Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CenterState Bank Corp | csfl-ex991_93.htm |

| EX-10.2 - EX-10.2 - CenterState Bank Corp | csfl-ex102_6.htm |

| EX-10.1 - EX-10.1 - CenterState Bank Corp | csfl-ex101_7.htm |

| EX-2.1 - EX-2.1 - CenterState Bank Corp | csfl-ex21_8.htm |

| 8-K - 8-K - CenterState Bank Corp | csfl-8k_20181123.htm |

Merger with National Commerce Corporation November 26, 2018 Exhibit 99.2

Forward Looking Statements This presentation contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. In general, forward-looking statements usually use words such as “may,” “believe,” “expect,” “anticipate,” “intend,” “will,” “should,” “plan,” “estimate,” “predict,” “continue” and “potential” or the negative of these terms or other comparable terminology, including statements related to the expected timing of the closing of the Merger, the expected returns and other benefits of the Merger to shareholders, expected improvement in operating efficiency resulting from the Merger, estimated expense reductions resulting from the transactions and the timing of achievement of such reductions, the impact on and timing of the recovery of the impact on tangible book value, and the effect of the Merger on CenterState’s capital ratios. Forward looking statements represent management’s beliefs, based upon information available at the time the statements are made, with regard to the matters addressed; they are not guarantees of future performance. Forward-looking statements are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial condition to differ materially from those expressed in or implied by such statements. Factors that could cause or contribute to such differences include, but are not limited to (1) the risk that the cost savings and any revenue synergies from the Merger may not be realized or take longer than anticipated to be realized, (2) disruption from the Merger with customer, supplier, employee or other business partner relationships, (3) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement, (4) the risk of successful integration of NCOM’s businesses into CenterState, (5) the failure to obtain the necessary approvals by the stockholders of NCOM, with respect to the Merger, or the shareholders of CenterState with respect to the issuance of CenterState common stock in connection with the Merger, (6) the amount of the costs, fees, expenses and charges related to the Merger, (7) the ability by CenterState to obtain required governmental approvals of the Merger, (8) reputational risk and the reaction of each of the companies’ customers, suppliers, employees or other business partners to the Merger, (9) the failure of the closing conditions in the Merger Agreement to be satisfied, or any unexpected delay in closing the Merger, (10) the risk that the integration of NCOM’s operations into the operations of CenterState will be materially delayed or will be more costly or difficult than expected, (11) the possibility that the Merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (12) the dilution caused by CenterState’s issuance of additional shares of its common stock in the Merger, and (13) general competitive, economic, political and market conditions. Additional factors which could affect the forward looking statements can be found in the cautionary language included under the headings “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” in CenterState’s Annual Report on Form 10-K for the year ended December 31, 2017, NCOM’s Annual Report on Form 10-K for the year ended December 31, 2017, and other documents subsequently filed by CenterState and NCOM with the SEC. Consequently, no forward-looking statement can be guaranteed. CenterState and NCOM do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

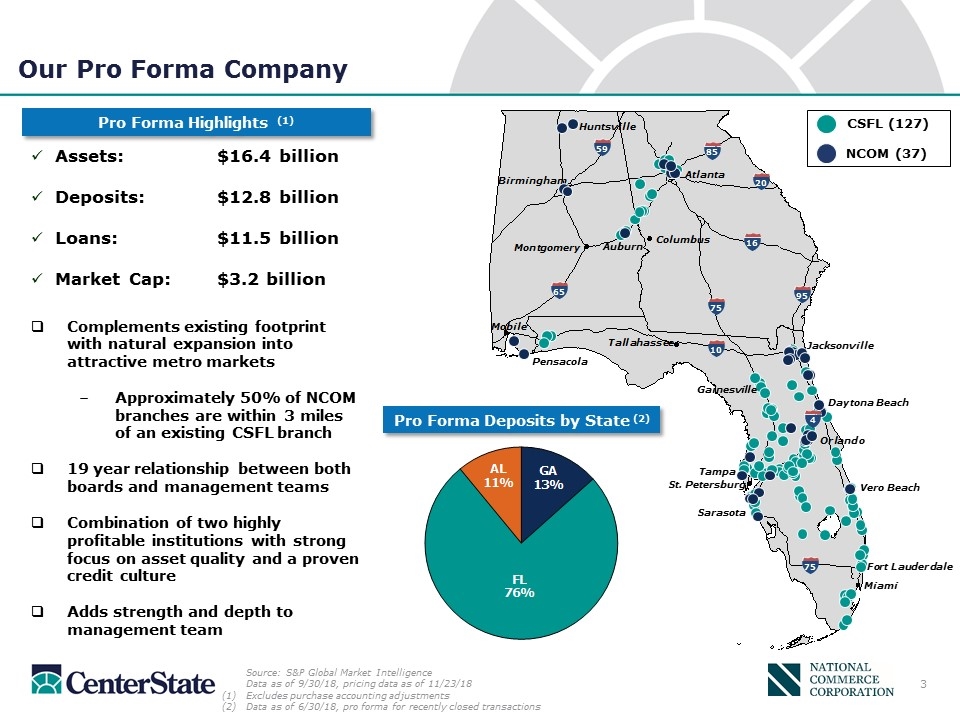

Assets: $16.4 billion Deposits: $12.8 billion Loans: $11.5 billion Market Cap: $3.2 billion Our Pro Forma Company Source: S&P Global Market Intelligence Data as of 9/30/18, pricing data as of 11/23/18 Excludes purchase accounting adjustments Data as of 6/30/18, pro forma for recently closed transactions Pro Forma Highlights (1) CSFL (127) NCOM (37) Complements existing footprint with natural expansion into attractive metro markets Approximately 50% of NCOM branches are within 3 miles of an existing CSFL branch 19 year relationship between both boards and management teams Combination of two highly profitable institutions with strong focus on asset quality and a proven credit culture Adds strength and depth to management team Pro Forma Deposits by State (2) Auburn Sarasota Vero Beach Daytona Beach 85 20 95 16 65 59 75 10 75 4 Pensacola Gainesville

Transaction Highlights Strategic Rationale Low Risk Profile Attractive Financial Returns Combination of two premier Southeast franchises to form a $16 billion regional bank Builds on existing presence in the following markets: Tampa, Orlando, Jacksonville and Atlanta Adds significant experience and deepens management team of combined company NCOM’s mortgage operation complements recent expansion into the line of business Mid-single digit EPS accretion, with cost savings fully phased in Minimal initial tangible book value dilution, earned back in approximately two years (1) with conservative assumptions Enhances profitability & efficiency metrics Pro forma company remains “well-capitalized” and remains under CRE guidelines All key executives under contract Market overlap mitigates integration and operational risk Shared cultural values, similar business strategies and long-term relationships Comprehensive due diligence with talented and practiced credit review team Based on the crossover method

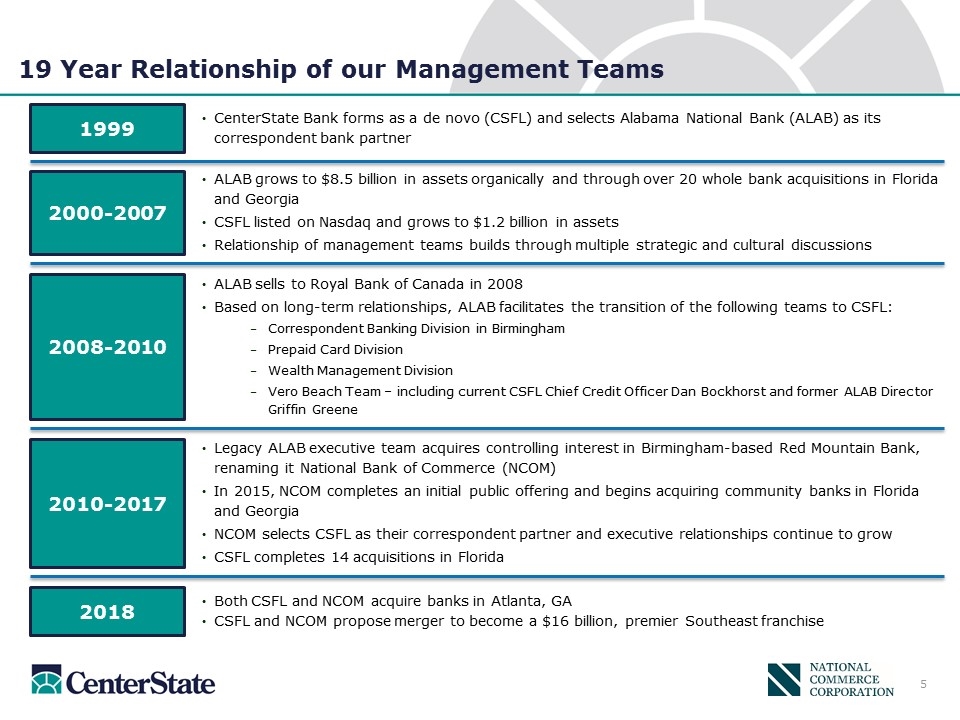

19 Year Relationship of our Management Teams 1999 CenterState Bank forms as a de novo (CSFL) and selects Alabama National Bank (ALAB) as its correspondent bank partner 2000-2007 ALAB grows to $8.5 billion in assets organically and through over 20 whole bank acquisitions in Florida and Georgia CSFL listed on Nasdaq and grows to $1.2 billion in assets Relationship of management teams builds through multiple strategic and cultural discussions 2008-2010 ALAB sells to Royal Bank of Canada in 2008 Based on long-term relationships, ALAB facilitates the transition of the following teams to CSFL: Correspondent Banking Division in Birmingham Prepaid Card Division Wealth Management Division Vero Beach Team – including current CSFL Chief Credit Officer Dan Bockhorst and former ALAB Director Griffin Greene 2010-2017 Legacy ALAB executive team acquires controlling interest in Birmingham-based Red Mountain Bank, renaming it National Bank of Commerce (NCOM) In 2015, NCOM completes an initial public offering and begins acquiring community banks in Florida and Georgia NCOM selects CSFL as their correspondent partner and executive relationships continue to grow CSFL completes 14 acquisitions in Florida 2018 Both CSFL and NCOM acquire banks in Atlanta, GA CSFL and NCOM propose merger to become a $16 billion, premier Southeast franchise

Pro Forma Leadership Board of Directors 16 CSFL Directors 3 NCOM Directors Pro Forma Organizational Chart John Corbett President & CEO Richard Murray Bank CEO Steve Young Chief Operating Officer Will Matthews Chief Financial Officer Dan Bockhorst Chief Credit Officer Beth DeSimone Chief Risk Officer & General Counsel Jennifer Idell Chief Administrative Officer

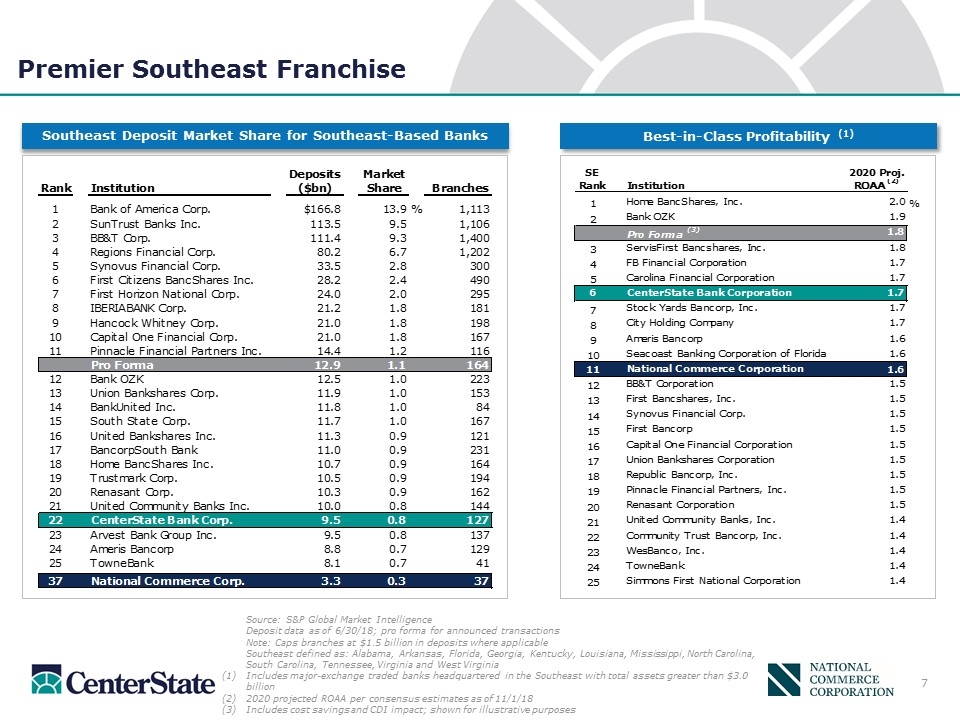

Southeast Deposit Market Share for Southeast-Based Banks Premier Southeast Franchise Source: S&P Global Market Intelligence Deposit data as of 6/30/18; pro forma for announced transactions Note: Caps branches at $1.5 billion in deposits where applicable Southeast defined as: Alabama, Arkansas, Florida, Georgia, Kentucky, Louisiana, Mississippi, North Carolina, South Carolina, Tennessee, Virginia and West Virginia Includes major-exchange traded banks headquartered in the Southeast with total assets greater than $3.0 billion (2) 2020 projected ROAA per consensus estimates as of 11/1/18 (3) Includes cost savings and CDI impact; shown for illustrative purposes Best-in-Class Profitability (1)

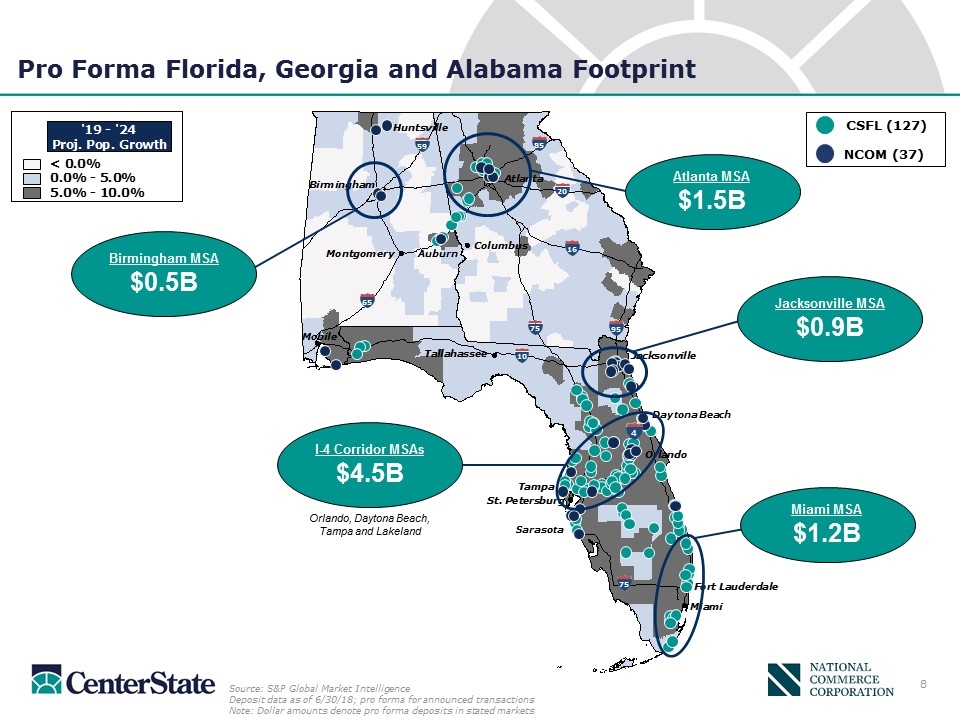

Pro Forma Florida, Georgia and Alabama Footprint Auburn Sarasota Daytona Beach Source: S&P Global Market Intelligence Deposit data as of 6/30/18; pro forma for announced transactions Note: Dollar amounts denote pro forma deposits in stated markets CSFL (127) NCOM (37) 20 95 16 65 59 75 10 75 85 8 Atlanta MSA $1.5B Jacksonville MSA $0.9B Miami MSA $1.2B Birmingham MSA $0.5B I-4 Corridor MSAs $4.5B Orlando, Daytona Beach, Tampa and Lakeland 4

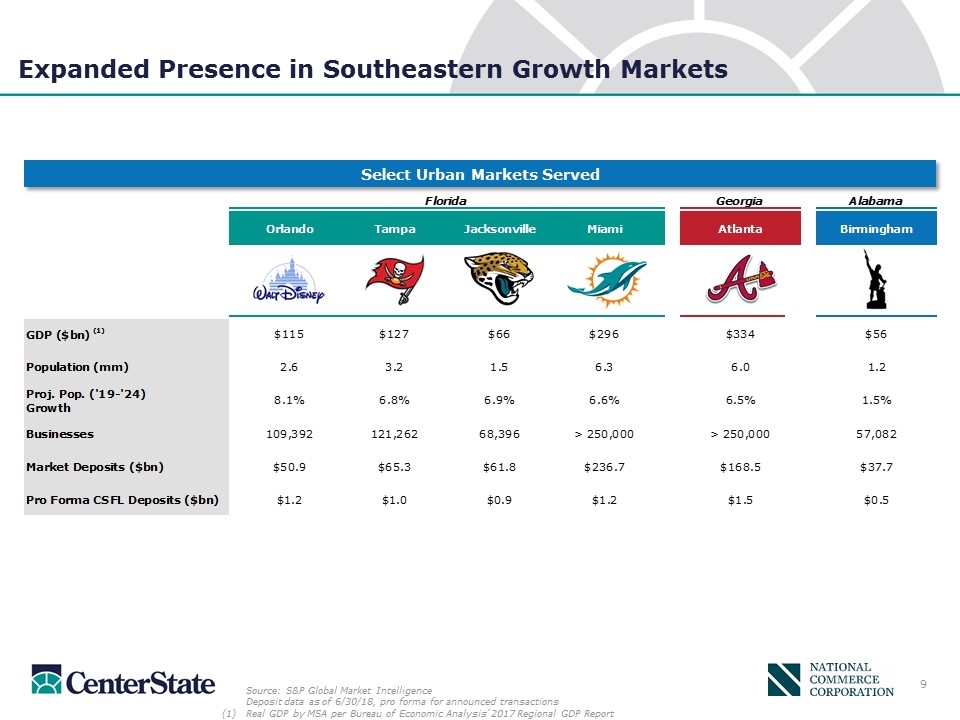

Expanded Presence in Southeastern Growth Markets Source: S&P Global Market Intelligence Deposit data as of 6/30/18, pro forma for announced transactions Real GDP by MSA per Bureau of Economic Analysis’ 2017 Regional GDP Report Select Urban Markets Served

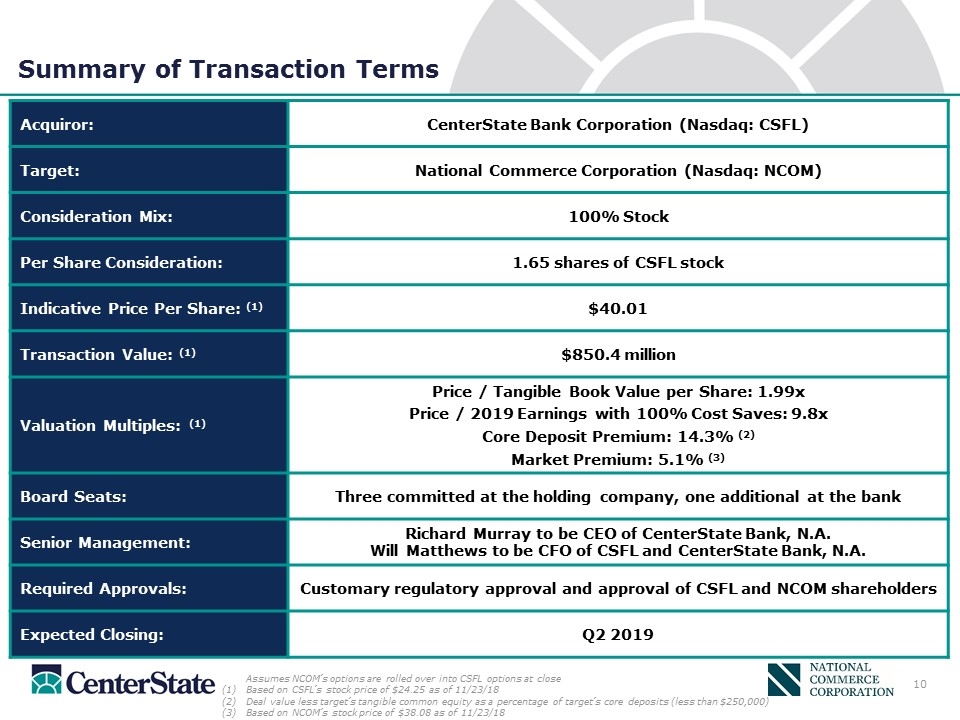

Summary of Transaction Terms Acquiror: CenterState Bank Corporation (Nasdaq: CSFL) Target: National Commerce Corporation (Nasdaq: NCOM) Consideration Mix: 100% Stock Per Share Consideration: 1.65 shares of CSFL stock Indicative Price Per Share: (1) $40.01 Transaction Value: (1) $850.4 million Valuation Multiples: (1) Price / Tangible Book Value per Share: 1.99x Price / 2019 Earnings with 100% Cost Saves: 9.8x Core Deposit Premium: 14.3% (2) Market Premium: 5.1% (3) Board Seats: Three committed at the holding company, one additional at the bank Senior Management: Richard Murray to be CEO of CenterState Bank, N.A. Will Matthews to be CFO of CSFL and CenterState Bank, N.A. Required Approvals: Customary regulatory approval and approval of CSFL and NCOM shareholders Expected Closing: Q2 2019 Assumes NCOM’s options are rolled over into CSFL options at close Based on CSFL’s stock price of $24.25 as of 11/23/18 Deal value less target’s tangible common equity as a percentage of target’s core deposits (less than $250,000) Based on NCOM’s stock price of $38.08 as of 11/23/18

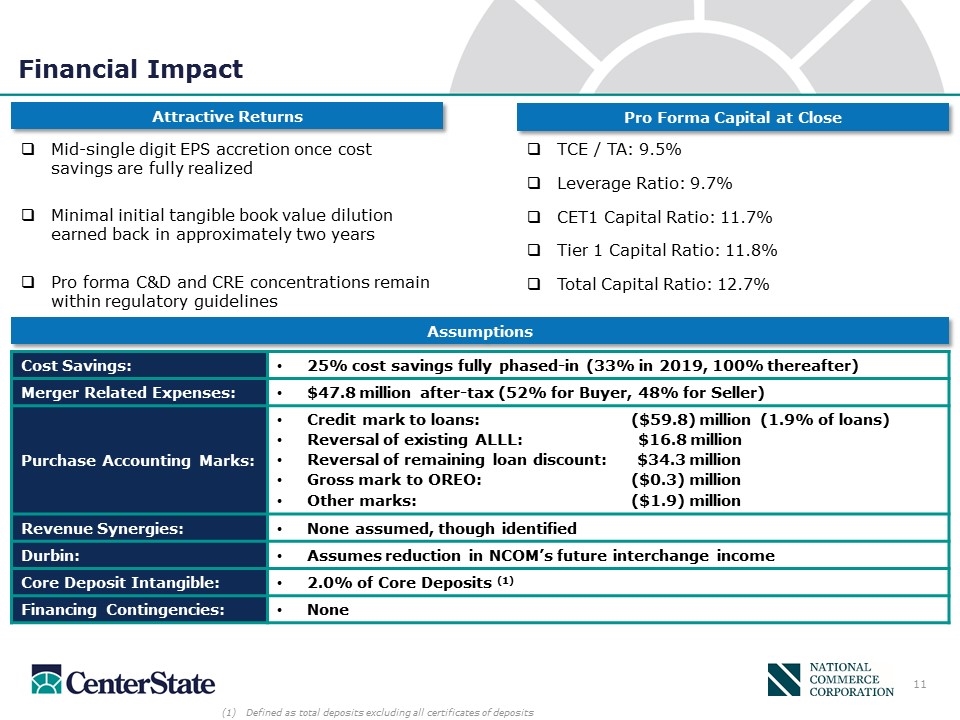

Financial Impact Cost Savings: 25% cost savings fully phased-in (33% in 2019, 100% thereafter) Merger Related Expenses: $47.8 million after-tax (52% for Buyer, 48% for Seller) Purchase Accounting Marks: Credit mark to loans:($59.8) million (1.9% of loans) Reversal of existing ALLL:$16.8 million Reversal of remaining loan discount: $34.3 million Gross mark to OREO:($0.3) million Other marks:($1.9) million Revenue Synergies: None assumed, though identified Durbin: Assumes reduction in NCOM’s future interchange income Core Deposit Intangible: 2.0% of Core Deposits (1) Financing Contingencies: None Defined as total deposits excluding all certificates of deposits Pro Forma Capital at Close Attractive Returns Assumptions Mid-single digit EPS accretion once cost savings are fully realized Minimal initial tangible book value dilution earned back in approximately two years Pro forma C&D and CRE concentrations remain within regulatory guidelines TCE / TA: 9.5% Leverage Ratio: 9.7% CET1 Capital Ratio: 11.7% Tier 1 Capital Ratio: 11.8% Total Capital Ratio: 12.7%

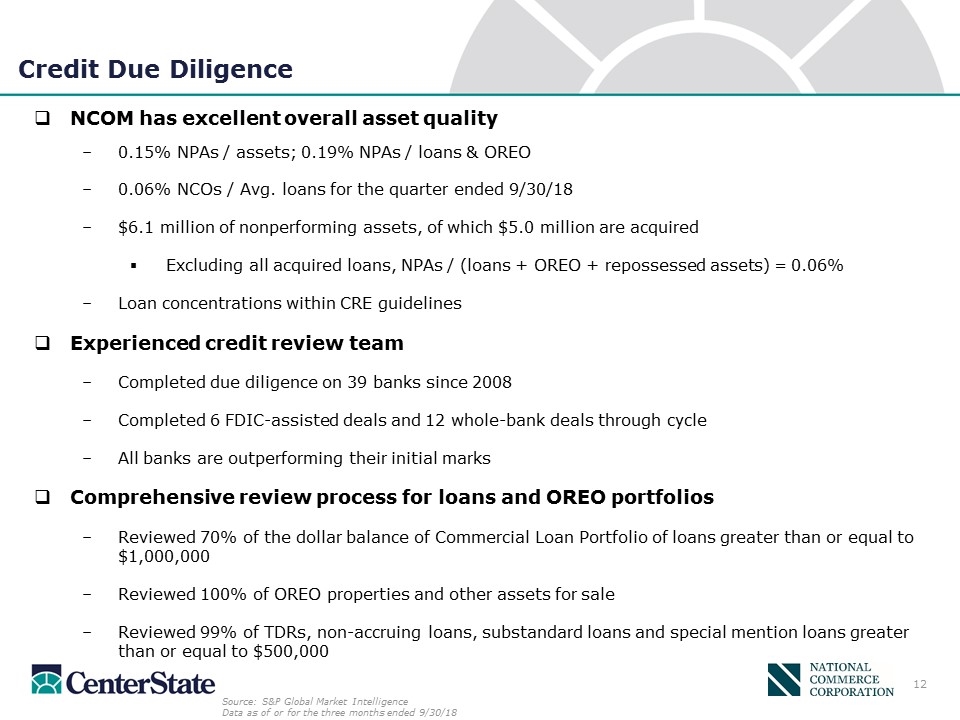

Credit Due Diligence NCOM has excellent overall asset quality 0.15% NPAs / assets; 0.19% NPAs / loans & OREO 0.06% NCOs / Avg. loans for the quarter ended 9/30/18 $6.1 million of nonperforming assets, of which $5.0 million are acquired Excluding all acquired loans, NPAs / (loans + OREO + repossessed assets) = 0.06% Loan concentrations within CRE guidelines Experienced credit review team Completed due diligence on 39 banks since 2008 Completed 6 FDIC-assisted deals and 12 whole-bank deals through cycle All banks are outperforming their initial marks Comprehensive review process for loans and OREO portfolios Reviewed 70% of the dollar balance of Commercial Loan Portfolio of loans greater than or equal to $1,000,000 Reviewed 100% of OREO properties and other assets for sale Reviewed 99% of TDRs, non-accruing loans, substandard loans and special mention loans greater than or equal to $500,000 Source: S&P Global Market Intelligence Data as of or for the three months ended 9/30/18

Concluding Thoughts Combination forms a $16 billion high-performing Southeast franchise NCOM provides additional depth and experience to the management team with a strong cultural fit Lower risk due to the strong relationship between the two companies built over the last 19 years Financially attractive, providing operating leverage through branch consolidation

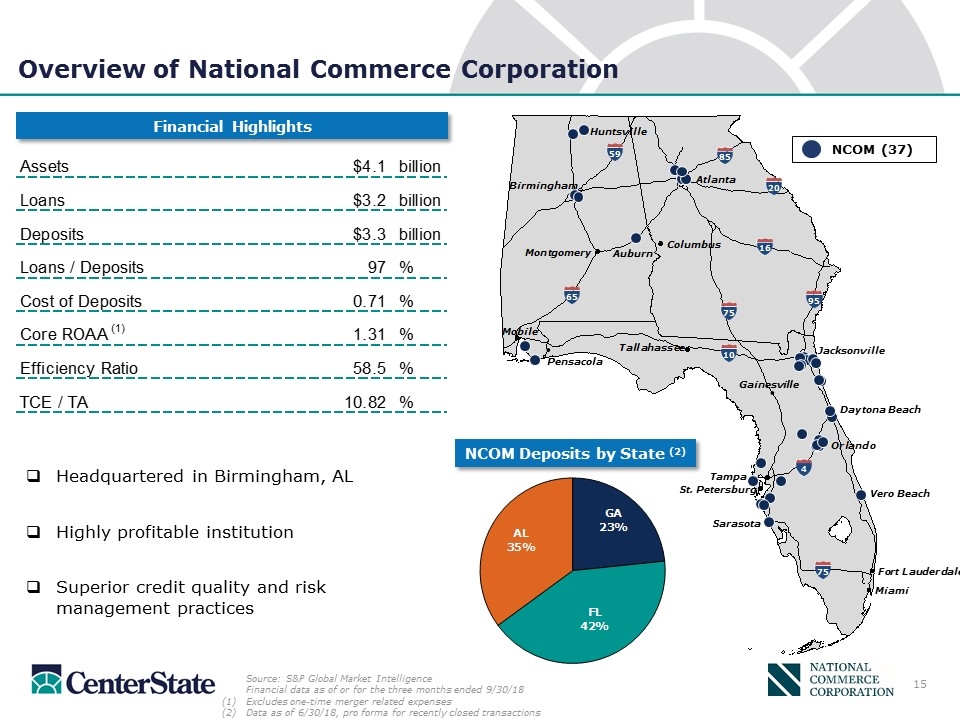

Overview of National Commerce Corporation Financial Highlights Source: S&P Global Market Intelligence Financial data as of or for the three months ended 9/30/18 (1)Excludes one-time merger related expenses (2)Data as of 6/30/18, pro forma for recently closed transactions Headquartered in Birmingham, AL Highly profitable institution Superior credit quality and risk management practices NCOM (37) NCOM Deposits by State (2) Auburn Sarasota Vero Beach Daytona Beach 85 20 95 16 65 59 75 10 75 4 Pensacola Gainesville

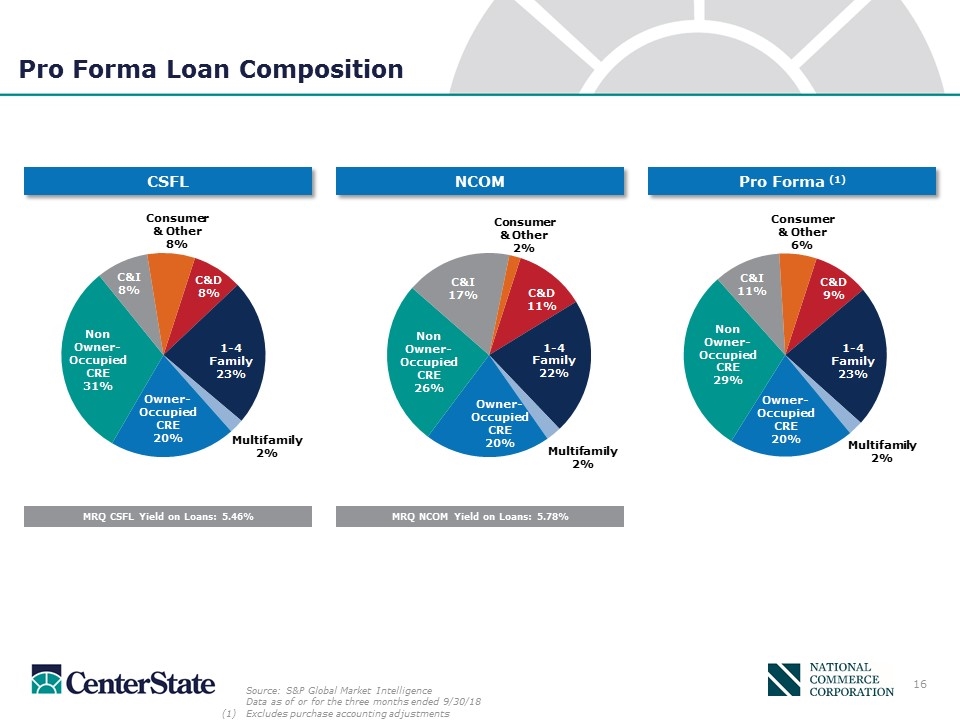

Pro Forma Loan Composition MRQ CSFL Yield on Loans: 5.46% MRQ NCOM Yield on Loans: 5.78% Source: S&P Global Market Intelligence Data as of or for the three months ended 9/30/18 Excludes purchase accounting adjustments CSFL NCOM Pro Forma (1)

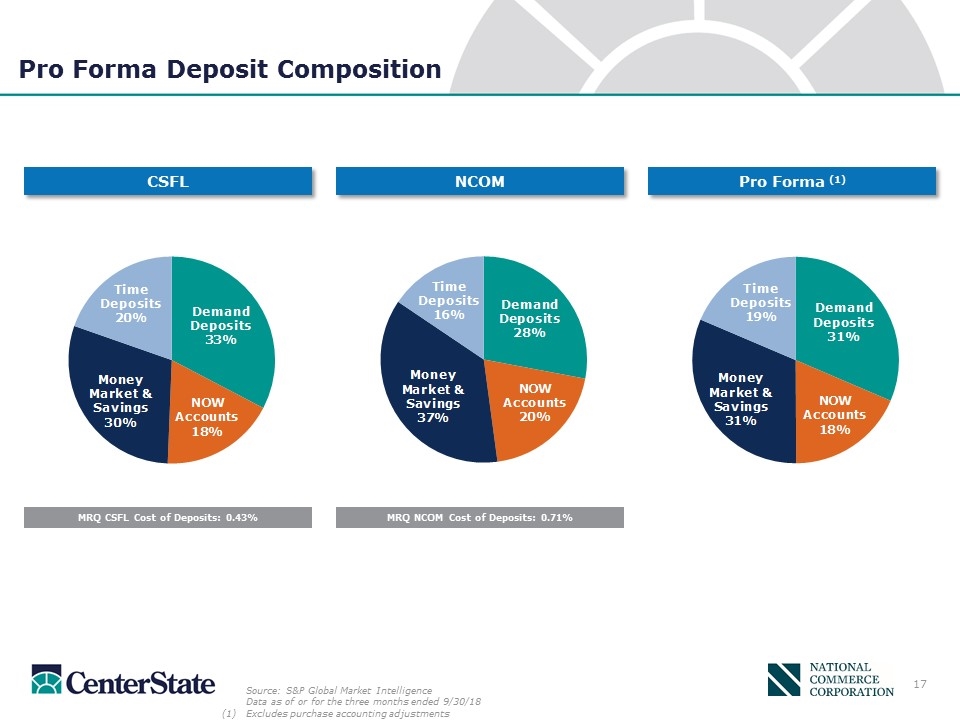

Pro Forma Deposit Composition Source: S&P Global Market Intelligence Data as of or for the three months ended 9/30/18 Excludes purchase accounting adjustments CSFL NCOM Pro Forma (1) MRQ CSFL Cost of Deposits: 0.43% MRQ NCOM Cost of Deposits: 0.71%

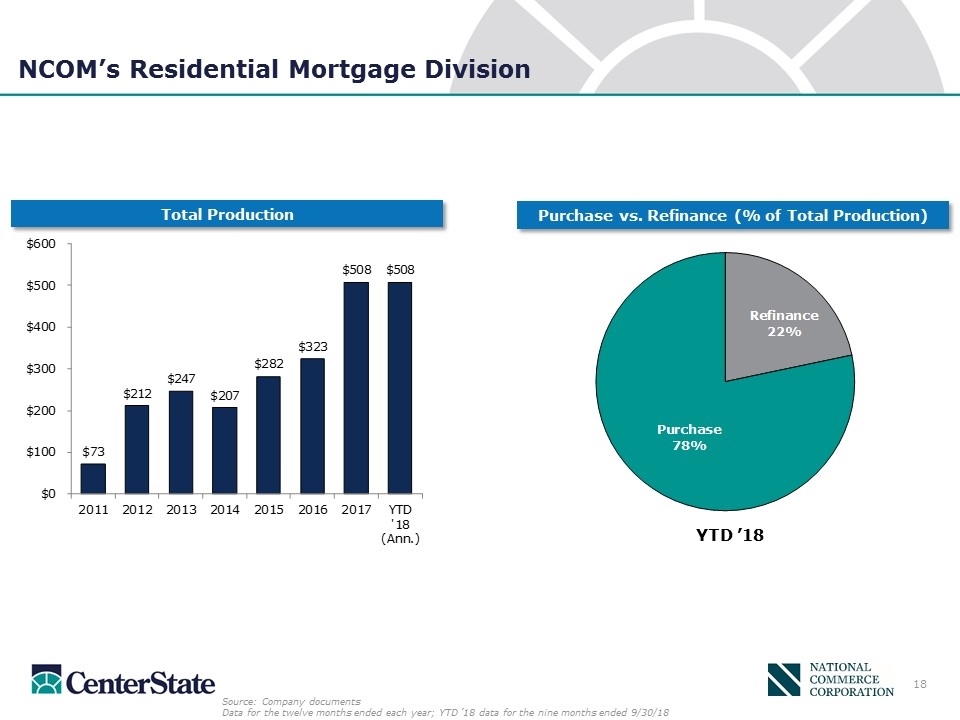

NCOM’s Residential Mortgage Division Source: Company documents Data for the twelve months ended each year; YTD ’18 data for the nine months ended 9/30/18 Purchase vs. Refinance (% of Total Production) Total Production YTD ’18

Additional Information CenterState intends to file a registration statement on Form S-4 with the Securities and Exchange Commission to register the shares of CenterState's common stock that will be issued to NCOM's shareholders in connection with the transaction. The registration statement will include a joint proxy statement/prospectus of CenterState and National Commerce and a prospectus of CenterState. A definitive joint proxy statement/prospectus will be sent to the shareholders of CenterState and the stockholders of National Commerce in connection with the proposed merger transaction involving CenterState and National Commerce. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, AND JOINT PROXY/PROSPECTUS WHEN IT BECOMES AVAILABLE (AND ANY OTHER DOCUMENTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE JOINT PROXY/PROSPECTUS) BECAUSE SUCH DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION REGARDING THE PROPOSED MERGER TRANSACTION. Investors and security holders may obtain free copies of these documents and other documents filed with the Securities and Exchange Commission on its website at www.sec.gov. Investors and security holders may also obtain free copies of the documents filed with the Securities and Exchange Commission by CenterState on its website at www.centerstatebanks.com and by NCOM on its website at www.nationalbankofcommerce.com. CenterState, NCOM and certain of their directors and executive officers may be deemed participants in the solicitation of proxies from NCOM stockholders and from CenterState shareholders in connection with the Merger. Information regarding the directors and executive officers of CenterState and NCOM and other persons who may be deemed participants in the solicitation of the stockholders of NCOM or the shareholders of CenterState in connection with the Merger will be included in the joint proxy statement/prospectus for NCOM’s special meeting of stockholders and CenterState special meeting of shareholders, which will be filed by CenterState with the SEC. Information about the directors and officers of CenterState and their ownership of CenterState common stock can also be found in CenterState’s definitive proxy statement in connection with its 2018 annual meeting of shareholders, as filed with the SEC on March 12, 2018, and other documents subsequently filed by CenterState with the SEC. Information about the directors and officers of NCOM and their ownership of NCOM common stock can also be found in NCOM’s definitive proxy statement in connection with its 2018 annual meeting of stockholders, as filed with the SEC on April 20, 2018, and other documents subsequently filed by NCOM with the SEC. Additional information regarding the interests of such participants will be included in the joint proxy statement/prospectus and other relevant documents regarding the Merger filed with the SEC when they become available.

Investor Contacts John Corbett President & CEO jcorbett@centerstatebank.com Jennifer Idell Chief Financial Officer jidell@centerstatebank.com Steve Young Chief Operating Officer syoung@centerstatebank.com Phone Number 863-293-4710 Phone Number 205-313-8100 Richard Murray Chairman & CEO rmurray@nationalbankofcommerce.com Will Matthews President & CFO wmatthews@nationalbankofcommerce.com

www.centerstatebank.com