Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Delek US Holdings, Inc. | dk-8kxinvestorpresentation.htm |

Delek US Holdings, Inc. Investor Presentation December 2018

Disclaimers Forward Looking Statements: Delek US Holdings, Inc. (“Delek US”) and Delek Logistics Partners, LP (“Delek Logistics”; and collectively with Delek US, “we” or “our”) are traded on the New York Stock Exchange in the United States under the symbols “DK” and ”DKL”, respectively. These slides and any accompanying oral and written presentations contain forward-looking statements that are based upon current expectations and involve a number of risks and uncertainties. Statements concerning current estimates, expectations and projections about future results, performance, prospects, opportunities, plans, actions and events and other statements, concerns, or matters that are not historical facts are “forward-looking statements,” as that term is defined under the federal securities laws. These forward-looking statements include, but are not limited to, the statements regarding the following: future crude slates; financial strength and flexibility; potential for and projections of growth; return of cash to shareholders, stock repurchases and the payment of dividends, including the amount and timing thereof; crude oil throughput; crude oil market trends, including production, quality, pricing, imports, exports and transportation costs; light production from shale plays and Permian growth; risks related to Delek US’ exposure to Permian Basin crude oil, such as supply, pricing, production and transportation capacity; differentials including increases, trends and the impact thereof on crack spreads and refineries; pipeline takeaway capacity and projects related thereto; refinery complexity, configurations, utilization, crude oil slate flexibility, capacities, equipment limits and margins; the ability to unlock value, and the estimated savings from the Alon USA Energy, Inc. (“ALJ”) and Alon USA Partners LP (“ALDW”) transactions; the ability to add flexibility and increase margin potential at the Krotz Springs refinery; our ability to complete the alkylation project at Krotz Springs and the Big Spring Gathering System successfully or at all and the benefits, flexibility, returns and EBITDA therefrom; the potential for, and estimates of cost savings and other benefits from, acquisitions, divestitures, dropdowns and financing activities; divestiture of non-core assets and matters pertaining thereto; increased capacity on the Paline Pipeline and the impacts and benefits therefrom; retail growth and the opportunities and value derived therefrom; long-term value creation from capital allocation; execution of strategic initiatives and the benefits therefrom; and access to crude oil and the benefits therefrom. Words such as "may," "will," "should," "could," "would," "predicts," "potential," "continue," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates," "appears," "projects" and similar expressions, as well as statements in future tense, identify forward-looking statements. Investors are cautioned that the following important factors, among others, may affect these forward-looking statements: risks and uncertainties related to the ability to successfully integrate the businesses of Delek US, ALJ and ALDW; the risks that the combined company may be unable to achieve cost-cutting synergies, or it may take longer than expected to achieve those synergies; uncertainty related to timing and amount of value returned to shareholders; risks and uncertainties with respect to the quantities and costs of crude oil we are able to obtain and the price of the refined petroleum products we ultimately sell; gains and losses from derivative instruments; management's ability to execute its strategy of growth through acquisitions and the transactional risks associated with acquisitions and dispositions; acquired assets may suffer a diminishment in fair value as a result of which we may need to record a write-down or impairment in carrying value of the asset; changes in the scope, costs, and/or timing of capital and maintenance projects; the ability to close the pipeline joint venture, obtain commitments and construct the pipeline; operating hazards inherent in transporting, storing and processing crude oil and intermediate and finished petroleum products; our competitive position and the effects of competition; the projected growth of the industries in which we operate; general economic and business conditions affecting the geographic areas in which we operate; and other risks contained in Delek US’ and Delek Logistics’ filings with the United States Securities and Exchange Commission. Forward-looking statements should not be read as a guarantee of future performance or results, and will not be accurate indications of the times at, or by which such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management’s good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Neither Delek US nor Delek Logistics undertakes any obligation to update or revise any such forward-looking statements. Non-GAAP Disclosures: Delek US and Delek Logistics believe that the presentation of earnings before interest, taxes, depreciation and amortization ("EBITDA"), distributable cash flow and distribution coverage ratio provide useful information to investors in assessing their financial condition, results of operations and cash flow their business is generating. Distributable cash flow is calculated as net cash flow from operating activities plus or minus changes in assets and liabilities, less maintenance capital expenditures net of reimbursements and other adjustments not expected to settle in cash. EBITDA, adjusted EBITDA, distributable cash flow and distribution coverage ratio should not be considered as alternatives to net income, operating income, cash from operations or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP. EBITDA, adjusted EBITDA, distributable cash flow and distribution coverage ratio have important limitations as analytical tools because they exclude some, but not all, items that affect net income. Additionally, because EBITDA, adjusted EBITDA, distributable cash flow and distribution coverage ratio may be defined differently by other companies in its industry, Delek US' and Delek Logistics’ definitions may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. Please see reconciliations of EBITDA, adjusted EBITDA, and distributable cash flow to their most directly comparable financial measures calculated and presented in accordance with U.S. GAAP in the appendix. 2

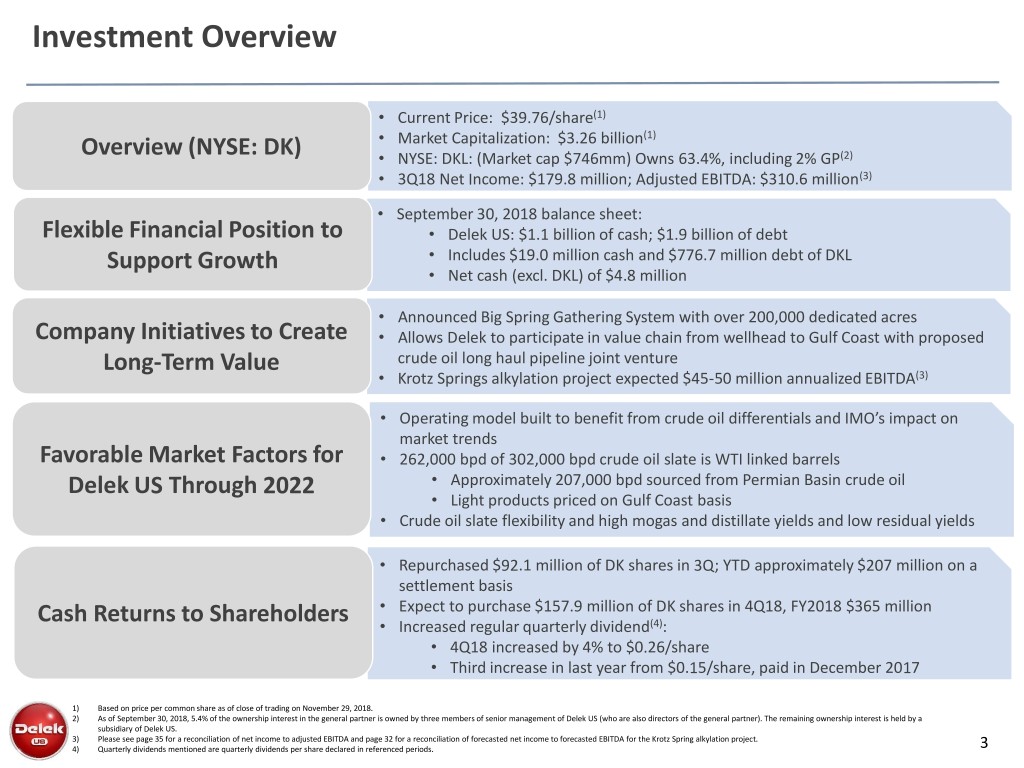

Investment Overview • Current Price: $39.76/share(1) • Market Capitalization: $3.26 billion(1) Overview (NYSE: DK) • NYSE: DKL: (Market cap $746mm) Owns 63.4%, including 2% GP(2) • 3Q18 Net Income: $179.8 million; Adjusted EBITDA: $310.6 million(3) • September 30, 2018 balance sheet: Flexible Financial Position to • Delek US: $1.1 billion of cash; $1.9 billion of debt Support Growth • Includes $19.0 million cash and $776.7 million debt of DKL • Net cash (excl. DKL) of $4.8 million • Announced Big Spring Gathering System with over 200,000 dedicated acres Company Initiatives to Create • Allows Delek to participate in value chain from wellhead to Gulf Coast with proposed Long-Term Value crude oil long haul pipeline joint venture • Krotz Springs alkylation project expected $45-50 million annualized EBITDA(3) • Operating model built to benefit from crude oil differentials and IMO’s impact on market trends Favorable Market Factors for • 262,000 bpd of 302,000 bpd crude oil slate is WTI linked barrels Delek US Through 2022 • Approximately 207,000 bpd sourced from Permian Basin crude oil • Light products priced on Gulf Coast basis • Crude oil slate flexibility and high mogas and distillate yields and low residual yields • Repurchased $92.1 million of DK shares in 3Q; YTD approximately $207 million on a settlement basis • Expect to purchase $157.9 million of DK shares in 4Q18, FY2018 $365 million Cash Returns to Shareholders • Increased regular quarterly dividend(4): • 4Q18 increased by 4% to $0.26/share • Third increase in last year from $0.15/share, paid in December 2017 1) Based on price per common share as of close of trading on November 29, 2018. 2) As of September 30, 2018, 5.4% of the ownership interest in the general partner is owned by three members of senior management of Delek US (who are also directors of the general partner). The remaining ownership interest is held by a subsidiary of Delek US. 3) Please see page 35 for a reconciliation of net income to adjusted EBITDA and page 32 for a reconciliation of forecasted net income to forecasted EBITDA for the Krotz Spring alkylation project. 4) Quarterly dividends mentioned are quarterly dividends per share declared in referenced periods. 3

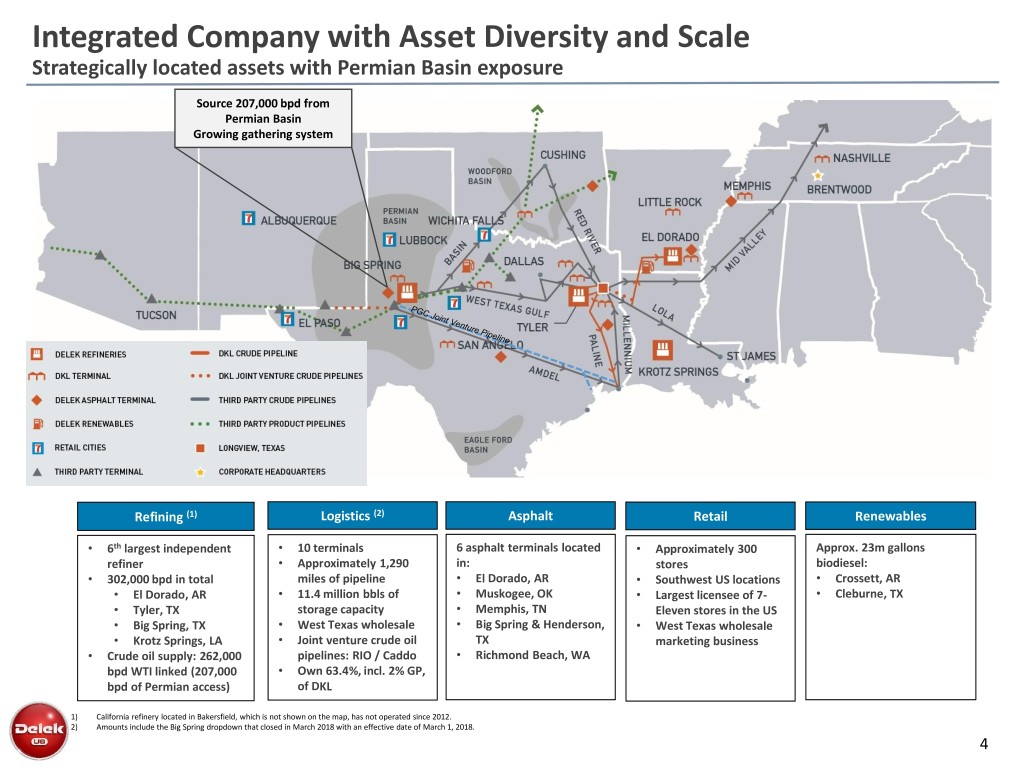

Integrated Company with Asset Diversity and Scale Strategically located assets with Permian Basin exposure Source 207,000 bpd from Permian Basin Growing gathering system Refining (1) Logistics (2) Asphalt Retail Renewables • 6th largest independent • 10 terminals 6 asphalt terminals located • Approximately 300 Approx. 23m gallons refiner • Approximately 1,290 in: stores biodiesel: • 302,000 bpd in total miles of pipeline • El Dorado, AR • Southwest US locations • Crossett, AR • El Dorado, AR • 11.4 million bbls of • Muskogee, OK • Largest licensee of 7- • Cleburne, TX • Tyler, TX storage capacity • Memphis, TN Eleven stores in the US • Big Spring, TX • West Texas wholesale • Big Spring & Henderson, • West Texas wholesale • Krotz Springs, LA • Joint venture crude oil TX marketing business • Crude oil supply: 262,000 pipelines: RIO / Caddo • Richmond Beach, WA bpd WTI linked (207,000 • Own 63.4%, incl. 2% GP, bpd of Permian access) of DKL 1) California refinery located in Bakersfield, which is not shown on the map, has not operated since 2012. 2) Amounts include the Big Spring dropdown that closed in March 2018 with an effective date of March 1, 2018. 4

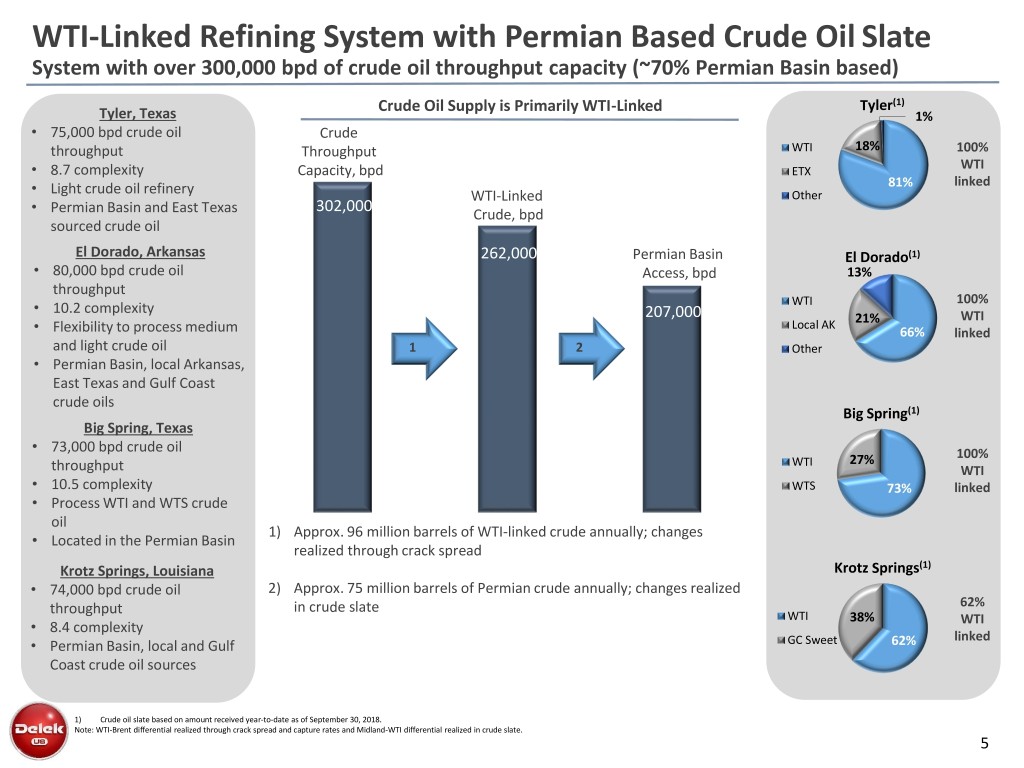

WTI-Linked Refining System with Permian Based Crude Oil Slate System with over 300,000 bpd of crude oil throughput capacity (~70% Permian Basin based) Crude Oil Supply is Primarily WTI-Linked Tyler(1) Tyler, Texas 1% • 75,000 bpd crude oil Crude throughput Throughput WTI 18% 100% WTI • 8.7 complexity Capacity, bpd ETX • 81% linked Light crude oil refinery WTI-Linked Other • 302,000 Permian Basin and East Texas Crude, bpd sourced crude oil El Dorado, Arkansas 262,000 Permian Basin El Dorado(1) • 80,000 bpd crude oil Access, bpd 13% throughput 100% • WTI 10.2 complexity 207,000 WTI Local AK 21% • Flexibility to process medium 66% linked and light crude oil 1 2 Other • Permian Basin, local Arkansas, East Texas and Gulf Coast crude oils Big Spring(1) Big Spring, Texas • 73,000 bpd crude oil 100% WTI 27% throughput WTI • 10.5 complexity WTS 73% linked • Process WTI and WTS crude oil 1) Approx. 96 million barrels of WTI-linked crude annually; changes • Located in the Permian Basin realized through crack spread Krotz Springs, Louisiana Krotz Springs(1) • 74,000 bpd crude oil 2) Approx. 75 million barrels of Permian crude annually; changes realized throughput in crude slate 62% WTI 38% WTI • 8.4 complexity linked • Permian Basin, local and Gulf GC Sweet 62% Coast crude oil sources 1) Crude oil slate based on amount received year-to-date as of September 30, 2018. Note: WTI-Brent differential realized through crack spread and capture rates and Midland-WTI differential realized in crude slate. 5

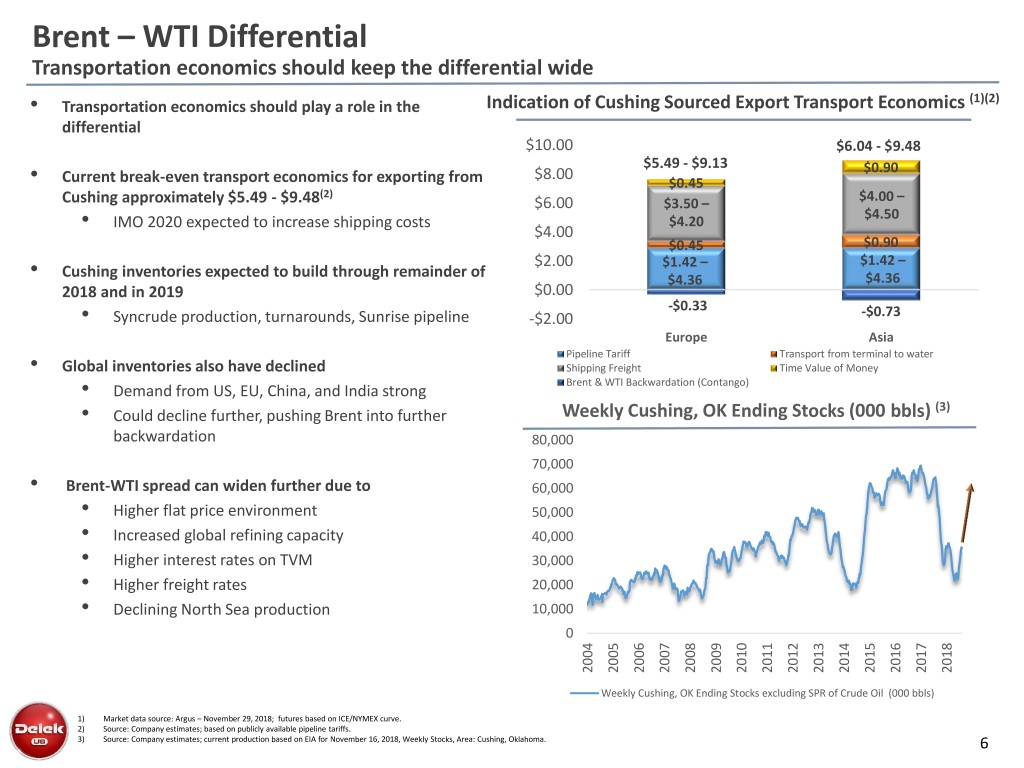

Brent – WTI Differential Transportation economics should keep the differential wide (1)(2) • Transportation economics should play a role in the Indication of Cushing Sourced Export Transport Economics differential $10.00 $6.04 - $9.48 $5.49 - $9.13 $8.00 $0.90 • Current break-even transport economics for exporting from $0.45 (2) $4.00 – Cushing approximately $5.49 - $9.48 $6.00 $3.50 – $4.50 • IMO 2020 expected to increase shipping costs $4.20 $4.00 $0.45 $0.90 $2.00 $1.42 – $1.42 – • Cushing inventories expected to build through remainder of $4.36 $4.36 2018 and in 2019 $0.00 -$0.33 • Syncrude production, turnarounds, Sunrise pipeline -$2.00 -$0.73 Europe Asia Pipeline Tariff Transport from terminal to water • Global inventories also have declined Shipping Freight Time Value of Money Brent & WTI Backwardation (Contango) • Demand from US, EU, China, and India strong (3) • Could decline further, pushing Brent into further Weekly Cushing, OK Ending Stocks (000 bbls) backwardation 80,000 70,000 • Brent-WTI spread can widen further due to 60,000 • Higher flat price environment 50,000 • Increased global refining capacity 40,000 • Higher interest rates on TVM 30,000 • Higher freight rates 20,000 • Declining North Sea production 10,000 0 2005 2008 2017 2004 2006 2007 2009 2010 2011 2012 2013 2014 2015 2016 2018 Weekly Cushing, OK Ending Stocks excluding SPR of Crude Oil (000 bbls) 1) Market data source: Argus – November 29, 2018; futures based on ICE/NYMEX curve. 2) Source: Company estimates; based on publicly available pipeline tariffs. 3) Source: Company estimates; current production based on EIA for November 16, 2018, Weekly Stocks, Area: Cushing, Oklahoma. 6

Permian Basin Outlook Production continues to grow while incremental takeaway capacity outlook is uncertain (1) • Steady growth has continued in production Average Annual Crude Oil Production (Mbpd) (2) • Drilling supported by improved technology and low and WTI-Midland Price costs 7.00 70.00 $59.63 $54.09 $54.27 • Midland prices still support production growth 6.00 $53.07 60.00 $49.88 5.00 $46.12 50.00 • Production may outpace incremental expansion in 2019 Current production 4.00 Oct 2018: 3.5m bpd 40.00 • In 2017 and 2018 Permian production outpaced initial forecasts 3.00 5.8 30.00 5.2 4.6 • DUCs have grown at a rapid rate to 3,866 2.00 4.0 20.00 • Short time to finish well with low capex costs 3.3 1.00 2.5 10.00 - - • In past cycles, not all pipelines were completed 2017 2018E 2019E 2020E 2021E 2022E • During 2015 – 2017, 56% of announced pipeline (1) takeaway capacity was cancelled Drilled but Uncompleted Wells • Average pipeline capacity was also smaller 4,500 30% • Locking in sufficient commitments is more 4,000 25% 3,500 challenging 20% 3,000 Pipeline operators would prefer one full pipeline • 2,500 15% rather than two half-full pipelines 2,000 10% 1,500 5% • Any shortfall in the takeaway balance can create volatility 1,000 500 0% in differentials 0 -5% 4/14 8/14 4/15 8/15 4/16 8/16 4/17 8/17 4/18 8/18 12/13 12/14 12/15 12/16 12/17 DUCs Incremental DUCs of New Drills % (Rolling 12-Month) 1) Source: Company estimates; current production based on EIA for October 2018, October Drilling Productivity Report, 2018 Drilling Productivity Report. 2) WTI Midland price source: Argus – November 29, 2018; futures based on ICE/NYMEX curve. 7

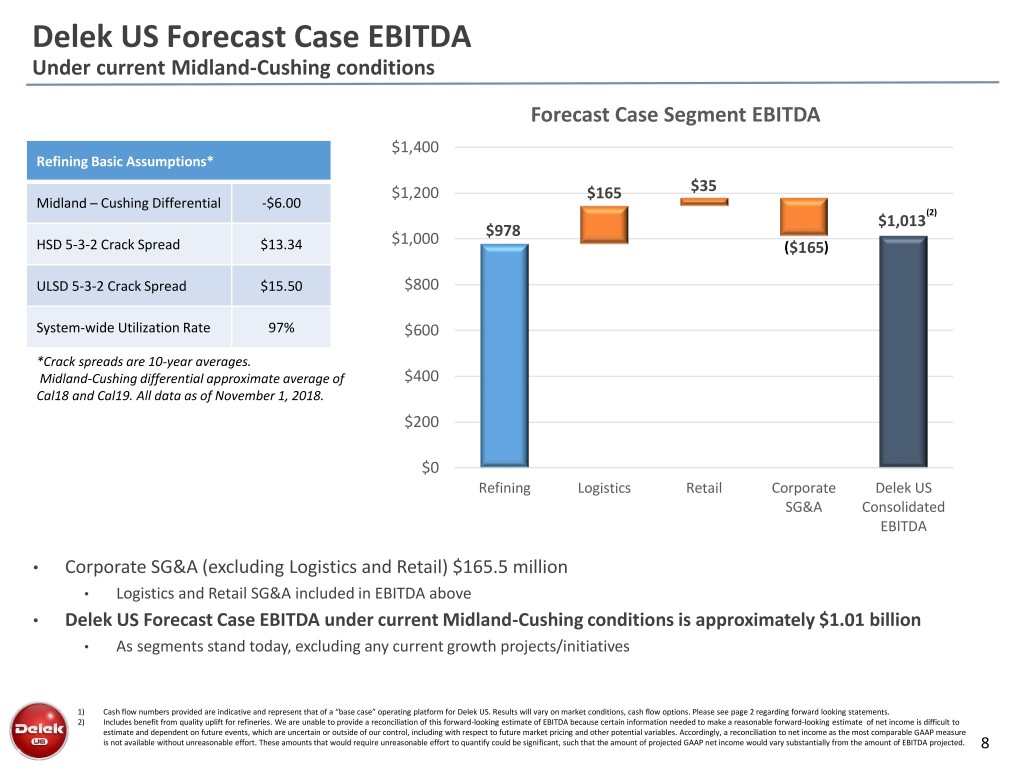

Delek US Forecast Case EBITDA Under current Midland-Cushing conditions Forecast Case Segment EBITDA $1,400 RefiningRefiningBasic Assumptions*Assumptions $1,200 $165 $35 Midland – Cushing Differential -$6.00 Midland Differential (2) $1,013 HSD 5-3-2 Crack Spread $1,000 $978 HSDULSD 5-3-2 Crack5-3- 2Spread Crack Spread $13.34 ($165) ULSDSystem5-3-2 Crack-wide Spread Utilization Rate$15.50 $800 System-wide Utilization Rate 97% $600 *Crack spreads are 10-year averages. Midland-Cushing differential approximate average of $400 Cal18 and Cal19. All data as of November 1, 2018. Sustaining Capex $200 $0 Refining Logistics Retail Corporate Delek US SG&A Consolidated EBITDA • Corporate SG&A (excluding Logistics and Retail) $165.5 million • Logistics and Retail SG&A included in EBITDA above • Delek US Forecast Case EBITDA under current Midland-Cushing conditions is approximately $1.01 billion • As segments stand today, excluding any current growth projects/initiatives 1) Cash flow numbers provided are indicative and represent that of a “base case” operating platform for Delek US. Results will vary on market conditions, cash flow options. Please see page 2 regarding forward looking statements. 2) Includes benefit from quality uplift for refineries. We are unable to provide a reconciliation of this forward-looking estimate of EBITDA because certain information needed to make a reasonable forward-looking estimate of net income is difficult to estimate and dependent on future events, which are uncertain or outside of our control, including with respect to future market pricing and other potential variables. Accordingly, a reconciliation to net income as the most comparable GAAP measure is not available without unreasonable effort. These amounts that would require unreasonable effort to quantify could be significant, such that the amount of projected GAAP net income would vary substantially from the amount of EBITDA projected. 8

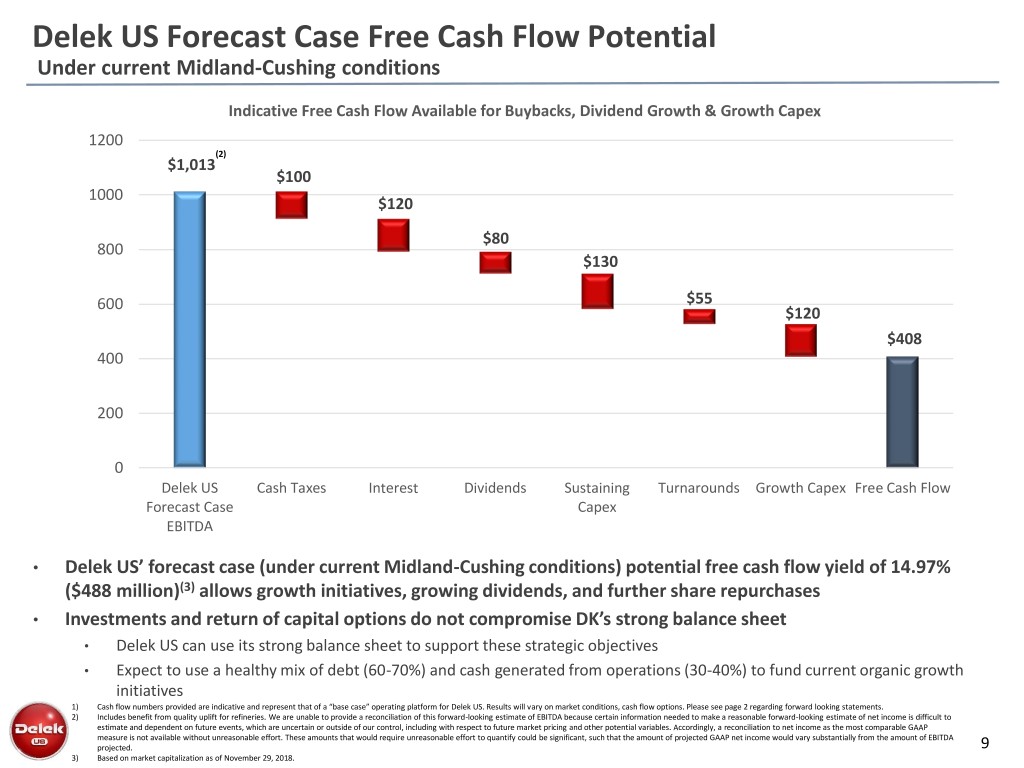

Delek US Forecast Case Free Cash Flow Potential Under current Midland-Cushing conditions Indicative Free Cash Flow Available for Buybacks, Dividend Growth & Growth Capex 1200 (2) $1,013 $100 1000 $120 $80 800 $130 600 $55 $120 $408 400 Sustaining200 Capex 0 Delek US Cash Taxes Interest Dividends Sustaining Turnarounds Growth Capex Free Cash Flow Forecast Case Capex EBITDA • Delek US’ forecast case (under current Midland-Cushing conditions) potential free cash flow yield of 14.97% ($488 million)(3) allows growth initiatives, growing dividends, and further share repurchases • Investments and return of capital options do not compromise DK’s strong balance sheet • Delek US can use its strong balance sheet to support these strategic objectives • Expect to use a healthy mix of debt (60-70%) and cash generated from operations (30-40%) to fund current organic growth initiatives 1) Cash flow numbers provided are indicative and represent that of a “base case” operating platform for Delek US. Results will vary on market conditions, cash flow options. Please see page 2 regarding forward looking statements. 2) Includes benefit from quality uplift for refineries. We are unable to provide a reconciliation of this forward-looking estimate of EBITDA because certain information needed to make a reasonable forward-looking estimate of net income is difficult to estimate and dependent on future events, which are uncertain or outside of our control, including with respect to future market pricing and other potential variables. Accordingly, a reconciliation to net income as the most comparable GAAP measure is not available without unreasonable effort. These amounts that would require unreasonable effort to quantify could be significant, such that the amount of projected GAAP net income would vary substantially from the amount of EBITDA projected. 9 3) Based on market capitalization as of November 29, 2018.

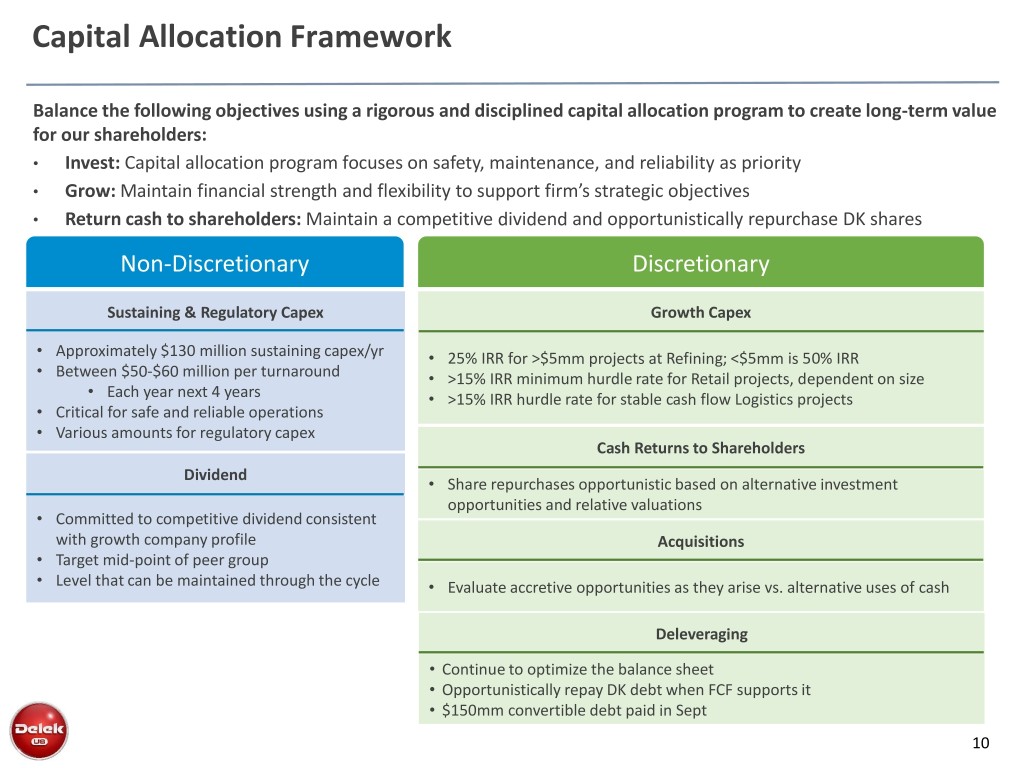

Capital Allocation Framework Balance the following objectives using a rigorous and disciplined capital allocation program to create long-term value for our shareholders: • Invest: Capital allocation program focuses on safety, maintenance, and reliability as priority • Grow: Maintain financial strength and flexibility to support firm’s strategic objectives • Return cash to shareholders: Maintain a competitive dividend and opportunistically repurchase DK shares Non-Discretionary Discretionary Sustaining & Regulatory Capex Growth Capex • Approximately $130 million sustaining capex/yr • 25% IRR for >$5mm projects at Refining; <$5mm is 50% IRR • Between $50-$60 million per turnaround • >15% IRR minimum hurdle rate for Retail projects, dependent on size • Each year next 4 years • >15% IRR hurdle rate for stable cash flow Logistics projects • CriticalSustaining for safe and Capex reliable operations • Various amounts for regulatory capex Cash Returns to Shareholders Dividend • Share repurchases opportunistic based on alternative investment opportunities and relative valuations • Committed to competitive dividend consistent with growth company profile Acquisitions • Target mid-point of peer group • Level that can be maintained through the cycle • Evaluate accretive opportunities as they arise vs. alternative uses of cash Deleveraging • Continue to optimize the balance sheet • Opportunistically repay DK debt when FCF supports it • $150mm convertible debt paid in Sept 10

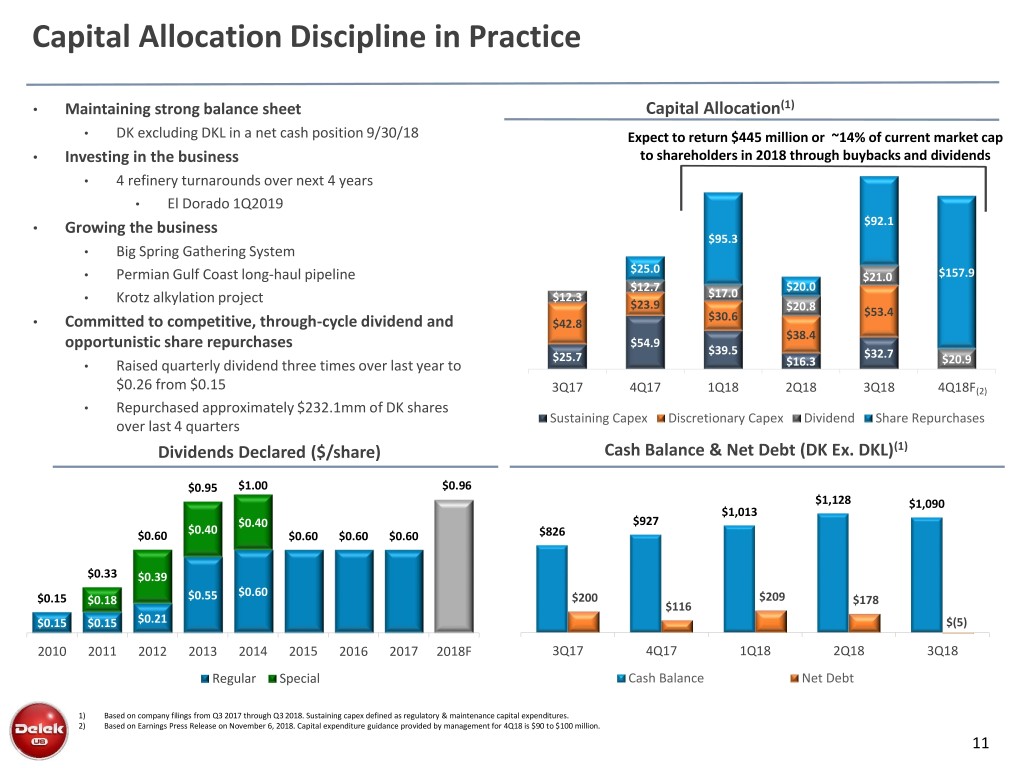

Capital Allocation Discipline in Practice • Maintaining strong balance sheet Capital Allocation(1) • DK excluding DKL in a net cash position 9/30/18 Expect to return $445 million or ~14% of current market cap • Investing in the business to shareholders in 2018 through buybacks and dividends • 4 refinery turnarounds over next 4 years • El Dorado 1Q2019 $92.1 • Growing the business $95.3 • Big Spring Gathering System $25.0 • Permian Gulf Coast long-haul pipeline $21.0 $157.9 $12.7 $20.0 • Krotz alkylation project $12.3 $17.0 $23.9 $20.8 $30.6 $53.4 • Committed to competitive, through-cycle dividend and $42.8 $38.4 $54.9 opportunistic share repurchases $39.5 $25.7 $32.7 $20.9 • Raised quarterly dividend three times over last year to $16.3 $0.26 from $0.15 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18F(2) • Repurchased approximately $232.1mm of DK shares Sustaining Capex Discretionary Capex Dividend Share Repurchases over last 4 quarters Dividends Declared ($/share) Cash Balance & Net Debt (DK Ex. DKL)(1) $0.95 $1.00 $0.96 $1,128 $1,090 $1,013 $0.40 $927 $0.40 $0.60 $0.60 $0.60 $0.60 $826 $0.33 $0.39 $0.60 $0.15 $0.55 $200 $209 $178 $0.18 $116 $0.15 $0.15 $0.21 $(5) 2010 2011 2012 2013 2014 2015 2016 2017 2018F 3Q17 4Q17 1Q18 2Q18 3Q18 Regular Special Cash Balance Net Debt 1) Based on company filings from Q3 2017 through Q3 2018. Sustaining capex defined as regulatory & maintenance capital expenditures. 2) Based on Earnings Press Release on November 6, 2018. Capital expenditure guidance provided by management for 4Q18 is $90 to $100 million. 11

Growth and Market Opportunities

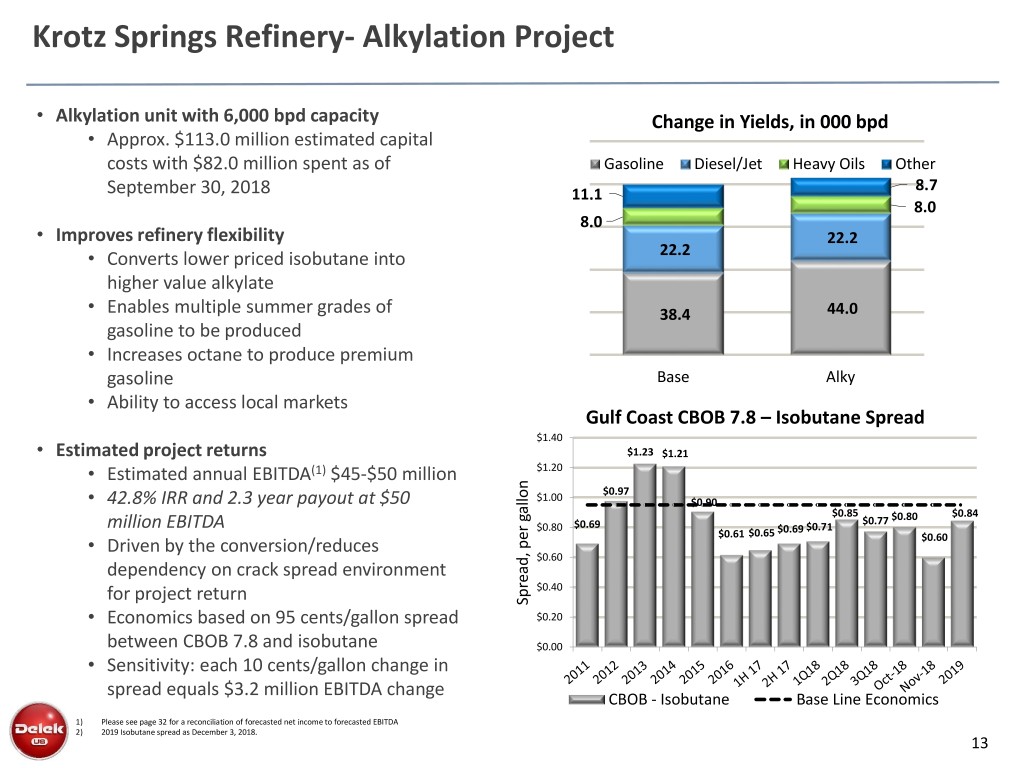

Krotz Springs Refinery- Alkylation Project • Alkylation unit with 6,000 bpd capacity Change in Yields, in 000 bpd • Approx. $113.0 million estimated capital costs with $82.0 million spent as of Gasoline Diesel/Jet Heavy Oils Other 8.7 September 30, 2018 11.1 8.0 8.0 • Improves refinery flexibility 22.2 • Converts lower priced isobutane into 22.2 higher value alkylate • Enables multiple summer grades of 38.4 44.0 gasoline to be produced • Increases octane to produce premium gasoline Base Alky • Ability to access local markets Gulf Coast CBOB 7.8 – Isobutane Spread $1.40 • Estimated project returns $1.23 $1.21 • Estimated annual EBITDA(1) $45-$50 million $1.20 $0.97 • 42.8% IRR and 2.3 year payout at $50 $1.00 $0.90 $0.85 $0.84 $0.77 $0.80 million EBITDA $0.80 $0.69 $0.71 $0.61 $0.65 $0.69 • Driven by the conversion/reduces $0.60 $0.60 dependency on crack spread environment for project return $0.40 Spread, per gallon per Spread, • Economics based on 95 cents/gallon spread $0.20 between CBOB 7.8 and isobutane $0.00 • Sensitivity: each 10 cents/gallon change in spread equals $3.2 million EBITDA change CBOB - Isobutane Base Line Economics 1) Please see page 32 for a reconciliation of forecasted net income to forecasted EBITDA 2) 2019 Isobutane spread as December 3, 2018. 13

Growing Midstream - Big Spring Gathering System Delek US’ Gathering Helps Control Crude Oil Quality and Costs into Refineries • 250-mile gathering system, 300Kbpd • Allows Delek US to get closer to throughput capacity wellhead to control crude oil quality • Currently more than 200,000 and cost dedicated acres • Provides improvement in refining • Points of origin: Howard, Borden, performance and cost structure Martin and Midland counties • 60 tank battery connections • Expected annualized EBITDA benefit • Total terminal storage of 650K bbls • $40 to $50 million by 2022 (1) • Connection to Delek US’ Big Spring, TX terminal • Potential future dropdown to DKL once • Expected total capital cost: $205 fully ramped million 1) Includes benefit from quality uplift for refineries. We are unable to provide a reconciliation of this forward-looking estimate of EBITDA because certain information needed to make a reasonable forward-looking estimate is difficult to estimate and dependent on future events, which are uncertain or outside of our control, including with respect to unknown construction timing, unanticipated construction costs and other potential variables. Accordingly, a reconciliation to net income as the most comparable GAAP measure is not available without unreasonable effort. 14

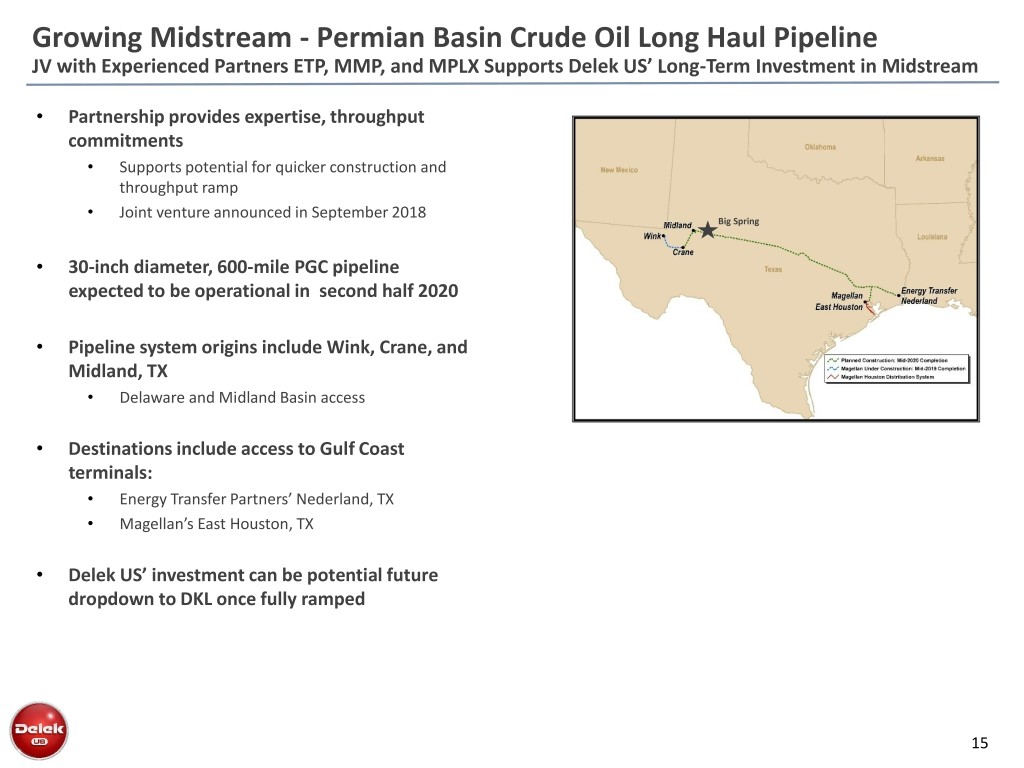

Growing Midstream - Permian Basin Crude Oil Long Haul Pipeline JV with Experienced Partners ETP, MMP, and MPLX Supports Delek US’ Long-Term Investment in Midstream • Partnership provides expertise, throughput commitments • Supports potential for quicker construction and throughput ramp • Joint venture announced in September 2018 Big Spring • 30-inch diameter, 600-mile PGC pipeline expected to be operational in second half 2020 • Pipeline system origins include Wink, Crane, and Midland, TX • Delaware and Midland Basin access • Destinations include access to Gulf Coast terminals: • Energy Transfer Partners’ Nederland, TX • Magellan’s East Houston, TX • Delek US’ investment can be potential future dropdown to DKL once fully ramped 15

DK Operations Positioned to Benefit from IMO 2020 Delek US positioned to benefit with high value product yields and crude oil slate flexibility 3Q18 Refiners’ Middle Distillates Yield % (1) (2) (3) • Refining system product yields • Middle distillate: average approx. 115,000 bpd of distillate or 43% 44 million barrels annually(4) 42% 39% • Gasoline: average approx. 150,000 bpd of gasoline or 55 38% 38% million barrels annually (4) 34% 32% • Crude oil slate has flexibility • Ability to increase sour crude oil processing to approximately CVRR DK HFC PSX VLO MPC PBF 50% based on market economics • Big Spring refinery currently processes 29% WTS and 3Q18 Refiners’ Gasoline Yield % (1) (2) (3) can increase to 100% • El Dorado refinery flexibility to process light to 51% 51% medium sour crude oil (up to 100%) based on 50% economics 49% 47% 47% • Krotz Springs refinery exploring ability to produce low sulfur marine fuel 44% DK CVRR HFC PBF VLO MPC PSX 1) Industry average collected from EIA refinery product yield data. 2) Middle distillates yield includes distillate fuel oil, kerosene and kerosene-type jet fuel. Latest data up to August 2018. 3) Sourced from Barclays U.S. Independent Refiners Guidebook to Refiners’ Financial & Operating Metrics – 3Q18 Edition, November 30, 2018. 4) Average calculated from 4Q17 results through 3Q18 results. 16

Delek US’ Initiatives Drive Potential EBITDA Growth Delek US positioned to generate strong cash flows to return cash to shareholders Difference $ in millions between -$2.50 Expected Incremental Benefit from Company Initiatives/Projects $1,400 and -$6.00 Midland-Cushing $160 $205 $1,200 differential $105 $53 $1,013 $1,000 $263 $800 $600 $750 Supports DK’s objective to reach $370 - $390 million of midstream EBITDA by 2022 $400 Differentials and crack spreads are 10-year Average 2017-1Q18 midstream market transactions were 14.4x on a 1-year Forward $200 averages as of November 1, EBITDA basis $0 2018 Forecast Case Delek US EBITDA 2019 2020 2021 2022 (1) (2) See Refining Basic Assumptions below Base Year: 2018 2019 2020 2021 2022 (Change from 2018) (Change from 2018) (Change from 2018) (Change from 2018) Company Initiatives/Projects: (2) Δ: +$50-55 million Δ: $100-110 million Δ: $155-165 million Δ: $200-210 million $0 Forecast Case Delek US EBITDA with Company $803 million $855 million $910 million $955 million Initiatives/Projects (1) (2) Refining Basic Assumptions(2) Midland – Cushing Differential -$2.50 HSD 5-3-2 Crack Spread $13.34 ULSD 5-3-2 Crack Spread $15.50 System-wide Utilization Rate 97% 1) Includes benefit from quality uplift for refineries. We are unable to provide a reconciliation of this forward-looking estimate of EBITDA because certain information needed to make a reasonable forward-looking estimate is difficult to estimate and dependent on future events, which are uncertain or outside of our control, including with respect to market pricing, unknown construction timing, unanticipated construction costs and other potential variables. Accordingly, a reconciliation to net income as the most comparable GAAP measure is not available without unreasonable effort. These amounts that would require unreasonable effort to quantify could be significant, such that the amount of projected GAAP net income would vary substantially from the amount of EBITDA projected. 2) Differentials and crack spreads are 10-year averages as of November 1, 2018. Logistics, retail, and corporate assumptions based on current operating structure. Please see page 8 for further detail. 17

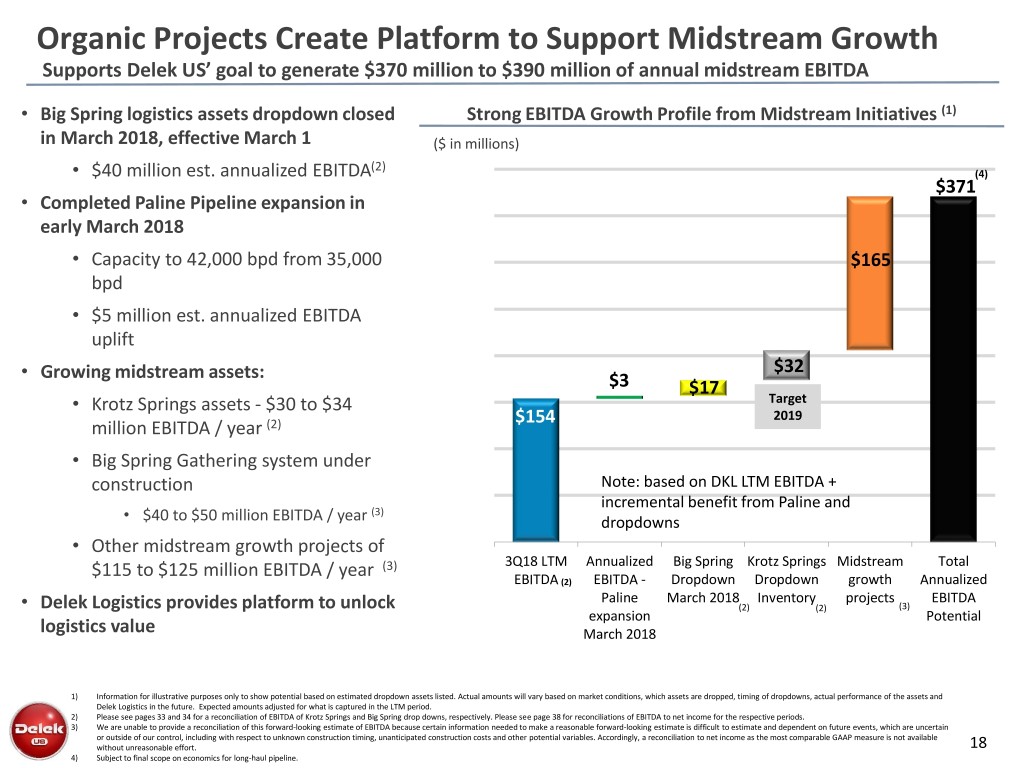

Organic Projects Create Platform to Support Midstream Growth Supports Delek US’ goal to generate $370 million to $390 million of annual midstream EBITDA • Big Spring logistics assets dropdown closed Strong EBITDA Growth Profile from Midstream Initiatives (1) in March 2018, effective March 1 ($ in millions) (2) • $40 million est. annualized EBITDA (4) $371 • Completed Paline Pipeline expansion in early March 2018 • Capacity to 42,000 bpd from 35,000 $165 bpd • $5 million est. annualized EBITDA uplift • Growing midstream assets: $32 $3 $17 • Krotz Springs assets - $30 to $34 Target $154 2019 million EBITDA / year (2) • Big Spring Gathering system under construction Note: based on DKL LTM EBITDA + incremental benefit from Paline and (3) • $40 to $50 million EBITDA / year dropdowns • Other midstream growth projects of $115 to $125 million EBITDA / year (3) 3Q18 LTM Annualized Big Spring Krotz Springs Midstream Total EBITDA (2) EBITDA - Dropdown Dropdown growth Annualized Paline March 2018 Inventory projects EBITDA • Delek Logistics provides platform to unlock (2) (2) (3) expansion Potential logistics value March 2018 1) Information for illustrative purposes only to show potential based on estimated dropdown assets listed. Actual amounts will vary based on market conditions, which assets are dropped, timing of dropdowns, actual performance of the assets and Delek Logistics in the future. Expected amounts adjusted for what is captured in the LTM period. 2) Please see pages 33 and 34 for a reconciliation of EBITDA of Krotz Springs and Big Spring drop downs, respectively. Please see page 38 for reconciliations of EBITDA to net income for the respective periods. 3) We are unable to provide a reconciliation of this forward-looking estimate of EBITDA because certain information needed to make a reasonable forward-looking estimate is difficult to estimate and dependent on future events, which are uncertain or outside of our control, including with respect to unknown construction timing, unanticipated construction costs and other potential variables. Accordingly, a reconciliation to net income as the most comparable GAAP measure is not available without unreasonable effort. 18 4) Subject to final scope on economics for long-haul pipeline.

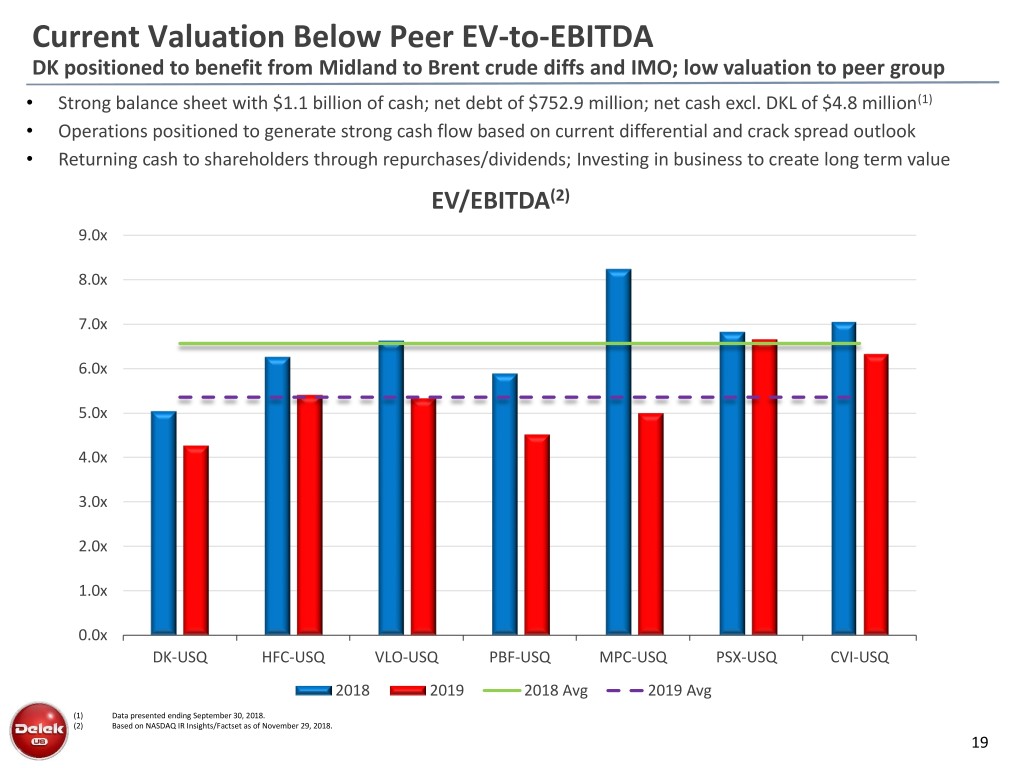

Current Valuation Below Peer EV-to-EBITDA DK positioned to benefit from Midland to Brent crude diffs and IMO; low valuation to peer group • Strong balance sheet with $1.1 billion of cash; net debt of $752.9 million; net cash excl. DKL of $4.8 million(1) • Operations positioned to generate strong cash flow based on current differential and crack spread outlook • Returning cash to shareholders through repurchases/dividends; Investing in business to create long term value EV/EBITDA(2) 9.0x 8.0x 7.0x 6.0x 5.0x 4.0x 3.0x 2.0x 1.0x 0.0x DK-USQ HFC-USQ VLO-USQ PBF-USQ MPC-USQ PSX-USQ CVI-USQ 2018 2019 2018 Avg 2019 Avg (1) Data presented ending September 30, 2018. (2) Based on NASDAQ IR Insights/Factset as of November 29, 2018. 19

An Integrated and Financial Flexibility to Diversified Refining, Support Strategic Logistics and Marketing Company Objectives Invest in the Business to Permian Focused Focus on Long-Term Operate Reliably and Refining System Shareholder Returns Safely Growing Midstream Platform to Diversify EBTIDA Stream

Appendix

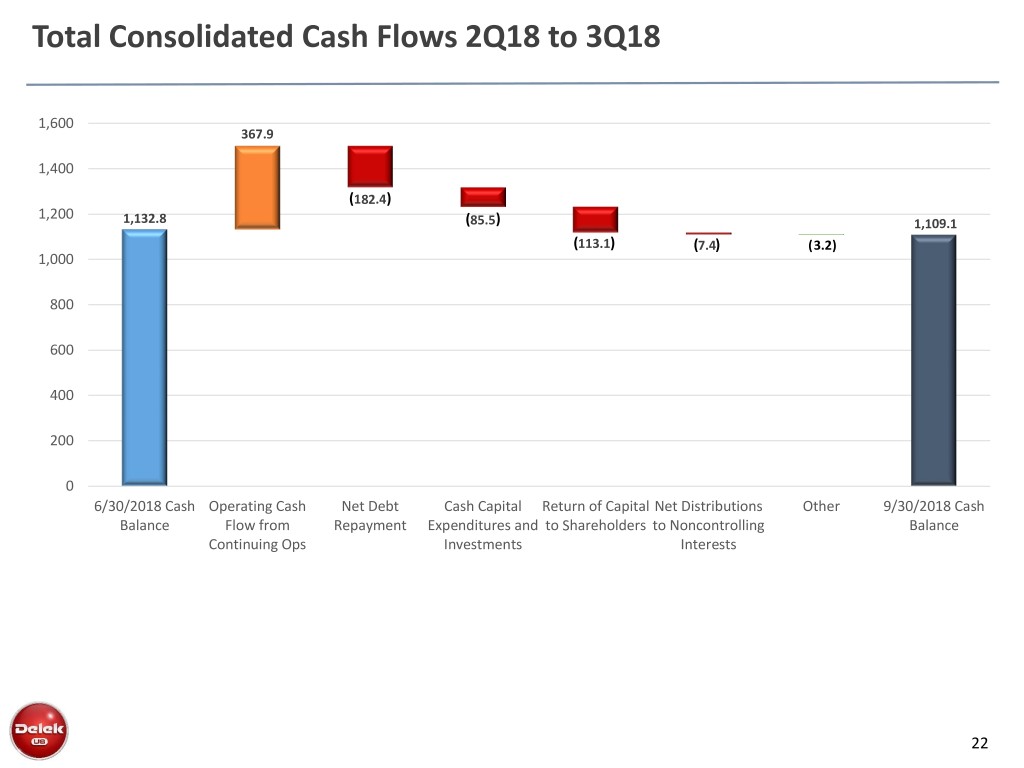

Total Consolidated Cash Flows 2Q18 to 3Q18 1,600 367.9 1,400 (182.4) 1,200 1,132.8 (85.5) 1,109.1 (113.1) (7.4) (3.2) 1,000 800 600 400 200 0 6/30/2018 Cash Operating Cash Net Debt Cash Capital Return of Capital Net Distributions Other 9/30/2018 Cash Balance Flow from Repayment Expenditures and to Shareholders to Noncontrolling Balance Continuing Ops Investments Interests 22

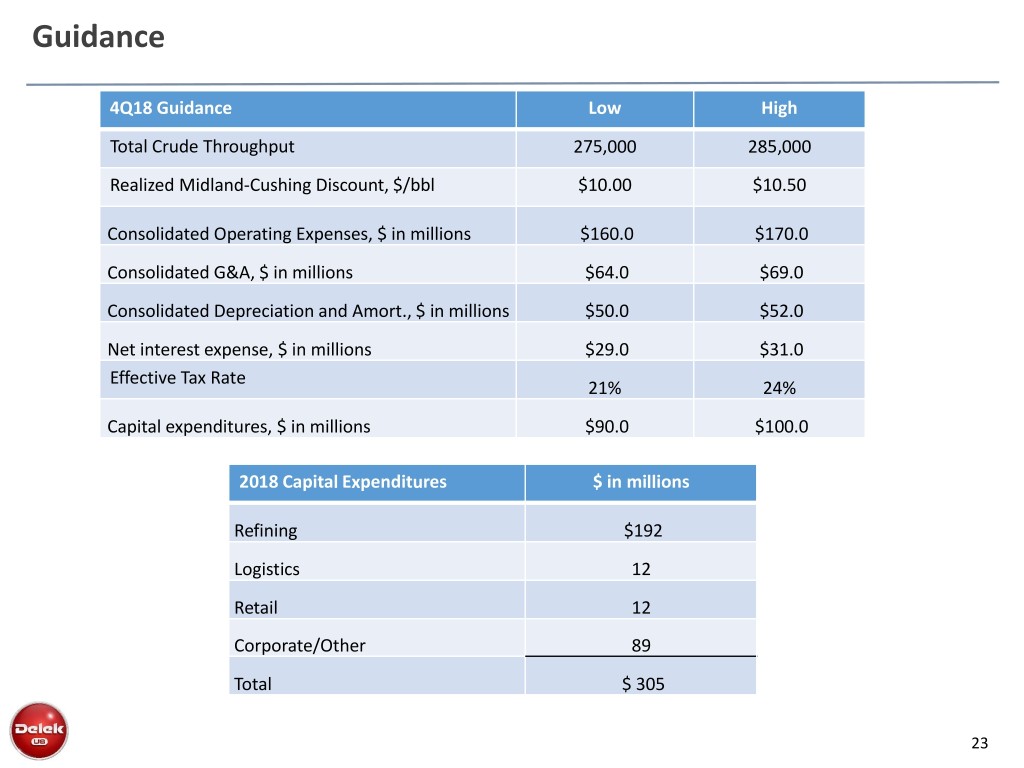

Guidance 4Q18 Guidance Low High Total Crude Throughput 275,000 285,000 Realized Midland-Cushing Discount, $/bbl $10.00 $10.50 Consolidated Operating Expenses, $ in millions $160.0 $170.0 Consolidated G&A, $ in millions $64.0 $69.0 Consolidated Depreciation and Amort., $ in millions $50.0 $52.0 Net interest expense, $ in millions $29.0 $31.0 Effective Tax Rate 21% 24% Capital expenditures, $ in millions $90.0 $100.0 2018 Capital Expenditures $ in millions Refining $192 Logistics 12 Retail 12 Corporate/Other 89 Total $ 305 23

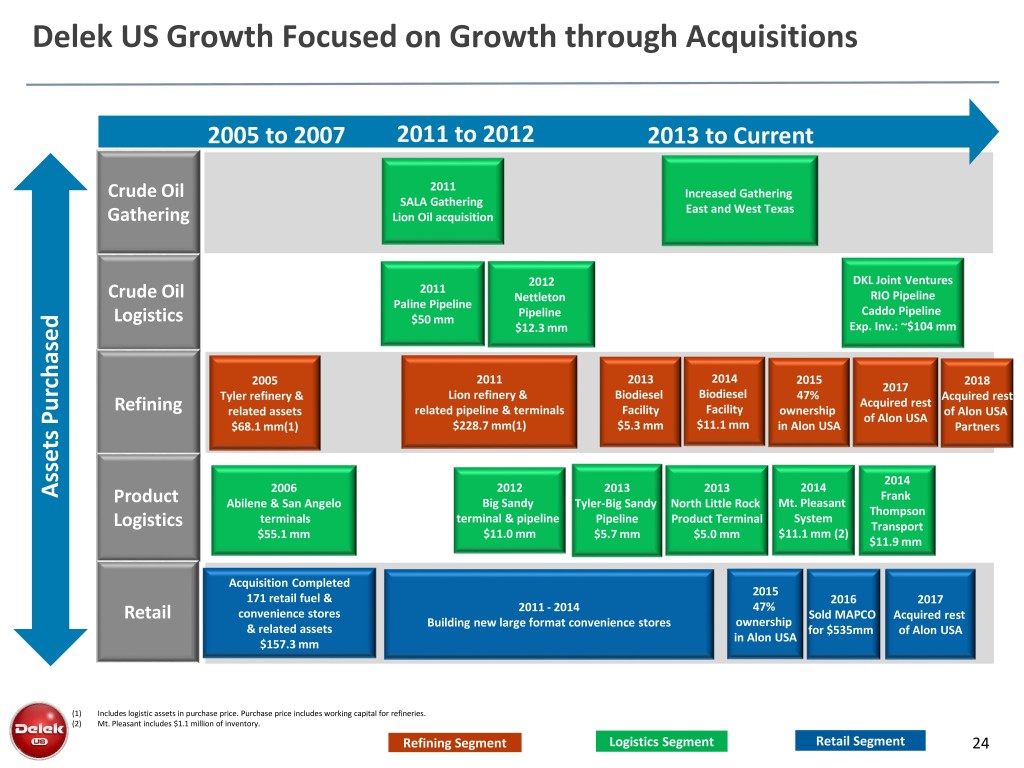

Delek US Growth Focused on Growth through Acquisitions 2005 to 2007 2011 to 2012 2013 to Current 2011 Crude Oil Increased Gathering SALA Gathering East and West Texas Gathering Lion Oil acquisition 2012 DKL Joint Ventures 2011 Crude Oil Nettleton RIO Pipeline Paline Pipeline Pipeline Caddo Pipeline Logistics $50 mm $12.3 mm Exp. Inv.: ~$104 mm 2005 2011 2013 2014 2015 2018 2017 Tyler refinery & Lion refinery & Biodiesel Biodiesel 47% Acquired rest Acquired rest Refining related assets related pipeline & terminals Facility Facility ownership of Alon USA of Alon USA $68.1 mm(1) $228.7 mm(1) $5.3 mm $11.1 mm in Alon USA Partners 2014 2006 2012 2013 2013 2014 Assets Purchased Assets Frank Product Abilene & San Angelo Big Sandy Tyler-Big Sandy North Little Rock Mt. Pleasant Thompson terminals terminal & pipeline Pipeline Product Terminal System Logistics Transport $55.1 mm $11.0 mm $5.7 mm $5.0 mm $11.1 mm (2) $11.9 mm Acquisition Completed 2015 171 retail fuel & 2016 2017 2011 - 2014 47% convenience stores Sold MAPCO Acquired rest Retail Building new large format convenience stores ownership & related assets for $535mm of Alon USA in Alon USA $157.3 mm (1) Includes logistic assets in purchase price. Purchase price includes working capital for refineries. (2) Mt. Pleasant includes $1.1 million of inventory. Refining Segment Logistics Segment Retail Segment 24

Current Delek US Corporate Structure 94.6% Delek US Holdings, Inc. ownership interest (1) NYSE: DK Market Cap: $3.26 billion(2) Delek Logistics GP, LLC (the General Partner) 61.4% interest in LP units 2.0% interest General partner interest Incentive distribution Delek Logistics Partners, LP rights NYSE: DKL Market Cap: $746 million(2) 1) As of September 30, 2018, a 5.4% interest in the Delek US ownership interest in the general partner is held by three members of senior management of Delek US. The remaining ownership interest is indirectly held by Delek US. 2) Market cap based on share and unit prices on November 29, 2018. 25

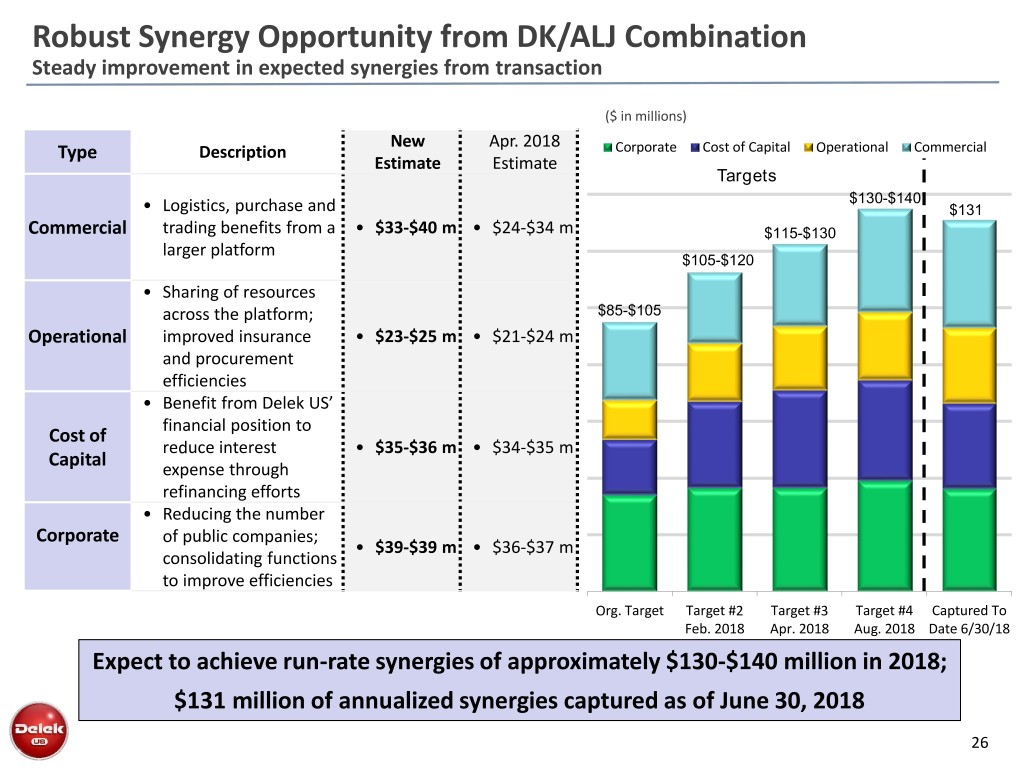

Robust Synergy Opportunity from DK/ALJ Combination Steady improvement in expected synergies from transaction ($ in millions) New Apr. 2018 Type Description Corporate Cost of Capital Operational Commercial Estimate Estimate Targets $130-$140 • Logistics, purchase and $131 Commercial trading benefits from a • $33-$40 m • $24-$34 m $115-$130 larger platform $105-$120 • Sharing of resources across the platform; $85-$105 Operational improved insurance • $23-$25 m • $21-$24 m and procurement efficiencies • Benefit from Delek US’ financial position to Cost of reduce interest • $35-$36 m • $34-$35 m Capital expense through refinancing efforts • Reducing the number Corporate of public companies; • $39-$39 m • $36-$37 m consolidating functions to improve efficiencies Org. Target Target #2 Target #3 Target #4 Captured To Feb. 2018 Apr. 2018 Aug. 2018 Date 6/30/18 Expect to achieve run-rate synergies of approximately $130-$140 million in 2018; $131 million of annualized synergies captured as of June 30, 2018 26

Market Data

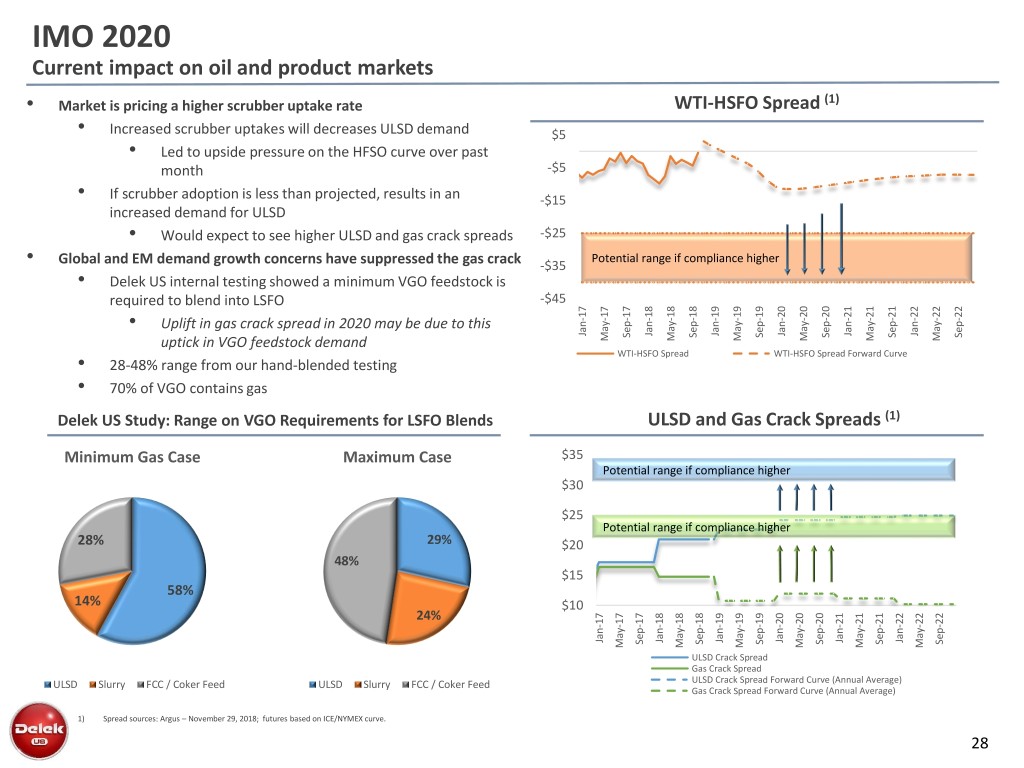

IMO 2020 Current impact on oil and product markets • Market is pricing a higher scrubber uptake rate WTI-HSFO Spread (1) • Increased scrubber uptakes will decreases ULSD demand $5 • Led to upside pressure on the HFSO curve over past month -$5 • If scrubber adoption is less than projected, results in an -$15 increased demand for ULSD • Would expect to see higher ULSD and gas crack spreads -$25 Potential range if compliance higher • Global and EM demand growth concerns have suppressed the gas crack -$35 • Delek US internal testing showed a minimum VGO feedstock is required to blend into LSFO -$45 • Uplift in gas crack spread in 2020 may be due to this Jan-17 Jan-18 Jan-19 Jan-20 Jan-21 Jan-22 Sep-21 Sep-17 Sep-18 Sep-19 Sep-20 Sep-22 May-18 May-19 May-20 May-21 May-22 uptick in VGO feedstock demand May-17 WTI-HSFO Spread WTI-HSFO Spread Forward Curve • 28-48% range from our hand-blended testing • 70% of VGO contains gas Delek US Study: Range on VGO Requirements for LSFO Blends ULSD and Gas Crack Spreads (1) Minimum Gas Case Maximum Case $35 Potential range if compliance higher $30 $25 Potential range if compliance higher 28% 29% $20 48% $15 58% 14% $10 24% Jan-17 Jan-18 Jan-19 Jan-20 Jan-21 Jan-22 Sep-18 Sep-17 Sep-19 Sep-20 Sep-21 Sep-22 May-17 May-18 May-19 May-20 May-21 May-22 ULSD Crack Spread Gas Crack Spread ULSD Slurry FCC / Coker Feed ULSD Slurry FCC / Coker Feed ULSD Crack Spread Forward Curve (Annual Average) Gas Crack Spread Forward Curve (Annual Average) 1) Spread sources: Argus – November 29, 2018; futures based on ICE/NYMEX curve. 28

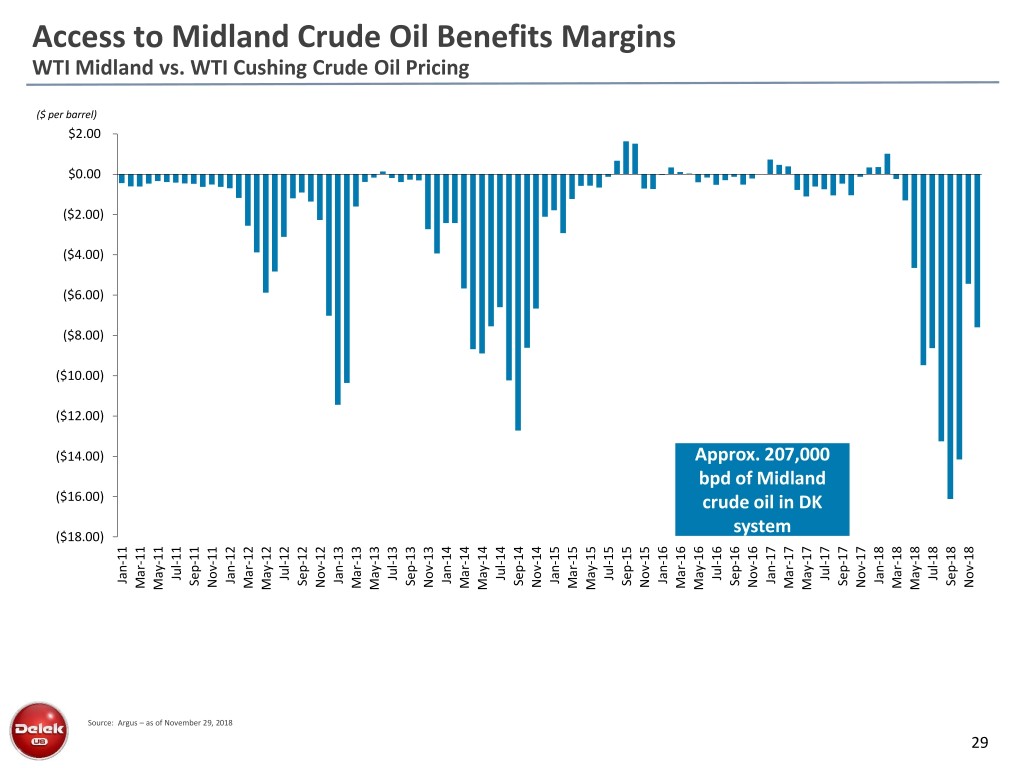

Access to Midland Crude Oil Benefits Margins WTI Midland vs. WTI Cushing Crude Oil Pricing ($ per barrel) $2.00 $0.00 ($2.00) ($4.00) ($6.00) ($8.00) ($10.00) ($12.00) ($14.00) Approx. 207,000 bpd of Midland ($16.00) crude oil in DK system ($18.00) Jul-12 Jul-11 Jul-13 Jul-14 Jul-15 Jul-16 Jul-17 Jul-18 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 Jan-18 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 Sep-16 Sep-17 Sep-18 Nov-16 Nov-11 Nov-12 Nov-13 Nov-14 Nov-15 Nov-17 Nov-18 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 May-11 May-12 May-13 May-14 May-15 May-16 May-17 May-18 Source: Argus – as of November 29, 2018 29

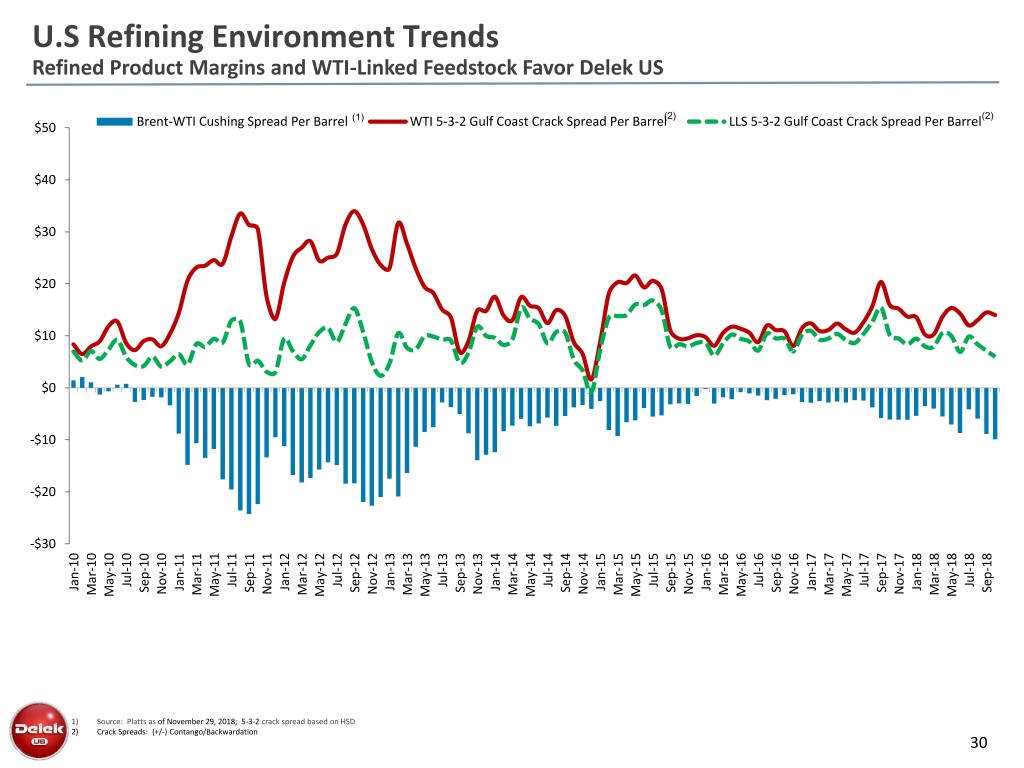

U.S Refining Environment Trends Refined Product Margins and WTI-Linked Feedstock Favor Delek US (1) (2) (2) $50 Brent-WTI Cushing Spread Per Barrel WTI 5-3-2 Gulf Coast Crack Spread Per Barrel LLS 5-3-2 Gulf Coast Crack Spread Per Barrel $40 $30 $20 $10 $0 -$10 -$20 -$30 Jul-17 Jul-10 Jul-11 Jul-12 Jul-13 Jul-14 Jul-15 Jul-16 Jul-18 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 Jan-18 Sep-18 Sep-10 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 Sep-16 Sep-17 Nov-10 Nov-11 Nov-12 Nov-13 Nov-14 Nov-15 Nov-16 Nov-17 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 May-16 May-10 May-11 May-12 May-13 May-14 May-15 May-17 May-18 1) Source: Platts as of November 29, 2018; 5-3-2 crack spread based on HSD 2) Crack Spreads: (+/-) Contango/Backwardation 30

Reconciliations

Non-GAAP Reconciliation of Potential Alkylation Project EBITDA(1) Reconcilation of Forecast U.S. GAAP Net Income (Loss) to Forecast EBITDA for Alkylation Project ($ in millions) Forecasted Range Forecasted Net Income $ 24.1 $ 27.3 Add: Interest expense, net - - Income tax expense 14.0 15.8 Depreciation and amortization 6.9 6.9 Forecasted EBITDA $ 45.0 $ 50.0 1) Based on projected range of potential future performance from the alkylation unit project at Krotz Springs. Amounts of EBITDA, net income and timing will vary. Actual amounts will be based on timing of completion, performance of the project and market conditions. 32

Non-GAAP Reconciliation of Krotz Spring Potential Dropdown EBITDA(1) Krotz Springs Logistics Drop Down Reconciliation of Forecasted Annualized Net Income to Forecasted EBITDA ($ in millions) Forecasted Range Forecasted Net Income $ 2.9 $ 3.3 Add: Depreciation and amortization 15.6 17.7 Interest and financing costs, net 11.5 13.0 Forecasted EBITDA $ 30.0 $ 34.0 1) Based on projected range of potential future logistics assets that could be dropped to Delek Logistics from Delek US in the future. Amounts of EBITDA, net income and timing will vary, which will affect the potential future EBITDA and associated deprecation and interest at DKL. Actual amounts will be based on timing, performance of the assets, DKL’s growth plans and valuation multiples for such assets at the time of any transaction. 33

Non-GAAP Reconciliations of Big Spring Potential Dropdown EBITDA(1) Big Spring Logistics Drop Down and Marketing Agreement Reconciliation of Forecasted Annualized Net Income to Forecasted EBITDA Tanks, Terminals ($ in millions) and Marketing Agreement Forecasted Net Income $ 13.3 Add: Income tax expense - Depreciation and amortization 5.1 Amortization of customer contract intangible assets 7.2 Interest expense, net 14.6 Forecasted EBITDA $ 40.2 1) Amounts of EBITDA, net income and timing vary, which affect the potential future EBITDA and associated deprecation and interest at DKL. Actual amounts are based on timing, performance of the assets, DKL’s growth plans and valuation multiples for such assets at the time of any transaction. 34

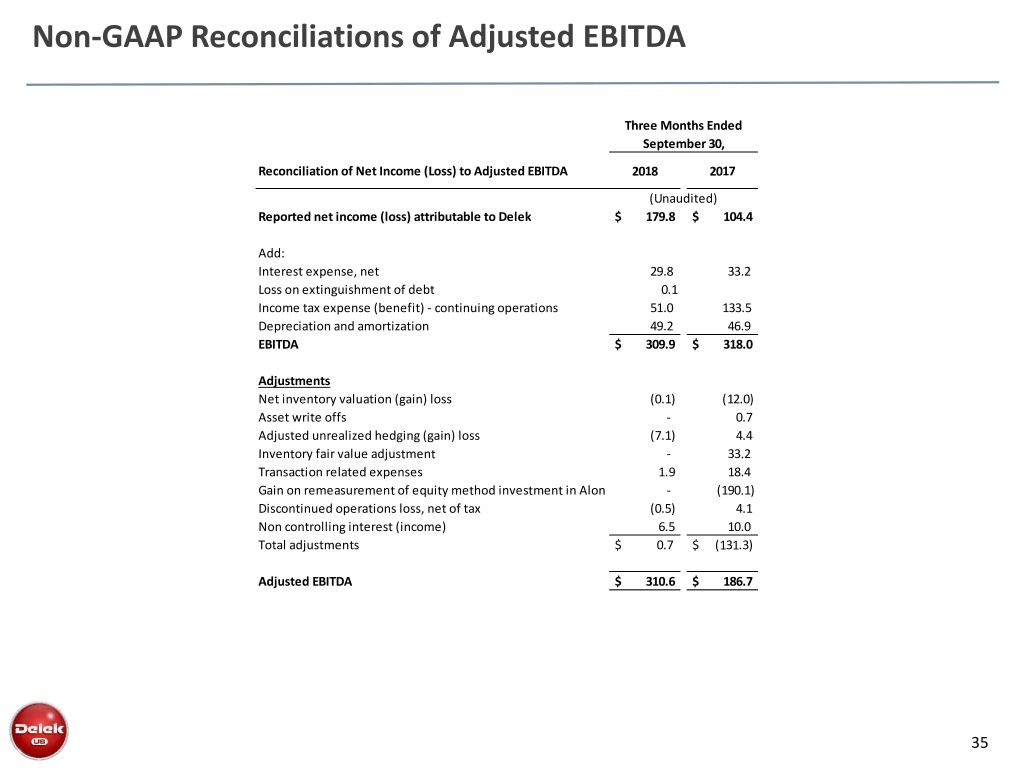

Non-GAAP Reconciliations of Adjusted EBITDA Three Months Ended September 30, Reconciliation of Net Income (Loss) to Adjusted EBITDA 2018 2017 (Unaudited) Reported net income (loss) attributable to Delek $ 179.8 $ 104.4 Add: Interest expense, net 29.8 33.2 Loss on extinguishment of debt 0.1 Income tax expense (benefit) - continuing operations 51.0 133.5 Depreciation and amortization 49.2 46.9 EBITDA $ 309.9 $ 318.0 Adjustments Net inventory valuation (gain) loss (0.1) (12.0) Asset write offs - 0.7 Adjusted unrealized hedging (gain) loss (7.1) 4.4 Inventory fair value adjustment - 33.2 Transaction related expenses 1.9 18.4 Gain on remeasurement of equity method investment in Alon - (190.1) Discontinued operations loss, net of tax (0.5) 4.1 Non controlling interest (income) 6.5 10.0 Total adjustments $ 0.7 $ (131.3) Adjusted EBITDA $ 310.6 $ 186.7 35

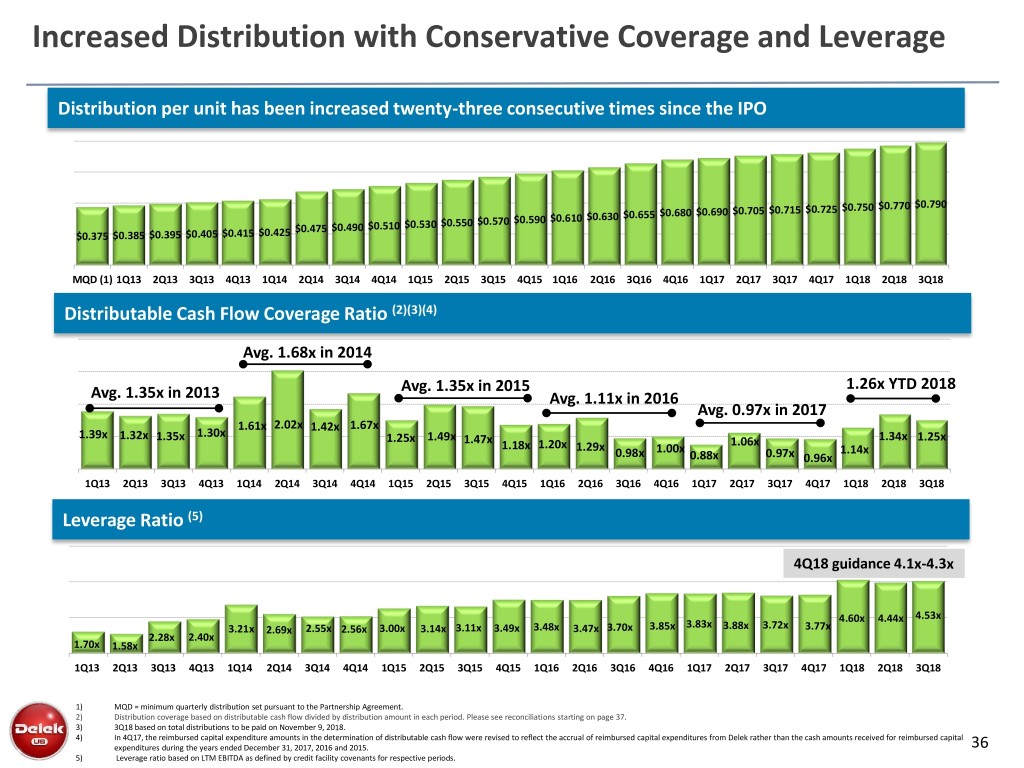

Increased Distribution with Conservative Coverage and Leverage Distribution per unit has been increased twenty-three consecutive times since the IPO $0.790 $0.705 $0.715 $0.725 $0.750 $0.770 $0.630 $0.655 $0.680 $0.690 $0.550 $0.570 $0.590 $0.610 $0.475 $0.490 $0.510 $0.530 $0.375 $0.385 $0.395 $0.405 $0.415 $0.425 MQD (1) 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 Distributable Cash Flow Coverage Ratio (2)(3)(4) Avg. 1.68x in 2014 Avg. 1.35x in 2015 1.26x YTD 2018 Avg. 1.35x in 2013 Avg. 1.11x in 2016 Avg. 0.97x in 2017 1.61x 2.02x 1.42x 1.67x 1.39x 1.30x 1.32x 1.35x 1.25x 1.49x 1.47x 1.06x 1.34x 1.25x 1.18x 1.20x 1.29x 1.00x 1.14x 0.98x 0.88x 0.97x 0.96x 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 Leverage Ratio (5) 4Q18 guidance 4.1x-4.3x 4.53x 3.83x 4.60x 4.44x 3.21x 2.69x 2.55x 2.56x 3.00x 3.14x 3.11x 3.49x 3.48x 3.47x 3.70x 3.85x 3.88x 3.72x 3.77x 2.28x 2.40x 1.70x 1.58x 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 1) MQD = minimum quarterly distribution set pursuant to the Partnership Agreement. 2) Distribution coverage based on distributable cash flow divided by distribution amount in each period. Please see reconciliations starting on page 37. 3) 3Q18 based on total distributions to be paid on November 9, 2018. 4) In 4Q17, the reimbursed capital expenditure amounts in the determination of distributable cash flow were revised to reflect the accrual of reimbursed capital expenditures from Delek rather than the cash amounts received for reimbursed capital expenditures during the years ended December 31, 2017, 2016 and 2015. 36 5) Leverage ratio based on LTM EBITDA as defined by credit facility covenants for respective periods.

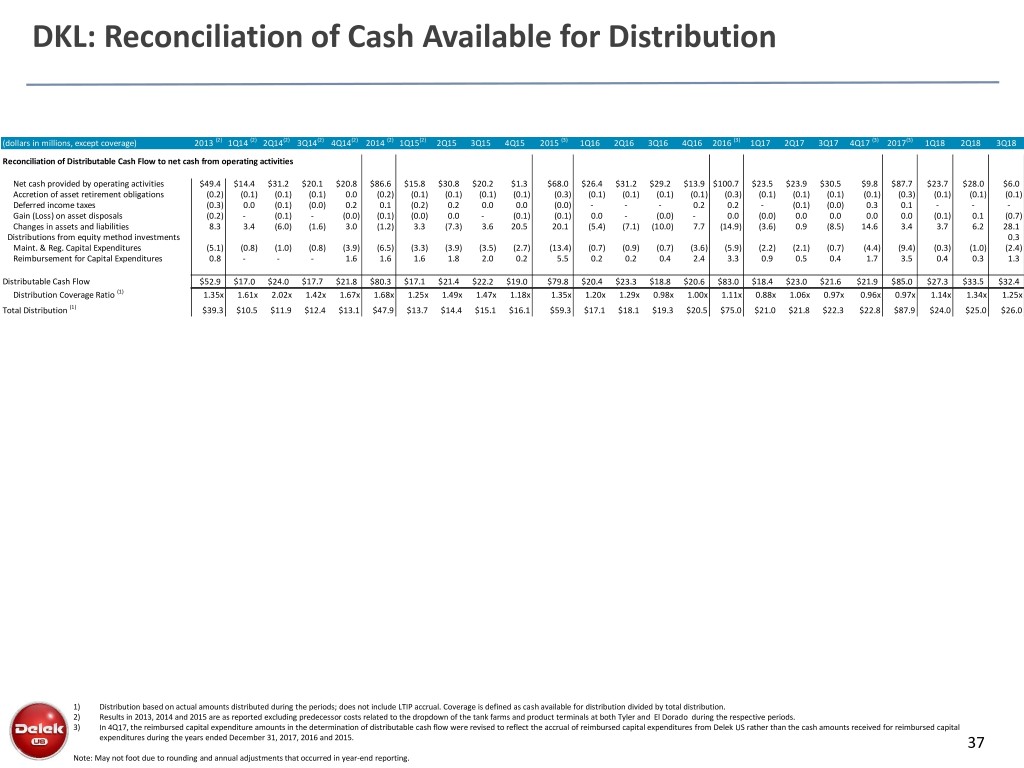

DKL: Reconciliation of Cash Available for Distribution (dollars in millions, except coverage) 2013 (2) 1Q14 (2) 2Q14(2) 3Q14(2) 4Q14(2) 2014 (2) 1Q15(2) 2Q15 3Q15 4Q15 2015 (3) 1Q16 2Q16 3Q16 4Q16 2016 (3) 1Q17 2Q17 3Q17 4Q17 (3) 2017(3) 1Q18 2Q18 3Q18 Reconciliation of Distributable Cash Flow to net cash from operating activities Net cash provided by operating activities $49.4 $14.4 $31.2 $20.1 $20.8 $86.6 $15.8 $30.8 $20.2 $1.3 $68.0 $26.4 $31.2 $29.2 $13.9 $100.7 $23.5 $23.9 $30.5 $9.8 $87.7 $23.7 $28.0 $6.0 Accretion of asset retirement obligations (0.2) (0.1) (0.1) (0.1) 0.0 (0.2) (0.1) (0.1) (0.1) (0.1) (0.3) (0.1) (0.1) (0.1) (0.1) (0.3) (0.1) (0.1) (0.1) (0.1) (0.3) (0.1) (0.1) (0.1) Deferred income taxes (0.3) 0.0 (0.1) (0.0) 0.2 0.1 (0.2) 0.2 0.0 0.0 (0.0) - - - 0.2 0.2 - (0.1) (0.0) 0.3 0.1 - - - Gain (Loss) on asset disposals (0.2) - (0.1) - (0.0) (0.1) (0.0) 0.0 - (0.1) (0.1) 0.0 - (0.0) - 0.0 (0.0) 0.0 0.0 0.0 0.0 (0.1) 0.1 (0.7) Changes in assets and liabilities 8.3 3.4 (6.0) (1.6) 3.0 (1.2) 3.3 (7.3) 3.6 20.5 20.1 (5.4) (7.1) (10.0) 7.7 (14.9) (3.6) 0.9 (8.5) 14.6 3.4 3.7 6.2 28.1 Distributions from equity method investments 0.3 Maint. & Reg. Capital Expenditures (5.1) (0.8) (1.0) (0.8) (3.9) (6.5) (3.3) (3.9) (3.5) (2.7) (13.4) (0.7) (0.9) (0.7) (3.6) (5.9) (2.2) (2.1) (0.7) (4.4) (9.4) (0.3) (1.0) (2.4) Reimbursement for Capital Expenditures 0.8 - - - 1.6 1.6 1.6 1.8 2.0 0.2 5.5 0.2 0.2 0.4 2.4 3.3 0.9 0.5 0.4 1.7 3.5 0.4 0.3 1.3 Distributable Cash Flow $52.9 $17.0 $24.0 $17.7 $21.8 $80.3 $17.1 $21.4 $22.2 $19.0 $79.8 $20.4 $23.3 $18.8 $20.6 $83.0 $18.4 $23.0 $21.6 $21.9 $85.0 $27.3 $33.5 $32.4 Distribution Coverage Ratio (1) 1.35x 1.61x 2.02x 1.42x 1.67x 1.68x 1.25x 1.49x 1.47x 1.18x 1.35x 1.20x 1.29x 0.98x 1.00x 1.11x 0.88x 1.06x 0.97x 0.96x 0.97x 1.14x 1.34x 1.25x Total Distribution (1) $39.3 $10.5 $11.9 $12.4 $13.1 $47.9 $13.7 $14.4 $15.1 $16.1 $59.3 $17.1 $18.1 $19.3 $20.5 $75.0 $21.0 $21.8 $22.3 $22.8 $87.9 $24.0 $25.0 $26.0 1) Distribution based on actual amounts distributed during the periods; does not include LTIP accrual. Coverage is defined as cash available for distribution divided by total distribution. 2) Results in 2013, 2014 and 2015 are as reported excluding predecessor costs related to the dropdown of the tank farms and product terminals at both Tyler and El Dorado during the respective periods. 3) In 4Q17, the reimbursed capital expenditure amounts in the determination of distributable cash flow were revised to reflect the accrual of reimbursed capital expenditures from Delek US rather than the cash amounts received for reimbursed capital expenditures during the years ended December 31, 2017, 2016 and 2015. 37 Note: May not foot due to rounding and annual adjustments that occurred in year-end reporting.

DKL: Income Statement and Non-GAAP EBITDA Reconciliation 2013(1) 1Q14(1) 2Q14 3Q14 4Q14 2014 (1) 1Q15(2) 2Q15 3Q15 4Q15 2015 1Q16 2Q16 3Q16 4Q16 2016 1Q17 2Q17 3Q17 4Q17 2017 1Q18 2Q18 3Q18 Net Revenue $907.4 $203.5 $236.3 $228.0 $173.3 $841.2 $143.5 $172.1 $165.1 $108.9 $589.7 $104.1 $111.9 $107.5 $124.7 $448.1 $129.5 $126.8 $130.6 $151.2 $538.1 $167.9 $166.3 $164.1 Cost of Sales (811.4) (172.2) (196.6) (194.1) (134.3) (697.2) (108.4) (132.5) (124.4) (71.0) (436.3) (66.8) (73.1) ($73.5) ($88.8) (302.2) (92.6) (85.0) ($89.1) ($106.1) (372.9) (119.0) (106.0) (105.6) Operating Expenses (excluding depreciation and amortization presented below) (25.8) (8.5) (9.5) (10.2) (9.7) (38.0) (10.6) (10.8) (11.6) (11.7) (44.8) (10.5) (8.7) ($9.3) ($8.8) (37.2) (10.4) (10.0) ($10.7) ($12.3) (43.3) (12.6) (14.9) (14.5) Depreciation and Amortization (6.3) Contribution Margin $70.3 $22.8 $30.2 $23.7 $29.3 $106.0 $24.5 $28.8 $29.1 $26.2 $108.6 $26.8 $30.0 $24.7 $27.2 $108.7 $26.5 $31.8 $30.8 $32.8 $121.9 $36.3 $45.3 $37.8 Operating Expenses (excluding depreciation and amortization presented below) (0.9) Depreciation and Amortization (10.7) (3.4) (3.5) (3.7) (3.9) (14.6) (4.0) (4.7) (4.5) (5.9) (19.2) (5.0) (4.8) ($5.4) ($5.6) (20.8) (5.2) (5.7) ($5.5) ($5.5) (21.9) (6.0) (7.0) (0.5) General and Administration Expense (6.3) (2.6) (2.2) (2.5) (3.3) (10.6) (3.4) (3.0) (2.7) (2.3) (11.4) (2.9) (2.7) ($2.3) ($2.3) (10.3) (2.8) (2.7) ($2.8) ($3.6) (11.8) (3.0) (3.7) (3.1) Gain (Loss) on Asset Disposal (0.2) - (0.1) - - (0.1) - - - (0.1) (0.1) 0.0 - ($0.0) $0.0 0.0 (0.0) 0.0 ($0.0) ($0.0) (0.0) - 0.1 (0.7) Operating Income $53.2 $16.8 $24.4 $17.5 $22.1 $80.8 $17.1 $21.1 $21.8 $17.9 $77.9 $19.0 $22.5 $17.0 $19.2 $77.7 $18.5 $23.4 $22.6 $23.7 $88.1 27.3 34.7 32.6 Interest Expense, net (4.6) (2.0) (2.3) (2.2) (2.1) (8.7) (2.2) (2.6) (2.8) (3.0) (10.7) (3.2) (3.3) ($3.4) ($3.7) (13.6) (4.1) (5.5) ($7.1) ($7.3) (23.9) (8.1) (10.9) (11.1) (Loss) Income from Equity Method Invesments (0.1) (0.3) (0.1) (0.6) (0.2) (0.2) ($0.3) ($0.4) (1.2) 0.2 1.2 $1.6 $1.9 5.0 0.8 1.9 1.9 Income Taxes (0.8) (0.1) (0.3) (0.2) 0.5 (0.1) (0.3) (0.1) (0.1) 0.6 0.2 (0.1) (0.129) ($0.1) $0.3 (0.1) (0.1) (0.1) ($0.2) $0.6 0.2 (0.1) (0.1) (0.1) Net Income $47.8 $14.7 $21.8 $15.1 $20.5 $72.0 $14.6 $18.3 $18.6 $15.3 $66.8 $15.4 $18.9 $13.2 $15.3 $62.8 $14.6 $19.0 $16.9 $18.9 $69.4 $20.0 $25.6 $23.3 EBITDA: Net Income $47.8 $14.7 $21.8 $15.1 $20.5 $72.0 $14.6 $18.3 $18.6 $15.3 $66.8 $15.4 $18.9 $13.2 $15.3 $62.8 $14.6 $19.0 $16.9 $18.9 $69.4 $20.0 $25.6 $23.3 Income Taxes 0.8 0.1 0.3 0.2 (0.5) 0.1 0.3 0.1 0.1 (0.6) (0.2) 0.1 0.1 0.13 (0.28) 0.1 0.1 0.1 0.2 ($0.6) (0.2) 0.1 0.1 0.1 Depreciation and Amortization 10.7 3.4 3.5 3.7 3.9 14.6 4.0 4.7 4.5 5.9 19.2 5.0 4.8 5.4 5.6 20.8 5.2 5.7 5.5 5.5 21.9 6.0 7.0 6.7 Amortization of customer contract intangible assets - - - - - - - - - - - - - - - - - - - - - 0.6 1.8 1.8 Interest Expense, net 4.6 2.0 2.3 2.2 2.1 8.7 2.2 2.6 2.8 3.0 10.7 3.2 3.3 3.4 3.7 13.6 4.1 5.5 7.1 7.3 23.9 8.1 10.9 11.1 EBITDA $63.8 $20.2 $27.9 $21.2 $26.1 $95.4 $21.1 $25.7 $26.1 $23.6 $96.5 $23.7 $27.1 $22.0 $24.4 $97.3 $23.9 $30.3 $29.7 $31.1 $115.0 $34.7 $45.4 $43.0 1) Results in 2013 and 2014 are as reported excluding predecessor costs related to the dropdown of the tank farms and product terminals at both Tyler and El Dorado during the respective periods. 2) Results for 1Q15 are as reported excluding predecessor costs related to the 1Q15 dropdowns. Note: May not foot due to rounding. 38

Investor Relations Contact: Kevin Kremke Keith Johnson Executive Vice President, CFO Vice President of Investor Relations 615-224-1323 615-435-1366