Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Ault Global Holdings, Inc. | ex99_2.htm |

| 8-K - Ault Global Holdings, Inc. | d11151818k.htm |

Exhibit 99.1

Q3 2018 BUSINESS UPDATE – NOVEMBER 15, 2018 Ticker: DPW

Disclaimers This presentation and other written or oral statements made from time to time by representatives of DPW Holdings, Inc. (somet ime s referred to as “DPW”) contain “forward - looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. Forward - looking statements reflect the current view about future events. Statements that are not historical in nature, suc h as forecasts for the industry in which we operate, and which may be identified by the use of words like “expects,” “assumes,” “projects,” “anticipates,” “estimates,” “ we believe,” “could be,” "future" or the negative of these terms and other words of similar meaning, are forward - looking statements. Such statements include, but are not limited to, statements contained in this presentation relating to our business, business strategy, expansion, growth, products and services we may offer in the future an d the timing of their development, sales and marketing strategy and capital outlook. Forward - looking statements are based on management’s current expectations and assump tions regarding our business, the economy and other future conditions and are subject to inherent risks, uncertainties and changes of circumstances that are diffi cult to predict and may cause actual results to differ materially from those contemplated or expressed. We caution you therefore against relying on any of these forw ard - looking statements. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10 - K for the fiscal year ended December 31, 2017 (the “2017 Annual Report”) and other information contained in subsequently filed current and periodic reports, each of which is av ail able on our website and on the Securities and Exchange Commission’s website (www.sec.gov). Any forward - looking statements are qualified in their entirety by reference to the factors discussed in the 2017 Annual Report. Should one or more of these risks or uncertainties materialize (or in certain cases fail to materialize), or shou ld the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned. Important factors that could cause actual results to differ materially from those in the forward looking statements include: a d ecline in general economic conditions nationally and internationally; decreased demand for our products and services; market acceptance of our products; the abilit y t o protect our intellectual property rights; impact of any litigation or infringement actions brought against us; competition from other providers and products; risks in pro duct development; inability to raise capital to fund continuing operations; changes in government regulation, the ability to complete customer transactions and capital ra isi ng transactions. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us t o p redict all of them. We cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward - looking statements to conform these statements to actual results. All forecasts are provided by management in this presentation and are based on information available to us at this time and m ana gement expects that internal projections and expectations may change over time. In addition, the forecasts are entirely on management’s best estimate of our future f ina ncial performance given our current contracts, current backlog of opportunities and conversations with new and existing customers about our products. Safe Harbor © 2018 DPW Holdings, Inc. 2 2

Diversified holding company acquiring undervalued assets and disruptive technologies with a global impact Continually evaluating portfolio for opportunities to enter adjacent markets and to monetize existing assets for the benefit of shareholders Targeting advance technologies, finance and strategic investments © 2018 DPW Holdings, Inc. 3

© 2018 DPW Holdings, Inc. DPW Technology Group Advance Tech. Manufacturing: - Defense & Aerospace - Power Solutions - Medical - Textiles DPW Financial Group Lending & Investments: - Blockchain Technologies - Hospitality - Real Estate - Other Opportunities Simplifying Structure 4 MTIX International (OTC:AVLP) Strategic Investments

DPW Technology Group Recent Highlights © 2018 DPW Holdings, Inc. • $4.3M order for advanced missile control system from an Israeli defense contractor • $4.1M multi - year order from top U.S. Defense Contractor for communications filters • $5M in orders for cutting - edge medical automated test and calibration equipment Technology Group secured over $15M in advanced technologies wins Grew order backlog total to over $71M as of November 13, 2018 5

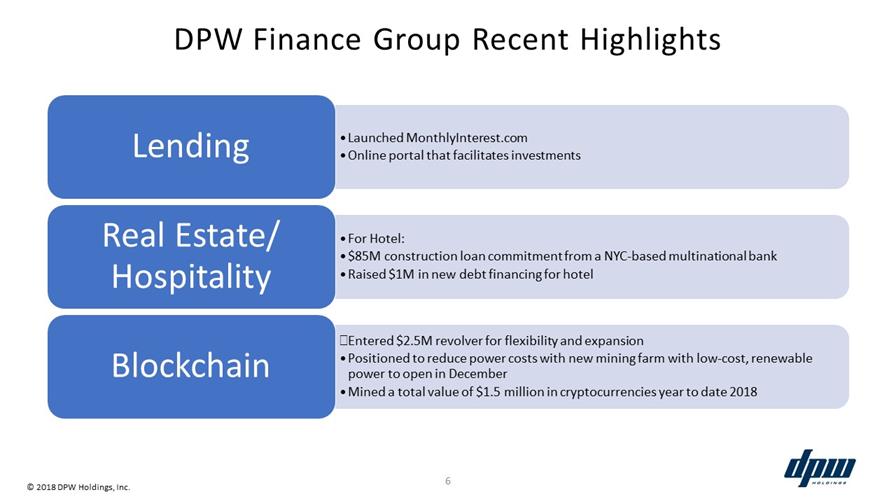

© 2018 DPW Holdings, Inc. • Launched MonthlyInterest.com • Online portal that facilitates investments Lending For Hotel: • $85M construction loan commitment from a NYC - based multinational bank • Raised $1M in new debt financing for hotel Real Estate/ Hospitality Entered $2.5M revolver for flexibility and expansion • Positioned to reduce power costs with new mining farm with low - cost, renewable power to open in December • Mined a total value of $1.5 million in cryptocurrencies year to date 2018 Blockchain DPW Finance Group Recent Highlights 6

2019 Initiatives: Focus on Strategic Growth © 2018 DPW Holdings, Inc. Technology • Implement sale and operational improvement plans • Execute on backlog, notably MTIX • Drive to profitability Finance • Continue expanding lending opportunities • Evaluate loans for investment and acquisitions opportunities • Leverage relationships with experts 7

Financial Highlights: Sept. 30, 2018 Statement of Operations • Gross Revenue: $8.3M, compared to $3.2M in 3Q 2017 • Gross Margins 24.3% compared to 34.0% in 3Q 2017 • Net Loss: $7.5M, compared to $2.1M in 3Q 2017 • Non - Cash Charges: $4.7M , compared to $1.2M in 3Q 2017 Balance Sheet • Total Assets: $53.1M compared to $53.4M at June 30, 2018 • Stockholders’ Equity: $28.1M compared to $31.5M at June 30, 2018. © 2018 DPW Holdings, Inc. 8

Full - Year 2018 Revenue Guidance $29M - $33M Triple compared to 2017 revenue of $10.0M © 2018 DPW Holdings, Inc. 9

Full - Year 2019 Revenue Guidance ~$60+M Double 2018 revenue guidance: • Technology Group ~ $40M • Finance Group ~ $20M © 2018 DPW Holdings, Inc. 10

Q&A Please visit www.DPWHoldings.com to review all our public filings and investor presentations. © 2018 DPW Holdings, Inc. BUSINESS UPDATE – November 15, 2018 11