Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Oaktree Strategic Income Corp | d664259dex991.htm |

| 8-K - 8-K - Oaktree Strategic Income Corp | d664259d8k.htm |

Fourth Quarter Fiscal Year 2018 Earnings Presentation November 29, 2018 Nasdaq: OCSI Exhibit 99.2

Forward Looking Statements Some of the statements in this presentation constitute forward-looking statements because they relate to future events or our future performance or financial condition. The forward-looking statements contained in this presentation may include statements as to: our future operating results and distribution projections; the ability of Oaktree Capital Management, L.P. (“Oaktree” or our “Investment Adviser”) to reposition our portfolio and to implement our Investment Adviser’s future plans with respect to our business; our business prospects and the prospects of our portfolio companies; the impact of the investments that we expect to make; the ability of our portfolio companies to achieve their objectives; our expected financings and investments and additional leverage we may seek to incur in the future; the adequacy of our cash resources and working capital; the timing of cash flows, if any, from the operations of our portfolio companies; and the cost or potential outcome of any litigation to which we may be a party. In addition, words such as “anticipate,” “believe,” “expect,” “seek,” “plan,” “should,” “estimate,” “project” and “intend” indicate forward-looking statements, although not all forward-looking statements include these words. The forward-looking statements contained in this presentation involve risks and uncertainties. Our actual results could differ materially from those implied or expressed in the forward-looking statements for any reason, including the factors set forth in “Risk Factors” and elsewhere in our annual report on Form 10-K for the fiscal year ended September 30, 2018. Other factors that could cause actual results to differ materially include: changes in the economy, financial markets and political environment; risks associated with possible disruption in our operations or the economy generally due to terrorism or natural disasters; future changes in laws or regulations (including the interpretation of these laws and regulations by regulatory authorities) and conditions in our operating areas, particularly with respect to business development companies or regulated investment companies; and other considerations that may be disclosed from time to time in our publicly disseminated documents and filings. We have based the forward-looking statements included in this presentation on information available to us on the date of this presentation, and we assume no obligation to update any such forward-looking statements. Although we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, you are advised to consult any additional disclosures that we may make directly to you or through reports that we in the future may file with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. Unless otherwise indicated, data provided herein are dated as of September 30, 2018.

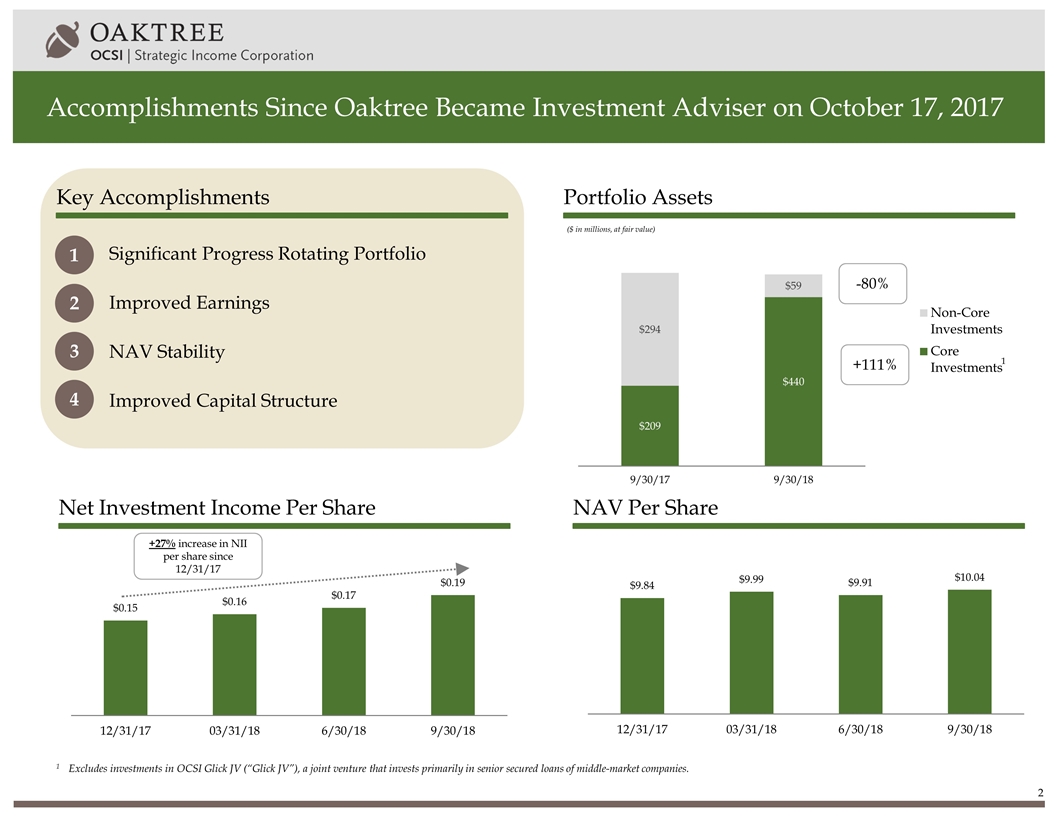

Accomplishments Since Oaktree Became Investment Adviser on October 17, 2017 Significant Progress Rotating Portfolio Improved Earnings NAV Stability Improved Capital Structure ($ in millions, at fair value) 1 Net Investment Income Per Share Portfolio Assets NAV Per Share Key Accomplishments +27% increase in NII per share since 12/31/17 1 2 3 4 +111% -80% 1Excludes investments in OCSI Glick JV (“Glick JV”), a joint venture that invests primarily in senior secured loans of middle-market companies.

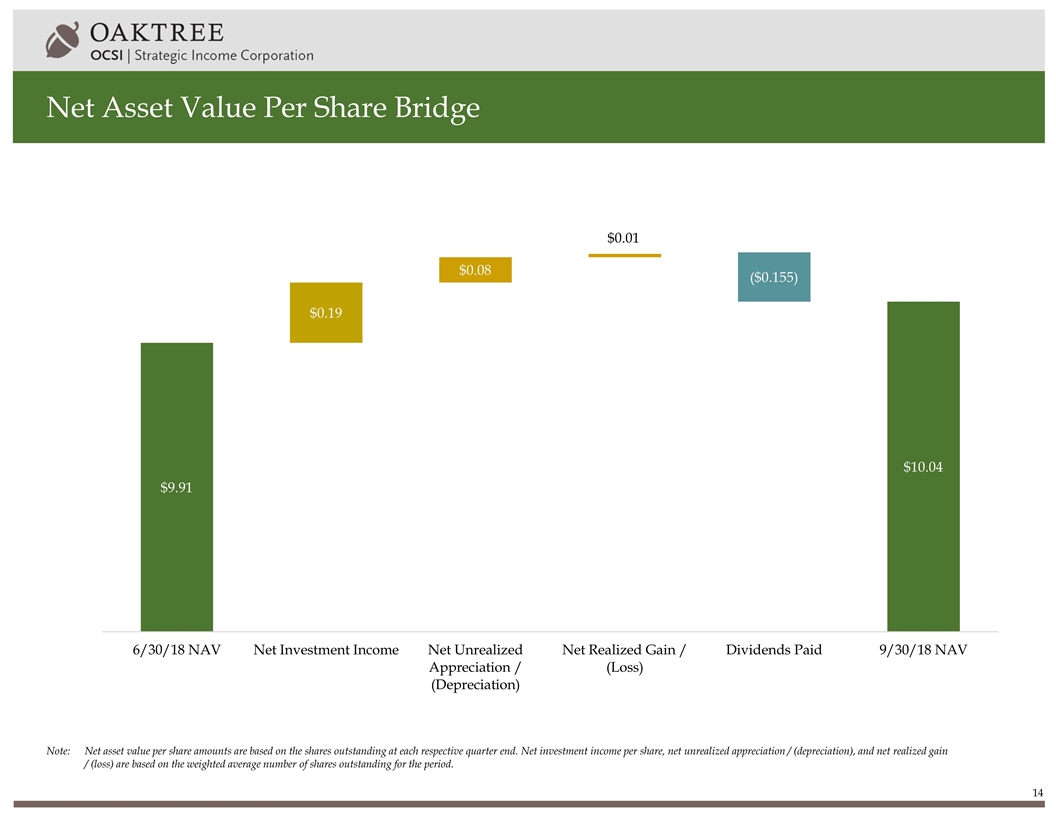

Q4 2018 Highlights Net asset value per share increased by $0.13 to $10.04 NAV remains stable, increasing $0.20 per share or approximately 2% since December 31, 2017 Realized gains resulting from monetizations of investments and unrealized write-ups of certain investments primarily contributed to the sequential NAV increase Net investment income per share increased by $0.02 to $0.19 Higher prepayment fees and OID acceleration on loan payoffs contributed to the sequential NII increase, partially offset by acceleration of deferred financing costs related to the redemption of the 2015 debt securitization Board of Directors declared a dividend of $0.155 per share, payable on December 28, 2018 to stockholders of record as of December 17, 2018 Monetized approximately $20 million of non-core investments Non-core investments decreased to 12% of the portfolio at fair value as of September 30, 20181 Monetized approximately $7 million or 12% of remaining non-core investments since October 1, 2018 Entered into $92 million of new investment commitments First lien originations represented 99% of new investment commitments 7.3% weighted average yield at cost of new investments 1 2 3 4 1Excludes investments in the Glick JV.

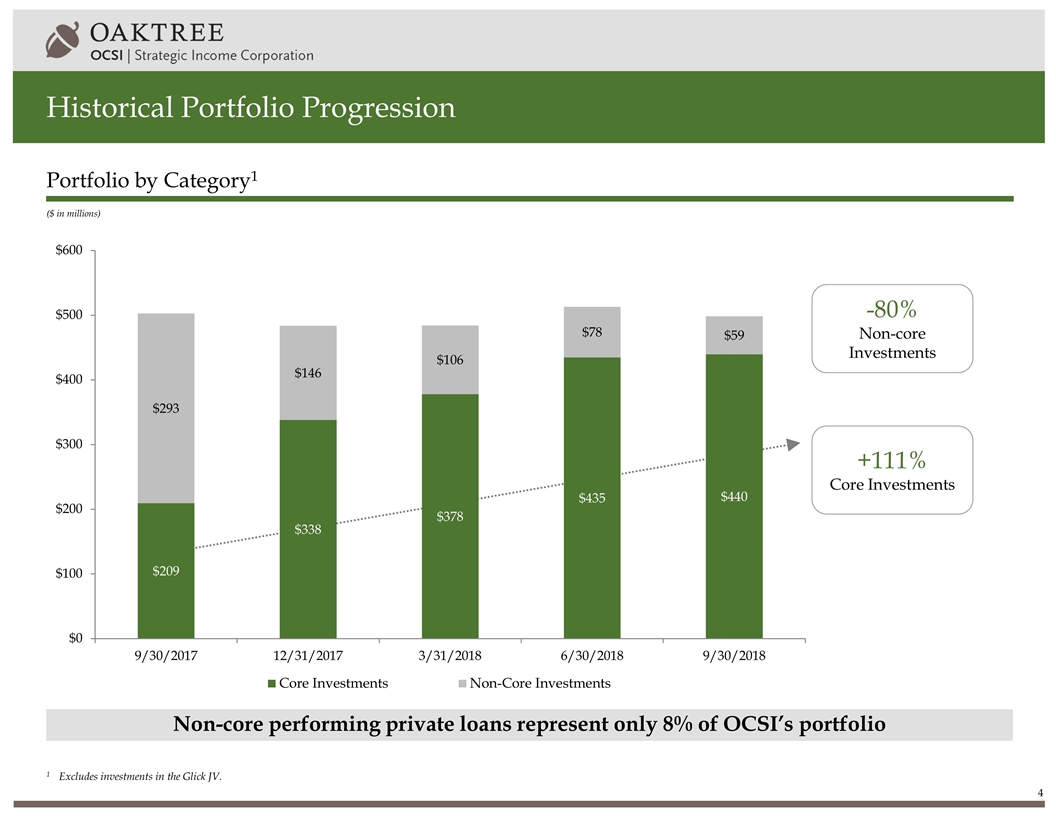

Historical Portfolio Progression Non-core performing private loans represent only 8% of OCSI’s portfolio ($ in millions) Portfolio by Category1 +111% Core Investments -80% Non-core Investments 1Excludes investments in the Glick JV.

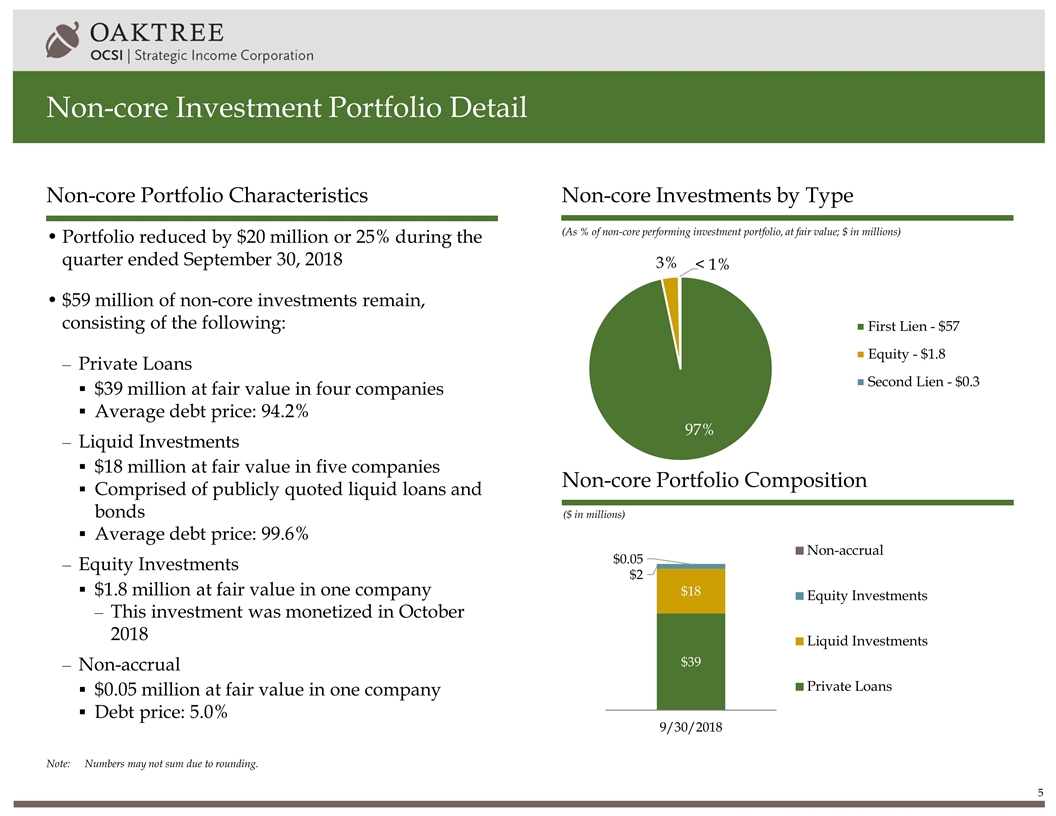

Note:Numbers may not sum due to rounding. Non-core Investment Portfolio Detail Non-core Portfolio Characteristics Portfolio reduced by $20 million or 25% during the quarter ended September 30, 2018 $59 million of non-core investments remain, consisting of the following: Private Loans $39 million at fair value in four companies Average debt price: 94.2% Liquid Investments $18 million at fair value in five companies Comprised of publicly quoted liquid loans and bonds Average debt price: 99.6% Equity Investments $1.8 million at fair value in one company This investment was monetized in October 2018 Non-accrual $0.05 million at fair value in one company Debt price: 5.0% (As % of non-core performing investment portfolio, at fair value; $ in millions) Non-core Investments by Type ($ in millions) Non-core Portfolio Composition < 1%

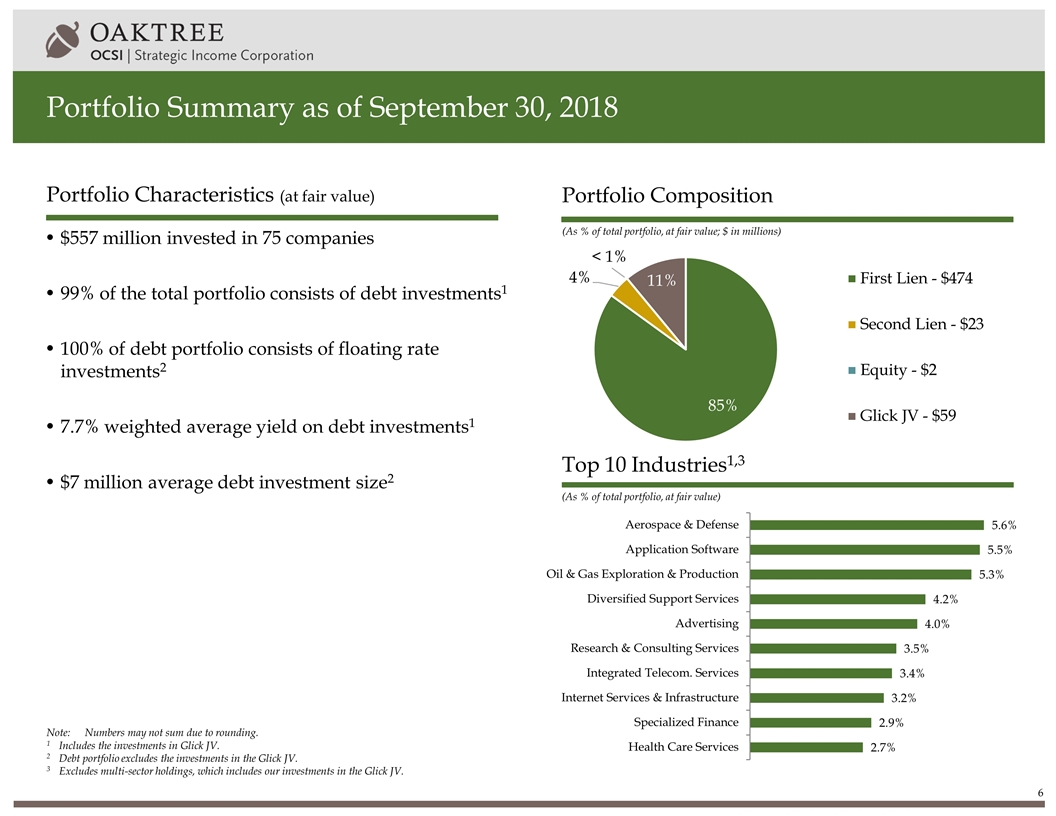

Portfolio Summary as of September 30, 2018 (As % of total portfolio, at fair value; $ in millions) (As % of total portfolio, at fair value) Portfolio Composition Top 10 Industries1,3 Portfolio Characteristics (at fair value) $557 million invested in 75 companies 99% of the total portfolio consists of debt investments1 100% of debt portfolio consists of floating rate investments2 7.7% weighted average yield on debt investments1 $7 million average debt investment size2 < 1% Note:Numbers may not sum due to rounding. 1Includes the investments in Glick JV. 2Debt portfolio excludes the investments in the Glick JV. 3Excludes multi-sector holdings, which includes our investments in the Glick JV.

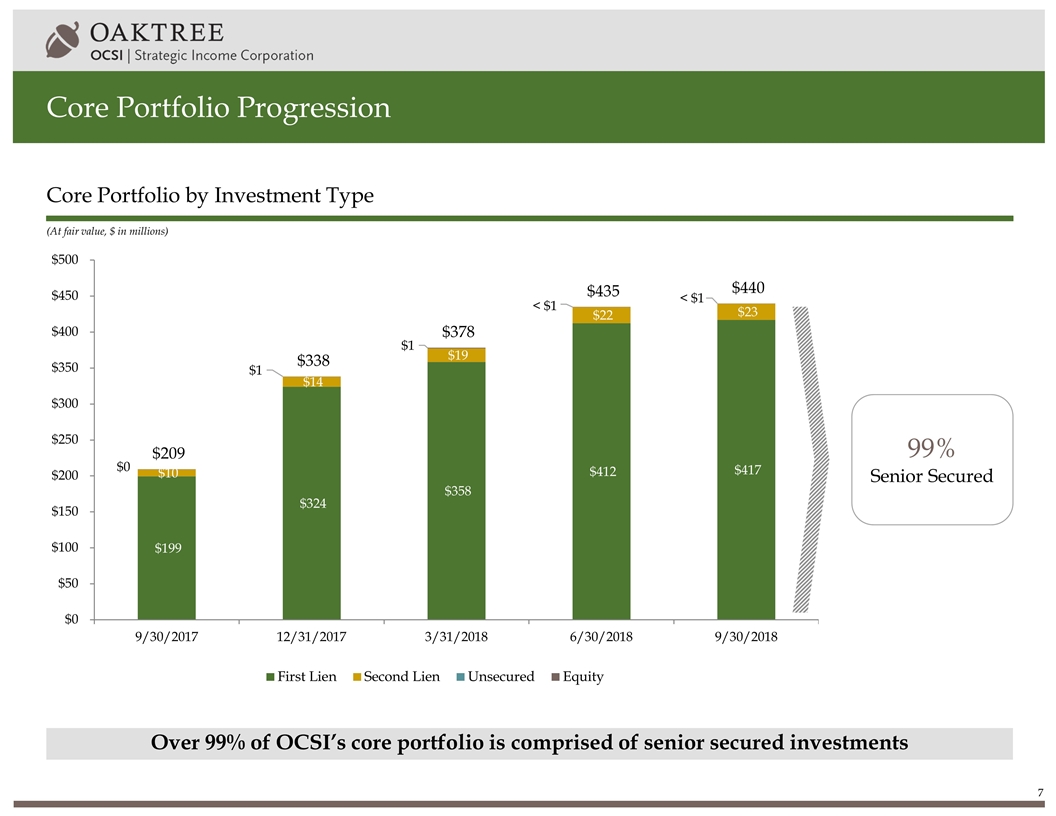

Core Portfolio Progression Over 99% of OCSI’s core portfolio is comprised of senior secured investments Core Portfolio by Investment Type (At fair value, $ in millions) 99% Senior Secured < $1

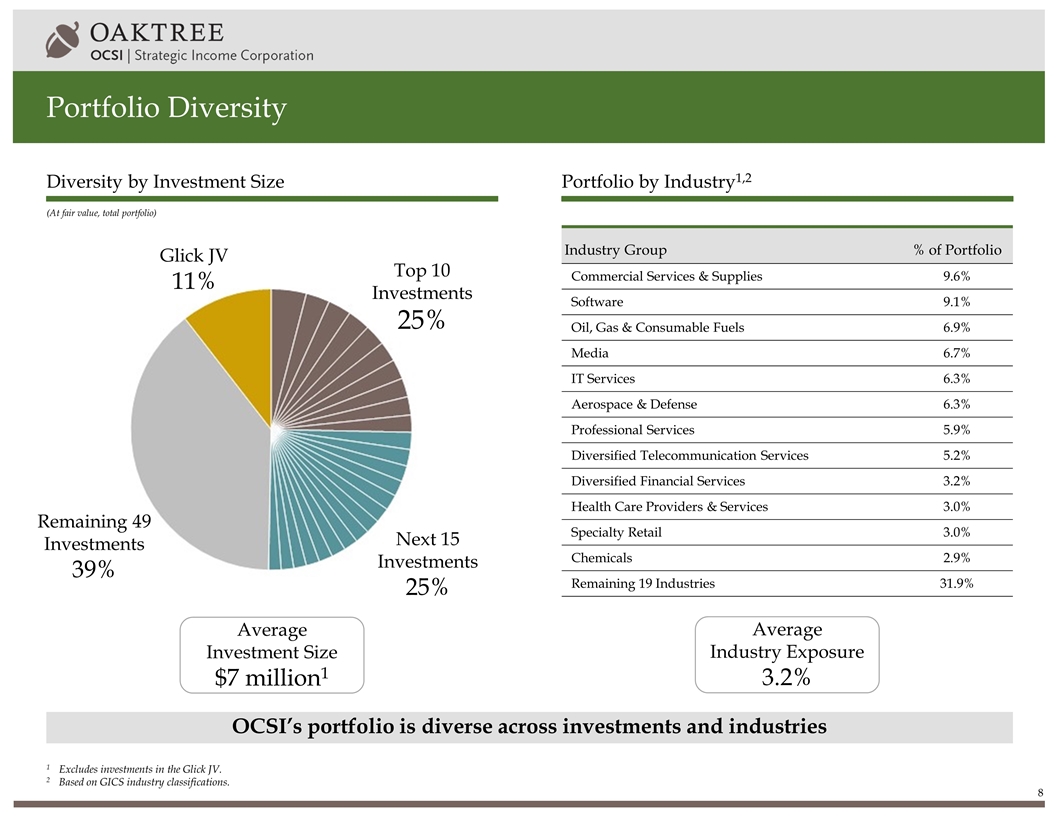

Portfolio Diversity OCSI’s portfolio is diverse across investments and industries (At fair value, total portfolio) Portfolio by Industry1,2 Diversity by Investment Size Top 10 Investments 25% Next 15 Investments 25% Remaining 49 Investments 39% Glick JV 11% Average Investment Size $7 million1 Industry Group % of Portfolio Commercial Services & Supplies 9.6% Software 9.1% Oil, Gas & Consumable Fuels 6.9% Media 6.7% IT Services 6.3% Aerospace & Defense 6.3% Professional Services 5.9% Diversified Telecommunication Services 5.2% Diversified Financial Services 3.2% Health Care Providers & Services 3.0% Specialty Retail 3.0% Chemicals 2.9% Remaining 19 Industries 31.9% Average Industry Exposure 3.2% 1Excludes investments in the Glick JV. 2Based on GICS industry classifications.

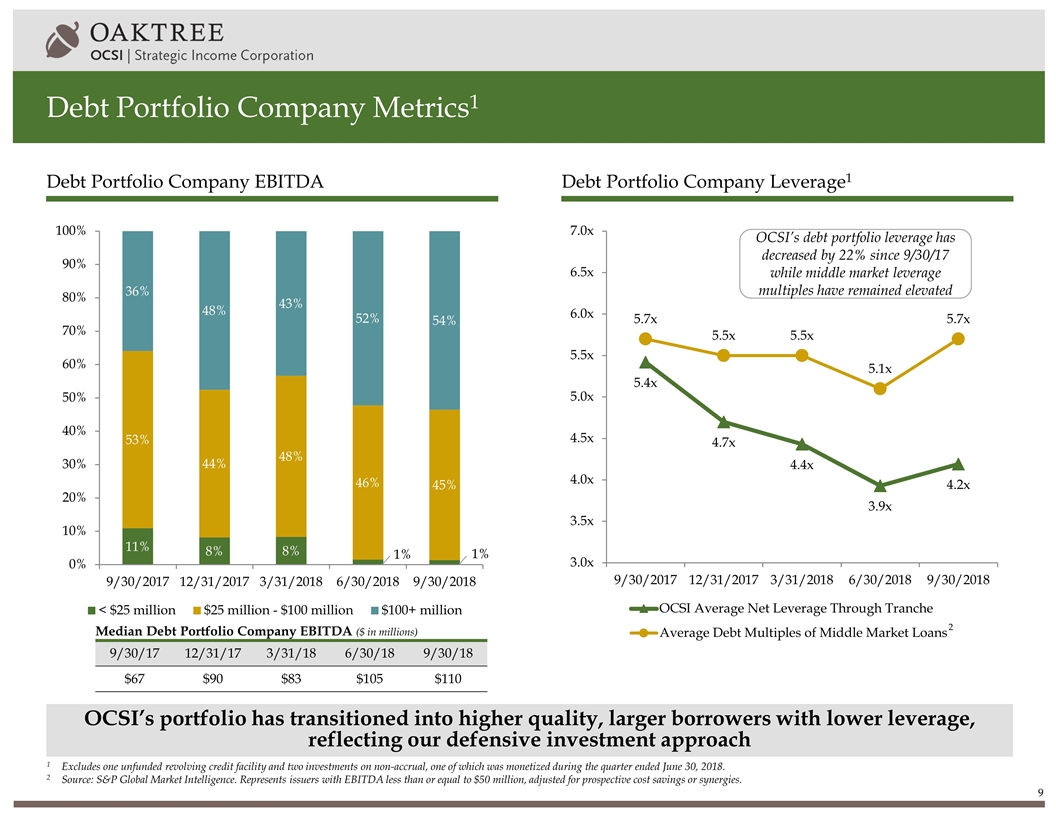

Debt Portfolio Company Metrics1 OCSI’s portfolio has transitioned into higher quality, larger borrowers with lower leverage, reflecting our defensive investment approach Debt Portfolio Company EBITDA Debt Portfolio Company Leverage1 Median Debt Portfolio Company EBITDA ($ in millions) OCSI’s debt portfolio leverage has decreased by 22% since 9/30/17 while middle market leverage multiples have remained elevated 1 Excludes one unfunded revolving credit facility and two investments on non-accrual, one of which was monetized during the quarter ended June 30, 2018. 2 Source: S&P Global Market Intelligence. Represents issuers with EBITDA less than or equal to $50 million, adjusted for prospective cost savings or synergies. 2 9/30/17 12/31/17 3/31/18 6/30/18 9/30/18 $67 $90 $83 $105 $110

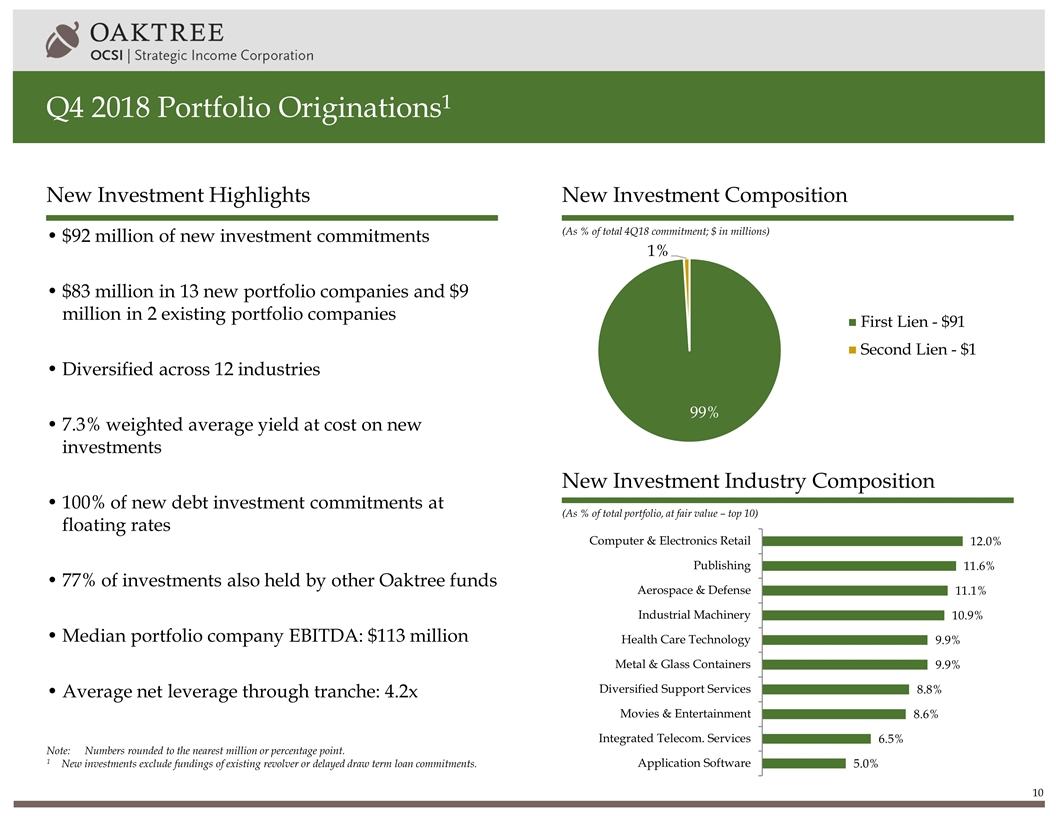

Q4 2018 Portfolio Originations1 $92 million of new investment commitments $83 million in 13 new portfolio companies and $9 million in 2 existing portfolio companies Diversified across 12 industries 7.3% weighted average yield at cost on new investments 100% of new debt investment commitments at floating rates 77% of investments also held by other Oaktree funds Median portfolio company EBITDA: $113 million Average net leverage through tranche: 4.2x New Investment Highlights (As % of total portfolio, at fair value – top 10) New Investment Industry Composition (As % of total 4Q18 commitment; $ in millions) New Investment Composition Note:Numbers rounded to the nearest million or percentage point. 1 New investments exclude fundings of existing revolver or delayed draw term loan commitments.

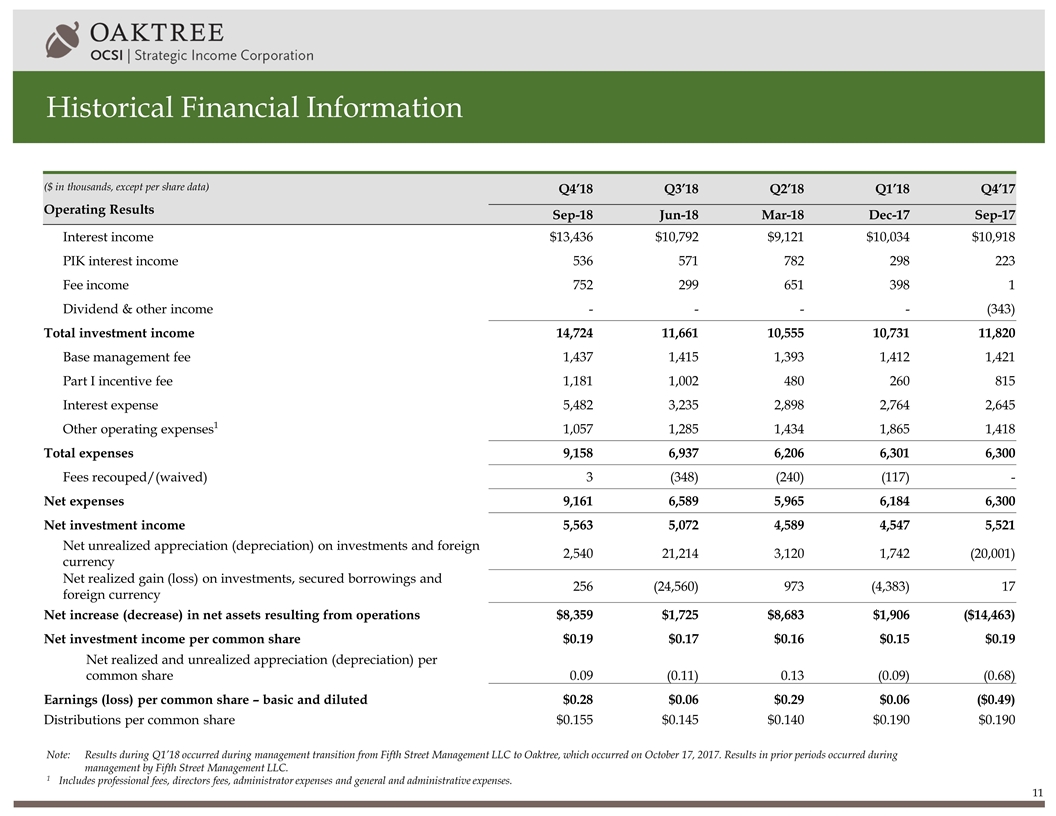

Historical Financial Information ($ in thousands, except per share data) Operating Results Q4’18 Q3’18 Q2’18 Q1’18 Q4’17 Sep-18 Jun-18 Mar-18 Dec-17 Sep-17 Interest income $13,436 $10,792 $9,121 $10,034 $10,918 PIK interest income 536 571 782 298 223 Fee income 752 299 651 398 1 Dividend & other income - - - - (343) Total investment income 14,724 11,661 10,555 10,731 11,820 Base management fee 1,437 1,415 1,393 1,412 1,421 Part I incentive fee 1,181 1,002 480 260 815 Interest expense 5,482 3,235 2,898 2,764 2,645 Other operating expenses1 1,057 1,285 1,434 1,865 1,418 Total expenses 9,158 6,937 6,206 6,301 6,300 Fees recouped/(waived) 3 (348) (240) (117) - Net expenses 9,161 6,589 5,965 6,184 6,300 Net investment income 5,563 5,072 4,589 4,547 5,521 Net unrealized appreciation (depreciation) on investments and foreign currency 2,540 21,214 3,120 1,742 (20,001) Net realized gain (loss) on investments, secured borrowings and foreign currency 256 (24,560) 973 (4,383) 17 Net increase (decrease) in net assets resulting from operations $8,359 $1,725 $8,683 $1,906 ($14,463) Net investment income per common share $0.19 $0.17 $0.16 $0.15 $0.19 Net realized and unrealized appreciation (depreciation) per common share 0.09 (0.11) 0.13 (0.09) (0.68) Earnings (loss) per common share – basic and diluted $0.28 $0.06 $0.29 $0.06 ($0.49) Distributions per common share $0.155 $0.145 $0.140 $0.190 $0.190 Note:Results during Q1’18 occurred during management transition from Fifth Street Management LLC to Oaktree, which occurred on October 17, 2017. Results in prior periods occurred during management by Fifth Street Management LLC. 1Includes professional fees, directors fees, administrator expenses and general and administrative expenses.

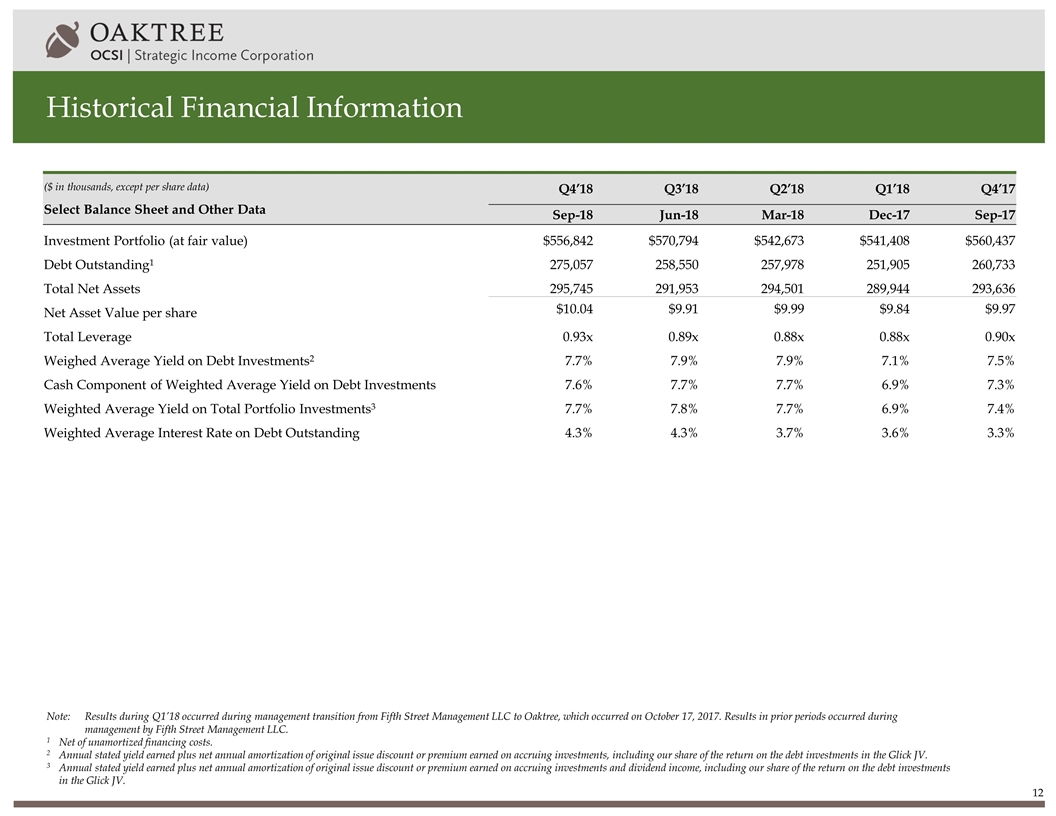

Historical Financial Information ($ in thousands, except per share data) Select Balance Sheet and Other Data Q4’18 Q3’18 Q2’18 Q1’18 Q4’17 Sep-18 Jun-18 Mar-18 Dec-17 Sep-17 Investment Portfolio (at fair value) $556,842 $570,794 $542,673 $541,408 $560,437 Debt Outstanding1 275,057 258,550 257,978 251,905 260,733 Total Net Assets 295,745 291,953 294,501 289,944 293,636 Net Asset Value per share $10.04 $9.91 $9.99 $9.84 $9.97 Total Leverage 0.93x 0.89x 0.88x 0.88x 0.90x Weighed Average Yield on Debt Investments2 7.7% 7.9% 7.9% 7.1% 7.5% Cash Component of Weighted Average Yield on Debt Investments 7.6% 7.7% 7.7% 6.9% 7.3% Weighted Average Yield on Total Portfolio Investments3 7.7% 7.8% 7.7% 6.9% 7.4% Weighted Average Interest Rate on Debt Outstanding 4.3% 4.3% 3.7% 3.6% 3.3% Note:Results during Q1’18 occurred during management transition from Fifth Street Management LLC to Oaktree, which occurred on October 17, 2017. Results in prior periods occurred during management by Fifth Street Management LLC. 1Net of unamortized financing costs. 2Annual stated yield earned plus net annual amortization of original issue discount or premium earned on accruing investments, including our share of the return on the debt investments in the Glick JV. 3Annual stated yield earned plus net annual amortization of original issue discount or premium earned on accruing investments and dividend income, including our share of the return on the debt investments in the Glick JV.

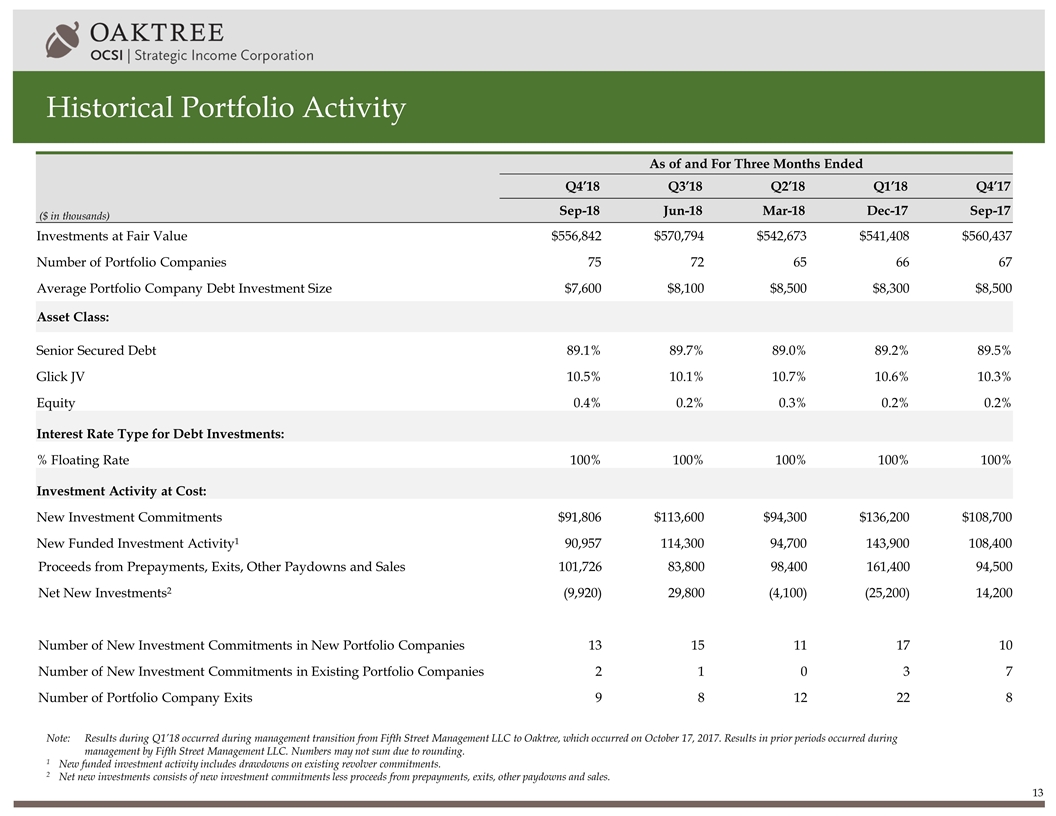

Historical Portfolio Activity ($ in thousands) As of and For Three Months Ended Q4’18 Q3’18 Q2’18 Q1’18 Q4’17 Sep-18 Jun-18 Mar-18 Dec-17 Sep-17 Investments at Fair Value $556,842 $570,794 $542,673 $541,408 $560,437 Number of Portfolio Companies 75 72 65 66 67 Average Portfolio Company Debt Investment Size $7,600 $8,100 $8,500 $8,300 $8,500 Asset Class: Senior Secured Debt 89.1% 89.7% 89.0% 89.2% 89.5% Glick JV 10.5% 10.1% 10.7% 10.6% 10.3% Equity 0.4% 0.2% 0.3% 0.2% 0.2% Interest Rate Type for Debt Investments: % Floating Rate 100% 100% 100% 100% 100% Investment Activity at Cost: New Investment Commitments $91,806 $113,600 $94,300 $136,200 $108,700 New Funded Investment Activity1 90,957 114,300 94,700 143,900 108,400 Proceeds from Prepayments, Exits, Other Paydowns and Sales 101,726 83,800 98,400 161,400 94,500 Net New Investments2 (9,920) 29,800 (4,100) (25,200) 14,200 Number of New Investment Commitments in New Portfolio Companies 13 15 11 17 10 Number of New Investment Commitments in Existing Portfolio Companies 2 1 0 3 7 Number of Portfolio Company Exits 9 8 12 22 8 Note:Results during Q1’18 occurred during management transition from Fifth Street Management LLC to Oaktree, which occurred on October 17, 2017. Results in prior periods occurred during management by Fifth Street Management LLC. Numbers may not sum due to rounding. 1New funded investment activity includes drawdowns on existing revolver commitments. 2Net new investments consists of new investment commitments less proceeds from prepayments, exits, other paydowns and sales.

Net Asset Value Per Share Bridge Note:Net asset value per share amounts are based on the shares outstanding at each respective quarter end. Net investment income per share, net unrealized appreciation / (depreciation), and net realized gain / (loss) are based on the weighted average number of shares outstanding for the period. $0.01

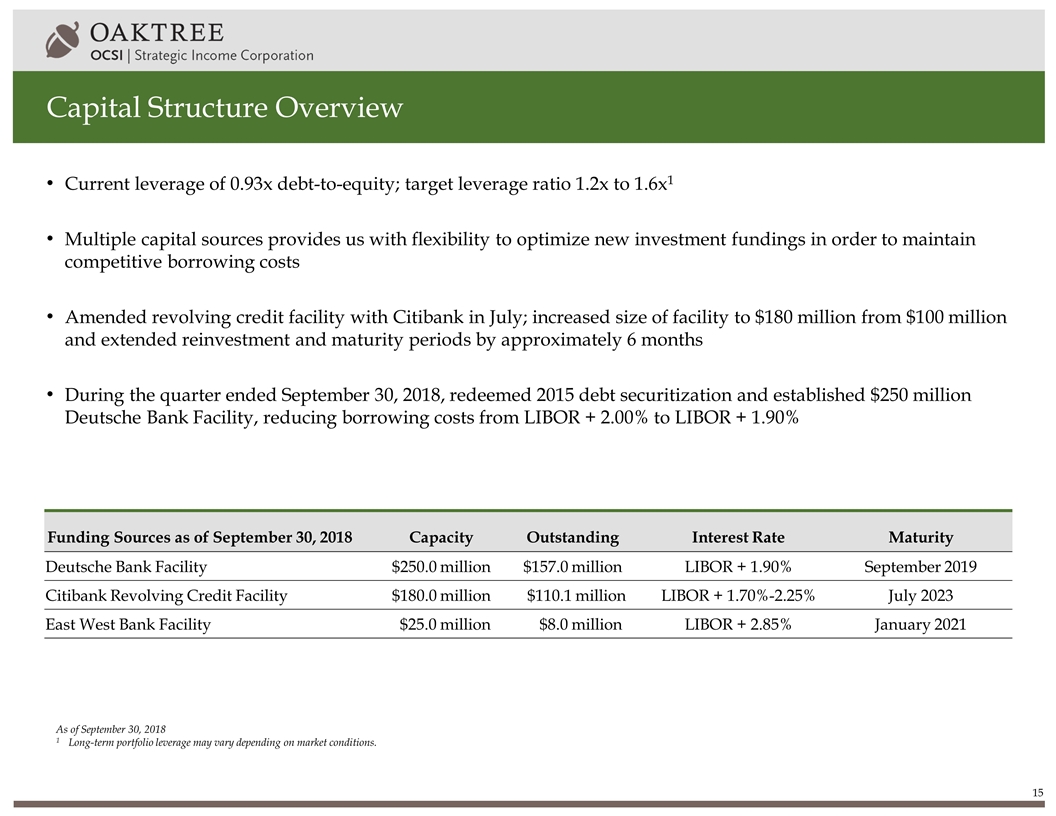

Capital Structure Overview As of September 30, 2018 1Long-term portfolio leverage may vary depending on market conditions. Current leverage of 0.93x debt-to-equity; target leverage ratio 1.2x to 1.6x1 Multiple capital sources provides us with flexibility to optimize new investment fundings in order to maintain competitive borrowing costs Amended revolving credit facility with Citibank in July; increased size of facility to $180 million from $100 million and extended reinvestment and maturity periods by approximately 6 months During the quarter ended September 30, 2018, redeemed 2015 debt securitization and established $250 million Deutsche Bank Facility, reducing borrowing costs from LIBOR + 2.00% to LIBOR + 1.90% Funding Sources as of September 30, 2018 Capacity Outstanding Interest Rate Maturity Deutsche Bank Facility $250.0 million $157.0 million LIBOR + 1.90% September 2019 Citibank Revolving Credit Facility $180.0 million $110.1 million LIBOR + 1.70%-2.25% July 2023 East West Bank Facility $25.0 million $8.0 million LIBOR + 2.85% January 2021

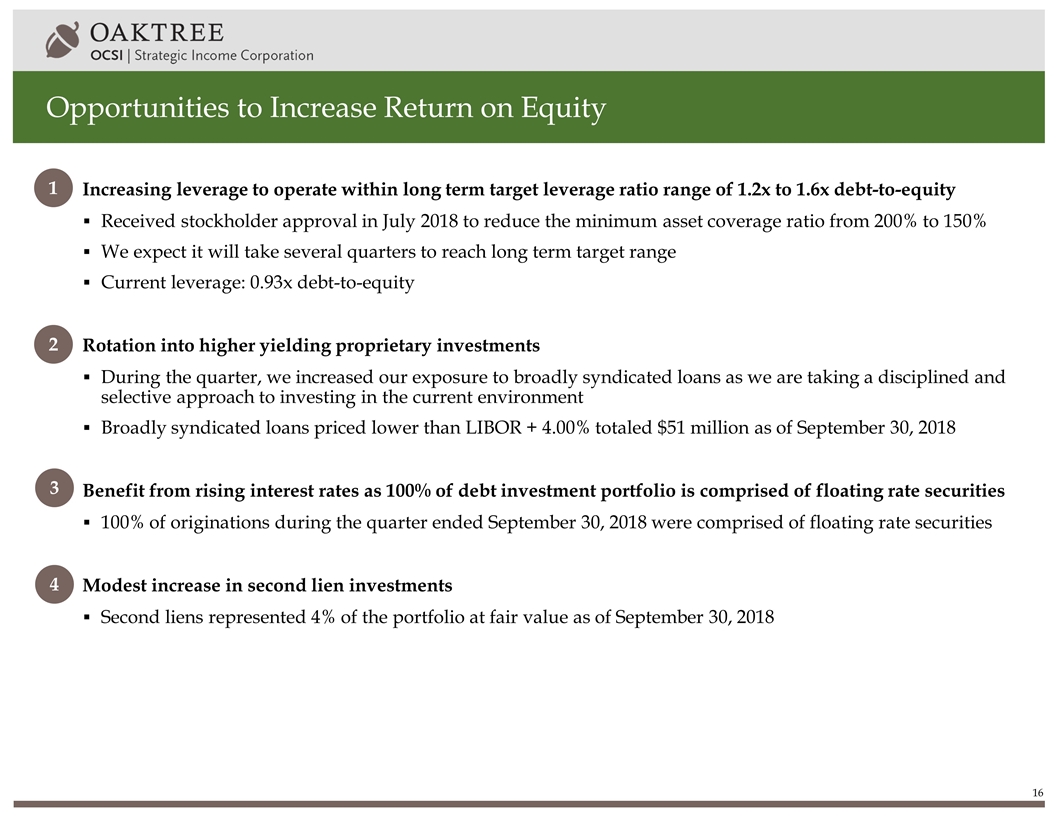

Opportunities to Increase Return on Equity Increasing leverage to operate within long term target leverage ratio range of 1.2x to 1.6x debt-to-equity Received stockholder approval in July 2018 to reduce the minimum asset coverage ratio from 200% to 150% We expect it will take several quarters to reach long term target range Current leverage: 0.93x debt-to-equity Rotation into higher yielding proprietary investments During the quarter, we increased our exposure to broadly syndicated loans as we are taking a disciplined and selective approach to investing in the current environment Broadly syndicated loans priced lower than LIBOR + 4.00% totaled $51 million as of September 30, 2018 Benefit from rising interest rates as 100% of debt investment portfolio is comprised of floating rate securities 100% of originations during the quarter ended September 30, 2018 were comprised of floating rate securities Modest increase in second lien investments Second liens represented 4% of the portfolio at fair value as of September 30, 2018 1 2 3 4

Appendix

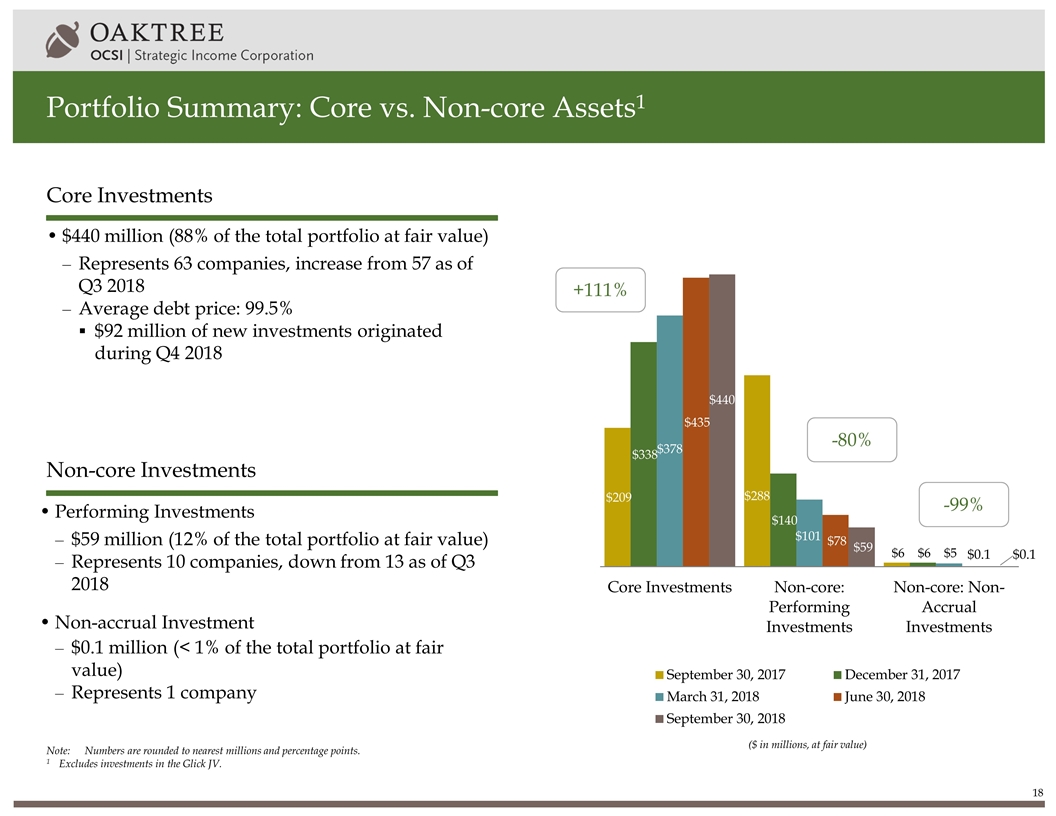

Portfolio Summary: Core vs. Non-core Assets1 ($ in millions, at fair value) $440 million (88% of the total portfolio at fair value) Represents 63 companies, increase from 57 as of Q3 2018 Average debt price: 99.5% $92 million of new investments originated during Q4 2018 Core Investments Non-core Investments Performing Investments $59 million (12% of the total portfolio at fair value) Represents 10 companies, down from 13 as of Q3 2018 Non-accrual Investment $0.1 million (< 1% of the total portfolio at fair value) Represents 1 company Note:Numbers are rounded to nearest millions and percentage points. 1Excludes investments in the Glick JV. $0.1 +111% -80% -99% $0.1

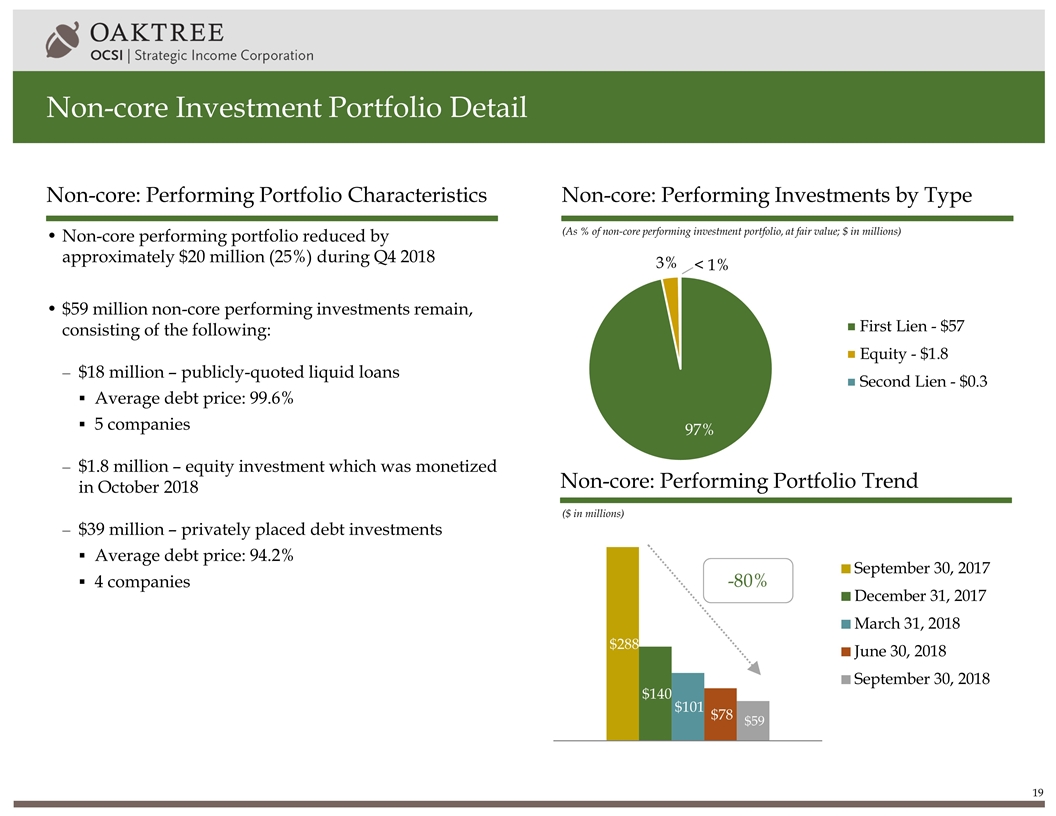

Non-core: Performing Portfolio Characteristics Non-core performing portfolio reduced by approximately $20 million (25%) during Q4 2018 $59 million non-core performing investments remain, consisting of the following: $18 million – publicly-quoted liquid loans Average debt price: 99.6% 5 companies $1.8 million – equity investment which was monetized in October 2018 $39 million – privately placed debt investments Average debt price: 94.2% 4 companies (As % of non-core performing investment portfolio, at fair value; $ in millions) Non-core: Performing Investments by Type Non-core Investment Portfolio Detail ($ in millions) Non-core: Performing Portfolio Trend -80%

Contact: Michael Mosticchio, Investor Relations ocsi-ir@oaktreecapital.com