systems, automatic fire doors and alarm systems. We believe that our facilities and equipment are well maintained, in excellent condition and suitable for the purposes for which they are intended.

For our new credit facility, as further described in Note 7 to the Consolidated Financial Statements, we have committed to encumber substantially all of our real property for the benefit of the lender under such facility.

We are involved in various legal proceedings which are ordinary routine litigation incidental to our business, some of which are covered in whole or in part by insurance. While it is impossible to estimate with certainty the ultimate legal and financial liability with respect to this litigation, we believe that while the final resolution of any such litigation may have an impact on our consolidated results for a particular reporting period, the ultimate disposition of such litigation will not have any material adverse effect on our financial position, results of operations or liquidity.

ITEM 4. Submission of Matters to a Vote of Security Holders

None

9

Executive Officers of the Registrant

|

|

|

|

|

|

|

Name |

|

Office (Year First Elected an Officer) |

|

Age |

|

Robert J. Olson + |

|

Chairman of the Board, Chief Executive Officer and President (1996) |

|

58 |

|

Raymond M. Beebe |

|

Vice President, General Counsel & Secretary (1974) |

|

67 |

|

Robert L. Gossett |

|

Vice President, Administration (1998) |

|

58 |

|

Roger W. Martin |

|

Vice President, Sales and Marketing (2003) |

|

49 |

|

Sarah N. Nielsen |

|

Vice President, Chief Financial Officer (2005) |

|

36 |

|

William J. O’Leary |

|

Vice President, Product Development (2001) |

|

60 |

|

Randy J. Potts |

|

Vice President, Manufacturing (2006) |

|

50 |

|

Brian J. Hrubes |

|

Controller (1996) |

|

58 |

|

Donald L. Heidemann |

|

Treasurer (2007) |

|

37 |

+ Director

Officers are elected annually by the Board of Directors. There are no family relationships between or among any of the Corporate Officers or Directors of the Company.

Mr. Olson has over 40 years of experience with Winnebago Industries. He was elected Chairman of the Board and Chief Executive Officer on May 5, 2008. He has been President since 2007, previously serving as Senior Vice President, Operations, since January 2006. He served as Vice President, Manufacturing, from August 1996 to January 2006.

Mr. Beebe has over 35 years of experience with Winnebago Industries. He has been Vice President, General Counsel and Secretary since 1986.

Mr. Gossett has over 10 years of experience with Winnebago Industries. He has been Vice President, Administration since joining the Company in 1998.

Mr. Martin has over 15 years of experience with Winnebago Industries. He has been Vice President, Sales and Marketing since February 2003. He joined the Company as Director of Marketing in 1994.

Ms. Nielsen has four years of experience with Winnebago Industries. She has been Vice President, Chief Financial Officer since November 2005. Ms. Nielsen joined the Company in August 2005. Prior to joining Winnebago Industries, she was employed by Deloitte & Touche LLP since 1995 in the position of Assurance and Advisory Services Senior Manager from 2003 to August 2005.

Mr. O’Leary has over 37 years of experience with Winnebago Industries. He has been Vice President, Product Development since 2001.

Mr. Potts has over 26 years of experience with Winnebago Industries. He was elected Vice President, Manufacturing in October 2006. He served as Director of Manufacturing from February 2006 to October 2006. Prior to that time, he served as General Manager of Manufacturing Services since 2001.

Mr. Hrubes has over 38 years of experience with Winnebago Industries. He has been Controller since December 1996.

Mr. Heidemann has two years of experience with Winnebago Industries and was elected to the position of Treasurer in August 2007. Prior to joining Winnebago Industries, Mr. Heidemann served in various treasury positions for Select Comfort Corporation from 2003 to July 2007.

10

ITEM 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Our common stock is listed on the New York and Chicago Exchanges with the ticker symbol of WGO.

Below are the New York Stock Exchange high, low and closing prices of Winnebago Industries, Inc. stock for each quarter of Fiscal 2009 and Fiscal 2008:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal 2009 |

High |

Low |

Close |

Fiscal 2008 |

High |

Low |

Close |

|||||||||||||||

|

First Quarter |

|

$ |

15.20 |

|

$ |

4.22 |

|

$ |

5.88 |

|

|

First Quarter |

|

$ |

30.09 |

|

$ |

20.66 |

|

$ |

21.27 |

|

|

Second Quarter |

|

|

7.47 |

|

|

3.90 |

|

|

4.05 |

|

|

Second Quarter |

|

|

24.03 |

|

|

18.16 |

|

|

20.07 |

|

|

Third Quarter |

|

|

9.23 |

|

|

3.14 |

|

|

7.67 |

|

|

Third Quarter |

|

|

24.14 |

|

|

13.98 |

|

|

14.92 |

|

|

Fourth Quarter |

|

|

12.23 |

|

|

6.01 |

|

|

11.62 |

|

|

Fourth Quarter |

|

|

14.94 |

|

|

9.09 |

|

|

11.35 |

|

Holders

Shareholders of record as of October 6, 2009: 3,642.

Dividends Paid Per Share

Listed below are the dates paid and amounts per share for Fiscal 2009 and Fiscal 2008:

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Fiscal 2009 |

|

|

|

|

|

Fiscal 2008 |

|

|

|

|

||

|

October 6, 2008 |

|

$ |

0.12 |

|

|

October 8, 2007 |

|

$ |

0.12 |

|

||

|

|

|

|

|

|

|

January 7, 2008 |

|

|

|

0.12 |

|

|

|

|

|

|

|

|

|

April 7, 2008 |

|

|

|

0.12 |

|

|

|

|

|

|

|

|

|

July 8, 2008 |

|

|

0.12 |

|

|

|

|

|

|

|

|

|

Total |

|

$ |

0.48 |

|

|

||

Dividends of $0.12 per share (approximately $3.5 million) were paid in the first quarter of Fiscal 2009; however, on October 15, 2008, our Board of Directors suspended future cash dividend payments in order to conserve capital and to maintain liquidity.

Our new credit facility, as further described in Note 7 to the Consolidated Financial Statements, contains typical covenants that limit our ability, among other things, to pay certain dividends and distributions including stock repurchases. Except for limited redemptions of Winnebago Industries’ common stock from employees, the credit facility prohibits us from making any cash dividends, distributions or payments with respect to or purchases of Winnebago Industries’ common stock without the consent of Burdale Capital Finance, Inc., as Agent and the lenders thereunder, in their sole discretion.

Issuer Purchases of Equity Securities

On December 19, 2007, the Board of Directors authorized the repurchase of outstanding shares of our common stock, depending on market conditions, for an aggregate consideration of up to $60 million. There is no time restriction on this authorization. During the fourth quarter of Fiscal 2009, there were no shares repurchased under this authorization. As of August 29, 2009, approximately 31,000 shares have been repurchased under the authorization, at an aggregate cost of approximately $407,000, which leaves approximately $59.6 million remaining under this authorization.

11

Equity Compensation Plan Information

The following table provides information as of August 29, 2009 with respect to shares of our common stock that may be issued under our existing equity compensation plans:

|

|

|

|

|

|

|

|

|

|

|

|

|

(Adjusted for the 2-for-1 |

(a) |

(b) |

(c) |

|||||||

|

Equity compensation plans approved by shareholders |

|

|

1,010,224 |

(1) |

$ |

27.31 |

|

|

1,012,771 |

(2) |

|

Equity compensation plans not approved by shareholders (3) |

87,881 |

(4) |

14.90 |

N/A |

(5) |

|||||

|

Total |

1,098,105 |

$ |

26.32 |

1,012,771 |

||||||

|

|

|

|

(1) |

This number includes 655,388 stock options granted under the 2004 Incentive Compensation Plan (the “Plan”). Also included are 354,836 options granted under the 1997 Stock Option Plan. |

|

(2) |

This number represents stock options available for grant under the Plan as of August 29, 2009. The Plan replaced the 1997 Stock Option Plan effective January 1, 2004. No new grants may be made under the 1997 Stock Option Plan. Any stock options previously granted under the 1997 Stock Option Plan will continue to be exercisable in accordance with their original terms and conditions. |

|

(3) |

Our sole equity compensation plan not previously submitted to our shareholders for approval is the Directors’ Deferred Compensation Plan. The Board of Directors may terminate the Directors’ Deferred Compensation Plan at any time. If not terminated earlier, the Directors’ Deferred Compensation Plan will automatically terminate on June 30, 2013. For a description of the key provisions of the Directors’ Deferred Compensation Plan, see the information in our Proxy Statement for the Annual Meeting of Shareholders scheduled to be held December 15, 2009 under the caption “Director Compensation,” which information is incorporated by reference herein. |

|

(4) |

Represents shares of common stock issued to a trust which underlie stock units, payable on a one-for-one basis, credited to stock unit accounts as of August 29, 2009 under the Directors’ Deferred Compensation Plan. |

|

(5) |

The table does not reflect a specific number of stock units which may be distributed pursuant to the Directors’ Deferred Compensation Plan. The Directors’ Deferred Compensation Plan does not limit the number of stock units issuable thereunder. The number of stock units to be distributed pursuant to the Directors’ Deferred Compensation Plan will be based on the amount of the director’s compensation deferred and the per share price of our common stock at the time of deferral. |

12

Performance Graph

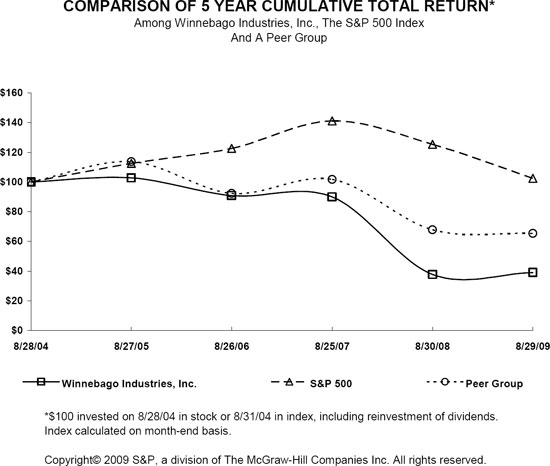

The following graph compares our five-year cumulative total shareholder return (including reinvestment of dividends) with the cumulative total return on the Standard & Poor’s 500 Index and a peer group.(1) It is assumed in the graph that $100 was invested in our common stock, in the stock of the companies in the Standard & Poor’s 500 Index and in the stocks of the peer group companies on August 28, 2004 and that all dividends received within a quarter were reinvested in that quarter. In accordance with the guidelines of the Securities and Exchange Commission, the shareholder return for each entity in the peer group index has been weighted on the basis of market capitalization as of each annual measurement date set forth in the graph.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Base Period |

|

Indexed Returns |

|||||||||||||||

|

Company/Index |

08/27/05 |

08/26/06 |

08/25/07 |

08/30/08 |

08/29/09 |

||||||||||||||

|

Winnebago Industries, Inc. |

|

|

100.00 |

|

|

102.78 |

|

|

90.81 |

|

|

89.98 |

|

|

37.67 |

|

|

38.95 |

|

|

S&P 500 Index |

|

|

100.00 |

|

|

112.56 |

|

|

122.56 |

|

|

141.11 |

|

|

125.38 |

|

|

102.50 |

|

|

Peer Group (1) |

|

|

100.00 |

|

|

113.70 |

|

|

92.28 |

|

|

101.69 |

|

|

67.80 |

|

|

65.43 |

|

|

|

|

|

(1) |

The peer group companies consisting of Thor Industries, Inc., Polaris Industries, Inc. and Brunswick Corporation were selected by us as they also manufacture recreational products. Coachmen Industries, Inc., a member of our peer group in prior fiscal years, has been omitted from our peer group as its RV related assets were sold to Forest River, Inc., a subsidiary of Berkshire Hathaway, Inc. in December 2008. Fleetwood Enterprises, Inc. and Monaco Coach Corporation, members of the peer group in prior fiscal years, were also omitted from our peer group because they filed for protection under Chapter 11 of the U.S. Bankruptcy Code in March of 2009 and their securities are no longer traded on the New York Stock Exchange (NYSE). |

ITEM 6. Selected Financial Data (See pages 62 and 63)

13

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Executive Overview

Winnebago Industries, Inc. is the leading U.S. manufacturer of motor homes with a proud history of manufacturing recreation vehicles for more than 50 years. Our strategy is to manufacture quality motor homes in a profitable manner. We produce all of our motor homes in highly vertically integrated manufacturing facilities in the state of Iowa. We distribute our products through independent dealers throughout the United States and Canada, who then retail the products to the end consumer. We have led the industry with the highest market share in the U.S. of Class A and C motor homes combined for the past eight calendar years and in Calendar 2009 through August 31, 2009. We began producing Class B motor homes in February 2008 and in Calendar Year through August 31, 2009, we hold the number three U.S. position in retail unit market share. See our U.S. retail unit market share for all categories in the following table:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Winnebago Industries U.S. Retail Market Share (1) |

|||||||||||

|

|

|

Calendar Year Through August 31, |

|

Calendar Year |

|||||||||

|

|

|

2009 |

|

2008 |

|

2008 |

|

2007 |

|

||||

|

Class A gas |

|

23.2 |

% |

|

23.3 |

% |

|

23.2 |

% |

|

22.0 |

% |

|

|

Class A diesel |

|

10.8 |

% |

|

7.6 |

% |

|

8.1 |

% |

|

8.9 |

% |

|

|

Total Class A |

|

16.5 |

% |

|

15.2 |

% |

|

15.3 |

% |

|

15.1 |

% |

|

|

Class C |

|

22.5 |

% |

|

23.0 |

% |

|

22.9 |

% |

|

24.0 |

% |

|

|

Total Class A and C |

|

19.1 |

% |

|

18.5 |

% |

|

18.3 |

% |

|

18.5 |

% |

|

|

Class B |

|

16.1 |

% |

|

2.8 |

% |

|

3.7 |

% |

|

0.0 |

% |

|

|

|

|

|

(1) |

As reported by Statistical Surveys. |

Company and Business Outlook

The RV industry saw substantial reductions in wholesale motor home shipments (down nearly 50 percent) and retail registrations (down nearly 40 percent) during Calendar 2008 as compared to 2007. The trend has worsened thus far in Calendar 2009, with motor home shipments down nearly 70 percent and retail registrations down over 40 percent, as detailed in the table below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Industry Wholesale Shipments (1) |

|

Industry Retail Registration (2) |

|||||||||||||||||||||

|

(In units) |

|

|

2008 |

|

|

2007 |

|

Decrease |

|

% of Decrease |

|

|

2008 |

|

|

2007 |

|

Decrease |

|

% of Decrease |

|

||||

|

First quarter |

|

|

10,400 |

|

|

13,600 |

|

(3,200 |

) |

|

(23.5 |

) |

|

|

8,800 |

|

|

11,500 |

|

(2,700 |

) |

|

(23.5 |

) |

|

|

Second quarter |

|

|

8,600 |

|

|

15,000 |

|

(6,400 |

) |

|

(42.7 |

) |

|

|

9,800 |

|

|

15,100 |

|

(5,300 |

) |

|

(35.1 |

) |

|

|

Third quarter |

|

|

4,600 |

|

|

12,400 |

|

(7,800 |

) |

|

(62.9 |

) |

|

|

6,300 |

|

|

12,200 |

|

(5,900 |

) |

|

(48.4 |

) |

|

|

Fourth quarter |

|

|

2,800 |

|

|

11,300 |

|

(8,500 |

) |

|

(75.2 |

) |

|

|

4,100 |

|

|

8,400 |

|

(4,300 |

) |

|

(51.2 |

) |

|

|

|

|

|

26,400 |

|

|

52,300 |

|

(25,900 |

) |

|

(49.5 |

) |

|

|

29,000 |

|

|

47,200 |

|

(18,200 |

) |

|

(38.6 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In units) |

|

|

2009 |

|

|

2008 |

|

Decrease |

|

% of Decrease |

|

|

2009 |

|

|

2008 |

|

Decrease |

|

% of Decrease |

|

||||

|

First quarter |

|

|

2,200 |

|

|

10,400 |

|

(8,200 |

) |

|

(78.8 |

) |

|

|

4,400 |

|

|

8,800 |

|

(4,400 |

) |

|

(50.0 |

) |

|

|

Second quarter |

|

|

2,900 |

|

|

8,600 |

|

(5,700 |

) |

|

(66.3 |

) |

|

|

6,000 |

|

|

9,800 |

|

(3,800 |

) |

|

(38.8 |

) |

|

|

July |

|

|

800 |

|

|

1,500 |

|

(700 |

) |

|

(46.7 |

) |

|

|

1,700 |

|

|

2,300 |

|

(600 |

) |

|

(26.1 |

) |

|

|

August |

|

|

1,000 |

|

|

1,500 |

|

(500 |

) |

|

(33.3 |

) |

|

|

1,600 |

|

|

2,000 |

|

(400 |

) |

|

(20.0 |

) |

|

|

|

|

|

6,900 |

|

|

22,000 |

|

(15,100 |

) |

|

(68.6 |

) |

|

|

13,700 |

|

|

22,900 |

|

(9,200 |

) |

|

(40.2 |

) |

|

|

|

|

|

(1) |

As reported by RVIA Class A and C wholesale shipments, rounded to the nearest hundred. |

|

(2) |

As reported by Statistical Surveys Class A and C retail registrations, rounded to the nearest hundred. |

The motorized market has been significantly impacted by highly unstable market conditions. The tightening of the wholesale and retail credit markets, low consumer confidence, the effect of the global recession and uncertainty related to fuel prices placed pressure on retail sales and as a result, our dealers have significantly reduced their inventory levels. Dealers continue to sell older model year units and during most of Fiscal 2009, they were not reordering inventory on a one-for-one basis, which negatively affected shipments and backlog. The decline in wholesale and retail demand has directly impacted our gross margins as we have produced and delivered far fewer units in Fiscal 2009 and we have also had to increase our discounts to meet competitive pricing and provide retail incentives to help dealers move inventory.

14

Order backlog for our motor homes was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As Of |

|||||||||||||||||||||||

|

(In units) |

|

August 29, |

|

Product Mix |

|

August 30, |

|

Product Mix |

|

Increase |

|

% |

|

||||||||||||

|

Class A gas |

|

|

|

345 |

|

|

|

|

36.7 |

|

|

|

|

119 |

|

|

20.0 |

|

|

226 |

|

|

|

189.9 |

|

|

Class A diesel |

|

|

|

198 |

|

|

|

|

21.0 |

|

|

|

|

100 |

|

|

16.8 |

|

|

98 |

|

|

|

98.0 |

|

|

Total Class A |

|

|

|

543 |

|

|

|

|

57.7 |

|

|

|

|

219 |

|

|

36.8 |

|

|

324 |

|

|

|

147.9 |

|

|

Class B |

|

|

|

10 |

|

|

|

|

1.1 |

|

|

|

|

46 |

|

|

7.7 |

|

|

(36 |

) |

|

|

(78.3 |

) |

|

Class C |

|

|

|

387 |

|

|

|

|

41.2 |

|

|

|

|

331 |

|

|

55.5 |

|

|

56 |

|

|

|

16.9 |

|

|

Total backlog (1) |

|

|

|

940 |

|

|

|

|

100.0 |

|

|

|

|

596 |

|

|

100.0 |

|

|

344 |

|

|

|

57.7 |

|

|

Total approximate revenue dollars (in thousands) |

|

|

$ |

86,626 |

|

|

|

|

|

|

|

|

$ |

50,599 |

|

|

|

|

|

$ 36,027 |

|

|

|

71.2 |

|

|

Dealer inventory (units) |

|

|

|

1,694 |

|

|

|

|

|

|

|

|

|

3,663 |

|

|

|

|

|

(1,969 |

) |

|

|

(53.8 |

) |

|

|

|

|

(1) |

We include in our backlog all accepted purchase orders from dealers to be shipped within the next six months. Orders in backlog can be canceled or postponed at the option of the dealer at any time without penalty and, therefore, backlog may not necessarily be an accurate measure of future sales. |

As noted above, our dealer inventories were nearly 54 percent lower than last year. We attribute the growth in our backlog to the very low level of dealer inventories and the strong acceptance of our 2010 product lineup. This increase may be a sign that the replenishment process is now beginning. As wholesale and retail credit availability and consumer confidence improve, we expect to see an increase in motor home demand as dealers will again have the ability to order units to maintain their inventory levels after an extended period of inventory reduction. A longer term positive outlook for the recreation vehicle industry is supported by favorable demographics as baby boomers reach the age group that has historically accounted for the bulk of retail RV sales.

Results of Operations

Fiscal 2009 Compared to Fiscal 2008

The following is an analysis of changes in key items included in the consolidated statements of income for the fiscal year ended August 29, 2009 compared to the fiscal year ended August 30, 2008:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended (1) |

||||||||||||||||||

|

(In thousands, except percent and per share data) |

|

August 29, |

|

% of Revenues |

|

August 30, |

|

% of Revenues |

|

(Decrease) |

|

% |

|

|||||||

|

Net revenues |

|

|

$ |

211,519 |

|

100.0 |

|

|

$ |

604,352 |

|

100.0 |

|

|

$ |

(392,833 |

) |

(65.0 |

) |

|

|

Cost of goods sold |

|

|

|

242,265 |

|

114.5 |

|

|

|

569,580 |

|

94.2 |

|

|

|

(327,315 |

) |

(57.5 |

) |

|

|

Gross (deficit) profit |

|

|

|

(30,746 |

) |

(14.5 |

) |

|

|

34,772 |

|

5.8 |

|

|

|

(65,518 |

) |

(188.4 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling |

|

|

|

12,616 |

|

6.0 |

|

|

|

18,482 |

|

3.1 |

|

|

|

(5,866 |

) |

(31.7 |

) |

|

|

General and administrative |

|

|

|

15,298 |

|

7.2 |

|

|

|

21,359 |

|

3.5 |

|

|

|

(6,061 |

) |

(28.4 |

) |

|

|

Asset impairment |

|

|

|

855 |

|

0.4 |

|

|

|

4,686 |

|

0.8 |

|

|

|

(3,831 |

) |

(81.8 |

) |

|

|

Operating expenses |

|

|

|

28,769 |

|

13.6 |

|

|

|

44,527 |

|

7.4 |

|

|

|

(15,758 |

) |

(35.4 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss |

|

|

|

(59,515 |

) |

(28.1 |

) |

|

|

(9,755 |

) |

(1.6 |

) |

|

|

(49,760 |

) |

(510.1 |

) |

|

|

Financial income |

|

|

|

1,452 |

|

0.7 |

|

|

|

4,314 |

|

0.7 |

|

|

|

(2,862 |

) |

(66.3 |

) |

|

|

Pre-tax loss |

|

|

|

(58,063 |

) |

(27.4 |

) |

|

|

(5,441 |

) |

(0.9 |

) |

|

|

(52,622 |

) |

(967.1 |

) |

|

|

Provision (benefit) for taxes |

|

|

|

20,703 |

|

9.8 |

|

|

|

(8,225 |

) |

(1.4 |

) |

|

|

28,928 |

|

351.7 |

|

|

|

Net (loss) income |

|

|

$ |

(78,766 |

) |

(37.2 |

) |

|

$ |

2,784 |

|

0.5 |

|

|

$ |

(81,550 |

) |

NMF |

|

|

|

Diluted (loss) income per share |

|

|

$ |

(2.71 |

) |

|

|

|

$ |

0.10 |

|

|

|

|

$ |

(2.81 |

) |

NMF |

|

|

|

Fully diluted average shares outstanding |

|

|

|

29,051 |

|

|

|

|

|

29,144 |

|

|

|

|

|

(93 |

) |

(0.3 |

) |

|

|

|

|

|

(1) |